Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JONES LANG LASALLE INC | jllform8k_aug282014htm.htm |

Investor Presentation 53,000 employees, 200 offices, 75 countries, 1 global platform August 2014

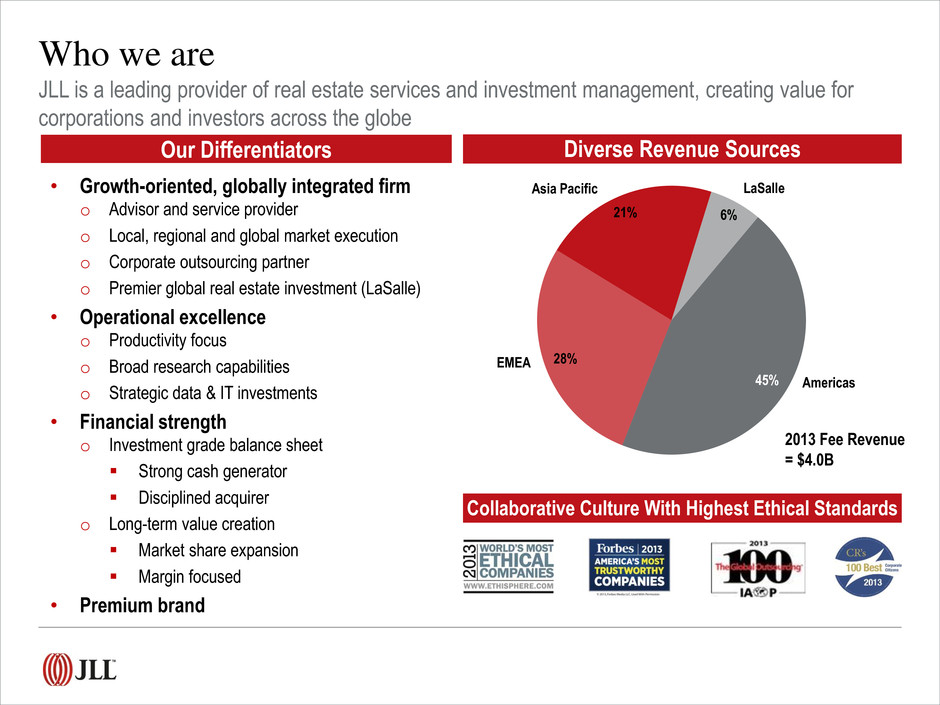

Diverse Revenue Sources Americas LaSalle Asia Pacific EMEA Our Differentiators • Growth-oriented, globally integrated firm o Advisor and service provider o Local, regional and global market execution o Corporate outsourcing partner o Premier global real estate investment (LaSalle) • Operational excellence o Productivity focus o Broad research capabilities o Strategic data & IT investments • Financial strength o Investment grade balance sheet Strong cash generator Disciplined acquirer o Long-term value creation Market share expansion Margin focused • Premium brand Collaborative Culture With Highest Ethical Standards 2013 Fee Revenue = $4.0B Who we are JLL is a leading provider of real estate services and investment management, creating value for corporations and investors across the globe 21% 6% 45% 28%

Jones Lang Wootton founded 1783 1968 1997 1999 LaSalle Partners founded LaSalle Partners initial public offering LaSalle Partners and Jones Lang Wootton merge to create Jones Lang LaSalle Integrated global platform (NYSE ticker “JLL”) 2008 The Staubach Company and Jones Lang LaSalle combine operations Largest merger in JLL history transforms U.S. local markets position King Sturge (est. 1760) and Jones Lang LaSalle merge EMEA operations Enhances strength and depth of service capabilities in the UK and EMEA 1760 13% compound annual revenue growth rate since 1999 merger thru 2013 2013 2011 How we got here - premier brand and global platform

Adjusted Operating Income ~7x $389 $59 2003 2013 Fee Revenue ~4x $4,027 $942 2003 2013 Note: All amounts in $ millions. 2003 market cap based on peak share price in the year; Current market cap based on August 2014 share price Long history of profitable revenue growth • 10-year compound annual revenue growth = 16%; Organic = 12% and M&A = 4% • 50+ mergers and acquisitions since 2003 Post-Great Recession success from adapting to market cycles and capturing market share Investment-grade financial strength maintained for future growth Experienced executive leadership creates value for clients and shareholders • Six-member Global Executive Board with combined 90-year tenure • 300+ International Directors drive growth and provide deep leadership bench Market Cap $685 ~9x $ 6,064 Current 2003 What we have accomplished

2013 Fee Revenue = $4.0B Global Diversification1 Leasing Advisory & Other LaSalle Inv. Mgmt. Property & Facility Mgmt. Project & Development Services Capital Markets EMEA (32%) Other Asia United Kingdom France Germany Other Europe Japan Greater China (incl. Hong Kong) Australia India Singapore Asia Pacific (23%) Americas (45%) United States 42% 3% 9% 4% 5% 14% 2% 3% 3% 6% 3% 6% Americas Other 33% 10% 6% 24% 9% 18% (1) Gross revenue Diversified and integrated global services

