Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIFTH THIRD BANCORP | d783147d8k.htm |

Barclays Capital

Global Financial Services Conference

Kevin Kabat

Vice Chair & Chief Executive Officer

September 8, 2014

Refer to earnings release dated July 17, 2014 and

10-Q dated August 7, 2014 for further information

Exhibit 99.1

Fifth Third Bank | All Rights Reserved |

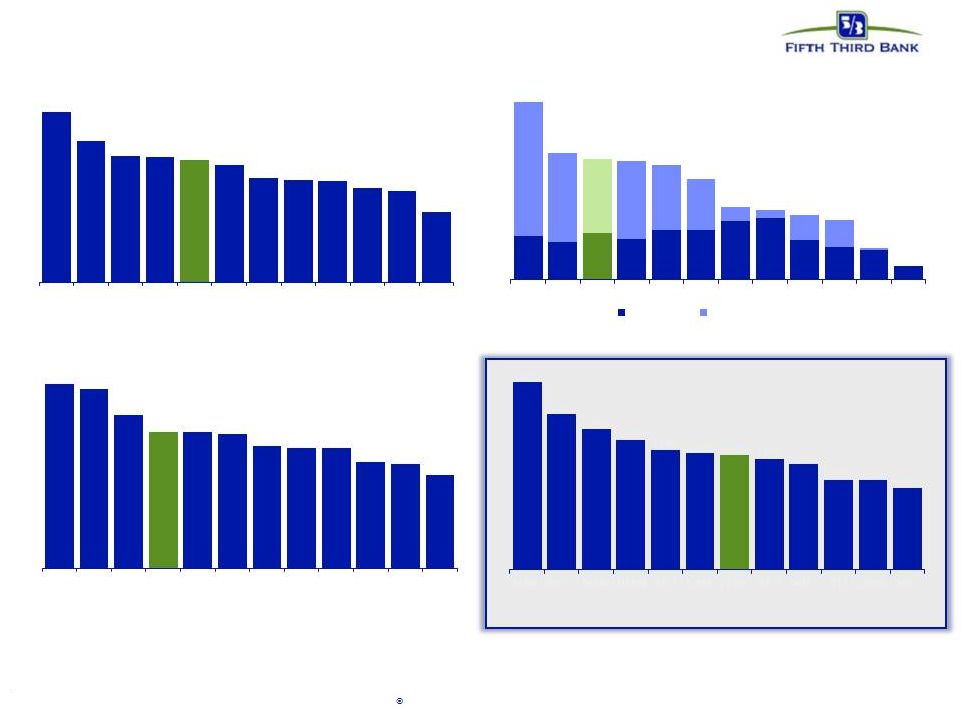

Solid

1H14 profitability results PPNR

1

/ Average assets

Total Payout Ratio

Price to Book Value

ROAA

…supporting strong returns to shareholders…

Strong pre-provision profitability…

Relative position not yet reflected in valuation.

…and driving above average profitability.

1

Annualized; excludes securities gains / losses for FITB and peers. Non-GAAP

measure; See Reg. G reconciliation in appendix. Source: SNL Financial and

company reports. Data as of 2Q14. Price to Book as of 9/3/14. Total payout ratio calculated based on dividends declared and shares

repurchased using average stock price during the period.

