Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Premier, Inc. | d782019dex992.htm |

| EX-99.1 - EX-99.1 - Premier, Inc. | d782019dex991.htm |

| 8-K - 8-K - Premier, Inc. | d782019d8k.htm |

Fourth Quarter and Fiscal Year 2014

Financial Results and Update

August 25, 2014

Exhibit 99.3 |

1

Forward-looking statements and Non-GAAP financial

measures

—Certain

statements

made

during

this

conference

call

and

included

in

this

presentation, including, but not limited to, those related

to our financial and business outlook, strategy and growth drivers,

acquisition activities and pipeline, revenue available under contract, and financial guidance

and

related

assumptions,

are

“forward-looking

statements.”

Forward-looking

statements

may

involve

known

and unknown risks, uncertainties and other factors that may cause the actual

results of Premier to be materially different from historical results or

from any future results or projections expressed or implied by such

forward-looking statements. Accordingly, readers should not place undue reliance on any forward

looking statements. Readers are urged to consider statements in the conditional or

future tenses or that include

terms

such

as

“believes,”

“belief,”

“expects,”

“estimates,”

“intends,”

“anticipates”

or

“plans”

to

be

uncertain and forward-looking.

Forward-looking statements may include comments as to Premier’s beliefs

and expectations as to future events and trends affecting its business and

are necessarily subject to uncertainties,

many

of

which

are

outside

Premier’s

control.

More

information

on

potential

risks

and

other

factors

that

could

affect

Premier’s

financial

results

is

included,

and

updated,

from

time

to

time,

in

Premier’s

periodic

and

current

filings

with

the

SEC

and

available

on

Premier’s

website.

Forward

looking

statements

speak only as of the date they are made. Premier undertakes no obligation to

publicly update or revise any forward-looking statements.

defined

in

Regulation

G

under

the

Securities

Exchange

Act

of

1934.

Schedules

are

attached that reconcile

the non-GAAP financial measures included in the following presentation to the

most directly comparable financial measures calculated and presented in

accordance with Generally Accepted Accounting Principles in the United

States. The press release attached as an Exhibit to our Form 8-K filed with the SEC in connection

with our earnings call, as well as our Form 10-K for the year ended June 30,

2014 to be filed shortly hereafter, provides

further

explanation

and

disclosure

regarding

our

use

of

non-GAAP

financial

measures

and

should

be

read in conjunction with these supplemental slides.

Non-GAAP

financial

measures

Forward-looking

statements

—This

presentation

includes

certain

“non-GAAP

financial

measures”

as |

Susan DeVore, President & CEO

Financial Highlights and Year in Review |

3

Fiscal

2014

highlights

1

(1) Comparisons are pro forma. See Adjusted EBITDA, Segment Adjusted EBITDA and

Adjusted Fully Distributed Net Income reconciliations to GAAP equivalents in

Appendix; pro forma reflects the impact of the company’s reorganization and initial public offering

Strong fourth quarter completes extraordinary year

Fourth-quarter net revenue up 17% and adjusted

EBITDA up 19%, driven by strength in both segments

Full-year net revenue up 14% to $869.3 million;

Adjusted EBITDA up 12% to $351.0 million

Strong cash position continues; over $540

million of cash & marketable securities at FY end

Expanded credit facility to $750 million, increasing

financial flexibility to support acquisition strategy

Executed focused and disciplined acquisition strategy |

4

Member and

industry needs

Co-innovation

Intelligence to transform from the inside

Leadership in population health

Shared infrastructure

Premier strategic

differentiation

•

Total cost reduction

•

Quality improvement

across the continuum

•

Evolving delivery and

payment models

•

Actionable data and

information

Unique business model addresses industry challenges

Helping health systems manage challenges, optimize

the transition, and build for the future….

…all

at

the

same

time

Scale |

5

Changing the game to drive out costs, improve outcomes

SUPPLY CHAIN SERVICES

PERFORMANCE SERVICES

•

SaaS-based analytics products

in cost, quality, safety and

population health

•

Enterprise data analytics

platform

•

Collaboratives

•

Advisory services

With integrated data and analytics, collaboratives, supply chain

solutions, and advisory and other services, we are enabling better

care and outcomes at a lower cost.

