UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

(Amendment No. 3)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2014

Enumeral Biomedical Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 333-185891 | 99-0376434 | ||

| (State or Other Jurisdiction | (Commission File | (I.R.S. Employer | ||

| of Incorporation) | Number) | Identification Number) |

One Kendall Square,

Building 400, 4th Floor

Cambridge, MA 02139

(Address of principal executive offices, including zip code)

+1 (617) 674-1865

(Registrant’s telephone number, including area code)

Krizikova 22

Prague 8, 18600, Czech Republic

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

EXPLANATORY NOTE

This Form 8-K/A is filed by Enumeral Biomedical Holdings, Inc. (the “Company”) to update Items 2.01 and 9.01 to provide updated historical financial information as of June 30, 2014 and for the three and six months ended June 30, 2014. References to Items in Form 8-K which are not included herein refer to Items previously filed by the Company.

Table of Contents

| i |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K (this “Current Report”) contains forward-looking statements, including, without limitation, in the sections captioned “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere. Any and all statements contained in this Current Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Current Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development of commercially viable pharmaceuticals, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the SEC, and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, the significant length of time associated with drug development and related insufficient cash flows and resulting illiquidity, our inability to expand our business, significant government regulation of pharmaceuticals and the healthcare industry, lack of product diversification, volatility in the price of our raw materials, existing or increased competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Current Report appears in the section captioned “Risk Factors” and elsewhere in this Current Report.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Current Report to reflect any new information or future events or circumstances or otherwise, except as required by law.

Readers should read this Current Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Current Report, and other documents which we may file from time to time with the Securities and Exchange Commission (the “SEC”).

We were incorporated as Cerulean Group, Inc. in Nevada on February 27, 2012. Prior to the Merger and Split-Off (each as defined below), we were a development stage company formed to develop and operate a website for self-travelers and backpackers.

As previously reported, on July 10, 2014, we (i) were converted from a Nevada corporation into a Delaware corporation under the name Enumeral Biomedical Holdings, Inc., and (ii) we increased our authorized capital stock from 75,000,000 shares of common stock, par value $0.001 per share, to 300,000,000 shares of common stock, par value $0.001 per share (the “Common Stock”), and 10,000,000 shares of “blank check” preferred stock, par value $0.001 per share.

Also as previously reported, on July 25, 2014, we completed a 4.62-for-1 forward split of our Common Stock in the form of a dividend, with the result that the 6,190,000 shares of Common Stock outstanding immediately prior to the stock split became 28,597,804 shares of Common Stock outstanding immediately thereafter. All share and per share numbers in this Current Report relating to our Common Stock have been adjusted to give effect to this stock split, unless otherwise stated.

On July 31, 2014, our wholly owned subsidiary, Enumeral Acquisition Corp., a corporation formed in the State of Delaware on July 21, 2014 (“Acquisition Sub”) merged (the “Merger”) with and into Enumeral Biomedical Corp., a corporation incorporated in the State of Delaware on December 11, 2009 (“Enumeral”). Enumeral was the surviving corporation in the Merger and became our wholly owned subsidiary. All of the outstanding Enumeral stock was converted into shares of our Common Stock, as described in more detail below.

In connection with the Merger and pursuant to the Split-Off Agreement (defined below), we transferred our pre-Merger assets and liabilities to our pre-Merger majority stockholder, in exchange for the surrender by her and cancellation of 23,100,000 shares of our Common Stock, leaving 5,497,804 shares outstanding before giving effect to the issuance of the Merger and the PPO (as defined below). See Item 2.01, “Split-Off”, below.

As a result of the Merger and Split-Off, we discontinued our pre-Merger business and acquired the business of Enumeral, and will continue the existing business operations of Enumeral as a publicly-traded company under the name Enumeral Biomedical Holdings, Inc.

Also on July 31, 2014, we closed a private placement offering (the “PPO”) of 21,549,510 Units of our securities, at a purchase price of $1.00 per Unit, each Unit consisting of one share of our Common Stock and a warrant to purchase one share of Common Stock at an exercise price of $2.00 per share and with a term of five years (the “PPO Warrants”). Additional information concerning the PPO and PPO Warrants is presented below under Item 2.01, “Merger and Related Transactions—the PPO” and “Description of Securities,” and Item 3.02, “Unregistered Sales of Equity Securities.”

In accordance with “reverse merger” accounting treatment, our historical financial statements as of period ends, and for periods ended, prior to the Merger will be replaced with the historical financial statements of Enumeral prior to the Merger in all future filings with the SEC.

Also on July 31, 2014, we changed our fiscal year from a fiscal year ending on October 31 of each year, which was used in our most recent filing with the SEC, to one ending on December 31 of each year, which is the fiscal year end of Enumeral.

As used in this Current Report henceforward, unless otherwise stated or the context clearly indicates otherwise, the terms the “Company,” the “Registrant,” “we,” “us,” and “our” refer to Enumeral Biomedical Holdings, Inc., incorporated in Delaware, after giving effect to the Merger, the Split-Off and the PPO.

This Current Report contains summaries of the material terms of various agreements executed in connection with the transactions described herein. The summaries of these agreements are subject to, and are qualified in their entirety by, reference to these agreements, which are filed as exhibits hereto and incorporated herein by reference.

| 2 |

This Current Report is being filed in connection with a series of transactions consummated by the Company and certain related events and actions taken by the Company.

This Current Report on Form 8-K/A responds to the following Items in Form 8-K:

Item 2.01. Completion of Acquisition or Disposition of Assets

Item 9.01. Financial Statements and Exhibits

Prior to the Merger, we were a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). As a result of the Merger, we have ceased to be a shell company. The information contained in this Current Report, together with the information contained in our Annual Report on Form 10-K for the fiscal year ended October 31, 2013, and our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as filed with the SEC, constitute the current “Form 10 information” necessary to satisfy the conditions contained in Rule 144(i)(2) under the Securities Act of 1933, as amended (the “Securities Act”).

Item 2.01 Completion of Acquisition or Disposition of Assets

THE MERGER AND RELATED TRANSACTIONS

Merger Agreement

On July 31, 2014 (the “Closing Date”), the Company, Acquisition Sub and Enumeral entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”), which closed on the same date. Pursuant to the terms of the Merger Agreement, Acquisition Sub merged with and into Enumeral, which was the surviving corporation and thus became our wholly-owned subsidiary.

Pursuant to the Merger, we acquired the business of Enumeral to discover and develop novel antibody therapeutics that help the human immune system attack diseased cells. (See “Description of Business” below.)

At the closing of the Merger (a) each share of Enumeral’s common stock issued and outstanding immediately prior to the closing of the Merger was converted into 1.102121 shares of our Common Stock, (b) each share of Enumeral’s Series A Preferred Stock issued and outstanding immediately prior to the closing of the Merger was converted into 1.598075 shares of our Common Stock, (c) each share of Enumeral’s Series A-1 Preferred Stock issued and outstanding immediately prior to the closing of the Merger was converted into 1.790947 shares of our Common Stock, (d) each share of Enumeral’s Series A-2 Preferred Stock issued and outstanding immediately prior to the closing of the Merger was converted into 1.997246 shares of our Common Stock, (e) each share of Enumeral’s Series B Preferred Stock issued and outstanding immediately prior to the closing of the Merger was converted into 2.927509 shares of our Common Stock, and (f) a convertible note was converted into 3,230,869 shares of our Common Stock. As a result, an aggregate of 22,700,649 shares of our Common Stock were issued to the holders of Enumeral’s stock (inclusive of 188,250 shares of common stock that is unvested and remains to a restricted stock award to each of Messrs. Rydzewski and Tinkelenberg as more fully described in “Executive Compensation – Employment Agreements”).

