Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - BOB EVANS FARMS INC | d781426d8k.htm |

Investor Presentation

August 2014 (revised 8.27.14)

Steve Davis, Chairman and Chief Executive Officer

Mark Hood, Chief Financial Officer

Scott Taggart, VP, Investor Relations

1

Exhibit 99.1 |

Safe

Harbor Statement 2

Under the Private Securities Litigation Reform Act of 1995

Certain statements in this presentation that are not historical facts are

forward-looking statements. Forward-looking statements involve various

important

assumptions,

risks

and

uncertainties.

Actual

results

may

differ

materially

from

those

predicted

by

the

forward-looking

statements because of

various factors and possible events, including, without limitation:

Negative publicity or litigation regarding allegations of food-related

illness, Failure to achieve and maintain positive same-store sales,

Changing business conditions, including energy costs,

Overall macroeconomic conditions that may affect consumer spending, either

nationwide or in one or more of the Company’s major markets Competition

in the restaurant and food products industries, Ability to control restaurant

operating costs, which are impacted by market changes in the cost or availability of labor and food, minimum wage and

other employment laws, health care costs, fuel and utility costs,

Changes

in

the

cost

or

availability

of

acceptable

new

restaurant

sites,

Adverse weather conditions in locations where we operate our restaurants,

Consumer acceptance of changes in menu offerings, price, atmosphere and/or service

procedures, Consumer

acceptance

of

our

restaurant

concepts

in

new

geographic

areas,

and

Changes in hog and other commodity costs.

We also bear the risk of incorrectly analyzing these risks or developing strategies

to address them that prove to be unsuccessful. Certain

risks,

uncertainties

and

assumptions

are

discussed

under

the

heading

“Risk

Factors”

in

Item

1A

of

our

Annual

Report

on

Form

10-K

for the fiscal

year ended April 25, 2014. We note these factors for investors as

contemplated by the Private Securities Litigation Reform Act of 1995. It is impossible to

predict or identify all such risk factors. Consequently, you should not

consider any such list to be a complete set of all potential risks and uncertainties.

Forward-looking statements speak only as of the date on which they are made,

and we undertake no obligation to update any forward-looking statement

to reflect circumstances or events that occur after the date on which the statement

is made to reflect unanticipated events. Any further disclosures in our

filings with the Securities and Exchange Commission should also be consulted.

All subsequent written and oral forward-looking statements attributable to

us or any person acting on behalf of the company are qualified by the cautionary

statements in this section. |

COMPANY FACT

SHEET FISCAL 2015 Q1

NASDAQ: BOBE

NEW RESTAURANTS

FY’14 4

FY’15E up to 8

562 Restaurants

19 States

as of 7/25/14

192

60

16

21

3

51

31

39

8

2

7

28

23

3

17

7

4

48

AVERAGE UNIT VOLUME

$1.71 million (FY’

14)

2

Bob

Evans

Farms,

Inc.

is

comprised

of

two

key

business

segments:

Bob

Evans

Restaurants

and

BEF

Foods.

Bob Evans

Restaurants operates 562 full-service restaurants located in 19 states with a heavy

concentration in the Midwest. BEF Foods produces and distributes refrigerated

side dishes, pork sausage and a variety of refrigerated and frozen convenience food

items through retail and food service channels. .

FOUR KEY LINES OF BUSINESS

Sausage, Refrigerated Sides, Frozen and Food Service

Sold at 30,000+ retail locations in 50 states and Mexico 3

Bob Evans Growth Opportunity Markets

Bob Evans Core Markets

Bob Evans Farms Investor Relations

www.bobevans.com

8111 Smith’s Mill Road

New Albany, Ohio 43054

GROWING OUR REGIONAL BRANDS INTO POWERFUL

NATIONAL BRANDS |

4

Powerful

NATIONAL

BRANDS

Make

Our

REGIONAL

BRANDS

BOB EVANS RESTAURANTS

BEF FOODS, INC. |

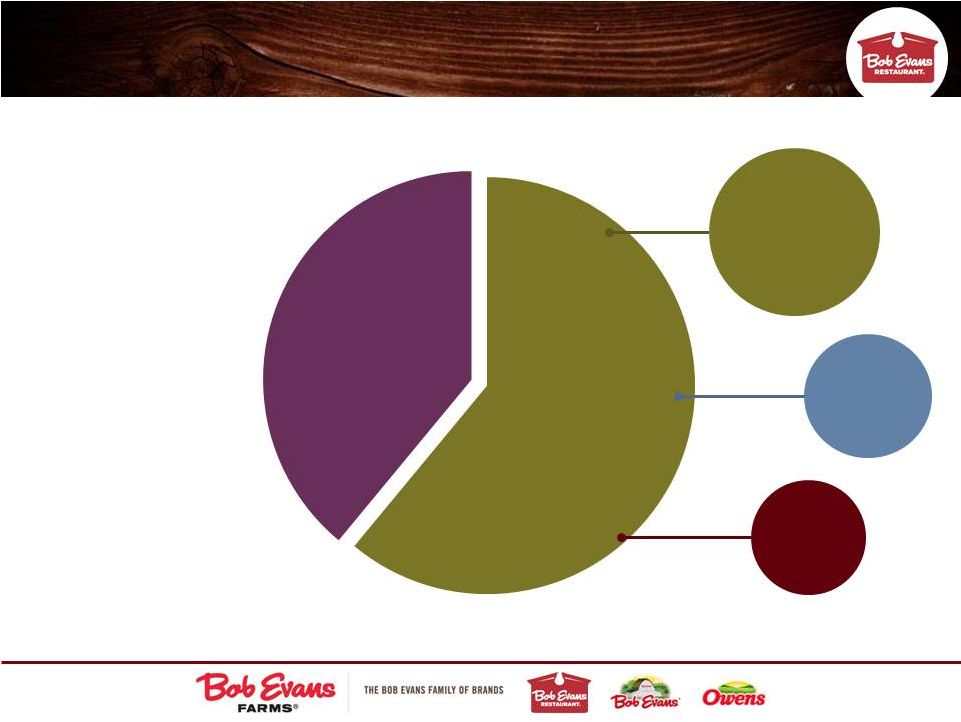

Business

Segments

(FY

2014)

5

28%

72% |

Bob

Evans is Well-Positioned to Capture Both Grocery and Restaurant

Consumption Percent Dollars Spent Over Time

6

35%

40%

45%

50%

55%

60%

65%

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12

13

Restaurant

Grocery

$13

Billion+

(The value of a

single share

point)

Source: IFMA Forecast & Outlook

‘82-’11 Technomic

’12-‘13 |

Our

Shareholder Value Creation Guiding Principles

7

PROFITABLY

PROFITABLY

GROW &

GROW &

CONTINUE

CONTINUE

TO TRANSFORM

TO TRANSFORM

OUR CORE

OUR CORE

BUSINESS

BUSINESS

DRIVE

DRIVE

SHAREHOLDER

SHAREHOLDER

VALUE WITH

VALUE WITH

DISCIPLINED

DISCIPLINED

CAPITAL

CAPITAL

ALLOCATION

ALLOCATION

SELECTIVELY

SELECTIVELY

INVEST IN

INVEST IN

HIGH R.O.I.C.

HIGH R.O.I.C.

