Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REGIONS FINANCIAL CORP | rf-20140909x8xk.htm |

Barclays Global Financial Services Conference September 9, 2014 Grayson Hall Chief Executive Officer Exhibit 99.1

Company profile *As of 2Q14, except Market Cap as of 9/4/2014 2 Company Snapshot* Associates 23,416 Assets $119B Loans $77B Deposits $94B Branches 1,673 ATMs 1,990 Market Cap $14.1B Top Ten MSAs ’14-’19 Population Growth Birmingham, AL Nashville, TN Tampa, FL Memphis, TN Miami, FL Atlanta, GA St. Louis, MO Jackson, MS New Orleans, LA Mobile, AL 1.0% 5.0% 2.6% 0.6% 6.4% 6.4% 2.9% 5.1% 6.2% 1.7% National Average: 3.5% Source: SNL Financial

Balance sheet growth 3 $92,454 $92,321 $92,453 $93,393 $93,822 88.4% 89.1% 89.5% 90.1% 90.5% 2Q13 3Q13 4Q13 1Q14 2Q14 Total Deposits Low Cost Deposits / Total Deposits ($ in millions) Deposits(1) ($ in millions) Loans(1) $74,990 $75,892 $74,609 $75,680 $76,513 2Q13 3Q13 4Q13 1Q14 2Q14 (1) Based on ending balances (2) Regions transferred $686 million of restructured residential first mortgage loans to loans held for sale during the fourth quarter of 2013. These loans were subsequently sold during the first quarter of 2014. (2)

$7,014 $6,930 $6,750 $6,992 $6,973 2Q13 3Q13 4Q13 1Q14 2Q14 $2,693 $2,889 $3,075 $3,253 $3,422 2Q13 3Q13 4Q13 1Q14 2Q14 $99 $112 $141 $161 $174 2Q13 3Q13 4Q13 1Q14 2Q14 Credit card sales ($ in millions) Key lending categories 4 Commercial and industrial loans(1) ($ in millions) Investor real estate lending(1) ($ in millions) (1) Based on ending balances ($ in millions) $28,954 $29,863 $29,413 $30,466 $31,354 2Q13 3Q13 4Q13 1Q14 2Q14 Indirect loans(1)

Steady progress 5 Declining deposit costs Note: Peer banks include BBT, CMA, FHN, FITB, HBAN, KEY, MTB, PNC, STI, USB, WFC, ZION Source: SNL Financial (1) Year-over-year change 0.15% 0.11% 0.23% 0.17% 2Q13 3Q13 4Q13 1Q14 2Q14 Regions Peer Median Lower total funding costs 9 Bp Decline(1) 4 Bp Decline(1) 8 Bp Increase(1) 0.40% 0.31% 0.41% 0.35% 2Q13 3Q13 4Q13 1Q14 2Q14 Net interest margin above peer average 3.16% 3.24% 3.34% 3.17% 2Q13 3Q13 4Q13 1Q14 2Q14 Regions Peer Average

Emphasis on non-interest revenue diversification • Achieved checking account growth and grew quality households in 2Q14, driven by philosophy • New home purchases driving mortgage production • Expanded small credit product offerings in order to meet customer needs • Total number of Financial Consultants has increased to 143 since 2Q13 Non-interest revenue ($ in millions) (1) Total Wealth Management income presented above does not include the portion of service charges on deposit accounts and similar smaller dollar amounts that are also attributable to the Wealth Management segment. 6

Meeting customer needs through innovation 7 Online / Mobile Contact Center Retail • Two Way Video Banker • Tablets • Universal Banker • Teller Kiosk • Deposit Secured Line of Credit • Intelligent Routing • Automated Phone System Personalization • Small Business Mobile Deposits • Small Business Online • Online Banking Platform Upgrade Products & Services

Channel optimization and integration 8 Channel Integration Total branch outlets Product sales by channel (in thousands) 2% Decline since 4Q12 14% Increase since 2012 Branch interactions (in millions) 11% Decline since 2012 Mobile banking 92% Increase in interactions since 2012 133 123 119 2012 2013 2014 YTD Annualized $1,343 $1,401 $1,525 2012 2013 2014 YTD Annualized Branch Online Contact Center (in millions) (in thousands) 1,711 1,705 1,673 4Q12 4Q13 2Q14 107 171 205 924 1,156 1,222 2012 2013 2014 YTD Annualized Mobile Banking Interactions Mobile Banking Customers