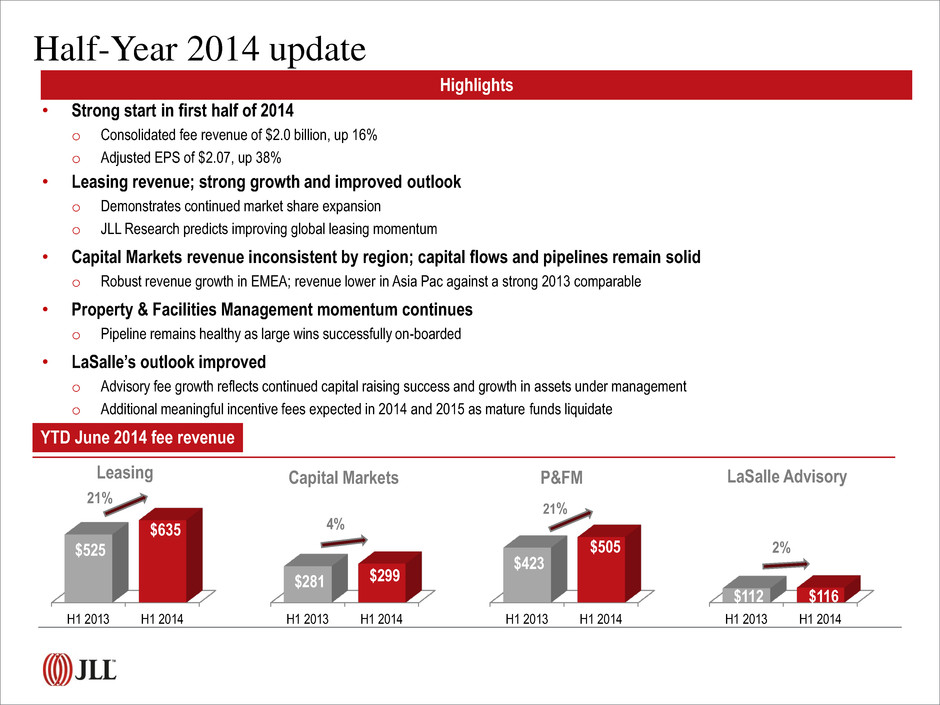

Half-Year 2014 update Highlights • Strong start in first half of 2014 o Consolidated fee revenue of $2.0 billion, up 16% o Adjusted EPS of $2.07, up 38% • Leasing revenue; strong growth and improved outlook o Demonstrates continued market share expansion o JLL Research predicts improving global leasing momentum • Capital Markets revenue inconsistent by region; capital flows and pipelines remain solid o Robust revenue growth in EMEA; revenue lower in Asia Pac against a strong 2013 comparable • Property & Facilities Management momentum continues o Pipeline remains healthy as large wins successfully on-boarded • LaSalle’s outlook improved o Advisory fee growth reflects continued capital raising success and growth in assets under management o Additional meaningful incentive fees expected in 2014 and 2015 as mature funds liquidate H1 2013 H1 2014 $281 $299 Capital Markets 4% H1 2013 H1 2014 $423 $505 P&FM 21% H1 2013 H1 2014 $112 $116 LaSalle Advisory 2% YTD June 2014 fee revenue H1 2013 H1 2014 $525 $635 Leasing 21%

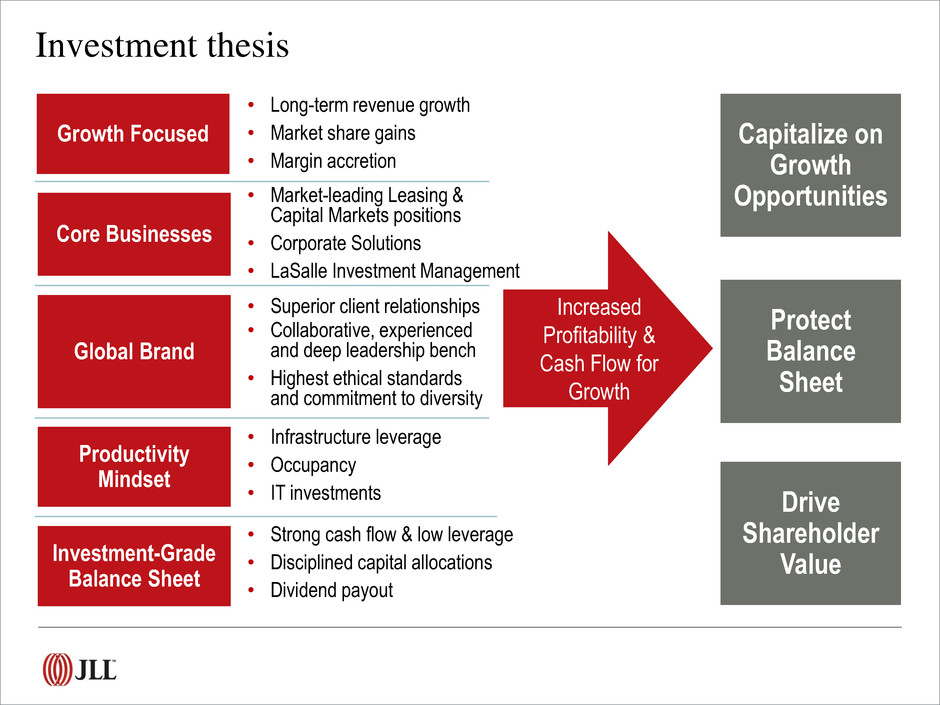

• Long-term revenue growth • Market share gains • Margin accretion Growth Focused • Infrastructure leverage • Occupancy • IT investments Productivity Mindset • Superior client relationships • Collaborative, experienced and deep leadership bench • Highest ethical standards and commitment to diversity Global Brand • Market-leading Leasing & Capital Markets positions • Corporate Solutions • LaSalle Investment Management Core Businesses • Strong cash flow & low leverage • Disciplined capital allocations • Dividend payout Investment-Grade Balance Sheet Investment thesis Capitalize on Growth Opportunities Protect Balance Sheet Drive Shareholder Value Increased Profitability & Cash Flow for Growth