2

Fifth Third Bank | All Rights Reserved

2.56%

2.13%

1.91%

1.90%

1.84%

1.77%

1.57%

1.54%

1.52%

1.42%

1.38%

1.06%

USB

WFC

PNC

MTB

FITB

BBT

HBAN

STI

RF

KEY

CMA

ZION

112%

80%

76%

75%

73%

64%

46%

44%

41%

38%

20%

8%

HBAN

KEY

FITB

CMA

USB

WFC

BBT

MTB

PNC

STI

RF

ZION

Dividends

Share Repurchases

1.58%

1.54%

1.32%

1.17%

1.16%

1.15%

1.05%

1.03%

1.03%

0.91%

0.90%

0.80%

USB

WFC

PNC

FITB

MTB

BBT

RF

HBAN

KEY

STI

CMA

ZION

201%

165%

149%

138%

127%

124%

122%

117%

113%

96%

95%

87%

USB

WFC

MTB

HBAN

BBT

CMA

FITB

KEY

PNC

STI

ZION

RF |

3

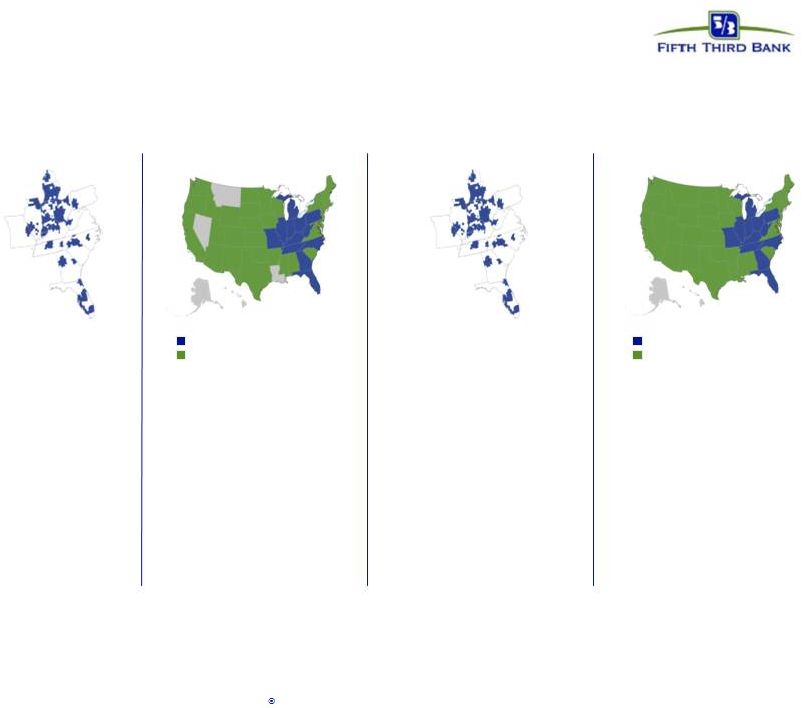

Broad scope of products and services

addressing the needs of wide array of customers

Consumer Lending

Branch Banking

Wealth Management

Wholesale Banking

Retail Bank

Cards

Mortgage

Auto

2013 total revenue of $560MM

2013 average loans of $2.0B

2013 average core deposits of $8.8B

$27B assets under management

$305B assets under care

2013 total revenue of $2.6B

2013 average loans of $47.3B

2013 average core deposits of $30.2B

2013 total revenue of $2.0B

2013 average loans of $17.5B

1,309 banking centers

2,619 ATMs

12 states

2013 total revenue of $1.1B

2013 average loans of $22.2B

Private Bank

Retail Brokerage

Institutional Services

Commercial Bank

Footprint

Business

Lines

Highlights

Diversified financial services company with local orientation and

strong national businesses

In footprint markets

National commercial banking

In footprint markets

National consumer lending

Fifth Third Bank | All Rights Reserved |

Key

strategies in the commercial bank driving success

Healthcare

•

Expanded suite of

products designed to

meet full range of

healthcare

clients’

needs

•

Innovative cash

management solutions

simplify cash handling

and improve cash flow

Currency Processing

Solutions

Segment

Specialization

Industry

Specialization

Treasury

Management

Capabilities

Energy

•

Launched in 3Q12

•

Focused on extraction and

distribution (upstream /

downstream)

Commercial Real Estate

•

Centralized group focused

on select opportunities

•

Target clients:

businesses that

generate $500MM to

$2B in revenue

•

Investments in capital

markets capabilities

•

“Lead left”

strategy

Mid-Corporate

•

Streamline processes,

reduce costs and

maximize convenience

Commercial Card

Solutions

CONSULTATIVE SALES APPROACH

4

Fifth Third Bank | All Rights Reserved |

Key

strategies in the commercial bank driving success

•

Commercial banking total revenue in 1H14

increased 6% vs. 1H13

–

Growth in capital markets fees driven

by industry verticals

•

Continued focus on C&I lending

–

76% of 2Q14 total average commercial

loans and leases (59% 4 years ago)

