Attached files

| file | filename |

|---|---|

| 8-K - ABRAXAS PETROLEUM CORP | axas8k090814.htm |

Abraxas Petroleum Corporate Update September 2014 Exhibit 99.1

* The information presented herein may contain predictions, estimates and other forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Although the Company believes that its expectations are based on reasonable assumptions, it can give no assurance that its goals will be achieved. Important factors that could cause actual results to differ materially from those included in the forward-looking statements include the timing and extent of changes in commodity prices for oil and gas, availability of capital, the need to develop and replace reserves, environmental risks, competition, government regulation and the ability of the Company to meet its stated business goals. Forward-Looking Statements

* I. Abraxas Petroleum Overview

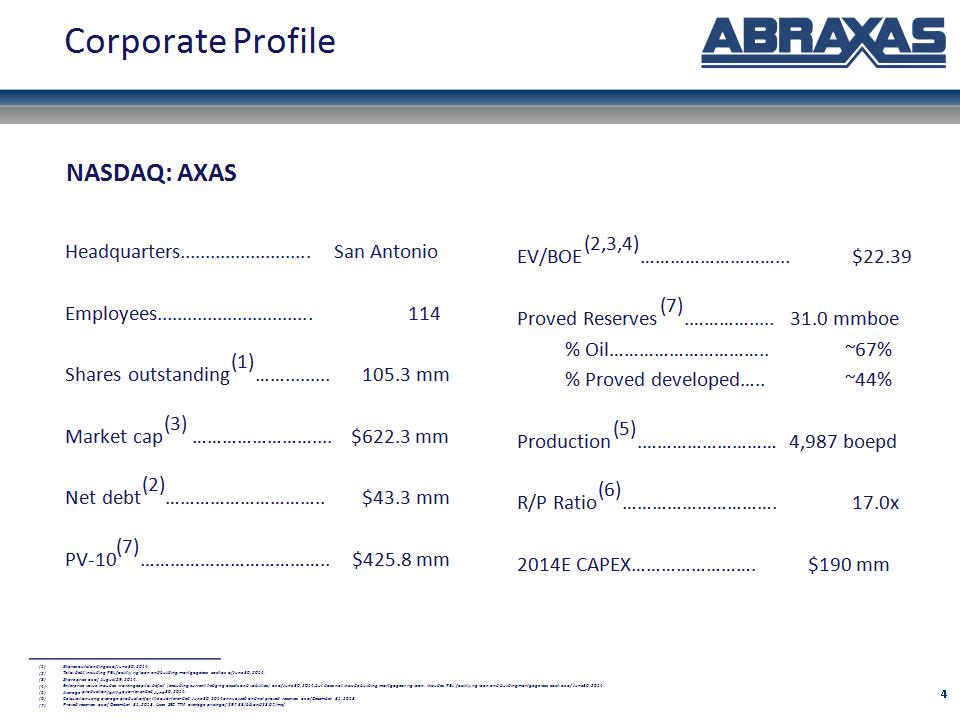

* Headquarters.......................... San Antonio Employees............................... 114 Shares outstanding(1)……......... 105.3 mm Market cap(3) …………………….... $622.3 mm Net debt(2)………………………….. $43.3 mm PV-10(7)……………………………….. $425.8 mm Shares outstanding as of June 30, 2014. Total debt including RBL facility, rig loan and building mortgage less cash as of June 30, 2014. Share price as of August 29, 2014. Enterprise value includes working capital deficit (excluding current hedging assets and liabilities) as of June 30, 2014, but does not include building mortgage or rig loan. Includes RBL facility, rig loan and building mortgage less cash as of June 30, 2014. Average production for the quarter ended June 30, 2014. Calculation using average production for the quarter ended June 30, 2014 annualized and net proved reserves as of December 31, 2013. Proved reserves as of December 31, 2013. Uses SEC TTM average pricing of $97.33/bbl and $3.67/mcf. EV/BOE(2,3,4)………………………... $22.39 Proved Reserves(7).…………..... 31.0 mmboe % Oil………………………….. ~67% % Proved developed….. ~44% Production(5).……………………… 4,987 boepd R/P Ratio(6)…………………………. 17.0x 2014E CAPEX……………………. $190 mm NASDAQ: AXAS Corporate Profile

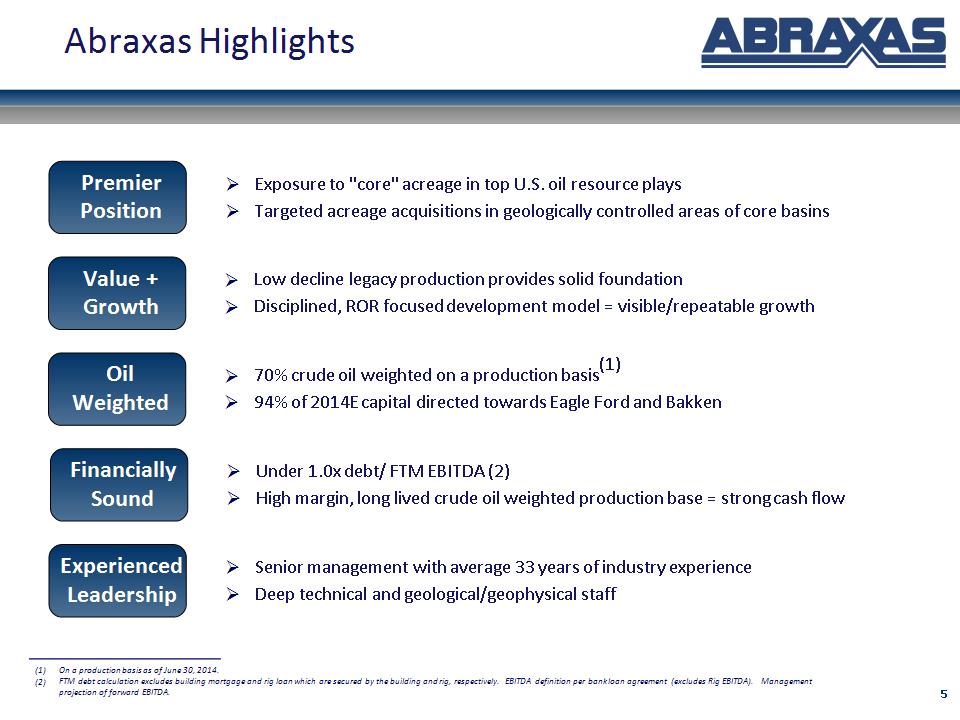

* Exposure to "core" acreage in top U.S. oil resource plays Targeted acreage acquisitions in geologically controlled areas of core basins Premier Position Value + Growth Low decline legacy production provides solid foundation Disciplined, ROR focused development model = visible/repeatable growth Oil Weighted 70% crude oil weighted on a production basis(1) 94% of 2014E capital directed towards Eagle Ford and Bakken Financially Sound Under 1.0x debt/ FTM EBITDA (2) High margin, long lived crude oil weighted production base = strong cash flow On a production basis as of June 30, 2014. FTM debt calculation excludes building mortgage and rig loan which are secured by the building and rig, respectively. EBITDA definition per bank loan agreement (excludes Rig EBITDA). Management projection of forward EBITDA. Experienced Leadership Senior management with average 33 years of industry experience Deep technical and geological/geophysical staff Abraxas Highlights

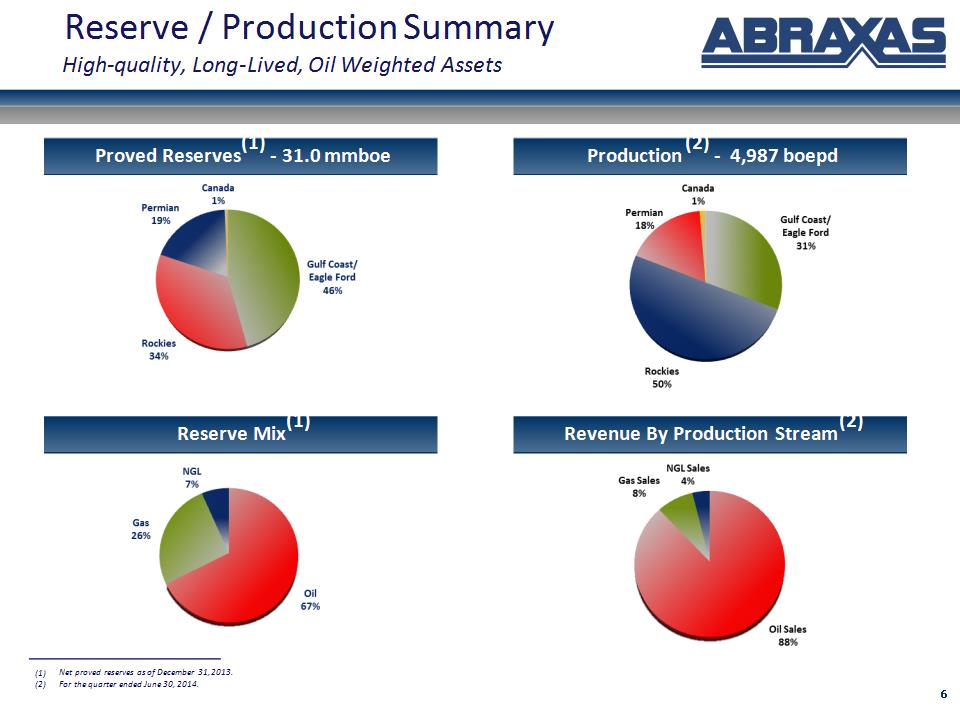

* Proved Reserves(1) – 31.0 mmboe Production(2) – 4,987 boepd Reserve Mix(1) Revenue By Production Stream(2) Reserve / Production Summary High-quality, Long-Lived, Oil Weighted Assets Net proved reserves as of December 31, 2013. For the quarter ended June 30, 2014.

