Attached files

Table of Contents

As filed with the Securities and Exchange Commission on August 29, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

ENOVATION CONTROLS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3823 | 47-1251427 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

5311 South 122nd East Avenue

Tulsa, Oklahoma 74146

(918) 317-4100

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Patrick W. Cavanagh

President and Chief Executive Officer

Enovation Controls, Inc.

5311 South 122nd East Avenue

Tulsa, Oklahoma 74146

(918) 317-4241

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

(Copies of all communications, including communications sent to agent for service)

| Daryl L. Lansdale, Jr. Gary H. McDaniel Fulbright & Jaworski LLP (a member of Norton Rose Fulbright) 300 Convent Street, Suite 2100 San Antonio, Texas 78205-3792 (210) 224-5575 |

Richard D. Truesdell, Jr. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4674 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered | Proposed Maximum Offering Price(1)(2) |

Amount of Registration Fee | ||

| Class A Common Stock, par value $0.00001 per share |

$100,000,000 | $12,880 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes offering price of shares of Class A common stock that the underwriters have the option to purchase to cover overallotments. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued August 29, 2014

Class A Shares

CLASS A COMMON STOCK

Enovation Controls, Inc. is offering shares of its Class A common stock. This is our initial public offering and no public market exists for our shares. We anticipate that the initial public offering price will be between $ and $ per share.

Immediately following the offering, the holders of our Class A common stock will collectively own 100% of the economic interests in Enovation Controls, Inc. and will have % of the voting power of Enovation Controls, Inc. The current owners of Enovation Controls, LLC will have the remaining % of the voting power of Enovation Controls, Inc. through ownership of 100% of the outstanding shares of our Class B common stock. We will be a holding company and our sole asset will be approximately % of the common units of Enovation Controls, LLC. The current owners of Enovation Controls, LLC will own the remaining % of the common units of Enovation Controls, LLC.

We will apply to list our Class A common stock on the New York Stock Exchange under the symbol “ENOV.”

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and, as such, may elect to comply with certain reduced reporting requirements after this offering. See “Prospectus Summary—Emerging Growth Company Status.”

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 23.

PRICE $ A SHARE

| Price to Public |

Underwriting and Commissions |

Proceeds, Before |

||||||||||

| Per share |

$ | $ | $ | |||||||||

| Total |

$ | $ | $ | |||||||||

| (1) | We have agreed to reimburse the underwriters for certain FINRA-related expenses. See “Underwriters.” |

We have granted the underwriters the right to purchase up to an additional shares of Class A common stock to cover overallotments at the initial public offering price less the underwriting discount.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of Class A common stock to purchasers on , 2014.

| MORGAN STANLEY | UBS INVESTMENT BANK | |||||

| PIPER JAFFRAY | BAIRD | BLAIR | RAYMOND JAMES |

, 2014

Table of Contents

We are responsible for the information contained in this prospectus and in any related free-writing prospectus we may prepare or authorize to be delivered to you. We and the underwriters have not authorized anyone to give you any other information, and we and the underwriters take no responsibility for any other information that others may give you. We are not, and the underwriters are not, making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

Until , 2014, all dealers that buy, sell, or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This requirement is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Non-GAAP Financial Measures

The SEC has adopted rules to regulate the use in filings with the SEC and in public disclosures of “non-GAAP financial measures,” such as Adjusted EBITDA. These measures are derived on the basis of methodologies other than in accordance with GAAP.

We have included one non-GAAP financial measure in this prospectus, Adjusted EBITDA. See “Prospectus Summary—Summary Historical and Pro Forma Consolidated Financial Data” for a description of the calculation of Adjusted EBITDA, as well as a reconciliation of our Adjusted EBITDA to net income (loss).

i

Table of Contents

Industry and Market Data and Forecasts

This prospectus includes industry and market data and forecasts that we obtained from industry publications and surveys, public filings, and internal company sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of such information. We have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. In other cases, such as statements as to our market position and ranking, such information is based on estimates made by our management, based on their industry and market knowledge and information from third-party sources. In addition, projections, assumptions, and estimates of the future performance of the industry in which we operate and our future performance are subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” Those and other factors could cause results to differ materially from those expressed in the estimates made in third-party sources and by us.

Trademarks and Service Marks

We own or have rights to trademarks, service marks, or trade names that we use in connection with the operation of our business, including the Enovation Controls logo, “EControls®,” “Murphy®,” and “EICS™.” Solely for convenience, trademarks, and trade names referred to in this prospectus may appear without the ® or ™ symbols. Other trademarks, service marks, and trade names appearing in this prospectus are the property of their respective owners. We do not intend our use or display of other parties’ trademarks, trade names, or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

Financial Statement Presentation

This prospectus includes certain selected historical consolidated financial data for Enovation Controls, LLC and its subsidiaries. Enovation Controls, LLC is our predecessor for financial reporting purposes. Enovation Controls, Inc. will be the financial reporting entity following this offering. The consolidated statement of operations data for each of the years in the three-year period ended December 31, 2013 and the consolidated balance sheet data as of December 31, 2013 and 2012 included in this prospectus are derived from the audited consolidated financial statements of Enovation Controls, LLC and its subsidiaries contained herein. The consolidated statement of operations data for the years ended December 31, 2010 and 2009 and the consolidated balance sheet data as of December 31, 2011, 2010, and 2009, have been derived from Enovation Controls, LLC’s audited consolidated financial statements not included in this prospectus. The consolidated statement of operations data for the six months ended June 30, 2014 and 2013 and the consolidated balance sheet data as of June 30, 2014 are derived from the unaudited consolidated financial statements of Enovation Controls, LLC and its subsidiaries contained herein. In the opinion of our management, such unaudited financial statements reflect all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the financial position and results of operations as of those dates and for those periods. Historical results are not necessarily indicative of results that may be expected for any future period, and the results for any interim period are not necessarily indicative of the results that may be expected for a full fiscal year.

This prospectus also includes an unaudited pro forma condensed consolidated balance sheet as of June 30, 2014 and unaudited pro forma condensed consolidated statements of income for the six month period ended June 30, 2014 and the year ended December 31, 2013, which present our consolidated financial position and results of operations to give pro forma effect to (i) the Transactions as described in “The Transactions,” which includes the reorganization transactions and the sale of shares in this offering (excluding shares issuable upon exercise of the underwriters’ option to purchase additional shares) and the application of the net proceeds from this offering as described in “Use of Proceeds,” (ii) the tax receivable agreement we will enter into with the existing Common Unitholders, (iii) a one-time special distribution of $60.0 million to Murphy Group and EControls Group and borrowings of $85.5 million under our senior credit facility to pay this distribution and

ii

Table of Contents

repay existing debt, which occurred on June 30, 2014, and (iv) the purchase of our San Antonio facility on July 25, 2014, from a third-party entity by a company jointly owned by Kennon Guglielmo, our Chief Technology Officer, and Frank W. Murphy, our Executive Chairman, in each case as if they had been completed as of January 1, 2013, with respect to the unaudited pro forma condensed consolidated statements of income, and June 30, 2014, with respect to the unaudited pro forma condensed consolidated balance sheet. As a result of the purchase described in the foregoing item (iv), the company jointly owned by Kennon Guglielmo, our Chief Technology Officer, and Frank W. Murphy, our Executive Chairman, must be accounted for as a variable interest entity which will result in the cost of the San Antonio facility, accumulated depreciation, mortgage debt and related depreciation and interest expense being consolidated (and the related rent expense being eliminated) in our financial statements. The unaudited pro forma condensed consolidated financial information reflects pro forma adjustments that are described in the accompanying notes and are based on available information and certain assumptions we believe are reasonable, but which are subject to change. We have made, in our opinion, all adjustments that are necessary to fairly present the unaudited pro forma condensed consolidated financial information. The unaudited pro forma condensed consolidated financial information is presented for informational purposes only and should not be considered indicative of actual results of operations that would have been achieved had the transactions set forth above been consummated on the dates indicated, and do not purport to be indicative of the financial condition or results of operations as of any future date or for any future period.

