Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EMC INSURANCE GROUP INC | kbwconferencepresentation9.htm |

1 Keefe, Bruyette, and Woods 2014 Insurance Conference Bruce Kelley President and Chief Executive Officer Mark Reese Senior Vice President and Chief Financial Officer September 4, 2014

2 Cautionary Note Regarding Forward-Looking Statements The Private Securities Litigation Reform Act of 1995 provides issuers the opportunity to make cautionary statements regarding forward-looking statements. Accordingly, any forward-looking statement contained in this presentation is based on management’s current beliefs, assumptions and expectations of the Company’s future performance, taking into account all information currently available to management. These beliefs, assumptions and expectations can change as the result of many possible events or factors, not all of which are known to management. If a change occurs, the Company’s business, financial condition, liquidity, results of operations, plans and objectives may vary materially from those expressed in the forward-looking statements. The risks and uncertainties that may affect the actual results of the Company include, but are not limited to, the following: • catastrophic events and the occurrence of significant severe weather conditions; • the adequacy of loss and settlement expense reserves; • state and federal legislation and regulations; • changes in the property and casualty insurance industry, interest rates or the performance of financial markets and the general economy; • rating agency actions; • “other-than-temporary” investment impairment losses; and • other risks and uncertainties inherent to the Company’s business, including those discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K. Management intends to identify forward-looking statements when using the words “believe,” “expect,” “anticipate,” “estimate,” “project,” or similar expressions. Undue reliance should not be placed on these forward-looking statements. The Company disclaims any obligation to update such statements or to announce publicly the results of any revisions that it may make to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

3 Key Reasons to Invest in EMCI Access to a large capital base and a diversified and seasoned book of business Regional, decentralized operating structure (Midwest focus) Strong organic growth in existing markets Proven ability to deliver attractive returns to shareholders: Compound annual total shareholder return of 5.9 percent over the past 10 years and 10.5 percent over the past 20 years* Dividend yield of 3.0 percent as of 6/30/2014 Conservative balance sheet Experienced senior management * Source: Bloomberg as of 6/30/2014

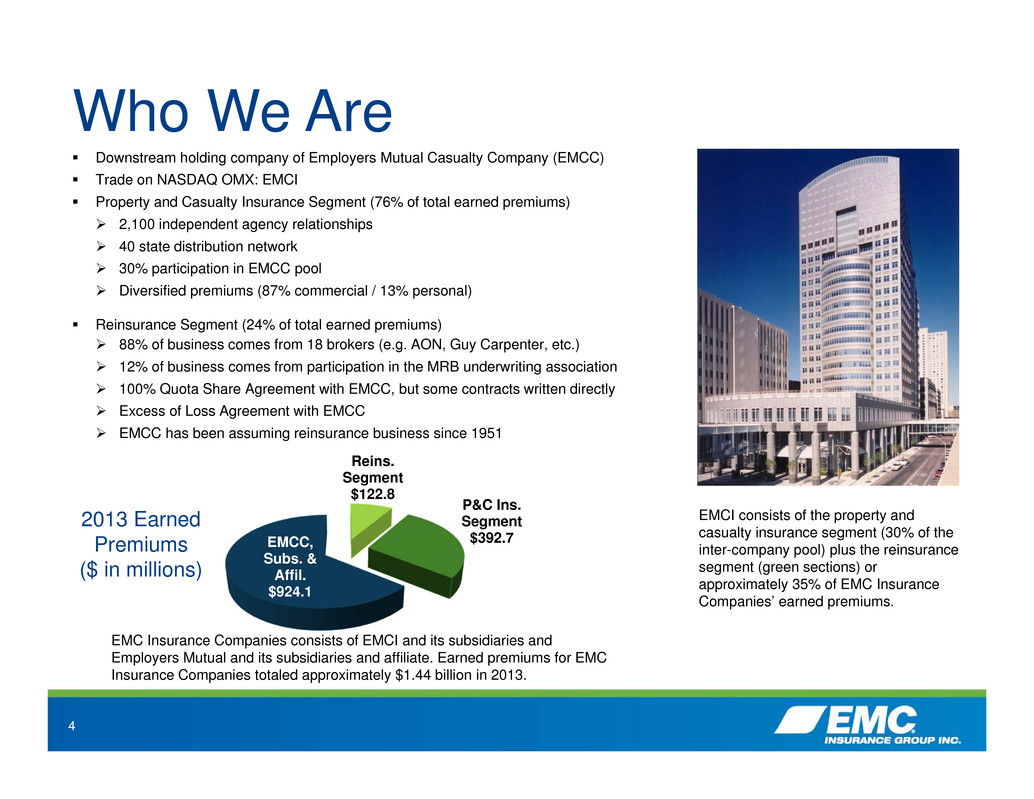

4 Reins. Segment $122.8 P&C Ins. Segment $392.7 EMCC, Subs. & Affil. $924.1 Who We Are Downstream holding company of Employers Mutual Casualty Company (EMCC) Trade on NASDAQ OMX: EMCI Property and Casualty Insurance Segment (76% of total earned premiums) 2,100 independent agency relationships 40 state distribution network 30% participation in EMCC pool Diversified premiums (87% commercial / 13% personal) Reinsurance Segment (24% of total earned premiums) 88% of business comes from 18 brokers (e.g. AON, Guy Carpenter, etc.) 12% of business comes from participation in the MRB underwriting association 100% Quota Share Agreement with EMCC, but some contracts written directly Excess of Loss Agreement with EMCC EMCC has been assuming reinsurance business since 1951 EMCI consists of the property and casualty insurance segment (30% of the inter-company pool) plus the reinsurance segment (green sections) or approximately 35% of EMC Insurance Companies’ earned premiums. EMC Insurance Companies consists of EMCI and its subsidiaries and Employers Mutual and its subsidiaries and affiliate. Earned premiums for EMC Insurance Companies totaled approximately $1.44 billion in 2013. 2013 Earned Premiums ($ in millions)

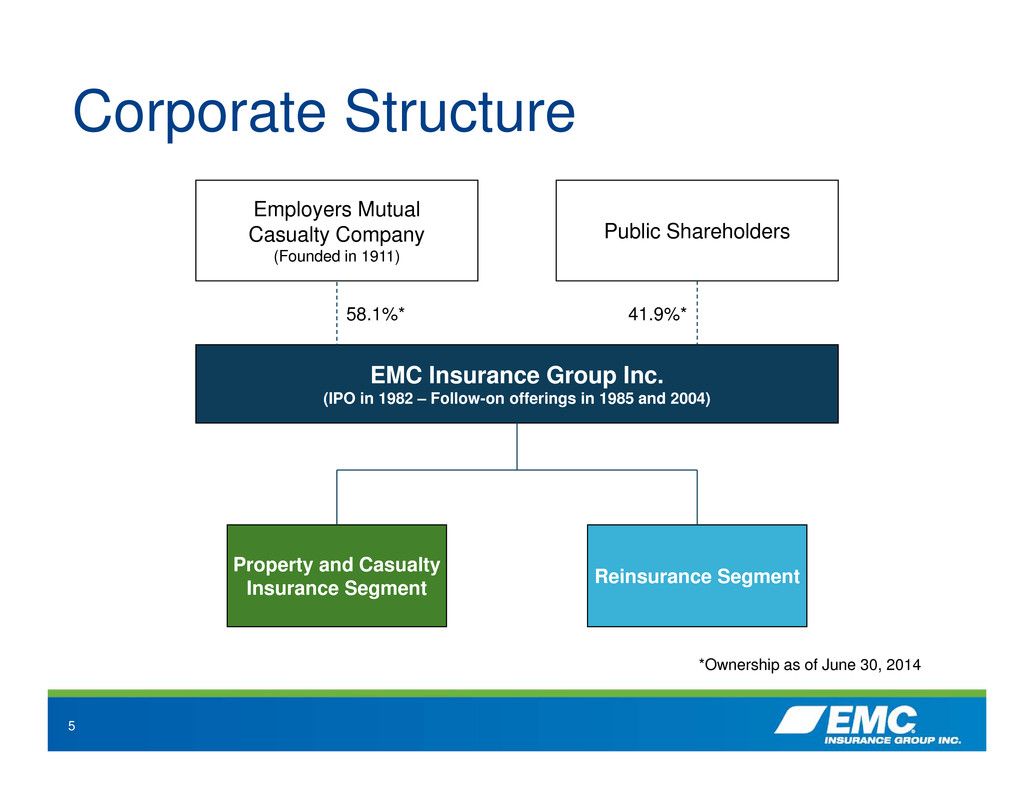

5 Corporate Structure Property and Casualty Insurance Segment Reinsurance Segment Employers Mutual Casualty Company (Founded in 1911) Public Shareholders EMC Insurance Group Inc. (IPO in 1982 – Follow-on offerings in 1985 and 2004) 58.1%* 41.9%* *Ownership as of June 30, 2014

