Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CBRE GROUP, INC. | a14-20540_18k.htm |

Exhibit 99.1

|

|

September 2014 CBRE GROUP, INC. Global Market Leader in Integrated Commercial Real Estate Services |

|

|

This presentation contains statements that are forward looking within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our future growth momentum, operations, financial performance and business outlook. These statements should be considered as estimates only and actual results may differ materially from these estimates. Factors that could cause actual results to differ include general business conditions and our ability to successfully execute our strategies, compete in and increase our share of material markets, and integrate new businesses. Except to the extent required by applicable securities laws, we undertake no obligation to update or publicly revise any of the forward-looking statements that you may hear today. Please refer to our most recent quarter earnings report, filed on Form 8-K, our most recent annual report on Form 10-K and our most recent quarterly report on Form 10-Q, in particular any discussion of risk factors or forward-looking statements, which are filed with the SEC and available at the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact any estimates made. We may make certain statements during the course of this presentation, which include references to “non-GAAP financial measures,” as defined by SEC regulations. As required by these regulations, we have provided reconciliations of these measures to what we believe are the most directly comparable GAAP measures, which are attached hereto within the appendix. FORWARD-LOOKING STATEMENTS |

|

|

THE GLOBAL MARKET LEADER CBRE is the premier global provider of integrated services to commercial real estate investors and occupiers. As of December 31, 2013; includes affiliates. As of June 30, 2014. GLOBAL LEADERSHIP WITH BROAD CAPABILITIES #1 Leasing #1 Property Sales #1 Outsourcing #1 Appraisal & Valuation #1 Commercial Real Estate Investment Manager SCALE AND DIVERSITY 440+ offices in over 60 countries1 Serves approximately 85% of the Fortune 100 $223.2 billion of transaction activity in 2013 3.5 billion property and corporate facilities square feet under management1 $92.8 billion of real estate investment assets under management2 |

|

|

THE LEADING GLOBAL BRAND CBRE is recognized as the foremost commercial real estate authority. Only commercial real estate services company in the Fortune 500 Ranked #1 brand for 13 consecutive years Top real estate services and investment company in “green” rankings Global Real Estate Advisor of the Year three years in a row Highest ranked commercial real estate services and investment company for four consecutive years Ranked #3 among outsourcing companies (all industries) and ranked #1 in real estate occupier outsourcing for five consecutive years Named a World’s Most Ethical Company Only commercial real estate services company in the S&P 500 S&P 500 Fortune 500 Fortune’s Most Admired Companies The Lipsey Company International Association of Outsourcing Professionals Euromoney Newsweek Ethisphere Ranked #7 in the Barron’s 500 Barron’s 500 Forbes Global 2000 Only commercial real estate services company in the Forbes Global 2000 |

|

|

CBRE SERVES INVESTORS AND OCCUPIERS CBRE’s integrated, best-in-class offering creates value for clients at every stage of the life cycle. |

|

|

Exploit unique leadership position with globally integrated solutions and specialized expertise to widen our competitive advantage and differentiation from other firms Drive continued market share gains in core brokerage business Continue expansion of Global Corporate Services (GCS or Occupier Outsourcing) business Expand self-perform model in Europe (Norland acquisition) Capitalize on increased global mandates Further penetrate vertical markets such as healthcare Seize growth opportunities afforded by CBRE Global Investors Achieve investment performance across risk/return spectrum and geographies Leverage synergies with real estate services business Continue to develop operating platform (IT, Research, Marketing) to improve support for our professionals, enhance capabilities for clients and sustain long-term growth Continue accretive acquisitions of strong companies in our space KEY STRATEGIC PRIORITIES |