Group purchasing, serving both

acute and alternate site

•

Direct sourcing

•

Specialty pharmacy

Physician preference items (PPI)

Capital planning |

6

Strategic acquisitions serve members and drive revenue

growth opportunities

Member channel allows us to rapidly expand capabilities, enhances

speed to market and augments Premier’s unique technology platform

Fiscal 2014

Q1 FY15

Data acquisition and

integration-as-a-service

company

(October 2013)

(July 2013)

Physician preference

item (PPI) contract mgmt.

and data services

company

(April 2014)

Capital equipment

planning, sourcing &

analytics business

(August 2014)*

Provider of clinical

surveillance software

(August 2014)*

Healthcare

supply spend

visibility &

supply chain

analytics firm

*Expected to close in Q1 FY15, subject to customary conditions; There can be no

assurance regarding the timing or ultimate closing of these acquisitions. |

7

Aperek acquisition addresses supply chain workflow

Expected to close in first quarter of FY15, subject

to customary closing conditions

Provider of leading real-time healthcare supply

spend visibility and SaaS-based supply chain

analytics

Provides opportunity to further automate supply

chain management processes

Purchase price of $48.5 million, subject to

closing price adjustments |

8

Data-based analytics platform continues to grow

PLATFORM

BILLING

PURCHASING

CLAIMS

CLINICAL

FINANCIAL

ANY

DATA

Number of facilities under contract as of 6/30/2014

*includes

TheraDoc

and

Aperek

transactions,

expected

to

close

in

Q1

FY15,

subject

to

customary

conditions

Social business

~1,300 facilities*

~1,100 facilities

~1,280 facilities

~1,000 facilities*

~500 facilities

9 organizations |

9

Continued growth trajectory with acquisition of TheraDoc

Expands clinical surveillance customer base

to approximately 1,000 facilities

Market leading provider of clinical surveillance

software

Future opportunity to create a next-generation

safety

solution

built

on

PremierConnect

®

Purchase price of $117 million, subject to

closing price adjustments

Expected to close in first quarter of FY15,

subject to customary closing conditions |

10

PHYSICIAN NETWORK

MANAGEMENT

POPULATION

ANALYTICS & RISK

MANAGEMENT

POPULATION

ENGAGEMENT

Subject Matter

Expertise

Collaboratives

Information

Technology

(SaaS-

based

Solutions)

POPULATION HEALTH

COLLABORATIVE

Shared Savings

Bundled Payments

Value-based Contracting

Clinical Integration

Network Development

ACO Readiness

PCMH

Care Management

Transitions in Care

Industry leader in driving population health solutions |

PremierConnect

®

Enterprise & Data Alliance Collaborative

PCE

Private Warehouse

Partners

Added in

Q4 FY14

Fairview

Health

Services

Mercy

Health

Baystate

Health

Baystate

Innovation

Center

University

Hospitals

Bon

Secours

Health

System

IBM

UNCC

Verisk

Health

Phytel

Carillion

Health

System

Texas

Health

Resources

Carolinas

Healthcare

System

11 |

12

Unique customer alignment

Data-driven, technology enabled

Diversified growth engine

Compelling financial profile

Well positioned for fiscal 2015 |

Craig McKasson, Chief Financial Officer

Financial Review |

14

15%

36%

Fourth-quarter consolidated and segment highlights

1

Consolidated

Net revenue (millions)

Supply Chain Services

Net revenue (millions)

Performance Services

Net revenue (millions)

Adjusted

EBITDA

(millions)

Adjusted EBITDA (millions)

Adjusted EBITDA (millions)

18%

15%

19%

(1) See Adjusted EBITDA and Segment Adjusted EBITDA reconciliations to GAAP

equivalents in Appendix; comparisons between fourth-quarter financial results

ended June 30, 2014, and year-ago pro forma results have been adjusted to

reflect the impact of the company’s reorganization and initial public offering.

$14.4

$19.5

Q4'13

Q4'14

$78.1

$93.2

Q4'13

Q4'14

$54.6

$62.6

Q4'13

Q4'14

$82.2

$94.4

Q4'13

Q4'14

$146.4

$172.8

Q4'13

Q4'14

$200.9

$235.5

Q4'13

Q4'14

17% |

15

Non-GAAP pro forma adjusted fully distributed net income

1

•

Calculates income taxes at 40%

on pre-tax income, assuming

taxable C corporate structure

•

Calculates adjusted fully

distributed earnings per share,

assuming total Class A and B

common shares held by public

(1) See pro forma adjusted fully distributed net income to GAAP

equivalents in Appendix; comparisons between fourth-quarter financial results

ended June 30, 2014, and year-ago pro forma results have been

adjusted to reflect the impact of the company’s reorganization and initial public offering.

