Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TWO HARBORS INVESTMENT CORP. | a8kq2-2014investorpresenta.htm |

Second Quarter 2014 Investor Presentation

Safe Harbor F O R W A R D - L O O K I N G S T A T E M EN T S This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward- looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2013, and any subsequent Quarterly Reports on form 10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to, higher than expected operating costs, changes in prepayment speeds of mortgages underlying our residential mortgage-backed securities (RMBS), the rates of default or decreased recovery on the mortgages underlying our non-Agency securities, failure to recover credit losses in our portfolio, changes in interest rates and the market value of our assets, the availability of financing, the availability of target assets at attractive prices, our ability to manage various operational risks associated with our business, our ability to maintain our REIT qualification, limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940, the impact of new legislation or regulatory changes on our operations, the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process, our ability to acquire mortgage loans or securitize the mortgage loans we acquire, our involvement in securitization transactions, the timing and profitability of our securitization transactions, the risks associated with our securitization transactions, our ability to acquire mortgage servicing rights (MSR), the impact of new or modified government mortgage refinance or principal reduction programs, unanticipated changes in overall market and economic conditions, and our exposure to claims and litigation, including litigation arising from our involvement in securitization transactions and investments in MSR. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Two Harbors does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Two Harbors’ most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Two Harbors or matters attributable to Two Harbors or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors. 2

Mission Based Strategy OUR MISSION IS TO BE RECOGNIZED AS THE INDUSTRY -LEADING MORTGAGE REIT: • Largest hybrid mortgage REIT investing in residential mortgage assets • Market capitalization of approximately $3.8 billion(1) • Provider of permanent capital to the U.S. mortgage market • Thought leader in the U.S. housing market BENEFITS OF OUR HYBRID MORTGAGE REIT MODEL: • Flexibility to take advantage of opportunities across Agency and non-Agency RMBS sectors and unsecuritized mortgage assets, including: ― RMBS ― Residential mortgage loans ― MSR ― Other financial assets IMPERATIVES: • Rigorous risk management system • Strong administrative infrastructure • Best practice disclosure and corporate governance • Logically diversify portfolio for benefit of stockholders 3 (1) Source: Bloomberg as of June 30, 2014.