6 Benefits of the Pooling Agreement Spread risk over a wide range of geographic locations, lines of insurance written, rate filings, commission plans and policy forms Benefit from capacity of the entire pool: $1.35 billion in net premiums written in 2013 $1.31 billion of statutory surplus as of 12/31/2013 “A” (Excellent) rating with stable outlook from A.M. Best Company Network of 2,100 insurance agencies in 40 state distribution network Merger and acquisition flexibility Economies of scale in operations and purchase of reinsurance

7 EMC Reinsurance Company’s 2014 Excess of Loss Agreement with EMCC Noteworthy items: Continuous coverage - no reinstatement premium after loss event No loss events in 2013 or through first six months of 2014 over $4 million retention amount Retention amount per event: First $4 million 20 percent of any losses between $4 million and $10 million 10 percent of any losses between $10 million and $50 million Cost of coverage: 8 percent of total assumed reinsurance premiums written

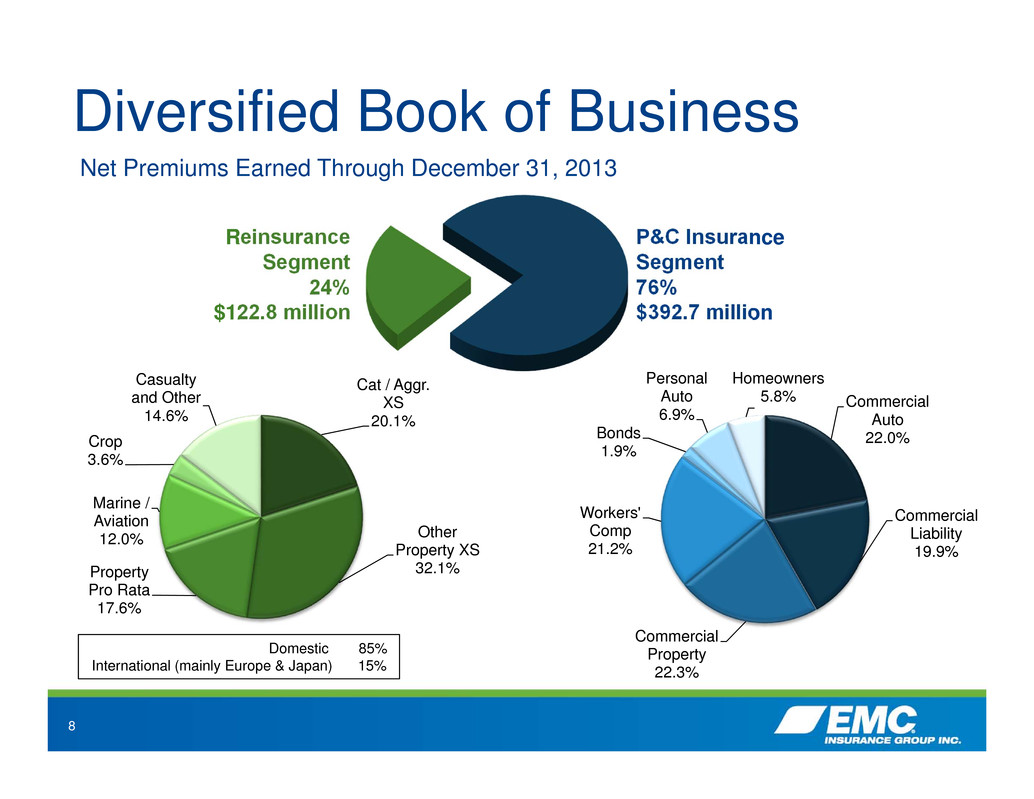

8 Reinsurance Segment 24% $122.8 million Diversified Book of Business Domestic 85% International (mainly Europe & Japan) 15% P&C Insurance Segment 76% $392.7 million Commercial Auto 22.0% Commercial Liability 19.9% Commercial Property 22.3% Workers' Comp 21.2% Bonds 1.9% Personal Auto 6.9% Homeowners 5.8% Cat / Aggr. XS 20.1% Other Property XS 32.1%Property Pro Rata 17.6% Marine / Aviation 12.0% Crop 3.6% Casualty and Other 14.6% Net Premiums Earned Through December 31, 2013

9 Local Service Focus Color coding indicates territories served by each branch, while each “dot” is an agency

10 Value of Local Market Presence Decentralized Decision Making/Guided Autonomy: Marketing Underwriting Risk Improvement Claims Strengthens agency relationships, get to quote best business generally resulting in a superior loss ratio Develop products, marketing strategies and pricing targeted to specific territories Individual approaches within EMC appetite and framework Retention levels that consistently stay in the mid to upper 80 percent range 85 percent at 6/30/2014

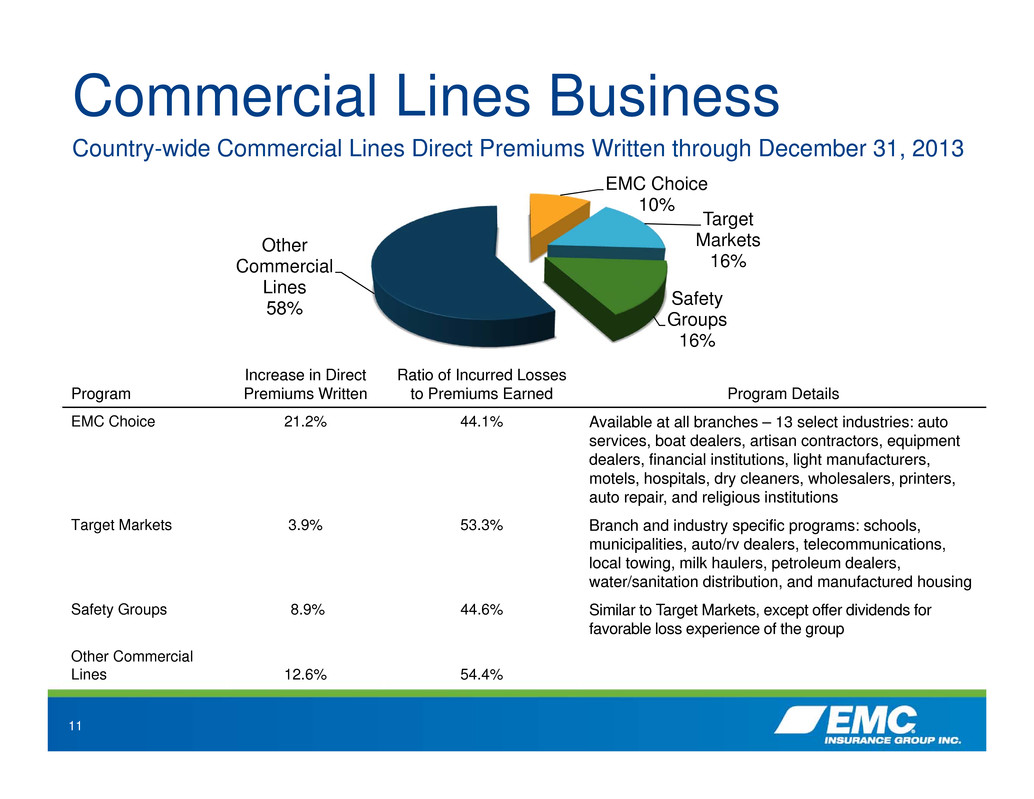

11 Commercial Lines Business Country-wide Commercial Lines Direct Premiums Written through December 31, 2013 EMC Choice 10% Target Markets 16% Safety Groups 16% Other Commercial Lines 58% Program Increase in Direct Premiums Written Ratio of Incurred Losses to Premiums Earned Program Details EMC Choice 21.2% 44.1% Available at all branches – 13 select industries: auto services, boat dealers, artisan contractors, equipment dealers, financial institutions, light manufacturers, motels, hospitals, dry cleaners, wholesalers, printers, auto repair, and religious institutions Target Markets 3.9% 53.3% Branch and industry specific programs: schools, municipalities, auto/rv dealers, telecommunications, local towing, milk haulers, petroleum dealers, water/sanitation distribution, and manufactured housing Safety Groups 8.9% 44.6% Similar to Target Markets, except offer dividends for favorable loss experience of the group Other Commercial Lines 12.6% 54.4%