You should read our selected historical consolidated financial data and unaudited pro forma condensed consolidated financial information and the accompanying notes in conjunction with, and each is qualified in their entirety by reference to, the consolidated historical financial statements and related notes included elsewhere in this prospectus and the financial and other information appearing elsewhere in this prospectus, including information contained in “Risk Factors,” “Use of Proceeds,” “Capitalization,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Other than the inception balance sheet, the financial statements of Enovation Controls, Inc. have not been included in this prospectus as it is a newly incorporated entity, has no business transactions or activities to date, has nominal capitalization, and had no assets or liabilities during the periods presented in this prospectus.

iii

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary may not contain all of the information that is important to you. Before investing in our Class A Shares, you should carefully read this prospectus in its entirety, especially the risks of investing in our Class A Shares that we discuss in the “Risk Factors” section of this prospectus beginning on page 23 of this prospectus and the financial statements and related notes. The following summary is qualified in its entirety by the more detailed information and financial statements and related notes included elsewhere in this prospectus.

In this prospectus, unless otherwise stated or the context otherwise requires, references to “we,” “us,” “our” and similar references refer: (i) following the consummation of this offering and the Transactions, collectively, to Enovation Controls, Inc., and unless otherwise stated, all of its subsidiaries, and (ii) prior to the completion of this offering and the Transactions, collectively, to Enovation Controls, LLC, and unless otherwise stated, all of its subsidiaries.

In this prospectus, we refer to Murphy Group, Inc., an Oklahoma corporation, and to EControls Group, Inc., a Texas corporation, which are currently members of Enovation Controls, LLC, together as the Founder Entities. Murphy Group, Inc. is owned and controlled by Frank W. Murphy, III, our Executive Chairman, and certain trusts for the benefit of his children. EControls Group, Inc. is majority owned and controlled by Kennon Guglielmo, our Chief Technology Officer, his wife, and certain trusts for the benefit of their children. Certain officers and employees of Enovation Controls, LLC hold Class B, C, and D Membership Interests of Enovation Controls, LLC which will be converted into Common Units in Enovation Controls, LLC in connection with this offering. See “Prospectus Summary—Our Structure—Enovation Controls, LLC.”

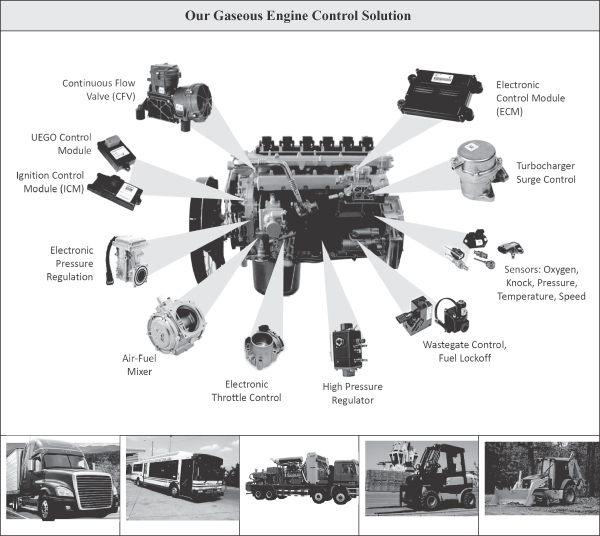

Company Overview

We are a leading global provider of sophisticated digital control systems for gaseous fuel engines and engine-driven equipment focused on the vehicle and energy markets. With a global installed base of over one million engine control systems, our EControls® and Murphy® brands are recognized for providing innovative, ruggedized, integrated turnkey solutions that combine proprietary software platforms and customized hardware. We develop high technology, mission-critical systems that are utilized in commercial CNG/LNG trucks and buses, natural gas production, distributed power generation, and a variety of industrial and off-highway applications. We provide critical solutions across the entire natural gas value chain based on our comprehensive understanding of engines and their applications in both the supply and demand sides of the natural gas market. This allows our customers to meet the most stringent global emissions standards while enabling the efficient, economical, and reliable operation of their equipment in extreme environments.

Due to our proprietary technology and strong engineering expertise, we believe we have developed many highly entrenched customer relationships, including several Fortune Global 500 corporations, based on deep technical collaboration. Our solutions represent a small portion of the overall cost of the end-use application, but are essential and integral to system functionality and operating performance. Many customers seek our assistance in engineering and designing complete engine control systems which creates high switching costs and results in us having a proprietary position for these engine platforms. In 2013, we generated $256 million in revenue and $41 million in operating income by leveraging the technology of our over 70 product families across more than 4,000 customers globally. We are geographically diverse, generating approximately 30% of our revenues in 2013 from international markets, including more than $60 million from the rapidly growing Asian market.

We believe we are well positioned to benefit from a number of significant trends driving demand in the industries in which we compete:

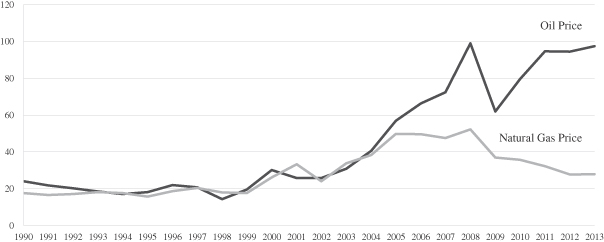

| • | Expected significant global increase in the production of and demand for natural gas supported by attractive cost, environmental, and geopolitical benefits relative to other hydrocarbon fuels; |

1

Table of Contents

| • | Anticipated growth in demand for advanced natural gas compression system controls in oil and gas applications driven by increased shale and tight formation production in the U.S. and globally; |

| • | Global adoption of natural gas vehicles (NGVs) due to significant economic and environmental advantages: |

| ¡ | According to ACT Research, natural gas could power 50% of Class 8 trucks, which are heavy duty trucks that are designed to carry more than 33,000 pounds, produced for the U.S. market by 2025, up from 6% in 2013; |

| ¡ | China is one of the largest and fastest growing NGV markets globally—the number of NGVs in China across all classes has grown from 36,000 in 2002 to approximately 1.6 million in 2012, at a compound annual growth rate (CAGR) of 45.9%, according to NGV Global; |

| • | Increasingly stringent global emissions regulations driving demand for advanced engine technologies that enable lower emissions, greater fuel economy, and regulatory compliance; and |

| • | Widespread adoption of advanced digital control solutions which integrate technologies such as high-resolution displays, highly configurable software, GPS navigation, telematics, vehicle management systems, and diagnostics to improve engine safety, energy efficiency, performance, and reliability with less dependence on operator skill. |

Our technological expertise and operating history with engine controls form the basis for all of our hardware and software product offerings. Our solutions include a variety of engine control and monitoring systems, sensors, displays, and panels that are used in gaseous fuel engines across several industries. Through our EControls® and Murphy® brands, we target two primary end markets: Vehicles and Energy.

In the Vehicle market, we design, engineer, and manufacture control and fuel injection systems for engines utilizing gaseous fuels such as compressed natural gas (CNG), liquefied natural gas (LNG), and liquefied petroleum gas (LPG or propane) as well as liquid fuels such as gasoline or diesel fuel. We are a leading provider of electronic engine control systems for commercial natural gas powered trucks and buses with approximately 200,000 systems deployed. We have deep technical relationships with several of the largest commercial NGV engine manufacturers in China, and we believe that we will continue to benefit from government regulations in this market including increasingly stringent emissions standards as China strives to improve its air quality. We provide complete engine management systems for natural gas, LPG, diesel, and gasoline engines used in off-highway, forklift and mobile, and stationary applications. We integrate products and technologies into our solutions that connect operators to vehicles through graphical displays, telematics, mobile device integration, and electro-hydraulic controls. We are often positioned as the sole-source provider to many of our top customers and develop proprietary engine control solutions for their new engine platforms.

