Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Sensata Technologies Holding plc | form8-k081814.htm |

| EX-99.1 - PRESS RELEASE - Sensata Technologies Holding plc | schraderpressrelease.htm |

| EX-2.1 - SHARE PURCHASE AGREEMENT - Sensata Technologies Holding plc | schraderex21.htm |

| EX-10.1 - COMMITMENT LETTER - Sensata Technologies Holding plc | schraderex101.htm |

INVESTOR PRESENTATION SENSATA TECHNOLOGIES ACQUIRES THE SCHRADER GROUP AUGUST 2014

SENSATA ACQUIRES SCHRADER 2 This presentation contains certain forward–looking statements that involve risks or uncertainties. For example, statements regarding financial guidance and product development goals are forward–looking. The Company’s future results may differ materially from the projections described in today’s discussion. Factors that might cause these differences include, but are not limited to, the failure to receive, on a timely basis or otherwise, the required approvals from government and regulatory authorities in connection with the transaction, the terms of those approvals, the risk that a condition to closing contemplated by the share purchase agreement may not be satisfied or waived, the inability to realize expected synergies or cost savings or difficulties related to the integration of the Schrader business, the ability to retain and hire key personnel and maintain relationships with customers, suppliers or other business partners of the Schrader business, the risk factors described in the Company’s Form 10-K, Form 10-Q and Form 8-K filings. Copies of all the Company’s filings are available from the Investor Relations section of our website, www.Sensata.com, and from the SEC. Forward–looking statements

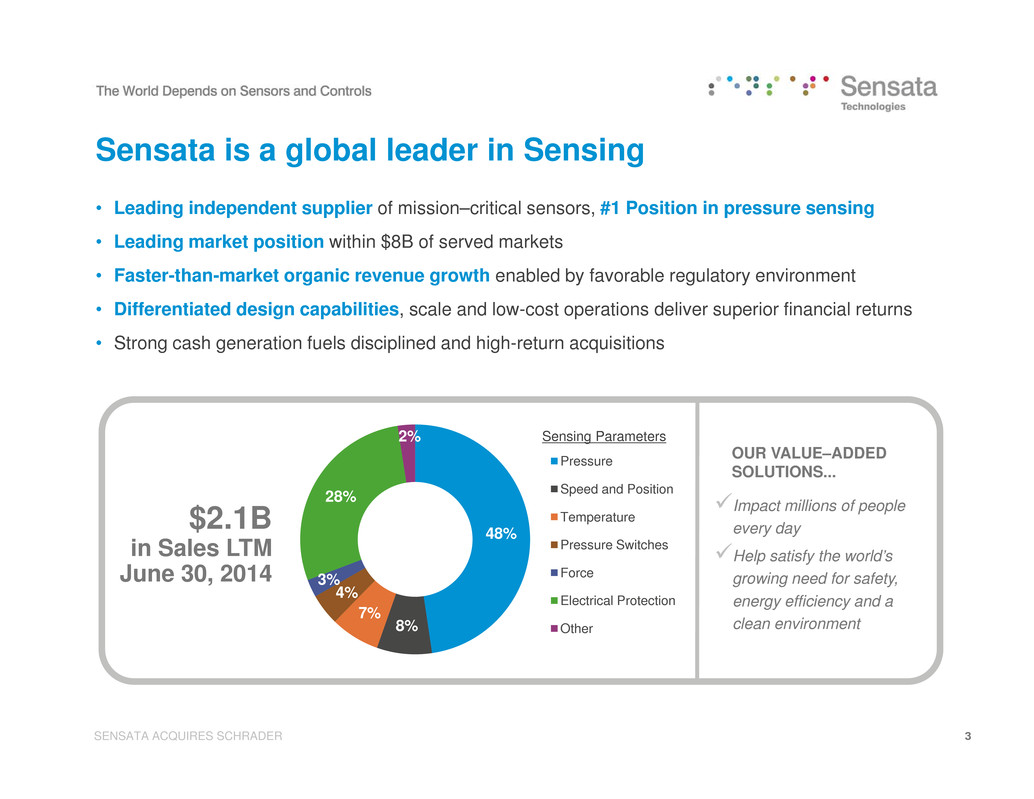

SENSATA ACQUIRES SCHRADER • Leading independent supplier of mission–critical sensors, #1 Position in pressure sensing • Leading market position within $8B of served markets • Faster-than-market organic revenue growth enabled by favorable regulatory environment • Differentiated design capabilities, scale and low-cost operations deliver superior financial returns • Strong cash generation fuels disciplined and high-return acquisitions 48% 8% 7% 4% 3% 28% 2% Pressure Speed and Position Temperature Pressure Switches Force Electrical Protection Other OUR VALUE–ADDED SOLUTIONS... ?Impact millions of people every day ?Help satisfy the world’s growing need for safety, energy efficiency and a clean environment $2.1B in Sales LTM June 30, 2014 Sensata is a global leader in Sensing 3 Sensing Parameters