1

1H11 and 1H12 have not been restated for changes in the structure of the reporting

units that occurred in 1Q14. Fifth Third Bank | All Rights Reserved

662

696

772

814

338

354

403

430

-

200

400

600

800

1,000

1,200

1,400

1H11

1H12

1H13

1H14

Commercial Bank Revenue ($MM)

1

Net Interest Income

Noninterest Income

$0

$10

$20

$30

$40

$50

$60

2Q11

2Q12

2Q13

2Q14

Total Avg. Commercial Loans ($B)

Middle Market

Energy

Healthcare

Large Corporate

Mid Corporate

CRE

Other

-

20

40

60

80

100

120

1H11

1H12

1H13

1H14

Capital Markets Fees ($MM)

Syndication Fees

Foreign Exchange

Institutional Sales

Derivatives

Commodities

5 |

Repositioning consumer bank

with investments and strategic changes

Maximize the value offered and the revenue earned from every relationship

•

Growth in high value segments

Execution consistency

Dedicated team of specialists for focused segmentation

Optimize the current distribution model

•

Redesign branch formats and re-define job categories while preserving revenue

streams •

Testing to break through the previous minimum staffing levels by

deploying new technologies

Enhance digital capabilities to lower costs while improving the customer

experience •

Enhancement of customer service levels through the ease and convenience of digital

banking •

Deliver solutions in digital channels for increased sales effectiveness and drive

adoption 1

Online banking

47%

50%

Mobile banking

9%

28%

Alternative channel delivery

% of checking households with

Branch transactions

Average monthly trans. in millions

7.7

7.0

6.4

2Q12

2Q13

2Q14

2009

2Q14

2011

2Q14

6

Fifth Third Bank | All Rights Reserved

2 |

Repositioning consumer bank

with investments and strategic changes

Consumer deposit activity

Transaction volume by ATM and Mobile channels

Total EOP Consumer Deposits ($B)

excludes CDs

•

Remote deposit capture launched in 2012

•

All ATMs image-enabled and 49 Smart ATMs

deployed with additional consumer-friendly

upgrades

–

Touch-screen and dual screen interface

–

Ability to split deposits into two accounts

–

Small denomination withdrawals

•

Testing smaller technology-focused branch

formats with lower staffing requirements

•

Redefining roles of branch personnel and testing

hybrid roles

Fifth Third Bank | All Rights Reserved

12%

22%

31%

0%

10%

20%

30%

40%

2Q12

2Q13

2Q14

$42.8

$45.7

$47.2

$0

$10

$20

$30

$40

$50

2Q12

2Q13

2Q14

(11%)

(22%)

6%

(25%)

(20%)

(15%)

(10%)

(5%)

0%

5%

10%

Total Banking

Center Staff

Total Service FTE

Total Sales FTE

Retail Banking Headcount

7

18-month

change

(Dec.

2012

-

June

2014) |

8

Retail

Brokerage

Private Bank

Institutional

Services

ClearArc

Capital

Mass market and mass affluent clients

Financial elite clients

Consulting, investment and record-keeping services for

corporations, financial institutions, foundations,

endowments and not-for-profit organizations

Provides asset management services to institutional clients

Investment Advisors serves individual and institutional clients with all levels of

wealth; provides for significant cross-sell opportunity

Retail brokerage revenue

($MM)

Assets under management

($B)

Institutional services revenue

($MM)

Assets under management

($B)

Wealth management contributing to

ongoing momentum

Fifth Third Bank | All Rights Reserved

117

144

FY11

FY13

16

21

FY11

2Q14

62

84

FY11

FY13

6.3

6.8

1Q13

2Q14

Teams of professionals dedicated to helping clients

achieve their financial goals

–

Retirement, investment and education planning, managed

money, annuities and transactional brokerage services

–

Retirement plans, endowment management, planned

giving and custody services

–

Divested all proprietary mutual funds in 2012 to complete

transition to open architecture

– |

9

Wealth management contributing to

ongoing momentum

•

Investment advisory fees excluding mutual

fund revenue increased 19% FY13 vs FY10;

