Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Altisource Portfolio Solutions S.A. | a14-20251_18k.htm |

Exhibit 99.1

|

|

September 2014 Investor Presentation |

|

|

Forward-Looking Statements / Non-GAAP Measures This presentation contains forward-looking statements. These statements may be identified by words such as “anticipate,” “intend,” “expect,” “may,” “could,” “should,” “would,” “plan,” “estimate,” “seek,” “believe” and similar expressions. We caution that forward-looking statements are qualified to certain risks and uncertainties that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors which could cause actual results to differ materially from these forward-looking statements may include, without limitation, general economic conditions, conditions in the markets in which Altisource is engaged, behavior of customers, suppliers and/or competitors, technological developments and regulatory rules. In addition, financial risks such as currency movements, liquidity and credit risks could influence future results. The foregoing list of factors should not be construed as exhaustive. Altisource disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Altisource management utilizes certain non-GAAP measures such as earnings before interest, taxes, depreciation and amortization, or EBITDA, as a key metric in evaluating its financial performance. EBITDA should be considered in addition to, rather than as a substitute for, income before income taxes, net income attributable to Altisource and cash flows from operations. This non-GAAP measure is presented as supplemental information and reconciled to net income attributable to Altisource in the Appendix. |

|

|

Table of Contents Strategy 3 Business Overview 10 Financial Performance 15 Growth Initiatives 18 Appendix 20 |

|

|

Strategy |

|

|

Home Sales Home Rentals Home Maintenance Mortgage Originations Mortgage Servicing Real Estate Marketplace Mortgage Marketplace Vision To be the premier real estate and mortgage marketplace offering both content and distribution to the marketplace participants Mission To offer homeowners, buyers, sellers, agents, mortgage originators and servicers trusted and efficient marketplaces to conduct real estate and mortgage transactions and improve outcomes for market participants Altisource Vision |

|

|

Large vendor network Technology to order, deliver and pay for services Affinity relationships BPM solutions and people Putting the Pieces Together to Serve Marketplaces |

|

|

Home Sales Home Rentals Home Maintenance Home buyers (and their agents) Home sellers (and their agents) Homeowners (and their agents) Renters (and their agents) Connecting With Homeowners (and their agents) Renters (and their agents) Service Providers Service Providers Service Providers Brokerage, on-line sales, title and escrow, valuation, insurance, etc. Brokerage, on-line rental, renovation management, property management, etc. Property inspection, preservation and renovation management, etc. Offering distribution Order and vendor management technology, payment and presentment technology, document management, advanced analytics models as a service, consumer engagement platform, etc. Offering content (SaaS solutions and people) Real Estate Marketplace |

|

|

Mortgage Origination Mortgage Servicing Mortgage Originators Service Providers Mortgage Servicers Service Providers Investors Origination technology, title and escrow, valuation, quality control, verification of employment and income, flood certifications, etc. Servicing technology and dialogue engines, title and escrow, insurance services, valuation, property inspection and preservation, default management services, etc. Order and vendor management technology, payment and presentment technology, document management, advanced analytics models as a service, consumer engagement platform, etc. Borrowers Borrowers Connecting With Offering content (SaaS solutions and people) Offering distribution Mortgage Marketplace |

|

|

Vendor selection Price discovery Order processing Fulfillment acceptance Quality control Compliance validation Vendor scoring Invoicing and payment Customer care Collections Advanced analytics Document management Rules engines and processing solutions that enable and improve the efficiency and effectiveness of the Real Estate and Mortgage Marketplaces. Our solutions are industry agnostic and can be applied to other marketplaces Distribution and Transaction Solutions Enabling the Marketplaces |

|

|

Real Estate Marketplace Mortgage Marketplace Home Sales1 5.0 million homes sold in the United States during the 12 months ended June 2014 for an aggregate sales price of ~$1.1 trillion Home Rentals2 21.3 million single family rental homes (13.8 million single unit rental homes) Home Maintenance2 74.5 million owner-occupied homes in the United States as of Q2’14 $396 per year per owner occupied home spent on home maintenance (excluding home improvement) (median amount) Mortgage Originations Estimated mortgage loan originations of $1.1 trillion and $1.2 trillion in 2014 and 2015, respectively 3 Between 15 and 20 transactions are ordered in connection with an originated loan4 Mortgage Servicing $9.9 trillion5 of unpaid principal balance in residential mortgage loans (approximately 49 million loans) outstanding in the United States as of Q1’14 1 Source: National Association of Realtors® 2 Source: U.S. Census Bureau 3 Source: Projections for 2014 and 2015 based on Mortgage Bankers Association July 15, 2014 forecast 4 Source: Internal estimates 5 Source: Federal Reserve Market Sizes |

