Attached files

| file | filename |

|---|---|

| EX-10.30 - EX-10.30 - Civitas Therapeutics, Inc. | d719498dex1030.htm |

| EX-10.26 - EX-10.26 - Civitas Therapeutics, Inc. | d719498dex1026.htm |

| EX-23.1 - EX-23.1 - Civitas Therapeutics, Inc. | d719498dex231.htm |

| EX-3.2 - EX-3.2 - Civitas Therapeutics, Inc. | d719498dex32.htm |

| EX-10.15 - EX-10.15 - Civitas Therapeutics, Inc. | d719498dex1015.htm |

| EX-10.17 - EX-10.17 - Civitas Therapeutics, Inc. | d719498dex1017.htm |

| EX-10.14 - EX-10.14 - Civitas Therapeutics, Inc. | d719498dex1014.htm |

| EX-4.2 - EX-4.2 - Civitas Therapeutics, Inc. | d719498dex42.htm |

| EX-10.2 - EX-10.2 - Civitas Therapeutics, Inc. | d719498dex102.htm |

| EX-10.16 - EX-10.16 - Civitas Therapeutics, Inc. | d719498dex1016.htm |

Table of Contents

As filed with the Securities and Exchange Commission on August 26, 2014.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CIVITAS THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2836 | 27-1482814 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

190 Everett Avenue

Chelsea, MA 02150

(617) 660-4110

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mark Iwicki

President and Chief Executive Officer

190 Everett Avenue

Chelsea, MA 02150

(617) 660-4110

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199 (617) 951-7000 |

Copies to: Bryan Stuart |

Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x |

Smaller reporting company | ¨ | ||||

|

(Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered |

Proposed maximum |

Amount of registration fee(2) | ||

| Common Stock, $0.001 par value per share |

$86,250,000 | $11,109 | ||

|

| ||||

|

| ||||

| (1) | Includes offering price of additional shares that the underwriters have the option to purchase. Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated August 26, 2014

Prospectus

Shares

Common Stock

This is an initial public offering of common shares by Civitas Therapeutics, Inc. Civitas is selling shares of common stock. The estimated initial public offering price is between $ and $ per share.

We have applied to list our common stock on The NASDAQ Global Market under the symbol “CVTS.”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, may elect to comply with certain reduced public company reporting requirements for future filings.

| Per share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to Civitas, before expenses |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain FINRA-related expenses. See “Underwriting” on page 137. |

Civitas has granted the underwriters an option for a period of 30 days to purchase up to additional common shares. The underwriters can exercise this right at any time within 30 days after the date of this prospectus.

Investing in our common stock involves risks. See “Risk factors” beginning on page 8 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2014.

| J.P. Morgan | BofA Merrill Lynch | |

| Cowen and Company | Oppenheimer & Co. | |

, 2014

Table of Contents

| Page | ||||

| 1 | ||||

| 8 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 43 | ||||

| 45 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

47 | |||

| 65 | ||||

| 98 | ||||

| 106 | ||||

| 119 | ||||

| 122 | ||||

| 125 | ||||

| 126 | ||||

| 131 | ||||

| Material U.S. federal income tax considerations for non-U.S. holders |

134 | |||

| 138 | ||||

| 145 | ||||

| 145 | ||||

| 145 | ||||

We are responsible for the information contained in this prospectus and in any free writing prospectus we prepare or authorize. We and the underwriters have not authorized anyone to provide you with different information, and we and the underwriters take no responsibility for any other information others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the cover of this prospectus.

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. The trademarks that we own include Civitas®. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

i

Table of Contents

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially “Risk factors” and “Management’s discussion and analysis of financial condition and results of operations,” before deciding to buy shares of our common stock. Unless the context requires otherwise, references in this prospectus to “Civitas,” “the Company,” “we,” “us” and “our” refer to Civitas Therapeutics, Inc.

Overview

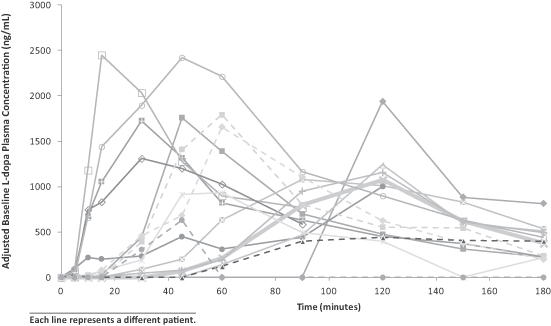

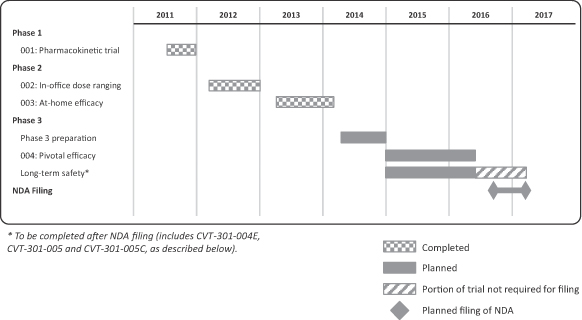

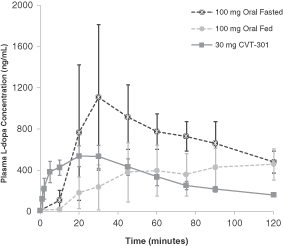

We are a biopharmaceutical company focused on developing and commercializing transformative therapeutics using our proprietary ARCUS technology, with an initial focus on treating debilitating OFF episodes, the unpredictable re-emergence of symptoms, in patients with Parkinson’s disease, or PD. We recently completed a Phase 2b clinical trial for our lead product candidate, CVT-301, demonstrating the ability to rapidly and predictably treat OFF episodes as they occur. PD is a progressive neurodegenerative disorder resulting from the gradual loss of certain neurons responsible for producing dopamine. It is characterized by symptoms including tremor at rest, rigidity and impaired movement. The standard of care for the treatment of symptoms of PD remains oral levodopa, or L-dopa, a drug approved over 40 years ago. While oral L-dopa is efficacious, there are significant challenges for physicians in creating a dosing regimen of oral L-dopa that consistently maintains L-dopa levels within a patient’s therapeutic range due both to the inherent nature of the L-dopa chemical structure as well as the physiologic manifestations of the disease in patients. This results in wide variability in the timing and amount of L-dopa absorption into the bloodstream, leading to episodes of unexpected and rapid return of PD symptoms, such as tremor at rest, rigidity and impaired movement. The unpredictable re-emergence of PD symptoms, or a period during which a patient’s oral L-dopa therapy is not adequately addressing their symptoms, is referred to as an OFF episode. CVT-301 is comprised of proprietary formulated dry powder capsules containing L-dopa, which are administered through a proprietary, easy to use, pocket-size, reusable inhaler. CVT-301 is being developed as a self-administered, adjunctive, as needed, inhaled L-dopa therapy for OFF episodes, providing rapid delivery of L-dopa to the brain to be used in conjunction with, but not as a substitute for, a patient’s individually optimized oral L-dopa regimen. We expect to initiate our pivotal Phase 3 clinical trial for CVT-301 by early 2015. Based on our discussions to date with the United States Food and Drug Administration, or FDA, we believe that CVT-301 will qualify for review through the 505(b)(2) pathway, which would allow for an abbreviated pathway to approval in the United States.

