Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NephroGenex, Inc. | a8-kirpresentation92014.htm |

Company Presentation September 2014 Exhibit 99.1

Forward-Looking Statements This presentation includes statements that are, or may be deemed, ‘‘forward-looking statements.’’ In some cases, these forward- looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately” or, in each case, their negative or other variations thereon or comparable terminology, although not all forward-looking statements contain these words. They appear in a number of places throughout this presentation and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, our ongoing and planned discovery and development of drugs targeting kidney diseases, the strength and breadth of our intellectual property, our ongoing and planned preclinical studies and clinical trials, the timing of and our ability to make regulatory filings and obtain and maintain regulatory approvals for our product candidates, the degree of clinical utility of our products, particularly in specific patient populations, expectations regarding clinical trial data, our results of operations, financial condition, liquidity, prospects, growth and strategies, the length of time that we will be able to continue to fund our operating expenses and capital expenditures, our expected financing needs and sources of financing, the industry in which we operate and the trends that may affect the industry or us. By their nature, forward-looking statements involve risks and uncertainties because they relate to events, competitive dynamics, and healthcare, regulatory and scientific developments and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated. Although we believe that we have a reasonable basis for each forward-looking statement contained in this presentation, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this presentation as a result of, among other factors, the factors referenced in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2013 filed with the Securities and Exchange Commission during March 2014. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with the forward-looking statements contained in this presentation, they may not be predictive of results or developments in future periods. Any forward- looking statements that we make in this presentation speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this presentation, except as required by law. You should read carefully our Forward-Looking Statements and the factors described in the “Risk Factors” sections of our Annual Report on Form 10-K for the year ended December 31, 2013 to better understand the risks and uncertainties inherent in our business. 2

Corporate Overview Late-stage company developing therapies that target the underlying cause of kidney disease Oral Pyridorin (Phase 3) – to slow progression of diabetic nephropathy (DN) I.V. Pyridorin (Preclinical) – to treat acute kidney injury (AKI) Oral Pyridorin for DN is in Phase 3 of development. In completed Phase 2 studies, Pyridorin has demonstrated >50% treatment effect in the patient population being studied in Phase 3 FDA Fast Track Designation Proof of concept established in two large Phase 2a studies Preferred patient population identified in large Phase 2b study (307 patients) Benign safety profile First patient enrolled in trial on June 13 of 2014 SPA (Special Protocol Assessment) with FDA New fully approvable endpoint that reduces trial follow-up time & cost by ~50% compared to other DN Phase 3 programs 3

The NephroGenex Pipeline 4 Clinical Program / Indication Preclinical Phase 1 Phase 2 Phase 3 Worldwide Commercial Rights ORAL PYRIDORIN ® Diabetic Nephropathy I.V. PYRIDORIN ® Acute Kidney Injury Chronic oral bid 300 mg tablet targets pathogenic oxidative chemistries 2015 I.V. formulation for hospital patients targets pathogenic oxidative chemistries in AKI Clinical Program

The NephroGenex Team Member Affiliation, Position Pierre Legault Director Jim Mitchum Heart to Heart International, CEO Chairman of Audit Committee Robert Seltzer Care Capital, Director Chairman of Nominating Committee Eugen Steiner, M.D. BioStratum, Director HealthCap, Partner Member Affiliation, Position Pierre Legault, CEO Sanofi-Aventis, President Worldwide Dermatology Eckerd, President Rite Aid, CAO OSI Pharmaceuticals, CFO Prosidion Ltd, CEO Board Member, Regado Biosciences J. Wesley Fox, Ph.D., President & CSO BioStratum, Co-Founder & CSO EnzyMed, Co-Founder and President Abbott Laboratories, Scientist Mark Klausner, M.D., CMO CorMedix, CMO Johnson & Johnson, VP Harvard Medical School, M.D., Clinical Fellow John Hamill, CFO Savient Pharmaceuticals, CFO PharmaNet, CFO Chairman of the Board Richard Markham Care Capital, Partner Aventis, COO & Vice Chairman Aventis Pharma, CEO Chairman of Compensation Committee Experienced management team focused on clinical success Management Team Board of Directors 5

