Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - FMC CORP | fmcex99109082014.htm |

| 8-K - FORM 8-K - FMC CORP | fmc8k09082014.htm |

September 8, 2014 FMC Corporation Announces Agreement to Acquire Cheminova A/S

Safe Harbor Statement • Statements in this presentation that are forward-looking statements are subject to various risks and uncertainties, including concerning specific factors described in FMC Corporation's 2013 Form 10-K and other SEC filings and risks related to the acquisition of Cheminova. Such forward-looking statements include, without limitation, statements regarding the Company’s expectations pertaining to the timing of completion of the acquisition, which remains subject to regulatory approvals and other conditions, the expected benefits of the acquisition, including the realization of anticipated synergies, and the Company’s future financial performance, including expectations for growth. Such information contained herein represents management's best judgment as of the date hereof based on information currently available. FMC Corporation does not intend to update this information and disclaims any legal obligation to the contrary. Historical information is not necessarily indicative of future performance. • These slides and the accompanying presentation contain “forward-looking statements” that represent management’s best judgment as of the date hereof based on information currently available. Actual results of the company may differ materially from those contained in the forward-looking statements. • Additional information concerning factors that may cause results to differ materially from those in the forward- looking statements is contained in the company’s periodic reports filed under the Securities Exchange Act of 1934, as amended. • The company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. 2

F M C A G R I C U L T U R A L S O L U T I O N S 3 Transaction Overview Strengthens Leadership Position in Crop Protection Chemistry • FMC to acquire 100% of the outstanding shares of Cheminova A/S, a wholly-owned subsidiary of Auriga Industries A/S • Aggregate purchase price of $1.8 billion • FMC to fund with 100% cash through committed debt facilities • Significant synergies from improved market access and efficiency improvements • Accretive to adjusted earnings in first full year • Closing expected in early 2015 subject to regulatory approvals and customary closing conditions • Commitment to strong investment grade rating; divesting Alkali Chemicals

F M C A G R I C U L T U R A L S O L U T I O N S 4 Strategic Rationale for Acquiring Cheminova • Broadens market access in Europe, Latin America and select Asian countries • Enhances portfolio with complementary technology and improves formulation capabilities • Expands position in existing crop segments and accelerates access to additional crops • Deepens regulatory expertise • Adds to robust innovation pipeline and ability to deliver new and differentiated products • Provides additional gains from manufacturing and operational efficiencies