In addition, pursuant to the Merger Agreement:

| · | warrants to purchase 694,443 shares of Enumeral’s common stock issued and outstanding immediately prior to the closing of the Merger were converted into warrants to purchase shares of our Common Stock at a conversion ratio of 1.102121 for one; |

| · | warrants to purchase 41,659 shares of Enumeral’s Series A Preferred Stock issued and outstanding immediately prior to the closing of the Merger were converted into warrants to purchase shares of our Common Stock at a conversion ratio of 1.598075 for one and |

| 3 |

| · | warrants to purchase 144,140 shares of Enumeral’s Series B Preferred Stock issued and outstanding immediately prior to the closing of the Merger were converted into warrants to purchase shares of our Common Stock at a conversion ratio of 2.927509 for one and |

| · | options to purchase 948,567 shares of Enumeral’s common stock issued and outstanding immediately prior to the closing of the Merger were converted into options to purchase shares of our Common Stock at a conversion ratio of 1.102121 for one. |

As a result, warrants to purchase an aggregate of 1,253,899 shares of our Common Stock and options to purchase an aggregate of 1,045,419 shares of our Common Stock were issued in connection with the Merger. See “Description of Securities—Warrants” and “—Options” below for more information.

The Merger Agreement provided certain anti-dilution protection to the holders of the Company’s Common Stock immediately prior to the Merger (after giving effect to the Split-Off), in the event that the aggregate number of Units sold in the PPO after the final closing thereof were to exceed 15,000,000 Accordingly, based on the final amount of gross proceeds raised in the PPO, the Company issued 1,693,747 additional shares of Common Stock to the holders of the Company’s Common Stock immediately prior to the Merger.

The Merger Agreement contained customary representations and warranties and pre- and post-closing covenants of each party and customary closing conditions. Breaches of the representations and warranties will be subject to indemnification provisions. Each of the stockholders of Enumeral as of the date of the Merger initially received in the Merger 98% of the shares to which each such stockholder is entitled, with the remaining 2% of such shares being held in escrow for 18 months to satisfy post-closing claims for indemnification by the Company (“Indemnity Shares”). Any of the Indemnity Shares remaining in escrow at the end of such 18-month period shall be distributed to the pre-Merger stockholders of Enumeral on a pro rata basis. The Merger Agreement also contains a provision providing for a post-Merger share adjustment as a means for which claims for indemnity may be made by the pre-Merger stockholders of Enumeral. Pursuant to this provision, up to 500,000 additional shares (“R&W Shares”) of Common Stock may be issued to the pre-Merger stockholders of Enumeral, pro rata, during the 18-month period following the Merger for breaches of representations and warranties by the Company. The value of the Indemnity Shares and the R&W Shares issued pursuant to the foregoing adjustment mechanisms is fixed at $1.00 per share. The foregoing mechanisms are the exclusive remedies of the Company on one hand and the pre-Merger stockholders of Enumeral on the other hand for satisfying indemnification claims under the Merger Agreement.

The Merger will be treated as a recapitalization of the Company for financial accounting purposes. Enumeral will be considered the acquirer for accounting purposes, and our historical financial statements prior to the Merger will be replaced with the historical financial statements of Enumeral prior to the Merger in all future filings with the SEC.

The Merger is intended to be treated as a tax-free reorganization under Section 368 of the Internal Revenue Code of 1986, as amended.

The issuance of shares of our Common Stock to holders of Enumeral’s capital stock in connection with the Merger was not registered under the Securities Act, in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act, which exempts transactions by an issuer not involving any public offering, and Regulation D promulgated by the SEC under that section. These securities may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirement, and are subject to further contractual restrictions on transfer as described below.

We also agreed not to register under the Securities Act the resale of the shares of our Common Stock received in the Merger by our officers, directors and key employees and holders of 10% or more of our Common Stock for a period of one year following the closing of the Merger.

The Merger Agreement is filed as Exhibit 2.1 to this Current Report on Form 8-K. All descriptions of the Merger Agreement herein are qualified in their entirety by reference to the text thereof filed as an exhibit hereto, which is incorporated herein by reference.

| 4 |

Split-Off

Upon the closing of the Merger and under the terms of a split-off agreement and a general release agreement, the Company transferred all of its pre-Merger operating assets and liabilities to its wholly-owned special-purpose subsidiary, Cerulean Operating Corp., a Delaware corporation (“Split-Off Subsidiary”), formed on July 24, 2014. Thereafter, pursuant to the split-off agreement, the Company transferred all of the outstanding shares of capital stock of Split-Off Subsidiary to Olesya Didenko, the pre-Merger majority stockholder of the Company, and the former sole officer and director of the Company (the “Split-Off”), in consideration of and in exchange for (i) the surrender and cancellation of an aggregate of 23,100,000 shares of our Common Stock held by Olesya Didenko (which were cancelled and will resume the status of authorized but unissued shares of our Common Stock) and (ii) certain representations, covenants and indemnities. All descriptions of the split-off agreement and the general release agreement herein are qualified in their entirety by reference to the text thereof filed as Exhibits 10.1 and 10.2 hereto, which are incorporated herein by reference.

The PPO

Concurrently with the closing of the Merger and in contemplation of the Merger, we held a closing of our PPO in which we sold 21,549,510 Units of our securities, at a purchase price of $1.00 per Unit, each Unit consisting of one share of the our Common Stock and PPO Warrant to purchase one share of Common Stock at an exercise price of $2.00 per share and with a term of five years.

The investors in the Units (for so long as such investors hold shares of Common Stock) will have anti-dilution protection on those Units purchased in the PPO and not subsequently transferred or sold (other than transfers to trusts or affiliates of such investors for the purpose of estate planning), such that if within two years after the final closing of the PPO the Company shall issue additional shares of Common Stock or Common Stock equivalents (subject to customary exceptions, including but not limited to (a) issuances of awards under the 2014 Plan (as defined below) and (b) other Exempt Securities (defined below)) for a consideration per share less than $1.00 (the “Lower Price”), each such investor will be entitled to receive from the Company additional Units in an amount such that, when added to the number of Units initially purchased by such investor, will equal the number of Units that such investor’s PPO subscription amount would have purchased at the Lower Price.

The PPO Warrants not subsequently transferred or sold (other than transfers to trusts or affiliates of such investors for the purpose of estate planning) have “weighted average” anti-dilution protection for the same period as the Units, subject to customary exceptions, including but not limited to issuances of awards under the 2014 Plan and other Exempt Securities.

“Exempt Securities” include: (i) shares of Common Stock issued or issuable upon conversion or exchange of any convertible securities or exercise of any options or warrants outstanding on the effective date of the Merger; (ii) shares of Common Stock issued or issuable upon exercise of the PPO Warrants or the Agent Warrants; (iii) shares of Common Stock issued in a registered public offering under the Securities Act; (iv) shares of Common Stock issued or issuable pursuant to the acquisition of another entity or business by the Company by merger, purchase of substantially all of the assets or other reorganization or pursuant to a joint venture or technology license agreement, but not including a transaction in which the Company is issuing securities primarily for the purpose of raising capital or to an entity whose primary business is investing in securities; (v) shares of Common Stock issued or issuable to officers, directors and employees of, or consultants to, the Company pursuant to stock grants, option plans, purchase plans or other employee stock incentive programs or arrangements approved by the Board of Directors, or upon exercise of options or warrants granted to such parties pursuant to any such plan or arrangement; and (vi) securities issued to financial institutions, institutional investors or lessors in connection with credit arrangements, equipment financings, lease arrangements or similar transactions, in the aggregate not exceeding ten percent (10%) of the number of shares of Common Stock outstanding at any time, and in case of clauses (iii) through (vi) above, such issuance is approved by a majority of disinterested directors of the Company and includes no “death spiral” provision of any kind.

The aggregate gross proceeds of the PPO were $21,549,510 (before deducting placement agent fees and expenses and expenses of the offering estimated of approximately $2,938,000).

| 5 |

The PPO was exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemption provided by Regulation D promulgated by the SEC thereunder. The PPO was sold to “accredited investors,” as defined in Regulation D, and was conducted on a “best efforts” basis.

