Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ZOGENIX, INC. | a8kzgnxmsinvestorpresentat.htm |

Overview September 2014 NASDAQ:

2 Forward Looking Statement Zogenix cautions you that statements included in this presentation that are not a description of historical facts are forward-looking statements. Words such as "believes," "anticipates," "plans," "expects," "indicates," "will," "intends," "potential," "suggests," "assuming," "designed" and similar expressions are intended to identify forward-looking statements. These statements are based on the company's current beliefs and expectations. These forward-looking statements include statements regarding: the market potential for Zogenix’s products and product candidates, and its ability to compete within those markets; the expected timing of various activities for Zogenix’s product pipeline; the potential to develop abuse deterrent formulations of Zohydro ER and extend its intellectual property protection; and financial guidance for 2014. The inclusion of forward-looking statements should not be regarded as a representation by Zogenix that any of its plans will be achieved. Actual results may differ from those set forth in this presentation due to the risks and uncertainties inherent in Zogenix's business, including, without limitation: Zogenix's ability to achieve broad market acceptance and generate revenues from sales of Zohydro ER; Zogenix’s ability to successfully execute its sales and marketing strategy for Zohydro ER; inadequate therapeutic efficacy or unexpected adverse side effects relating to Zohydro ER that could prevent its ongoing commercialization, or that could result in recalls or product liability claims; risks and uncertainties associated with the development and regulatory approval of an abuse deterrent formulation of Zohydro ER and Zogenix’s reliance on its collaborators in such development efforts; the ability of Zogenix and its licensors to obtain, maintain and successfully enforce adequate patent and other intellectual property protection of its products and product candidates and the ability to operate its business without infringing the intellectual property rights of others; difficulties in identifying, negotiating and carrying out strategic transactions relating to Zohydro ER, DosePro Needle-Free Delivery Platform and Relday; the inherent risks of clinical development of Relday, including potential delays in enrollment and completion of clinical trials; Zogenix's dependence on its existing collaboration with DURECT Corporation and potential new partners to develop Relday; the market potential for Zogenix’s product candidates, and its ability to compete within those markets; and other risks described in Zogenix's filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and Zogenix undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof, except as required by law. All forward-looking statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

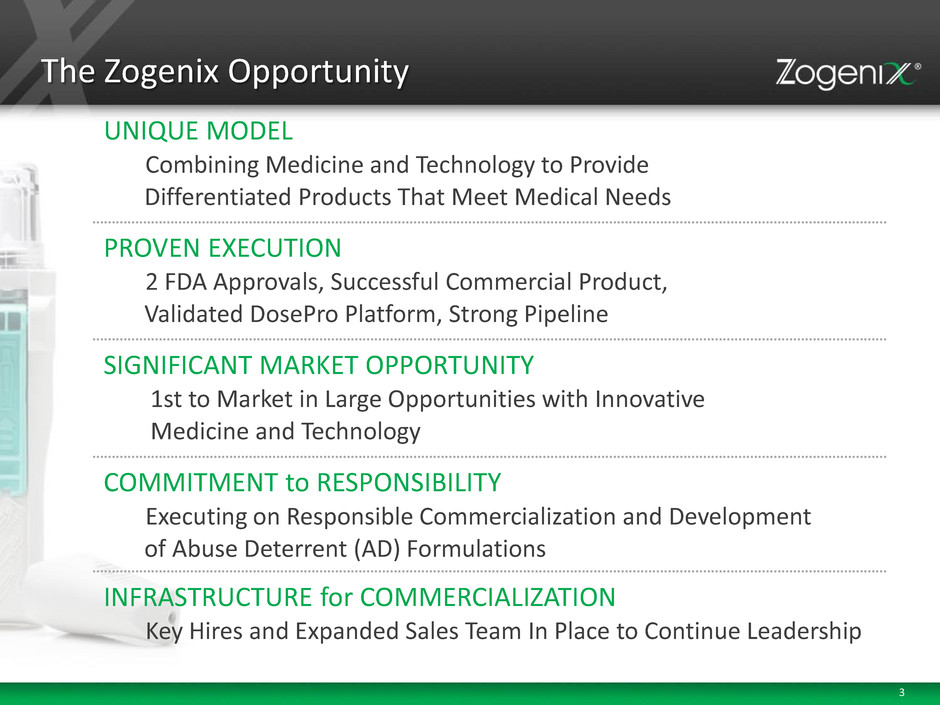

3 The Zogenix Opportunity UNIQUE MODEL Combining Medicine and Technology to Provide Differentiated Products That Meet Medical Needs PROVEN EXECUTION 2 FDA Approvals, Successful Commercial Product, Validated DosePro Platform, Strong Pipeline SIGNIFICANT MARKET OPPORTUNITY 1st to Market in Large Opportunities with Innovative Medicine and Technology INFRASTRUCTURE for COMMERCIALIZATION Key Hires and Expanded Sales Team In Place to Continue Leadership COMMITMENT to RESPONSIBILITY Executing on Responsible Commercialization and Development of Abuse Deterrent (AD) Formulations

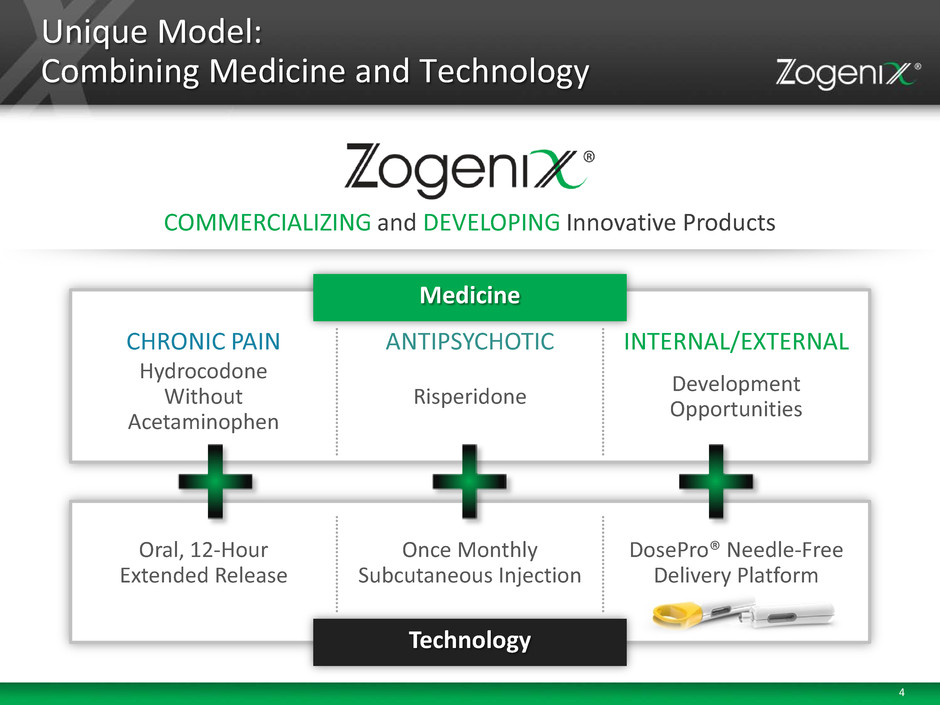

4 Oral, 12-Hour Extended Release Once Monthly Subcutaneous Injection DosePro® Needle-Free Delivery Platform Unique Model: Combining Medicine and Technology COMMERCIALIZING and DEVELOPING Innovative Products CHRONIC PAIN ANTIPSYCHOTIC INTERNAL/EXTERNAL Hydrocodone Without Acetaminophen Risperidone Development Opportunities Medicine Technology

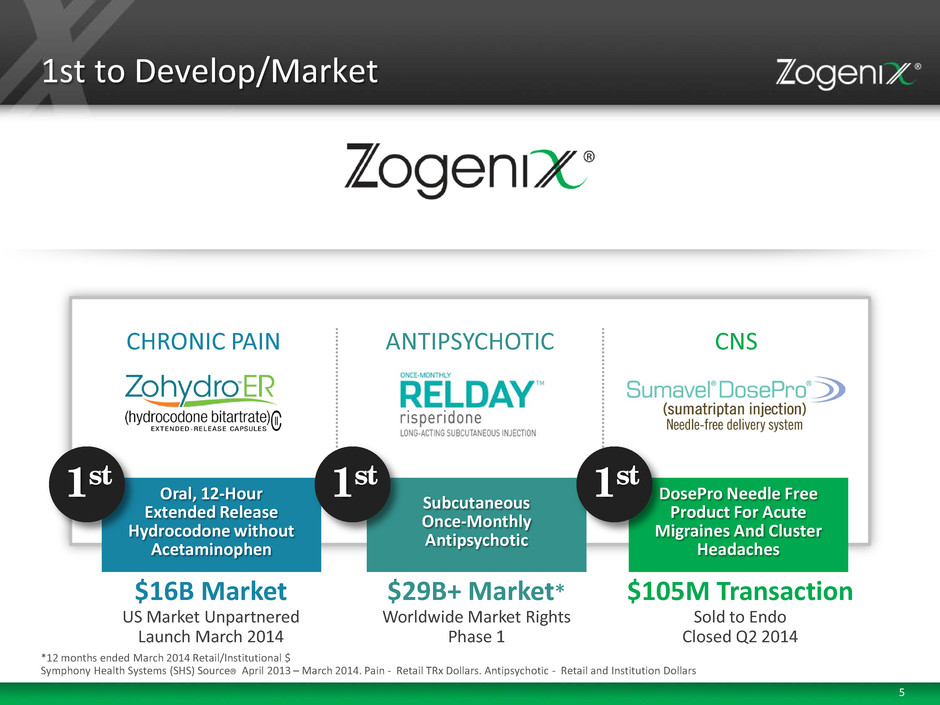

5 CHRONIC PAIN ANTIPSYCHOTIC CNS 1st to Develop/Market Oral, 12-Hour Extended Release Hydrocodone without Acetaminophen 1st $16B Market US Market Unpartnered Launch March 2014 Subcutaneous Once-Monthly Antipsychotic 1st $29B+ Market* Worldwide Market Rights Phase 1 *12 months ended March 2014 Retail/Institutional $ Symphony Health Systems (SHS) Source® April 2013 – March 2014. Pain - Retail TRx Dollars. Antipsychotic - Retail and Institution Dollars DosePro Needle Free Product For Acute Migraines And Cluster Headaches 1st $105M Transaction Sold to Endo Closed Q2 2014