|

|

Since the beginning of 2013, CBRE has completed 19 acquisitions Acquired UK-based Norland Managed Services in December 2013 for an initial cash purchase price of approximately $434 million1,2 with approximately $629 million revenue3 10 in-fill acquisitions across the globe in 2013 with an initial aggregate purchase price of $110 million4 and annual revenues of approximately $105 million5 8 in-fill acquisitions across the globe YTD through July 2014 with an initial aggregate purchase price of $94 million4 and annual revenues of approximately $147 million5 Evaluation of acquisition candidates based on: Strategic rationale/value proposition for clients Financial metrics Cultural fit Ability to integrate Transactions generally fall into two categories: Strategic in-fill acquisitions sourced principally by lines of business Larger, transformational transactions driven by macro strategy (e.g., Norland) CBRE intends to remain active in pursuing acquisitions for the foreseeable future Continue to identify opportunities to acquire strong businesses that meet our financial criteria MERGERS & ACQUISITIONS STRATEGY See slide 26 for footnotes. |

|

|

DIVERSIFICATION From 2006 to TTM Q2 2014, contractual revenue increased 3.7x. REVENUE MIX BY BUSINESS Total Revenue: $4,0321 Total Revenue: $7,9565 See slide 26 for footnotes. Contractual Revenues include GCS and Asset Services (excludes associated sales and lease revenue, most of which is contractual), Global Investment Management, and Appraisal & Valuation. 3.7x |

|

|

Revenue ($ in millions) Contractual Revenue Sources Capital Markets Global Corporate Services and Asset Services2 Investment Management Appraisal & Valuation Leasing Sales Commercial Mortgage Services Development Services Other Total YTD Q2 2014 $ 1,762.2 $ 238.8 $ 199.3 $ 970.6 $ 602.4 $ 153.0 $ 20.9 $ 40.4 $ 3,987.6 % of YTD Q2 2014 Total 44% 6% 5% 24% 15% 4% 1% 1% 100% YTD Q2 20131 $ 1,191.9 $ 243.3 $ 194.0 $ 867.1 $ 528.2 $ 148.8 $ 25.3 $ 27.4 $ 3,226.0 Growth Rate (Change YTD Q2 2014-over-YTD Q2 2013) USD 48% -2% 3% 12% 14% 3% -17% 47% 24% Local Currency 49% -4% 4% 12% 15% 3% -17% 45% 24% YTD Q2 2014 BUSINESS LINE REVENUE Includes revenue from discontinued operations. See slide 27 for details. Global Corporate Services (GCS) and Asset Services revenue excludes all associated leasing and sales revenue, most of which is contractual. 79% of total revenue Contractual revenue plus leasing, which is largely recurring, is 79% of total revenue |

|

|

LONG-TERM GROWTH 3 4 4 See slide 26 for footnotes. ($ in millions) 4,5 4 4 2 From 2003 to 2013 total revenue has increased 4.0x and Normalized EBITDA1 has increased 5.6x. 4,6 Revenue CAGR 15% Normalized EBITDA CAGR 18% |