GROWTH

GROWTH

OPPORTUNITIES

OPPORTUNITIES

(Internal & External)

(Internal & External) |

8

Our Plan: Transformed and Poised for Growth

Farm Fresh Refresh Completed

Up to 8 New Restaurants in FY15

10-12 Annually Thereafter

10-20 BEX to be

Licensed/Franchised Annually

Side Dish Vertical Integration

Sausage Network Optimization

Transportation Consolidation

Capital and Resource Allocation

Enterprise Resource Planning

Margin Innovation

Bob Evans Restaurants

Bob Evans Foods

Corporate |

9

Significant Asset Closures/Dispositions:

Over $125 Million of Asset Dispositions Since FY06

Asset

Consolidation

Sausage operations

(five facilities into two)

Ready-to-eat

operations

(four facilities into one)

Business

Closure

76 restaurants closed

Business

Reengineering

Direct-store-delivery to

warehouse conversion

Springfield, OH

transportation center

(four facilities into one)

Business

Sold/Divested

Mimi’s Cafe

Springfield, Ohio

distribution center

The Board does not hesitate to re-evaluate strategic decisions;

every business asset is subject to a review every quarter

Mimi’s Café

(California)

Headquarters closures

Owens HQ (Texas) |

Key

Components of 10-12% Long-Term Diluted EPS Growth Guidance

10

3.0% to 3.5%

sales forecasting/labor management

food cost optimization

menu management

back-of-the-house optimization

side dish vertical integration

implement lean manufacturing

w/side dish production

transformational systems upgrades

Refinancing/interest reduction

ERP implementation

6.0% to 7.0%

Avg. Annual Net Sales

Growth:

Margin Innovation:

(300-350 basis point

improvement)

same-store sales and new

restaurants expected to

contribute equally to net sales

growth (~1.50% to 1.75% each)

expand points of distribution and

average SKU count per point of

distribution

refrigerated side dish and food

service products to drive growth

up to10 new restaurants

annually |

11

BOBE’S Strategic and Balanced Approach to Capital Allocation Drives

Significant Shareholder Value

INTERNAL FACTORS

Potential future investment opportunities

Lifecycle stage of firm

Projected operating performance

Regularity and certainty of income

Structure of assets

Financial covenants

Desire to return capital

Period and purpose of financing

EXTERNAL FACTORS

Macroeconomic environment

Economic fluctuations

Seasonal variations

Nature of industry competition

Capital market conditions

Bank market conditions

Nature/orientation of investors

Statutory requirements

Taxation policy

Maximize

flexibility

Minimize

financial risk

Minimize

cost of capital

Maximize return

to shareholders

Minimize

complexity

Between Fiscal Year 2007 and 2014, BOBE returned over $800 million

to shareholders through dividends and share repurchases

DRIVE

OPTIMAL CAPITAL

STRUCTURE |

12

A Track Record of Balanced Capital Allocation

Fiscal 2007-2012

Bob Evans has returned meaningful capital to stockholders in a prudent, consistent

fashion Debt Repayment

Capex

Share Repurchases

Dividends

Acquisition

Fiscal 2013

Over $800 million returned

to stockholders through

share repurchases and

dividends since FY07

Fiscal 2014

FY15 Capex expected to

be $85 to $90 million, in-

line with historical average

$339M

$485M

$167M

$130M

$52M

$30M

$118M

$63M

$191M

$225M |

13

Track Record of Meaningful Dividends and

Share Repurchase

Trailing 12-month yield

(8/8/14):

BOBE: 2.6%

S&P 500: 1.9%

Annual Dividend Per Share has Doubled Since FY08

Weighted Average Diluted Shares Decreased by 27% since FY07 (000’s)

36,484

33,315

30,744

30,890

30,422

29,925

28,488

26,704

FY 2007

FY 2008

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

FY 2014

FY 2007

FY 2008

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

FY 2014

$0.54

$0.56

$0.60

$0.68

$0.78

$0.95

$1.075

$1.205 |

14

Weighted Average Diluted Shares Outstanding (000’s)

Ongoing Share Repurchase Programs have Reduced

Diluted Shares Outstanding by 27%

Since Fiscal 2007

36,484

33,315

30,744

30,890

30,422

29,925

28,488

26,704

23,000

25,000

27,000

29,000

31,000

33,000

35,000

37,000

FY 2007

FY 2008

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

FY 2014 |

Annual Dividend has Doubled Over the Last Five Years

15

Trailing 12-month

yield

(7/3/14):

BOBE –

2.4%

S&P 500 –

1.9%

$0.54

$0.56

$0.60

$0.68

$0.78

$0.95

$1.075

$1.205

FY 2007

FY 2008

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

FY 2014 |

16

($ millions)

Capital Expenditures

2

Transforming our Company and

Rewarding

Shareholders

1

For additional details concerning FY 2015 guidance, see the Company’s 1Q Fiscal

2015 earnings release dated August 26, 2014. 2

Note: excludes Mimi’s Café.

Share Repurchases

1

Since FY’07, annual capital

expenditures have averaged

approximately

$80

million.

$69

$155

$5

$21

$19

$70

$63

$225

up to

$100

$45

$64

$65

$41

$39

$81

$118

$191

$85-$90

$0

$50

$100

$150

$200

$250

2007

2008

2009

2010

2011

2012

2013

2014

2015E

2 |

17

($ millions)

Investing Efficiently with Prudent Debt Management

1

Note: excludes Mimi’s Café.

Net Debt

Capital Expenditures

1

$177

$276

$238

$173

$92

$100

$193

$452

$45

$64

$65

$41

$39

$81

$118

$191

$0

$100

$200

$300

$400

$500

2007

2008

2009

2010

2011

2012

2013

2014 |

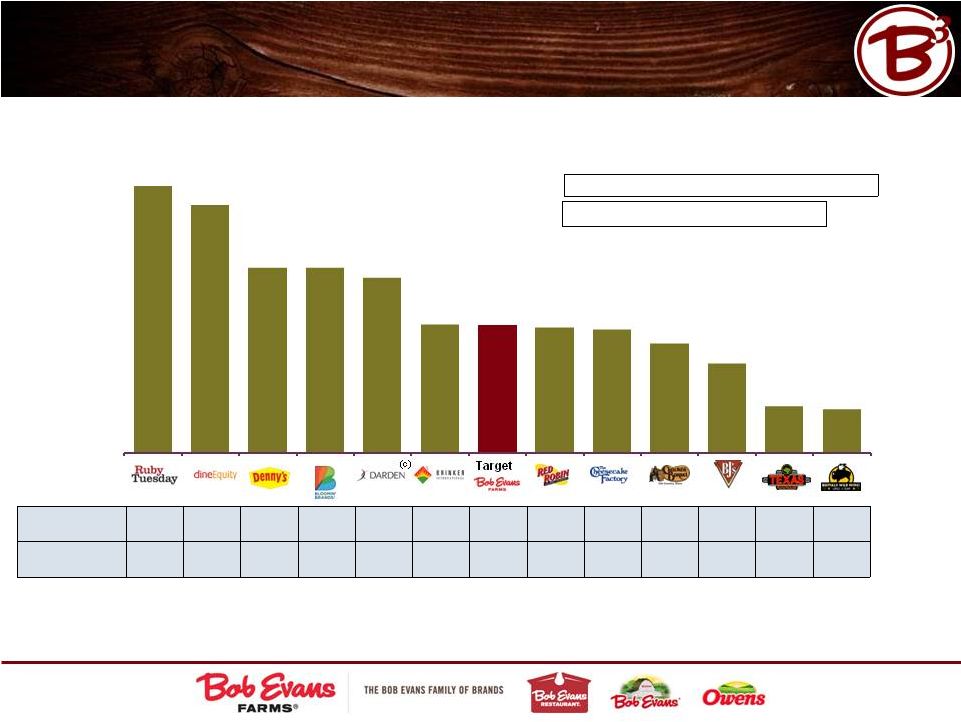

Target Leverage Ratio In-line with Other

Restaurant Companies

18

Adjusted net debt peer average (ex-BOBE):

3.4x

Adjusted Leverage Benchmarking Analysis

Note:

Rent expense is capitalized at 8.0x; LTM EBITDAR represents LTM EBITDA plus

annualized rent expense for the most recent filing; balance sheet data

based on latest publicly available information as of 7/25/14.