Our global strategy for continued success JLL Actions • Balance top-line growth, platform investments and productivity to maximize profit • Leverage global positions to grow market share and invest strategically as industry consolidates • Increase productivity and manage costs to improve margins • Maintain financial strength and flexibility to respond to opportunities and challenges • Strategy 2020 o Pursue business and operational strategies to sustain long-term performance o Work streams developed to accelerate G5 strategies G5: Global Growth Drivers Grow LaSalle Investment Management’s leadership position Conn ection s G4 G2 G3 G1 Build our local and regional Markets business Capture the leading share of global capital flows for investment sales Strengthen our winning positions in Corporate Solutions G5 CONNECTIONS: Differentiate and Sustain

Capital Markets & Leasing Markets Volumes Leasing Activity Uneven; Signs of Improvement Investment Volume Strength Varies HISTORICAL FORECAST Q2 2014 v. Q2 2013 Q2 TTM 2014 v. Q2 TTM 2013 FY 2014 v. FY 2013 Market Volumes Market Volumes Market Volumes Capital Markets(1) Americas 30% 34% ~ 25% EMEA 49% 42% ~ 15% Asia Pacific -2% 12% ~ 10% Total 28% 32% ~ 20% HISTORICAL FORECAST Q2 2014 v. Q2 2013 Q2 TTM 2014 v. Q2 TTM 2013 FY 2014 v. FY 2013 Gross Absorption Gross Absorption Gross Absorption Leasing Americas (U.S. only) 0% 5% ~ 0-5% EMEA (Europe only) 11% -3% ~ 5% Asia Pacific (select markets) 20% 7% ~ 15-20% Total 5% 3% ~ 5% (1) Market volume data excludes multi-family assets. Source: JLL Research, July 2014

G1 - Scale and leadership in local markets *July 2008: Staubach Company acquired, annual revenue = $375 million **May 2011: King Sturge acquired, annual revenue = $260 million Asia Pacific EMEA Americas ($ in millions) Competitive Advantages • Leasing: Proven market share growth o Transformative Staubach merger in 2008 o Compound annual growth rate since 2007: Consolidated = 15% and Americas = 25% • Property Management: Scale in key markets including Australia, China, Germany, UK, U.S. • Project & Development Services: Successful Tetris business model expanding into new markets • iDesk: Leverage JLL’s global platform to deliver consistent services to our clients across markets JLL Leasing Revenue $241 $373 $500 $638 $760 $830 $879 $227 $247 $173 $203 $236 $250 $272 $125 $133 $108 $159 $192 $198 $179 2007 2008 2009 2010 2011 2012 2013 $593 $781 $753 $1,000 $1,188 $1,278 * $1,330 Consolidated CAGR 15% ** Americas CAGR 25%

G2 - Global outsourcing propels Corporate Solutions 2013 JLL Client Wins Wins 59 Wins 43 Expansions 18 Renewals 17 Large Corporations Middle Market Competitive Advantages • Transformative outsourcing & workplace optimization • Integrated expertise across services & geographies to capitalize on market trends • Scalable global position leveraging our local market execution • Long-term contracts driving annuity revenue • Win rate ~60% Note: Reimbursable vendor, subcontractor and out-of-pocket costs reported as revenue and expense in JLL financial statements have been increasing steadily. Margins diluted as gross-accounting requirements increase revenue and costs without corresponding profit. Business managed on a “fee” basis to focus on margin expansion in the base business Asia Pacific EMEA Americas ($ in millions) JLL Property & Facilities Mgmt Fee Revenue $142 $197 $226 $269 $324 $359 $408 $126 $140 $136 $143 $153 $171 $193 $170 $208 $266 $304 $285 $320 $348 2007 2008 2009 2010 2011 2012 2013 $438 $545 $627 $716 $762 * $948 $850

* May 2011: King Sturge acquired, annual revenue = $260 million Asia Pacific EMEA Americas ($ in millions) Competitive Advantages • Strong market positions • Significant investment to grow US platform • King Sturge expanded UK and EMEA capabilities • Increased Asia Pacific transparency driving opportunity • International Capital Group capturing increasing cross-border opportunities • Dominant global Hotels & Hospitality brand JLL Capital Markets Revenue G3 – Capturing market share in growing global capital flows $114 $61 $38 $84 $136 $169 $217 $339 $196 $107 $141 $229 $235 $333 $104 $60 $58 $81 $95 $109 $158 2007 2008 2009 2010 2011 2012 2013 $557 $317 $203 $306 $460 * $708 $513 *