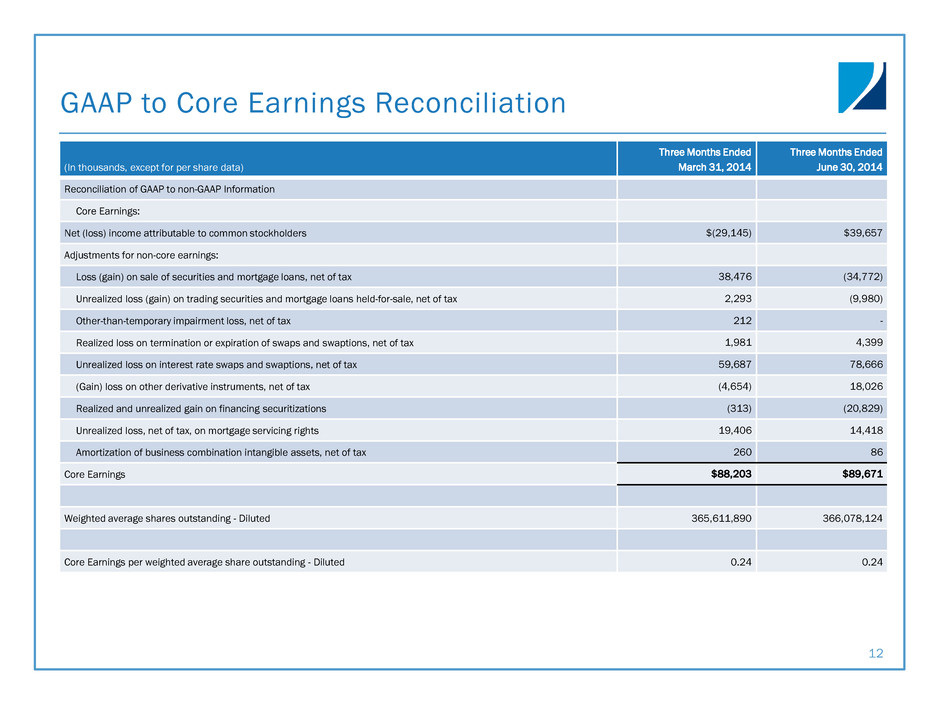

Executive Summary A DVANC I NG ST R AT E G IC I N I T I AT IV E S • Mortgage loan conduit and securitization platform gaining momentum — Completed ABMT 2014-1 securitization; prime jumbo pipeline remains robust — Anticipate completing additional securitizations • Mortgage Servicing Rights — Working with a variety of counterparties to expand initiative; evaluating numerous bulk and flow opportunities • Examining other opportunities to create attractive investments for portfolio ST RO N G S E C O N D Q UA RT E R 2 014 R E S U LT S • Reported book value of $11.09 per share ― Total return on book value 6.0% for Q2-2014; 9.9% year-to-date(1) • Delivered Comprehensive Income of $230.8 million — Return on average equity of 23.0%, or $0.63 per share • Generated Core Earnings of $89.7 million, or $0.24 per share(2) 4 (1) Return on book value for quarter ended June 30, 2014 is defined as the increase in book value per diluted share, from March 31, 2014 to June 30, 2014 of $0.38, plus dividend declared of $0.26 per share, divided by March 31, 2014 diluted book value of $10.71 per share. Return on book value for year-to-date 2014 is defined as the increase in book value per diluted share, from December 31, 2013 to June 30, 2014 of $0.53, plus dividend declared of $0.52 per share, divided by December 31, 2013 diluted book value of $10.56 per share. (2) Core Earnings is a non-GAAP measure that we define as net income, excluding impairment losses, realized and unrealized gains or losses on the aggregate portfolio, certain non-recurring gains and losses related to discontinued operations and amortization of business combination intangible assets, and certain non-recurring upfront costs related to securitization transactions. As defined, Core Earnings includes interest income or expense, and premium income or loss on derivative instruments and servicing income, net of estimated amortization on MSR. Core Earnings is provided for purposes of comparability to other peer issuers. For a reconciliation of GAAP to non-GAAP financials, please refer to the GAAP to non-GAAP reconciliation table in the Appendix on slide 12.

RATES STRATEGY CREDIT STRATEGY MACROECONOMIC CONSIDERATIONS Second Quarter 2014 Market Overview • Federal Reserve remains the largest buyer in the mortgage market • Federal Reserve tapering can create opportunities • Agency RMBS spreads tightened • Legacy Non-Agency RMBS fundamentals remain strong • Improving housing metrics continue to drive performance • Prime jumbo credit remains tight • Securitization market showing nascent recovery 5 (1) Source: CoreLogic Home Price Index rolling 12-month change as of June 30, 2014. • Low interest rates overall • Muted volatility environment • Unemployment recovery • Appreciating home prices; CoreLogic Home Price Index +7.5% on a rolling 12-month basis(1) • End of Federal Reserve’s Quantitative Easing • GSE reform • Actively engaged with multiple parties in Washington • FHFA oversight POLICY CONSIDERAT IONS

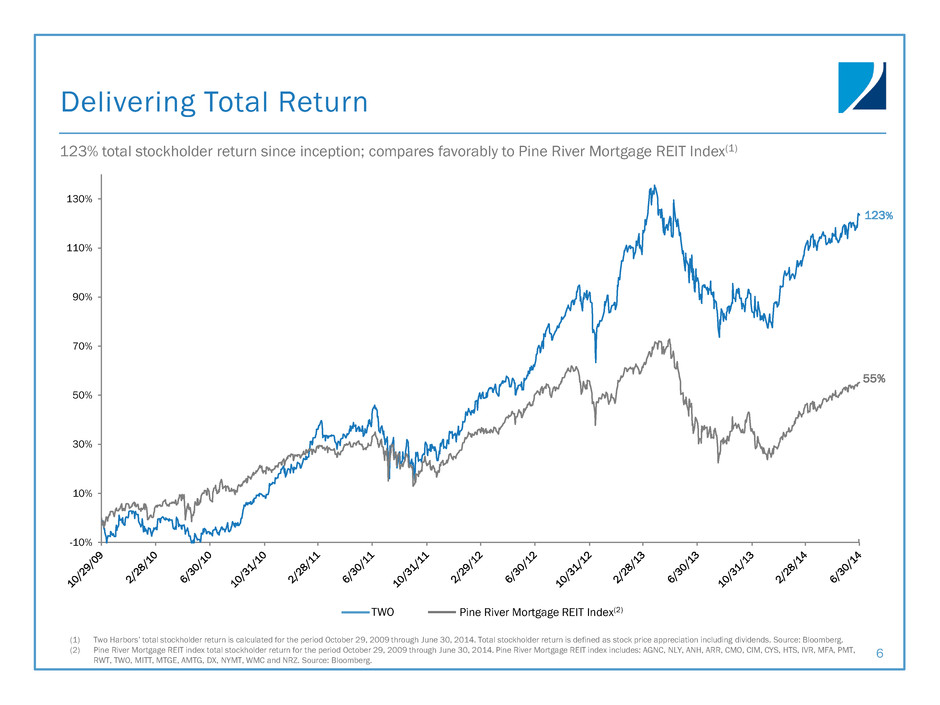

-10% 10% 30% 50% 70% 90% 110% 130% Delivering Total Return 123% total stockholder return since inception; compares favorably to Pine River Mortgage REIT Index(1) (1) Two Harbors’ total stockholder return is calculated for the period October 29, 2009 through June 30, 2014. Total stockholder return is defined as stock price appreciation including dividends. Source: Bloomberg. (2) Pine River Mortgage REIT index total stockholder return for the period October 29, 2009 through June 30, 2014. Pine River Mortgage REIT index includes: AGNC, NLY, ANH, ARR, CMO, CIM, CYS, HTS, IVR, MFA, PMT, RWT, TWO, MITT, MTGE, AMTG, DX, NYMT, WMC and NRZ. Source: Bloomberg. 6 TWO Pine River Mortgage REIT Index(2) 123% 55%