(a)

(b)

(c)

Franchise Mix

(a)

11%

98%

91%

11%

2%

45%

0%

26%

0%

0%

0%

17%

56%

Real Estate

Ownership

(b)

82%

36%

21%

20%

84%

83%

86%

8%

0%

66%

3%

36%

26%

BOBE’s 7/25/14 leverage ratio:

3.69x 6.2x

5.8x

4.3x

4.3x

4.1x

3.0x

3.0x

2.9x

2.9x

2.6x

2.1x

1.1x

1.0x

Owned property applies to both land or building and accounts for only company-operated

restaurants based on most recently available filings.

Data excludes Red Lobster.

Defined as number of franchised locations as a percentage of total systemwide units based on most

recent quarterly filings as of 7/25/14. |

19

Focused on Low-Cost, Flexible Financing

Revolving

Credit Facility

Incremental

Term Debt

Secured

Financing

Unsecured

Bonds

Sale

Leaseback

Minimally

Minimally

restrictive

restrictive

Highly

Highly

restrictive

restrictive

Low

Low

cost

cost

High

High

cost

cost |

1

See reconciliation of Adjusted Operating Income (non-GAAP) to Reported

Operating Income (GAAP) in the Appendix of this presentation. Mimi’s

Café Divestiture Improves Adjusted

Operating Margin

1

Profile

20

FY 2015E

FY 2013

7.8%

8.8%

8.1%

4.4%

3.5%

4.2%

FY 2014

Significant FY ‘14 Costs:

($ millions)

4.8-5.2%

6.2-8.2%

5.3-6.1%

BER

BEF

Consol

BER

BEF

Consol

BER

BEF

Consol

BER: Severe winter weather -

$13

BER: FFR remodel costs -

$7

BER: Workforce management -

$2.5

BEF: Supplier dispute -

$4

BEF: Plant startup inefficiencies -

$6

Corp: Activist stockholder costs -

$3

Corp: Strengthening internal controls -

$3 |

1

For additional details concerning FY 2015 guidance, see the Company’s 1Q

Fiscal 2015 earnings release dated August 26, 2014.

21

Key Drivers of FY’14 to FY’15 Margin Expansion

FY 2014

4.8-5.2%

6.2-8.2%

5.3-6.1%

Key FY ’15 Drivers

1

Bob Evans Restaurants

•

SSS: 1.5% to 2.5%

•

up to 8 new restaurants

BEF Foods

•

•

Corporate

•

Activist stockholder costs

~$6.5M

•

Strengthening internal

controls ~$2.0M

BER

BEF

Consol

10 to 12% net sales growth

on 2014 base of $372M

(excludes ~$22M interco

sales)

Efficiencies from plant

network

consolidation/optimization

and supply integration

BER

BEF

Consol

4.4%

3.5%

4.2%

FY 2015E

1 |

$10M

of Mimi’s Café Carryover Costs Eliminated,

Further Savings Opportunities Remain

22 |

*

40% sales flow-through assumed Farm Fresh Refresh Financial Impact

Improves Free Cash Flow in FY2015

-$3.1

23

($ millions)

4/25/14 -

4/24/15

-$7.2

-$6.8

$2.5

$2.4

$2.0

$4.3

$4.8

$0.0

FY2012

FY2013

FY2014E

FY2015E

Est. Closed Day Sales Impact*

Expenses

-

-

-

-

-

$1.1

-

# of remodels

195

0

87

229

Impact

to P&L |

1

See reconciliation of Adjusted Operating Income (non-GAAP) to Reported

Operating Income (GAAP) in the Appendix of this presentation. Strategic Plant

Network Optimization Leading to a New Adjusted Operating Margin

1

Trajectory at BEF Foods

24

8.8%

3.5%

11.8-12.3%

6.2-8.2%

FY13

FY14

FY15E

FY18E

2Q’14:

2Q’14:

Richardson, Texas, fresh sausage plant closure

3Q’14:

3Q’14:

Completion

of

Bidwell

and

Springfield,

Ohio

plant

consolidations

to state-of-the-art Sulphur Springs, Texas plant

FY’14:

FY’14:

Vertical

integration

and

expansion

of

Kettle

Creations’

Lima,

Ohio,

plant |

1

See reconciliation of Adjusted Operating Income (non-GAAP) to Reported

Operating Income (GAAP) in the Appendix of this presentation. 25

Transformations Drive Estimated Five-Year 300-350

Adjusted Operating Margin Basis Point Improvement

4.8-5.2%

6.2-8.2%

5.3-6.1%

BER

BEF

Consol

FY 2013

7.8%

8.8%

8.1%

FY 2015E

FY 2018E

BER

BEF

Consol

11.2-11.8%

11.8-12.3%

10.8-11.3%

1

BER

BEF

Consol |

26

“Get in on something good”

562 restaurants in 19 states

as of 7/25/14

Full-service family restaurants featuring a

wide variety of menu items for both on-and-off premise dining

TM |

Net

Sales (FY 2014) $957 million Average Annual Unit Sales (FY

2014) $1.71 million Overview: Bob Evans Restaurants

ALL THREE DAYPARTS SERVED (1Q FY 2015)

Breakfast

Lunch

Dinner

27

34%

36%

30%

Avg. Dine-In Guest Check/Per Guest (1Q FY 2015) $18.25/$9.21

Average Carryout Check (1Q FY 2015) $14.93 |

Accelerated Farm Fresh Refresh Program:

-

Completed April 2014 -

28

Dining Room &

Lobby

Restrooms

Bakery,

Catering &

Carryout

Exterior,

Signage,

& Landscaping

CapEx Summary

(24% growth

capital, 76% maintenance capital)

44%

10%

24%

22%

FY11

FY12

FY13

FY14

5%

20%

100%

56%

(32 units)

(87 units)

(195 units)

(229 units)

Approximate % of Chain Remodeled by Fiscal Year

Average capital investment per remodeled restaurant: ~$225k

|

BER:

Remodeled and Ready to Grow 29

Recently completed Farm Fresh

Refresh

o

First comprehensive remodeling

program in brand history

o

76% maintenance capex and 24%

growth capex

o

Refreshed restaurants have

consistently outperformed non-

refreshed restaurants

We are confident BER has exciting

growth potential:

o

New sales layer growth (e.g.,

carryout, Broasted platform and

five-dollar soups to go)

o

Leveraging our regional strength

to catalyze new unit growth

o

Developing

the

compelling

new

Bob

Evans

Express

("BEX")

license/franchise format

Farm Fresh Refresh Transformation

Exciting New Restaurant Design

Compelling New BEX Growth Format |

30

Refreshed stores consistently outperformed the non-refreshed stores over

the last three years

The Company Recently Completed a Multi-Year

Renovation Program

Dining Room &

Lobby

Restrooms

Bakery,

Catering &

Carryout

Exterior,

Signage,

& Landscaping

CapEx Summary

(76% maintenance capital, 24% growth capital)

Average Capital Investment per

Remodeled Restaurant: ~$225K

According to WD Partners and Nation’s Restaurant News, Bob Evans has

made significant progress in areas of food quality, value, service, menu

variety

and

atmosphere,

and

took

top

position

in

the

“cleanliness”

category

44%

10%

24%

22%

(1) Nation’s Restaurant News, Consumer Picks, March 24, 2014.

