Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Global Eagle Entertainment Inc. | v388214_8k.htm |

Exhibit 99.1

GLOBAL EAGLE ENTERTAINMENT Investor Presentation September 2014

2 Safe Harbor Statement We make forward - looking statements in this presentation within the meaning of the Securities Litigation Reform Act of 1995. These forward - looking statements relate to expectations or forecasts for future events, including without limitation our earnings, revenues, expenses or other future financial or business performance or strategies, or the impact of legal or regulatory matters on our business, results of operations or financial condition. These statements may be preceded by, followed by or include the words “may,” “might,” “will,” “will likely result,” “should,” “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “continue,” “target” or similar expressions. These forward - looking statements are based on information available to us as of the date they were made, and should not be relied upon as representing our views as of any subsequent date. These forward - looking statements are subject to a number of risks and uncertainties, including without limitation those risks and uncertainties described in our most recent annual report on Form 10 - K and subsequently filed reports on Form 10 - Q. As a result, our actual results or performance may be materially different from those expressed or implied by these forward - looking statements. We do not undertake any obligation to update forward - looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Safe Harbor Statement

3 • Global Eagle Entertainment (“GEE”) is a l eading full - service supplier to the rapidly growing In - flight Entertainment and Connectivity (“IFE&C”) media market • Offers best - in - class technology and the most diverse product offering to our 150+ airline customers globally • Bringing together media content and distribution into an integrated package for airline customers • Rapid IFE&C market growth, driven by increasing passenger demand to be “always connected” and the growth in air travel worldwide • Strong revenue growth and solid balance sheet and over $215 million in cash on the balance sheet • Seasoned management team and board with deep airline, media, and technology backgrounds Business Overview

4 Industry Leadership Financial Execution • Record 2Q14 quarterly revenue of $98 million • Strong adjusted EBITDA growth to $6.5 million • Completed acquisition of AIA in 2Q14 • Integration of acquisitions/AIA expected to add over $10 million in combined run - rate synergies • Continued growth both organically and through targeted acquisitions • 150+ Airline customers • Delivering satellite connectivity to 560+ planes worldwide • Multiple connectivity trials underway • ~60 % share of global market for in - flight content • Delivering content in 47 languages • Integrated content and connectivity solution Solid Execution of Strategic Priorities * As of June 30, 2014 Select Airline Customers

5 Wireless IFE • Wireless IFE content and software solution for BYOD passengers • Approved for secure AVOD streaming • Hardware agnostic platform Full Suite of In - flight Media Options Connectivity Solutions • White - labeled connectivity solution with airline - specific branding and interface • Internet connectivity • Live television and VOD • Sponsorship/Ads Embedded Systems • GEE is the largest supplier of content, media and apps • Easy - to - use , sleek GUI design • Integration with all major seatback IFE vendors Sponsorship and advertising opportunities increasing across all three platforms

6 Convergence of Content and Distribution Content Connectivity + = Integrated Solution • Offer all forms of media content from multiple languages across the globe • Accessible via multiple forms / portals - VOD - Live - Personal device and / or seatback • Capture high growth demand for in - flight WiFi • Gate - to - Gate • Proven satellite solution - Global partners - Ku / KuHTS - Deployed in 560+ aircraft • Digital media on any platform • Seamless, comprehensive offering • “One - stop shop” • Sponsorship opportunities • Enhanced passenger monetization opportunities

7 0 5000 10000 15000 0 4000 8000 IFE&C market estimated at ~$3bn in 2013 and growing rapidly, driven by proliferation of handheld devices and growth in worldwide air travel IFE&C Attractive Market Growth Rates Source: IMDC ( 1) Excludes L - band connected aircraft. IFE&C Rapid IFE&C Market Growth Aircraft with Connectivity Installed (1) ( # of Aircraft) Aircraft with IFE Installed ( # of Aircraft)

8 Large Addressable Market Source: IMDC and IATA Total Uncommitted Market : circa 13,000 Aircraft 1.1 Billion Passengers Per Year Total Global Carriers 29,264 – 100% Active Commercial Aircraft 23,151 – 79% Exclude props Aircraft >16 years old 16,050 – 55% Exclude connected (narrowband, broadband) ~13,433 Backlog (971 – 1,815) Large Connectivity Market Opportunity ( Unit: Number of Aircraft ) 5. 7 % U.S. International Low International Penetration Short Haul Long Haul Current Industry Take - Rate <>50% 9 - 10% 6 - 7%