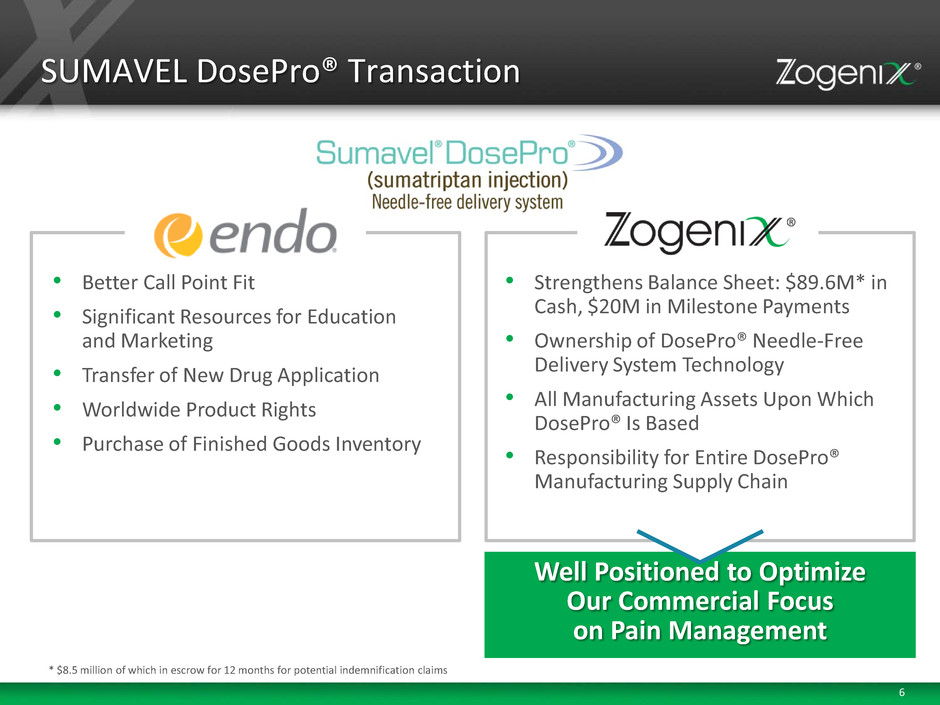

6 SUMAVEL DosePro® Transaction • Better Call Point Fit • Significant Resources for Education and Marketing • Transfer of New Drug Application • Worldwide Product Rights • Purchase of Finished Goods Inventory • Strengthens Balance Sheet: $89.6M* in Cash, $20M in Milestone Payments • Ownership of DosePro® Needle-Free Delivery System Technology • All Manufacturing Assets Upon Which DosePro® Is Based • Responsibility for Entire DosePro® Manufacturing Supply Chain Well Positioned to Optimize Our Commercial Focus on Pain Management * $8.5 million of which in escrow for 12 months for potential indemnification claims

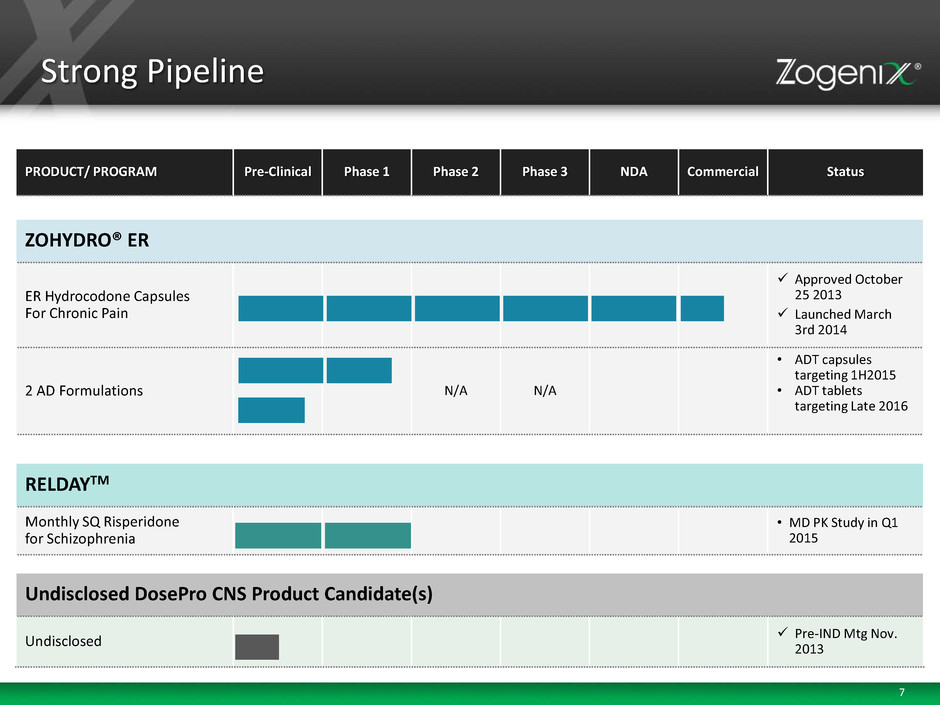

7 Strong Pipeline PRODUCT/ PROGRAM Pre-Clinical Phase 1 Phase 2 Phase 3 NDA Commercial Status ZOHYDRO® ER ER Hydrocodone Capsules For Chronic Pain Approved October 25 2013 Launched March 3rd 2014 2 AD Formulations N/A N/A • ADT capsules targeting 1H2015 • ADT tablets targeting Late 2016 RELDAYTM Monthly SQ Risperidone for Schizophrenia • MD PK Study in Q1 2015 Undisclosed DosePro CNS Product Candidate(s) Undisclosed Pre-IND Mtg Nov. 2013

8 Oral, Extended Release Hydrocodone Acetaminophen-Free Hydrocodone Product FDA Approved October 2013 Launched March 2014 1st 1st

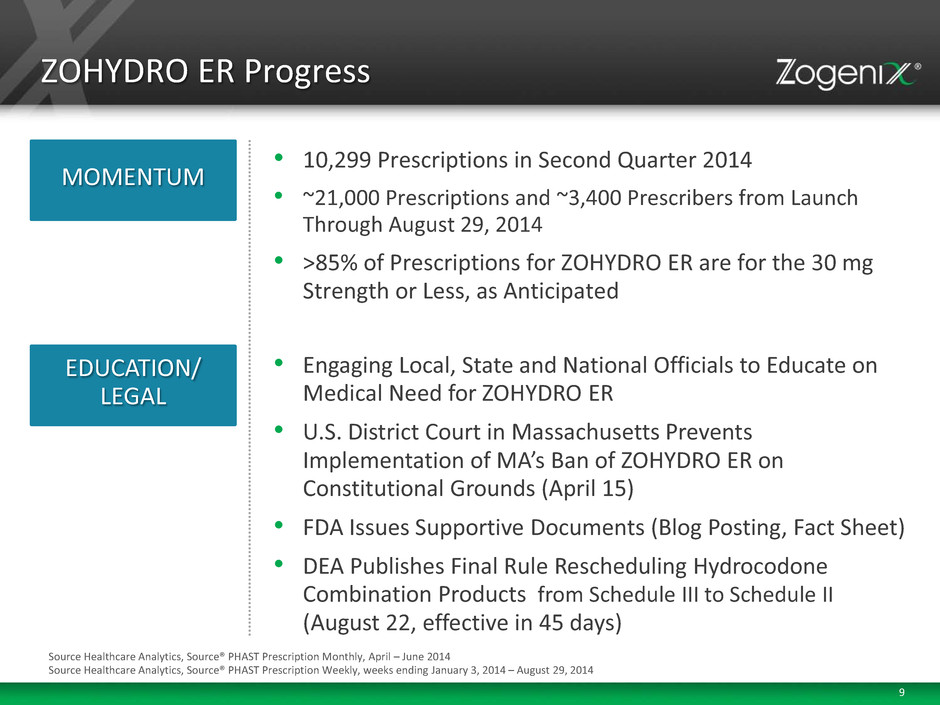

9 ZOHYDRO ER Progress • 10,299 Prescriptions in Second Quarter 2014 • ~21,000 Prescriptions and ~3,400 Prescribers from Launch Through August 29, 2014 • >85% of Prescriptions for ZOHYDRO ER are for the 30 mg Strength or Less, as Anticipated MOMENTUM EDUCATION/ LEGAL • Engaging Local, State and National Officials to Educate on Medical Need for ZOHYDRO ER • U.S. District Court in Massachusetts Prevents Implementation of MA’s Ban of ZOHYDRO ER on Constitutional Grounds (April 15) • FDA Issues Supportive Documents (Blog Posting, Fact Sheet) • DEA Publishes Final Rule Rescheduling Hydrocodone Combination Products from Schedule III to Schedule II (August 22, effective in 45 days) Source Healthcare Analytics, Source® PHAST Prescription Monthly, April – June 2014 Source Healthcare Analytics, Source® PHAST Prescription Weekly, weeks ending January 3, 2014 – August 29, 2014