|

|

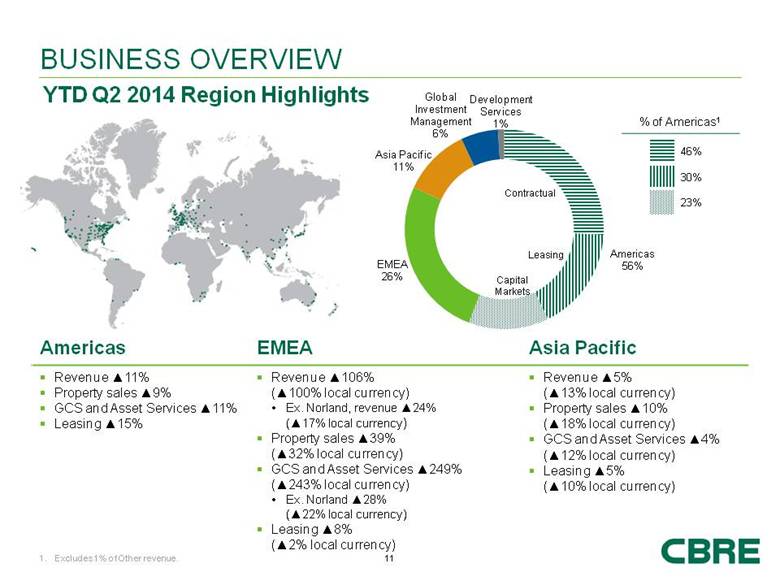

Americas EMEA Asia Pacific Revenue 11% Property sales 9% GCS and Asset Services 11% Leasing 15% Revenue 106% (100% local currency) Ex. Norland, revenue 24% (17% local currency) Property sales 39% (32% local currency) GCS and Asset Services 249% (243% local currency) Ex. Norland 28% (22% local currency) Leasing 8% (2% local currency) Revenue 5% (13% local currency) Property sales 10% (18% local currency) GCS and Asset Services 4% (12% local currency) Leasing 5% (10% local currency) YTD Q2 2014 Region Highlights BUSINESS OVERVIEW % of Americas1 46% 30% 23% Contractual Leasing Capital Markets Excludes 1% of Other revenue. |

|

|

Global Corporate Services (GCS) revenue excludes associated sales and leasing revenue, most of which is contractual. As of December 31, 2013; includes affiliates. Per International Association of Outsourcing Professionals (IAOP). New 44 Expansions 39 Renewals 27 HISTORICAL FEE REVENUE1 FULL SERVICE OFFERING YTD Q2 2014 TOTAL CONTRACTS ($ in millions) Facilities Management – 1.0 billion sq. ft. globally2 Project Management Transaction and Portfolio Services Strategic Consulting Ranked #3 outsourcing company (all industries) and ranked #1 Real Estate Outsourcing brand for five consecutive years3 GLOBAL CORPORATE SERVICES Integrated Global Solutions for Occupiers Facilities Management Transaction Services Project Management YTD Q2 REPRESENTATIVE CLIENTS |

|

|

HISTORICAL FEE REVENUE1 OVERVIEW KEY STRATEGIC ACCOUNTS ($ in millions) Asset services revenue excludes associated sales and leasing revenue, most of which is contractual. As of December 31, 2013; includes affiliates. Asset Services operates buildings for investors Highly synergistic with property leasing Manage approximately 2.5 billion sq. ft. globally2 300+ trophy assets in major CBDs (approximately 450 million sq. ft.) ASSET SERVICES Maximizing Building Operating Performance for Investors YTD Q2 |

|

|

CAPITAL RAISED1 Performance-driven global real estate investment manager More than 600 institutional clients Equity to deploy: $6.6 billion1,2 Co-Investment: $167.2 million2 3 ASSETS UNDER MANAGEMENT (AUM) OVERVIEW ($ in billions) As of 6/30/2014 See slide 26 for footnotes. ($ in billions) INVESTMENT MANAGEMENT Performance Across Risk/Return Options Globally YTD Q2 |

|

|

PREMIER CLIENTS ($ in millions) 132,000+ assignments in 2013 Up 12% from 2012 Euromoney Global Valuation Advisor of the Year Clients include lenders, life insurance companies, special servicers and REITs OVERVIEW APPRAISAL & VALUATION Serving Clients Globally HISTORICAL FEE REVENUE YTD Q2 |

|

|

As of January 1, 2014; excludes affiliates. OVERVIEW RECENT TRANSACTIONS Credit Suisse Sony King & Wood Mallesons New York, NY New York, NY Sydney, Australia 1.1M SF 500,000 SF 124,000 SF Serve occupiers and investors in formulating and executing leasing strategies Tailored service delivery by property type and industry/market specialization Strategic insight and high-level execution driving significant market share gains Approximately 4,3501 leasing professionals worldwide #1 global market position – $83.1 billion lease transactions in 2013 Office: $56.2 billion Industrial: $10.5 billion Retail: $15.1 billion Other: $ 1.3 billion LEASING Strategic Advisory and Execution ($ in millions) HISTORICAL FEE REVENUE YTD Q2 |

|

|

Hong Kong Sydney, Australia New Jersey, USA Citigroup Mirvac KBS REIT III $700 Million $427 Million $109 Million Property Acquisition Property Sale (50% interest) Property Sale As of January 1, 2014; excludes affiliates. RECENT TRANSACTIONS Represent investors (sellers and buyers) in commercial real estate #1 global market share in 2013, per Real Capital Analytics 650 basis point advantage over #2 firm in 2013 180 basis point increase from 2012 Approximately 1,6251 investment sales specialists worldwide #1 global market position – $140.1 billion sales transactions in 2013 Office: $59.9 billion Industrial: $19.0 billion Retail: $21.6 billion Multi-family: $26.3 billion Other: $13.3 billion OVERVIEW HISTORICAL FEE REVENUE PROPERTY SALES Insight and Execution Across Markets & Property Types ($ in millions) YTD Q2 |

