Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23 - UNITED BANCSHARES INC/OH | ex23.htm |

| EX-21 - EXHIBIT 21 - UNITED BANCSHARES INC/OH | ex21.htm |

| EX-99 - EXHIBIT 99 - UNITED BANCSHARES INC/OH | ex99.htm |

| EX-32 - EXHIBIT 32.2 - UNITED BANCSHARES INC/OH | ex32-2.htm |

| EX-31 - EXHIBIT 31.1 - UNITED BANCSHARES INC/OH | ex31-1.htm |

| EX-31 - EXHIBIT 31.2 - UNITED BANCSHARES INC/OH | ex31-2.htm |

| EX-32 - EXHIBIT 32.1 - UNITED BANCSHARES INC/OH | ex32-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - UNITED BANCSHARES INC/OH | Financial_Report.xls |

| 10-K/A - FORM 10-K/A - UNITED BANCSHARES INC/OH | uboh20140821_10ka.htm |

Exhibit 13

Table of Contents

|

Page | |

|

President’s Letter |

1 |

|

| |

|

Market Price and Dividends on Common Stock |

2 |

|

| |

|

Five-Year Summary of Selected Financial Data |

3 |

|

| |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

4 |

|

| |

|

Report of Independent Registered Public Accounting Firm |

21 |

|

| |

|

Financial Statements |

|

|

| |

|

Consolidated Balance Sheets |

22 |

|

| |

|

Consolidated Statements of Income |

23 |

|

| |

|

Consolidated Statements of Comprehensive Income |

24 |

|

| |

|

Consolidated Statements of Shareholders’ Equity |

25 |

|

| |

|

Consolidated Statements of Cash Flows |

26 |

|

| |

|

Notes to Consolidated Financial Statements |

28 |

|

| |

|

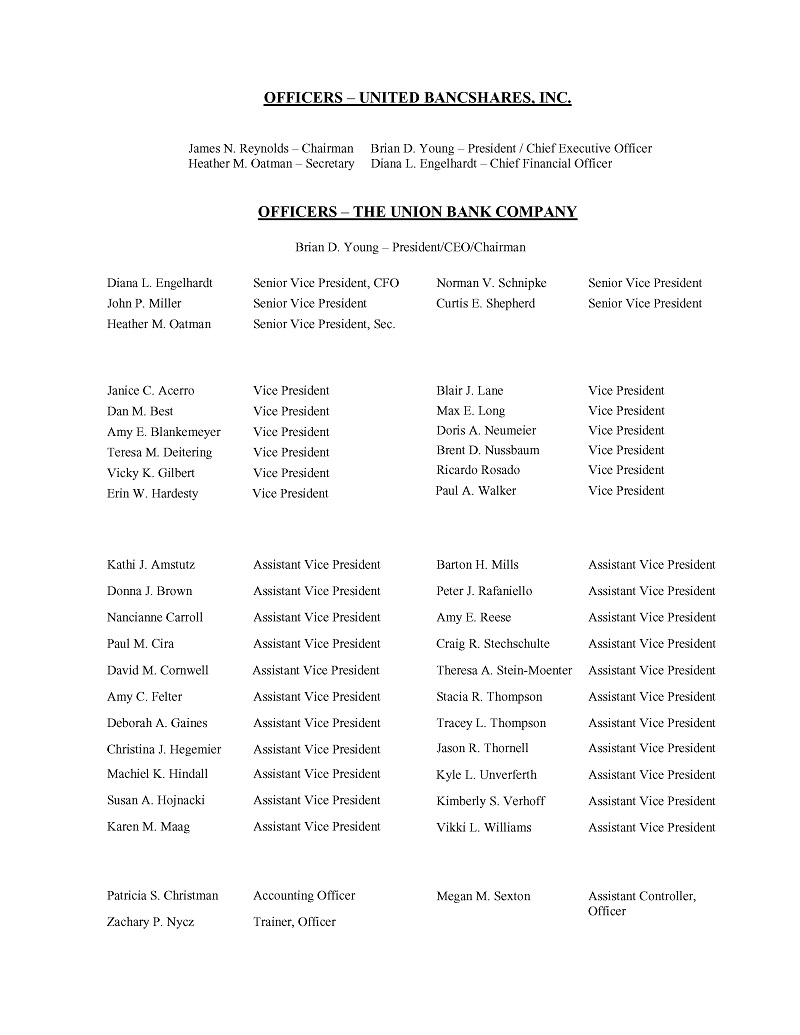

Directors and Officers |

66 |

|

| |

|

Employee Anniversaries |

67 |

Shareholders, Customers, and Employees:

As a result of the hard work and dedication of the Company’s team members, I am proud to report that your Company had another successful year in 2013. In addition to reporting net income of approximately $4.6 million ($1.35 basic earnings per share), your Company’s shares traded 47% higher by the end of 2013 as compared to the end of 2012. This increase in share price resulted in a $15.7 million increase in your Company’s market capitalization.

Despite the fact that net interest income decreased as a result of a flat yield curve and slow economic activity in our marketplace, your Company was able to increase net income by improving asset quality and decreasing non-interest expenses. The improvements in asset quality warranted a negative provision for loan losses of $833,000 for the year. Additionally, the Company executed a balance sheet restructuring strategy resulting in the early repayment of a $10 million advance from the Federal Home Loan Bank of Cincinnati (FHLB). This strategy required the Company to incur a prepayment penalty that decreased net income by approximately $650,000. Excluding the aforementioned FHLB prepayment costs, we decreased non-interest expenses by approximately $1.5 million in 2013 as compared to 2012.

We continue to focus on increasing assets and liabilities through growth in quality loans and core deposits. This growth objective will be accomplished through further development of our current customer relationships, identifying new customer relationships and reviewing acquisition opportunities. We believe that through this process, we enhance our ability to serve our customers and communities while enhancing shareholder value.

It was also great to report throughout the year that after ongoing reviews of your Company’s earnings, capital position, and improved risk profile, your Board of Directors declared dividends in March, June, September and December, as well as a Special Cash Dividend that was paid to shareholders on February 14, 2014.

Although uncertainty still remains in our markets, I continue to believe that the single most important driver of the Company’s success is, and will continue to be, my fellow team members. Their talents and strong corporate values of respect and accountability for our shareholders, customers, colleagues, and communities are only exceeded by their concern for others. It is because of these quality individuals that I am excited for the future of your Company.

Thank you for your continued support and the trust you have placed in us to manage your investment in our Company.

Respectfully,

Brian D. Young

President & CEO

UNITED BANCSHARES, INC.

DESCRIPTION OF THE CORPORATION

United Bancshares, Inc., an Ohio corporation (the “Corporation”), is a bank holding company registered under the Bank Holding Company Act of 1956, as amended, and is subject to regulation by the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”). The Corporation was incorporated and organized in 1985. The executive offices of the Corporation are located at 100 S. High Street, Columbus Grove, Ohio 45830. Following the merger of the Company’s other two bank subsidiaries into The Union Bank Company, Columbus Grove, Ohio (“Bank”) in March 2003, the Company is now a one-bank holding company, as that term is defined by the Federal Reserve Board. Effective February 1, 2007, the Bank formed a wholly-owned subsidiary, UBC Investments, Inc. (“UBC”) to hold and manage its securities portfolio. The operations of UBC are located in Wilmington, Delaware. Effective, December 4, 2009, the Bank formed a wholly-owned subsidiary UBC Property, Inc. to hold and manage certain property that was acquired in lieu of foreclosure. Through its subsidiary, the Bank, the Corporation is engaged in the business of commercial banking and offers a full range of commercial banking services.

The Union Bank Company is an Ohio state-chartered bank, which serves Allen, Hancock, Putnam, Sandusky, Van Wert and Wood Counties, with office locations in Bowling Green, Columbus Grove, Delphos, Findlay, Gibsonburg, Kalida, Leipsic, Lima, Ottawa, and Pemberville, Ohio.