12 Property and Casualty Insurance Segment up 7.5 percent Commercial Lines Rate level increases on renewal business Growth in insured exposures Increase in retained policies Personal Lines Intentional reduction in policy count to lessen exposure concentrations Reinsurance Segment up 8.9 percent Increase in a pro rata casualty account first written in 2013 Increase in offshore energy and liability proportional account Addition of some new business Growth in Premiums Earned Through June 30, 2014

13 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $550 2011 2012 2013 Reinsurance Segment P&C Insurance Segment Net Premiums Earned ( $ i n m i l l i o n s ) Growth in Premiums Earned $0 $50 $100 $150 $200 $250 $300 Six months ended June 30, 2013 Six months ended June 30, 2014 Reinsurance Segment P&C Insurance Segment Net Premiums Earned ( $ i n m i l l i o n s )

14 Powerful Rate Compare System Unique and powerful online system that rates current exposures of commercial renewal policies at current and prior period rates Provides a measure of the actual rate increase obtained by policy, account, underwriter, line of business or branch Ability to drill down on aggregate results to see details driving the numbers Used in performance management to achieve desired rate level increases Provides a tool to provide accountability for our branch offices and underwriters Near real-time measure of rate changes on renewal policies

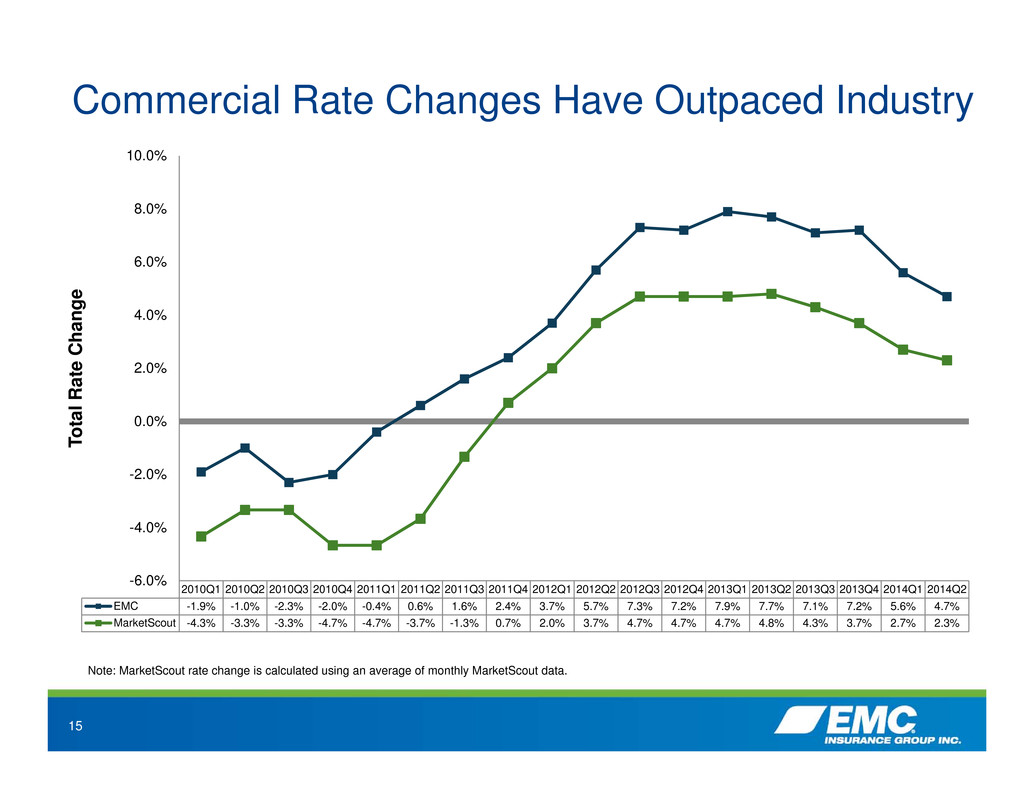

15 Commercial Rate Changes Have Outpaced Industry 2010Q1 2010Q2 2010Q3 2010Q4 2011Q1 2011Q2 2011Q3 2011Q4 2012Q1 2012Q2 2012Q3 2012Q4 2013Q1 2013Q2 2013Q3 2013Q4 2014Q1 2014Q2 EMC -1.9% -1.0% -2.3% -2.0% -0.4% 0.6% 1.6% 2.4% 3.7% 5.7% 7.3% 7.2% 7.9% 7.7% 7.1% 7.2% 5.6% 4.7% MarketScout -4.3% -3.3% -3.3% -4.7% -4.7% -3.7% -1.3% 0.7% 2.0% 3.7% 4.7% 4.7% 4.7% 4.8% 4.3% 3.7% 2.7% 2.3% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% T o t a l R a t e C h a n g e Note: MarketScout rate change is calculated using an average of monthly MarketScout data.

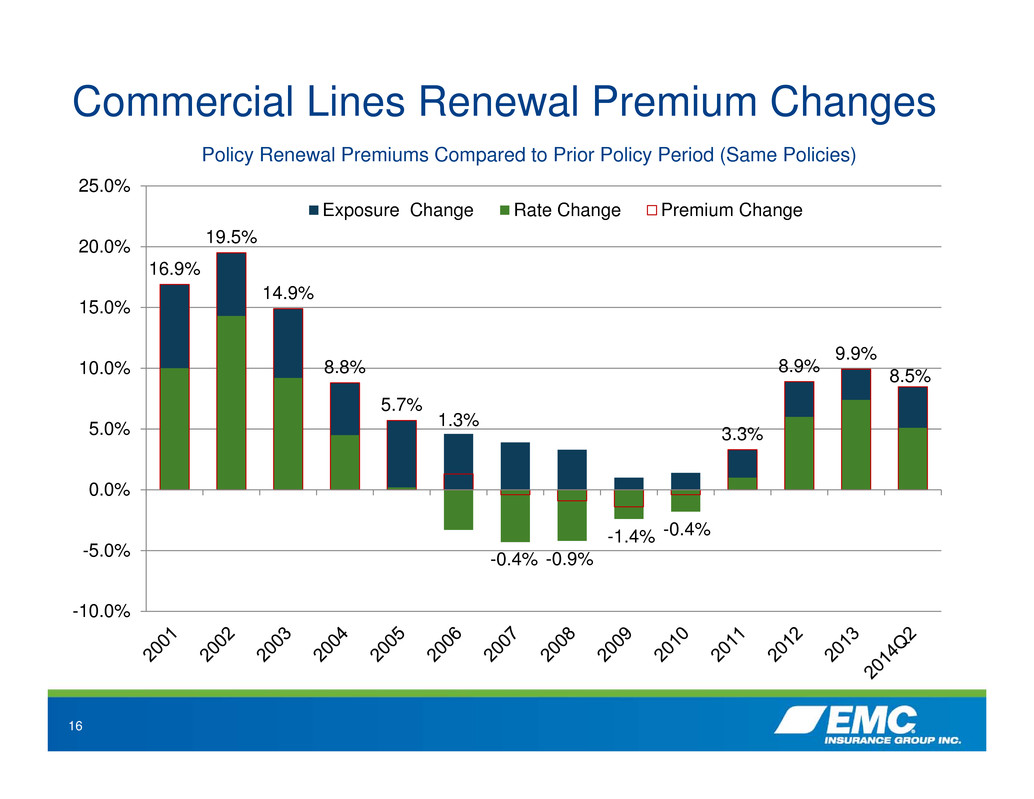

16 Commercial Lines Renewal Premium Changes 16.9% 19.5% 14.9% 8.8% 5.7% 1.3% -0.4% -0.9% -1.4% -0.4% 3.3% 8.9% 9.9% 8.5% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% Policy Renewal Premiums Compared to Prior Policy Period (Same Policies) Exposure Change Rate Change Premium Change

