Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NTELOS HOLDINGS CORP. | d779279d8k.htm |

Investor Presentation

August 2014

NASDAQ: NTLS

Exhibit 99.1 |

Presentation of Financial and Other Important Information

2

USE OF NON-GAAP FINANCIAL MEASURES

Included in this presentation are certain non-GAAP

financial measures that are not determined in accordance with US generally accepted accounting principles

(“GAAP”). These financial performance measures are not

indicative of cash provided or used by operating activities and exclude the effects of certain operating,

capital and financing costs and may differ from comparable information

provided by other companies, and they should not be considered in isolation, as an

alternative to, or more meaningful than measures of financial

performance determined in accordance with US generally accepted accounting principles. These

financial performance measures are commonly used in the industry and

are presented because NTELOS believes they provide relevant and useful information to

investors. NTELOS utilizes these financial performance measures to

assess its ability to meet future capital expenditure and working capital requirements, to

incur indebtedness if necessary, and to fund continued growth.

NTELOS also uses these financial performance measures to evaluate the performance of its

business, for budget planning purposes and as factors in its employee

compensation programs. Adjusted EBITDA is defined as net income attributable to

NTELOS Holdings Corp. before interest, income taxes, depreciation and

amortization, accretion of asset retirement obligations, deferred SNA revenue, gain/loss

on derivatives, net income attributable to non-controlling

interests, other expenses/income, equity based compensation charges, business separation charges,

certain employee separation charges, gain/loss on sale of assets,

secondary offering costs and net loss from discontinued operations and costs related to the

separation of the wireless and wireline companies. SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

Any statements contained in this presentation that are not statements

of historical fact, including statements about our beliefs and expectations, are forward-

looking statements and should be evaluated as such. The words

“anticipates,” “believes,” “expects,” “intends,” “plans,” “estimates,” “targets,” “projects,”

“should,” “may,” “will” and similar words

and expressions are intended to identify forward-looking statements. Such forward-looking statements reflect, among

other things, our current expectations, plans and strategies, and

anticipated financial results, all of which are subject to known and unknown risks, uncertainties

and factors that may cause our actual results to differ materially from

those expressed or implied by these forward-looking statements. Many of these risks are

beyond our ability to control or predict. Because of these risks,

uncertainties and assumptions, you should not place undue reliance on these forward-looking

statements. Furthermore, forward-looking statements speak only as

of the date they are made. We do not undertake any obligation to update or review any

forward-looking information, whether as a result of new

information, future events or otherwise. Important factors with respect to any such forward-looking

statements, including certain risks and uncertainties that could cause

actual results to differ from those contained in the forward-looking statements, include, but

are not limited to: our ability to attract and retain retail

subscribers to our services; our dependence on our strategic relationship with Sprint Corporation

(“Sprint”); a potential increase in roaming rates and

wireless handset subsidy costs; rapid development and intense competition in the telecommunications

industry; our ability to finance, design, construct and realize the

benefits of any planned network technology upgrade; our ability to acquire or gain access to

additional spectrum; the potential to experience a high rate of

customer turnover; the potential for competitors to build networks in our markets; cash and capital

requirements; operating and financial restrictions imposed by our

credit agreement; adverse economic conditions; federal and state regulatory fees, requirements

and developments; loss of ability to use our current cell sites; our

continued reliance on indirect channels of retail distribution; our reliance on certain suppliers

and vendors; and other unforeseen difficulties that may occur. These

risks and uncertainties are not intended to represent a complete list of all risks and

uncertainties inherent in our business, and should be read in

conjunction with the more detailed cautionary statements and risk factors included in our SEC

filings, including our quarterly reports filed on Form 10-Q and

our most recent Annual Report filed on Form 10-K. |

•

Leading “pure-play”

publicly traded regional wireless carrier

•

8.0 million licensed POPs; 6.0 million covered POPs; 458,100

subscribers

•

Branded retail business and stable wholesale business with

recurring revenue stream

•

Exclusive wholesale network provider for Sprint in WV and

Western Va. through December 2022

Company Overview

About nTelos

Headquarters

Waynesboro,

Va.