SENSATA ACQUIRES SCHRADER Schrader extends Sensata’s leadership in Sensing • Leading market position in tire pressure monitoring sensors (TPMS) • Faster-than-market growth fundamentals of TPMS • Europe roll–out underway • China adoption will provide significant growth • Sticky, regulation–driven revenue growth • Differentiated design capabilities in low pressure MEMS, ASICs and wireless • 2014 revenue: ~$550M • Employees: ~2,500 4

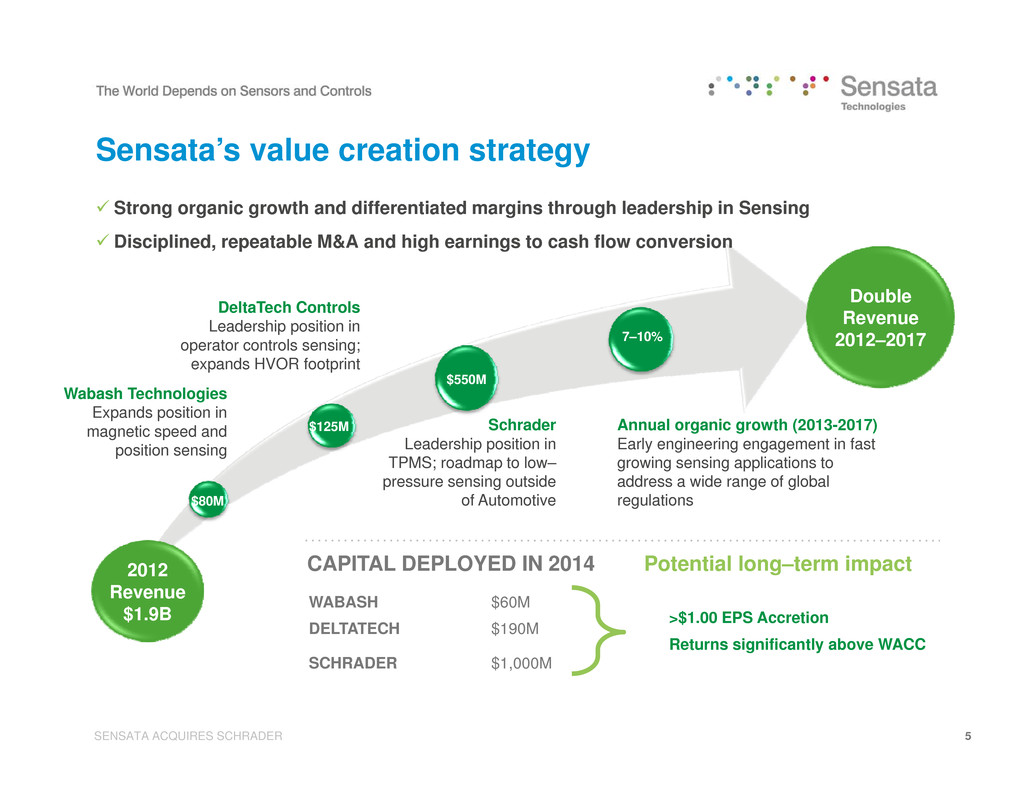

SENSATA ACQUIRES SCHRADER Schrader Leadership position in TPMS; roadmap to low– pressure sensing outside of Automotive 2012 Revenue $1.9B Double Revenue 2012–2017 DeltaTech Controls Leadership position in operator controls sensing; expands HVOR footprint Wabash Technologies Expands position in magnetic speed and position sensing Current Road Map Annual organic growth (2013-2017) Early engineering engagement in fast growing sensing applications to address a wide range of global regulations$80M $125M $550M 7–10% Sensata’s value creation strategy ? Strong organic growth and differentiated margins through leadership in Sensing ?Disciplined, repeatable M&A and high earnings to cash flow conversion WABASH $60M DELTATECH $190M SCHRADER $1,000M CAPITAL DEPLOYED IN 2014 Potential long–term impact >$1.00 EPS Accretion Returns significantly above WACC 5