The closing of the PPO and the closing of the Merger were conditioned upon each other.

In connection with the PPO, we agreed to pay our placement agents, EDI Financial, Inc. and Katalyst Securities LLC (the “Placement Agents”), a commission of equal to 10% of the gross proceeds raised from investors in the PPO). In addition, the Placement Agents collectively received warrants to purchase 10% of the number of shares of Common Stock included in the Units sold in the PPO, provided, however, that the Placement Agents are not entitled to any warrants on the sale of Units in excess of 20,000,000), with a term of five (5) years and an exercise price of $1.00 per share (the “Agent Warrants”). Any sub-agent of the Placement Agents or certain individuals identified by the Company that introduced investors to the PPO were entitled to share in the cash fees and warrants attributable to those investors as described above. We also agreed to pay to the Placement Agents a cash fee (a “Subsequent Offering Fee”) on the amount that any person or entity contacted by the Placement Agents, in connection with the Offering (each, an “Introduced Investor”), invests in the Company at any time prior to the date that is eighteen (18) months after the final closing of the PPO, whether or not such Introduced Investor invested in the PPO, provided, that such person was introduced to the Company by the Placement Agents prior to or during the PPO and was provided with a copy of the Private Placement Memorandum; and provided further, that an Introduced Investor shall not include (x) any investors who were investors in Enumeral prior to the Offering, (y) any employees, directors or officers of the Company or Enumeral, or (z) were introduced to the Company by employees, officers or directors of Enumeral (and who were not a client of the Placement Agents prior to the Offering), whether or not they participate in the placement. The Subsequent Offering Fee shall be equal to (i) the highest percentage of amount raised paid to any placement agent affiliated with the offering, or (ii) 10% if no placement agents are engaged as part of such offering.

As a result of the foregoing, the Placement Agents and their respective sub-agents were collectively paid an aggregate commission of $2,154,951 and were issued Agent Warrants to purchase an aggregate of 2,000,000 shares of our Common Stock. We were also required to reimburse the Placement Agents up to $30,000 of legal expenses incurred in connection with the PPO, in the aggregate.

We agreed to indemnify the Placement Agents and their respective sub-agents to the fullest extent permitted by law, against certain liabilities that may be incurred in connection with the PPO, including certain civil liabilities under the Securities Act, and, where such indemnification is not available, to contribute to the payments the Placement Agents and their respective sub-agents may be required to make in respect of such liabilities.

All descriptions of the PPO Warrants and the Agent Warrants herein are qualified in their entirety by reference to the text of the forms of such documents filed as Exhibits 10.5, 10.8 and 10.36 hereto, which are incorporated herein by reference.

| 6 |

Registration Rights

In connection with the PPO, we entered into a Registration Rights Agreement, pursuant to which we have agreed that promptly, but no later than 90 calendar days from the final closing of the PPO, the Company will file a registration statement with the SEC (the “Registration Statement”) covering (a) the shares of Common Stock issued in the PPO, (b) the shares of Common Stock issuable upon exercise of the PPO Warrants, (c) the shares of Common Stock underlying the Agent Warrants, (d) up to 50% of shares of Common Stock issued in the Merger in exchange for the preferred and common stock held by the former stockholders of Enumeral prior to the Merger (the “Enumeral Stockholders”) who are not parties to a lock-up agreement (provided that any registered Enumeral Stockholder that purchased Units in the PPO having a purchase price equal to at least 50% of the total amount invested by such holder in Enumeral stock prior to the PPO, the Registration Statement will include 100% of shares of Common Stock issued in the Merger to an Enumeral Stockholder in exchange for Enumeral’s preferred and common stock held by such person) and (e) the True-Up Shares, if any (clauses (a) through (e), collectively, the “Registrable Shares”). The Company agreed to use its commercially reasonable efforts to ensure that such Registration Statement is declared effective within 180 calendar days of filing with the SEC. If the Company is late in filing the Registration Statement or if the Registration Statement is not declared effective within 180 days of filing with the SEC, the Company will be required to pay the holders of Registrable Shares that have not been so registered, liquidated damages at a rate equal to 1.00% of the Offering Price per share for each full month that (i) the Company is late in filing the Registration Statement, (ii) the Registration Statement is late in being declared effective by the SEC or (iii) after the Registration Statement is declared effective, the Registration Statement ceases for any reason to remain continuously effective or the holders of the Registrable Shares are otherwise not permitted to utilize the prospectus therein to resell the Registrable Securities for a period of more than 30 consecutive trading days; provided, however, that in no event shall the aggregate of any such liquidated damages exceed 8% of the PPO offering price per share. No liquidated damages will accrue and accumulate with respect to (a) any Registrable Shares removed from the Registration Statement in response to a comment from the staff of the SEC limiting the number of shares of Common Stock which may be included in the Registration Statement (a “Cutback Comment”), or (b) after the shares may be resold under Rule 144 under the Securities Act or another exemption from registration under the Securities Act.

The Company is required to use its commercially reasonable efforts to keep the Registration Statement “evergreen” for two years from the date it is declared effective by the SEC or until Rule 144 is available to the holders of Registrable Shares who are not and have not been affiliates of the Company with respect to all of their registrable shares, whichever is earlier.

Prior to the Merger, the Company was a “shell company” as defined in Rule 12b-2 under the Exchange Act. Pursuant to Rule 144(i), securities issued by a current or former shell company that otherwise meet the holding period and other requirements of Rule 144 nevertheless cannot be sold in reliance on Rule 144 until twelve (12) months after the company (a) is no longer a shell company; and (b) has filed current “Form 10 information” (as defined in Rule 144(i)) with the SEC reflecting that it is no longer a shell company, and provided that at the time of a proposed sale pursuant to Rule 144, the company is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act and has filed all reports and other materials required to be filed by Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding twelve (12) months (or for such shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports. As a result, the restrictive legends on certificates for our Common Stock and Warrants cannot be removed (a) except in connection with an actual sale meeting the foregoing requirements or (b) pursuant to an effective registration statement.

The holders of Registrable Shares (including any shares of Common Stock removed from the Registration Statement as a result of a Cutback Comment) and the holders of the Company’s common stock prior to the Merger (but not holders of the shares issued to the stockholders of Enumeral in consideration for the Merger) will have two “piggyback” registration rights for such shares with respect to any registration statement filed by the Company following the effectiveness of the Registration Statement that would permit the inclusion of such shares, subject to customary cut-backs on a pro rata basis if the underwriter or the Company determines that marketing factors require a limitation on the number of shares of stock or other securities to be underwritten.

We will pay all expenses in connection with any registration obligation provided in the Registration Rights Agreement, including, without limitation, all registration, filing, stock exchange fees, printing expenses, all fees and expenses of complying with applicable securities laws, and the fees and disbursements of our counsel and of our independent accountants. Each investor will be responsible for its own sales commissions, if any, transfer taxes and the expenses of any attorney or other advisor that such investor decides to employ.

We also have agreed not to file any other registration statements under the Securities Act, with customary exceptions, including shares issued in any acquisitions or covering any equity incentive plans, for a period of one year following the Merger.

All descriptions of the Registration Rights Agreement herein are qualified in their entirety by reference to the text of the form of such document filed as an Exhibit 10.9 hereto, which is incorporated herein by reference.