Farm

Fresh

Stores

–

Incremental

SSS

(Year-One Stores vs. Non-Refreshed Stores)

4.3%

4.8%

2.6%

3.6%

4.5%

4.0%

2.2%

2.8%

2.7%

3.4%

3.6%

FY12

Q1

FY12

Q2

FY12

Q3

FY12

Q4

FY13

Q1

FY13

Q2

FY13

Q3

FY13

Q4

FY14

Q1

FY14

Q2

FY14

Q3

1 |

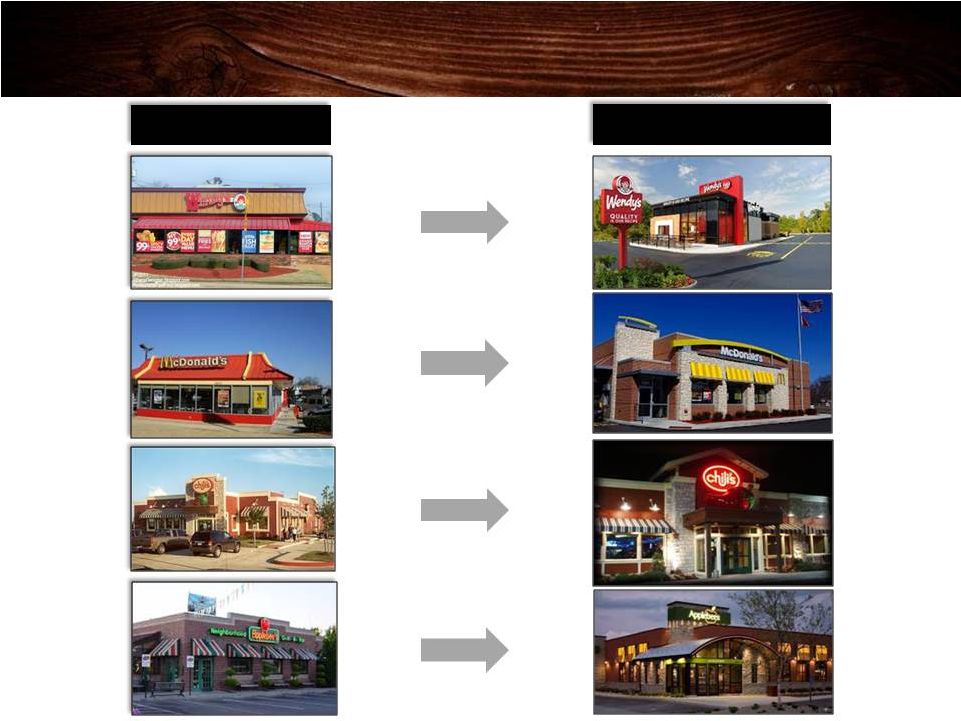

Aspirational Concepts Reimage their Brands to

Remain Relevant

31

Before

After |

Dinner is Our Challenge….and Opportunity

32

First-Quarter Fiscal 2015 SSS% Daypart Performance

Daypart

On-Premise

Off-Premise

Total

-1.2%

-1.6%

-4.0%

-2.1%

Breakfast

0.1%

7.4%

0.7%

Lunch

-2.3%

0.3%

-2.0%

Dinner

-5.6%

0.5%

-4.7%

Total

-2.5%

1.9%

-2.0% |

BE

Outperformed Knapp Family Trends in key geographies for first quarter of

FY15 Same Store

Sales Trend

(%)

Same Store

Sales Trend

(%)

States

# BE

Restaurants

Family

Excluding BE

BE

Total U.S

-1.6

-2.0

West North Central

KS, MO

24

-1.3

-4.0

East North Central

IL, IN, OH, MI

318

-2.8

-2.2

East &West South Central

AR, KY, TN

28

-2.0

-5.0

FLA

N/A

48

-1.9

+4.5

South Atlantic

DE, MD, NC, SC,

VA , WV

94

-3.6

-2.4

Mid Atlantic

NJ, NY, PA

49

-4.4

-3.2

Source: Knapp Track May/June/July results, Family Category. Category trend

aggregated results of participants |

New

Broasted Chicken Platform 34

Quickly rose to top-selling item in the Cincinnati test market,

replacing the long-time best seller Rise & Shine Breakfast

3-Course meal

starting at $9.99

2-Piece meal at

$7.99

Family Meals to Go

at $19.99 |

Positioning Broasted Chicken Will Immediately

Impact 68% of the Business, and Ultimately 100%

35

Lunch

36%

Dinner

30%

2-Piece meal

at $7.99

Family Meals to Go

at $19.99

3-Course meal

starting at $9.99

Breakfast

34%

Dine-In

66%

(lunch & dinner)

Off-Premise

~12% |

Dine-In Value Sales Layers

36

BREAKFAST

Rise & Shine Breakfast

~ $65 million / 7%

of annual revenue.

LUNCH

$7.99 Knife & Fork and

Lunch Combos

~ $40 million / 4%

of annual revenue.

3-Course Dinners

~ $72 million / 8%

of annual revenue.

DINNER |

Bob

Evans’ Off-Premise Opportunity

37

Annual Consumption of Restaurant Meals (per capita)

Dine-In

39%

Off-Premise

61%

QSR

74%

FULL

SERVICE

16%

Source: NPD Group -

12 months ending 4/30/14

FAMILY

SEGMENT

10% |

+8.6%

+8.6%

Bold Goal: Drive Off-Premise to 25% of Sales Mix

Off-Premise Sales Mix and Growth % by Year

Sales Mix

Growth %

38

+5.3%

+5.3%

+8.5%

+8.5%

+3.9%

+3.9%

+0.6%

+0.6%

+15.4%

+15.4%

+12.9%

+12.9%

+7.9%

+7.9%

+2.4%

+2.4%

2014

8.0%

7.5%

6.5%

7.0%

8.5%

9.0%

9.5%

12.0%

11.5%

11.0%

10.5%

10.0%

2006

2007

2008

2009

2010

2011

2012

2013

12.5%

Family Meals to Go

Bakery

Catering/Carryout |

Off-Premise Sales Layers

39

CATERING

FY 2014 Growth / Mix

13.1% / 0.6%

BAKERY

FY 2014 Growth / Mix

18.5% / 1.7%

CARRYOUT

FY 2014 Growth / Mix

1.8% / 11.7% |

Leveraging a Remodeled Base: Product and Operational Innovation to

Drive Positive Same-Store Sales in FY'15 and Beyond

40

Menu Innovation

Operational Innovation

Labor

Management

Carryout Service

Enhancements

New Kitchen

Technology &

Equipment

Objectives:

Drive traffic

Increase avg. check

Leverage off-premise

Enhance margins

Carryout

Catering

Bakery

New Sales Layers

All Initiatives

Rigorously Tested

KDS (kitchen

displays)

Clamshell grill

Broaster

Batch holding |

New

Restaurant Opening Strategy 41

NEW CONTIGUOUS MARKETS

FILL-IN EXISTING MARKETS

4 new restaurants opened FY 2014.

4 new restaurants opened FY 2014.

Open up to 8 new restaurants during FY 2015.

Open up to 8 new restaurants during FY 2015.

Altoona, PA

Harrison, OH |

Reduced

building cost by approximately 13%

through efficient design in

Finneytown, OH and

Altoona, PA

Objectives:

•

•

•

42

Accentuate Farm heritage

Leverage Farm Fresh

Refresh program insights

Test new “back-of-the-

house”

technologies and

layouts

New Restaurant Prototype:

Brand relevant/lower investment |

Bob

Evans Express Licensing Opportunity •

Popular favorites covering all

dayparts

•

High quality menu to ensure

serving guests in a quick manner

•

License up to 10 new locations by

the end of FY 2015

•

Potential to independently

develop locations

Bob Evans Express produces four

revenue streams:

1.

A one-time licensing fee of up to $15k;

2.

A royalty fee of up to 6% of gross

sales;

3.

An ad fund of up to 4% of gross sales;

and

4.

Products “insourced”

from Bob Evans

Farms Foods business.

43

•

•

First location, BMW USA manufacturing plant

First location, BMW USA manufacturing plant

in Spartanburg, SC, opened August 2013

in Spartanburg, SC, opened August 2013

•

•

Second location, Bob Evans Farms, Inc.