Ticker

NTLS

Exchange

NASDAQ

Price

$12.64

Market Cap

$274 million

Shares

21.7 million

52 Week Range

$11.20

–

$23.03

As of August 18, 2014

3 |

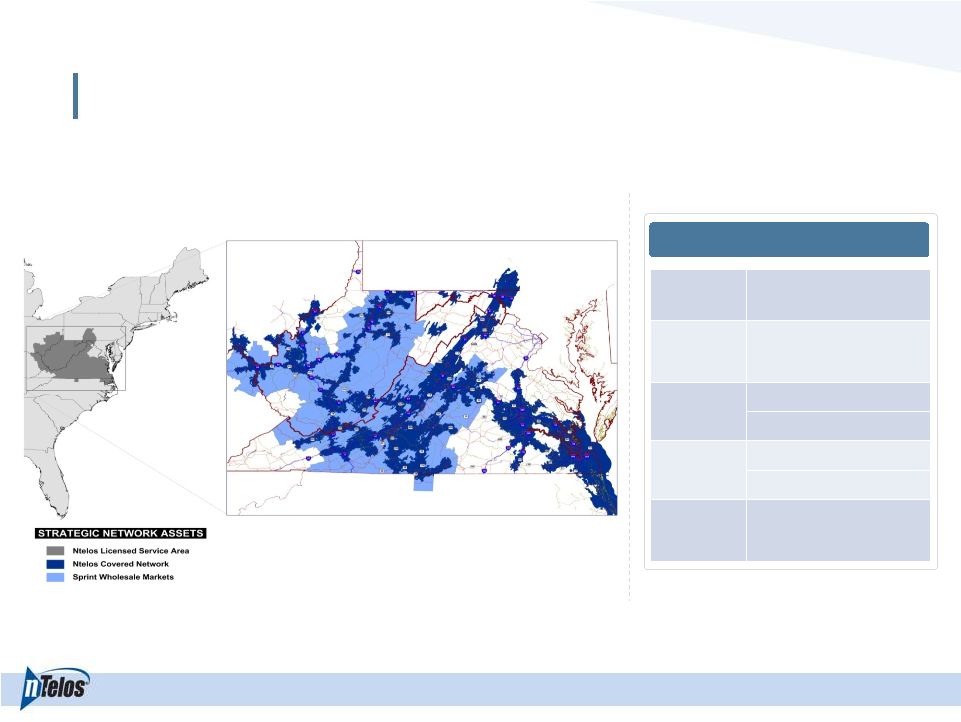

4

nTelos Network

Operational Footprint

POPs

8.0 million

Covered

POPs

6.0 million

LTE

POPs

2.8 million (6/30/14)

3.3 million (Est. 12/31/14)

Spectrum

nTelos: AWS / PCS / 2.5 GHz

Sprint: 800 MHz / PCS / 2.5 GHz

Total Cell

Sites

1,445 |

5

Retail

Prepay

Retail subscriber base

comprised of two-thirds

postpay subscribers

Postpay

458,100

33%

67%

Retail revenues of $79.5

million

in

2Q14,

or

67%

of

total revenues

•

High quality device offering

including iPhone, Samsung

Galaxy, and Moto X

•

127 branded retail locations

•

715 total points of distribution

nTelos operates the postpay

business under NTELOS

brand and prepay under the

FRAWG brand

Subscriber Base

Platform

Revenue

$60.0

$70.0

$80.0

$90.0 |

6

Wholesale and Other Revenues

nTelos provides wholesale services to

other wireless carriers. The primary

source of wholesale revenues comes from

the Strategic Network Alliance (SNA) with

Sprint.

Wholesale & Other Revenues

Wholesale and other revenue

accounted for 33%

of total

revenues in 2Q14

SNA covers 2.1 mm

covered POPs in West Virginia and

western Virginia; 853

cell sites

SNA billed revenue accounted for

96%

of wholesale and other

revenues in 2Q14

Includes $9.0 million from September 2013 SNA Settlement with Sprint

1

$118

$145

$169

$83

$79

$0

$40

$80

$120

$160

$200

2010

2011

2012

2013

YTD 2013

YTD 2014

Wholesale and Other Revenues

$175

1 |

7

Wireless Industry Trends

Adjusted EBITDA (billions)

EIP as % of Total Subs

Wireless Service Revenue (billions)

% Data

Deal Value (billions)

Sources: Bloomberg, SNL Kagan

Competition

Data Usage

Consolidation

Deal Count

Data Revenue Growth

Telecom M&A

EIP Lifting Big Four’s Adjusted EBITDA

Fierce competition has led to

increased promotional activity

that has pressured revenue.

