Attached files

| file | filename |

|---|---|

| EX-3.2 - EX-3.2 - ENDOSTIM, INC. | d718829dex32.htm |

| EX-3.1 - EX-3.1 - ENDOSTIM, INC. | d718829dex31.htm |

| EX-10.8 - EX-10.8 - ENDOSTIM, INC. | d718829dex108.htm |

| EX-10.4 - EX-10.4 - ENDOSTIM, INC. | d718829dex104.htm |

| EX-23.1 - EX-23.1 - ENDOSTIM, INC. | d718829dex231.htm |

| EX-10.1 - EX-10.1 - ENDOSTIM, INC. | d718829dex101.htm |

| EX-10.9 - EX-10.9 - ENDOSTIM, INC. | d718829dex109.htm |

| EX-10.7 - EX-10.7 - ENDOSTIM, INC. | d718829dex107.htm |

| EX-10.5 - EX-10.5 - ENDOSTIM, INC. | d718829dex105.htm |

| EX-10.16 - EX-10.16 - ENDOSTIM, INC. | d718829dex1016.htm |

| EX-10.19 - EX-10.19 - ENDOSTIM, INC. | d718829dex1019.htm |

| EX-10.14 - EX-10.14 - ENDOSTIM, INC. | d718829dex1014.htm |

| EX-10.13 - EX-10.13 - ENDOSTIM, INC. | d718829dex1013.htm |

| EX-10.18 - EX-10.18 - ENDOSTIM, INC. | d718829dex1018.htm |

| EX-10.15 - EX-10.15 - ENDOSTIM, INC. | d718829dex1015.htm |

| EX-10.10 - EX-10.10 - ENDOSTIM, INC. | d718829dex1010.htm |

| EX-10.17 - EX-10.17 - ENDOSTIM, INC. | d718829dex1017.htm |

| EX-4.2 - EX-4.2 - ENDOSTIM, INC. | d718829dex42.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 5, 2014.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EndoStim, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3845 | 27-0373496 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

4041 Forest Park Avenue, Suite 220

St. Louis, Missouri 63108

Tel: (314) 615-6345

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Bevil J. Hogg

President and Chief Executive Officer

EndoStim, Inc.

4041 Forest Park Avenue, Suite 220

St. Louis, Missouri 63108

Tel: (314) 615-6345

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| James L. Nouss, Jr. Robert J. Endicott Bryan Cave LLP One Metropolitan Square 211 North Broadway, Suite 3600 St. Louis, Missouri 63102 (314) 259-2000 |

Steven M. Skolnick Lowenstein Sandler LLP 1251 Avenue of the Americas New York, New York 10020 (646) 414-6947 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED |

PROPOSED MAXIMUM AGGREGATE OFFERING PRICE (1) |

AMOUNT OF REGISTRATION FEE (2) | ||

| Common Stock, $0.001 par value per share |

$40,250,000 | $5,184.20 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended, and includes the offering price of shares of common stock that the underwriters have an option to purchase to cover over-allotments, if any. |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION, DATED SEPTEMBER 5, 2014

PROSPECTUS

Shares

Common Stock

This is the initial public offering of EndoStim, Inc. We are selling shares of our common stock. We anticipate that the initial public offering price of our shares of common stock will be between $ and $ per share.

After the pricing of the offering, we expect that the shares will trade on The NASDAQ Capital Market under the symbol “STIM.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and will be subject to reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company.”

| Per Share |

Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions (1) |

$ | $ | ||||||

| Proceeds to us, before expenses |

$ | $ | ||||||

| (1) | See “Underwriting” for additional disclosure regarding underwriting discounts, commissions and estimated offering expenses. |

We have granted a 30-day option to the representative of the underwriters to purchase up to additional shares of common stock solely to cover over-allotments, if any.

The underwriters expect to deliver our shares to purchasers in the offering on or about , 2014.

Wedbush PacGrow Life Sciences

| Craig-Hallum Capital Group | Roth Capital Partners |

The date of this prospectus is , 2014.

Table of Contents

| PAGE | ||||

| 1 | ||||

| 10 | ||||

| Special Note Regarding Forward-Looking Statements and Industry Data |

43 | |||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 49 | ||||

| 51 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

52 | |||

| 69 | ||||

| 100 | ||||

| 108 | ||||

| 120 | ||||

| 124 | ||||

| 128 | ||||

| 133 | ||||

| Material U.S. Federal Income Tax Consequences to Non-U.S. Holders |

135 | |||

| 138 | ||||

| 143 | ||||

| 143 | ||||

| 144 | ||||

| F-2 | ||||

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not, and the underwriters have not, authorized anyone to provide you with information that is different. We are offering to sell shares of our common stock, and seeking offers to buy shares of our common stock, only in jurisdictions where offers and sales are permitted. The information in this prospectus is complete and accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

For investors outside the United States: neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of shares of our common stock and the distribution of this prospectus outside the United States.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “EndoStim,” “the company,” “we,” “us,” “our” and similar references refer to EndoStim, Inc. and its subsidiary. We own various U.S. federal trademark registrations and applications, and unregistered trademarks and servicemarks, including EndoStim™ and our corporate logo. All other trademarks or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

i

Table of Contents

The following summary highlights information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. Before you decide to invest in our common stock, you should read and carefully consider the following summary together with the entire prospectus, including our financial statements and the related notes thereto appearing elsewhere in this prospectus and the matters discussed in the sections in this prospectus entitled “Risk Factors,” “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements and Industry Data.” Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in the “Risk Factors” and other sections of this prospectus.

Overview

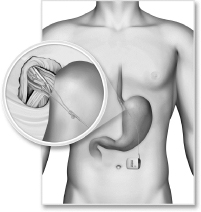

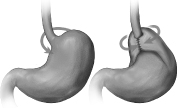

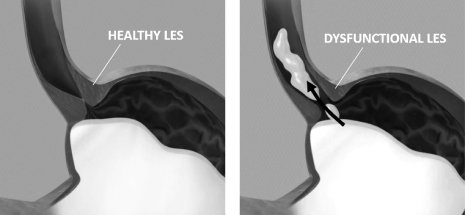

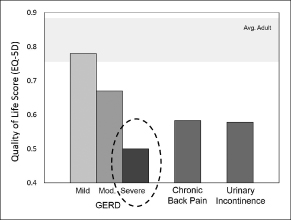

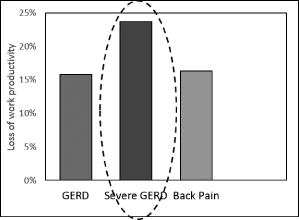

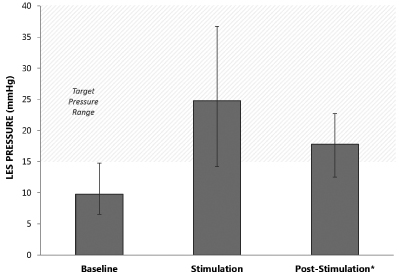

We are a medical device company focused on the development and commercialization of a novel neurostimulation system for the treatment of severe gastroesophageal reflux disease, or GERD. Severe GERD is a debilitating condition that significantly disrupts patients’ quality of life, work productivity and sleep. Based on several international third party studies, we believe the impact of severe GERD on quality of life can be worse than that of chronic back pain or urinary incontinence, two other chronic conditions that are successfully treated with neurostimulation. Moreover, the impact of severe GERD on work productivity has been shown to be significantly greater than that attributable to back pain. Our innovative approach targets the main cause of GERD — a dysfunctional lower esophageal sphincter, or LES, a muscle at the junction of the esophagus and stomach. The EndoStim neurostimulation system, which has a form and function similar to a pacemaker, delivers low energy electrical stimulation to the LES. In our clinical trials to date, this stimulation has been shown to improve the tone and function of the LES, thereby significantly reducing the pathological reflux symptoms of GERD. Our laparoscopically implantable neurostimulation system is minimally-invasive, reversible and preserves the anatomy of the esophagus and stomach.

