Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION - Grand China Energy Group Ltd | f10k2013a1ex31ii_china.htm |

| EX-32.1 - CERTIFICATION - Grand China Energy Group Ltd | f10k2013a1ex32i_china.htm |

| EX-32.2 - CERTIFICATION - Grand China Energy Group Ltd | f10k2013a1ex32ii_china.htm |

| EX-31.1 - CERTIFICATION - Grand China Energy Group Ltd | f10k2013a1ex31i_china.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Grand China Energy Group Ltd | Financial_Report.xls |

| EX-10.4 - EQUITY TRANSFER AGREEMENT - Grand China Energy Group Ltd | f10k2013a1ex10iv_china.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2013

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________________ to __________________

Commission file number: 000-53490

GRAND CHINA ENERGY GROUP LIMITED

(Exact name of registrant as specified in its charter)

| British Columbia | N/A | |

| State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization | Identification No.) |

| Room 1601, 16/F, China Taiping Tower Phase II, 8 Sunning Road, Causeway Bay Hong Kong |

| (Address of principal executive offices and Zip Code) |

Registrant's telephone number, including area code: (852) 3691-8831

SGB INTERNATIONAL HOLDINGS, INC.

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act

| Title of Each Class | Name of each Exchange on which registered | |

| Nil | N/A |

Securities registered pursuant to Section 12(g) of the Act

Common Stock, no par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes o No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

| (Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

173,118,558 shares of common stock at a price of $0.01 per share for an aggregate market value of about $1,731,196.1

1 The aggregate market value of the voting stock held by non-affiliates is computed by reference to the price of shares of common stock sold on April 8, 2014.

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

373,793,578 shares of common stock are issued and outstanding as of April 8, 2014.

Explanatory Note

Grand China Energy Group Limited. (Former name: SGB International Holdings Inc., the “Company”, “SGB”, “we”, “us”, “our”) is filing this Amendment No. 1 (Amendment) to its Annual Report on Form 10-K for the year ended December 31, 2013 (Original Form 10-K) filed with the Securities and Exchange Commission (SEC) on April 15, 2014 (Original Filing Date) to revise the Company’s disclosure related to the equity interest transfer of our subsidiaries in its Original Form 10-K.

Except for the foregoing amended and restated information, no other changes have been made to the Original Form 10-K. This Amendment continues to describe conditions as of the date of the Original Filing Date, and the disclosures contained herein have not been updated to reflect events, results or developments that have occurred after the Original Filing Date, or to modify or update those disclosures affected by subsequent events.

Accordingly, forward-looking statements included in this Amendment represent management’s views as of the Original Filing Date and should not be assumed to be accurate as of any date thereafter. This Amendment should be read in conjunction with the Company’s other filings with the SEC, together with any amendments to those filings.

TABLE OF CONTENTS

Forward-Looking Statements

This report contains forward-looking statements. Forward-looking statements are statements that relate to future events or future financial performance. In some cases, you can identify forward-looking statements by the use of terminology such as “may”, “should”, “intend”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “project”, “predict”, “potential”, or “continue” or the negative of these terms or other comparable terminology. These statements speak only as of the date of this report. Examples of forward-looking statements made in this annual report include statements pertaining to, among other things:

| · | our future development programs and results; |

| · | our future capital expenditures; |

| · | our future investments in and acquisitions of mineral properties; |

| · | our financial and operating performance; |

| · | the estimation of mineral reserves and the realization of mineral reserve estimates; |

| · | operating expenditures; |

| · | governmental regulation of mining operations; and |

| · | our need for, and our ability to raise, capital. |

The material assumptions supporting these forward-looking statements include, among other things:

| · | our ability to obtain any necessary financing on acceptable terms, if and when needed; |

| · | timing and amount of capital expenditures; |

| · | our ability to obtain necessary drilling and related equipments in a timely and cost-effective manner to carry out operating activities; |

| · | retention of skilled personnel; |

| · | the timely receipt of required regulatory approvals; |

| · | continuation of current tax and regulatory regime; |

| · | current exchange rate and interest rates; and |

| · | general economic and financial market conditions. |

| 2 |

Although management considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

These forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, including:

| · | risks and uncertainties relating to the interpretation of sampling results, the geology, grade and continuity of mineral deposits; |

| · | statements respecting anticipated business activities; |

| · | planned expenditures; |

| · | corporate strategies; |

| · | proposed acquisitions and dispositions of assets; |

| · | anticipated capital expenditures; |

| · | future production; |

| · | expected mine life; |

| · | future exploration and expenditures on our company’s properties; |

| · | estimates of future Chinese demand for coal; |

| · | risks and uncertainties that results of initial sampling and mapping will not be consistent with our expectations; |

| · | mining and development risks, including risks related to accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in production; |

| · | the potential for delays in exploration, development, or production activities; |

| · | risks related to the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses; |

| · | risks related to commodity price fluctuations; |

| · | risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our operations; |

| · | risks related to environmental regulation and liability; |

| · | risks that the amounts reserved or allocated for environmental compliance, reclamation, post-closure control measures, monitoring and on-going maintenance may not be sufficient to cover such costs; |

| · | risks related to tax assessments; |

| · | political and regulatory risks associated with mining development and exploration; and |

| · | the risks in the section entitled “Risk Factors”. |

These risks, as well as risks that we cannot currently anticipate, could cause our company’s or our industry’s actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. Except as required by applicable law, including the securities laws of the United States and Canada, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

In this report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock. “RMB” or “Renminbi” refers to the legal currency of China and “$” or “US$” refers to the legal currency of the United States. “China” or “PRC” refers to the People’s Republic of China.

| 3 |

As used in this report, the terms “we”, “us”, and “ our” refer to SGB International Holdings Inc. and its newly acquired subsidiaries, Dragon International Resources Group Co., Limited, a Hong Kong corporation, and Fujian Huilong Coal Mine Co., Ltd. (formerly Yongding County Shangzhai Coal Mine Co., Ltd.), a People’s Republic of China corporation, unless the context clear indicates otherwise. As used in this report, the terms “Dragon International” and “Fujian Huilong” refer to Dragon International Resources Group Co., Limited and Fujian Huilong Coal Mine Co., Ltd., respectively.

Foreign Private Issuer Status

We are a foreign private issuer as defined under Rule 3b-4 promulgated under the Securities Exchange Act of 1934, but voluntarily file our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K.

We have elected to voluntarily file our annual, quarterly, and current reports on U.S. domestic forms because we have used such forms ever since we began filing the reports under the Securities Exchange Act of 1934. Going forward, we intend to continue to comply with our reporting requirements under Section 13 of the Securities Exchange Act of 1934 using the Forms 10-K, 10-Q, and 8-K.

As a foreign private issuer, we are not required to use the U.S. domestic forms to comply with our reporting requirements under Section 13 of the Securities Exchange Act of 1934. Instead, we can file an annual report on Form 20-F each year with the Securities and Exchange Commission and file our interim financial statements and management’s discussion and analysis and reports about material changes to our company, in the forms required by Canadian securities legislation, with the Securities and Exchange Commission on Form 6-K.

Corporate History

We were incorporated on November 6, 1997 in the province of British Columbia, Canada under the name “Slocan Valley Minerals Ltd.” with an authorized share capital of 10,000,000 common shares without par value. Following our incorporation we were not actively engaged in any business activities. On June 1, 2004 we increased our authorized share capital from 10,000,000 common shares without par value to an unlimited number of common shares without par value. On June 11, 2004 we changed our name to “Orca International Language Schools Inc.”