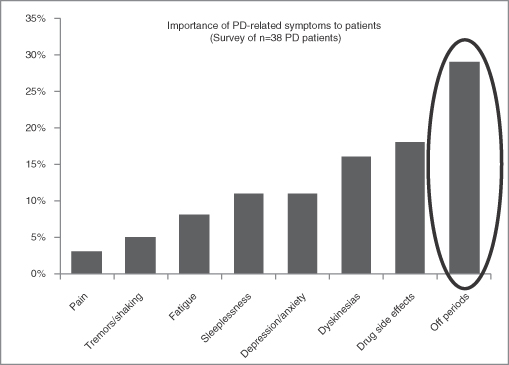

Over one million people in the United States and between seven and 10 million people worldwide suffer from PD. The majority of PD patients experience OFF episodes, which increase in frequency and severity during the course of their disease. OFF episodes are considered one of the greatest unmet medical needs facing PD patients as they often result in patients’ inability to perform simple daily tasks such as eating, bathing and dressing. As the disease progresses, patients are often forced to leave the workforce early and become increasingly dependent on care-givers.

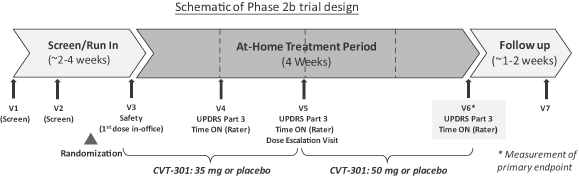

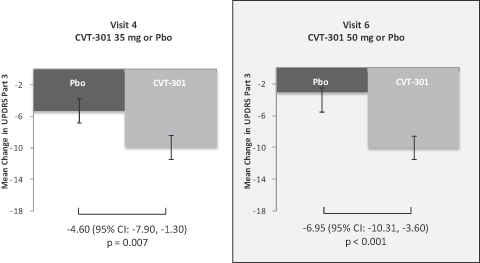

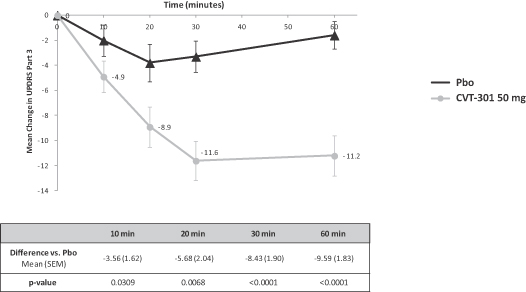

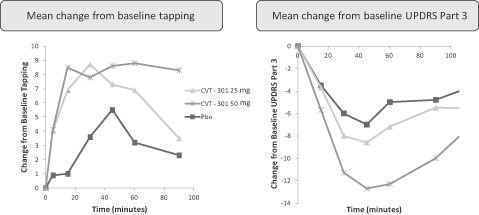

We have shown that CVT-301 is easy for PD patients to use. Over the course of our clinical trials, PD patients have successfully self-administered drug or placebo contained in approximately 11,100 capsules during approximately 4,500 OFF episodes, taking, on average, 30 seconds per capsule. In our recently completed Phase 2b take-home clinical trial, we met our primary endpoint with statistical significance demonstrating that CVT-301 provides patients with a rapid, clinically important improvement in motor function. Patients treated an average of two OFF episodes per day in this trial, and CVT-301 provided onset of action within 10 minutes with durable effects lasting for the entire 60 minutes measured in the trial and was safe and well tolerated.

1

Table of Contents

Pulmonary administration of drugs provides an efficient and rapid path for systemic delivery via the bloodstream as well as local delivery to the lung due to the large, highly vascularized surface of the lung. Inhaled therapies have traditionally relied on small, dense particle aerosols requiring significant energy for dispersion, limiting dosing for breath-actuated inhalers to microgram or single digit milligram, or mg, quantities. Our proprietary ARCUS technology uniquely enables the delivery of precise doses of dry powder drug product of over 50 mg per inhalation utilizing a pocket-size breath-actuated inhaler. This is achieved by formulating active drug into large, porous particles. The large particle size enables powders to be dispersed at much lower energies while the porous nature allows the particles to retain the optimal aerodynamic size for effective lung delivery. A consistent dose is delivered using a patient’s natural inhalation. Our ARCUS technology allows us to administer large therapeutic doses via pulmonary administration, which we believe presents a highly compelling opportunity to effectively treat many diseases. In addition to CVT-301, we are exploring opportunities for other proprietary products in which inhaled delivery using our ARCUS technology can provide a transformative therapeutic benefit to patients.

We have a robust portfolio of over 100 issued patents relating to CVT-301 and our ARCUS technology which covers, among other things, important aspects of the formulated drug product, the inhaler, the method of delivery of drug and the manufacturing processes for CVT-301. We retain global commercial rights to CVT-301. We expect to commercialize CVT-301 ourselves in the United States and anticipate that a targeted sales effort of approximately 85 to 100 sales representatives that we believe will enable us to effectively market CVT-301 in the United States primarily to high-prescribing neurologists. We may choose to partner with companies that have the necessary expertise to develop and commercialize CVT-301 in ex-U.S. markets.

Civitas was founded in 2009. Our ARCUS technology was acquired from the pulmonary delivery division of Alkermes, Inc., or Alkermes. CVT-301 drug product and other ARCUS products will be manufactured in our state-of-the-art, 90,000 square foot facility located in Chelsea, Massachusetts. The facility was built by Alkermes in 2002 specifically for the commercial-scale manufacture of dry powder ARCUS-based products. Over the course of a prior collaboration between Alkermes and Eli Lilly to produce inhaled insulin, over 36 million capsules of ARCUS-formulated insulin were filled and over one million doses delivered in clinical trials. Eli Lilly and Alkermes ended their collaboration in 2008, following which Alkermes made the decision to deprioritize pulmonary delivery. We have produced human doses of CVT-301 compliant with good manufacturing practices, or GMP, for Phase 1 and Phase 2 clinical trials, and are now producing GMP-quality CVT-301 powder for our pivotal Phase 3 clinical trial. The facility has capacity to enable us to meet anticipated commercial needs of CVT-301 and additional products.