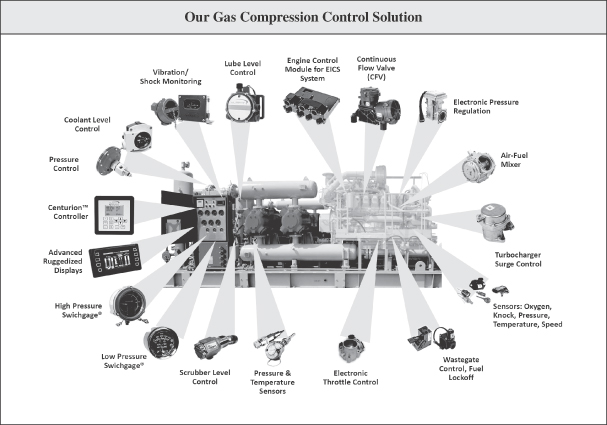

In the Energy market, we design, engineer, and manufacture a range of sophisticated products for the monitoring and control of mission-critical equipment including natural gas compressors, generators, pumps, and other engine-driven systems used in the extraction, transmission, and storage of natural gas. We are one of the leading providers of advanced controls for the natural gas compression market. Our Murphy® branded products include integrated engine management systems, custom-engineered and programmable compressor controls, control end-devices (including valves and sensors), and advanced ruggedized displays. Our Engine Integrated Control System (EICSTM) is a ground-breaking, turnkey control system primarily designed for natural gas compressor engines which integrates multiple critical functions (including ignition system, air-fuel ratio control, speed control, sensors, diagnostics, and an advanced graphical user interface) into a single pre-configured system. Due to its unique level of integration and ease of installation and operation, EICSTM is being adopted by large engine OEMs and system integrators. Our marketing team leverages our technology and products to

2

Table of Contents

provide solutions to adjacent engine-driven markets with similar requirements, such as oil and gas drilling services equipment and distributed power generation.

| Target Markets |

Target Applications |

Our Hardware and Software Solutions | ||

| Vehicle |

• Natural Gas Commercial Trucks and Buses

• Forklift and Mobile Equipment

• Off-Highway Equipment

• Off-Highway Recreational Vehicles

• Marine

• Distributed Power Generation and Industrial |

• Engine Control Modules

• Fuel Injection Devices

• Electro-Hydraulic Control Modules

• Fuel Pressure and Flow Control Devices

• Engine Aftertreatment Systems

• Power Distribution Modules

• Advanced Ruggedized Displays

• Engine Sensors

• Cruise and Speed Control Systems

• Telematics | ||

| Energy |

• Natural Gas Compression Equipment

• Natural Gas Engine-Driven Equipment

• Oil & Gas Production Equipment

• Distributed Power Generation

• Industrial Pumping Equipment |

• Integrated Engine Control Systems

• Supervisory Control Systems

• Engine Aftertreatment Systems

• Monitoring Equipment

• Ignition Systems & Accessories

• Level Transmitters and Maintainers

• Instrumentation

• Pressure Control Valves

• Advanced Ruggedized Displays

• Vibration, Pressure, and Temperature Sensors

• Wireless Sensor Solutions

• Telematics |

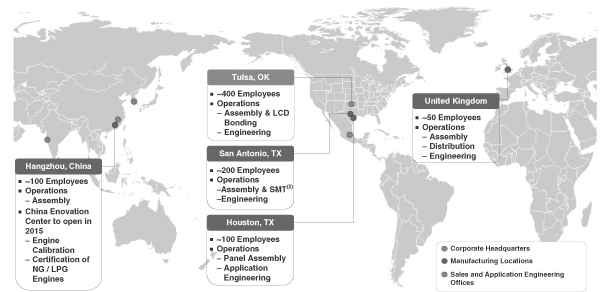

We generally seek to localize our product manufacturing and support to our customer base around the world. We have established manufacturing, sales, and engineering application centers in the U.S., Mexico, the U.K., China, India, and South Korea to serve our key geographies. We currently operate five manufacturing and distribution centers in the U.S., Europe, and Asia. In 2015, we plan to open our state-of-the-art China Enovation Center, co-located with our manufacturing operations in Hangzhou, China. This Center will provide additional technical and support services for our customers in the vehicle market in China, India, South Korea, and Japan and will include sophisticated engine calibration and certification capabilities. We drive operational excellence through advanced manufacturing techniques, leading industry management practices, and global supply chain optimization. We maintain our high standards of quality through disciplined new product design, manufacturing processes, supplier selection, and adherence to global quality certifications along with comprehensive testing and validation laboratories in the U.S. and China. We establish customer intimacy with strong relationships based on ethics, trust, performance, and rapid responsiveness. Our strong track record of consistent revenue growth and cash flow generation is a testament to our ability to continually deliver innovative products in our markets while maintaining a high degree of customer focus.

3

Table of Contents

Industry Overview

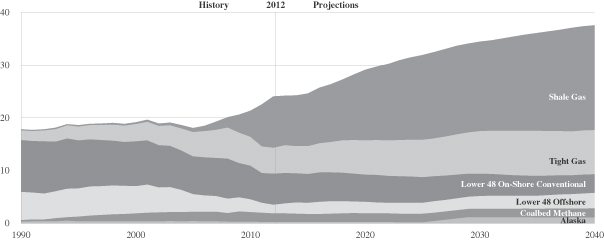

Shale Gas Revolution

The natural gas industry has undergone a dramatic transformation in recent years. According to the U.S. Energy Information Administration (EIA), global reserves of natural gas have increased by 56% from 1992 to 2013. North America has seen the strongest production growth in recent years, benefitting from improved production technologies such as hydraulic fracturing, or fracking, and horizontal drilling techniques resulting in increased extraction from shale and tight formations.

Natural gas is expected to become an even more important component of the global energy mix, accounting for approximately 30% of global energy needs by 2035 as the supply of natural gas increases by nearly 50%.

Gas compression is an essential process used throughout the production cycle to lift oil in tight formations and to transport gas to the end user. According to Frost & Sullivan, increases in shale gas production will increase revenues at an accelerating pace from 2012 to 2018 for total compressors in oil and gas applications.

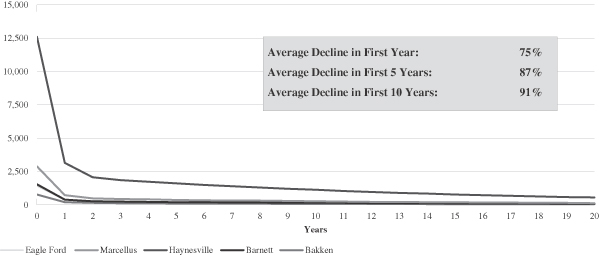

Relative to traditional fuels, unconventional natural gas resources contained in shale and tight formations have significant initial production decline rates which necessitate increased drilling activity and compression to maintain production levels. This trend in decline rates is driving increased compression demand and will benefit companies, such as ourselves, that provide the critical technologies required to operate these systems. Gas lifts, which are predominantly used to artificially lift oil by introducing high pressure compressed gas into the outlet tube of the well, are also increasing in prevalence and resulting in greater compression demand.

Accelerating Shift to Natural Gas Vehicles

Due to its current and expected long-term benefits, natural gas has become an important and attractive transportation fuel. According to NGV Global, there are approximately 16.7 million NGVs in operation globally. These vehicles include medium- and heavy-duty commercial vehicles, off-highway trucks, buses, light-duty vehicles, locomotives, marine vessels, and recreational vehicles. As natural gas has become increasingly attractive as a low-cost fuel source and government regulators have implemented stringent emissions regulations, the global population of NGVs has increased by more than seven-fold since 2002 according to NGV Global. Commercial NGVs are experiencing adoption rates significantly higher than other vehicle classes due to high annual fuel consumption and the resulting substantial fuel cost per-mile advantages of natural gas. According to Navigant, approximately 170,000 natural gas trucks and buses were sold globally in 2013.