Product Solutions

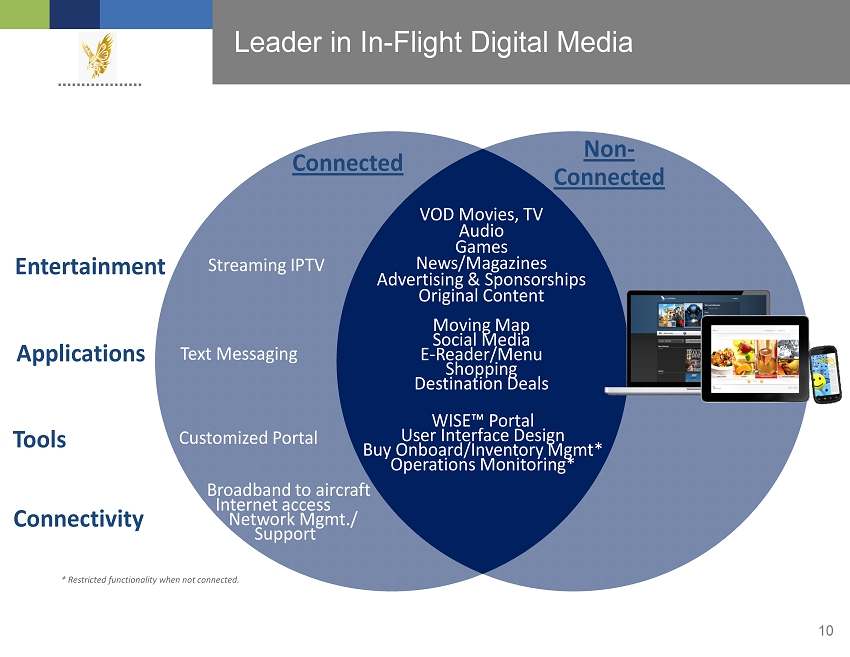

10 Entertainment Entertainment Applications Connectivity Tools VOD Movies, TV Audio Games News/Magazines Advertising & Sponsorships Original Content Connected Non - Connected Streaming IPTV Moving Map Social Media E - Reader/Menu Shopping Destination Deals Text Messaging Leader in In - Flight Digital Media * Restricted functionality when not connected. WISE™ Portal User Interface Design Buy Onboard/Inventory Mgmt* Operations Monitoring * Customized Portal Broadband to aircraft Internet access Network Mgmt ./ Support

11 Superior Product and Technology Platform Exclusive relationship with Hughes in North America; partner with leading providers in other regions Ku - band technology provides high speed broadband internet via flexible and scalable satellite platform Leading provider of in - flight Internet connectivity that can cover both land and sea EQUIPPED AIRCRAFT GROUND EARTH STATIONS INTERNET TCP IP & UDP IPoS LINK TCP IP & UDP IPoS LINK Customer Service Aircraft Maintenance/ IFE Management Billing System Network Management Center - Chicago, Il Ku SATELLITE Superior Connectivity Product and Technology Platform

12 Coverage Bandwidth Broadcast Expansion Ability Ku L - Band Ka Air - to - Ground – – – Connectivity Landscape • Global coverage • Greater number of installations • Larger number of satellite providers • Enables Gate - to - Gate • Proven • Redundancy • Broadcast (Live TV) suitability Advantages Disadvantages Ku Ka • High speed bandwidth • Low cost per MB • Regional coverage • Susceptible to weather interference • Heavy reliance upon limited number of suppliers • Lacks redundancy • Not suitable for broadcast • Higher cost per MB ( future cost reduction with High Throughput Satellite [HTS] ) • Lower bandwidth ( HTS will offer vastly increased bandwidth )

13 Largest Deployed Fleet of Satellite - Based Connectivity Systems Current fleet of customer aircraft – 568 system installations Largest Deployed Fleet of Satellite - Based Connectivity Systems