1H14 up 3% vs 1H13

•

Shift towards recurring revenue streams;

77% of total revenue is recurring as of 2Q14

compared with 71% in 2010

•

Significant cross-sell opportunity

–

Private Bank revenue per household

increased 79% 2Q14 compared with 2012

–

Number of >$1MM households increased

8% in last 12 months

Noninterest expense ($MM)

Fifth Third Bank | All Rights Reserved

$290

$310

$330

$350

$370

$390

2010

2011

2012

2013

Investment advisory fees ($MM)

$330

$353

$361

$393

$31

$22

$13

IA Fees (excl. mutual fund)

Mutual fund fees

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

$550

2011

2012

2013

Total Revenue ($MM)

373

396

406

113

117

154

Noninterest Income

Net Interest Income

$421

$437

$453

$200

$250

$300

$350

$400

$450

$500

2011

2012

2013 |

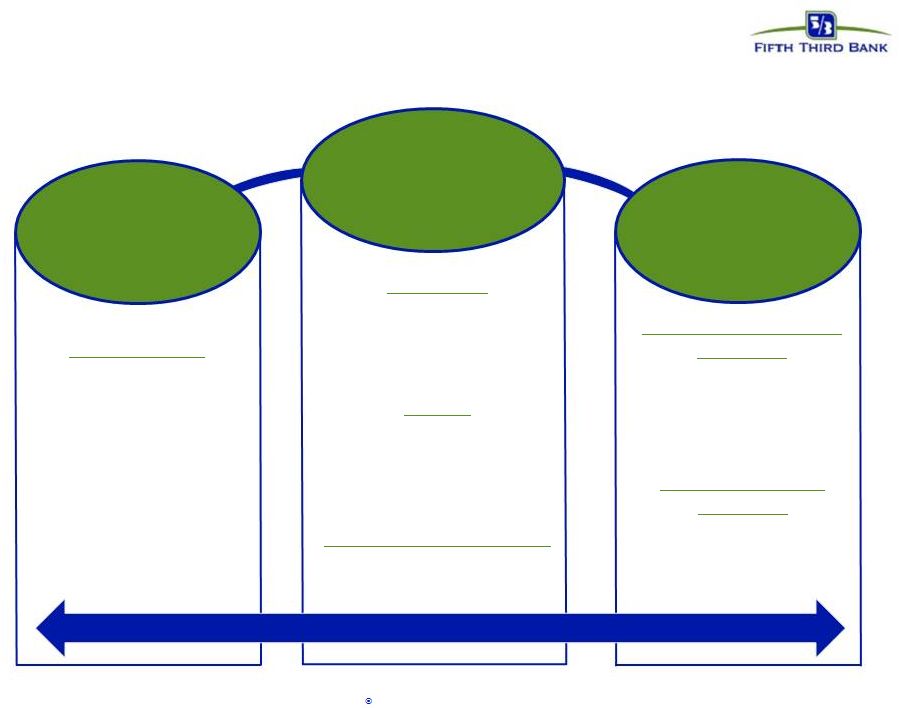

10

Adding value through newly created

Payments and Commerce Solutions division

Future

Opportunity

Efficiencies

Gained

Competitive

Advantage

•

Growing core existing payments

markets

•

New market development

•

Innovative sector solutions (e.g.

Healthcare and Retail)

•

Extensive payments

infrastructure

•

Scale and experience in

enrollment, access, support

services, etc.