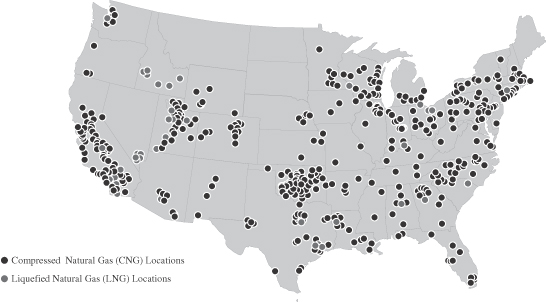

Expanding Natural Gas Refueling Infrastructure

One historical barrier to the adoption of NGVs has been a lack of broad-based refueling infrastructure. This limitation is being addressed through aggressive station buildout in numerous geographies. China is a leader in the buildout of NGV refueling with a network of almost 4,900 refueling stations in 2013, and the number of refueling stations is expected to grow to about 6,000 refueling stations by the end of 2014. In the U.S., natural gas refueling infrastructure has undergone significant growth as well. Since 2010, refueling stations have increased by over 50% to 1,344 nationwide. New public stations were constructed at a rate of approximately 3.4 per week in 2013, compared to a rate of 1.4 in 2010. The refueling station infrastructure continues to be developed across major U.S. shipping corridors to service national fleets of heavy commercial vehicles. While government subsidies exist in some foreign markets, the U.S. NGV refueling station market remains subsidy free and growth is being driven by private companies such as Clean Energy Fuels, Questar Fueling, TruStar Energy, Shell Oil Products U.S., Love’s Travel Stops, Blu LNG, Prometheus Energy, and Kwik Trip.

4

Table of Contents

Stringent Emissions Regulations

Concerns regarding climate change and other environmental considerations have led to implementation of laws and regulations that restrict, cap or tax emissions in the vehicle market and throughout other industries. While emission standards vary significantly around the world, such standards have become increasingly more stringent. Over the last ten years in particular, there has been a significant increase in regulation of commercial on-highway and off-highway engine emissions. Industrial OEMs have also experienced pressure to redesign their engines to address these emission regulations, as products that are unable to meet new standards cannot be sold in the marketplace. However, we believe few suppliers to commercial NGV OEMs and industrial OEMs have been capable of providing, or are willing to make the investments necessary to provide, engine control system products that economically meet the new U.S. Environmental Protection Agency (EPA) and California Air Resources Board (CARB) requirements.

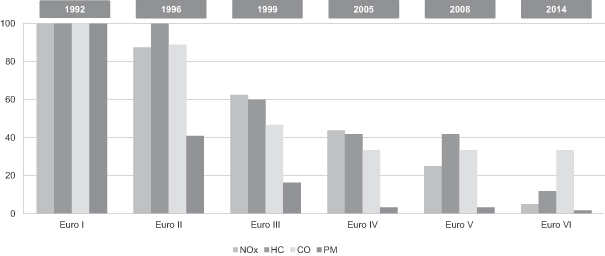

Countries outside of the U.S. have historically adopted emission regulations aligned with those of the U.S., and it is anticipated that regulations comparable to current and future EPA and CARB emission regulations will continue to be implemented internationally. For example, policies in Europe, generally referred to as Euro I, II, III, IV, V, and VI regulations, limit tailpipe emissions of commercial vehicles. Similar to various stages of regulations in the U.S., these regulations in Europe call for comparable reductions in emissions of hydrocarbons, nitrogen oxide, and particulate matter. Emissions standards similar to Euro standards have been adopted by India, China, Argentina, and Brazil.

Competitive Strengths

We believe we have a number of competitive strengths that differentiate us, including:

Leading Provider of Mission-Critical Digital Control Solutions for Natural Gas Engines. We are one of the leading providers of digital control systems for gaseous fuel engines and have an installed base of over one million engine control systems globally. In addition, we are a leading provider of electronic engine control systems for commercial natural gas powered trucks and buses with approximately 200,000 systems deployed, and one of the leading providers of advanced controls for the natural gas compression market. Our EControls® and Murphy® brands are recognized for providing innovative, ruggedized, integrated turnkey solutions that deliver consistent and reliable performance for engine-driven equipment operating on a variety of gaseous fuels. Our solutions represent a small portion of the overall cost of the end-use application, but are essential and integral to system functionality and operating performance. We are a preferred partner for global OEMs and end users across a wide variety of high-growth markets, applications, and geographies.

Aligned with Global Industry Trends to Drive Growth. We are strategically positioned to benefit from compelling global trends in each of our primary end markets:

| • | Expected significant global increase in the production of and demand for natural gas supported by attractive cost, environmental, and geopolitical benefits relative to other hydrocarbon fuels; |

| • | Anticipated growth in demand for advanced natural gas compression system controls in oil and gas applications driven by increased shale and tight formation production in the U.S. and globally; |

| • | Global adoption of NGVs due to significant economic and environmental advantages; |

| • | Increasingly stringent global emissions regulations driving demand for advanced engine technologies that enable lower emissions, greater fuel economy, and regulatory compliance; and |

| • | Widespread adoption of advanced digital control solutions which integrate technologies such as high-resolution displays, highly configurable software, GPS navigation, telematics, vehicle management systems, and diagnostics to improve engine safety, energy efficiency, performance, and reliability with less dependence on operator skill. |

5

Table of Contents

We believe each of these trends will continue to create significant demand for our products.

Innovative Product Design Driven by Deep Application Knowledge. We are a recognized leader in designing and developing innovative and sophisticated new products within our markets. Over the past three years, we have developed and launched 55 new products, which had an average gross margin of approximately 50% for the year ended December 31, 2013. Our intellectual property portfolio includes millions of lines of software source code, proprietary manufacturing techniques and, as of June 30, 2014, 46 issued and pending patents and patent applications. Driven by deep application knowledge, we deliver forward-thinking solutions ahead of our customers’ needs to create sustainable competitive advantages. Our application engineering expertise and know-how enables us to deliver optimized solutions combining proprietary software platforms and customized hardware. Our design and engineering efforts are led by an in-house team of 160 full-time engineers across all disciplines with strong product development and application expertise in gaseous fuel engines and engine-driven equipment.

Entrenched Customer Relationships Built on Technical Collaboration. Our commitment to technological innovation, proven product performance, and superior service has enabled us to develop longstanding, collaborative relationships with a broad group of more than 4,000 customers globally. These customers represent a diverse group of OEMs and distributors located across the globe including Exterran, Power Solutions, RES Energy Solutions, Yuchai, John Deere, Caterpillar, Volvo Penta, and Wuxi Faw. As a result of our application and engineering expertise, we have a deep and unique understanding of our customers’ gaseous fuel engines and engine-driven equipment, and we are often positioned as the sole-source solution provider to our customers.

Established Global Footprint. We maintain a manufacturing, sales, and service infrastructure presence on three continents, enabling us to effectively serve our worldwide customer base. In 2013, approximately 71% of our net sales were generated in North and South America, 24% in Asia and 5% in Europe, the Middle East, and Africa. We believe we have developed strong trusting relationships with local customers and suppliers based on our local manufacturing and sales presence, track record of performance, and brand recognition. In 2015, we plan to open our state-of-the-art China Enovation Center, co-located with our manufacturing operations in Hangzhou, China, that will provide additional technical support as well as engine calibration and certification services to our customers in China, India, South Korea, and Japan. We provide natural gas engine control systems to several of the largest commercial NGV engine manufacturers in China—one of the largest and fastest growing commercial NGV markets.

