Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - DermTech International | d693305dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on August 14, 2014

Registration No. 333-195825

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

DERMTECH INTERNATIONAL

(Exact name of registrant as specified in its charter)

| California | 3841 | 33-0708997 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

11099 N. Torrey Pines Road, Suite 100

La Jolla, California 92037

(858) 450-4222

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John Dobak, M.D.

President and Chief Executive Officer

11099 N. Torrey Pines Road, Suite 100

La Jolla, California 92037

(858) 450-4222

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Martin J. Waters Wilson Sonsini Goodrich & Rosati, P.C. 12235 El Camino Real, Suite 100 San Diego, California 92130 (858) 350-2300 |

Steven Kemper Chief Financial Officer 11099 N. Torrey Pines Road, Suite 100 La Jolla, California 92037 (858) 450-4222 |

Steven M. Skolnick Lowenstein Sandler LLP 1251 Avenue of the Americas New York, New York 10020 (212) 262-6700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1)(2) |

Amount of Registration Fee (3) | ||

| Common Stock, par value $0.0001 per share |

$15,000,000 | $1,932.00 | ||

|

| ||||

|

| ||||

| (1) | Includes offering price of any additional shares that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (3) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price of the securities registered hereunder. $3,220 was previously paid by the Registrant upon the initial filing of this Registration Statement. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion: Dated August 14, 2014.

Shares of Common Stock

This is an initial public offering of shares of common stock of DermTech International.

We are offering shares of our common stock in the offering.

Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . We intend to apply to list our common stock on The NASDAQ Capital Market under the symbol “DMTK.”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 11 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount (1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

The underwriters have the option to purchase up to an additional shares from us at the initial public offering price less the underwriting discount within 45 days of the date on which the shares are delivered against payment to cover overallotments, if any.

The underwriters expect to deliver the shares against payment in New York, New York on , 2014.

Sole Booking–Running Manager

Maxim Group LLC

Co-Manager

Feltl and Company

Prospectus dated , 2014.

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 11 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 51 | ||||

| 53 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

55 | |||

| 65 | ||||

| 86 | ||||

| 92 | ||||

| 102 | ||||

| 105 | ||||

| 107 | ||||

| 112 | ||||

| Material U.S. Federal Income Tax and Estate Tax Consequences to Non-U.S. Holders |

115 | |||

| 119 | ||||

| 125 | ||||

| 125 | ||||

| 125 | ||||

| F-1 | ||||

Through and including , 2014 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

For investors outside the United States: neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

-i-

Table of Contents

This summary highlights selected information appearing elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. This summary may not contain all the information you should consider before investing in our common stock. You should carefully read this prospectus in its entirety before investing in our common stock, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this prospectus. Unless the context otherwise requires, we use the terms “DermTech,” “we,” “us,” and “our” in this prospectus to refer to DermTech International.

Business Overview

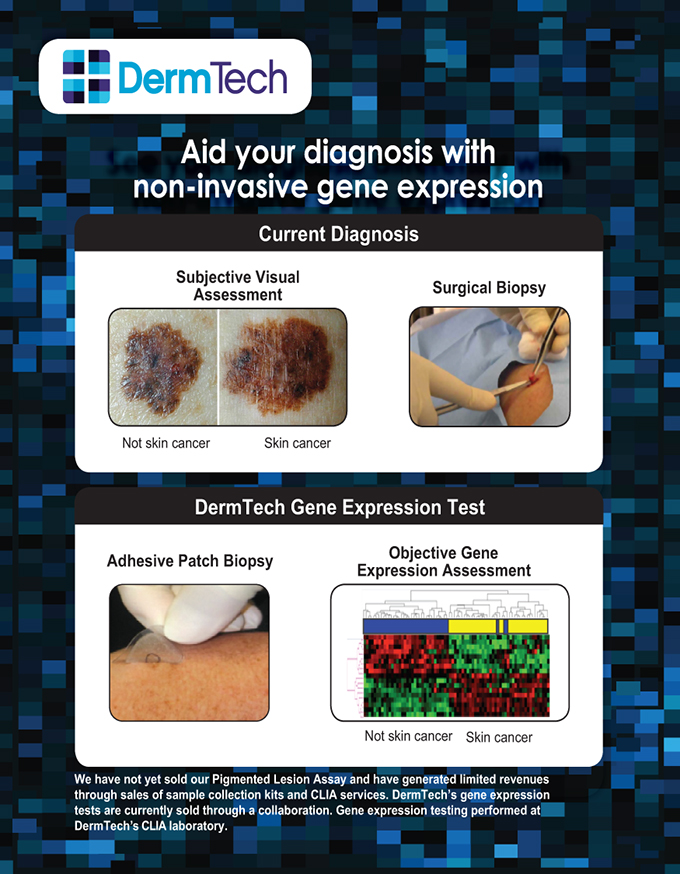

We are an emerging growth diagnostics company developing and marketing novel non-invasive gene expression tests to aid in the diagnosis of various skin conditions, including skin cancer, inflammatory diseases, and aging-related conditions. Our technology provides a highly accurate alternative to surgical biopsy, eliminating patient pain, scarring, and risk of infection, while maximizing convenience. Our scalable gene expression assays have been designed to work with a proprietary “adhesive patch biopsy” that provides a tissue sample non-invasively. Current dermatologic diagnosis is primarily based on subjective visual pattern recognition that is prone to error and results in a substantial number of unnecessary surgical biopsies.

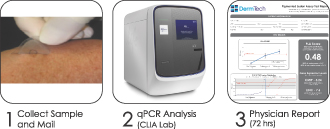

We analyze the skin cells taken from the patient using our adhesive patch with a proprietary process that allows us to extract ribonucleic acid, or RNA, from the patch with sufficient quality and quantity to run our gene expression analysis. Our quantitative polymerase chain reaction, or qPCR, tests provide objective, biology-based information that is highly accurate and can significantly reduce unnecessary surgical biopsies. We offer our gene expression tests through our 6,000 square foot state-of-the-art government-licensed laboratory located in our company headquarters. We believe we will be the first company to offer a non-invasive gene expression test to the clinical dermatology market, which is in contrast to the vast majority of molecular diagnostic tests that are sold into the highly saturated pathology and oncology markets.