Continued focus on expense management 9 Non-interest expense(1) 2Q14 vs. 1Q14 (1) Adjusted to exclude non-core items – See appendix for reconciliation (2) Non-GAAP – See appendix for reconciliation Peer banks include: BBT, CMA, FHN, FITB, HBAN, KEY, MTB, PNC, STI, USB, WFC, ZION Source: SNL Financial Note: Data excludes non-recurring and merger expenses as defined by SNL; goodwill impairment charges have been excluded in all income or expense measures Efficiency ratio(2) 63.1% 64.2% 64.2% 64.0% 2Q13 3Q13 4Q13 1Q14 2Q14 Regions Peer Median 12% 4% 4% 3% 3% 2% 2% 1% 0% 0% -2% -3% -4% Bank #13 Bank #12 Bank #11 Bank #10 Bank #9 Bank #8 Bank #7 Bank #6 Bank #5 Bank #4 Bank #2 Bank #1

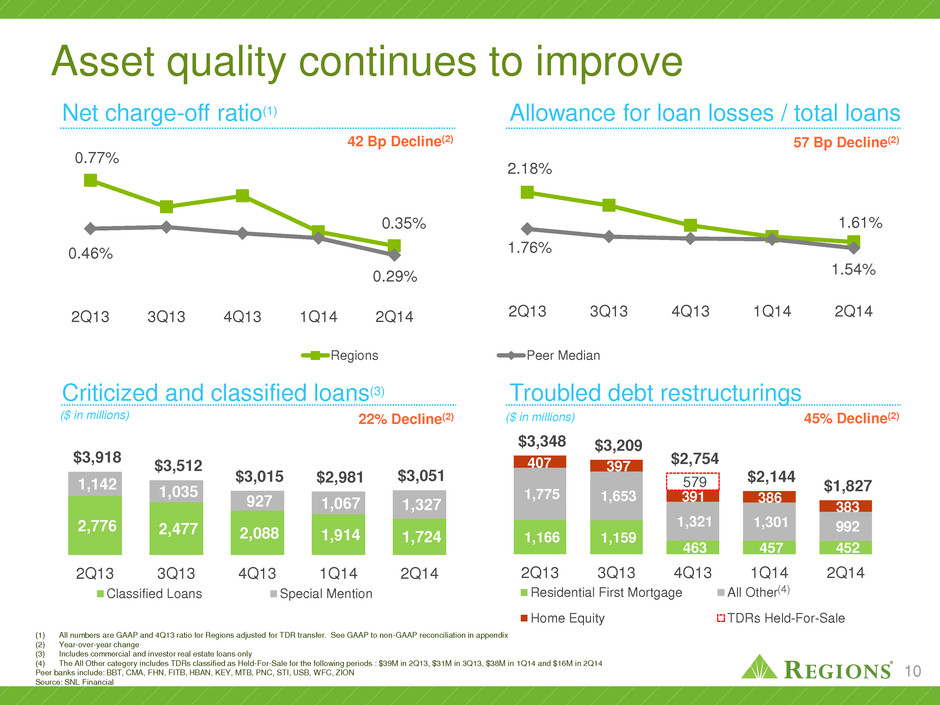

Asset quality continues to improve Net charge-off ratio(1) Allowance for loan losses / total loans Criticized and classified loans(3) ($ in millions) Troubled debt restructurings ($ in millions) 42 Bp Decline(2) 57 Bp Decline(2) 22% Decline(2) 45% Decline(2) 10 (1) All numbers are GAAP and 4Q13 ratio for Regions adjusted for TDR transfer. See GAAP to non-GAAP reconciliation in appendix (2) Year-over-year change (3) Includes commercial and investor real estate loans only (4) The All Other category includes TDRs classified as Held-For-Sale for the following periods : $39M in 2Q13, $31M in 3Q13, $38M in 1Q14 and $16M in 2Q14 Peer banks include: BBT, CMA, FHN, FITB, HBAN, KEY, MTB, PNC, STI, USB, WFC, ZION Source: SNL Financial (4) (4) (4) 2.18% 1.61% 1.76% 1.54% 2Q13 3Q13 4Q13 1Q14 2Q14 2,776 2,477 2,088 1,914 1,724 1,142 1,035 927 1,067 1,327 $3,918 $3,512 $3,015 $2,981 $3,051 2Q13 3Q13 4Q13 1Q14 2Q14 Classified Loans Special Mention 1,166 1,159 463 457 452 1,775 1,653 1,321 1,301 992 407 397 391 386 383 579 $3,348 $3,209 $2,754 $2,144 $1,827 2Q13 3Q13 4Q13 1Q14 2Q14 Residential First Mortgage All Other Home Equity TDRs Held-For-Sale 0.77% 0.35% 0.46% 0.29% 2Q13 3Q13 4Q13 1Q14 2Q14 Regions Peer Median

$6.69 $8.12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 Well positioned for growth 11 (1) Non-GAAP – See appendix for reconciliation (2) Based on ending balances Note: Peer banks include BBT, CMA, FHN, FITB, HBAN, KEY, MTB, PNC, STI, USB, WFC, ZION Source: SNL Financial Liquidity Loan to deposit ratio(2) 81.1% 81.6% 89.4% 90.3% 2Q13 3Q13 4Q13 1Q14 2Q14 Capital Tier 1 Common ratio(1) Tangible book value(1) per share 11.1% 11.6% 10.2% 10.5% 2Q13 3Q13 4Q13 1Q14 2Q14 Regions Peer Median Capital management priorities Invest Organically › Grow loans consistent with our risk tolerance › Opportunistically evaluate complementary portfolios and other transactions Return Capital to Shareholders › Increase dividends closer to peer average payout levels › Share repurchases