Composition of the Board; Voting Agreement

In connection with the Merger, the parties agreed that the Board of Directors of the Company will consist of seven members. The Board of Directors is initially composed of:

| 7 |

| (i) | six directors nominated by Enumeral, who shall be composed of |

| (a) | four of whom shall initially be John J. Rydzewski, Arthur H. Tinkelenberg, Allan Rothstein and Barry Buckland, |

| (b) | one of whom shall be a director nominated by Harris & Harris Group, Inc. (the “H&H” Director), who is reasonably acceptable to Enumeral and who shall initially be Daniel Wolfe; provided, that the right of H&H shall cease at such time as the number of shares of Common Stock owned directly by H&H is less than five percent of the total number of shares of Common Stock outstanding, and |

| (c) | one additional person to be designated by the directors specified in clauses (a) and (b) above (which director has not yet been designated), and |

| (ii) | one independent director nominated by Montrose Capital Limited and the Placement Agents, who is reasonably acceptable to the pre-Merger stockholders of Enumeral (which director has not yet been designated). |

In connection with the Merger, certain stockholders of the Company (holding in excess of 70.0% of the common stock), including all of the investors in the PPO, all of the pre-Merger stockholders of the Company and certain of the Enumeral Stockholders (including all of its officers and directors and certain of its principal stockholders), entered into a Voting Agreement in which they have agreed to vote their Company stock to maintain the composition of the Company’s Board of Directors as described above.

The Voting Agreement will terminate two years from the date of closing of the Merger. All descriptions of the Voting Agreement herein are qualified in their entirety by reference to the text thereof filed as an Exhibit 10.10 hereto, which is incorporated herein by reference.

2014 Equity Incentive Plan

Before the Merger, our Board of Directors adopted, and our stockholders approved, our 2014 Equity Incentive Plan (the “2014 Plan”), which provides for the issuance of incentive awards of up to 8,100,000 shares of our Common Stock. Incentive awards generally may be issued to officers, key employees, consultants and directors. In connection with the Merger, options to purchase an aggregate of 1,045,419 shares of our Common Stock were issued under the 2014 Plan in exchange for outstanding options that were previously issued to officers, key employees, consultants and directors of Enumeral. In addition, options to purchase 1,221,250 shares of our Common Stock were issued on the Closing Date, consisting of incentive stock options to purchase 1,105,000 shares of our Common Stock issued to our executive officers, and incentive stock options to purchase 116, 250 issued to other employees. Following the Merger, on August 4, 2014, nonqualified options to purchase 120,000 shares of our Common Stock were issued to the non-executive Directors of the Company. See “Market Price of and Dividends on Common Equity and Related Stockholder Matters—Securities Authorized for Issuance under Equity Compensation Plans” below for more information about the 2014 Plan and the outstanding stock options.

All descriptions of the 2014 Plan herein are qualified in their entirety by reference to the text thereof filed as an Exhibit 10.11 hereto, which is incorporated herein by reference.

Departure and Appointment of Directors and Officers

On the Closing Date, our Board of Directors was authorized to consist of, and currently consists of, five members, two of whom are independent. On the Closing Date, Olesya Didenko, our sole director before the Merger, resigned her position as a director, and Arthur H. Tinkelenberg, John J. Rydzewski, Daniel B. Wolfe, Allan Rothstein and Barry Buckland were appointed to the Board of Directors. Pursuant to the Voting Agreement, we expect to add two additional directors in the near future. See “—Composition of the Board; Voting Agreement” above.

| 8 |

Also on the Closing Date, Ms. Olesya Didenko, our President, Secretary and Treasurer before the Merger, resigned from these positions, and John J. Rydzewski was appointed as our Executive Chairman, Arthur H. Tinkelenberg was appointed as our Chief Executive Officer and President, Derek Brand was appointed as our Vice President of Business Development and Secretary, Anhco Nguyen was appointed as our Vice President of Research and Development and Kevin Sarney was appointed as our Vice President of Finance and Chief Accounting Officer.

See “—Security Ownership of Certain Beneficial Owners and Management – Directors and Executive Officers” below for information about our new directors and executive officers.

Lock-up Agreements and Other Restrictions

In connection with the Merger, each of our executive officers and directors named above, key employees and holders of five percent or more of our Common Stock after giving effect to the Merger and the PPO (“5% Stockholders” and together with our directors, officers and key employees, collectively, the “Restricted Holders”), holding in the aggregate 12,457,103 shares of our Common Stock (exclusive of shares they have the right to acquire upon exercise of options and warrants), entered into agreements (the “Lock-Up and No Shorting Agreements”), whereby they are restricted for a period of 18 months (in the case of directors and 5% Stockholders) or 24 months (in the case of officers and key employees) after the Merger from making certain sales or dispositions of our Common Stock held by them immediately after the Merger, except in certain limited circumstances (the “Lock-Up”) and subject to termination with the written approval of the lead underwriter of any underwritten public offering of the Company’s securities with gross proceeds of $40,000,000 or more or upon the Restricted Holder’s resignation from the board, resignation or termination as an employee of the Company or ownership of less than five percent of our Common Stock, as applicable.

Further, for the respective periods indicated above after the Merger, each Restricted Holder has agreed in the Lock-Up and No Shorting Agreements to be subject to restrictions on engaging in certain transactions, including effecting or agreeing to effect short sales, whether or not against the box, establishing any “put equivalent position” with respect to our Common Stock, borrowing or pre-borrowing any shares of our Common Stock, or granting other rights (including put or call options) with respect to our Common Stock or with respect to any security that includes, relates to or derives any significant part of its value from our Common Stock, or otherwise seeks to hedge his position in our Common Stock, but in any of the foregoing events, excluding the pledge of the Common Stock as collateral for any bona fide loan, provided that the lender agrees in writing that the Common Stock subject to the Lock-Up will continue to be subject to the restrictions on transfer set forth in Lock-Up and No Shorting Agreement.

The Company has agreed that, following the second anniversary of the closing of the Merger, and upon the request of Restricted Holders who collectively own at least 51% of the shares subject to Lock-Up, to promptly, but no later than 90 calendar days from the date of the notice, file a registration statement with the SEC covering up to 50% of the shares of Common Stock issued in the Merger to the Restricted Holders. The Company agreed to use its commercially reasonable efforts to ensure that such registration statement is declared effective within 180 calendar days of filing with the SEC. The Company is required to use its commercially reasonable efforts to keep the registration statement “evergreen” for nine months from the date it is declared effective by the SEC or until such time as none of the Restricted Holders are affiliates of the Company

All descriptions of the Lock-Up and No Shorting Agreements herein are qualified in their entirety by reference to the text of the form of such document filed as an Exhibit 10.3 hereto, which is incorporated herein by reference.

Pro Forma Ownership

Immediately after giving effect to (i) the Merger, (ii) the cancellation of 23,100,000 shares in the Split-Off, and (iii) the issuance of 21,549,510 shares at the closing of the PPO, there were 51,591,710 issued and outstanding shares of our Common Stock, as follows:

| · | the Enumeral Stockholders and a former holder of an Enumeral convertible note own 22,700,649 shares of our Common Stock (inclusive of 188,250 shares of common stock that is unvested and remains to a restricted stock award to each of Messrs. Rydzewski and Tinkelenberg as more fully described in “Executive Compensation – Employment Agreements”); |

| 9 |

| · | the stockholders of the Company prior to the Merger own 7,191,551 shares of our Common Stock (inclusive of 1,693,747 shares of common stock that were issued pursuant to the Merger Agreement’s anti-dilution provisions); |

| · | a sub-agent to one of the Placement Agents owns 150,000 shares of our Common Stock; and |

| · | investors in the PPO own 21,549,510 shares of our Common Stock. |

In addition,

| · | investors in the PPO hold PPO Warrants to purchase 21,549,510 shares of our Common Stock; |

| · | the Placement Agents and their respective sub-agents hold Agent Warrants to purchase 2,000,000 shares of our Common Stock; |

| · | warrants to purchase an aggregate of 1,253,899 shares of our Common Stock are held by certain former Enumeral warrant holders; and |

| · | the 2014 Plan authorizes issuance of up to 8,100,000 shares of our Common Stock and effective as of the Closing of the Merger options to purchase 2,266,669 shares of our Common Stock had been granted, consisting of options to purchase 1,045,419 shares of our Common Stock issued in exchange for Enumeral options in connection with the Merger, options to purchase 1,105,000 shares of our Common Stock issued to our officers on the Closing Date, and options to purchase 116,250 shares of our Common Stock issued to other employees. |

No other securities convertible into or exercisable or exchangeable for our Common Stock are outstanding.