|

|

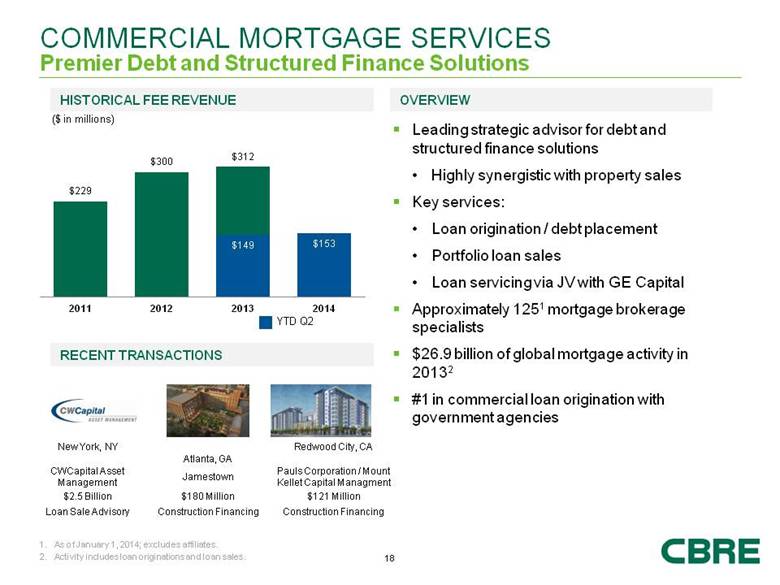

New York, NY Atlanta, GA Redwood City, CA CWCapital Asset Management Jamestown Pauls Corporation / Mount Kellet Capital Managment $2.5 Billion $180 Million $121 Million Loan Sale Advisory Construction Financing Construction Financing As of January 1, 2014; excludes affiliates. Activity includes loan originations and loan sales. RECENT TRANSACTIONS Leading strategic advisor for debt and structured finance solutions Highly synergistic with property sales Key services: Loan origination / debt placement Portfolio loan sales Loan servicing via JV with GE Capital Approximately 1251 mortgage brokerage specialists $26.9 billion of global mortgage activity in 20132 #1 in commercial loan origination with government agencies OVERVIEW HISTORICAL FEE REVENUE COMMERCIAL MORTGAGE SERVICES Premier Debt and Structured Finance Solutions ($ in millions) YTD Q2 |

|

|

Hess Tower Knox Logistics Center Denver Union Station Shops at Dakota Crossing Houston, TX Office Riverside, CA Industrial Denver, CO Mixed-Use Washington, DC Retail 2 PROJECTS IN PROCESS/PIPELINE1 OVERVIEW RECENT PROJECTS Merchant builder business model Premier brand in U.S. development 65+ year record of excellence Partner with leading institutional capital sources $96.0 million of co-investment at the end of Q2 2014 $13.0 million of recourse debt to CBRE and repayment guarantees at the end of Q2 2014 DEVELOPMENT SERVICES Pre-eminent Merchant Builder Brand in U.S. ($ in billions) 3 See slide 26 for footnotes. |

|

|

We are pleased with how 2014 is unfolding Mixed macro global environment but signs of improvement in U.S. and Europe For first half 2014: Property sales in line with expectations for full-year double-digit growth Property leasing pacing ahead of full-year expectations Occupier outsourcing (GCS) should continue its strong growth rate GSE mortgage originations now expected to be down modestly for full-year U.S. valuation & appraisal services expected to be down for 2014 Our principal businesses, Investment Management and Development Services, remain on track with some upside Raised full-year adjusted EPS guidance to $1.60 to $1.651 Upside driven by transactional activity anticipated entirely in Q4 2014 Expectations BUSINESS OUTLOOK See slide 26 for footnotes. |

