Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Koppers Holdings Inc. | d785268d8k.htm |

Investor Presentation

September 2014

Exhibit 99.1 |

2

The following information contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These

forward-looking statements are based on management’s current

expectations and beliefs, as well as a number of assumptions concerning

future events. These statements are subject to risks, uncertainties,

assumptions and other important factors. You are cautioned not to put

undue reliance on such forward-looking statements because actual

results may vary materially from those expressed or implied. Koppers

assumes

no

obligation

to,

and

expressly

disclaims

any

obligation

to,

update or revise any forward-looking statements, whether as a result of

new information, future events or otherwise. This presentation also

includes non-GAAP measures.

Forward Looking Statements |

The

New Koppers: a Leading Global Supplier to Infrastructure and Construction

Markets 3

Top producer of carbon compounds, performance

chemicals and treated wood products

Unique product portfolio and niche end market focus

Strategic global presence

Long-term relationships with large blue chip customers

Focused on delivering sustainable profitable growth at

attractive returns |

The

New Koppers: Three Core Complementary Business Segments

4

Carbon

Materials and

Chemicals

(CMC)

2013 Pro Forma

Revenue $906mm

Railroad and

Utility Products

and Services

(RUPS)

2013 Pro Forma

Revenue $628mm

Performance

Chemicals

(PC)

2013 Pro Forma

Revenue $334mm |

Unique

Product Portfolio and Niche End Market Focus…

Specialty Products/Services Mix:

•

Railroad Bridge Services

•

Railroad Crossties

•

Rail Joint Bars

•

Utility Poles

•

Wood Preservation Chemicals

•

Carbon Pitch

•

Creosote

•

Naphthalene

•

Phthalic Anhydride

•

Carbon Black Feedstock

Performance:

•

2013 Pro Forma Sales: $1,868 mm

Diverse End Markets:

•

Railroad

•

Utilities

•

Construction

•

Agricultural

•

Aluminum/Steel

•

Rubber

Strategic Global Presence:

•

North America

•

Europe

•

Australia and New Zealand

•

Emerging Markets

•

Asia

•

Middle East

•

South and Central America

5

…Generate Stable Cash Flows and Provide Growth Opportunities

|

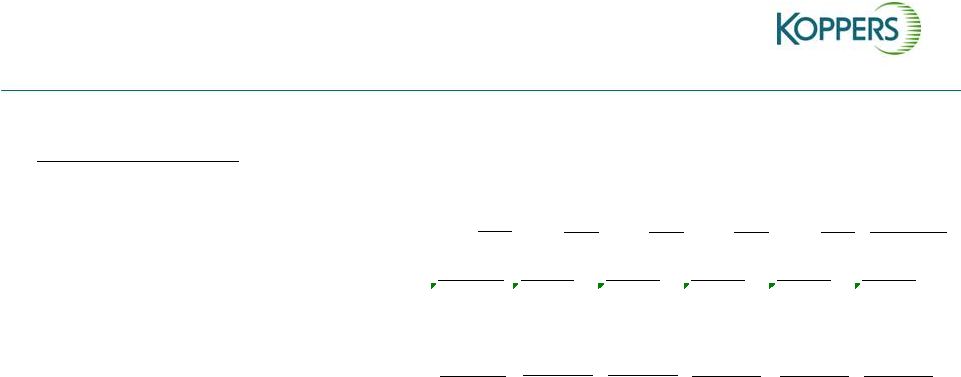

Addition of Osmose Enhances Koppers

Diversity, Stability and Growth Potential

2013 Sales by End Market

6

$1,478mm

$1,478mm

$1,868mm

$1,868mm

Railroad crossties

27%

Carbon pitch

26%

Creosote and

carbon black

feedstock

15%

Naphthalene /

PAA

12%

Utility poles

8%

Other

12%

Railroad products

and services

32%

Aluminum / steel

28%

Construction

11%

Rubber

11%

Utility poles

8%

Other

10%

Railroad products

and services

27%

Aluminum / Steel

22%

Construction

19%

Rubber

9%

Utilities

8%

Agriculture

7%

Other

8%

Creosote and

carbon black

feedstock

12%

Naphthalene /

PAA

10%

Utility poles

6%

Other

12%

Railroad crossties

Carbon pitch

21%

Preservation

chemicals

18%

21%

2013 Sales by Product |

The

acquired Osmose entities are comprised of (i) a global market leader in wood

preservative chemicals (Performance Chemicals) and (ii) a service provider to the

rail industry (Railroad Structures)

