Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Zyla Life Sciences | a14-18535_38k.htm |

Exhibit 99.1

|

|

Corporate Highlights |

|

|

Forward-Looking Statements This presentation contains forward-looking statements about Egalet Limited and Egalet Corporation based on management’s current expectations which are subject to known and unknown uncertainties and risks. Our actual results could differ materially from those discussed due to a number of factors, including, but not limited to, our ability to raise additional equity and debt financing on favorable terms, the success of our clinical trials, our ability to obtain regulatory approval of our product candidates and other risk factors included in our Registration Statement on Form S-1, originally filed with the Securities and Exchange Commission on October 16, 2013, as amended and the Company’s Form 10-K for the year ended December 31, 2013. We are providing this information as of the date of this presentation and do not undertake any obligation to update any forward-looking statements contained in this presentation as a result of new information, future events or otherwise. |

|

|

Our mission at Egalet is to help ensure access to effective medications for individuals living with chronic pain while protecting physicians, families and communities 100 million people suffer from moderate to severe chronic pain (Institute of Medicine) Prescription drug abuse is the #1 cause of accidental death in U.S. (CDC) 3 |

|

|

We are bridge between issue of patient access to medicines and deterrence of prescription drug abuse Environment supports the need for safe and effective opioids Large market opportunity – $8.3B1 in U.S. opioid sales Pipeline based on Egalet’s Guardian Technology™, a novel, proprietary, abuse-deterrent technology Making progress to prepare for commercialization of our late-stage portfolio Collaboration with Shionogi for AD hydrocodone opioids Extensive IP portfolio covering technology and products Experienced management team with a track record of success 1 12 months ended 9/30/12. |

|

|

Management team with track record of developing and commercializing products Karsten Lindhardt – MSc, Ph.D., DBE Site Manager and VP of R&D Jeffrey Dayno, M.D. CMO Stan Musial, CPA, MBA CFO Robert Radie President & CEO Led commercial launch of Prozac, Zyprexa, Actos CEO of Topaz and Transmolecular Txn experience: Topaz/Sanofi, TMI/Morphotek, Prestwick / Biovail, Morphotek / Eisai & Vicuron / Pfizer CFO of Prism, Strategic Diagnostics, others KPMG Clinician with neurology and pain experience VP, Global Medical Affairs at ViroPharma (Shire) CMO at Labopharm where he worked on abuse-deterrent opioids 15 years of R&D experience Confidential Mark Strobeck - Ph.D. Chief Business Officer Former CBO Topaz Pharmaceuticals, Trevena, Inc, VP of Business Development at GSK, Principal at SROne |

|

|

July 19: STOPP (Stop Tampering of Prescription Pills) Act introduced & would require shift to abuse-deterrent products and removal of non-abuse-deterrent products Implications: companies with AD forms of opioids will now be sole providers of opioids Jan 19: FDA introduced draft guidance on the study design & data requirements necessary to obtain AD claims in a product label for first time Mar 13: Attorney Generals from 48 states sent letter to FDA requesting AD products Apr 16: FDA approves for first opioid product with AD labeling (OxyContin®) & determined non –AD OxyContin to be unsafe & removed from Approved Drug List Implications: Allows sales team to make claims regarding AD features if approved for inclusion on label and generics without AD features will not be approved which is significant for morphine which does not have an AD drug on the market Mar 14: Legislation introduced into both the House and Senate to withdraw the recent approval of Zohydro ER Time is now for abuse-deterrent opioids 2013 2012 2014 |

|

|

Egalet® late-stage portfolio Egalet-002 (AD ER oxycodone) Phase 1* Two Phase 3 studies NDA * Upscaling of manufacturing/production is included in this timeline. ** Potential for multiple product candidates. 2013 2015 2014 2016 Phase 1* NDA Egalet-001 (AD ER morphine) Bioequivalence studies* AD ER hydrocodone Preclinical AD combination hydrocodone Preclinical** Egalet-003 (AD opioid) Phase 1 |

|

|

Manufacturing process drives differentiation Proprietary erodible matrix technology providing AD features First technology to combine injection molding with pharmaceutical production Established and well-characterized process Drives key product attributes Know-how developed creates barriers to entry |

|

|

Guardian™ Technology—Novel system designed to address common methods of abuse Addresses products abused primarily via injection Hard matrix Extremely hard and resistant to crushing, grinding, chewing and smoking, in addition to injection Addresses products abused primarily via crushing and snorting Hard matrix with a shell Extremely hard and resistant to injection and smoking, in addition to crushing and snorting Egalet-001 Egalet-002 |