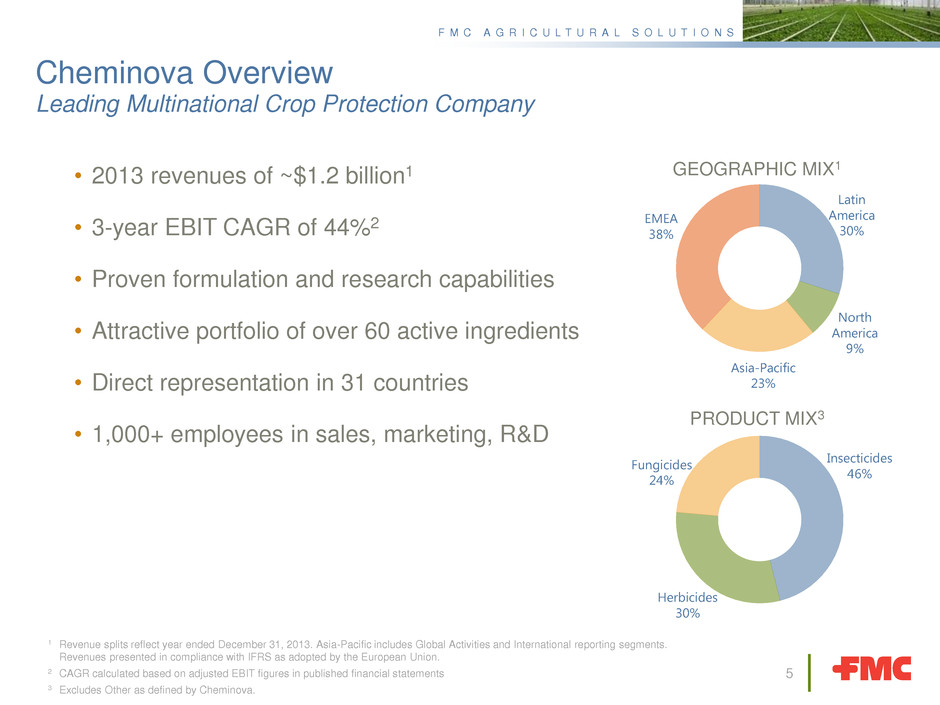

F M C A G R I C U L T U R A L S O L U T I O N S PRODUCT MIX3 Cheminova Overview Leading Multinational Crop Protection Company • 2013 revenues of ~$1.2 billion1 • 3-year EBIT CAGR of 44%2 • Proven formulation and research capabilities • Attractive portfolio of over 60 active ingredients • Direct representation in 31 countries • 1,000+ employees in sales, marketing, R&D 1 Revenue splits reflect year ended December 31, 2013. Asia-Pacific includes Global Activities and International reporting segments. Revenues presented in compliance with IFRS as adopted by the European Union. 2 CAGR calculated based on adjusted EBIT figures in published financial statements 3 Excludes Other as defined by Cheminova. 5 Latin America 30% North America 9% Asia-Pacific 23% EMEA 38% Insecticides 46% Herbicides 30% Fungicides 24% GEOGRAPHIC MIX1

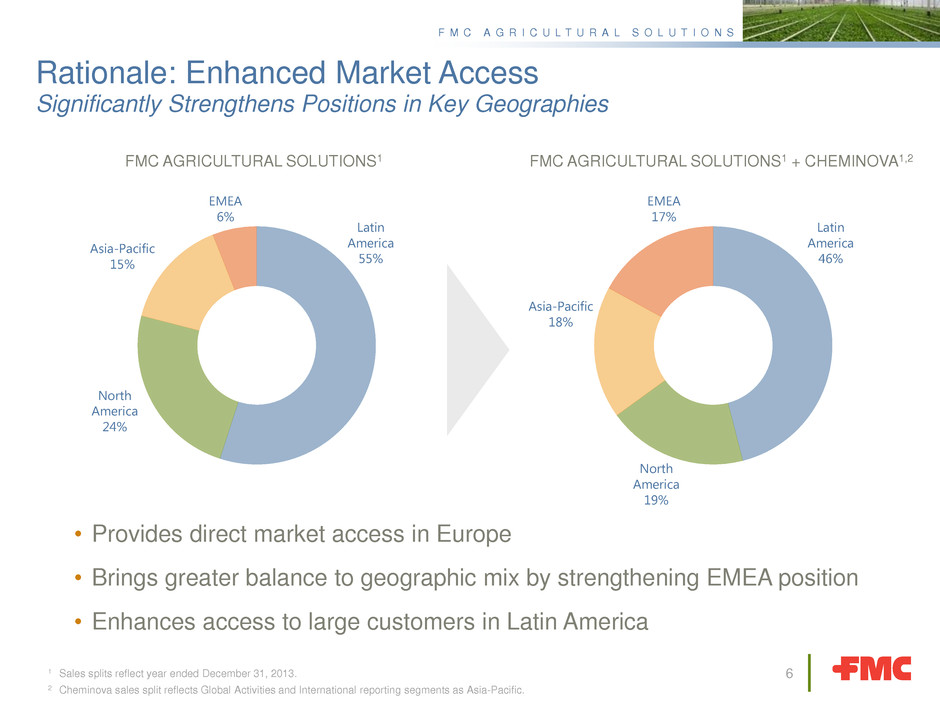

F M C A G R I C U L T U R A L S O L U T I O N S FMC AGRICULTURAL SOLUTIONS1 + CHEMINOVA1,2 FMC AGRICULTURAL SOLUTIONS1 6 Latin America 55% North America 24% Asia-Pacific 15% EMEA 6% North America 19% Asia-Pacific 18% EMEA 17% Latin America 46% 1 Sales splits reflect year ended December 31, 2013. 2 Cheminova sales split reflects Global Activities and International reporting segments as Asia-Pacific. Rationale: Enhanced Market Access Significantly Strengthens Positions in Key Geographies • Provides direct market access in Europe • Brings greater balance to geographic mix by strengthening EMEA position • Enhances access to large customers in Latin America