Effective March 3, 2009, we changed our name from “Orca International Language Schools Inc.” to “SGB International Holdings Inc.” and we created a new class of preferred shares. As a result, our authorized capital consists of an unlimited number of common shares without par value and an unlimited number of preferred shares without par value. We have not issued any preferred shares. Effective March 4, 2009, we effected a 4.5 for one forward split of our issued and outstanding common shares.

Our goal originally was to provide management services to schools in the international education industry based on the principles of: improving their administrative, operational, marketing, sales and human resources functions; building links with other schools worldwide to foster student exchange; and repositioning the schools to concentrate their curriculum on preparing students for one of the three major English proficiency tests. We have been searching for a school as the initial client but we have not been successful in finding any such school. Since we have incurred losses since November 6, 1997, in March 2009, our board of directors has decided to explore the possibility of adopting a different business plan to protect our shareholders’ value.

Prior to the date of our reverse acquisition, discussed below, we were considered as a “shell company” under the Rule 405 promulgated under the Securities Act of 1933 and Rule 12b-2 promulgated under the Securities Exchange Act of 1934 because we had nominal operations and nominal assets.

As described above, on April 12, 2011, we entered into the share exchange agreement with Dragon International Resources Group Co., Limited, its shareholders and Fujian Huilong Coal Mine Co., Ltd. (formerly known as YongdingShangzhai Coal Mine Co., Ltd.) and as a result of the closing of this agreement on May 11, 2011, we adopted the business of Fujian Huilong Coal Mine Co., Ltd. and abandoned our prior business.

| 4 |

Reverse Acquisition of Dragon International Resources Group Co., Limited

On May 11, 2011, we completed a reverse acquisition transaction with the shareholders of Dragon International Resources Group Co., Limited pursuant to which we acquired 100% of the issued and outstanding capital stock of Dragon International Resources Group Co. in exchange for an aggregate of 220,522,000 common shares of our company, which constituted 90% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the reverse acquisition.

Dragon International was incorporated in the Hong Kong on October 5, 2010, and is a holding company for Fujian Huilong. Fujian Huilong was incorporated in the People’s Republic of China on August 4, 2005.

There was no material relationship that existed between our company, our former principal shareholders, and the shareholders of Dragon International prior to the time of the reverse acquisition other than in respect of the reverse acquisition. No third parties played a material role in arranging or facilitating the transactions and no third parties received benefits from arranging or facilitating the transaction between our company and the former shareholders of Dragon International.

Because we did not have any active business operations prior to the reverse take over of Dragon International and were considered a “shell company”, our previous management, including Mr. Xin Li, actively pursued opportunities for us to acquire an operating business to enhance shareholders value. Mr. Li met representatives of Fujian Huilong Coal Mine Co., Ltd. in a business meeting and learned that Fujian Huilong is contemplating going public in North America through its holding company in Hong Kong, Dragon International. The parties started negotiating the terms of the transaction and subsequently agreed to terms of the share exchange agreement entered into between our company and shareholders of Dragon International. Other than Mr. Li and principals of Dragon International, no third parties played a material role in arranging or facilitating the transactions. Mr. Li is considered a promoter of our company and he did not receive anything of value from our company for these transactions.

As a result of the reverse acquisition, we have assumed the business and operations of Fujian Huilong Coal Mine Co., Ltd., a wholly-owned subsidiary of Dragon International Resources Group Co., Limited. Fujian Huilong Coal Mine Co., Ltd. is a company engaged in coal production and sales by exploring, developing and mining coal properties. Fujian Huilong Coal Mine Co., Ltd. owns and operates a coal mine, located at Shangzhai Village, Yongding County, Longyan City of Fujian Province, People’s Republic of China, which has coal reserves of an estimated 1,354,000 t as of December 31, 2009, including 416,000 t proven coal reserve, and 938,000 t probable coal reserve. The current coal production was conducted within the parameter stated in the mining permit. The remaining coal reserve as of December 31, 2012 is still pending for the geological report to be issued from an independent and qualified Canada based geologist company, Wardrop Engineering Inc. (the “Wardrop”). Because the scope of Wardrop’s work on its May 2011 NI-43-101 technical report covered 5.7 km2 area of the mining permit numbered 3500000620055, which provides for an annual production rate of 90,000 t/a and is in good standing until April 2016, but Wardrop noted that Fujian Huilong production was over 200,000 t in year 2009 , over 150,000 t in year 2010, about 114,000 t in year 2012 and 67702t in year 2013. Because of the unique geological structure and coal deposits in the Fujian Province, coal productions require a higher level of human input together with machinery to achieve a desirable rate of return, which is unlike coal deposits in Northwestern China that are more suitable for larger production using mostly large machinery. Accordingly, when a new coal mining operation applies for a permit in the Fujian Province, the typical annual production rate granted would be in the range of 60,000 t/a to 90,000 t/a. This initial annual production rate, which may be considered as a trial period production rate, may be adjusted and increases can be applied for subsequently, depending on the development of a particular mine. We initially applied for an annual production rate of 90,000 t/a for our mining permit number 3500000620055 because of this practice in the Fujian Province. We are in the process of applying to increase our annual production rate to up to 300,000 t/a. As of May 13, 2011, Shangzhai has obtained another mining permit (C3500002011051120112047) for an area of 6.8 km2 that is adjacent to (and with a small overlapping area with) the 5.7 km2area covered by its existing mining permit, which also allows it to mine at different mining levels. With respect to the estimated 1,354,000 t reserves in the valid 5.7 km2 mining area, Shangzhai has confirmed that about 70% coal reserves have been assigned to the current mine shaft and mining equipment, while the rest 30% coal reserves will require sustaining capital for coal production.

The run of mine coal from underground are sold without further processing. The major application of the coal is used as solid fuel to produce heat and electricity. The coal product has a typical calorific value of around 7,000 kcal/kg, as received. The total sulfur contained in the product is typically about 0.6%, dry basis. The total moisture in the coal product is about 4.4%.

| 5 |

On October 3, 2013, a wholly owned subsidiary of SGB, SGB Investment Limited, was incorporated.

On December 19, 2013, the Company sold its 100% equity interest in Dragon International Resources Group Co and its wholly owned subsidiary Fujian Huilong Coal Mine Co., Ltd to an independent third party at cash consideration of HKD 1,000,000 (approximately USD 129,000). This is because the existing PPE are too old to be replaced and the current mining right cannot provide coal up to the quality to our existing clients.

After selling all the equity of Dragon International and Fujian Huilong for the purpose of disposing the old PPE, before the new mining area being developed with the new mining right, the Company and its subsidiaries remain to conduct its operation by procuring external market to serve its existing clients.

The Company and its subsidiaries are considered to be operating in one segment based on its organizational structure and strategic decision making method.