$178 $245 $242 $238 $245 $228 $223 $0 $100 $200 $300 2006 2007 2008 2009 2010 2011 2012 2013 2006 to 2013 Advisory Fees ($ millions) Building Advisory Fees in Healthy Markets Global Financial Crisis Stabilized Advisory Fees G4 - Performance drives LaSalle Investment Management Competitive Advantages • Proven performance history with long-standing client relationships • Diversified global platform • Consistent client services delivery model • Financial backing of well-capitalized parent company • Successful capital raise; $7 billion committed in 2013 Assets Under Management ($ billions) Note: AUM data reported on a one-quarter lag. Q2 2014 AUM $50.0 Separate Accounts $26.1 Fund Management $ 13.0 Public Securities $ 10.9 $278

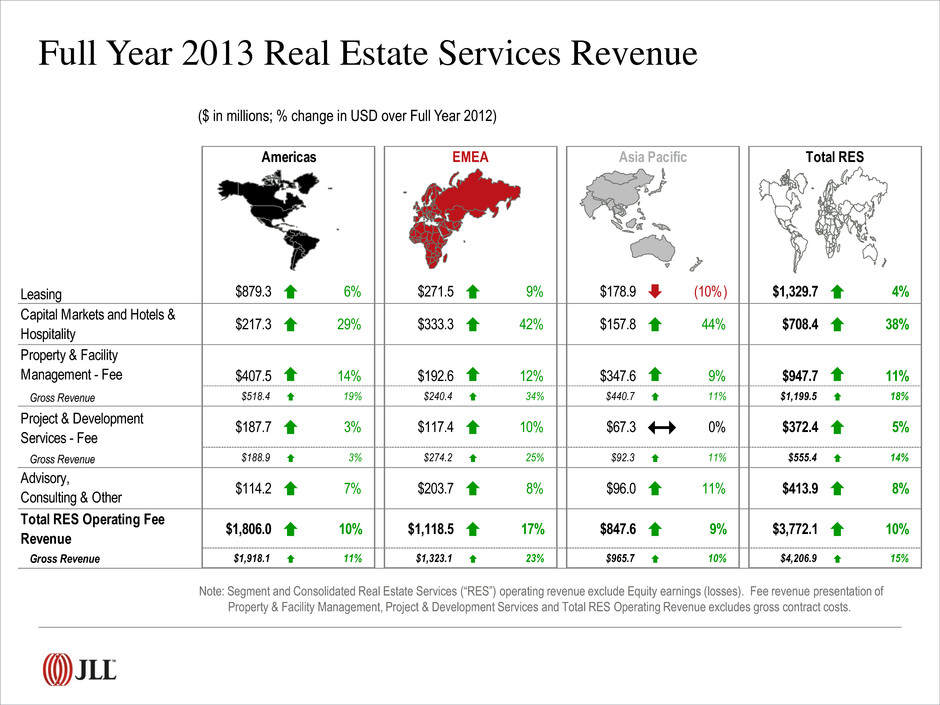

2012 $245M $5.48 $340M / 9.3% $3.6B US GAAP: $208M US GAAP: $4.63 $289M / 8.0% Gross revenue: $3.9B FY 2013 Performance Notes: (1) 2013 and 2012 adjusted for restructuring and intangible amortization. Margin is calculated on a fee revenue basis. (2) Percentage growth reflective of change in local currency. 2013 Fee Revenue $4.0B Adjusted Net Income $285M Adjusted EPS $6.32 Adjusted Op. Income $389M / 9.7% Adjusted EBITDA Gross revenue : $4.5B Op. Income: $369M / 9.2% US GAAP: $5.98 US GAAP: $270M $XXXM / X.X% $498M / 12.4% EBITDA: $480M / 11.9% $437M / 12.0% $392M / 10.8% Consolidated earnings scorecard 2013 Revenue Contribution Americas LaSalle Asia Pacific EMEA 28% 21% 6% 45% • Full-year fee revenue up 12% from 2012 • Growth led by Capital Markets & Hotels, up 40%, and Property & Facility Management, up 14% on a fee revenue basis • Adjusted EBITDA margin calculated on a fee revenue basis of 12.4%, up from 12.0% in 2012 • Adjusted operating income margin calculated on a fee revenue basis of 9.7%, up from 9.3% in 2012 • Successful capital raise by LaSalle Investment Management; $7 billion committed in 2013

• Investment grade balance sheet; Baa2 / BBB- (Positive) o In June 2014, Standard & Poor’s improved its outlook on JLL rating to Positive from Stable o Low debt cost: FY 2013 net interest expense of $34.7m down from $35.2m o Renewed bank credit facility in October 2013; increased size to $1.2 billion with initial pricing at LIBOR + 1.25%, maturity extended to October 2018 o Diversified, long-term debt maturities in 2018 (credit facility) and 2022 (bonds) • Healthy net debt position entering historically strong second half o Reduced net debt by $162 million from Q2 2013 o Acceptable Leverage Ratio ~ 2.0x - 2.25x (Bank-defined); well below maximum allowable ratio of 3.5x • Semi-annual dividend increased by 5% to $0.23 per share declared April 30, 2014 o Paid June 13, 2014 Balance Sheet Q2 Q4 Q2 $ millions 2014 2013 2013 Cash $ 151 $ 153 $ 122 Short Term Borrowings 25 25 51 Credit Facility 410 155 479 Net Bank Debt $ 284 $ 27 $ 408 LT Senior Notes 275 275 275 Deferred Acquisition Obligations 113 135 151 Total Net Debt $ 672 $ 437 $ 834 Highlights (1) Full years 2013, 2012, 2011 (2) Other Financing Activities include debt issue costs and share activity related to taxes on stock awards Strong balance sheet position 3-Year1 Cash Deployment = $1 billion (Cash from Operations = $832m plus Net Debt increase =$164m) Acquisitions Co-Investment Other Financing Activities2 Dividends CapEx (primarily IT) 27% 55% 5% 5% 8% (33% upfront; 22% deferred)

Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. ($ in millions; % change in local currency over Full Year 2012) Full Year 2013 Real Estate Services Revenue

2013 Fee Revenue Operating Income $184M Operating Income Margin 10.2% EBITDA $229M EBITDA Margin 12.7% Gross revenue : $1.9B 2012 $167M 10.2% $209M 12.7% $1.6B $1.8B FY 2013 Performance 2013 Revenue Contribution Note: Margin is calculated on a fee revenue basis. See Appendix for calculation of fee revenue. Americas Real Estate Services United States Brazil Canada Mexico Other Americas 89% 5% 2% 2% 2% • Full-year fee revenue up 10% from 2012 • Largest growth in Capital Markets & Hotels, up 29%, and Property & Facility Management, up 14% on a fee revenue basis • Operating income margin calculated on a fee revenue basis was 10.2%, consistent with 2012; Q4 2013 margin of 14.7%, up 60 basis points over Q4 2012

2013 Fee Revenue Adj. Operating Income $92M Adj. Operating Income Margin 8.2% EBITDA $110M EBITDA Margin 9.8% Gross revenue : $1.3B 2012 $59M 6.2% $76M 8.0% $952M $1.1B FY 2013 Performance 2013 Revenue Contribution Note: Operating income has been adjusted to exclude $2 and $5 million of King Sturge intangibles amortization in 2013 and 2012, respectively. Margin is calculated on a fee revenue basis. See Appendix for calculation of fee revenue. EMEA Real Estate Services France U.K. Other EMEA MENA Italy Belgium Netherlands Spain Russia Germany 16% 41% 12% 11% 2% 2% 3% 4% 5% 4% • Full-year fee revenue up 17% from 2012 • Revenue growth broad-based for the year, led by the UK, Germany, France, Russia and the Netherlands • Adjusted operating income margin calculated on a fee revenue basis was 8.2% compared with 6.2% in 2012

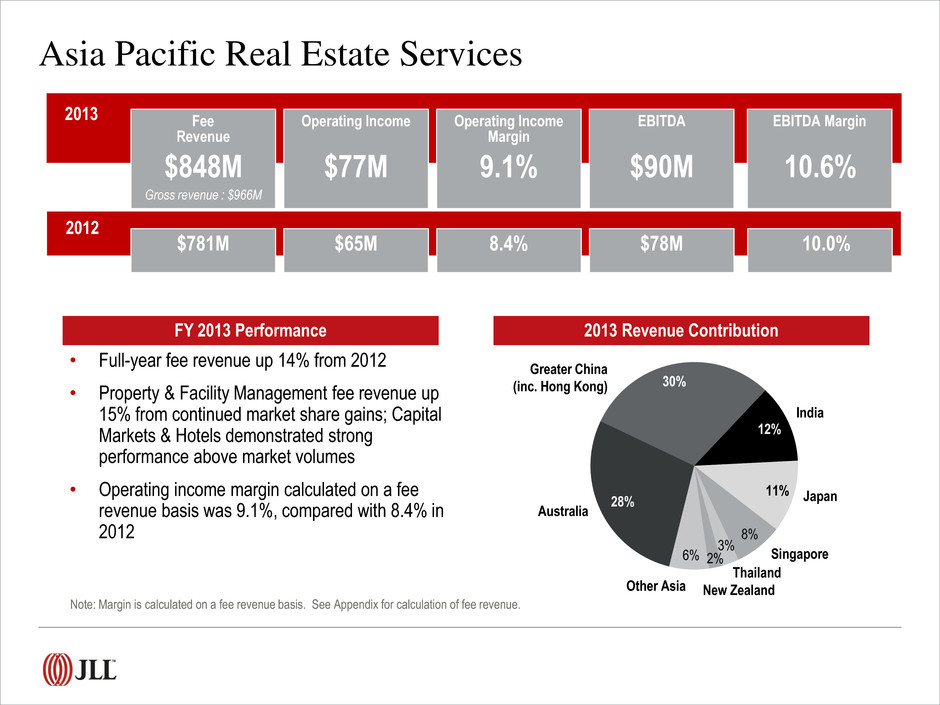

Asia Pacific Real Estate Services 2013 Fee Revenue Operating Income $77M Operating Income Margin 9.1% EBITDA $90M EBITDA Margin 10.6% Gross revenue : $966M 2012 $65M 8.4% $78M 10.0% $781M $848M FY 2013 Performance 2013 Revenue Contribution Note: Margin is calculated on a fee revenue basis. See Appendix for calculation of fee revenue. India Japan Singapore Thailand Greater China (inc. Hong Kong) Australia New Zealand Other Asia 30% 28% 12% 11% 8% 3% 2% 6% • Full-year fee revenue up 14% from 2012 • Property & Facility Management fee revenue up 15% from continued market share gains; Capital Markets & Hotels demonstrated strong performance above market volumes • Operating income margin calculated on a fee revenue basis was 9.1%, compared with 8.4% in 2012