Expectations for 2014 › Prolonged low interest rate environment › Evolving regulatory environment › Leverage to grow customer relationships across business groups by 2% to 4% › Loan growth of 3% to 5% on a point-to-point basis › Deposit growth of 1% to 2% on a point-to-point basis › Moderate compression to net interest margin in 2H14 of 5 to 7 bps › Grow net interest income concurrent with loan growth › 2014 adjusted expenses(1) lower than 2013 adjusted expenses(1) (1) See GAAP to non-GAAP reconciliation in appendix for the last 5 quarters and Table 2 in our 2013 Form 10-K for full year 2013. 12

Appendix 13

Non-GAAP reconciliation: Non-interest expense and efficiency ratio The table below presents computations of the efficiency ratio (non-GAAP), which is a measure of productivity, generally calculated as non-interest expense divided by total revenue. The table also shows the fee income ratio (non-GAAP), generally calculated as non-interest income divided by total revenue. Management uses these ratios to monitor performance and believes these measures provide meaningful information to investors. Non-interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP), which is the numerator for the efficiency ratio. Non-interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non-GAAP), which is the numerator for the fee income ratio. Net interest income on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue (GAAP). Adjustments are made to arrive at adjusted total revenue (non-GAAP), which is the denominator for the fee income and efficiency ratios. Regions believes that the exclusion of these adjustments provides a meaningful base for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. 14 NM – Not Meaningful (1) Gain on sale of a non-core portion of a Wealth Management business. Quarter Ended ($ amounts in millions) 6/30/2014 3/31/2014 12/31/2013 9/30/2013 6/30/2013 2Q14 vs. 1Q14 2Q14 vs. 2Q13 Non-interest expense (GAAP) $ 820 $ 817 $ 946 $ 884 $ 884 $ 3 0.4 % $ (64 ) (7.2 )% Adjustments: Loss on early extinguishment of debt — — — (5 ) (56 ) — NM 56 (100.0 )% Regulatory (charge) credit 7 — (58 ) — — 7 NM 7 NM Branch consolidation and property and equipment charges — (6 ) (5 ) — — 6 (100.0 )% — NM Gain on sale of TDRs held for sale, net — 35 — — — (35 ) (100.0 )% — NM Adjusted non-interest expense (non-GAAP) A $ 827 $ 846 $ 883 $ 879 $ 828 $ (19 ) (2.2 )% $ (1 ) (0.1 )% Net interest income (GAAP) $ 822 $ 816 $ 832 $ 824 $ 808 $ 6 0.7 % $ 14 1.7 % Taxable-equivalent adjustment 15 15 14 14 13 — NM 2 15.4 % Net interest income, taxable-equivalent basis 837 831 846 838 821 6 0.7 % 16 1.9 % Non-interest income (GAAP) 457 438 526 495 497 19 4.3 % (40 ) (8.0 )% Adjustments: Leveraged lease termination gains, net — (1 ) (39 ) — — 1 (100.0 )% — NM Securities gains, net (6 ) (2 ) — (3 ) (8 ) (4 ) 200.0 % 2 (25.0 )% Gain on sale of other assets(1) — — — (24 ) — — NM — NM Adjusted non-interest income (non-GAAP) B 451 435 487 468 489 16 3.7 % (38 ) (7.8 )% Adjusted total revenue (non-GAAP) C $ 1,288 $ 1,266 $ 1,333 $ 1,306 $ 1,310 $ 22 1.7 % $ (22 ) (1.7 )% Adjusted efficiency ratio (non-GAAP) A/C 64.2 % 66.9 % 66.3 % 67.3 % 63.1 %