|

|

Long-Acting Opioid Sales $4.1B in U.S. sales - 2012 Large addressable markets Long-Acting Opioid Prescriptions 14.8M U.S. prescriptions - 2012 Oxycodone was the highest selling long-acting opioid in the U.S. in 2012 Increased from $1.0 billion in 2007 to $2.8 billion in 2012 Morphine was the most widely prescribed long-acting opioid in the U.S. in 2012 Increased from 4.2 million Rx in 2007 to 7.1 million Rx in 2012 Sources: IMS Health, IMS NSP & NPA Audits. All stats are for the 12 months ended 9/30. SDI Vector One. |

|

|

Egalet-001: AD, extended release morphine Fast Track status from FDA Positive results from category 1 abuse-deterrence studies Completed two of three bioequivalence studies BE on measure of AUC Initiated Category 2/3 abuse-deterrence studies Data available in Q4 Completed tech transfer for Egalet-001 commercial manufacturing 15 mg BE trial expected to complete in Q3 |

|

|

Egalet-001: AD, extended release morphine Regulatory: 505(b)(2) pathway with bioequivalence studies MS Contin® as reference drug AD studies per FDA draft guidance Dosing: 2-3x / day Abuse-Deterrent Features: Resistant to injection, crushing, chewing, grinding, smoking Developed to be especially protective against abuse via injection No food effect or alcohol dose-dumping Timing: Expected NDA filing in Q4:14 pending BE data and discussions with FDA Target Market: Morphine is the most prescribed long-acting opioid in the U.S. |

|

|

Egalet-001 is bioequivalent to MS Contin at 60 mg FDA guidance for determining bioequivalence between two products, requires that the statistical range for AUC and Cmax should be within a 90% confidence interval of 80% and 125% of the reference standard, in this case MS Contin In a pivotal PK trial Egalet-001 was bioequivalent to MS Contin at 60 mg, as per FDA guidelines Egalet-001/MS-Contin Ratio Lower 90% CI Accept > 80% Upper 90% CI Accept < 125% AUC0- (ng/mL*h) 94 91 98 Cmax (ng/mL) 90 82 99 |

|

|

Top-line results from 100 mg fasted BE study Met bioequivalence criteria as measured by the area under the curve (AUC) For chronic pain medications AUC is an important indicator of efficacy Did not meet bioequivalence criteria as measured by peak plasma concentration (Cmax) Ratio of Cmax (122) was within the BE criteria of 80-125 however upper limit of 90% confidence interval fell just outside range (127) 15 mg fasted BE study to be completed in third quarter |

|

|

Category 1 studies showed Egalet’s abuse-deterrence features including non-injectible In vitro studies tested ability to resist a range of common methods of physical and chemical manipulation Demonstrated Egalet-001 resists common forms of physical and chemical manipulation as compared to MS Contin Importantly Egalet-001 showed ability to resist one of most common methods of abuse—injection Confirmed tests previously conducted in Egalet's laboratory that showed Egalet-001's strong abuse-deterrence features Confidential MS Contin Egalet-001 |

|

|

Branded products such as MS Contin, Kadian® and Avinza® comprised the majority of U.S. opioid sales, due to premium pricing, over the 12 months ended 9/30/11 Long-acting morphine U.S. market overview Source: IMS NPS & NPA Audits. All stats are for the 12 months ended 9/30. % Share of Total Number of U.S. Prescriptions – 2011 % Share of U.S. Sales – 2011 |

|

|

Abuse-deterrent morphine case study: Embeda Embeda® CII (morphine sulfate and naltrexone hydrochloride) Extended Release (ER) Capsules Approved by FDA in Aug 2009 and launched Sept 2009 $71M in sales for the 12 months ended 28 Feb 2011 Although Embeda was designed with AD features, these features were excluded from Embeda label Guidance had not yet been provided on including AD claims in product label Embeda removed from market in early 2011 due to manufacturing problems Sales growth trajectory impeded by multiple product recalls |

|

|

Egalet-002: AD, extended release oxycodone Regulatory: 505(b)(2) pathway with two Phase 3 studies Oxycontin OP as reference drug AD studies per FDA draft guidelines Dosing: 2x / day with improved PK profile Abuse-Deterrent Features: Resistant to injection, crushing, chewing, grinding, smoking Developed to be especially protective against abuse via crushing and snorting No food effect or alcohol dose-dumping Timing: Expected NDA filing in H1:16 Target Market: Oxycodone is the highest selling long-acting opioid -- $2.5B for the 2013 calendar year |

|

|

Steady State BID Egalet-002 OxyContin OP % Improvement Cmin+ 22 18 20 Cmax+ 48 59 23 AUC * [range] 1008 [687-1519] 942 [620-1782] N/A Egalet-002 demonstrates improved PK profile to OxyContin OP + ng/mL *ngxh/mL |

