Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Virtu KCG Holdings LLC | d786650d8k.htm |

KCG Holdings, Inc. (NYSE: KCG)

Barclays Global Financial Services Conference

September 10, 2014

Exhibit 99.1 |

Safe Harbor

Certain statements contained herein may constitute “forward-looking

statements” within the meaning of the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of 1995. Forward-looking statements

are typically identified by words such as “believe,” “expect,”

“anticipate,” “intend,” “target,”

“estimate,” “continue,” “positions,” “prospects” or “potential,” by future conditional verbs such as “will,” “would,”

“should,” “could” or “may,” or by variations of

such words or by similar expressions. These “forward-looking statements” are not historical facts

and are based on current expectations, estimates and projections about KCG’s

industry, management’s beliefs and certain assumptions made by

management, many of which, by their nature, are inherently uncertain and beyond

our control. Any forward-looking statement contained herein speaks

only as of the date on which it is made. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of

future performance and are subject to certain risks, uncertainties and

assumptions that are difficult to predict including, without limitation, risks

associated with: (i) the strategic business combination (the “Mergers”)

of Knight Capital Group, Inc. (“Knight”) and GETCO Holding Company,

LLC (“GETCO”), including, among other things, (a) difficulties and

delays in integrating the Knight and GETCO businesses or fully realizing cost

savings and other benefits, (b) the inability to sustain revenue and earnings

growth, and (c) customer and client reactions to the Mergers; (ii) the

August 1, 2012 technology issue that resulted in Knight’s broker-dealer

subsidiary sending numerous erroneous orders in NYSE-listed and NYSE

Arca securities into the market and the impact to Knight’s business as well

as actions taken in response thereto and consequences thereof; (iii) the

sale of KCG’s reverse mortgage origination and securitization business and

the departure of the managers of KCG’s listed derivatives group; (iv)

changes in market structure, legislative, regulatory or financial reporting

rules, including the increased focus by regulators, the New York Attorney

General, Congress and the media on market structure issues, and in particular,

the scrutiny of high frequency trading, alternative trading systems,

market fragmentation, colocation, access to market data feeds, and remuneration

arrangements such as payment for order flow and exchange fee structures;

(v) past or future changes to organizational structure and management; (vi) KCG’s ability to develop competitive new products and

services in a timely manner and the acceptance of such products and services by

KCG’s customers and potential customers; (vii) KCG’s ability to

keep up with technological changes; (viii) KCG’s ability to effectively

identify and manage market risk, operational and technology risk, legal risk,

liquidity risk, reputational risk, counterparty and credit risk, international

risk, regulatory risk, and compliance risk; (ix) the cost and other effects

of material contingencies, including litigation contingencies, and any adverse

judicial, administrative or arbitral rulings or proceedings; and (x) the

effects of increased competition and KCG’s ability to maintain and expand

market share. The list above is not exhaustive. Readers should carefully

review the risks and uncertainties disclosed in KCG’s reports with the SEC,

including, without limitation, those detailed under “Risk Factors” in

KCG’s Annual Report on Form 10-K for the year-ended December 31,

2013, under “Certain Factors Affecting Results of Operations” in KCG’s

Quarterly Report on Form 10-Q for the period ended June 30, 2014, and other

reports or documents KCG files with, or furnishes to, the SEC from time to

time. For additional disclosures, please see

https://www.kcg.com/legal/global-disclosures. |

Investment Rationale

1.

A better model for the emerging competitive landscape –

agile, scalable,

pure-play, execution-only, non-bank

2.

A developer of advanced technologies driving the shift in trading from analog

to digital across asset classes

3.

Additional integration-related synergies yet to be realized

4.

Prospects for multiyear organic growth direct from core capabilities

5.

Long-term growth opportunities from the implementation of regulations

instituted in response to the global financial crisis of 2008

1 |

KCG helps retail and institutional investors

efficiently deploy capital in the secondary

market.