•

Existing customer contacts

and relationships

•

Shift from opportunistic

player to proactive market

leader

•

Resource optimization

through consolidated card

strategy, product

development, and

operational execution

•

Creates a focused and

more nimble organization

with industry expertise

•

Incremental revenue

streams reflected on

Commercial and Consumer

Bank P&L through value-

add solution offerings

How we will control expenses

and grow revenue

How we will compete with

non-bank entities

How we will increase our

value proposition

Fifth Third Bank | All Rights Reserved

–

Treasury management

–

Financial supply chain

management

–

Currency processing

solutions

–

Card solutions

–

Payment security

–

Mobile payments

–

Cobranded cards and

loyalty |

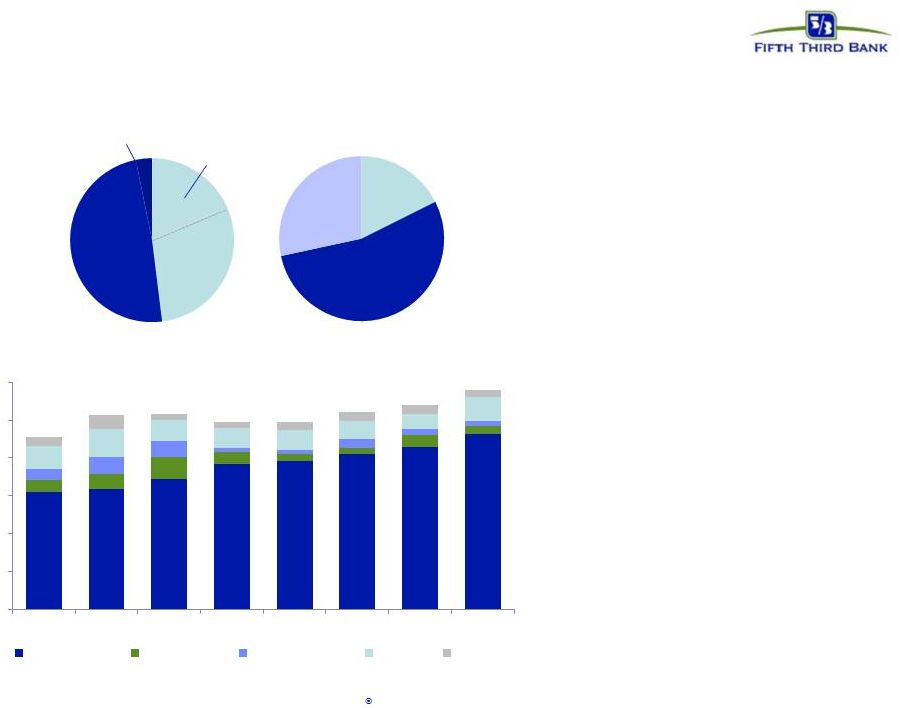

11

Balance sheet positioning

1

Estimate; funding (DDAs + interest-bearing liabilities); liabilities attributed

to fixed or floating using terms and expected beta Fixed / Floating

Portfolio Interest-Earning Assets

Funding

1

•

Asset sensitive positioning

•

Mix of asset classes (59% commercial, 41%

consumer)

•

Disciplined loan growth

•

Balance sheet well-positioned for the new

LCR rules

•

Minimal reliance on short-term borrowings

•

Core deposits represent over 80% of total

liabilities vs. 68% in 2Q07

–

Represent approximately 2 percent of total

liabilities

–

Focused in areas with strong cross-sell

opportunities (verticals, cap. mkts, TM)

–

Additional portfolio leverage or cash

levels to be added to generate higher

buffer to minimum ratio requirements

Fifth Third Bank | All Rights Reserved

Total Average Liabilities ($B)

Fixed

18%

Floating

54%

Non-

Interest

Bearing

28%

Fixed

48%

Floating

52%

Investment

Portfolio

18%

Loans

30%

Investment

Portfolio 3%

0

20

40

60

80

100

120

2Q07

2Q08

2Q09

2Q10

2Q11

2Q12

2Q13

2Q14

Core Deposits

CDs-

$100K+

S-T Borrowings

L-T debt

Other

Loans

49%

$116 B

$91 B |

12

Expense discipline

2Q14 Efficiency ratio

Peer median: 64%

Total FTE

•

Operating leverage strategic priority in all

environments

•

Expect continued improvement in 2014

•

Mid-50% efficiency ratio target in normalized

interest rate environment

Noninterest expense ($MM)

Source: SNL Financial and company reports. Efficiency ratio calculated as reported

noninterest expense / (net interest income (fully taxable equivalent)+ noninterest income)

•

Reduction in FTE includes the impact of branch

and mortgage staffing changes

–

50% of year-over-year decline in mortgage

and 37% in retail

•

Carefully managing expenses in response to

revenue environment (total noninterest

expense down 8% year-over-year)

•

Continued R&D investments with increased

technology, communications, and equipment

expense in 2014

Fifth Third Bank | All Rights Reserved |

13

1Q12-2Q14 Common Equity Repurchased /

2011 Total Common Equity

Strong capital position

1

Non-GAAP measure; See Reg. G reconciliation in appendix.