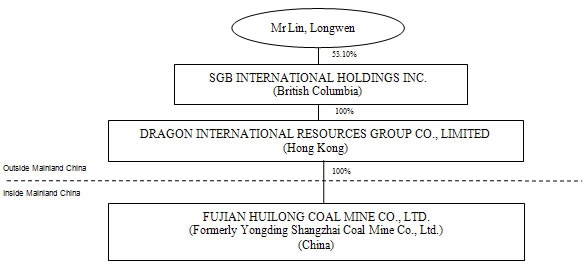

Corporate Structure

As a result of the consummation of the transactions contemplated under the share exchange agreement:

| · | Dragon International Resources Group Co., Limited became our wholly-owned subsidiary and Fujian Huilong Coal Mine Co., Ltd., the wholly-owned subsidiary of Dragon International Resources Group Co., Limited became our wholly-owned subsidiary; |

| · | We issued an aggregate of 220,522,000 common shares of our company, representing approximately 90% of our issued and outstanding common shares on a fully diluted basis, in exchange for all of outstanding capital stock of Dragon International. |

The organization and ownership structure of our company subsequent to the consummation of the reverse acquisition as summarized in the paragraphs above is as follows:

Fujian Huilong Coal Mine Co., Ltd. (formerly known as YongdingShanzahi Coal Ming Co., Ltd.) is a wholly foreign-owned limited liability company operating in China and is wholly owned by the foreign investor (Dragon International in our case). Dragon International was incorporated on October 5, 2010 in Hong Kong to acquire all of the equity interest in Fujian Huilong Coal Mine Co., Ltd. from its previous owners, Mr. Chuanzhen Lin, Mr. Wensi Lin, and Mr. Qingdong Shi, and to change the status of Fujian Huilong into a wholly foreign-owned subsidiary. Dragon International was also created to facilitate the share exchange between SGB International Holdings, Inc. and the shareholders of Dragon International as Chinese laws do not allow SGB International Holdings, Inc. to effect share exchanges directly with any owners of Fujian Huilong.

| 6 |

On November 1, 2010, Dragon International entered into a share transfer agreement with Mr. Chuanzhen Lin, Mr. Wensi Lin, and Mr. Qingdong Shi, under which Dragon International acquired all of the outstanding equity shares of Fujian Huilong. On February 21, 2011, Fujian Huilong received its new business license and became a WFOE under the People’s Republic of China (“PRC”) laws. Mr. Longwen Lin, a key management member of Fujian Huilong, subsequently acquired 90% of the Dragon International. At that time, Mr. Longwen Lin did not have other relationship with Dragon International, Fujian Huilong or these entities’ shareholders in connection with the reverse merger. Mr. Peifeng Huang was also a key management member of Fujian Huilong before its acquisition by Dragon International, but he did not have other relationship with Dragon International, Fujian Huilong or these entities’ shareholders in connection with the reverse merger. Mr. Thomas TzeKhern Yeo did not have other relationship with Dragon International, Fujian Huilong or these entities’ shareholders in connection with the reverse merger.

We anticipate that we will rely principally on dividends from our PRC subsidiary, Fujian Huilong, for our cash requirements outside of PRC, including servicing any debt we may incur outside of PRC and obtaining the funds necessary to pay dividends and other cash distributions to our shareholders and pay our operating expenses outside of PRC.

Under the PRC law, as a WFOE, the PRC subsidiary, Fujian Huilong, may pay dividends only out of its accumulated retained earnings determined in accordance with the PRC accounting standards and regulations and tax laws, which will subject to a withholding tax of 10%. Pursuant to a special arrangement between Hong Kong and the PRC government, known as the Arrangement between the Mainland and Hong Kong Special Administrative Region on the Avoidance of Double Taxation and Prevention of Fiscal Evasion, effective August 21, 2006 (the “Arrangement”), Dragon International may qualify for a lower rate of 5% for any dividends remitted from Fujian Huilong in Mainland China to Dragon International in Hong Kong. In October 2009, the State Administration of Taxation of China, or the SAT, further issued the Circular on How to Interpret and Recognize the “Beneficial Owner” in Tax Agreements, or Circular 601. According to Circular 601, non-resident enterprises that cannot provide valid supporting documents as “beneficial owners” may not be approved to enjoy the preferential tax rate under the Arrangement. “Beneficial owners” are individuals, enterprises or other organizations that are normally engaged in substantive operations. These rules also set forth certain adverse factors to the recognition of a “beneficial owner.” Specifically, they expressly exclude a “conduit company,” or any company established for the purposes of avoiding or reducing tax obligations or transferring or accumulating profits and not engaged in actual operations such as manufacturing, sales or management, from being a “beneficial owner.” As a result, although Fujian Huilong is a wholly owned subsidiary of Dragon International, Dragon International may not be able to enjoy the preferential withholding tax rate under the Arrangement and therefore be subject to withholding tax at a rate of 10% with respect to dividends to be paid by Fujian Huilong.

In accordance to the Article 167 of the PRC Company Law, the PRC subsidiary, Fujian Huilong, is required to set aside at least 10% of its after-tax profit based on PRC accounting standards to its statutory surplus reserve fund until the accumulative amount of such reserve reaches 50% of its respective registered capital. These reserves are not distributable as cash dividends. The board of directors of a WFOE has the discretion to allocate a portion of its after-tax profits to its staff welfare and bonus funds. After the allocation of relevant welfare and funds, the equity owners can distribute the remaining net after-tax profits after deducting the accumulated losses in the previous fiscal year. According to the PRC Company Law, companies may subject to a fine up to RMB5,000 for non-compliance with the above rules.

The registered capital of Fujian Huilong was RMB1 million as at December 31, 2010 and has been increased to and remains as RMB13.28 million as at December 31, 2011 and December 31, 2012 respectively. Fujian Huilong will set aside at least 10% of its after-tax profit until it reached the minimum 50% of its respective registered capital requirement.

After paying the withholding taxes applicable to Fujian Huilong, making appropriations for its statutory reserve funds and retaining any profits from accumulated profits, the remaining net profits of Fujian Huilong would be available for distribution to its sole shareholder, Dragon International, our wholly owned subsidiary in Hong Kong, and from Dragon International to us. Dragon International is subject to the uniform tax rate of 16.5% in Hong Kong. Under the Hong Kong tax laws, Dragon International is exempted from the Hong Kong income tax on its foreign-derived income and there are no withholding taxes in Hong Kong on remittance of dividends.

| 7 |

Our Business

As a result of the reverse acquisition, we are mainly engaged in coal production in the province of Fujian in the People’s Republic of China. Through our wholly owned subsidiary, Fujian Huilong Coal Minde Co., Ltd., we manage and operate the Shangzhai coal mine, which is located at Yongding County, Fujian Province, People’s Republic of China. The Shangzhai coal mine currently sells unprocessed coal.

On December 19, 2013, even the company has disposed its PPE and the new mining right are yet to be obtained, the company has remained its operation to source coal through external market to serve its existing clients.

Our Products

All of our coal is classified as anthracite. The coloring of this coal is dark gray to slightly silver-gray. The coal is of sufficient quality to be used for power generation, production of cement, as raw material for ammonia production, and for domestic uses.

Because the capacity of the screen system for coal processing is too small to be used, we sell the coal unprocessed. In addition, sale contractors are responsible for hauling coal from the mine site to customers. Therefore, there are no processing or hauling costs.

After December 19, 2013, we are still sourcing the coal at the same standard and quality to serve its existing clients.