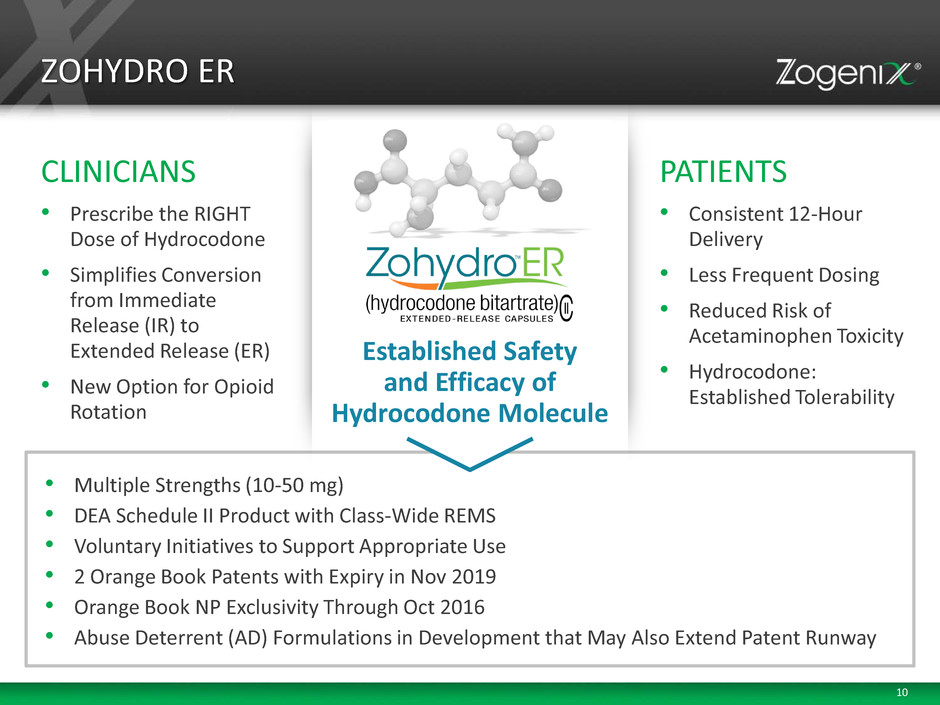

10 • Multiple Strengths (10-50 mg) • DEA Schedule II Product with Class-Wide REMS • Voluntary Initiatives to Support Appropriate Use • 2 Orange Book Patents with Expiry in Nov 2019 • Orange Book NP Exclusivity Through Oct 2016 • Abuse Deterrent (AD) Formulations in Development that May Also Extend Patent Runway CLINICIANS • Prescribe the RIGHT Dose of Hydrocodone • Simplifies Conversion from Immediate Release (IR) to Extended Release (ER) • New Option for Opioid Rotation PATIENTS • Consistent 12-Hour Delivery • Less Frequent Dosing • Reduced Risk of Acetaminophen Toxicity • Hydrocodone: Established Tolerability ZOHYDRO ER Established Safety and Efficacy of Hydrocodone Molecule

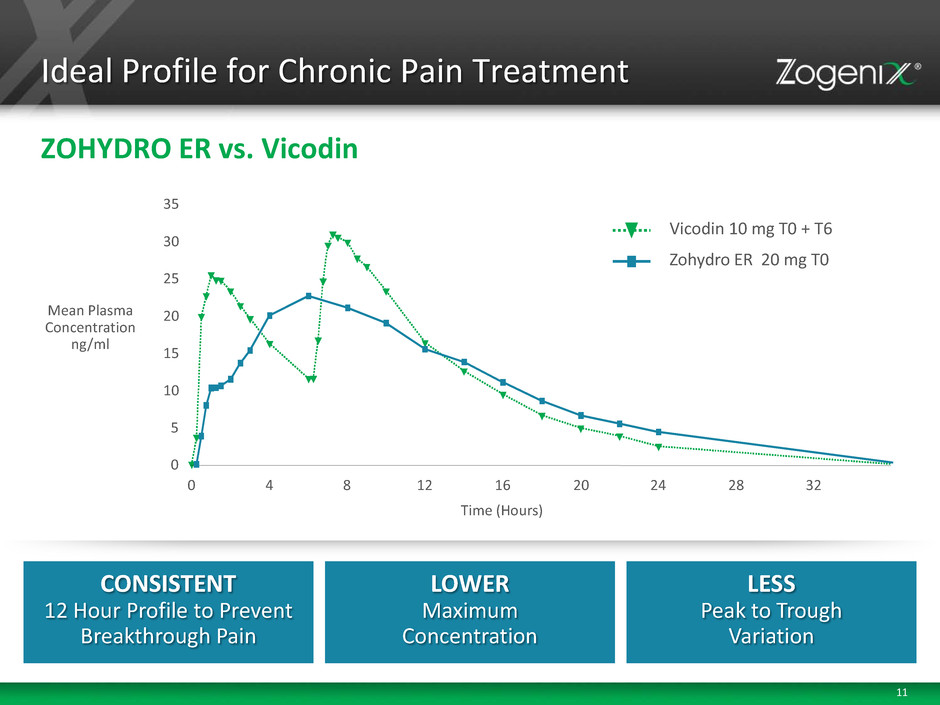

11 Ideal Profile for Chronic Pain Treatment ZOHYDRO ER vs. Vicodin CONSISTENT 12 Hour Profile to Prevent Breakthrough Pain LOWER Maximum Concentration LESS Peak to Trough Variation Mean Plasma Concentration ng/ml 0 5 10 15 20 25 30 35 0 4 8 12 16 20 24 28 32 Time (Hours) Zohydro ER 20 mg T0 Vicodin 10 mg T0 + T6

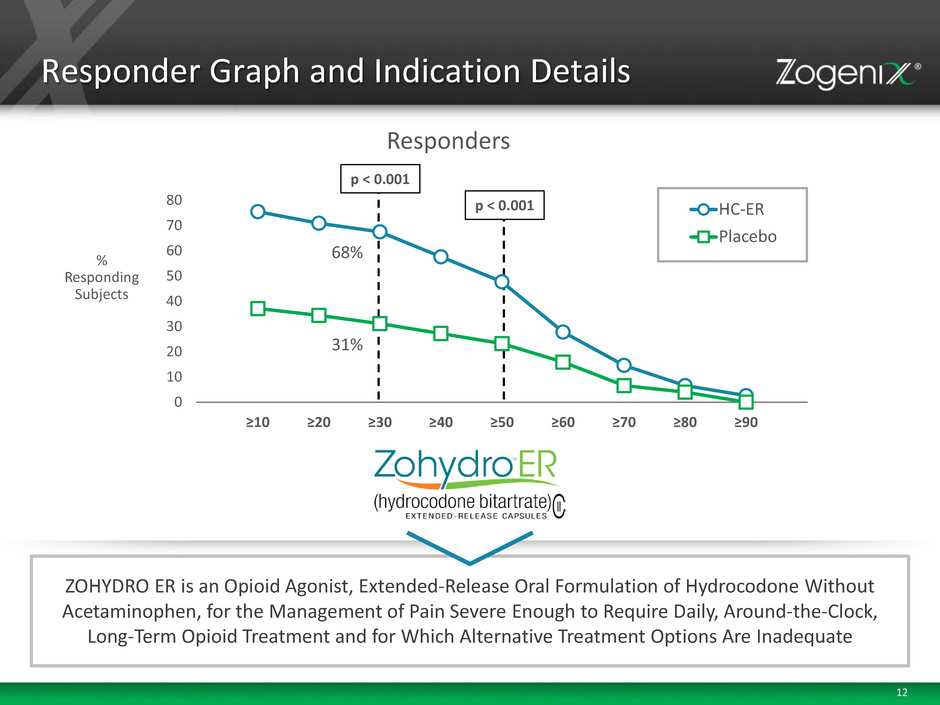

12 p < 0.001 p < 0.001 68% 31% 0 10 20 30 40 50 60 70 80 ≥10 ≥20 ≥30 ≥40 ≥50 ≥60 ≥70 ≥80 ≥90 HC-ER Placebo ZOHYDRO ER is an Opioid Agonist, Extended-Release Oral Formulation of Hydrocodone Without Acetaminophen, for the Management of Pain Severe Enough to Require Daily, Around-the-Clock, Long-Term Opioid Treatment and for Which Alternative Treatment Options Are Inadequate Responder Graph and Indication Details % Responding Subjects Responders