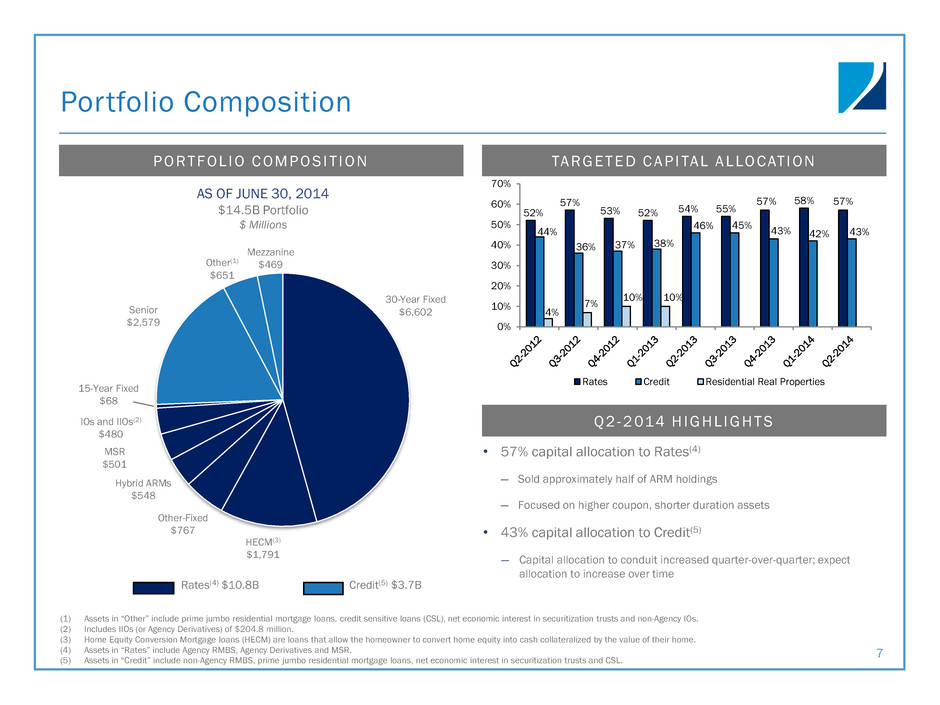

TA RG ET E D C A P I TAL A L LO C AT I O N Q 2 - 2 014 H I G H L I G H T S P O RT FO L I O C O M P O S I T I O N Portfolio Composition 7 • 57% capital allocation to Rates(4) — Sold approximately half of ARM holdings — Focused on higher coupon, shorter duration assets • 43% capital allocation to Credit(5) — Capital allocation to conduit increased quarter-over-quarter; expect allocation to increase over time Rates(4) $10.8B Credit(5) $3.7B AS OF JUNE 30, 2014 $14.5B Portfolio $ Millions (1) Assets in “Other” include prime jumbo residential mortgage loans, credit sensitive loans (CSL), net economic interest in securitization trusts and non-Agency IOs. (2) Includes IIOs (or Agency Derivatives) of $204.8 million. (3) Home Equity Conversion Mortgage loans (HECM) are loans that allow the homeowner to convert home equity into cash collateralized by the value of their home. (4) Assets in “Rates” include Agency RMBS, Agency Derivatives and MSR. (5) Assets in “Credit” include non-Agency RMBS, prime jumbo residential mortgage loans, net economic interest in securitization trusts and CSL. 30-Year Fixed $6,602 HECM(3) $1,791 Senior $2,579 Mezzanine $469 MSR $501 Hybrid ARMs $548 15-Year Fixed $68 Other-Fixed $767 IOs and IIOs(2) $480 Other(1) $651 52% 57% 53% 52% 54% 55% 57% 58% 57% 44% 36% 37% 38% 46% 45% 43% 42% 43% 4% 7% 10% 10% 0% 10% 20% 30% 40% 50% 60% 70% Rates Credit Residential Real Properties

Hedging Strategy and Financing Profile (1) 8 H E D G I N G ST R AT E GY • Hedges structured to protect book value in a variety of interest rate environments • Use a variety of hedging tools, including swaps, swaptions, interest- only bonds, inverse interest-only bonds, MSR and To-Be-Announced (TBA) contracts • Maintain low overall rate posture • Modest leverage and low basis risk H E D G I N G A N D R I S K M A N AGE ME NT F U N D ING A N D L I Q U I D IT Y P RO F I L E L E N GT H Y AG G R E GAT E F I N A NC ING P RO F I L E R E P U RC H A SE AG R E E M E NTS • Focus on diversification and financial stability • Continue to ladder repo maturities; averaged 68 days to maturity • 24 counterparties at June 30, 2014 F E D E R A L H O M E LOA N BA N K O F D E S M O I N E S • Outstanding secured advances of $1.5 billion; using total available borrowing capacity — Average maturity approximately 47 months; borrowing rate 0.4% (1) Data as of June 30, 2014. (2) Represents estimated percentage change in book value for theoretical parallel shifts in interest rates. Change in book value is total net asset change. -100 bps -50 bps +50 bps +100 bps Change in book value 1.0% 1.1% (0.7)% (2.0)% BO O K VA LU E E X P O S U R E TO C H A N G E I N R AT E S (2 )