GERD Therapy Gap

In patients with GERD, a dysfunctional LES allows gastric contents, including stomach acid and bile, to pass inappropriately from the stomach into the esophagus. As a result, patients often suffer from heartburn, regurgitation, chest pain, and difficulty swallowing, among other symptoms, which can severely impact their quality of life. In more serious cases, GERD can result in a precancerous condition called “Barrett’s esophagus” that can lead to esophageal cancer. Patients who suffer from daily GERD symptoms experience a sevenfold increase in the risk of esophageal cancer, for which the World Health Organization reported 456,000 new cases worldwide in 2012.

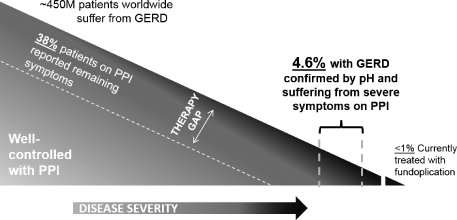

Today, GERD is most often treated with chronic medication, specifically proton pump inhibitors, or PPIs, such as Nexium and Prilosec, which suppress the production of acid in the stomach. However, PPIs do not address the main cause of GERD, a dysfunctional LES. Therefore, PPIs do not prevent the regurgitation of stomach contents into the esophagus. As a result, 38% of patients taking PPIs to treat GERD reported continuing symptoms that were not resolved by their medication, according to a 2010 study of over 1,000 patients by the American Gastroenterological Association. We expect to initially target a subset of these patients who experience severe symptoms while on medication, and whose GERD can be confirmed by an esophageal acid test. We estimate this subset to comprise approximately 4.6% of all GERD patients, or about 21 million patients worldwide.

The traditional alternative for patients with continuing symptoms on PPIs has been fundoplication, a surgical procedure where the top of the stomach is wrapped and secured around the lower esophagus to augment the LES

1

Table of Contents

in order to create a mechanical barrier to reflux. This is a highly invasive procedure which permanently changes the anatomy, can result in a number of side effects and is difficult to correct or reverse. As a result of these concerns, fewer than 1% of patients who are unsatisfied with PPIs are treated with fundoplication.

Several competing mechanical devices have been developed and evaluated in clinical trials in attempts to address this therapy gap. These include the LINX Reflux Management System (Torax Medical), EsophyX (EndoGastric Solutions) and Stretta (Mederi Therapeutics). Use of these devices, which typically employ mechanical constriction or thermal ablation of the anatomy to restrict the migration of stomach contents into the esophagus, have either shown low efficacy in suppressing esophageal acid or have led to unwanted side effects such as difficulty swallowing. We believe that our therapy offers superior clinical efficacy in controlling esophageal acid and also offers a better safety and side effect profile by preserving normal anatomy and swallow function.

Our Solution

Unlike fundoplication and other mechanical interventions, our treatment does not interfere with the natural LES relaxation which is necessary to allow for normal LES functions, such as swallowing and belching. We believe that our neurostimulation system, when compared with fundoplication and other available implantable devices, offers the following advantages:

| • | targets the main cause of GERD by restoring the natural functioning of a dysfunctional LES; |

| • | is effective in alleviating patient symptoms and reducing or eliminating daily PPI use; |

| • | is minimally-invasive and reversible; |

| • | has minimal side effects and adverse events based on available clinical data; |

| • | is CE marked for use with MRI procedures for head and limb imaging and is potentially compatible with 3T MRI systems for full body exposure; and |

| • | has the ability to be wirelessly customized at post procedure follow-ups to accommodate a patient’s individual lifestyle, responses to treatment, and personal preferences. |

Although our solution is novel for the treatment of GERD, neurostimulation has been used successfully over many years for the treatment of a wide variety of diseases, such as lower back pain, incontinence, various heart conditions and epilepsy.

Regulatory Approval and Commercialization

In 2012, we received CE Mark regulatory approval to commercialize our neurostimulation system in Europe and in other countries recognizing the CE Mark. We launched our system commercially in late 2013. More than 40 sites in Germany, Switzerland, Argentina and Colombia have obtained access to third-party reimbursement for the procedure. We currently use a direct sales force in key European countries and specialized distributors in other European countries, South America and Asia to commercialize our products.

In the United States, our device has not been approved for sale by the FDA. However, we have received approval from the FDA for our Investigational Device Exemption, or IDE, application, which allows us to conduct a pivotal clinical trial in the United States. The trial design is double-blind sham-controlled, which means that neither the investigator nor the patient knows whether or not the patient implanted with the device is actually receiving stimulation therapy. This guards against a “sham” or “placebo” effect where patients perceive their symptoms to have improved merely due to their awareness of receiving an experimental treatment, or indirectly as a result of the investigator’s behavior. The clinical trial endpoints which the FDA will use to evaluate the effects of our neurostimulation treatment, are similar to the endpoints of our prior overseas clinical work. Most importantly, in our prior long-term clinical trials, we have consistently demonstrated the positive effect of our treatment on acid

2

Table of Contents

exposure to the esophagus. This is the outcome required by the FDA as the primary efficacy endpoint of our United States pivotal trial.

The FDA has recommended a minimum of 100 patients to be treated for one year; therefore, we plan to enroll a minimum of 110 patients to allow for dropouts. Based on our own prior open-label clinical results and published sham responses from other sham-controlled trials for GERD devices, we believe we can achieve a successful outcome with 100 completed patients. However, we have the ability to increase the total number of patients in the United States trial up to 200 if we believe it is necessary to successfully meet the primary endpoint. Provided our United States clinical trial is successful, we do not believe there would be any material hurdles to receiving FDA approval that would permit us to sell our neurostimulation system in the United States.

