Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NORTHERN TRUST CORP | d785973d8k.htm |

|

|

P R I N C I P L E S T H A T E N D U R E EXHIBIT 99.1

Northern Trust Corporation

Service Expertise Integrity Steven L. Fradkin

President, Wealth Management

Barclays Global Financial Services Conference

New York

September 9, 2014

© 2014 Northern Trust Corporation northerntrust.com

|

|

Forward Looking Statement

This presentation may include forward-looking statements concerning Northern Trust’s financial results and outlook, capital adequacy, dividend policy, anticipated expense levels and technology spending, risk management policies, contingent liabilities, strategic initiatives, industry trends, and expectations regarding the impact of recent legislation. Forward-looking statements are typically identified by words or phrases such as “believe”, “expect”, “anticipate”, “intend”, “estimate”, “project”, “likely”, “may increase”, “plan”, “goal”, “target”, “strategy”, and similar expressions or future or conditional verbs such as “may”, “will”, “should”, “would”, and “could”. Forward-looking statements are Northern Trust’s current estimates or expectations of future events or future results, and involve risks and uncertainties that are difficult to predict. These statements are based on assumptions about many important factors, including the factors discussed in Northern Trust’s most recent annual report on Form 10-K and other filings with the U.S. Securities and Exchange Commission, all of which are available on

Northern Trust’s website.

We caution you not to place undue reliance on any forward-looking statement as actual results may differ materially from those expressed or implied by forward-looking statements. Northern Trust assumes no obligation to update its forward-looking statements.

2 Barclays Global Financial Services Conference

|

|

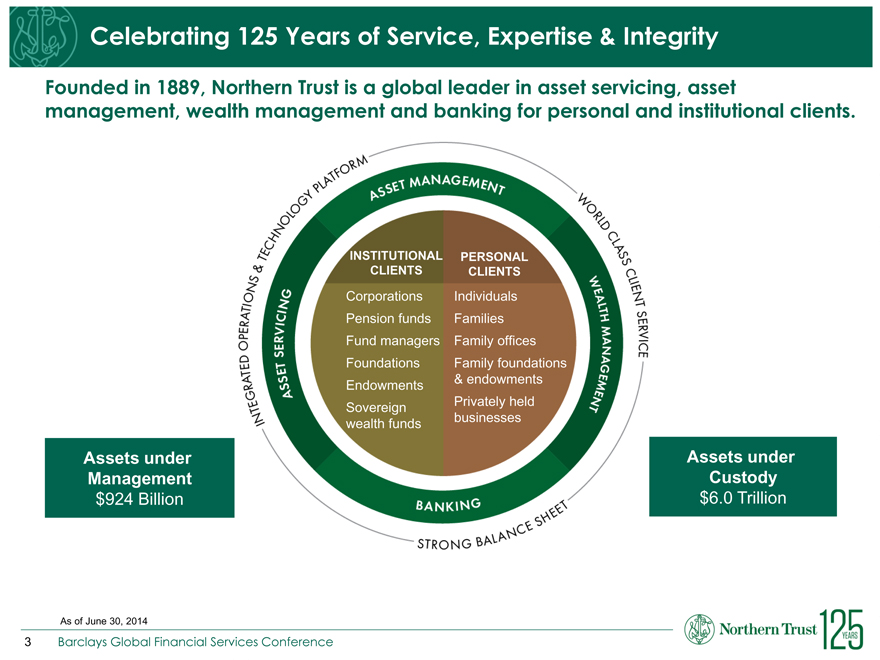

Celebrating 125 Years of Service, Expertise & Integrity

Founded in 1889, Northern Trust is a global leader in asset servicing, asset management, wealth management and banking for personal and institutional clients.

INSTITUTIONAL PERSONAL CLIENTS CLIENTS

Corporations Individuals Pension funds Families Fund managers Family offices Foundations Family foundations & endowments Endowments Privately held Sovereign businesses wealth funds