* (Bopd) 6M14A Debt/EBITDA calculated using annualized 6M14 EBITDA. 2014 estimate assumes the midpoint of 2014 guidance of 5,800 – 6,000 boepd and 2014 guidance for an average 70% crude oil production percentage. Total Debt includes RBL facility, Rig Loan and Building Loan. TTM recurring EBITDA. Equivalent to Revenue – Realized Hedge Settlements – LOE – Production Taxes – Cash G&A – Other Expenses. Does not include EBITDA contribution from Raven Drilling or contributions from liquidated hedge settlements. Prudent Growth Growing Oil Volumes while Prudently Managing the Balance Sheet (Debt/TTM Recurring EBITDA) Daily Oil Production vs. Debt/TTM Recurring EBITDA (3)

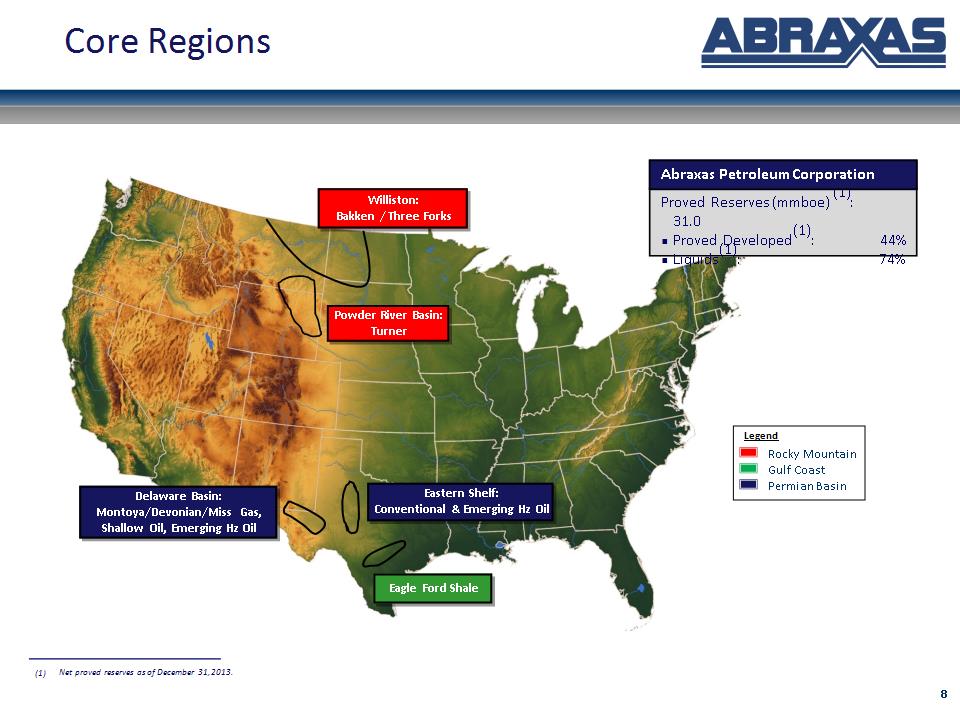

* Williston: Bakken / Three Forks Powder River Basin: Turner Eastern Shelf: Conventional & Emerging Hz Oil Eagle Ford Shale Delaware Basin: Montoya/Devonian/Miss Gas, Shallow Oil, Emerging Hz Oil Proved Reserves (mmboe)(1): 31.0 Proved Developed(1): 44% Liquids(1): 74% Abraxas Petroleum Corporation Core Regions Net proved reserves as of December 31, 2013.

* II. Strategic Plan

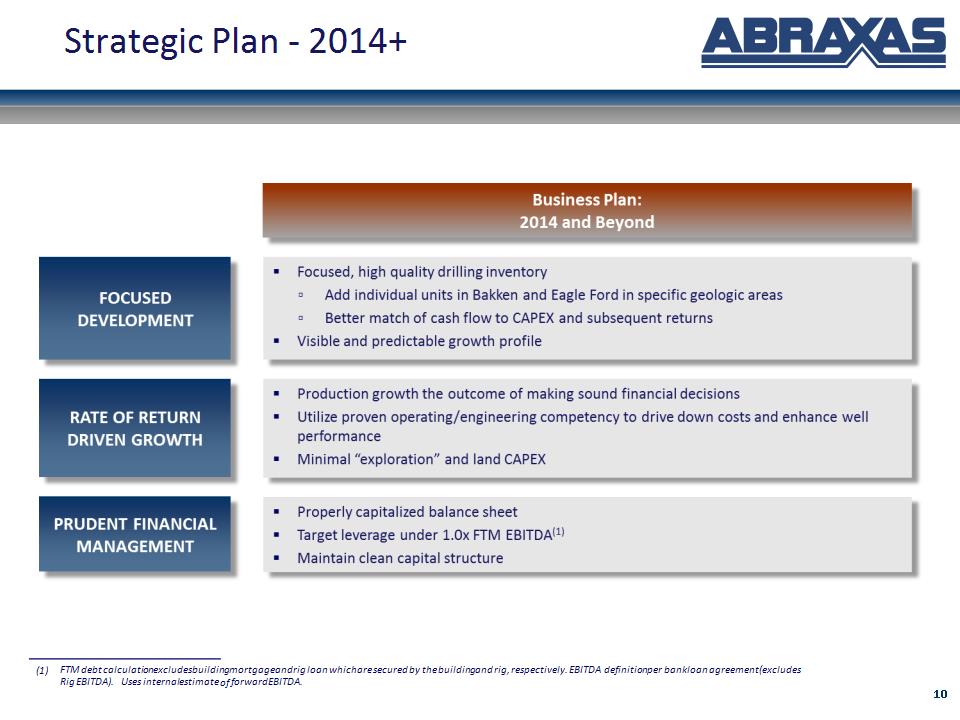

* Strategic Plan – 2014+ FTM debt calculation excludes building mortgage and rig loan which are secured by the building and rig, respectively. EBITDA definition per bank loan agreement (excludes Rig EBITDA). Uses internal estimate of forward EBITDA.

* III. Abraxas Petroleum Financial Overview

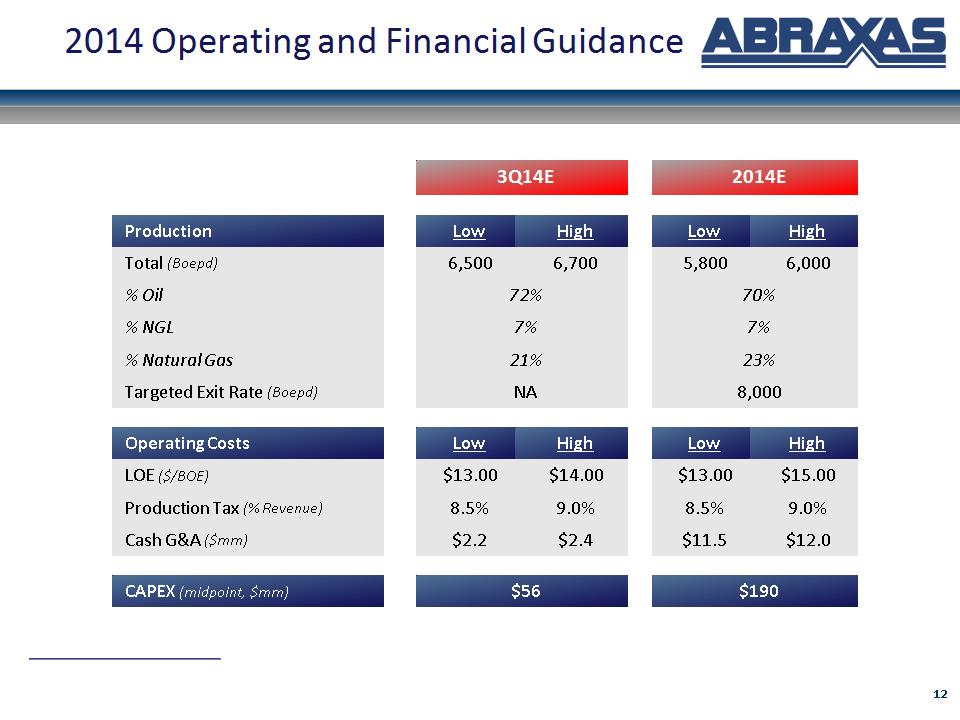

* 2014 Operating and Financial Guidance 3Q14E 3Q14E 2014E 2014E Production Low High Low High Total (Boepd) 6,500 6,700 5,800 6,000 % Oil 72% 72% 70% 70% % NGL 7% 7% 7% 7% % Natural Gas 21% 21% 23% 23% Targeted Exit Rate (Boepd) NA NA 8,000 8,000 Operating Costs Low High Low High LOE ($/BOE) $13.00 $14.00 $13.00 $15.00 Production Tax (% Revenue) 8.5% 9.0% 8.5% 9.0% Cash G&A ($mm) $2.2 $2.4 $11.5 $12.0 CAPEX (midpoint, $mm) $56 $56 $190 $190