Peer average includes: BBT, CMA, HBAN, KEY, MTB, PNC, RF, STI, USB, WFC, and

ZION Tier 1 common equity

1

From building capital…

…to maintaining

capital at relatively

stable levels…

…through share repurchase activity

Capital generation and overall capital position,

well above current and future requirements,

support balance sheet growth and continued prudent capital return to

shareholders. Fifth Third Bank | All Rights Reserved

|

Valuable ownership stake in Vantiv, Inc.

March 2009

Significant unrecognized value unlocked

March 2009 –

Present

Realizing earning potential

Ongoing impact

Positioned well to generate future value

$2.35 billion enterprise value

Debt incurred

Equity value

•

Equity valuation of $1.1B

–

Including $561MM cash payment

related to Advent’s 51% ownership

and put rights

–

Fifth Third retained 49% ownership

with additional warrants

Recognized value to date

($MM pre-tax)

•

Currently own 23% interest in

Vantiv Holding, LLC, convertible to

Vantiv, Inc. shares (NYSE: VNTV)

–

Carrying (book) value of

$384MM as of 6/30/14

–

Ownership (market) value of

~$1.4B as of 6/30/14

•

Ongoing equity method earnings

•

Warrant to purchase additional

shares in Vantiv

–

Carried as a derivative asset at

fair value of $412MM as of

6/30/14

•

Annual payment corresponding

with tax benefits accruing to Fifth

Third associated with the tax

receivable agreement (TRA)

–

FITB realized $9MM in 4Q13

Equity ownership & earnings

Total gains / earnings recognized ~$3.1 billion

$1.10B

$1.25B

Enterprise Value Components

$115

$618

$362

$254

Gain on IPO

Gains on share

sales and TRA

Net put and

warrant

valuation gains

Equity method

earnings

83.9

70.2

48.8

43.0

$0

$20

$40

$60

$80

0

15

30

45

60

75

90

2011

2012

2013

2014 YTD

Class B shares (MM)

Equity method earnings ($MM)

1

1

1

Before Fifth Third’s valuation of warrants, put rights, and minority interest discounts expected

to reduce its implied valuation of the business by an estimated $50 million. •

Pre-tax gain of $1.8B

Fifth Third Bank | All Rights Reserved

14 |

15

Investment thesis

Investing in the

future of our

company

Creating

shareholder value

with long-term

focus while

optimizing our

current

opportunities

Continuously

improving all of

our business

platforms to

adapt to changing

environment

Managing

prudently in the

current

competitive

environment

Fifth Third Bank | All Rights Reserved |

16

Cautionary statement

Fifth Third Bank | All Rights Reserved

This report contains statements that we believe are “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated

thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule

3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future

performance or business. They usually can be identified by the use of forward-looking language

such as “will likely result,” “may,” “are expected to,” “is

anticipated,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as

“believes,” “plans,” “trend,” “objective,”

“continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,”

“should,” “could,” “might,” “can,” or similar verbs. You

should not place undue reliance on these statements, as they are subject to risks and

uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K. When considering

these forward-looking statements, you should keep in mind these risks and uncertainties, as well

as any cautionary statements we may make. Moreover, you should treat these statements as

speaking only as of the date they are made and based only on information then actually known to

us.