Financial Information Financial Information as of June 30, 2014: 8,855,114 common shares outstanding Approximately $29.9 million in cash, cash equivalents and investments Sufficient cash balance to reach early part of 2016 Capital structure ~ 9.7 M shares (8.8M common, 0.8 Options and 0.1 warrants) Closing stock price as of August 27, 2014 $5.15 (market cap of $45.6 million) Average volume (3 months) – 14,466 Principal investors: Care Capital: 4.24 million shares (47.9%) Rho Ventures: 1.33 million shares (15.0%) BioStratum: 0.54 million shares (6.1%) Visium: 0.48 million shares (5.4%) 6

7 Oral Pyridorin for Diabetic Nephropathy Overview

Oral Pyridorin Market Potential DN patients progress from high risk, to early stage (microalbuminuria), to overt nephropathy (macroalbuminuria), to end stage renal disease (ESRD) and dialysis 19 M diagnosed diabetics in the US, of which 33% (6.3 M) exhibit kidney disease 2.8 M macroalbuminuria (overt nephropathy) 3.5 M microalbuminuria and 3.6 M additional patients are at high risk of progressing to DN Diabetic nephropathy is a significant healthcare financial burden Current approved therapies are marginally effective Only ACEIs and ARBs are approved for DN, which do not treat the underlying cause of the disease A significant unmet medical need remains for treatments that can slow or halt DN Current treatments do not address underlying causes of DN, and patients progressively deteriorate Potential for significant worldwide revenues Could potentially treat 10 M patients in the U.S. 8

Pathophysiology of DN Hyperglycemia increases pathogenic oxidative chemistries* Elevated levels of oxidative chemistries promote the development and progression of DN* DN is the leading cause of dialysis and chronic kidney failure Pyridorin targets pathogenic oxidative chemistries, a key underlying cause of DN Pyridorin is an inhibitor and scavenger of the pathogenic oxidative chemistries that promote DN Oxidative damage to the kidney are caused by the accumulation of AGE (advanced glycation end products) which are inhibited and prevented by Pyridorin Pyridorin is an effective drug candidate for treating DN Pyridorin is the only advanced drug candidate for DN targeting an underlying cause of the disease N H 2 O H C H 3 C H O H N H 2 2 C Pyridorin™ *Contrib Nephrol (2011) Vol 170, p66; Kidney International (2000) Vol 58, Supp 77, pS26 9

Pyridorin Mechanism of Action O2/M n+ Protein Protein Protein Schiff base O2/M n+ O2/M n+ Reactive carbonyl species MGO & 3-DG and ROS O2/M n+ Protein Protein Amadori A.G.E. Protein A.G.E. Glucose Toxic carbonyl compounds Advanced glycation end-products ROS - Reactive oxygen species Advanced glycation end-products PYR PYR PYR PYR X X X X X PYR Oxidative Chemistries AGEs promote Diabetic Nephropathy 10

NephroGenex Phase 2a PYR-205/207 Pyridorin at a 250 mg bid dose is well tolerated and slows the rate of SCr increase in moderate to advanced disease patients Two multi-center, randomized, double-blind, placebo-controlled trials Number of centers: 20 (U.S., Belgium, United Kingdom, Canada, South Africa) Dose: 50mg BID x 2 weeks; 100mg BID x 2 weeks; 250mg BID x 20 weeks Study objectives: assess safety, tolerability and biological activity. All analyses done on combined studies Diabetic patients with DN due to type 1 or type 2 diabetes N=84 (57 treated, 27 placebo) Patients had macroalbuminuria and a bSCr < 3.5 mg/dL Note: Virtually all patients on standard of care at screening – ACEI/ARB therapy and blood pressure control 11 Patient Population Number of Subjects PYR, Placebo Baseline SCr PYR Placebo SCr Change from Baseline PYR Placebo Treatment Effect P value All Patients 57, 27 1.75 0.64 1.96 0.86 0.11 0.26 0.34 0.92 68% 0.0322

