Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CareTrust REIT, Inc. | d772474d8k.htm |

| EX-99.1 - EX-99.1 - CareTrust REIT, Inc. | d772474dex991.htm |

Investor Presentation

August 18, 2014

Exhibit 99.2 |

This

presentation

contains

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

These

forward-looking

statements

include

all

statements

that

are

not

historical

statements

of

fact

and

those

regarding

our

intent,

belief

or

expectations,

including,

but

not

limited

to,

statements

regarding

future

financing

plans,

business

strategies,

growth

prospects

and

operating

and

financial

performance;

expectations

regarding

the

making

of

distributions

and

the

payment

of

dividends;

and

compliance

with

and

changes

in

governmental

regulations.

Words

such

as

"anticipate(s),"

"expect(s),"

"intend(s),"

"plan(s),"

"believe(s),"

"may,"

"will,"

"would,"

"could,"

"should,"

"seek(s)"

and

similar

expressions,

or

the

negative

of

these

terms,

are

intended

to

identify

such

forward-looking

statements.

These

statements

are

based

on

Management's

current

expectations

and

beliefs,

and

are

subject

to

a

number

of

risks

and

uncertainties

that

could

lead

to

actual

results

differing

materially

from

those

projected,

forecasted

or

expected.

Although

Management

believes

that

the

assumptions

underlying

the

forward-looking

statements

are

reasonable,

they

are

not

guarantees

and

the

Company

can

give

no

assurance

that

their

expectations

will

be

attained.

Factors

which

could

have

a

material

adverse

effect

on

CareTrust's

operations

and

future

prospects

or

which

could

cause

actual

results

to

differ

materially

from

expectations

include,

but

are

not

limited

to:

(i)

the

ability

to

achieve

some

or

all

of

the

expected

benefits

from

the

completed

spin-off

and

to

successfully

conduct

CareTrust's

business

following

the

spin-off;

(ii)

the

ability

and

willingness

of

Ensign

to

meet

and/or

perform

its

obligations

under

the

contractual

arrangements

that

it

entered

into

with

CareTrust

in

connection

with

the

spin-off,

including

the

Master

Leases,

and

any

of

its

obligations

to

indemnify,

defend

and

hold

CareTrust

harmless

from

and

against

various

claims,

litigation

and

liabilities;

(iii)

the

ability

and

willingness

of

CareTrust's

tenants

to

(a)

comply

with

laws,

rules

and

regulations

in

the

operation

of

the

properties

CareTrust

leases

to

them,

and

(b)

renew

their

leases

with

CareTrust

upon

expiration,

or

in

the

alternative,

(c)

CareTrust's

ability

to

reposition

and

re-let

its

properties

on

the

same

or

better

terms

in

the

event

of

nonrenewal

or

replacement

of

an

existing

tenant

and

any

obligations,

including

indemnification

obligations,

that

CareTrust

may

incur

in

replacing

an

existing

tenant;

(iv)

the

availability

of,

and

the

ability

to

identify

and

acquire,

suitable

acquisition

opportunities

and

lease

the

same

to

reliable

tenants

on

accretive

terms;

(v)

the

ability

to

generate

sufficient

cash

flows

to

service

CareTrust's

outstanding

indebtedness;

(vi)

access

to

debt

and

equity

capital

markets;

(vii)

fluctuating

interest

rates;

(viii)

the

ability

to

retain

and

properly

incentivize

key

management

personnel;

(ix)

the

ability

to

qualify

or

maintain

CareTrust's

status

as

a

REIT;

(x)

changes

in

the

U.S.

tax

laws

and

other

state,

federal

or

local

laws,

whether

or

not

specific

to

REITs;

(xi)

other

risks

inherent

in

the

real

estate

business,

including

potential

liability

relating

to

environmental

matters

and

illiquidity

of

real

estate

investments;

and

(xii)

any

additional

factors

included

in

this

presentation

and

any

included

in

the

section

entitled

"Risk

Factors"

in

CareTrust's

Registration

Statement

on

Form

10

and

in

Item

1A

of

Part

II

of

CareTrust's

most

recently

filed

Form

10-Q.