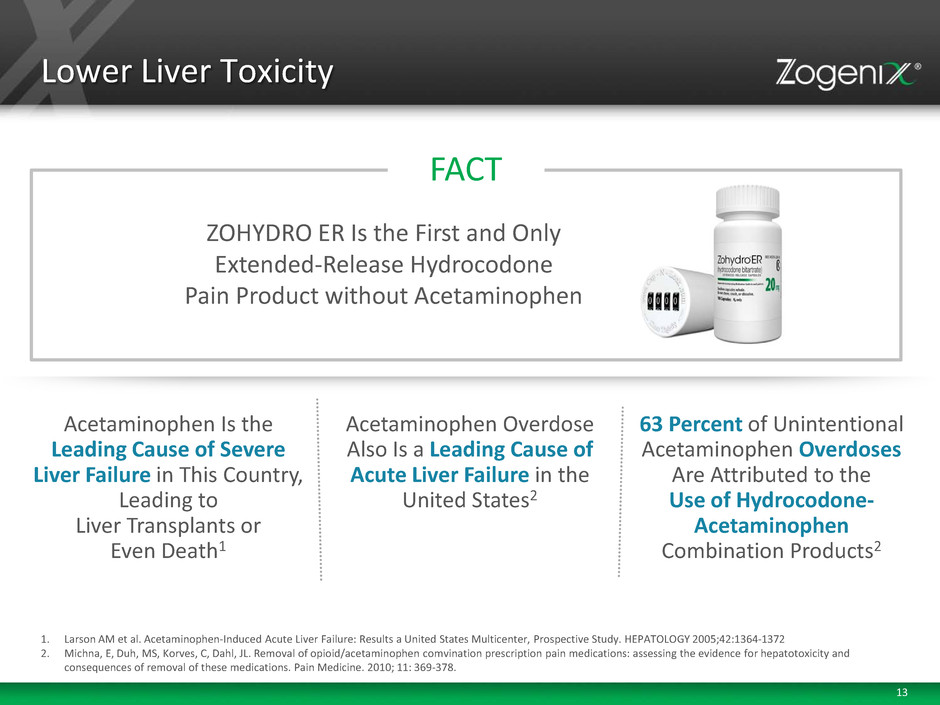

13 Lower Liver Toxicity 1. Larson AM et al. Acetaminophen-Induced Acute Liver Failure: Results a United States Multicenter, Prospective Study. HEPATOLOGY 2005;42:1364-1372 2. Michna, E, Duh, MS, Korves, C, Dahl, JL. Removal of opioid/acetaminophen comvination prescription pain medications: assessing the evidence for hepatotoxicity and consequences of removal of these medications. Pain Medicine. 2010; 11: 369-378. Acetaminophen Is the Leading Cause of Severe Liver Failure in This Country, Leading to Liver Transplants or Even Death1 63 Percent of Unintentional Acetaminophen Overdoses Are Attributed to the Use of Hydrocodone- Acetaminophen Combination Products2 Acetaminophen Overdose Also Is a Leading Cause of Acute Liver Failure in the United States2 FACT ZOHYDRO ER Is the First and Only Extended-Release Hydrocodone Pain Product without Acetaminophen

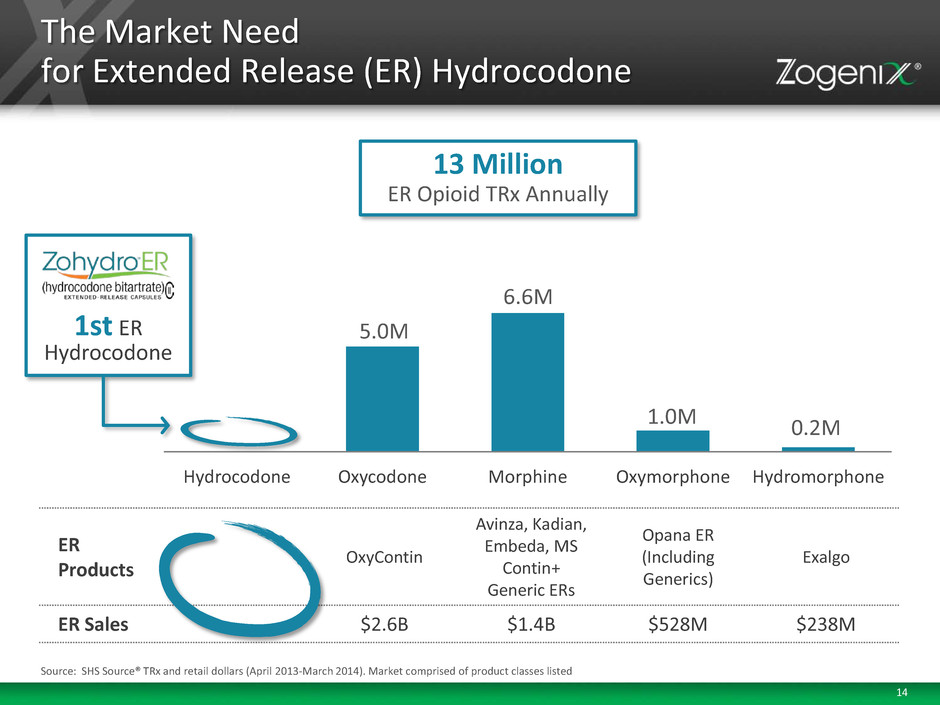

14 13 Million ER Opioid TRx Annually The Market Need for Extended Release (ER) Hydrocodone Hydrocodone Oxycodone Morphine Oxymorphone Hydromorphone 5.0M 6.6M 1.0M 0.2M ER Products OxyContin Avinza, Kadian, Embeda, MS Contin+ Generic ERs Opana ER (Including Generics) Exalgo ER Sales $2.6B $1.4B $528M $238M 1st ER Hydrocodone Source: SHS Source® TRx and retail dollars (April 2013-March 2014). Market comprised of product classes listed

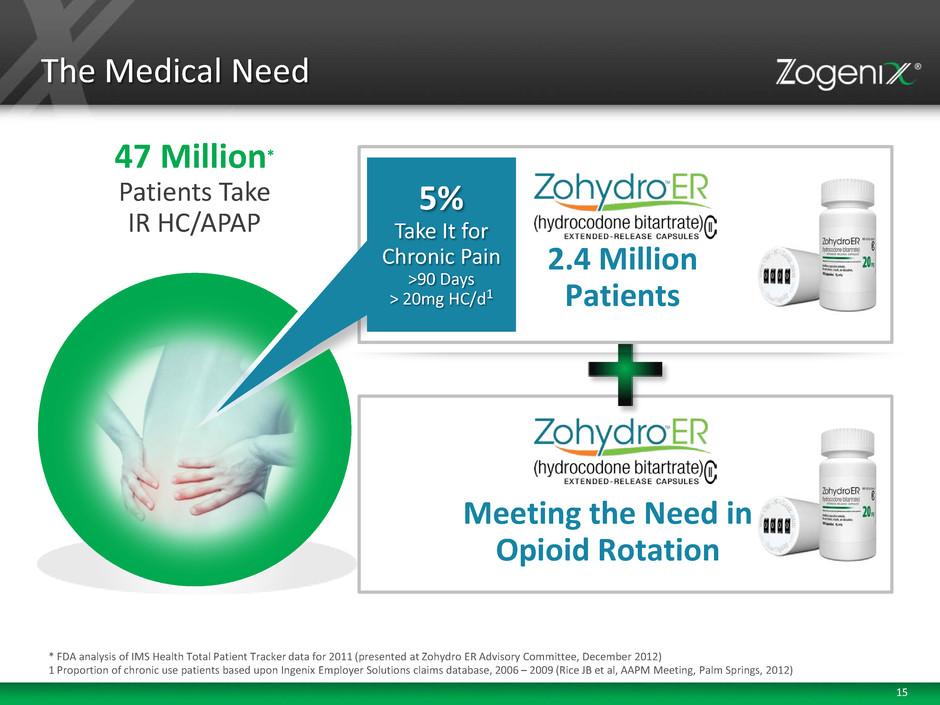

15 The Medical Need 47 Million* Patients Take IR HC/APAP Meeting the Need in Opioid Rotation * FDA analysis of IMS Health Total Patient Tracker data for 2011 (presented at Zohydro ER Advisory Committee, December 2012) 1 Proportion of chronic use patients based upon Ingenix Employer Solutions claims database, 2006 – 2009 (Rice JB et al, AAPM Meeting, Palm Springs, 2012) 2.4 Million Patients 5% Take It for Chronic Pain >90 Days > 20mg HC/d1

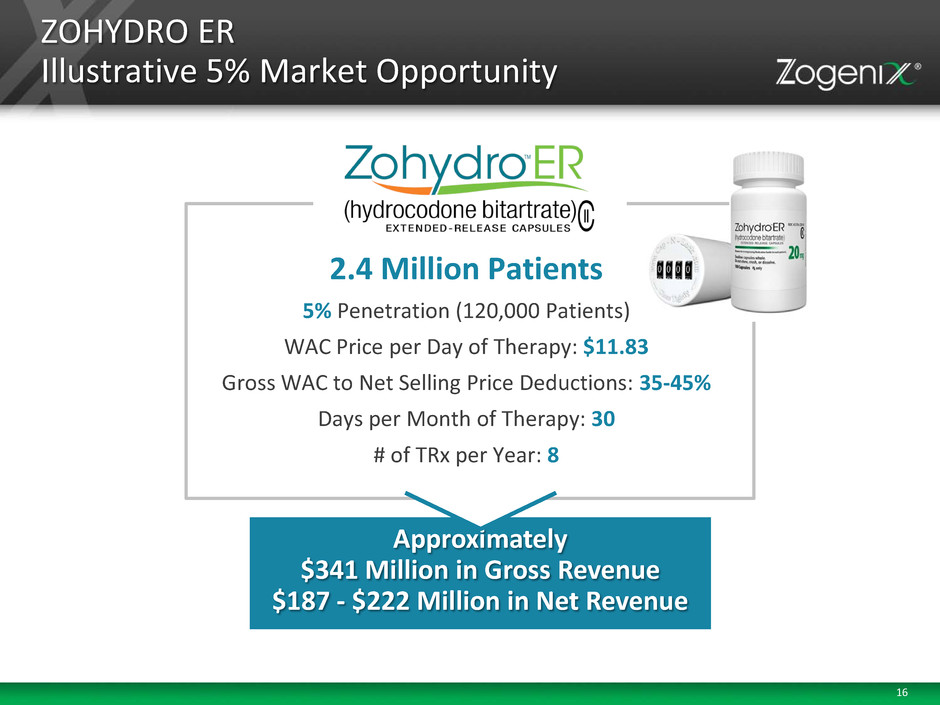

16 2.4 Million Patients 5% Penetration (120,000 Patients) WAC Price per Day of Therapy: $11.83 Gross WAC to Net Selling Price Deductions: 35-45% Days per Month of Therapy: 30 # of TRx per Year: 8 ZOHYDRO ER Illustrative 5% Market Opportunity Approximately $341 Million in Gross Revenue $187 - $222 Million in Net Revenue

