Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

(Amendment No. 1)

x | Annual Report Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 2013

o | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission File Number: 000-51515

CORE-MARK HOLDING COMPANY, INC.

(Exact name of registrant as specified in its charter)

Delaware | 20-1489747 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

395 Oyster Point Boulevard, Suite 415 South San Francisco, California 94080 | (650) 589-9445 |

(Address of Principal Executive Offices, including Zip Code) | (Registrant's Telephone Number, including Area Code) |

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer o |

Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of June 28, 2013, the last business day of the registrant's most recently completed second fiscal quarter: $711,883,006

As of February 14, 2014, the registrant had 11,532,968 shares of its common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information called for by Part III of this Form 10-K will be included in an amendment to this Form 10-K or incorporated by reference to the registrant's 2014 definitive proxy statement to be filed pursuant to Regulation 14A.

EXPLANATORY NOTE

This Amendment No. 1 amends Core-Mark Holding Company, Inc.’s (the “Company”) Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the Securities and Exchange Commission on March 3, 2014 (the “Original Filing”). The Company is filing this Amendment No. 1 for the purpose of including conformed signatures of the Chief Executive Officer in exhibits 31.1 and 32.1 and the Chief Financial Officer in exhibits 31.2 and 32.2, which signatures were inadvertently omitted in the Original Filing. Additionally, a typographical error located on page one regarding the U.S. convenience retail industry gross profit for in-store sales was corrected to read "$62.5 billion." The entire Original Filing, as amended, is being re-filed.

Except as described above, there have been no changes to the Original Filing. The Company has not updated the disclosures contained therein to reflect any events which occurred subsequent to the Original Filing, or to modify the disclosures contained in the Original Filing other than to reflect the changes described above.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2013

TABLE OF CONTENTS

Page | ||

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this Annual Report on Form 10-K that are not statements of historical fact are forward-looking statements made pursuant to the safe-harbor provisions of the Exchange Act of 1934 and the Securities Act of 1933.

Forward-looking statements in some cases can be identified by the use of words such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “would,” “project,” “predict,” “continue,” “plan,” “propose” or other similar words or expressions. Forward-looking statements are made only as of the date of this Form 10-K and are based on our current intent, beliefs, plans and expectations. They involve risks and uncertainties that could cause actual results to differ materially from historical results or those described in or implied by such forward-looking statements.

A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in Part I, Item 1A, “Risk Factors” of this Form 10-K. Except as required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

SEC Regulation G - Non-GAAP Information

The financial statements in this Annual Report are prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”). Core-Mark Holding Company, Inc. (“Core-Mark”) uses certain non-GAAP financial measures including remaining gross profit, remaining gross profit margin, Adjusted EBITDA and net sales, less excise taxes. We believe these non-GAAP financial measures provide meaningful supplemental information for investors regarding the performance of our business and facilitate a meaningful period to period evaluation. Management uses these non-GAAP financial measures in order to have comparable financial results to analyze changes in Core-Mark’s underlying business. These non-GAAP measures should be considered as a supplement to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

ii

PART I

ITEM 1. BUSINESS

Unless the context indicates otherwise, all references in this Annual Report on Form 10-K to “Core-Mark”, “the Company”, “we”, “us”, or “our” refer to Core-Mark Holding Company, Inc. and its subsidiaries.

Company Overview

Core-Mark is one of the largest marketers of fresh and broad-line supply solutions to the convenience retail industry in North America, providing sales and marketing, distribution and logistics services to customer locations across the U.S. and Canada. Our origins date back to 1888, when Glaser Bros., a family-owned-and-operated candy and tobacco distribution business, was founded in San Francisco, California.

Core-Mark offers retailers the ability to take advantage of manufacturer and Company-sponsored sales and marketing programs, merchandising and product category management services and the use of information systems and data services that are focused on minimizing retailers' investment in inventory, while seeking to maximize their sales and profits. In addition, our wholesale distributing capabilities provide valuable services to both manufacturers of consumer products and convenience retailers. Manufacturers benefit from our broad retail coverage, inventory management, efficiency in processing small orders and frequency of deliveries. Convenience retailers benefit from our distribution capabilities by gaining access to a broad product line, optimizing inventory management and accessing trade credit.

We operate in an industry where, in 2012, based on the National Association of Convenience Stores (NACS) 2013 State of the Industry (“SOI”) Report, total in-store sales at convenience retail locations in the U.S. increased 2.2% to approximately $199 billion and were generated through approximately 149,000 stores. According to a more recent report from NACS, the number of convenience stores grew 1.4% in 2013 to approximately 151,000 stores. The U.S. convenience retail industry gross profit for in-store sales decreased 1.3% to approximately $62.5 billion in 2012 from $63.3 billion in 2011. Over the ten years from 2003 through 2013, U.S. convenience in-store sales increased by a compounded annual growth rate of 5.5%. In Canada, based on the Canadian Convenience Store Association (CCSA) 2013 Industry Report, we estimate that total in-store sales at convenience locations were approximately $23.1 billion generated through approximately 23,100 stores.

We operate a network of 28 distribution centers (excluding two distribution facilities we operate as a third party logistics provider) in the U.S. and Canada, which distribute a diverse line of national, regional and private label products to over 30,000 customer locations in 50 states in the U.S. and five Canadian provinces. The products we distribute include cigarettes, other tobacco products, candy, snacks, fast food, groceries, fresh products, dairy, bread, beverages, general merchandise and health and beauty care products. Cigarettes comprised approximately 68.0% of our total net sales in 2013, while approximately 70.5% of our gross profit in 2013 was generated from our food/non-food products.

We service traditional convenience stores as well as alternative outlets selling consumer packaged goods. We estimate that on average 45% to 50% of the products sold in convenience stores are supplied by broad-line wholesale distributors such as Core-Mark. Our traditional convenience store customers include many of the major national and super-regional convenience store operators, as well as thousands of multi- and single-store customers. Our alternative outlet customers comprise a variety of store formats, including grocery stores, drug stores, liquor stores, cigarette and tobacco shops, hotel gift shops, military exchanges, college and corporate campuses, casinos, movie theaters, hardware stores, airport concessions and other specialty and small format stores that carry convenience products.

Our net sales grew from $7.3 billion in 2010 to $9.8 billion in 2013, yielding an annual compounded growth rate of approximately 10%, while our annual Adjusted EBITDA(1) increased from $70.0 million to $109.5 million, or approximately 16%, compounded annually during the same period. Our growth has been driven primarily by our business strategies described more fully below. We believe these strategies have positioned us to continue to grow our approximate 4% market share of total in-store sales within the convenience store channel in North America and to take advantage of growth opportunities with other retail store formats.

________________________________________

(1) | Adjusted EBITDA is a non-GAAP financial measure and should be considered as a supplement to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Adjusted EBITDA is equal to net income adding back net interest expense, provision for income taxes, depreciation and amortization, LIFO expense, stock-based compensation expense and net foreign currency transaction losses. |

1

Competitive Strengths

We believe we have the following fundamental competitive strengths, which form the foundation for our business strategy:

Experience in the Industry. Our origins date back to 1888, when Glaser Bros., a family-owned-and-operated candy and tobacco distribution business, was founded in San Francisco, California. The executive management team, as of the end of 2013, comprised of our CEO and 14 senior managers, had an average tenure of 20 years and applied its expertise to critical functional areas including logistics, sales and marketing, purchasing, information technology, finance, business development, human resources and retail store support.

Innovation and Flexibility. Wholesale distributors typically provide convenience retailers access to a broad product line, the ability to place small quantity orders, inventory management and access to trade credit. As a large, full-service wholesale distributor, we offer retailers a wide array of manufacturer and Company-sponsored sales and marketing programs, merchandising and product category management services and the use of information systems that are focused on minimizing retailers' investment in inventory, while seeking to maximize their sales and profit.