Clinical Trials

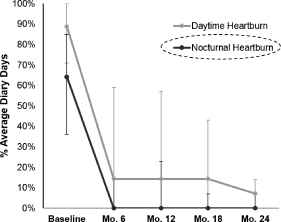

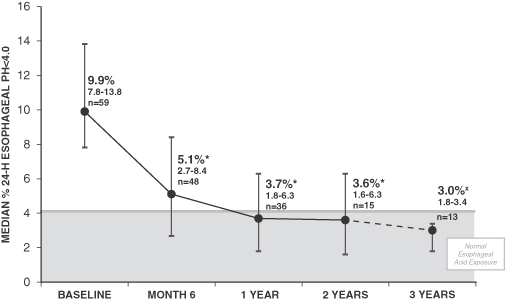

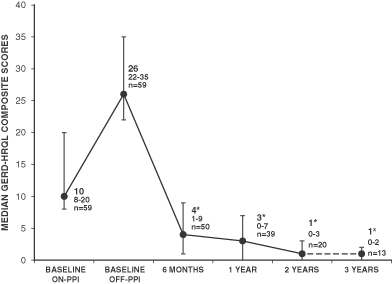

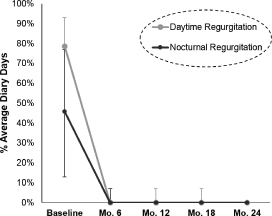

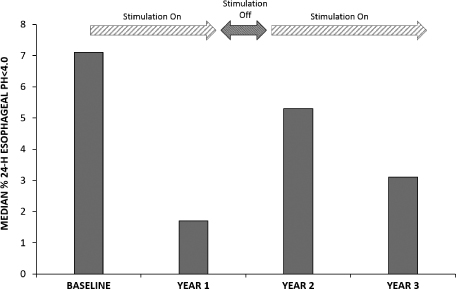

To date, over 130 patients have been implanted with our system, 65 of whom have been treated in open-label clinical trials. These clinical trials have shown promising outcomes with respect to the safety and clinical efficacy of our technology as measured by objective and subjective criteria described under “— Clinical Trials.” The results of these clinical trials have been published in peer-reviewed medical journals. The trials have been conducted in Europe, South America and Asia with a follow-up period of up to three years. A total of 39 patients in these trials have been treated for more than one year, of whom:

| • | 72% achieved successful control of objectively measured esophageal acid exposure, considered the “gold standard” within our industry in evaluating GERD therapies, at their last follow-up (where “success” is defined using FDA criteria of normalization of values or a decrease of more than 50% from a baseline); |

| • | 85% reported clinically significant improvement in symptoms, as evidenced by 50% or more improvement in GERD-HRQL score (a standard, internationally validated questionnaire-based measure of GERD-related quality of life), at their last follow-up; and |

| • | 97% were able to discontinue regular PPI use at their one-year evaluation (regular PPI use is defined as use of PPIs during 50% or more of diary days). |

For a more detailed description of these results, please refer to “Business — Clinical Trials — Summary of Findings” below. Although these trials have shown promising results, they were open-label studies performed at a limited number of clinical sites on a limited number of patients who were followed for a period of up to 36 months. Open-label trials are subject to various limitations that may exaggerate any therapeutic effect, including the “sham” or “placebo” effect described above under “— Regulatory Approval and Commercialization.” Moreover, these patients likely included a high number of severe sufferers, and their symptoms may have been bound to improve notwithstanding treatment with our neurostimulation system. Please refer to “Risk Factors — We have collected limited clinical data about the efficacy and safety of our neurostimulation system and may be unable to reproduce historical clinical results in large-scale and double-blind controlled clinical trials.” To partially mitigate the placebo effect in our open-label trials, we included the measurement of esophageal acid exposure described in the first bullet above, which provides a more objective measure of reflux.

Our Strategy

Our goal is to establish our neurostimulation system as the leading therapy for treatment of severe GERD. Currently, our target market is 21 million patients worldwide, a subset of the patients in the GERD “therapy gap.” The key components of our strategy include the following:

| • | we intend to drive sales growth primarily in countries where the marketing of our neurostimulation system is approved and where third-party reimbursement is available; |

3

Table of Contents

| • | we aim to expand regulatory approval and third-party reimbursement to additional countries worldwide; |

| • | we intend to seek FDA regulatory approval and third-party reimbursement to commercialize our system in the United States; and |

| • | we intend to broaden our customer base by developing new applications for, and enhancements to, our therapy. This is expected to include the development of an endoscopic approach to the delivery of our leads and electrodes, as well as the potential expansion of our therapy to other sphincter disorders. |

Our Risks and History of Losses

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. These risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include, but are not limited to, the following:

| • | we have a history of losses and expect to continue losses in the future, and we may never generate enough revenue from the commercialization of our neurostimulation system to achieve or sustain profitability; |

| • | we will likely need to raise additional capital in the future to fund our operations, and we may not be able to do so on favorable terms or at all; |

| • | our neurostimulation system may never achieve broad market acceptance, and may not be commercially successful; |

| • | lack of third-party coverage and reimbursement for our neurostimulation system could delay or limit the adoption of our neurostimulation system; |

| • | while we have CE Mark approval, we do not have, and may never receive, approval to market our neurostimulation system in the United States; |

| • | our neurostimulation system has only been used in 130 patients worldwide and, while it has been shown to be safe, there is no certainty that this will continue to be the case; and |

| • | we may be unable to adequately protect our intellectual property, or our intellectual property may infringe the intellectual property rights of third parties, either of which could adversely affect our business. |

We have incurred net losses since our inception in 2009, including net losses of $7.5 million and $5.5 million before deduction for the accretion of redeemable preferred stock and undeclared dividends on Series A convertible preferred stock for the years ended December 31, 2013 and 2012, respectively, and $3.6 million for the six months ended June 30, 2014. As of June 30, 2014, our accumulated deficit was approximately $29.5 million. Due to the uncertainty of our ability to meet our current operating and capital expenses, our independent auditors included an explanatory paragraph regarding concerns about our ability to continue as a going concern in their report on our audited annual financial statements as of and for the year ended December 31, 2013.

Our Corporate Information

We were incorporated under the laws of the State of Delaware in 2009. Our principal executive offices are located at 4041 Forest Park Avenue, Suite 220, St. Louis, Missouri 63108, and our telephone number is (314) 615-6345. Our website address is http://www.endostim.com. Our website and the information contained on, or that can be accessed through, the website will not be deemed to be incorporated by reference in, and are not considered part of, this prospectus. You should not rely on any such information in making your decision whether to purchase our common stock.

4

Table of Contents

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| • | a requirement to have only two years of audited financial statements and only two years of related management’s discussion and analysis; |

| • | an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal controls over financial reporting; |

| • | an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| • | reduced disclosure about the company’s executive compensation arrangements; and |

| • | exemptions from the requirements to obtain a non-binding advisory vote on executive compensation or a stockholder approval of any golden parachute arrangements. |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues, have more than $700 million in market value of our capital stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some, but not all, of the available benefits under the JOBS Act. We have taken advantage of some reduced reporting burdens in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have elected to avail ourselves of delayed adoption of new or revised accounting standards and, therefore, our financial statements may not be comparable to the financial statements of other public companies.