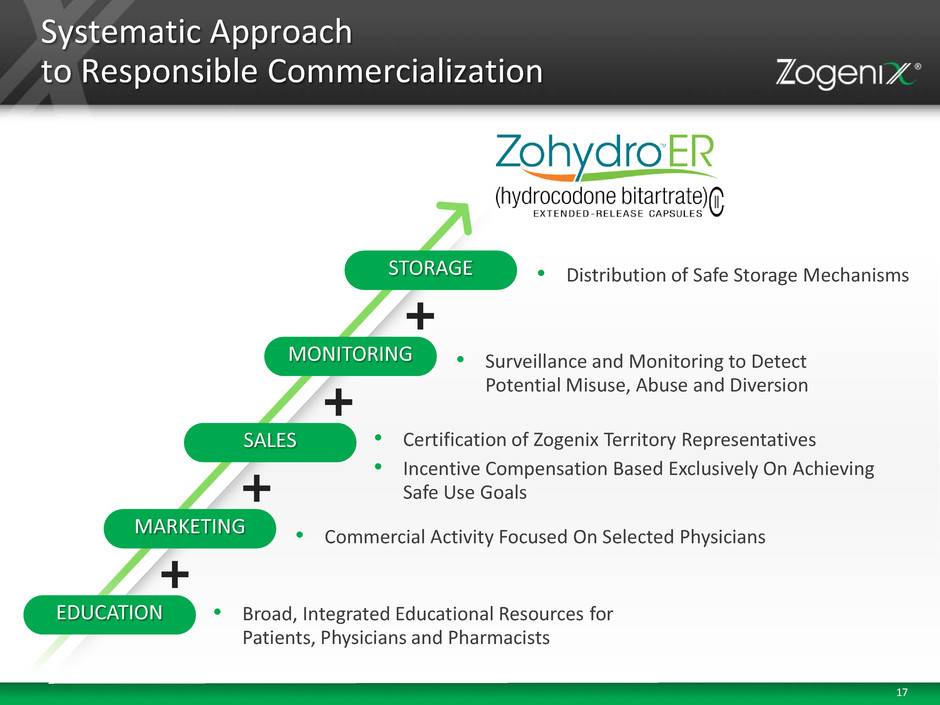

17 Systematic Approach to Responsible Commercialization • Broad, Integrated Educational Resources for Patients, Physicians and Pharmacists EDUCATION • Commercial Activity Focused On Selected Physicians MARKETING • Certification of Zogenix Territory Representatives • Incentive Compensation Based Exclusively On Achieving Safe Use Goals SALES • Surveillance and Monitoring to Detect Potential Misuse, Abuse and Diversion MONITORING • Distribution of Safe Storage Mechanisms STORAGE

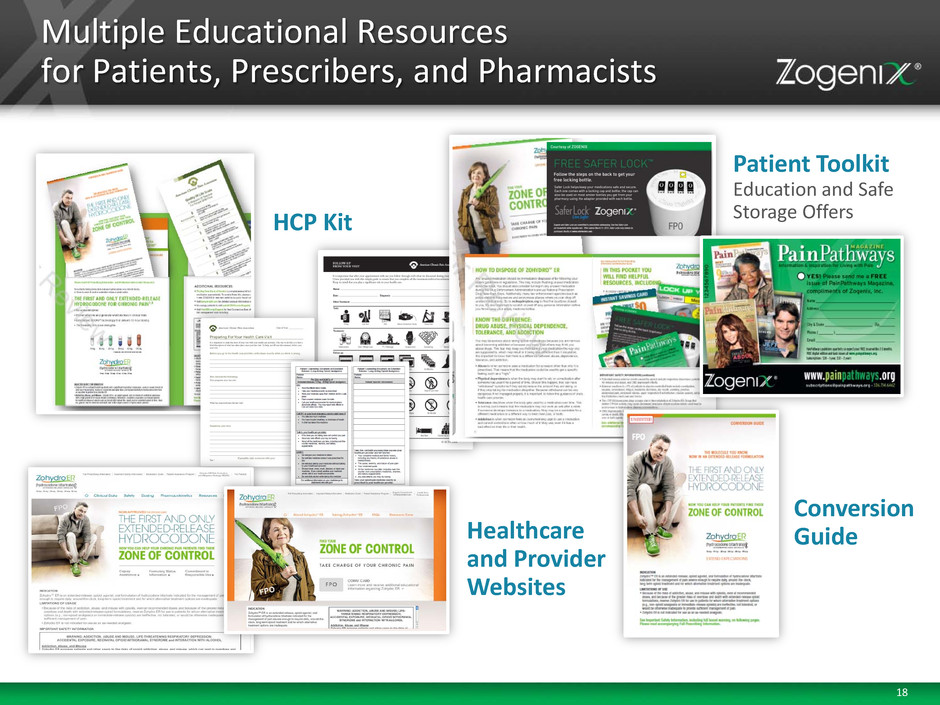

18 Multiple Educational Resources for Patients, Prescribers, and Pharmacists HCP Kit Patient Toolkit Education and Safe Storage Offers Conversion Guide Healthcare and Provider Websites

19 Successful Execution: ZOHYDRO ER Targeting a Significant Footprint 20,000 High Decile ER/LA Opioid Prescribers (Top 6 Deciles) of ER Opioid Market 60% Commercial Organization of 190 Employees FOCUS COMMITMENT COMPLIANCE CONTROL Responsibly Building Adoption for Long-Term Success

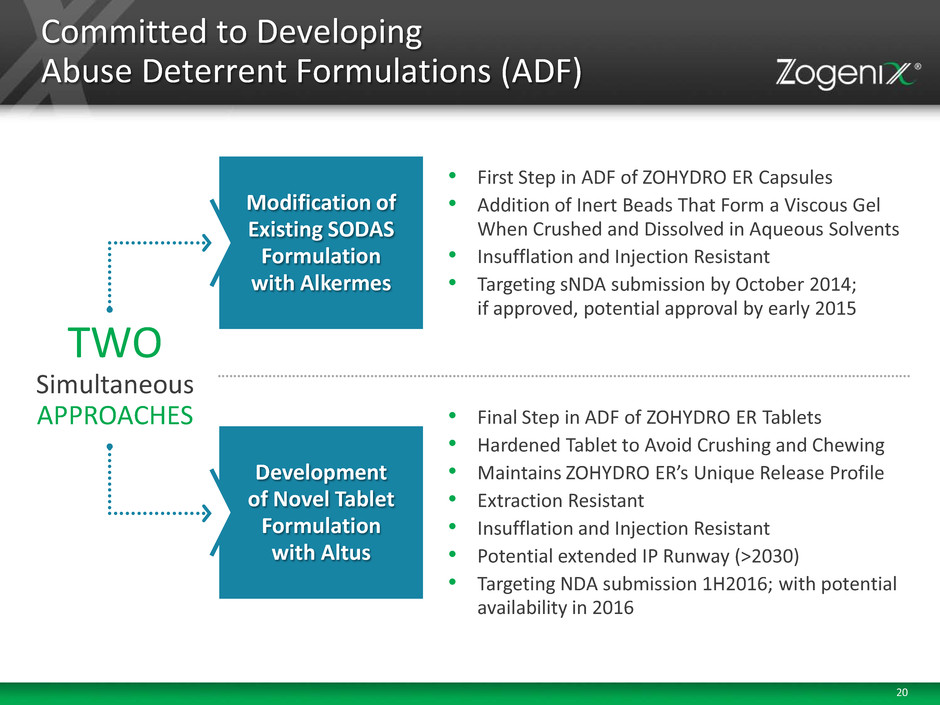

20 Modification of Existing SODAS Formulation with Alkermes • First Step in ADF of ZOHYDRO ER Capsules • Addition of Inert Beads That Form a Viscous Gel When Crushed and Dissolved in Aqueous Solvents • Insufflation and Injection Resistant • Targeting sNDA submission by October 2014; if approved, potential approval by early 2015 Development of Novel Tablet Formulation with Altus • Final Step in ADF of ZOHYDRO ER Tablets • Hardened Tablet to Avoid Crushing and Chewing • Maintains ZOHYDRO ER’s Unique Release Profile • Extraction Resistant • Insufflation and Injection Resistant • Potential extended IP Runway (>2030) • Targeting NDA submission 1H2016; with potential availability in 2016 Committed to Developing Abuse Deterrent Formulations (ADF) TWO Simultaneous APPROACHES

21 Once-Monthly Risperidone With A Unique PK Profile, Available as a Subcutaneous Injection for Treatment of Schizophrenia 1st Phase 1 Proof of Concept Established