Second location, Bob Evans Farms, Inc.

corporate headquarters, opened October 2013

corporate headquarters, opened October 2013

•

•

Finalizing details for airport and mall locations

Finalizing details for airport and mall locations

to open late summer/ early fall

to open late summer/ early fall |

44

Revolutionary People Development/Culture

Drive profitable guest counts –

on and

off-premise by being relevant and reliable

Improve controllable expenses: Cost of Sales,

Cost of Labor, Direct Operating Expenses

Deliver the brand promise through a “Best for

my Guest”

experience both on and off-premise

Successfully open up to 8 new Bob Evans

Restaurants and license up to 10 BE Express

locations

FY’15 Vital Few Priorities |

“Discover farm-fresh goodness ”

TWO BRANDS

distinct geographic strengths

45

TM |

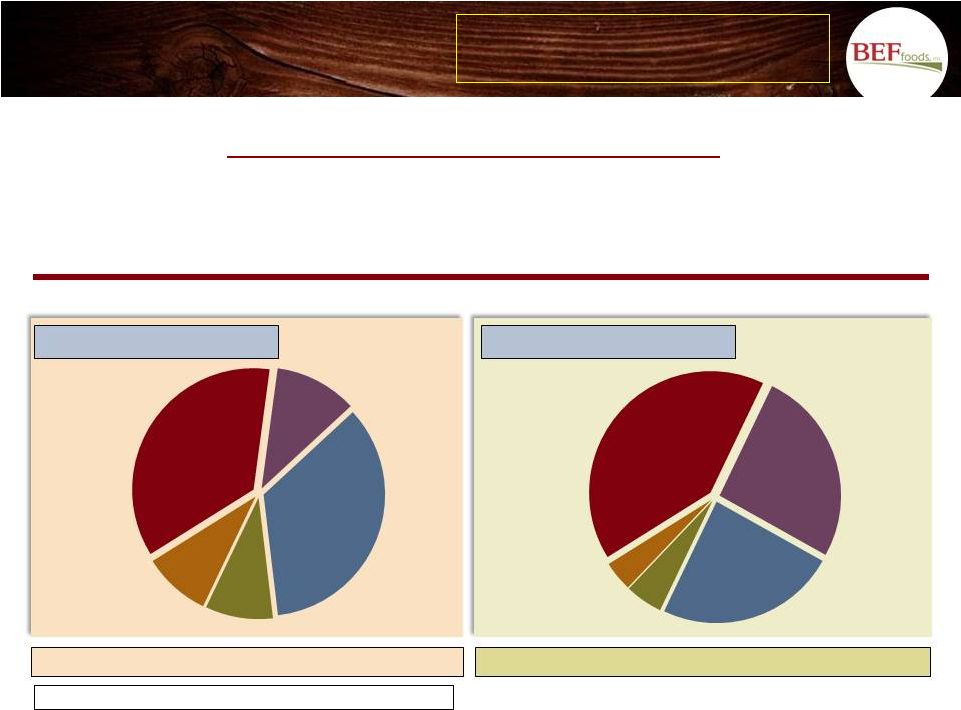

Overview: BEF Foods

46

FOUR KEY LINES OF BUSINESS

Sausage, Refrigerated Side Dishes, Frozen and Food Service

Sold at 30,000+ retail locations in 50 states and Mexico

sausage mix (% of total sales): 42%

sausage mix (% of total sales): 33%

Net Sales (FY’14) $387 million

28% of total

*Note: Insourced sales data reflects sales to Bob Evans Restaurants.

FY 2010 Sales Mix (pounds)

Food Service

Side

Dishes

36%

11%

35%

9%

9%

Other

Frozen

Retail

Sausage

FY 2014 Sales Mix (pounds)

Side

Dishes

Food

Service

(4% insourced*)

Other

4%

Frozen

5%

Retail Sausage

41%

26%

24%

(2% insourced*) |

Source:

IRI BEF Foods: Store/SKU Count

11.6

11.7

10.2

17

2010

Q1 2014

Q1 2015

2018

average SKUs per store

28,407

31,382

31,181

40,000

2010

Q1 2014

Q1 2015

2018

#

of

stores

47 |

CORE MARKETS

NON CORE MARKETS

SKUs/Store ACV

BEF Foods: SKU Count and ACV Distribution

Core vs. Non-Core

SOURCE: IRI, Q1, FY15 ending 7/13/14

Core Market: Chicago, Cincinnati, Cleveland, Columbus, Toledo, Detroit, Grand Rapids,

Indianapolis, Peoria/Springfield, Pittsburgh, Philadelphia, Baltimore/Washington,

Buffalo/Rochester

Opportunity

in Non-Core

Markets

SKUs/Store ACV

SKUs/Store ACV

SKUs/Store ACV

Q1 FY 14

Q1 FY 15

FY ‘14

FY15

81.4

67.7

67.9

7.1

8.9

21.3

81.4

21.9

48 |

BEF

Foods Inc. Network Optimization 49

Hillsdale, MI

Hillsdale, MI

2014 and beyond

4 Facilities,

Limited co-packing relationships

Xenia, OH

Xenia, OH

Sulphur Springs, TX

Sulphur Springs, TX

Lima, OH

Lima, OH

Asset Actions:

FY2011:

Bidwell and Galva fresh sausage

operations closed

FY2012:

Bidwell and Hillsdale transportation

centers closed; Springfield

distribution center sold

FY2013:

Consolidated transportation

operations; Kettle Creations (Lima)

acquired;

FY2014:

Bidwell, Springfield, Richardson

plant, office, and transportation

center closed; SWH sold; Sulphur

Springs and Lima expanded

Fresh sausage

Fresh sausage

Ready-to-eat

Side dishes

2007

Galva, IL

Galva, IL

Bidwell, OH

Bidwell, OH

Richardson, TX

Richardson, TX

Xenia, OH

Xenia, OH

Sulphur Springs, TX

Sulphur Springs, TX

SWH Fullerton, CA

SWH Fullerton, CA

Hillsdale, MI

Hillsdale, MI

Lima, OH

Lima, OH

9 Facilities, 2 co-packers

50% Vertical Integration

Springfield, OH

Springfield, OH

Ready-to-eat

Fresh sausage

Sausage/Ready-

to-eat/ Dist. Ctr.

Fresh sausage

Copacker

Copacker

Fresh sausage/

Ready-to-eat

Fresh sausage

Mimi’s Café

prep kitchen

Fresh sausage/

Ready-to-eat |

1

See reconciliation of Adjusted Operating Income (non-GAAP) to Reported

Operating Income (GAAP) in the Appendix of this presentation. BEF

Foods’ Transformation Expected to Offset

~$44MM Sow Cost Impact in Fiscal 2015

50

Adjusted Operating Income ($ millions)

FY 12

No Mitigation

Launched lean mfg. program

Transitioned from DSD

to warehouse

Expanded side dish products

(Kettle Creations acquisition)

Optimized sausage plant

network

Enhanced pricing and trade

spending capabilities

Avg

Sow

Cost

$44.93

$61.58

$53.87

$73.23

Est. Sow

cost

impact vs

2009

($ millions)

$17

$9

$28

NOTE: daily sow cost information available at:

http://www.ams.usda.gov/mnreports/lm_hg230.txt $87

$44

~$25-$35

$16.0

$1.8

$18.8

$30.7

$12.9

FY 09

FY 12

FY 13

FY 14

FY 15E

1 |

1

For

additional

detail

concerning

risks

associated

with

sow

costs,

please

refer

to

Item

1A,

“Risk

Factors”

in

the

Company’s

FY

2014

10K

filing.