Our Customers

We sell our coal directly to local sale contractors, and are responsible only for loading contractors’ trucks at the mine site. Subsequently, sale contractors haul coal from the mine site to consumers. For the years ended December 31, 2012 and December 31, 2013, the Company had three (2012) and four (2013) customers accounted for more than 10% of total sales representing 73% (2012) and 55% (2013) of total sales, respectively:

| Name | % of the sales in FY2012 | |||

| Mr. Wei Mingji | 29 | % | ||

| Mr. Huang Jingyang | 24 | % | ||

| Mr. Lin Jinxiu | 20 | % | ||

| Mr. Ling Tianyun | 0 | % | ||

| Mr. Yan Dechang | 0 | % | ||

| Mr. Dai Jinsheng | 0 | % | ||

| Name | % of the sales in FY2013 | |||

| Mr. Wei Mingji | 23 | % | ||

| Mr. Lu Liesheng | 12 | % | ||

| Mr. Lu Qiliang | 10 | % | ||

| Mr. Lai Linhai | 10 | % | ||

| 8 |

As coal is currently a scarce commodity in Fujian province and demand is significantly higher than supply, we sell our coal on a per ton basis directly to our customers on cash basis or wire transfer payment. Our coal is generally sold to a few major individual customers and also on-site sales to other smaller customers on cash basis only. There was a significant increase of sales in 2007 through 2011 mainly driven by market demands and also due to the improvement on our productivity. Our sales personnel conduct routine customer visits and customer satisfaction surveys. We typically enter into contracts with our customers on a yearly basis, which contracts are renewable annually. These contracts do not provide for minimum purchase amount requirements. Once our coal is mined, it is typically picked up immediately by, or loaded immediately for delivery to, customers so we do not currently maintain an inventory of the mined coal.

Product Pricing

Coal prices are generally determined by market price or are based on contractual terms. The price for certain thermal coal used for power generation is determined among coal suppliers and power plant buyers in accordance with the pricing guideline published by the PRC Government. However, we are not required to abide by the government pricing guideline as our customer do not comprise of power plant buyers. In addition, we do not believe we will be required to abide by the government pricing guidelines because we are not obligated to determine to whom our customers will sell the coal they purchased from us and as such the government pricing guidelines do not apply to the purchase and sale of coal between our company and our customers.

We set pricing by taking into account: (i) prices in the relevant local coal markets; (ii) grade and quality of the coal; and (iii) relationships with customers. Transportation costs are normally borne by the customers. The average price for raw coal from the Shangzhai coal mine in 2012 was about US$112 per ton, which is $31 or 29% higher than the average price of about US$81 per ton in 2013.

Sources and Availability of Raw Materials and the Principal Suppliers

We purchase certain materials in connection with our coal mining operations, including: (i) mining equipment and vehicles; (ii) lift cylinders; and (iii) iron boards, etc. Because these materials are readily available, we do not purchase them exclusively from any one supplier for our operation.

The price of these materials is set at market rates or determined through negotiations. We believe we have established stable cooperative relationships with the suppliers that we deal with to ensure a reliable supply of the materials required for our mining operations.

Research and Development

We had no research and development expenses in 2012 and in 2013. We currently have no plans for any research and development activities and do not anticipate any material research and development costs.

Intellectual Properties and Licenses

We have no material patents, licenses or other intellectual property.

Competition

In the area where we operate the Shangzhai coal mine, there are no other coal mine operating in the Shangzhai district but there are about 4 other licensed coal mines within the Yongding County which directly compete with us: Yongding County Dakedu coal mine, Yongding County Dawanke coal mine, Yongding County Huangyoukeng coal mine and Yongding County Jiaozhi coal mine. Yongding County Dakedu coal mine has an annual production capacity of about 90,000 tons/a and the remaining competitors have an annual production capacity of about 60,000 tons/a. However, because demand for coal currently outpaces supply, we do not face any meaningful competition for the sale of our coal from the Shangzhai coal mine.

| 9 |

The Coal Industry Policy, issued by the National Development and Reform Commission (NDRC) in November 2007, stipulates that new coal mines and expansions of existing coal mines in Fujian Province must have a minimum output of 90,000 t/a. The approved production capacity of the Shangzhai coal mine is 90,000 t/a, which is in accordance with this policy. According to the Circular on Assigning the Plan for Closing Small Scale Coal Mines in the Last Three Years of the ‘Eleventh Five Year’ Period issued by the NDRC, National Energy Bureau, State Administration of Work Safety, and the State Administration of Coal Mine Safety in October 2008, Chinese coal mines with an annual production capacity of less than 300,000 t/a are considered to be small-scale coal mines and will be closed, merged, or limited; there was plans to reduce the number of small-scale coal mines in Fujian Province and our mine is not expected to be one of the affected one.

Yongding County Coal Industry Management Bureau is the direct government agency responsible for implementing the “Circular on Assigning the Plan for Closing Small Scale Coal Mines in the Last Three Years of the ‘Eleventh Five Year’ Period’” in Yongding County and the officer with whom we had a conversion regarding effect of the Circular on our company was the deputy chief and he has the overall decision making power of this bureau. He indicated to us that because Fujian Province does not have sufficient coal production for use by local industries and relies heavily on import from other provinces, and because our mine has consistently demonstrated excellent safety records, we will not be one of the small-scale mines affected by the Circular. However, we have not received any written assurance regarding the applicability of the “Circular on Assigning the Plan for Closing Small Scale Coal Mines in the Last Three Years of the ‘Eleventh Five Year’ Period’” to our mine operations and it is possible that decisions regarding the Circular on the local level could be overruled at the national level. Our past coal production outside of the areas covered by our mining permit may not be considered in determining whether we have a coal production capacity of at least 300,000 t/a. However, after receiving the new mining permit covering additional 6.8 km2, we intend to conduct our mining operations only within the areas covered by our valid mining permits and our coal production in the future will be considered whether we have a coal production capacity of at least 300,000 t/a.

According to the Opinions of the NDRC on Expediting the Merger and Reorganization of Coal Mines, issued by the General Office of the State Council in October 2010, large-scale coal mining companies are encouraged to merge with or acquire small-scale coal mines in order to reduce the overall number of coal mining enterprises.

Regulatory Overview

Coal Law

On August 29, 1996, the PRC Government promulgated the People’s Republic of China Coal Law (the “Coal Law”), which became effective on December 1, 1996. The Coal Law sets forth requirements for all coal mines, including state-owned mines and privately owned mines, mainly providing for resource exploitation planning, approval of new mines, the issuance of mining and safety production permits, implementation of safety standards, processing of coal, business management, protection of mine areas from destructive exploitation, and safety protection for miners and administrative supervision.

According to the Coal Law, entities seeking to establish mining enterprises must apply to the relevant government office and obtain all necessary approvals. Upon obtaining such approvals, the entities concerned will be granted a mining permit from the Ministry of Land and Resources. Thereafter, an entity must obtain a coal production permit and a coal operation permit and other related quality permits in order to commence coal production and sell coal products in the PRC. We have applied for and received a mining permit valid until 2016 and a coal production permit valid until 2031. Our management believes that we have complied with the relevant provisions of the Coal Law. We will be forced to terminate our business if we do not have the necessary approvals from the relevant government offices. The PRC Government is in the process of amending the Coal Law, in response to concerns over the lack of a well-coordinated development plan for mining, which contributed to a significant amount of waste of valuable coal resources. The lack of effective penalty provisions or the lenient enforcement of existing provisions in the Coal Law has been cited as another important reason for the current rulemaking effort.