|

|

Premier global provider of integrated services to real estate investors and occupiers Global leadership and scale The leading global brand with a balanced and diversified business mix Known for delivering high-quality solutions that create value for clients CBRE has significantly evolved its business profile Revenue from contractual sources has increased 3.7x from 2006 to TTM Q2 20141 Contractual revenues and Leasing, which is largely recurring, represented 79% of total revenue YTD Q2 2014 Acquisitions have strengthened CBRE’s service offering and increased contractual revenue Track record of long-term growth Revenue has increased 4.0x from 2003 to 2013 Normalized EBITDA has increased 5.6x from 2003 to 2013 CBRE intends to remain active in pursuing acquisitions for the foreseeable future Continue to identify opportunities to acquire strong businesses that meet our financial criteria Highly focused on extending competitive advantage with globally integrated solutions and a unique product line and geographic footprint that others find difficult to match KEY TAKEAWAYS See slide 27 for footnote. |

|

|

APPENDIX |

|

|

As of June 30, 2014 MANDATORY AMORTIZATION AND MATURITY SCHEDULE ($ in millions) $1,200.0 million revolver facility matures in March 2018. As of June 30, 2014, the outstanding revolver balance was $336.0 million. 1 Global Cash Available Revolver 1,187 20 40 68 255 416 2 352 198 800 - 250.0 500.0 750.0 1,000.0 1,250.0 1,500.0 Q2 2014 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Current Liquidity Term Loan A Term Loan B Revolver Sr. Unsecured Notes - 6.625% Sr. Unsecured Notes - 5.00% |

|

|

CAPITALIZATION Excludes $47.2 million of cash in consolidated funds and other entities not available for Company use at June 30, 2014. Represents notes payable on real estate in Development Services that are recourse to the Company. Excludes non-recourse notes payable on real estate of $85.8 million at June 30, 2014. Excludes $731.5 million of aggregate warehouse facilities outstanding at June 30, 2014. Calculation includes EBITDA from discontinued operations. See slide 27 for details. Cash 1 $ 334.7 Revolving credit facility 336.0 Senior secured term loan A 453.1 Senior secured term loan B 212.3 Senior unsecured notes 5.0% 800.0 Senior unsecured notes 6.625% 350.0 Notes payable on real estate 2 4.0 Other debt 3 10.7 Total debt $ 2,166.1 Stockholders’ equity 2,132.8 Total capitalization 4,298.9 Total net debt $ 1,831.4 Net debt to TTM Normalized EBITDA 4 1.70x As of June 30, 2014 ($ in millions) |

|

|

Twelve Months Ended December 31, ($ in millions) TTM Q2 2014 2013 2012 2011 2010 2009 Normalized EBITDA 1 $ 1,079.5 $ 1,022.3 $ 918.4 $ 802.6 $ 681.3 $ 453.9 Adjustments: Cost containment expenses 17.6 17.6 17.6 31.1 15.3 43.6 Integration and other costs related to acquisitions 11.1 12.6 39.2 68.8 7.2 5.7 Carried interest incentive compensation 2 10.8 9.2 - - - - Write-down of impaired assets - - - 9.4 11.3 32.5 EBITDA1 1,040.0 982.9 861.6 693.3 647.5 372.1 Add: Interest Income 3 5.5 6.3 7.6 9.4 8.4 6.1 Less: Depreciation and amortization 3 228.9 191.3 170.9 116.9 109.0 99.5 Non-amortizable intangible asset impairment 98.1 98.1 19.8 - - - Interest expense 3 111.8 138.4 176.6 153.5 192.7 189.1 Write-off of financing costs - 56.3 - - 18.1 29.3 Provision for income taxes 3 224.4 188.6 186.3 193.1 135.8 27.0 Net Income attributable to CBRE Group, Inc. 3 $ 382.3 $ 316.5 $ 315.6 $ 239.2 $ 200.3 $ 33.3 RECONCILIATION OF NORMALIZED EBITDA TO EBITDA TO NET INCOME Includes discontinued operations. See slide 27 for details. Carried interest incentive compensation is related to funds that began recording carried interest expense in Q2 2013 and beyond. Includes immaterial amount of discontinued operations. |

