Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COLE CORPORATE INCOME TRUST, INC. | ccitq220148-k.htm |

Q2 2014 SUPPLEMENTAL INFORMATIONQ2 2014 SUPPLEMENTAL INFORMATION EXHIBIT 99.1 Cole Corporate Income Trust, Inc. (CCIT)

Q2 2014 SUPPLEMENTAL INFORMATION Overview Page 3 Financial Information Page Financial Summary 4 Balance Sheets 5 Statement of Operations 6 FFO, MFFO, AFFO, and Per Share Information 7 EBITDA and Ratio Analysis 8 Net Operating Income by Property Type 9 Debt Summary 10 Portfolio Metrics Page(s) Portfolio Composition by Tenant 11-12 Portfolio Composition by State 13 Portfolio Composition by Tenant Industry 14 Lease Expiration Schedule 15 Portfolio Composition by Property Type 16-17 Top Tenant Descriptions 18-19 Definitions 20-21 CCIT Supplemental Information June 30, 2014 Table of Contents This data and other information described herein are as of and for the three-month period ended June 30, 2014, and subsequent events assessed through August 8, 2014, unless otherwise indicated. Future performance may not be consistent with past performance and is subject to change and inherent risks and uncertainties. This information should be read in conjunction with the financial statements and the management’s discussion and analysis of financial condition and results of operations section contained in CCIT’s Annual Report on Form 10-K for the year ended December 31, 2013 and Quarterly Report on Form 10-Q for the three and six months ended June 30, 2014. Forward-Looking Statements Certain statements contained herein may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). CCIT intends for all such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable. Such statements include, in particular, statements about CCIT’s plans, strategies, and prospects and are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of CCIT’s performance in future periods. Such forward-looking statements can generally be identified by CCIT’s use of forward-looking terminology such as “may,” “will,” “would,” “could,” “should,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. CCIT makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements contained herein, and does not intend, and undertakes no obligation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Factors and risks that could cause actual results to differ materially from expectations are disclosed from time to time in greater detail in CCIT’s filings with the Securities and Exchange Commission including, but not limited to, CCIT’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, as well as CCIT’s press releases.

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 3 Overview: Cole Corporate Income Trust, Inc. 1. See the Definitions section beginning on page 20 for a description of the Company’s non-GAAP measures and pages 7 and 8 for GAAP reconciliations. Cole Corporate Income Trust, Inc. (the “Company”) is a Maryland corporation that was formed on April 6, 2010, which has elected to be taxed, and currently qualifies, as a real estate investment trust (“REIT”) for federal income tax purposes. The Company owns and operates a diversified portfolio of commercial real estate investments primarily consisting of single-tenant, income-producing necessity corporate office and industrial properties, which are net-leased to creditworthy tenants and strategically located throughout the United States. As of June 30, 2014, the Company owned 86 properties comprising approximately 17.5 million rentable square feet of commercial space located in 30 states, which were 100% leased. HIGHLIGHTS Financial Performance1 — The Company generated revenue of $56.6 million, EBITDA of $40.6 million, and Modified Funds from Operations (MFFO) of $33.7 million during the quarter, which represented changes of 5.8%, 5.0%, and 5.0%, respectively, from the first quarter of 2014. Real Estate Investments — The Company made $161.6 million of real estate investments during the quarter, acquiring $118.4 million of office properties and $43.3 million of industrial properties, based on purchase price, with a weighted average remaining lease term of 10.2 years. As of June 30, 2014, the Company owned $2.6 billion of real estate assets consisting of $2.0 billion of office properties and $641.3 million of industrial properties, based on purchase price, with a weighted average remaining lease term of 11.5 years. Leverage Profile — The Company’s net leverage ratio was 36% as of June 30, 2014 with over $2.0 billion, or 79%, of its assets unencumbered. The Company had $352 million of available borrowings on its Credit Facility at June 30, 2014. Recent Activity — The Company did not purchase any properties subsequent to June 30, 2014.

