Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ITERIS, INC. | Financial_Report.xls |

| 10-K - 10-K - ITERIS, INC. | a2221256z10-k.htm |

| EX-32.2 - EX-32.2 - ITERIS, INC. | a2221256zex-32_2.htm |

| EX-23 - EX-23 - ITERIS, INC. | a2221256zex-23.htm |

| EX-31.2 - EX-31.2 - ITERIS, INC. | a2221256zex-31_2.htm |

| EX-31.1 - EX-31.1 - ITERIS, INC. | a2221256zex-31_1.htm |

| EX-21 - EX-21 - ITERIS, INC. | a2221256zex-21.htm |

| EX-32.1 - EX-32.1 - ITERIS, INC. | a2221256zex-32_1.htm |

Exhibit 10.29

FIRST AMENDMENT TO LEASE

This FIRST AMENDMENT TO LEASE (“Amendment”) is made as of February 21st, 2014, between RREF II FREEWAY ACQUISITIONS, LLC, a Delaware limited liability company (“Landlord”), and ITERIS, INC., a Delaware corporation (“Tenant”), with reference to the following:

RECITALS

A. Tenant and Landlord’s predecessor-in-interest, Crown Carnegie Associates, LLC, a Delaware limited liability company (“Crown”) are parties to that certain Office Lease, dated as of May 24, 2007 (“Lease”), pursuant to which Tenant leased from Crown certain office space within the office building at 1700 E. Carnegie Avenue, Suites 100 & 200, Santa Ana, California, as more particularly described in the Lease (“Premises”) within the complex known as Freeway Corporate Park (“Development”);

B. Landlord acquired the Development, including the Premises, from Crown on or about May 30, 2013;

C. The current term of the Lease, exclusive of available option periods, expires on January 31, 2015; and

D. Landlord and Tenant desire to amend the Lease to reduce the size of the Premises, extend the term of the Lease and make certain other modifications to the Lease, upon the terms and conditions set forth herein.

NOW, THEREFORE, for good, valuable and sufficient consideration received, Landlord and Tenant hereby agree as follows:

1. Terms. All capitalized terms used but not defined herein shall have the meaning given to them in the Lease.

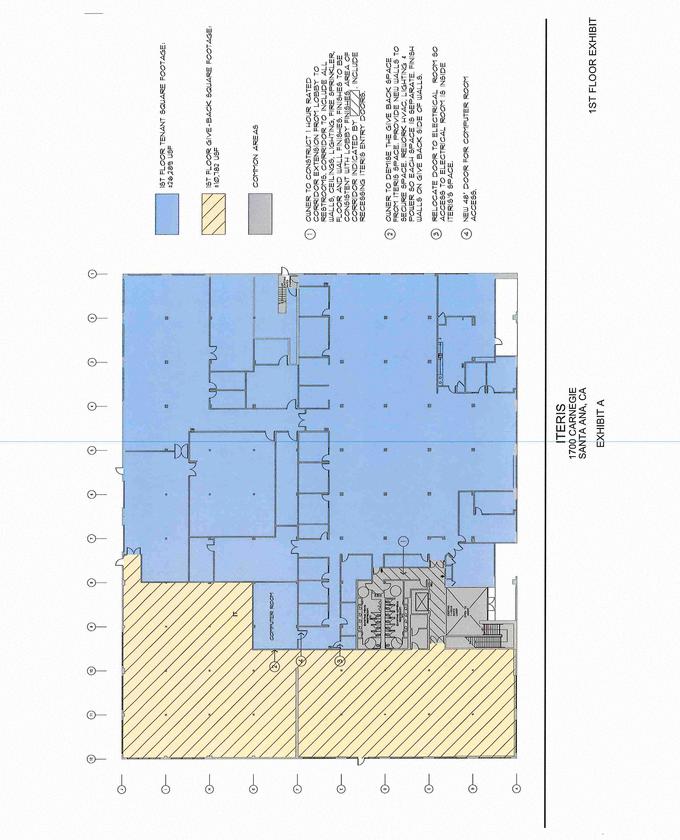

2. Premises. Tenant desires to relinquish to Landlord 11,059 rentable square feet within Suite 100 of the Premises (“Returned Space”). Effective upon the Commencement Date as amended herein, the Premises shall be reduced to 41,057 rentable square feet and 37,225 usable square feet. Suite 100 shall contain approximately 28,423 rentable square feet and 25,455 usable square feet. Suite 200 shall remain unchanged. Exhibit A to the Lease depicting the Premises is hereby deleted in its entirety and replaced with Exhibit A attached hereto.