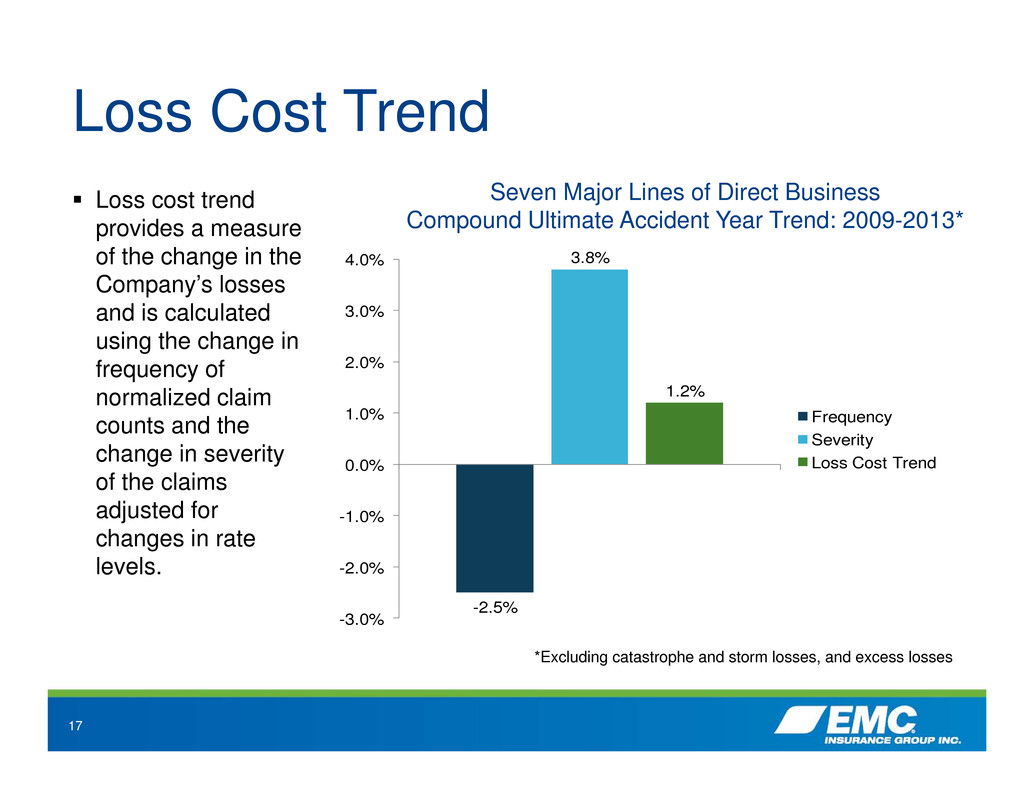

17 Loss Cost Trend *Excluding catastrophe and storm losses, and excess losses -2.5% 3.8% 1.2% -3.0% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% Frequency Severity Loss Cost Trend Seven Major Lines of Direct Business Compound Ultimate Accident Year Trend: 2009-2013* Loss cost trend provides a measure of the change in the Company’s losses and is calculated using the change in frequency of normalized claim counts and the change in severity of the claims adjusted for changes in rate levels.

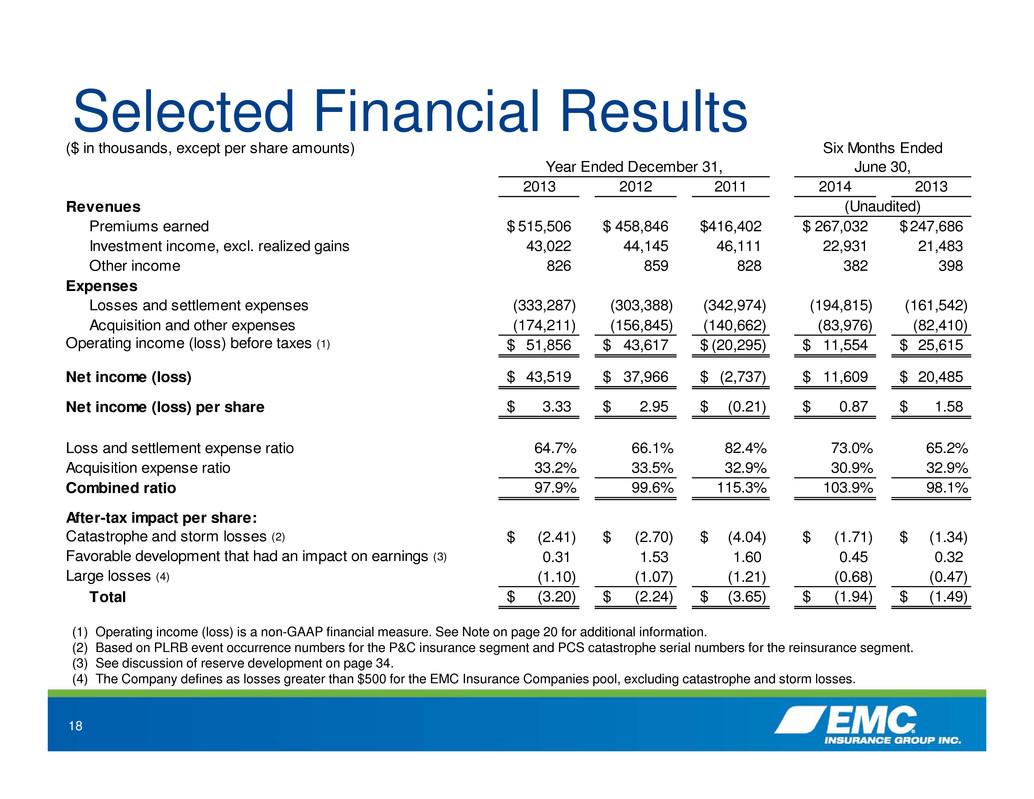

18 Selected Financial Results ($ in thousands, except per share amounts) 2013 2012 2011 2014 2013 Revenues Premiums earned 515,506$ 458,846$ 416,402$ 267,032$ 247,686$ Investment income, excl. realized gains 43,022 44,145 46,111 22,931 21,483 Other income 826 859 828 382 398 Expenses Losses and settlement expenses (333,287) (303,388) (342,974) (194,815) (161,542) Acquisition and other expenses (174,211) (156,845) (140,662) (83,976) (82,410) Operating income (loss) before taxes (1) 51,856$ 43,617$ (20,295)$ 11,554$ 25,615$ Net income (loss) 43,519$ 37,966$ (2,737)$ 11,609$ 20,485$ Net income (loss) per share 3.33$ 2.95$ (0.21)$ 0.87$ 1.58$ Loss and settlement expense ratio 64.7% 66.1% 82.4% 73.0% 65.2% Acquisition expense ratio 33.2% 33.5% 32.9% 30.9% 32.9% Combined ratio 97.9% 99.6% 115.3% 103.9% 98.1% After-tax impact per share: Catastrophe and storm losses (2) (2.41)$ (2.70)$ (4.04)$ (1.71)$ (1.34)$ Favorable development that had an impact on earnings (3) 0.31 1.53 1.60 0.45 0.32 Large losses (4) (1.10) (1.07) (1.21) (0.68) (0.47) Total (3.20)$ (2.24)$ (3.65)$ (1.94)$ (1.49)$ June 30, (Unaudited) Year Ended December 31, Six Months Ended (1) Operating income (loss) is a non-GAAP financial measure. See Note on page 20 for additional information. (2) Based on PLRB event occurrence numbers for the P&C insurance segment and PCS catastrophe serial numbers for the reinsurance segment. (3) See discussion of reserve development on page 34. (4) The Company defines as losses greater than $500 for the EMC Insurance Companies pool, excluding catastrophe and storm losses.