* IV. Asset Base Overview

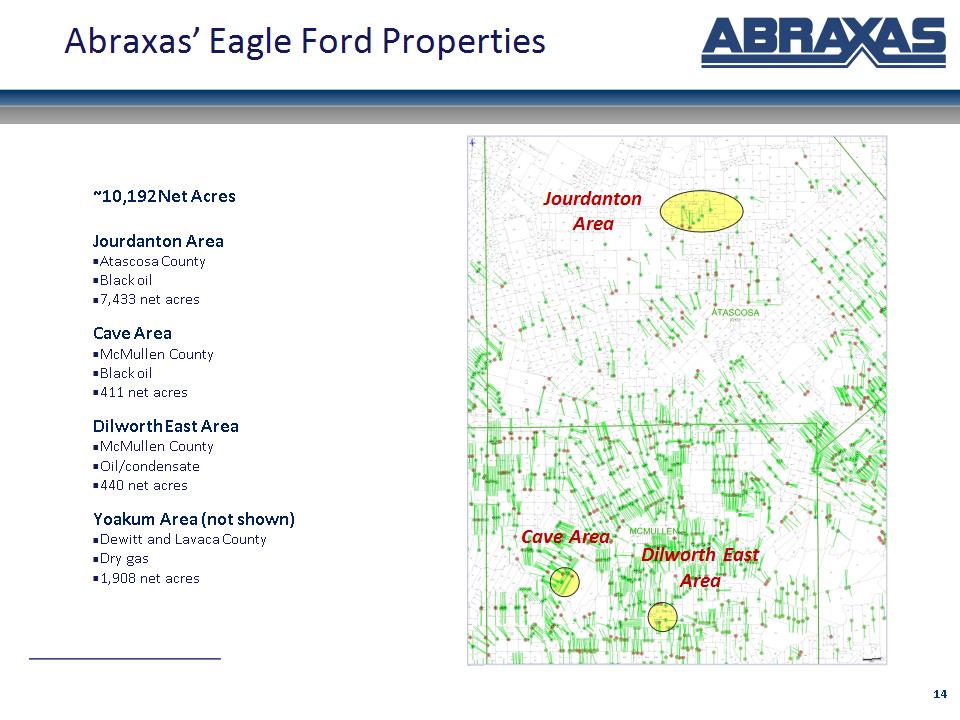

* Abraxas’ Eagle Ford Properties ~10,192 Net Acres Jourdanton Area Atascosa County Black oil 7,433 net acres Cave Area McMullen County Black oil 411 net acres Dilworth East Area McMullen County Oil/condensate 440 net acres Yoakum Area (not shown) Dewitt and Lavaca County Dry gas 1,908 net acres Jourdanton Area Cave Area Dilworth East Area

* Eagle Ford Jourdanton Jourdanton 7,433 net acre lease block, 100% WI 90+ well Eagle Ford potential Austin Chalk and Buda also prospective Blue Eyes 1H 30 day IP: 527 boepd (1,2) Snake Eyes 1H 30 day IP: 759 boepd (1, 2) Spanish Eyes 1H 30 day IP: 215 boepd (1, 2) Eagle Eyes 1H 30 day IP: 249 boepd (1, 2) Additional 2014 Activity Ribeye 1H: producing Ribeye 2H: producing Cat Eye 1H: budgeted 2014 Jourdanton Well 1: budgeted 2014 Represents highest 30 days of production after well was placed on sub-pump. The production rates for each well do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas. Abraxas Blue Eyes 1H Cinco Area Recent Activity Hunt Area Recent Activity EOG Area Recent Activity Abraxas Snake Eyes 1H Abraxas Spanish Eyes 1H Abraxas Eagle Eyes 1H Abraxas Ribeye 1H, 2H

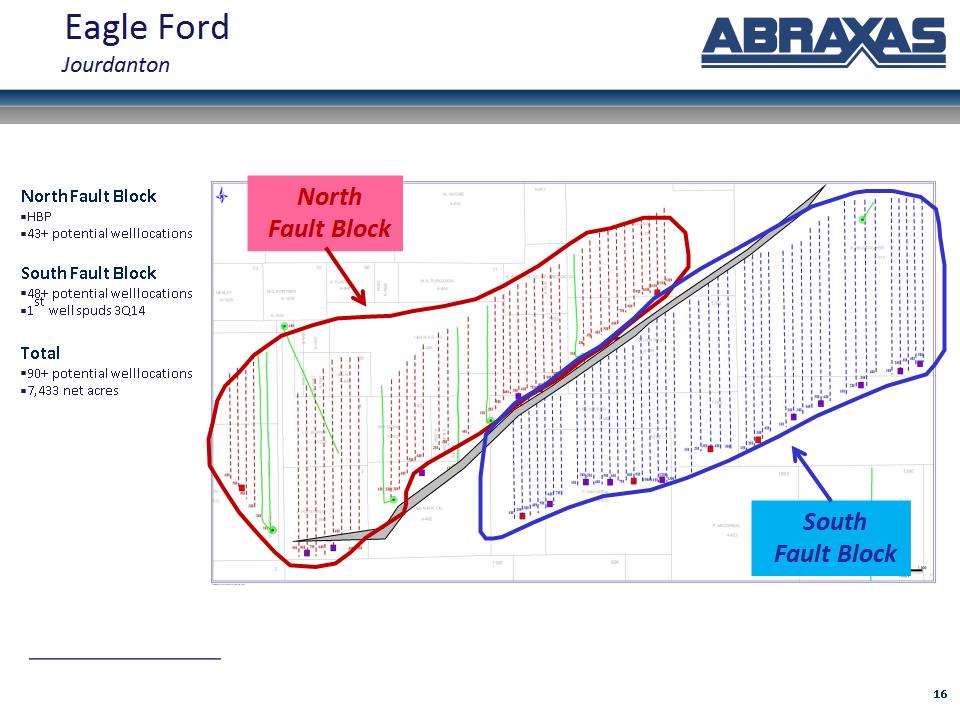

* Eagle Ford Jourdanton North Fault Block South Fault Block North Fault Block HBP 43+ potential well locations South Fault Block 48+ potential well locations 1st well spuds 3Q14 Total 90+ potential well locations 7,433 net acres

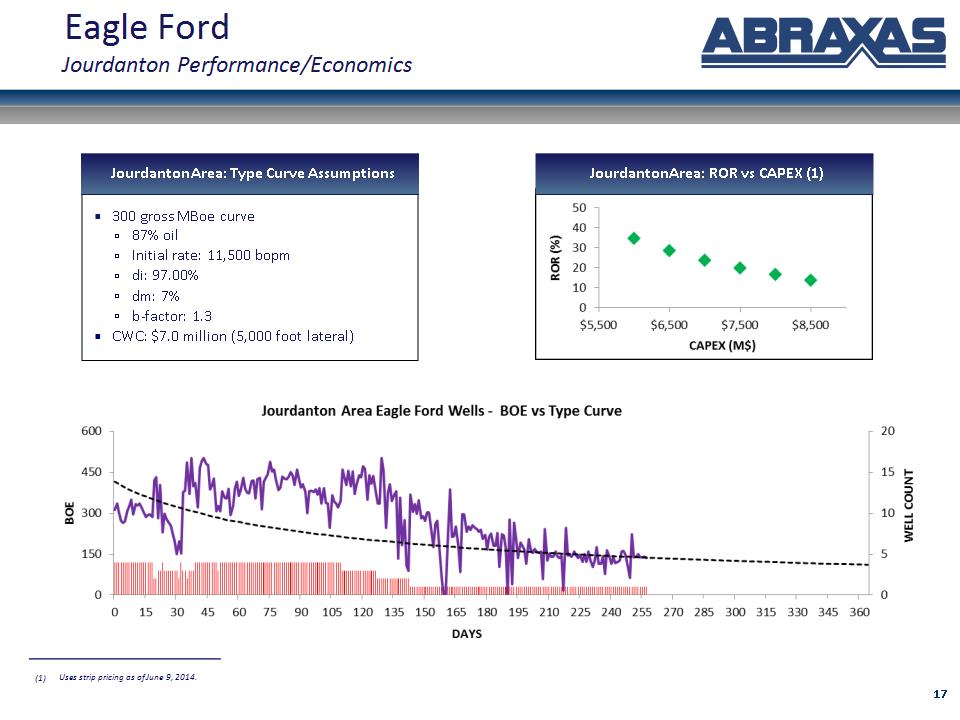

* Eagle Ford Jourdanton Performance/Economics Jourdanton Area: ROR vs CAPEX (1) Uses strip pricing as of June 9, 2014. 300 gross MBoe curve 87% oil Initial rate: 11,500 bopm di: 97.00% dm: 7% b-factor: 1.3 CWC: $7.0 million (5,000 foot lateral) Jourdanton Area: Type Curve Assumptions

* Eagle Ford Cave Cave 411 net acre lease block, 100% WI Additional locations (red) Two 9,000’ lateral locations Best month cumulative oil shown in green Offset operators : 8-10 mbo Abraxas Dutch 2H: 29 mbo Dutch 2H 30 day IP: 1,093 boepd (1) On production Dutch 1H 30 day IP: 786 boepd (1) On production Additional 2014 Activity Dutch 3H: drilled and cased Dutch 4H: drilling The production rates for each well do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas.