Our common stock is quoted on the OTC Markets (OTCQB) under the symbol “ENUM,” which changed from “CEUL” on July 21, 2014.

Accounting Treatment; Change of Control

The Merger is being accounted for as a “reverse merger,” and Enumeral is deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the Merger will be those of Enumeral and will be recorded at the historical cost basis of Enumeral, and the consolidated financial statements after completion of the Merger will include the assets and liabilities of Enumeral, historical operations of Enumeral and operations of the Company and its subsidiaries from the closing date of the Merger. As a result of the issuance of the shares of our Common Stock pursuant to the Merger, a change in control of the Company occurred as of the date of consummation of the Merger. Except as described in this Current Report, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of members of our Board of Directors and, to our knowledge, no other arrangements exist that might result in a change of control of the Company.

Following the Merger, we will continue to be a “smaller reporting company,” as defined under the Exchange Act, and an “emerging growth company” under the JOBS Act. We believe that as a result of the Merger we have ceased to be a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act).

Immediately following the Merger, the business of Enumeral became our business.

| 10 |

History

As described above, we were incorporated in Nevada as Cerulean Group, Inc. on February 27, 2012, and converted to a Delaware corporation on July 10, 2014. Our original business was to develop and operate a website for self-travelers and backpackers that would allow a person with a mobile device or computer and access to the Internet to build a trip. Prior to the Merger, our Board of Directors determined to discontinue operations in this area to seek a new business opportunity. As a result of the Merger, we have acquired the business of Enumeral. In connection with the Merger, we have also changed our name to Enumeral Biomedical Holdings, Inc. and changed our state of incorporation from Nevada to Delaware.

Our authorized capital stock currently consists of 300,000,000 shares of common stock, par value $0.001, and 10,000,000 shares of “blank check” preferred stock, par value $0.001. Our common stock is quoted on the OTC Markets (OTCQB) under the symbol “ENUM,” which changed from “CEUL” on July 21, 2014.

Our principal executive offices are located at One Kendall Square, Building 400, 4th Floor, Cambridge, MA 02139. Our telephone number is 1-617-674-1865. Our website address is www.enumeral.com.

Enumeral was incorporated on December 11, 2009 under the laws of the State of Delaware.

General

Enumeral is discovering and developing novel antibody therapeutics that help the immune system attack diseased cells (“immunomodulators”). We believe that we have a unique ability to extensively interrogate cells of the human immune system for drug candidate validation and that this ability gives us a distinct advantage in selecting potential best-in-class therapeutic candidates. We are building a pipeline of drug candidates for the treatment of cancer and inflammatory diseases and leveraging the breadth of our technology in order to drive near-term cash flows from out-licensing of our drug candidates and through strategic collaboration partnerships. Our near-term goals include performance of preclinical testing on drug candidates resulting from our internal programs to generate data to support our ability to obtain revenue from co-development partners. The Company has focused its research efforts on using its proprietary drug discovery platform utilizing, in part, technology licensed by Enumeral from M.I.T., Harvard University and other institutions to identify and elucidate antibodies and antigens that are relevant to diseases that affect millions of individuals and are underserved by current therapeutic alternatives. These diseases have included cancer, infectious, and inflammatory diseases. We believe that the breadth of our drug discovery platform offers us the potential to grow our business through revenue-generating collaborative research and development partnerships.

Our strategy is to generate superior antibodies that we will co-develop, either through collaborative partnerships, or out-licensing partnerships, with larger biotechnology or pharmaceutical companies. Our goal initially is to obtain such partners following completion of “ex vivo” human and animal preclinical studies, and prior to completion of full investigational new drug (“IND”)-enabling studies, or we may fund IND-enabling studies and seek collaboration partners at that point. The immediate commercial goal of our programs is to reach significant value inflection points in the next twelve to eighteen months in order to obtain from the sale or license of product discovery programs a combination of up-front payments; subsequent milestone payments as the candidate clears pre-clinical and clinical regulatory hurdles; and royalty payments upon future sales of the marketed drug.

The protein targets on immune cells on which we are focused on function as “immune checkpoint” components of regulatory processes within the body that help coordinate an appropriate immune response. Checkpoint proteins serve as “brakes” that the body uses to prevent runaway immune responses, which can be debilitating, or even deadly. However, checkpoint control mechanisms can hinder the anti-cancer immune response, or responses to other diseased cells. In addition, cancer cells can sabotage the function of these control mechanisms as a defense against an immune system attack. Thus, while checkpoints usually function to appropriately regulate immune responses, cancers can “co-opt” checkpoint processes to evade destruction by the immune system.

| 11 |

There is increasing evidence that autoimmune, inflammatory, and infectious disease processes may be under similar checkpoint controls in the body (see “Programmed death-1 pathway in cancer and autoimmunity”, Clinical Immunology (2014) 153, 145–152). Immunomodulators (or immunotherapies) are potential drugs (usually antibodies) that bind to checkpoint proteins and either enhance or block specific checkpoint processes. Such approaches to cancer therapy are designed to make cancers more susceptible to destruction by the body’s immune responses. Immunomodulators include Bristol-Meyers Squibb’s Yervoy (forecast to reach $1B to $1.5B in peak sales; see http://www.fiercebiotech.com/special-reports/fdas-top-10-blockbuster-decisions/ipilimumab-fdas-top-10-blockbuster-decisions) PD-1 antagonists from Merck (Pembrolizumab) and Bristol-Myers Squibb (Nivolumab), both currently in Phase 3 clinical trials.

The Company’s principal objective is to use its technology platform to enable and accelerate the discovery and development of therapeutic products, particularly antibody therapies. Such antibodies may originally be identified in human patients, or from more traditional sources such as target-focused animal immunization and screening.

We employ a proprietary and patented “microengraving” technology in the discovery and development of monoclonal antibodies (“mAbs”) and other novel biologics for use in the diagnosis and treatment of cancer, and infectious and inflammatory diseases. We seek to: (1) create valuable products through internal product discovery programs for novel therapeutics and biomarkers that can be licensed or sold; (2) create and co-own valuable products and generate revenues through collaborative partnerships with leading pharmaceutical companies that apply our microengraving technology in therapeutic and biomarker discovery; and (3) develop novel means to utilize our microengraving technology through foundation and government funded grants and contracts programs to further benefit our internal and collaborative discovery programs.

Our corporate objective is to apply our microengraving technology to the development of more effective therapeutics at a lower cost by enabling better understanding of which drug candidates might work in which patients. We believe that our discoveries will be valuable for the development of therapeutic products (including vaccines and drugs based on new monoclonal antibodies) as well as potential diagnostic products.

Our technology enables us to perform sensitive measurements in primary patient-derived biopsy tissue in order to mine the human immune system’s rich collection of cells for information that is difficult to obtain using other methods and that may guide the development of effective therapeutics and diagnostics. We believe that the efficiency and sensitivity of our platform technology increases the probability of finding rare cell types associated with disease or drug response, as well as rare and previously unknown antibodies that may have the characteristics essential to becoming safe and effective drugs.

In effect, our platform enables us to study at high resolution the responses of rare immune cells from a patient in a single chip, thereby potentially identifying drug candidates earlier in the drug discovery and development process. Enumeral’s vision is to employ its platform to better predict, using human tissues from patient cohorts, which antibody drug candidates are most likely to be effective in a targeted group of patients.

