Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Seven Seas Cruises S. DE R.L. | d783539d8k.htm |

| EX-99.2 - EX-99.2 - Seven Seas Cruises S. DE R.L. | d783539dex992.htm |

Exhibit 99.1

NORWEGIAN CRUISE LINE HOLDINGS LTD. NCL NORWEGIAN CRUISE LINE® ACQUISITION OF PRESTIGE CRUISES INTERNATIONAL, INC. OCEANIA CRUISES SEPTEMBER 2, 2014 REGENT SEVEN SEAS CRUISES

MANAGEMENT PRESENTERS

Kevin Sheehan President and Chief Executive Officer Norwegian Cruise Line Holdings Ltd. Wendy Beck Executive Vice-president and Chief Financial Officer Norwegian

Cruise Line Holdings Ltd. Frank Del Rio Chairman and Chief Executive Officer Prestige Cruises International, Inc. Andrea DeMarco Director, Investor Relations Norwegian Cruise Line Holdings Ltd.

2 NCL NORWEGIAN CRUISE LINE®

FORWARD LOOKING STATEMENTS

This presentation may contain statements, estimates or projections that constitute “forward-looking statements” as defined under U.S. federal securities

laws. Generally, the words “will,” “may,” “believes,” “expects,” “intends,” “anticipates,” “projects,” “plans,” “seeks,” and similar expressions are intended

to identify forward-looking statements, which are not historical in nature.

Forward-looking statements are based on management’s current expectations and

assumptions, and are subject to significant business, economic, regulatory and competitive risks and uncertainties (many of which are beyond the control of the company and management) that could cause actual results, performance or achievements to

differ significantly from Norwegian’s historical results or those implied in forward-looking statements. You should not place undue reliance on forward-looking statements as a prediction of actual results. Norwegian expressly disclaims any

obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in expectations or events, conditions or circumstances on which any such statements are based. For a discussion of some of

the important factors that could cause these variations, please consult the “Risk Factors” section of the prospectus filed with the SEC.

We use certain

non-GAAP financial measures in this presentation, such as EBITDA, Adjusted EBITDA, net onboard yield, and compound annual growth rate, to enable us to analyze our performance. We utilize these financial measures to manage our business on a

day-to-day basis and believe that they are the most relevant measures of our financial performance. Some of these measures are commonly used in the cruise industry to measure performance. Our use of a non-GAAP financial measure may not be comparable

to other companies within our industry. For a discussion concerning non-GAAP financial measures, please refer to our respective filings with the SEC.

This

information is confidential, and should not be photocopied, distributed or disclosed to anyone other than to whom it is provided, and your acceptance of this document is deemed to be an agreement to these terms.

3 NCL NORWEGIAN CRUISE LINE®

ADDITIONAL INFORMATION ABOUT THE TRANSACTION

The transaction discussed in this presentation is being provided for informational purposes only. WE ARE NOT ASKING FOR

A PROXY, AND YOU ARE REQUESTED NOT TO SEND A PROXY.

In connection with the transaction, we

will file relevant materials with the SEC, including a Schedule 14C information statement. Investors and security holders are urged to read these documents (if and when they become available) and any other relevant documents filed with the SEC, as

well as any amendments or supplements to those documents, because they will include important information about Prestige, Norwegian, and the transaction. Investors and stockholders will be able to obtain free copies of the information statement and

other documents containing important information about Prestige and Norwegian, once such documents are filed with the SEC by Norwegian, through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by

[Norwegian] will be available free of charge of [Norwegian’s] investor relations website at www.investor.ncl.com or by contacting Norwegian’s Investor Relations Department at 305-468-2339.

This presentation is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for

any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the acquisition or otherwise.