MARKET PRICE AND DIVIDENDS ON COMMON STOCK

United Bancshares, Inc. has traded its common stock on the Nasdaq Markets Exchange under the symbol “UBOH” since March 2001. From January 2000 to March 2001, the Corporation’s common stock was traded on the Nasdaq Over-The-Counter Bulletin Board. Prior to January 2000, there was no established public trading market for United Bancshares, Inc. common stock. As of February 28, 2014, the common stock was held by 1,351 shareholders of record. Below are the trading highs and lows for the periods noted.

|

Year 2013 |

High |

Low |

||||||

|

First Quarter |

$ | 13.00 | $ | 9.67 | ||||

|

Second Quarter |

$ | 12.25 | $ | 11.50 | ||||

|

Third Quarter |

$ | 13.22 | $ | 11.77 | ||||

|

Fourth Quarter |

$ | 14.74 | $ | 11.81 | ||||

|

Year 2012 |

High |

Low |

||||||

|

First Quarter |

$ | 8.48 | $ | 6.71 | ||||

|

Second Quarter |

$ | 9.24 | $ | 6.54 | ||||

|

Third Quarter |

$ | 9.23 | $ | 8.65 | ||||

|

Fourth Quarter |

$ | 10.75 | $ | 9.00 | ||||

Dividends declared by United Bancshares, Inc. on its common stock during the past two years were as follows:

|

2013 |

2012 |

|||||||

|

First Quarter |

$ | .05 | $ | - | ||||

|

Second Quarter |

.05 | - | ||||||

|

Third Quarter |

.05 | - | ||||||

|

Fourth Quarter |

.05 | .05 | ||||||

|

Total |

$ | .20 | $ | .05 | ||||

AVAILABILITY OF MORE INFORMATION

To obtain a copy, without charge, of the United Bancshares, Inc.’s annual report (Form 10-K) filed with the Securities and Exchange Commission, please write to:

|

|

Heather Oatman, Secretary United Bancshares, Inc. 100 S. High Street Columbus Grove, Ohio 45830 800-837-8111 |

UNITED BANCSHARES, INC.

FIVE YEAR SUMMARY OF SELECTED FINANCIAL DATA

|

Years ended December 31, |

||||||||||||||||||||

|

2013 |

2012 |

2011 |

2010 |

2009 |

||||||||||||||||

|

(Dollars in thousands, except per share data) |

||||||||||||||||||||

|

Statements of income: |

||||||||||||||||||||

|

Total interest income |

$ | 19,854 | $ | 22,591 | $ | 26,461 | $ | 30,264 | $ | 32,867 | ||||||||||

|

Total interest expense |

3,250 | 4,675 | 7,326 | 8,959 | 12,317 | |||||||||||||||

|

Net interest income |

16,604 | 17,916 | 19,135 | 21,305 | 20,550 | |||||||||||||||

|

Provision for loan losses |

(833 | ) | 200 | 4,375 | 6,550 | 7,525 | ||||||||||||||

|

Net interest income after provision for loan losses |

17,437 | 17,716 | 14,760 | 14,755 | 13,025 | |||||||||||||||

|

Total non-interest income |

4,468 | 4,353 | 3,831 | 3,718 | 4,492 | |||||||||||||||

|

Total non-interest expenses |

16,024 | 16,513 | 15,546 | 15,522 | 14,478 | |||||||||||||||

|

Income before federal income taxes |

5,881 | 5,556 | 3,045 | 2,951 | 3,039 | |||||||||||||||

|

Federal income taxes |

1,240 | 1,071 | 102 | 143 | 156 | |||||||||||||||

|

Net income |

$ | 4,641 | $ | 4,485 | $ | 2,943 | $ | 2,808 | $ | 2,883 | ||||||||||

|

Per share of common stock: |

||||||||||||||||||||

|

Net income - basic |

$ | 1.35 | $ | 1.30 | $ | 0.85 | $ | 0.82 | $ | 0.84 | ||||||||||

|

Dividends |

0.20 | 0.05 | - | 0.45 | 0.60 | |||||||||||||||

|

Book value |

$ | 18.31 | $ | 18.62 | $ | 17.34 | $ | 15.97 | $ | 15.76 | ||||||||||

|

Average shares outstanding – basic |

3,446,662 | 3,446,133 | 3,445,469 | 3,444,703 | 3,443,093 | |||||||||||||||

|

Year end balances: |

||||||||||||||||||||

|

Loans (1) |

$ | 295,737 | $ | 307,402 | $ | 340,700 | $ | 383,907 | $ | 407,815 | ||||||||||

|

Securities (2) |

201,974 | 182,502 | 156,850 | 145,334 | 143,480 | |||||||||||||||

|

Total assets |

556,235 | 572,448 | 587,045 | 612,617 | 616,405 | |||||||||||||||

|

Deposits |

468,000 | 471,199 | 480,486 | 488,651 | 469,668 | |||||||||||||||

|

Shareholders' equity |

63,008 | 64,170 | 59,748 | 55,005 | 54,279 | |||||||||||||||

|

Average balances: |

||||||||||||||||||||

|

Loans (1) |

299,379 | 325,114 | 360,669 | 398,378 | 417,913 | |||||||||||||||

|

Securities (2) |

192,578 | 167,766 | 151,736 | 149,748 | 139,373 | |||||||||||||||

|

Total assets |

561,757 | 568,466 | 593,465 | 625,281 | 612,943 | |||||||||||||||

|

Deposits |

462,368 | 464,448 | 481,600 | 493,089 | 462,742 | |||||||||||||||

|

Shareholders' equity |

63,364 | 62,034 | 57,429 | 55,846 | 52,862 | |||||||||||||||

|

Selected ratios: |

||||||||||||||||||||

|

Net yield on average interest-earning assets (3) |

3.38 | % | 3.55 | % | 3.64 | % | 3.85 | % | 3.75 | % | ||||||||||

|

Return on average assets |

0.83 | % | 0.79 | % | 0.50 | % | 0.45 | % | 0.47 | % | ||||||||||

|

Return on average shareholders equity |

7.33 | % | 7.23 | % | 5.12 | % | 5.03 | % | 5.45 | % | ||||||||||

|

Net loan charge-offs as a percentage of average outstanding net loans |

0.71 | % | 0.58 | % | 1.07 | % | 0.84 | % | 1.42 | % | ||||||||||

|

Allowance for loan losses as a percentage of year end loans |

1.36 | % | 2.27 | % | 2.51 | % | 2.09 | % | 1.18 | % | ||||||||||

|

Shareholders' equity as a percentage of total assets |

11.33 | % | 11.21 | % | 10.18 | % | 8.98 | % | 8.81 | % | ||||||||||

Notes:

|

1) |

Includes loans held for sale. | |

|

2) |

Includes Federal Home Loan Bank Stock. | |

|

3) |

Net yield on average interest-earning assets was computed on a tax-equivalent basis. | |

|

4) |

Financial data for 2010 includes the impact of the March 2010 Findlay branch acquisition. |

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion provides additional information relating to the financial condition and results of operations of United Bancshares, Inc.

PERFORMANCE SUMMARY

Consolidated net income for United Bancshares, Inc. (the “Corporation”) and its wholly-owned subsidiary, The Union Bank Company (the “Bank”), was $4.6 million in 2013 compared to $4.5 million in 2012 and $2.9 million in 2011.

Net income in 2013 as compared to 2012 was favorably impacted by a $1.0 million decrease in the provision for loan losses, a $489,000 decrease in non-interest expenses and a $114,000 increase in non-interest income, and unfavorably impacted by a $1.3 million decrease in net interest income and a $169,000 increase in the provision for income taxes. The decrease in the provision for loan losses is more fully explained in the “Provision for Loan Losses and the Allowance for Loan Losses” section. The decrease in net interest income is due to a decline in the Corporation’s net interest margin from 3.55% in 2012 to 3.38% in 2013, as well as a decrease in the level of average interest-earning assets in 2013 as compared to 2012.

The Corporation’s return on average assets was .83% in 2013, compared to .79% in 2012, and .50% in 2011. The Corporation’s return on average shareholders’ equity was 7.33% in 2013, 7.23% in 2012, and 5.12% in 2011. Basic net income per share was $1.35 per share in 2013, an increase of $0.05 per share from $1.30 in 2012. Basic net income per share of $1.30 in 2012 represented an increase of $0.45 per share from $0.85 in 2011. Changes in these amounts from year to year were generally reflective of changes in the level of net income.

The Corporation’s assets decreased to $556.2 million at December 31, 2013, compared to $572.4 million at December 31, 2012. Loans decreased $9.1 million, or 3%, to $295.3 million at December 31, 2013, compared to $304.4 million at December 31, 2012. The decrease in loans resulted from continued soft loan demand in the Corporation’s market area, and $2.1 million of net loan charge-offs recognized in 2013. Deposits decreased $3.2 million, or 0.7%, to $468 million at December 31, 2013, from $471.2 million at December 31, 2012. Shareholders' equity at December 31, 2013 was $63 million, a 1.8% decrease compared to $64.2 million at December 31, 2012.