$0.29

$0.34

Non-GAAP earnings per share on fully distributed

net income

Q4'13

Q4'14

(in millions, except per share data)

$42.2

$49.9

18% |

16

Cash flow and capital structure at June 30, 2014

Cash, cash equivalents and marketable

securities of $540.4 million

Capital expenditures of $55.7 million, up 31%

YOY primarily due to capitalized internally

developed software

Cash flow from operations of $368.1 million

$750 million five-year unsecured revolving

credit facility secured in June 2014 |

17

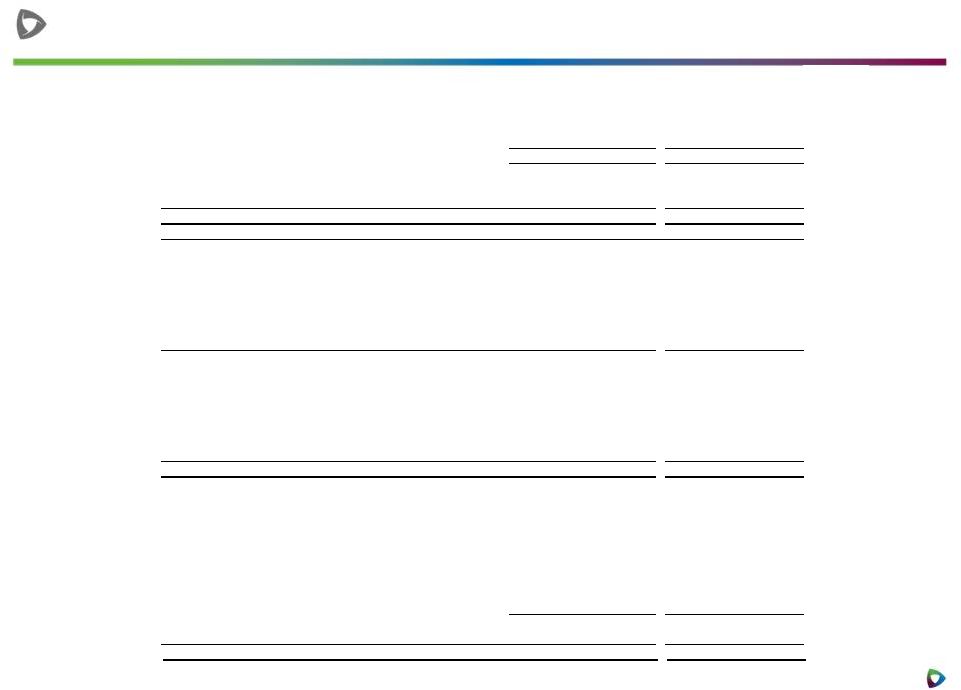

Fiscal 2015 guidance

1

1

As of fiscal 2014 fourth-quarter conference call, 08/25/2014. For non-GAAP

measures, see reconciliations to GAAP equivalents

in

Appendix.

Pro

forma

guidance

measures

are

“forward-looking

statements.”

For

information

regarding

the use and limitations of non-GAAP financial measures and forward-looking

statements, see “Forward-looking statements and Non-GAAP

financial measures” at the front of this presentation.

Premier, Inc. introduces full-year fiscal 2015 financial guidance:

(in millions, except per share data)

FY 2015

YoY Change

Pro Forma Net Revenue:

Supply Chain Services segment

$688 -

$707

8% -

11%

Performance Services segment

$281 -

$288

21% -

24%

Total Pro Forma Net Revenue

$969 -

$995

11% -

14%

Non-GAAP pro forma adjusted

EBITDA

$379 -

$390

8 -

11%

Non-GAAP pro forma adjusted

fully distributed EPS

$1.39 -

$1.44

7-

11% |

18

Fiscal 2015 guidance assumptions

Steady growth in Supply Chain Services

driven by:

Continued growth in Performance Services

driven by:

•

Demand for integrated offerings of SaaS-based

products, advisory services and collaboratives

•

Demand for offerings of recent acquisitions

•

Continuation of high SaaS institutional renewal

rates

•

Low to mid-single-digit growth in net

administrative fees revenue, driven by increase

in members and existing acute and alternate site

member GPO penetration

•

Continuation of high GPO retention rates

•

Strong

15%

-

20%

growth

of

direct

sourcing

and

specialty pharmacy

18 |

19

Additional performance metrics

PERFORMANCE METRICS

FY 2015

FY 2014

3 Year Average

Revenue available under contract

$898M

---

---

GPO retention rate

(1)

---

99%

97%

SaaS institutional renewal rate

(2)

---

94%

94%

(1)