However, the popularity of

Equipment Installment Plans

(EIP) over the traditional

subsidy models has muted

the impact and lifted

Adjusted EBITDA.

As more consumers use

smartphones and tablets,

data usage on the networks

has continued to grow

dramatically. Carriers have

introduced shared data plans

and increased data

allowances to leverage their

investments in 4G.

Wireless M&A has been

particularly strong in the past

few years as carriers use

acquisitions to bolster their

spectrum position to meet the

increases in data traffic,

generate increased scale and

grow their subscriber base.

0

2

4

6

8

10

12

14

16

18

20

2010

2011

2012

2013

YTD 2014

$0

$20

$40

$60

$80

$100

$120

$140

$160

2013

2014E

2015E

2016E

2017E

$0

$50

$100

$150

$200

$250

$300

40%

45%

50%

55%

60%

65%

70%

1Q13

2Q13

3Q13

4Q13

1Q14

0%

1%

2%

3%

4%

5%

6%

$15

$16

$16

$17

$17

$18

$18

$19

$19

$20 |

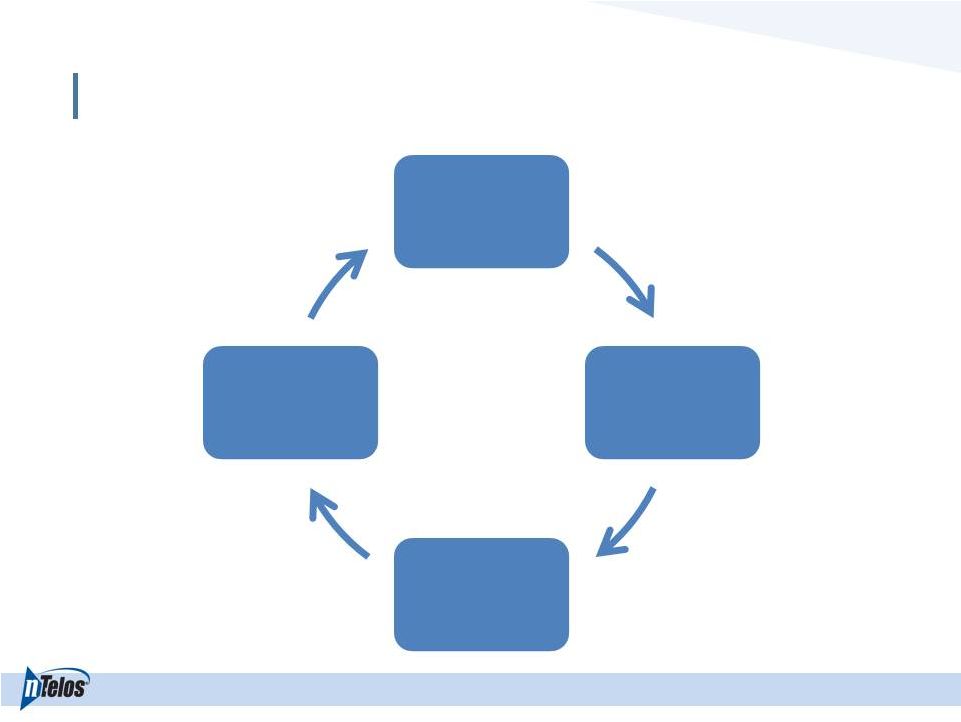

Strategic Objectives

8

of our assets

strategic relevance

Increase the

nTelos’s operations

Sprint to enhance

relationship with

strategic

Leverage our

performance

retail sales

Strengthen our

efficient

become more

processes and

Improve our |

Operating Objectives

9

Grow

strategic

partnerships

Strengthen

brand and

customer

loyalty

Enhance

network

capabilities

Improve

operating

efficiency

Sprint/DISH

Subscribers

4G LTE

Operations |

Retail Growth Drivers Going Forward

•

nControl pricing plans

•

Equipment Installment Plan (EIP)