Performance Chemicals manufactures wood

preservation chemicals for use in treating wood

products

#1 global producer of wood preservation

chemicals

(2)

U.S. leader in residential treated lumber

(1)

Treated wood is used in a variety of products including

wood decking, fencing, construction materials, piers and

docks

Serves 6 of the top 10 largest lumber treating

companies in the US and 3 of the 4 largest lumber

wood treating companies in Canada

Railroad Structures offers a broad range of railroad

bridge inspection, treatment, repair, and construction

services throughout North America

Serves Class I and Short Line railroad operators

Key customers include Union Pacific, Genesee &

Wyoming, Canadian National Railway, and

BNSF Railway

Performance Chemicals

Railroad Structures

7

Osmose Overview

Performance

Chemicals & Railroad

Structures

2013 Revenue: $390mm

(1)

1.

Includes $16 million of residential treated lumber revenues that are added to RUPS

2. Management estimates

|

8

Products Fulfill Industry Demand Across

Diverse End Markets…

.

Drivers

Coal

Tar

Carbon

Pitch

PAA

Naph-

thalene

CBF

Creosote

Railroad

Crossties

Treating

Chemicals

BF Steel

EAF Steel

Aluminum

Automotive

Rubber

Construction

Class I RR

Budgets

Crosstie

Insertions

…Providing Counter-Cyclical Earnings Stability

|

Strategically Located Facilities to Best Serve

Clients and Meet Growing Demand

Facilities are well-positioned to capture worldwide growth in demand

Europe

4 facilities

North America

19 facilities

China

3 facilities

Carbon Materials and Chemicals

Railroad and Utility Products and Services

Performance Chemicals

Australasia

9 facilities

2013 Point of Sale

South America

2 facilities (1)