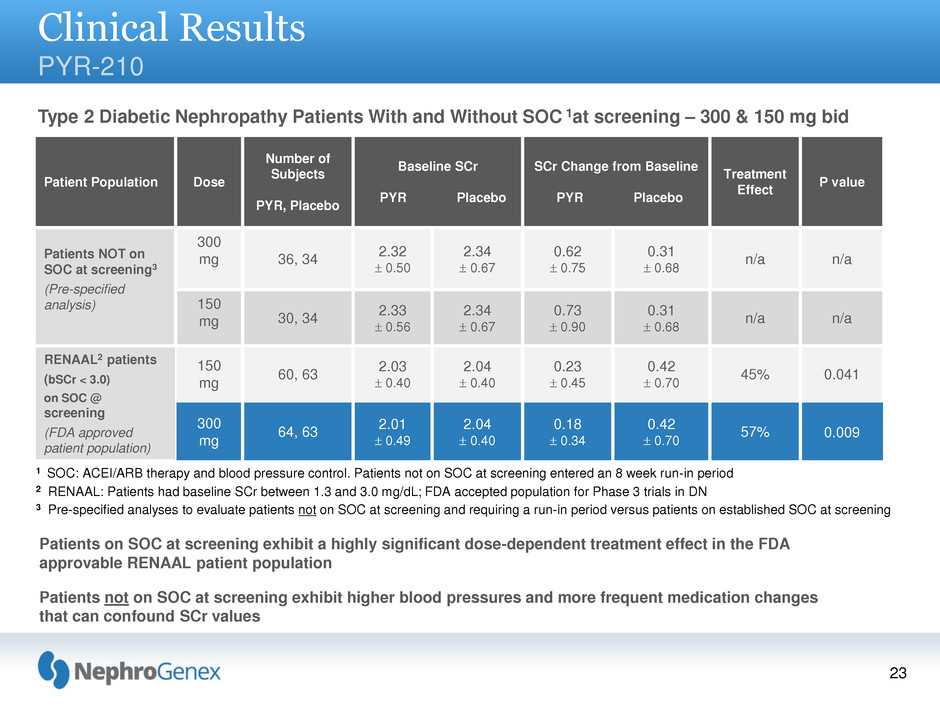

NephroGenex Phase 2b PYR-210 Established SOC patients approved by FDA for Phase 3 Patients on established (or stable) standard of care (SOC) at screening exhibit a highly significant dose-dependent treatment effect in the FDA approvable RENAAL patient population Patients not on SOC at screening exhibited higher initial blood pressures, more frequent medication changes, and drops in blood pressure during treatment, confounding SCr measurements (overall study did not meet end point) Multi-center, randomized, double-blind, placebo-controlled Number of centers: 61 (U.S., Australia, Israel) Doses:150mg BID x 12 months; 300mg BID x 12 months Endpoint: year-one SCr change Two doses were utilized to establish a dose-dependent treatment effect 2 RENAAL: Patients had baseline SCr between 1.3 and 3.0 mg/dL; FDA accepted population for Phase 3 trials in DN 3 300 mg is the go forward dose for phase 3 program 12 Patient Population Dose Number of Subjects PYR, Placebo Baseline SCr PYR Placebo SCr Change from Baseline PYR Placebo Treatment Effect P value RENAAL2 patients (bSCr < 3.0) on SOC @ screening (FDA approved patient population) 150 mg 60, 63 2.03 0.40 2.04 0.40 0.23 0.45 0.42 0.70 45% 0.041 300 mg 3 64, 63 2.01 0.49 2.04 0.40 0.18 0.34 0.42 0.70 57% 0.009

NephroGenex Phase 2 Safety Trials Pyridorin was well tolerated, had a benign safety profile, and slowed the rate of SCr increase in patients on stable SOC at screening There were no meaningful differences between groups in Aes • There were increases in diarrhea and constipation with the higher Pyridorin 300 mg bid dose - Diarrhea: Placebo = 6%, 150 mg = 3%, 300 mg = 11% - Constipation: Placebo = 4%, 150 mg = 4%, 300 mg = 10% There were no differences between groups in SAEs, mortality or ESRD There were no differences between groups for laboratory parameters (hematology, chemistry, HbA1c) There was no effect of Pyridorin on the QTc interval Pyridorin has a benign safety profile with the possible exception of a small increase in diarrhea and constipation with the higher dose of 300 mg bid 13