•

Prepay rate plan resets

•

Expansion of 4G LTE network

•

Improved device line up

Prices as of July 28, 2014

10 |

EIP Features

Launched in mid-

August

No money down

on device

purchases

Eligible for early

upgrade after 12

months

Customers can

still choose a

subsidized device

plan

11 |

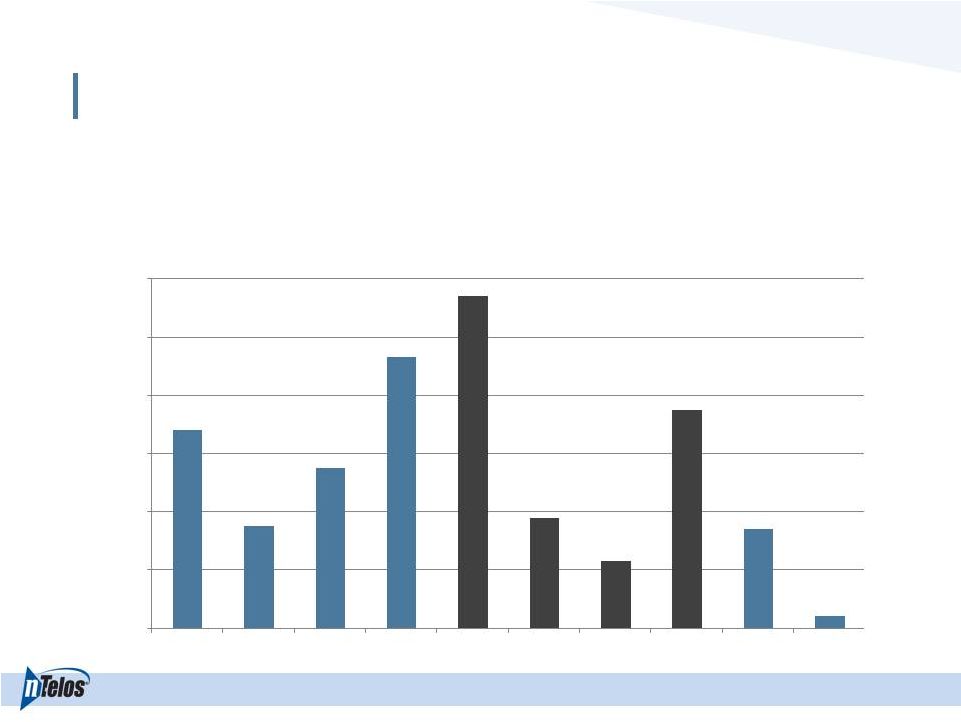

Subscribers –

Net Addition Trend

•

Ten consecutive quarters of positive net adds

12

6,800

3,500

5,500

9,300

11,400

3,800

2,300

7,500

3,400

400

0

2,000

4,000

6,000

8,000

10,000

12,000

1Q 2012

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

4Q 2013

1Q 2014

2Q 2014 |

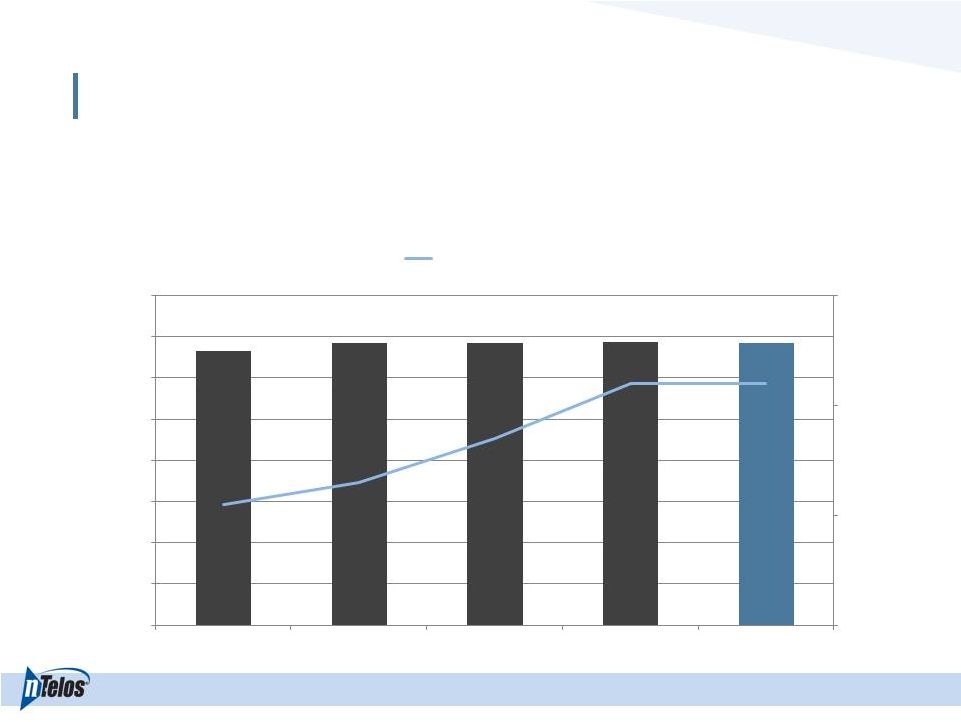

Average Revenue Per Account (ARPA)

ARPA

Subscribers Per Account

•

2Q14 postpay subscribers per account of 2.2

13

$133.34

$136.90

$136.88

$137.47

$137.20

2.0

2.1

2.2

2.3

$0.00

$20.00

$40.00

$60.00

$80.00

$100.00

$120.00

$140.00

$160.00

2Q 2013

3Q 2013

4Q 2013

1Q 2014

2Q 2014

Subscribers Per Account |

Continued Focus on Operational Efficiencies

Steps

Refine retail offerings

Right-Fitting retail customer base

Enhance online support and self-service

Streamline legacy processes and systems

Align organization

Goals

Improve customer experience

Increase productivity

Reduce costs

14 |

Sprint Agreement –

Platform For Growth

Terms

Amended SNA (Announced May 22, 2014)

Expiration

December 31, 2022

Coverage Area

•

2.1 mm covered POPs in West Virginia and western Virginia

•

853 cell sites

•

36,800 square miles

Network

2G/3G/4G LTE / future feature upgrades

Spectrum

800/1.9/2.5 (nTelos & Sprint)

Anticipated 4G LTE Buildout Timeline

Expect to be completed no later than May 2017

Nationwide Roaming

2G/3G/4G LTE

Exclusivity

•

Exclusive wholesale provider in SNA territory

•

Can sign wholesale agreements with other carriers

Equipment Vendor Relationships

Leverage Sprint’s device and equipment relationships

Incremental Investment

Agreed

to

build

4G

LTE

network

($150mm

-

$175mm)