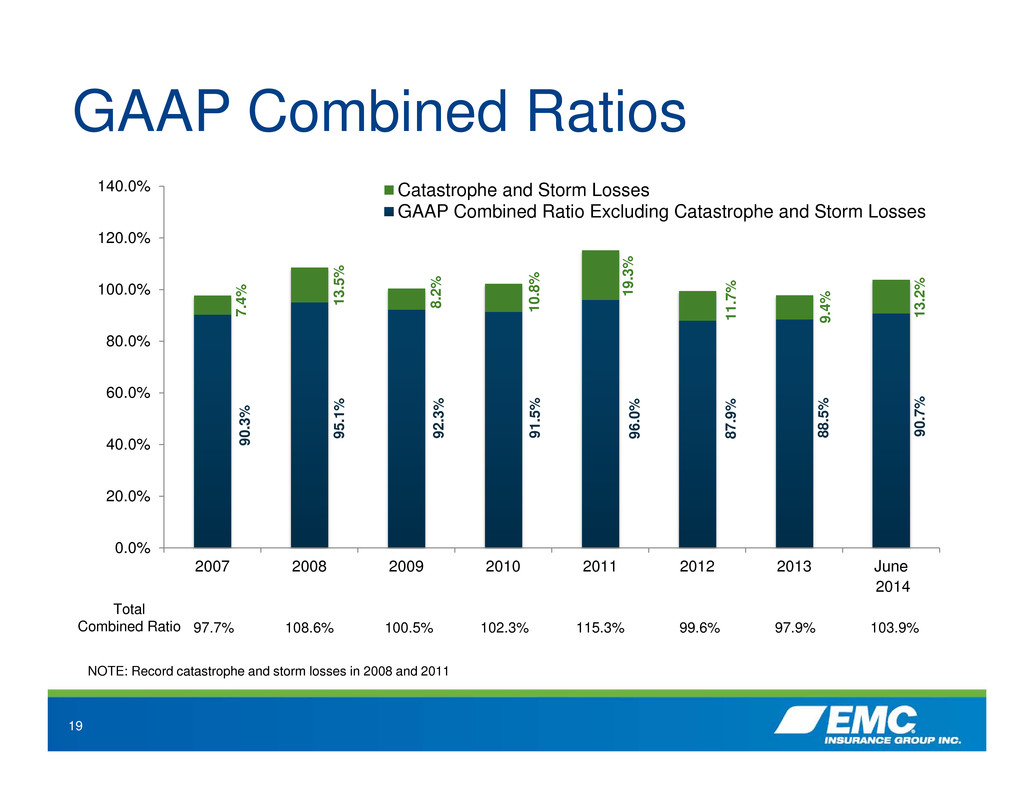

19 97.7% 108.6% 100.5% 102.3% 115.3% 99.6% 97.9% 103.9% GAAP Combined Ratios Total Combined Ratio NOTE: Record catastrophe and storm losses in 2008 and 2011 9 0 . 3 % 9 5 . 1 % 9 2 . 3 % 9 1 . 5 % 9 6 . 0 % 8 7 . 9 % 8 8 . 5 % 9 0 . 7 % 7 . 4 % 1 3 . 5 % 8 . 2 % 1 0 . 8 % 1 9 . 3 % 1 1 . 7 % 9 . 4 % 1 3 . 2 % 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 140.0% 2007 2008 2009 2010 2011 2012 2013 June Catastrophe and Storm Losses GAAP Combined Ratio Excluding Catastrophe and Storm Losses 2014

20 2014 Guidance NOTE: Operating income/loss is a non-GAAP financial measure, calculated by excluding net realized investment gains/losses from net income/loss. The Company’s calculation of operating income/loss may differ from similar measures used by other companies, so investors should exercise caution when comparing the Company’s measure of operating income/loss to the measure of other companies. Management’s projected operating income guidance is also considered a non-GAAP financial measure. Management believes operating income/loss is useful to investors because it illustrates the performance of our normal, ongoing operations, which is important in understanding and evaluating our financial condition and results of operations. While this measure is consistent with measures utilized by investors to evaluate performance, it is not a substitute for the GAAP financial measure of net income/loss. A reconciliation of the non-GAAP financial measure of operating income/loss to the GAAP financial measure of net income/loss is available on the Company’s website at www.emcins.com/ir in the Company’s news releases regarding quarterly financial results. Based on results for the first six months of 2014 and management’s expectations for the remainder of the year, management revised its 2014 operating income guidance from the previous range of $2.65 to $2.90 per share to a revised range of $2.00 to $2.25 per share. The revised guidance is based on a projected GAAP combined ratio of 101.0 percent for the year, and a mid-single digit increase in investment income. The projected GAAP combined ratio has a load of 11.2 percentage points for catastrophe and storm losses. Disclaimer: The 2014 earnings guidance was revised as of July 21, 2014, the date of EMCI’s pre-release of anticipated second quarter results. The Company will not update or comment on its previous earnings guidance until the Company provides an update in its third quarter earnings release or an update is dictated by the Company’s policy for issuing a pre-release of quarterly operating results.

21 Health Reimbursement Arrangement Effective January 1, 2015, Employers Mutual Casualty Company (Employers Mutual) will be replacing its retiree healthcare plan with a new Employers Mutual- funded Health Reimbursement Arrangement. Financial Impact: As of December 31, 2013, EMCI’s share of the plan’s projected benefit obligation declined $26.9 million. As a result, stockholders’ equity increased $17.5 million after tax. Substantial decline in the plan’s net periodic benefit cost beginning in 2014 Amortization of the prior service credit associated with the plan amendment, coupled with declines in both the service cost and interest cost components of net periodic benefit cost of the revised plan, will result in approximately $3.1 million of net periodic benefit income in 2014, compared to $3.0 million of expense in 2013. As the amortization of the prior service credit is reflected in net income, it will be reclassified out of accumulated other comprehensive income so that stockholders’ equity is not impacted.

22 Book Value Per Share Change in BV 15.1% -18.9% 22.6% 9.3% -2.5% 13.6% 10.1%* 5.4% * Approximately 4.2 percentage points ($1.32 per share) of the increase is attributable to a change in Employers Mutual Casualty Company’s retiree healthcare plan. See additional detail on slide 21. $25.83 $20.94 $25.67 $28.07 $27.37 $31.08 $34.21 $36.05 $22.72 $21.69 $24.45 $26.18 $25.25 $27.38 $29.78 $30.18 $- $15.00 $30.00 $45.00 2007 2008 2009 2010 2011 2012 2013 June Book Value Book Value excluding Accum. Other Comp. Income 2014

23 Strong Balance Sheet Investments $1.3 billion invested assets 81.0 percent fixed maturity securities (based on fair value) • 99.7 percent investment grade 10-yr average total rate of return on equity portfolio: 9.1 percent • 10-yr average S&P 500 total rate of return: 7.8 percent Loss and Settlement Expense Reserves Quarterly internal actuarial reviews Any necessary adjustments are made on a timely basis Debt Only debt is $25 million of surplus notes issued by the property and casualty insurance subsidiaries to Employers Mutual • Annual interest rate of 1.35 percent (effective 2/1/2013, adjusted every 5 years) June 30, 2014