Sow Costs: Enterprise Risk

(1)

1)

BEF Foods’

Retail cost of goods sold

~73%

2)

BEF Foods’

Food Service cost of goods sold

~17%

3)

Bob Evans Restaurants’

cost of goods sold

~10%

4)

BEF Foods’

Retail

Sales Volume impact

A $1 change in average annual sow costs impacts cost of goods

sold by approximately $1.1 million.

51

Most mitigation activities trail sow cost increases by 30 to

120 days and do not typically achieve 100% price realization.

1)

BEF Retail: Pricing, Trade Spending, Lean Manufacturing,

Mix 2)

BEF Food Service: Indexed Pricing

3)

Restaurants: Pricing, Portion Size, Menu

Optimization 4)

BEF Foods’

Retail Sales Volume: Mix

Market Structure

and Competitor

Actions

BOBE Mitigation

Activities |

The

Cumulative Sow Cost Impact was $66 Million Versus Fiscal 2009 Average Sow

Cost of $44.93/cwt 52

~$66 million

cumulative annual

cost impact relative to

2009

sow price levels.

$ avg

cost/cwt

($ 000’s)

$73.23

$53.87

$42.18

$61.58

$57.17

NOTE: daily sow cost information available at:

http://www.ams.usda.gov/mnreports/lm_hg230.txt |

The

Increase in Sow Costs, Largely Driven by Unforeseen PED Virus Outbreaks, Was

the Main Driver of Reduced Guidance 53

Note: USDA data reflects top of trading range

$65-$70/cwt

(issued 8/19/13)

$60-$65/cwt

(issued 6/4/13)

$72-$77/cwt

(issued 1/21/14)

BOBE

Guidance

There is no effective sow cost hedging mechanism in the U.S.

$88-$90/cwt

(issued 7/8/14)

Bob Evans

Cost

USDA

Cost |

Publicly Available Sow Cost Pricing and

Livestock Commentary

(1)

54

daily sow cost report:

http://www.ams.usda.gov/mnreports/lm_hg230.txt

daily livestock commentary:

http://www.dailylivestockreport.com/

1

Information provided by external entities. Bob Evans Farms Inc. disclaims any

and all responsibility for the information provided at these sites. |

BER

and BEF: Synergies Drive Value Across Multiple Dimensions

55

Brand and Advertising Synergies

Product Innovation

Supply Chain Savings

Food Service Credibility/Expansion

Margin Expansion and G&A leverage at

BER and BEF

Restaurant Operational Efficiencies |

FY

2014: Vital Few Priorities 56

Expand “in-source”

supplier relationships for the

restaurant segments and the food service industry

Drive sales through new authorizations

and geographic expansion

Drive margin expansion through cost reductions

and Lean manufacturing efficiencies

Optimize our plant and distribution network

Drive best-in-class ROIC |

57

Appendix |

Summary of Performance Drivers: Fiscal 2015

Guidance Relative to Fiscal 2014 Results

58

1Q (actual)

2Q

3Q

4Q

Full

Year

sss% 2015 (guidance)

-2.0%

flat to low

single-digit

high single-

digit

high single-

digit

1.5% to

2.5%

sss% 2014 (actual)

-0.6%

-1.9%

-1.8%

-4.1%

-2.1%

sow costs (per hundredweight) 2015 (guidance)

$87.87

$90 to $95

$80 to $90

$80 to $90

$87

sow costs (per hundredweight) 2014 (actual)

$63.24

$77.33

$72.36

$78.47

$73.23

estimated Broasted Chicken®

rollout

(% of restaurants)

6%

41%

51%

100% |

Board

Composition and Governance Track Record 59

•

Governance Ranking

•

Peer Group Comparisons |

Strong Corporate Governance is a Priority at

Bob Evans Farms

(1) Source: Yahoo Finance –

per Yahoo Finance, ISS

QuickScore data is presented as of July 1, 2014.

ISS

Overall

Governance

Quickscore

versus

Selected

Peers

1

1

2

3

4

5

6

7

8

9

10

Mean ex. BOBE: 5.2

60

1

1

1

1

1

1

2

2

3

4

4

4

5

5

5

6

6

7

7

7

8

9

9

9

10

10

•

An overwhelming majority of independent directors (all but the CEO);

•

Institutional

Shareholder

Services

(“ISS”)

has

awarded

Bob

Evans’

overall

corporate

governance

the

highest

possible

score per QuickScore rankings.

•

Bob Evans’

Board has:

•

Annual director elections –

no classified board;

•

Majority vote election standard with a director resignation policy;

•

Entirely independent nominating, audit and compensation committees;

•

A lead independent director empowered with robust responsibilities;

•

Strong stock ownership guidelines for directors;

•

Board and committee-level self-evaluations for board effectiveness;

•

No authorization to issue blank check preferred stock without shareholder approval.

|

BOBE’s Strong Balance Sheet Enables Above-

Average Returns of Capital

Return of Capital by Casual Dining Companies

Payout Ratios

Dividends

Net Share

Repurchases

(c)

Source: FactSet and company filings.

(a)

Payout ratio calculated as a percentage of cash flow from operations for the last

30 fiscal quarters. (b)

Indicative annual dividend yield defined as most recent quarterly dividend

multiplied by 4, divided by stock price as of 7/25/14. (c)

Share repurchases are net of any equity issuance.

Return of Capital

(a)

Dividend Yield

(b)

Median of Dividend

Paying Companies: 2.6%

61

16%

4%

16%

21%

16%

22%

4%

11%

77%

64%

48%

36%

38%

16%

25%

17%

93%

68%

63%

57%

54%

38%

28%

28%

23%

14%

(2%)

(2%)

Median: 33%

4.9%

3.9%

3.1%

2.6%

2.4%

2.1%

1.3%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0% |

Other Mature

Casual

BOBE’s

Valuation

Relative

to

Other

Restaurant

and Branded Protein Companies

EV/CY 2014E EBITDA

Differentiated Casual

Family Dining

Branded Protein

Mean:

9.5x

Mean:

9.1x

Mean:

9.6x

Mean:

9.3x

(a)

Excludes Red Lobster.

(b)

Market data as of 5/26/14, one-day prior to Pilgrim’s Pride’s

announced bid for Hillshire Brands. 62

10.1x

10.2x

9.2x

9.1x

11.6x

8.4x

8.2x

8.1x

12.2x

11.3x

9.3x

9.0x

9.0x

6.8x

11.7x

9.6x

6.6x

Source:

Company filings and FactSet as of 7/25/14. |

Over

$125 Million of Strategic Asset Dispositions 63

•

Consolidation of Three Home Office Locations

into One State-of-the-Art Facility

•

Business Dispositions

•

Restaurant Closures

•

Plant Closures/Consolidations

•

Real Estate Sales and Disposals

•

Business Transformations

•

DSD to warehouse conversion

•

Distribution center sale |

64

New Corporate Campus Consolidates Three

Former Locations Into One

New Corporate HQ

New Albany, Ohio

(constructed 2013)

Previous Corporate HQ:

Columbus, Ohio

(constructed 1968)

Mimi’s Café

Divisional HQ:

Irvine, California

(acquired 2004)

Owens Sausage

Divisional HQ:

Richardson,

Texas

(acquired 1987)

Consolidation Project Summary*

($ millions)

$48.2

Land/Building Cost

($12.1)

Sale of Columbus HQ/Richardson HQ (est.)

($4.7)

Tax Savings/Incentives (realized over 10 to 15 years)

$31.4

Net Cost

*$1.3M

of

annual

operating

expenses

of

Owens’

and

Mimi’s

HQ

offices

eliminated in consolidation. |

Significant Asset Closures/Dispositions:

over $125M since FY 2006

Every

business

segment

subject

to

review

every

quarter.