We are initially commercializing tests that will address unmet needs in the diagnostic pathway of pigmented skin lesions, such as moles or dark colored skin spots. Our products are designed to facilitate the clinical assessment of pigmented skin lesions for melanoma, aid the histopathologic staging of melanoma, and determine the metastatic potential of melanoma. Our first product in this area is the Pigmented Lesion Assay, which can be used to reduce unnecessary surgical biopsy procedures by ruling out false positives based on visual assessment prior to performing a surgical biopsy. The development of our Pigmented Lesion Assay has involved over 500 lesion samples, including over 250 melanomas. We have completed the development of our Pigmented Lesion Assay and plan to introduce our product in the second half of 2014. We plan to initially market this test directly to a concentrated group of 250 to 500 dermatologists that treat a majority of the 750,000 patients with the highest risk of melanoma in the United States. While we have not yet generated any sales from our Pigmented Lesion Assay, and have a history of net losses of $40.6 million since our inception. We have begun generating revenue of $31,000 from our sample collection kits and CLIA testing services during the first quarter of 2014 through research collaborations with Biogen Idec and others.

Over the next three years, we also plan to commercialize additional solutions in skin cancer and pursue additional partnering and licensing opportunities for our platform technology in areas such, inflammatory skin diseases, aesthetic/cosmetic indications, and acne. We have developed proof-of-concept tests and gene expression profiles and classifiers in some of these areas that demonstrate the potential utility of our technology. These opportunities involve clinical trial support and can produce revenue from sample processing. In addition, they may lead to companion diagnostic products for new or existing drug therapies. We have begun recognizing revenue with customers who purchase our sample collection kits and CLIA testing services.

-1-

Table of Contents

Our proposed products have been validated as Laboratory Developed Tests, or LDTs, for use in our laboratory, which has been certified under the Clinical Laboratory Improvement Amendments of 1988, or CLIA. Our sample collection kit is a Class I medical device that is manufactured by a supplier approved by the Food and Drug Administration, or FDA. Our validation studies have been performed under Quality System Regulations, or QSR, standards. Our current plans are to launch our assay as an LDT in our CLIA laboratory. There is uncertainty surrounding the regulatory path for new healthcare technologies, and if the FDA required us to submit our product for pre-market approval or 510K clearance, there would be significant delays in our product launch and our ability to generate revenue, while we would incur additional costs for clinical trials and related expenses. The FDA indicated that it is reviewing the regulatory requirements that apply to LDTs. In July 2010, the FDA held a two-day public meeting to obtain input from stakeholders on how it should apply its authority to implement a reasonable, risk-based, and effective regulatory framework for LDTs, including genetic tests. However, the FDA has not yet issued the additional guidance, and they do not have such guidance in their current fiscal year goals, but may generate such guidance in the future.

Our Competitive Advantages

We believe we are strategically positioned to address the unmet medical needs in dermatologic diagnosis. Our first product for the assessment of pigmented skin lesions highlights the potential impact of our technology platform. Our competitive advantages include:

| • | Highly accurate tests that can significantly reduce unnecessary surgical biopsies. Our Pigmented Lesion Assay test demonstrates an accuracy of 91.0% in differentiating melanoma from non-melanoma using histopathology as the reference standard. Our prevalence-weighted negative predictive value, or NPV, exceeds 99.4% such that the probability that a negative test may actually be positive is less than 0.6%. This compares with the current standard of care’s estimated NPV of 76%. |

| • | Superior ease of use. Our non-invasive adhesive patch biopsy procedure can be performed in less than five minutes by the physician. All the necessary items including adhesive patches, instructions, a marking pen for outlining, and a pre-addressed and prepaid return shipping label are contained in our kit. |

| • | Physician services can be reimbursed using existing Current Procedure Terminology, or CPT, codes. Unlike competing solutions for which there are no CPT reimbursement codes, physicians using our tests can seek reimbursement under an existing biopsy CPT code. |

| • | Lower cost of dermatologic diagnosis. We believe our Pigmented Lesion Assay highlights how our technology can provide better care at a reduced cost. We have performed an economic analysis that demonstrates an average direct cost savings of more than $50 per lesion tested, plus additional benefits, such as reductions in lost productivity and improved quality of life. |

| • | Simple integration into clinical practice. Our test and adhesive patch aim to replace the scalpel in the initial assessment. Unlike alternative device technologies, we do not require the installation and maintenance of capital equipment. The nursing support, documentation and specimen processing, are substantially similar to current practice. These issues are critical in a busy clinical practice where, on average, clinicians see a new patient every five-to-seven minutes. |

| • | Highly differentiated diagnostic technology. Our tests measure objective biological changes in gene expression rather than subjective visual pattern changes. Consequently, we believe the performance of our tests is superior to that of other technologies. Because we are assessing the changes in cellular biology, we can identify other gene expression profiles that are associated with the cancer stage and its probability of metastasis. |

| • | Technology platform that can address other skin conditions. We are pursuing partnering and licensing opportunities for our platform technology in other areas such as inflammatory skin diseases, aesthetic/cosmetic indications, and acne. We are currently partnering with Biogen Idec, Inc., a large |

-2-

Table of Contents

| multi-national biotechnology company to assist in developing a drug product for an inflammatory disease of the skin, and have generated revenues from this collaboration. In connection with this collaboration, we are providing services, such as assay development, adhesive patch testing using gene expression, and sample storage to Biogen Idec. |

| • | Strong intellectual property protection. We have five issued U.S. patents, of which two are broadly directed to the use of an adhesive to collect samples containing RNA from the skin for analysis. We also have patent applications pending on unique gene expression profiles and classifiers. We have developed processes and know-how that allow us to extract RNA material from adhesive patch samples suitable for qPCR analysis. |

Strategy

Our objective is to be the leader in non-invasive molecular tests for dermatology. To achieve this objective, we intend to:

| • | Build a specialized sales force to introduce our products, starting with the Pigmented Lesion Assay. We intend to build a specialty sales force. This sales force will initially call on the 250 to 500 pigmented lesion specialists that treat the more than 750,000 patients with the highest risk for melanoma. We will then expand our sales force to penetrate 80% of the approximately 7,500 U.S. dermatologists with active clinical practices. |

| • | Integrate our products into the standard of care. We intend to conduct rigorous clinical and basic science research, and publish the results of this research in peer-reviewed journals. We will work with, and establish, boards of key opinion leaders in fields relevant to our products. We have assembled a world-renowned board of melanoma experts and will work with these advisors to incorporate our melanoma products into the diagnostic pathway guidelines for melanoma. |

| • | Secure broad reimbursement coverage for our assays. We plan to target regional and national payors to secure favorable coverage decisions for the reimbursement of our tests. We will focus on completing our clinical utility studies, building an in-house reimbursement team, publishing additional papers, and completing our Medicare dossier. National Medicare coverage is currently determined through the MolDx coverage decision program and we plan to submit our application in the next 12 months. |

| • | Expand our product offerings. We have identified other gene expression profiles and classifiers in other areas of dermatology. We have also developed gene expression profiles that can assess the stage of melanoma and determine if the tumor has become invasive or remains confined to the outermost skin layer. In addition, we have identified differential gene expression that should form the basis for a test that can determine the metastatic potential of the lesion. Development of this test could reduce the need for sentinel lymph node surgery, which can be extensive, can cause significant morbidity, and is costly. |

| • | Develop new products and explore licensing and partnership opportunities. In 2013, we initiated a collaboration with Biogen Idec, Inc., or Biogen Idec, to support the development of a new drug for an inflammatory skin disease. We will continue to explore through our own research and with partners, the use of our technology in other dermatologic conditions, including other skin cancers, anti-aging treatments, acne, and inflammatory skin diseases. |