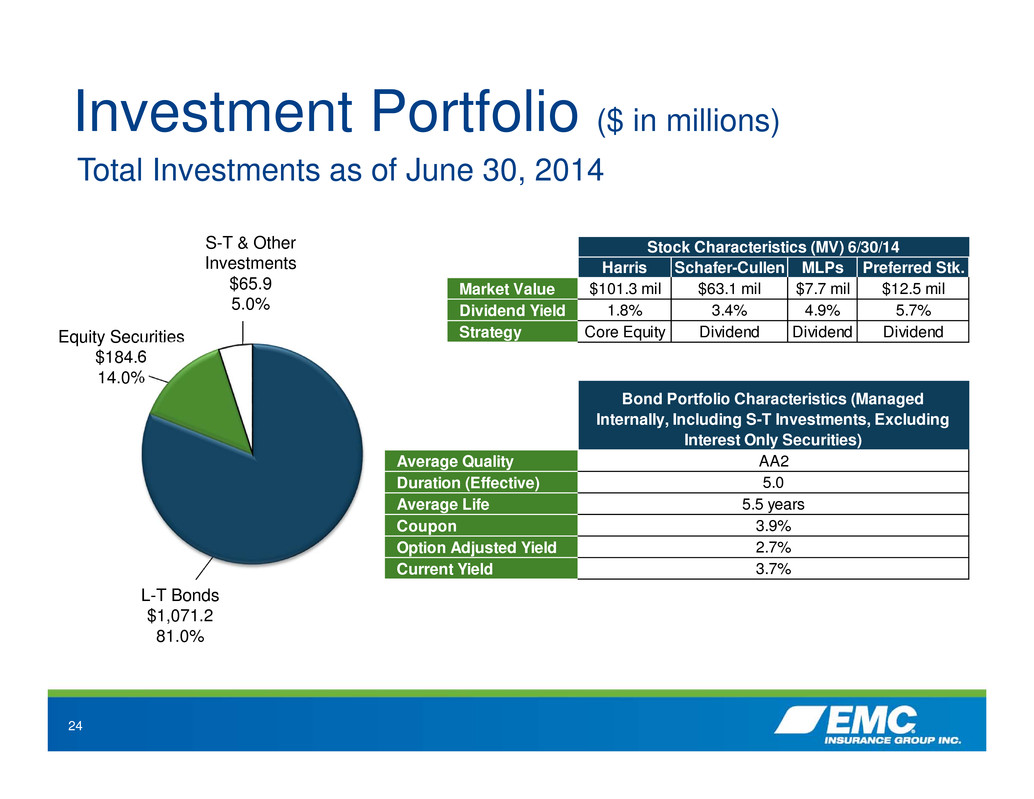

24 Investment Portfolio ($ in millions) Total Investments as of June 30, 2014 S-T & Other Investments $65.9 5.0% Equity Securities $184.6 14.0% L-T Bonds $1,071.2 81.0% Harris Schafer-Cullen MLPs Preferred Stk. Market Value $101.3 mil $63.1 mil $7.7 mil $12.5 mil Dividend Yield 1.8% 3.4% 4.9% 5.7% Strategy Core Equity Dividend Dividend Dividend 2.7% 3.7% Option Adjusted Yield Current Yield Average Quality Duration (Effective) Average Life Coupon 3.9% Stock Characteristics (MV) 6/30/14 Bond Portfolio Characteristics (Managed Internally, Including S-T Investments, Excluding Interest Only Securities) AA2 5.0 5.5 years

25 Investment Philosophy in Current Market Environment Low treasury rates and risk spreads near historical lows generally make fixed income securities a rich asset class Individual security selection provides opportunity for outperformance, more so than recent history Historically identified undervalued sectors and picked best securities – Now identifying undervalued securities within rich asset class Examples of recent purchases: Corporate bonds Tax-exempt municipals Agency debentures Prepayment protected interest-only strips

26 Action Taken to Help Protect Value of Equity Portfolio Hired outside manager to implement equity tail-risk hedging strategy during the first quarter of 2014 to help protect EMCI from significant monthly downside price volatility in the equity markets There is a cost associated with this protection, which is reflected in net realized investment gains/losses. Management views this cost similar to the cost of an insurance policy.

27 Capital Management Quarterly Dividend The Company has paid a quarterly dividend since its inception in 1982. The most recent quarterly dividend of $0.23 per share was declared on May 22, 2014. It was paid on June 10, 2014 to shareholders of record on June 3, 2014. EMCI Stock Repurchase Program In November 2011, EMCI’s Board authorized a new $15 million stock repurchase program upon the completion of the previous $25 million repurchase program. No stock has been repurchased under this program. EMCC Stock Purchase Program In May 2005, EMCC’s Board authorized a $15 million stock purchase program, which is 70 percent complete (dormant while EMCI’s program is in effect).

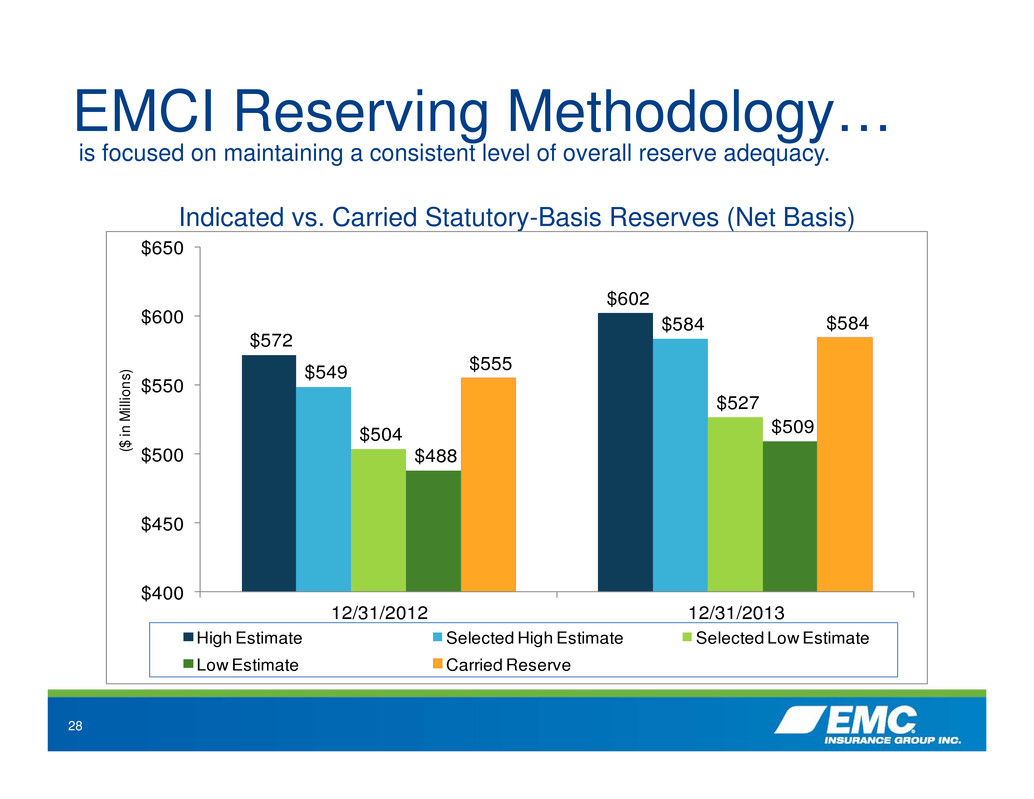

28 EMCI Reserving Methodology… Indicated vs. Carried Statutory-Basis Reserves (Net Basis) $572 $602 $549 $584 $504 $527 $488 $509 $555 $584 $400 $450 $500 $550 $600 $650 12/31/2012 12/31/2013 ( $ i n M i l l i o n s ) High Estimate Selected High Estimate Selected Low Estimate Low Estimate Carried Reserve is focused on maintaining a consistent level of overall reserve adequacy.

29 Reserving Methodology – Property and Casualty Insurance Segment1 Management does not use accident year loss picks to establish carried reserves The following reserves are established independently and added together to get the total loss and settlement expense reserve: Case loss reserves (including bulk case loss reserves) IBNR loss reserves Settlement expense reserves Bulk case loss reserves supplement the aggregate case loss reserves Used to establish the best estimate of liability for reported claims 1See presentation Appendix for additional information regarding the property and casualty insurance segment’s reserving methodology.