2013 Fee Revenue Operating Income $68M Operating Income Margin 23.7% EBITDA $70M EBITDA Margin 24.4% 2012 $72M 25.2% $74M 25.9% $285M • Winning new mandates and clients while selling vintage funds for investor performance and JLL equity earnings • Advisory fee outlook remains stable for 2014 with longer-term growth potential from capital deployment • Strong equity earnings in 2013; current expectation is for reduced level of equity earnings in 2014 $286M FY 2013 Performance Q2 2014 Assets Under Management ($ in billions) LaSalle Investment Management Note: AUM data reported on a one-quarter lag. $16.9 $4.8 $12.6 $4.8 $10.9 Q2 2014 AUM = $50.0B U.K. Continental Europe North America Public Securities Asia Pacific

Appendix

as of Q2 2014 Leasing Values Asia Pacific EMEA Americas as of Q2 2014 Capital Values JLL Property ClocksSM Capital Value growth slowing Capital Value growth accelerating Capital Values bottoming out Capital Values falling Hong Kong Sydney, Singapore Shanghai London Seoul Tokyo Mumbai, Beijing Amsterdam Paris Madrid Milan Brussels Stockholm San Francisco Houston, Frankfurt Berlin Toronto, Mexico City Moscow Washington, DC Dallas Boston, Chicago New York, Los Angeles Sao Paulo Rental Value growth slowing Rental Value growth accelerating Rental Values bottoming out Rental Values falling Shanghai New York, Stockholm Tokyo Singapore Los Angeles, Mumbai Boston Washington, DC Madrid, Milan Paris, Brussels Hong Kong, Sydney Seoul Chicago, Dubai Istanbul, Beijing London Frankfurt Berlin Moscow Amsterdam Dallas Houston San Francisco Johannesburg Toronto Sao Paulo Mexico City Based on rents for Grade A space in CBD or equivalent. US positions relate to the overall market Source: JLL Research, July 2014

Consolidating industry leads to JLL opportunity Transformative Results The Staubach Company King Sturge Meghraj Trinity Funds Management Strategy Establish leading U.S. local market tenant rep position Strengthen local market scale, particularly in the UK Augment India corporate business with leading local presence Gain scale and credibility in Australia for LaSalle Purchase Price $613 million £197 million $60 million A$9 million Payment Structure 36% upfront; 64% deferred over 5 years 50% upfront; 50% deferred over 5 years 50% upfront: 50% deferred over 5 years 100% upfront EBITDA multiple 8.0x notional, 7.0x on PV basis 7.5x notional, 7.0x on PV basis 7.5x 4.0x Strategic Align with G5 strategy Enhance service delivery for clients Cultural alignment Meet financial goals Financial Profit growth to shareholders Neutral to accretive EBITDA multiples EPS accretive within 12-18 months Maintain investment grade strength