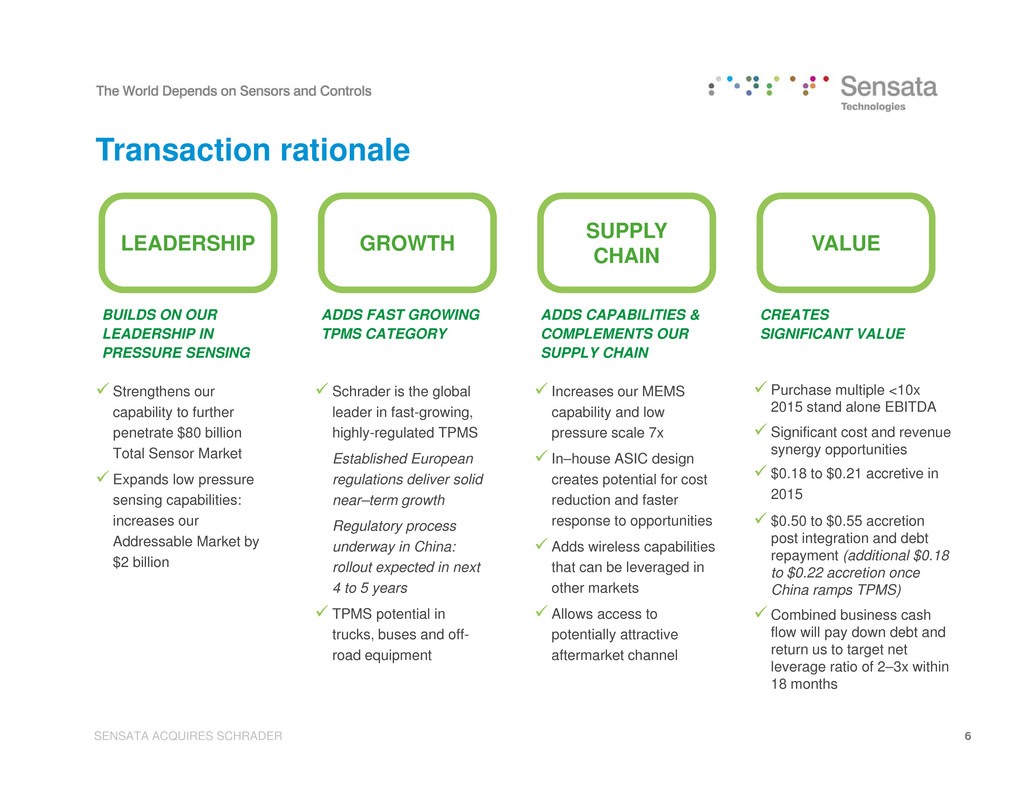

SENSATA ACQUIRES SCHRADER ? Strengthens our capability to further penetrate $80 billion Total Sensor Market ? Expands low pressure sensing capabilities: increases our Addressable Market by $2 billion ? Schrader is the global leader in fast-growing, highly-regulated TPMS Established European regulations deliver solid near–term growth Regulatory process underway in China: rollout expected in next 4 to 5 years ? TPMS potential in trucks, buses and off- road equipment ? Increases our MEMS capability and low pressure scale 7x ? In–house ASIC design creates potential for cost reduction and faster response to opportunities ? Adds wireless capabilities that can be leveraged in other markets ? Allows access to potentially attractive aftermarket channel ? Purchase multiple <10x 2015 stand alone EBITDA ? Significant cost and revenue synergy opportunities ? $0.18 to $0.21 accretive in 2015 ? $0.50 to $0.55 accretion post integration and debt repayment (additional $0.18 to $0.22 accretion once China ramps TPMS) ? Combined business cash flow will pay down debt and return us to target net leverage ratio of 2–3x within 18 months Transaction rationale LEADERSHIP BUILDS ON OUR LEADERSHIP IN PRESSURE SENSING GROWTH ADDS FAST GROWING TPMS CATEGORY SUPPLY CHAIN ADDS CAPABILITIES & COMPLEMENTS OUR SUPPLY CHAIN VALUE CREATES SIGNIFICANT VALUE 6

SENSATA ACQUIRES SCHRADER 17M vehicles North America: TREAD Act passed in 2000 required all cars be equipped with TPMS by 2008 Growth: Opportunities driven by regulation Regulation drives rapid TPMS growth; significant opportunities in China 23M vehicles China: Mandate underway 4.7M vehicles South Korea: Revised its Vehicle Safety Standards to mandate TPMS on all vehicles by Jan. 2015 SENSATA’S STRONG POSITION IN CHINA, including infrastructure and relationships with all major OEMs, will help greatly accelerate TPMS growth there 20M vehicles Europe: ECE–R64 requires all new passenger vehicles to have TPMS installed by manufacturers by Nov. 2014 7