PIONEER Pyridorin Phase 3 Trials Protocol Objective: Evaluate safety and efficacy of Pyridorin at a 300 mg twice daily dose compared to placebo to reduce the rate of renal disease progression due to type 2 diabetes mellitus Patient Population Baseline SCr from 1.3 to 3.0 mg/dL with a PCR >1,200 mg/g; patients on established, stable regimen of SOC for 6 months Appropriate and stable dose of ACEi/ARB and BP medications Overall Trial Design Two identical, double-blind Phase 3 studies of 600 patients each, dose at 300 mg bid 105 centers world-wide (approximately: 55% U.S. and 45% rest of world) Duration estimated at approximately 3.5 years Powering 247 events 90% powering to detect a 28% treatment effect (57% treatment effect observed in Phase 2b study in relevant patient population) Endpoint: Time to a 50% SCr increase or ESRD Interim analysis: After all 600 patients have received study drug for at least 6 months, there will be an event-based endpoint analysis Financial resources: Sufficient resources to reach early part of 2016 14

PIONEER Pyridorin Phase 3 Trials Protocol Evaluate Pyridorin 300 mg twice daily (BID) efficacy compared to placebo in reducing the rate of progression of renal disease due to type 2 diabetes mellitus. With time to the composite endpoint consisting of the earliest event amongst: A Serum Creatinine (SCr) increase of ≥50% from baseline or; End Stage Renal Disease (ESRD) ESRD is defined as the initiation of permanent dialysis, receiving a kidney transplant, or a SCr value ≥ 6.0 mg/dL (528 μmol/L) with a second SCr confirmation value ≥ 6.0 mg/dL (528 μmol/L) obtained 4 – 6 weeks later. The key secondary objectives of the study (Pyridorin 300 mg BID to placebo) : 1) Time to the composite endpoint event of a SCr increase of ≥100% from baseline or ESRD 2) Safety of Pyridorin compared to placebo, as assessed by adverse events, 12-lead electrocardiograms (ECGs), vital signs, physical examination, clinical chemistries, glycosylated hemoglobin (HbA1c), and hematology 3) Additional secondary objectives of the study (Pyridorin 300 mg BID to placebo) at year 1 and 2: 15 Change in SCr from baseline Change in serum cystatin-C from baseline Change in urine protein/creatinine ratio (PCR) from baseline Change in urinary transforming growth factor-beta (TGF-β) excretion from baseline

PIONEER Trial Interim Analysis The Company expects to conduct an interim analysis after all 600 patients have received at least 6 months of study drug The analysis will be event-based and conducted by an independent third party biostatistician One of the following three outcomes will be delivered to NephroGenex: The study is on track to reach the primary endpoint The study will need additional events than originally planned to reach the primary endpoint The study is unlikely to reach the primary endpoint and results should be examined to generate new hypotheses for investigation 16

Exclusivity Patents and New Chemical Entity (NCE) U.S. Method of use (including patient population and dosage) patent December 2028 (with anticipated patent term extension) Method of manufacture patent February 2025 NCE - 5 year exclusivity Europe Method of use (including patient population and dosage) patent June 2024 (plus up to 5 year patent term extension) NCE - 10 year exclusivity Canada Method of use (including patient population and dosage) patent June 2024 NCE - 8 year exclusivity Japan NCE - 8 year exclusivity Pyridorin for DN is unencumbered: No future royalties, one minimal $200K milestone at approval 17

Corporate Summary Experienced management team focused on clinical success Diabetic nephropathy represents a large and growing unmet need Oral Pyridorin could potentially treat as many as 10 M patients, more than half of the diabetic population in the U.S. No FDA approved alternative treatments for DN Pyridorin could significantly decrease the rate of progression of diabetic nephropathy, the onset of ESRD and improve patient quality of life Oral Pyridorin Pivotal Phase 3 program in DN initiated Demonstrated benign safety profile in Phase 1 and Phase 2 studies >50% treatment effect in patient population from Phase 2b study selected for the Phase 3 program First patient in Phase 3 trial in June 2014 FDA Fast Track, SPA agreement with endpoint and patient population that reduces the time, cost and risk of Phase 3 development 18

19 Appendix

Pyridorin Phase 2a Program PYR-206 Multi-center, randomized, double-blind, placebo-controlled trial Number of centers: 46 Location of centers: U.S. Dose: 50mg BID x 24 weeks Study objectives: assess safety, tolerability and biological activity Diabetic patients with DN due to type 1 or type 2 diabetes N = 128 (65 treated, 63 placebo) Patients had macroalbuminuria and a baseline SCr (bSCr) ≤ 2.0 mg/dL A dose of 50 mg bid was examined in mild to moderate disease patients Pyridorin was well tolerated and slowed the rate of SCr increase 20