9

(1) Toll producing facilities

North

America, 60%

Europe,

14%

Australia,

11%

Emerging

Markets, 15% |

10

Long-Term Relationships with Large

Blue Chip Customers Create Revenue Visibility

Select Key Customers |

Market Challenges

Depressed global aluminum market has resulted in a difficult pricing

environment for carbon pitch

Recessionary conditions in Europe have resulted in reduced volumes and

pricing for carbon pitch, naphthalene and CBF

North American CMC business continues to be challenged by difficult market

conditions

KCCC

joint

venture

in

China

is

being

closed

as

a

result

of

our

JV

partner

being

ordered

to

cease

operations

at

their

coke

ovens

due

to

pollution

concerns

In

the

Middle

East,

despite

the

growth

in

production

in

this

low

energy

cost

region, competition remains strong and pitch prices continue to be depressed

Railroad business negatively impacted in 2014 due to reduced crosstie

availability

11 |

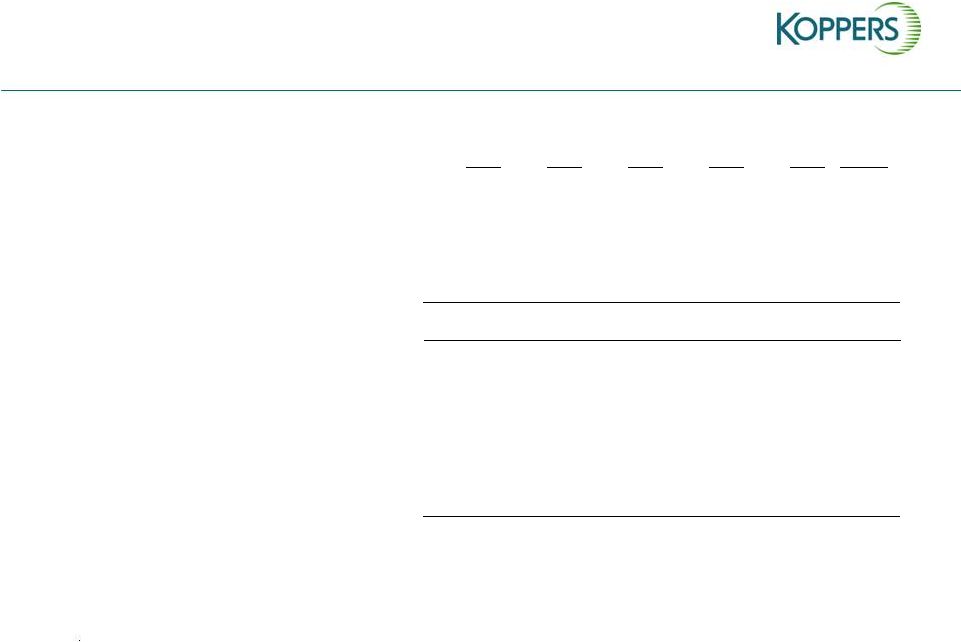

2014:

Transitional Year for Koppers 12

Adjusted EPS

$1.73

$2.32

$2.80

$3.27

$2.60

$2.08

($ millions except EPS)

(1) Calculations of historical Adjusted EPS can be found in our earnings press releases at www.koppers.com under Investor Relations |

13

Focused on Delivering Long-Term Sustainable

Profitable Growth at Attractive Returns

Achieve above-market sales growth

Growth

Profitability

Improve margins by at least 200 basis

points

Execution of These Priorities Will Deliver Increased Shareholder

Value

Capital

Deployment

Maintain ROCE greater than WACC |

Decisive Actions Have Been Taken…

14

Diversified business

risk through Osmose

acquisition

Completed

construction of new

distillation facility in

China (KJCC)

Added to scale of

RUPS business

through Ashcroft

acquisition

Ceased distillation

activities at Uithoorn

facility in The

Netherlands

Commenced

restructuring of

North American CMC

facilities

Continued

investments in

structural

improvements in

RUPS

…to Generate Substantial Sustainable Profit

Improvement Beginning in 2015 |

Osmose Enhances Koppers Strategic

Objectives

Growth

Achieve above-market sales

growth

Profitability

Improve margins by

at least 200 basis points

Capital Deployment

Maintain ROCE

higher than WACC

Target Market

Selective, complementary core

and near-adjacent acquisitions in

infrastructure space

Earnings

Impact

Must be accretive

in near term

Koppers Objectives

Commentary

Source: Management estimates.

(a) Koppers and Osmose management

estimates do not include synergies. 15

2010 –

2013 Sales CAGR of 8.1% exceeds Koppers Sales CAGR of 7.5%

over that same period

Ability to leverage Osmose geographic footprint to enhance Koppers sales

opportunities

Acquisition is expected to be accretive to consolidated EBITDA margins,

and consistent with the company’s goals of achieving at least a 12%

EBITDA

margin

by

the

end

of

2015

(a)

IRR exceeds Weighted Average Cost of Capital (WACC)

Lower cost financing will reduce WACC

Performance

Chemicals

business complements Koppers traditional

creosote wood treating chemical business

Railroad

Structures maintenance-of-way business serves same customer

base as Koppers Railroad and Utility Products and Services

(“RUPS”) business

Acquisition is expected to be accretive to earnings by the end of 2015

without

$12 million of estimated synergies |

Strong Cash Flow and Liquidity

Financing Structure at

Close of Transaction

Advantages to Financing

Approach

Low debt service cost

Mix of fixed and floating debt

Pre-payment flexibility at no cost (term loan A)

Bridge-free financing solution

New five year $500 million revolver ($230 million drawn) to replace current $350

million revolver at initial interest rate of 3.25%

New five year amortizing term loan A of $300 million at initial interest rate of

3.25% Leave

the

existing

senior

notes

in

place

and

ratably

secure

with

the

revolver/term

loan

Pro

forma

net

leverage

of

~4x

(1)

with

near-term

focus

on

reduction

of

net

leverage

to

~3x

Will take advantage of market conditions to evaluate long term capital structure

options 1.