Non-GAAP reconciliation: Net charge-off ratio Select calculations for annualized net charge-offs as a percentage of average loans are presented in the table below. During the fourth quarter of 2013, Regions made the strategic decision to transfer certain primarily accruing restructured residential first mortgage loans to loans held for sale. These loans were marked down to fair value through net charge-offs upon transfer to held for sale. Management believes that excluding the incremental increase to net charge-offs from the affected net charge-off ratios will assist investors in analyzing the Company's credit quality performance as well as provide a better basis from which to predict future performance. Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. *Annualized 15 As of and for Quarter Ended ($ amounts in millions) 6/30/2014 3/31/2014 12/31/2013 9/30/2013 6/30/2013 Total net charge-offs (GAAP) A $ 67 $ 82 $ 278 $ 114 $ 144 Less: Net charge-offs associated with transfer to loans held for sale — — 151 — — Adjusted net charge-offs (non-GAAP) B $ 67 $ 82 $ 127 $ 114 $ 144 Total average loans (GAAP) C $ 76,390 $ 75,139 $ 75,843 $ 75,359 $ 74,549 Add: Average balances of residential first mortgage loans transferred to loans held for sale — — 74 — — Adjusted total average loans (non-GAAP) D $ 76,390 $ 75,139 $ 75,917 $ 75,359 $ 74,549 Total net charge-off percentage (GAAP)* A/C 0.35 % 0.44 % 1.46 % 0.60 % 0.77 % Adjusted total net charge-off percentage (non-GAAP)* B/D 0.35 % 0.44 % 0.67 % 0.60 % 0.77 %