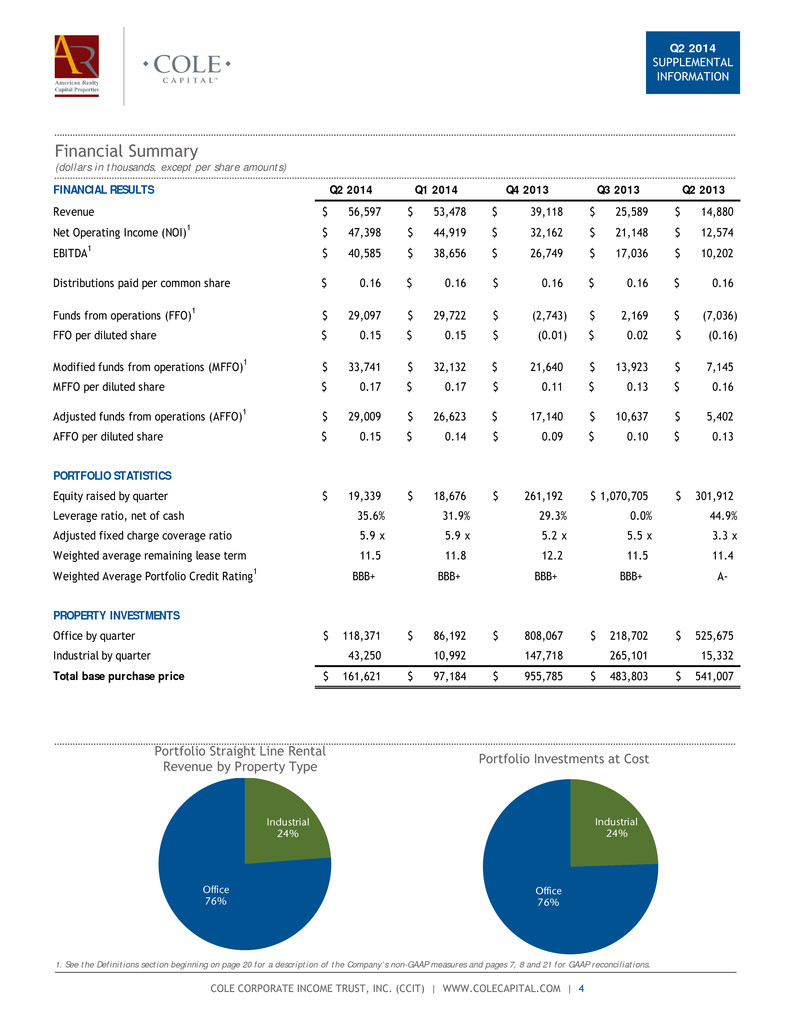

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 4 Financial Summary (dollars in thousands, except per share amounts) 1. See the Definitions section beginning on page 20 for a description of the Company’s non-GAAP measures and pages 7, 8 and 21 for GAAP reconciliations. Portfolio Straight Line Rental Revenue by Property Type Portfolio Investments at Cost Industrial 24% Office 76% Industrial 24% Office 76% FINANCIAL RESULTS Q2 2014 Q1 2014 Q4 2013 Q3 2013 Q2 2013 Revenue 56,597$ 53,478$ 39,118$ 25,589$ 14,880$ Net Operating Income (NOI)1 47,398$ 44,919$ 32,162$ 21,148$ 12,574$ EBITDA1 40,585$ 38,656$ 26,749$ 17,036$ 10,202$ Distributions paid per common share 0.16$ 0.16$ 0.16$ 0.16$ 0.16$ Funds from operations (FFO)1 29,097$ 29,722$ (2,743)$ 2,169$ (7,036)$ FFO per diluted share 0.15$ 0.15$ (0.01)$ 0.02$ (0.16)$ Modified funds from operations (MFFO)1 33,741$ 32,132$ 21,640$ 13,923$ 7,145$ MFFO per diluted share 0.17$ 0.17$ 0.11$ 0.13$ 0.16$ Adjusted funds from operations (AFFO)1 29,009$ 26,623$ 17,140$ 10,637$ 5,402$ AFFO per diluted share 0.15$ 0.14$ 0.09$ 0.10$ 0.13$ PORTFOLIO STATISTICS Equity raised by quarter 19,339$ 18,676$ 261,192$ 1,070,705$ 301,912$ Leverage ratio, net of cash 35.6% 31.9% 29.3% 0.0% 44.9% Adjusted fixed charge coverage ratio 5.9 x 5.9 x 5.2 x 5.5 x 3.3 x Weighted average remaining lease term 11.5 11.8 12.2 11.5 11.4 Weighted Average Portfolio Credit Rating1 BBB+ BBB+ BBB+ BBB+ A- PROPERTY INVESTMENTS Office by quarter 118,371$ 86,192$ 808,067$ 218,702$ 525,675$ Industrial by quarter 43,250 10,992 147,718 265,101 15,332 Total base purchase price 161,621$ 97,184$ 955,785$ 483,803$ 541,007$