Distribution Capabilities. The wholesale distribution industry is highly fragmented and historically has consisted of a large number of small, privately-owned businesses and a small number of large, full-service wholesale distributors serving multiple geographic regions. Relative to smaller competitors, large distributors such as Core-Mark benefit from several competitive advantages including: increased purchasing power, the ability to service large national chain accounts, economies of scale in sales and operations, and the resources to invest in information technology and other productivity-enhancing technologies.

Business Strategy

Our objective is to increase overall return to stockholders by growing our market share, revenues and profitability. As one of the largest marketers of fresh and broad-line supply solutions to the convenience retail industry in North America, with the proven capability of effectively selling into other retail channels, we are well-positioned to continue meeting this objective. Our business strategy also includes the following initiatives, designed to further enhance the value we provide to our retail customers:

Leverage our Vendor Consolidation Initiative (“VCI”). We expect our VCI program will allow us to continue to grow our sales by capitalizing on the highly fragmented supply chain that services the convenience retail industry. A convenience retailer generally receives store merchandise through a large number of direct-store deliveries. This represents a highly inefficient and costly process for the retailers. Today, we estimate that Core-Mark sells on average 45% to 50% of what a convenience retailer purchases from their vendors. Our VCI program offers the retailer the ability to receive multiple weekly deliveries for the bulk of their products, including dairy and other merchandise they would historically purchase from direct-store-delivery companies. This simplifies the supply chain and provides retailers with an opportunity to improve inventory turns and working capital, eliminate operational and transaction costs, and greatly diminish their out-of-stocks on best-selling items.

Deliver Fresh Products. We believe there is an increasing trend among consumers to purchase fresh food and dairy products from convenience and other retail formats. To meet this expected demand, we have modified and upgraded our refrigerated capacity, including investing in chill docks and tri-temperature trailers, which provides the infrastructure to deliver a significant range of chilled items including milk, produce and other fresh foods to retail outlets. We have established partnerships with strategically-located dairies, fresh kitchens and bakeries to further enable us to deliver the freshest product possible, with premium consumer items such as sandwiches, wraps, cut-fruit, parfaits, pastries, doughnuts, bread and home meal replacement solutions. We continue to expand the array of fresh products through the development of unique and comprehensive marketing programs and equipment programs that assist the retailer in showcasing their “fresh” product offering. We believe our investments in infrastructure, combined with our strategically located suppliers and in-house expertise, position us as the leader in providing fresh products and programs to the convenience retail industry. Proper execution of VCI, with the cornerstone being dairy distribution, provides Core-Mark the critical mass necessary to offer retailers a multiple weekly delivery platform, which facilitates the proper handling and dating of "Fresh" products.

Expand our Presence Eastward. We believe there is significant opportunity to increase our market presence and revenue growth by continuing to expand our presence east of the Mississippi River. According to the 2013 SOI Report, during 2012, aggregate U.S. traditional convenience retail in-store sales were approximately $199 billion through approximately 149,000 stores with 61% of those stores located in the eastern portion of the country. We believe our continued expansion in the Eastern U.S. will be accomplished through acquisitions and by gaining new customers, both national and regional, through a combination of exemplary service, VCI programs, fresh product deliveries, innovative marketing strategies, and competitive pricing.

Some of our recent expansion activities include:

• | On May 7, 2013, we signed a three year distribution agreement with Turkey Hill, a subsidiary of the Kroger Co. (“Kroger”) and the largest of Kroger's convenience divisions, to service all their convenience stores, which are located across |

2

Pennsylvania, Ohio and Indiana. With the addition of the Turkey Hill stores, we serviced approximately 700 Kroger convenience locations as of December 31, 2013.

• | On December 17, 2012, we acquired J.T. Davenport & Sons, Inc. (“Davenport”), a large convenience wholesaler based in North Carolina, which services customers in the eight states of North Carolina, South Carolina, Georgia, Maryland, Ohio, Kentucky, West Virginia and Virginia. This acquisition increased our market presence primarily in the Southeastern United States and further enhanced our ability to cost effectively service national and regional retailers. |

• | On September 7, 2011, we signed a distribution agreement (“the Customer Agreement”) with Alimentation Couche-Tard Inc. ("Couche-Tard") to service Couche-Tard corporate stores, under the Circle K brand, within Couche-Tard's Southeast, Gulf Coast and Florida markets. We added a new distribution facility located in Tampa, Florida in 2011 as a result of the Customer Agreement. As of December 31, 2013, we serviced nearly 1,000 Circle K stores in these markets. |

• | In May 2011, we acquired Forrest City Grocery Company (“FCGC”), a regional wholesale distributor providing Core-Mark with additional infrastructure and market share by servicing customers in Arkansas, Mississippi, Tennessee and the surrounding states. |

Continue Building Sustainable Competitive Advantage. We believe our ability to increase sales and profitability with existing and new customers is highly dependent upon our ability to deliver consistently high levels of service, innovative marketing programs, technology solutions and logistics support. To that fundamental end, we are committed to further improving operational efficiencies in our distribution centers while containing our costs to enhance profitability. We were one of the first to recognize emerging trends and to offer retailers our unique strategic solutions such as VCI and Fresh. In addition, we continue to leverage our Focused Marketing Initiative (“FMI”), which is designed to drive deeper entrenchment with our customer base and to further differentiate us in the market place. The FMI program is centered on increasing the sales and profitability of the independent store through improved category insights, optimized retail price strategy, demographic decision-making along with providing Core-Mark's marketing solutions to create a complete retail marketing strategy. We believe our innovative approach, which focuses on building a trusted partnership with our customers, has established us as the market leader in providing valuable marketing and supply chain solutions to the convenience retail industry.

Customers, Products and Suppliers

We service over 30,000 customer locations in 50 states in the U.S. and five Canadian provinces. Our primary customer base consists of large national, regional, and independent convenience retailers in the U.S. and Canada. In addition, we are expanding our distribution into alternative channels including drug stores and large-scale retailers. Our top ten customers accounted for 35.4% of our net sales in 2013 including Couche-Tard, our largest customer, which accounted for 14.7% of our total net sales.

Below is a comparison of our net sales mix by primary product category for the last three years (in millions):

Year Ended December 31, | ||||||||||||||||||||

2013 | 2012 | 2011 | ||||||||||||||||||

Product Category | Net Sales | % of Net Sales | Net Sales | % of Net Sales | Net Sales | % of Net Sales | ||||||||||||||

Cigarettes | $ | 6,642.0 | 68.0 | % | $ | 6,139.4 | 69.0 | % | $ | 5,710.6 | 70.4 | % | ||||||||

Food | 1,342.3 | 13.7 | 1,178.6 | 13.4 | 995.7 | 12.3 | ||||||||||||||

Candy | 527.2 | 5.4 | 489.5 | 5.5 | 459.8 | 5.7 | ||||||||||||||

Other tobacco products | 787.8 | 8.1 | 687.8 | 7.7 | 607.9 | 7.5 | ||||||||||||||

Health, beauty & general | 327.3 | 3.4 | 269.2 | 3.0 | 237.5 | 2.9 | ||||||||||||||

Beverages | 139.1 | 1.4 | 125.6 | 1.4 | 100.9 | 1.2 | ||||||||||||||

Equipment/other | 1.9 | — | 2.3 | — | 2.5 | — | ||||||||||||||

Total food/non-food products | 3,125.6 | 32.0 | 2,753.0 | 31.0 | 2,404.3 | 29.6 | ||||||||||||||

Total net sales | $ | 9,767.6 | 100.0 | % | $ | 8,892.4 | 100.0 | % | $ | 8,114.9 | 100.0 | % | ||||||||

Cigarette Products. We purchase cigarette products from major U.S. and Canadian manufacturers. With cigarettes accounting for approximately $6,642.0 million, or 68.0% of our total net sales, and 29.5% of our total gross profit in 2013, we control major purchases of cigarettes centrally to optimize inventory levels and purchasing opportunities. The daily replenishment of inventory and brand selection is controlled by our distribution centers.