14 WISE Application • WISE platform provides an end - to - end wireless IFE content and software solution • Easy - to - use portal accessed via the aircraft’s WiFi system. Passengers can: • watch movies, • listen to music, • play video games, • read digital publications, et al • Sold to airline clients through third party hardware partners • Hardware agnostic platform. Partners include: • O nAir , Airbus/KID System, Honeywell and Rockwell Collins and other manufacturers • Multiple airlines have chosen WISE and deliveries began in 1H ’14 with launch customer Philippine Airlines WISE™ Wireless In - Flight Services & Entertainment WISE is approved by all major Hollywood studios for secured AVOD streaming of movies and TV programs Wireless IFE

15 Global Eagle Offers the Most Diverse Content Offering Original Content, Apps and Games • Largest market share in in - flight gaming content (180 game titles) • Original content creator • Leader in paperless cabin (eMeal menu, eDuty Free, eReader, eSurvey, World Traveler ) • GUI development • Safety videos • Exclusive airline distributor of Lionsgate / Summit, other independent movie products, and international content • Distributor of Asian, Bollywood, European and Middle Eastern content to airlines • Licensing of over 24 Chinese movies and 50 Hollywood titles a year • Post - production services making content usable for airlines • Services include subtitles, editing, encoding, duplicating, integrating, reformatting, voice - over, customizing • Video and audio content from worldwide sources delivered in 47 languages on multiple IFE platforms Licensing Content Services Global Eagle Offers the Most Diverse Content Offering

Financial Overview

17 Content and Connectivity Business Segments In - flight connectivity In - flight content Source of Revenue Connectivity Content Licensing ▪ Sale or license of media content, video and music programming, applications, and video games ▪ N/A Services ▪ Technical services such as encoding and editing of media content ▪ Wi - Fi, TV, VoD, Music, eBooks, Messaging ▪ Sponsorship, shopping and travel - related revenue Equipment ▪ N/A ▪ Sale of satellite - based connectivity equipment Content and Connectivity Business Segments

18 $44 $53 $57 $64 $72 $0 $20 $40 $60 $80 Q2-'13 Q3-'13 Q4-'13 Q1-'14 Q2-'14 Content Revenue ($MM) Adjusted EBITDA* ($ MM) Strong Business and Financial Momentum $1.2 $4.5 $8.6 $5.1 $6.5 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 Q2-'13 Q3-'13 Q4-'13 Q1-'14 Q2-'14 $19 $21 $23 $22 $27 $0 $10 $20 $30 Q2-'13 Q3-'13 Q4-'13 Q1-'14 Q2-'14 * See Appendix A for a reconciliation of Adjusted EBITDA and a reconciliation to Net Income Connectivity Revenue ($MM)

19 • On August 13, 2014, GEE commenced an offer to exchange 0.3333 shares of GEE’s common stock for each outstanding GEE warrant exercisable for shares of common stock at an exercise price of $11.50 per share ( approximately one share for every three warrants tendered), up to a maximum of 15,000,000 warrants . • The purpose of the offer is to reduce the number of shares of common stock that would become outstanding upon the exercise of warrants . • Warrants eligible to be tendered (subject to proration) include 15,791,262 warrants issued in GEE’s IPO and 7,040,001 warrants issued in a private placement to GEE’s founders in connection with GEE’s IPO. • The offer is not conditioned on the tender of any minimum number of warrants, but is subject to certain customary conditions. • GEE’s officers and directors are eligible to tender warrants pursuant to the offer. Two of GEE’s directors, Harry E. Sloan and Jeff Sagansky, hold an aggregate of 7,040,001 warrants and have agreed to tender all of their warrants. • The offer will expire, unless extended, at 9:00 a.m., Eastern Time, on Thursday, September 11, 2014 . See Appendix C for important information regarding the exchange offer. Enabling the first ‘Gate to Gate’ Wi - Fi and messaging solution Exchange Offer

20 Why We Win: Managing the Customer Experience • Driving new revenue streams for the airlines with solutions that manage the end - to - end customer experience • Integrated content, connectivity and digital media solution • Production facilities, studio relationships and logistics that drive scale and create competitive barriers • Proven satellite technology and network management with long history of successful international deployments • White - label solution enables the airline to maintain brand consistency during the inflight experience, providing new revenue opportunities and improving the passenger experience • New product roadmap for airlines and the travel industry to better engage their customers