Our strategy

Our vision is to build a biopharmaceutical company focused on developing and commercializing transformative therapeutics using our proprietary ARCUS technology, with an initial focus on treating debilitating OFF episodes in patients with PD. Key elements of our strategy include:

| • | rapidly advance development of and seek regulatory approval for CVT-301 for the treatment of the unexpected and debilitating OFF episodes experienced by PD patients; |

| • | build our organizational infrastructure to commercialize CVT-301 in the United States; |

| • | advance the development and commercialization of CVT-301 outside the United States; |

| • | utilize in-house commercial-scale manufacturing capabilities to ensure reliable product supply; and |

| • | leverage our validated technology and approach to advance additional ARCUS-based products into clinical development. |

2

Table of Contents

Risk factors

An investment in our common stock involves numerous risks. Any of the factors set forth under “Risk factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk factors” in deciding whether to invest in our common stock. Among these important risks are the following:

| • | We have incurred net losses of $81.0 million from our inception to June 30, 2014 and anticipate that we will continue to incur substantial operating losses for the foreseeable future. We may never achieve or sustain profitability. As of June 30, 2014, we had a deficit accumulated during the development stage of $89.3 million. |

| • | We will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed could force us to delay, limit, reduce or terminate our development or commercialization efforts of our inhaled therapeutic candidates. |

| • | If our inhaled therapeutic candidates fail to demonstrate safety and efficacy to the satisfaction of regulatory authorities, we may incur additional costs or experience delays in completing, or ultimately be unable to obtain regulatory approval for our inhaled therapeutic candidates. |

| • | If our inhaled therapeutic candidates are approved, our future commercial success will depend upon attaining significant market acceptance among physicians, patients and health care payors and, if we fail to do so, our business will be materially harmed. |

| • | We may not be able to manufacture our inhaled therapeutic candidates in quantities sufficient for our clinical trials and/or any commercial launch of our product candidates. If we fail to meet deadlines or perform in an unsatisfactory manner our business could be harmed. |

| • | If we are unable to obtain or protect our intellectual property rights, including proprietary information and trade secrets, related to our inhaled therapeutic candidates, we may not be able to prevent competitors with the same or similar inhaled therapeutics from entering our markets. |

| • | If we fail to attract and keep senior management and key scientific personnel, we may be unable to successfully develop our inhaled therapeutics, conduct our clinical trials and commercialize our inhaled therapeutic candidates. |

Implications of being an emerging growth company

As a company with less than $1.0 billion in revenue during our most recently completed fiscal year, we qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable, in general, to public companies that are not emerging growth companies. These provisions include:

| • | reduced disclosure about our executive compensation arrangements; |

| • | no non-binding stockholder advisory votes on executive compensation or golden parachute arrangements; |

| • | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting; and |

| • | reduced disclosure of financial information in this prospectus, including only two years of audited financial information and two years of selected financial information. |

3

Table of Contents

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues as of the end of any fiscal year, if we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission, or SEC, or if we issue more than $1.0 billion of non-convertible debt over a three-year period.

The JOBS Act permits an emerging growth company to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We are choosing to “opt out” of this provision, and this decision is irrevocable.

Corporate information

We were incorporated in the state of Delaware in June 2009 as Corregidor Therapeutics, Inc., and we subsequently changed our name to Civitas Therapeutics, Inc. Our principal executive offices are located at 190 Everett Avenue, Chelsea, Massachusetts 02150, and our telephone number is (617) 660-4110. Our Internet website is www.civitastherapeutics.com. The information on, or that can be accessed through, our website is not part of this prospectus, and you should not rely on any such information in making the decision whether to purchase our common stock.

4

Table of Contents

THE OFFERING

| Common stock offered by us |

shares |

| Common stock to be outstanding immediately after this offering |

shares |

| Option to purchase additional shares |

The underwriters have an option for a period of 30 days to purchase up to additional shares of our common stock. |

| Use of proceeds |

The net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional shares in full, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering as follows: (1) approximately $ million to fund the continued development of CVT-301, including our Phase 3 clinical trials, (2) approximately $ million to manufacture clinical supplies of CVT-301, (3) approximately $ million to fund other early stage pipeline development programs, and (4) the remainder for working capital and other general corporate purposes, including funding the costs of operating as a public company. See “Use of proceeds.” |

| Risk factors |

You should read the “Risk factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| Proposed NASDAQ Global Market symbol |

“CVTS” |

The number of shares of common stock to be outstanding after this offering is based on 81,410,487 shares of common stock outstanding as of August 22, 2014 and excludes the following:

| • | 14,393,818 shares of common stock issuable upon exercise of stock options outstanding as of August 22, 2014 at a weighted-average exercise price of $0.78 per share; |

| • | 106,383 shares of common stock issuable upon exercise of outstanding warrants as of August 22, 2014 at a weighted-average exercise price of $1.41 per share; |

| • | shares of common stock reserved for future issuance under the Civitas Therapeutics, Inc. 2014 Equity Incentive Plan, or the 2014 Equity Plan; and |

| • | shares of common stock reserved for issuance under our Employee Stock Purchase Plan. |

Unless otherwise indicated, all information in this prospectus reflects or assumes the following:

| • | the filing and effectiveness of our amended and restated certificate of incorporation and the adoption of our amended and restated by-laws, which will occur upon the closing of this offering; |

| • | a 1-for- reverse split of our common stock and preferred stock effected on , 2014; |

| • | the conversion of all outstanding shares of our preferred stock into 74,354,904 shares of our common stock upon the closing of this offering; |

| • | the conversion of outstanding warrants exercisable for 106,383 shares of our preferred stock into warrants exercisable for 106,383 shares of our common stock upon the closing of this offering; |

| • | no issuance or exercise of stock options or warrants on or after August 22, 2014; and |

| • | no exercise by the underwriters of their option to purchase up to an additional shares of our common stock in this offering. |

5

Table of Contents

SUMMARY FINANCIAL DATA

The following summary financial data for the years ended December 31, 2012 and 2013 are derived from our audited financial statements included elsewhere in this prospectus. The summary financial data for the six months ended June 30, 2013 and 2014 and for the period from June 17, 2009 (Inception) to June 30, 2014 and the balance sheet data as of June 30, 2014 are derived from our unaudited financial statements included elsewhere in this prospectus. In our opinion, the unaudited financial statements have been prepared on a basis consistent with our audited financial statements and contain all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of such financial data. You should read this data together with our audited financial statements and related notes included elsewhere in this prospectus and the information under the captions “Selected financial data” and “Management’s discussion and analysis of financial condition and results of operations.” Our historical results are not necessarily indicative of our future results, and our operating results for the six-month period ended June 30, 2014 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2014 or any other interim periods or any future year or periods. The summary financial data in this section are not intended to replace our audited and unaudited financial statements and related notes included elsewhere in this prospectus.

| Year ended December 31, | Six Months Ended June 30, |

Period from June 17, 2009 (Inception) to June 30, 2014 |

||||||||||||||||||

| (in thousands, except share and per share data) | 2012 | 2013 | 2013 | 2014 | ||||||||||||||||

| Statements of operations data: |

||||||||||||||||||||

| Service revenue |

$ | 535 | $ | 53 | $ | 53 | $ | — | $ | 1,043 | ||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development |

9,272 | 15,526 | 6,656 | 9,295 | 40,565 | |||||||||||||||

| General and administrative |

2,538 | 4,812 | 1,796 | 4,481 | 14,240 | |||||||||||||||

| Re-measurement of contingent consideration |

4,998 | 5,255 | 599 | 8,955 | 23,431 | |||||||||||||||

| Amortization of purchased intangible assets |

224 | 193 | 96 | 96 | 740 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

17,032 | 25,786 | 9,147 | 22,827 | 78,976 | |||||||||||||||

| Loss from operations |

(16,497 | ) | (25,733 | ) | (9,094 | ) | (22,827 | ) | (77,933 | ) | ||||||||||

| Other income (expense), net |

(50 | ) | (2,665 | ) | (1,578 | ) | (235 | ) | (2,949 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before provision for income taxes |