There are a number of important factors that could cause future results to differ materially from

historical performance and these forward- looking statements. Factors that might cause such

a difference include, but are not limited to: (1) general economic conditions and weakening in

the economy, specifically the real estate market, either nationally or in the states in which Fifth Third, one or more acquired

entities and/or the combined company do business, are less favorable than expected; (2) deteriorating

credit quality; (3) political developments, wars or other hostilities may disrupt or increase

volatility in securities markets or other economic conditions; (4) changes in the interest rate

environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan

loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate

sources of funding and liquidity; (7) maintaining capital requirements may limit Fifth

Third’s operations and potential growth; (8) changes and trends in capital markets; (9) problems

encountered by larger or similar financial institutions may adversely affect the banking industry

and/or Fifth Third; (10) competitive pressures among depository institutions increase

significantly; (11) effects of critical accounting policies and judgments; (12) changes in

accounting policies or procedures as may be required by the Financial Accounting Standards Board

(FASB) or other regulatory agencies; (13) legislative or regulatory changes or actions, or

significant litigation, adversely affect Fifth Third, one or more acquired entities and/or the

combined company or the businesses in which Fifth Third, one or more acquired entities and/or the combined company are engaged,

including the Dodd-Frank Wall Street Reform and Consumer Protection Act; (14) ability to maintain

favorable ratings from rating agencies; (15) fluctuation of Fifth Third’s stock price;

(16) ability to attract and retain key personnel; (17) ability to receive dividends from its

subsidiaries; (18) potentially dilutive effect of future acquisitions on current shareholders’

ownership of Fifth Third; (19) effects of accounting or financial results of one or more

acquired entities; (20) difficulties from Fifth Third’s investment in, relationship with, and

nature of the operations of Vantiv, LLC; (21) loss of income from any sale or potential sale of

businesses that could have an adverse effect on Fifth Third’s earnings and future growth;

(22) ability to secure confidential information and deliver products and services through the use

of computer systems and telecommunications networks; and (23) the impact of reputational risk created

by these developments on such matters as business generation and retention, funding and

liquidity.

You should refer to our periodic and current reports filed with the Securities and Exchange

Commission, or “SEC,” for further information on other factors, which could cause

actual results to be significantly different from those expressed or implied by these forward-looking

statements. |

17

Appendix

Fifth Third Bank | All Rights Reserved |

18

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

Fifth Third Bancorp and Subsidiaries

Regulation G Non-GAAP Reconcilation

$ and shares in millions

(unaudited)

June

March

December

September

June

2014

2014

2013

2013

2013

Income before income taxes (U.S. GAAP)

$606

$438

$561

$604

$841

Add:

Provision expense (U.S. GAAP)

76

69

53

51

64

Pre-provision net revenue (a)

682

507

614

655

905

Net income available to common shareholders (U.S. GAAP)

416

309

383

421

582

Add:

Intangible amortization, net of tax

1

1

1

1

1

Tangible net

income available to common shareholders 417

310

384

422

583

Tangible net income available to common

shareholders (annualized) (b) 1,673

1,257

1,523

1,674

2,338

Average Bancorp shareholders' equity (U.S. GAAP)

15,157

14,862

14,757

14,440

14,221

Less:

Average preferred stock

(1,119)

(1,034)

(703)

(593)

(717)

Average goodwill

(2,416)

(2,416)

(2,416)

(2,416)

(2,416)

Average intangible assets

(17)

(19)

(20)

(22)

(24)

Average tangible common equity

(c) 11,605

11,393

11,618

11,409

11,064

Total Bancorp shareholders' equity (U.S. GAAP)

15,469

14,826

14,589

14,641

14,239

Less:

Preferred stock

(1,331)

(1,034)

(1,034)

(593)

(991)

Goodwill

(2,416)

(2,416)

(2,416)

(2,416)

(2,416)

Intangible assets

(17)

(18)

(19)

(21)

(23)

Tangible common equity, including

unrealized gains / losses (d) 11,705

11,358

11,120

11,611

10,809

Less: Accumulated other comprehensive income

(382)

(196)

(82)

(218)

(149)

Tangible common equity, excluding unrealized gains /

losses (e) 11,323

11,162

11,038

11,393

10,660

Total assets (U.S. GAAP)

132,562

129,654

130,443

125,673

123,360

Less:

Goodwill

(2,416)

(2,416)

(2,416)