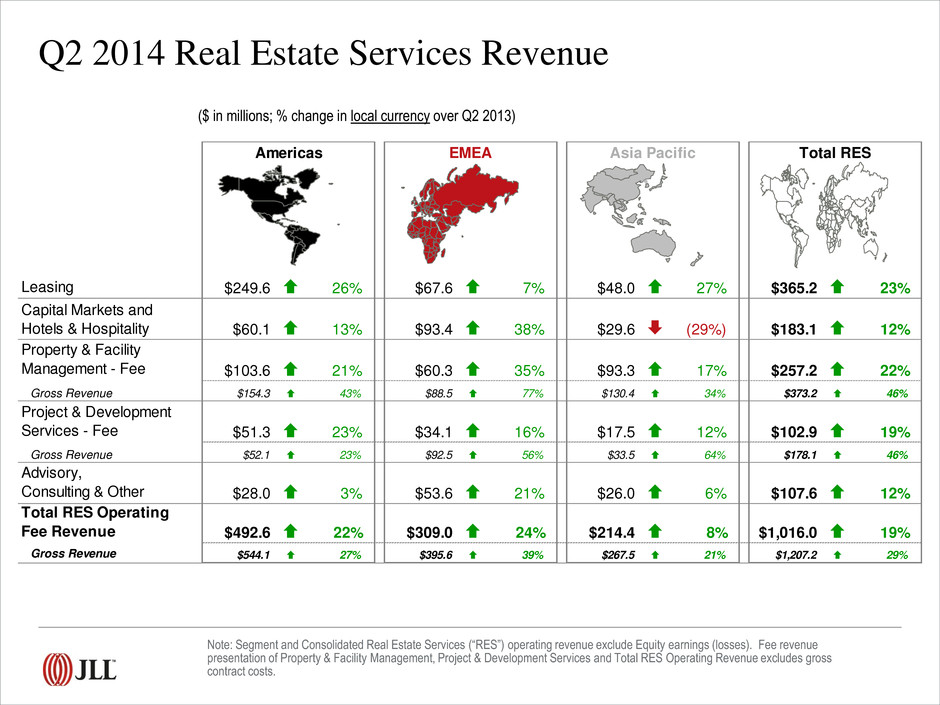

Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Leasing $249.6 26% $67.6 7% $48.0 27% $365.2 23% Capital Markets and Hotels & Hospitality $60.1 13% $93.4 38% $29.6 (29%) $183.1 12% Property & Facility Management - Fee $103.6 21% $60.3 35% $93.3 17% $257.2 22% Gross Revenue $154.3 43% $88.5 77% $130.4 34% $373.2 46% Project & Development Services - Fee $51.3 23% $34.1 16% $17.5 12% $102.9 19% Gross Revenue $52.1 23% $92.5 56% $33.5 64% $178.1 46% Advisory, Consulting & Other $28.0 3% $53.6 21% $26.0 6% $107.6 12% Total RES Operating Fee Revenue $492.6 22% $309.0 24% $214.4 8% $1,016.0 19% Gross Revenue $544.1 27% $395.6 39% $267.5 21% $1,207.2 29% Americas EMEA Asia Pacific Total RES ($ in millions; % change in local currency over Q2 2013) Q2 2014 Real Estate Services Revenue

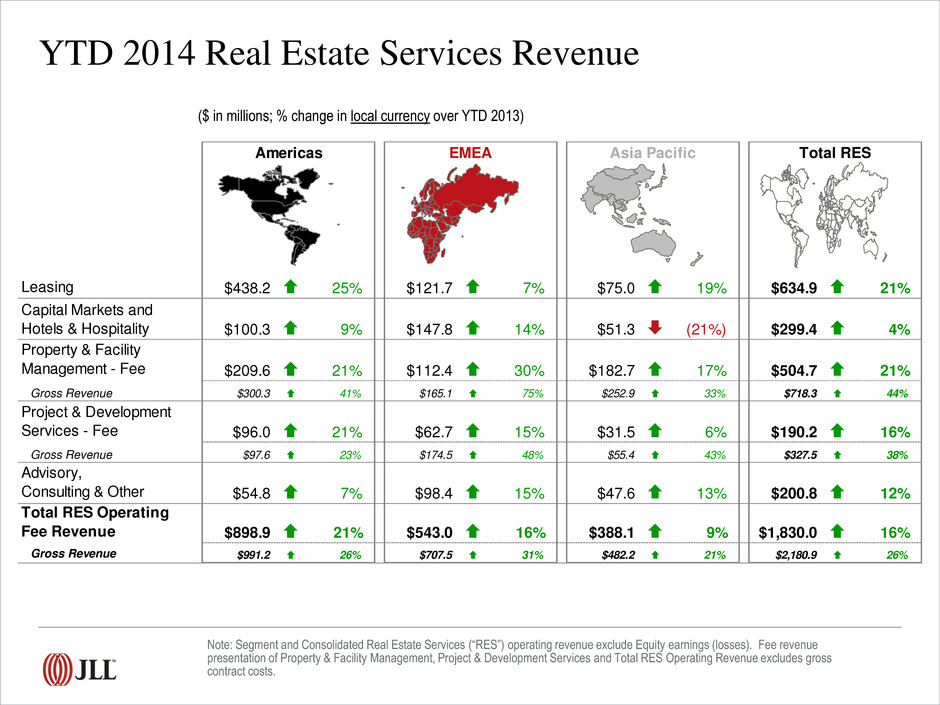

Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Leasing $438.2 25% $121.7 7% $75.0 19% $634.9 21% Capital Markets and Hotels & Hospitality $100.3 9% $147.8 14% $51.3 (21%) $299.4 4% Property & Facility Management - Fee $209.6 21% $112.4 30% $182.7 17% $504.7 21% Gross Revenue $300.3 41% $165.1 75% $252.9 33% $718.3 44% Project & Development Services - Fee $96.0 21% $62.7 15% $31.5 6% $190.2 16% Gross Revenue $97.6 23% $174.5 48% $55.4 43% $327.5 38% Advisory, Consulting & Other $54.8 7% $98.4 15% $47.6 13% $200.8 12% Total RES Operating Fee Revenue $898.9 21% $543.0 16% $388.1 9% $1,830.0 16% Gross Revenue $991.2 26% $707.5 31% $482.2 21% $2,180.9 26% Americas EMEA Asia Pacific Total RES ($ in millions; % change in local currency over YTD 2013) YTD 2014 Real Estate Services Revenue

($ in millions; % change in USD over Full Year 2012) Full Year 2013 Real Estate Services Revenue Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Leasing $879.3 6% $271.5 9% $178.9 (10%) $1,329.7 4% Capital Markets and Hotels & Hospitality $217.3 29% $333.3 42% $157.8 44% $708.4 38% Property & Facility Management - Fee $407.5 14% $192.6 12% $347.6 9% $947.7 11% Gross Revenue $518.4 19% $240.4 34% $440.7 11% $1,199.5 18% Project & Development Services - Fee $187.7 3% $117.4 10% $67.3 1 0% $372.4 5% Gross Revenue $188.9 3% $274.2 25% $92.3 11% $555.4 14% Advis y, Consulting & Other $114.2 7% $203.7 8% $96.0 11% $413.9 8% Total RES Operating Fee Revenue $1,806.0 10% $1,118.5 17% $847.6 9% $3,772.1 10% Gross Revenue $1,918.1 11% $1,323.1 23% $965.7 10% $4,206.9 15% Americas EMEA Asia Pacific Total RES