4 NCL NORWEGIAN CRUISE LINE®

NCL NORWEGIAN CRUISE LINE®

OCEANIA CRUISES

REGENT SEVEN SEAS CRUISES

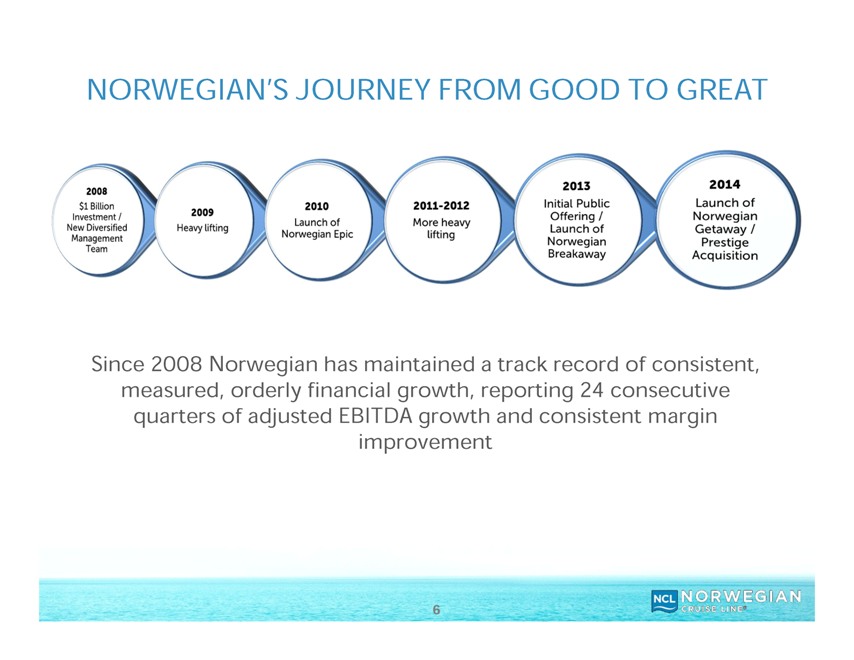

NORWEGIAN’S JOURNEY FROM GOOD TO GREAT

2008

$1 Billion Investment /

New Diversified Management Team 2009 Heavy lifting 2010 Launch of Norwegian Epic 2011-2012 More heavy lifting 2013 Initial Public Offering / Launch of Norwegian Breakaway 2014

Launch of Norwegian Getaway / Prestige Acquisition

Since 2008 Norwegian has maintained a track record of consistent, measured, orderly financial growth, reporting

24 consecutive quarters of adjusted EBITDA growth and consistent margin improvement

6 NCL NORWEGIAN CRUISE LINE®

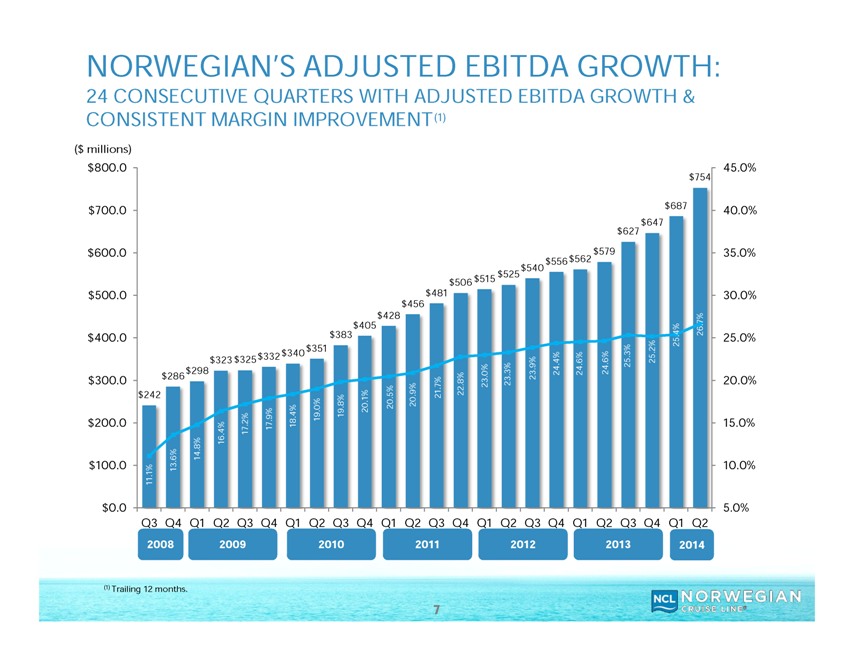

NORWEGIAN’S ADJUSTED EBITDA GROWTH:

24 CONSECUTIVE QUARTERS WITH ADJUSTED EBITDA GROWTH & CONSISTENT MARGIN IMPROVEMENT(1)

($ millions)

$800.0

$700.0

$600.0

$500.0

$400.0

$300.0

$200.0

$100.0

$0.0

45.0%

40.0%

35.0%

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2008 2009 2010 2011 2012 2013 2014

11.1% $242

13.6% $286

14.8% $298

16.4% $323

17.2% $325

17.9% $332

18.4% $340

19.0% $351

19.8% $383

20.1% $405

20.5% $428

20.9% $456

21.7% $481

22.8% $506

23.0% $515

23.3% $525

23.9% $540

24.4% $556

24.6% $562

24.6% $579

25.3% $627

25.2% $647

25.4% $687

26.7% $754

(1) Trailing 12 months.