Forward-looking

statements

speak

only

as

of

the

date

made.

Except

in

the

normal

course

of

the

CareTrust's

public

disclosure

obligations,

CareTrust

expressly

disclaims

any

obligation

to

release

publicly

any

updates

or

revisions

to

any

forward-looking

statements

to

reflect

any

change in its expectations or any change in events, conditions or circumstances on

which any statement is based. Reconciliations

of

certain

non-GAAP

financial

measures

used

in

this

presentation,

including

a

reconciliation

of

our

net

income

(loss)

per

GAAP

to

EBITDA,

Adjusted

EBITDA,

FFO,

normalized

FFO,

FAD

and

normalized

FAD,

are

included

in

this

presentation.

The

definitions

of

our

non-

GAAP

measures

used

in

this

presentation

are

included

in

our

press

release

dated

August

13,

2014,

which

is

incorporated

herein

by

reference

and

available

on

our

website

at

www.investors.caretrustreit.com.

Safe Harbor Statement

2 |

Geographically

Diverse

Portfolio

Strong

Tenant

Rent

Coverage

Experienced

Management

Team

Growth &

Diversification

Opportunities

Attractive Industry

Fundamentals

Investment Highlights Summary

3

Financially

Secure “Platform”

Tenant

Favorable Long-Term

Lease Structure |

Greg Stapley

CEO

Management

4

Bill Wagner

CFO

Dave Sedgwick

VP Operations

•

27 years of experience in the

acquisition, development and

disposition of real estate

•

Co-Founder of Ensign,

instrumental in assembling the

real estate portfolio was

transferred to CareTrust

•

Previously the General Counsel

of a 192-location national

retailer and Partner at a law

firm

•

22 years of accounting and

finance experience, primarily

in real estate, including

11 years with publicly-traded

REITs

•

Served as SVP and CAO of

Nationwide Health Properties,

Inc. and Sunstone Hotel

Investors, Inc.

•

Ernst & Young Kenneth

Leventhal Real Estate Group

•

12 years of experience in

skilled nursing operations

•

Trained over 100 Ensign

nursing home administrators as

Ensign’s Chief Human Capital

Officer

•

Led five SNFs as Administrator/

CEO; developed Ensign’s

approach to cultural, clinical

and financial performance

Mark Lamb

Director of Investments

•

Three years as Director of

Investments at Nationwide

Health Properties, underwriting

over $1 billion of new

investments across the Seniors

Housing and Skilled Nursing

sectors.

•

Led three SNFs as

Administrator for Plum

Healthcare & North American

Health Care in California.

•

Investment Associate at The

Bascom Group, a private equity

real estate investment firm. |

•

A leading provider of skilled nursing

care and assisted living services

•

Strong financial performance with

dependable cash flows and liquidity

•

Long-tenured and successful

management team

•

Portfolio of 97 quality assets with Ensign

as initial tenant except for three facilities

operated by CareTrust

•

“Platform”

tenant initially has attractive

1.85x rent coverage supported by long-

term, triple-net lease structures

•

Focus will be on broadening geographic

reach, tenant base and asset class

•

Management team with deep real estate

and healthcare industry expertise

Transaction Overview

5

Spin-Off

On June 1, 2014 The Ensign Group split into

two publicly traded

companies

through a

tax-free spin-off

transaction.

Operations

Real Estate |

Strong Liquidity for Growth

6

(1) Does not reflect deduction of cash portion of earnings and profits

(“E&P”) purge, to be determined after spin-off, which will be 20% to

25% of CTRE’s allocation of Ensign’s historical E&P (Ensign’s

E&P estimated to be between $350 to $385 million before spin-off)

Cash on hand as of June 30, 2014¹

$80

million

Undrawn Senior Secured Credit Facility with

approximately $84 million of availability as

of June 30, 2014

$150

million

Plus access to public equity and debt

markets, and other forms of long-term

capital. |

INVESTMENT HIGHLIGHTS

7 |

Portfolio Snapshot

Triple Net Leased Properties

CareTrust Operated ILF

8 |

Varying Deal Size

(One-Offs to Portfolios)