(16,547 | ) | (28,398 | ) | (10,672 | ) | (23,062 | ) | (80,882 | ) | ||||||||||

| Provision for income taxes |

49 | 49 |

|

25 |

|

|

25 |

|

|

142 |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (16,596 | ) | $ | (28,447 | ) |

$ |

(10,697 |

) |

$ |

(23,087 |

) |

$ |

(81,024 |

) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss attributable to common stockholders — basic and diluted |

$ | (18,982 | ) | $ | (31,867 | ) |

$ |

(11,855 |

) |

$ |

(25,873 |

) |

$ |

(90,850 |

) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per share applicable to common stockholders — basic and diluted |

$ | (5.39 | ) | $ | (6.64 | ) |

$ |

(2.74 |

) |

$ |

(4.26 |

) |

$ |

(34.37 |

) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted-average number of common shares used in computing net loss per share applicable to common stockholders — basic and diluted |

3,521,134 | 4,799,832 |

|

4,328,007 |

|

|

6,071,222 |

|

|

2,643,342 |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net loss per share applicable to common stockholders — basic and diluted (unaudited) |

$ | (0.66 | ) |

$ |

(0.36 |

) |

||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Pro forma weighted-average number of common shares used in computing net loss per share applicable to common stockholders — basic and diluted (unaudited) |

42,806,119 | 63,426,126 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

6

Table of Contents

The table below presents our balance sheet data at June 30, 2014:

| • | on an actual basis; |

| • | on a pro forma basis to give effect to: |

| • | the issuance of 17,000,000 shares of Series C Preferred Stock in August 2014 and our receipt of the proceeds therefrom; |

| • | the conversion of all outstanding shares of our preferred stock, including the shares of our Series C Preferred Stock, into an aggregate of 74,354,904 shares of our common stock, which will occur upon the closing of this offering; |

| • | the conversion of outstanding warrants exercisable for 106,383 shares of our preferred stock into warrants exercisable for 106,383 shares of our common stock, which will occur upon the closing of this offering; and |

| • | the filing and effectiveness of our amended and restated certificate of incorporation and the adoption of our amended and restated by-laws, which will occur upon the closing of this offering; and |

| • | on a pro forma as adjusted basis to give further effect to the sale of shares of our common stock in this offering at an assumed initial public offering price of $ per share (the midpoint of the range set forth on the cover page of this prospectus), after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. |

| As of June 30, 2014 | ||||||||||

| (in thousands) | Actual | Pro forma | Pro forma as adjusted(1) | |||||||

| Balance sheet data: |

||||||||||

| Cash and cash equivalents |

$ | 13,906 | $ | 69,156 | ||||||

| Total assets |

29,263 | 84,513 | ||||||||

| Total liabilities |

40,208 | 40,006 | ||||||||

| Series A Preferred Stock |

35,220 | — | ||||||||

| Series B Preferred Stock |

43,178 | — | ||||||||

| Series C Preferred Stock |

— | — | ||||||||

| Common stock |

6 | 81 | ||||||||

| Additional paid-in capital |

— | 125,450 | ||||||||

| Deficit accumulated during the development stage |

(89,349 | ) | (81,024 | ) | ||||||

| Total stockholders’ (deficit) equity |

(89,343 | ) | 44,507 | |||||||

| (1) | Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus, would increase (decrease) each of pro forma as adjusted additional paid-in capital, stockholders’ equity and total capitalization by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same. We may also increase or decrease the number of shares we are offering. An increase (decrease) of 1,000,000 in the number of shares we are offering would increase (decrease) each of pro forma as adjusted additional paid-in capital, stockholders’ equity and total capitalization by approximately $ million, assuming the assumed initial public offering price per share, as set forth on the cover page of this prospectus, remains the same. |

7

Table of Contents

Investing in our common stock involves numerous risks. You should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus, including our financial statements and related notes appearing at the end of this prospectus, before deciding to invest in our common stock. If any of the following risks actually occurs, our business, prospects, operating results and financial condition could suffer materially, the trading price of our common stock could decline and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

Risks related to our financial position and need for additional capital

We have incurred net losses since our inception and anticipate that we will continue to incur substantial operating losses for the foreseeable future. We may never achieve or sustain profitability.

We have incurred net losses during each fiscal period since our inception. Our net loss was $28.4 million for the year ended December 31, 2013 and $23.1 million for the six months ended June 30, 2014. As of June 30, 2014, we had a deficit accumulated during the development stage of $89.3 million. We do not know when or whether we will become profitable. To date, we have not commercialized any products or generated any revenues from the sale of products, and we do not expect to generate any product revenues in the foreseeable future. Our losses have resulted principally from costs incurred in our discovery and development activities. Our net losses may fluctuate significantly from quarter to quarter and year to year.

We have devoted most of our financial resources to research and development, including our clinical and preclinical development activities. To date, we have financed our operations primarily through the sale of equity securities and convertible debt and, to a lesser extent, through grants from charitable foundations. The amount of our future net losses will depend, in part, on the rate of our future expenditures and our ability to obtain funding through equity or debt financings, strategic collaborations or additional grants. We have not completed pivotal clinical trials for any product candidate and it will be several years, if ever, before we have a product candidate ready for commercialization. Even if we obtain regulatory approval to market a product candidate, our future revenues will depend upon the size of any markets in which our product candidates have received approval, and our ability to achieve sufficient market acceptance, reimbursement from third-party payors and adequate market share for our product candidates in those markets.

We expect to continue to incur significant expenses and increasing net losses for at least the next several years. We expect our expenses will increase substantially in connection with our ongoing activities, as we:

| • | conduct our Phase 3 clinical trials for CVT-301; |

| • | continue to invest in manufacturing capabilities for our Phase 3 clinical trials and potential commercial launch of CVT-301; |

| • | seek regulatory approval for CVT-301; |

| • | add personnel to support our product development and commercialization efforts; |

| • | continue our research and development efforts for new product opportunities; and |

| • | operate as a public company. |

If we are required by the FDA, or any equivalent foreign regulatory authority to perform clinical trials or studies in addition to those we currently expect to conduct, or if there are any delays in completing the clinical trials of CVT-301, our expenses could increase.

8

Table of Contents

To become and remain profitable, we must succeed in developing our inhaled therapeutic candidates, obtaining regulatory approval for them, and manufacturing, marketing and selling those products for which we may obtain regulatory approval. We may not succeed in these activities, and we may never generate revenue from product sales that is significant enough to achieve profitability. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Our failure to become or remain profitable would depress our market value and could impair our ability to raise capital, expand our business, discover or develop other inhaled therapeutic candidates or continue our operations. A decline in the value of our company could cause you to lose all or part of your investment.

We will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed could force us to delay, limit, reduce or terminate our product development or commercialization efforts.