NCL NORWEGIAN

CRUISE LINE®

7

COMPELLING STRATEGIC RATIONALE

• Combination creates a diversified, industry-leading cruise operating company

- Three

complementary brands with presence across market segments

• Further enhances industry-leading financial metrics

• Sharing of best practices among brands and synergies from breadth of scale

•

Increases economies of scale providing greater operational leverage

• Expands growth trajectory and global footprint

• Complementary new build programs provides measured, orderly capacity growth annually through 2019

8 NCL NORWEGIAN CRUISE LINE®

TRANSACTION OVERVIEW

Overview

• Total purchase price of $3.025 billion (~11x 2014E Adjusted

EBITDA) subject to certain other adjustments(1)

• Day one identified synergies of $25 million with continuing benefits to be realized over the next several

years

Pro Forma Impact

• Combined Pro Forma LTM June 30 Revenue of

$4.1 billion and Adjusted EBITDA of $1.0 billion(2)

- Pro Forma net leverage at September 30 of 5.3x(2)(3) and target leverage of approximately 4x within 18

months

• Expected to be accretive to earnings in 2015 pre-synergies

-

High single-digit percentage adjusted EPS accretion with synergies(4)

Sources of Funding

• Equity issuance of approximately 20.3 million shares or $670 million to Prestige shareholders, equivalent to ~10% of NCLH current shares outstanding(5)

- Certain Prestige shareholders will be subject to lock-up

• Remaining consideration in

cash, to be financed with a mix of bank debt, bonds and cash on hand

- Fully committed financing in place

Timing

• Expected to close in the fourth quarter of 2014

1. Additional contingent cash consideration of $50 million, upon achievement of certain performance metrics in 2015.

2. Including $25 million in identified synergies.

3. Includes annualized contribution for

Norwegian Getaway.

4. Excludes non-recurring amortization from purchase accounting.

5. Weighted average diluted shares outstanding at June 30, 2014.

9 NCL NORWEGIAN CRUISE

LINE®

PRESTIGE CRUISES INTERNATIONAL OVERVIEW

• Global leader in the upscale cruise segment with approximately 46% of berth capacity

• Operates two brands, Oceania Cruises and Regent Seven Seas Cruises

- 8

ships, approximately 6,500 berths with 87% balconies

- Loyal followings with high repeat guest rates

OCEANIA CRUISES

• Among the highest space-to-guest and crew to passenger ratios in the

industry, providing guests with unparalleled accommodations and individually-tailored service levels

Regent SEVEN SEAS CRUISES

• Brands cater to affluent and seasoned travelers

- Guests are less impacted by

recessionary pressures

• Attractive financial characteristics

-

Industry-leading net yield

- High visibility to future bookings

- Strong

EBITDA and earnings growth

Note: Upscale refers to Upper Premium and Luxury segments.

10 NCL NORWEGIAN CRUISE LINE®

ABOUT OCEANIA CRUISES

OCEANIA CRUISES

• Operates five small to mid-size vessels that provide

an upscale and sophisticated experience

• Offers destination-oriented cruises to approximately 330 ports around the globe with gourmet culinary experiences,

elegant accommodations and personalized service

• Expanded capacity by 122% with the addition of two 1,250-berth newbuilds in 2011 and 2012

• Conde Nast Traveler Gold List Platinum Circle 2013; Best Premium Cruise Line 2013 Virtuoso Awards

11 NCL NORWEGIAN CRUISE LINE®

ABOUT REGENT SEVEN SEAS CRUISES

Regent SEVEN SEAS CRUISES

‰ The most inclusive luxury product offering in the industry

‰ Operates three all-suite ships with a fourth under construction

‰

Focus on high level of personal service, unique shore excursions, world-class accommodations and top-rated cuisine

‰ Imaginative itineraries to approximately

300 ports worldwide

‰ Best Luxury Cruise Line 2013 Virtuoso Awards; Best for Luxury 2013 Cruise Critic Editor’s Choice