U.S. and Canadian cigarette consumption steadily declined from 2002 to 2012. Based on the 2012 statistics provided by the Tobacco Merchants Association (“TMA”) published in 2013 compiled from the U.S. Department of Agriculture - Economic Research Service, total cigarette consumption in the U.S. declined from 425 billion cigarettes in 2002 to 294 billion cigarettes in

3

2012, or a compounded annual decline of approximately 3.6%. Total cigarette consumption also declined in Canada from 37 billion cigarettes in 2002 to 25 billion cigarettes in 2012, or a compounded annual decline of approximately 3.8%, based on statistics provided by the TMA. Our total cigarette carton sales increased 7.6% in 2013 attributable primarily to our acquisition of Davenport in December of 2012 and net market gain shares. Excluding the acquisition of Davenport, our carton sales in the U.S. declined 1.8%. Our carton sales in Canada decreased 7.5% in 2013 on a comparative basis to the prior year due primarily to the loss of two non-major customers in the fourth quarter of 2012. Although we anticipate overall cigarette consumption will continue to decline, we expect to offset these declines through market share expansion, growth in our non-cigarette categories and incremental gross profit from cigarette manufacturer price increases. We expect cigarette manufacturers will continue to raise prices as carton sales decline in order to maintain or enhance their overall profitability.

We have no long-term cigarette purchase agreements and buy substantially all of our products on an as-needed basis. Cigarette manufacturers historically offer structured incentive programs to wholesalers based on maintaining market share and executing promotional programs. These programs are subject to change by the manufacturers without notice.

Excise taxes are levied on cigarettes and other tobacco products by the U.S. and Canadian federal governments and are also imposed by the various states, localities and provinces. We collect state, local and provincial excise taxes from our customers and remit these amounts to the appropriate authorities based on the credit terms, if applicable, extended by each jurisdiction. Excise taxes are a significant component of our net sales and cost of sales. During 2013, net sales and cost of sales included offsetting amounts of approximately $2,050.8 million related to state, local and provincial excise taxes. As of December 31, 2013, state cigarette excise taxes in the U.S. jurisdictions we serve ranged from $0.17 per pack of 20 cigarettes in the state of Missouri to $4.35 per pack of 20 cigarettes in the state of New York. In the Canadian jurisdictions we serve, provincial excise taxes ranged from C$2.47 per pack of 20 cigarettes in Ontario to C$5.80 per pack of 20 cigarettes in Manitoba. Federal excise taxes are levied on the manufacturers who pass the tax on to us as part of the product cost and thus are not a component of our excise taxes.

Food/Non-food Products. Our food products include fast food, candy, snacks, groceries, beverages and fresh products such as sandwiches, juices, salads, produce, dairy and bread. Our non-food products include cigars, tobacco, health and beauty care products, general merchandise and equipment. Net sales of the combined food/non-food product categories grew 13.5% in 2013 to $3,125.6 million, which was 32.0% of our total net sales. More specifically, sales in the food category grew 13.9% to $1,342.3 million, by far the largest contributor to our overall food/non-food sales improvement. This is consistent with our strategy to grow food/non-food products at a faster pace than cigarettes through a combination of market share gains and execution of our VCI, Fresh, FMI and acquisition strategies.

Gross profit for food/non-food categories grew $52.8 million, or 16.2%, to $378.6 million in 2013, which was 70.5% of our total gross profit. Food/non-food products generated gross margins of 13.0% excluding excise taxes in 2013, while the cigarette category generated gross margins of 3.3% excluding excise taxes. In order to take advantage of the significantly higher margins earned by food/non-food products, two of our key business strategies, VCI and the delivery of fresh products, focus primarily on the highest margin categories in the food/non-food group. There is a special emphasis on fresh categories, which include items such as milk, bread, sandwiches, fruit, produce, baked goods, home meal replacements and other fresh products. We have made significant capital investments over the years to create the proper infrastructure to successfully deliver these highly perishable items.

Another primary aspect of our VCI strategy is to take cost out of the supply chain by putting more of the product that the retailers purchase on our delivery trucks. We targeted $100 million of incremental sales for the last five years, which contributed to the growth in our food/non-food sales and gross profit dollars. In addition, our FMI strategy was created to assist our independent retailer to sell more food/non-food items and to increase profitability.

We completed five acquisitions between 2006 and 2012. At the time of acquisition, most of these companies generally had a higher index of cigarette sales than our company-wide average; however, through our marketing programs we are able to grow the higher margin food/non-food categories of these acquired businesses as we bring our strategies to their customers. In addition, our market share has grown steadily over the last several years, due, in part, to our capability to deliver fresh and perishable categories. We believe that fresh items are increasingly driving consumer decisions, and fresh products will continue to be an important category going forward.

Our Suppliers. We purchase products for resale from approximately 4,700 trade suppliers and manufacturers located across the U.S. and Canada. In 2013, we purchased approximately 64% of our products from our top 20 suppliers, with our top two suppliers, Philip Morris USA, Inc. and R.J. Reynolds Tobacco Company, accounting for approximately 28% and 14% of our purchases, respectively. We coordinate our purchasing from suppliers by negotiating, on a corporate-wide basis, special arrangements to obtain volume discounts and additional incentives, while also taking advantage of promotional and marketing incentives offered to us as a wholesale distributor. In addition, buyers in each of our distribution facilities purchase products, particularly food, directly from the manufacturers, improving product mix and availability for individual markets.

4

Seasonality

We typically generate slightly higher net sales and higher gross profits during the warm weather months (April through September) than in other times throughout the year. We believe this occurs because the convenience store industry which we serve tends to be busier during this period due to vacations and other travel by consumers. We generated approximately 53%, 52% and 53% of our net sales during the second and third quarters of 2013, 2012, and 2011, respectively.