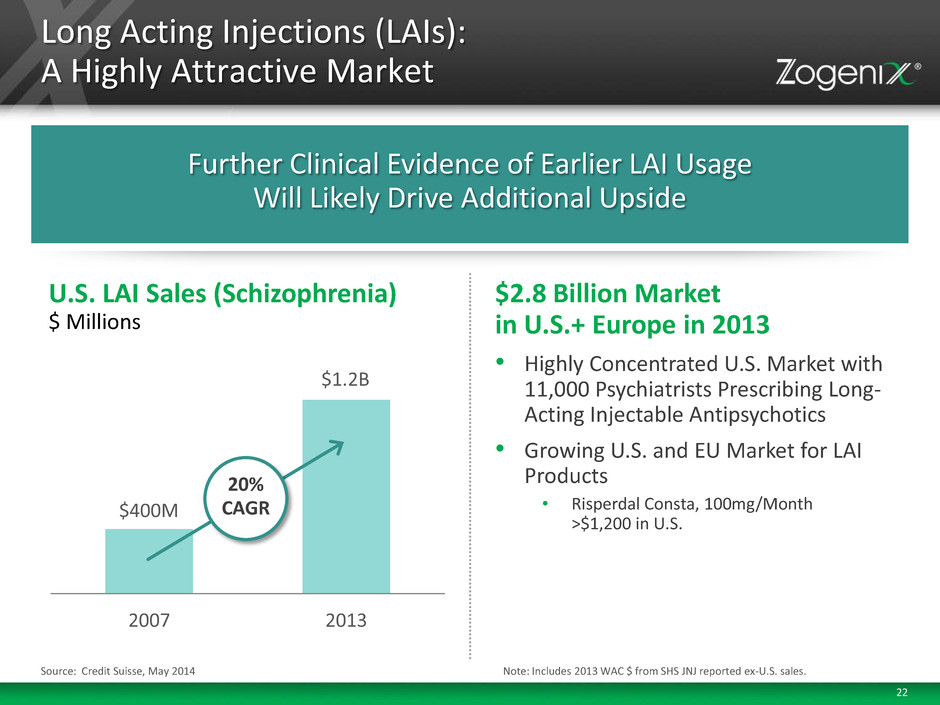

22 • Highly Concentrated U.S. Market with 11,000 Psychiatrists Prescribing Long- Acting Injectable Antipsychotics • Growing U.S. and EU Market for LAI Products • Risperdal Consta, 100mg/Month >$1,200 in U.S. $2.8 Billion Market in U.S.+ Europe in 2013 Long Acting Injections (LAIs): A Highly Attractive Market Source: Credit Suisse, May 2014 Further Clinical Evidence of Earlier LAI Usage Will Likely Drive Additional Upside Note: Includes 2013 WAC $ from SHS JNJ reported ex-U.S. sales. 2007 2013 U.S. LAI Sales (Schizophrenia) $ Millions $400M $1.2B 20% CAGR

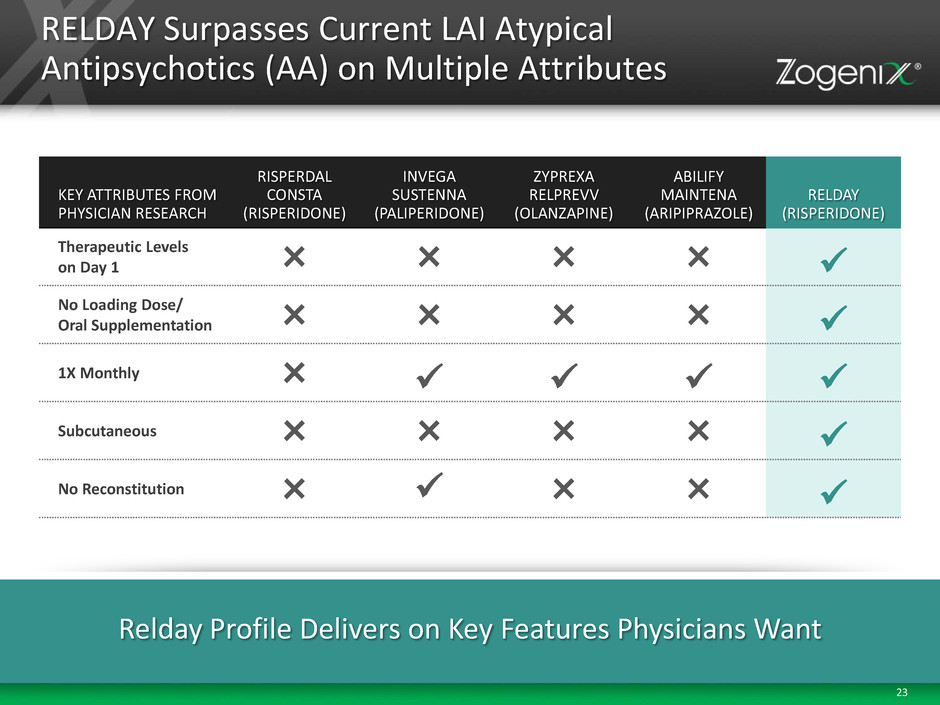

23 RELDAY Surpasses Current LAI Atypical Antipsychotics (AA) on Multiple Attributes KEY ATTRIBUTES FROM PHYSICIAN RESEARCH RISPERDAL CONSTA (RISPERIDONE) INVEGA SUSTENNA (PALIPERIDONE) ZYPREXA RELPREVV (OLANZAPINE) ABILIFY MAINTENA (ARIPIPRAZOLE) RELDAY (RISPERIDONE) Therapeutic Levels on Day 1 × × × × No Loading Dose/ Oral Supplementation × × × × 1X Monthly × Subcutaneous × × × × No Reconstitution × × × Relday Profile Delivers on Key Features Physicians Want

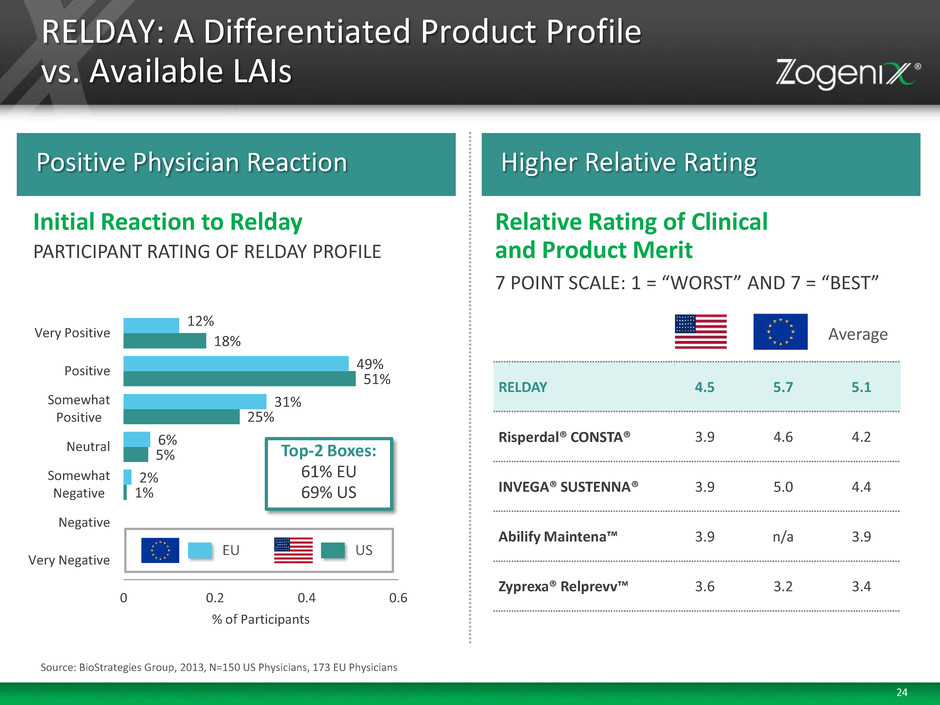

24 RELDAY: A Differentiated Product Profile vs. Available LAIs 1% 5% 25% 51% 18% 2% 6% 31% 49% 12% 0 0.2 0.4 0.6 Very Negative Negative Somewhat Negative Neutral Somewhat Positive Positive Very Positive % of Participants Positive Physician Reaction Higher Relative Rating 7 POINT SCALE: 1 = “WORST” AND 7 = “BEST” Relative Rating of Clinical and Product Merit PARTICIPANT RATING OF RELDAY PROFILE Initial Reaction to Relday RELDAY 4.5 5.7 5.1 Risperdal® CONSTA® 3.9 4.6 4.2 INVEGA® SUSTENNA® 3.9 5.0 4.4 Abilify Maintena™ 3.9 n/a 3.9 Zyprexa® Relprevv™ 3.6 3.2 3.4 Average Top-2 Boxes: 61% EU 69% US EU US Source: BioStrategies Group, 2013, N=150 US Physicians, 173 EU Physicians