The KCG Model

Trading

Venues

Agency

Execution

Market

Making

Direct-to-client and non-client,

exchange-based market making

Agency-based trading

on behalf of clients

Agency-based trading between

principals to transactions

2

A leading, independent global securities firm

specializing in trading

Develops and applies advanced technologies to

market making, agency execution and trading

venues in multiple asset classes

Consistently delivers executions to sell-

and buy-

side clients that drive trading performance

Contributes to better price discovery, deeper

liquidity, tighter spreads and lower costs for all

market participants |

3Q14 Intra-Quarter Updates

Market conditions remain weak across asset classes

Avg. daily consolidated U.S. equity volume of 5.5 billion QTD through August

(-8.5% QoQ) and “retail”

SEC Rule 605 shares traded of approximately 673 million (-2.5% QoQ)

Avg. realized volatility for the S&P 500 of 9.3 QTD through August (9.2 in

2Q14) KCG actions to further reconfigure the client offering

Announced the sale of futures commission merchant (FCM) KCG Futures

Completed the integration of GETMatched ATS in the U.S. into other products

Discontinued corporate access

services to concentrate on the execution only institutional market

Aggressive capital return to KCG stockholders continues

Repurchased approximately 2.9 million shares from the close of 2Q14 to the

publication of the Quarterly Report on Form 10-Q

New direction provided on regulatory initiatives

Public comment period on SEC pilot program to widen tick sizes for stocks of

smaller companies Additional SEC initiatives on U.S. equity market

structure to focus on stability, fairness and transparency as well as

eliminating broker conflicts 3

†

The number of shares outstanding of KCG Class A Common Stock was 118.1 million

including restricted stock units at August 7, 2014 compared to 121.1 million including RSUs at June 30, 2014.

† |

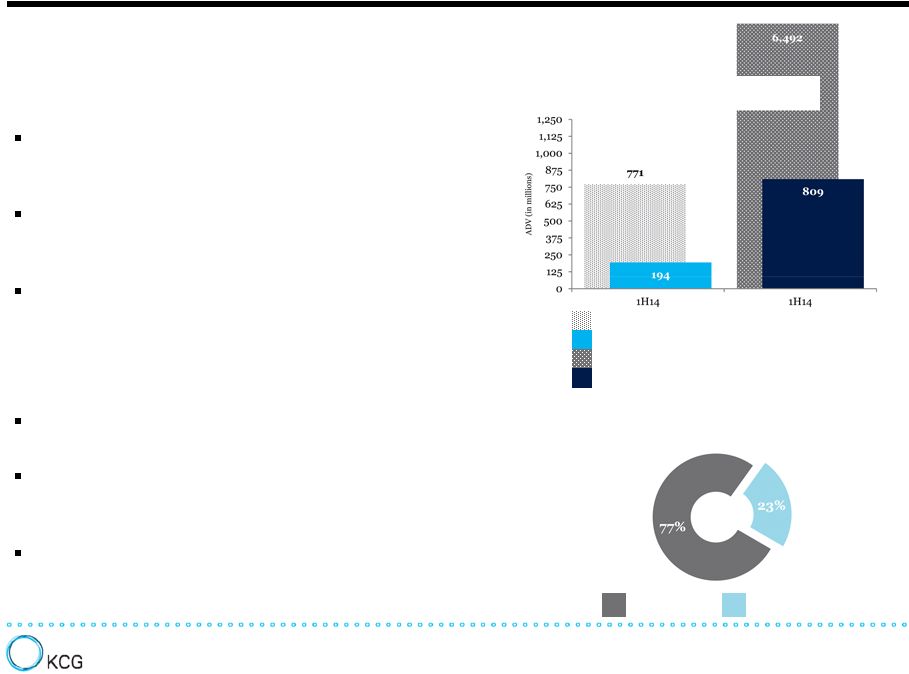

The Market Making Segment

Market Making revenue distribution

1H14

U.S. equities

Non-U.S. equities

Direct-to-client market making

A leading direct-to-client market maker serving

the sell side globally in an expanding number of

asset classes

A scale operation with competition based on

client relationships, market coverage, speed, fill

rates and execution quality

Currently offer liquidity in U.S. equities, listed

U.S. options, European equities, U.S.