* Eagle Ford Cave Area Performance/Economics Uses strip pricing as of June 9, 2014. 584 MBoe gross type curve 83% oil Initial rate: 22,100 bopm di: 98.0% dm: 7.0% b-factor: 1.3 CWC: $11.0 million Cave Area: Type Curve Assumptions Cave Area: ROR vs CAPEX (1)

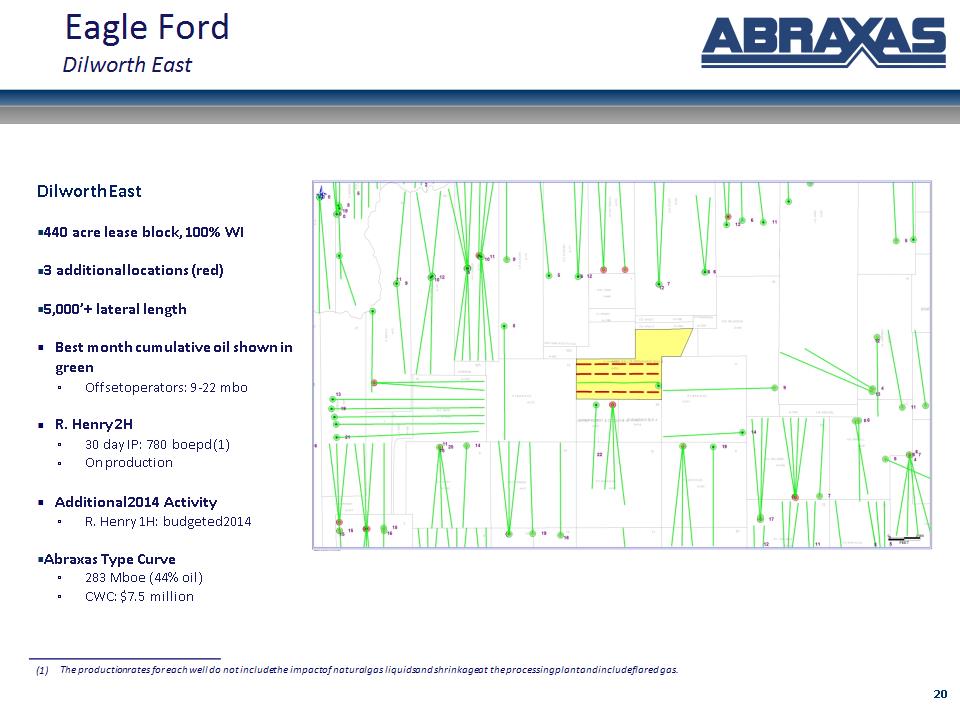

* Eagle Ford Dilworth East Dilworth East 440 acre lease block, 100% WI 3 additional locations (red) 5,000’+ lateral length Best month cumulative oil shown in green Offset operators: 9-22 mbo R. Henry 2H 30 day IP: 780 boepd (1) On production Additional 2014 Activity R. Henry 1H: budgeted 2014 Abraxas Type Curve 283 Mboe (44% oil) CWC: $7.5 million The production rates for each well do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas.

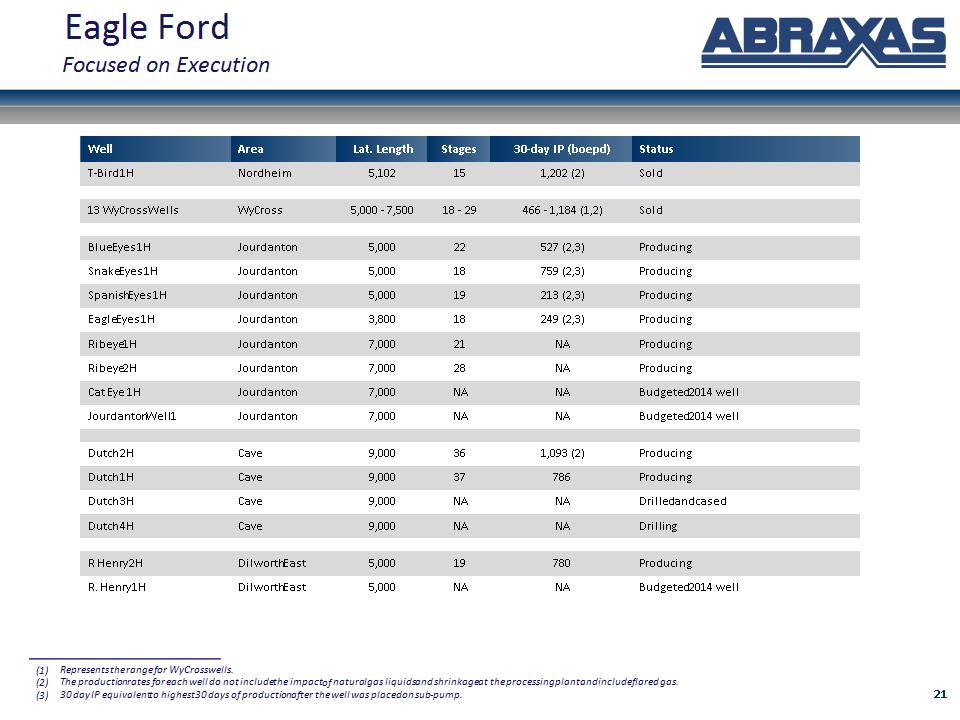

* Well Area Lat. Length Stages 30-day IP (boepd) Status T-Bird 1H Nordheim 5,102 15 1,202 (2) Sold 13 WyCross Wells WyCross 5,000 – 7,500 18 – 29 466 – 1,184 (1,2) Sold Blue Eyes 1H Jourdanton 5,000 22 527 (2,3) Producing Snake Eyes 1H Jourdanton 5,000 18 759 (2,3) Producing Spanish Eyes 1H Jourdanton 5,000 19 213 (2,3) Producing Eagle Eyes 1H Jourdanton 3,800 18 249 (2,3) Producing Ribeye 1H Jourdanton 7,000 21 NA Producing Ribeye 2H Jourdanton 7,000 28 NA Producing Cat Eye 1H Jourdanton 7,000 NA NA Budgeted 2014 well Jourdanton Well 1 Jourdanton 7,000 NA NA Budgeted 2014 well Dutch 2H Cave 9,000 36 1,093 (2) Producing Dutch 1H Cave 9,000 37 786 Producing Dutch 3H Cave 9,000 NA NA Drilled and cased Dutch 4H Cave 9,000 NA NA Drilling R Henry 2H Dilworth East 5,000 19 780 Producing R. Henry 1H Dilworth East 5,000 NA NA Budgeted 2014 well Eagle Ford Focused on Execution Represents the range for WyCross wells. The production rates for each well do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas. 30 day IP equivalent to highest 30 days of production after the well was placed on sub-pump.

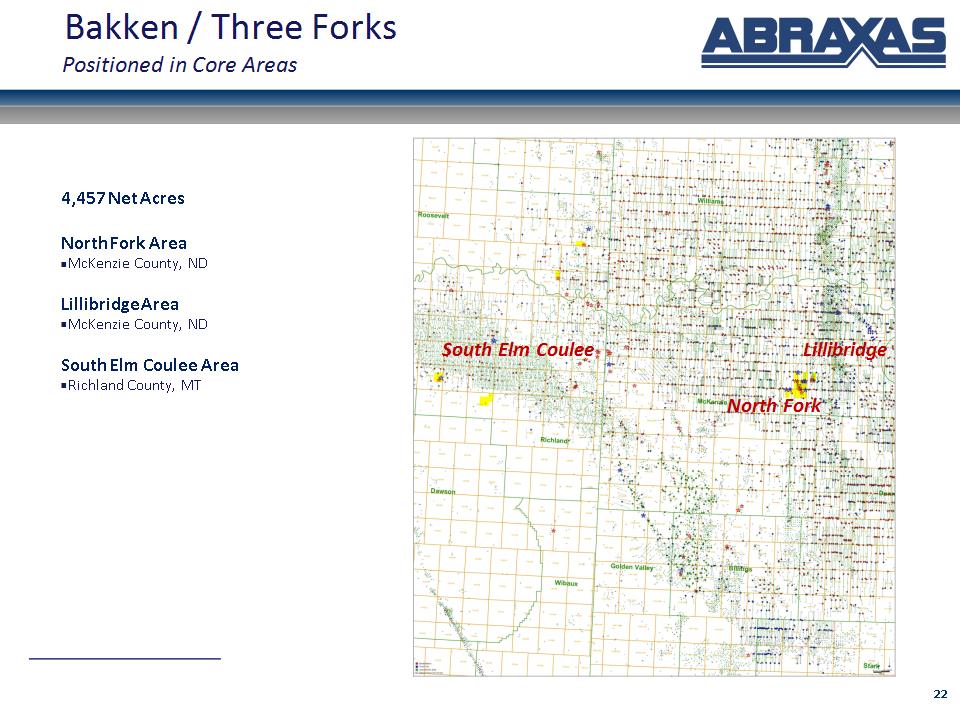

* Bakken / Three Forks Positioned in Core Areas North Fork 4,457 Net Acres North Fork Area McKenzie County, ND Lillibridge Area McKenzie County, ND South Elm Coulee Area Richland County, MT Lillibridge South Elm Coulee