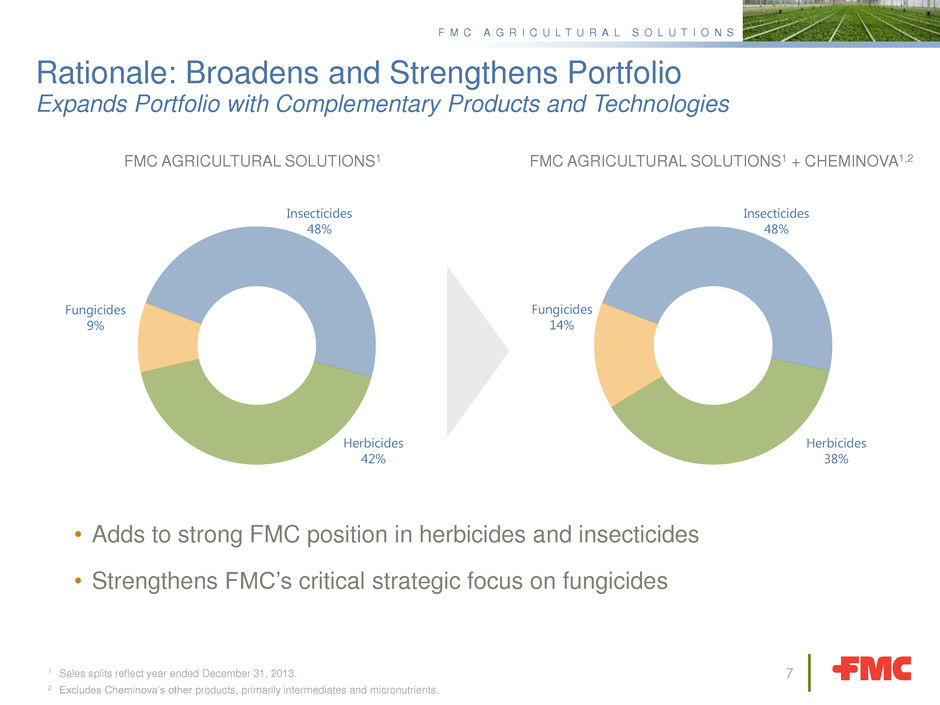

F M C A G R I C U L T U R A L S O L U T I O N S 7 Insecticides 48% Herbicides 42% Fungicides 9% Herbicides 38% Fungicides 14% Insecticides 48% 1 Sales splits reflect year ended December 31, 2013. 2 Excludes Cheminova’s other products, primarily intermediates and micronutrients. Rationale: Broadens and Strengthens Portfolio Expands Portfolio with Complementary Products and Technologies FMC AGRICULTURAL SOLUTIONS1 + CHEMINOVA1,2 FMC AGRICULTURAL SOLUTIONS1 • Adds to strong FMC position in herbicides and insecticides • Strengthens FMC’s critical strategic focus on fungicides

F M C A G R I C U L T U R A L S O L U T I O N S Rationale: Technology and Research Deepens Product Development Competencies with Regulatory Efficiencies • Additional active ingredients supplement FMC’s rapid market innovation activities • Brings formulation capabilities to new product development • $200 million current combined investments in R&D • Broader regional regulatory and field development network 8 Formulation Research + More Robust Innovation Pipeline + Speed to Market Active Ingredients Science Expertise