Market Opportunity—Melanoma

Melanoma is currently one of the fastest growing cancers and the subject of significant attention in the medical community. The incidence of melanoma has doubled since 1973. While there has been a 20% decline in

-3-

Table of Contents

cancer deaths overall since 1991, melanoma is one of three cancers facing increasing rates. According to a study from the Mayo Clinic, the incidence of melanoma increased eightfold among women under 40 and fourfold among men under 40 from 1970 to 2009.

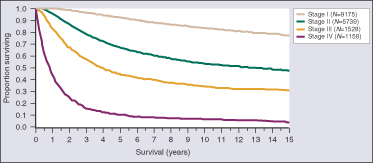

The American Cancer Society projects that 9,710 people will die in the United States from melanoma in 2014. If diagnosed and removed early in its evolution, when confined to the outermost skin layer and deemed to be “in situ (Stage 0),” patients are expected to have a survival rate of almost 100%. Invasive melanomas that are thin and extend into the uppermost regions of the second skin layer still have cure rates that are greater than 90%. However, once the cancer advances into the deeper layers of skin, the risk of it spreading to other parts of the body, or metastasizing, increases significantly, as does the risk of death.

We estimate that approximately 3.0 million surgical biopsies are performed in the United States each year to diagnose about 138,000 cases of melanoma—more than 61,000 non-invasive (in situ) and 77,000 invasive. Based on those volumes, we estimate the total U.S. market opportunity for our tests and products for pigmented skin lesions and melanoma exceeds $1.0 billion annually, and the select worldwide market opportunity outside of the United States exceeds $500 million annually. The Surveillance, Epidemiology, and End Results (SEER) program of the National Cancer Institute (NCI) is a source of epidemiologic information on the incidence and survival rates of cancer in the United States. According to the SEER Registries database, biopsies per patient can range from one per year to over fifty per year for certain conditions.

Limitations of Current Melanoma Diagnostic Pathway

Pigmented skin lesions suspicious for melanoma are clinically atypical and meet one or more subjective visual grading criteria. If identified as suspicious for melanoma, a lesion may be surgically biopsied or followed for further change. Patients can have many atypical lesions, which can complicate the decision of which lesions to surgically biopsy, and it may not be practical to surgically biopsy all lesions. Due to the low sensitivity of clinical assessment, on average 80%, we believe lesions with a lower suspicion for melanoma may not be selected for biopsy, such that approximately 20% may have a delayed diagnosis. Studies show that the current standard clinical assessment of pigmented lesions for biopsy demonstrate an accuracy of less than 20%, with sensitivities on average of 80% and specificities ranging from 5% to 20%. Technologies that involve image, spectral, or electrical impedance analysis, can be used at this point to provide further assessment for biopsy need, but typically lack the accuracy needed to meaningfully improve clinical assessment.

Lesions selected for surgical biopsy are ideally subjected to an excisional procedure. However, physicians looking to minimize patient discomfort and recovery time will employ simpler, but less accurate biopsy procedures known as “shave” and “punch” biopsies approximately 70% of the time. Shave and punch biopsies can confound the histopathologic diagnosis, can lead to a delayed diagnosis, and can result in a substantial number of rebiopsies (approximately 20% or greater).

After a lesion is surgically biopsied it is sent for histopathologic assessment, which is also subjective and challenging. Consequently, there is a high rate of discordant diagnosis (two pathologists do not make the same diagnosis when evaluating the same tissue), which is estimated to be as high as 20% to 30%. Studies have demonstrated that pathology, the current standard of care, has a false negative rate and false positive rate of approximately 10% and 10%, respectively, and samples can have ambiguous findings which can preclude a definitive pathologic diagnosis.

Our Platform Technology and Diagnostic Solutions

Cancer and many skin conditions result from changes in gene expression that alter cell growth, function, and ability of cells to invade and metastasize. The information provided by gene expression analysis is both objective and biologically-based. This shift from subjective pattern recognition-based information to objective biological information provides highly relevant information to clinicians about skin conditions.

-4-

Table of Contents

Adhesive Skin Sample Collection Kit

The adhesive patch allows for the collection of skin samples with minimal patient discomfort. A single kit contains all of the necessary components to complete the sample collection for our analysis, including the adhesive patches, instructions for use, a marking pen for lesion outlining, and a pre-addressed and prepaid return shipping pack. The unique properties of the tape maximize the collection of informative cellular material for our Pigmented Lesion Assay and the entire procedure takes less than five minutes.

Pigmented Lesion Assay

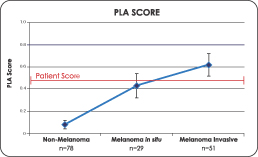

The development of our Pigmented Lesion Assay has involved over 500 lesion samples, including over 250 melanomas. The initial effort involved a genome wide screen (approximately 47,000 genes) to identify genes that were differentially expressed between melanoma and non-melanoma. We utilize a qPCR technology platform to test and identify gene expression profiles for our commercial test result.

The Pigmented Lesion Assay produces a PLA score derived from the company’s proprietary algorithm that utilizes the expression data from our assay. The PLA Score steadily increases from non-melanoma lesions, to melanoma in situ, to invasive melanoma, demonstrating the progression of the gene expression as the cancer advances. In the validation studies involving 158 lesions (80 melanoma and 78 non-melanoma), statistically significant differences (p £ 0.00001) in gene expression between melanoma and non-melanoma samples were measured. A p-value as shown above, of less than or equal to 0.00001 means that there is at least a 99.999% probability that the increased PLA score in the sample group is a result of the melanoma tested and not due to chance.