|

|

Shionogi collaboration for AD oral hydrocodone opioid product candidates Egalet received a $10M upfront cash payment in December 2013 Shionogi purchased $15M in Egalet common stock in a private placement concurrent with the IPO Egalet is eligible to receive regulatory and sales-based milestone payments Regulatory milestone payments could exceed $300M if multiple products approved Sales-based milestone payments could exceed $100M if certain sales thresholds attained Egalet is eligible for tiered royalties Mid-single to low-double digits based on net sales Shionogi will fund all development costs associated with the product candidates Shionogi has exclusive global rights to commercialize any resulting products |

|

|

Build a specialty sales force to target HCPs Support launch of product candidates ~50 sales professionals to focus on 5k targeted health care professionals (HCPs) initially Pain thought leaders Pain management specialists High-prescribing HCPs Primary care physician (PCP) expansion through partnering to efficiently build out targeting Enter into collaboration(s) for development and commercialization outside of the U.S. |

|

|

Egalet’s extensive IP portfolio Egalet IP Portfolio Technical Platform Identity Platform Technology Patents One-Component Two-Component Product Patents Pipeline Know-How Injection Molding Trademark Designs Products Technology 8 issued or allowed U.S. patents 6 pending U.S. patent applications 50 patents issued outside of the U.S. 22 additional pending patent applications worldwide Protection to 2033 |

|

|

Significant growth opportunities for future abuse-deterrent products with Egalet technology Extended Release Opioids: Oxymorphone Hydromorphone Others Immediate Release Opioids: Oxycodone Hydromorphone Others Combination products Developed multiple tablet architectures that allow for the release of two APIs at the same rate or at different rates Other classes of drugs including stimulants and CNS products (e.g., ADHD) |

|

|

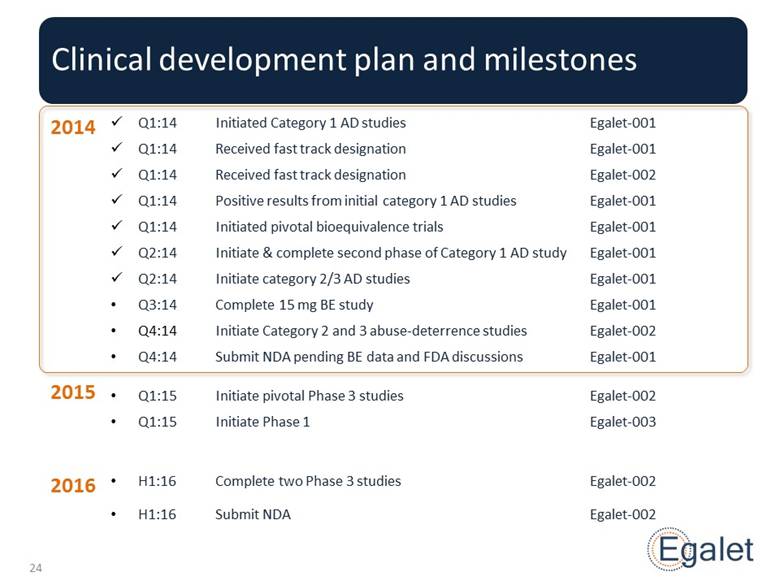

2014 Q1:14 Initiated Category 1 AD studies Egalet-001 Q1:14 Received fast track designation Egalet-001 Q1:14 Received fast track designation Egalet-002 Q1:14 Positive results from initial category 1 AD studies Egalet-001 Q1:14 Initiated pivotal bioequivalence trials Egalet-001 Q2:14 Initiate & complete second phase of Category 1 AD study Egalet-001 Q2:14 Initiate category 2/3 AD studies Egalet-001 Q3:14 Complete 15 mg BE study Egalet-001 Q4:14 Initiate Category 2 and 3 abuse-deterrence studies Egalet-002 Q4:14 Submit NDA pending BE data and FDA discussions Egalet-001 2015 Q1:15 Initiate pivotal Phase 3 studies Egalet-002 Q1:15 Initiate Phase 1 Egalet-003 2016 H1:16 Complete two Phase 3 studies Egalet-002 H1:16 Submit NDA Egalet-002 Clinical development plan and milestones |

|

|

Focused on developing abuse-deterrent (AD) pain products at the right time Environment supports the need for safe and effective opioids Making progress to prepare for commercialization of our late-stage portfolio Large market opportunity – $8.3B1 in U.S. opioid sales Collaboration with Shionogi for AD hydrocodone opioids Guardian™ Technology supports opportunities beyond lead product candidates Extensive IP portfolio covering technology and products Experienced management team with a track record of success 1 12 months ended 9/30/12. |

|

|

Thank you |