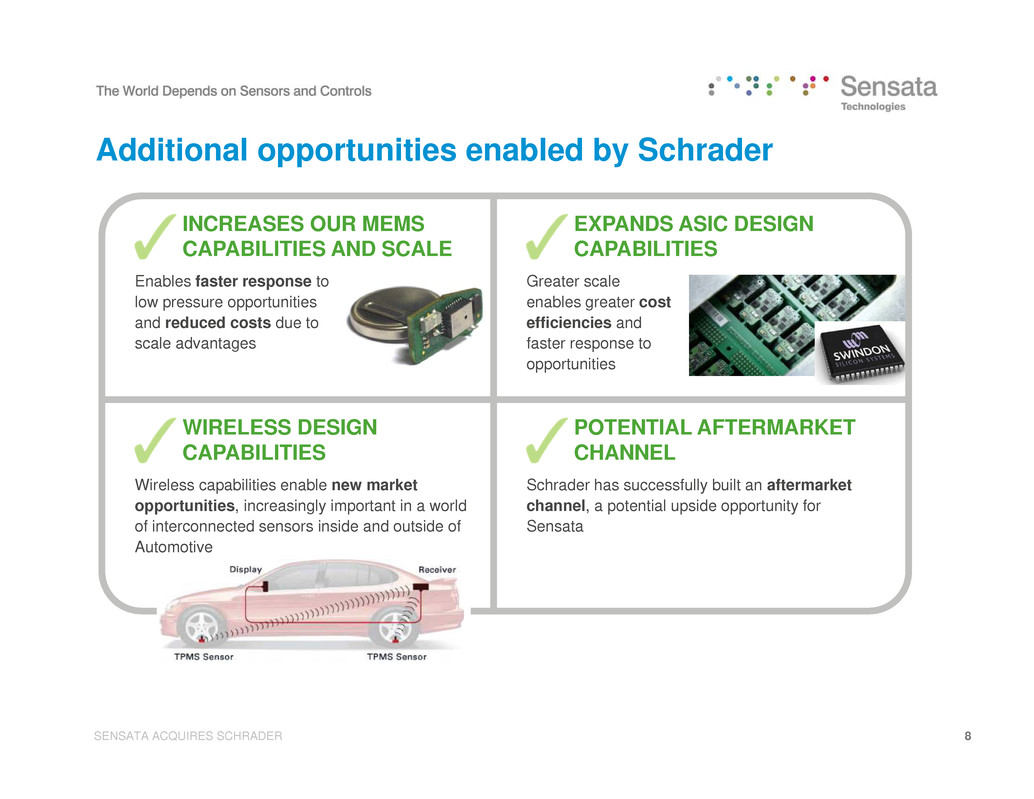

SENSATA ACQUIRES SCHRADER Additional opportunities enabled by Schrader Enables faster response to low pressure opportunities and reduced costs due to scale advantages Greater scale enables greater cost efficiencies and faster response to opportunities WIRELESS DESIGN CAPABILITIES POTENTIAL AFTERMARKET CHANNEL Schrader has successfully built an aftermarket channel, a potential upside opportunity for Sensata EXPANDS ASIC DESIGN CAPABILITIES INCREASES OUR MEMS CAPABILITIES AND SCALE Wireless capabilities enable new market opportunities, increasingly important in a world of interconnected sensors inside and outside of Automotive 8