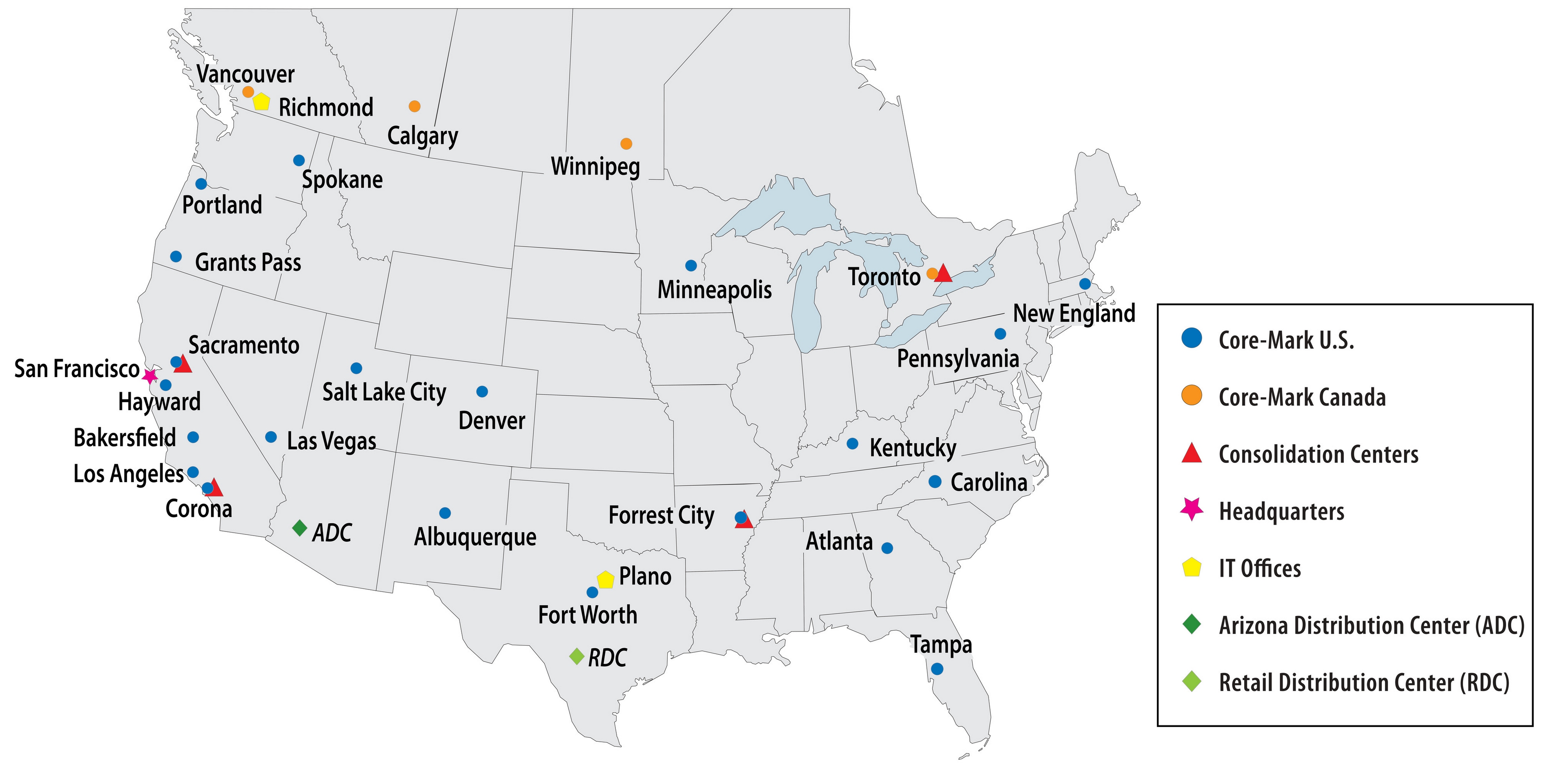

Operations

We operate a network of 28 distribution centers in the U.S. and Canada (excluding two distribution facilities we operate as a third party logistics provider). Twenty-four of our distribution centers are located in the U.S. and four are located in Canada. The map below depicts the scope of our operations and the names of our distribution centers.

Map of Operations

__________________________________________

We operate four consolidation centers, including one that opened in Toronto, Canada in the fourth quarter of 2013, which buy products from our suppliers in bulk quantities and then distribute the products to many of our other distribution centers. The products purchased by our consolidation centers include frozen and chilled items, health and beauty care and general merchandise products. The new center in Toronto was launched with an exclusive distribution arrangement with a retail beverage manufacturer. We expect to obtain additional consolidated purchasing opportunities for Canada in 2014. We operate two additional facilities as a third party logistics provider. One distribution facility located in Phoenix, Arizona, referred to as the Arizona Distribution Center (“ADC”), is dedicated solely to supporting the logistics and management requirements of one of our major customers, Couche-Tard. The second distribution facility located in San Antonio, Texas, referred to as the Retail Distribution Center (“RDC”), is dedicated solely to supporting another major customer, CST Brands, Inc. (formerly, Valero Energy Corporation).

We purchase a variety of brand name and private label products, in excess of 53,000 SKUs, from suppliers and manufacturers. Cigarette products represent less than 5% of our total SKUs purchased. We offer customers a variety of food/non-food products, including fast food, candy, snacks, groceries, fresh products, dairy, bread, beverages, other tobacco products, general merchandise and health and beauty care products.

A typical convenience store order consists of a mix of dry, frozen and chilled products. Our receivers, stockers, order selectors, stampers, forklift drivers and loaders received, stocked and picked approximately 615 million, 551 million and 476 million items or 96 million, 86 million and 71 million cubic feet of product, during the years ended December 31, 2013, 2012 and 2011, respectively, while limiting the service error rate to less than 2.7 errors per thousand items shipped in 2013.

Our proprietary Distribution Center Management System platform provides our distribution centers with the flexibility to adapt rapidly to changing business needs and allows them to provide our customers with necessary information technology requirements and integration capabilities.

5

Distribution

At December 31, 2013, we had approximately 1,300 transportation department personnel, including delivery drivers, shuttle drivers, routers, training supervisors and managers who focus on achieving safe, on-time deliveries. Our daily orders are picked and loaded nightly in reverse order of scheduled delivery. At December 31, 2013, our trucking fleet consisted of over 800 tractors, trucks and vans, of which mostly all were leased. We have made a significant investment over the past few years in upgrading our trailer fleet to tri-temperature (“tri-temp”), which gives us the capability to deliver frozen, chilled and non-refrigerated goods in one delivery. As of December 31, 2013, approximately 80% of our trailers were tri-temp, with the remainder capable of delivering refrigerated and non-refrigerated foods. This provides us the multiple temperature zone capability needed to support our focus on delivering fresh products to our customers. In addition, in 2013, we began converting portions of our fleet to tractors, which use compressed natural gas ("CNG"). At December 31, 2013, we had 57 CNG tractors. We plan to convert a large portion of our fleet to CNG tractors in order to lower our fuel costs with the added benefit of reducing carbon emissions. Our fuel consumption costs in 2013 totaled approximately $16.9 million, net of fuel surcharges passed on to customers, which represented an increase of approximately 16%, from $14.6 million in 2012, due primarily to a 11.9% increase in miles driven due to the addition of Davenport and the growth in our business.

Competition

We estimate that, as of December 31, 2013, there were approximately 300 wholesale distributors serving traditional convenience retailers in the U.S. and Canada. We believe McLane Company, Inc., a subsidiary of Berkshire Hathaway, Inc., and Core-Mark are the two largest convenience wholesale distributors (measured by annual sales) in North America. There are two other large regional companies that provide products to specific areas of the country, H.T. Hackney Company in the Southeast and Eby-Brown Company in the Midwest and Mid-Atlantic regions. In addition there are several hundred local distributors serving small regional chains and independent convenience retailers. In Canada, there is one large national company, Wallace & Carey, Inc., one regional company, which services the Ontario market, Karrys Bros., Limited, and more recently one large national grocery wholesaler, Sobeys Inc., aside from Core-Mark, that make up the competitive landscape.

Beyond the traditional wholesale supply channels, we face potential competition from at least three other supply avenues. First, certain manufacturers such as Budweiser, Miller-Coors, Coca-Cola, Frito-Lay and PepsiCo deliver their products directly to convenience retailers. Secondly, club wholesalers such as Costco and Sam's Club provide a limited selection of products at generally competitive prices; however, they often have limited delivery options and limited services. Finally, some large convenience retail chains self-distribute products due to the geographic density of their stores and their belief that they can economically service such locations.

Competition within the industry is based primarily on the range and quality of the services provided, price, product selection and the reliability of wholesalers' logistics. We operate from a perspective that focuses heavily on flexibility and providing outstanding customer service through our distribution centers, order fulfillment rates, on-time delivery performance using delivery equipment sized for the small format store, innovative marketing solutions and merchandising support, as well as competitive pricing. We believe this represents a contrast to some large competitors that offer a standardized logistics approach, with emphasis on uniformity of product lines, and company determined delivery schedules using large delivery equipment designed for large format stores. While this emphasis on a standardized logistics approach allows for competitive pricing, we do not believe it is best suited for retailers looking for more customized solutions and support from their supply partners in addition to competitive pricing. Alternatively, some small competitors focus on customer service and long-standing customer relationships but often lack the range of offerings of the larger distributors. We believe that our unique combination of service, marketing solutions and price is a compelling combination that is highly attractive to retailers and helps to enhance their growth and profitability.