Assets under Assets under Management Custody $924 Billion $6.0 Trillion

As of June 30, 2014

3 Barclays Global Financial Services Conference

|

|

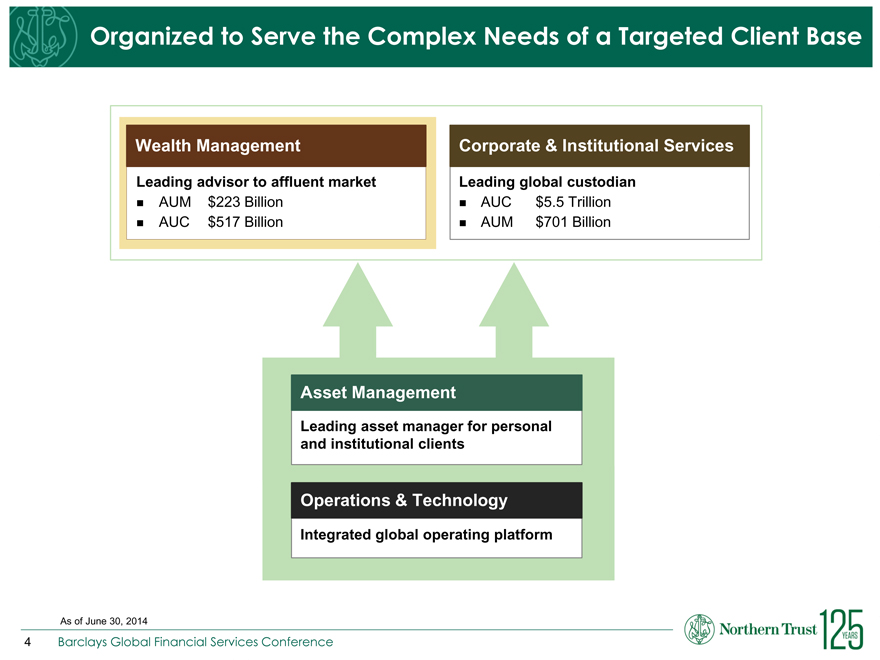

Organized to Serve the Complex Needs of a Targeted Client Base

Wealth Management Corporate & Institutional Services

Leading advisor to affluent market Leading global custodian

AUM $223 Billion AUC $5.5 Trillion AUC $517 Billion AUM $701 Billion

Asset Management

Leading asset manager for personal and institutional clients

Operations & Technology

Integrated global operating platform

As of June 30, 2014

4 Barclays Global Financial Services Conference

|

|

Wealth Management is an Attractive Business

Favorable industry trends align well with Northern Trust’s Wealth Management business model.

Wealth is expected to continue growing in the United States and globally Growth trends Up-market wealth segments exhibiting faster growth

Share of wealth moving to “advice” channels continues to grow

Attractive financial returns versus many other sectors in financial services Business model Recurring fee revenue, offering more sustainable economics Fee-based models winning over commission-oriented models

Wealth clients cite relationship and client experience as critical drivers Opportunity to of provider selection differentiate

Brand and differentiated advice matter

Source: The Boston Consulting Group and NT analysis

5 Barclays Global Financial Services Conference

|

|

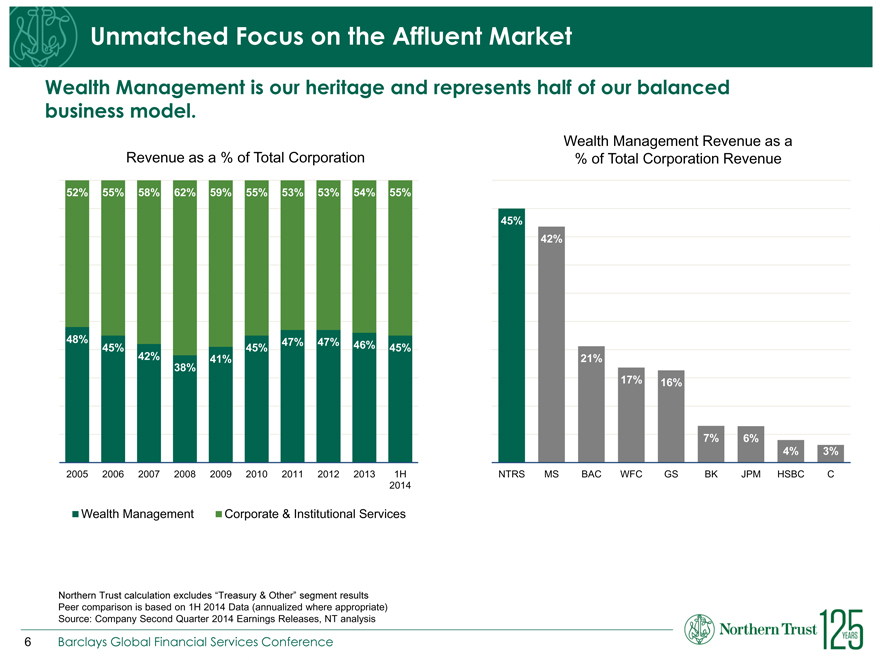

Unmatched Focus on the Affluent Market

Wealth Management is our heritage and represents half of our balanced business model.