Mining activities in the PRC are also subject to the People’s Republic of China Mineral Resources Law (“Mineral Resources Law”), promulgated by the PRC Government on March 19, 1986 and amended on August 29, 1996. The Mineral Resources Law regulates matters relating to the planning or engaging in the exploration, exploitation and mining of mineral resources. According to the Mineral Resources Law all mineral resources, including coal, are owned by the state. Except under limited circumstances, any enterprise planning to engage in the exploration, exploitation and mining of mineral resources must first apply for and obtain exploration rights and mining rights before commencing the relevant activities. The Mineral Resources Law prohibits the transfer of exploration and exploitation rights in general unless the transfer falls within certain specified circumstances. Our management believes that we are in compliance with the Mineral Resources Law in this respect because we have applied for and obtained the mining permit and coal production permit.

| 10 |

We are principally subject to governmental supervision and regulation by the following agencies of the PRC Government:

| · | the State Council, which is the highest level of the executive branch, is responsible for the examination and approval of major investment projects specified in the 2004 Catalogue of Investment Projects released by the PRC Government; |

| · | the National Development and Reform Commission, which formulates and implements major policies concerning China’s economic and social development, examines and approves investment projects exceeding certain capital expenditure amounts or in specified industry sectors, including examination and approval of foreign investment projects, oversees reform of state-owned enterprises and formulates industrial policies and investment guidelines for the natural resource industries, such as coal production. In addition, the NDRC administers coal export activities and export quotas jointly with the Ministry of Commerce. The NDRC is also responsible for the evaluation and implementation of the price-linking mechanism between the prices of coal and power; |

| · | the Ministry of Commerce of China (“MOFCOM”) and/or its local counterpart, which regulates foreign investment in China, such as review and approval of foreign invested companies in China and mergers and acquisitions of Chinese domestic enterprises by foreign investors; |

| · | the Ministry of Land and Resources of China (“MLR”) and/or its local counterpart, which has the authority to grant land use licenses and mining right permits, approves transfer and lease of mining rights, and reviews mining rights premium and reserve valuation; |

| · | the State Administration of Coal Mine Safety (“SACMS”) and/or its local counterpart, which is responsible for the implementation and supervision of the relevant safety laws and regulations applicable to coal mines and coal mining operations; |

| · | the Ministry of Environmental Protection of China (“MEP”) and/or its local counterpart, which supervises and controls environmental protection and monitors China’s environmental system; |

| · | the Ministry of Construction of China (“MOC”) and/or its local counterpart, which is responsible for the management of survey and design of construction projects, including but not limited to the survey and design of coal mines; |

| · | the National and State Tax Bureaus and/or their local counterparts, which are responsible for the federal and local income, VAT and other taxes; |

| · | the State Administration of Foreign Exchange of China (“SAFE”) and/or its local counterpart, which is responsible for the convertibility of RMB into foreign currencies, registration of foreign debt or loans of Chinese companies and, in certain cases, the remittance of currency out of the PRC, such as repayment of bank loans or dividends denominated in foreign currencies; and |

| · | the State Administration for Industry and Commerce of China (“SAIC”) and/or its local counterpart, which is responsible for review and approval of establishment of domestic and foreign invested companies in China and issuance of their business licenses. |

The following is a brief summary of the principal laws, regulations, policies and administrative directives to which we are subject.

Pricing

Until 2002, the production and pricing of coal was largely subject to close control and supervision by the PRC Government, which centrally manages the production and pricing of coal. Previously, the price of coal was determined based on a government-devised pricing guideline which set out the suggested prices for coal. However, to effectuate the transformation from planned economy to market economy practices, from January 1, 2002 China eliminated the state guidance price for coal and allowed prices for all types of coal to be determined in accordance with market demand. However, as the PRC Government continues to maintain control over the national railway system, which is the primary means for coal transportation in China, the PRC Government still may exert influence over the pricing of coal through its allocation of railway transportation capacity for coal.

| 11 |

In addition, under the Price Law of the PRC, promulgated December 29, 1997, effective May 1, 1998, in the event of an actual increase or potential increase in the prices of important products such as coal, the State Council and the provincial governments, autonomous regions and municipalities directly under the PRC Government may adopt intervention measures, such as restricting the ratio of price differentials or of profits, and imposing price limits, etc. In August 2004, the NDRC issued a notice setting forth temporary measures to be imposed on thermal coal prices for certain regions. In December 2004, the NDRC issued a notice setting forth guidelines for pricing of thermal coal sales in 2005. Under these guidelines, the coal suppliers and their customers may not negotiate for the sale of coal at prices exceeding the government suggested price range.

Similar to coal pricing, the production and supply of coal, which is dictated by the PRC Government’s annual state coal allocation plan, has been gradually liberalized and largely subject to market forces. Major domestic coal suppliers and coal purchasers attend the Annual National Coal Trading Convention to negotiate and discuss the price and quantity of coal to be supplied and purchased for the coming year through the signing of letters of intent and short and long-term supply contracts.

On December 18, 2006, the National Development and Reform Committee issued the Notice Relating to the Good Preparation for Inter Provincial Coal Production Transportation Works (Fa Gai Yun Xing [2006] No. 2867). According to the notice, in 2007, policies were to be implemented to encourage the reform of the market system for determining coal prices by allowing parties to determine prices through discussions in accordance with market demand, and to encourage price determination based on quality. On December 27, 2006, the relevant government departments and units, such as the National Development and Reform Committee for railway operations, and the Transportation Department, convened a 2007 coal industry video and telephone conference. This symbolized the end of the Annual National Coal Trading Convention that has been in place for over 50 years. Under the State’s macroeconomic controls, the new mechanism for enterprises to freely determine prices through negotiations was put in place.

Fees and Taxes

There are various taxes and fees that are imposed upon coal producers in Fujian Province, as well as statutory reserves which coal producers are required to set aside. Such taxes, fees and statutory reserves as applicable to our company at December 31, 2013 which coal company has to purchase and pay RMB 165 per tons to the local Coal Management Authority that set out the relevant tax rate as follows:

| Item | Base | Rate | ||

| Corporate income tax | Taxable income |

About US$0.85 per ton (equivalent to RMB 5.5 per ton) | ||

| VAT | Revenue from domestic sales |

About US$3.62 per ton (equivalent to RMB 23.4 per ton) | ||

| City construction tax | Amount of VAT and business tax |

About US$0.18 per ton (equivalent to RMB 1.17 per ton) | ||

| Education surcharge | Amount of VAT and business tax |

About US$0.15 per ton (equivalent to RMB 0.94 per ton) | ||

| Stamp duty fee | Proceeds from the sale of coal |

About US$0.01 per ton (equivalent to RMB 0.05 per ton) | ||

| Resource tax | Volume of raw coal produced |

About US$0.39 per ton (equivalent to RMB 2.5 per ton) | ||

| General fund (comprise of safety fund, maintenance fund, environmental fund and forestry fund) | Volume of raw coal produced |

About US$19.93 per ton (equivalent to RMB 128.94 per ton) | ||

| Individual income tax | Volume of raw coal produced |

About US$0.39 per ton (equivalent to RMB 2.5 per ton) |

| 12 |

Under the Mineral Resources Law, if mining results in damage to arable land, grasslands or forest areas, the mining enterprise must take effective measures to return the land to an arable state, plant trees or grass or take other measures. The Mineral Resources Law and other applicable laws and regulations also state that anyone who causes others to suffer loss in terms of production or in terms of living standards is held liable for the loss under the law and is required to compensate the persons affected and to remedy the situation. In addition, the Mineral Resources Law also provides for (i) regulations concerning labor safety and hygiene and (ii) environmental protection.