15 |

•

Solidifies Sprint relationship through December 2022 and allows for additional

collaboration •

Contributes recurring wholesale revenues to nTelos

•

Provides access to Sprint’s 800 MHz/1.9 GHz/2.5 GHz spectrum and vendor

relationships •

Attracts high-value customers by facilitating a robust LTE experience in SNA

territory •

Provides 4G LTE nationwide roaming for nTelos retail customers

Extended Agreement

–

Beneficial Impact

16 |

Financial Overview |

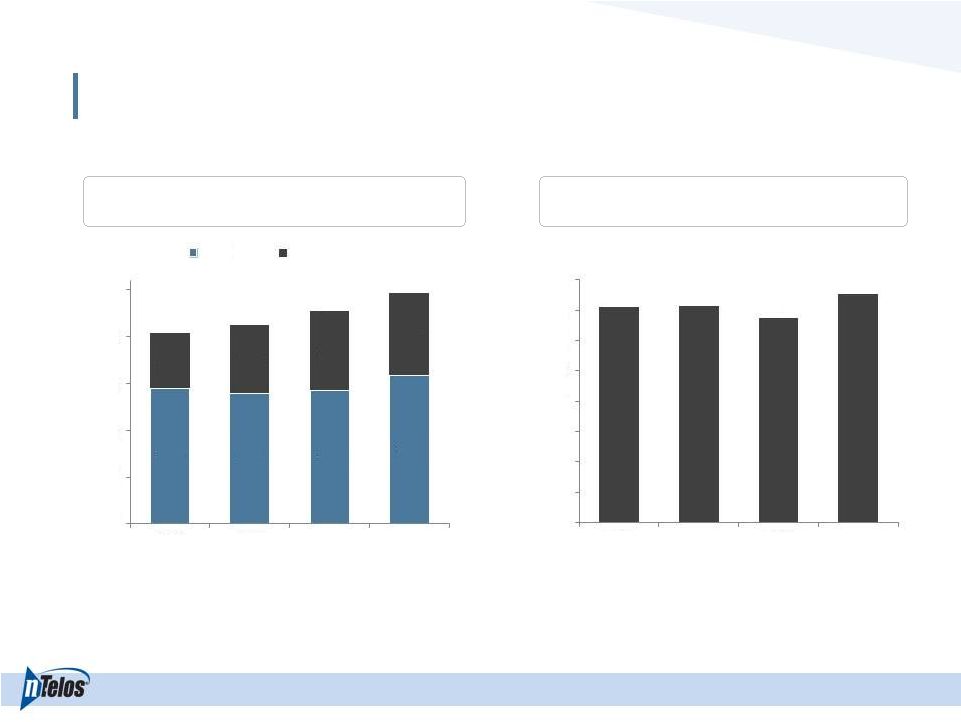

Historical Financial Overview

Revenue

Adjusted EBITDA

¹

Includes $9.0 million of revenues and $9.6 million of EBITDA related to September

2013 SNA Settlement with Sprint .

1

1

($mm)

($mm)

18

$289

$278

$285

$317

$118

$145

$169

$175

$407

$423

$454

$492

$0

$100

$200

$300

$400

$500

2010

2011

2012

2013

Retail

Sprint, Wholesale & Other

$142

$143

$135

$151

$0

$20

$40

$60

$80

$100

$120

$140

$160

2010

2011

2012

2013 |

Capital Expenditure

CapEx vs. Revenues

Note: Excludes wireline revenue generated and capex incurred prior to October 2011

business separation 19

$85

$97

$71

$52

$58

$72

$81

$350

$375

$400

$425

$450

$475

$500

$0

$25

$50

$75

$100

2007

2008

2009

2010

2011

2012

2013

Maintenance, IT & Other

Capacity

Growth

Technology Upgrade

CapEx ($mm)

Revenues ($mm) |

Capitalization Overview

($ in millions)

June 30, 2014

Cash, unrestricted

$108.3

Total Debt

$527.8

Net Debt

$419.5

LTM Adjusted EBITDA

$140.6

Secured Term Loan

$526.9

Net Debt Leverage

3.0x

20 |

Guidance (as of July 28, 2014)

21

For the year ended December 31, 2014:

•

Adjusted

EBITDA

of

$128

-

$135

million

•

CapEx

of

$110

-

$120

million |

Strategic Objectives

22

Increase the

strategic relevance

of our assets

Strengthen our

retail sales

performance

Leverage our

strategic

relationship with

Sprint to enhance

nTelos’s operations

Improve our

processes and

become more

efficient |

Appendix |

Adjusted EBITDA Reconciliation

24

Reconciliation of Net Income Attributable to NTELOS Holdings Corp. to Adjusted EBITDA

(In thousands)

2Q14

1Q14

4Q13

3Q13

2Q13

Net Income Attributable to NTELOS Holdings Corp.

484

$

1,286

$

(784)

$

10,583

$

9,386

$

Net income attributable to noncontrolling interests

373

436

403

588

541

Net Income

857

1,722

(381)

11,171

9,927

Interest expense

8,315

7,959

7,504

7,480

7,398

Income taxes

640

1,110

80

8,340

6,380

Other expense (income), net

92

1,072

161

431

(151)

Operating income

9,904

11,863

7,364

27,422

23,554

Depreciation and amortization

19,929

19,067

17,486

16,559

20,443

Gain on sale of intangible assets

-

-

-

-

(4,442)

Accretion of asset retirement obligations

331

315

171

135

173

Equity-based compensation

1,283

1,311

1,330

1,442

1,460

SNA Straight Line Adjustment

2,043

1

-

-

-

-

Other

2

874

1,367

375

-

-

Adjusted EBITDA

34,364

$

33,923

$

26,726

$

45,558

$

41,188

$

1

Adjustment for impact of recognizing a portion of the billed SNA contract on a straight line

basis 2

Includes legal and advisory fees, employee seperation charges

and secondary offering costs. |

ARPA Reconciliation

ARPA Reconciliation - Postpay

Average Monthly Revenue per Account (ARPA) ¹

2Q14

1Q14

4Q13

3Q13

2Q13

(In thousands, except for accounts and ARPA)

Operating revenues

117,795

$

122,082

$

121,766

$

130,912

$

119,859

$

Less: prepay service revenues

(16,206)

(16,960)

(16,956)

(16,478)

(16,182)

Less: equipment revenues

(6,560)

(7,491)

(6,573)

(6,541)

(5,499)

Less: wholesale and other adjustments

(37,900)

(40,018)

(40,525)

(50,142)

(41,179)

Postpay service revenues

57,129

$

57,613

$

57,712

$

57,751

$

56,999

$

Average number of postpay accounts

138,800

139,700

140,500

140,600

142,500

Postpay ARPA

137.20

$

137.47

$

136.88

$

136.90

$

133.34

$

¹

Average

monthly

revenue

per

account

(ARPA)

is

computed

by

dividing

postpay

service

revenues

per

period

by

the

average

number

of

postpay

accounts

during

that

period.

As

defined,

ARPA

may

not

be

similar

to

ARPA

measures

of

other

companies,

is

not

a

measurement

under

GAAP

and

should

be

considered

in

addition

to,

but

not

as

a

substitute

for,

the

information

contained

in

the

Company’s

consolidated

Income

Statement.

The

Company

closely

monitors

the

effects

of

new

rate

plans

and

service

offerings

on

ARPA

in

order

to

determine

their

effectiveness.

ARPA

provides

management

useful

information

concerning

the

appeal

of

NTELOS

rate

plans

and

service

offerings

and

the

Company’s performance in attracting and retaining high-value customers.

25 |

Key Metrics

26

Key Metrics

Quarter Ended:

6/30/2013

9/30/2013

12/31/2013

3/31/2014

6/30/2014

6/30/2013

6/30/2014

Subscribers

Beginning Subscribers

451,000

454,800

457,100

464,600

468,000

439,600

464,600

Postpay

299,700

298,700

298,000

306,700

306,800

297,400

306,700

Prepay

151,300

156,100

159,100

157,900

161,200

142,200

157,900

Gross Additions

40,100

44,500

50,800

45,400

39,000

88,600

84,400

Postpay

16,300

20,000

28,700

20,200

20,400

36,500

40,600

Prepay

23,800

24,500

22,100

25,200

18,600

52,100

43,800

Disconnections

1

36,300

42,200

43,300

42,000

38,600

73,400

80,600

Postpay

16,100

19,600

19,800

19,900

17,100

33,000

37,000

Prepay

20,200

22,600

23,500

22,100

21,500

40,400

43,600

Net Additions (Losses)

1

3,800

2,300

7,500

3,400

400

15,200

3,800

Postpay

200

400

8,900

300

3,300

3,500

3,600

Prepay

3,600

1,900

(1,400)

3,100

(2,900)

11,700

200

Ending Subscribers

¹

454,800

457,100

464,600

468,000

458,100

454,800

458,100

Postpay

298,700

298,000

306,700

306,800

308,200

298,700

308,200

Prepay

156,100

159,100

157,900

161,200

149,900

156,100

149,900

Churn, net

¹

2.7%

3.1%

3.1%

3.0%

2.8%

2.7%

2.9%

Postpay

1.8%

2.2%

2.2%

2.2%

1.8%

1.8%

2.0%

Prepay

4.4%

4.8%

4.9%

4.6%

4.5%

4.5%

4.6%

¹

During the quarter, the Company terminated approximately 2,100 postpay subscribers

that repeatedly exceeded their terms and conditions relating to permitted usage.

Additionally, the Company changed its business rules related to reporting of

long-term, non-revenue prepay subscribers. This change resulted in approximately

8,200 prepay subscribers being excluded from our ending subscriber base. The

impact of these Company-initiated terminations and change in business rules

is reflected in our ending subscriber totals as of June 30, 2014, and is not

reflected in our disconnections, net additions and churn calculations for the periods

ended June 30, 2014.

Six Months Ended |