Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ASPEN GROUP, INC. | aspu_8k.htm |

EXHIBIT 99.1

SeeThruEquity ConferenceSeptember 11, 2014 www.aspen.edu ASPEN GROUP, INC.

SAFE HARBOR STATEMENT * Certain statements in this presentation and responses to various questions include forward-looking statements including statements regarding our opportunities and expectations from the nursing education sector, and our strategic plans and projections. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Important factors that could cause actual results to differ from those in the forward-looking statements include competition, ineffective media and/or marketing, changes in the nursing industry which make having a degree less attractive, failure to maintain growth in degree seeking students, and failure to generate sufficient revenue. Further information on our risk factors is contained in our filings with the SEC, including the 10-K dated July 29, 2014. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

THE OPPORTUNITY * The for-profit education business model is broken; industry is ripe for change $1.2 Trillion Student Debt BubbleTuition rates have increased by 500%+ since 1980’sThis is an enormous business$23 Billion for-profit education sectorOnly 39% of adults hold a college degree*Nursing expected to be a critical growth driver in post-secondary education sector over next decade *Lumina Foundation, June 2013

ASPEN UNIVERSITY HAS BUILT A NEW BUSINESS MODEL * Aspen University offers world class online education at half the cost of its competitors; committed to cash-based, pay-as-you-go educationAnnounced the ‘debtless’ education vision; “Let’s Change Higher Education Forever” Aspen University passes on cost savings to students in the form of Monthly Payment Plans Students can pay $325/month for a Master’s degree = $11,700 (36 monthly payments)Students can pay $250/month for a Bachelor’s Degree = $15,000 (60 monthly payments)Aspen’s primary focus is on expanding its Nursing school

THE NURSING DILEMNA * Critical Nursing shortage projected next decade (260,000 RN shortage by 2025)Demand for RNs expected to grow next decade as baby boomers reach their 60’s and beyond More than 1 million RNs will reach retirement age within next 10-15 years (average age of RNs is 47 years old); 525,000 replacement Nurses expected, bringing the job openings growth to 1.05mm by 2022Nursing expected to be among fastest growing occupation in U.S. through 2022 --RN workforce expected to grow from 2.71mm RNs in 2012 to 3.24mm in 2022 (19%)U.S. Nursing schools turned away 79,659 qualified applicants from Baccalaureate and Graduate programs in 2012 due to insufficient number of Faculty and classroom sites**American Association of Colleges of Nursing Report

NURSING: TOTAL AVAILABLE MARKET TO 2022 * ONLY 55% OF RNs HAVE A BACHELOR OF SCIENCE IN NURSING (BSN) DEGREE OR HIGHER1.75mm RNs is the total targetable market size to 2022 (3.24mm workforce, minus 1.49mm of RNs that currently have BSN or higher degree) $9,750* x 1,750,000 = $17 Billion Opportunity*American Association of Colleges of Nursing Report

ASPEN’S PROGRESS IN NURSING * Aspen’s Master of Science in Nursing (MSN) program CCNE accredited; BSN decision this fallMSN and RN-to-MSN programs grew from inception to 886 students in 2.5 years (34% of Aspen full-time degree student body) Other key programs include Business Administration (BSBA/MBA), Education (MEd/EdD), Criminal Justice (BS/MS), Information Technology (MS IM/IT) & Psychology and Addiction Counseling (BA/MA) We’re already 40% of the size of Chamberlain College’s MSN program

STUDENT ENROLLMENT TRENDS * 74% of previous fiscal year enrollment growth was Nursing students FY’2014 33% Y/O/Y Student Enrollment Growth

HOW ASPEN OFFERS LOW TUITION WHILE ACHIEVING HIGH MARGINS * Best-in-class customer acquisitionManagement’s expertise in Internet marketing and lead generation led to vertically-integrating marketingDo not utilize third-party lead gen firmsAll Aspen brandedAverage customer acquisition costs of $705 is 1/6th the cost of competitors (~$4,000 - $5,000)Can continue to scale at low customer acquisition costsMay get even lower with continued expansion into very high demand fields like BSNCompletely variable teaching costs$160 per student course completionHigh-quality faculty – 61% hold Doctorate