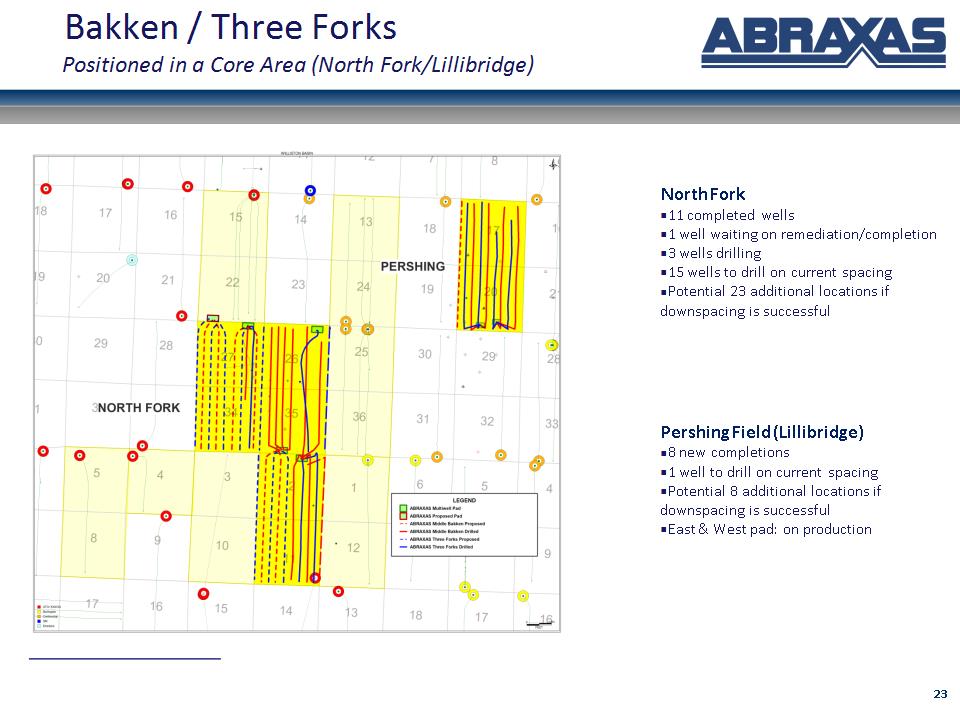

* North Fork 11 completed wells 1 well waiting on remediation/completion 3 wells drilling 15 wells to drill on current spacing Potential 23 additional locations if downspacing is successful Pershing Field (Lillibridge) 8 new completions 1 well to drill on current spacing Potential 8 additional locations if downspacing is successful East & West pad: on production Bakken / Three Forks Positioned in a Core Area (North Fork/Lillibridge)

* North Fork Downspacing Downspace to 660 feet between wells in same reservoir Planned nine multi-well pads First downspacing test on production (Ravin 5H-7H) 48 total wells vs 26 wells at current spacing Approved by NDIC Lillibridge Downspacing Downspace to 660 feet between wells in same reservoir Planned two more multi-well pads 16 total wells versus nine wells at current spacing Approved by NDIC Bakken / Three Forks Increased Density (North Fork/Lillibridge) Potential

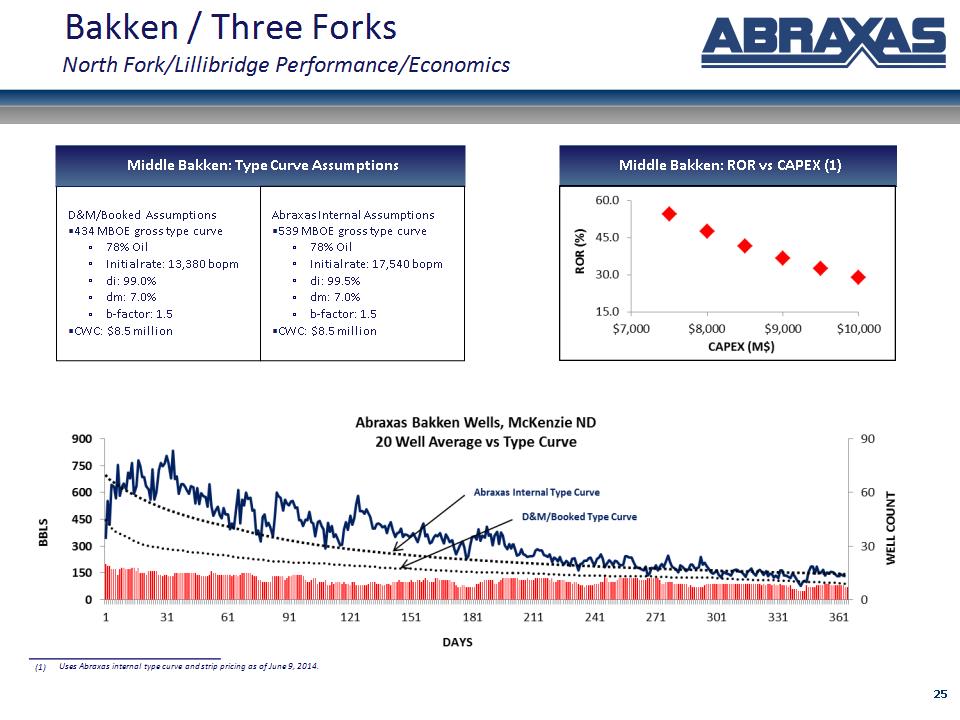

* Bakken / Three Forks North Fork/Lillibridge Performance/Economics Middle Bakken: ROR vs CAPEX (1) Uses Abraxas internal type curve and strip pricing as of June 9, 2014. D&M/Booked Assumptions 434 MBOE gross type curve 78% Oil Initial rate: 13,380 bopm di: 99.0% dm: 7.0% b-factor: 1.5 CWC: $8.5 million Middle Bakken: Type Curve Assumptions Abraxas Internal Assumptions 539 MBOE gross type curve 78% Oil Initial rate: 17,540 bopm di: 99.5% dm: 7.0% b-factor: 1.5 CWC: $8.5 million

* Well Objective Lat. Length Stages 30-day IP (boepd) (1) Status Ravin 1H Three Forks 10,000 23 391 Producing Stenehjem 1H Middle Bakken 6,000 17 688 Producing Jore Federal 3H Three Forks 10,000 35 510 Producing Ravin 26-35 2H Middle Bakken 10,000 16 421 Producing Ravin 26-35 3H Middle Bakken 10,000 26 627 Producing Lillibridge 4H Three Forks 8,472 26 922 Producing Lillibridge 3H Middle Bakken 10,000 33 1,291 Producing Lillibridge 2H Three Forks 9,529 30 958 Producing Lillibridge 1H Middle Bakken 10,000 33 1,275 Producing Lillibridge 8H Three Forks 10,000 33 1,020 Producing Lillibridge 7H Middle Bakken 10,000 34 1,005 Producing Lillibridge 6H Three Forks 10,000 33 921 Producing Lillibridge 5H Middle Bakken 10,000 33 1,049 Producing Jore Federal 1H Three Forks 10,000 33 1,037 Producing Jore Federal 2H Middle Bakken 10,000 33 833 Producing Jore Federal 4H Middle Bakken 10,000 33 975 Producing Bakken / Three Forks Focused on Execution The production rates for each well do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas.

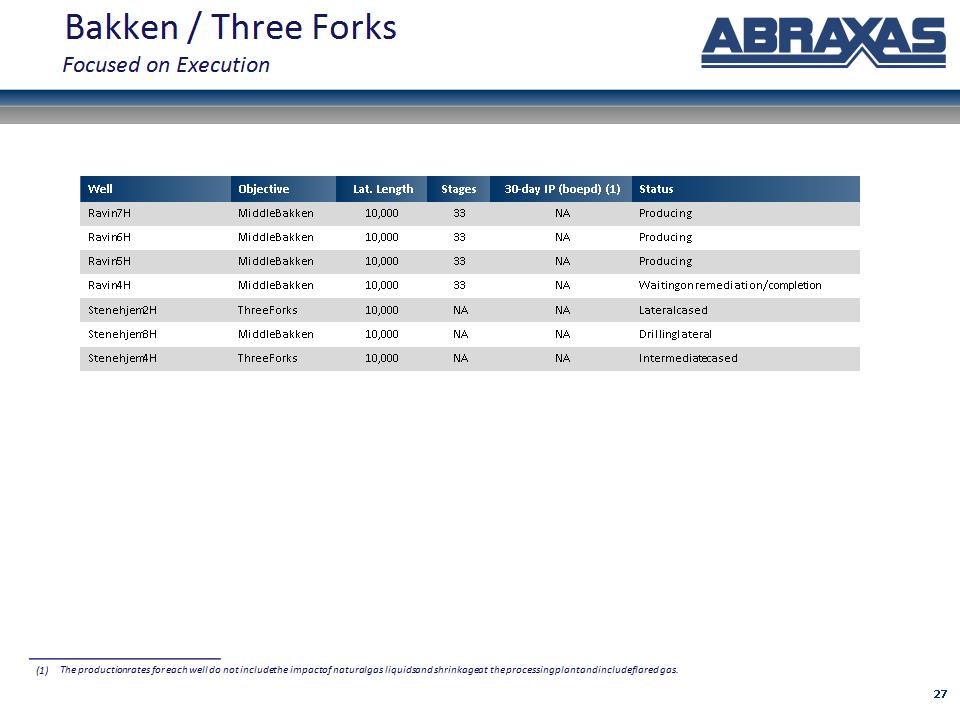

* Well Objective Lat. Length Stages 30-day IP (boepd) (1) Status Ravin 7H Middle Bakken 10,000 33 NA Producing Ravin 6H Middle Bakken 10,000 33 NA Producing Ravin 5H Middle Bakken 10,000 33 NA Producing Ravin 4H Middle Bakken 10,000 33 NA Waiting on remediation/completion Stenehjem 2H Three Forks 10,000 NA NA Lateral cased Stenehjem 3H Middle Bakken 10,000 NA NA Drilling lateral Stenehjem 4H Three Forks 10,000 NA NA Intermediate cased Bakken / Three Forks Focused on Execution The production rates for each well do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas.