All coal producers are subject to PRC environmental protection laws and regulations which currently impose fees for the discharge of waste substances, require the payment of fines for serious pollution and provide for the discretion of the PRC Government to close any facility which fails to comply with orders requiring it to cease or cure operations causing environmental damage. We have not been notified by the PRC Government authorities of any environmental damages.

Domestic Trading of Coal

Pursuant to the Measures for the Regulation of Coal Operations promulgated by the NDRC on December 27, 2004, the state implemented a system to examine coal operation qualifications in respect of coal operations, including the wholesale and retail of raw coal and processed coal products, and the processing and distribution of coal for civilian use. Before an enterprise can engage in coal operations, it must obtain a coal operation qualification certificate. A coal production enterprise that deals in coal products which it did not itself produce and process is required to obtain coal operation qualifications. The enterprise is also prohibited from dealing in coal products produced and/or processed by a coal mine enterprise that does not have a coal production permit. An enterprise is also prohibited from selling coal products to a coal operation enterprise that does not have coal operation qualifications. Our company has applied for and obtained a coal production permit and this permit is valid until December of 2031.

Although the PRC Government indirectly influences coal prices through its broad regulation of electricity prices and control over the allocation of national railway capacity, domestic coal prices have mainly been market-driven since 2002, when the PRC Government eliminated the price control measures for coal used in electric power generation.

Prior to 2006, however, the PRC Government continued to implement temporary measures to prevent and control any unusual fluctuations in thermal coal prices. This, among other reasons, has caused thermal coal contract prices for major users to be generally lower than spot market prices during this period. On January 1, 2006, the NDRC announced the elimination of such temporary intervention practices on thermal coal price, thus completely removing control over thermal coal prices, including contract prices for major users.

Environmental Protection Laws and Regulations

Pursuant to the Environmental Protection Law, MEP is empowered to formulate national environmental quality and discharge standards and to monitor China’s environmental system at the national level for the purpose of preventing and eliminating environmental pollution and damage to ecosystems. Environmental protection bureaus at the county level and above are responsible for environmental protection within their areas of jurisdiction.

Environmental regulations require companies to file an environmental impact report with the relevant environmental authority for approval before undertaking the construction of a new production facility or any major expansion or renovation of an existing production facility. New facilities built pursuant to this approval are not permitted to operate until the relevant environmental authority has performed an inspection and has found that the facilities are in compliance with environmental standards. Our current facilities are in compliance with environmental standards.

Mining operations, including both open pit mines and underground mines, may result in disturbances of surface and underground land and cause water pollution, landslides and other types of environmental damage. To manage the adverse effects that the coal industry has on the environment, China promulgated a series of laws and regulations. Through these laws and regulations, China established national and local environmental protection legal frameworks and issued standards applicable to emission controls, discharges of wastes and pollutants to the environment, generation, handling, storage, transportation, treatment and disposal of waste materials by production facilities, land rehabilitation and reforestation.

| 13 |

The Environmental Protection Law, promulgated by the National People’s Congress December 26, 1989, is the cardinal law for environmental protection in China. The law establishes the basic principle for coordinated advancement of economic growth, social progress and environmental protection, and defines the rights and duties of governments at all levels. Local environmental protection bureaus may set stricter local standards than the national standards and enterprises are required to comply with the stricter of the two sets of standards. The Environmental Protection Law requires any entity operating a facility that produces pollutants or other hazards to incorporate environmental protection measures into its operations and to establish an environmental protection responsibility system, which must adopt effective measures to control and properly dispose of waste gases, waste water, waste residue, dust or other waste materials.

New construction, expansion or reconstruction projects and other installations that directly or indirectly discharge pollutants to the environment shall be subject to relevant state regulations governing environmental protection for such projects. Entities undertaking such projects must submit a pollutant discharge declaration statement detailing the amount, type, location and method of treatment to the competent authorities for examination. The authorities will allow the construction project operator to release a certain amount of pollutants into the environment and will issue a pollutant discharge license for that amount of discharge subject to the payment of discharge fees. The release of pollutants is subject to monitoring by the competent environmental protection authorities. If an entity discharges more than the amount permitted by the pollutant discharge license, the local environmental protection bureau can fine the entity up to several times the discharge fees payable by the offending entity for its allowable discharge, require the offending entity to close its operations, or take other measures to remedy the problem. We have not received any notices from the relevant government authorities demanding us to pay any fines or threatening to close our operations.

In the environmental impact statement of a construction project, the project operator shall make an assessment regarding the pollution and environmental hazards the project is likely to produce and its impact on the ecosystem, and measures for their prevention and control. The operator shall submit the statement according to the specified procedure to the competent environmental protection authority for examination and approval. The building of sewage outlets within any water conservancy projects, such as canals, irrigation channels and reservoirs, shall be subject to the consent of the competent authority in charge of water conservancy projects.

The rehabilitation of mining sites is another important issue the PRC Government has sought to address. Under the Law of Land Administration of the People’s Republic of China, promulgated June 15, 1986, and amended on August 28, 2004, and the Land Rehabilitation Regulations, issued by the State Council in 1988 and effective January 1, 1989, coal producers must undertake measures to restore the mining site to its original state within a prescribed time frame if mining activities result in damage to arable land, grassland or forest. The rehabilitated land must meet rehabilitation standards, as required by law from time to time, and may only be subsequently used upon examination and approval by the land authorities. A coal producers’ failure to comply with this requirement or its failure to return the mining site to its original state will result in the imposition of fines, rehabilitation fees and/or rejection of applications for land use rights by the local bureau of land and resources.

Emissions of waste water by coal mines and coking plants are regulated by the Law on Prevention and Control of Water Pollution of the PRC, promulgated by the Standing Committee of National People’s Congress in May 1984 and as amended in May 1996 and February 2008, which became effective in June 2008, and the Administrative Regulations on the Levy and Use of Discharge Fees, issued by the State Council in January 2003 and effective in July 2003. Any new construction projects, such as coal mines and coking plants, must submit an environmental impact statement, which shall include an assessment of the water pollution hazards the project is likely to produce and its impact on the ecosystem. The environmental impact statement must also contain measures to prevent and control the water pollution hazards. Every new production facility must be equipped with waste water processing facilities which must be put in use together with the production facilities. Construction projects that discharge pollutants into water shall pay a pollutant discharge fee in accordance with state regulations.

| 14 |

Violators of the Environmental Protection Law and various environmental regulations may be subject to warnings, payment of damages and fines. Any entity undertaking construction work or manufacturing activities before the pollution and waste control and processing facilities are inspected and approved by the environmental protection department may be ordered to suspend production or operations and may be fined. The violators of relevant environmental protection laws and regulations may be exposed to criminal liability if violations result in severe loss of property, personal injuries or death. Our management is of the view that we are in compliance with the Environmental Protection Law and various environmental regulations. We have not received any notice from the relevant government authorities advising us that we are in violation of the Environmental Protection Law or various environmental regulations.