RESULTS OF OPERATIONS – 2013 Compared to 2012

Net Interest Income

Net interest income, which represents the revenue generated from interest-earning assets in excess of the interest cost of funding those assets, is the Corporation's principal source of income. Net interest income is influenced by market interest rate conditions and the volume and mix of interest-earning assets and interest-bearing liabilities. Many external factors affect net interest income and typically include the strength of client loan demand, client preference for individual deposit account products, competitors’ loan and deposit product offerings, the national and local economic climates, and Federal Reserve monetary policy.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS – 2013 Compared to 2012 (CONTINUED)

Net Interest Income, Continued

Net interest income for 2013 was $16.6 million, a decrease of $1.3 million (7.3%) from 2012. The decrease in net interest income was primarily due to a decrease in the Corporation’s net interest margin. The average yield on loans for 2013 decreased to 5.09% compared to 5.51% in 2012, and the average rate on interest-bearing liabilities decreased to 0.77% in 2013 from 1.06% in 2012. Net Interest Income was also negatively impacted by the $9.1 million decrease in gross loans, but favorably impacted by the $10.6 million decrease in non-accrual loans. The Corporation also decreased cash by investing in the securities portfolio, which increased $19.5 million during 2013. The effect of these and other factors resulted in the net interest yield on average interest-earning assets, on a tax-equivalent basis, decreasing in 2013 to 3.38% from 3.55% in 2012.

Provision for Loan Losses and the Allowance for Loan Losses

The Corporation’s loan policy provides guidelines for managing both credit risk and asset quality. The policy details acceptable lending practices, establishes loan-grading classifications, and prescribes the use of a loan review process. The Corporation has a credit administration department that performs regular credit file reviews which facilitate the timely identification of problem or potential problem credits, ensure sound credit decisions, and assist in the determination of the allowance for loan losses. The Corporation also engages an outside credit review firm to supplement the credit analysis function and to provide an independent assessment of the loan review process. The loan policy, loan review process, and credit analysis function facilitate management's evaluation of the credit risk inherent in the lending function.

As mentioned, ongoing reviews are performed to identify potential problem and nonperforming loans and also provide in-depth analysis with respect to the quarterly allowance for loan losses calculation. Part of this analysis involves assessing the need for specific reserves relative to impaired loans. This evaluation typically includes a review of the recent performance history of the credit, a comparison of the estimated collateral value in relation to the outstanding loan balance, the overall financial strength of the borrower, industry risks pertinent to the borrower, and competitive trends that may influence the borrower’s future financial performance. Loans are considered impaired when, based upon the most current information available, it appears probable that the borrower will not be able to make payments according to the contractual terms of the loan agreement. Impaired loans are recorded at the observable market price of the loan, the fair value of the underlying collateral (if the loan is collateral dependent), or the present value of the expected future cash flows discounted at the loan's effective interest rate. Given that the Corporation’s impaired loans are typically collateralized by real estate or other borrower assets, the fair value of individual impaired loans is most often based upon the underlying collateral value net of estimated selling costs. Large groups of smaller balance homogenous loans are collectively evaluated for impairment.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS – 2013 Compared to 2012 (CONTINUED)

Provision for Loan Losses and the Allowance for Loan Losses, Continued

To determine the allowance for loan losses, the Corporation prepares a detailed analysis that focuses on delinquency trends, the status of nonperforming loans (i.e., impaired, nonaccrual, restructured, and past due 90 days or more), current and historical trends of charged-off loans within each loan category (i.e., commercial, real estate, and consumer), existing local and national economic conditions, and changes within the volume and mix in each loan category. Higher loss rates are applied in calculating the allowance for loan losses relating to potential problem loans. Loss rates are periodically evaluated considering historic loss rates in the respective potential problem loan categories (i.e., special mention, substandard, doubtful) and current trends.

Regular provisions are made in amounts sufficient to maintain the balance in the allowance for loan losses at a level considered by management to be adequate for losses within the portfolio. Even though management uses all available information to assess possible loan losses, future additions or reductions to the allowance may be required as changes occur in economic conditions and specific borrower circumstances. The regulatory agencies that periodically review the Corporation’s allowance for loan losses may also require additions to the allowance or the charge-off of specific loans based upon the information available to them at the time of their examinations.

The allowance for loan losses at December 31, 2013 was $4.0 million, or 1.36% of total loans, compared to $6.9 million, or 2.27% of total loans at December 31, 2012. The change in the allowance for loan losses during 2013 included an $833,000 negative provision for loan losses charged to operations and loan charge-offs, net of recoveries, of $2.1 million.

The provision for loan losses charged to operations is determined by management after considering the amount of net losses incurred as well as management’s estimation of losses inherent in the portfolio based on an evaluation of loan portfolio risk and current economic factors. The negative provision for loan losses of $833,000 in 2013 compares to a provision of $200,000 million in 2012. The decrease in the provision for loan losses resulted primarily from declining historic loss rates, which are used to calculate the reserve for the homogenous pool of loans, a decrease in risk rated loans and an overall decrease in the loan portfolio. The negative provision during the year ended December 31, 2013 was also warranted as a result of an improving market value on collateral held against one impaired loan, an individual credit that had a specific reserve becoming pass rated during the third quarter and an individual credit with a specific reserve that paid off during the fourth quarter.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS – 2013 Compared to 2012 (CONTINUED)

Provision for Loan Losses and the Allowance for Loan Losses, Continued

The Corporation considers a loan to be impaired when it becomes probable that the Corporation will be unable to collect under the contractual terms of the loan, based on current information and events. Impaired loans, principally consisting of commercial and commercial real estate credits, amounted to $2.8 million at December 31, 2013 compared to $15.6 million at December 31, 2012, a decrease of $12.8 million. Impaired loans at December 31, 2013, included $2.1 million of loans with no specific reserves included in the allowance for loan losses and $660,000 of loans with specific reserves of $179,000 included in the Corporation’s December 31, 2013 allowance for loan losses. Impaired loans at December 31, 2013 with no specific reserves include $2.2 million of loan charge-offs during 2013. Impaired loans at December 31, 2012, included $3.1 million of loans with no specific reserves included in the allowance for loan losses and $12.5 million of loans with specific reserves of $2.9 million included in the Corporation’s December 31, 2012 allowance for loan losses. Impaired loans at December 31, 2012 with no specific reserves include $359,000 of loans which were charged down during 2012.

In addition to impaired loans, the Corporation had other potential problem credits of $13.4 million at December 31, 2013 compared to $17.1 million at December 31, 2012, a decrease of $3.7 million (21.6%). The Corporation’s credit administration department continues to closely monitor these credits.

Non-Interest Income

Total non-interest income increased $115,000 (2.6%) to $4.5 million in 2013 from $4.4 million in 2012. With the exception of net securities gains, most of the components of non-interest income are recurring, although certain components are more susceptible to change than others. Net securities gains decreased in 2013 to $134,000 compared to $268,000 in 2012.

Significant recurring components of non-interest income include service charges on deposit accounts, secondary market lending activities, and increases in the cash surrender value of life insurance. Service charges on deposit accounts increased $106,000 (9.2%) to $1,252,000 in 2013 compared to $1,146,000 in 2012. This increase is largely attributable to changes in customer overdraft behaviors.

The Corporation has elected to sell in the secondary market substantially all fixed rate residential real estate loans originated, and typically retains the servicing rights relating to such loans. During 2013, gain on sale of loans was $719,000, including $313,000 of capitalized servicing rights. Gain on sale of loans was $1,297,000 in 2012, including $445,000 of capitalized servicing rights. The significant decrease in gain on sale of loans was attributable to a decrease in loan demand during 2013 with loan sales in 2013 amounting to $31.9 million compared to $68.9 million in 2012. The Corporation’s serviced portfolio increased $1.2 million during 2013 to $176.8 million at December 31, 2013. The earnings rate used in determining the fair value of servicing at December 31, 2013 was 0.25% compared to 1.0% at December 31, 2012. The earnings rate was decreased to reflect changes in the observable market.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS – 2013 Compared to 2012 (CONTINUED)

Non-Interest Income, Continued

The Corporation reports its mortgage servicing rights using the fair value measurement method. As a result, the Corporation recognized a $316,000 increase in the fair value of mortgage servicing rights during 2013, compared to a $16,000 increase in the fair value of mortgage servicing rights in 2012. Prepayment assumptions are a key valuation input used in determining the fair value of mortgage servicing rights. While prepayment assumptions are constantly subject to change, such changes typically occur within a relatively small parameter from period to period. The prepayment assumptions used in determining the fair value of servicing are based on the Public Securities Association (PSA) Standard Prepayment Model. At December 31, 2013 the PSA factor was 164 compared to 398 at December 31, 2012.