(2,416)

(2,416)

Intangible assets

(17)

(18)

(19)

(21)

(23)

Tangible assets, including

unrealized gains / losses (f) 130,129

127,220

128,008

123,236

120,921

Less: Accumulated other comprehensive income / loss, before tax

(588)

(302)

(126)

(335)

(229)

Tangible assets, excluding unrealized gains / losses

(g) 129,541

126,918

127,882

122,901

120,692

Common shares outstanding (h)

844

848

855

887

851

Ratios:

Return on average tangible common equity (b) / (c)

14.4%

11.0%

13.1%

14.7%

21.1%

Tangible common equity (excluding unrealized gains/losses) (e) / (g)

8.74%

8.79%

8.63%

9.27%

8.83%

Tangible common equity (including unrealized gains/losses) (d) / (f)

9.00%

8.93%

8.69%

9.42%

8.94%

Tangible book value per share (d) / (h)

$13.86

$13.40

$13.00

$13.09

$12.69

For the Three Months Ended |

19

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

Fifth Third Bancorp and Subsidiaries

Regulation G Non-GAAP Reconcilation

$ and shares in millions

(unaudited)

June

March

December

September

June

2014

2014

2013

2013

2013

Total Bancorp shareholders' equity (U.S. GAAP)

$15,469

$14,826

$14,589

$14,641

$14,239

Goodwill and certain other intangibles

(2,484)

(2,490)

(2,492)

(2,492)

(2,496)

Unrealized gains

(382)

(196)

(82)

(218)

(149)

Qualifying trust preferred securities

60

60

60

810

810

Other

(19)

(18)

19

21

22

Tier I capital

12,644

12,182

12,094

12,762

12,426

Less:

Preferred stock

(1,331)

(1,034)

(1,034)

(593)

(991)

Qualifying trust preferred securities

(60)

(60)

(60)

(810)

(810)

Qualifying noncontrolling interest in consolidated

subsidiaries (1)

(1)

(37)

(39)

(38)

Tier I common equity (a)

11,252

11,087

10,963

11,320

10,587

Risk-weighted assets, determined in accordance with

prescribed regulatory requirements (b)

117,117

116,622

115,969

113,801

111,559

Ratio:

Tier I common equity (a) / (b)

9.61%

9.51%

9.45%

9.95%

9.49%

Basel III - Estimated Tier 1 common equity ratio

June

March

December

September

2014

2014

2013

2013

Tier 1 common equity (Basel I)

11,252

11,087

10,963

11,320

Add:

Adjustment related to capital components

96

99

82

88

Estimated Tier 1 common equity under final Basel III rules without AOCI (opt out)(c)

11,348

11,186

11,045

11,408

Add:

Adjustment related to AOCI

382

196

82

218

Estimated Tier 1 common equity under final Basel III rules with AOCI (non opt out)(d)

11,730

11,382

11,127

11,626

Estimated risk-weighted assets under final Basel III rules (e)

122,465

122,659

122,074

120,447

Estimated Tier 1 common equity ratio under final Basel III rules (opt out) (c) / (e)

9.27%

9.12%

9.05%

9.47%

Estimated Tier 1 common equity ratio under final Basel III rules (non opt out) (d) / (e)

9.58%

9.28%

9.12%

9.65%

(c), (d)

(e)

Under the final Basel III rules, non-advanced approach banks are permitted to make a one-time

election to opt out of the requirement to include AOCI in Tier 1 common equity. Other adjustments

include mortgage servicing rights and deferred tax assets subject to threshold limitations and

deferred tax liabilities related to intangible assets. Key differences under Basel III in the

calculation of risk-weighted assets compared to Basel I include: (1) Risk weighting for commitments under 1 year; (2) Higher risk weighting for exposures to

securitizations, past due loans, foreign banks and certain commercial real estate; (3) Higher risk

weighting for mortgage servicing rights and deferred tax assets that are under certain thresholds as

a percent of Tier 1 capital; and (4) Derivatives are differentiated between exchange clearing and

over-the-counter and the 50% risk-weight cap is removed. For the Three Months

Ended |