|

|

Business Overview |

|

|

Business Overview Services to the real estate and mortgage marketplaces that are typically outsourced by loan servicers, originators and home owners Accounts receivable management and customer relationship management services Business process management solutions and distribution solutions to enable the real estate and mortgage marketplaces and infrastructure support Technology Services Mortgage Services Consolidated Altisource - 6/30/2014 LTM Service Revenue: $846.0mm Operating Income: $200.6mm EBITDA(1): $258.1mm Financial Services (1) EBITDA defined as net income attributable to Altisource plus income taxes, interest expense, depreciation and amortization |

|

|

Mortgage Services – Summary Service revenue growth principally from continued growth of Ocwen, services expansion and growth of services provided to Lenders One® members Operating margins have generally expanded due to scale benefits and operating efficiencies, partially offset by amortization of the intangible assets associated with the 2013 acquisition of the fee based businesses Overview 2008 – 6/30/14 LTM CAGR: 55% Operating margin is calculated using Service revenue, which we define as revenue less revenue from expense reimbursement and non-controlling interest Does not include eliminations. Some categories include default and originations related revenue |

|

|

Operating margin is calculated using Service revenue, which we define as revenue less revenue from expense reimbursement and non-controlling interest Operating income and margin exclude $2.8mm of goodwill impairment recognized in 2010 Financial Services – Summary 55 During 2013, asset recovery management significantly expanded its higher margin mortgage charge-off collections services Operating margins have expanded due to our expense management initiatives and customer base evolution towards the more stable and profitable customer relationship management and mortgage charge-off collections businesses (2) Overview |

|

|

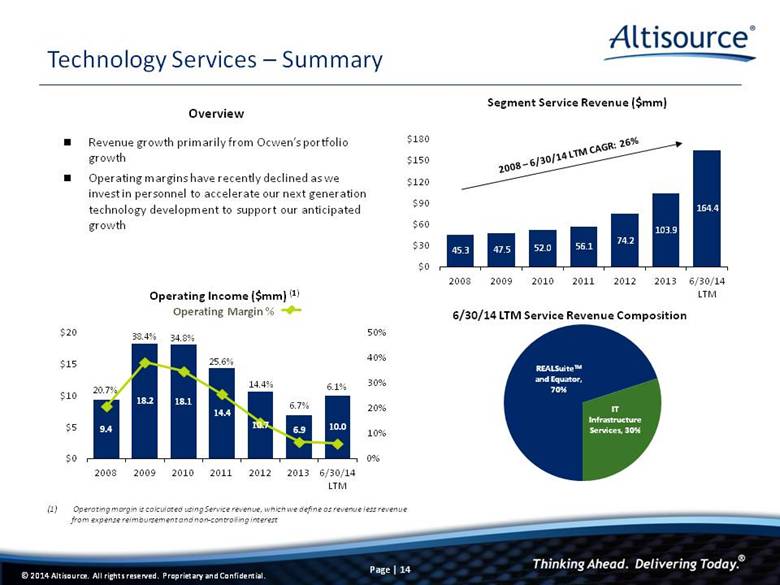

Technology Services – Summary Revenue growth primarily from Ocwen’s portfolio growth Operating margins have recently declined as we invest in personnel to accelerate our next generation technology development to support our anticipated growth 2008 – 6/30/14 LTM CAGR: 26% Overview (1) Operating margin is calculated using Service revenue, which we define as revenue less revenue from expense reimbursement and non-controlling interest |

|

|

Financial Performance |

|

|

Historical Performance |

|

|

Historical Performance |

|

|

Growth Initiatives |

|

|

Supporting Ocwen Expanding Hubzu to other institutions and the non-distressed home sale market Providing asset management services to the single family rental market Marketplace: Real Estate Supporting Ocwen Growing our origination related services through our access to over 14% of the U.S. origination market through Lenders One and Ocwen Developing NextGen REALServicing® technology Developing NextGen REALDoc®, REALTrans®, REALRemit®, REALAnalytics™ technologies, among others Deploying platform business process outsourcing offerings leveraging our next generation software with traditional BPO services Marketplace: Mortgage Distribution and Transaction Solutions Growth Initiatives |

|

|

Appendix |

|

|

Historical Financial Information – EBITDA Reconciliation LTM ($ mm) 6/30/14 Net Income attributable to Altisource $165.3 Income tax provision 10.5 Interest expense, net of interest income 21.7 Depreciation and amortization 60.6 EBITDA $258.1 |

|

|

About Altisource We are a premier marketplace and transaction solutions provider for the real estate, mortgage and consumer debt industries offering both distribution and content. We leverage proprietary business process, vendor and electronic payment management software and behavioral science based analytics to improve outcomes for marketplace participants. Contact Information All Investor Relations inquiries should be sent to: shareholders@altisource.lu Exchange NASDAQ Global Select Market Ticker ASPS Headquarters Luxembourg Employees More than 9,200 Investor Relations Information |