Net leverage defined as net debt (total debt less cash) divided by adjusted

EBITDA 16

Transaction Sources and Uses

Sources of Funds

Uses of Funds

New Revolver

$500

Osmose Purchase net of cash acquired

$467

New Term Loan A

300

Existing RCF Repayment, LCs & Fees

93

Liquidity

240

Total Sources

$800

Total Uses

$800 |

Bond

Refinancing Opportunity •

Current outstanding bonds of $300 million

•

Coupon @ 7.785% with first call date at 12/1/2014

•

Call premium approximately $12 million at call date; earlier call

would cost additional $3-4 million

•

Expectation is to refinance in 2014 with 175-225 bp reduction

•

Intention is to upsize the bond issue with portion >$300 million

used to reduce existing term loan

•

Rate reduction would reduce interest expense and cost of capital

17 |

2015

– Strong Prospects for New Koppers

•

Some industry headwinds beginning to abate

–

Positive signs of a stronger global aluminum market with higher LME pricing

European economy showing signs of recovery

Expect crosstie procurement volumes to rebound in the second half of 2014 as

sawmill capacity continues to grow in response to increased end-market

demand

•

Actions taking hold

Stopped distillation activities at our Uithoorn facility in The Netherlands in

April and moved those production volumes to remaining two European

facilities Restructuring of our North American CMC facilities is providing

cost savings Freezing and funding of US pension plans has reduced pension

expense by >$5 million on an annual basis

•

Osmose synergy and margin expectations

Addition of Osmose should have significant impact on progress towards

achieving

sustainable

12%

EBITDA

margins

on

a

consolidated

basis

and

be

accretive to existing margins in 2015

Synergies

from

the

acquisition

of

Osmose

businesses

are

expected

to

reach

an

annualized run rate of $12 million by 4Q 2015

18

–

–

–

–

–

–

– |

The

New Koppers: A Leading Global Supplier to Infrastructure and Construction

Markets 19

•

Market

leadership

positions

and

long-term customer

relationships

provide

for

a

stable

base

business

and

recurring

revenue stream

•

Diversity

of products, end markets, and locations provides

counter-cyclical earnings stability

•

Proven

track

record

of creating shareholder value through

strategic

investments

that

generate

high

returns

on

capital

•

Comprehensive

long-term

business

strategy

with

specific

actions

targeted

to

significantly

grow

the

top

and

bottom

lines

•

Strong

cash

flow

and

liquidity

provides

ample

capital

for

execution of long-term business strategy |

Appendix

20 |

COAL TAR

Carbon Pitch 50%

Primary End Products

Chemical Oils 20%

Distillate 30%

Primary End Markets

Naphthalene

Phthalic Anhydride

Anodes, Electrodes

and Needle Coke

Vinyl, Paint, Concrete

and Fiberglass

Railroad Crossties and

Carbon Black

Aluminum and Steel

Construction, Housing

and Automotive

Railroads and Rubber

Koppers buys coal tar from over 60 suppliers in 16 countries

Vertically Integrated Operations:

A Competitive Advantage

Creosote

Carbon Black Feedstock

21 |

Carbon Materials and Chemicals

Sales and EBITDA Summary

2013 Point of Sale

2013 Sales by End Market

Sales ($mm)

Adjusted EBITDA ($mm)

Aluminum/

Steel 46%

Construction

18%

Other

18%

Rubber

18%

North

America

38%

Europe

25%

Australia

10%

Emerging

Markets

27%

(1)

Other includes refined tar, petroleum pitch, benzole and misc. products.