Treasuries and FX (beta testing)

Non-client, exchange-based market making

A provider of best prices for buy and sell orders

on market centers

Active globally in select asset classes that are

largely electronic, fairly liquid and centrally

cleared

Anticipated future growth from the

modernization of markets for global equities,

fixed income, currencies and commodities

4

Sources: KCG, VistaOne Solutions, BATS Global Markets

ADV overall "retail" SEC Rule 605-eligible shares traded

KCG market making ADV of "retail" SEC Rule 605-eligible shares

traded ADV consolidated U.S. equity shares traded

KCG market making ADV of exchange-listed shares traded

KCG market making’s presence

in the U.S. equity market |

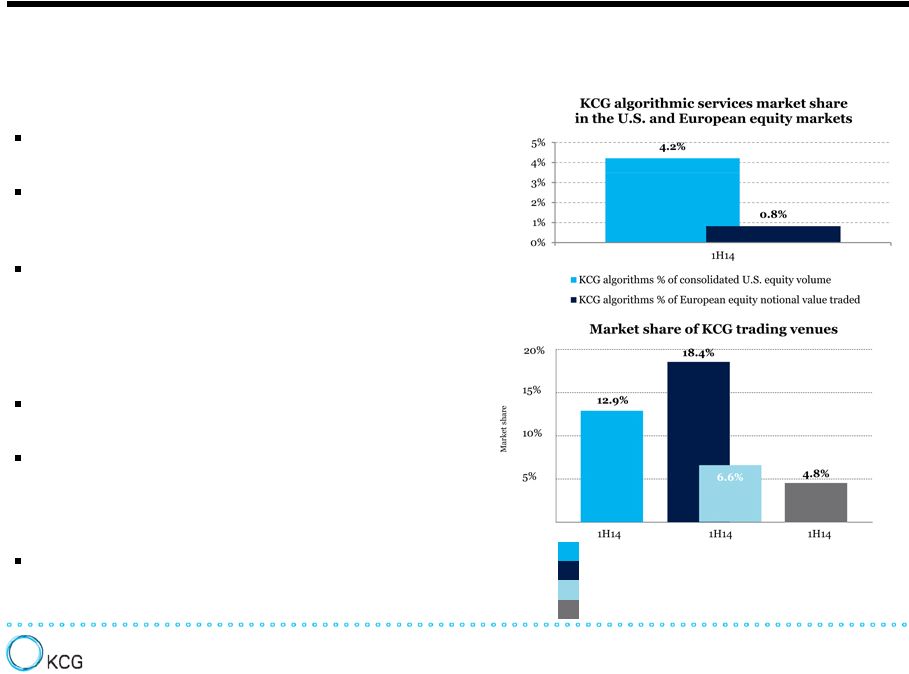

The Global Execution Services Segment

Agency execution

A leading execution-only broker serving the buy

side in global equities

Offer algorithmic trading and an order routing

as well as access to sales traders for complex

trades

Anticipated future growth from increasing

penetration of KCG algorithms among the

leading asset managers

Trading venues

A developer and operator of marketplaces in

strategic asset classes

Anticipated future growth from the

modernization of markets –

in particular FX

and fixed income –

that remain manual, non-

transparent and illiquid

A 16.7% stake in global exchange BATS

KCG Hotspot % of institutional spot FX notional dollar volume among reporting

venues KCG BondPoint % of interdealer corporate bond transactions

under 250 bonds

KCG BondPoint % of interdealer muni bond transactions under 250 bonds

Knight Match ATS % of dark U.S. equity liquidity

Sources:

KCG,

BATS

Global

Markets,

Bloomberg,

Reuters,

EBS,

TRACE,

MSRB,

Rosenblatt;

†

KCG’s

strategic

investment

in

BATS

Global

Markets,

Inc.