5

Table of Contents

THE OFFERING SUMMARY

| Common stock to be offered by us |

shares |

| Common stock to be outstanding immediately following this offering |

shares |

| Over-allotment option |

We have granted the underwriters an option for 30 days from the date of this prospectus to purchase up to additional shares of common stock to cover over-allotments. |

| Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their over-allotment option in full, assuming an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

| We currently expect to use the net proceeds from this offering for the following purposes: |

| • | approximately $ for commercialization activities; |

| • | approximately $ for clinical development activities, most importantly our United States pivotal trial to support a PMA filing with the FDA; and |

| • | any remaining proceeds for working capital and general corporate purposes. |

| See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

| Risk factors |

You should read the “Risk Factors” section of this prospectus for a discussion of factors to carefully consider before deciding to invest in shares of our common stock. |

| Proposed NASDAQ Capital Market symbol |

“STIM” |

The number of shares of our common stock outstanding immediately following this offering set forth above is based on shares of our common stock outstanding as of June 30, 2014, and excludes the following:

| • | 1,335,946 shares of our common stock issuable upon the exercise of outstanding stock options as of June 30, 2014, at a weighted average price of $0.25 per share; |

| • | 889,453 shares of our common stock issuable upon the exercise of outstanding warrants as of June 30, 2014, of which warrants to purchase 550,000 shares have an exercise price of $0.01 per share, and warrants to purchase 339,453 shares have an exercise price of $0.50 per share; |

| • | shares of our common stock reserved for issuance pursuant to future awards under our 2014 Stock Incentive Plan, including 140,333 shares of our common stock reserved for issuance under our 2009 Stock Incentive Plan as of June 30, 2014, which will become available for issuance under our 2014 Stock Incentive Plan following the consummation of this offering. |

6

Table of Contents

Except as otherwise indicated, all information in this prospectus assumes:

| • | the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 11,719,975 shares of common stock, the conversion of which will occur immediately prior to the completion of this offering; |

| • | the automatic conversion of the principal and accrued interest on the approximately $6.4 million aggregate principal amount of convertible promissory notes issued in June 2014 and the approximately $1.1 million aggregate principal amount of convertible promissory notes issued in August 2014 into an aggregate of shares of common stock, assuming an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, and a conversion date of , 2014, which is the expected closing date of this offering; |

| • | the filing and effectiveness of our amended and restated certificate of incorporation in Delaware and the adoption of our amended and restated bylaws, each of which will occur immediately prior to the completion of this offering; and |

| • | no exercise by the underwriters of their option to purchase up to an additional shares of common stock from us in this offering. |

7

Table of Contents

SUMMARY FINANCIAL DATA

The following table summarizes our financial data. We have derived the following statements of operations data for the years ended December 31, 2013 and December 31, 2012 from our audited financial statements, included elsewhere in this prospectus. We have derived the statements of operations data for the six months ended June 30, 2014 and 2013 and the balance sheet data as of June 30, 2014 from our unaudited financial statements, included elsewhere in this prospectus. Our historical results are not necessarily indicative of results to be expected for any period in the future. The summary financial data presented below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes thereto, included elsewhere in this prospectus. The summary financial data in this section is not intended to replace our financial statements and the related notes thereto.

| Six months ended June 30, | Fiscal year ended December 31, | |||||||||||||||

| 2014 | 2013 | 2013 | 2012 | |||||||||||||

| Consolidated statement of operations data: |

||||||||||||||||

| Revenue |

$ | 324,837 | $ | 106,466 | $ | 301,432 | $ | 33,350 | ||||||||

| Cost of revenue |

151,496 | 62,995 | 194,911 | 23,064 | ||||||||||||

| Gross margin |

173,341 | 43,471 | 106,521 | 10,286 | ||||||||||||

| Operating expenses: |

||||||||||||||||

| Research and development |

1,256,966 | 1,337,758 | 3,195,979 | 2,613,429 | ||||||||||||

| Sales and marketing |

1,392,508 | 1,056,177 | 2,232,514 | 1,025,364 | ||||||||||||

| General and administrative |

1,125,466 | 1,055,172 | 2,211,222 | 1,910,423 | ||||||||||||

| Total operating expenses |

3,774,940 | 3,449,107 | 7,639,715 | 5,549,216 | ||||||||||||

| Loss from operations |

(3,601,599 | ) | (3,405,636 | ) | (7,533,194 | ) | (5,538,930 | ) | ||||||||

| Other (expense) income |

(20,184 | ) | 3,206 | 5,962 | 1,857 | |||||||||||

| Net loss |

(3,621,783 | ) | (3,402,430 | ) | (7,527,232 | ) | (5,537,073 | ) | ||||||||

| Accretion of redeemable preferred stock |

(1,247,583 | ) | (908,142 | ) | (1,884,822 | ) | (853,561 | ) | ||||||||

| Undeclared dividends on Series A convertible preferred stock |

(81,580 | ) | (23,562 | ) | (47,125 | ) | (71,446 | ) | ||||||||

| Net loss attributable to common stockholders |

$ | (4,950,946 | ) | $ | (4,334,134 | ) | $ | (9,459,179 | ) | $ | (6,462,080 | ) | ||||

| Basic and diluted net loss per common share attributable to common stockholders |

$ | (3.53 | ) | $ | (3.09 | ) | $ | (6.74 | ) | $ | (4.71 | ) | ||||

| Shares used in computing basic and diluted net loss per common share attributable to common shareholders |

1,403,721 | 1,403,721 | 1,403,721 | 1,371,863 | ||||||||||||

| As of June 30, 2014 | ||||||||

| Actual | As adjusted (1) | |||||||

| Consolidated balance sheet data: |

||||||||

| Cash and cash equivalents |

$ | 7,732,992 | $ | |||||

| Working capital |

6,659,531 | |||||||

| Total assets |

9,667,914 | |||||||

| Note payable |

4,345,281 | |||||||

| Embedded derivative |

1,651,084 | |||||||

| Deferred revenue |

277,179 | |||||||

| Total stockholders’ equity (deficit) |

(27,460,161 | ) | ||||||

| (1) | The “As adjusted” column reflects (i) the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 11,719,975 shares of common stock, the conversion of which will occur |

8

Table of Contents

| immediately prior to the completion of this offering, (ii) the automatic conversion of the principal and accrued interest on the approximately $6.4 million aggregate principal amount of convertible promissory notes issued in June 2014 and the approximately $1.1 million aggregate principal amount of convertible promissory notes issued in August 2014 into an aggregate of shares of common stock and (iii) the sale by us of $ of shares of our common stock in this offering after deducting the underwriting discount and estimated offering expenses payable by us, in each case assuming an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, and a conversion date of , 2014, which is the expected closing date of this offering. |

Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders’ (deficit) equity by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. Each increase (decrease) of 1.0 million shares in the number of shares offered by us would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders’ (deficit) equity by approximately $ million, assuming that the assumed initial public offering price, which is the midpoint of the price range set forth on the cover page of this prospectus, remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. The “As adjusted” information discussed above is illustrative only and will adjust based on the actual initial public offering price and other terms of this offering determined at pricing.