Thank You

22 Appendix A: Reconciliation of Adjusted EBITDA ($MM) 2Q13 3Q13 4Q13 1Q14 2Q14 Net Income (13.2) (5.4) (70.6) (26.3) 12.0 Net Inc. Attributable to Non - Controlling Interests 0.1 - 0.3 0.2 - Income Tax 0.6 1.2 1.1 1.3 0.8 Other Income (Expense) 5.0 (1.7) 60.1 15.9 (20.3) Depreciation and Amortization 7.0 8.7 11.0 9.4 8.3 Stock - based Compensation 0.9 (0.6) 1.1 2.6 2.0 Acquisition and Realignment Costs 1.4 3.2 5.5 2.1 3.6 F/X Gain (Loss) on Intercompany Loan (0.5) (0.8) - - - Adjusted EBITDA $1.2 $4.5 $8.6 $5.1 $6.5 Note: Numbers may not add due to rounding

23 To supplement our consolidated financial statements, which are prepared and presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”), we use Adjusted EBITDA, which is a non - GAAP financial measure. The presentation of Adjusted EBITDA is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. For more information on this non - GAAP financial measure, please see the tables captioned “Reconciliations of Non - GAAP Measures to Unaudited Consolidated Statements of Operations” included at the end of this release. Adjusted EBITDA is the primary measure used by the Company's management and board of directors to understand and evaluate its financial performance and operating trends, including period to period comparisons, to prepare and approve its annual budget and to develop short and long term operational plans. Additionally, Adjusted EBITDA is the primary measure used by the compensation committee of the Company's board of directors to establish the funding targets for and fund its annual bonus pool for the Company's employees and executives. We believe our presentation of Adjusted EBITDA is useful to investors both because (1) it allows for greater transparency with respect to key metrics used by management in its financial and operational decision - making and (2) management frequently uses it in its discussions with investors, commercial bankers, securities analysts and other users of its financial statements. We define Adjusted EBITDA as net income (loss) before income tax expense, other income (expense), interest expense (income), depreciation and amortization, stock - based compensation, acquisition and realignment costs, F/X gain (loss) on intercompany loans and any gains or losses on certain asset sales or dispositions. Acquisition and realignment costs include such items, when applicable, as (a) non - cash GAAP purchase accounting adjustments for certain deferred revenue and costs, (b) legal, accounting and other professional fees directly attributable to acquisition activity, (c) employee severance payments and third party professional fees directly attributable to acquisition or corporate realignment activities, (d) certain non - recurring expenses associated with the Company’s expansion into China that did not generate associated revenue in 2014, and (e) expenditures related to the January 2013 business combination. Management does not consider these costs to be indicative of the Company's core operating results. With respect to projected full year 2014 Adjusted EBITDA*, a quantitative reconciliation is not available without unreasonable efforts, and we are unable to address the probable significance of the unavailable information. Appendix B : Definition of Adjusted EBITDA

24 This presentation is for informational purposes only and is neither an offer to buy nor the solicitation of an offer to sell any warrants to purchase shares of GEE common stock or any shares of GEE’s common stock. The exchange offer is being made only pursuant to the Offer to Exchange Letter, the Letter of Transmittal and related materials dated August 13, 2014 that GEE distributed to its warrantholders and filed with the Securities and Exchange Commission (“SEC”). Warrantholders should read carefully the Offer to Exchange Letter, the Letter of Transmittal and related materials because they contain important information, including the various terms and conditions of the exchange offer. Warrantholders are urged to carefully read these materials prior to making any decision with respect to the exchange offer. Warrantholders may obtain free copies of the Offer to Exchange Letter, the Letter of Transmittal and other related materials filed with the SEC at the SEC's website at www.sec.gov or GEE’s website at www.globaleagleent.com. In addition, warrantholders may also obtain copies of these documents, as available, free of charge, by contacting Morrow & Co., LLC, the Information Agent for the exchange offer, in writing at 470 West Avenue – 3rd Floor, Stamford, CT 06902, or by telephone at (800) 607 - 0088. Further , warrantholders who have questions regarding the exchange offer may contact Morrow as described above or Piper Jaffray & Co ., the financial advisor for the exchange offer, at ( 800) 214 - 0540. Enabling the first ‘Gate to Gate’ Wi - Fi and messaging solution Appendix C : Important Information Regarding the Exchange Offer