is

contained

in

the

Corporate

and

Other

segment

5

† |

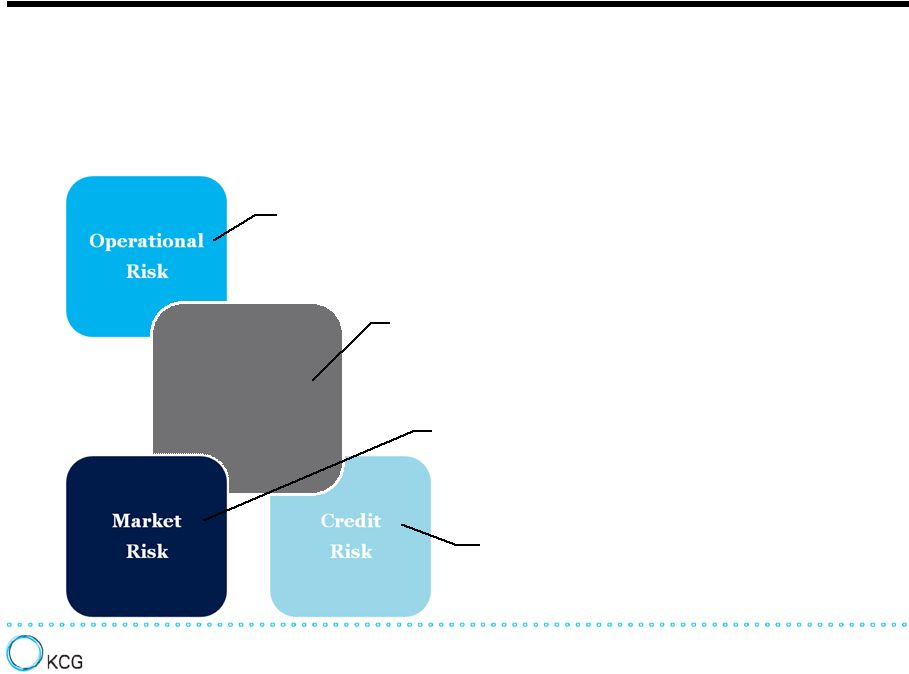

KCG Risk Management

KCG’s risk management framework provides comprehensive controls and

processes for ongoing management and monitoring of the major risks

associated with the firm's daily business activities.

Risk of loss resulting from inadequate or failed internal

processes, systems, human error or external events

Real-Time

Risk

Risk of loss resulting from high-speed intra-day

activities managed by real-time risk processes and

controls

Financial or other loss derived through failure,

non-performance or underperformance of a

counterparty

Adverse change in the market value of portfolios and

financial instruments caused by a change in market

prices, spread, or rates

6 |

Strategic Imperatives

1.

Get the integration right.

2.

Concentrate on technology-based, scalable, non-capital intensive

businesses. 3.

Foster KCG’s intellectual capital, technology development and

collaborative culture.

4.

Strengthen the offering and expand the client network.

5.

Focus on generating cash and maintaining a liquid balance sheet.

7 |

Primary Year One Activities

1.

Get the integration right.

–

Integrated direct-to-client and non-client, exchange-

based U.S. equity market making

–

Consolidated institutional U.S. equity sales

–

Combined overlapping units including algorithmic

services, options market making, DMM and LMM

–

Consolidated broker dealers in the U.S. and U.K.

–

Reorganized KCG Europe

–

Consolidated support functions including Technology,

Finance, Legal, Compliance, Risk, HR and Facilities

2.

Concentrate on technology-based,

scalable, non capital-intensive

businesses.

–

Restructured the institutional ETF desk

–

Sold subsidiary Urban Financial of America

3.

Foster KCG’s intellectual capital,

technology development and

collaborative vulture.

–

More than 15% of all KCG employees joined since the

merger close

–

Began integrating the legacy technology platforms

–

Consolidated offices in Chicago and London

4.

Strengthen the offering and expand the

client network.

–

Began beta testing direct-to-client market making in FX

–

Introduced a new algorithm offering institutional clients

access to retail order flow

–

Added quantitative-based trading strategy and analysis to

the client offering

5.

Focus on generating cash and

maintaining a liquid balance sheet.