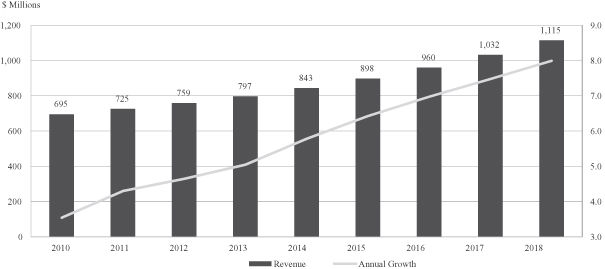

Strong Financial Performance with Attractive Cash Flow. We have demonstrated the strength of our platform through robust growth and cash flow generation. We grew revenues from $148 million in 2010 to $256 million in 2013. This organic growth has been driven by our new product introductions, geographic expansion, acquisition of new customers, and increasing market share, as well as broader market trends such as the proliferation of commercial NGVs and the energy infrastructure buildout. In addition, we estimate that we generate approximately one-third of our revenues from the Energy market from sales of replacement parts and services, which provides an attractive margin and recurring revenue stream. As evidence of our engineering leadership and compelling value proposition, we generated gross margin of 42% in 2013, an increase of more than 477 basis points since 2010, due to disciplined design reuse, modular hardware and software concepts, high-level graphical software configurability, integrated global sourcing, process improvements, strategic value-based pricing, and an intentional focus on a more favorable customer and product sales mix. Our business historically has required low capital expenditures, which have averaged less than 3% of revenue between 2010 and 2013. In 2013, we generated Adjusted EBITDA of $47 million, net income of $40 million, and net cash provided by operations of $37 million before distributions for taxes.

6

Table of Contents

Growth Strategy

We believe that we are well positioned to extend our market leading position in sophisticated digital engine control systems for gaseous fuel engines and engine-driven equipment and capitalize on positive global trends. The principal elements of our growth strategy are as follows:

Accelerate Product Innovation and Expansion. We distinguish ourselves from our competitors with our proprietary technology and strong engineering expertise. We are committed to driving our level of technological sophistication and the pace of product innovation. For example, since 2002, we have successfully developed four generations of innovative gaseous engine control platforms and fuel metering technology, with each new generation advancing fuel economy, decreasing emissions, and improving reliability. We plan to continue to leverage our core technology platforms across many different products and applications targeting our served markets to maximize the impact of our research, development, and engineering investments.

Increase Product Sales and Services with Existing Customers. Our deep relationships with our existing customers, as well as our strong track record of developing innovative and forward-thinking products and solutions, have enabled us to systematically increase sales and margins. We believe this approach has been a key driver of our 52% aggregate sales growth from our top ten customers from 2011 to 2013. As a trusted incumbent solution provider with a wide range of customers across numerous markets, we have numerous cross-selling opportunities in which we leverage our existing technologies and respective customer relationships for incremental sales growth.

Develop New Customer Relationships in the Fast Growing Vehicle Market. We are expanding our customer base by developing new OEM relationships in our target markets. We are working with leading North American heavy-duty commercial vehicle manufacturers and global engine OEMs to leverage our technological and engineering capabilities on their new engine platforms. We believe that our global manufacturing, sales, service infrastructure, and partnerships with customers position us to capture market share in both mature and high-growth markets.

Drive Continuous Improvement in Manufacturing and Operations. We believe that our strong manufacturing, engineering, and advanced production capabilities, anchored by our focus on efficiency and quality, are core elements of our financial strength. We intend to increase these advantages by leveraging our proprietary Enovation Controls Operating System (ECOS) to enable high flexibility and superior quality in our manufacturing processes. This system allows for the implementation of continuous improvement initiatives that are designed to support significant operating efficiencies and strong profitability.

Selectively Pursue Strategic Acquisitions and Alliances. Our industry leadership makes us an ideal platform to acquire or partner with companies in our target markets. We provide complete engine control system solutions across a wide range of applications and will continue to explore synergistic acquisition opportunities which enhance our position in our served markets. We will seek strategic transactions that extend our presence into new geographies or applications, expand our customer base, and/or add new products or technologies to our existing platform solutions.

Risks Associated with Our Business

There are a number of risks and uncertainties that may affect our financial and operating performance, our competitive position, and our growth prospects. You should carefully consider all of the risks discussed under the caption “Risk Factors,” which begins on page 23, before investing in our Class A Shares. These risks include the following:

| • | If one or more of the favorable industry trends we have identified fails to occur, or occurs at a slower rate than expected, our business will be adversely affected. |

7

Table of Contents

| • | If we are unable to continue our technological innovation and successful introduction of new commercial products, our business will be adversely affected. |

| • | The market for natural gas engines may not develop according to our expectations and, as a result, our business may not grow as planned and our business plan may be adversely affected. |

| • | Fuel price differentials among natural gas, diesel, and gasoline fuels are hard to predict and may be less favorable in the future. |

| • | Our growth is partly dependent on global natural gas refueling infrastructure that may not be developed. |

| • | Changes in laws or government regulations regarding hydraulic fracturing could increase the cost of natural gas exploration and production or limit the areas in which such exploration and production may occur, which could adversely impact the demand for our products and solutions. |

| • | We currently face, and will continue to face, significant competition, which could materially and adversely affect us. |

| • | We derive a significant portion of our revenue from a limited number of major customers, and our revenue, profitability, and cash flows could be materially adversely affected if we are unable to maintain relationships with these customers, or if their demand for our products decreases. |

| • | If we are unable to protect the confidentiality of our trade secrets, our business and competitive position would be harmed. |

| • | The inability to protect our intellectual property and know-how could reduce or eliminate any competitive advantage and reduce our sales and profitability, and the cost of protecting our intellectual property may be significant. |

8

Table of Contents

Our Structure

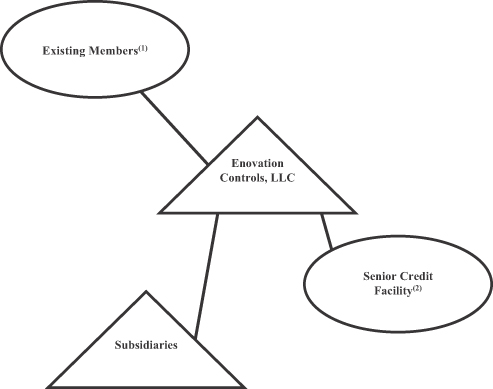

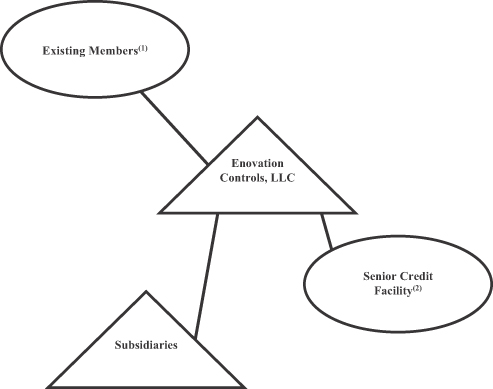

The diagram below depicts our organizational structure immediately prior the consummation of this offering and related transactions. See “—The Transactions.”

| (1) | The existing members consist of Murphy Group, EControls Group, and Employee Holders. Murphy Group holds an approximately % economic interest in Enovation Controls, LLC through its ownership of Class A Units. EControls Group holds an approximately % economic interest in Enovation Controls, LLC through its ownership of Class A Units. Employee Holders hold an approximately % economic interest in Enovation Controls, LLC through their ownership of Class B, C, and D Management Interests. |

| (2) | Enovation Controls, LLC’s senior credit facility is guaranteed by its U.S. subsidiaries. |