Additional Opportunities

We are in various stages of developing and exploring additional applications for our technology platform including:

| • | In situ vs. invasive staging (Micro Staging); |

| • | metastatic potential; |

| • | other skin cancers; |

| • | inflammatory indications; |

| • | aesthetic and cosmetic indications; and |

| • | acne. |

Risks That We Face

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. The risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include, but are not limited to, the following:

| • | we are an early-stage company with a history of substantial net losses, we have never been profitable and we have an accumulated deficit of approximately $40.6 million as of June 30, 2014. We expect to incur net losses in the future, and we may never achieve sustained profitability; |

| • | our business depends on us being able to recruit and hire a sales and marketing team, scientists, licensed laboratory personnel, and other personnel with extensive experience in our field, who are in short supply; |

| • | our business depends on the launch and commercial success of our Pigmented Lesion Assay; |

-5-

Table of Contents

| • | our business may depend on our ability to continue to develop and commercialize novel, innovative, and non-invasive diagnostic tests and services; |

| • | our current cash resources are insufficient to fund our operations beyond August 2014 without raising additional capital; |

| • | our business depends on executing our sales and marketing strategy for our cancer diagnostic tests and on gaining acceptance of our current test and potentially future tests in the market; |

| • | our business depends on being able to obtain adequate reimbursement from governmental and other third-party payors for tests and services; |

| • | our business could be subject to FDA regulation or enforcement actions; |

| • | if our sole laboratory facility becomes damaged or inoperable, or we are required to vacate the facility, our ability to sell and provide molecular tests and pursue our research and development efforts may be jeopardized; |

| • | our business depends on satisfying numerous applicable United States and international regulatory requirements; |

| • | our business depends on our ability to effectively compete with other diagnostic tests, methods and services that now exist or may hereafter be developed; and |

| • | we need to obtain or maintain patents or other appropriate intellectual property protection for the intellectual property utilized in our current and planned tests and services, and we must avoid infringement of third-party intellectual property rights. |

Corporate and Other Information

We were incorporated in California in 1995. In connection with this offering, we plan to reincorporate in Delaware. Our principal offices are located at 11099 North Torrey Pines Road, Suite 100, La Jolla, California 92037. Our telephone number is (858) 450-4222 and our website address is www.dermtech.com. Information contained on or accessible through our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| • | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus; |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements, and registration statements; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

-6-

Table of Contents

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended, or the Securities Act, which such fifth anniversary will occur in 2019. However, if certain events occur before the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion, or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company before the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than the information you might receive from other public reporting companies in which you hold equity interests.

-7-

Table of Contents

The Offering

| Common stock we are offering |

shares of common stock |

Common stock outstanding after the

| offering |

shares of common stock |

Offering price

Underwriters’ option to purchase

| additional shares |

shares of common stock |

| Use of proceeds |

We currently intend to use the net proceeds of the offering: to hire sales and marketing personnel and support increased sales and marketing activities; to fund further research and development, clinical utility studies, and future enhancements of our current test; to fund research and development and clinical studies for our planned products; to acquire equipment, implement automation, and scale our capabilities to prepare for significant test volume; and for general corporate purposes and to fund ongoing operations and the expansion of our business. See “Use of Proceeds.” |

| Risk Factors |

See the section entitled “Risk Factors” and any other information included in this prospectus for a discussion of factors you should consider carefully before deciding to invest in shares of our common stock. |

Proposed NASDAQ Capital Market

| Symbol |

DMTK |

The number of shares of our common stock to be outstanding immediately after this offering is based on 2,126,072 shares of our common stock outstanding as of June 30, 2014 (including preferred stock on an as-converted basis), and excludes:

| • | 393,089 shares of common stock issuable upon exercise of options outstanding as of June 30, 2014, at a weighted average exercise price of $0.75 per common share; and |

| • | 55,198 shares of common stock issuable upon exercise of warrants outstanding as of June 30, 2014, at a weighted average exercise price of $2.93 per common share. |

Unless the context otherwise requires, all share and per share amounts in this prospectus have been adjusted on a pro forma basis to give effect to our one-for-seventy-five reverse split which we plan to effect prior to the completion of this offering and unless otherwise indicated, all information in this prospectus assumes:

| • | the conversion of all outstanding shares of our convertible preferred stock into an aggregate of shares of common stock upon the closing of this offering; |

| • | the filing of our amended and restated certificate of incorporation immediately prior to the closing of this offering; |

| • | no exercise by the underwriters of their option to purchase additional shares; and |

| • | no options, warrants or shares of common stock were issued after June 30, 2014, and no outstanding options were exercised after June 30, 2014. |

-8-

Table of Contents

Summary Financial Data

The following table summarizes our selected financial data for the periods and as of the dates indicated. Our selected statements of operations data for the years ended December 31, 2012 and 2013 and our selected balance sheet data as of December 31, 2012 and 2013 have been derived from our audited financial statements and their related notes, which are included elsewhere in this prospectus. All “Weighted average shares outstanding” data and all “Net loss per common share” data in the table below have been adjusted to reflect a 1-for-75 reverse stock split which we plan to effect prior to the completion of this offering. Our selected statements of operations data for the six months ended June 30, 2013 and 2014 and our selected balance sheet data as of June 30, 2014 have been derived from our unaudited interim financial statements which are included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results to be expected for any future periods and our interim results are not necessarily indicative of the results to be expected for the full fiscal year. Our unaudited financial statements have been prepared on the same basis as the audited financial statements and, in the opinion of management, include all adjustments, consisting of normal recurring adjustments necessary for a fair presentation of our financial condition as of such dates and our results of operations for such periods. Our summary financial data should be read together with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and with our financial statements and their related notes, which are included elsewhere in this prospectus.

| Year Ended December 31, | Six Months Ended June 30, | |||||||||||||||

| 2012 | 2013 | 2013 | 2014 | |||||||||||||

| (in thousands, except per share data) | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||

| Revenues |

$ | — | $ | — | $ | — | $ | 46 | ||||||||

| Cost of revenues |

— | — | — | 15 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

— | — | — | 31 | ||||||||||||

| Operating expenses: |

||||||||||||||||

| Sales and marketing |

126 | 31 | 11 | 92 | ||||||||||||

| Research and development |

976 | 1,958 | 888 | 1,476 | ||||||||||||

| General and administrative |

1,064 | 1,273 | 713 | 1,064 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(2,166 | ) | (3,262 | ) | (1,612 | ) | (2,601 | ) | ||||||||

| Total other income/(expense) |

(62 | ) | (1,916 | ) | (100 | ) | (3 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (2,228 | ) | $ | (5,178 | ) | $ | (1,712 | ) | $ | (2,604 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares outstanding used in computing net loss per common share, basic and diluted (1) |

45,884 | 62,906 | 45,884 | 106,052 | ||||||||||||

| Net loss per common share outstanding, basic and diluted |

$ | (48.55 | ) | $ | (82.32 | ) | $ | (37.32 | ) | $ | (24.55 | ) | ||||

| Weighted average shares outstanding used in computing pro forma net loss per share basic and diluted (unaudited) (2) |