–

Generated $186 million in free cash flow from operating

income

–

Released $200 million in trapped excess liquidity

–

Maintain a liquidity buffer of $350 million to support

day-to-day operations

–

Substantially all financial instruments held as assets and

liabilities are Level 1

–

Reduced debt by $793 million and lowered the debt-to-

tangible equity ratio to 0.32

8 |

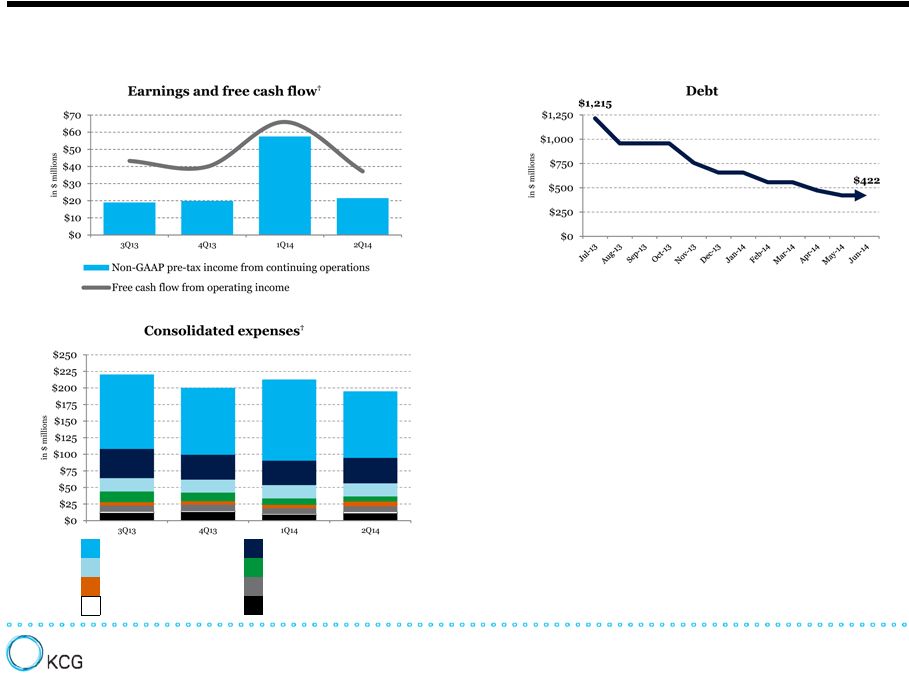

Consolidated Financials

†

See addendum for a reconciliation of GAAP to non-GAAP financial results. Free

cash flow represents income from continuing operations less capital expenditures plus non-cash items such as

depreciation and amortization, stock-based compensation and non-GAAP

adjustments included in the Regulation G tables. Expenses exclude items contained in the Regulation G tables.

KCG balance sheet

(in $ millions)

As of June 30, 2014

Cash and cash equivalents

600.9

Debt

422.3

Stockholders’

equity

1,533.7

—

—

—

Debt-to-tangible equity ratio

0.32

—

—

—

Book value per share

$12.66

Tangible book value per share

$11.04

Compensation and benefits

Communications and data processing

Depreciation and amortization

Debt interest expense

Professional fees

Occupancy and equipment rentals

Business development

Other

9 |

Potential Catalysts

Improvement in market conditions across asset classes

Growth from organic initiatives already underway

Realization of additional integration-related synergies

Further clarity on SEC market structure initiatives

Continued capital return through share repurchases

Long-term secular shifts in trading driven by regulation, technology and

competition

10 |

|

3

months ended June 30, 2014 Market Making

Global Execution

Services

Corporate and

Other

Consolidated

Reconciliation of GAAP pre-tax to non-GAAP pre-tax:

GAAP income (loss) from continuing operations before income taxes

$ 36,004

$ 736

$ (22,233)

$ 14,507

Writedown of capitalized debt costs

-

-

1,995

1,995

Compensation related to reduction in workforce

383

1,886

800

3,069

Writedown of assets and lease loss accrual, net

452

-

1,489

1,941

Non-GAAP income (loss) from continuing operations before income taxes

$ 36,839

$ 2,622

$ (17,949)

$ 21,512

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended March 31, 2014

Market Making

Global Execution

Services

Corporate and

Other

Consolidated

Reconciliation of GAAP pre-tax to non-GAAP pre-tax:

GAAP income (loss) from continuing operations before income taxes

$ 76,032

$ 2,016

$ (18,664)

$ 59,384

Writedown of capitalized debt costs

-

-

7,557

7,557

Income resulting from the merger of BATS and Direct Edge, net

-

-

(9,644)

(9,644)

Writedown of assets and lease loss accrual, net

359

-

(93)

266

Non-GAAP income (loss) from continuing operations before income taxes

$ 76,391

$ 2,016

$ (20,844)

$ 57,563

11 |

3

months ended September 30, 2013 Market Making

Global Execution

Services

Corporate and

Other

Consolidated

Reconciliation of GAAP pre-tax to non-GAAP pre-tax:

GAAP income (loss) from continuing operations before income taxes

$ 47,853

$ (16,354)

$ 89,874

$ 121,373

Gain on investment in Knight Capital Group, Inc.