Background

Pharmaceutical Antibody and Biologics Market

The pharmaceutical industry is facing major challenges, which include increased pressure from sluggish prescription drug trends, intensifying generic competition, growing regulatory costs and rapidly escalating R&D costs that result in unproductive product pipelines, and an increasing rate of costly failures of drugs in Phase II and Phase III clinical trials. The significant imbalance between new product introductions and unprecedented patent losses of “blockbuster” (generally taken to mean a drug generating more than $1 billion of annual revenue) small molecule drugs has caused pharmaceutical companies to fundamentally re-orient their drug product portfolios to contain both large-molecule, protein and small-molecule, chemical therapeutics over the past decade-and-a-half.

The portfolio rebalancing has been so profound that it is now predicted that antibody products will dominate the list of top-selling products by 2018 (Evaluate Pharma, June 2013). As depicted in the following table, it is forecast that five of the top ten selling products in 2014 will be mAbs (Thomson Reuters). This compares to only one biotech product making it into the top 100 in 2000, Amgen’s erythropoietin agent, Epogen. Illustrating the importance of these products as industry growth drivers, EvaluatePharma, Ltd. projects in its World Preview 2016 Report that biotech drugs will account for 50% of the top 100 drugs in 2014.

| 12 |

Top Ten Products by Projected 2014 Revenues

| Rank | Product | Indication | Company | Worldwide Sales ($ billion) | Technology | |||||||

| 1 | Avastin | Cancer | Roche | $ | 8.9 | mAb | ||||||

| 2 | Humira | Arthritis | Abbott | $ | 8.5 | mAb | ||||||

| 3 | Enbrel | Arthritis | Pfizer/Amgen | $ | 8.0 | Recombinant (biologic) | ||||||

| 4 | Crestor | Cholesterol | AstraZeneca | $ | 7.7 | Small molecule chemistry | ||||||

| 5 | Remicade | Arthritis | Merck/JNJ | $ | 7.6 | mAb | ||||||

| 6 | Rituxan | Cancer | Roche | $ | 7.4 | mAb | ||||||

| 7 | Lantus | Diabetes | Sanofi | $ | 7.1 | Recombinant (biologic) | ||||||

| 8 | Advair | Asthma/COPD | GlaxoSmithKline | $ | 6.8 | Small molecule chemistry | ||||||

| 9 | Herceptin | Cancer | Roche | $ | 6.4 | mAb | ||||||

| 10 | Novolog | Diabetes | Novo Nordisk | $ | 5.7 | Recombinant (biologic) | ||||||

Source: Thomson Reuters

The Immune System and Monoclonal Antibodies

The immune system is a system of biological structures and processes within an organism that protects against diseases. In humans and other vertebrate species, the immune system can be classified into two subsystems, the innate immune system and the adaptive immune system. The innate immune system, also known as the non-specific immune system, comprises the cells and mechanisms that defend the host from infection by other organisms in a non-specific manner. The cells of the innate system recognize and respond to pathogens in a generic way, but, unlike the adaptive immune system, they do not confer long-lasting or protective immunity to the host. The adaptive immune system, also known as the acquired immune system, is composed of highly specialized, systemic cells and processes that eliminate or prevent pathogen growth, and, in certain cases, can protect against the inappropriate growth of cancer cells. Acquired immunity creates immunological memory after an initial response to a specific pathogen or disease antigen, leading to an enhanced response to subsequent encounters with that same pathogen or disease antigen. The cells of the acquired immune system are B and T lymphocytes (B cells and T cells). B cells respond to pathogens or disease antigens by producing large quantities of antibodies, which then neutralize foreign objects like bacteria and viruses, and disease antigen-specific cells. In response to pathogens or disease antigens, some T cells, called T helper cells, produce signaling molecules (“cytokines”) that direct the immune response, while other T cells, called cytotoxic T cells, produce toxic granules that contain powerful enzymes that induce the death of target cells. Following activation, B cells and T cells leave a lasting legacy of the disease they have encountered, in the form of memory cells.

An antibody is a specialized protein secreted by B cells that recognizes and binds to a specific target molecule, called an antigen, in an interaction similar to a ‘lock and key’. Antigens are often proteins from bacteria, viruses, and diseased cells. Antibodies circulate in the body until they find and attach to the antigen. Once attached, they can recruit other parts of the immune system to destroy the cells containing the antigen. Researchers have learned how to design antibodies that specifically target a certain antigen, such as one that is found on cancer cells. They can then make many copies of that antibody in the lab. These are known as monoclonal antibodies (“mAbs”).

| 13 |

Among pharmaceutical products, mAbs are one of the fastest growing product categories. Global sales are forecast to exceed $141 billion in 2017 (Reportbuyer.com), up from $44.6 billion in 2011, driven by growth in the more than 30 FDA-approved mAbs now on the market, and anticipated launch of several of the 200-plus mAbs currently in clinical studies and 600 more in preclinical development. Four of the top six selling drugs in 2014 are projected to be mAbs, and today seven have sales exceeding one billion-dollars. Four of the 15 fastest growing drugs (with 2012 revenues exceeding $500) are biologics that modulate a patient’s immune system. A detailed overview of the antibody therapeutic market and its dynamics can be found in “Therapeutic antibodies: Market considerations, disease targets and bioprocessing”, J.G. Elvin et al., International Journal of Pharmaceutics 440 (2013) 83– 98.

There are a number of reasons why antibodies have become a key therapeutic class for a broad range of diseases. Antibodies as drugs (versus traditional, orally-available drugs derived from small molecule chemistry) have enabled pharmaceutical companies to develop drugs against intractable target classes (e.g., secreted hormones and cytokines (proteins involved in cell-to-cell signaling), and cell surface sensing molecules that activate internal cellular responses) that have traditionally not been “druggable” via small molecule chemistry. The therapeutic potential of mAbs is derived from their high specificities for their antigen targets, which facilitates precise action. In addition, they often display long half-lives, enabling infrequent dosing.

Novel technologies have continued to be introduced that further improve through engineering or novel selection methods the potential of the antibody therapies, leading to improved risk-benefit ratios (“The safety and side effects of monoclonal antibodies”, T.T. Hansel et al., Nature Reviews Drug Discovery Vol. 9 (April 2010) 325-338. This potentially can lead to fewer side effects experienced with mAbs than with conventional, small-molecule drugs, and overall, is reflected in approval rates of around 20% compared with 5% for small molecule-based drugs.

However, antibody therapeutics have been associated with a range of adverse events related to the class and also to specific target-induced mechanisms of action. Both are desirable to eliminate, and increasing attention has been paid to this area, leading to interest in novel platforms that can mitigate such risks. (see “Monoclonal antibody successes in the clinic”, J.M. Reichert et al., Nature Biotechnology 23 (2005) 1073-1078, and “Development trends for human monoclonal antibody therapeutics”, A.L. Nelson et al., Nature Reviews Drug Discovery Vol. 9 (April 2010) 767 – 774).

Approved antibody therapies have so far been focused on the treatment of cancer, inflammatory and autoimmune disorders, and infectious disease. The two largest categories by worldwide pharmaceutical revenues are represented by the blockbuster oncology mAb products Avastin, Rituxan, Herceptin and Erbitux (a blockbuster not in the ‘Top Ten’) and the anti-TNF biologic drugs for the treatment of rheumatoid arthritis (“RA”), including Humira (antibody), Enbrel (fusion protein) and Remicade (antibody).