12 NCL NORWEGIAN CRUISE LINE®

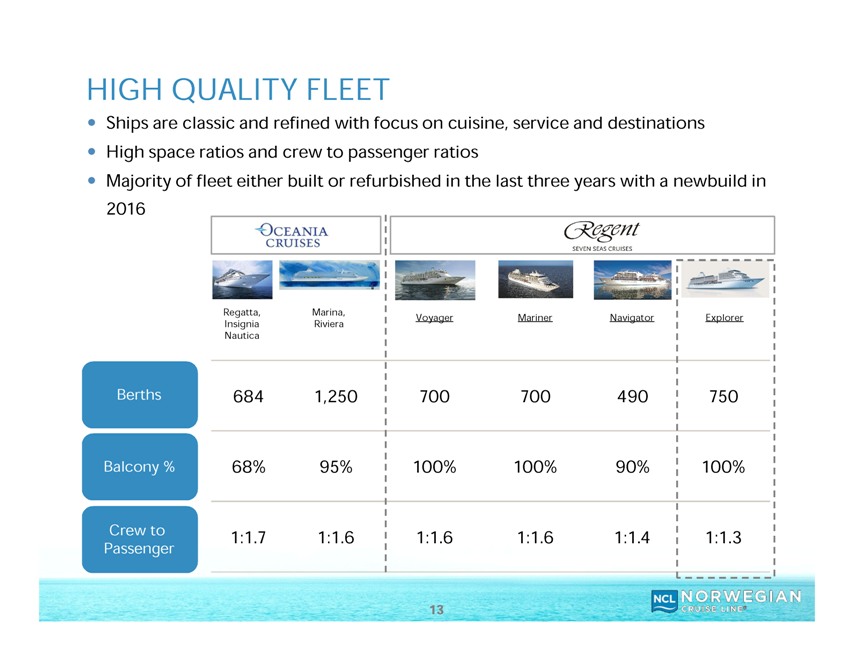

HIGH QUALITY FLEET

‰

Ships are classic and refined with focus on cuisine, service and destinations

‰ High space ratios and crew to passenger ratios

‰ Majority of fleet either built or refurbished in the last three years with a newbuild in 2016

OCEANIA CRUISES Regent SEVEN SEAS CRUISES

Regatta, Insignia Nautica Marina, Riviera Voyager

Mariner Navigator Explorer

Berths 684 1,250 700 700 490 750

Balcony % 68% 95%

100% 100% 90% 100%

Crew to Passenger 1:1.7 1:1.6 1:1.6 1:1.6 1:1.4 1:1.3

13

NCL NORWEGIAN CRUISE LINE®

REVENUE OPPORTUNITIES AND SYNERGIES

REVENUE ENHANCEMENT OPPORTUNITIES

‰ Leverage cross-selling opportunities by offering

products for every stage of a guests’ life cycle

- Leverage customer databases to offer targeted multi-generational and other experiences (i.e. The Haven)

‰ Explore multi-brand joint partnerships

‰ Use combined expertise

on product delivery to enhance the guest experience across the brands

‰ Glean learnings to benefit Pride of America’s unique proposition

SYNERGY OPPORTUNITIES

‰ Purchasing and procurement

‰ Crew recruitment and training

‰ Global port contracts

‰ Insurance

‰ Fuel and fuel efficiencies

‰ Marketing / Sponsorships / Partnerships

‰ Maintenance contracts and dry-docks

Revenue Enhancements and Synergies focused on maintaining brand integrity with no impact on the guest experience