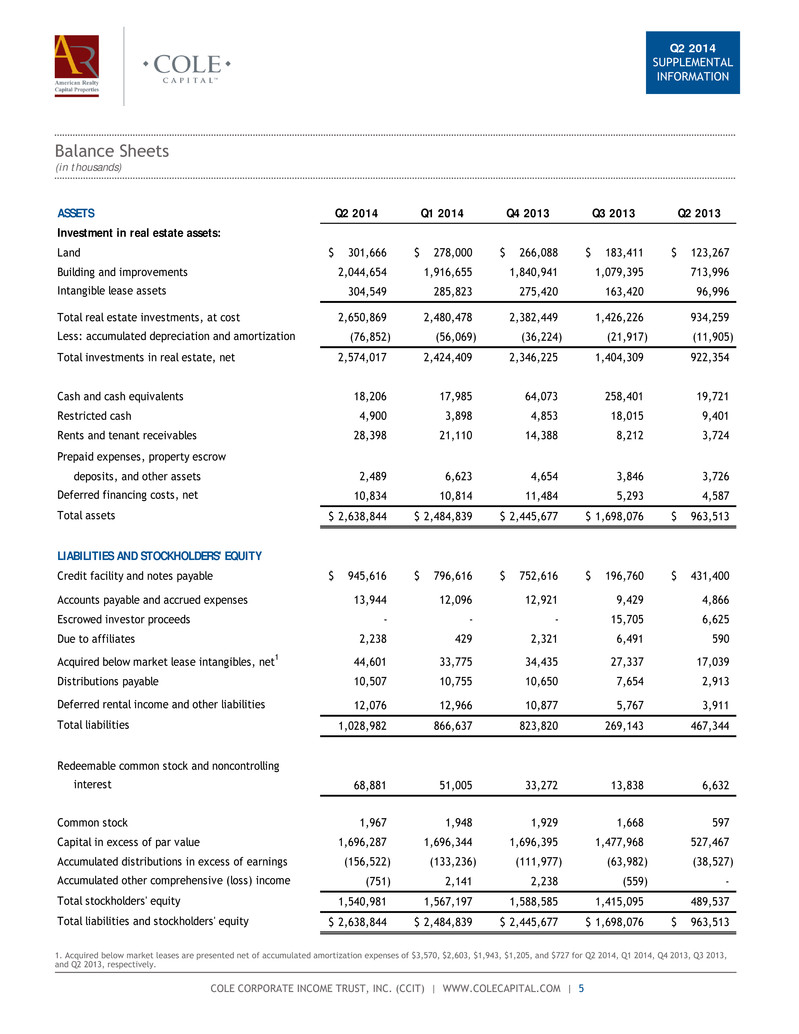

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 5 Balance Sheets (in thousands) 1. Acquired below market leases are presented net of accumulated amortization expenses of $3,570, $2,603, $1,943, $1,205, and $727 for Q2 2014, Q1 2014, Q4 2013, Q3 2013, and Q2 2013, respectively. ASSETS Q2 2014 Q1 2014 Q4 2013 Q3 2013 Q2 2013 Investment in real estate assets: Land 301,666$ 278,000$ 266,088$ 183,411$ 123,267$ Building and improvements 2,044,654 1,916,655 1,840,941 1,079,395 713,996 Intangible lease assets 304,549 285,823 275,420 163,420 96,996 Total real estate investments, at cost 2,650,869 2,480,478 2,382,449 1,426,226 934,259 Less: accumulated depreciation and amortization (76,852) (56,069) (36,224) (21,917) (11,905) Total investments in real estate, net 2,574,017 2,424,409 2,346,225 1,404,309 922,354 Cash and cash equivalents 18,206 17,985 64,073 258,401 19,721 Restricted cash 4,900 3,898 4,853 18,015 9,401 Rents and tenant receivables 28,398 21,110 14,388 8,212 3,724 Prepaid expenses, property escrow deposits, and other assets 2,489 6,623 4,654 3,846 3,726 Deferred financing costs, net 10,834 10,814 11,484 5,293 4,587 Total assets 2,638,844$ 2,484,839$ 2,445,677$ 1,698,076$ 963,513$ LIABILITIES AND STOCKHOLDERS' EQUITY Credit facility and notes payable 945,616$ 796,616$ 752,616$ 196,760$ 431,400$ Accounts payable and accrued expenses 13,944 12,096 12,921 9,429 4,866 Escrowed investor proceeds - - - 15,705 6,625 Due to affiliates 2,238 429 2,321 6,491 590 Acquired below market lease intangibles, net1 44,601 33,775 34,435 27,337 17,039 Distributions payable 10,507 10,755 10,650 7,654 2,913 Deferred rental income and other liabilities 12,076 12,966 10,877 5,767 3,911 Total liabilities 1,028,982 866,637 823,820 269,143 467,344 Redeemable common stock and noncontrolling interest 68,881 51,005 33,272 13,838 6,632 Common stock 1,967 1,948 1,929 1,668 597 Capital in excess of par value 1,696,287 1,696,344 1,696,395 1,477,968 527,467 Accumulated distributions in excess of earnings (156,522) (133,236) (111,977) (63,982) (38,527) Accumulated other comprehensive (loss) income (751) 2,141 2,238 (559) - Total stockholders' equity 1,540,981 1,567,197 1,588,585 1,415,095 489,537 Total liabilities and stockholders' equity 2,638,844$ 2,484,839$ 2,445,677$ 1,698,076$ 963,513$