902,449 | 2,071,569 | ||||||||||||||

| Pro forma net loss per common share, basic and diluted (3) |

$ | (5.74 | ) | $ | (1.26 | ) | ||||||||||

| (1) | Basic and diluted net loss per common share is determined by dividing net loss applicable to common shareholders by the weighted average common shares outstanding during the period. Because there is a net loss attributable to common shareholders for the years ended December 31, 2012 and 2013 and the six months ended June 30, 2013 and 2014, the outstanding shares of Preferred stock, warrants, and common stock options have been excluded from the calculation of diluted loss per common share because their effect would be anti-dilutive. Therefore, the weighted average shares used to calculate both basic and diluted loss per share are the same. Net loss per common share, diluted, excludes the effect of anti-dilutive equity instruments including 191,136, 735,414, 193,942 and 1,744,681 shares of common stock issuable upon |

-9-

Table of Contents

| conversion of our Preferred stock, and 8,241, 433,763, 5,989 and 448,287 shares of common stock issuable upon the exercise of outstanding warrants and stock options, for 2012, 2013 and the six months ended June 30, 2013 and 2014, respectively. |

| (2) | The weighted average shares outstanding used in computing pro forma net loss per share assumes the conversion of all outstanding preferred stock and preferred stock warrants into an aggregate of 856,565 and 1,965,516 shares of common stock, respectively, for 2013 and the six months ended June 30, 2014. |

| (3) | The pro forma net loss per share, basic and diluted, is calculated using the net loss, adjusted to eliminate the interest on convertible debt during the period, divided by the pro forma weighted average shares outstanding, respectively for 2013 and the six months ended June 30, 2014. |

| As of December 31, | As of June 30, | |||||||||||||

| 2012 | 2013 | 2014 | Pro Forma As Adjusted (1) | |||||||||||

| (in thousands) | (in thousands, unaudited) | |||||||||||||

| Balance Sheet Data: |

||||||||||||||

| Cash and cash equivalents |

$ | 1,353 | $ | 1,105 | $ | 1,569 | ||||||||

| Total assets |

1,429 | 1,200 | 2,285 | |||||||||||

| Current liabilities |

3,240 | 637 | 1,415 | |||||||||||

| Total liabilities |

3,240 | 637 | 1,420 | |||||||||||

| Convertible preferred stock |

1 | 12 | 15 | |||||||||||

| Accumulated deficit |

(32,819 | ) | (37,997 | ) | (40,601 | ) | ||||||||

| Total stockholders’ equity (deficit) |

(1,810 | ) | 564 | 865 | ||||||||||

| (1) | The pro forma as adjusted balance sheet data above reflects the conversion of all outstanding shares of preferred stock into an aggregate of 2,020,019 shares of our common stock, plus the sale of shares of our common stock in this offering and application of the net proceeds at an assumed initial public offering price of $ per share, the midpoint of the pricing range set forth on the cover of this prospectus, after deducting the estimated underwriting discount and estimated offering expenses payable by us. |

-10-

Table of Contents

An investment in our common stock involves a high degree of risk. You should consider carefully the specific risk factors described below in addition to the other information contained in this prospectus, including our financial statements and related notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations included elsewhere in the prospectus, before making your investment decision. The occurrence of any of the events or developments described below could harm our business, financial condition, results of operations, and growth prospects. In such an event, the market price of our common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

Risks Relating to Our Financial Condition and Capital Requirements

We are an emerging growth company with a history of net losses; we expect to incur net losses in the future, and we may never achieve sustained profitability.

We have historically incurred substantial net losses, including net losses of $2.2 million in 2012 and $5.2 million in 2013; and we have never been profitable. As of June 30, 2014, our accumulated deficit is $40.6 million.

We expect our losses to continue as a result of costs relating to ongoing research and development expenses, for increased sales and marketing costs and related to the planned launch of our first commercial product. These losses have had, and will continue to have, an adverse effect on our working capital, total assets, and stockholders’ equity. Because of the numerous risks and uncertainties associated with our commercialization efforts, we are unable to predict when we will become profitable, and we may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our inability to achieve and then maintain profitability would negatively affect our business, financial condition, results of operations, and cash flows.

Our independent registered public accounting firm’s report for the year ended December 31, 2013 includes an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern.

Due to the deficit that we have accumulated since our inception, in their report on our audited annual financial statements as of and for the year ended December 31, 2013, our auditors included an explanatory paragraph regarding concerns about our ability to continue as a going concern. Recurring losses from operations raise substantial doubt about our ability to continue as a going concern. If we are unable to obtain sufficient funding at acceptable terms, we may be forced to significantly curtail our operations, and the lack of sufficient funding may have a material adverse impact on our ability to continue as a going concern. If we are unable to continue as a going concern, we might have to liquidate our assets and the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements. In addition, the inclusion of an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern and our lack of cash resources may materially adversely affect our share price and our ability to raise new capital or to enter into critical contractual relations with third parties.

We have a limited operating history and we expect a number of factors to cause our operating results to fluctuate on a quarterly and annual basis, which may make it difficult to predict our future performance.

We are an emerging molecular diagnostics company with a limited operating history. Our operations to date have been primarily focused on developing our technology. We have not obtained regulatory approvals for any of our tests. Consequently, if regulatory approval is determined to be necessary, any predictions made about our future success or viability may not be as accurate as they could be if we had a longer operating history or

-11-

Table of Contents

commercialized products. Our financial condition and operating results have varied significantly in the past and will continue to fluctuate from quarter-to-quarter or year-to-year due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include other factors described elsewhere in this prospectus and also include:

| • | our ability to obtain additional funding to develop our products and tests; |

| • | our ability to obtain and maintain any necessary regulatory approval for any of our tests in the United States and foreign jurisdictions; |

| • | potential side effects of tests that could delay or prevent commercialization, limit the indications for any of our tests, require the establishment of risk evaluation and mitigation strategies, or cause any of our commercialize tests to be taken off the market; |

| • | our dependence on third-party suppliers and manufacturers, to supply or manufacture our products; |

| • | our ability to establish or maintain collaborations, licensing, or other arrangements; |

| • | market acceptance of our products and tests; |

| • | our ability to establish and maintain an effective sales and marketing infrastructure, either through the creation of a commercial infrastructure or through strategic collaborations; |

| • | competition from existing products or new products that may emerge; |

| • | the ability of patients or healthcare providers to obtain coverage of or sufficient reimbursement for our products; |

| • | our ability to leverage our proprietary technology platform to discover and develop additional product candidates; |

| • | our ability to successfully obtain, maintain, defend, and enforce intellectual property rights important to our business; |

| • | our ability to attract and retain key personnel to manage our business effectively; |

| • | our ability to build our finance infrastructure and improve our accounting systems and controls; |

| • | potential product liability claims; |

| • | potential liabilities associated with hazardous materials; and |

| • | our ability to obtain and maintain adequate insurance policies. |

Accordingly, the results of any quarterly or annual periods should not be relied upon as indications of future operating performance.