In the U.S. we purchase cigarettes primarily from manufacturers covered by the tobacco industry's Master Settlement Agreement (“MSA”), which was signed in November 1998. Competition amongst cigarette wholesalers is based primarily on service, price and variety, whereas competition amongst manufacturers for cigarette sales is based primarily on brand positioning, price, product attributes, consumer loyalty, promotions, marketing and retail presence. Cigarette brands produced by the major tobacco product manufacturers generally require competitive pricing, substantial marketing support, retail programs and other financial incentives to maintain or improve a brand's market position. Historically, major tobacco product manufacturers have had a competitive advantage in the U.S. because significant cigarette marketing restrictions and the scale of investment required to compete made gaining consumer awareness and trial of new brands difficult.

We face competition from the diversion into the U.S. and Canadian markets of cigarettes intended for sale outside of such markets, including the sale of cigarettes in non-taxable jurisdictions, inter-state/provincial and international smuggling of cigarettes, the sale of counterfeit cigarettes by third parties, increased imports of foreign low priced brands, the sale of cigarettes by third parties over the internet and by other means designed to avoid collection of applicable taxes. The competitive environment has been characterized by a continued influx of cheap products that challenge sales of higher priced and fully taxed cigarettes.

6

We also believe the competitive environment has been impacted by alternative smoking products, such as snus, electronic cigarettes and the emergence of nicotine consumption through vapor devices. In addition, cigarette prices continue to rise due to continuing pressure on taxing jurisdictions to raise revenues through excise taxes. Further, cigarette list prices have historically increased for those manufacturers who are parties to the MSA. As a result, the lower priced products of numerous small share brands manufactured by non-MSA participants have held their market share, putting profitability pressure on MSA products.

Working Capital Practices

We sell products on credit terms to our customers that averaged, as measured by days sales outstanding, about nine days for each of 2013, 2012 and 2011. Credit terms may impact pricing and are competitive within our industry. An increasing number of our customers remit payment electronically, which facilitates efficient and timely monitoring of payment risk. Canadian days sales outstanding in receivables tend to be lower as Canadian industry practice is for shorter credit terms than in the U.S.

We maintain our inventory of products based on the level of sales of the particular product and manufacturer replenishment cycles. The number of days a particular item of inventory remains in our distribution centers varies by product and is principally driven by the turnover of that product and economic order quantities. We typically order and carry in inventory additional amounts of certain critical products to assure high order fulfillment levels for these items. Periodically, we may carry higher levels of inventory to take advantage of anticipated manufacturer price increases. The number of days of cost of sales in inventory averaged about 16 days in each of 2013, 2012 and 2011 with the cigarette category averaging 10 days and food/non-food categories averaging 30 days. We obtain terms from our vendors and certain taxing jurisdictions based on industry practices, consistent with our credit standing. We take advantage of the full complement of term offerings, which may include enhanced cash discounts for earlier payment or prepayment. Terms for our accounts payable and cigarette and tobacco taxes payable range anywhere from three days prepaid to 60 days credit. Days payable outstanding for both categories, excluding the impact of prepayments, during each of 2013, 2012 and 2011 averaged about 11 days.

Employees

The following chart provides a breakdown of our employees by function and geographic region (including employees at our third party logistic facilities) as of December 31, 2013:

TOTAL EMPLOYEES BY BUSINESS FUNCTIONS

U.S. | Canada | Total | ||||||

Sales and Marketing | 1,256 | 65 | 1,321 | |||||

Warehousing and Distribution | 3,255 | 297 | 3,552 | |||||

Management, Administration, Finance and Purchasing | 628 | 116 | 744 | |||||

Total Categories | 5,139 | 478 | 5,617 | |||||

Three of our distribution centers, Hayward, Las Vegas and Calgary, have employees who are covered by collective bargaining agreements with local affiliates of The International Brotherhood of Teamsters (Hayward and Las Vegas) and United Food and Commercial Workers (Calgary). Approximately 210 employees, or 4% of our workforce, are unionized. There have been no disruptions in customer service, strikes, work stoppages or slowdowns as a result of union activities, and we believe we have satisfactory relations with our employees.

7

Regulation

As a distributor of food products in the U.S., we are subject to the Federal Food, Drug and Cosmetic Act and regulations promulgated by the U.S. Food and Drug Administration (“FDA”). The FDA regulates food products through its current good manufacturing practice regulations, specifies the standards of identity for certain foods and prescribes the format and content of certain information required to appear on food product labels. A limited number of the over-the-counter medications that we distribute are subject to the regulations of the U.S. Drug Enforcement Administration (“DEA”). In Canada, similar standards related to food and over-the-counter medications are governed by Health Canada. The products we distribute are also subject to federal, state, provincial and local regulation through such measures as the licensing of our facilities, enforcement by state, provincial and local health agencies of relevant standards for the products we distribute and regulation of our trade practices in connection with the sale of our products. Our facilities are inspected periodically by federal, state, provincial and local authorities, including the Occupational Safety and Health Administration under the U.S. Department of Labor (“OSHA”), which require us to comply with certain health and safety standards to protect our employees.

We are also subject to regulation by numerous other federal, state, provincial and local regulatory agencies including, but not limited to, the U.S. Department of Labor, which sets employment practice standards for workers, the U.S. and Canadian Departments of Transportation, which regulate transportation of perishable goods, and similar state, provincial and local agencies. Non-compliance with, or significant changes to, these laws or the implementation of new laws, could have a material effect on our results of operations.

In September 2011, the Tobacco Products Labeling Regulations (Cigarettes and Little Cigars) came into force in Canada with strengthened labeling requirements for cigarettes and little cigar packages. The requirements include graphic health warnings and health information messages which are prominently displayed on the front and back of most tobacco packages and focus primarily on the health hazards posed by tobacco use.

We voluntarily participate in random quality inspections of all of our distribution centers, conducted by the American Institute of Baking (“AIB”). The AIB publishes standards as a tool to permit operators of distribution centers to evaluate the food safety risks within their operations and determine the levels of compliance with the standards. AIB conducts an inspection, which is composed of food safety and quality criteria. AIB conducts its inspections based on five categories: adequacy of the company's food safety program, pest control, operational methods and personnel practices, maintenance of food safety and cleaning practices. Within these five categories, the AIB evaluates over 100 criteria items. In 2013, 96.8% of the audits of our distribution centers received a score of 900 or greater (on a possible 1,000 point scale).

Registered Trademarks

We have registered trademarks including the following: Arcadia Bay®, Arcadia Bay Coffee Company®, BOONDOGGLES™, Cable Car®, Core-Mark®, Core-Mark International®, EMERALD®,, Java Street®, QUICKEATS®, SmartStock®, and Tastefully Yours®..

Segment and Geographic Information

We operate in two geographic areas -- the U.S. and Canada. See Note 16 - Segment and Geographic Information to our consolidated financial statements.

Corporate and Available Information

Our corporate headquarters is located at 395 Oyster Point Boulevard, Suite 415, South San Francisco, California, 94080 and our telephone number is (650) 589-9445.