9

Table of Contents

Before you invest in our common stock, you should understand the high degree of risk involved. You should carefully consider the following risks and other information in this prospectus, including our consolidated financial statements and related notes included elsewhere in this prospectus, before you decide to purchase shares of our common stock. The following risks may adversely impact our business and financial condition. As a result, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Financial Condition and Capital Requirements

We have limited operating history, which may make it difficult to evaluate our current business and to forecast our future performance.

We have little operating history and are addressing an emerging market. As a result, our current and future business prospects are difficult to evaluate. All potential investors must consider our business prospects in light of the risks and difficulties we have encountered and will continue to encounter as a startup company in a rapidly evolving market. Some of these risks relate to our potential inability to:

| • | effectively manage our business and technology; |

| • | recruit and retain sales and marketing, scientific, technical and managerial personnel; |

| • | obtain required regulatory approvals and approvals from governmental and private insurers and medical expense reimbursement providers; |

| • | develop a safe and effective product; |

| • | recruit and retain sales personnel and appropriate distributor relationships; |

| • | successfully develop and protect our intellectual property portfolio; |

| • | successfully provide high levels of service as our business expands; and |

| • | successfully address other risks, as described in this prospectus or otherwise. |

If we do not address these risks successfully, it could have a material adverse effect on our business and financial condition.

We have a history of net losses. We expect to continue to incur net losses in the future and we may never generate sufficient revenue from the commercialization of our neurostimulation system to achieve or sustain profitability.

We have incurred net losses since our inception in 2009, including net losses of $7.5 million and $5.5 million before deduction for the accretion of redeemable preferred stock and undeclared dividends on Series A convertible preferred stock for the years ended December 31, 2013 and 2012, respectively, and $3.6 million for the six months ended June 30, 2014. As of June 30, 2014, our accumulated deficit was approximately $29.5 million. Although we have received CE Mark regulatory approval to commercialize our neurostimulation system in Europe and those countries worldwide that recognize the CE Mark, we expect to incur significant sales and marketing expenses prior to recording sufficient revenue to offset these expenses. In the United States, we expect to incur substantial additional losses as a result of the costs associated with our pivotal clinical trial, continued research and development, and, following the offering, costs associated with operating as a public company. Development of a new medical device, including conducting clinical trials and seeking regulatory approvals, is a long, expensive and uncertain process, and we expect that our expenses will increase as we seek regulatory approval for our neurostimulation system in the United States.

These losses have had, and will continue to have an adverse effect on our working capital, total assets and stockholders’ equity (deficit). Our ability to become and remain profitable will depend on our ability to generate significantly higher product sales outside the United States based on our CE Mark approval, which depends upon a number of factors, including successful sales, manufacturing, marketing and distribution of our products.

10

Table of Contents

Because of the numerous risks and uncertainties associated with our commercialization efforts, we are unable to predict when we will become profitable, and we may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our inability to achieve and then sustain profitability would have a material adverse effect on our business and financial condition.

We will need to raise additional capital to fund our existing operations, commercialize our technology and expand our operations.

We believe that the net proceeds of this offering, together with our existing cash balances, will be sufficient to cover our cash needs for the next months. If our available cash balances, net proceeds from this offering, and anticipated cash flow from operations are lower than we anticipate, including due to changes in our business plan, a lower demand for our products or other risks described in this prospectus, we may seek to raise additional capital sooner than currently expected.

We may also consider raising additional capital in the future to expand our business, to pursue strategic investments, to take advantage of financing opportunities or for other reasons, including to:

| • | fund development of our products; |

| • | acquire, license or invest in technologies or intellectual property relating to our existing technology; |

| • | acquire or invest in complementary businesses or assets; and |

| • | finance capital expenditures and general and administrative expenses. |

Our present and future funding requirements will depend on many factors, including:

| • | success of our current commercialization efforts outside of the United States; |

| • | our revenue growth rate and ability to generate cash flows from product sales; |

| • | our research and product development activities, particularly those related to obtaining regulatory approval for our neurostimulation system in the United States; |

| • | effects of competing technological and market developments; |

| • | changes in regulatory oversight applicable to our products. |

The various alternatives for raising additional capital include short-term or long-term debt financings, equity offerings, collaborations or licensing arrangements and each one carries potential risks. If we raise funds by issuing equity securities, our stockholders will be further diluted. Any equity securities issued also could provide for rights, preferences or privileges senior to those of holders of our common stock. If we raise funds by issuing debt securities, those debt securities would have rights, preferences and privileges senior to those of holders of our common stock. The terms of debt securities issued or borrowings pursuant to a credit agreement could impose significant restrictions on our operations or our ability to issue additional equity securities or issue additional indebtedness. We may also be required under additional debt financing to grant security interests on our assets, including our intellectual property. If we raise funds through collaborations and licensing arrangements, we might be required to relinquish significant rights to our neurostimulation system, or grant licenses on terms that are not favorable to us which could lower the economic value of those programs to us. The credit markets and the financial services industry have previously experienced unprecedented turmoil and upheaval characterized by the bankruptcy, failure, collapse, or sale of various financial institutions and an unprecedented level of intervention from the U.S. federal government. These events have generally made equity and debt financing more difficult to obtain. Accordingly, additional equity or debt financing might not be available on reasonable terms, if at all. If we cannot secure additional funding when needed, including due to changes in our business plan, a lower demand for our products or other risks described in this prospectus, we may have to delay, reduce the scope of, or eliminate one or more sales and marketing initiatives, clinical trials or other research and development programs all of which would have a materially adverse effect on our business.

11

Table of Contents

Our ability to use our net operating loss carryforwards to offset future taxable income may be subject to certain limitations.

In general, under Section 382 of the Internal Revenue Code of 1986, as amended, or the Code, a corporation that undergoes an “ownership change” is subject to annual limitations on its ability to use its pre-change net operating loss carryforwards, or NOLs, or other tax attributes to offset future taxable income or reduce taxes. Our past issuances of stock and other changes in our stock ownership may have resulted in ownership changes within the meaning of Section 382 of the Code; accordingly, our pre-change NOLs may be subject to limitation under Section 382. State NOL carryforwards may be similarly limited. Furthermore, the closing of this offering, alone or together with transactions in our stock that have occurred in the past and may occur in the future, may trigger an ownership change pursuant to Section 382. Because of the cost and complexity involved in the analysis of a Section 382 ownership change and the fact that we do not have any taxable income to offset, we have not undertaken a study to assess whether an “ownership change” has occurred or whether there have been multiple ownership changes since we became a “loss corporation” as defined in Section 382. Shares issued in this offering or future changes in our stock ownership (either in combination with this offering or separately) could result in ownership changes under Section 382 of the Code further limiting our ability to utilize our NOLs. Furthermore, our ability to use NOLs of companies that we may acquire in the future may be subject to limitations. For these reasons, even if we attain profitability, we may not be able to use a material portion of our NOLs, and this would reduce our earnings and the valuation of our stock.