Our cash and cash equivalents were $13.9 million as of June 30, 2014, and we received an additional $55.3 million in cash proceeds from our Series C Preferred Stock financing that we completed in August 2014. We believe that we will continue to expend substantial resources for the foreseeable future developing CVT-301 and new inhaled therapeutic candidates. These expenditures will include costs associated with research and development, conducting preclinical studies and clinical trials, potentially obtaining regulatory approvals and manufacturing products, as well as marketing and selling products approved for sale, if any, and potentially acquiring new technologies. In addition, other unanticipated costs may arise. Because the outcome of our planned and anticipated clinical trials is highly uncertain, we cannot reasonably estimate the actual amounts necessary to successfully complete the development and commercialization of our inhaled therapeutic candidates. Our costs will increase if we suffer any delays in our Phase 3 clinical trials for CVT-301, including delays in enrollment of patients. Upon the closing of this offering, we expect to incur additional costs associated with operating as a public company, hiring additional personnel and expanding our facilities.

Our future capital requirements depend on many factors, including:

| • | the scope, progress, results and costs of researching and developing CVT-301 and our other potential inhaled therapeutic candidates and conducting preclinical studies and clinical trials; |

| • | the timing of, and the costs involved in, obtaining regulatory approvals for CVT-301 and our other potential inhaled therapeutic candidates if clinical trials are successful; |

| • | the cost of commercialization activities for CVT-301 and our other potential inhaled therapeutic candidates, if any of these inhaled therapeutic candidates are approved for sale, including marketing, sales and distribution costs; |

| • | the cost of manufacturing CVT-301 and our other potential inhaled therapeutic candidates for clinical trials in preparation for regulatory approval and in preparation for commercialization; |

| • | our ability to establish and maintain strategic partnerships, licensing or other arrangements and the financial terms of such agreements; |

| • | the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent claims, including litigation costs and the outcome of such litigation; and |

| • | the timing, receipt, and amount of sales of, or royalties on, our future products, if any. |

Based on our current operating plan, we believe that the net proceeds we receive from this offering, together with our existing cash and cash equivalents and the $55.3 million in cash proceeds from our Series C Preferred Stock financing that we completed in August 2014, will be sufficient to fund our projected operating requirements into the second half of 2016 and completion of our pivotal Phase 3 clinical trial for CVT-301. However, our operating plan may change as a result of many factors currently unknown to us. As a result of these factors, we may need additional funds sooner than planned. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our

9

Table of Contents

current or future operating plans. Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available to us on a timely basis, we may be required to delay, limit, reduce or terminate preclinical studies, clinical trials or other development activities for one or more of our inhaled therapeutic candidates or delay, limit, reduce or terminate our establishment of sales and marketing capabilities or other activities that may be necessary to commercialize our inhaled therapeutic candidates.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or inhaled therapeutics on unfavorable terms to us.

We may seek additional capital through a variety of means, including through private and public equity offerings and debt financings. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms of such equity or convertible debt securities may include liquidation or other preferences that are senior to or otherwise adversely affect your rights as a stockholder. In addition, if we make an additional draw under our senior secured credit facility, we will be required to issue additional warrants. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take certain actions, such as incurring additional debt, making capital expenditures, declaring dividends or encumbering our assets to secure future indebtedness. If we raise additional funds through strategic partnerships with third parties, we may have to relinquish valuable rights to our technologies or inhaled therapeutic candidates, or grant licenses on terms that are not favorable to us. If we are unable to raise additional funds through equity or debt financing when needed, we may be required to delay, limit, reduce or terminate our product development or commercialization efforts for CVT-301 or any other inhaled therapeutic candidates, or grant rights to develop and market inhaled therapeutic candidates that we would otherwise prefer to develop and market ourselves.

Risks related to regulatory review and approval of our inhaled therapeutic candidates

Clinical failure may occur at any stage of clinical development, and we may never succeed in developing marketable products or generating product revenue.

Although the active ingredient in CVT-301, L-dopa, has been used safely as an oral therapeutic treatment for PD for a number of years, it has not previously been approved or demonstrated to be safe over an extended period of time as an inhaled therapeutic. Our early encouraging clinical results for CVT-301 are not necessarily predictive of the results of our ongoing or future clinical trials, including our pivotal Phase 3 clinical trial. Promising results in preclinical studies of a drug candidate may not be predictive of similar results in humans during clinical trials. Any Phase 3 or other clinical trials that we may conduct may not demonstrate the efficacy and safety necessary to obtain regulatory approval to market our product candidates. If the results of our ongoing or future clinical trials are inconclusive with respect to the efficacy of our inhaled therapeutic candidates or if we do not meet the clinical endpoints with statistical significance or if there are safety concerns associated with our inhaled therapeutic candidates, we may be prevented or delayed in obtaining marketing approval for our inhaled therapeutic candidates. In some instances, there can be significant variability in safety or efficacy results between different clinical trials of the same product candidate due to numerous factors, including changes in trial procedures set forth in protocols, differences in the size and type of the patient populations, changes in and adherence to the clinical trial protocols and the rate of dropout among clinical trial participants.

Alternatively, even if we obtain regulatory approval, that approval may be for indications or patient populations that are not as broad as intended or desired or may require labeling that includes significant use or distribution restrictions or safety warnings. We may also be required to perform additional or unanticipated clinical trials to obtain approval or be subject to additional post-marketing testing requirements to maintain regulatory approval. In addition, regulatory authorities may withdraw their approval of a product or impose restrictions on its distribution, such as in the form of a modified Risk Evaluation and Mitigation Strategy, or REMS. The failure to obtain timely regulatory approval of product candidates, any product marketing limitations or a product withdrawal would negatively impact our business, results of operations and financial condition.

10

Table of Contents

Delays in the commencement, enrollment or completion of clinical trials of our inhaled therapeutic candidates could result in increased costs to us as well as a delay or failure in obtaining regulatory approval, or prevent us from commercializing our inhaled therapeutic candidates on a timely basis, or at all.

We cannot guarantee that clinical trials, including those associated with our anticipated pivotal Phase 3 clinical trial for CVT-301, will be conducted as planned or completed on schedule, if at all. A failure of one or more clinical trials can occur at any stage of testing. Events that may prevent successful or timely commencement, enrollment or completion of clinical development include:

| • | delays by us in reaching a consensus with regulatory agencies on trial design; |

| • | delays in reaching agreement on acceptable terms with prospective clinical research organizations, or CROs, and clinical trial sites; |

| • | delays in obtaining required Institutional Review Board, or IRB, approval at each clinical trial site; |

| • | delays in recruiting suitable patients to participate in clinical trials; |

| • | imposition of a clinical hold by regulatory agencies for any reason, including safety concerns or after an inspection of clinical operations or trial sites; |

| • | failure by CROs, other third parties or us to adhere to clinical trial requirements; |

| • | failure to perform in accordance with the FDA’s good clinical practices, or GCP, or applicable regulatory guidelines in other countries; |

| • | delays in the testing, validation, manufacturing and delivery of the inhaled therapeutic candidates to the clinical sites; |

| • | delays caused by patients not completing participation in a trial or not returning for post-treatment follow-up; |

| • | clinical trial sites or patients dropping out of a trial; |

| • | occurrence of serious adverse events, or AEs, in clinical trials that are associated with the inhaled therapeutic candidates that are viewed to outweigh its potential benefits; or |

| • | changes in regulatory requirements and guidance that require amending or submitting new clinical protocols. |

Delays, including delays caused by the above factors, can be costly and could negatively affect our ability to complete a clinical trial. If we are not able to successfully complete clinical trials, we will not be able to obtain regulatory approval and will not be able to commercialize our inhaled therapeutic candidates.