30 Investment Highlights Access to a large capital base and a diversified and seasoned book of business through participation in the EMCC pool Regional, decentralized operating structure (Midwest focus) Proven ability to deliver attractive returns to shareholders: Compound annual total shareholder return of 5.9 percent over the past 10 years and 10.5 percent over the past 20 years* Dividend yield of 3.0 percent as of 6/30/2014 Conservative investment philosophy Experienced senior management * Source: Bloomberg as of 6/30/2014

31 Appendix 31

32 Award-Winning Workplace No. 115 Top Workplace in U.S. 26th of 40 Best Companies for LeadersNo. 5 Top Workplace in Iowa Forbes 100 Most Trustworthy Companies Chief Executive BEST COMPANIES FOR LEADERS 2014

33 Property and Casualty Insurance Segment’s Reserving Methodology The Company’s reserving methodology is focused on maintaining a consistent level of overall reserve adequacy. Management does not use accident year loss picks to establish the property and casualty insurance segment’s carried reserves. Case loss and IBNR loss reserves, as well as settlement expense reserves, are established independently of each other and added together to get the total loss and settlement expense reserve. The property and casualty insurance segment’s reserving methodology also includes bulk case loss reserves, which supplement the aggregate case loss reserves and are used by management to establish its best estimate of liability for reported claims. There is an inherent amount of uncertainty involved in the establishment of insurance liabilities. This uncertainty is greatest in the current and more recent accident years because a smaller percentage of the expected ultimate claims have been reported, adjusted and settled compared to more mature accident years. For this reason, carried reserves for these accident years reflect prudently conservative assumptions. As the carried reserves for these accident years run off, the overall expectation is that, more often than not, favorable development will occur. However, there is also the possibility that the ultimate settlement of liabilities associated with these accident years will show adverse development, and such adverse development could be substantial. The property and casualty insurance segment’s bulk reserves (formula IBNR loss reserve, bulk case loss reserve and settlement expense reserve) are initially established for all accident years combined, and are then allocated to the various accident years for financial reporting purposes. It is important to note that development on prior years’ reserves resulting solely from changes in the allocation of bulk reserves between the current and prior accident years does not have an impact on earnings. This is due to the fact that such development is simply a mathematical by-product of the mechanical process used to reallocate bulk reserves to the various accident years for financial reporting purposes. Earnings are only impacted by changes in the total amount of carried reserves. For the reasons noted above, development amounts reported on prior accident years’ reserves are less meaningful under the Company’s reserving methodology than reserving methodologies used by other companies. Accordingly, from management’s perspective, whether the Company has maintained a consistent level of overall reserve adequacy is more relevant to understanding the Company’s results of operations than the composition of the underwriting results between the current and prior accident years.

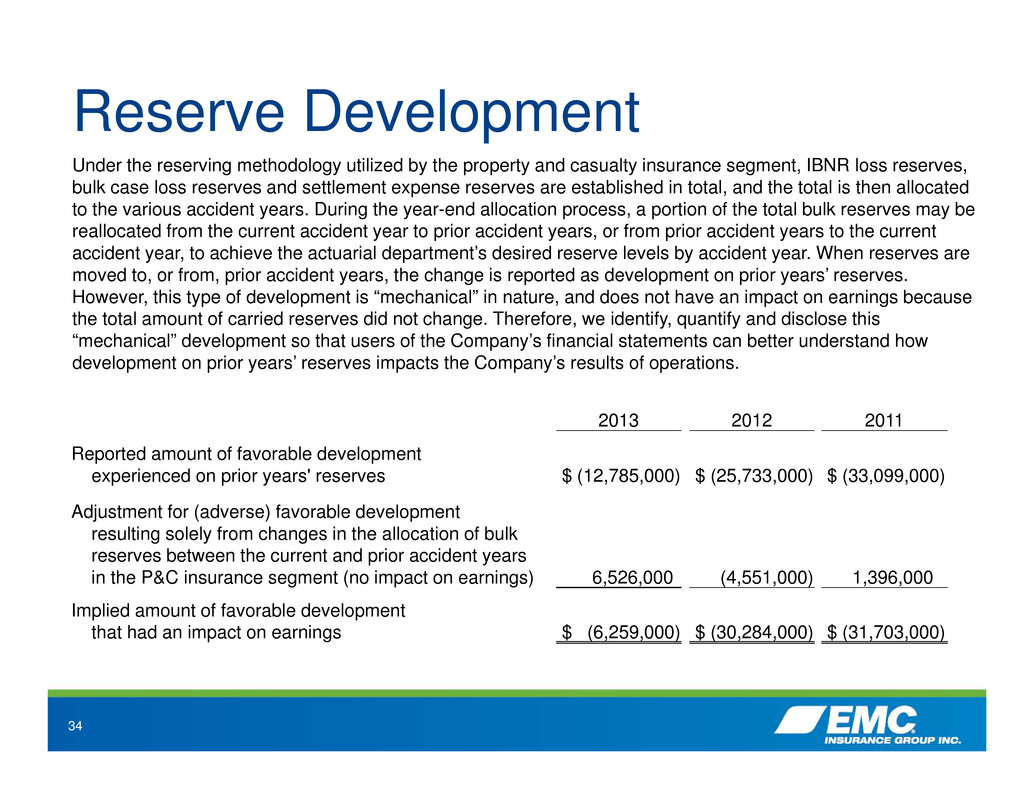

34 Reserve Development 2013 2012 2011 Reported amount of favorable development experienced on prior years' reserves $ (12,785,000) $ (25,733,000) $ (33,099,000) Adjustment for (adverse) favorable development resulting solely from changes in the allocation of bulk reserves between the current and prior accident years in the P&C insurance segment (no impact on earnings) 6,526,000 (4,551,000) 1,396,000 Implied amount of favorable development that had an impact on earnings $ (6,259,000) $ (30,284,000) $ (31,703,000) Under the reserving methodology utilized by the property and casualty insurance segment, IBNR loss reserves, bulk case loss reserves and settlement expense reserves are established in total, and the total is then allocated to the various accident years. During the year-end allocation process, a portion of the total bulk reserves may be reallocated from the current accident year to prior accident years, or from prior accident years to the current accident year, to achieve the actuarial department’s desired reserve levels by accident year. When reserves are moved to, or from, prior accident years, the change is reported as development on prior years’ reserves. However, this type of development is “mechanical” in nature, and does not have an impact on earnings because the total amount of carried reserves did not change. Therefore, we identify, quantify and disclose this “mechanical” development so that users of the Company’s financial statements can better understand how development on prior years’ reserves impacts the Company’s results of operations.

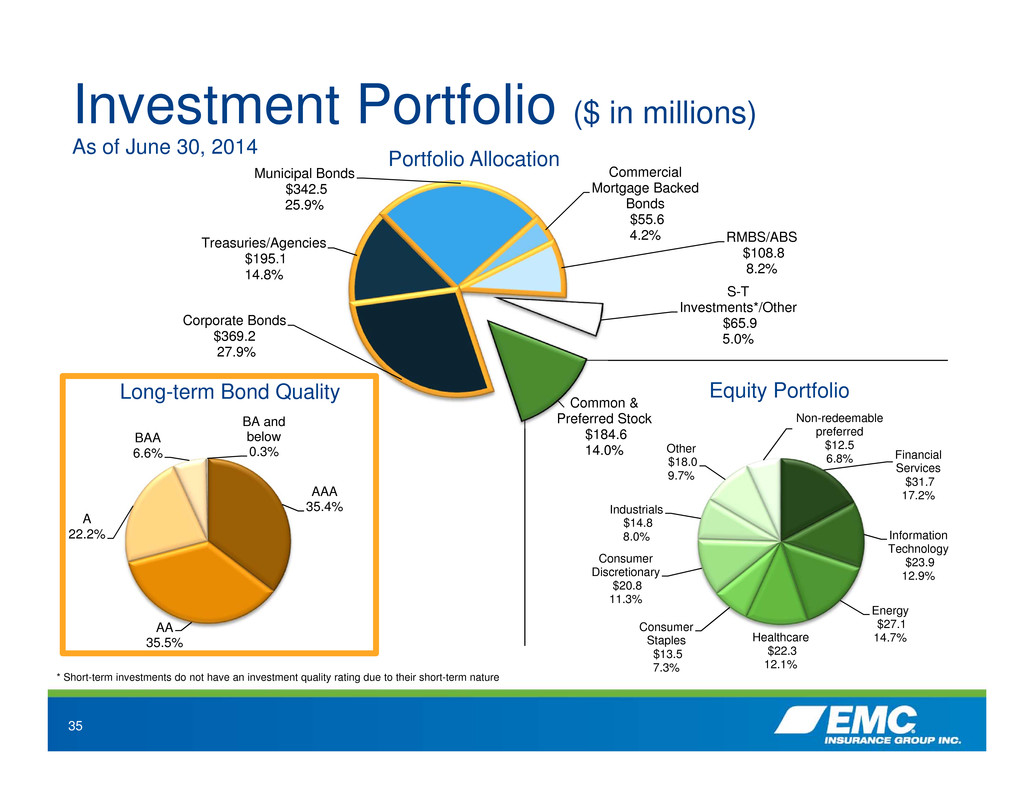

35 Investment Portfolio ($ in millions) As of June 30, 2014 * Short-term investments do not have an investment quality rating due to their short-term nature Portfolio Allocation Equity Portfolio Financial Services $31.7 17.2% Information Technology $23.9 12.9% Energy $27.1 14.7%Healthcare $22.3 12.1% Consumer Staples $13.5 7.3% Consumer Discretionary $20.8 11.3% Industrials $14.8 8.0% Other $18.0 9.7% Non-redeemable preferred $12.5 6.8% Treasuries/Agencies $195.1 14.8% Municipal Bonds $342.5 25.9% Commercial Mortgage Backed Bonds $55.6 4.2% RMBS/ABS $108.8 8.2% S-T Investments*/Other $65.9 5.0% Common & Preferred Stock $184.6 14.0% Corporate Bonds $369.2 27.9% AAA 35.4% AA 35.5% A 22.2% BAA 6.6% BA and below 0.3% Long-term Bond Quality