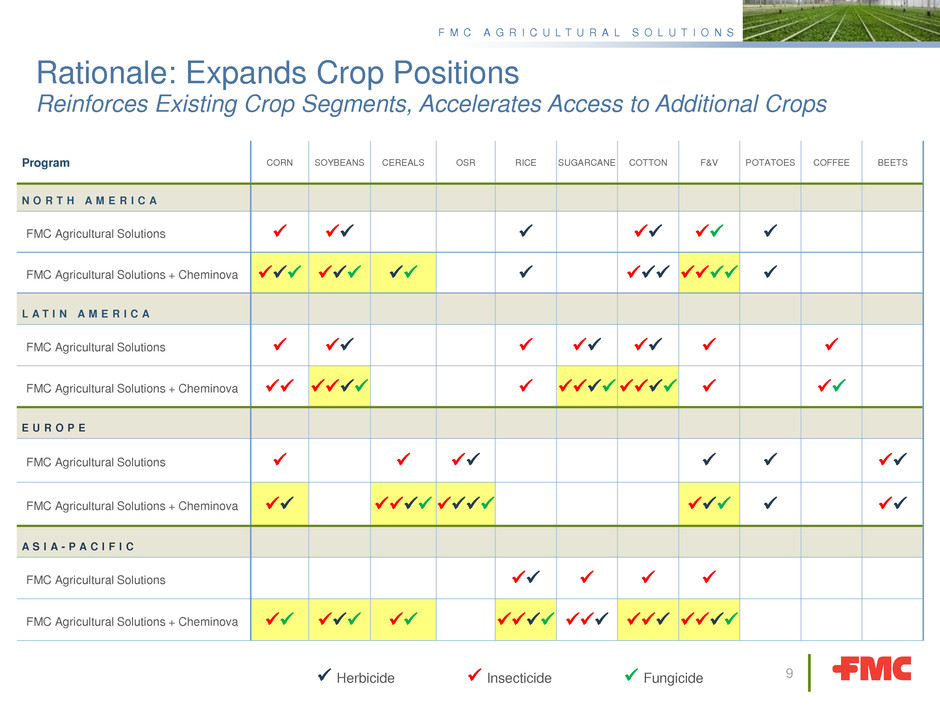

F M C A G R I C U L T U R A L S O L U T I O N S 9 Rationale: Expands Crop Positions Reinforces Existing Crop Segments, Accelerates Access to Additional Crops Program CORN SOYBEANS CEREALS OSR RICE SUGARCANE COTTON F&V POTATOES COFFEE BEETS N O R T H A M E R I C A FMC Agricultural Solutions FMC Agricultural Solutions + Cheminova L A T I N A M E R I C A FMC Agricultural Solutions FMC Agricultural Solutions + Cheminova E U R O P E FMC Agricultural Solutions FMC Agricultural Solutions + Cheminova A S I A - P A C I F I C FMC Agricultural Solutions FMC Agricultural Solutions + Cheminova Herbicide Insecticide Fungicide