Non-GAAP reconciliation: Tier 1 common The following table provides calculations of Tier 1 capital (regulatory) and "Tier 1 common equity" (non-GAAP). Traditionally, the Federal Reserve and other banking regulatory bodies have assessed a bank's capital adequacy based on Tier 1 capital, the calculation of which is prescribed in amount by federal banking regulations. In connection with the Company's Comprehensive Capital Analysis and Review ("CCAR"), these regulators are supplementing their assessment of the capital adequacy of a bank based on a variation of Tier 1 capital, known as Tier 1 common equity. While not prescribed in amount by federal banking regulations (under Basel I), analysts and banking regulators have assessed Regions' capital adequacy using the Tier 1 common equity measure. Because Tier 1 common equity is not formally defined by GAAP or prescribed in any amount by federal banking regulations (under Basel I), this measure is currently considered to be a non-GAAP financial measure and other entities may calculate it differently than Regions' disclosed calculations. Since analysts and banking regulators may assess Regions' capital adequacy using Tier 1 common equity, management believes that it is useful to provide investors the ability to assess Regions' capital adequacy on this same basis. Tier 1 common equity is often expressed as a percentage of risk-weighted assets. Under the risk-based capital framework, a company's balance sheet assets and credit equivalent amounts of off-balance sheet items are assigned to one of four broad risk categories. The aggregated dollar amount in each category is then multiplied by the risk-weighted category. The resulting weighted values from each of the four categories are added together and this sum is the risk-weighted assets total that, as adjusted, comprises the denominator of certain risk-based capital ratios. Tier 1 capital is then divided by this denominator (risk-weighted assets) to determine the Tier 1 capital ratio. Adjustments are made to Tier 1 capital to arrive at Tier 1 common equity (non-GAAP). Tier 1 common equity (non-GAAP) is also divided by the risk-weighted assets to determine the Tier 1 common equity ratio (non-GAAP). The amounts disclosed as risk-weighted assets are calculated consistent with banking regulatory requirements. As of and for Quarter Ended ($ amounts in millions) 6/30/2014 3/31/2014 12/31/2013 9/30/2013 6/30/2013 TIER 1 COMMON RISK-BASED RATIO (1) —CONSOLIDATED Stockholders’ equity (GAAP) $ 17,029 $ 16,132 $ 15,768 $ 15,489 $ 15,329 Accumulated other comprehensive (income) loss 52 229 319 411 478 Non-qualifying goodwill and intangibles (4,797 ) (4,804 ) (4,798 ) (4,804 ) (4,812 ) Disallowed servicing assets (28 ) (29 ) (31 ) (30 ) (30 ) Qualifying trust preferred securities — — — — 3 Tier 1 capital (regulatory) $ 12,256 $ 11,528 $ 11,258 $ 11,066 $ 10,968 Qualifying trust preferred securities — — — — (3 ) Preferred stock (920 ) (442 ) (450 ) (458 ) (466 ) Tier 1 common equity (non-GAAP) A $ 11,336 $ 11,086 $ 10,808 $ 10,608 $ 10,499 Risk-weighted assets (regulatory) B 98,036 97,418 96,416 96,486 94,640 Tier 1 common risk-based ratio (non-GAAP) A/B 11.6 % 11.4 % 11.2 % 11.0 % 11.1 % 16 (1) Current quarter amount and the resulting ratio are estimated.

Non-GAAP reconciliation: Tangible book value 17 ($ amounts in millions, except per share data) 6/30/2014 3/31/2014 12/31/2013 9/30/2013 6/30/2013 TANGIBLE COMMON RATIOS—CONSOLIDATED Stockholders’ equity (GAAP) $ 17,029 $ 16,132 $ 15,768 $ 15,489 $ 15,329 Less: Preferred stock (GAAP) 920 442 450 458 466 Intangible assets (GAAP) 5,097 5,110 5,111 5,123 5,134 Deferred tax liability related to intangibles (GAAP) (183 ) (186 ) (188 ) (189 ) (187 ) Tangible common stockholders’ equity (non-GAAP) C $ 11,195 $ 10,766 $ 10,395 $ 10,097 $ 9,916 Total assets (GAAP) $ 118,719 $ 117,933 $ 117,396 $ 116,864 $ 118,707 Less: Intangible assets (GAAP) 5,097 5,110 5,111 5,123 5,134 Deferred tax liability related to intangibles (GAAP) (183 ) (186 ) (188 ) (189 ) (187 ) Tangible assets (non-GAAP) D $ 113,805 $ 113,009 $ 112,473 $ 111,930 $ 113,760 Shares outstanding—end of quarter E 1,378 1,378 1,378 1,378 1,395 Tangible common stockholders’ equity to tangible assets (non-GAAP) C/D 9.84 % 9.53 % 9.24 % 9.02 % 8.72 % Tangible common book value per share (non-GAAP) C/E $ 8.12 $ 7.81 $ 7.54 $ 7.32 $ 7.11 The following table provides calculations of end of period “tangible common stockholders’ equity” ratios and a reconciliation of stockholders’ equity (GAAP) to tangible common stockholders’ equity (non-GAAP). Tangible common stockholders’ equity ratios have become a focus of some investors and management believes they may assist investors in analyzing the capital position of the Company absent the effects of intangible assets and preferred stock. Analysts and banking regulators have assessed Regions’ capital adequacy using the tangible common stockholders’ equity measure. Because tangible common stockholders’ equity is not formally defined by GAAP, this measure is currently considered to be a non-GAAP financial measure and other entities may calculate it differently than Regions’ disclosed calculation. Since analysts and banking regulators may assess Regions’ capital adequacy using tangible common stockholders’ equity, management believes that it is useful to provide investors the ability to assess Regions’ capital adequacy on this same basis. 3/31/2013 12/31/2012 9/30/2012 6/30/2012 $ 15,740 $ 15,499 $ 14,901 $ 14,455 474 482 - - 5,147 5,161 5,181 5,207 (189 ) (191 ) (195 ) (201 ) $ 10,308 $ 10,047 $ 9,915 $ 9,449 $ 119,718 $ 121,347 $ 121,798 $ 122,345 5,147 5,161 5,181 5,207 (189 ) (191 ) (195 ) (201 ) $ 114,760 $ 116,377 $ 116,812 $ 117,339 1,413 1,413 1,413 1,413 8.98 % 8.63 % 8.49 % 8.04 % $ 7.29 $ 7.11 $ 7.02 $ 6.69 As of and for Quarter Ended