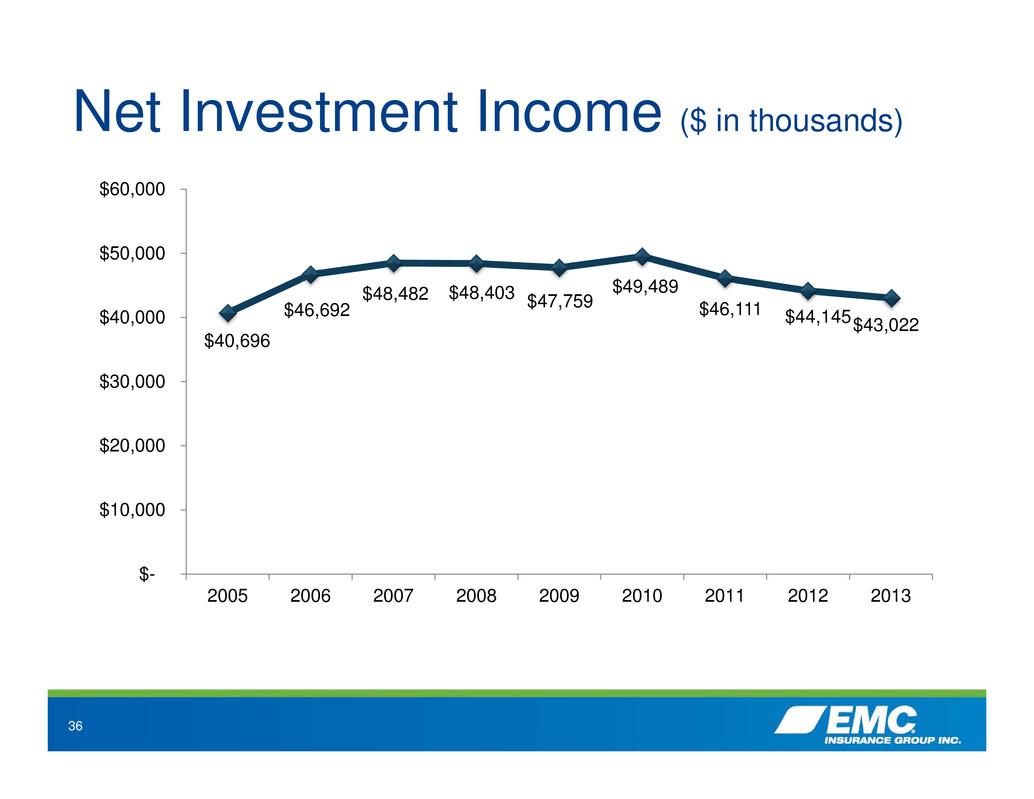

36 Net Investment Income ($ in thousands) $40,696 $46,692 $48,482 $48,403 $47,759 $49,489 $46,111 $44,145 $43,022 $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 2005 2006 2007 2008 2009 2010 2011 2012 2013

37 $0 $50,000 $100,000 $150,000 $200,000 $250,000 ( $ i n 0 0 0 ’ s ) Total Principal Cash Flows Total Interest Cash Flows NOTE: Cash flows to expected call date. The 2014 amount includes cash and short-term investments. As of 12/31/2013 Bond Portfolio Expected Cash Flows

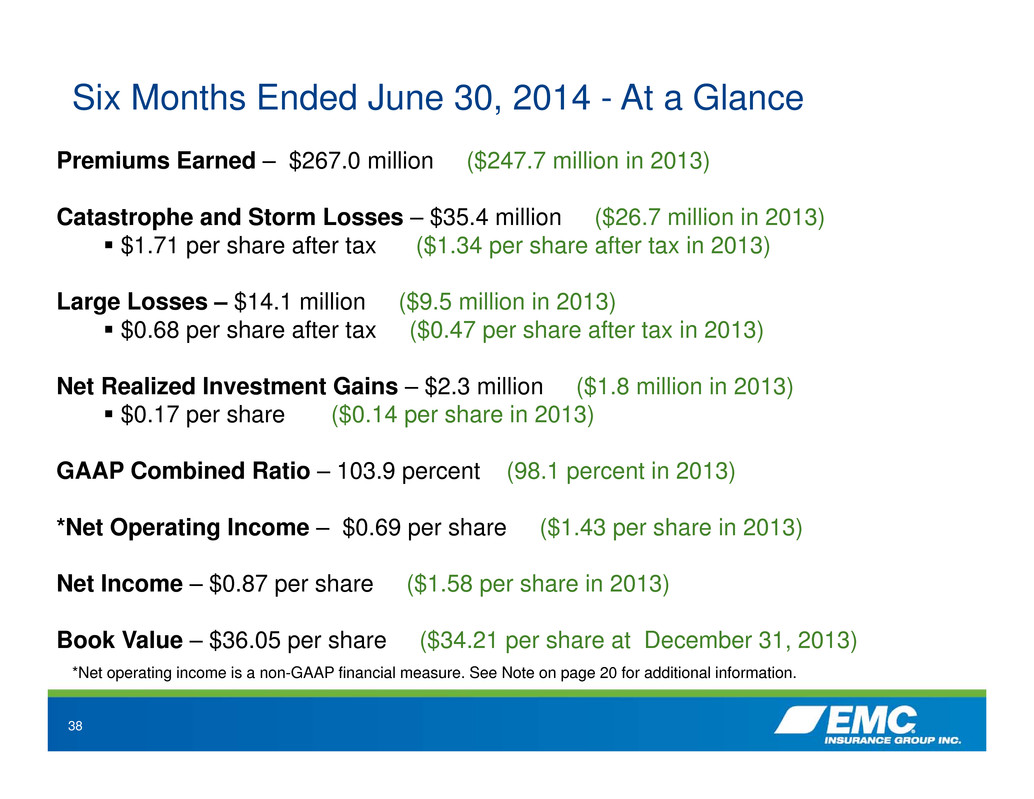

38 Six Months Ended June 30, 2014 - At a Glance Premiums Earned – $267.0 million ($247.7 million in 2013) Catastrophe and Storm Losses – $35.4 million ($26.7 million in 2013) $1.71 per share after tax ($1.34 per share after tax in 2013) Large Losses – $14.1 million ($9.5 million in 2013) $0.68 per share after tax ($0.47 per share after tax in 2013) Net Realized Investment Gains – $2.3 million ($1.8 million in 2013) $0.17 per share ($0.14 per share in 2013) GAAP Combined Ratio – 103.9 percent (98.1 percent in 2013) *Net Operating Income – $0.69 per share ($1.43 per share in 2013) Net Income – $0.87 per share ($1.58 per share in 2013) Book Value – $36.05 per share ($34.21 per share at December 31, 2013) *Net operating income is a non-GAAP financial measure. See Note on page 20 for additional information.

Contact: Steve Walsh, CPA Director Investor Relations 717 Mulberry Street | Des Moines, IA 50309 | 515-345-2515 emcins.group@emcins.com | www.emcins.com/ir ©Copyright EMC Insurance Group Inc. 2013. All rights reserved.