9

Table of Contents

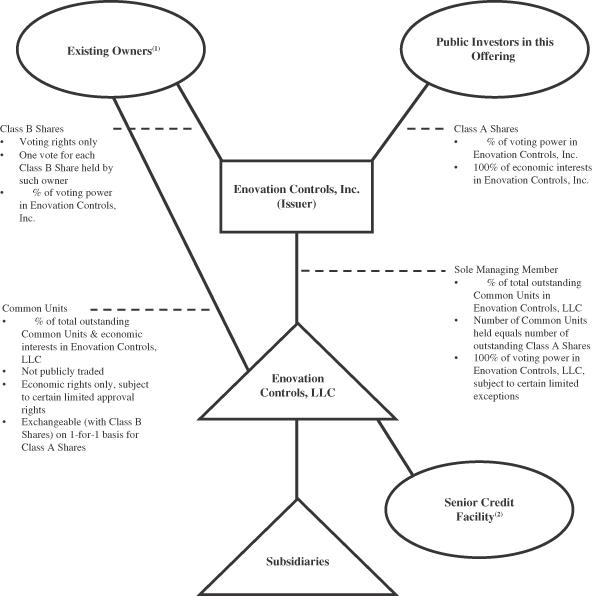

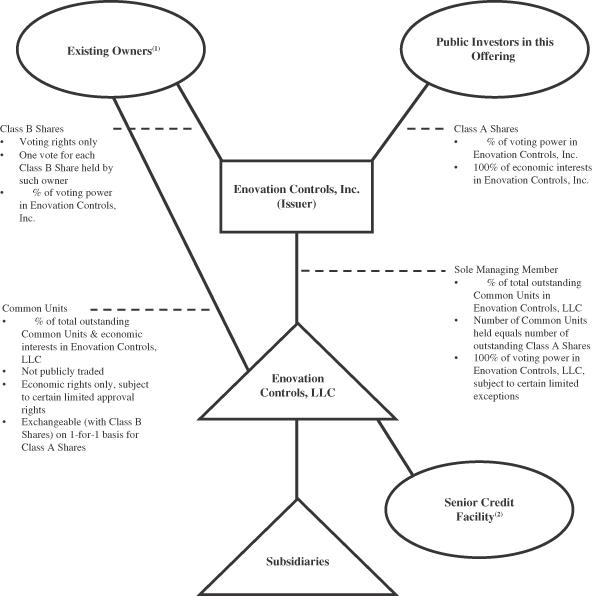

The diagram below depicts our organizational structure immediately after the consummation of this offering and related transactions. See “—The Transactions.”

| (1) | The existing owners consist of Murphy Group, EControls Group, and Employee Holders. Murphy Group will hold Class B Shares representing % of the voting power and 0% of the economic interest; Murphy Group also will hold a % economic interest in Enovation Controls, LLC. EControls Group will hold Class B Shares representing % of the voting power and 0% of the economic interest; EControls Group also will hold a % economic interest in Enovation Controls, LLC. Employee Holders will hold Class B Shares representing % of the voting power and 0% of the economic interest; Employee Holders also will hold a % economic interest in Enovation Controls, LLC. |

| (2) | Enovation Controls, LLC’s senior credit facility is guaranteed by its U.S. subsidiaries. |

10

Table of Contents

Enovation Controls, LLC. We will operate our business through Enovation Controls, LLC and its consolidated subsidiaries.

The current members of Enovation Controls, LLC are described below.

| • | Murphy Group, Inc., which we refer to as the Murphy Group, is owned by Frank W. Murphy, III, our Executive Chairman, and certain trusts for the benefit of his children, and holds an approximately % economic interest in Enovation Controls, LLC through its ownership of Class A Units, which will be converted into an aggregate of Common Units (with a corresponding number of Class B Shares) in connection with this offering. |

| • | EControls Group, Inc., which we refer to as the EControls Group, is majority owned by Kennon Guglielmo, our Chief Technology Officer, his wife, and certain trusts for the benefit of their children, and holds an approximately % economic interest in Enovation Controls, LLC through its ownership of Class A Units, which will be converted into an aggregate of Common Units (with a corresponding number of Class B Shares) in connection with this offering. Certain employees of Enovation Controls, LLC hold a minority ownership interest in EControls Group. We collectively refer to the Murphy Group and EControls Group as the Founder Entities. |

| • | Certain of our officers and other employees, whom we collectively refer to as the Employee Holders, hold an approximately % economic interest in Enovation Controls, LLC through their ownership of Class B, C, and D Management Interests which will be converted into an aggregate of Common Units (with a corresponding number of Class B Shares) in connection with this offering in a manner that reflects the percentage of Enovation Controls, LLC currently owned by the Class B, C, and D Management Interest holders, taking into account their current distribution entitlement and the fair value of Enovation Controls, LLC based on the offering price. Approximately % of converted Common Units will be subject to forfeiture at the time of the conversion and will vest only if the holder remains employed by us through the applicable period or upon a change in control. The conversion will have no direct or indirect economic effect on us. |

Enovation Controls, Inc. Upon completion of the offering, we will use the net proceeds received to purchase Common Units directly from the Murphy Group, EControls Group, and Employee Holders and, to the extent necessary to pay offering expenses, from Enovation Controls, LLC. Immediately after our acquisition of these Common Units, our only material asset will be our ownership of % of the total Common Units and our only business will be acting as the sole managing member of Enovation Controls, LLC. You should note, in particular, that:

| • | We will be the sole managing member of Enovation Controls, LLC. |

| • | Investors in this offering will own 100% of our Class A Shares (and % of our Class A Shares on a fully diluted basis assuming all Common Units and Class B Shares are exchanged for Class A Shares). The outstanding Class A Shares will represent 100% of the economic interest in us, but initially only % of our voting power, and we will own % of the economic interest in Enovation Controls, LLC. |

| • | Our Class A Shares will entitle the holders to receive 100% of any distributions we make. Upon our liquidation, dissolution, or winding up, holders of Class A Shares will be entitled to share ratably in all assets available for distribution after payment of our liabilities. |

| • | Immediately after the completion of this offering, the only outstanding Class A Shares will be the Class A Shares issued pursuant to this offering. |

| • | The Common Unitholders will own 100% of our Class B Shares, which will vote together with the Class A Shares as a single class. Each Class A Share has one (1) vote per share and each Class B Share has one (1) vote per share. The Class B Shares will represent, upon completion of this offering, % of the combined voting power of our common stock. The Class B Shares do not represent an economic interest in us and are therefore not entitled to any dividends that we may pay. However, each holder of a Class B Share owns an economic interest in Enovation Controls, LLC through a corresponding |

11

Table of Contents

| Common Unit. The Common Unitholders will hold substantially more than 50% of the combined voting power of our common stock and they will hold all the Class B Shares. |

| • | We intend to enter into a stockholders agreement, which we refer to as the Stockholders Agreement, with Murphy Group and EControls Group that will become effective upon the completion of this offering. The Stockholders Agreement will contain provisions that will prevent a Founder Entity from transferring its shares without the consent of the other Founder Entity, except in the case of sales to affiliates, sales to any member of its family group (as defined therein), tag-along sales of our common stock by both Founder Entities, or transfers pursuant to the Registration Rights Agreement, until the earlier of the third anniversary of the offering or the time at which the Founder Entities collectively hold less than 10% of our outstanding Class A Shares and Class B Shares. The Stockholders Agreement will also grant each Founder Entity the right, subject to certain ownership thresholds, to nominate a specified number of designees to our board of directors and committees of our board of directors. Each Founder Entity will have the right to designate two members to our board of directors for so long as such Founder Entity owns 10% or more of our outstanding Class A Shares and Class B Shares on a combined basis. The Founder Entities will also have the right to designate one mutually agreed additional member to our board of directors. The Founder Entities will agree to vote all of their shares of our common stock to elect such designees to our board of directors. If, at any time, a Founder Entity owns 5% or more but less than 10% of our outstanding Class A Shares and Class B Shares on a combined basis, such Founder Entity will have the right to designate one nominee for election to our board of directors. If a Founder Entity’s ownership level falls below 5% of our outstanding Class A Shares and Class B Shares on a combined basis, such Founder Entity will no longer have any right to designate a nominee and the right of the Founder Entities to designate a mutually agreed upon designee will also terminate. In addition, for so long as the Founder Entities together hold at least 25% of the outstanding Class A Shares and Class B Shares on a combined basis, certain actions may not be taken without the prior written consent of each Founder Entity owning at least 5% of the outstanding Class A Shares and Class B Shares on a combined basis. See “The Transactions—Stockholders Agreement” for further information. |

| • | Pursuant to the amended and restated operating agreement of Enovation Controls, LLC, in order to provide liquidity to the Common Unitholders, each Common Unit, together with the corresponding number of our Class B Shares, held by a Common Unitholder will be exchangeable for (i) one of our Class A Shares, or (ii) at our option, cash equal to the market value of one of our Class A Shares, at any time and from time to time after the expiration or earlier termination (if any) of the lock-up agreement between the underwriters of this offering and each Common Unitholder. These exchange rights may be exercised with respect to unvested Common Units only with our consent. In addition, the percentage of an Employee Holder’s Common Units that can be exchanged (taken together with any Common Units sold to us in connection with the offering) is limited to the aggregate percentage of Common Units exchanged or sold in connection with or following the offering by Murphy Group or EControls Group (whichever is higher). This percentage limitation will expire three years after the offering or, if sooner, when the Founder Entities together cease to own at least 15% of the outstanding Class A Shares and Class B Shares on a combined basis. The exchange of the Common Units and Class B Shares corresponding to these Common Units for our Class A Shares will increase the number of outstanding Class A Shares and decrease the number of outstanding Class B Shares. |

| • | Following this offering, the members of Enovation Controls, LLC, other than us, will consist of Murphy Group, EControls Group, and the Employee Holders. |