Forward-looking statements The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors" of Regions' Annual Report on Form 10-K for the year ended December 31, 2013 and the caption “Forward-Looking Statements” of Regions’ Quarterly Report on Form 10-Q for the quarters ended March 31 and June 30, 2014, as filed with the Securities and Exchange Commission. The words “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can,” and similar expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. We assume no obligation to update or revise any forward-looking statements that are made from time to time. •Current and future economic and market conditions in the United States generally or in the communities we serve, including the effects of declines in property values, unemployment rates and potential reduction of economic growth. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations. • The effects of a possible downgrade in the U.S. government’s sovereign credit rating or outlook. • Possible changes in market interest rates. • Any impairment of our goodwill or other intangibles, or any adjustment of valuation allowances on our deferred tax assets due to adverse changes in the economic environment, declining operations of the reporting unit, or other factors. • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, loan loss provisions or actual loan losses. • Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities. • Our ability to effectively compete with other financial services companies, some of whom possess greater financial resources than we do and are subject to different regulatory standards than we are. • Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments. • Our ability to develop and gain acceptance from current and prospective customers for new products and services in a timely manner. • Changes in laws and regulations affecting our businesses, including changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self-regulatory agencies. • Our ability to obtain regulatory approval (as part of the CCAR process or otherwise) to take certain capital actions, including paying dividends and any plans to increase common stock dividends, repurchase common stock under current or future programs, or issue or redeem preferred stock or other regulatory capital instruments. • Our ability to comply with applicable capital and liquidity requirements (including the finalized Basel III capital standards), including our ability to generate capital internally or raise capital on favorable terms. • The costs and other effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our subsidiaries are a party. • Any adverse change to our ability to collect interchange fees in a profitable manner, whether such change is the result of regulation, legislation or other governmental action. • Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our business. • Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • Inability of our framework to manage risks associated with our business such as credit risk and operational risk, including third-party vendors and other service providers. • The inability of our internal disclosure controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • The effects of geopolitical instability, including wars, conflicts and terrorist attacks. •The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes and environmental damage. • Our ability to keep pace with technological changes. • Our ability to identify and address cyber-security risks such as data security breaches, “denial of service” attacks, “hacking” and identity theft. • Possible downgrades in our credit ratings or outlook. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally. • The effects of the failure of any component of our business infrastructure which is provided by a third party. • Our ability to receive dividends from our subsidiaries. • Changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or other regulatory agencies. • The effects of any damage to our reputation resulting from developments related to any of the items identified above. This presentation may include forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, which reflect Regions’ current views with respect to future events and financial performance. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward- looking statements are based on management’s expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. These risks, uncertainties and other factors include, but are not limited to, those described below: 18

19