* Why Abraxas?

* Appendix

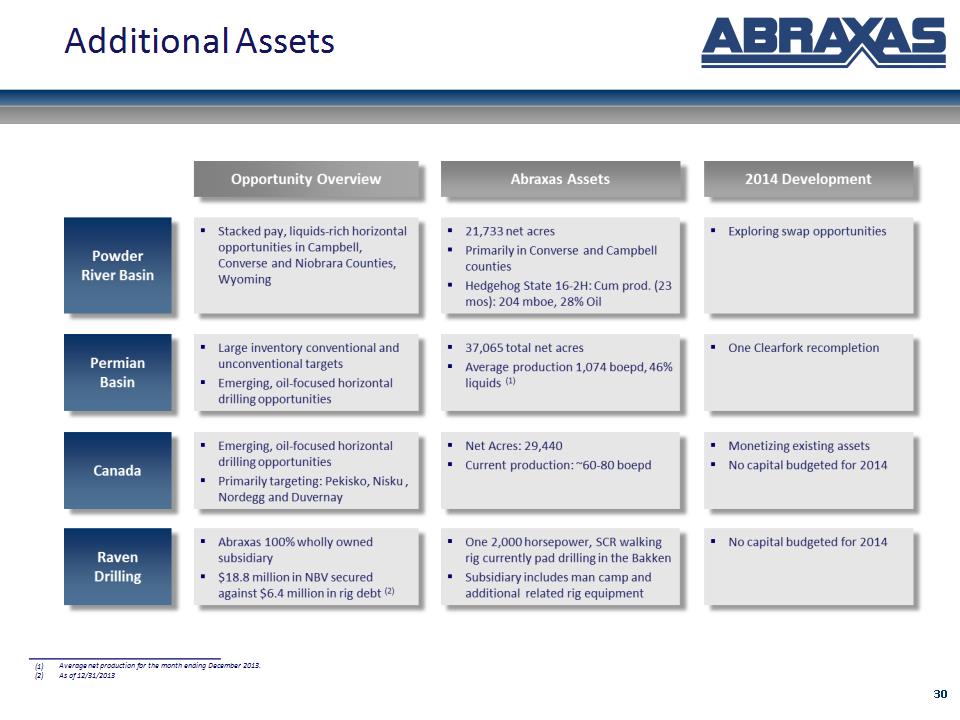

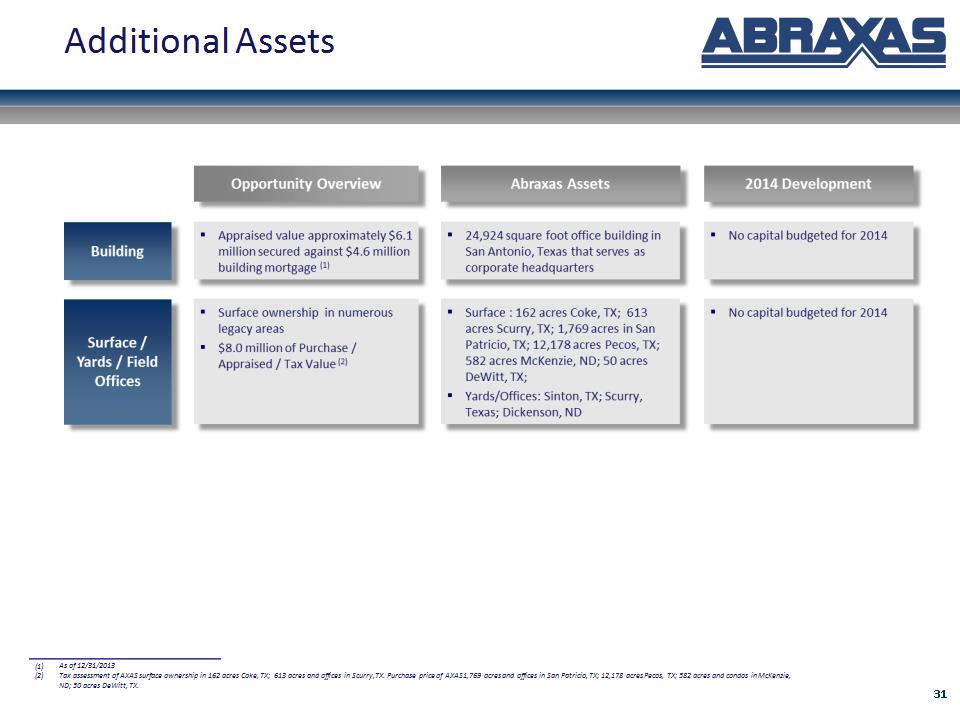

* Additional Assets Average net production for the month ending December 2013. As of 12/31/2013

* Additional Assets As of 12/31/2013 Tax assessment of AXAS surface ownership in 162 acres Coke, TX; 613 acres and offices in Scurry, TX. Purchase price of AXAS 1,769 acres and offices in San Patricio, TX; 12,178 acres Pecos, TX; 582 acres and condos in McKenzie, ND; 50 acres DeWitt, TX.

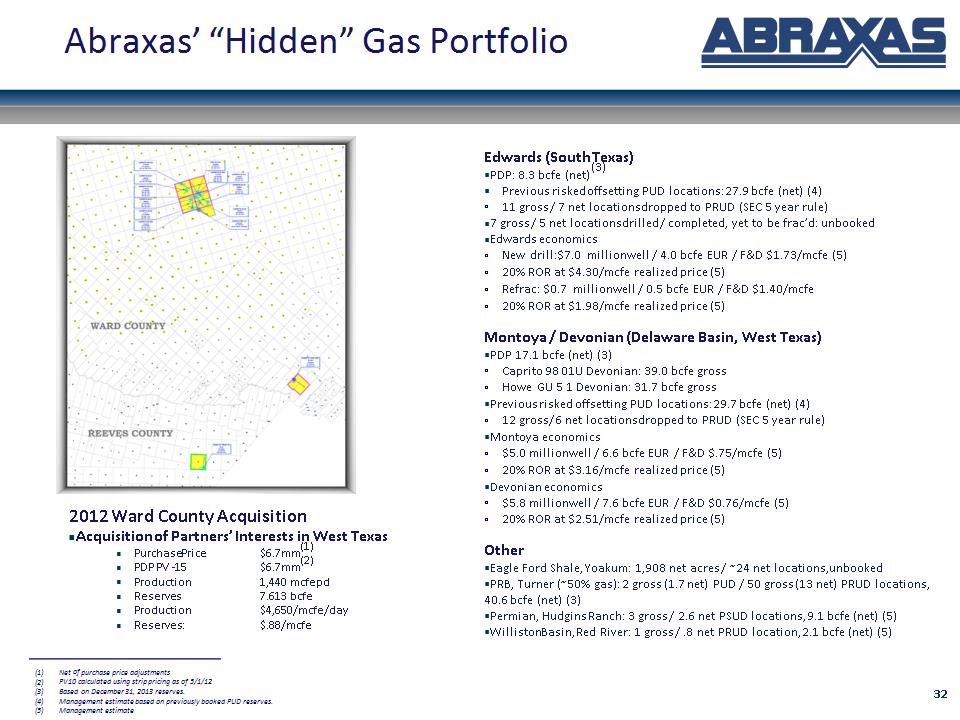

* Edwards (South Texas) PDP: 8.3 bcfe (net)(3) Previous risked offsetting PUD locations: 27.9 bcfe (net) (4) 11 gross / 7 net locations dropped to PRUD (SEC 5 year rule) 7 gross / 5 net locations drilled / completed, yet to be frac’d: unbooked Edwards economics New drill: $7.0 million well / 4.0 bcfe EUR / F&D $1.73/mcfe (5) 20% ROR at $4.30/mcfe realized price (5) Refrac: $0.7 million well / 0.5 bcfe EUR / F&D $1.40/mcfe 20% ROR at $1.98/mcfe realized price (5) Montoya / Devonian (Delaware Basin, West Texas) PDP 17.1 bcfe (net) (3) Caprito 98 01U Devonian: 39.0 bcfe gross Howe GU 5 1 Devonian: 31.7 bcfe gross Previous risked offsetting PUD locations: 29.7 bcfe (net) (4) 12 gross/ 6 net locations dropped to PRUD (SEC 5 year rule) Montoya economics $5.0 million well / 6.6 bcfe EUR / F&D $.75/mcfe (5) 20% ROR at $3.16/mcfe realized price (5) Devonian economics $5.8 million well / 7.6 bcfe EUR / F&D $0.76/mcfe (5) 20% ROR at $2.51/mcfe realized price (5) Other Eagle Ford Shale, Yoakum: 1,908 net acres / ~24 net locations, unbooked PRB, Turner (~50% gas): 2 gross (1.7 net) PUD / 50 gross (13 net) PRUD locations, 40.6 bcfe (net) (3) Permian, Hudgins Ranch: 3 gross / 2.6 net PSUD locations, 9.1 bcfe (net) (5) Williston Basin, Red River: 1 gross / .8 net PRUD location, 2.1 bcfe (net) (5) Net of purchase price adjustments PV10 calculated using strip pricing as of 5/1/12 Based on December 31, 2013 reserves. Management estimate based on previously booked PUD reserves. Management estimate 2012 Ward County Acquisition Acquisition of Partners’ Interests in West Texas Purchase Price $6.7mm(1) PDP PV -15 $6.7mm(2) Production 1,440 mcfepd Reserves 7.613 bcfe Production $4,650/mcfe/day Reserves: $.88/mcfe Abraxas’ “Hidden” Gas Portfolio