|

|

FOOTNOTES Slide 10 Normalized EBITDA excludes merger-related and other non-recurring charges, gains/losses on trading securities acquired in the Trammell Crow Company acquisition, cost containment expenses, one-time IPO-related compensation expense, integration and other costs related to acquisitions, certain carried interest expense to better match with carried interest revenue realization and the write-down of impaired assets. Includes Insignia activity for the period July 23, 2003 through December 31, 2003. Includes Trammell Crow Company activity for the period December 20, 2006 through December 31, 2006. See discontinued operations discussion on slide 27. Includes CRES, ING REIM Asia and ING REIM Europe beginning July 1, October 3 and October 31, 2011, respectively. Includes Norland Managed Services beginning January 1, 2014. Slide 8 Includes Trammell Crow Company for the period December 20, 2006 through December 31, 2006. Other includes Development Services (1% in both 2006 and TTM Q2 2014) and Other (1% in both 2006 and TTM Q2 2014). Capital Markets includes Sales (31% in 2006 and 17% in TTM Q2 2014) and Commercial Mortgage Services (3% in 2006 and 4% TTM Q2 2014). Contractual Revenues include GCS and Asset Services (14% in 2006 and 38% in TTM Q2 2014; excludes associated sales and lease revenues, most of which are contractual), Global Investment Management (6% in 2006 and 7% in TTM Q2 2014), and Appraisal & Valuation (7% in 2006 and 5% in TTM Q2 2014). See discontinued operations discussion on slide 27. Slide 14 Excludes global securities business. As of June 30, 2014. Includes CRES, ING REIM Asia and ING REIM Europe beginning July 1, October 3 and October 31, 2011, respectively. Slide 20 We have not reconciled the non-GAAP EPS guidance to the most directly comparable GAAP measure because this cannot be done without unreasonable effort. Slide 19 As of December 31 for each year presented. In Process figures include Long-Term Operating Assets (LTOA) of $0.3 billion for Q2 14, $0.9 billion for Q4 13, $1.2 billion for Q4 12 and $1.5 billion for Q4 11. LTOA are projects that have achieved a stabilized level of occupancy or have been held 18-24 months following shell completion or acquisition. Pipeline deals are those projects we are pursuing which we believe have a greater than 50% chance of closing or where land has been acquired and the projected construction start is more than twelve months out. Slide 7 Excludes deal costs, deferred consideration and / or earnouts. As of July 31, 2014 we have paid $40 million of deferred consideration for Norland. Acquisition also includes 362,916 shares of common stock issued to Norland senior management, the value of which is not included in this figure. For fiscal year ended April 5, 2013. Excludes deal costs, deferred consideration and / or earnouts. Annual revenue approximations are based on revenues at the time of purchase. |

|

|

DISCONTINUED OPERATIONS Discontinued Operations (Slides 8, 9, 10, 21, 24 and 25) Under GAAP, the Company has historically classified most of its gains on dispositions of consolidated real estate as income from discontinued operations rather than as revenue and earnings from continuing operations. The Company’s Development Services segment, and occasionally its Global Investment Management segment, are engaged in developing and selling real estate projects in the normal course of business. Management believes that the characterization of these gains as income from discontinued operations may create the inaccurate impression that the Company is exiting this business. Effective January 1, 2014, CBRE adopted new GAAP accounting standards that no longer require us to report dispositions of real estate as income from discontinued operations. Revenue from discontinued operations totaled: $1.3 million for the year ended December 31, 2008, $3.9 million for the year ended December 31, 2010, $6.7 million for the year ended December 31, 2011, $5.7 million for the year ended December 31, 2012, $9.4 million for the year ended December 31, 2013 and $0.5 million for the twelve months ended June 30, 2014. EBITDA related to discontinued operations totaled: $16.9 million for the year ended December 31, 2008, $16.4 million for the year ended December 31, 2010, $14.1 million for the year ended December 31, 2011, $5.6 million for the year ended December 31, 2012, $7.9 million for the year ended December 31, 2013 and $0.5 million for the twelve months ended June 30, 2014. |