Multiple

Operator

Partnerships

No Geographic

Constraints

Promising &

Stabilized

SNF/ALF Assets

Future

Diversification

into MOB,

Acute Care and

Life Sciences

Wider Investment Parameters

9

Cluster

Cluster

Ready

Ready

Local

Local

Leader

Leader

Pipeline

Pipeline

Geographic

Geographic

Limits

Limits

Turnaround

Turnaround

Opportunities

Opportunities

Ensign Strategy

Ensign Strategy

Note: For one year after the Spin-Off, CareTrust is subject to the

Opportunities Agreement with Ensign which affords Ensign certain rights of

first refusal to some of CareTrust’s investment opportunities under certain circumstances

CareTrust Strategy |

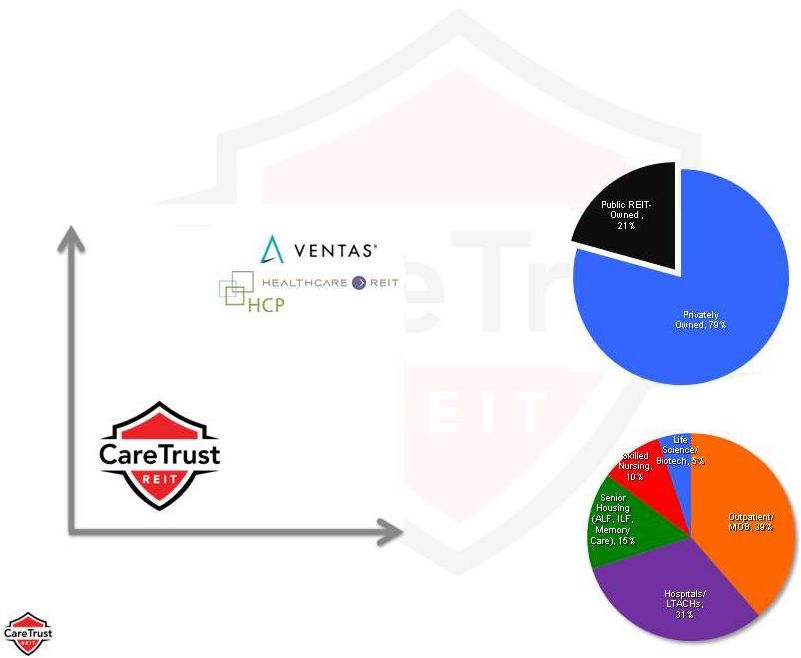

Healthcare Real Estate Ownership

Real Estate Asset Breakdown

Note:

Healthcare

Real

Estate

Ownership

Breakdown

and

Real

Estate

Asset

Breakdown

from

Stifel

Nicolaus

industry

analysis

Healthcare Real Estate Market

Estimated at Over $1 Trillion

10

Deal

Size

Tenant Size

Large REITs focused on larger acquisitions |

Fragmented Markets With Value

Arbitrage Opportunities

11

Fragmented market,

underserved by capital

providers

Limited access to capital

and liquidity for local and

regional operators

Limited competition from

other REITs for SNFs

and mid-market assisted

living properties

Quality one-off, small-

&

mid-sized portfolios

Conservative

underwriting strategy

Leverage robust number

of existing relationships

Partner with successful

local & regional players

Creative capital solutions

Attractive investment

spreads over cost of

capital

Public/private market

discrepancies

Substantial growth

through smaller, non-

marketed transactions

Market Backdrop

CareTrust Role

Results |

Disciplined Investment Strategy

Focused on Driving Value

12

Senior Housing

Facilities

(ALF, ILF, MC)

Skilled Nursing

Facilities

Medical Office

Buildings

Acute Care

Triple Net Leases

Core

Core

Opportunistic

Opportunistic

Mortgage Debt

Relationship

Relationship

Opportunistic

Opportunistic

Development

Funding

Relationship

Relationship

RIDEA

Opportunistic |

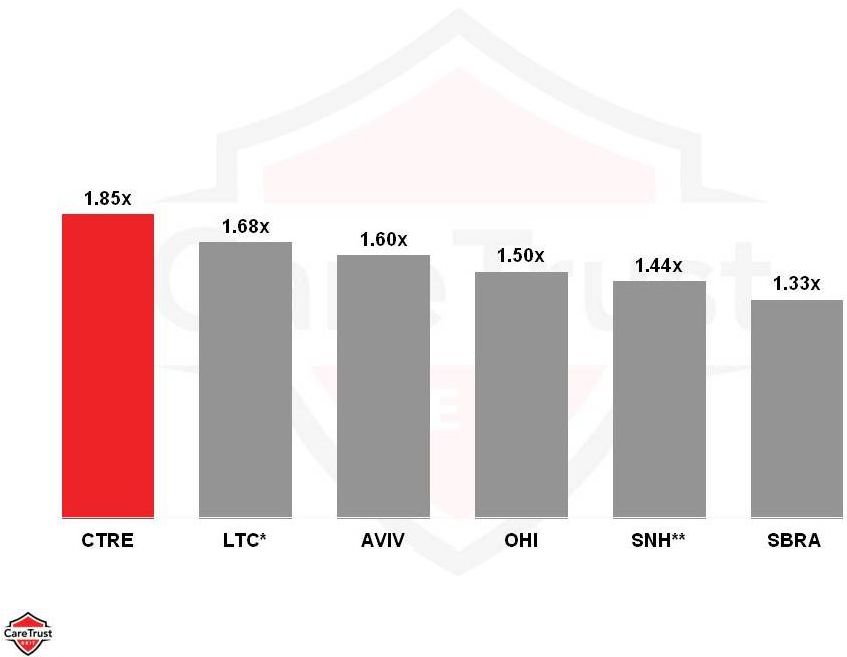

Total LTM EBITDAR Tenant Rent Coverage

*

Represents

facility

EBITDAR

coverage

for

LTC’s

skilled

nursing

portfolio

**

Rent

coverage

is

calculated

as

operating

cash

flow

from

SNH

tenants’

operations

of

SNH

properties,

before

subordinated

charges,

divided

by

rents

payable

to

SNH

Source:

Company

filings,

as

of

12/31/13

for

AVIV,

LTC,

and

SBRA

12/31/13,

and

9/30/13

for

SNH

and

OHI.

Rent

coverage

is

as

of

3/31/14

for

the

reported

EBITDAR

from

CTRE’s

Ensign

portfolio

Leading Tenant Rent Coverage

13 |

Real Estate Acquisition & Development Experience

The CareTrust Team brings its

Experience, Relationships & Track Record

from Ensign

14

Ensign Annual Facilities Growth

Ensign Historical Asset Acquisitions |

Attractive Industry Dynamics for SNF Operators

15

Numbers in millions

Relative Costs of Treatment Across Care Providers

SNF

IRF

LTAC

Source: AHCA, CMS OSCAR data, U.S. Census Bureau, Medpac

Number of Skilled Nursing Facilities

Age 65+ Population

US SNF Properties |

Skilled Nursing Reimbursement Rates:

Stable and Increasing Over Time

16

Source: Eljay LLC and composite of CMS, AHCA, AQNHC and Avalere Group Data; ENSG

company filings Skilled Nursing Reimbursement Rates (2000-2013)

4.2%

4.2%

4.0%

4.0%

3.4%

3.4%

CAGR

In

In

May

May

2014,

2014,

CMS

CMS

proposed

proposed

a

a

2%

2%

aggregate

aggregate

increase

increase

for

for

2015

2015

SNF

SNF

payments

payments |

“THE”

Platform Tenant

17

As of June 30, 2014, Ensign operated 125 facilities, 10 home health

and 8 hospice operations, 12 urgent care centers and a mobile

x-ray diagnostic company, all located in 12 states

Ensign has a strong track record of integrating turnaround

opportunities

–

Improves operations through increased occupancy, quality mix

and acuity shift

Long-tenured and successful management team has been an

integral part of Ensign’s business strategy

Ensign Operated Facilities

SNFs, ALFs & ILFs

Home Health & Hospice

Urgent Care Clinics

Note:

EBITDAR is a non-GAAP measure and represents net income before (a) interest

expense, net, (b) provision for income taxes, (c) depreciation and (d)

facility rent expense. See Ensign’s public filings for a reconciliation of EBITDAR to GAAP and additional

information on Ensign’s performance.

Revenue

Ensign Business Overview

Adjusted EBITDAR |

Turnaround Track Record

Acquisition Track Record based on an average for all SNF

acquisitions from 2001 through October 1, 2012 measuring

five quarters of operating performance.

4-Quarter

Performance

Q1

Q5

Improvement

EBITDAR

Margin

11.3%

14.5%

322 bps

Occupancy

70.9%

74.0%

316 bps

Skilled Mix

(Rev)

31.3%

38.7%

732 bps

Quality Mix

(Rev)

48.4%

51.6%

321 bps

Ensign Track Record

Operational Excellence

18

Recognized Skilled Nursing Facility Quality

CMS Star ratings as reported on cms.gov

http://www.medicare.gov/nursinghomecompare/ |

FINANCIAL SUMMARY

19 |

Guidance

20

CareTrust’s

guidance

for

the

12

months

immediately

post-spin

1

is:

•

$56 million in rent from Ensign

•

$24

million

in

interest

expense

2

•

$4.5 million to $5.0 million in G&A expense

•

$1.23 to $1.25 in normalized FFO per diluted common share

•

$1.33 to $1.35 in normalized FAD per diluted common share

•

$0.24

to

$0.26

of

net

income

per

diluted

common

share

2

(1)

June

1,

2014

though

May

31,

2015

projections

(i)

are

based

on

22.4

million

diluted

weighted

average

common

shares,

and

exclude

any

shares

to

be

issued

in

connection

with

the

purging

distribution;

and

(ii)

assume

no

additional

acquisitions

or

dispositions

beyond

those

made

to

date,

exclusion

of

stock-

and

incentive-

based

cash

compensation,

exclusion

of

spin-related

costs,

and

exclusion

of

acquisition-related

costs

and

amortization

costs

related

to

intangible

assets

acquired.

(2)

Includes

$2.2

million

in

amortization

of

deferred

financing

costs. |

Guidance

RECONCILIATION OF NET INCOME TO

NON-GAAP FINANCIAL MEASURES

1

21

Low Guide

High Guide

Net income

$0.24

$0.26

Depreciation and amortization

0.98

0.98

FFO

1.22

1.24

Costs associated with the spin-off

0.01

0.01

Normalized FFO

$1.23

$1.25

Net income

$0.24

$0.26

Depreciation and amortization

0.98

0.98

Amortization of deferred financing costs

0.10

0.10

FAD

1.31

1.34

Costs associated with the spin-off

0.01

0.01

Normalized FAD

$1.33

$1.35

(1) Per share amounts based on 22.4 million weighted average shares outstanding on

a per diluted common share basis |

APPENDIX

22 |

23

Assets

Real estate investments

$420,059

Cash and cash equivalents*

80,345

Accounts receivable

1,871

Prepaid expenses and other assets

77

Deferred financing costs, net

11,000

Total assets

$513,352

Liabilities and Stockholders' Equity

Senior unsecured notes payable

$260,000

Mortgage notes payable

99,504

Accounts payable and accrued liabilities

6,190

Total liabilities

365,694

Stockholders' Equity:

Common stock

222

Additional paid-in capital

146,980

Retained earnings

456

Total

stockholders'

equity

147,658

Total

liabilities

and

stockholders' equity

$513,352

* Does not reflect pending deduction of cash portion of E&P purge, to be

determined and paid prior to year-end, which will be 20% to 25% of

CTRE’s allocation of Ensign’s E&P (Ensign’s E&P estimated to be between $350 to $385 million before spin-off)

Q2 2014 Financial Summary

BALANCE SHEET

(in thousands) |

Q2

2014 Financial Summary DEBT SUMMARY

(in thousands)

24

Interest Rate/

Maturity

June 30, 2014

Debt

Collateral

Spread

Date

Balance

Fixed Rate Debt

Senior unsecured notes payable

Unsecured

5.875%

2021

$260,000

GECC mortgage notes payable (1)

10 properties

7.252%

2017

48,220

Other mortgage note payable

1 property

6.000%

2019

607

308,827

Floating Rate Debt

GECC mortgage notes payable (1)

10 properties

L + 3.35%

2017

50,677

Senior secured revolving credit facility (2)

11 properties

L + 2%-2.5%

2018

-

50,677

Total Debt

$359,504

Debt Statistics

% Fixed Rate Debt

85.9%

% Floating Rate Debt

14.1%

Total

100.0%

Average Interest Rates:

Fixed

6.1%

Floating

3.9%

Blended

5.8%

(1) The fixed rate portion of the GECC mortgage notes payable converts to the

floating rate in May 2017. The floating rate portion is subject to a

Libor floor of 0.50%. The GECC mortgage notes have two 12-month

extension options.

(2) Borrowings available under the senior secured revolving credit facility totaled

$84.2 million at June 30, 2014. Funds can also be borrowed at the Base Rate

(as defined) plus 1.0% to 1.5%. |

25

One Month

Ended

June 30, 2014

Revenues:

Rental income

$4,667

Tenant reimbursement

396

Other revenue

211

Total revenues

5,274

Expenses:

Depreciation and amortization

1,794

Interest expense

1,967

Property taxes

396

Operating expenses

161

General and administrative

500

Total expenses

4,818

Net income

$456

Earnings per common share:

Basic

$0.02

Diluted

$0.02

Weighted average shares outstanding:

Basic

22,237

Diluted

22,436

Q2 2014 Financial Summary

STATEMENT OF INCOME

(in thousands, except per share amounts) |

Q2

2014 Financial Summary NON-GAAP FINANCIAL MEASURES

(in thousands, except per share amounts)

26

One Month

Ended

June 30, 2014

Net income

$456

Real estate related depreciation and amortization

1,794

Interest expense

1,967

EBITDA

4,217

Costs associated with the spin-off

254

Adjusted EBITDA

$4,471

Net income

$456

Real estate related depreciation and amortization

1,794

Funds from Operations (FFO)

2,250

Costs associated with the spin-off

254

Normalized FFO

$2,504

Net income

$456

Real estate related depreciation and amortization

1,794

Amortization of deferred financing costs

175

Funds Available for Distribution (FAD)

2,425

Costs associated with the spin-off

254

Normalized FAD

$2,679

FFO per share

$0.10

Normalized FFO per share

$0.11

FAD per share

$0.11

Normalized FAD per share

$0.12

Diluted weighted average shares outstanding

22,436 |

Total

Skilled Nursing

Facilities

Multi-Specialty Campuses

Assisted Living and

Independent Living

Facilities ¹

Independent Living

Facilities Operated

by CareTrust ¹

State

Properties

Beds/Units

Facilities

Beds

Campuses

SNF Beds

ALF Units

ILF Units

Facilities

Units

Facilities

Units

California

18

1,991

14

1,465

2

158

121

24

2

223

---

---

Texas

27

3,241

22

2,699

1

123

77

20

2

115

2

207

Arizona

10

1,327

7

799

1

162

100

---

2

266

---

---

Utah

12

1,305

9

907

1

235

37

---

1

69

1

57

Colorado

5

463

3

210

---

---

---

---

2

253

---

---

Idaho

6

477

5

408

1

45

24

---

---

---

---

---

Washington

6

555

5

453

---

---

---

---

1

102

---

---

Nevada

3

304

1

92

---

---

---

---

2

212

---

---

Nebraska

5

366

3

220

2

105

41

---

---

---

---

---

Iowa

5

356

3

185

2

109

62

---

---

---

---

---

Total

97

10,385

72

7,438

10

937

462

44

12

1,240

3

264

(1) The initial portfolio of four ILFs includes one that is leased to and operated

by Ensign and three owned and operated by CareTrust CareTrust Geographic

Detail 27 |