The retention rate is calculated based upon the aggregate purchasing volume among

all members participating in our GPO for such fiscal year less the

annualized GPO purchasing volume for departed members for such fiscal year,

divided by the aggregate purchasing volume among all members participating

in our GPO for such fiscal year. (2)

The renewal rate is calculated based upon the total number of members that have

SaaS revenue in a given period that also have revenue in the corresponding

prior year period divided by the total number of members that have SaaS

revenue in the same period of the prior year. |

20

Capital expenditures of ~$63M for the year

Adjusted EBITDA margin approximating

40% of net revenue

Effective tax rate of 40%

Additional fiscal 2015 guidance assumptions |

Questions |

Contact Investor Relations

Jim Storey

Vice President, Investor Relations

jim_storey@premierinc.com

Thank you |

Appendix |

24

Premier, Inc. supplemental financial information

(Unaudited, in thousands)

2014*

2013

2014

2013

Reconciliation of Pro Forma Net Revenue to Net Revenue:

Pro Forma Net Revenue

235,466

$

200,938

$

869,286

$

764,278

$

Pro forma adjustment for revenue share post-IPO

—

39,663

41,263

105,012

Net Revenue

235,466

$

240,601

$

910,549

$

869,290

$

Reconciliation of Pro Forma Adjusted EBITDA and Segment Adjusted

EBITDA to Net Income and Operating Income:

Net income

66,632

$

103,496

$

332,617

$

375,086

$

Pro forma adjustment for revenue share post-IPO

—

(39,663)

(41,263)

(105,012)

Interest and investment income, net

(378)

(366)

(1,019)

(965)

Income tax expense

3,248

3,788

27,709

9,726

Depreciation and amortization

9,809

7,883

36,761

27,681

Amortization of purchased intangible assets

904

385

3,062

1,539

Pro Forma EBITDA

80,215

75,523

357,867

308,055

Stock-based compensation

6,358

—

19,476

—

Acquisition related expenses

711

—

2,014

—

Strategic and financial restructuring expenses

146

1,823

3,760

5,170

Adjustment to tax receivable agreement liability

6,215

—

6,215

—

Gain on sale of investment

(522)

—

(38,372)

—

Other (income) expense, net

121

783

65

788

Pro Forma Adjusted EBITDA

93,244

$

78,129

$

351,025

$

314,013

$

Pro Forma Adjusted EBITDA

93,244

$

78,129

$

351,025

$

314,013

$

Depreciation and amortization

(9,809)

(7,883)

(36,761)

(27,681)

Amortization of purchased intangible assets

(904)

(385)

(3,062)

(1,539)

Stock-based compensation

(6,358)

—

(19,476)

—

Acquisition related expenses

(711)

—

(2,014)

—

Strategic and financial restructuring expenses

(146)

(1,823)

(3,760)

(5,170)

Adjustment to tax receivable agreement liability

(6,215)

—

(6,215)

—

Equity in net income of unconsolidated affiliates

(4,805)

(3,636)

(16,976)

(11,968)

Deferred compensation plan expense

(1,972)

—

(1,972)

—

62,324

64,402

260,789

267,655

Pro forma adjustment for revenue share post-IPO

—

39,663

41,263

105,012

Operating income

62,324

$

104,065

$

302,052

$

372,667

$

* Note that no pro forma adjustments were made for the three months

ended June 30, 2014; as such, actual results are presented for the

three months ended June 30, 2014.

Three Months Ended

June 30,

Year Ended

June 30,

Supplemental

Financial

Information

-

Reporting

of

Pro

Forma

Adjusted

EBITDA

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

and Non-GAAP Adjusted Fully Distributed Net Income

|

25

Premier, Inc. supplemental financial information

(Unaudited, in thousands)

2014*

2013

2014

2013

Reconciliation of Non-GAAP Adjusted Fully Distributed Net

Income: Non-GAAP Adjusted Fully Distributed Net Income (pro

forma): Net income (loss) attributable to shareholders

8,879

$

(797)

$

28,332

$

7,376

$

Pro forma adjustment for revenue share post-IPO

—

(39,663)

(41,263)

(105,012)

Income tax expense

3,248

3,788

27,709

9,726

Stock-based compensation

6,358

—

19,476

—

Gain on sale of investment

(522)

—

(38,372)

—

Acquisition related expenses

711

—

2,014

—

Strategic and financial restructuring expenses

146

1,823

3,760

5,170

Adjustment to tax receivable agreement liability

6,215

—

6,215

—

Amortization of purchased intangible assets

904

385

3,062

1,539

Net income attributable to noncontrolling interest in Premier LP

57,281

104,726

303,336

369,189

Non-GAAP adjusted fully distributed income before income

taxes 83,220

70,262

314,269

287,988

Income tax expense on fully distributed income before income

taxes 33,288

28,105

125,708

115,195

Non-GAAP adjusted fully distributed net income (pro forma)

49,932

$

42,157

$

188,561

$

172,793

$

* Note that no pro forma adjustments were made for the three months

ended June 30, 2014; as such, actual results are presented for the

three months ended June 30, 2014.