We will need to raise additional capital to fund our existing operations, commercialize our products, and expand our operations.

As of June 30, 2014, our cash and cash equivalents totaled approximately $1.6 million. Based on our current business operations, we believe the net proceeds from this offering, together with our current cash and cash equivalents, will be sufficient to meet our anticipated cash requirements for the 24-month period following this offering. If our available cash balances, net proceeds from this offering, and anticipated cash flow from operations are insufficient to satisfy our liquidity requirements including due to changes in our business operations, a lengthier sales cycle, lower demand for our products, or other risks described in this prospectus, we may seek to raise additional capital through equity offerings, debt financings, collaborations, or licensing arrangements. We may also consider raising additional capital in the future to expand our business, to pursue strategic investments, to take advantage of financing opportunities, or for other reasons, including to:

| • | increase our efforts to drive market adoption of our tests and address competitive developments; |

| • | fund development activities and efforts of any future products; |

-12-

Table of Contents

| • | acquire, license, or invest in technologies; |

| • | acquire or invest in complementary businesses or assets; and |

| • | finance capital expenditures and general and administrative expenses. |

Our present and future funding requirements will depend on many factors, including:

| • | our revenue growth rate and ability to generate cash flows from operating activities; |

| • | our sales and marketing and research and development activities; |

| • | effects of competing technological and market developments; |

| • | costs of and potential delays in product development; |

| • | changes in regulatory oversight applicable to our tests; and |

| • | costs related to international expansion. |

The various ways we could raise additional capital carry potential risks. If we raise funds by issuing equity securities, dilution to our stockholders could result. Any equity securities issued also could provide for rights, preferences, or privileges senior to those of holders of our common stock. If we raise funds by issuing debt securities, those debt securities would have rights, preferences, and privileges senior to those of holders of our common stock. The terms of debt securities issued or borrowings pursuant to a credit agreement could impose significant restrictions on our operations. If we raise funds through collaborations and licensing arrangements, we might be required to relinquish significant rights to our platform technologies or products, or grant licenses on terms that are not favorable to us. The credit markets and the financial services industry have experienced a period of unprecedented turmoil and upheaval characterized by the bankruptcy, failure, collapse, or sale of various financial institutions and an unprecedented level of intervention from the U.S. federal government. These events have generally made equity and debt financing more difficult to obtain. Accordingly, additional equity or debt financing might not be available on reasonable terms, if at all. If we cannot secure additional funding when needed, we may have to delay, reduce the scope of, or eliminate one or more research and development programs or sales and marketing initiatives. In addition, we may have to work with a partner on one or more of our development programs, which could lower the economic value of those programs to us.

We will also need to raise additional capital to expand our business to meet our long-term business objectives. Additional financing may be from the sale of equity or convertible or other debt securities in a public or private offering, from a credit facility or strategic partnership coupled with an investment in us, or a combination of both. For further discussion of our liquidity requirements as they relate to our long-term plans, see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

We expect to continue to incur significant expenses to develop and market our tests, which could make it difficult for us to achieve and sustain profitability.

In recent years, we have incurred significant costs in connection with the development of our tests. For the year ended December 31, 2013, our research and development expenses were $2.0 million and our general and administrative expenses were $1.3 million. For the year ended December 31, 2012, our research and development expenses were $1.0 million and our general and administrative expenses were $1.1 million. We expect our expenses to continue to increase for the foreseeable future as we conduct studies of our current test and our planned other tests, establish a sales and marketing organization, drive adoption of and reimbursement for our tests, and develop new tests. As a result, we need to generate significant revenues in order to achieve sustained profitability.

-13-

Table of Contents

Risks Relating to Our Business and Strategy

We may not be able to generate sufficient revenue from the commercialization of our Pigmented Lesion Assay or successfully develop and commercialize other tests to achieve or sustain profitability.

We recorded our first revenues from our planned principal operations in the three months ended March 31, 2014. We are in varying stages of research and development for other tests that we may offer in the future. We believe that our commercialization success is dependent upon our ability to significantly increase the number of customers that are using our tests. In addition, demand for our tests may not increase as quickly as planned and we may be unable to increase our revenue levels as expected. We are currently not profitable. Even if we succeed in increasing adoption of our Pigmented Lesion Assay by dermatologists, in maintaining and creating relationships with our existing and new customers, and developing and commercializing additional molecular diagnostic testing products, we may not be able to generate sufficient revenue to achieve or sustain profitability.

If we are unable to execute our sales and marketing strategy for our Pigmented Lesion Assay and are unable to gain acceptance in the market, we may be unable to generate sufficient revenue to sustain our business.

Although we believe that our current test and our planned future tests represent a promising commercial opportunity, our tests may never gain significant acceptance in the marketplace and therefore may never generate substantial revenue or profits for us. We will need to establish a market for our tests and build that market through physician education, awareness programs, and the publication of clinical trial results. Gaining acceptance in medical communities requires publication in leading peer-reviewed journals of results from studies using our current test and/or our planned future tests. The process of publication in leading medical journals is subject to a peer-review process and peer-reviewers may not consider the results of our studies sufficiently novel or worthy of publication. Failure to have our studies published in peer-reviewed journals would limit the adoption of our current test and our planned tests.

Our ability to successfully market the tests that we develop will depend on numerous factors, including:

| • | conducting clinical utility studies of such tests in collaboration with key thought leaders to demonstrate their use and value in important medical decisions such as treatment selection; |

| • | the success of the sales force that we intend to hire with some of the proceeds of this offering; |

| • | whether healthcare providers believe such tests provide clinical utility; |

| • | whether the medical community accepts that such tests are sufficiently sensitive and specific to be meaningful in patient care and treatment decisions; and |

| • | whether health insurers, government health programs, and other third-party payors will cover and pay for such tests and, if so, whether they will adequately reimburse us. |

Failure to achieve widespread market acceptance of our current test and our planned future tests would materially harm our business, financial condition, and results of operations.

If we cannot develop tests to keep pace with rapid advances in technology, medicine and science, our operating results and competitive position could be harmed.

In recent years, there have been numerous advances in technologies relating to the molecular diagnosis for cancer and other medical conditions. Several new cancer drugs have been approved, including two for melanoma, and a number of new drugs in clinical development may increase patient survival time. There have also been advances in methods used to identify patients likely to benefit from these drugs based on analysis of biomarkers. We must continuously develop new tests and enhance any existing tests to keep pace with evolving standards of care. Our current test and our planned tests could become obsolete unless we continually innovate and expand them to demonstrate benefit in the diagnosis, monitoring, or prognosis of patients with cancer and

-14-

Table of Contents

other dermatologic conditions. If we cannot adequately demonstrate the applicability of our current test and our planned future tests to new diagnostic and treatment developments, sales of our tests could decline, which would have a material adverse effect on our business, financial condition, and results of operations.