Conduit and MSR Platform S E C O N D Q UA RT E R R E V I E W • Prime jumbo holdings $377 million; pipeline (i.e., interest rate locks) approximately $650 million at June 30, 2014 • Completed Agate Bay Mortgage Trust 2014-1 in August – $268 million prime jumbo securitization; created attractive investments for our portfolio • Acquired $4.8 billion UPB MSR in bulk purchase from Flagstar Bank, $545 million UPB MSR via flow arrangement with PHH Corp. C O N D U IT A N D M S R O U T LO O K • Focus on building additional originator relationships; on target for 35-40 originators by year-end • Conduit holdings and pipeline total approximately $1.0 billion(1); anticipate completing future securitizations • Goal to provide suite of products that meet originator-partners and borrowers needs – Create attractive investments for portfolio – Examining non-QM and other potential products – Serves goal to be a provider of capital to U.S. mortgage market • Aim to add MSR flow arrangements – Focus on new production MSR given attractive yield and hedging benefits 9 (1) As of August 6, 2014.

…LESS INTEREST RATE EXPOSURE ( 3 ) . . . Attractive Returns With Lower Risk 10 A T T R A C T I VE & C O M P A R A B L E D I V I D E N D Y I E L D ( 1 ) …WITH LOWER LEVERAGE ( 2 ) . . . SUPERIOR ASSET SELECTION AND RISK MANAGEMENT DRIVE RETURNS WITH LESS RISK TWO Peer Average TWO Peer Average TWO Peer Average …AND LESS PREPAYMENT R ISK ( 4 ) TWO Peer Average Note: Two Harbors and peer financial data for Dividend Yield, Leverage, Prepayment Risk and Interest Rate Exposure on this slide is based on available financial information as of June 30, 2014 as filed with the SEC. Company peers include AGNC, ANH, ARR, CMO, CYS, HTS, IVR, MFA and NLY. (1) Represents average of annualized yields on all quarterly cash dividends per respective fiscal year. Two Harbor’s first quarter 2013 dividend yield used in annual average calculation was based on cash dividend of $0.32 per share and does not include Silver Bay Realty Trust common stock distribution of $1.01 per share. Annualized yields for each quarter are calculated by dividing annualized quarterly dividends, by closing share price as of respective quarter-ends. Peer dividend data based on peer company press releases. Historical dividends may not be indicative of future dividend distributions. Our company ultimately distributes dividends based on its taxable income per share of common stock. (2) Represents average of debt-to-equity ratios for all reportable quarters per respective fiscal year. Debt-to-equity is defined as total borrowings to fund RMBS, mortgage loans held-for-sale and Agency derivatives divided by total equity. (3) Represents average of estimated percentage change in equity value for theoretical +100bps parallel shift in interest rates for all reportable quarters per respective fiscal year. Change in equity market capitalization is adjusted for leverage. CMO data not available for Q1-2011 through Q2-2012. (4) Represents average of the constant prepayment rate (“CPR”) on the Agency RMBS portfolio including Agency derivatives for all reportable quarters per respective fiscal year. 4.1x 3.8x 3.2x 2.9x 6.8x 6.8x 6.9x 6.4x 0.0x 2.0x 4.0x 6.0x 8.0x 2011 2012 2013 2014 2011 2012 2013 2014 -2.8% -1.7% 1.8% -0.4% -10.9% -9.4% -11.7% -8.0% -15.0% -10.0% -5.0% 0.0% 5.0% 2011 2012 2013 2014 2011 2012 2013 2014 16.4% 15.8% 11.2% 10.0% 16.3% 13.7% 13.6% 11.7% 0.0% 5.0% 10.0% 15.0% 20.0% 2011 2012 2013 2014 2011 2012 2013 2014 5.5% 6.1% 8.1% 7.5% 15.7% 16.9% 15.0% 10.0% 0.0% 5.0% 10.0% 15.0% 20.0% 2011 2012 2013 2014 2011 2012 2013 2014

Appendix 11

GAAP to Core Earnings Reconciliation 12 (In thousands, except for per share data) Three Months Ended March 31, 2014 Three Months Ended June 30, 2014 Reconciliation of GAAP to non-GAAP Information Core Earnings: Net (loss) income attributable to common stockholders $(29,145) $39,657 Adjustments for non-core earnings: Loss (gain) on sale of securities and mortgage loans, net of tax 38,476 (34,772) Unrealized loss (gain) on trading securities and mortgage loans held-for-sale, net of tax 2,293 (9,980) Other-than-temporary impairment loss, net of tax 212 - Realized loss on termination or expiration of swaps and swaptions, net of tax 1,981 4,399 Unrealized loss on interest rate swaps and swaptions, net of tax 59,687 78,666 (Gain) loss on other derivative instruments, net of tax (4,654) 18,026 Realized and unrealized gain on financing securitizations (313) (20,829) Unrealized loss, net of tax, on mortgage servicing rights 19,406 14,418 Amortization of business combination intangible assets, net of tax 260 86 Core Earnings $88,203 $89,671 Weighted average shares outstanding - Diluted 365,611,890 366,078,124 Core Earnings per weighted average share outstanding - Diluted 0.24 0.24