14 NCL NORWEGIAN CRUISE LINE®

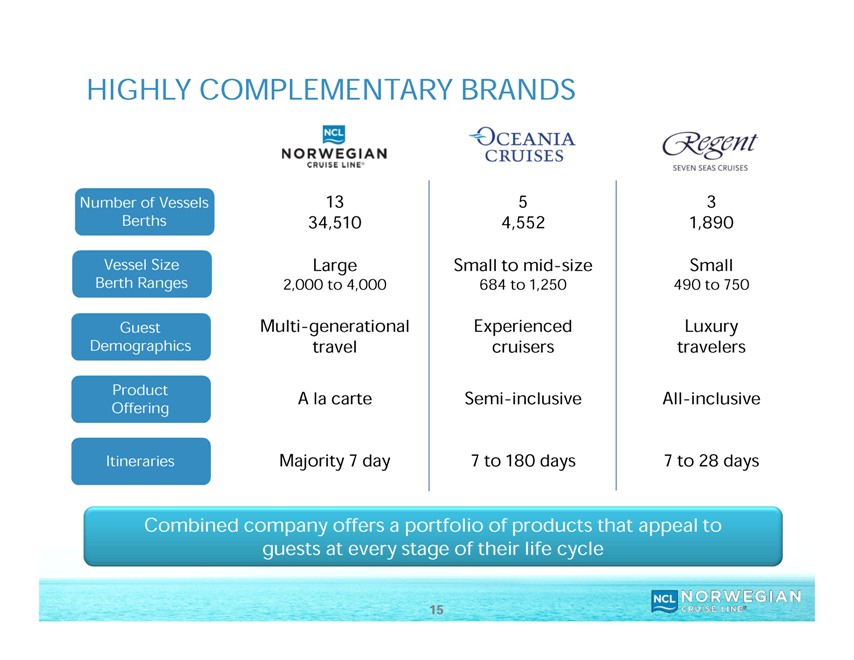

HIGHLY COMPLEMENTARY BRANDS

NCL NORWEGIAN CRUISE LINE® OCEANIA CRUISES Regent SEVEN SEAS CRUISES

Number of Vessels Berths 13 34,510 5 4,552 3 1,890

Vessel Size Berth Ranges

Large 2,000 to 4,000 Small to mid-size 684 to 1,250 Small 490 to 750

Guest Demographics Multi-generational travel Experienced cruisers Luxury travelers

Product Offering A la carte Semi-inclusive All-inclusive

Itineraries Majority 7 day 7 to 180

days 7 to 28 days

Combined company offers a portfolio of products that appeal to guests at every stage of their life cycle