-

-

(127,972)

(127,972)

Compensation and other expenses related to reduction in workforce

2,309

15,132

-

17,441

Professional

and

other

fees

related

to

Mergers

and

August

1

technology

issue

-

-

7,269

7,269

Writedown of assets and lease loss accrual, net

108

-

828

936

Non-GAAP income (loss) from continuing operations before income taxes

$ 50,270

$ (1,222)

$ (30,001)

$ 19,048

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended December 31, 2013

Market Making

Global Execution

Services

Corporate and

Other

Consolidated

Reconciliation of GAAP pre-tax to non-GAAP pre-tax:

GAAP income (loss) from continuing operations before income taxes

$ 47,951

$ (4,491)

$ (60,159)

$ (16,699)

Compensation and other expenses related to reduction in workforce

5,254

5,447

708

11,409

Professional

and

other

fees

related

to

Mergers

and

August

1

technology

issue

-

-

2,785

2,785

Writedown of capitalized debt costs

-

-

13,209

13,209

Gain on strategic asset

-

-

(1,359)

(1,359)

Writedown of assets and lease loss accrual

-

1,681

8,819

10,500

Non-GAAP income (loss) from continuing operations before income taxes

$ 53,205

$ 2,637

$ (35,997)

$ 19,845

12

st

st |

3

months ended June 30, 2014 GAAP

Adjustments for

non-GAAP presentation

KCG adjusted, normalized

expenses

Reconciliation of GAAP expenses to normalized non-GAAP expenses:

Employee compensation and benefits

103,430

3,069

100,361

Communications and data processing

38,279

-

38,279

Depreciation and amortization

19,823

-

19,823

Debt interest expense

7,497

-

7,497

Professional fees

7,337

-

7,337

Occupancy and equipment rentals

8,235

-

8,235

Business development

2,609

-

2,609

Writedown of assets, lease loss accrual and capitalized debt costs

3,936

3,936

-

Other

10,767

-

10,767

Total expenses

$ 201,913

$ 7,005

$ 194,908

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

13 |

3

months ended March 31, 2014 GAAP

Adjustments for

non-GAAP presentation

KCG adjusted, normalized

expenses

Reconciliation of GAAP expenses to normalized non-GAAP expenses:

Employee compensation and benefits

122,319

-

122,319

Communications and data processing

36,796

-

36,796

Depreciation and amortization

20,103

-

20,103

Debt interest expense

9,524

-

9,524

Professional fees

5,402

-

5,402

Occupancy and equipment rentals

8,285

-

8,285

Business development

1,683

-

1,683

Writedown of assets, lease loss accrual and capitalized debt costs

7,823

7,823

-

Other

8,643

-

8,643

Total expenses

$ 220,578

$ 7,823

$ 212,755

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

14 |

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended December 31, 2013

GAAP

Adjustments for

non-GAAP presentation

KCG adjusted, normalized

expenses

Reconciliation of GAAP expenses to normalized non-GAAP expenses:

Employee compensation and benefits

112,209

11,409

100,800

Communications and data processing

37,512

-

37,512

Depreciation and amortization

19,566

-

19,566

Debt interest expense

12,943

-

12,943

Professional fees

7,734

2,491

5,243

Occupancy and equipment rentals

9,358

-

9,358

Business development

1,923

-

1,923

Writedown of assets, lease loss accrual and capitalized debt costs

23,709

23,709

-

Other

13,066

294

12,772

Total expenses

$ 238,020

$ 37,903

$ 200,117

15 |

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended September 30, 2013

GAAP

Adjustments for

non-GAAP presentation

KCG adjusted, normalized

expenses

Reconciliation of GAAP expenses to normalized non-GAAP expenses:

Employee compensation and benefits

129,631

17,441

112,190

Communications and data processing

44,046

-

44,046

Depreciation and amortization

20,091

-

20,091

Debt interest expense

19,350

2,982

16,368

Professional fees

9,077

4,087

4,990

Occupancy and equipment rentals

8,898

-

8,898

Business development

2,644

200

2,444

Writedown of assets and lease loss accrual, net

936

936

-

Other

11,318

-

11,318

Total expenses

$ 245,991

$ 25,647

$ 220,345

16 |

|