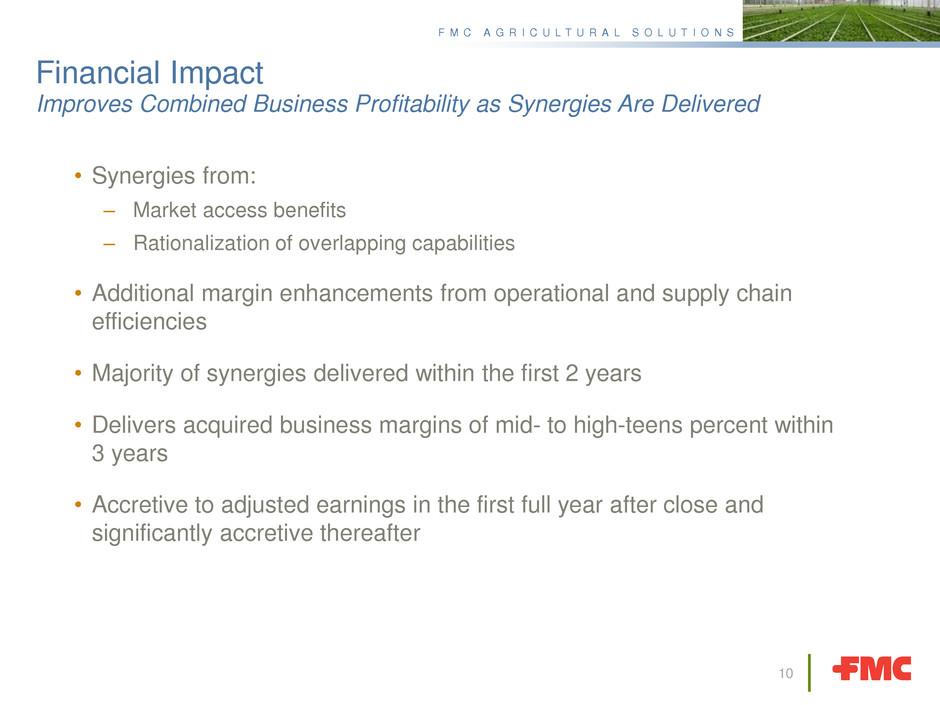

F M C A G R I C U L T U R A L S O L U T I O N S Financial Impact Improves Combined Business Profitability as Synergies Are Delivered • Synergies from: – Market access benefits – Rationalization of overlapping capabilities • Additional margin enhancements from operational and supply chain efficiencies • Majority of synergies delivered within the first 2 years • Delivers acquired business margins of mid- to high-teens percent within 3 years • Accretive to adjusted earnings in the first full year after close and significantly accretive thereafter 10

• Alkali Chemicals a high-quality business with substantial cash generation – 3 year average EBITDA of $177 million, EBITDA margin of 26% and ROCE of 24%1 – World’s largest producer of natural soda ash – Attractive industry structure and significant delivered cost advantage – Tradition of operational excellence – Proven track record of strong cash generation and high return on capital • Proceeds from sale used to pay down debt • Lithium will be retained and will ultimately become a separate operating segment of FMC – One of two global integrated manufacturers – The only brine-to-metal producer in the world – Strategically focused on energy storage, polymer and pharmaceuticals markets 11 Plans to Divest Alkali Chemicals and Retain Lithium Achieves Benefits of Previously Announced Separation 1 3-year average represents the contribution of Alkali Chemicals to segment operating profit of the FMC Minerals operating segment plus depreciation and amortization associated with Alkali Chemicals.