65

continued on following page…

Fiscal

Year

Announced

Business Unit

Action(s) Announced

Strategic Rationale

2006

Bob Evans Restaurants

16 underperforming restaurants closed

margin/ROIC improvement

Corporate

8 underperforming restaurants closed

margin/ROIC improvement

(Owens restaurant chain closed)

2007

Bob Evans Restaurants

18 underperforming restaurants closed

margin/ROIC improvement

BEF Foods

Initiates transition from direct-store-delivery to direct-ship-

upgrade to the distribution model required by most large retailers

warehouse distribution model (multi-year evolution of fleet

and other transportation assets including the 2012

transportation center consolidation)

2008

Bob Evans Restaurants

10 underperforming restaurants closed

margin/ROIC improvement

2009

Bob Evans Restaurants

2 underperforming restaurants closed

margin/ROIC improvement

2010

Bob Evans Restaurants

1 underperforming restaurant closed

margin/ROIC improvement

2011

Bob Evans Restaurants

8 underperforming restaurants closed

margin/ROIC improvement

Corporate

1 underperforming Mimi's Café restaurant closed

margin/ROIC improvement

BEF Foods

Bidwell, Ohio (fresh sausage) production line closed

plant network optimization (reduce fresh sausage over-capacity)

BEF Foods

Galva, Illinois (fresh sausage) plant closure

plant network optimization (reduce fresh sausage over-capacity) |

66

Significant Asset Closures/Dispositions: $125M+ since FY

2006 Every

business

segment

subject

to

review

every

quarter.

Fiscal

Year

Announced

Business Unit

Action(s) Announced

Strategic Rationale

2012

Bob Evans Restaurants

2 underperforming restaurants closed

margin/ROIC improvement

BEF Foods

Bidwell/Hillsdale Transportation Center closures

transportation hubs consolidated in Springfield, Ohio

BEF Foods

Springfield Distribution Center sold

sold facility to best-in-class distribution co.; retained access to

facility 2013

Bob Evans Restaurants

7 underperforming restaurants closed

margin/ROIC improvement

Corporate

Divestiture of Mimi's Café

and HQ consolidation

focus on driving profitable growth of the Bob Evans brand

BEF Foods

Bidwell, Ohio and Springfield, Ohio plant closures

plant network optimization: consolidate pre-cooked/ready-to-eat

estimated $7 million to $8 million annual pre-tax benefit (FY

'15->) production at state-of-the-art Sulphur Springs,

Texas plant YTD 2014

Bob Evans Restaurants

3 underperforming restaurants closed; 31 closed/excess

margin/ROIC improvement

restaurant properties sold

Corporate

Closure and sale of Columbus home office

focus on driving profitable growth of the Bob Evans brand

BEF Foods

Richardson, Texas (fresh sausage) plant and hq closure

plant network optimization (reduce fresh sausage over-capacity)

estimated $2 million to $2.5 million annual pre-tax benefit (FY

'16->) BEF Foods

Sale of Fullerton, California prep kitchen facility

plant network optimization: consolidate pre-cooked/ready-to-eat

production at state-of-the-art Sulphur Springs, Texas plant

Bob Evans Restaurants

Close underperforming locations to improve local market performance and reinvest

in higher potential locations BEF Foods: Reinvest proceeds from sale of

non-core/low-growth assets in high-growth refrigerated side dish and prepared foods assets

Corporate:

Disposals/divestitures

to

improve

margins

and

focus

on

growth |

Additional Information

67

•

ERP

Implementation Schedule

•

Reconciliation of Adjusted Operating Income

(Non-GAAP) to Reported Operating Income

(GAAP) |

68

Updated 7/2014

Fiscal Yr.

Key Actions

$ Millions

Capex

Expense

Benefits

2013

-

RFP Completed & Software Purchased.

-

Team Formulation.

(3.8)

(1.0)

0.0

-

Project Planning and Scoping Defined.

2014

Corporate: Financials Design

(7.6)

(1.9)

0.0

Foods: Manufacturing and Supply Chain Design

2015

Corporate: Financials, HR & Payroll

(13.9)

(4.6)

0.0

Foods: Manufacturing, Procurement, ASCP

Restaurants: Employee Self-Service

2016

Corporate: Order to Cash

(7.1)

(8.1)

3.7

Foods: Transportation, Order Mgt, Trade Planning

2017

Corporate: Property Manager, Enterprise Asset Mgt

(3.3)

(7.7)

6.5

Foods: Product Lifecycle Management

2018

Expenses Stabilize, Benefits Continue to Ramp Up

0.0

(6.9)

8.8

ERP Implementation Schedule |

69

Consolidated Results

Bob Evans Restaurants

BEF Foods

Three Months Ended

Three Months Ended

Three Months Ended

July 25, % of

2014

Sales

July 26, % of

2013

Sales

July 25, % of

2014

Sales

July 26,

2013

% of Sales

July 25, % of

2014

Sales

July 26,

2013

% of Sales

Operating income as reported

Net sales

326,341

329,449

240,151

244,551

86,190

84,898

Cost of sales

113,463

34.8%

106,641

32.4%

63,211

26.3%

62,653

25.6%

50,252

58.3%

43,988

51.8%

Operating wage and fringe benefit

expenses

104,228

31.9%

102,847

31.2%

94,639

39.4%

93,221

38.1%

9,589

11.1%

9,626

11.3%

Other operating expenses

49,508

15.2%

48,847

14.8%

42,505

17.7%

41,313

16.9%

7,003

8.1%

7,534

8.9%

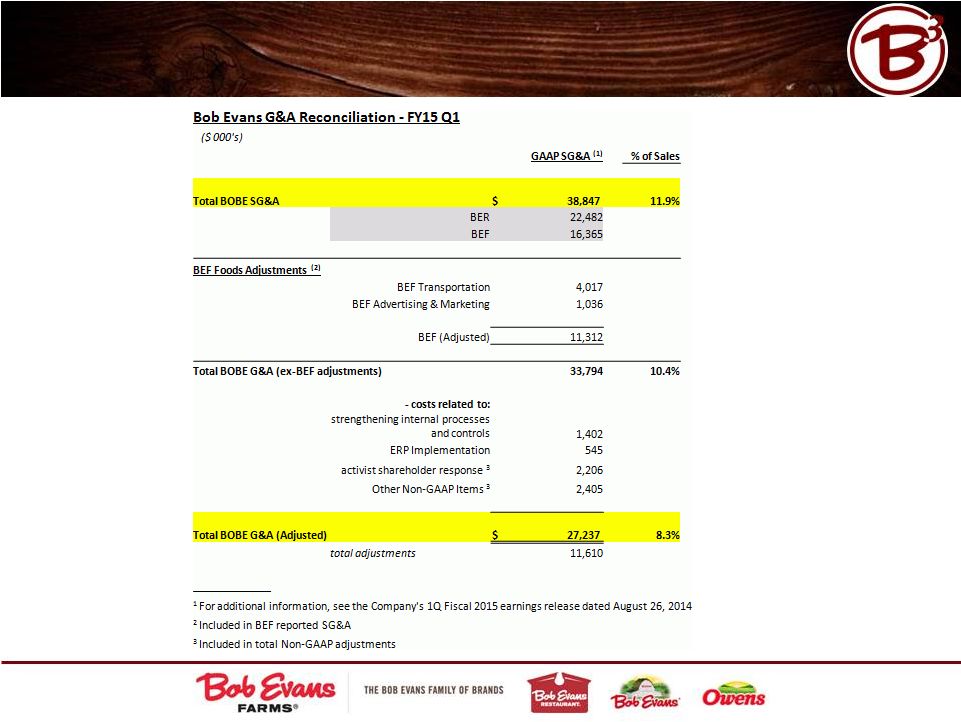

Selling, general and administrative

expenses

38,847

11.9%

33,276

10.1%

22,482

9.4%

18,082

7.4%

16,365

19.0%

15,194

17.9%

Depreciation and amortization expense

19,973

6.1%

17,230

5.2%

15,341

6.4%

14,191

5.8%

4,632

5.4%

3,039

3.6%

Impairment of assets held for sale

258

0.1%

8,609

2.6%

258

0.1%

8,609

0.0%

-

0.0%

-

0.0%

Total as Reported

64

0.0%

11,999

3.6%

1,715

0.7%

6,482

2.7%

(1,651)