3. Term. The Term is hereby amended to be ninety-six (96) months, commencing on the Commencement Date as amended herein. Provided Tenant has executed and delivered this Amendment to Landlord on or before February 18, 2014, the Commencement Date is hereby amended to be April 1, 2014. If Tenant does not execute and deliver this Amendment to Landlord on or before February 18, 2014, the Commencement Date shall be delayed to May 1, 2014. The Expiration Date is hereby amended to be the date immediately preceding the date which is ninety-six (96) months following the Commencement Date; provided, however, that if

the Commencement Date of this Amendment is a date other than the first day of a month, the Expiration Date shall be the last day of the month which is ninety-six (96) months after the month in which the Commencement Date falls. All references to the Term set forth in the Lease shall now mean and refer to the Term set forth herein.

4. Option to Extend Term. Tenant currently has one (1) Option to extend the Term for a period of five (5) years as set forth in Section 1.2 of the Lease. Landlord hereby grants to Tenant an one (1) additional Option to extend the Term for a period of five (5) years, so that Tenant now has a total of two (2) consecutive five (5) year Options to extend the Term. The terms of Section 1.2 of the Lease shall continue to govern with respect to each Option.

5. Base Rent. Upon the Commencement Date as amended herein, the amount of Base Rent shall be adjusted as follows:

|

Months |

|

Rent per square foot |

|

Monthly Base Rent |

| ||

|

1-4 |

|

$ |

0.00 |

|

$ |

0.00 |

|

|

5-12 |

|

$ |

1.85 |

|

$ |

75,955.45 |

|

|

13-24 |

|

$ |

1.90 |

|

$ |

78,008.30 |

|

|

25-36 |

|

$ |

1.95 |

|

$ |

80,061.15 |

|

|

37-48 |

|

$ |

2.00 |

|

$ |

82,114.00 |

|

|

49-60 |

|

$ |

2.05 |

|

$ |

84,166.85 |

|

|

61-72 |

|

$ |

2.10 |

|

$ |

86,219.70 |

|

|

73-84 |

|

$ |

2.15 |

|

$ |

88,272.55 |

|

|

85-96 |

|

$ |

2.20 |

|

$ |

90,325.40 |

|

6. Tenant’s Share; Base Year; Operating Expenses. Effective as of the Commencement Date as amended herein, Tenant’s Share is hereby amended to be 52.291% with respect to the Project and 32.009% with respect to the Development. Effective as of the Commencement Date as amended herein, the Base Year is hereby amended to be Calendar Year 2014. Notwithstanding anything to the contrary in the Lease: (a) Tenant shall not be responsible to pay for Tenant’s Share of excess Operating Expenses, if any, for the first twelve (12) months of the Term following the Commencement Date as amended herein; (b) the amount of Operating Expenses that are controllable by Landlord shall be capped on a cumulative and compounded basis at five percent (5%) annually; and (c) all costs related to bringing the Development into compliance with the Americans With Disabilities Act of 1990 (“ADA”) shall be excluded from Operating Expenses.

7. Tenant Improvement Allowance. Landlord shall provide to Tenant an allowance for Tenant Improvements (defined below) to be made to the Premises in the amount of up to Eight Dollars ($8.00) per rentable square foot for a total of Three Hundred Twenty-Eight Thousand Four Hundred Fifty-Six Dollars ($328,456) (“Tenant Improvement Allowance”). Tenant may use all or any portion of the Tenant Improvement Allowance for all improvements to the Premises and other related work, including but not limited to: (a) space planning and construction drawings; (b) profit, overhead and general conditions of contractors; (c) purchase or installation of telephone/computer cabling costs; (d) the cost to purchase or lease any furniture,

fixtures and equipment for the Premises; or (e) such other improvements or repairs to the Premises as Tenant elects (collectively, “Tenant Improvements”). In addition, Tenant may apply the Tenant Improvement Allowance toward Base Rent, in which event such credit shall be applied toward the next months’ Base Rent following Landlord’s receipt of written notice thereof from Tenant. The Tenant Improvement Allowance must be utilized by Tenant on or before the date that is twelve (12) months after the Commencement Date as amended herein. After such date, any unused amount of the Tenant Improvement Allowance shall no longer be available to Tenant. Landlord shall pay the Tenant Improvement Allowance to Tenant within thirty (30) days after Landlord’s receipt of (as applicable): (a) copies of all invoices for the Tenant Improvements; (b) final as-built plans for Tenant Improvements; (c) copies of all permits for Tenant Improvements, if any; and (d) unconditional lien releases from Tenant’s general contractor and all subcontractors. The Tenant Improvements and any other Alternations made by Tenant remain subject to the requirements of Section 11 of the Lease; provided, however, that Landlord will not be entitled to receive an “administrative/coordination fee” (as described in Section 11.2 of the Lease). All improvements to the Premises made by Tenant covered by the Tenant Improvement Allowance shall become the property of Landlord upon the expiration or sooner termination of this Lease. Tenant shall be solely responsible for all costs to improve or repair the Premises in excess of the Tenant Improvement Allowance, including any costs to bring the Premises into compliance with the ADA. Landlord shall be responsible for the cost of demising the Premises to exclude the Returned Space from the Premises and any improvements and repairs to the Returned Space, including the creation of a corridor to connect the lobby with the restrooms (as shown on attached Exhibit A) and any costs associated with ADA compliance within the Returned Space. Landlord and Tenant each agree to be responsible to pull their own permits for their respective work.