Three Months Ended

June 30,

Year Ended

June 30,

Supplemental Financial Information - Reporting of Pro Forma Adjusted

EBITDA Reconciliation of Selected Non-GAAP Measures to GAAP

Measures and Non-GAAP Adjusted Fully Distributed Net Income

|

26

Premier, Inc. supplemental financial information

(Unaudited, in thousands)

2014*

2013

2014

2013

Reconciliation of numerator for GAAP EPS to Adjusted Fully Distributed

EPS Net

income

(loss)

attributable

to

shareholders

after

adjustment

of

redeemable

limited partners' capital to redemption amount

491,389

$

(797)

$

(2,713,256)

$

7,376

$

Adjustment

of

redeemable

limited

partners'

capital

to

redemption

amount

(482,510)

-

2,741,588

-

Net income (loss) attributable to shareholders

8,879

(797)

28,332

7,376

Pro forma adjustment for revenue share post-IPO

—

(39,663)

(41,263)

(105,012)

Income tax expense

3,248

3,788

27,709

9,726

Stock-based compensation

6,358

—

19,476

—

Gain on sale of investment

(522)

—

(38,372)

—

Acquisition related expenses

711

—

2,014

—

Strategic and financial restructuring expenses

146

1,823

3,760

5,170

Adjustment to tax receivable agreement liability

6,215

—

6,215

—

Amortization of purchased intangible assets

904

385

3,062

1,539

Net income attributable to noncontrolling interest in Premier LP

57,281

104,726

303,336

369,189

Non-GAAP adjusted fully distributed income before income

taxes 83,220

70,262

314,269

287,988

Income tax expense on fully distributed income before income

taxes 33,288

28,105

125,708

115,195

Non-GAAP adjusted fully distributed net income (pro forma)

49,932

$

42,157

$

188,561

$

172,793

$

Reconciliation of denominator for GAAP EPS to Adjusted Fully Distributed

EPS Weighted Average:

Common shares used for basic and diluted earnings per share

32,375

5,733

25,633

5,858

Potentially dilutive shares

194

-

124

-

Class A common shares outstanding

-

26,642

6,742

26,517

Conversion of Class B common units

112,511

112,608

112,584

112,608

Weighted

average

fully

distributed

shares

outstanding

-

diluted

145,080

144,983

145,083

144,983

Reconciliation of GAAP EPS to Adjusted Fully Distributed EPS

GAAP income (loss) per share

$

15.18

$

(0.14) $ (105.85)

$

1.26 Impact of adjustment of redeemable limited partners'

capital to redemption amount

$

(14.90)

$

-

$ 106.96

$

- Impact of additions:

Pro forma adjustment for revenue share post-IPO

$

-

$

(6.92)

$

(1.61) $

(17.93) Income tax expense

$

0.10

$

0.66

$

1.08

$

1.66 Stock-based compensation

$

0.20

$

-

$

0.76

$

- Gain on sale of

investment

$

(0.02)

$

-

$

(1.50)

$

- Acquisition related

expenses

$

0.02

$

-

$

0.08

$

- Strategic and financial

restructuring expenses

$

0.00

$

0.32

$

0.15

$

0.88 Adjustment to tax receivable agreement

liability

$

0.19

$

-

$

0.24

$

- Amortization of purchased

intangible assets

$

0.03

$

0.07

$

0.12

$

0.26 Net income attributable to noncontrolling interest in

Premier LP

$

1.77

$ 18.27

$ 11.83

$

63.02 Impact of corporation taxes

$

(1.03)

$

(4.90)

$

(4.90) $

(19.66) Impact of increased share count

$

(1.20)

$

(7.06)

$

(6.06) $

(28.31) Non-GAAP

earnings

per

share

on

adjusted

fully

distributed

net

income

-

diluted

$

0.34

$

0.29

$

1.30

$

1.19 * Note that actual results are presented for the three

months ended June 30, 2014. Three Months Ended

June 30,

Year Ended

June 30,

Supplemental

Financial

Information

-

Reporting

of

Net

Income

and

Earnings

Per

Share

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

|