Rates: Agency RMBS Metrics 13 AGENCY RMBS CPR(5) AGENCY PORTFOLIO YIELDS AND METRICS (1) Agency yield includes impact of Agency Derivatives. Interest income on Agency Derivatives was $7.0 million and $7.9 million for the first and second quarters of 2014, respectively. (2) Cost of financing Agency RMBS includes interest spread expense associated with the portfolio’s interest rate swaps of $12.1 million and $16.0 million for the first and second quarters of 2014, respectively. Interest spread expense increased cost of financing Agency RMBS by 0.5% and 0.7% in the first and second quarters of 2014, respectively. (3) Securities collateralized by loans of less than or equal to $85K. (4) Securities collateralized by loans with greater than or equal to 80% loan-to-value ratio (LTV). High LTV pools are predominately Making Homeownership Affordable (MHA) pools. MHA pools consist of borrowers who have refinanced through HARP. (5) Agency weighted average 3-month Constant Prepayment Rate (CPR) includes IIOs (or Agency Derivatives). (6) Weighted average cost basis includes RMBS principal and interest securities only. Average purchase price utilized carrying value for weighting purposes. (7) Securities collateralized by loans of less than or equal to $175K, but more than $85K. (8) Securities collateralized by loans held by lower credit borrowers as defined by Fair Isaac Corporation (FICO). Portfolio Yield Realized Q1-2014 At March 31, 2014 Realized Q2-2014 At June 30, 2014 Agency yield(1) 3.3% 3.2% 3.4% 3.2% Cost of financing(2) 0.9% 0.9% 1.1% 1.1% Net interest spread 2.4% 2.3% 2.3% 2.1% Portfolio Metrics Q1-2014 Q2-2014 Weighted average 3-month CPR(5) 6.4% 8.5% Weighted average cost basis(6) $108.3 $108.4 Agency: Vintage & Prepayment Protection Q1-2014 Q2-2014 2006 & subsequent vintages – Premium and IOs 14% 18% HECM 18% 18% $85K Max Pools(3) 17% 17% High LTV (predominately MHA)(4) 16% 15% Other Low Loan Balance Pools(7) 12% 12% Low FICO(8) 7% 6% Seasoned (2005 and prior vintages) 5% 5% Prepayment Protected 5% 5% 2006 & subsequent vintages – Discount 6% 4% AGENCY PORTFOLIO COMPOSITION 8.7% 8.7% 7.9% 6.4% 8.5% 0.0% 5.0% 10.0% 15.0% Q2-2013 Q3-2013 Q4-2013 Q1-2014 Q2-2014 Agency RMBS CPR