Our internet website address is www.core-mark.com. We provide free access to various reports that we file with or furnish to the U.S. Securities and Exchange Commission (“SEC”) through our website, as soon as reasonably practicable after they have been filed or furnished. These reports include, but are not limited to, our annual reports on Form 10-K, quarterly reports on Form 10-Q and any amendments to those reports. Our SEC reports can be accessed through the “Investor Relations” section of our website under “Financials and Filings”, or through www.sec.gov. Also available on our website are printable versions of Core-Mark's Audit Committee Charter, Compensation Committee Charter, Nominating and Corporate Governance Committee Charter, Code of Business Conduct and Ethics, Corporate Governance Guidelines and Principles and other corporate information. Copies of these documents may also be requested from:

Core-Mark International

395 Oyster Point Blvd, Suite 415

South San Francisco, CA 94080

Attention: Investor Relations

8

Corporate Governance--Code of Business Conduct and Ethics and Whistle Blower Policy:

Our Code of Business Conduct and Ethics is designed to promote honest, ethical and lawful conduct by all employees, officers and directors and is available on the “Investor Relations” section of our website at www.core-mark.com under “Corporate Governance.”

Additionally, the Audit Committee (“Audit Committee”) of the Board of Directors of Core-Mark has established procedures to receive, retain, investigate and act on complaints and concerns of employees, stockholders and others regarding accounting, internal accounting controls and auditing matters, including complaints regarding attempted or actual circumvention of internal accounting controls or complaints regarding violations of the Company's accounting policies. The procedures are also described on our website at www.core-mark.com under “Corporate Governance” in the “Investor Relations” section.

9

ITEM 1. A. RISK FACTORS

Our business is subject to a variety of risks. Set forth below are certain of the important risks that we face, the occurrence of which may have a material adverse effect on our business, financial condition or results of operations. These risks are not the only ones we face. We could also be affected by additional factors that are presently unknown to us or that we currently believe to be immaterial to our business.

Risks Related to Our Business and Industry

We are dependent on the convenience retail industry, and our results of operations could suffer if it experiences an overall decline or consolidation.

The majority of our sales are made under purchase orders and short-term contracts with convenience retail stores which inherently involve significant risks. These risks include declining sales in the convenience retail industry due to general economic conditions, including rising gasoline prices, which may impact “in store” retail sales, competition from grocery stores and other retail outlets, termination of customer relationships and consolidation of our customer base. Such events could cause us to experience decreases in revenues and put pressure on our margins. In addition, any decline in the convenience store industry may place a number of our convenience retail customers under financial stress, which could increase our credit risk and potential bad debt exposure.

Many of the markets in which we compete are highly competitive and we may lose market share and suffer a decline in sales and profitability in these markets if we are unable to outperform our competition.

Our distribution centers operate in highly competitive markets. We face competition from local, regional and national tobacco and consumable products distributors on the basis of service, price, reliability, delivery schedules, and variety of products offered. We also face competition from club stores and alternate sources that sell consumable products to convenience retailers. Some of our competitors, including McLane Company, Inc. (a subsidiary of Berkshire Hathaway Inc.), have substantial financial resources and long-standing customer relationships. In addition, heightened competition among our existing competitors, or by new entrants into the distribution market, could create additional competitive pressures that may reduce our margins and adversely affect our business. If we fail to successfully respond to these competitive pressures or to implement our strategies effectively, we may lose market share and our results of operations could suffer.

Our failure to maintain relationships with large customers could potentially harm our business.

We have relationships with many large regional and national convenience store chains. While we expect to maintain these relationships for the foreseeable future, any termination, non-renewal or reduction in services that we provide to such customers could cause our revenues and operating results to suffer.

We may lose business if manufacturers or large retail customers convert to direct distribution of their products.

In the past, certain large manufacturers and customers have elected to engage in direct distribution or third party distribution of their products and eliminate wholesale distributors such as Core-Mark. If other manufacturers or retail customers make similar elections in the future, our revenues and profits would be adversely affected and there can be no assurance that we will be able to mitigate such losses.

Our business is sensitive to fuel prices and related transportation costs, which could adversely affect our business.

Our operating results are sensitive to, and may be adversely affected by, unexpected increases in fuel or other transportation-related costs, including costs from the use of third party carriers, temporary staff and overtime. Historically, we have been able to pass on a substantial portion of increases in our own fuel or other transportation costs to our customers in the form of fuel or delivery surcharges, but our ability to continue to pass through these increases, is not assured. If we are unable to continue to pass on fuel and transportation-related cost increases to our customers or do not realize the benefits we expect from converting a large percentage of our trucks to operate on natural gas, our operating results could be materially and adversely affected.

Cigarette and consumable goods distribution is a low-margin business sensitive to inflation and deflation.

We derive most of our revenues from the distribution of cigarettes, other tobacco products, candy, snacks, fast food, groceries, fresh products, dairy, beverages, general merchandise and health and beauty care products. Our industry is characterized by a high volume of sales with low profit margins. Our food/non-food sales are generally priced based on the manufacturer's cost of the product plus a percentage markup. As a result, our profit levels may be negatively impacted during periods of cost deflation or stagnation for these products, even though our gross profit as a percentage of the price of goods sold may remain relatively constant. In addition, periods of product cost inflation may have a negative impact on our gross profit margins with respect to sales of cigarettes because gross profit on cigarette sales are generally fixed on a cents per carton basis. Therefore, as cigarette prices increase, gross profit generally decreases as a percentage of sales. In addition, if the cost of the cigarettes that we purchase increases

10

due to manufacturer price increases, reduced or eliminated manufacturer discounts and incentive programs or increases in applicable excise tax rates, our inventory carrying costs and accounts receivable could rise, placing pressure on our working capital requirements.

We rely on manufacturer discount and incentive programs and cigarette excise stamping allowances, and any material changes in these programs could adversely affect our results of operations.

We receive payments from the manufacturers on the products we distribute for allowances, discounts, volume rebates and other merchandising and incentive programs. These payments are a substantial benefit to us. The amount and timing of these payments are affected by changes in the programs by the manufacturers, our ability to sell specified volumes of a particular product, attaining specified levels of purchases by our customers and the duration of carrying a specified product. In addition, we receive discounts from certain taxing jurisdictions in connection with the collection of excise taxes. If the manufacturers or taxing jurisdictions change or discontinue these programs or change the timing of payments, or if we are unable to maintain the volume of our sales required by such programs, our results of operations could be negatively affected.

We depend on relatively few suppliers for a large portion of our products, and any interruptions in the supply of the products that we distribute could adversely affect our results of operations.

We obtain the products we distribute from third party suppliers. At December 31, 2013, we had approximately 4,700 vendors, and during 2013 we purchased approximately 64% of our products from our top 20 suppliers, with our top two suppliers, Philip Morris USA, Inc. and R.J. Reynolds Tobacco Company, representing approximately 28% and 14% of our purchases, respectively. We do not have any long-term contracts with our suppliers committing them to provide products to us. Our suppliers may not provide the products we distribute in the quantities we request on favorable terms, or at all. We are also subject to delays caused by interruption in production due to conditions outside our control, such as slow-downs or strikes by employees of suppliers, inclement weather, transportation interruptions, regulatory requirements and natural disasters. Our inability to obtain adequate supplies of the products we distribute could cause us to fail to meet our obligations to our customers and reduce the volume of our sales and profitability.

Our ability to operate effectively could be impaired by the risks and costs associated with expansion activities.

Market share growth is one of our key company initiatives. To accomplish this growth we have focused on strategic acquisitions and securing large regional and national customers as key elements of success. Any significant expansion activity comes with inherent risks. Acquisitions may entail various risks such as identifying suitable candidates, realizing acceptable rates of return on the investment, identifying potential liabilities, obtaining adequate financing, negotiating acceptable terms and conditions, and successfully integrating operations and converting systems post acquisition. Integrating a large new customer has similar risks of realizing acceptable returns on invested working capital, negotiating acceptable pricing and service levels, while managing resources and business interruptions as we integrate the new business into our current infrastructure. We may realize higher costs or lower margins than originally anticipated and may experience disruption to our base business, and may not realize the anticipated benefits or savings from expansion activities to the extent or in the time frame expected.