Our independent auditor’s report for the fiscal year ended December 31, 2013 includes an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern.

Due to the uncertainty of our ability to meet our current operating and capital expenses, in their report on our audited annual financial statements as of and for the year ended December 31, 2013, our independent auditors included an explanatory paragraph regarding concerns about our ability to continue as a going concern. Recurring losses from operations raise substantial doubt about our ability to continue as a going concern. If we are unable to continue as a going concern, we might have to liquidate our assets and the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements. In addition, the inclusion of an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern and our lack of cash resources may materially adversely affect our share price and our ability to raise new capital or to enter into critical contractual relations with third parties.

Risks Relating to Our Business

We operate in a very competitive business environment and if we are unable to compete successfully against existing GERD treatments, as well as future treatments, our sales and operating results may be negatively affected and we may not grow.

The health care industry is highly competitive, subject to rapid change and significantly affected by new product introductions and other market activities of industry participants. Some of the competitive factors impacting success in our markets include the features and capabilities of product offerings, product safety, availability of compelling clinical data, recommendations of key opinion leaders and professional medical societies, competitive pricing, favorable reimbursement, strong customer service and continued product enhancements.

We are aware of several companies offering competitive medical device solutions for treating GERD and many of these companies already have FDA approval to sell their products in the United States. Such competitors include Torax Medical and EndoGastric Solutions. Other therapeutic devices for treating GERD are under development. In addition, some of our targeted patients may opt to undergo the Stretta Procedure, an outpatient endoscopic approach that delivers radio frequency ablation to the LES in an attempt to strengthen the LES. Our current and potential competitors may have significant competitive advantages over us, including:

| • | substantially greater financial, technical and other resources; |

| • | extensive intellectual property portfolios and greater resources for patent protection; |

12

Table of Contents

| • | current FDA and other regulatory clearances and approvals for their products; |

| • | greater experience in obtaining and maintaining FDA and other regulatory clearances and approvals for products and product enhancements; |

| • | greater experience in launching, marketing, distributing and selling products, including strong sales forces and established distribution networks; |

| • | established manufacturing operations and contract manufacturing relationships; |

| • | established relationships with healthcare providers and payors; |

| • | significantly longer operating history, more established reputations and widely recognized trademarks; |

| • | endoscopic rather than laparoscopic delivery of their therapeutic solution resulting in lower procedure cost and greater patient acceptance; and |

| • | more favorable pricing. |

We expect that the medical device market will continue to develop rapidly, and our future success will depend on our ability to develop and maintain a competitive position. Our competitors may succeed in developing products that render our neurostimulation system obsolete or noncompetitive. Additionally, developers of PPIs have developed and will continue to innovate and develop new pharmaceuticals that may satisfactorily address the symptoms of GERD. Further, we will face competition from existing surgical procedures, such as fundoplication.

We cannot be certain that our neurostimulation system will be able to achieve broad market acceptance, replace established treatments, or that physicians or the medical community will accept and utilize our products over competing devices, including those that are being developed. If physicians, surgeons and patients prefer the use of our competitors’ medical devices or current treatments, our ability to generate revenue will be significantly impaired which would have a material adverse effect on our business and financial condition.

Our current neurostimulation system may never find broad market acceptance and become commercially successful.

Our neurostimulation system is commercially available only in a limited number of countries and will not be available in other countries, including the United States, until clinical development is completed and regulatory approvals are obtained. These may never occur. The successful commercialization of our products will require significant, time-consuming and costly sales and marketing efforts. If the commercialization of our current neurostimulation system is unsuccessful or we are unable to market our neurostimulation system due to market developments, failure to obtain and maintain regulatory approvals, development of alternative treatments or otherwise, we will be required to expend significant additional resources on research and development to improve our neurostimulation system. A part of our business strategy is to expand the addressable patient market, and we may be unable to do so. The development of a new device will be subject to the risks of failure inherent in the creation of any innovative new medical technology. These risks include the possibilities that our device will not be effective or of acceptable quality, will fail to receive necessary regulatory clearances, will be uneconomical to manufacture or market or does not achieve broad market acceptance, and that third parties market a superior or equivalent product. Even if our product is effective, it may not be accepted by patients, who may find our neurostimulation system too harsh for an implanted device. The failure of our research and development activities to result in any commercially viable products would have a material adverse effect on our business and financial condition.

We have limited marketing and sales resources and personnel and have limited experience with the distributors on which we will depend to sell our products.

We have limited experience in sales, marketing and distribution of our products and are just beginning the process of developing a sales and marketing organization, including by establishment of a distributor network. Our lack of experience and/or limited resources could negatively impact our ability to enter into or maintain

13

Table of Contents

collaborative arrangements or other third party relationships which are important to the successful commercialization of our products and potential profitability. We may be unable to establish or maintain adequate sales and distribution capabilities.

In some countries we intend to market directly to customers through our own sales personnel. As a result, we will need to attract, train and retain sufficient personnel to maintain an effective sales and marketing force. Developing a sales force is expensive and time consuming, and our sales force will be competing with the experienced and well-funded marketing and sales organizations of our more established competitors. Also, we may not be able to recruit and retain skilled sales, marketing, service or support personnel with industry expertise. Even if we are successful in developing high-performing sales representatives with strong customer relationships, new or existing competitors may target our representatives in their recruitment efforts. If such representatives are recruited by our competitors, our sales could be materially adversely impacted.

In some countries we will rely on third party distributors to market and sell our products. In these markets, our profit margins will likely be lower than if we sold directly to customers ourselves. In addition, we would necessarily be relying on the skills and efforts of others for the successful marketing of our product.

If we are unable to establish and maintain effective sales and marketing capabilities, independently or with others, we may not be able to generate product revenue and may not become profitable. If we are unable to adequately address our customers’ needs, it could negatively impact sales and market acceptance of our products and we may not be able to generate significant revenue and may not become profitable.

We have collected limited clinical data about the efficacy and safety of our neurostimulation system and may be unable to reproduce historical clinical results in large-scale and double-blind controlled clinical trials.