Other operating income increased $433,000 (3.6%) to $1.6 million in 2013 from $1.2 million in 2012. The increase in non-interest income for the year ended December 31, 2013 includes recognition of a $178,000 signing bonus that was received as a result of converting the Corporation’s debit cards and a $156,000 increase in debit card fee income.

Non-Interest Expenses

Total non-interest expenses amounted to $16,024,000 in 2013, compared to $16,513,000 in 2012, a decrease of $489,000 (3%). The decrease in non-interest expenses for the year ended December 31, 2013 was primarily attributable to a $317,000 decrease in salaries and benefits, a $455,000 decrease in other real estate owned expenses, a $372,000 decrease in FDIC premium expenses, a $285,000 decrease in deposit losses and recoveries and a $191,000 decrease in data processing offset by a $1,111,000 increase in miscellaneous expenses resulting from a $985,000 prepayment penalty for payment of a $10 million Federal Home Loan Corporation advance during the fourth quarter of 2013.

The significant components of other operating expenses are summarized in Note 10 to the consolidated financial statements.

Provision for Income Taxes

The provision for income taxes for 2013 was $1,240,000, an effective tax rate of 21.1%, compared to $1,071,000 in 2012, an effective rate of 19.3%. The Corporation’s effective tax rate was reduced from the federal statutory rate of 34% as a result of tax-exempt securities and loan interest income (10.7%) and life insurance contracts (2.4%). At December 31, 2013, the Corporation has available alternative minimum tax credits of $614,000 which can be used in the future to the extent regular tax exceeds the alternative minimum tax.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FINANCIAL POSITION – 2013 Compared to 2012

Securities

Management monitors the earnings performance and liquidity of the securities portfolio on a regular basis through Asset/Liability Committee (ALCO) meetings. As a result, all securities, except Federal Home Loan Bank of Cincinnati (FHLB) stock, have been designated as available-for-sale and may be sold if needed for liquidity, asset-liability management or other reasons. Such securities are reported at fair value, with any net unrealized gains or losses reported as a separate component of shareholders’ equity, net of related income taxes.

Securities, including FHLB stock, totaled $202 million at December 31, 2013 compared to $182.5 million at December 31, 2012, an increase of $19.5 million (10.7%). The amortized cost of the securities portfolio increased $27.1 million in 2013, and the Corporation experienced net unrealized losses on securities of $7.5 million during 2013.

The Corporation is required to maintain a certain level of FHLB stock based on outstanding borrowings from the FHLB. FHLB stock is considered a restricted security which is carried at cost and evaluated periodically for impairment. There were no purchases or sales of FHLB stock during 2013.

At December 31, 2013, the Corporation’s investment securities portfolio included $66.5 million in U.S. states and political subdivisions, which comprises 105.6% of shareholders’ equity. The largest exposure to any one state is $10.9 million or 16%, issued within the state of Ohio. The Corporation’s procedures for evaluating investments in securities issued by states, municipalities and political subdivisions are in accordance with guidance issued by the Board of Governors of the Federal Reserve System, “Investing in Securities without Reliance on Nationally Recognized Statistical Rating Agencies” (SR 12-15) and other regulatory guidance. Credit ratings are considered in our analysis only as a guide to the historical default rate associated with similarly-rated bonds. There have been no significant differences in our internal analyses compared with the ratings assigned by the third party credit rating agencies.

At December 31, 2013, net unrealized losses on available-for-sale securities amounted to $2.1 million compared to net unrealized gains on available for sale securities of $5.6 million at December 31, 2012. At December 31, 2013, the Corporation held one hundred and sixty securities which were in a loss position with the fair value and gross unrealized losses of such securities amounting to $118.6 million and $4.3 million, respectively. Management has considered the current interest rate environment, typical volatilities in the bond market, and the Corporation’s liquidity needs in the near term in concluding that the impairment on these securities is temporary.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FINANCIAL POSITION – 2013 Compared to 2012 (CONTINUED)

Loans

At December 31, 2013, total loans, including loans held for sale, amounted to $295.7 million compared to $307.4 million at December 31, 2012, a decrease of $11.7 million (3.8%). All categories within the loan portfolio decreased during 2013, with residential real estate decreasing $2.1 million (3.6%), commercial loans decreasing $1.9 million (1%), agriculture loans decreasing $4.7 million (10.9%), and consumer loans decreasing $462,000 (10.5%). The overall decrease in the loan portfolio is attributable to continued slow economic conditions experienced throughout the Corporation’s market area.

Other Assets

During 2013, other real estate owned (OREO) decreased $900,000 to $668,000 at December 31, 2013, compared to $1.6 million at December 31, 2012. During 2013, no loans were transferred to OREO. Throughout 2013, the Corporation evaluated its OREO portfolio and made $220,000 of impairment adjustments. The Corporation also sold two properties from OREO and received net proceeds of $694,000 resulting in net gain on sales of $14,000.

Deposits

Total deposits at December 31, 2013 amounted to $468 million, a decrease of $3.2 million (0.7%) compared with total deposits of $471.2 million at December 31, 2012. The decrease in deposits includes a $12 million decrease in interest bearing deposits offset by an $8.8 million increase in non-interest bearing deposits.

Other Borrowings

The Corporation also utilizes other borrowings as an alternative source of funding, as necessary, to support asset growth and periodic deposit shrinkage. Other borrowings, consisting of FHLB advances and customer repurchase agreements, amounted to $12.1 million at December 31, 2013, compared to $22.6 million at December 31, 2012, a decrease of $10.5 million (46.5%). The decrease in other borrowings included $10 million of repayments of FHLB borrowings, and a $457,000 decrease in customer repurchase agreements.

RESULTS OF OPERATIONS – 2012 Compared to 2011

Net interest income for 2012 was $17.9 million, a decrease of $1.2 million (6.4%) from 2011. The decrease in net interest income was primarily due to a decrease in the Corporation’s net interest margin. The average yield on loans for 2012 decreased to 5.51% compared to 5.87% in 2011, and the average rate on interest-bearing liabilities decreased to 1.06% in 2012 from 1.53% in 2011. The effect of these and other factors resulted in the net interest yield on average interest-earning assets, on a tax-equivalent basis, decreasing in 2012 to 3.55% from 3.64% in 2011.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS – 2012 Compared to 2011 (CONTINUED)

The allowance for loan losses at December 31, 2012 was $6.9 million, or 2.27% of total loans, compared to $8.5 million, or 2.53% of total loans at December 31, 2011. The change in the allowance for loan losses during 2012 included a $200,000 provision for loan losses charged to operations and loan charge-offs, net of recoveries, of $1.8 million.

Impaired loans, principally consisting of commercial and commercial real estate credits, amounted to $15.6 million at December 31, 2012 compared to $21 million at December 31, 2011, a decrease of $5.4 million. Impaired loans at December 31, 2012, included $3.1 million of loans with no specific reserves included in the allowance for loan losses and $12.5 million of loans with specific reserves of $2.9 million included in the Corporation’s December 31, 2012 allowance for loan losses. Impaired loans at December 31, 2012 with no specific reserves include $359,000 of loans which were charged down during 2012. Impaired loans at December 31, 2011, included $7.7 million of loans with no specific reserves included in the allowance for loan losses and $13.3 million of loans with specific reserves of $2 million included in the Corporation’s December 31, 2011 allowance for loan losses. Impaired loans at December 31, 2011 with no specific reserves include $2.3 million of loans which were charged down during 2011.

In addition to impaired loans, the Corporation had other potential problem credits of $17.1 million at December 31, 2012 compared to $19.3 million at December 31, 2011, a decrease of $2.2 million (17.3%). The Corporation’s credit administration department continues to closely monitor these credits.

Total non-interest income increased $523,000 (13.6%) to $4.3 million in 2012 from $3.8 million in 2011. With the exception of net securities gains, most of the components of non-interest income are recurring, although certain components are more susceptible to change than others. Net securities gains decreased in 2012 to $268,000 compared to $897,000 in 2011.

Significant recurring components of non-interest income include service charges on deposit accounts, secondary market lending activities, and increases in the cash surrender value of life insurance. Service charges on deposit accounts increased $47,000 (4.3%) to $1,146,000 in 2012 compared to $1,099,000 in 2011. This increase appears to be largely attributable to changes in customer overdraft behaviors.