Certain Attributes of Our Structure. Our structure following this offering will be designed to accomplish a number of objectives, the most important of which are as follows:

| • | The structure will allow us to serve as a holding company, with our sole asset being our ownership interest in Enovation Controls, LLC. The Common Unitholders, however, will retain their economic |

12

Table of Contents

| investment in the form of direct interests in Enovation Controls, LLC, rather than through our Class A Shares. Following this offering, all of the businesses operated by Enovation Controls, LLC or its subsidiaries prior to this offering, and all of the interests held by Enovation Controls, LLC and its subsidiaries in such businesses prior to this offering, will be operated or held, as the case may be, by Enovation Controls, LLC and its subsidiaries, and our current management will continue to manage these businesses. As a result, we and the Common Unitholders will participate in the net operating results of Enovation Controls, LLC on a pari passu basis, in accordance with our respective ownership of Enovation Controls, LLC. |

| • | In connection with this offering, we will issue to the Common Unitholders non-economic Class B “vote-only” shares that as a percentage of the combined voting power of our common stock will be equal to their economic ownership in Enovation Controls, LLC. |

| • | In the event that a Common Unitholder wishes to exchange Common Units for Class A Shares, the holder must deliver the Common Units to us, together with a corresponding number of Class B Shares, and in exchange therefor we will deliver to the exchanging holder a number of Class A Shares corresponding to the number of Common Units delivered to us. We will cancel any Class B Shares delivered to us. |

| • | Under the terms of the amended and restated operating agreement of Enovation Controls, LLC, Common Unitholders will be able to exchange their Common Units, together with a corresponding number of Class B Shares, for Class A Shares at any time and from time to time after the expiration or earlier termination (if any) of the lock-up agreement between the underwriters of this offering and each Common Unitholder, subject to certain limitations. |

The Transactions

In connection with this offering:

| • | The amended and restated operating agreement of Enovation Controls, LLC will be amended and restated to provide, among other things, (i) for us to act as the sole managing member and (ii) that Common Units held by the Common Unitholders together with a corresponding number of Class B Shares will be exchangeable for (a) one of our Class A Shares, or (b) at our option, cash equal to the market value of one of our Class A Shares, as applicable, at any time and from time to time after the expiration or earlier termination (if any) of the lock-up agreement between the underwriters of this offering and each Common Unitholder, subject to certain limitations, in order to provide liquidity to these holders. |

| • | We will issue the Class A Shares for net proceeds of approximately $ million, after deducting underwriting discounts (assuming the Class A Shares are sold at $ per share, which is the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus). |

| • | We intend to use the net proceeds that we receive from this offering to purchase Common Units directly from the Murphy Group, EControls Group, and Employee Holders and Enovation Controls, LLC at a price per Common Unit equal to the public offering price per share of our Class A Shares, less underwriting discounts. The number of Common Units being sold to us by the Murphy Group, EControls Group, and Employee Holders is based upon a pro rata allocation among the Murphy Group, EControls Group, and those Employee Holders (based on the number of vested Common Units held by such Employee Holders) electing to participate in the sale. We will use $ million to purchase % of the Common Units held by Murphy Group, $ million to purchase % of the Common Units held by EControls Group and $ million to purchase % of the Common Units held by the Employee Holders and $ million to purchase % of the Common Units from Enovation Controls, LLC. Enovation Controls, LLC will use the proceeds from our purchase of Common Units from it to repay offering expenses. Upon completion of the offering, we will have acquired Common Units representing a % interest in Enovation Controls, LLC. |

13

Table of Contents

| • | We will enter into a stockholders agreement with Murphy Group and EControls Group immediately prior to this offering. See “The Transactions—Stockholders Agreement.” |

| • | We will enter into a registration rights agreement with all Common Unitholders immediately prior to this offering. See “The Transactions—Registration Rights Agreement.” |

| • | We will enter into a tax receivable agreement with all Common Unitholders immediately prior to this offering. See “The Transactions—Tax Receivable Agreement.” |

| • | We will amend and restate our certificate of incorporation to provide for, among other things, the issuance of our Class A Shares and Class B Shares. |

We refer to the foregoing collectively as the “Transactions.” No fairness opinion was sought nor was one obtained for any aspect of the Transactions. If you invest in our Class A Shares, your interest in us will be diluted to the extent of the difference between the initial public offering price per Class A Share and the pro forma net tangible book value per Class A Share after this offering, which is $ . Assuming we sell the Class A Shares in this offering at $ per share, the extent of your dilution will be $ per share. See “Dilution” for further information.

Tax Receivable Agreement. As described in “The Transactions,” we intend to enter into a tax receivable agreement with all Common Unitholders. The tax receivable agreement will require us to pay those Common Unitholders 85% of the amount of cash savings, if any, in U.S. federal, state and local income or franchise tax that we actually realize, or in some circumstances we are deemed to realize, in any tax year beginning with and following 2014 (a “covered tax year”) from increases in tax basis realized as a result of the initial purchase and any future exchanges by Common Unitholders of their Common Units (and Class B Shares) for Class A Shares (or cash), including increases attributable to payments made under the tax receivable agreement and deductions attributable to imputed interest. We expect to benefit from the remaining 15% of cash savings, if any, in income and franchise tax that we actually realize during a covered tax year.

Controlled Company Status

As a result of the significant ownership of our Class B Shares by the Founder Entities and the Stockholders Agreement described above, more than 50% of the combined voting power of our common stock will be held by the Founder Entities. As a result, we will be considered a “controlled company” under the rules of the NYSE. A controlled company may elect not to comply with certain NYSE corporate governance standards, including the requirements that: (i) a majority of our board of directors consist of independent directors; (ii) we have a nominating and corporate governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and (iii) we have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities. Following this offering, in reliance upon the foregoing exemptions, a majority of our board of directors will not consist of independent directors, we will not have a nominating and corporate governance committee, and our compensation committee will not be composed entirely of independent directors, and we may use any of these exemptions for so long as we are a controlled company. Accordingly, you will not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of the NYSE. See “Risk Factors—Risks Related to this Offering and Ownership of Our Class A Shares—As a controlled company, we will not be subject to all of the corporate governance rules of the NYSE” and “Management—Director Independence” for further information.

In addition, the Founder Entities will be able to significantly influence, and as long as they together own a majority of our outstanding common stock, control the outcome of all matters requiring a stockholder vote, including: the election of directors; mergers, consolidations and acquisitions; the sale of all or substantially all of our assets and other decisions affecting our capital structure; the amendment of our certificate of incorporation

14

Table of Contents

and our bylaws; and our winding up and dissolution. This concentration of ownership may delay, deter or prevent acts that would be favored by our other stockholders or deprive holders of Class A Shares of an opportunity to receive a premium for their Class A Shares as part of a sale of our business and it is possible that the interests of the Founder Entities may in some cases conflict with our interests and the interests of our other holders of Class A Shares, including you.

Corporate Information

Our principal executive offices are located at 5311 South 122nd East Avenue, Tulsa, Oklahoma 74146 and our telephone number at that address is (918) 317-4100. Our website is located at www.enovationcontrols.com. This website and the information contained therein is not part of this prospectus, and you should rely only on the information contained in this prospectus when making a decision as to whether to invest in our Class A Shares.