Wealth Management Revenue as a Revenue as a % of Total Corporation % of Total Corporation Revenue

52% 55% 58% 62% 59% 55% 53% 53% 54% 55%

45%

42%

48% 47% 47%

45% 45% 46% 45%

42% 41% 21% 38%

17% 16%

7% 6%

4% 3%

2005 2006 2007 2008 2009 2010 2011 2012 2013 1H NTRS MS BAC WFC GS BK JPM HSBC C 2014

Wealth Management Corporate & Institutional Services

Northern Trust calculation excludes “Treasury & Other” segment results

Peer comparison is based on 1H 2014 Data (annualized where appropriate) Source: Company Second Quarter 2014 Earnings Releases, NT analysis

6 Barclays Global Financial Services Conference

|

|

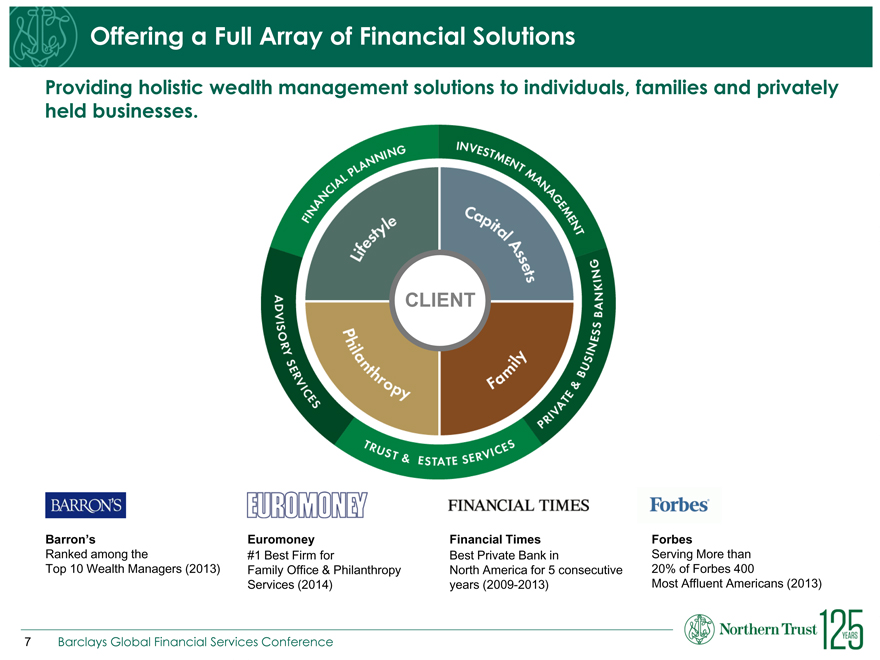

Offering a Full Array of Financial Solutions

Providing holistic wealth management solutions to individuals, families and privately held businesses.

CLIENT

Barron’s Euromoney Financial Times Forbes

Ranked among the #1 Best Firm for Best Private Bank in Serving More than Top 10 Wealth Managers (2013) Family Office & Philanthropy North America for 5 consecutive 20% of Forbes 400

Services (2014) years (2009-2013) Most Affluent Americans (2013)