During 2012, gain on sale of loans was $1,297,000, including $445,000 of capitalized servicing rights. Gain on sale of loans was $493,000 in 2011, including $168,000 of capitalized servicing rights. The significant increase in gain on sale of loans was attributable to an increase in loan sales activities during 2012 with loan sales in 2012 amounting to $68.9 million compared to $26.7 million in 2011. The Corporation’s serviced portfolio increased $11 million during 2012 to $175.6 million at December 31, 2012.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS – 2012 Compared to 2011 (CONTINUED)

The Corporation recognized a $16,000 increase in the fair value of mortgage servicing rights during 2012, compared to a $315,000 decrease in the fair value of mortgage servicing rights in 2011, a comparative $331,000 favorable impact on income before income taxes. Prepayment assumptions are a key valuation input used in determining the fair value of mortgage servicing rights. While prepayment assumptions are constantly subject to change, such changes typically occur within a relatively small parameter from period to period. The prepayment assumptions used in determining the fair value of servicing are based on the Public Securities Association (PSA) Standard Prepayment Model. At December 31, 2012 the PSA factor was 398 compared to 465 at December 31, 2011.

Total non-interest expenses amounted to $16,513,000 in 2012, compared to $15,546,000 in 2011, an increase of $967,000 (6.2%). The increase in non-interest expenses for the year ended December 31, 2012 was primarily attributable to a $621,000 increase in salaries and benefits, a $309,000 increase in deposit losses, a $200,000 increase in other real estate owned expenses, a $92,000 increase in ATM/debit card processing expenses, and an $82,000 increase in loan closing fees, offset by a $243,000 decrease in FDIC premium expenses and a $136,000 decrease in asset management legal expenses.

The provision for income taxes for 2012 was $1,071,000, an effective tax rate of 19.3%, compared to $102,000 in 2011, an effective rate of 3.4%. The Corporation’s effective tax rate was reduced from the federal statutory rate of 34% as a result of tax-exempt securities and loan interest income (11%), life insurance contracts (2.6%), and a reduction in the reserve for uncertain tax positions (1.2%). At December 31, 2012, the Corporation has available alternative minimum tax credits of $432,000 which can be used in the future to the extent regular tax exceeds the alternative minimum tax.

FINANCIAL POSITION – 2012 Compared to 2011

Securities, including FHLB stock, totaled $182.5 million at December 31, 2012 compared to $156.8 million at December 31, 2011, an increase of $25.7 million (16.4%). The amortized cost of the securities portfolio increased $25.5 million in 2012, and the Corporation experienced net unrealized gains on securities of $151,000 during 2012.

The Corporation is required to maintain a certain level of FHLB stock based on outstanding borrowings from the FHLB. FHLB stock is considered a restricted security which is carried at cost and evaluated periodically for impairment. There were no purchases or sales of FHLB stock during 2012.

At December 31, 2012, net unrealized gains on available-for-sale securities amounted to $5.6 million compared to net unrealized gains on available for sale securities of $5.5 million at December 31, 2011. At December 31, 2012, the Corporation held twenty-four securities which were in a loss position with the fair value and gross unrealized losses of such securities amounting to $14.1 million and $88,000, respectively. Management has considered the current interest rate environment, typical volatilities in the bond market, and the Corporation’s liquidity needs in the near term in concluding that the impairment on these securities is temporary.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FINANCIAL POSITION – 2012 Compared to 2011 (CONTINUED)

At December 31, 2012, total loans, including loans held for sale, amounted to $307.4 million compared to $340.7 million at December 31, 2011, a decrease of $33.3 million (9.8%). All categories within the loan portfolio decreased during 2012, with residential real estate decreasing $3.8 million (6.1%), commercial loans decreasing $25.1 million (11.2%), agriculture loans decreasing $3.6 million (7.7%), and consumer loans decreasing $1 million (18.5%). The overall decrease in the loan portfolio is attributable to continued slow economic conditions experienced throughout the Corporation’s market area.

During 2012, other real estate owned (OREO) decreased $1.2 million to $1.6 million at December 31, 2012, compared to $2.8 million at December 31, 2011. During 2012, $421,000 of loans was transferred to OREO. Throughout 2012, the Corporation evaluated its OREO portfolio and made $564,000 of impairment adjustments. The Corporation also sold several properties from OREO and received net proceeds of $1.1 million resulting in net loss on sales of $64,000.

Total deposits at December 31, 2012 amounted to $471.2 million, a decrease of $9.3 million (1.9%) compared with total deposits of $480.5 million at December 31, 2011. The decrease in deposits includes a $20.8 million decrease in interest bearing deposits offset by a $11.5 million increase in non-interest bearing deposits.

Other borrowings, consisting of FHLB advances and customer repurchase agreements, amounted to $22.6 million at December 31, 2012, compared to $32.8 million at December 31, 2011, a decrease of $10.2 million (31.1%). The decrease in other borrowings included $10.1 million of repayments of FHLB borrowings, and a $159,000 decrease in customer repurchase agreements.

LIQUIDITY

Liquidity relates primarily to the Corporation’s ability to fund loan demand, meet the withdrawal requirements of deposit customers, and provide for operating expenses. Assets used to satisfy these needs consist of cash and due from banks, federal funds sold, securities available-for-sale, and loans held for sale. A large portion of liquidity is provided by the ability to sell or pledge securities. Accordingly, the Corporation has designated all securities other than FHLB stock as available-for-sale. A secondary source of liquidity is provided by various lines of credit facilities available through correspondent banks and the Federal Reserve. Another source of liquidity is represented by loans that are available to be sold. Certain other loans within the Corporation’s loan portfolio are also available to collateralize borrowings.

The consolidated statements of cash flows for the years presented provide an indication of the Corporation’s sources and uses of cash as well as an indication of the ability of the Corporation to maintain an adequate level of liquidity. A discussion of cash flows for 2013, 2012, and 2011 follows.

The Corporation generated cash from operating activities of $5.1 million in 2013, $7.3 million in 2012, and $9.6 million in 2011.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

LIQUIDITY (CONTINUED)

Net cash flows from investing activities amounted to $(18.1) million in 2013, $5.1 million in 2012, and $30.2 million in 2011. Significant investing cash flow activities in 2013 included $27.8 million of net cash outflows resulting from securities purchases, net of proceeds received from sales and maturities. Significant investing cash inflow activities in 2013 resulted from a $9.6 million decrease in loans. Significant investing cash outflow activities in 2012 included $26.2 million of net cash outflows resulting from securities purchases, net of proceeds received from sales and maturities. Investing cash inflows of $31 million resulted from a decrease in loans and $1 million from the sale of other real estate owned. Significant investing cash outflow activities in 2011 included $8.6 million of net cash outflows resulting from securities purchases, net of proceeds received from sales and maturities, and $1.7 million resulting from the purchase of certificates of deposit. Investing cash inflows of $38.9 million resulted from a decrease in loans and $1.9 million from the sale of other real estate owned.

Net cash flows from financing activities amounted to $(14.5) million in 2013, $(19.7) million in 2012, and $(31.1) million in 2011. Net cash used in financing activities in 2013 primarily resulted from $10 million of repayment on FHLB borrowings and a $3.2 million decrease in deposits. Net cash used in financing activities in 2012 primarily resulted from $10 million of repayment on FHLB borrowings and a $9.3 million decrease in deposits. Net cash used in financing activities in 2011 primarily resulted from $17 million of repayment on FHLB borrowings, $8.1 million decrease in deposits, and $6 million decrease in customer repurchase agreements.

ASSET LIABILITY MANAGEMENT

Closely related to liquidity management is the management of interest-earning assets and interest-bearing liabilities. The Corporation manages its rate sensitivity position to avoid wide swings in net interest margins and to minimize risk due to changes in interest rates.

The difference between a financial institution’s interest rate sensitive assets (assets that will mature or reprice within a specific time period) and interest rate sensitive liabilities (liabilities that will mature or reprice within the same time period) is commonly referred to as its “interest rate sensitivity gap” or, simply, its “gap”. An institution having more interest rate sensitive assets than interest rate sensitive liabilities within a given time interval is said to have a “positive gap”. This generally means that, when interest rates increase, an institution’s net interest income will increase and, when interest rates decrease, the institution’s net interest income will decrease. An institution having more interest rate sensitive liabilities than interest rate sensitive assets within a given time interval is said to have a “negative gap”. This generally means that, when interest rates increase, the institution’s net interest income will decrease and, when interest rates decrease, the institution’s net interest income will increase. The Corporation’s one year cumulative gap at December 31, 2013 is approximately 85% which means the Corporation has more liabilities than assets re-pricing within one year.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

EFFECTS OF INFLATION

The assets and liabilities of the Corporation are primarily monetary in nature and are more directly affected by fluctuations in interest rates than inflation. Movement in interest rates is a result of the perceived changes in inflation as well as monetary and fiscal policies. Interest rates and inflation do not necessarily move with the same velocity or within the same period; therefore, a direct relationship to the inflation rate cannot be shown. The financial information presented in the Corporation’s consolidated financial statements has been presented in accordance with accounting principles generally accepted in the United States, which require that the Corporation measure financial position and operating results primarily in terms of historical dollars.