($ in millions) 2014 2013 2014 2013 Consolidated Revenue 1,277.2$ 989.4$ 2,314.6$ 1,845.4$ Consolidated Operating Expenses 1,185.5 923.6 2,238.2 1,759.5 Adjusted Operating Income Margin 7.7% 7.4% 5.1% 5.2% Gross Contract Costs: Property & Facility Management 50.8 23.8 90.7 43.0 Project & Development Services 0.7 0.4 1.5 0.6 Total Gross Contract Costs 51.5 24.2 92.2 43.6 Property & Facility Management 28.2 4.9 52.6 7.0 Project & Development Services 58.5 28.7 111.9 60.5 Total Gross Contract Costs 86.7 33.6 164.5 67.5 Property & Facility Management 37.0 18.2 70.2 35.8 Project & Development Services 16.1 5.2 23.9 9.6 Total Gross Contract Costs 53.1 23.4 94.1 45.4 Consolidated Fee Revenue 1,086.0$ 908.3$ 1,963.7$ 1,688.8$ Consolidated Fee-based Operating Expenses 994.3$ 842.5$ 1,887.3$ 1,602.9$ Adjusted Operating Income Margin ("fee"-based) 9.0% 8.0% 6.1% 5.7% Asia Pacific Americas EMEA Q2 YTD • Reimbursable vendor, subcontractor and out-of-pocket costs reported as revenue and expense in JLL financial statements have been increasing steadily • Margins diluted as gross-accounting requirements increase revenue and costs without corresponding profit • Business managed on a “fee” basis to focus on margin expansion in the base business Fee revenue / expense reconciliation Note: Consolidated revenue and fee revenue exclude equity earnings (losses). Restructuring and acquisition charges are excluded from operating expenses. Restructuring and acquisition charges as well as intangible amortization related to the King Sturge acquisition are excluded from operating expenses when calculating adjusted operating income margin.

2014 2013 2013 2012 71.8$ 46.3$ 87.7$ 59.4$ 45,278 45,141 45,220 45,091 1.58$ 1.03$ 1.94$ 1.32$ 71.8$ 46.3$ 87.7$ 59.4$ 4.1 5.0 5.2 7.4 0.4 0.4 0.9 0.8 76.3$ 51.7$ 93.8$ 67.6$ 45,278 45,141 45,220 45,091 1.68$ 1.15$ 2.07$ 1.50$ Adjusted earnings per share Three Months Ended June 30, Six Months Ended June 30, ($ in millions) GAAP Net income attributable to common shareholders Shares (in 000s) GAAP earnings per share GAAP Net income attributable to common shareholders Restructuring and acquisition charges, net Intangible amortization, net Adjusted net income Shares (in 000s) Reconciliation of GAAP net income to adjusted net income and calculations of earnings per share

Reconciliation of GAAP operating income to adjusted operating income and net income to adjusted EBITDA 2014 2013 2014 2013 91.7$ 65.8$ 76.4$ 85.9$ 5.5 6.6 41.4 9.8 0.6 0.6 1.1 1.1 97.8 73.0 118.9 96.8 72.4$ 49.5$ 88.5$ 62.7$ 7.7 9.0 14.3 17.0 24.1 16.4 (5.0) 20.8 22.8 20.2 45.2 39.3 127.0$ 95.1$ 143.0$ 139.8$ 5.5 6.6 41.4 9.8 132.5$ 101.7$ 184.4$ 149.6$ Adjusted EBITDA Three Months Ended June 30, Six Months Ended June 30, ($ in millions) GAAP Net income Interest expense, net of interest income Provision for income taxes Depreciation and amortization EBITDA Restructuring and acquisition charges Operating Income Restructuring and acquisition charges Intangible amortization Adjusted Operating Income

Statements in this presentation regarding, among other things, future financial results and performance, achievements, plans and objectives and dividend payments may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance, achievements, plans and objectives of JLL to be materially different from those expressed or implied by such forward-looking statements. For additional information concerning risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated in forward-looking statements, and risks to JLL’s business in general, please refer to those factors discussed under “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Quantitative and Qualitative Disclosures about Market Risk,” and elsewhere in JLL’s Annual Report on Form 10-K for the year ended December 31, 2013, in the Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, in the Quarterly Report on Form 10-Q for the quarter ended June 30, 2014, and in other reports filed with the Securities and Exchange Commission. There can be no assurance that future dividends will be declared since the actual declaration of future dividends, and the establishment of record and payment dates, remains subject to final determination by the Company’s Board of Directors. Any forward-looking statements speak only as of the date of this presentation, and except to the extent required by applicable securities laws, JLL expressly disclaims any obligation or undertaking to publicly update or revise any forward-looking statements contained herein to reflect any change in JLL’s expectations or results, or any change in events. © 2014 Jones Lang LaSalle IP, Inc. All rights reserved. No part of this publication may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of Jones Lang LaSalle IP, Inc. Cautionary note regarding forward-looking statements