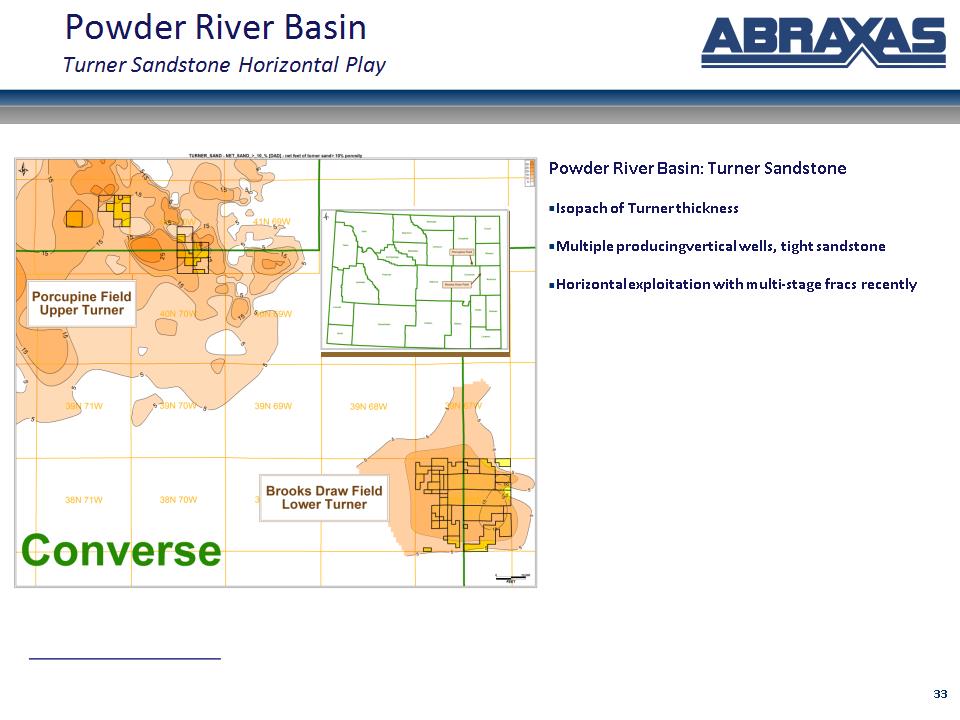

* Powder River Basin Turner Sandstone Horizontal Play Powder River Basin: Turner Sandstone Isopach of Turner thickness Multiple producing vertical wells, tight sandstone Horizontal exploitation with multi-stage fracs recently

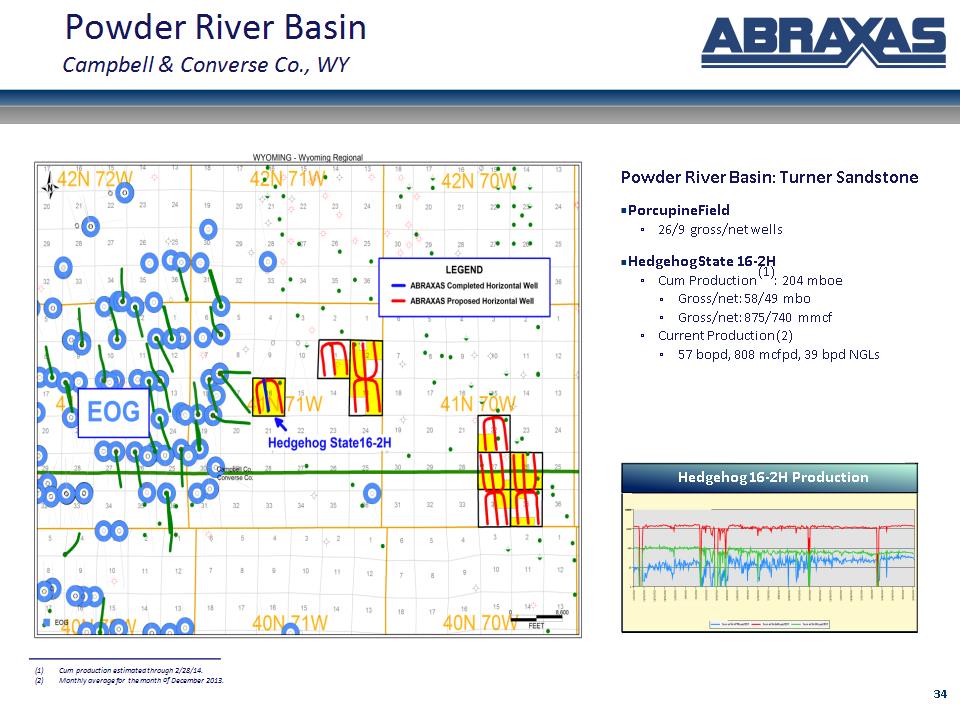

* Powder River Basin Campbell & Converse Co., WY Powder River Basin: Turner Sandstone Porcupine Field 26/9 gross/net wells Hedgehog State 16-2H Cum Production (1): 204 mboe Gross/net: 58/49 mbo Gross/net: 875/740 mmcf Current Production (2) 57 bopd, 808 mcfpd, 39 bpd NGLs Cum production estimated through 2/28/14. Monthly average for the month of December 2013. Hedgehog 16-2H Production

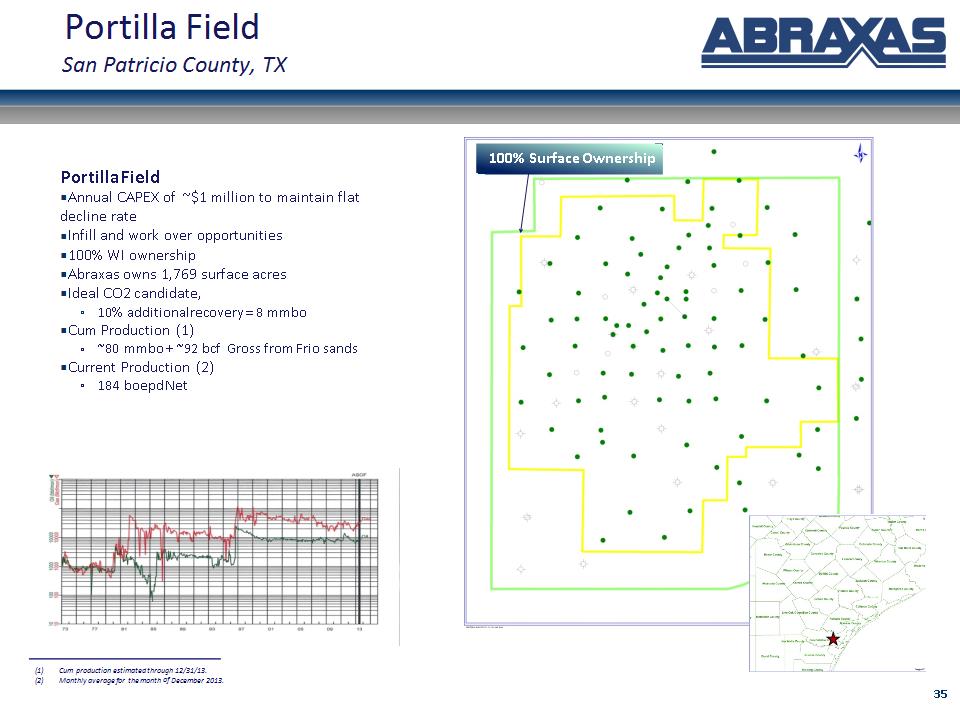

* Portilla Field San Patricio County, TX Portilla Field Annual CAPEX of ~$1 million to maintain flat decline rate Infill and work over opportunities 100% WI ownership Abraxas owns 1,769 surface acres Ideal CO2 candidate, 10% additional recovery = 8 mmbo Cum Production (1) ~80 mmbo + ~92 bcf Gross from Frio sands Current Production (2) 184 boepd Net 100% Surface Ownership Cum production estimated through 12/31/13. Monthly average for the month of December 2013.