-1.9%

5,517

6.5%

Adjustments

Net sales

-

-

-

-

-

-

Cost of sales

-

-

-

-

-

-

Operating wage and fringe benefit

expenses

(14)

-

(14)

-

-

-

Other operating expenses

(149)

107

(149)

-

-

107

Selling, general and administrative

expenses

(4,611)

(2,258)

(3,381)

(963)

(1,230)

(1,295)

Depreciation and amortization expense

-

51

-

51

-

-

Impairment of assets held for sale

(258)

(8,609)

(258)

(8,609)

-

-

Total adjustments

5,032

10,709

3,802

9,521

1,230

1,188

Non-GAAP operating income

Net sales

326,341

329,449

240,151

244,551

86,190

84,898

Cost of sales

113,463

34.8%

106,641

32.4%

63,211

26.3%

62,653

25.6%

50,252

58.3%

43,988

51.8%

Operating wage and fringe benefit

expenses

104,214

31.9%

102,847

31.2%

94,625

39.4%

93,221

38.1%

9,589

11.1%

9,626

11.3%

Other operating expenses

49,359

15.1%

48,954

14.9%

42,356

17.6%

41,313

16.9%

7,003

8.1%

7,641

9.0%

Selling, general and administrative

expenses

34,236

10.5%

31,018

9.4%

19,101

8.0%

17,119

7.0%

15,135

17.6%

13,899

16.4%

Depreciation and amortization expense

19,973

6.1%

17,281

5.2%

15,341

6.4%

14,242

5.8%

4,632

5.4%

3,039

3.6%

Impairment of assets held for sale

-

0.0%

-

0.0%

-

0.0%

-

0.0%

-

0.0%

-

0.0%

Total non-GAAP operating income

5,096

1.6%

22,708

6.9%

5,517

2.3%

16,003

6.5%

(421)

-0.5%

6,705

7.9%

Reconciliation of Adjusted Operating Income

(Non-GAAP) to Reported Operating Income (GAAP) |

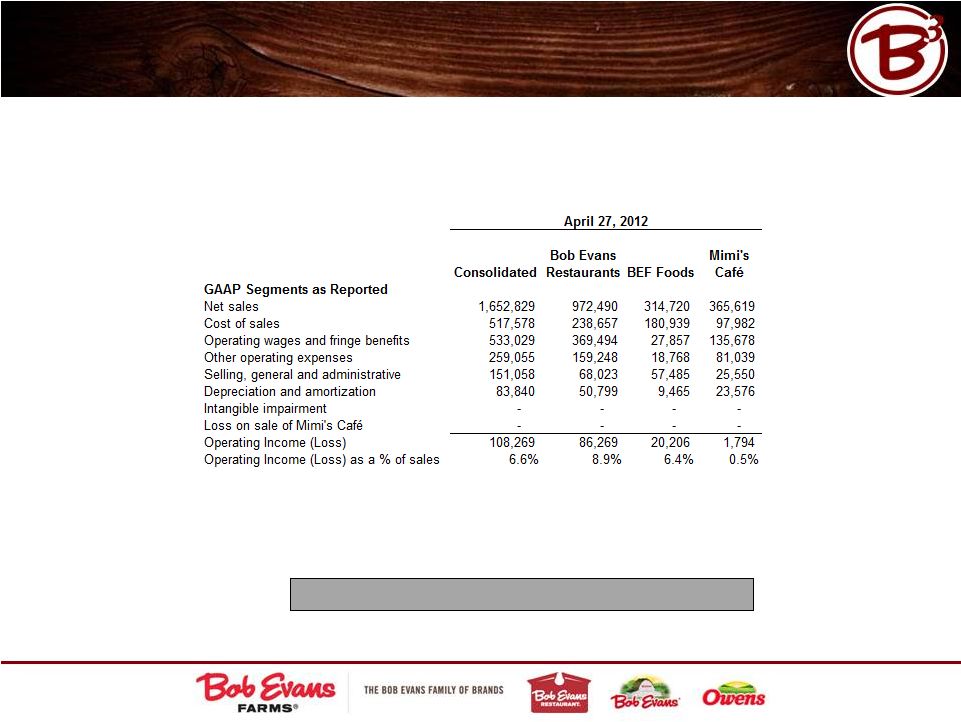

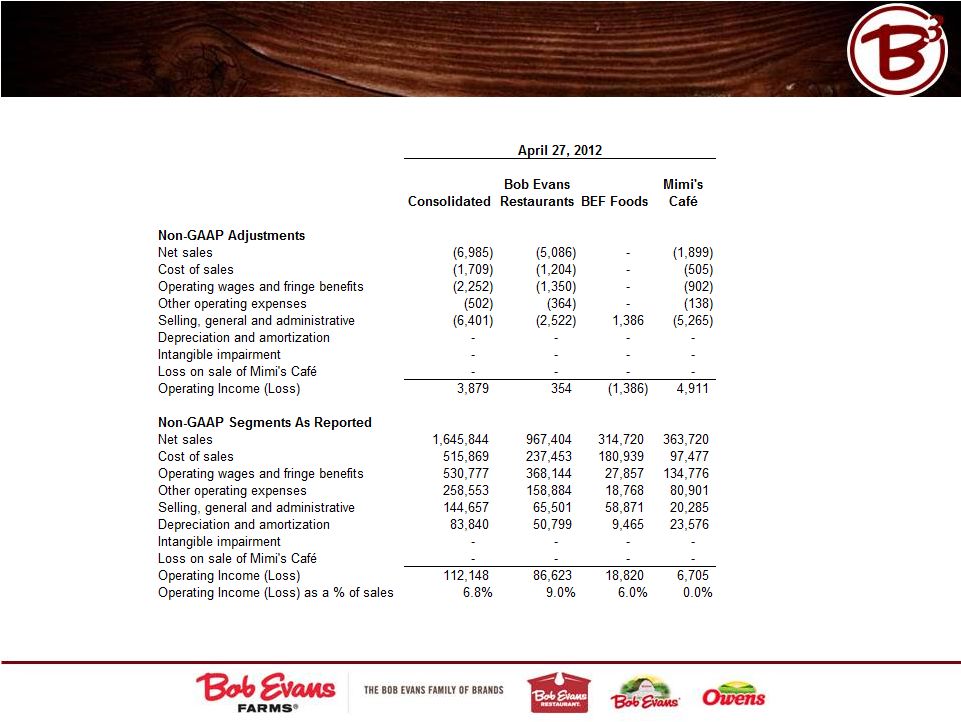

Reconciliation of Adjusted Operating Income

(Non-GAAP) to Reported Operating Income (GAAP)

70

This schedule continues on the following page. |

Reconciliation of Adjusted Operating Income

(Non-GAAP) to Reported Operating Income (GAAP)

71 |

Reconciliation of Adjusted Operating Income

(Non-GAAP) to Reported Operating Income (GAAP)

72

This schedule continues on the following page. |

Reconciliation of Adjusted Operating Income

(Non-GAAP) to Reported Operating Income (GAAP)

73 |

Reconciliation of Adjusted Operating Income

(Non-GAAP) to Reported Operating Income (GAAP)

Fiscal 2009 BEF reported operating income (GAAP)

$15,571

Non-GAAP adjustment: Other operating expenses

400

Fiscal 2009 BEF reported operating income (GAAP)

$15,971

($ thousands)

74

2009 BEF Foods’ (formerly “Food Products”) Operating

Income Reconciliation |