In addition to the PRC environmental laws and regulations, China is a signatory to the 1992 United Nations Framework Convention on Climate Change and the 1998 Kyoto Protocol, which propose emission targets to reduce greenhouse gas emissions. The Kyoto Protocol came into force on February 16, 2005. At present, the Kyoto Protocol has not set any specific emission targets for certain countries, including China.

Mineral Resources Laws and Regulations

Exploration, exploitation and mining operations must comply with the relevant provisions of the Mineral Resources Law and other relevant regulations, and are under the supervision of the Ministry of Land and Resources. Exploration and exploitation of mineral resources are also subject to examination and approval by the Ministry of Land and Resources and relevant local authorities. We have applied for and received our mining permit (*3500000620055) valid until April of 2016. Upon approval, a mining permit is issued by the relevant administrative authorities, which are responsible for supervision and inspection of mining exploitation in their jurisdictions. The holders of mining rights are required to file annual reports with the relevant administrative authorities. We have filed our annual reports with the relevant administrative authorities to maintain the validity of our mining permit.

The Mineral Resources Law governs, among other things, the assignment of mining rights. If the entity holding the mining rights is to be changed due to a sale of enterprise assets or other circumstances that may cause a change in the property rights to the assets of the enterprise, the enterprise may assign its mining rights, subject to approval according to the Coal Law, the Mineral Resources Law and other laws and regulations.

The PRC Government permits mine operators of collectively owned mines to exploit mineral resources in designated areas and individuals to mine scattered mineral resources. Such mine operators and individuals are subject to government regulation. Mining activities by individuals are restricted. Individuals are not permitted to exploit mineral reserves allocated for exploitation by a mining enterprise or company or protected reserves. Indiscriminate mining that damages mineral resources is prohibited.

It is unlawful for an entity or individual to conduct mining operations in areas designated for other legal mining operators. A mining operator whose exploitation causes harm to others in terms of production or in terms of living standards is liable for compensation and is required to take necessary remedial measures. When a mine is closed, a mine closure report and information concerning the mining facilities, hidden dangers, remediation and environmental protection must be submitted for examination and approval in accordance with the relevant law.

Mineral products illegally extracted and incomes derived from such activities may be confiscated and may result in fines, revocation of the mining permit and, in serious circumstances, criminal liability. Because we have mined and produced coal from an area beyond the area covered by our valid mining permit, we may be subject to fine or revocation of our mining permit. However, our management believes that the likelihood of any enforcement action is low as we have applied for and obtained in May of 2011 another mining permit covering an additional 6.8 km2 of mining area.

Mining safety

On June 7, 2005, the State Council promulgated Several Opinions on Promoting the Healthy Development of the Coal Industry (the “Opinions”), announcing the PRC Government’s policies with respect to the development and restructuring of the coal industry. The Opinions are consistent with the NDRC’s announcement on the revision of the Coal Law and reiterated the PRC Government’s policies with respect to the administration of coal reserves, enhancement of coal mine safety, encouragement of industry consolidation among coal producers, acceleration of the construction of large coal production bases, improvement of mining techniques and equipment for coal production and the organization and regulation of small coal mines.

| 15 |

The Measures for Implementing Work Safety Permits in Coal Mine Enterprises

The State Administration of Work Safety and the SACMS issued “The Measures for Implementing Work Safety Permits in Coal Mine Enterprises”, which came into effect on May 17, 2004. Pursuant to this document, a coal mine enterprise without a work safety permit may not engage in coal production activities. We have received a safety production permit ((2005)F107(G1)) that is valid until December of 2011. Coal mining enterprises and their mines that do not satisfy the safety conditions set forth in this document, or those that violate the provisions of this document, will be punished accordingly.

Special Regulations by the State Council on Preventing Work Safety Related Accidents in Coal Mines and Five Setsof Supplemental Rules and Regulations

The Special Regulations by the State Council on Preventing Work Safety Related Accidents in Coal Mines were promulgated and entered into effect on September 3, 2005. This regulation specifies that coal mine enterprises are responsible for preventing coal mine work safety-related accidents. If a coal mine has not obtained, in accordance with the law, a mining right permit, work safety permit, coal production permit or business license and if the mine manager has not obtained, in accordance with the law, a mine manager qualification certificate and a mine manager safety qualification certificate, the coal mine may not engage in production. As disclosed earlier, we have applied for and received a mining right permit, work safety permit, coal production permit. We also have a valid business license (350000100007198) and our mine manager has received a mine manager qualification certificate (MK350120043) and a mine manager safety qualification certificate (10035050100182). A coal mine should have adequate safety equipment, facilities and resources and should have in place measures to guard against the occurrence of work safety related accidents, as well as a sound contingency plan to deal with emergencies. Coal mining enterprises should establish a sound system for the detection, elimination, treatment and reporting of latent work safety-related dangers. If a major latent work safety-related danger as specified exists in a coal mine, the enterprise should immediately suspend production and eliminate the latent danger. Coal mining enterprises should provide their personnel working underground and their special operation personnel with safety education and training in accordance with relevant state regulations. The person in charge of a coal mine and the production and operation management personnel should go into mines and act as foremen on a rotating basis in accordance with state regulations, while a file recording their entry into the mine should be maintained. In addition, the State Administration of Work Safety issued five sets of supplemental measures:

| 1. | The Measures for Determining Major Latent Work Safety Related Dangers in Coal Mines (for Trial Implementation) stipulates the specific criteria for determining major latent work safety-related dangers. It further defines each of the latent safety related dangers specified in the Special Regulations of the State Council on Preventing Work Safety Related Accidents in Coal Mines, and lists more than 60 major latent safety related dangers. | |

| 2. | The Implementing Measures for the Detection and Elimination of Latent Dangers in Coal Mines and the Rectification and Closure of Such Mines (for Trial Implementation) specifies that coal mining enterprises are responsible for the detection and elimination of latent work safety-related dangers and that the main persons in charge of coal mining enterprises are fully responsible for the detection, elimination and treatment of latent work safety-related dangers in their enterprises. | |

| 3. | The Measures for the Supervision and Inspection of Coal Mine Safety Training (for Trial Implementation) specifies that coal mining enterprises must arrange and provide safety education and training to all of their mining personnel in accordance with relevant regulations; select and send their principal persons in charge, work safety management personnel and special operations personnel to qualified coal mine safety training institutions for training in a timely manner; and obtain the corresponding qualification certificates. | |

| 4. | The Guiding Opinions on Persons in Charge of Coal Mines and Production and Operation Management Personnel Going into Mines as Foremen requires the various types of coal mines to arrange for their persons in charge and production and operation management personnel to go into the mines to act as foremen and to ensure that each shift has at least one such person on site directing the operations. Coal mining enterprises are required to establish such procedures, clarify foremen’s duties and responsibilities and strictly implement internal management and performance appraisal. | |

| 5. | The Measures for Rewarding the Reporting of Major Latent Work Safety Related Dangers in, and Violations of the Law by, Coal Mines (for Trial Implementation) specifies that all units or individuals have the right to report major latent work safety-related dangers in, and violations of law by, coal mines. |

| 16 |

Special Regulation by the State Council on Shutting Down Small Coal Mines

The Special Regulation by the State Council on Shutting Down Small Coal Mines went into effect on September 28, 2006. The passage of regulation is the launch of a national campaign to close down small coal mines defined as having annual coal production capacity of 30,000 tons or less, as well as coal mines without proper licenses or permits. The intent of the regulation is to reduce both the high rate of accidents and pollution in the PRC coal mining industry. Under this regulation, 9,887 small and/or illegal coal mines were to have been shut down by the end of 2009. The regulation specifies that the Central Government will support the development of big coal mining operations, defined as having annual coal production capacity of 300,000 tons or more. However, the regulation is silent as to the PRC government’s position on coal mine operations having annual production capacity of more than 30,000 tons but less than 300,000 tons. We believe that the likelihood of our mining operation being shut down pursuant to The Special Regulation by the State Council on Shutting Down Small Coal Mines is relatively small because Fujian Province, where our mining operation is currently located, does not have sufficient coal production for use by local industries and relies heavily on import from other provinces. We have been advised by the County Coal Industry Management Bureau that we are not likely to be forced to shut down. Furthermore, our management also believes that, despite the fact that we have mined and produced coal beyond the area then covered by our valid mining permit, we will not likely be shut down because we have applied for and obtained in May 2011 another mining permit for an additional 6.8 km2 of mining area and that we have consistently demonstrated excellent safety records.