7 Barclays Global Financial Services Conference

|

|

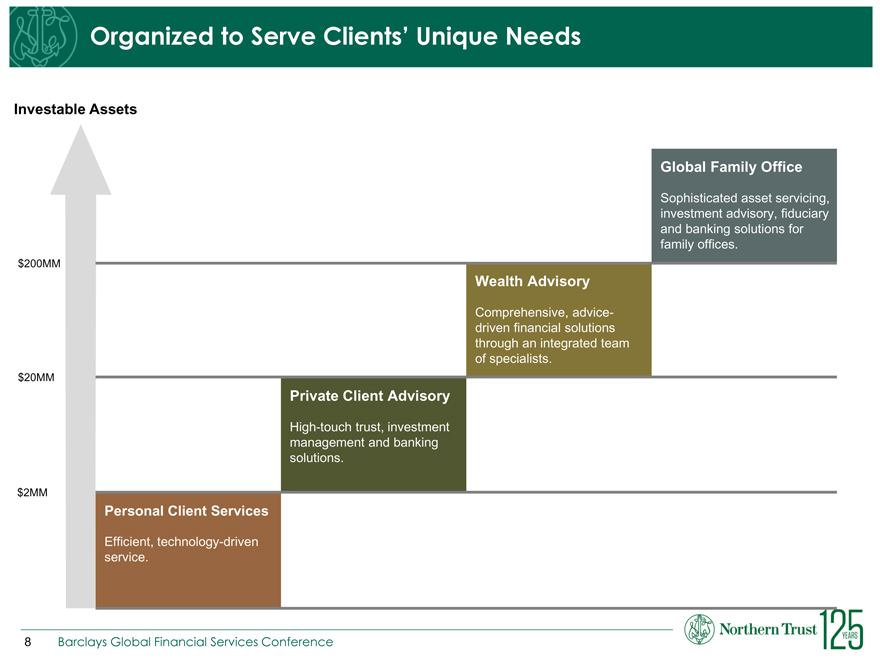

Organized to Serve Clients’ Unique Needs

Investable Assets

Global Family Office

Sophisticated asset servicing, investment advisory, fiduciary and banking solutions for family offices. $200MM

Wealth Advisory

Comprehensive, advice-driven financial solutions through an integrated team of specialists. $20MM

Private Client Advisory

High-touch trust, investment management and banking solutions.

$2MM

Personal Client Services

Efficient, technology-driven service.

8 Barclays Global Financial Services Conference

|

|

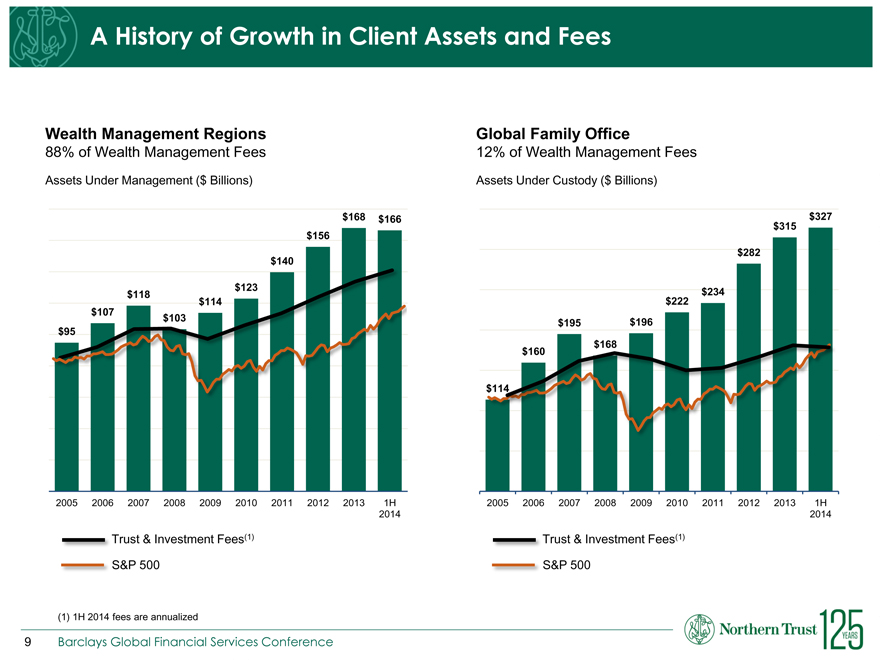

A History of Growth in Client Assets and Fees

Wealth Management Regions Global Family Office

88% of Wealth Management Fees 12% of Wealth Management Fees

Assets Under Management ($ Billions) Assets Under Custody ($ Billions)

$168 $166 $327 $156 $315 $140 $282 $222 $234 $195 $196

2005 2006 2007 2008 2009 2010 2011 2012 2013 1H 2005 2006 2007 2008 2009 2010 2011 2012 2013 1H 2014 2014

Trust & Investment Fees(1) Trust & Investment Fees(1)