SIGNIFICANT ACCOUNTING POLICIES

The Corporation’s consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States of America and follow general practices within the commercial banking industry. Application of these principles requires management to make estimates, assumptions, and judgments that affect the amounts reported in the financial statements. These estimates, assumptions, and judgments are based upon the information available as of the date of the financial statements.

The Corporation’s most significant accounting policies are presented in Note 1 to the consolidated financial statements. These policies, along with other disclosures presented in the Notes to Consolidated Financial Statements and Management’s Discussion and Analysis, provide information about how significant assets and liabilities are valued in the financial statements and how those values are determined. Management has identified the determination of the allowance for loan losses, valuation of goodwill and mortgage servicing rights, and fair value of securities and other financial instruments as the areas that require the most subjective and complex estimates, assumptions and judgments and, as such, could be the most subjective to revision as new information becomes available.

As previously noted, a detailed analysis to assess the adequacy of the allowance for loan losses is performed. This analysis encompasses a variety of factors including the potential loss exposure for individually reviewed loans, the historical loss experience for each loan category, the volume of non-performing loans, the volume of loans past due 30 days or more, a segmentation of each loan category by internally-assigned risk grades, an evaluation of current local and national economic conditions, any significant changes in the volume or mix of loans within each category, a review of the significant concentrations of credit, and any legal, competitive, or regulatory concerns.

Management considers the valuation of goodwill resulting from the 2003 Gibsonburg and Pemberville and the 2010 Findlay branch acquisitions through an annual impairment test which considers, among other things, the assets and equity of the Corporation as well as price multiples for sales transactions involving other local financial institutions. Management engaged an independent valuation specialist to perform a goodwill impairment evaluation as of September 30, 2013, which supported management’s assessment that no impairment adjustments to goodwill were warranted. To date, none of the goodwill evaluations have revealed the need for an impairment charge. Management does not believe that any significant conditions have changed relating to the goodwill assessment through December 31, 2013.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Mortgage servicing rights are recognized when acquired through sale of mortgage loans and are reported at fair value. Changes in fair value are reported in net income for the period the changes occur. The Corporation generally estimates fair value for servicing rights based on the present value of future expected cash flows, using management’s best estimates of the key assumptions – credit losses, prepayment speeds, servicing costs, earnings rate and discount rates commensurate with the risks involved. The Corporation has engaged an independent consultant to calculate the fair value of mortgage servicing rights on a quarterly basis. Management regularly reviews the calculation, including assumptions used in making the calculation, and discusses with the consultant. Management also reconciles information used by the consultant, with respect to the Corporation’s serviced portfolio, to the Corporation’s accounting records.

The Corporation reviews securities prices and fair value estimates of other financial instruments supplied by an independent pricing service, as well as their underlying pricing methodologies, for reasonableness and to ensure such prices are aligned with traditional pricing matrices. The Corporation’s securities portfolio primarily consists of U.S. Government agencies, and political subdivision obligations, and mortgage backed securities. Pricing for such instruments is typically based on models with observable inputs. From time to time, the Corporation will validate, on a sample basis, prices supplied by the independent pricing service by comparison to prices obtained from other third-party sources or derived using internal models. The Corporation also considers the reasonableness of inputs for financial instruments that are priced using unobservable inputs.

IMPACT OF RECENT ACCOUNTING PRONOUNCEMENTS

A summary of new accounting standards adopted or subject to adoption in 2013, as well as newly-issued but not effective accounting standards at December 31, 2013, is presented in Note 2 to the consolidated financial statements.

OFF-BALANCE SHEET ARRANGEMENTS, CONTRACTUAL OBLIGATIONS, AND CONTINGENT LIABILITIES AND COMMITMENTS

The following table summarizes loan commitments, including letters of credit, as of December 31, 2013:

|

Amount of commitment to expire per period |

||||||||||||||||||||

|

Total |

Less than |

1 – 3 |

4 – 5 |

Over |

||||||||||||||||

|

Amount |

1 year |

years |

years |

5 years |

||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||

|

Type of commitment |

||||||||||||||||||||

|

Commercial lines-of-credit |

$ | 37,883 | $ | 37,442 | $ | 405 | $ | 35 | $ | - | ||||||||||

|

Real estate lines-of-credit |

36,883 | 2,041 | 3,300 | 3,731 | 27,812 | |||||||||||||||

|

Consumer lines-of-credit |

331 | - | - | - | 331 | |||||||||||||||

|

Letters of Credit |

1,225 | 1,225 | - | - | - | |||||||||||||||

|

Total commitments |

$ | 76,322 | $ | 40,708 | $ | 3,705 | $ | 3,766 | $ | 28,143 | ||||||||||

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OFF-BALANCE SHEET ARRANGEMENTS, CONTRACTUAL OBLIGATIONS, AND CONTINGENT LIABILITIES AND COMMITMENTS (CONTINUED)

As indicated in the preceding table, the Corporation had $76.3 million in total loan commitments at December 31, 2013, with $40.7 million of that amount expiring within one year. All lines-of-credit represent either fee-paid or legally binding loan commitments for the loan categories noted. Letters-of-credit are also included in the amounts noted in the table since the Corporation requires that each letter-of-credit be supported by a loan agreement. The commercial and consumer lines represent both unsecured and secured obligations. The real estate lines are secured by mortgages in residential and nonresidential property. Many of the commercial lines are due on a demand basis, and are established for seasonal operating purposes. It is anticipated that a significant portion of these lines will expire without being drawn upon.

The following table summarizes the Corporation’s contractual obligations as of December 31, 2013:

|

Payments due by period |

||||||||||||||||||||

|

Total |

Less than |

1– 3 |

4 – 5 |

Over |

||||||||||||||||

|

Amount |

1 year |

years |

years |

5 years |

||||||||||||||||

|

(Dollars in thousands) |

||||||||||||||||||||

|

Contractual obligations |

||||||||||||||||||||

|

Long-term debt |

$ | 17,800 | $ | - | $ | - | $ | 7,500 | $ | 10,300 | ||||||||||

|

Capital leases |

- | - | - | - | - | |||||||||||||||

|

Operating leases |

- | - | - | - | - | |||||||||||||||

|

Unconditional purchase obligations |

- | - | - | - | - | |||||||||||||||

|

Time deposits |

172,348 | 86,977 | 66,664 | 17,477 | 1,230 | |||||||||||||||

|

Deposits without stated maturities |

295,652 | - | - | - | 295,652 | |||||||||||||||

|

Other long-term liabilities reflected under GAAP |

256 | 20 | 49 | 62 | 125 | |||||||||||||||

|

Total obligations |

$ | 486,056 | $ | 86,997 | $ | 66,713 | $ | 25,039 | $ | 307,307 | ||||||||||

Long-term debt presented in the preceding table is comprised of a $7.5 million borrowing from the FHLB, and $10.3 million from the issuance of junior subordinated deferrable interest debentures.

The FHLB borrowing includes a note that requires monthly interest payments, with principal due at maturity, as disclosed in Note 8 to the consolidated financial statements. The outstanding FHLB borrowing at December 31, 2013 consists of an advance with a fixed interest rate. Certain fixed rate obligations have variable options that stipulate a prepayment penalty if the note’s interest rate exceeds the current market rate for similar borrowings at the time of repayment. As a note matures, the Corporation evaluates the liquidity and interest-rate circumstances at that point in time to determine whether to pay-off or renew the note. The evaluation process typically includes the strength of current and projected customer loan demand, the current federal funds sold or purchased position, projected cash flows from maturing securities, the current and projected market interest rate environment, local and national economic conditions, and customer demand for deposit product offerings. The $7.5 million fixed rate advance at December 31, 2013 can be put back at the option of the FHLB.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OFF-BALANCE SHEET ARRANGEMENTS, CONTRACTUAL OBLIGATIONS, AND CONTINGENT LIABILITIES AND COMMITMENTS (CONTINUED)

Time deposits and deposits without stated maturities included in the preceding table are comprised of customer deposit accounts. Management believes that they have the ability to attract and retain deposit balances by adjusting the interest rates offered.

The other long-term liabilities reflected under GAAP, as noted in the preceding table, represents the Corporation ’s agreement with its current Chairman of the Board of Directors to provide for retirement compensation benefits as more fully described in Note 12 of the consolidated financial statements. At December 31, 2013, the net present value of future deferred compensation payments amounted to $256,000, which is included in other liabilities in the December 31, 2013 consolidated balance sheet.