We may be subject to product liability claims and counterfeit product claims which could materially adversely affect our business.

As a distributor of food and consumer products, we face the risk of exposure to product liability claims in the event that the use of a product sold by us causes injury or illness. In addition, certain products that we distribute may be subject to counterfeiting. Our business could be adversely affected if consumers lose confidence in the safety and quality of the food and other products we distribute. Further, our operations could be subject to disruptions as a result of manufacturer recalls. This risk may increase as we continue to expand our distribution of fresh products. If we do not have adequate insurance, if contractual indemnification from the supplier or manufacturer of the defective, contaminated or counterfeit product is not available, or if a supplier or manufacturer cannot fulfill its indemnification obligations to us, the liability relating to such product claims or disruption as a result of recall efforts could materially adversely impact our results of operations.

We may not be able to achieve the expected benefits from the implementation of marketing initiatives.

We are continuously improving our competitive performance through a series of strategic marketing initiatives. The goal of this effort is to develop and implement a comprehensive and competitive business strategy, addressing the special needs of the convenience industry environment, increasing our market position within the industry and ultimately creating increased shareholder value. Customer acceptance of new distribution formats that we implement may not be as anticipated or competitive pressures may cause us to curtail or abandon these initiatives, resulting in lower revenue growth and unachieved cost savings.

Our information technology systems may be subject to failure, disruptions or security breaches which could compromise our ability to conduct business, seriously harm our business and adversely affect our financial results.

11

Our business is highly dependent on our customized enterprise information technology systems. We rely on our information technology systems and our internal information technology staff to maintain the information required to operate our distribution centers and to provide our customers with fast, efficient and reliable deliveries. We have taken steps to increase redundancy in our information technology systems and have disaster recovery plans in place to mitigate unforeseen events that could disrupt our systems' service. However, if our systems fail or are not reliable, we may suffer disruptions in service to our customers and our results of operations could suffer. We may upgrade and replace various components of our proprietary ERP system periodically with the goal of maintaining and improving overall functionality, performance and service. Some of our upgrades may include the implementation of leading software solutions or enhanced customizations to our existing systems. There are inherent risks associated with any system project and there can be no guarantee any implementation will be free of disruptions or other operational problems.

In addition, we retain sensitive data, including intellectual property, proprietary business information and personally identifiable information, in our secure data centers and on our networks. We may face threats to our data centers and networks of unauthorized access, security breaches and other system disruptions. Despite our security measures, our infrastructure may be vulnerable to attacks by experienced hackers or other disruptive problems. Any such security breach may compromise information stored on our networks and may result in significant data losses or theft of intellectual property, proprietary business information or personally identifiable information belonging to us or our customers, business partners or employees.

We may be subject to various claims and lawsuits that could result in significant expenditures.

The nature of our business exposes us to the potential for various claims and litigation related to labor and employment, personal injury, property damage, business practices, environmental liability and other matters. Any material litigation or a catastrophic accident or series of accidents could have a material adverse effect on our business, financial position and results of operations.

We depend on our senior management and other key personnel.

We substantially depend on the continued services and performance of our senior executive officers as named in our Proxy Statement and other key employees. We do not maintain key person life insurance policies on these individuals, and we do not have employment agreements with any of them. The loss of the services of any of our senior executive officers or other key personnel could harm our business.

Shortages of qualified labor could negatively impact our business and profitability.

Our continued success will depend partly on our ability to attract and retain qualified personnel. We compete with other businesses in each of our markets with respect to attracting and retaining qualified employees. A shortage of qualified employees, especially drivers, in a market could require us to enhance our wage and benefit packages in order to compete effectively in the hiring and retention of qualified employees or to hire more expensive temporary employees. Any such shortage of qualified employees could decrease our ability to effectively serve our customers and might lead to lower profits because of higher labor costs.

Unions may attempt to organize our employees.

As of December 31, 2013, 210, or 4%, of our employees were covered by collective bargaining agreements with labor organizations, which expire at various times. We cannot assure you that we will be able to renew our respective collective bargaining agreements on favorable terms, that employees at other facilities will not unionize or that our labor costs will not increase. In addition, the National Labor Relations Board is becoming more active with the passage of administrative rules that could impact our ability to manage our labor force. To the extent we suffer business interruptions as a result of strikes or other work stoppages or slow downs, or our labor costs increase and we are not able to recover such increases through increased prices charged to customers or offsets by productivity gains, our results of operations could be materially adversely affected.

Employee health benefit costs represent a significant expense to us and may negatively affect our profitability.

With over 3,600 employees and their families participating in our health plans, our expenses relating to employee health benefits are substantial. In past years, we have experienced significant increases in certain of these costs, largely as a result of economic factors beyond our control, including, in particular, ongoing increases in health care costs well in excess of the rate of inflation. Continued increasing health care costs, as well as changes in laws, regulations and assumptions used to calculate health and benefit expenses, may adversely affect our business, financial position and results of operations. In addition, the implementation of the Patient Protection and Affordable Care Act (“ACA”) may significantly increase our employee healthcare-related costs. While we have taken steps to minimize the impact of ACA, there is no guarantee our efforts will be successful.

If we are unable to comply with governmental regulations that affect our business or if there are substantial changes in these regulations, our business could be adversely affected.

12

As a distributor of food and other consumable products, we are subject to regulation by the FDA, Health Canada and similar regulatory authorities at the state, provincial and local levels. In addition, our employees operate tractor trailers, trucks, forklifts and various other powered material handling equipment and we are therefore subject to regulation by the U.S. and Canadian Departments of Transportation. Our operations are also subject to regulation by OSHA, the DEA and a myriad of other federal, state, provincial and local agencies. Each of these regulatory authorities has broad administrative powers with respect to our operations. Regulations, and the costs of complying with those regulations, have been increasing in recent years. If we fail to adequately comply with government regulations, we could experience increased inspections or audits, regulatory authorities could take remedial action including imposing fines or shutting down our operations or we could be subject to increased compliance costs. If any of these events were to occur, our results of operations would be adversely affected.

Natural disaster damage could have a material adverse effect on our business.

Our headquarters and several of our warehouses in California, as well as one of our data centers and one warehouse located near Vancouver, British Columbia, Canada, are in or near high hazard earthquake zones. In addition, one of our data centers is located in Plano, Texas, which is susceptible to wind storms. We also have operations in areas that have been affected by natural disasters such as hurricanes, tornados, floods, and ice and snow storms. While we maintain insurance to cover us for such potential losses, our insurance may not be sufficient in the event of a significant natural disaster or payments under our policies may not be received timely enough to prevent adverse impacts on our business. Our customers could also be affected by like events, which could adversely impact our sales and results of operations.

Insurance and claims expenses could have a material adverse effect on us.

We have a combination of both self-insurance and high-deductible insurance programs for the risks arising out of the services we provide and the nature of our operations throughout North America, including claims exposure resulting from personal injury, property damage, business interruption and workers' compensation. Workers' compensation, automobile and general liabilities are determined using actuarial estimates of the aggregate liability for claims incurred and an estimate of incurred but not reported claims. Our accruals for insurance reserves reflect certain actuarial assumptions and management judgments, which are subject to a high degree of variability. If the number or severity of claims for which we are retaining risk increases, our financial condition and results of operations could be adversely affected. If we lose our ability to self-insure these risks, our insurance costs could materially increase and we may find it difficult to obtain adequate levels of insurance coverage.

Risks Related to the Distribution of Cigarettes and Other Tobacco Products

Our sales volume is largely dependent upon the distribution of cigarettes, sales of which are declining generally.