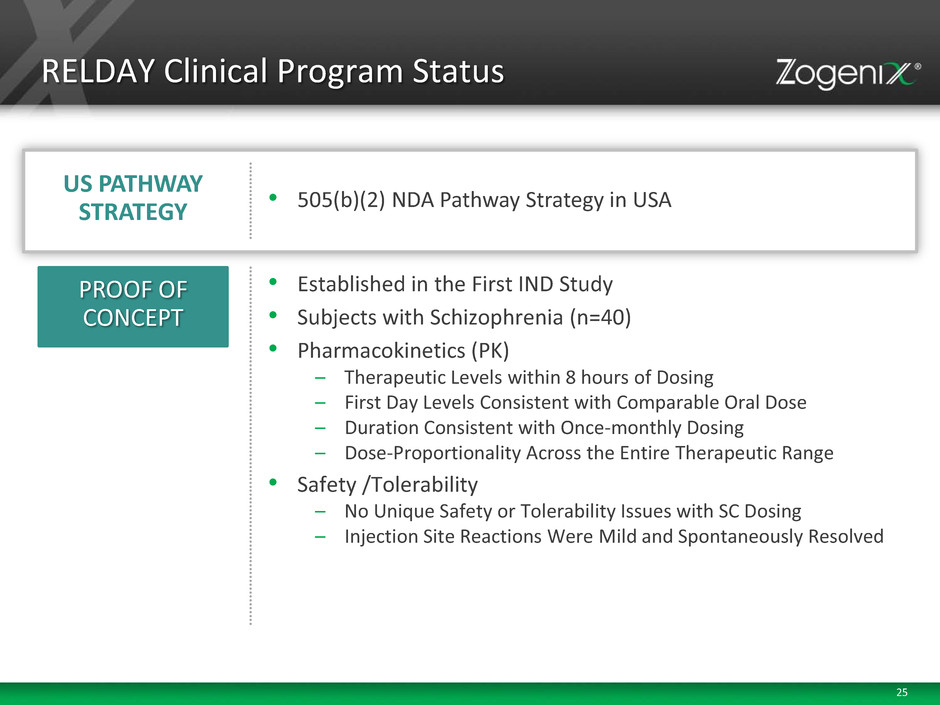

25 RELDAY Clinical Program Status • Established in the First IND Study • Subjects with Schizophrenia (n=40) • Pharmacokinetics (PK) – Therapeutic Levels within 8 hours of Dosing – First Day Levels Consistent with Comparable Oral Dose – Duration Consistent with Once-monthly Dosing – Dose-Proportionality Across the Entire Therapeutic Range • Safety /Tolerability – No Unique Safety or Tolerability Issues with SC Dosing – Injection Site Reactions Were Mild and Spontaneously Resolved US PATHWAY STRATEGY PROOF OF CONCEPT • 505(b)(2) NDA Pathway Strategy in USA

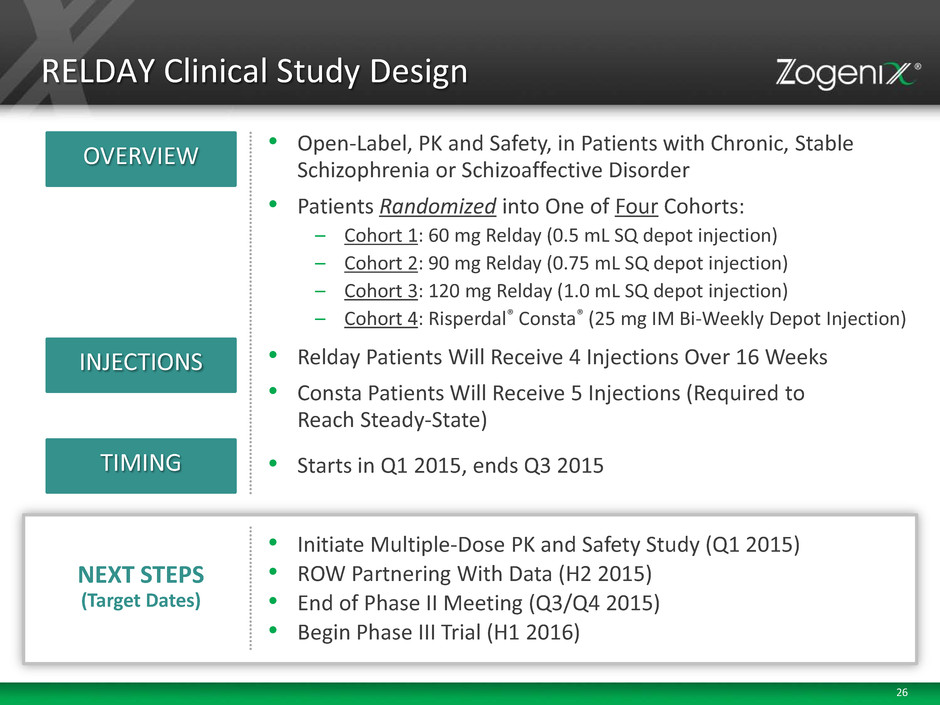

26 RELDAY Clinical Study Design • Starts in Q1 2015, ends Q3 2015 • Initiate Multiple-Dose PK and Safety Study (Q1 2015) • ROW Partnering With Data (H2 2015) • End of Phase II Meeting (Q3/Q4 2015) • Begin Phase III Trial (H1 2016) OVERVIEW INJECTIONS TIMING NEXT STEPS (Target Dates) • Relday Patients Will Receive 4 Injections Over 16 Weeks • Consta Patients Will Receive 5 Injections (Required to Reach Steady-State) • Open-Label, PK and Safety, in Patients with Chronic, Stable Schizophrenia or Schizoaffective Disorder • Patients Randomized into One of Four Cohorts: – Cohort 1: 60 mg Relday (0.5 mL SQ depot injection) – Cohort 2: 90 mg Relday (0.75 mL SQ depot injection) – Cohort 3: 120 mg Relday (1.0 mL SQ depot injection) – Cohort 4: Risperdal® Consta® (25 mg IM Bi-Weekly Depot Injection)

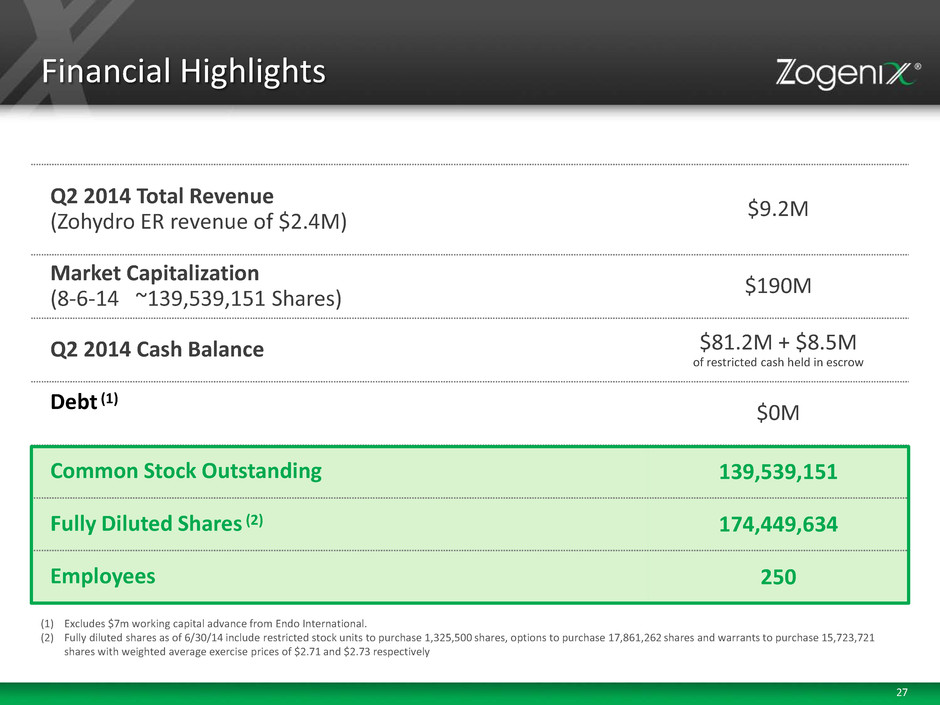

27 Financial Highlights Q2 2014 Total Revenue (Zohydro ER revenue of $2.4M) $9.2M Market Capitalization (8-6-14 ~139,539,151 Shares) $190M Q2 2014 Cash Balance $81.2M + $8.5M of restricted cash held in escrow Debt (1) $0M Common Stock Outstanding 139,539,151 Fully Diluted Shares (2) 174,449,634 Employees 250 (1) Excludes $7m working capital advance from Endo International. (2) Fully diluted shares as of 6/30/14 include restricted stock units to purchase 1,325,500 shares, options to purchase 17,861,262 shares and warrants to purchase 15,723,721 shares with weighted average exercise prices of $2.71 and $2.73 respectively

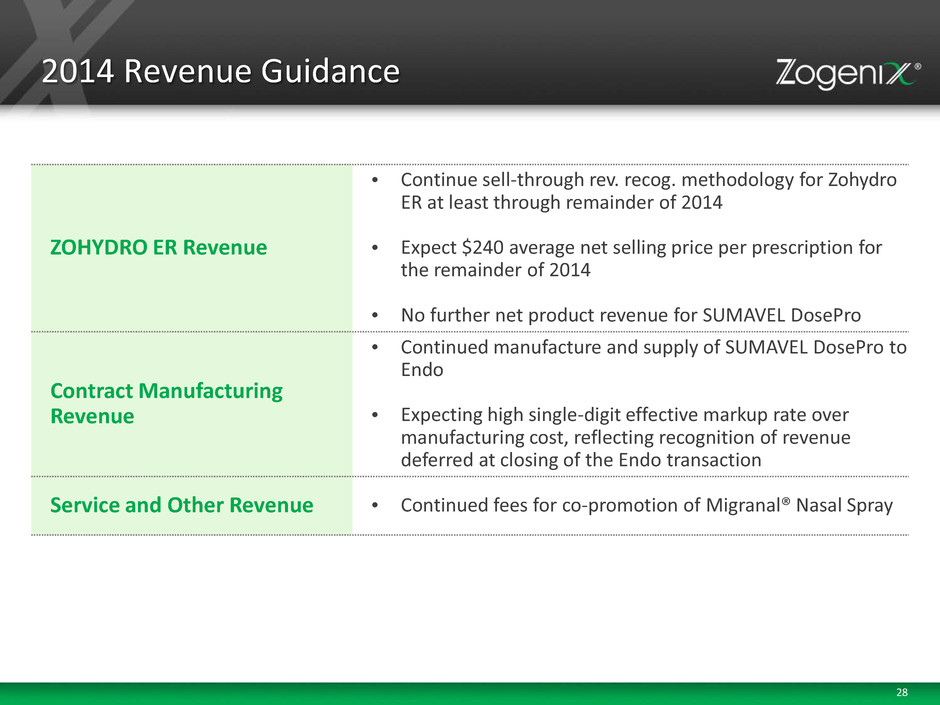

28 2014 Revenue Guidance ZOHYDRO ER Revenue • Continue sell-through rev. recog. methodology for Zohydro ER at least through remainder of 2014 • Expect $240 average net selling price per prescription for the remainder of 2014 • No further net product revenue for SUMAVEL DosePro Contract Manufacturing Revenue • Continued manufacture and supply of SUMAVEL DosePro to Endo • Expecting high single-digit effective markup rate over manufacturing cost, reflecting recognition of revenue deferred at closing of the Endo transaction Service and Other Revenue • Continued fees for co-promotion of Migranal® Nasal Spray