8. Parking Spaces. The number of unreserved parking spaces allotted to Tenant is hereby reduced to one hundred twenty-eight (128) unreserved parking spaces. All other terms related to parking spaces and the Parking Lot remain unchanged.

9. Additional Allowance. Pursuant to Section 2.1.2 of Exhibit D to the Lease, Tenant has been making monthly payments of $1,550.62 to reimburse Landlord for the Additional Allowance. Effective as of the Commencement Date as amended herein, Landlord hereby waives the entire outstanding balance of the Additional Allowance and Tenant shall have no further obligation to reimburse Landlord for the Additional Allowance.

10. Lease Unchanged and Complete. Except as changed by this Amendment, the Lease remains unchanged and contains the entire agreement of Landlord and Tenant with respect to the Premises. Landlord and Tenant each represent and warrant it does not believe or claim there are any oral or written agreements between Landlord and Tenant relating to the Premises, and that it is not relying on any agreements relating to the Premises, other than those agreements contained in the Lease as amended by this Amendment.

11. Authority. Each person signing this Amendment on behalf of Landlord or Tenant represents and warrants that that party has duly authorized him or her to execute and deliver this Amendment and by so doing to bind that party.

12. Counterparts. This Amendment may be signed in any number of counterparts, each of which shall constitute one and the same instrument.

[Signatures on following page]

IN WITNESS WHEREOF, Landlord and Tenant have executed this Amendment as of the date first set forth above.

|

“LANDLORD” |

| |||||

|

|

| |||||

|

RREF II FREEWAY ACQUISITIONS, LLC, |

| |||||

|

a Delaware limited liability company |

| |||||

|

|

|

|

|

|

| |

|

By: |

RREF II REI, LP, |

| ||||

|

|

a Delaware limited partnership, |

| ||||

|

|

its Sole Member |

| ||||

|

|

|

|

|

|

| |

|

|

By: |

Rialto Partners GP II, LLC, |

| |||

|

|

|

a Delaware limited liability company, |

| |||

|

|

|

its General Partner |

| |||

|

|

|

|

|

|

| |

|

|

|

By: |

Rialto Capital Advisors, LLC, |

| ||

|

|

|

|

a Delaware limited liability company, |

| ||

|

|

|

|

its Attorney in fact |

| ||

|

|

|

|

|

|

| |

|

|

|

|

By: |

/s/ Mike Farley |

| |

|

|

|

|

Name: |

Mike Farley |

| |

|

|

|

|

Title: |

Director |

| |

|

|

|

|

|

|

| |

|

“TENANT” |

| |||||

|

|

| |||||

|

ITERIS, INC., |

| |||||

|

a Delaware corporation |

| |||||

|

|

|

|

|

|

| |

|

By: |

/s/ Abbas Mohaddes |

| ||||

|

Name: |

Abbas Mohaddes |

| ||||

|

Title: |

CEO |

| ||||

|

|

|

|

| |||

|

By: |

/s/ Dan Gilliam |

| ||||

|

Name: |

Dan Gilliam |

| ||||

|

Title: |

Assistant Secretary |

| ||||

EXHIBIT A

PREMISES

[See attached]

EXHIBIT A

|

|

1ST FLOOR TENANT SQUARE FOOTAGE: 126,289 USF 1ST FLOOR GIVE-BACK SQUARE FOOTAGE: 410,182 USF COMMON AREAS OWNER TO CONSTRUCT 1 HOUR RATED CORRIDOR EXTENSION FROM LOBBY TO RESTROOMS. CORRIDOR TO INCLUDE ALL WALLS, CEILINGS, LIGHTING, FIRE SPRINKLER, FLOOR AND WALL FINISHES. FINISHES TO BE CONSISTENT WITH LOBBY FINISHES. AREA OF CORRIDOR INDICATED BY. INCLUDE RECESSING 1TERIS ENTRY DOORS. OWNER TO DEMISE THE GIVE BACK SPACE FROM ITERIS SPACE. PROVIDE NEW WALLS TO SECURE SPACE. REWORK HVAC, LIGHTING 4 POWER SO EACH SPACE IS SEPARATE. FINISH WALLS ON GIVE BACK SIDE OF WALLS, RELOCATE DOOR TO ELECTRICAL ROOM SO ACCESS TO ELECTRICAL ROOM IS INSIDE ITERIS’S SPACE. NEW 48’ DOOR FOR COMPUTER ROOM ACCESS. ITERIS 1700 CARNEGIE SANTA ANA, CA EXHIBIT A 1ST FLOOR EXHIBIT |

|

|

EXHIBIT “A” PREMISES Suite 200 EXHIBIT A” -2- |