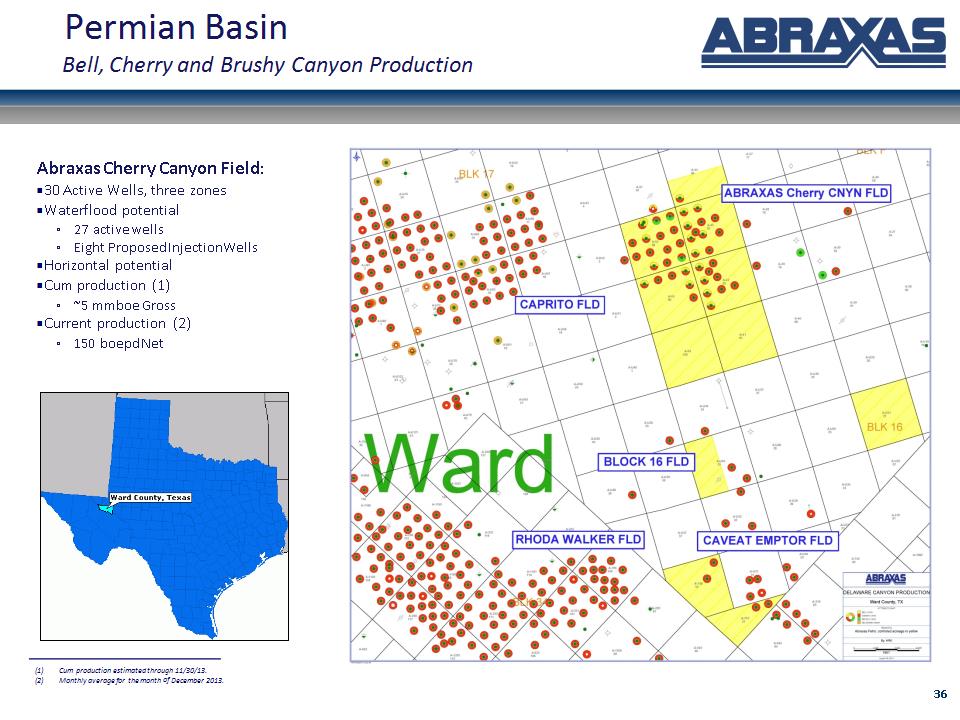

* Abraxas Cherry Canyon Field: 30 Active Wells, three zones Waterflood potential 27 active wells Eight Proposed Injection Wells Horizontal potential Cum production (1) ~5 mmboe Gross Current production (2) 150 boepd Net Permian Basin Bell, Cherry and Brushy Canyon Production Cum production estimated through 11/30/13. Monthly average for the month of December 2013.

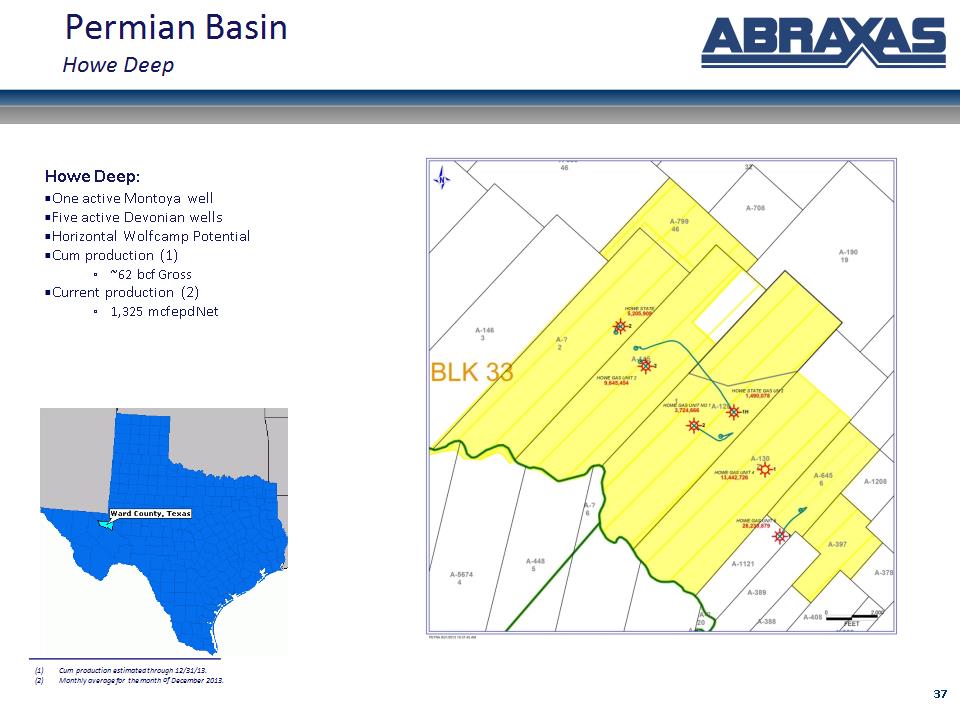

* Howe Deep: One active Montoya well Five active Devonian wells Horizontal Wolfcamp Potential Cum production (1) ~62 bcf Gross Current production (2) 1,325 mcfepd Net Permian Basin Howe Deep Cum production estimated through 12/31/13. Monthly average for the month of December 2013.

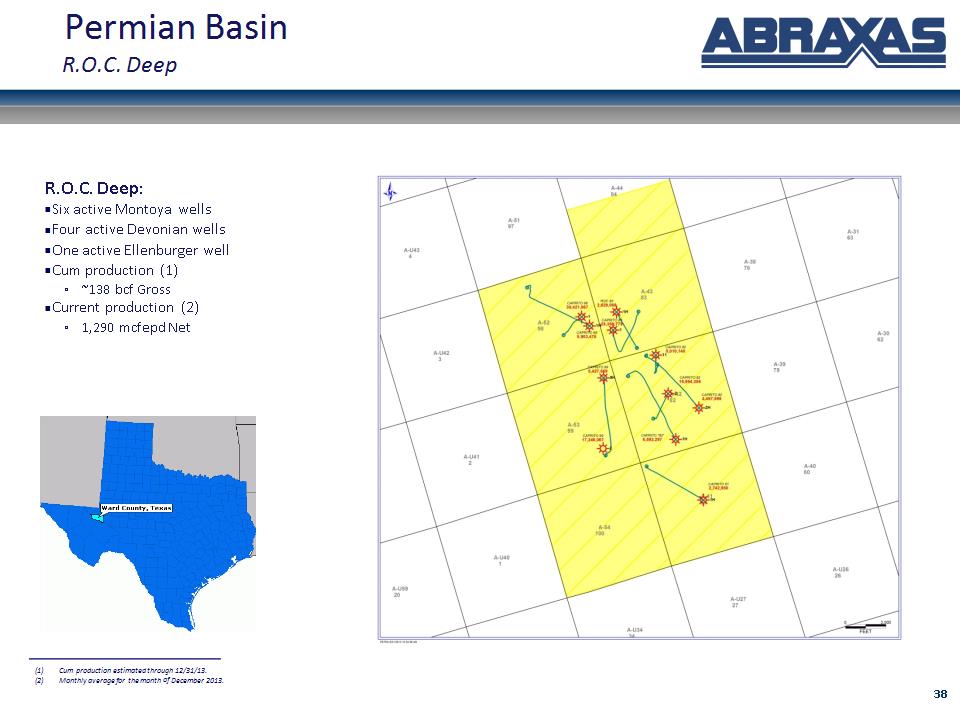

* R.O.C. Deep: Six active Montoya wells Four active Devonian wells One active Ellenburger well Cum production (1) ~138 bcf Gross Current production (2) 1,290 mcfepd Net Permian Basin R.O.C. Deep Cum production estimated through 12/31/13. Monthly average for the month of December 2013.

* Sharon Ridge/Westbrook: Clearfork Trend 89 active wells San Andres, Glorietta, Clearfork Cooperative water flood on some leases 114 potential new, direct offset and down-spaced locations 20 potential recompletes/reworks Cum production (1) ~6.3 MMBO Gross Current production (2) 108 bopd Net Permian Basin Sharon Ridge - Westbrook: Clearfork Trend Cum production estimated through 12/31/13. Monthly average for the month of December 2013.

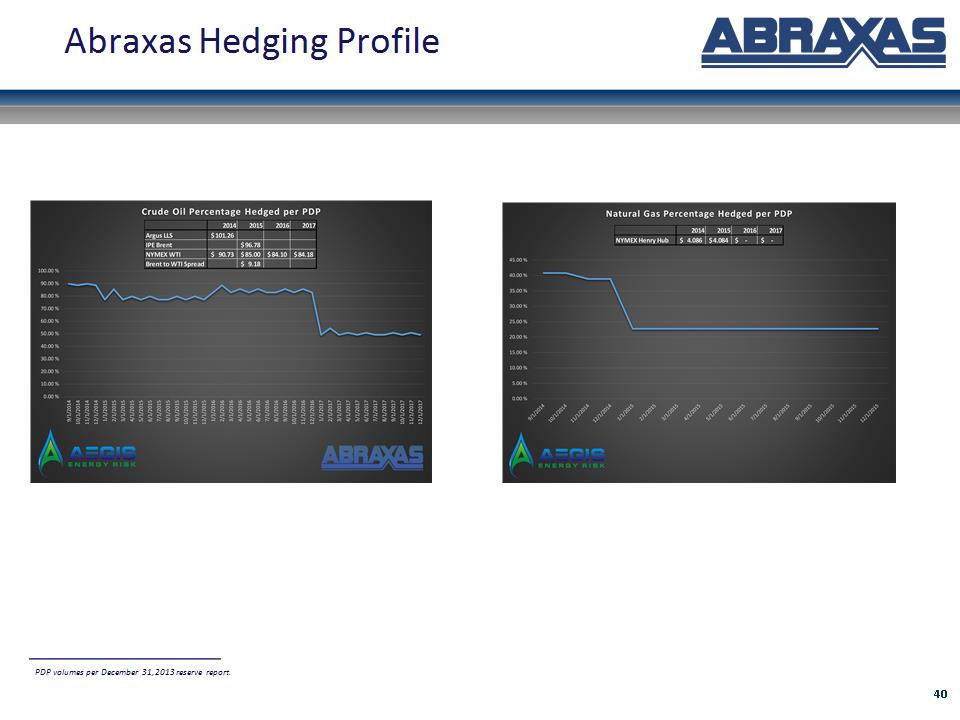

* Abraxas Hedging Profile PDP volumes per December 31, 2013 reserve report.

* NASDAQ: AXAS