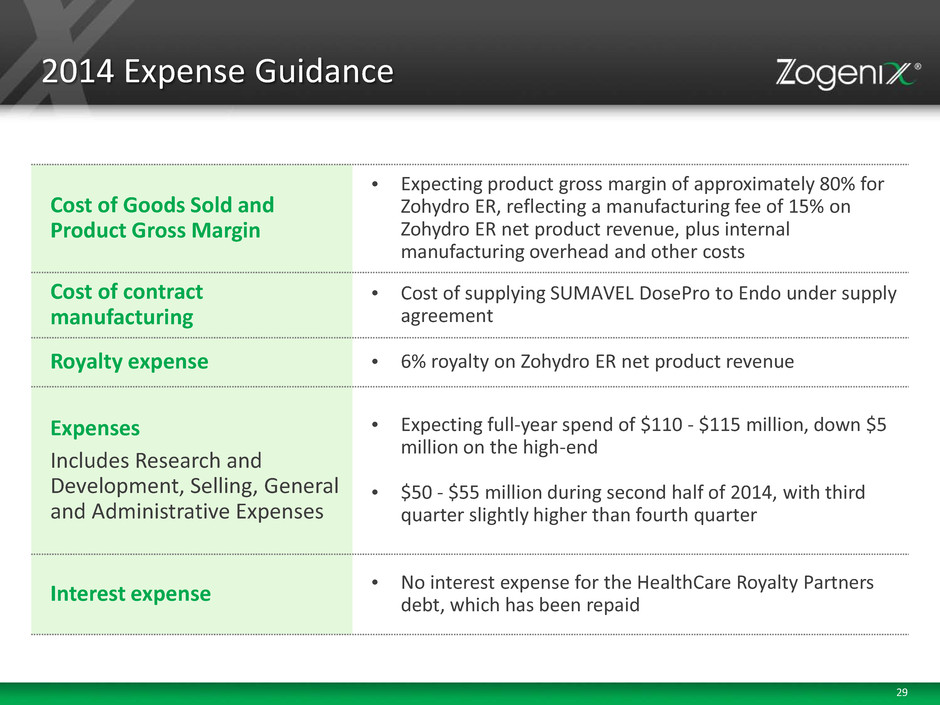

29 2014 Expense Guidance Cost of Goods Sold and Product Gross Margin • Expecting product gross margin of approximately 80% for Zohydro ER, reflecting a manufacturing fee of 15% on Zohydro ER net product revenue, plus internal manufacturing overhead and other costs Cost of contract manufacturing • Cost of supplying SUMAVEL DosePro to Endo under supply agreement Royalty expense • 6% royalty on Zohydro ER net product revenue Expenses Includes Research and Development, Selling, General and Administrative Expenses • Expecting full-year spend of $110 - $115 million, down $5 million on the high-end • $50 - $55 million during second half of 2014, with third quarter slightly higher than fourth quarter Interest expense • No interest expense for the HealthCare Royalty Partners debt, which has been repaid

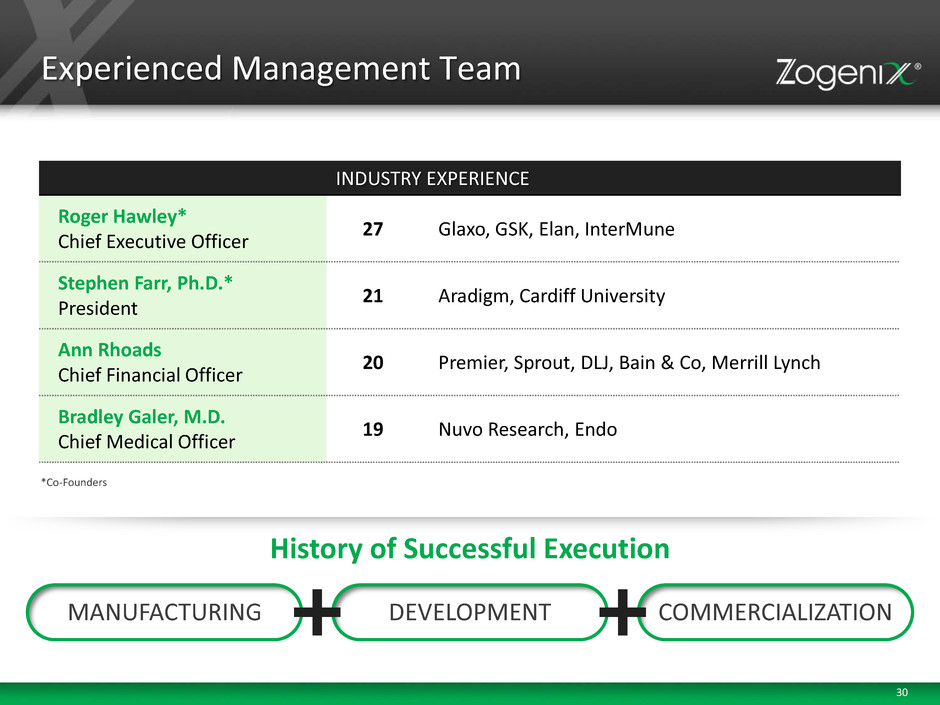

30 Experienced Management Team INDUSTRY EXPERIENCE Roger Hawley* Chief Executive Officer 27 Glaxo, GSK, Elan, InterMune Stephen Farr, Ph.D.* President 21 Aradigm, Cardiff University Ann Rhoads Chief Financial Officer 20 Premier, Sprout, DLJ, Bain & Co, Merrill Lynch Bradley Galer, M.D. Chief Medical Officer 19 Nuvo Research, Endo *Co-Founders MANUFACTURING DEVELOPMENT COMMERCIALIZATION History of Successful Execution

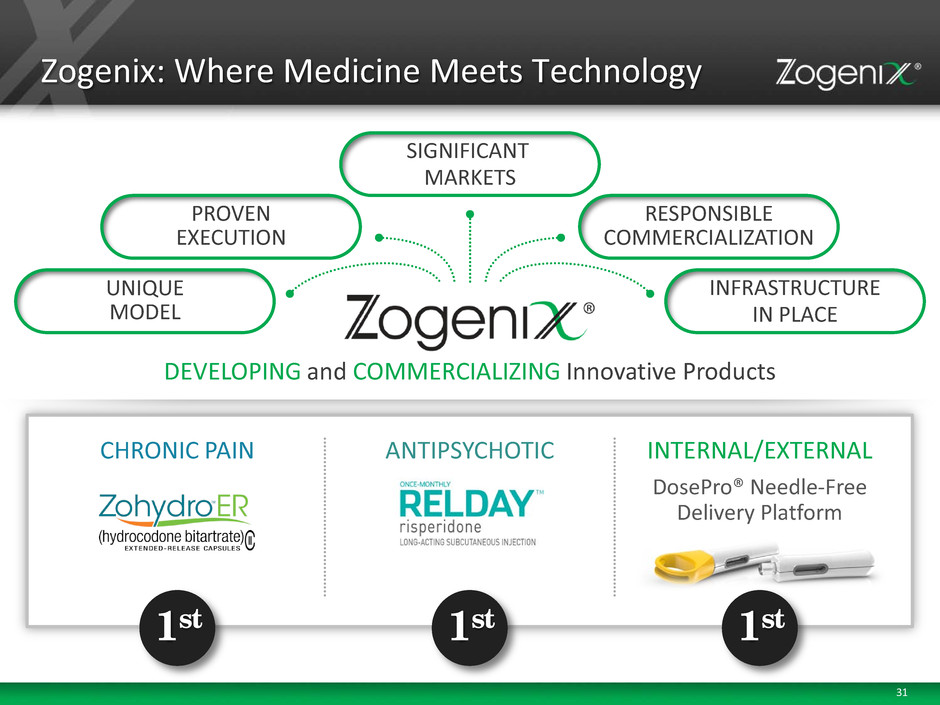

31 Zogenix: Where Medicine Meets Technology DEVELOPING and COMMERCIALIZING Innovative Products PROVEN EXECUTION RESPONSIBLE COMMERCIALIZATION UNIQUE MODEL INFRASTRUCTURE IN PLACE SIGNIFICANT MARKETS CHRONIC PAIN 1st INTERNAL/EXTERNAL 1st DosePro® Needle-Free Delivery Platform ANTIPSYCHOTIC 1st

NASDAQ: