Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT321 - FIRST COLOMBIA GOLD CORP. | exhibit321.htm |

| EX-31.1 - EXHIBIT311 - FIRST COLOMBIA GOLD CORP. | exhibit311.htm |

| EX-31.2 - EXHIBIT312 - FIRST COLOMBIA GOLD CORP. | exhibit312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10- Q

(Mark One)

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the quarterly period ended June 30, 2014

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from __________ to __________

Commission File Number: 000-51203

First Colombia Gold Corp.

(Exact name of registrant as specified in its charter)

|

Nevada

|

98-0425310

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

6000 Poplar Avenue , Suite 250, Memphis , TN 34119

(Address of principal executive offices)

|

|

|

888-224-6561

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

__________________________________________________________________

|

|

|

(Former name, former address and former fiscal year, if changed since last report)

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). xYes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” and “a smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

(Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

|

Class

|

Outstanding at August 18, 2014

|

|

|

Common Stock, $0.00001 par value

|

158,476,833

|

|

FORM 10-Q

FIRST COLOMBIA GOLD CORP.

June 30,2014

|

Page

|

|

|

PART I – FINANCIAL INFORMATION

|

||

|

Item 1.

|

3

|

|

|

Item 2.

|

4

|

|

|

Item 3.

|

24

|

|

|

Item 4.

|

25

|

|

|

PART II – OTHER INFORMATION

|

||

|

Item 1.

|

26

|

|

|

Item 1A.

|

26

|

|

|

Item 2.

|

26

|

|

|

Item 3.

|

26

|

|

|

Item 4.

|

26

|

|

|

Item 5.

|

26

|

|

|

Item 6.

|

28

|

|

PART I - FINANCIAL INFORMATION

|

Our unaudited interim condensed consolidated financial statements included in this Form 10-Q as of June 30, 2014 are as follows:

|

|

|

F-1

|

|

|

F-2

|

|

|

F-3

|

|

|

F-4

|

|

These unaudited interim consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and the SEC instructions to Form 10-Q. In the opinion of management, all adjustments considered necessary for a fair presentation have been included. Operating results for the interim period ended June 30, 2014 are not necessarily indicative of the results that can be expected for the full year.

|

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

|

||||||||

|

30 June

|

31 December

|

|||||||

|

2014

|

2013

|

|||||||

|

(Unaudited)

|

||||||||

| $ | $ | |||||||

|

Assets

|

||||||||

|

Current Assets

|

||||||||

|

Cash and cash equivalents

|

$ | 491 | $ | - | ||||

|

Prepaid expenses

|

1,645 | 1,145 | ||||||

|

Accounts Receivable

|

- | 16,500 | ||||||

|

Total current assets

|

2,136 | 17,645 | ||||||

|

Property and Equipment

|

3,232 | 4,113 | ||||||

|

Total Assets

|

$ | 5,368 | $ | 21,758 | ||||

|

Liabilities and Stockholders' Equity (Deficit)

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable and accrued liabilities

|

$ | 180,780 | $ | 218,260 | ||||

|

Accounts payable, related parties

|

5,200 | 38,346 | ||||||

|

Accrued interest

|

26,349 | 12,595 | ||||||

|

Convertible notes payable, net of discounts of $64,150 and $38,697, respectively

|

81,201 | 39,798 | ||||||

|

Notes Payable

|

23,000 | - | ||||||

|

Advances - related parties

|

29,550 | - | ||||||

|

Current portion of long term notes payable

|

90,000 | - | ||||||

|

Derivative liabilities

|

394,157 | 671,998 | ||||||

|

Total Current Liabilities

|

830,237 | 980,998 | ||||||

|

Long term notes payable

|

151,100 | 241,100 | ||||||

|

Total Liabilities

|

981,337 | 1,222,098 | ||||||

|

Liabilities and Stockholders' Deficit

|

||||||||

|

Stockholders' Deficit

|

||||||||

|

Preferred Stock

|

||||||||

|

Blank check preferred stock, par value $0, 116,818,182 shares authorized,

|

||||||||

|

0 shares issued and outstanding at June 30, 2014 and December 31, 2013

|

- | - | ||||||

|

Series A convertible preferred stock, par value $.001, 50,000,000 shares

|

||||||||

|

authorized, 47,068,500 and 47,568,500 shares issued and outstanding

|

||||||||

|

at June 30, 2014 and December 31, 2013, respectively

|

47,069 | 47,569 | ||||||

|

Series B convertible preferred stock, par value $.001, 33,181,818 shares

|

||||||||

|

authorized, 2,000,000 and 0 shares issued and outstanding

|

||||||||

|

at June 30, 2014 and December 31, 2013, respectively

|

2,000 | - | ||||||

|

Common Stock

|

||||||||

|

Par value $,00001, 4,000,000,000 shares authorized, 30,799,024 and

|

||||||||

|

1,168,029 shares issued and outstanding at June 30, 2014 and

|

||||||||

|

December 31, 2013, respectively

|

308 | 12 | ||||||

|

Additional paid-in capital

|

20,085,155 | 18,964,770 | ||||||

|

Accumulated deficit

|

(21,110,501 | ) | (20,212,689 | ) | ||||

|

Total Stockholders' Deficit

|

(975,969 | ) | (1,200,340 | ) | ||||

|

Total liabilities and stockholders' deficit

|

$ | 5,368 | $ | 21,758 | ||||

|

The accompanying notes are an integral part of these condensed consolidated financial statements

|

||||||||

|

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

|

||||||||||||||||

|

(Unaudited)

|

||||||||||||||||

|

For the

|

For the

|

For the

|

For the

|

|||||||||||||

|

three month

|

three month

|

six month

|

six month

|

|||||||||||||

|

period ended

|

period ended

|

period ended

|

period ended

|

|||||||||||||

|

30 June

|

30 June

|

30 June

|

30 June

|

|||||||||||||

|

2014

|

2013

|

2014

|

2013

|

|||||||||||||

| $ | $ | $ | $ | |||||||||||||

|

Expenses

|

(restated)

|

(restated)

|

||||||||||||||

|

Depreciation and amortization

|

440 | 440 | 881 | 881 | ||||||||||||

|

General and administrative

|

921,994 | 46,666 | 947,613 | 97,510 | ||||||||||||

|

Impairment loss on mineral properties

|

- | - | - | 36,650 | ||||||||||||

|

Mineral property exploration expenditures

|

24,750 | 16,500 | 27,250 | 29,500 | ||||||||||||

|

Total Operating Expense

|

947,184 | 63,606 | 975,744 | 164,541 | ||||||||||||

|

Loss from operations

|

(947,184 | ) | (63,606 | ) | (975,744 | ) | (164,541 | ) | ||||||||

|

Other Income/(Expense)

|

||||||||||||||||

|

Gain on debt extinguishment

|

17,253 | - | 17,253 | 45,357 | ||||||||||||

|

Interest expense

|

(428,008 | ) | (93,058 | ) | (468,627 | ) | (173,094 | ) | ||||||||

|

Gain/(Loss) on derivative liabilities

|

245,851 | (248,869 | ) | 529,306 | (66,533 | ) | ||||||||||

|

Total Other Income/(Expense)

|

(164,904 | ) | (341,927 | ) | 77,932 | (194,270 | ) | |||||||||

|

Net loss

|

(1,112,088 | ) | (405,533 | ) | (897,812 | ) | (358,811 | ) | ||||||||

|

Loss per common share - basic and diluted

|

(0.09 | ) | (1.17 | ) | (0.13 | ) | (1.30 | ) | ||||||||

|

Weighted average shares outstanding of common - basic and diluted

|

12,346,349 | 346,735 | 6,815,668 | 275,890 | ||||||||||||

|

The accompanying notes are an integral part of these condensed consolidated financial statements

|

||||||||||||||||

|

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

|

||||||||

|

(Unaudited)

|

||||||||

|

For the

|

For the

|

|||||||

|

six month

|

six month

|

|||||||

|

period ended

|

period ended

|

|||||||

|

30 June

|

30 June

|

|||||||

|

2014

|

2013

|

|||||||

| $ | $ | |||||||

|

Cash Flows Used in Operating Activities:

|

(restated)

|

|||||||

|

Net Income (Loss)

|

(897,812 | ) | (358,811 | ) | ||||

|

Adjustments to reconcile net loss with net cash used in operating activities:

|

||||||||

|

Amortization

|

881 | 881 | ||||||

|

Debt discount amortization and origination interest

|

454,874 | 167,655 | ||||||

|

Gain on extinguishment of debt

|

(17,253 | ) | (45,357 | ) | ||||

|

Gain/(Loss) on derivative liabilities

|

(529,306 | ) | 66,533 | |||||

|

Stock issued for services

|

804,501 | - | ||||||

|

Write-down of mineral property interests

|

- | 36,650 | ||||||

|

Changes in operating assets and liabilities

|

||||||||

|

Other Receivable & Prepaid Expenses

|

16,000 | 27,500 | ||||||

|

Increase (decrease) in accounts payable - related parties

|

16,282 | |||||||

|

Increase (decrease) in accounts payable and accrued liabilities

|

14,274 | 49,099 | ||||||

|

Net Cash used in Operating Activities

|

(137,559 | ) | (55,850 | ) | ||||

|

Net Cash Used In Investing Activities

|

||||||||

|

Mineral property acquisition

|

- | (4,150 | ) | |||||

|

Net Cash Used In Investing Activities

|

- | (4,150 | ) | |||||

|

Cash Flows From Financing Activities:

|

||||||||

|

Proceeds from notes payable

|

138,050 | 60,000 | ||||||

|

Cost of repurchase of common stock

|

- | - | ||||||

|

Warrants excercised

|

- | - | ||||||

|

Issuance of common stock, net of share issue costs

|

- | - | ||||||

|

Net Cash Provided by Financing Activities

|

138,050 | 60,000 | ||||||

|

Net Increase (Decrease) in Cash

|

491 | - | ||||||

|

Cash at Beginning of Period

|

- | - | ||||||

|

Cash at End of Period

|

491 | - | ||||||

|

Supplemental disclosure of noncash investing and financing activities:

|

||||||||

|

Common shares issued upon conversion of promissory notes

|

42,433 | 169,499 | ||||||

|

Common shares issued for settlement of accounts payable

|

43,432 | - | ||||||

|

Preferred shares issued for settlement of accounts payable

|

28,000 | 104,650 | ||||||

|

The accompanying notes are an integral part of these condensed consolidated financial statements

|

||||||||

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

June 30, 2014

1. Nature, Basis of Presentation and Continuance of Operations

First Colombia Gold Corp. (the “Company”) was incorporated under the laws of the State of Nevada, U.S.A. under the name “Gondwana Energy, Ltd.” on 5 September 1997. On 23 January 2007, the Company changed its name to “Finmetal Mining Ltd.”. On 27 November 2006, the Company completed the acquisition of 100% of the shares of Finmetal Mining OY (“Finmetal OY”), a company incorporated under the laws of Finland. During the fiscal year ended 31 December 2006, the Company changed its operational focus from development of oil and gas properties, to acquisition of, exploration for and development of mineral properties in Finland.

On 22 May 2008, the Company changed its name to “Amazon Goldsands Ltd.” and on 18 September 2008, the Company entered into a Mineral Rights Option Agreement and concurrently re-focused on the acquisition of, exploration for and development of mineral properties located in Peru. On 29 November 2010, the Company changed its name to “First Colombia Gold Corp.”. The Company changed its name pursuant to a parent/subsidiary merger between the Company (as Amazon Goldsands Ltd.) and its wholly-owned non-operating subsidiary, First Colombia Gold Corp., which was established for the purpose of giving effect to this name change. In 2011 the Company expanded geographic focus to include North America, acquiring two mineral property interests while terminating its agreements related to the mineral property located in Peru in September 2011.

The business of mining and exploring for minerals involves a high degree of risk and there can be no assurance that current exploration programs will result in profitable mining operations. The recoverability of the carrying value of exploration properties and the Company’s continued existence are dependent upon the preservation of its interest in the underlying properties, the discovery of economically recoverable reserves, the achievement of profitable operations, or the ability of the Company to raise alternative financing, if necessary, or alternatively upon the Company’s ability to dispose of its interests on an advantageous basis. Changes in future conditions could require material write downs of the carrying values.

Although the Company has taken steps to verify the title to the properties on which it is conducting exploration and in which it has an interest, in accordance with industry standards for the current stage of exploration of such properties, these procedures do not guarantee the Company’s title. Property title may be subject to unregistered prior agreements and non-compliance with regulatory requirements.

The accompanying consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) applicable to exploration stage enterprises, and are expressed in U.S. dollars. The Company’s fiscal year end is 31 December.

The Company’s consolidated financial statements as at 30 June 2014 and the three and six months then ended have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business.

The Company had a net loss of $897,812 for the six months ended 30 June 2014 (2013– Net loss of $358,811) and has a working capital deficit of $828,101 at 30 June 2014 (31 December 2013 – $963,353), but management cannot provide assurance that the Company will ultimately achieve profitable operations or become cash flow positive, or raise additional debt and/or equity capital. The Company’s solvency, ability to meet its liabilities as they become due, and to continue its operations, has been dependent on funding provided by Asher Enterprises, Inc. (“Asher”), and in the quarter ending June 30,2014 the Company secured advances and loans from a third party, and a company controlled by an officer. If these parties are unwilling to provide ongoing funding to the Company and/or if the Company is unable to raise additional capital in the immediate future, the Company will need to curtail operations, liquidate assets, seek additional capital on less favorable terms and/or pursue other remedial measures or cease operations. This material uncertainty may cast significant doubt about the ability of the Company to continue as a going concern. These condensed consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern including adjustments related to employee severance pay and other costs related to ceasing operations.

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

If the Company is unable to raise additional capital in the immediate future, the Company will need to curtail operations, liquidate assets, seek additional capital on less favorable terms and/or pursue other remedial measures or cease operations. This material uncertainty may cast significant doubt about the ability of the Company to continue as a going concern. These condensed consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern including adjustments related to employee severance pay and other costs related to ceasing operations.

These unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and the SEC instructions to Form 10-Q. In the opinion of management, all adjustments considered necessary for a fair presentation have been included, and consist solely of normal recurring adjustments. Operating results for the interim period ended June 30, 2014 are not necessarily indicative of the results that can be expected for the full year.

2. Significant Accounting Policies

The following is a summary of significant accounting policies used in the preparation of these condensed consolidated financial statements.

Principles of consolidation

The accompanying condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary, Finmetal OY, a company incorporated under the laws of Finland, since its date of acquisition on 27 November 2006 and the results of Beardmore Holdings, Inc. (“Beardmore”), a company incorporated under the laws of Panama, to the date of disposal on 21 September 2011. All inter-company balances and transactions have been eliminated in these condensed consolidated financial statements.

Cash and cash equivalents

The Company considers all highly liquid instruments with a maturity of three months or less at the time of issuance to be cash equivalents. As at 30 June 2014 and as at 31 December 2013, the Company had $491 and $0 in cash and cash equivalents.

Property and equipment

Furniture, computer equipment, office equipment and computer software are carried at cost and are amortized over their estimated useful lives of three to five years at rates as follows:

|

Furniture, computer and office equipment

|

Five years

|

|

Computer software

|

Three Years

|

The property and equipment is written down to its net realizable value if it is determined that its carrying value exceeds estimated future benefits to the Company.

Mineral property costs

Mineral property acquisition costs are initially capitalized as tangible assets when purchased. At the end of each fiscal quarter, the Company assesses the carrying costs for impairment. If proven and probable reserves are established for a property and it has been determined that a mineral property can be economically developed, costs will be amortized using the units-of-production method over the estimated life of the probable reserve.

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

Mineral property exploration costs are expensed as incurred.

Estimated future removal and site restoration costs, when determinable, are provided over the life of proven reserves on a units-of-production basis. Costs, which include production equipment removal and environmental remediation, are estimated each period by management based on current regulations, actual expenses incurred, and technology and industry standards. Any charge is included in exploration expense or the provision for depletion and depreciation during the period and the actual restoration expenditures are charged to the accumulated provision amounts as incurred.

As of the date of these condensed consolidated financial statements, the Company has not established any proven or probable reserves on its mineral properties and incurred only acquisition and exploration costs.

Although the Company has taken steps to verify title to mineral properties in which it has an interest, according to the usual industry standards for the stage of exploration of such properties, these procedures do not guarantee the Company’s title. Such properties may be subject to prior agreements or transfers and title may be affected by undetected defects.

Environmental costs

Environmental expenditures that are related to current operations are charged to operations or capitalized as appropriate. Expenditures that relate to an existing condition caused by past operations, and which do not contribute to current or future revenue generation, are charged to operations. Liabilities are recorded when environmental assessments and/or remedial efforts are probable, and the cost can be reasonably estimated. Generally, the timing of these accruals coincides with the earlier of completion of a feasibility study or the Company’s commitments to a plan of action based on the then known facts.

Stock-based compensation

Effective 1 January 2006, the Company adopted the provisions of ASC 718, “Compensation – Stock Compensation”, which establishes accounting for equity instruments exchanged for employee services. Under the provisions of ASC 718, stock-based compensation cost is measured at the grant date, based on the calculated fair value of the award, and is recognized as an expense over the employees’ requisite service period (generally the vesting period of the equity grant).

Basic and diluted loss per share

The Company computes net loss per share in accordance with ASC 260, “Earnings per Share”. ASC 260 requires presentation of both basic and diluted earnings per share (“EPS”) on the face of the income statement. Basic EPS is computed by dividing net loss available to common stockholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excluded all dilutive potential shares if their effect was anti-dilutive. As of June 30, 2014 and June 30, 2013, the Company had 127,718,741 and 95,707,680 potential common shares, from its convertible debt and convertible preferred stock.

Financial instruments

The carrying value of amounts receivable, bank indebtedness, accounts payable and convertible promissory notes approximates their fair value because of the short maturity of these instruments. The Company’s financial risk is the risk that arises from fluctuations in foreign exchange rates and the degree of volatility of these rates. Currently, the Company does not use derivative instruments to reduce its exposure to foreign currency risk.

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

Income taxes

Deferred income taxes are reported for timing differences between items of income or expense reported in the financial statements and those reported for income tax purposes in accordance with ASC 740, “Income Taxes”, which requires the use of the asset/liability method of accounting for income taxes. Deferred income taxes and tax benefits are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases, and for tax losses and credit carry-forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The Company provides for deferred taxes for the estimated future tax effects attributable to temporary differences and carry-forwards when realization is more likely than not.

Long-lived assets impairment

Long-term assets of the Company are reviewed for impairment whenever events or circumstances indicate that the carrying amount of assets may not be recoverable, pursuant to guidance established in ASC 360-10-35-15, “Impairment or Disposal of Long-Lived Assets”. Management considers assets to be impaired if the carrying value exceeds the future projected cash flows from related operations (undiscounted and without interest charges). If impairment is deemed to exist, the assets will be written down to fair value. Fair value is generally determined using a discounted cash flow analysis. The company recorded an impairment loss of $0 and $0 for the three months ended June 30, 2014 and 2013, respectively.

Asset retirement obligations

The Company has adopted ASC 410, “Assets Retirement and Environmental Obligations”, which requires that the fair value of a liability for an asset retirement obligation be recognized in the period in which it is incurred. ASC 410 requires the Company to record a liability for the present value of the estimated site restoration costs with a corresponding increase to the carrying amount of the related long-lived assets. The liability will be accreted and the asset will be depreciated over the life of the related assets. Adjustments for changes resulting from the passage of time and changes to either the timing or amount of the original present value estimate underlying the obligation will be made. As at 30 June 2014 and 31 December 2013, the Company did not have any asset retirement obligations.

Convertible debt

The Company has adopted ASC 470-20, “Debt with Conversion and Other Options” and applies this guidance retrospectively to all periods presented upon those fiscal years. The Company records a beneficial conversion feature related to the issuance of convertible debts that have conversion features at fixed or adjustable rates. The beneficial conversion feature for the convertible instruments is recognized and measured by allocating a portion of the proceeds as an increase in additional paid-in capital and as a reduction to the carrying amount of the convertible instrument equal to the intrinsic value of the conversion features. The beneficial conversion feature will be accreted by recording additional non-cash interest expense over the expected life of the convertible notes.

As of January 1, 2013, it was determined that the conversion features in the convertible debt were derivative liabilities. Accordingly, we have separately measured and accounted for these derivative liabilities, in accordance with ASC 815-15.

Use of estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the period. Actual results may differ from those estimates.

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

Reclassifications

Certain prior period amounts have been reclassified to conform to current period presentation.

Recent Accounting Pronouncements

In June 2014, the FASB issued ASU 2014-10, “Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation”. The guidance eliminates the definition of a development stage entity thereby removing the incremental financial reporting requirements from U.S. GAAP for development stage entities, primarily presentation of inception to date financial information. The provisions of the amendments are effective for annual reporting periods beginning after December 15, 2014, and the interim periods therein. However, early adoption is permitted. Accordingly, the Company has adopted this standard as of June 30, 2014.

The Company does not expect the adoption of any other recent accounting pronouncements to have a material impact on its financial statements.

3. Mineral Property Interests

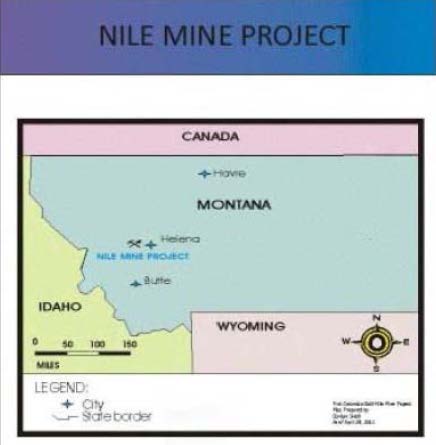

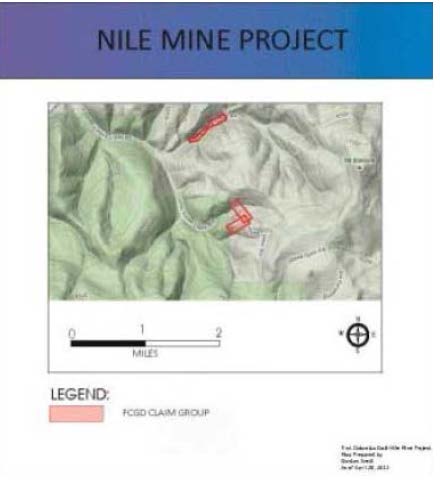

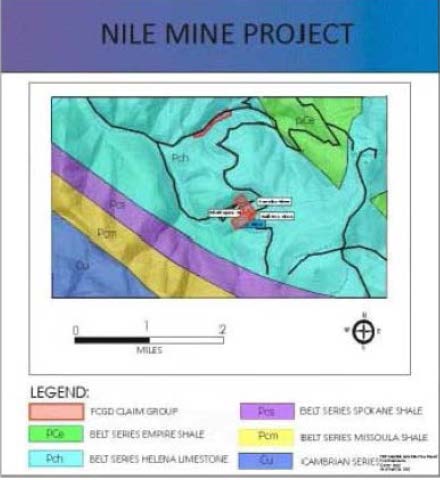

Boulder Hill Project

On December 16, 2011, we entered into a Purchase and Sale Agreement (“Purchase Agreement”) with Boulder Hill Mines Inc., an Idaho corporation (“Boulder Hill”) relating to the purchase from Boulder Hill of three unpatented mining claims situated in Lincoln County, Montana (the “Boulder Hill Claims”).

During the year ended 31 December 2013, the Company decided to cancel the portion of the Boulder Hill project involving the state lease, and is in the process of re-staking unpatented mining claims. During the six month period ended 30 June 2014 the Company spent $1,250 in consulting fees related to preparation for the re-staking ($0 exploration costs during six month period ended 30 June 2013).

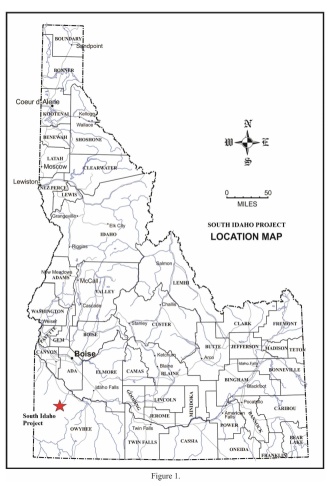

South Idaho Silver Project

On 7 December 2011 (the “Effective Date”), the Company entered into an Assignment and Assumption Agreement (the “CCS Assignment”) with Castle Creek Silver Inc. (“Castle Creek”), an Idaho corporation, and Robert Ebisch (“Robert E”) to acquire by way of assignment from Castle Creek all of its rights, responsibilities and obligations under an Option to Purchase and Royalty Agreement (the “Purchase Agreement”) dated 15 July 2011, by and between Castle Creek and Robert E. Castle Creek, under the Purchase Agreement, had the option to acquire an undivided 100% of the right, title and interest of Robert E in the unpatented mining claims owned and situated in Owyhee County, Idaho (the “South Idaho Property”).

Pursuant to the terms of the CCS Assignment, Castle Creek transferred and assigned the Company all of its right, title and interest, in, to and under the Purchase Agreement and the Company assumed the assignment of the Purchase Agreement agreeing to be bound, the same extent as Castle Creek, to the terms and conditions of the Purchase Agreement.

The Company is currently in default with regards to certain obligations related to the South Idaho Property and is in the process of renegotiating the terms with Castle Creek, or determining to re-stake the mining claims. During 2013, the Company recorded a provision for write-down of mineral property interests of in the amount of $36,650 related to the South Idaho Property. During the six month period ended 30 June 2014, the Company paid $1,250 for a review and update of its database in preparation of re-staking (no exploration costs were incurred during the six month period ended 30 June 2013).

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

Skip Silver Prospect

The Company owns two unpatented mining claims covering approximately forty acres in central Montana.

4. Property and Equipment

|

Cost

$

|

Accumulated

Depreciation

$

|

Net Book

Value

$

|

||||||||||

|

As of June 30, 2014 :

|

||||||||||||

|

Furniture, computer and office equipment

|

47,433

|

44,201

|

3,232

|

|||||||||

|

As of December 31, 2013 :

Furniture, computer and office equipment

|

47,433

|

43,320

|

4,113

|

|||||||||

During the period ending June 30, 2014 total additions to property and equipment were $Nil.

5. Convertible Promissory Notes

On 29 April 2013, the Company issued a convertible note to Asher in the amount of $32,500, bearing interest at a rate of 8% per annum on any unpaid principal balance, unsecured, with principal and interest amounts due and payable upon maturity on 31 January 2014 (the “Asher Note #6”). Any amount of principal or interest amount not paid on 31 January 2014 (the “Default Amount #6”) shall bear interest of 22% per annum commencing on 31 January 2013 to the date the amount is paid.

Asher has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time commencing 6 months after the date of issuance up to the later of 31 January 2014 or the date of the Default Amount #6 is paid, at a conversion price equal to 45% of the average of the lowest 3 trading prices for the common stock during the 30 trading day period ending on the latest complete trading day prior to the conversion date.

The Asher Note #6 contains a provision limiting the number of shares of common stock into which the Asher Note #3 is convertible to 4.99% of the outstanding shares of the Company’s common stock. However, the provision in the Asher Note #6 may be waived by Asher upon 61 days’ prior notice. The Company has a right of prepayment of the Asher Note #6 anytime from the date of the Asher Note #5 until 180 days thereafter, subject to a prepayment penalty in the amount of 140% to 150% of the outstanding principal and interest of the Asher Note #6 based on the date of prepayment.

The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .01% to .10%; Dividend rate of 0%; and, historical volatility rates ranging from 353.55% to 852.32%. Based on this calculation, the Company recorded a derivative liability of $97,733, and loss on derivative liability of $174,610. The Company also recorded a debt discount of $32,500 (to be amortized over the term of the debt). During the six month periods ended 30 June 2014 and 2013, the Company recorded a related gain on derivative liability of $30,933 and $67,164, respectively.

During the six month periods ended 30 June 2014 and 2013, the Company recorded interest expense of $23,645 and $72,949, respectively, of which $3,637 and $7,274, respectively, related to the amortization of debt discount. Additionally, as the Company went into default on this note agreement, they were required to record a default penalty of $16,899 on 31 January 2014. This amount increased interest expense and the principal amount due on the convertible note.

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

During the six month periods ended 30 June 2014 and 2013, the Company issued 8,026,412 and 0 common shares, respectively, for the conversion of $42,435 in debt related to Asher #6.

On 8 August 2013, the Company issued a convertible note to Asher in the amount of $12,995, bearing interest at a rate of 8% per annum on any unpaid principal balance, unsecured, with principal and interest amounts due and payable upon maturity on May 12 2014 (the “Asher Note #7”). Any amount of principal or interest amount not paid on 12 May 2014 (the “Default Amount #7”) shall bear interest of 22% per annum commencing on 12 May 2014 to the date the amount is paid.

Asher has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time commencing 6 months after the date of issuance up to the later of 12 May or the date of the Default Amount #7 is paid, at a conversion price equal to 45% of the average of the lowest 3 trading prices for the common stock during the 30 trading day period ending on the latest complete trading day prior to the conversion date.

The Asher Note #7 contains a provision limiting the number of shares of common stock into which the Asher Note #3 is convertible to 4.99% of the outstanding shares of the Company’s common stock. However, the provision in the Asher Note #7 may be waived by Asher upon 61 days’ prior notice. The Company has a right of prepayment of the Asher Note #7 anytime from the date of the Asher Note #7 until 180 days thereafter, subject to a prepayment penalty in the amount of 140% to 150% of the outstanding principal and interest of the Asher Note #7 based on the date of prepayment.

The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rate of 0.07%; Dividend rate of 0%; and, historical volatility rates ranging from 248,45% to 267,73%. Based on this calculation, the Company recorded a derivative liability of $25,224 and a loss on derivative liability of $87,273. The Company also recorded a debt discount of $12,995 (to be amortized over the term of the debt). During the six month periods ended 30 June 2014 and 2013, the Company recorded a related gain on derivative liability of $57,488 and $0, respectively.

During the six month periods ended 30 June 2014 and 2013, the Company recorded interest expense of $14,047 and $0, respectively, of which $6,192 and $0, respectively, related to the amortization of debt discount. Additionally, as the Company went into default on this note agreement, they were required to record a default penalty of $6,892 on 12 May 2014. This amount increased interest expense and the principal amount due on the convertible note.

On 30 October 2013, the Company issued a convertible note to Asher in the amount of $16,500, bearing interest at a rate of 8% per annum on any unpaid principal balance, unsecured, with principal and interest amounts due and payable upon maturity on 1 August 2014 (the “Asher Note #8”). Any amount of principal or interest amount not paid on 1August 2014 (the “Default Amount #8”) shall bear interest of 22% per annum commencing on August 1,2014 to the date the amount is paid.

Asher has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time commencing 6 months after the date of issuance up to the later of 1 August 2014 or the date of the Default Amount #8 is paid, at a conversion price equal to 45% of the average of the lowest 3 trading prices for the common stock during the 30 trading day period ending on the latest complete trading day prior to the conversion date.

The Asher Note #8 contains a provision limiting the number of shares of common stock into which the Asher Note #8 is convertible to 4.99% of the outstanding shares of the Company’s common stock. However, the provision in the Asher Note #8 may be waived by Asher upon 61 days’ prior notice. The Company has a right of prepayment of the Asher Note #8 anytime from the date of the Asher Note #8 until 180 days thereafter, subject to a prepayment penalty in the amount of 140% to 150% of the outstanding principal and interest of the Asher Note #8 based on the date of prepayment.

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rate of .12%; Dividend rate of 0%; and, historical volatility rates ranging from 412.87% to 425.91%. Based on this calculation, the Company recorded a derivative liability of $62,095, and loss on derivative liability of $81,235. The Company also recorded a debt discount of $16,500 (to be amortized over the term of the debt). During the six month periods ended 30 June 2014 and 2013, the Company recorded a related gain on derivative liability of $98,564 and $0, respectively.

During the six month periods ended 30 June 2014 and 2013, the Company recorded interest expense of $11,515 and $0, respectively, of which $10,860 and $0, respectively, related to the amortization of debt discount.

On 24 December 2013, the Company issued a convertible note to Asher in the amount of $16,500, bearing interest at a rate of 8% per annum on any unpaid principal balance, unsecured, with principal and interest amounts due and payable upon maturity on 30 August 2014 (the “Asher Note #9”). Any amount of principal or interest amount not paid on 30 September 2014 (the “Default Amount #9”) shall bear interest of 22% per annum commencing on 30 September 2014 to the date the amount is paid.

Asher has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time commencing 6 months after the date of issuance up to the later of 30 September 2014 or the date of the Default Amount #9 is paid, at a conversion price equal to 45% of the average of the lowest 3 trading prices for the common stock during the 30 trading day period ending on the latest complete trading day prior to the conversion date.

The Asher Note #9 contains a provision limiting the number of shares of common stock into which the Asher Note #8 is convertible to 4.99% of the outstanding shares of the Company’s common stock. However, the provision in the Asher Note #9 may be waived by Asher upon 61 days’ prior notice. The Company has a right of prepayment of the Asher Note #9 anytime from the date of the Asher Note #9 until 180 days thereafter, subject to a prepayment penalty in the amount of 140% to 150% of the outstanding principal and interest of the Asher Note #9 based on the date of prepayment.

The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .09% to .10%; Dividend rate of 0%; and, historical volatility rates ranging from 283.69% to 461.93%. Based on this calculation, the Company recorded a derivative liability of $180,020, and gain on derivative liability of $36,192. The Company also recorded a debt discount of $16,500 (to be amortized over the term of the debt). During the six month periods ended 30 June 2014 and 2013, the Company recorded a related gain on derivative liability of $99,396 and $0, respectively.

During the six month periods ended 30 June 2014 and 2013, the Company recorded interest expense of $11,321 and $0, respectively, of which $10,666 and $0, respectively, related to the amortization of debt discount.

On 27 February 2014, the Company issued a convertible note to Asher in the amount of $13,500, bearing interest at a rate of 8% per annum on any unpaid principal balance, unsecured, with principal and interest amounts due and payable upon maturity on 3 December 2014 (the “Asher Note #10”). Any amount of principal or interest amount not paid on 30 September 2014 (the “Default Amount #10”) shall bear interest of 22% per annum commencing on 3 December 2014, to the date the amount is paid.

Asher has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time commencing 6 months after the date of issuance up to the later of 30 September 2014 or the date of the Default Amount #9 is paid, at a conversion price equal to 45% of the average of the lowest 3 trading prices for the common stock during the 30 trading day period ending on the latest complete trading day prior to the conversion date.

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

The Asher Note #10 contains a provision limiting the number of shares of common stock into which the Asher Note #8 is convertible to 4.99% of the outstanding shares of the Company’s common stock. However, the provision in the Asher Note #10 may be waived by Asher upon 61 days’ prior notice. The Company has a right of prepayment of the Asher Note #10 anytime from the date of the Asher Note #10 until 180 days thereafter, subject to a prepayment penalty in the amount of 140% to 150% of the outstanding principal and interest of the Asher Note #10 based on the date of prepayment.

The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .09% to .10%; Dividend rate of 0%; and, historical volatility rates ranging from 283.69% to 461.93%. Based on this calculation, the Company recorded a derivative liability of $29,224. The Company also recorded a debt discount of $13,500 (to be amortized over the term of the debt). During the six month periods ended 30 June 2014 and 2013, the Company recorded a related loss on derivative liability of $6,638 and $0, respectively.

During the six month periods ended 30 June 2014 and 2013, the Company recorded interest expense of $22,617 and $0, respectively, of which $15,731 and $0, respectively, related to origination interest, and $6,522 and $0, respectively, related to the amortization of debt discount.

On 1 April 2014, the Company issued a convertible note to a private party (“Sergio #1) in the amount of $35,000, bearing interest at a rate of 8% per annum on any unpaid principal balance, unsecured, with principal and interest amounts due and payable upon maturity on 31 December 2014 (the “Sergio Note #1”). Any amount of principal or interest amount not paid on 31 December 2014 (the “Default Amount #10”) shall bear interest of 22% per annum commencing on 31 December 2014, to the date the amount is paid.

Sergio has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time commencing 6 months after the date of issuance up to the later of 1 February 2015 at a conversion price equal to 50% of the average of the lowest 3 trading prices for the common stock during the 30 trading day period ending on the latest complete trading day prior to the conversion date.

The Sergio Note #1 contains a provision limiting the number of shares of common stock into which the Sergio Note #1 is convertible to 4.99% of the outstanding shares of the Company’s common stock. However, the provision in the Sergio #1 may be waived by Sergio upon 61 days’ prior notice. The Company has a right of prepayment of the Sergio Note #1 anytime from the date of the Sergio Note #1 until 180 days thereafter, subject to a prepayment penalty in the amount of 140% to 150% of the outstanding principal and interest of the Sergio Note #1 based on the date of prepayment.

The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .07% to .09%; Dividend rate of 0%; and, historical volatility rates ranging from 502.92% to 993.98%. Based on this calculation, the Company recorded a derivative liability of $207,643. The Company also recorded a debt discount of $35,000 (to be amortized over the term of the debt). During the six month periods ended 30 June 2014 and 2013, the Company recorded a related gain on derivative liability of $124,535 and $0, respectively.

During the six month periods ended 30 June 2014 and 2013, the Company recorded interest expense of $184,829 and $0, respectively, of which $172,643 and $0, respectively, related to origination interest and $11,496 and $0, respectively, related to the amortization of debt discount.

On 11 April 2014, the Company issued a convertible note to KBM in the amount of $37,000, bearing interest at a rate of 8% per annum on any unpaid principal balance, unsecured, with principal and interest amounts due and payable upon maturity on 14 January 2015 (the “KBM #1”). Any amount of principal or interest amount not paid on 14 January 2015 shall bear interest of 22% per annum commencing on 15 January 2015, to the date the amount is paid.

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

KBM has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time commencing 6 months after the date of issuance up to the later of 14 January 2015 or the date the default interest is paid, at a conversion price equal to 45% of the average of the lowest 3 trading prices for the common stock during the 30 trading day period ending on the latest complete trading day prior to the conversion date.

The KBM #1 contains a provision limiting the number of shares of common stock into which the KBM #1 is convertible to 4.99% of the outstanding shares of the Company’s common stock. However, the provision in the KBM #1 may be waived by KBM upon 61 days’ prior notice. The Company has a right of prepayment of the KBM #1 anytime from the date of the KBM #1 until 180 days thereafter, subject to a prepayment penalty in the amount of 140% to 150% of the outstanding principal and interest of the KBM #1 based on the date of prepayment.

The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .07% to .09%; Dividend rate of 0%; and, historical volatility rates ranging from 505.40% to 987.93%. Based on this calculation, the Company recorded a derivative liability of $219,669. The Company also recorded a debt discount of $37,000 (to be amortized over the term of the debt). During the six month periods ended 30 June 2014 and 2013, the Company recorded a related gain on derivative liability of $97,418 and $0, respectively.

During the six month periods ended 30 June 2014 and 2013, the Company recorded interest expense of $183,317 and $0, respectively, of which $182,669 and $0, respectively, related to origination interest and $10,647 and $0, respectively, related to the amortization of debt discount.

The following is the summary of convertible promissory notes that are issued and outstanding as at 30 June 2014 and as at 31 December 2013:

|

Principal

|

2014

|

2013

|

||||||

|

Asher Note #6

|

6,964 | 32,500 | ||||||

|

Asher Note #7

|

19,887 | 12,995 | ||||||

|

Asher Note #8

|

16,500 | 16,500 | ||||||

|

Asher Note #9

|

16,500 | - | ||||||

|

Asher Note#10

|

13,500 | - | ||||||

|

Sergio #1

|

35,000 | - | ||||||

|

Asher Note #11

|

37,000 | - | ||||||

|

Total

|

145,351 | 61,995 | ||||||

|

Unamortized Discount

|

(64,150 | ) | (38,697 | ) | ||||

|

Convertible notes payable, net

|

81,201 | 39,978 | ||||||

6. Related Party Transactions

During the periods ended 30 June 2014 and 2013, the Company paid or accrued $15,500 and 20,500 for management fees to officers and directors of the Company. Additionally, 20,000,000 shares of common stock were issued to officers and directors for services rendered, valued at $800,000 using the quoted market price of the stock.

During the year ended 31 December 2013 the Company settled $23,200 in liabilities accrued to officers and directors through the issuance of Preferred A convertible stock.

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

During the six month period ended 30 June 2014 the Company settled $20,000 in liabilities accrued to officers and directors through the issuance of 2,000,000 shares of Preferred B convertible stock. The stock was valued on an “if-converted” basis using the quoted price of the Company’s common stock. This method generated a fair value of $28,000. Therefore, $8,000 was recorded as a contribution to additional paid-in capital. Also, during the six month period ended 30 June 2014, the Company issued 236,111 shares of common stock to settle accounts payable with officers and directors, valued at $19,433 using the quoted market price of the stock.

During the period ended 30 June 2014 the Company borrowed $29,550 from a company controlled by its CEO. These amounts are classified as advances from related parties on the balance sheet.

7. Stockholders’ Deficit

Authorized

The total authorized capital consists of

|

●

|

4,000,000,000 common shares with par value of $0.00001

|

|

●

|

116,818,182 blank check preferred shares with no par value

|

|

●

●

|

50,000,000 designated class A preferred shares with par value of $0.001

33,181,818 designated class B preferred shares with par value of $0.001

|

Issued and outstanding

Common Stock

On 3 January 2014, the Company effected a 500 to 1 reverse split of its common stock. All share references in these condensed consolidated financial statements have been retroactively adjusted for this split.

During the six month period ended 30 June 2014, the Company issued 8,026,412 common shares upon the conversion of debt; 1,000,000 common shares upon the conversion of Series A Preferred stock; 20,000,000 shares of stock for services provided (valued at $800,000), 156,250 shares of common stock for exploration expense (valued at $4,500), and 458,333 shares of common stock to settle accounts payable (valued at $43,433).

During the six month period ended 30 June 2013, the Company issued 215,841 common shares upon the conversion of debt.

On 23 January 2013, the Company amended its number of authorized shares of common stock and the related par value from 200,000,000 to 850,000,000 subsequent to the approval of the Board of Directors and the holders of a majority of the outstanding shares of the common stock and class A Preferred Convertible stock.

Preferred Stock

Preferred A

On November 15, 2012, the Company filed a Certificate of Designation for its Class Series A Preferred Convertible Stock with the Secretary of State of Nevada designating 50,000,000 shares of its authorized Preferred Stock as Class A Preferred Convertible Stock. The Class A Preferred Shares have a par value of $.001 per share. The Class A Preferred Shares are convertible into shares of the Company’s common stock at a rate of 1 preferred share equals 2 common shares. In addition, the Class A Preferred Shares rank senior to the Company’s common stock. The Class A Preferred Shares have voting rights equal to that of the common stockholders and may vote on any matter that common shareholders may vote. One Class A Preferred Shares is the voting equivalent of two common shares. The Company has the right, at its discretion, to redeem the Class A Preferred shares at a price of $.01 per share.

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

On February 1, 2013 the Company agreed to issue 47,568,500 shares of its Class A Preferred Convertible Stock, in exchange for the settlement of debt of approximately $104,651 to both unrelated parties and certain officers and directors of the Company. The Class A Preferred shares were issued at a price of $0.0022 per share. Related forgiveness of debt income was recorded of $50,730 as of 31 December 2013.

During the six month period ended 30 June 2014 certain Preferred A shareholders converted 500,000 Preferred A shares to 1,000,000 common shares.

Preferred B

On 13 December 2013, the Company designated 33,181,818 of the 200,000,000 authorized preferred shares as class B preferred shares with a par value of $0.001 per share. The conversion price for each class B preferred share is $.01 divided by the average 5 days closing price of the Company’s common stock, and is convertible at the option of the holder. On January 20, 2014, the Company issued 2,000,000 shares of series B preferred convertible stock to 2 directors to extinguish accounts payable of $20,000. The if-converted value of these shares (based on the closing price of the Company’s common stock on January 20, 2014) was $28,000. Therefore, the Company has recorded $8,000 as a reduction to additional paid-in capital.

Stock options

The following stock options are outstanding as at 30 June 2014:

|

Number of

options

|

Exercise

price

|

Remaining life

(years)

|

|||||||

|

Options

|

75,000

|

0.15

|

8.34

|

||||||

During the year ended 31 December 2007, the Company adopted the Stock Incentive Plan (the “Plan”), which provides for the grant of incentive stock options, non-qualified stock options, stock appreciation rights, restricted stock, performance shares and performance units, and stock awards to officers, directors or employees of, as well as advisers and consultants to, the Company.

All stock options and rights are to vest over a period determined by the Board of Directors and expire not more than ten years from the date granted. Pursuant to the Plan, the maximum aggregate number of shares that may be issued for awards is 500,000 and the maximum aggregate number of shares that may be issued for incentive stock options is 500,000.

The following is a summary of stock option activity during the six month period ended 30 June 2014:

|

Number of

stock options

|

Weighted

average

exercise

price

$

|

|||||||

|

Outstanding and exercisable at 1 January 2014

|

75,000

|

0.15

|

||||||

|

Granted

|

-

|

-

|

||||||

|

Exercised

|

-

|

-

|

||||||

|

Expired

|

-

|

-

|

||||||

|

Outstanding and exercisable at 30 June 2014

|

75,000

|

0.15

|

||||||

|

Weighted average fair value of options granted during the period

|

-

|

-

|

||||||

|

Weighted average fair value of options granted during the period

|

-

|

0.00

|

||||||

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

The aggregate intrinsic value of options outstanding and exercisable at 30 June 2014 was $nil.

8. Commitments and Contingencies

The Company is committed to making repayments related to the convertible promissory notes payable.

9. Fair Value of Financial Instruments

A fair value hierarchy was established that prioritizes the inputs used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurements).

The fair values of the financial instruments were determined using the following input levels and valuation techniques:

|

Level 1:

|

classification is applied to any asset or liability that has a readily available quoted market price from an active market where there is significant transparency in the executed/quoted price.

|

|

Level 2:

|

classification is applied to assets and liabilities that have evaluated prices where the data inputs to these valuations are observable either directly or indirectly, but do not represent quoted market prices from an active market.

|

|

Level 3:

|

classification is applied to assets and liabilities when prices are not derived from existing market data and requires us to develop our own assumptions about how market participants would price the asset or liability.

|

Our financial assets and (liabilities) carried at fair value measured on a recurring basis as of June 30, 2014, consisted of the following:

|

Fair Value Measurements Using

|

||||||||||||

|

Total Fair

|

Quoted prices in

|

Significant other

|

Significant

|

|||||||||

|

Value at

|

active markets

|

observable inputs

|

Unobservable inputs

|

|||||||||

|

Description

|

June 30, 2014

|

(Level 2)

|

(Level 2)

|

(Level 3)

|

||||||||

|

Derivative liabilities

|

$

|

394,157

|

$

|

-

|

$

|

394,157

|

$

|

-

|

||||

Our financial assets and (liabilities) carried at fair value measured on a recurring basis as of December 31, 2013, consisted of the following:

|

Fair Value Measurements Using

|

||||||||||||

|

Total Fair

|

Quoted prices in

|

Significant other

|

Significant

|

|||||||||

|

Value at

|

active markets

|

observable inputs

|

Unobservable inputs

|

|||||||||

|

Description

|

June 30, 2013

|

(Level 2)

|

(Level 2)

|

(Level 3)

|

||||||||

|

Derivative liabilities

|

$

|

671,998

|

$

|

-

|

$

|

671,998

|

$

|

-

|

||||

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

As of 30 June 2014 the carrying amounts of amounts receivable and accounts payable and accrued liabilities approximated their estimated fair values because of the short maturity of these financial instruments.

Credit Risk

Credit risk is the risk of an unexpected loss if a customer or counterparty to a financial instrument fails to meet its contractual obligations and arises primarily from the Company’s cash and cash equivalents. The Company manages its credit risk relating to cash and cash equivalents by dealing only with highly-rated United States financial institutions. As a result, credit risk is considered insignificant.

Currency Risk

The majority of the Company’s cash flows and financial assets and liabilities are denominated in US dollars, which is the Company’s functional and reporting currency. Foreign currency risk is limited to the portion of the Company’s business transactions denominated in currencies other than the US dollar.

The Company monitors and forecasts the values of net foreign currency cash flow and balance sheet exposures and from time to time could authorize the use of derivative financial instruments such as forward foreign exchange contracts to economically hedge a portion of foreign currency fluctuations. Currently, the Company does not use derivative instruments to reduce its exposure to foreign currency risk.

Liquidity Risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company manages liquidity risk by continuously monitoring actual and projected cash flows and matching the maturity profile of financial assets and liabilities. The Company had a working capital deficit of $963,353 at 31 December 2013, and $828,101 at 30 June 2014, but management cannot provide assurance that the Company will ultimately achieve profitable operations or become cash flow positive, or raise additional debt and/or equity capital.

Other Risks

Unless otherwise noted, the Company is not exposed to significant interest rate risk and commodity price risk.

10. Other receivable

As of 31 December 2013, the Company has recorded other receivable for loan proceeds, where the debt instrument was finalized, but proceeds were not received until after period end.

11. Restatement

The Company has identified that its 30 June 2013 statements of operations (three and six months ended) and cash flows (six months ended) needed to be restated due to its requirement to record and record and remeasure derivative liabilities associated with its convertible debt. See the restatement adjustments below.

For the three months ended 30 June 2013

Statement of Operations

|

As originally reported

|

Adjustments

|

Restated

|

||||||||||

|

Interest expense

|

$

|

35,465

|

$

|

57,593

|

$

|

93,058

|

||||||

|

Loss on derivative liabilities

|

$

|

0

|

$

|

248,869

|

$

|

248,869

|

||||||

|

Net loss

|

$

|

135,721

|

$

|

269,812

|

$

|

405,533

|

||||||

|

Net loss per share

|

$

|

.00

|

$

|

1.17

|

$

|

1,17

|

||||||

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

For the six months ended 30 June 2013

Statement of Operations

|

As originally reported

|

Adjustments

|

Restated

|

||||||||||

|

Interest expense

|

$

|

57,694

|

$

|

118,400

|

$

|

173,094

|

||||||

|

Loss on derivative liabilities

|

$

|

0

|

$

|

66,533

|

$

|

66,533

|

||||||

|

Net loss

|

$

|

176,878

|

$

|

181,933

|

$

|

358,811

|

||||||

|

Net loss per share

|

$

|

.00

|

$

|

1.30

|

$

|

1.30

|

||||||

Statement of Cash Flows

|

As originally reported

|

Adjustments

|

Restated

|

||||||||||

|

Net loss

|

$

|

176,878

|

$

|

181,933

|

$

|

358,811

|

||||||

|

Debt discount amortization and origination interest

|

$

|

881

|

$

|

166,774

|

167,655

|

|||||||

|

Loss on derivative liabilities

|

$

|

0

|

$

|

66,533

|

66,533

|

|||||||

|

Net cash used in operating activities

|

$

|

55,837

|

$

|

13

|

55,850

|

|||||||

12. Notes Payable

As of 30 June 2014, the following notes payable were outstanding:

Note Issuance Date Note Maturity Date Interest Rate $

June 30, 2013 June 29, 2015 5.0% 90,000

August 20, 2013 August 19, 2015 5.0% 43,000

September 30, 2013 September 29, 2015 5.0% 68,100

December 30, 2013 December 30, 2015 5.0% 40,000

May 15, 2014 August 13, 2014 10.0% 23,000

May 2, 2014 July 31, 2014 10.0% 23,550

June 17, 2014 September 15, 2014 10.0% 6,000

Total Notes Payable 293,650

Less : Current portion of long term debt (90,000)

Less: Short term debt (52,550)

Total : Long Term Portion 151,100

For the six months ended, and as of 30 June 2014, total interest expense and accrued interest for the above notes payable were $6,670 and $10,580, respectively. No related interest expense or accrued interest as of 30 June 2013.

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

June 30, 2014

13. Subsequent Events

On July 17, 2014, the Company issued 1,408,333 common shares upon the conversion of $4,225 in Asher debt.

The Company issued 100,000,000 shares of restricted common stock to its CEO on July 9,2014, for services provided.

The Company issued 10,000,000 shares of restricted common stock in connection with a Purchase and Sale Agreement entered into on July 15, 2014. The purchase price was 10,000,000 shares valued at $80,000, which is based on the quoted value of the Company’s stock on that date. The Company acquired land, furniture and fixtures, computer equipment, vehicles, other equipment, and disposal well leases.

The Company on August 7, 2014 reached an agreement with a convertible note holder to settle all notes outstanding to the note holder issued prior to April 1, 2014, by August 13, 2014 in an amount of $110,000, and for the Company to have the right to settle an additional $74,500 without interest or premium in cash by September 12, 2014.

The Company’s Board of Directors on August 17, 2014 elected to increase the authorized shares of common stock

to 4,000,000,000 shares.

During July 2014, the Company received advances from a third party in the amount of $28,500. These advances carry no terms and are payable on demand.

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “may,” “should,” “could,” “will,” “plan,” “future,” “continue,” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. These forward-looking statements are based largely on our expectations or forecasts of future events, can be affected by inaccurate assumptions, and are subject to various business risks and known and unknown uncertainties, a number of which are beyond our control. Therefore, actual results could differ materially from the forward-looking statements contained in this document, and readers are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A wide variety of factors could cause or contribute to such differences and could adversely impact revenues, profitability, cash flows and capital needs. There can be no assurance that the forward-looking statements contained in this document will, in fact, transpire or prove to be accurate.

Important factors that may cause the actual results to differ from the forward-looking statements, projections or other expectations include, but are not limited to, the following:

|

●

|

risk that we will not be able to remediate identified material weaknesses in our internal control over financial reporting and disclosure controls and procedures;

|

|

●

|

risk that we are not able to meet the requirements of agreements under which we may have any cash payments to on the option or any exploration obligations that we have regarding these properties, which could result in the loss of our right to exercise these options to acquire certain mining, oil mineral rights underlying these properties; or loan guarantees that Company is obligated for;

|

|

●

|

the risk that we will be unable to pay our debt obligations as they become due or comply with the covenants contained in agreements with debt holders;

|

|

●

|

risk that we will be unable to secure additional financing in the near future in order to commence and sustain our planned exploration work and be forced to cease our exploration and development program;

|

|

●

|

risk that we cannot attract, retain and motivate qualified personnel, particularly employees, consultants and contractors for our operations in the United States;

|

|

●

|

risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits;

|

|

●

|

results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with our expectations;

|

|

●

|

mining and development risks, including risks related to accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in production;

|

|

●

|

the potential for delays in exploration or development activities or the completion of feasibility studies;

|

|

●

|

risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses;

|

|

●

|

risks related to commodity price fluctuations;

|

|

●

|

the uncertainty of profitability based upon our history of losses;

|

|

●

|

risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned exploration and development projects;

|

|

●

|

risks related to environmental regulation and liability;

|

|

●

|

risks that the amounts reserved or allocated for environmental compliance, reclamation, post-closure control measures, monitoring and on-going maintenance may not be sufficient to cover such costs;

|

|

●

|

risks related to tax assessments;

|

|

●

|

political and regulatory risks associated with mining development and exploration; and

|

|

●

|

other risks and uncertainties related to our prospects, properties and business strategy.

|

The foregoing list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.