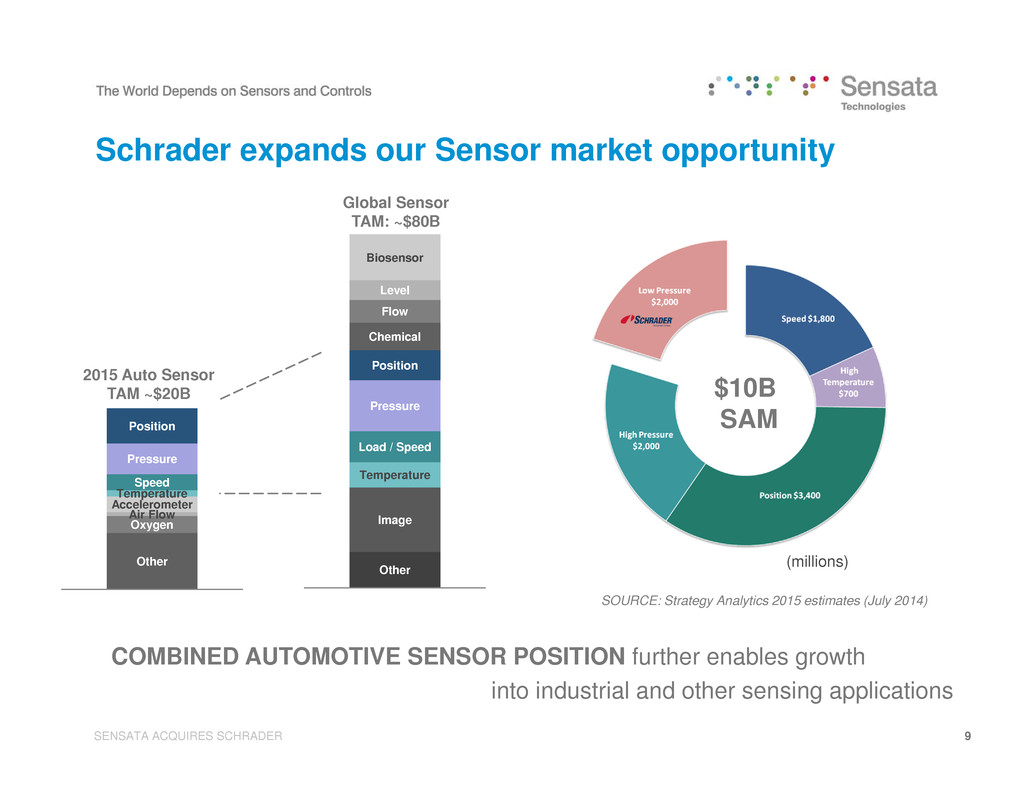

SENSATA ACQUIRES SCHRADER Other Image Temperature Load / Speed Pressure Position Chemical Flow Level Biosensor Other Oxygen Air Flow Accelerometer Temperature Speed Pressure Position $10B SAM (millions) SOURCE: Strategy Analytics 2015 estimates (July 2014) 2015 Auto Sensor TAM ~$20B Global Sensor TAM: ~$80B Schrader expands our Sensor market opportunity COMBINED AUTOMOTIVE SENSOR POSITION further enables growth into industrial and other sensing applications 9

SENSATA ACQUIRES SCHRADER Acquisition of Schrader creates significant value ?Purchase multiple <10x 2015 stand-alone EBITDA ?Significant cost and revenue synergy opportunities ?$0.18 to $0.21 accretive in 2015 ?$0.50 to $0.55 accretion post integration and dept repayment (and additional $0.18 to $0.22 once China ramps TPMS) ?Combined business cash flow will pay down debt and return us to target leverage ratio of 2–3x within 18 months 10

SENSATA ACQUIRES SCHRADER BACKUP 11

SENSATA ACQUIRES SCHRADER Q2 2014 Pro forma End 2014 Within 18 Months Net Debt / Adj EBITDA ~ 4x 2-3x 2.7x Financing structure Sensata intends to finance the Schrader acquisition primarily through issuance of debt • Debt markets are extremely attractive • $1,000M of committed financing • Anticipate financing through combination of bonds and term loan • Strong free cash flow enables rapid debt repayment and de–levering • Financial impacts: • $0.13 to $0.16 dilutive to ANI in Q4 2014 due to anticipated integration and transaction costs • $0.18 to $0.21 accretive in 2015; $0.50 to $0.55 after integration and dept pay down; the China opportunity represents an additional $0.18 to $0.22 accretion 12

SENSATA ACQUIRES SCHRADER 13 This presentation includes references to Adjusted net income and Adjusted EBITDA amounts. Adjusted net income is a non–GAAP financial measure. The Company defines Adjusted net income as follows: Net income before costs associated with debt refinancing and other financing activities, unrealized (gain)/loss on other hedges and (gain)/loss on currency remeasurement on debt, depreciation and amortization expense related to the step–up in fair value of fixed and intangible assets and inventory, deferred income tax and other tax expense, amortization of deferred financing costs, restructuring and special charges, and other costs. Adjusted EBITDA is also a non-GAAP financial measure. The Company defines Adjusted EBITDA as follows: Net income before interest expense (net of interest income), provision for/(benefit from) income taxes, depreciation and amortization expense, costs associated with debt refinancing and other financing activities, unrealized (gain)/loss on other hedges and (gain)/loss on currency remeasurement on debt, restructuring and special charges, and other costs. The Company believes Adjusted net income and Adjusted EBITDA provide investors with helpful information with respect to the performance of the Company's operations, and management uses Adjusted net income and Adjusted EBITDA to evaluate its ongoing operations and for internal planning and forecasting purposes. Adjusted net income and Adjusted EBITDA are not measures of liquidity. Please refer to the Company’s financial press releases, Form 8-K filings, and financial reports for a further description of our non–GAAP financial measures, including reconciliations of these measures to Net income. Copies of all the Company’s filings are available from the Investor Relations section of our website, Sensata.com, and from the SEC. Non-GAAP measures