Clinical Results PYR-206 Mild to Moderate Diabetic Nephropathy – Dose 50 mg BID Pyridorin at a 50 mg bid dose is well tolerated and slows the rate of SCr increase in mild to moderate disease patients Note: Virtually all patients on standard of care at screening – ACEI/ARB therapy and blood pressure control 21 Patient Population Number of Subjects PYR, Placebo Baseline SCr PYR Placebo SCr Change from Baseline PYR Placebo Treatment Effect P value All Patients 65, 63 1.27 0.34 1.33 0.38 0.12 0.40 0.16 0.28 27% 0.2426 Type 2 Diabetes 40, 40 1.28 0.34 1.30 0.36 0.08 0.29 0.17 0.30 53% 0.0573 Baseline SCr ≥ 1.3 mg/dL 34, 30 1.54 0.21 1.65 0.28 0.13 0.53 0.26 0.33 50% 0.0691 Type 2 Diabetes, Baseline SCr ≥ 1.3 mg/dL 22, 19 1.53 0.20 1.59 0.73 0.06 0.37 0.29 0.35 79% 0.0074

Clinical Results PYR-205/207 Moderate to Advanced Diabetic Nephropathy – Dose 250 mg bid Pyridorin at a 250 mg bid dose is well tolerated and slows the rate of SCr increase in mild to moderate disease patients Note: Virtually all patients on standard of care at screening – ACEI/ARB therapy and blood pressure control 22 Patient Population Number of Subjects PYR, Placebo Baseline SCr PYR Placebo SCr Change from Baseline PYR Placebo Treatment Effect P value All Patients 57, 27 1.75 0.64 1.96 0.86 0.11 0.26 0.34 0.92 68% 0.0322 Type 2 Diabetes 45, 22 1.74 0.67 1.94 0.92 0.12 0.27 0.38 1.02 68% 0.0498 Baseline SCr ≥ 1.3 mg/dL 42, 19 2.00 0.55 2.37 0.67 0.12 0.30 0.47 1.09 74% 0.0454 Type 2 Diabetes, Baseline SCr ≥ 1.3 mg/dL 33, 15 2.00 0.58 2.40 0.73 0.14 0.31 0.55 1.22 75% 0.058

Clinical Results PYR-210 Type 2 Diabetic Nephropathy Patients With and Without SOC 1at screening – 300 & 150 mg bid Patients on SOC at screening exhibit a highly significant dose-dependent treatment effect in the FDA approvable RENAAL patient population Patients not on SOC at screening exhibit higher blood pressures and more frequent medication changes that can confound SCr values 1 SOC: ACEI/ARB therapy and blood pressure control. Patients not on SOC at screening entered an 8 week run-in period 2 RENAAL: Patients had baseline SCr between 1.3 and 3.0 mg/dL; FDA accepted population for Phase 3 trials in DN 3 Pre-specified analyses to evaluate patients not on SOC at screening and requiring a run-in period versus patients on established SOC at screening 23 Patient Population Dose Number of Subjects PYR, Placebo Baseline SCr PYR Placebo SCr Change from Baseline PYR Placebo Treatment Effect P value Patients NOT on SOC at screening3 (Pre-specified analysis) 300 mg 36, 34 2.32 0.50 2.34 0.67 0.62 0.75 0.31 0.68 n/a n/a 150 mg 30, 34 2.33 0.56 2.34 0.67 0.73 0.90 0.31 0.68 n/a n/a RENAAL2 patients (bSCr < 3.0) on SOC @ screening (FDA approved patient population) 150 mg 60, 63 2.03 0.40 2.04 0.40 0.23 0.45 0.42 0.70 45% 0.041 300 mg 64, 63 2.01 0.49 2.04 0.40 0.18 0.34 0.42 0.70 57% 0.009

Rationale Pyridorin targets specific pathogenic oxidative chemistries that emerge in diabetes These pathogenic oxidative chemistries also emerge in acute kidney injury caused by: − Reperfusion injury in CV surgery − Contrast media in angiography − Severe AKI may result in acute renal failure (ARF) Commercial Opportunity Hospitalized patients at risk for AKI I.V. formulation of Pyridorin Large unmet medical need as ~5% of all inpatients experience AKI I.V. Pyridorin Himmelfarb J et al. JASN 2004;15:2449-2456 Pathogenic oxidative chemistries surge in AKI 24