Clinical development, regulatory review and approval of the FDA and comparable foreign authorities are lengthy, time consuming, and inherently unpredictable. If we are ultimately unable to obtain regulatory approval for our product candidates, our business will be substantially harmed.

Our inhaled therapeutic candidates will be subject to extensive governmental regulations relating to, among other things, development, clinical trials, manufacturing and commercialization. In order to obtain regulatory approval for the commercial sale of any inhaled therapeutic candidates, we must demonstrate through extensive preclinical studies and clinical trials that the inhaled therapeutic candidate is safe and effective for use in each target indication.

The time required to obtain approval by the FDA and comparable foreign authorities is unpredictable, typically takes many years following the commencement of clinical trials, and depends upon numerous factors. In addition, approval policies, regulations, or the type and amount of clinical data necessary to gain approval may change during the course of a product candidate’s clinical development and may vary among jurisdictions, which may cause delays in the approval or the decision not to approve an application. We have not obtained regulatory approval for any product candidate, and it is possible that none of our existing product candidates or any product candidates we may seek to develop in the future will ever obtain regulatory approval. In addition, we may gain regulatory approval for

11

Table of Contents

CVT-301 or any other inhaled therapeutic candidate in some but not all of the territories available or some but not all of the target indications, resulting in limited commercial opportunity for the approved inhaled therapeutics.

Applications for our product candidates could be delayed or could fail to receive regulatory approval for many reasons, including but not limited to the following:

| • | the FDA or comparable foreign regulatory authorities may disagree with the design or implementation of our clinical trials; |

| • | the population studied in the clinical program may not be sufficiently broad or representative to assure safety in the full population for which we seek approval; |

| • | the FDA or comparable foreign regulatory authorities may disagree with our interpretation of data from nonclinical studies or clinical trials; |

| • | the data collected from clinical trials of our product candidates may not be sufficient to support the submission of a new drug application, or NDA, or biologics license application or other submission or to obtain regulatory approval in the United States or elsewhere; |

| • | the FDA may determine that we cannot rely on Section 505(b)(2) for any of our product candidates, in which case we may be required to conduct additional clinical trials, provide additional data and information and meet additional standards for product approval, resulting in increased time and financial resources required to obtain FDA approval for our product candidates; |

| • | the FDA may determine that we have identified the wrong Reference Listed Drug, or RLD, or RLDs or that approval of a Section 505(b)(2) application for any of our product candidates is blocked by patent or non-patent exclusivity of the RLD or RLDs; |

| • | the FDA may require us to conduct additional clinical trials depending on the safety data from our planned future clinical trials, including our planned pivotal Phase 3 clinical trial for CVT-301; |

| • | we may be unable to demonstrate to the FDA or comparable foreign regulatory authorities that a product candidate’s risk-benefit ratio for its proposed indication is acceptable; |

| • | the FDA or comparable foreign regulatory authorities may fail to approve the manufacturing processes, test procedures and specifications, or facilities of third-party manufacturers with which we contract for clinical and commercial supplies; |

| • | we or any third-party service providers may be unable to demonstrate compliance with GMP to the satisfaction of the FDA or comparable foreign regulatory authorities which could result in delays in regulatory approval or require us to withdraw or recall products and interrupt commercial supply of our products; and |

| • | the approval policies or regulations of the FDA or comparable foreign regulatory authorities may significantly change in a manner rendering our clinical data insufficient for approval. |

This lengthy approval process, as well as the unpredictability of the results of clinical trials, may result in our failing to obtain regulatory approval to market any of our product candidates, which would significantly harm our business, results of operations, and prospects.

We currently have only one inhaled therapeutic candidate, CVT-301, in clinical trials and are substantially dependent on this single product candidate. A failure of this product candidate in clinical development would adversely affect our business and may require us to discontinue development of other inhaled therapeutic candidates based on the same technology.

CVT-301 is our only clinical-stage development product candidate. While we have certain pre-clinical programs in development and intend to develop other product candidates, it will take several years and substantial additional investment for such programs to reach the same stage of development as CVT-301. If we were required to discontinue development of CVT-301 or if CVT-301 does not receive regulatory approval or fails to achieve

12

Table of Contents

sufficient market acceptance, we would be delayed by many years in our ability to achieve profitability, if ever. In addition, since we anticipate that all of our inhaled therapeutic candidates will be based on the same ARCUS technology, if CVT-301 fails in development as a result of any underlying problem with the ARCUS technology, then we may be required to discontinue development of all inhaled therapeutic candidates that are based on the same technology. In such event, our business will be adversely affected.

If we fail to obtain regulatory approval in jurisdictions outside the United States, we will not be able to market our products in those jurisdictions.

We intend to market our inhaled therapeutic candidates, including CVT-301, if approved, in international markets either directly or through partnerships. Such marketing will require separate regulatory approvals in each market and compliance with numerous and varying regulatory requirements. The approval procedures vary from country to country and may require additional testing that we are not required to perform to obtain regulatory approval in the United States. Moreover, the time required to obtain approval may differ from that required to obtain FDA approval. In addition, in many countries outside the United States, an inhaled therapeutic must be approved for reimbursement before it can be approved for sale in that country. Approval by the FDA does not ensure approval by regulatory authorities in other countries or jurisdictions, and approval by one foreign regulatory authority does not ensure approval by regulatory authorities in other foreign countries or by the FDA. The foreign regulatory approval process may include all of the risks associated with obtaining FDA approval. We may not obtain foreign regulatory approvals on a timely basis, if at all. We may not be able to file for regulatory approvals and may not receive necessary approvals to commercialize our products in any market. If we or any future partner are unable to obtain regulatory approval for CVT-301 in one or more significant foreign jurisdictions, then the commercial opportunity for CVT-301, and our financial condition, will be adversely affected.

Even if we receive regulatory approval for our inhaled therapeutic candidates, such products will be subject to ongoing regulatory review, which may result in significant additional expense. Additionally, our inhaled therapeutic candidates, if approved, could be subject to labeling and other restrictions, and we may be subject to penalties if we fail to comply with regulatory requirements or experience unanticipated problems with our products.

Any regulatory approvals that we receive for our inhaled therapeutic candidates may also be subject to limitations on the approved indicated uses for which the product may be marketed or to conditions of approval, or contain requirements for potentially costly post-marketing testing, including Phase 4 clinical trials, and surveillance to monitor safety and efficacy. In addition, if the FDA approves any of our inhaled therapeutic candidates, the manufacturing processes, labeling, packaging, distribution, AE reporting, storage, advertising, promotion and recordkeeping for the product will be subject to extensive and ongoing regulatory requirements. These requirements include submissions of safety and other post-marketing information and reports, registration, as well as continued compliance with current good manufacturing practice and GCP, for any clinical trials that we conduct post-approval.