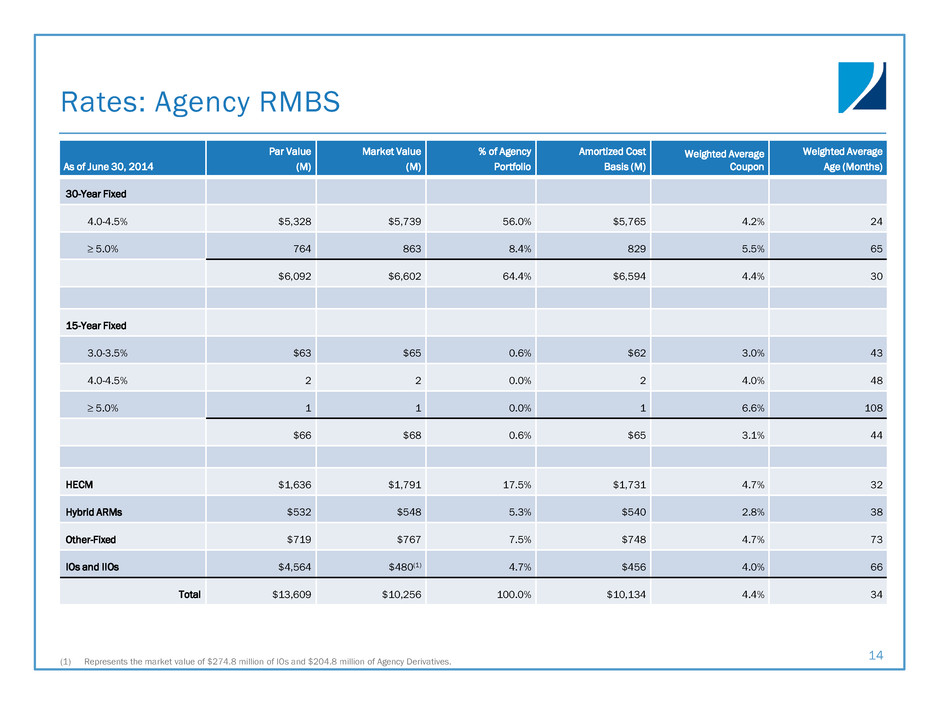

Rates: Agency RMBS 14 As of June 30, 2014 Par Value (M) Market Value (M) % of Agency Portfolio Amortized Cost Basis (M) Weighted Average Coupon Weighted Average Age (Months) 30-Year Fixed 4.0-4.5% $5,328 $5,739 56.0% $5,765 4.2% 24 ≥ 5.0% 764 863 8.4% 829 5.5% 65 $6,092 $6,602 64.4% $6,594 4.4% 30 15-Year Fixed 3.0-3.5% $63 $65 0.6% $62 3.0% 43 4.0-4.5% 2 2 0.0% 2 4.0% 48 ≥ 5.0% 1 1 0.0% 1 6.6% 108 $66 $68 0.6% $65 3.1% 44 HECM $1,636 $1,791 17.5% $1,731 4.7% 32 Hybrid ARMs $532 $548 5.3% $540 2.8% 38 Other-Fixed $719 $767 7.5% $748 4.7% 73 IOs and IIOs $4,564 $480(1) 4.7% $456 4.0% 66 Total $13,609 $10,256 100.0% $10,134 4.4% 34 (1) Represents the market value of $274.8 million of IOs and $204.8 million of Agency Derivatives.

Rates: Mortgage Servicing Rights 15 As of March 31, 2014 As of June 30, 2014 Fair Value ($M) $476.7 $500.5 Unpaid Principal Balance ($M) $41,596.3 $45,629.2 Weighted Average Coupon 3.9% 3.9% Original FICO Score 738 740 Original LTV 75% 74% 60+ Day Delinquencies 1.0% 1.2% Net Servicing Spread 25 basis points 25 basis points Vintage: Pre-2009 3.7% 3.8% 2009-2012 62.8% 64.5% Post 2012 33.5% 31.7% Percent of MSR Portfolio: Conventional 67.1% 71.1% Government FHA 24.7% 21.7% Government VA/USA 8.2% 7.2%

Credit: Non-Agency RMBS Metrics 16 NON-AGENCY PORTFOLIO COMPOSITION NON-AGENCY PORTFOLIO YIELDS AND METRICS (1) Cost of financing non-Agency RMBS includes interest spread expense associated with the portfolio’s interest rate swaps of $2.0 million and $3.1 million for the first and second quarters of 2014, respectively. Interest spread expense increased cost of financing non-Agency RMBS by 0.4% and 0.7% first and second quarters of 2014, respectively. (2) Weighted average cost basis includes RMBS principal and interest securities only. Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, total non-Agency RMBS excluding the company’s non-Agency interest-only portfolio would have been $51.23 at June 30, 2014. Portfolio Yield Realized Q1-2014 At March 31, 2014 Realized Q2-2014 At June 30, 2014 Non-Agency yield 9.1% 9.0% 8.7% 8.6% Cost of financing(1) 2.3% 2.3% 2.6% 2.6% Net interest spread 6.8% 6.7% 6.1% 6.0% NON-AGENCY RMBS CPR Non-Agency: Loan Type Q1-2014 Q2-2014 Sub-Prime 83% 78% Prime 5% 11% Option-ARM 8% 7% Alt-A 4% 4% Portfolio Metrics Q1-2014 Q2-2014 Weighted average 3-month CPR 3.4% 3.6% Weighted average cost basis(2) $53.3 $55.4 4.0% 4.8% 3.8% 3.4% 3.6% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% Q2-2013 Q3-2013 Q4-2013 Q1-2014 Q2-2014 Non-Agency RMBS CPR

Credit: Non-Agency RMBS 17 As of June 30, 2014 Senior Bonds Mezzanine Bonds Total P&I Portfolio Characteristics: Carrying Value ($M) $2,579.3 $469.5 $3,048.8 % of Credit Portfolio 84.6% 15.4% 100.0% Average Purchase Price(1) $54.68 $59.30 $55.39 Average Coupon 2.3% 1.7% 2.2% Weighted Average Market Price(2) $70.21 $79.01 $71.44 Collateral Attributes: Average Loan Age (months) 87 106 90 Average Loan Size ($K) $288 $204 $275 Average Original Loan-to-Value 72.4% 71.1% 72.2% Average Original FICO(3) 630 649 633 Current Performance: 60+ Day Delinquencies 28.4% 25.1% 27.9% Average Credit Enhancement(4) 8.5% 22.1% 10.6% 3-Month CPR(5) 3.3% 5.4% 3.6% (1) Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, the average purchase price for senior, mezzanine and total non-Agency RMBS, excluding our non- Agency interest-only portfolio, would have been $50.28, $57.15 and $51.23, respectively. (2) Weighted average market price utilized current face for weighting purposes. (3) FICO represents a mortgage industry accepted credit score of a borrower. (4) Average credit enhancement remaining on our non-Agency RMBS portfolio, which is the average amount of protection available to absorb future credit losses due to defaults on the underlying collateral. (5) 3-Month CPR is reflective of the prepayment speed on the underlying securitization; however, it does not necessarily indicate the proceeds received on our investment tranche. Proceeds received for each security are dependent on the position of the individual security within the structure of each deal.