S&P 500 S&P 500

(1) 1H 2014 fees are annualized

$95 $107 $118 $103 $114 $123 $140 $114 $160 $168

9 Barclays Global Financial Services Conference

|

|

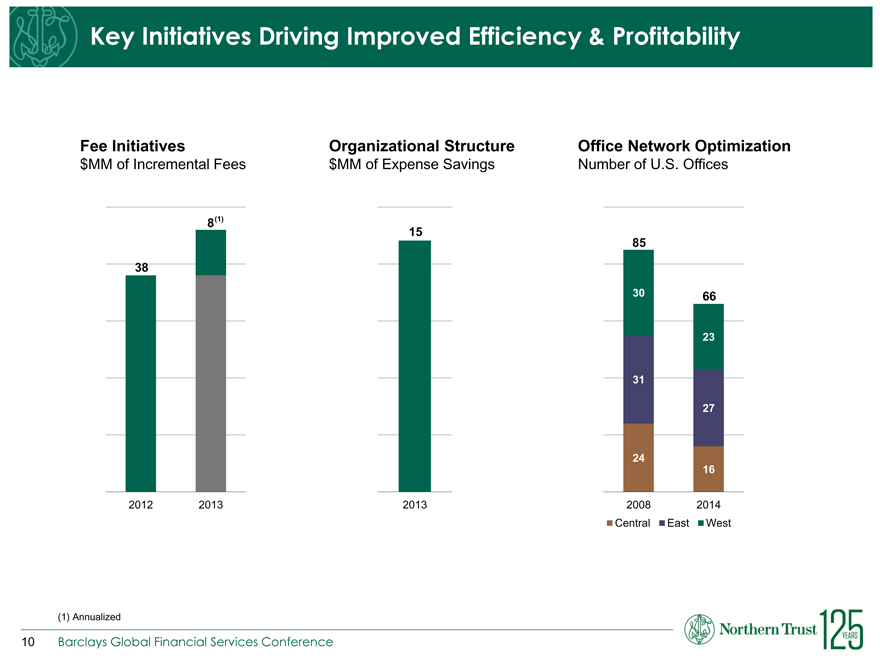

Key Initiatives Driving Improved Efficiency & Profitability

Fee Initiatives Organizational Structure Office Network Optimization $MM of Incremental Fees $MM of Expense Savings Number of U.S. Offices

8 (1)

15 85

38

30 66 23

31

27

24

16

2012 2013 2013 2008 2014 Central East West

(1) Annualized

10 Barclays Global Financial Services Conference

|

|

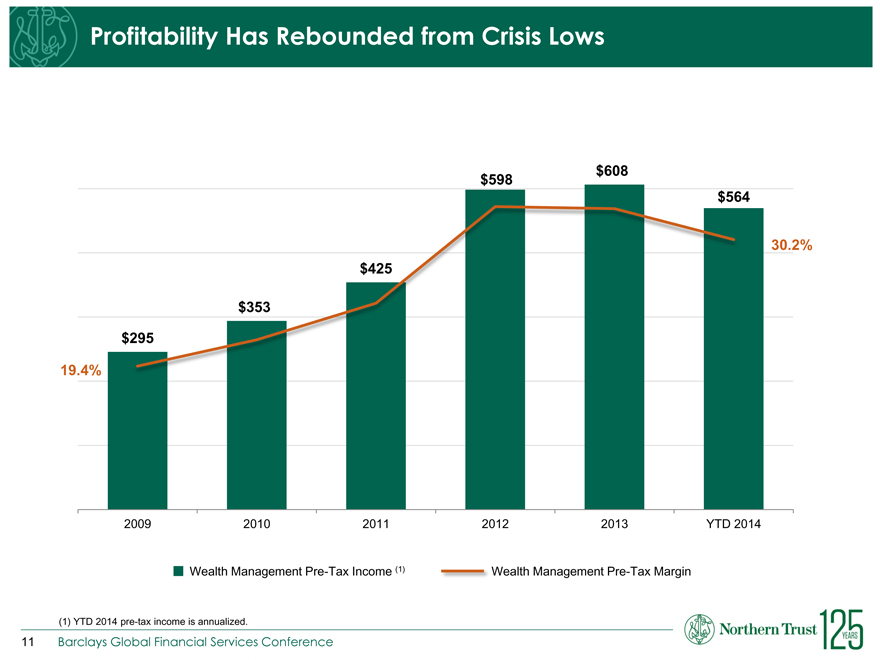

Profitability Has Rebounded from Crisis Lows

$608 $598 $564

30.2% $425

$353 $295 19.4%

2009 2010 2011 2012 2013 YTD 2014

Wealth Management Pre-Tax Income (1) Wealth Management Pre-Tax Margin

(1) YTD 2014 pre-tax income is annualized.

11 Barclays Global Financial Services Conference

|

|

Investing for the Future

Key Trends Key Investments

Continued growth domestically and internationally with up-market segments growing faster

Demographic changes and evolving client needs Digitization of wealth management

Marketing in a multi-channel world

12 Barclays Global Financial Services Conference

|

|

Northern Trust Corporation

Consistently Strong and Focused

Market Leader in Focused Businesses Strong Wealth Management Positioning A History of Organic Growth Improving Profitability & Returns Investing for the Future

13 Barclays Global Financial Services Conference