(2)

Construction includes PAA and naphthalene,

Adjusted EBITDA Margin

22

$795

$1,016

$1,000

$906

$867

$655

2009

2010

2011

2012

2013

TTM

$97

$79

$69

$101

$105

$78

8.0%

8.7%

10.0%

10.3%

12.2%

11.9%

2009

2010

2011

2012

2013

TTM

6/2014

6/2014 |

$35

$44

$59

$71

$64

$46

9.8%

7.8%

8.4%

10.7%

12.5%

11.4%

2009

2010

2011

2012

2013

TTM

6/2014

Railroad and Utility Products and Services

Sales and EBITDA Summary

2013 Point of Sale

2013 Sales by End Market

Adjusted EBITDA Margin

Sales ($mm)

Adjusted EBITDA ($mm)

Railroad Products

and Services 79%

Utility Poles

21%

North America

87%

$450

$523

$555

$572

$559

$469

2009

2010

2011

2012

2013

TTM

6/2014

Australia/NZ

13%

23 |

24

Return On Capital Employed (ROCE)

(not restated for discontinued operations)

($ in millions)

.

Return On Capital Employed

(Prior periods not restated for discontinued operations)

TTM

2009

2010

2011

2012

2013

6/30/2014

Interest expense

36.3

$

27.1

$

27.2

$

27.9

$

26.8

$

26.7

$

Loss/(gain) on debt extinguishment

22.4

-

-

-

-

-

Total interest expense

58.7

$

27.1

$

27.2

$

27.9

$

26.8

$

26.7

$

US Effective tax rate (including state)

40.0%

40.0%

40.0%

40.0%

40.0%

40.0%

Tax effected interest

35.2

$

16.3

$

16.3

$

16.7

$

16.1

$

16.0

$

Add:

Adjusted net income

37.7

48.0

58.3

68.7

54.1

42.9

A

Adjusted Net Operating Profit After Tax (A)

72.9

$

64.3

$

74.6

$

85.4

$

70.2

$

58.9

$

S/T debt and current portion of L/T debt

0.2

$

1.0

$

-

$

-

$

-

$

-

$

L/T debt

335.1

295.4

302.1

296.1

303.1

358.4

Stockholders' equity (less minority interest)

43.8

88.7

94.8

150.6

169.8

170.9

Add(Deduct) tax effected net income adjustments

18.6

3.7

21.4

3.0

13.6

23.9

Total Capital Employed

397.7

$

388.8

$

418.3

$

449.7

$

486.5

$

553.2

$

B

Average Capital Employed (B)

404.2

$

393.3

$

403.6

$

434.0

$

468.1

$

503.8

$

A/B

Return on Invested Capital (A/B)

18.0%

16.3%

18.5%

19.7%

15.0%

11.7% |

25

Sales and EBITDA Reconciliation

(not restated for discontinued operations)

($ in millions)

.

Note:

Koppers believes that adjusted EBITDA provides information useful to investors in

understanding the underlying operational performance of the company, its

business and performance trends and facilitates comparisons between periods and with other

corporations in similar industries. The exclusion of certain items permits

evaluation and a comparison of results for ongoing business operations, and

it is on this basis that Koppers management internally assesses the company's performance. Although Koppers believes