The distribution of cigarettes is currently a significant portion of our business. In 2013, approximately 68.0% of our net sales (which includes excise taxes) and 29.5% of our gross profit were generated from the distribution of cigarettes. Due to increases in the prices of cigarettes, restrictions on marketing and promotions by cigarette manufacturers, increases in cigarette regulation and excise taxes, health concerns, increased pressure from anti-tobacco groups, the rise in popularity of electronic cigarettes and other factors, cigarette consumption in the U.S. and Canada has been declining gradually over the past few decades. We expect consumption trends of legal cigarette products will continue to be negatively impacted by the factors described above. In addition, we expect rising prices may lead to a higher percentage of consumers purchasing cigarettes through illicit markets, over the internet and by other means designed to avoid payment of cigarette taxes. If we are unable to sell other products to make up for these declines in cigarette unit sales, our operating results may suffer.

Legislation and other matters are negatively affecting the cigarette and tobacco industry.

The tobacco industry is subject to a wide range of laws and regulations regarding the marketing, distribution, sale, taxation and use of tobacco products imposed by governmental entities. Various jurisdictions have adopted or are considering legislation and regulations restricting displays and marketing of tobacco products, establishing fire safety standards for cigarettes, raising the minimum age to possess or purchase tobacco products, requiring the disclosure of ingredients used in the manufacture of tobacco products, imposing restrictions on public smoking, restricting the sale of tobacco products directly to consumers or other recipients over the internet and other tobacco product regulation. In addition, the FDA has been empowered to regulate changes to nicotine yields and the chemicals and flavors used in tobacco products (including cigars and pipe products), require ingredient listings be displayed on tobacco products, prohibit the use of certain terms which may attract youth or mislead users as to the risks involved with using tobacco products, as well as limit or otherwise impact the marketing of tobacco products by requiring additional labels or warnings as well as pre-approval of the FDA. Such legislation and related regulation is likely to continue adversely impacting the market for tobacco products and, accordingly, our sales of such products.

In Canada, many provinces have enacted legislation authorizing and facilitating the recovery by provincial governments of tobacco-related health care costs from the tobacco industry by way of lawsuit. Some Canadian provincial governments have either

13

already initiated lawsuits or indicated an intention that such lawsuits will be filed. It is unclear at this time how such restrictions and lawsuits may affect Core-Mark and its Canadian operations.

If excise taxes are increased or credit terms are reduced, our sales of cigarettes and other tobacco products could decline and our liquidity could be negatively impacted.

Cigarettes and tobacco products are subject to substantial excise taxes in the U.S. and Canada. Significant increases in cigarette-related taxes and/or fees have been proposed or enacted and are likely to continue to be proposed or enacted by various taxing jurisdictions within the U.S. and Canada as a means of increasing government revenues. These tax increases negatively impact consumption. Additionally, they may cause a shift in sales from premium brands to discount brands, illicit channels or electronic cigarettes as smokers seek lower priced options.

Taxing jurisdictions have the ability to change or rescind credit terms currently extended for the remittance of tax that we collect on their behalf. If these excise taxes are substantially increased or credit terms are substantially reduced, it could have a negative impact on our liquidity. Accordingly, we may be required to obtain additional debt financing, which we may not be able to obtain on satisfactory terms or at all.

Our distribution of cigarettes and other tobacco products exposes us to potential liabilities.

In June 1994, the Mississippi attorney general brought an action against various tobacco industry members on behalf of the state to recover state funds paid for health care costs related to tobacco use. Most other states sued the major U.S. cigarette manufacturers based on similar theories. In November 1998, the major U.S. tobacco product manufacturers entered into a Master Settlement Agreement (“MSA”) with 46 states, the District of Columbia and certain U.S. territories. The other four states--Mississippi, Florida, Texas and Minnesota (the “non-MSA states”)--settled their litigations with the major cigarette manufacturers by separate agreements. The MSA and the other state settlement agreements settled health care cost recovery actions and monetary claims relating to future conduct arising out of the use of, or exposure to, tobacco products, imposed a stream of future payment obligations on major U.S. cigarette manufacturers and placed significant restrictions on the ability to market and sell cigarettes. The payments required under the MSA result in the products sold by the participating manufacturers to be priced at higher levels than non-MSA manufacturers. In addition, the growth in market share of discount brands since the MSA was signed has had an adverse impact on the total volume of the cigarettes that we sell.

In connection with the MSA, we were indemnified by most of the tobacco product manufacturers from which we purchase cigarettes and other tobacco products for liabilities arising from our sale of the tobacco products that they supply to us. Should the MSA ever be invalidated, we could be subject to substantial litigation due to our distribution of cigarettes and other tobacco products, and we may not be indemnified for such costs by the tobacco product manufacturers in the future. In addition, even if we are indemnified by cigarette manufacturers that are parties to the MSA, future litigation awards against such cigarette manufacturers and could be so large as to prevent the manufacturers from satisfying their indemnification obligations.

Risks Related to Financial Matters, Financing and Foreign Exchange

Changes to federal, state or provincial income tax legislation could have a material adverse effect on our business and results of operations.

From time to time, new tax legislation is adopted by the federal government and various states or other regulatory bodies. Significant changes in tax legislation could adversely affect our business or results of operations in a material way. For example, in the U.S. the federal government has proposed legislation, which effectively could limit, or even eliminate, use of the LIFO inventory method for financial and income tax purposes. Although the final outcome of these proposals cannot be ascertained at this time, the ultimate financial impact to us of the transition from LIFO to another inventory method could be material to our operating results.

Our pension plan is currently underfunded and we will be required to make cash payments to the plan, reducing the cash available for our business.

We record a liability associated with the underfunded status of our pension plan when the benefit obligation exceeds the fair value of the plan assets. Our December 31, 2013 balance sheet includes $2.1 million in pension liabilities related to underfunded pension obligations, compared to $10.0 million in underfunded pension obligations as of December 31, 2012. The funded level of our pension plan improved to 95% as of December 31, 2013 and we have adopted a dynamic strategy to reduce the plan’s investment risk as its funded status improves. This strategy will reduce the allocation to return seeking assets and increase the allocation to liability hedging assets over time with the intention of reducing volatility of the funded status and pension costs. We expect this strategy will reduce the risk associated with the funding level of our pension plan, but if the performance of the assets in our pension plan does not meet our expectations, or if other actuarial assumptions are modified, our future cash payments to our pension plan could be substantially higher than we expect.

14

The pension plan is subject to the Employee Retirement Income Security Act of 1974 (“ERISA”). Under ERISA, the Pension Benefit Guaranty Corporation (“PBGC”) has the authority to terminate an underfunded pension plan under limited circumstances. In the event our pension plan is terminated for any reason while it is underfunded, we will incur a liability to the PBGC that may be equal to the entire amount of the underfunding in the pension plan. If this were to occur, our working capital and results of operations could be adversely impacted.

There can be no assurance that we will continue to declare cash dividends in the future or in any particular amounts and if there is a reduction in dividend payments, our stock price may be harmed.

Since the fourth quarter of 2011, we have paid a quarterly cash dividend to our stockholders. We intend to continue to pay quarterly dividends subject to capital availability and periodic determinations by our Board of Directors that cash dividends are in the best interest of our stockholders and are in compliance with all applicable laws and agreements to which we are a party. Future dividends may be affected by a variety of factors such as available cash, anticipated working capital requirements, overall financial condition, credit agreement restrictions, future prospects for earnings and cash flows, capital requirements for acquisitions, stock repurchase programs, reserves for legal risks and changes in federal and state income tax laws or corporate laws. Our Board of Directors may, at its discretion, decrease or entirely discontinue the payment of dividends at any time. Any such action could have a material, negative effect on our stock price.