15 NCL NORWEGIAN CRUISE LINE®

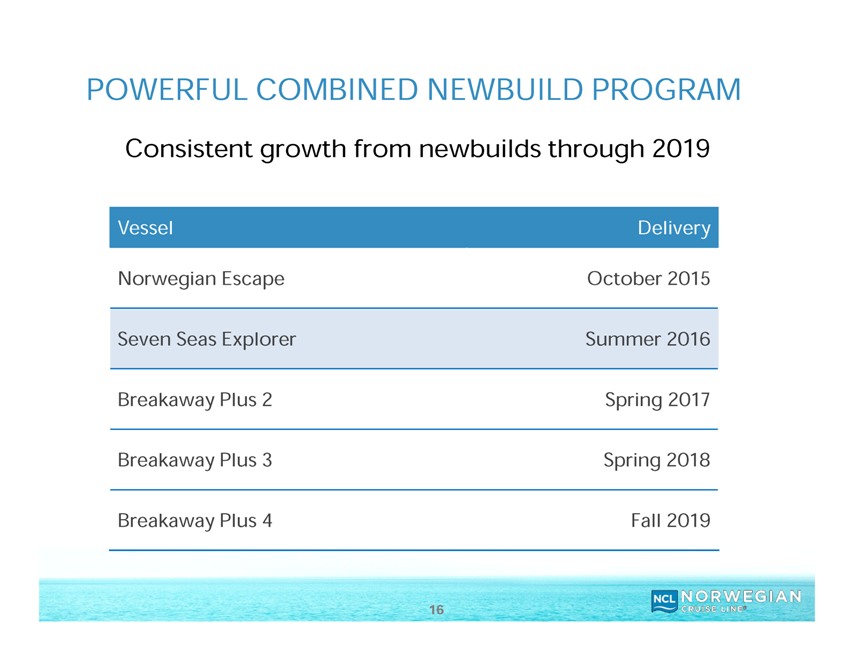

POWERFUL COMBINED NEWBUILD PROGRAM

Consistent growth from newbuilds through 2019

Vessel Delivery

Norwegian Escape October 2015

Seven Seas Explorer Summer 2016

Breakaway Plus 2 Spring 2017

Breakaway Plus 3 Spring 2018

Breakaway Plus 4 Fall 2019

16 NCL NORWEGIAN CRUISE LINE®

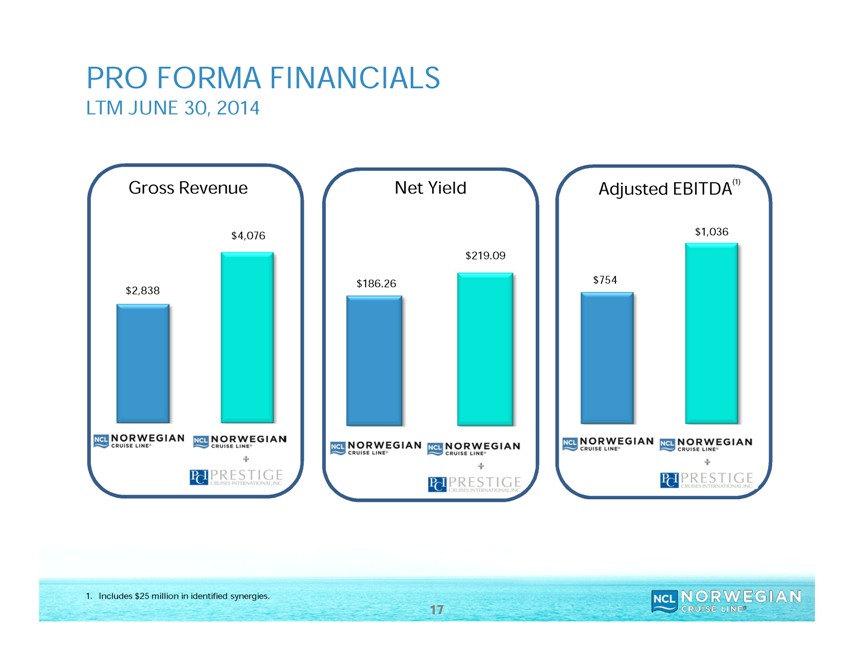

PRO FORMA FINANCIALS

LTM

JUNE 30, 2014

Gross Revenue Net Yield Adjusted EBITDA(1)

$2,838 $4,076

$186.26 $219.09

$754 $1,036

NCL NORWEGIAN CRUISE LINE® NCL NORWEGIAN CRUISE LINE® NCL NORWEGIAN CRUISE LINE® NCL NORWEGIAN CRUISE LINE® NCL NORWEGIAN CRUISE LINE® NCL NORWEGIAN CRUISE

LINE®

PCI PRESTIGE CRUISES INTERNATIONAL, INC. PCI PRESTIGE CRUISES INTERNATIONAL, INC. PCI PRESTIGE CRUISES INTERNATIONAL, INC.

1. Includes $25 million in identified synergies.

17 NCL NORWEGIAN CRUISE LINE®

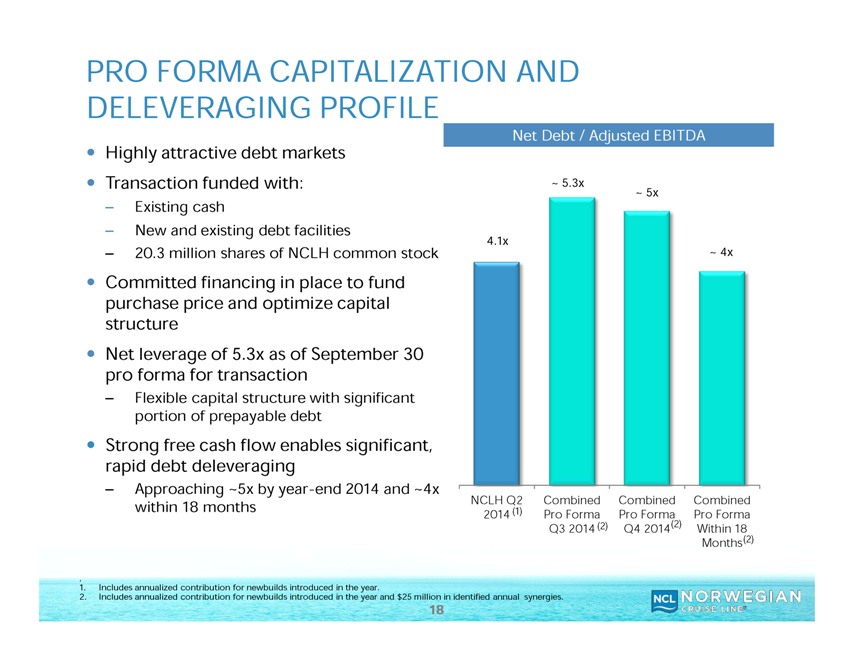

PRO FORMA CAPITALIZATION AND DELEVERAGING PROFILE

Highly attractive debt markets

Transaction funded with:

– Existing cash

– New and existing debt facilities

– 20.3 million shares of NCLH common stock

Committed financing in place to fund purchase

price and optimize capital structure

Net leverage of 5.3x as of September 30 pro forma for transaction

– Flexible capital structure with significant portion of prepayable debt

– Strong

free cash flow enables significant, rapid debt deleveraging

Approaching ~5x by year-end 2014 and ~4x within 18 months

Net Debt / Adjusted EBITDA

4.1x

NCLH Q2 2014 (1)

~5.3x

Combined Pro Forma

Q3 2014 (2)

~5x

Combined Pro Forma

Q4 2014(2)

~4x

Combined Pro Forma

Within 18 Months(2)

’

1. Includes annualized contribution for newbuilds introduced in the year.

2. Includes annualized contribution for newbuilds introduced in the year and $25 million in identified annual synergies.

18 NCL NORWEGIAN CRUISE LINE®

IN CONCLUSION, THIS TRANSACTION:

Combines Three Successful, Complementary Brands Across Different Market Segments

Will Retain

Distinct Brand Proposition, Guest Experience and Culture of Brands

Enhances Already Best-In-Class Financial Metrics

Expands Growth Trajectory with Measured Orderly Capacity Growth Through 2019

Is Immediately

Accretive on a non-GAAP, Adjusted EPS Basis

Provides Significant Synergies with Benefits for Years to Come

NCL NORWEGIAN CRUISE LINE®

OCEANIA CRUISESSM

Your World. Your WAY.SM

Regent SEVEN SEAS CRUISES

19 NCL NORWEGIAN CRUISE LINE®

NORWEGIAN CRUISE LINE HOLDINGS LTD.

ACQUISITION OF PRESTIGE CRUISES INTERNATIONAL, INC.

SEPTEMBER 2, 2014

NCL NORWEGIAN CRUISE LINE®

OCEANIA CRUISES

Regent SEVEN SEAS CRUISES

NORWEGIAN CRUISE LINE HOLDINGS LTD.

NON-GAAP RECONCILING INFORMATION

(unaudited)

Adjusted EBITDA (1) is calculated as follows (in thousands):

| Twelve months ended, | ||||||||||||||||||||||||

| September 30, 2008 |

December 31, 2008 |

March 31, 2009 |

June 30, 2009 |

September 30, 2009 |

December 31, 2009 |

|||||||||||||||||||

| Net income (loss) |

$ | (133,710 | ) | $ | (211,761 | ) | $ | (61,066 | ) | $ | (19,373 | ) | $ | (104,833 | ) | $ | 66,952 | |||||||

| Interest expense, net |

165,973 | 149,568 | 127,209 | 119,675 | 111,352 | 114,514 | ||||||||||||||||||

| Income tax expense |

1,192 | 874 | 820 | 634 | 554 | 503 | ||||||||||||||||||

| Depreciation and amortization expense |

162,048 | 162,565 | 160,793 | 158,530 | 155,853 | 152,700 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EBITDA |

195,503 | 101,246 | 227,756 | 259,466 | 162,926 | 334,669 | ||||||||||||||||||

| Other (income) expense |

15,389 | (1,886 | ) | (111,822 | ) | (105,220 | ) | 1,567 | (10,874 | ) | ||||||||||||||

| Other |

28,061 | 186,632 | 182,476 | 169,180 | 159,993 | 8,459 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 238,953 | $ | 285,992 | $ | 298,410 | $ | 323,426 | $ | 324,486 | $ | 332,254 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Twelve months ended, | ||||||||||||||||||||||||

| March 31, 2010 |

June 30, 2010 |

September 30, 2010 |

December 31, 2010 |

March 31, 2011 |

June 30, 2011 |

|||||||||||||||||||

| Net income |

$ | 47,507 | $ | 17,779 | $ | 23,948 | $ | 22,986 | $ | 28,939 | $ | 72,210 | ||||||||||||

| Interest expense, net |

125,261 | 135,923 | 156,440 | 173,672 | 185,730 | 195,402 | ||||||||||||||||||

| Income tax expense |

457 | 400 | 338 | 136 | 85 | 791 | ||||||||||||||||||

| Depreciation and amortization expense |

152,573 | 153,334 | 161,663 | 170,191 | 178,591 | 186,205 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EBITDA |