Although the clinical trials performed to date using our neurostimulation system have shown promising results, these results were generated from open-label studies performed at a limited number of clinical sites on a limited number of patients over 36 months. Open-label trials are subject to various limitations that may exaggerate any therapeutic effect. Patients in open-label studies are aware that they are receiving treatment. Therefore, open-label trials may be subject to a “sham-effect” where patients perceive their symptoms to have improved merely due to their awareness of receiving an experimental treatment. Patients selected for early clinical studies often include the most severe sufferers and their symptoms may have been bound to improve notwithstanding the new treatment. Finally, those assessing and reviewing the physiological outcomes of the clinical trials are aware which patients have received treatment and may interpret the information of the treated group more favorably given this knowledge. Our first clinical trial was completed in Chile. Patients in Chile are genetically similar to European and North American patients, but there may be unidentified genetic differences that may result in variable therapeutic response in patients in other countries. Our initial safety profile has been favorable, but safety could be dependent on operator skills. It is possible that we may experience a higher rate of adverse events in the future with wider application of our technology in real-world practice outside of clinical trials. Finally, GERD is a disease that is affected by patients’ diet and lifestyle and hence variation in these factors among different regions of the world may result in variation in observed therapeutic response to our therapy. The conclusive evidence of efficacy and magnitude of therapeutic effect of our therapy can only be established in a well-designed, randomized sham-controlled trial where patients are randomly selected to receive either electrical stimulation or no stimulation. We have never conducted such a clinical trial. If our planned pivotal trial fails to demonstrate sufficient efficacy of electrostimulation therapy over a non-active (sham) device implant, we may be unable to obtain regulatory approval and/or reimbursement coverage to successfully commercialize our neurostimulation system in the United States. Our commercialization efforts elsewhere in the world would also likely suffer due to reduced physician and patient acceptance of our neurostimulation system outside the United States based on studies conducted in the United States causing our financial results to be materially adversely effected.

14

Table of Contents

Any clinical trials that we may conduct may not begin on time, or at all, may not be completed on schedule, or at all, or may be more expensive that we expect, which could prevent or delay regulatory approval of our products or impair our financial position.

The commencement or completion of any clinical trials that we may conduct may be delayed or halted for numerous reasons, including, but not limited to, the following:

| • | the FDA or other regulatory authorities suspend or place on hold a clinical trial, or do not approve a clinical trial protocol or a clinical trial; |

| • | the data and safety monitoring committee or applicable hospital institutional ethics review board recommends that a trial be placed on hold or suspended; |

| • | fewer patients meet our clinical study criteria and our enrollment rate is lower than we expected; |

| • | patients do not return for follow-up as expected; |

| • | clinical trial sites decide not to participate or cease participation in a clinical trial; |

| • | patients experience adverse side effects or events related to our neurostimulation system or for unrelated reasons; |

| • | third-party clinical investigators do not perform our clinical trials on schedule or consistent with the clinical trial protocol and good clinical practices, or other third-party organizations do not perform data collection and analysis in a timely or accurate manner; |

| • | we fail regulatory inspections of our manufacturing facilities requiring us to undertake corrective action or suspend or terminate our clinical trials; |

| • | governmental regulations require additional testing not contemplated in our pivotal trial or implement administrative actions; |

| • | interim results of the clinical trial are inconclusive or negative; |

| • | pre-clinical or clinical data are interpreted by third parties in unanticipated ways; or |

| • | our trial design, although approved, is inadequate to demonstrate safety and/or efficacy. |

Patient enrollment in clinical trials and completion of patient follow-up in clinical trials depend on many factors, including the size of the patient population, the nature of the trial protocol, the proximity of patients to clinical sites and the eligibility criteria for the study and patient compliance. For example, patients may be discouraged from enrolling in our clinical trials if the trial protocol requires them to undergo extensive post-treatment procedures to assess the safety and effectiveness of our product candidates, or they may be persuaded to participate in contemporaneous trials of competitive products. Additionally, patients may be unwilling to participate in a trial of a surgical implant procedure that includes the potential for assignment to an arm that has a period of no therapy. Delays in patient enrollment or failure of patients to continue to participate in a study may cause an increase in costs and delays or result in the failure of the trial.

Our clinical trial costs will increase if we have material delays in those trials or if we need to perform more or larger trials than planned. Adverse events during a clinical trial could cause us to repeat a trial, terminate a trial or cancel an entire program. Should our clinical development plan be delayed, this could have a material adverse effect on our operations and financial condition.

15

Table of Contents

The safety of our neurostimulation system is supported by limited clinical data and our product may not be a safe and efficient alternative to existing treatments; unfavorable safety outcomes could lead to product recalls in markets where we are commercializing our products.

We have not yet obtained the endorsement of the relevant professional medical societies in each country in which we intend to commercialize our neurostimulation system and as such, physicians may be slow to incorporate the therapy into their respective treatment guidelines. Although initial clinical experience shows a favorable safety profile, future patient studies or a broader clinical experience may indicate that:

| • | patients may experience side effects during treatment with our neurostimulation system, which may be severe, such as: |

| • | prolonged difficulty in swallowing (dysphagia); |

| • | significant and prolonged discomfort or pain at the implant site; |

| • | system component dislodgement, migration or erosion into unintended areas leading to discomfort, pain, hemorrhage or unintended stimulation of other physiological structures, intestinal obstruction, or severe infections; or |

| • | discomfort from the neurostimulation system being implanted, especially with thinner patients; or |

| • | the neurostimulation system or any of its components could malfunction, causing a loss of therapeutic benefit or serious injuries to the patient, or may result in other unexpected or serious complications. |

Any of these side effects or complications could require surgical removal of the implant, and, in rare instances, could result in death, either from the complications themselves or from surgical implant or removal procedure. Additionally, the effective life of the neurostimulation system may be shorter than anticipated which would cause the neurostimulation system to be removed and replaced sooner than anticipated, requiring an unanticipated surgical procedure. Moreover, any such or other unexpected outcomes may also subject us to voluntary or mandatory product recalls, suspension or significant legal liability, or lead to withdrawal of any regulatory approvals that may be obtained. The FDA and other governmental authorities have the authority to require the recall of commercialized products in the event of material deficiencies or defects in design or manufacture or in the event that a product poses an unacceptable risk to health. Manufacturers may, under their own initiative, recall a product if any material deficiency is found. A government-mandated or voluntary recall by us or one of our distributors could occur as a result of an unacceptable risk to health, component failures, manufacturing errors, design or labeling defects or other deficiencies and issues. Recalls of our neurostimulation system would divert managerial and financial resources, and could impair our ability to produce our neurostimulation system in a cost-effective and timely manner in order to meet our customers’ demands. Recall may be unsuccessful if we are unable to locate patients with an implanted neurostimulation system, potentially increasing our risk of liability. We may also be required to bear other costs or take other actions that may have a negative impact on our future sales and our ability to generate profits. Any of these outcomes could significantly reduce our ability to achieve expected sales and as a result could have a material adverse effect on our business and financial condition.

We face the risk of product liability claims that could be expensive, divert management’s attention and harm our reputation and business. We may not be able to obtain adequate product liability insurance.

Our business exposes us to a risk of product liability claims that is inherent in the testing, manufacturing and marketing of medical devices. The medical device industry has historically been subject to extensive litigation over product liability claims. We may be subject to product liability claims if our products cause, or appear to have caused, an injury. Claims may be made by consumers, governmental authorities, healthcare providers, third-party strategic collaborators or others selling our neurostimulation system.