I N T E R E ST R AT E SWA P S (3 ) Repurchase Agreements(1) 18 (1) As of June 30, 2014. (2) Pledged collateral includes RMBS, Agency Derivatives and mortgage loans held-for-sale; does not include U.S. Treasuries with repurchase agreements of $1.0 billion outstanding. (3) Notional amounts do not include $7.0 billion of notional interest rate swaps economically hedging our investment portfolio. Swaps Maturities Notional Amounts ($B) Average Fixed Pay Rate Average Receive Rate Average Maturity (Years) 2016 $10.3 0.563% 0.228% 1.92 2017 4.0 0.950% 0.230% 3.04 2018 1.1 1.314% 0.230% 3.99 2019 and after 1.2 2.536% 0.228% 8.79 $16.6 0.848% 0.228% 2.82 Amount ($M) Percent (%) Within 30 days $3,919.9 38% 30 to 59 days 3,050.8 29% 60 to 89 days 1,089.1 10% 90 to 119 days 1,027.1 10% 120 to 364 days 1,211.1 12% One year and over 93.2 1% 10,391.2 R E P O M AT U R IT IE S (2 )

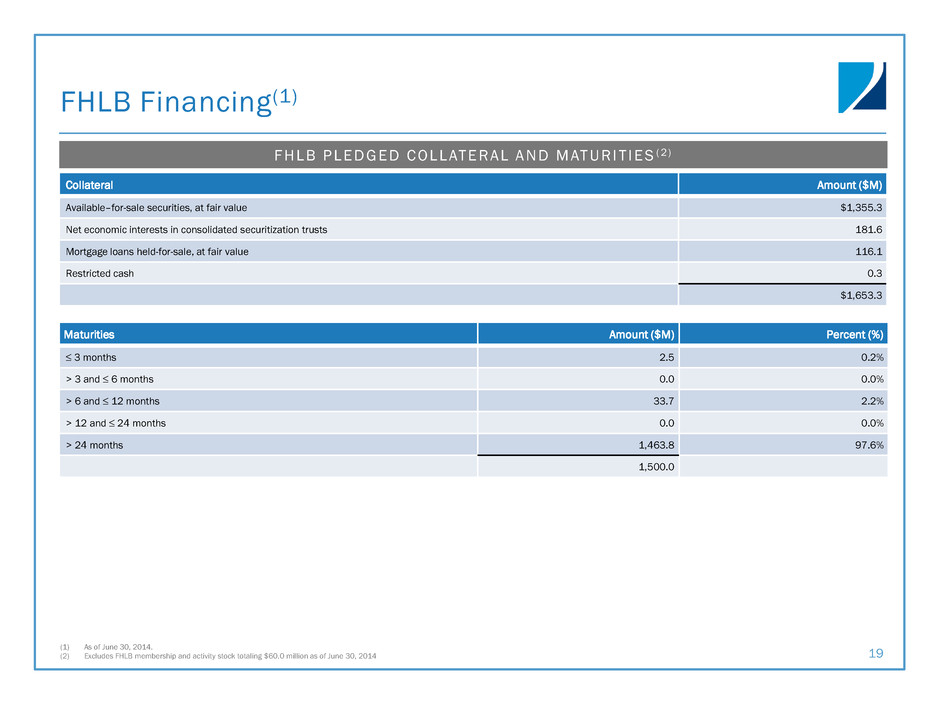

FHLB Financing(1) 19 (1) As of June 30, 2014. (2) Excludes FHLB membership and activity stock totaling $60.0 million as of June 30, 2014 Collateral Amount ($M) Available–for-sale securities, at fair value $1,355.3 Net economic interests in consolidated securitization trusts 181.6 Mortgage loans held-for-sale, at fair value 116.1 Restricted cash 0.3 $1,653.3 Maturities Amount ($M) Percent (%) ≤ 3 months 2.5 0.2% > 3 and ≤ 6 months 0.0 0.0% > 6 and ≤ 12 months 33.7 2.2% > 12 and ≤ 24 months 0.0 0.0% > 24 months 1,463.8 97.6% 1,500.0 F H L B P L E D G E D C O L L AT E RAL A N D M AT U RI T I E S (2 )