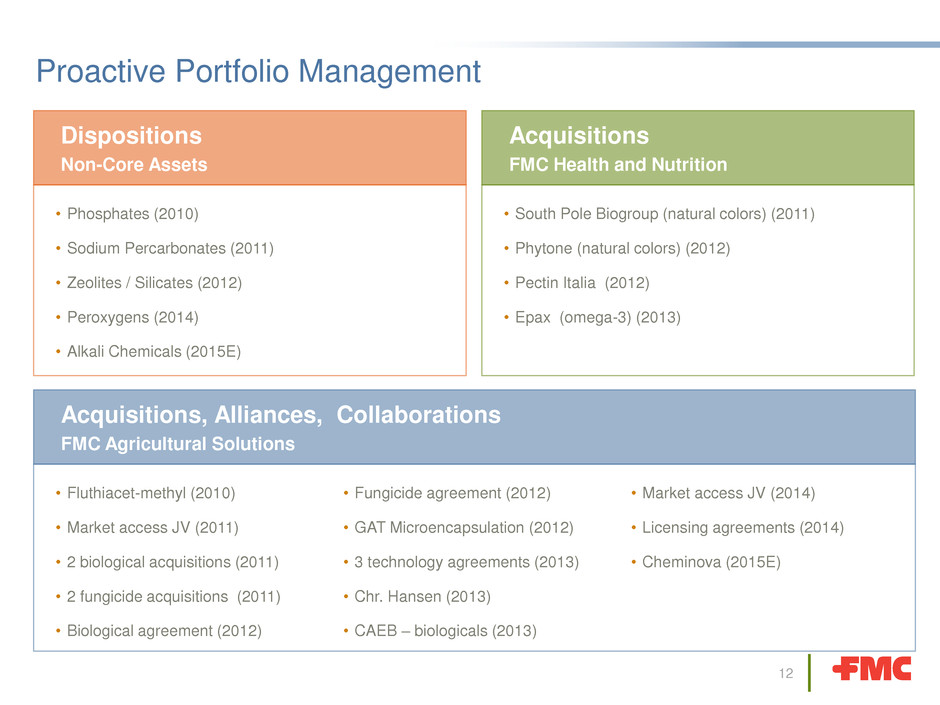

12 Proactive Portfolio Management • Phosphates (2010) • Sodium Percarbonates (2011) • Zeolites / Silicates (2012) • Peroxygens (2014) • Alkali Chemicals (2015E) Dispositions Non-Core Assets • Fluthiacet-methyl (2010) • Market access JV (2011) • 2 biological acquisitions (2011) • 2 fungicide acquisitions (2011) • Biological agreement (2012) • Fungicide agreement (2012) • GAT Microencapsulation (2012) • 3 technology agreements (2013) • Chr. Hansen (2013) • CAEB – biologicals (2013) • Market access JV (2014) • Licensing agreements (2014) • Cheminova (2015E) Acquisitions, Alliances, Collaborations FMC Agricultural Solutions • South Pole Biogroup (natural colors) (2011) • Phytone (natural colors) (2012) • Pectin Italia (2012) • Epax (omega-3) (2013) Acquisitions FMC Health and Nutrition

13 1 Comprised of FMC Agricultural Solutions, FMC Health and Nutrition as well as Lithium and Alkali Chemicals divisions. Also included is the FMC Peroxygens segment discontinued in FY2013. 2 LTM 2014 sales as of June 30, 2014, excluding discontinued FMC Peroxygens. 3 Sum of LTM 2014 sales of FMC operating segments (excluding Alkali Chemicals) and Cheminova as of June 30, 2014 presented in compliance with IFRS as adopted by the European Union. FMC Corporation Business Profile Completes Strategic Realignment to Agriculture and Health and Nutrition 37% 20% 6% 10% 6% 21% FY 20091 $2.8B Agricultural Solutions Health and Nutrition Lithium Foret Peroxygens Alkali Chemicals 55% 20% 6% 19% $4.0B LTM 20142 77% 18% 5% $4.5B Pro Forma3

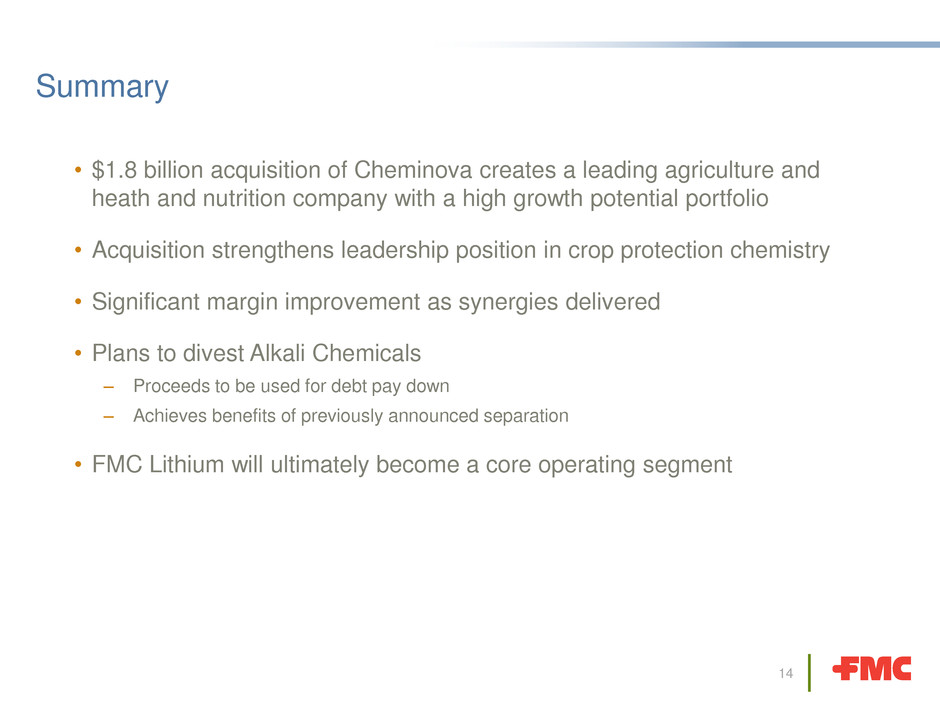

• $1.8 billion acquisition of Cheminova creates a leading agriculture and heath and nutrition company with a high growth potential portfolio • Acquisition strengthens leadership position in crop protection chemistry • Significant margin improvement as synergies delivered • Plans to divest Alkali Chemicals – Proceeds to be used for debt pay down – Achieves benefits of previously announced separation • FMC Lithium will ultimately become a core operating segment 14 Summary