OPERATING METRICS * Marketing budget decreased 28% y/o/y (CY 2014 to date) Enrollments up 15% y/o/y (CY 2014 to date) Conversion rate on all leads rose y/o/y from 5.2% to 8.2% (FY Q4) Cost per enrollment dropped y/o/y from $1,102 to $705 (FY Q4) New Class Starts are up 36% since start of FY’15 (May 1); Average tuition rate/course up 9% Courses paid through monthly payment methods has risen to 26% since March announcement

UNIT ECONOMICS AMONG BEST IN SECTOR * Low customer acquisition costs and variable teaching costs create highly attractive unit economics – 70%+ Gross Margins at scaleAverage course completions per student enrollment is 8 = $6,240 revenue (average $780 tuition/course today and rising)Customer acquisition cost = $705 Teaching cost = 8 * $160 = $1,280Gross Profit/Student = $4,255

INNOVATIVE BUSINESS MODEL NOW PROVEN, TIME TO SCALE * $5.4 million equity financing closed on 9/4/14Convertible debentures retired on 9/4/14, payoff of $2.31mmCash on Balance Sheet as of 9/5/14: $3.5 millionRevenue growth rate of 30%+ this fiscal year (FY’15), expect accelerated growth rate in FY’16 and FY’17

PROVEN MANAGEMENT TEAM * Experienced team can deliver sustainable growth and strong results while maintaining high qualityCEO: Michael MathewsBuilt revenues from run rate of $6 Million in 2007 to$100+ Million in 2010 as CEO of Interclick (NASDAQ: ICLK)In 2011, Interclick sold to Yahoo for $270 MillionHeld officer/senior exec positions at two other public companies (ACOM, CKSG)Extensive knowledge of internet marketing industry CAO: Cheri St. ArnauldFormer Provost/CAO of Grand Canyon University (NASDAQ:LOPE)CFO: Janet GillFormer CFO of Athena Schools, Asst. Controller of NYNEX Corporation COO: Gerard WendolowskiFormer VP, Marketing of Atrinsic (Digital Marketing firm)EVP Marketing: Angela SiegelOnline Marketing Manager at Grand Canyon Education (NASDAQ:LOPE)Extensive experience in online lead generation and enrollment operations

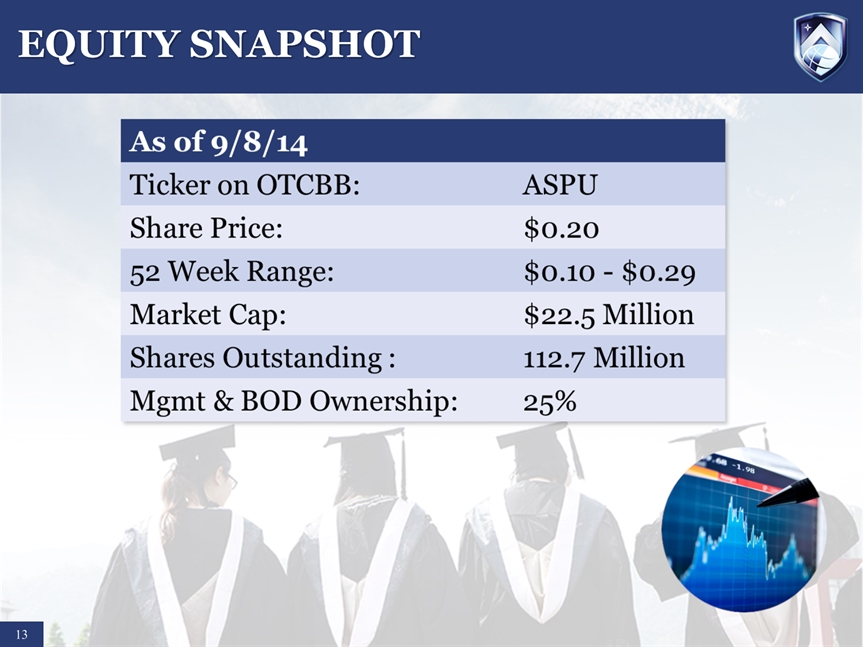

EQUITY SNAPSHOT *

QUESTIONS & ANSWERS ASPEN GROUP, INC.