Continuing Challenges

Despite the exponential growth in the market for mAbs, considerable unmet medical needs remain. One area where the heretofore limited application of antibody therapeutics represents a particular opportunity is the development of antibodies targeting immune checkpoints — immunotherapies for cancer and other indications, where modulation of targets such as CTLA-4 (a protein receptor found on the surface of T cells that downregulates the immune system) and PD-1 (programmed cell death protein 1, which is expressed on the surface of T cells and other lymphocytes) has shown impressive results in clinical care (Yervoy, which targets CTLA-4, and was approved for Stage IV melanoma) and in ongoing clinical studies (PD-1, see http://www.fiercebiotech.com/story/asco-big-four-immuno-oncology-players-wager-13b-next-gen-cancer-drugs/2014-05-29). The so-called immunomodulatory therapies that utilize the power of the patient’s own immune system by targeting these proteins to fight cancer are predicted by analysts to enter widespread clinical use and comprise up to 50% of all cancer treatment within the next decade. A key bottleneck in the field is limited understanding of human patient immunology at the level of human cells to guide validation and development of best-in-class therapies that effectively target the right patients. Our human cell-based evaluation methods (developed under a National Cancer Institute (“NCI”) contract; see below, “—Grants and Contracts: National Cancer Institute”) coupled with our unique antibody screening capabilities should, in our opinion, provide us with a distinct competitive advantage in this field.

| 14 |

Advances in the identification of antibody drug candidates have progressed through multiple waves of technology with respect to species origin of the underlying protein sequences, starting with murine (mouse), to chimeric mouse-human, to humanized, to fully-human. Multiple platforms now exist, including camel- and rabbit-derived. Screening or panning technologies have also evolved, including human-engineered antibody protein fragment library approaches (e.g., phage display), cellular immortalization methods (e.g., hybridoma), and more recently, single cell technology approaches. As novel antibodies have entered drug development, unforeseeable negative attributes have been discovered, with the largest remaining challenge being fine-tuning precise targeting of antibodies to maximize therapeutic effect over induction of undesirable side effects. The latter can also be stated as poor understanding of the inherent target and antibody-induced variability among a targeted group of patients. Even with incremental improvements in widely employed discovery platforms, antibody drug discovery and development may continue to require significant time and resources and will yield little assurance of predictable outcomes once products are tested in human clinical trials (for discussion generally on these topics, see “The safety and side effects of monoclonal antibodies”, T.T. Hansel et al., Nature Reviews Drug Discovery Vol. 9 (April 2010) 325-338).

Increasingly, regulators are looking for specific biomarker signatures that new drugs are both safe and effective, and in the areas of immunology and inflammation, are seeking efficacy and safety measurements at the level of the targeted immune cell subpopulations. In particular, we believe that the experience of Tegenero in 2006, and Raptiva and Tysabri in 2008 may lead regulators to require that drug developers prove that their products do not generate adverse, and potentially fatal, reactions in humans that were not observable in animal safety and toxicology studies (“Safety and immunotoxicity assessment of immunomodulatory monoclonal antibodies”, MAbs. 2010 May-Jun; 2(3):233–255). Such adverse events, including massive immune system-wide inflammation, known as “cytokine storms”, have occurred in human trials of novel antibody therapeutics (“Severity of the TGN1412 trial disaster cytokine storm correlated with IL-2 release”, Br J Clin Pharmacol. 2013 Aug;76(2):299-315). Indeed, recent reports on Yervoy have demonstrated numerous immune-related adverse events in patients that did not correlate with response rate, and that were not observed in studies using monkeys (“Opportunistic Autoimmune Disorders Potentiated by Immune-Checkpoint Inhibitors Anti-CTLA-4 and Anti-PD-1”, Front Immunol. 2014 May 16;5:206; and “In vitro Characterization of the Anti-PD-1 Antibody Nivolumab, BMS-936558, and in vivo Toxicology in Non-Human Primates”, Cancer Immunol Res. 2014 May 28. pii: canimm.0040.2014).

So even with incremental improvements in these widely employed discovery platforms, antibody drug discovery and development may continue to require significant time and resources and will yield little assurance of predictable outcomes once products are tested in human clinical trials.

Our Strategy

Our objective is to discover and develop mAbs and other novel biologics for use in the diagnosis and treatment of cancer, and infectious and inflammatory diseases through our platform’s capability to identify antibodies based on their ability to modulate the activity of human immune cells directly in human biopsy samples from patients. If we are successful deploying our platform to measure patient responses to our antibody candidates, we believe we may substantially reduce the time-consuming testing processes typically employed to test novel antibodies, with the potential for both significantly lowered discovery and development costs and accelerated regulatory approval. Key elements of our strategy include:

| - | Employ our proprietary microengraving technology to discover monoclonal antibodies and other novel biologics. |

| - | Engage in internal product discovery programs to develop novel immunotherapies. |

| - | Establish collaborative partnerships with leading pharmaceutical companies to accelerate product development, regulatory approvals and commercialization and to leverage our technological resources. |

| - | Participate in foundation and government funded grants and contracts programs to further benefit our internal and collaborative discovery programs. |

| 15 |

Our Technology Platform

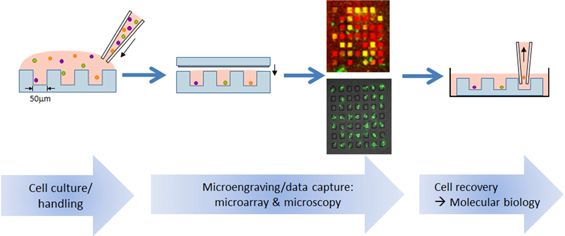

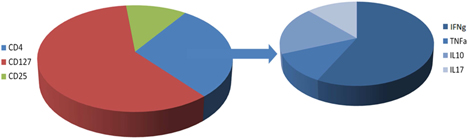

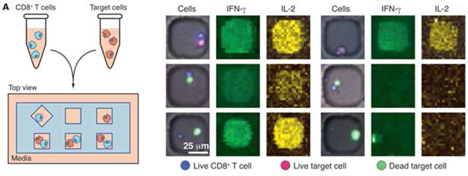

Currently, we have utilized our platform in two key areas: Therapeutic Discovery and Immune Profiling. In Therapeutic Discovery, our inputs are cellular libraries that are solely owned by Enumeral and that are derived from our own target-specific mouse immunization campaigns or cellular libraries from human patient donors sourced from commercial vendors or Enumeral’s own institutional review board-approved clinical operations activities. Antibody hits and leads are the output of our microengraving and data capture and our cell recovery and molecular biology activities. These hits and leads are further characterized for biological activity, confirmation of which may lead to drug candidates that can be brought to clinical trials. It is important to note that our platform enables rapid, low-cost generation of proprietary libraries, removing the need for in-licensing potentially expensive third-party libraries.

In Immune Profiling our inputs are tissue samples sourced from patients or commercial vendors, and the outputs are single cell functional profiles including assessment of the frequencies of functional immune cells. When such assays are carried out with cells in the presence of potential antibody candidates, as a way of measuring the potential modulation effects of the tested candidate, we believe such information will enable us to rationally select antibody therapeutic candidates with the best immune cell targeting properties – that is, those candidate that are observed, through application of our platform, to interact with and activate or modulate appropriate effector cells preferentially over potentially harmful inflammatory or other damaging cells.

Our microengraving technology integrates proprietary and standard laboratory processes with data acquisition and management software in order to link multiple parameters of cell function with high throughput and sensitivity. We have used the technology in partnerships with pharmaceutical company partners, and we believe we will generate additional partnerships based on internal validation data that we have generated.