that this non-GAAP measure enhances investors' understanding of its business

and performance, this non-GAAP financial measure should not be

considered an alternative to GAAP basis financial measures. TTM

2009

2010

2011

2012

2013

6/2014

$1,124.4

$1,245.5

$1,538.9

$1,555.0

$1,478.3

$1,425.2

18.8

44.1

36.9

65.6

42.8

21.2

58.7

27.1

27.2

27.9

26.8

26.7

24.8

28.1

48.8

28.2

37.6

41.6

13.8

29.1

14.9

33.3

36.8

21.2

0.3

0.2

–

0.1

0.1

0.2

116.4

128.6

127.8

155.1

144.1

110.9

2.6

0.4

0.7

1.6

1.3

-2.7

119.0

129.0

128.5

156.7

145.4

108.2

0.6

0.5

20.8

2.8

4.2

23.7

2.8

–

–

–

–

–

–

-1.6

-0.9

–

-1.8

-1.8

1.6

1.6

–

–

–

–

–

1.5

–

–

–

–

–

–

–

–

2.6

2.6

–

0.9

–

–

–

–

$124.0

$131.9

$148.4

$159.5

$150.4

$132.7

EBITDA with noncontrolling interests

Years Ended December 31

Net sales

Net income attributable to Koppers

Interest expense including refinancing

Depreciation and amortization

Income tax provision

Discontinued operations

EBITDA

Non-controlling interest

Tank and tank car cleaning

Legal settlements

Adjusted EBITDA with noncontrolling interests

Unusual items impacting net income

Plant closings and restructuring

Plant outages

Gain on sale

Acquisition cost write-off

Incremental 4

th

quarter LIFO and LCM |

Carbon

Materials and Chemicals EBITDA Reconciliation

(prior years not restated for discontinued operations)

($ in millions)

Note: Koppers believes that adjusted EBITDA provides information useful to

investors in understanding the underlying operational performance of the

company, its business and performance trends and facilitates comparisons

between periods and with other corporations in similar industries. The exclusion of certain items

permits evaluation and a comparison of results for ongoing business operations,

and it is on this basis that Koppers management internally assesses the

company's performance. Although Koppers believes that this non-GAAP

measure enhances investors' understanding of its business and performance, this non-GAAP

financial measure should not be considered an alternative to GAAP basis financial

measures. 26

TTM

2009

2010

2011

2012

2013

6/2014

$58.5

$77.6

$45.4

$83.1

$43.9

$13.3

(0.6)

(0.8)

(0.6)

(0.8)

(1.0)

(3.1)

17.5

18.3

39.8

17.4

30.7

34.5

(1.3)

2.1

0.2

0.4

1.3

0.4

$74.1

$97.2

$84.8

$100.1

$74.9

$45.1

–

–

20.8

–

1.6

21.4

–

–

(0.9)

–

–

–

1.6

1.6

–

–

–

–

2.4

–

–

–

–

–

–

–

–

–

2.6

2.6

–

(2.1)

–

–

–

–

$78.1

$96.7

$104.7

$100.1

$79.1

$69.1

Depreciation and amortization

Allocated other income

EBITDA

Years Ended December 31

Operating profit

Allocated corporate operating profit

Tank and tank car cleaning

(Gain) on legal settlements

Adjusted EBITDA

Unusual items impacting net income

Plant closings and restructuring

(Gain) on sale of licensing

Acquisition cost write-off

Plant outages |

RUPS

EBITDA Reconciliation (prior years not restated for discontinued

operations) Note: Koppers believes that adjusted EBITDA provides

information useful to investors in understanding the underlying operational

performance of the company, its business and performance trends and facilitates comparisons between

periods and with other corporations in similar industries. The exclusion of

certain items permits evaluation and a comparison

of

results

for

ongoing

business

operations,

and

it

is

on

this

basis

that

Koppers

management

internally

assesses the company's performance. Although Koppers believes that this

non-GAAP measure enhances investors' understanding of its business and

performance, this non-GAAP financial measure should not be considered an alternative

to GAAP basis financial measures.

27

($ in millions)

TTM

2009

2010

2011

2012

2013

6/2014

$38.2

$23.0

$34.8

$45.1

$58.3

$53.4

(1.2)

(0.8)

(0.6)

(0.8)

(0.9)

(2.9)

7.3

9.8

9.0

10.8

10.9

11.1

0.6

(0.2)

0.5

1.5

2.2

1.5

$44.9

$31.8

$43.7

$56.6

$70.5

$63.1

0.6

0.5

–

2.8

2.6

2.3

–

(1.6)

–

–

(1.8)

(1.8)

–

3.0

–

–

–

–

0.4

–

–

–

–

–

–

1.5

–

–

–

–

$45.9

$35.2

$43.7

$59.4

$71.3

$63.6

Depreciation and amortization

Years Ended December 31

Operating profit

Allocated corporate operating profit

Co-generation plant outage

Incremental LIFO charges

Adjusted EBITDA

Allocated other income

EBITDA

Unusual items impacting net income

Plant closings and restructuring

(Gain) on sale

Legal settlements |