325,798 | 307,436 | 342,389 | 366,985 | 393,345 | 454,608 | ||||||||||||||||||

| Other (income) expense |

7,110 | 36,682 | 32,995 | 33,815 | 30,831 | (3,300 | ) | |||||||||||||||||

| Other |

7,089 | 6,833 | 7,703 | 4,313 | 3,994 | 4,624 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 339,997 | $ | 350,951 | $ | 383,087 | $ | 405,113 | $ | 428,170 | $ | 455,932 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Twelve months ended, | ||||||||||||||||||||||||

| September 30, 2011 |

December 31, 2011 |

March 31, 2012 |

June 30, 2012 |

September 30, 2012 |

December 31, 2012 |

|||||||||||||||||||

| Net income |

$ | 88,821 | $ | 126,859 | $ | 138,076 | $ | 144,883 | $ | 165,562 | $ | 168,556 | ||||||||||||

| Interest expense, net |

199,092 | 190,187 | 188,488 | 190,711 | 188,019 | 189,930 | ||||||||||||||||||

| Income tax expense |

1,624 | 1,700 | 1,775 | 1,103 | 626 | 706 | ||||||||||||||||||

| Depreciation and amortization expense |

186,181 | 183,985 | 183,525 | 183,695 | 185,601 | 189,537 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EBITDA |

475,718 | 502,731 | 511,864 | 520,392 | 539,808 | 548,729 | ||||||||||||||||||

| Other (income) expense |

113 | (2,634 | ) | (3,287 | ) | (889 | ) | (4,280 | ) | (2,099 | ) | |||||||||||||

| Other |

5,596 | 5,942 | 6,175 | 5,922 | 4,898 | 9,004 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 481,427 | $ | 506,039 | $ | 514,752 | $ | 525,425 | $ | 540,426 | $ | 555,634 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Twelve months ended, | ||||||||||||||||||||||||

| March 31, 2013 |

June 30, 2013 |

September 30, 2013 |

December 31, 2013 |

March 31, 2014 |

June 30, 2014 |

|||||||||||||||||||

| Net income attributable to Norwegian Cruise Line Holdings Ltd. |

$ | 68,877 | $ | 24,005 | $ | 66,675 | $ | 101,714 | $ | 249,376 | $ | 369,833 | ||||||||||||

| Interest expense, net |

271,416 | 326,197 | 305,628 | 282,602 | 186,118 | 114,292 | ||||||||||||||||||

| Income tax expense |

2,828 | 3,804 | 11,339 | 11,802 | 218 | 2,295 | ||||||||||||||||||

| Depreciation and amortization expense |

192,488 | 199,662 | 207,336 | 215,593 | 228,485 | 238,090 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EBITDA |

535,609 | 553,668 | 590,978 | 611,711 | 664,197 | 724,510 | ||||||||||||||||||

| Net income attributable to non-controlling interest |

(1,105 | ) | (1,179 | ) | 857 | 1,172 | 2,702 | 4,439 | ||||||||||||||||

| Other income |

(379 | ) | (2,807 | ) | (537 | ) | (1,403 | ) | (426 | ) | 328 | |||||||||||||

| Other |

27,728 | 29,448 | 35,291 | 35,715 | 20,242 | 24,495 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 561,853 | $ | 579,130 | $ | 626,589 | $ | 647,195 | $ | 686,715 | $ | 753,772 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The financial data presented for the years 2007 through 2012 are derived from NCLC’s consolidated financial statements and should be read in conjunction with those financial statements. Prior to the period ended March 31, 2013, the financial data presented are those of NCLC.

| (1) | Adjusted EBITDA is defined as EBITDA adjusted for other (income) expense, impairment loss and other supplemental adjustments (“Other”). We believe that Adjusted EBITDA is appropriate as a supplemental financial measure as it is used by management to assess operating performance, is a factor in the evaluation of the performance of management and is the primary metric used in determining the Company’s performance incentive bonus paid to its employees. We believe that Adjusted EBITDA is a useful measure in determining the Company’s performance as it reflects certain operating drivers of the Company’s business, such as sales growth, operating costs, marketing, general and administrative expense and other operating income and expense. Adjusted EBITDA is not a defined term under GAAP. Adjusted EBITDA is not intended to be a measure of liquidity or cash flows from operations or measures comparable to net income as it does not take into account certain requirements such as capital expenditures and related depreciation, principal and interest payments and tax payments and it includes other supplemental adjustments. |