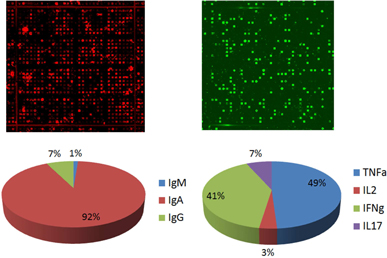

The platform employs a proprietary chip that is manufactured by Enumeral, containing on its surface a soft molded dense array of spatially addressable subnanoliter microwells (the “Device”) that is affixed to a glass slide, and standard laboratory equipment such as manual pipetting devices, slide washers, microscopes and microarray readers. The device is currently manufactured from polydimethylsiloxane (PDMS) (a soft silicone-type organic polymer), but we believe other materials would work as well. As depicted in Figure 1 below, the platform facilitates:

| (i) | Cell culture and cell handling, working with a wide variety of cell types (T-Cells, B-Cells, PBMCs (peripheral blood mononuclear cells), mucosal, cerebral spinal fluid, bone marrow tissue types) sourced from humans and mice; |

| (ii) | Data capture about cell surface markers and numerous types of cell secretion (antibodies, cytokines) through our proprietary microengraving process utilizing microarrays and microscopy; and |

| (iii) | Recovery of individual cells in order to obtain single cell gene sequence information through reverse transcription polymerase chain reaction (“RT-PCR”), a method for amplifying and copying rare DNA molecules. |

| 16 |

Figure 1: Platform Overview

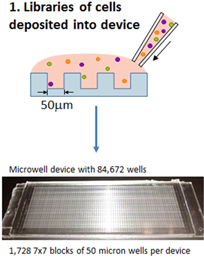

The first component of the platform process is a thin PDMS chip the size of a standard microscope slide that contains on its surface a molded dense array of spatially addressable subnanoliter microwells. It may be configured for arrays containing 85,000 or 250,000 microwells, depending on the experimental protocol. Utilizing custom-crafted molds, lab technicians are able to manufacture chips on-site in our laboratory.

The second component of the process is a glass microscope slide (the “Slide”) that has been functionalized (i.e. coated with capture reagents) to enable it to create a “printed” microarray representation of secreted proteins from individual cells within each microwell following the Slide’s brief attachment to the top of the Device, in effect, sealing each individual subnanoliter microwell for a fixed period of time.

Sample preparation and loading onto the Device and subsequent microarray “printing” on the surface of the Slide follows routine laboratory procedures which can be performed and scaled rapidly. For screening of antibody-producing cells (B cells), a blood sample is fractionated, diluted and then spread across the Device via a simple pipetting step.

Tissue samples, for example biopsy specimens from the intestinal wall of human patients, can be disaggregated and similarly spread across the Device. Cells are loaded directly onto the Device without prior enrichment or other laboratory-based manipulations that invariably lead to loss of efficiency, viability, or both (e.g. Epstein-Barr Virus-based transformation), preserving the entire original population of cells for analysis.

As illustrated in the diagram of the microengraving process in Figure 2 below, after introduction of human cells (from blood, serum or tissue) to the Device, they are allowed to settle naturally from suspension (optimized at the number of cells/well that best meets experimental objectives) into microwells and weakly adhere to the bottom of the individual wells (Step 1). Device design facilitates cell dispersion across its surface, resulting in rapid loading and analysis by the user.

The microwell configuration defines a collection of independent and viable sub-nanoliter cultures of individual human cells (or mouse cells, as the experimental protocol dictates). The small volumes used to confine each cell enables rapid detection of material secreted by the living cells. Because an individual cell within a well represents a significant portion of the volume of the well in which it settles, commonly employed artificial signal amplification procedures that can bias research output, e.g. cell proliferation, prove unnecessary.

Detectable secreted material include antibodies, cytokines and other pharmacologically relevant substances. The extremely small scale ensures that adequate quantities of secreted materials are available for analysis after very short incubation periods (10–60 minutes).

| 17 |

The Device is then placed in contact with a Slide and the cell secretions occurring in each microwell during the incubation period are captured via a ‘printing’ step where each location on the now printed Slide is spatially registered to a corresponding microwell in the Device (Step 2).

To accomplish this transfer/printing, the Device is temporarily attached and sealed to the Slide which has already been functionalized (with user-defined capture reagents) to bind the secreted material from each cell onto the surface of the Slide. Slides can be functionalized with multiple capture reagents, enabling multiplexed assays to be performed.

After Device and Slide are subsequently separated (Step 3), the Slide surface retains a microarray (essentially, a recording) of secreted material where each spot in the microarray corresponds to the secretions/metabolic activity of an individual cell, and the Device retains the individual viable cells within the microwells.

The Slide’s surface is then studied (“interrogated”) in a manner identical to other microarrays using fluorescent-labeled detection reagents and off-the-shelf slide scanners to reveal and characterize, for example, antibodies and their properties, such as potential affinity and specificity. These data are similar to those obtained by more laborious assays for function (such as ELISpot, Enzyme-Linked ImmunoSpot assay, a widely-used method for monitoring responses of immune cells that relies on populations rather than single cells), phenotype (such as FACS, Fluorescence-activated cell sorting, whereby cells are labeled with fluorescent dyes and suspended in a stream of fluid and passed by a laser-based detection apparatus), and genotype (RT-PCR). However, unlike those assays, we believe our platform permits more efficient assessment of all of these functions within the context of the single cell microwells and retrieval of single viable cells in a planar format, enabling higher sensitivity and detection of rare events.

While analysis of the Slide’s microarray proceeds, the cells are retained in their Device microwells and remain viable during the printing process and analysis of phenotype. Assay methods for determining cell function and phenotype (ELISpot, FACs, et. al.) that are common to other approaches usually result in the death of the cells under study. Thus, with our platform, individual cell secretions can be analyzed while retaining viable cells for further analysis.

The cells that correspond to the antibodies of interest can later be retrieved from individual wells by manual or automatic micromanipulation for further analysis, including cell-cell assays, gene-based analysis and gene recovery via RT-PCR. In addition, further sequential rounds of micro-engraving onto additional multiplexed capture Slides can be performed, greatly expanding the analytic capability of our platform.

| 18 |

Screening

|

|

| ||

| Simple pipetting step achieves desired cell density, e.g. single cell occupancy | Secreted proteins bind to capture antibodies on cover slide | Spatially-registered custom protein microarray allows identification of cells for recovery |

Analysis & Recovery

Figure 2: Schematic Diagram of our Microengraving process – Screening, Analysis and Recovery.

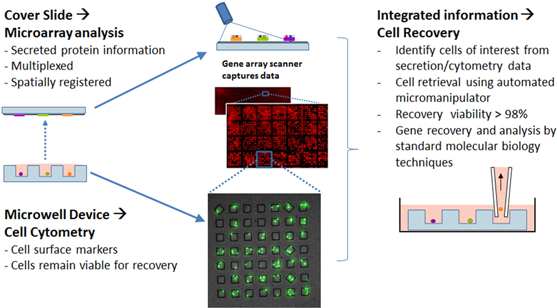

In Figure 3 below, the relationship between the Device (in which cells have been distributed and settled) and the cover Slide (which registers secretions from the deposited cells) is illustrated.

The cover Slide is diagrammed on the right as having been “functionalized”, meaning it is coated with a “capture reagent”. As a result of this functionalization process, proteins (including antibodies) that the in-well cells secrete will now bind on the surface of the Slide.

| 19 |

When the Slide is read by our automated slide reader, we observe the antibodies secreted by the cells as colored features produced by fluorescent dyes as displayed in an actual Slide image as shown on the lower left. The spatial registration of the Slide and the Device enable one-to-one identification of image and cell. Software is provided by third-party vendors and developed by Enumeral to implement automated data collection and registration.

Figure 3: Reading of antibody secretion events from single cells.

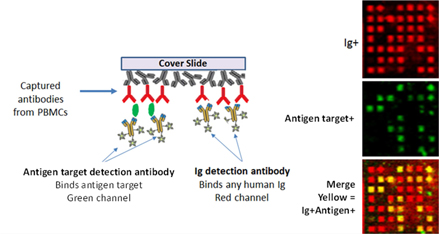

In Figure 4 below, the cover Slide on the left depicts several antibodies attaching themselves to the capture agent that coats the cover Slide, as shown previously. But now, the target (Antigen, or Ag) is diagramed as attaching or “binding” to certain of the antibodies that had been captured by the specific reagents which had functionalized the cover Slide.

To enable us to “see” where the target has bound to antibodies, a fluorescent reagent that produces a specific color is introduced and it signals those locations where the target is present in the middle right Slide image (shown as green in this case). The spatial registration of the Slide and the Device enable one-to-one identification of image and cell.