Emerging Growth Company Status

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, which we refer to as the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are applicable to other companies that are not emerging growth companies. Accordingly, we have included detailed compensation information for only our three most highly compensated executive officers and have not included a compensation discussion and analysis (CD&A) of our executive compensation programs in this prospectus. In addition, for so long as we are an “emerging growth company,” we will not be required to:

| • | engage an auditor to report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes–Oxley Act of 2002 (the “Sarbanes–Oxley Act”); |

| • | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| • | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay,” “say-on-frequency,” and “say-on-golden parachutes;” or |

| • | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparison of the chief executive officer’s compensation to median employee compensation. |

In addition, the JOBS Act provides that an “emerging growth company” can use the extended transition period for complying with new or revised accounting standards. However, we are choosing to “opt out” of such extended transition period and, as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for companies that are not emerging growth companies. The JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

We will remain an “emerging growth company” until the earliest to occur of:

| • | our reporting $1 billion or more in annual gross revenues; |

| • | our issuance, in a three year period, of more than $1 billion in non-convertible debt; |

| • | the end of the fiscal year in which the market value of our common stock held by non-affiliates exceeds $700 million on the last business day of our second fiscal quarter; and |

| • | December 31, 2019. |

15

Table of Contents

THE OFFERING

| Class A Shares being offered by us |

Class A Shares | |

| Underwriters’ overallotment option to purchase additional Class A Shares |

Class A Shares | |

| Class A Shares to be outstanding immediately after this offering |

Class A Shares | |

| Class A Shares to be outstanding immediately after this offering, assuming the exchange of all Common Units |

Class A Shares. See “—Exchange Rights” below. | |

| Class B Shares to be held by the holders of Common Units immediately after this offering |

Class B Shares | |

| Voting |

Each of our Class A Shares will entitle its holder to one (1) vote on all matters to be voted on by stockholders generally. Each of our Class B Shares will entitle its holder to one (1) vote on all matters to be voted on by stockholders generally. Except as required by law, our Class A Shares and Class B Shares will vote together on all matters submitted to a vote of our stockholders. | |

| Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $ million, after deducting underwriting discounts (assuming the Class A Shares are sold at $ per share, which is the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus), or $ million if the underwriters exercise in full their option to purchase additional shares to cover overallotments. We intend to use $ million of the net proceeds of this offering to purchase Common Units of Enovation Controls, LLC directly from the EControls Group, Murphy Group and Employee Holders at a price per Common Unit equal to the public offering price per share of our Class A Shares, less underwriting discounts. The number of Common Units being sold to us by the Murphy Group, EControls Group, and Employee Holders is based upon a pro rata allocation among the Murphy Group, EControls Group, and those Employee Holders (based on the number of vested Common Units held by such Employee Holders) electing to participate in the sale. We intend to use the remaining $ million of the proceeds of this offering to purchase newly issued Common Units of Enovation Controls, LLC from Enovation Controls, LLC at a price per Common Unit equal to the public offering price per share of our Class A Shares, less underwriting discounts. These proceeds will be used by Enovation Controls, LLC to pay estimated offering | |

16

Table of Contents

| expenses. Upon completion of the offering, we will have acquired Common Units representing a % economic interest in Enovation Controls, LLC (or Common Units representing a % economic interest if the underwriters exercise in full their option to purchase additional shares to cover overallotments).

We will not retain any of the proceeds used to purchase the Common Units from the Common Unitholders.

The net proceeds from any exercise of the underwriters’ overallotment option will be used to purchase a corresponding additional number of Common Units directly from the EControls Group, Murphy Group, and Employee Holders at a price per Common Unit equal to the public offering price per share of our Class A Shares, less underwriting discounts. See “Use of Proceeds.” | ||

| Exchange rights |

Subject to the terms and conditions of the amended and restated operating agreement of Enovation Controls, LLC, each Common Unitholder will have the right to exchange Common Units together with the corresponding number of our Class B Shares, for (i) our Class A Shares, or (ii) at our option, cash equal to the market value of the Class A Shares issuable upon exchange. See “The Transactions—Operating Agreement of Enovation Controls, LLC—Exchange Rights.” To effect an exchange, a Common Unitholder must simultaneously deliver to us its Common Units and a corresponding number of Class B Shares. Unless we exercise our option to pay cash in lieu of Class A Shares, we will deliver an equivalent number of Class A Shares to the exchanging holder. The Class B Shares surrendered by the exchanging holder will be cancelled. As a holder exchanges its Common Units, our percentage of economic ownership of Enovation Controls, LLC will be correspondingly increased. | |

| Dividend policy |

We currently anticipate that we will retain all of our future earnings for use in the expansion and operation of our business and do not anticipate paying any cash dividends in the foreseeable future. The declaration and payment of future dividends to holders of Class A Shares will be at the discretion of our board of directors and will depend on many factors, including our financial condition, earnings, legal requirements, restrictions under our senior credit facility and any other debt agreements we are then parties to, and other factors our board of directors deems relevant. See “Risk Factors—Risks Related to this Offering and Ownership of Our Class A Shares—We are a holding company and depend upon our subsidiaries for our cash flow.” | |

17

Table of Contents

| Proposed NYSE symbol |

“ENOV.” | |

| Risk factors |

You should read the “Risk Factors” section of this prospectus beginning on page 23 for a discussion of the factors to consider carefully before deciding to purchase any of our Class A Shares. | |

The number of shares outstanding after this offering and other information based thereon in this prospectus excludes:

| • | up to Class A Shares expected to be available for future grant under the Enovation Controls, Inc. 2014 Long-Term Incentive Plan after the consummation of this offering; |

| • | up to Class A Shares issuable upon exchange of Common Units by the current holders thereof; and |

| • | up to Class A Shares that the underwriters may purchase from us to the extent that they exercise their overallotment option. |

Except as otherwise indicated, the number of shares outstanding after this offering and other information based thereon in this prospectus includes all of our outstanding Class B Shares.

Except as otherwise indicated, all information in this prospectus assumes an initial public offering price of $ per Class A Share, the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus.

In the event the initial public offering price in this offering is less than $ per share, the aggregate number of Common Units issuable in exchange for the Class B, C, and D Management Interests will decrease and the aggregate number of Common Units issuable to the Murphy Group and the EControls Group will commensurately increase. The exact amount of any such adjustments, if any, will be based on the actual per share initial public offering price. However, any such adjustments will not result in any change to the aggregate number of Class A Shares issuable in exchange for the Common Units, nor any change in the aggregate number of Class A Shares outstanding after this offering (other than any increase or decrease resulting from the elimination of fractional shares).

18

Table of Contents

SUMMARY HISTORICAL AND PRO FORMA CONSOLIDATED FINANCIAL DATA

The following table presents the summary historical consolidated financial data of Enovation Controls, LLC, our accounting predecessor, and summary unaudited pro forma financial data of Enovation Controls, Inc., for the periods and as of the dates indicated. The summary financial data presented below should be read in conjunction with “Capitalization,” “Unaudited Pro Forma Condensed Consolidated Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and accompanying notes thereto included elsewhere in this prospectus. Historical results are not necessarily indicative of results that may be expected for any future period, nor should the results for any interim period be considered indicative of the expected results for a full fiscal year.

The consolidated statement of operations data for the years ended December 31, 2013, 2012, and 2011 have been derived from Enovation Controls, LLC’s audited consolidated financial statements included elsewhere in this prospectus. The consolidated statement of operations data for the six months ended June 30, 2014 and 2013 and the consolidated balance sheet data as of June 30, 2014 are derived from the unaudited consolidated financial statements of Enovation Controls, LLC included elsewhere in this prospectus. In the opinion of management, such unaudited financial statements include all adjustments (consisting only of normal recurring adjustments) necessary for a fair presentation of the financial position and results of operations as of the dates and for the periods indicated.