Our mining activities in the past had gone beyond the area covered by our mining permit and to a certain extent these activities have not met applicable regulatory requirements for permitting, inspections, conduct of operations, submission of information. However, we have not received any notice of penalty or fines for our past non-compliance. We believe the likelihood of our company being penalized or fined for past non-compliance is small as the Natural Resource Department of Fujian Province was made aware of our past non-compliance when we submitted our application for a new mining permit in May 2010 for an additional 7.5 km2 of mining area. As the coal deposit had been depleted by our past mining activities in some of the 7.5 km2 of mining area applied for, we were granted a mining permit for an area of 6.8 km2. As we have obtained in May 2011 the new mining permit for an additional 6.8 km2 of mining area, we intend to conduct our mining operation only within the areas covered by our valid mining permits.

We did not need to obtain additional environmental, health and safety permitting requirements when we applied for the new mining permit C3500002011051120112047 as our new mining permit was issued on the basis of our existing environmental, health and safety permitting approvals.

Laws and Regulations Applicable to Foreign Invested Enterprises (FIEs)

Under Chinese law, foreign invested enterprises refer to the enterprises jointly invested by Chinese investors and foreign investors or solely invested by foreign investors in China. Sino-foreign equity joint venture, Sino-foreign contractual joint venture and wholly foreign owned enterprise are the three types of foreign invested enterprises. Fujian Huilong, our operating subsidiary in China, is a wholly foreign owned enterprise invested by Dragon International and is a FIE under Chinese law.

| 17 |

The following is a brief summary of the principal law and regulations that apply to Fujian Huilong as a FIE.

Corporate Laws and Industry Catalogue Relating to Foreign Investment

The establishment, operation and management of corporate entities in China generally are governed by the Company Law of the PRC, or the Company Law, effective in 1994, as amended in 1999, 2004, 2005, respectively. The Company Law is applicable to, Fujian Huilong, our PRC Subsidiary, unless the PRC laws on foreign investment have stipulated otherwise.

The establishment, approval, registered capital requirement and day-to-day operational matters of WFOEs, such as our PRC Subsidiary, Fujian Huilong, is regulated by the Wholly Foreign Owned Enterprise Law of the PRC effective in 1986, as amended in 2000, and the Implementation Rules of the Wholly Foreign-owned Enterprise Law of the PRC effective in 1990, as amended in 2001. According to relevant provisions of the Wholly Foreign Owned Enterprise Law of the PRC and its Implementation Rules, MOFCOM Fujian branch issued the certificate of approval no. [2010] 0056 for the establishment of Fujian Huilong as a WFOE on December 21, 2010, and the SAIC Fujian branch issued the business license no. 350000100007198 for Fujian Huilong as a WFOE.

Investment activities in the PRC by foreign investors are principally governed by the Guidance Catalogue of Industries for Foreign Investment, or the Catalogue, which was promulgated and is amended from time to time by MOFOM and the National Development and Reform Commission, or the NDRC. The Catalogue divides industries into three categories: encouraged, restricted and prohibited. Industries not listed in the Catalogue are generally open to foreign investment unless specifically restricted by other PRC regulations. The industry that Fujian Huilong is involved in is not listed in the Catalogue and is open to foreign investment.

Regulations of Taxation

On March 16, 2007, the Chinese government enacted the new Enterprise Income Tax Law, or the New EIT Law, and promulgated the New EIT Law Implementation Regulations. Both the New EIT Law and the New EIT Law Implementation Regulations became effective on January 1, 2008. Under the New EIT Law and the New EIT Law Implementation Regulations, foreign invested enterprises incorporated in the PRC, such as Fujian Huilong is subject to a uniform income tax rate of 25%.

Pursuant to the Provisional Regulations on Value-Added Tax of the PRC, promulgated by the State Council on December 13, 1993, as amended on November 5, 2008 (effective on January 1, 2009), and the Rules for Implementation of Provisional Regulations on Value-Added Tax of the PRC, promulgated on December 25, 1993 and amended on December 15, 2008 (effective on January 1, 2009), all entities and individuals engaged in selling goods, providing repair and placement services or importing goods into the PRC are generally subject to a value-added tax, or VAT, at a rate of 17% of the gross sales proceeds received (with the exception of certain goods which are subject to a rate of 13% or lower), less any VAT already paid or borne by the taxpayer on goods or services purchased and utilized in the production of goods or provision of services that have generated the gross sales proceeds. Fujian Huilong is subject to such value-added tax but according to local regulations, the local Coal Management Authority is the government authority responsible for collecting VAT as part of the approximately US$18.56 or RMB 120 per ton for all taxes, fees and statutory reserves payable by Fujian Huilong. The amount of VAT imposed by the local Coal Management Authority is about US$3.62 or RMB 23.4 per ton. The understanding of Fujian Huilong that the local Coal Management Authority is responsible for collecting VAT payment is for an indefinite period and rate is subject to adjustment by the local Coal Management Authority from time to time. For the last three years, the local Coal Management Authority has not adjusted the rate of VAT that they have imposed on our company. As compared to the rate of VAT applicable to other businesses subject to VAT rate of 17% on their gross proceeds received, our company’s effective VAT rates for the last years were 5.95% for 2008, 5.28% for 2009, 3.98% for 2010 and 3.41% for 2011. However, because the local Coal Management Authority is able to adjust the VAT rate unilaterally and arbitrarily, there is no assurance that the local Coal Management Authority will not impose materially higher VAT rate on our company in the future.

Regulations on Foreign Exchange

Foreign exchange activities of FIEs, such as Fujian Huilong, our PRC subsidiary, are primarily governed by the following regulations:

| 1. | Foreign Currency Administration Rules (2008), or the Exchange Rules; and |

| 2. | Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996), or the Administration Rules. |

| 18 |

Under the Exchange Rules, if documents certifying the purposes of the conversion of RMB into foreign currency are submitted to the relevant foreign exchange conversion bank, the RMB will be convertible for current account items, including the distribution of dividends, interest and royalties payments, and trade and service-related foreign exchange transactions. Conversion of RMB for capital account items, such as direct investment, loan, securities investment and repatriation of investment, however, is subject to the approval of the SAFE or its local counterpart.

Under the Administration Rules, FIEs may only buy, sell and/or remit foreign currencies at banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from the SAFE or its local counterpart.