As indicated in the table, the Corporation had no capital lease obligations as of December 31, 2013. The Corporation also has a non-qualified deferred compensation plan covering certain directors and officers, and has provided an estimated liability of $604,000 at December 31, 2013 for supplemental retirement benefits. Since substantially all participants under the plan are still active, it is not possible to determine the terms of the contractual obligations and, consequently, such liability is not included in the table.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The most significant market risk to which the Corporation is exposed is interest rate risk. The business of the Corporation and the composition of its balance sheet consist of investments in interest-earning assets (primarily loans and securities), which are funded by interest bearing liabilities (deposits and borrowings). These financial instruments have varying levels of sensitivity to changes in the market rates of interest, resulting in market risk. None of the Corporation’s financial instruments are held for trading purposes.

The Corporation manages interest rate risk regularly through its Asset Liability Committee. The Committee meets on a regular basis and reviews various asset and liability management information, including but not limited to, the Corporation’s liquidity positions, projected sources and uses of funds, interest rate risk positions and economic conditions.

The Corporation monitors its interest rate risk through a sensitivity analysis, whereby it measures potential changes in its future earnings and the fair values of its financial instruments that may result from one or more hypothetical changes in interest rates. This analysis is performed by estimating the expected cash flows of the Corporation’s financial instruments using interest rates in effect at year-end. For the fair value estimates, the cash flows are then discounted to year-end to arrive at an estimated present value of the Corporation’s financial instruments. Hypothetical changes in interest rates are then applied to the financial instruments, and the cash flows and fair values are again estimated using these hypothetical rates. For the net interest income estimates, the hypothetical rates are applied to the financial instruments based on the assumed cash flows. The Corporation applies these interest rate “shocks” to its financial instruments up and down 200 and 300 and up 400 basis points.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK (CONTINUED)

The following table shows the Corporation’s estimated earnings sensitivity profile as of December 31, 2013:

|

Change in Interest Rates (basis points) |

Percentage Change in Net Interest Income |

Percentage Change in Net Income |

|||||||||

| +200 | -1.4% | -2.4% | |||||||||

| -200 | -6.2% | -13.5% | |||||||||

| +300 | -2.8% | -5.2% | |||||||||

| -300 | N/A | N/A | |||||||||

| +400 | -4.3% | -8.3% | |||||||||

Given a linear 200bp increase in the yield curve used in the simulation model, it is estimated that net interest income for the Corporation would decrease by 1.4% and net income would decrease by 2.4%. A 200bp decrease in interest rates would decrease net interest income by 6.2% and decrease net income by 13.5%. Given a linear 300bp increase in the yield curve used in the simulation model, it is estimated that net interest income for the Corporation would decrease by 2.8% and net income would decrease by 5.2%. A 300bp decrease in interest rates cannot be simulated at this time due to the historically low interest rate environment. A 400bp increase in interest rates would decrease net interest income by 4.3% and decrease net income by 8.3%. Management does not expect any significant adverse effect to net interest income in 2014 based on the composition of the portfolio and anticipated trends in rates.

OTHER INFORMATION

The Dodd-Frank Act, enacted in 2010, is complex and several of its provisions are still being implemented. The Dodd-Frank Act established the Consumer Financial Protection Bureau, which has extensive regulatory and enforcement powers over consumer financial products and services, and the Financial Stability Oversight Council, which has oversight authority for monitoring and regulating systemic risk. In addition, the Dodd-Frank Act altered the authority and duties of the federal banking and securities regulatory agencies, implemented certain corporate governance requirements for all public companies including financial institutions with regard to executive compensation, proxy access by shareholders, and certain whistleblower provisions, and restricted certain proprietary trading and hedge fund and private equity activities of banks and their affiliates. The Dodd-Frank Act also required the issuance of numerous regulations, many of which have not yet been issued. The regulations will continue to take effect over several more years, continuing to make it difficult to anticipate the overall impact.

UNITED BANCSHARES, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FORWARD-LOOKING STATEMENTS

This report includes certain forward-looking statements by the Corporation relating to such matters as anticipated operating results, prospects for new lines of business, technological developments, economic trends (including interest rates), and similar matters. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements, and the purpose of this paragraph is to secure the use of the safe harbor provisions. While the Corporation believes that the assumptions underlying the forward looking statements contained herein and in other public documents are reasonable, any of the assumptions could prove to be inaccurate, and accordingly, actual results and experience could differ materially from the anticipated results or other expectations expressed by the Corporation in its forward-looking statements. Factors that could cause actual results or experience to differ from results discussed in the forward-looking statements include, but are not limited to: economic conditions, volatility and direction of market interest rates, governmental legislation and regulation, material unforeseen changes in the financial condition or results of operations of the Corporation’s customers, customer reaction to and unforeseen complications with respect to the integration of acquisition, product design initiative, and other risks identified, from time-to-time in the Corporation’s other public documents on file with the Securities and Exchange Commission.

Report of Independent Registered Public Accounting Firm

Shareholders and Board of Directors

United Bancshares, Inc.

Columbus Grove, Ohio

We have audited the accompanying consolidated balance sheets of United Bancshares, Inc. and subsidiaries as of December 31, 2013 and 2012, and the related consolidated statements of income, comprehensive income, shareholders’ equity, and cash flows for each of the years in the three-year period ended December 31, 2013. These consolidated financial statements are the responsibility of the Corporation’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of United Bancshares, Inc. and subsidiaries as of December 31, 2013 and 2012, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2013, in conformity with accounting principles generally accepted in the United States of America.

Toledo, Ohio

March 19, 2014

UNITED BANCSHARES, INC.

CONSOLIDATED BALANCE SHEETS

December 31, 2013 and 2012

| 2013 | 2012 | |||||||

| ASSETS | ||||||||

|

CASH AND CASH EQUIVALENTS |

||||||||

|

Cash and due from banks |

$ | 13,698,325 | $ | 10,605,662 | ||||

|

Interest-bearing deposits in other banks |

8,709,133 | 39,306,145 | ||||||

|

Total cash and cash equivalents |

22,407,458 | 49,911,807 | ||||||

|

SECURITIES, available-for-sale |

197,079,925 | 177,607,765 | ||||||

|

FEDERAL HOME LOAN BANK STOCK, at cost |

4,893,800 | 4,893,800 | ||||||

|

CERTIFICATES OF DEPOSIT, at cost |

2,739,000 | 2,490,000 | ||||||

|

LOANS HELD FOR SALE |

423,720 | 2,957,060 | ||||||

|

LOANS |

295,313,069 | 304,445,298 | ||||||

|

Less allowance for loan losses |

4,014,391 | 6,917,605 | ||||||

|

Net loans |

291,298,678 | 297,527,693 | ||||||

|

PREMISES AND EQUIPMENT, net |

9,165,532 | 9,217,876 | ||||||

|

GOODWILL |

8,554,979 | 8,554,979 | ||||||

|

CORE DEPOSIT INTANGIBLE ASSETS, net |

132,786 | 173,643 | ||||||

|

CASH SURRENDER VALUE OF LIFE INSURANCE |

14,173,138 | 13,761,183 | ||||||

|

OTHER REAL ESTATE OWNED |

667,954 | 1,568,000 | ||||||

|

OTHER ASSETS, including accrued interest receivable |

4,697,774 | 3,783,822 | ||||||

|

TOTAL ASSETS |

$ | 556,234,744 | $ | 572,447,628 | ||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||

|

LIABILITIES |

||||||||

|

Deposits: |

||||||||

|

Non-interest bearing |

$ | 86,752,995 | $ | 77,924,051 | ||||

|

Interest-bearing |

381,247,070 | 393,275,063 | ||||||

|

Total deposits |

468,000,065 | 471,199,114 | ||||||

|

Other borrowings |

12,100,552 | 22,557,220 | ||||||

|

Junior subordinated deferrable interest debentures |

10,300,000 | 10,300,000 | ||||||

|

Other liabilities |

2,826,262 | 4,221,089 | ||||||

|

Total liabilities |

493,226,879 | 508,277,423 | ||||||

|

SHAREHOLDERS’ EQUITY |

||||||||

|

Common stock, stated value $1.00, authorized 10,000,000 shares; issued 3,760,557 shares |

3,760,557 | 3,760,557 | ||||||

|

Surplus |

14,663,861 | 14,661,664 | ||||||

|

Retained earnings |

50,807,689 | 46,855,865 | ||||||

|

Accumulated other comprehensive income (loss) |

(1,358,205 | ) | 3,697,363 | |||||

|

Treasury stock, at cost, 318,506 shares in 2013 and 314,252 shares in 2012 |

(4,866,037 | ) | (4,805,244 | ) | ||||

|

Total shareholders’ equity |

63,007,865 | 64,170,205 | ||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

$ | 556,234,744 | $ | 572,447,628 | ||||

The accompanying notes are an integral part of the consolidated financial statements.