Our future success will depend in part upon our ability to enhance our Pigmented Lesion Assay and to develop, introduce, and commercialize other novel innovative and non-invasive diagnostics tests and services. New test development involves a lengthy and complex process and we may be unable to commercialize new or improved tests or any other products we may develop on a timely basis, or at all.

Our future success will depend in part upon our ability to enhance our Pigmented Lesion Assay and to develop new innovative products. Our failure to successfully develop new products on a timely basis could have a material adverse effect on our revenue, results of operations, and business.

The development of new or enhanced tests is a complex and uncertain process requiring precise technological execution. In addition, the successful development of new products may depend on the development of new technologies. We may be required to undertake time-consuming and costly development activities. We may experience difficulties that could delay or prevent the successful development, commercialization, and marketing of these new products. Before we can commercialize any new products, we will need to expend significant funds in order to conduct substantial research and development, including validation studies.

Our product development process involves a high degree of risk, and product development efforts may fail for many reasons, including a failure to demonstrate the performance of the product or an inability to obtain any required certification or regulatory approval.

As we develop products, we will have to make significant investments in product development, as well as sales and marketing resources. In addition, competitors may develop and commercialize competing products faster than we are able to do so, which could have a material adverse effect on our revenue, results of operations and business.

We have limited experience manufacturing our tests on a commercial scale and there are no established standards for their manufacture. As a result, manufacturing issues may arise that could cause delays or increase costs, and if we are unable to adequately address our customers’ needs, it could negatively impact sales and market acceptance of our product and we may never generate sufficient revenue to achieve or sustain profitability.

We have limited experience manufacturing our tests on a commercial scale. We have developed manufacturing processes that have never been tested in commercial production; however, there is no established generally accepted manufacturing or quality standard for the production of our tests. Also, as we scale-up manufacturing of any approved product, our suppliers and manufacturers may encounter unexpected issues relating to the manufacturing process or the quality, purity, and stability of our tests and we may be required to refine or alter our manufacturing processes to address these issues. Resolving these issues could result in significant delays and may result in significantly increased costs. If we experience delays or other obstacles in producing any of our products for commercial scale, our ability to market and sell any products may be adversely affected and our business could suffer. Further, if we are unable to adequately address our customers’ needs, it could negatively impact sales and market acceptance of our products and we may never generate sufficient revenue to achieve or sustain profitability.

Our tests employ a novel diagnostic platform and may never be accepted by their intended markets.

Our activities have focused on the discovery and development of novel gene expression tests and preparation for commercial activities. Our future success depends on our ability to successfully commercialize our tests, as well as our ability to develop and market other tests that use our proprietary technology platform.

-15-

Table of Contents

The scientific discoveries that form the basis of our proprietary technology platform and our tests are relatively new. We are not aware of any other gene expression tests such as ours and there can be no assurance that physicians will be willing to use them. If we do not successfully develop and commercialize our tests based upon our technological approach, we may not become profitable and the value of our common stock may decline.

The novel nature of our tests also means that fewer people are trained in or experienced with products of this type, which may make it difficult to find, hire, and retain capable personnel for research, development, and manufacturing positions.

Further, our focus solely on gene expression tests, as opposed to multiple, more proven technologies for patient diagnosis, increases the risks associated with the ownership of our common stock. If we do not achieve market acceptance for our tests, we may be required to change the scope and direction of our product development activities. In that case, we may not be able to identify and implement successfully an alternative product development strategy.

If our current test and our planned tests do not to perform as expected, as a result of human error or otherwise, it could have a material adverse effect on our operating results, reputation, and business.

Our success depends on the market’s confidence that we can provide reliable, high-quality diagnostic results. There is no guarantee that any accuracy we have demonstrated to date will continue, particularly as the number of tests using our assays increases and as the number of different tests that we develop and commercialize expands. We believe that our customers are likely to be particularly sensitive to test defects and errors. As a result, the failure of our current or planned tests to perform as expected could significantly impair our reputation and the public image of our tests. As a result, the failure or perceived failure of our products to perform as expected could have a material adverse effect on our business, financial condition and results of operation.

We may be unable to manage our future growth effectively, which could make it difficult to execute our business strategy.

As part of our strategy, we expect to increase our number of employees as our business grows. This future growth could create strain on our organizational, administrative, and operational infrastructure, including laboratory operations, quality control, customer service, and sales and marketing. Our ability to manage our growth properly will require us to continue to improve our operational, financial, and management controls, as well as our reporting systems and procedures. If our current infrastructure is unable to handle our growth, we may need to further expand our infrastructure and staff and implement new reporting systems. The time and resources required to implement such expansion and systems could adversely affect our operations. Our expected future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain, and integrate additional employees. Our future financial performance and our ability to commercialize our products and to compete effectively will depend, in part, on our ability to manage this potential future growth effectively, without compromising quality.

If our sole laboratory facility becomes damaged or inoperable, or we are required to vacate the facility, our ability to sell and provide molecular tests and pursue our research and development efforts may be jeopardized.

We do not have any clinical reference laboratory facilities outside of our facility in La Jolla, California. Our facilities and equipment could be harmed or rendered inoperable by natural or man-made disasters, including fire, earthquake, flooding, and power outages, which may render it difficult or impossible for us to perform our diagnostic tests for some period of time. The inability to perform our current test, our planned tests, or the backlog of tests that could develop if our facility is inoperable for even a short period of time may result in the loss of customers or harm to our reputation or relationships with scientific or clinical collaborators, and we may

-16-

Table of Contents

be unable to regain those customers or repair our reputation in the future. Furthermore, our facilities and the equipment we use to perform our research and development work could be costly and time-consuming to repair or replace.

The San Diego area has recently experienced serious fires and power outages, and is considered to lie in an area with earthquake risk.

Additionally, a key component of our research and development process involves using biological samples as the basis for our diagnostic test development. In some cases, these samples are difficult to obtain. If the parts of our laboratory facility where we store these biological samples were damaged or compromised, our ability to pursue our research and development projects, as well as our reputation, could be jeopardized. We carry insurance for damage to our property and the disruption of our business, but this insurance may not be sufficient to cover all of our potential losses and may not continue to be available to us on acceptable terms, if at all.

Further, if our Clinical Laboratory Improvement Amendments of 1988, or CLIA, laboratory became inoperable we may not be able to license or transfer our technology to another facility with the necessary state licensure and CLIA certification under the scope of which our current test and our planned future tests could be performed. Even if we find a facility with such qualifications to perform our tests, it may not be available to us on commercially reasonable terms.

If we cannot compete successfully with our competitors, we may be unable to increase or sustain our revenues or achieve and sustain profitability.

Our principal competition comes from mainstream clinical diagnostic methods, used by dermatologists for many years, which focus on visual tumor tissue analysis. It may be difficult to change the methods or behavior of dermatologists to incorporate our Pigmented Lesion Assay and Adhesive Skin Sample Collection Kit into their practices in conjunction with, or instead of, tissue biopsies and analysis. In addition, companies offering capital equipment and kits or reagents to local dermatologists represent another source of potential competition. These tests are used directly by the dermatologists, which can facilitate adoption. We plan to focus our marketing and sales efforts on medical dermatologists rather than pathologists.

We also face competition from companies that offer device products or are conducting research to develop device products for analysis of pigmented lesions. In particular, MELA Sciences, Inc., markets its MelaFind® device to dermatologists. Scibase AB and Verisante Technology, Inc., have devices under development and may market their medical products directly to dermatologists if and when they obtain Food and Drug Administration, or FDA, approval. In addition to these companies, our competitors also include other device companies selling photographic technologies, whole body photography services, dermatoscopes, or confocal microscopy, such as Fotofinder, Molemate, Canfield Scientific, MedX, and Caliber I.D. Many of these groups, in addition to operating research and development laboratories, are selling equipment and devices.

In addition to these device companies, Myriad Genetics, Inc., offers an expression test for melanoma that is used on surgical biopsy specimens. Myriad Genetics, Inc., could also try and market their test as a biopsy aid at the point-of-care. Gene expression testing is a relatively new area of science, especially in dermatology and we cannot predict what tests others will develop that may compete with or provide results similar or superior to the results we are able to achieve with the tests we develop. There are a number of companies that are focused on the oncology diagnostic market and expression tests including Veracyte, Inc., Genomic Health, Inc., Trovagene, Inc., and others.

Additionally, projects related to cancer diagnostics and particularly genomics have received increased government funding, both in the United States and internationally. As more information regarding cancer genomics becomes available to the public, we anticipate that more products aimed at analyzing pigmented lesions and identifying melanoma may be developed and that these products may compete with ours. In addition, competitors may develop their own versions of our current or planned tests in countries where we did not apply

-17-

Table of Contents

for patents or where our patents have not issued or have expired and may compete with us in those countries, including encouraging the use of their test by physicians or patients in other countries. In addition, one or more competitors may seek to invalidate or render unenforceable any of our patents in a court of competent jurisdiction or at the United States Patent and Trademark Office. If any such proceeding were to be successful and result in the invalidation or unenforceability of one or more patents in our intellectual property portfolio, we may be unable to prevent unlicensed third-party competition in the marketplace with respect to our current and planned future tests.

Some of our present and potential competitors have widespread brand recognition and substantially greater financial and technical resources and development, production, and marketing capabilities than we do. Others may develop lower-priced, less complex tests that payors and dermatologists could view as functionally equivalent to our current or planned tests, which could force us to lower the list price of our tests and impact our operating margins and our ability to achieve and maintain profitability. In addition, technological innovations that result in the creation of enhanced diagnostic tools that are more sensitive or specific than ours may enable other clinical laboratories, hospitals, physicians, or medical providers to provide specialized diagnostic tests similar to ours in a more patient-friendly, efficient, or cost-effective manner than is currently possible. If we cannot compete successfully against current or future competitors, we may be unable to increase or create market acceptance and sales of our current or planned tests, which could prevent us from increasing or sustaining our revenues or achieving or sustaining profitability.

Our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards, or customer requirements. We anticipate that we will face increased competition in the future as existing companies and competitors develop new or improved products and distribution strategies and as new companies enter the market with new technologies and distribution strategies. We may not be able to compete effectively against these organizations. Our ability to compete successfully and to increase our market share is dependent upon our reputation for providing responsive, professional, and high-quality products and services and achieving strong customer satisfaction. Increased competition in the future could adversely affect our revenue, revenue growth rate, if any, margins and market share.

If dermatologists decide not to order the Pigmented Lesion Assay, or our future tests, we may be unable to generate sufficient revenue to sustain our business.

To generate demand for our current test and our planned tests, we will need to educate dermatologists and other health care professionals on the clinical utility, benefits, and value of the tests we provide through published papers, presentations at scientific conferences, educational programs, and one-on-one education sessions by members of our sales force. In addition, we need to assure dermatologists of their ability to obtain and maintain adequate reimbursement coverage from third-party payors for the adhesive patch sample collection method. If we cannot convince medical practitioners to order our current test and our planned tests, we will likely be unable to create demand in sufficient volume for us to achieve sustained profitability.

If we are unable to identify collaborators willing to work with us to conduct clinical utility studies, or the results of those studies do not demonstrate that a test provides clinically meaningful information and value, commercial adoption of our tests may be slow, which would negatively impact our business.

We believe clinical utility studies will show how the Pigmented Lesion Assay changes the decision-making of the dermatologist toward making a surgical biopsy decision, in particularly to avoid making a surgical biopsy when the test is negative. Clinical utility studies also show the impact of the test results on patient care and management. Clinical utility studies are typically performed with collaborating dermatologists at medical centers and hospitals, analogous to a clinical trial, and generally result in peer-reviewed publications. Sales and marketing representatives use these publications to demonstrate to customers how to use a clinical test, as well as why they should use it. These publications are also used with payors to obtain coverage for a test, helping to assure there is appropriate reimbursement.

-18-

Table of Contents

We are currently conducting a clinical utility study for our Pigmented Lesion Assay with investigators from the University of Pittsburgh Medical Center and Northwestern University Medical School. We will need to conduct additional studies for this test, as well as other tests we plan to introduce, to drive test adoption in the marketplace and reimbursement. Should we not be able to perform these studies, or should their results not provide clinically meaningful data and value for oncologists, adoption of our tests could be impaired and we may not be able to obtain reimbursement for them.

We are undergoing a management transition.

We have recently added several new senior management positions, including Chief Financial Officer and Chief Operating Officer. As of April 1, 2014, Steven Kemper became our Chief Financial Officer and Michael Willis, Ph.D. became our Chief Operating Officer. We have also recruited and hired other senior staff. Such a management transition subjects us to a number of risks, including risks pertaining to coordination of responsibilities and tasks, creation of new management systems and processes, differences in management style, effects on corporate culture, and the need for transfer of historical knowledge. In addition, our operations will be adversely affected if our management does not work together harmoniously, do not efficiently allocate responsibilities between themselves, or do not implement and abide by effective controls.

The loss of key members of our executive management team could adversely affect our business.