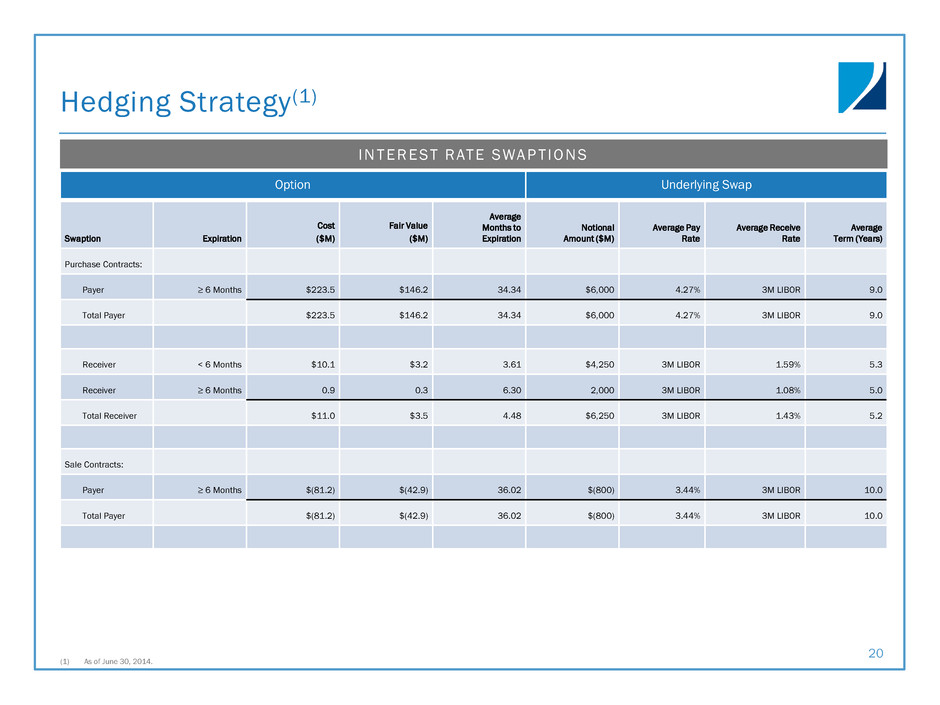

I N T E R E ST R AT E SWA P T I O NS Hedging Strategy(1) 20 (1) As of June 30, 2014. Option Underlying Swap Swaption Expiration Cost ($M) Fair Value ($M) Average Months to Expiration Notional Amount ($M) Average Pay Rate Average Receive Rate Average Term (Years) Purchase Contracts: Payer ≥ 6 Months $223.5 $146.2 34.34 $6,000 4.27% 3M LIBOR 9.0 Total Payer $223.5 $146.2 34.34 $6,000 4.27% 3M LIBOR 9.0 Receiver < 6 Months $10.1 $3.2 3.61 $4,250 3M LIBOR 1.59% 5.3 Receiver ≥ 6 Months 0.9 0.3 6.30 2,000 3M LIBOR 1.08% 5.0 Total Receiver $11.0 $3.5 4.48 $6,250 3M LIBOR 1.43% 5.2 Sale Contracts: Payer ≥ 6 Months $(81.2) $(42.9) 36.02 $(800) 3.44% 3M LIBOR 10.0 Total Payer $(81.2) $(42.9) 36.02 $(800) 3.44% 3M LIBOR 10.0

EXECUTIVE OFFICERS Overview of Two Harbors Team 21 CHIEF F INANCIAL OFFICER BRAD FARRELL • Most recently served as Two Harbors’ Controller from 2009 to 2011 • Previously Vice President and Executive Director of Financial Reporting at GMAC ResCap from 2007 to 2009 and held financial roles at XL Capital Ltd from 2002 to 2007; began his career with KPMG SIGNIF ICANT OPERATIONS AND RMBS EXPERTISE • Substantial operations team; deep servicing and mortgage operations experience • Strong RMBS team focused on trading, investment analysis and research • Leverages proprietary analytical systems INVESTMENT & OPERATIONS TEAM CHIEF EXECUTIVE OFFICER THOMAS SIERING • Also serves as Pine River Capital Management Partner • 33 years of investing and management experience; commenced career at Cargill • Previously Partner and head of Value Investment Group at EBF & Associates CHIEF INVESTMENT OFFICER WILL IAM ROTH • Also serves as Pine River Capital Management Partner • 33 years in mortgage securities market • Managing Director in proprietary trading group at Citi and Salomon Brothers prior to Two Harbors

EXPERIENCED, COHESIVE TEAM (3) ESTABLISHED INFRASTRUCTURE GLOBAL ASSET MANAGEMENT F IRM Overview of Pine River Capital Management • Eighteen partners with average of 22 years experience • Approximately 490 total employees, including 145 investment professionals • Historically low attrition • Strong corporate governance • Registrations include: SEC/NFA (U.S.), FSA (U.K.), SFC (Hong Kong) and SEBI (India) • Proprietary technology • Global footprint with 8 offices world-wide 22 • Global, multi-strategy asset management firm • Comprehensive portfolio management, transparency and liquidity • Institutional and high net worth investors • Founded in 2002 • Demonstrated success achieving growth and managing scale • Approximately $15.4 billion assets under management(1) – $6.5 billion is dedicated to mortgage strategies(2) – Experience managing Agency RMBS, non-Agency RMBS and other mortgage-related assets (1) Defined as estimated assets under management as of June 30, 2014, inclusive of Two Harbors and Silver Bay Realty Trust Corp. (2) Defined as estimated mortgage-related assets under management as of June 30, 2014, inclusive of Two Harbors and Silver Bay Realty Trust Corp. (3) Employee data as of June 30, 2014.