Later discovery of previously unknown problems with an approved inhaled therapeutic, including AEs of unanticipated severity or frequency, or with manufacturing operations or processes, or failure to comply with regulatory requirements, may result in, among other things:

| • | restrictions on the marketing or manufacturing of the product, withdrawal of the product from the market, or voluntary or mandatory product recalls; |

| • | fines, warning letters, or holds on clinical trials; |

| • | refusal by the FDA to approve pending applications or supplements to approved applications filed by us, or suspension or revocation of product license approvals; |

| • | product seizure or detention, or refusal to permit the import or export of products; and |

| • | injunctions or the imposition of civil or criminal penalties. |

13

Table of Contents

The FDA’s policies may change and additional government regulations may be enacted that could prevent, limit or delay regulatory approval of our inhaled therapeutic candidates. We cannot predict the likelihood, nature or extent of government regulation that may arise from future legislation or administrative action, either in the United States or abroad. If we are slow or unable to adapt to changes in existing requirements or the adoption of new requirements or policies, or not able to maintain regulatory compliance, we may lose any marketing approval that may have been obtained and we may not achieve or sustain profitability, which would adversely affect our business.

Our inhaled therapeutics may cause undesirable side effects or have other properties that delay or prevent their regulatory approval or limit their commercial potential.

Undesirable side effects caused by our inhaled therapeutics could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in the denial of regulatory approval by the FDA or other regulatory authorities and potential product liability claims. Serious AEs deemed to be caused by our inhaled therapeutics could have a material adverse effect on the development of our inhaled therapeutic candidates and our business as a whole. The most common AEs to date in the clinical trials evaluating the safety and efficacy of CVT-301 have been dizziness and headache, which were observed with similar frequency in CVT-301 and placebo treated patients, and cough, which was observed infrequently. Our understanding of the relationship between CVT-301 and these events may change as we gather more information, and additional unexpected AEs may occur. In addition, although L-dopa has been in use for over 40 years, the long-term impact of using L-dopa as an inhaled therapeutic is not well understood.

If we or others identify undesirable side effects caused by our inhaled therapeutic candidates either before or after receipt of marketing approval, a number of potentially significant negative consequences could result, including:

| • | our clinical trials may be put on hold; |

| • | we may be unable to obtain regulatory approval for our inhaled therapeutic candidates; |

| • | regulatory authorities may withdraw approvals of our inhaled therapeutic candidates; |

| • | regulatory authorities may require additional warnings on the label; |

| • | a medication guide outlining the risks of such side effects for distribution to patients may be required; |

| • | we could be sued and held liable for harm caused to patients; and |

| • | our reputation may suffer. |

Any of these events could prevent us from achieving or maintaining market acceptance of our inhaled therapeutics and could substantially increase commercialization costs.

Risks related to our manufacturing facility and our reliance on third parties

We have limited experience manufacturing our inhaled therapeutic candidates at a commercial scale. We may not be able to manufacture our inhaled therapeutic candidates in quantities sufficient for commercial launch of our product candidates, if our product candidates are approved, or for any future commercial demand for our product candidates.

Although we have manufactured clinical quantities of CVT-301 in our manufacturing facility and relatively large clinical quantities of other products have been manufactured in our facility, we have only limited experience in manufacturing commercial quantities of our product candidates. If CVT-301 is approved for commercialization and marketing, we may be required to manufacture the product in large quantities to meet demand. Producing product in commercial quantities requires developing and adhering to complex manufacturing processes that are different from the manufacture of a product in smaller quantities for clinical

14

Table of Contents

trials, including adherence to regulatory standards. Although we believe that we have developed processes and protocols that will enable us to manufacture commercial-scale quantities of product at acceptable costs, we cannot provide assurance that such processes and protocols will enable us to manufacture CVT-301 in quantities that may be required for commercialization of the product with yields and at costs that will be commercially attractive. If we are unable to establish or maintain commercial manufacture of the product or are unable to do so at costs that we currently anticipate, our business will be adversely affected.

If we are unable to use our manufacturing facility for any reason, we would be unable to manufacture clinical supply and, if approved, commercial quantities of our inhaled therapeutic candidates for a substantial amount of time, which would harm our business.

We currently manufacture all clinical supply of CVT-301 at our own manufacturing facility that we have subleased under an operating lease that expires December 31, 2015, which we may extend for two five-year terms. Other than in connection with the option described below, this is a non-cancelable lease. Under an Asset Purchase and License Agreement with Alkermes, or the Alkermes Agreement, we have the option to purchase the current commercial-scale manufacturing equipment from Alkermes for $30.0 million upon the earlier of (i) the assignment of the Alkermes Agreement to an acquiror of us, (ii) a certain number of years after the manufacture of an ARCUS product intended for sale by us or an affiliate or (iii) the manufacture of an ARCUS product intended for sale by a collaboration partner. In the event we do not exercise the option, Alkermes has the right to terminate our sublease with them. We intend to manufacture all commercial supplies of CVT-301, if approved for commercial sale, as well as supplies of all additional inhaled therapeutic candidates that we may develop, in our manufacturing facility. If we were to lose the use of our facility or equipment, our manufacturing facility and manufacturing equipment would be difficult to replace and could require substantial replacement lead-time and substantial additional funds. Our facility may be affected by natural disasters, such as floods or fire, or we may lose the use of our facility due to manufacturing issues that arise at our facility, such as contamination or regulatory concerns following a regulatory inspection of our facility. We do not currently have back-up capacity and there is only limited third-party manufacturing capacity that would be available to manufacture our products. In the event of a loss of the use of all or a portion of our facility or equipment for the reasons stated above or any other reason, we would be unable to manufacture any of our inhaled therapeutic candidates until such time as our facility could be repaired, rebuilt or we are able to address other manufacturing issues at our facility. Although we currently maintain global property insurance with personal property limits of $20.0 million and business interruption insurance coverage of $8.5 million for damage to our property and the disruption of our business from fire and other casualties, such insurance may not cover all occurrences of manufacturing disruption or be sufficient to cover all of our potential losses in the event of occurrences that are covered and may not continue to be available to us on acceptable terms, or at all.

We intend to rely on third-party manufacturers to make the inhaler and to supply the active pharmaceutical ingredient in CVT-301, and any failure by a third-party manufacturer or supplier may delay or impair our ability to complete clinical trials or commercialize CVT-301.

We have manufactured the capsules containing formulized L-dopa for our preclinical studies, Phase 1 clinical trials and Phase 2 clinical trials of CVT-301 in our own manufacturing facility and expect to continue to do so for our pivotal Phase 3 clinical trial. We have relied, and we expect to continue to rely, on third-party plastic molding manufacturers for production of our inhalers and third-party suppliers of L-dopa, the active pharmaceutical ingredient in CVT-301. Our reliance on third parties for the manufacture of inhalers increases the risk that we will not have sufficient quantities of our inhalers or will not be able to obtain such quantities at an acceptable cost or quality, which could delay, prevent or impair our development or commercialization efforts. We have recently ordered enough inhalers to complete our pivotal Phase 3 clinical trial. If our third-party plastic molding manufacturer fails to supply the inhalers and we need to enter into alternative arrangements with a different supplier, it could delay our product development activities, as we would have to revalidate the molding and assembly processes pursuant to FDA requirements. If this failure of supply were to occur after we received approval for and commenced commercialization of CVT-301, we might be unable to meet the demand for this product and our business could be adversely affected. In addition, because we do not have any control over the

15

Table of Contents

process or timing of the supply of the active pharmaceutical ingredient, there is greater risk that we will not have sufficient quantities of the active pharmaceutical ingredient at an acceptable cost or quality, which could delay, prevent or impair our development or commercialization efforts.