We maintain product liability insurance which currently covers our neurostimulation system used in our clinical trials and those we commercially sell outside of the United States in an amount that we believe is sufficient for our line of business. However, our current product liability insurance may not continue to be available to us on

16

Table of Contents

acceptable terms, if at all, may not be expanded to cover new markets, and, if available, the coverage may not be adequate to protect us against any future product liability claims. If we are unable to obtain insurance at an acceptable cost and on acceptable terms for an adequate coverage amount, or otherwise to protect against potential product liability claims, we could be exposed to significant liabilities, which may harm our business. A product liability claim, recall or other claim with respect to uninsured liabilities or for amounts in excess of insured liabilities could have a material adverse effect on our business, financial condition and results of operations. These liabilities could prevent or interfere with our product commercialization efforts. Defending a suit, regardless of merit, could be costly, could divert management attention and might result in adverse publicity, which could result in the withdrawal of, or inability to recruit, clinical trial volunteers or result in reduced acceptance of our products in the market.

In addition, we offer warranties for our products against defects in materials and workmanship. Significant product warranty claims would lead to unanticipated additional costs and a loss of reputation.

Some physicians and surgeons may have difficulty in procuring or maintaining liability insurance to protect them from liability when treating patients with our neurostimulation system. Medical malpractice carriers are withdrawing coverage in certain states or substantially increasing premiums. If this trend continues or worsens, physicians and surgeons may discontinue using our neurostimulation system or may choose to not purchase our neurostimulation system in the future due to the cost or inability to procure insurance coverage. This would limit the number of physicians using our electrostimulation therapy, reduce our sales and adversely impact our financial condition.

We currently rely on one company outside of the United States to manufacture our neurostimulation system. We may be unable to cost-effectively source our product to meet our quality standards, regulatory requirements and customer demand or we may experience disruptions in the sourcing process.

The manufacture of our neurostimulation system is a complex and costly operation involving a number of separate processes and components. We currently rely on a sole source in Uruguay to manufacture our neurostimulation system. Such reliance results in a number of risks including control over product quality, access to materials or components and the risks of doing business internationally, which may result in an interruption in supply of our products or an increase in our cost of goods. Vandalism, terrorism or a natural or other disaster, such as an earthquake, fire or flood, could damage or destroy the manufacturing equipment related to our neurostimulation system, and could cause substantial delays in our operations. The manufacturer could elect to stop making our product for any reason. If our manufacturer discontinues making our product or experiences delays, disruptions, capacity constraints or quality control problems in its manufacturing operations, becomes insolvent or otherwise fails to supply us with our products in sufficient quantities or on a timely basis, then shipments to us and our customers could be adversely impacted, which could restrict our growth and harm our competitive position and reputation.

The manufacturer was recently acquired by a larger medical device and component company, which may adversely affect our relationship with the manufacturer and may subject us to additional risks. We may now interact with different management and operating personnel. Also, our relationship may not be as important to the manufacturer since it is now part of a much larger company and our business will accordingly account for a smaller portion of the company’s total business. Additionally, the manufacturer may change its business priorities, and we may not be able to negotiate modifications or extensions of our current agreement on favorable pricing or other terms, or at all.

We cannot quickly replace our manufacturer or establish additional new suppliers for our products, particularly due to both the complex nature of the manufacturing process and the time and effort that would be required to establish appropriate quality control systems, and to obtain new regulatory approvals to use materials from alternative suppliers. There are a limited number of suppliers and third-party manufacturers that have the necessary expertise and capacity to manufacture our neurostimulation system and that operate under the FDA’s

17

Table of Contents

current Good Manufacturing Practices, or cGMP, and Quality System Regulation, or QSR, which is a prerequisite for commercialization of our product in the United States. As a result, if it were necessary to terminate our relationship with our existing manufacturer, or if the manufacturer terminates its relationship with any of its suppliers, it may be difficult for us to locate another manufacturer or for the manufacturer to locate other suppliers that could promptly fulfill our anticipated needs. In addition, if we are required to obtain an alternate manufacturer, we may be unable to negotiate an arrangement that is acceptable to us.

Further, because we place our orders based on forecasts of expected demand for our neurostimulation system, if we inaccurately forecast demand, we may be unable to obtain adequate quantities of neurostimulation system as needed by us to meet our customers’ delivery requirements or we may accumulate excess inventory. In determining the required quantities of our product, we must make significant judgments and estimates based on historical experience, inventory levels, current market trends and other related factors. An interruption in our clinical trials, sales and operations would occur if we encounter delays or difficulties in securing our neurostimulation systems from our manufacturer. We may also experience quality problems, substantial costs and unexpected delays in efforts to upgrade and expand our manufacturing, assembly and testing capabilities. Because of the inherent nature of estimates and the numerous uncertainties regarding the manufacturing process may fail to provide our customers with the neurostimulation systems they require, which could harm our business and results of operations.

We have limited manufacturing experience and may encounter difficulties in increasing production to provide an adequate supply to customers.

To date, our manufacturer has produced moderate quantities of our neurostimulation system for use in clinical studies and for initial commercial sales outside the United States. Increasing production to commercial quantities may require changes in the manufacturing processes. Neither we nor our current manufacturer have experience in manufacturing our neurostimulation system on a commercial scale. We do not know of any other contract manufacturers with experience in the production of 10,000 or more implantable neurostimulators per year. As a result, high-volume sourcing of our neurostimulation system may not be available or at prices which are acceptable to us, our customers, third-party payors or privately paying potential patients, and we may be unable to meet the expected future demand for our products.

We may encounter difficulties in increasing our supply due to limited manufacturing capacity and in manufacturing larger commercial quantities, including:

| • | maintaining quality control and assurance; |

| • | providing component and service availability; |

| • | maintaining adequate control policies and procedures; and |

| • | maintaining low cost of goods, either through direct purchase, import/export tariffs or currency exchange rates. |

Difficulties encountered in increasing our required manufacturing volumes or any shipment delays could harm perception of our business and have a material adverse effect on our business and financial condition.

We rely on third parties for various aspects of our business. Any delays or disruptions in the business of such third parties could have a material adverse effect on our business and financial condition.

In addition to our third-party manufacturer in business, we rely on various other suppliers for supplying our neurostimulation system, including individual components of our neurostimulation system, such as batteries. We also rely on third parties in the conduct of our clinical trials. Further, we rely on a single provider of warehousing services in Europe.

18

Table of Contents

Reliance on third parties entails many costs and risks to which we would not be subject if we conducted such operation ourselves, including costs associated with auditing and monitoring the third parties for regulatory and other compliance, the possibility of increases in pricing for our products, the possibility of breach of the applicable agreements by the third parties, third-party credit risk, and the possibility of termination or non-renewal of our agreements with the third parties. If any of these risks materialize, it could significantly increase our costs and negatively impact our ability to meet demand for our neurostimulation system. Further, since we rely on a single provider of warehousing services in Europe, vandalism, terrorism or a natural or other disaster, such as an earthquake, fire or flood, could damage or destroy a significant part of our inventory and could cause substantial delays in our operations.

If our third-party distributors will not perform according to our expectations, we could suffer from decreased sales or other adverse consequences, which could have a material adverse effect on our business and financial condition.