UNITED BANCSHARES, INC.

CONSOLIDATED STATEMENTS OF INCOME

Years Ended December 31, 2013, 2012 and 2011

|

2013 |

2012 |

2011 |

||||||||||

|

INTEREST INCOME |

||||||||||||

|

Loans, including fees |

$ | 15,243,402 | $ | 17,912,408 | $ | 21,169,719 | ||||||

|

Securities: |

||||||||||||

|

Taxable |

2,429,043 | 2,543,299 | 3,018,435 | |||||||||

|

Tax-exempt |

1,858,801 | 1,787,431 | 1,935,623 | |||||||||

|

Other |

322,681 | 348,274 | 337,218 | |||||||||

|

Total interest income |

19,853,927 | 22,591,412 | 26,460,995 | |||||||||

|

INTEREST EXPENSE |

||||||||||||

|

Deposits |

2,142,274 | 3,347,697 | 5,540,060 | |||||||||

|

Borrowings |

1,107,098 | 1,328,093 | 1,785,806 | |||||||||

|

Total interest expense |

3,249,372 | 4,675,790 | 7,325,866 | |||||||||

|

Net interest income |

16,604,555 | 17,915,622 | 19,135,129 | |||||||||

|

PROVISION (CREDIT) FOR LOAN LOSSES |

(832,925 | ) | 200,000 | 4,375,000 | ||||||||

|

Net interest income after provision for loan losses |

17,437,480 | 17,715,622 | 14,760,129 | |||||||||

|

NON-INTEREST INCOME |

||||||||||||

|

Service charges on deposit accounts |

1,252,379 | 1,146,263 | 1,099,424 | |||||||||

|

Gain on sale of loans |

719,289 | 1,296,875 | 492,747 | |||||||||

|

Net securities gains |

134,177 | 267,513 | 896,764 | |||||||||

|

Change in fair value of mortgage servicing rights |

315,758 | 15,931 | (314,566 | ) | ||||||||

|

Increase in cash surrender value of life insurance |

411,955 | 425,596 | 456,584 | |||||||||

|

Other operating income |

1,634,438 | 1,201,374 | 1,199,969 | |||||||||

|

Total non-interest income |

4,467,996 | 4,353,552 | 3,830,922 | |||||||||

|

NON-INTEREST EXPENSES |

||||||||||||

|

Salaries, wages and employee benefits |

8,237,152 | 8,554,404 | 7,932,975 | |||||||||

|

Occupancy expenses |

1,555,242 | 1,474,140 | 1,505,033 | |||||||||

|

Other operating expenses |

6,231,878 | 6,484,813 | 6,108,398 | |||||||||

|

Total non-interest expenses |

16,024,272 | 16,513,357 | 15,546,406 | |||||||||

|

Income before income taxes |

5,881,204 | 5,555,817 | 3,044,645 | |||||||||

|

PROVISION FOR INCOME TAXES |

1,240,000 | 1,071,000 | 102,000 | |||||||||

|

NET INCOME |

$ | 4,641,204 | $ | 4,484,817 | $ | 2,942,645 | ||||||

|

NET INCOME PER SHARE (basic and diluted) |

$ | 1.35 | $ | 1.30 | $ | .85 | ||||||

The accompanying notes are an integral part of the consolidated financial statements.

UNITED BANCSHARES, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Years Ended December 31, 2013, 2012 and 2011

|

2013 |

2012 |

2011 |

||||||||||

|

NET INCOME |

$ | 4,641,204 | $ | 4,484,817 | $ | 2,942,645 | ||||||

|

OTHER COMPREHENSIVE INCOME (LOSS) |

||||||||||||

|

Unrealized gains (losses) on securities: |

||||||||||||

|

Unrealized holding gains (losses) during period |

(7,525,775 | ) | 418,016 | 3,604,866 | ||||||||

|

Reclassification adjustments for gains included in net income |

(134,177 | ) | (267,513 | ) | (896,764 | ) | ||||||

|

Other comprehensive income (loss), before income taxes |

(7,659,952 | ) | 150,503 | 2,708,102 | ||||||||

|

Income tax benefit (expense) related to items of other comprehensive income (loss) |

2,604,384 | (51,171 | ) | (920,755 | ) | |||||||

|

Other comprehensive income (loss) |

(5,055,568 | ) | 99,332 | 1,787,347 | ||||||||

|

COMPREHENSIVE INCOME (LOSS) |

$ | (414,364 | ) | $ | 4,584,149 | $ | 4,729,992 | |||||

The accompanying notes are an integral part of the consolidated financial statements.

UNITED BANCSHARES, INC.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Years Ended December 31, 2013, 2012 and 2011

|

Common stock |

Surplus |

Retained earnings |

Accumulated other comprehensive income |

Treasury stock |

Total |

|||||||||||||||||||

|

BALANCE AT DECEMBER 31, 2010 |

$ | 3,760,557 | $ | 14,660,000 | $ | 39,600,718 | $ | 1,810,684 | $ | (4,826,896 | ) | $ | 55,005,063 | |||||||||||

|

Comprehensive income: |

||||||||||||||||||||||||

|

Net income |

- | - | 2,942,645 | - | - | 2,942,645 | ||||||||||||||||||

|

Other comprehensive income |

- | - | - | 1,787,347 | - | 1,787,347 | ||||||||||||||||||

|

Sale of 790 treasury shares |

- | 579 | - | - | 12,080 | 12,659 | ||||||||||||||||||

|

BALANCE AT DECEMBER 31, 2011 |

3,760,557 | 14,660,579 | 42,543,363 | 3,598,031 | (4,814,816 | ) | 59,747,714 | |||||||||||||||||

|

Comprehensive income: |

||||||||||||||||||||||||

|

Net income |

- | - | 4,484,817 | - | - | 4,484,817 | ||||||||||||||||||

|

Other comprehensive income |

- | - | - | 99,332 | - | 99,332 | ||||||||||||||||||

|

Sale of 626 treasury shares |

- | 1,085 | - | - | 9,572 | 10,657 | ||||||||||||||||||

|

Cash dividends declared, $0.05 per share |

- | - | (172,315 | ) | - | - | (172,315 | ) | ||||||||||||||||

|

BALANCE AT DECEMBER 31, 2012 |

3,760,557 | 14,661,664 | 46,855,865 | 3,697,363 | (4,805,244 | ) | 64,170,205 | |||||||||||||||||

|

Comprehensive income: |

||||||||||||||||||||||||

|

Net income |

- | - | 4,641,204 | - | - | 4,641,204 | ||||||||||||||||||

|

Other comprehensive loss |

- | - | - | (5,055,568 | ) | - | ( 5,055,568 | ) | ||||||||||||||||

|

Repurchase of 5,000 shares |

(72,200 | ) | (72,200 | ) | ||||||||||||||||||||

|

Sale of 746 treasury shares |

- | 2,197 | - | - | 11,407 | 13,604 | ||||||||||||||||||

|

Cash dividends declared, $0.20 per share |

- | - | (689,380 | ) | - | - | (689,380 | ) | ||||||||||||||||

|

BALANCE AT DECEMBER 31, 2013 |

$ | 3,760,557 | $ | 14,663,861 | $ | 50,807,689 | $ | (1,358,205 | ) | $ | (4,866,037 | ) | $ | 63,007,865 | ||||||||||

The accompanying notes are an integral part of the consolidated financial statements.

UNITED BANCSHARES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended December 31, 2013, 2012 and 2011

|

2013 |

2012 |

2011 |

||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES |

||||||||||||

|

Net income |

$ | 4,641,204 | $ | 4,484,817 | $ | 2,942,645 | ||||||

|

Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||||||

|

Depreciation and amortization |

649,056 | 772,483 | 697,967 | |||||||||

|

Deferred income taxes |

1,032,000 | 516,431 | (232,354 | ) | ||||||||

|

Provision for loan losses |

(832,925 | ) | 200,000 | 4,375,000 | ||||||||

|

Gain on sale of loans |

(719,289 | ) | (1,296,875 | ) | (492,747 | ) | ||||||

|

Net securities gains |

(134,177 | ) | (267,513 | ) | (896,764 | ) | ||||||

|

Change in fair value of mortgage servicing rights |

(315,758 | ) | (15,931 | ) | 314,566 | |||||||

|

Loss on sale or write-down of other real estate owned |

205,775 | 627,615 | 334,840 | |||||||||

|

Increase in cash surrender value of life insurance |