Our third-party manufacturers and suppliers may be subject to FDA inspection from time to time. Failure by our third-party manufacturers to pass such inspections and otherwise satisfactorily complete the FDA approval regimen with respect to our product candidates may result in regulatory actions such as the issuance of FDA Form 483 notices of observations, warning letters or injunctions or the loss of operating licenses. Based on the severity of the regulatory action, our clinical or commercial supply of plastic molds and other services could be interrupted or limited, which could have a material adverse effect on our business.

We rely on third parties to conduct preclinical studies and clinical trials for CVT-301, and if they do not properly and successfully perform their obligations to us, we may not be able to obtain regulatory approvals for CVT-301 or any other inhaled therapeutic candidates that we may develop in the future.

We have designed the clinical trials for CVT-301 and intend to do so for any future unpartnered inhaled therapeutic candidates that we may develop. However, we rely on CROs and other third parties to assist in managing, monitoring and otherwise carrying out many of these trials. We compete with many other companies for the resources of these third parties. The third parties on whom we rely generally may terminate their engagements at any time, and having to enter into alternative arrangements would delay development and commercialization of our inhaled therapeutic candidates.

The FDA and comparable foreign regulatory authorities require compliance with regulations and standards, including GCP, for designing, conducting, monitoring, recording, analyzing, and reporting the results of clinical trials to assure that the data and results are credible and accurate and that the rights, integrity and confidentiality of trial participants are protected. Although we rely on third parties to conduct many of our clinical trials, they are not our employees, and we are responsible for ensuring that each of these clinical trials is conducted in accordance with its general investigational plan, protocol and other requirements. Our reliance on these third parties for research and development activities will reduce our control over these activities but will not relieve us of our responsibilities.

If these third parties do not successfully carry out their duties under their agreements, if the quality or accuracy of the data they obtain is compromised due to their failure to adhere to clinical trial protocols or to regulatory requirements, or if they otherwise fail to comply with clinical trial protocols or meet expected deadlines, the clinical trials of our inhaled therapeutic candidates may not meet regulatory requirements. If clinical trials do not meet regulatory requirements or if these third parties need to be replaced, preclinical development activities or clinical trials may be extended, delayed, suspended or terminated. If any of these events occur, we may not be able to obtain regulatory approval of our inhaled therapeutic candidates on a timely basis or at all.

We may not be successful in establishing and maintaining strategic partnerships, which could adversely affect our ability to develop and commercialize products, negatively impacting our operating results.

We continue to strategically evaluate and, as deemed appropriate, we expect to enter into partnerships in the future when strategically attractive, including potentially with major biotechnology or pharmaceutical companies. In particular, we may enter into one or more partnerships for the development and commercialization of CVT-301 in Europe or other countries outside of the United States. We face significant competition in seeking appropriate partners for our inhaled therapeutic candidates, and the negotiation process is time-consuming and complex. In order for us to successfully partner our inhaled therapeutic candidates, potential partners must view these inhaled therapeutic candidates as economically valuable in markets they determine to be attractive in light of the terms that we are seeking and other available products for licensing by other companies. Even if we are successful in our efforts to establish strategic partnerships, the terms that we agree upon may not be favorable to us, and we may not be able to maintain such strategic partnerships if, for example, development or approval of an

16

Table of Contents

inhaled therapeutic is delayed or sales of an approved product are disappointing. Any delay in entering into strategic partnership agreements related to our inhaled therapeutic candidates could delay the development and commercialization of such candidates and reduce their competitiveness even if they reach the market.

If we fail to establish and maintain strategic partnerships related to our inhaled therapeutic candidates, we will bear all of the risk and costs related to the development of any such inhaled therapeutic candidate, and we may need to seek additional financing, hire additional employees and otherwise develop expertise, such as regulatory expertise, for which we have not budgeted. This could negatively affect the development of any unpartnered inhaled therapeutic candidate.

Risks related to commercialization of our inhaled therapeutic candidates

Our future commercial success depends upon attaining significant market acceptance of our inhaled therapeutic candidates, if approved, among physicians, patients and health care payors.

Even if we obtain regulatory approval for CVT-301 or any other inhaled therapeutics that we may develop or acquire in the future, the product candidate may not gain market acceptance among physicians, health care payors, patients and the medical community. Market acceptance of any approved products depends on a number of factors, including:

| • | the efficacy and safety of the product, as demonstrated in clinical trials; |

| • | the indications for which the product is approved and the label approved by regulatory authorities for use with the product, including any warnings that may be required on the label; |

| • | acceptance by physicians and patients of the product as a safe and effective treatment; |

| • | the cost, safety and efficacy of treatment in relation to alternative treatments; |

| • | the availability of adequate reimbursement and pricing by third-party payors and government authorities; |

| • | relative convenience and ease of administration; |

| • | the prevalence and severity of adverse side effects; and |

| • | the effectiveness of our sales and marketing efforts. |

Market acceptance is critical to our ability to generate significant revenue and become profitable. Any therapeutic candidate, if approved and commercialized, may be accepted in only limited capacities or not at all. If any approved products are not accepted by the market to the extent that we expect, we may not be able to generate significant revenue and our business would suffer.

The market for our product candidate may not be as large as we expect.

Our estimates of the potential market opportunity for CVT-301 include several key assumptions based on our industry knowledge, industry publications, third-party research reports and other surveys. These assumptions include the prevalence and growth of PD, the percentage of patients receiving L-dopa as part of their treatment regimen and the percentage of these patients experiencing OFF episodes. While we believe that our internal assumptions are reasonable, if any of these assumptions proves to be inaccurate, then the actual market for CVT-301 could be smaller than our estimates of our potential market opportunity. If the actual market for CVT-301 is smaller than we expect, our product revenue may be limited and it may be more difficult for us to achieve or maintain profitability.

In addition, we anticipate that the label may include certain limitations on the patients and uses of CVT-301. For example, CVT-301 may not be appropriate for use by patients with pre-existing conditions that restrict the use of inhaled therapeutics, such as asthmatics and smokers. Further, we are not developing and testing CVT-301

17

Table of Contents

to address OFF episodes upon waking, also known as early morning OFFs, and may not do so. If we do not develop CVT-301 to address these early morning OFFs, we may not receive approval to market CVT-301 for these early morning OFFs. As a result, even if we attain market acceptance among physicians, health care payors, patients and the medical community for approved uses of CVT-301, we would not be able to market or promote this product candidate for early morning OFFs and may not generate any revenue from sales of CVT-301 to address early morning OFFs.

If we are unable to establish sales, marketing and distribution capabilities, we may not be successful in commercializing our product candidates if and when they are approved.

We do not have a sales or marketing infrastructure and have no experience in the sale, marketing or distribution of products. To achieve commercial success for any product for which we have obtained marketing approval, we will need to establish a sales and marketing organization.