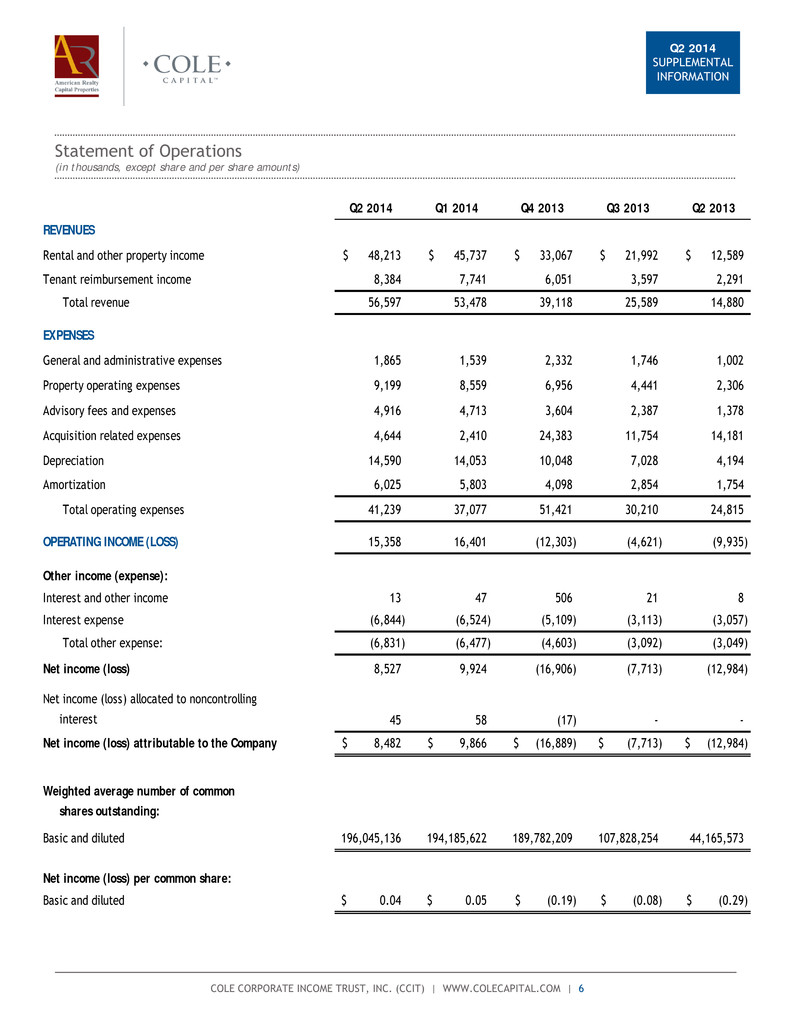

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 6 Statement of Operations (in thousands, except share and per share amounts) Q2 2014 Q1 2014 Q4 2013 Q3 2013 Q2 2013 REVENUES Rental and other property income 48,213$ 45,737$ 33,067$ 21,992$ 12,589$ Tenant reimbursement income 8,384 7,741 6,051 3,597 2,291 Total revenue 56,597 53,478 39,118 25,589 14,880 EXPENSES General and administrative expenses 1,865 1,539 2,332 1,746 1,002 Property operating expenses 9,199 8,559 6,956 4,441 2,306 Advisory fees and expenses 4,916 4,713 3,604 2,387 1,378 Acquisition related expenses 4,644 2,410 24,383 11,754 14,181 Depreciation 14,590 14,053 10,048 7,028 4,194 Amortization 6,025 5,803 4,098 2,854 1,754 Total operating expenses 41,239 37,077 51,421 30,210 24,815 OPERATING INCOME (LOSS) 15,358 16,401 (12,303) (4,621) (9,935) Other income (expense): Interest and other income 13 47 506 21 8 Interest expense (6,844) (6,524) (5,109) (3,113) (3,057) Total other expense: (6,831) (6,477) (4,603) (3,092) (3,049) Net income (loss) 8,527 9,924 (16,906) (7,713) (12,984) Net income (loss) allocated to noncontrolling interest 45 58 (17) - - Net income (loss) attributable to the Company 8,482$ 9,866$ (16,889)$ (7,713)$ (12,984)$ Weighted average number of common shares outstanding: Basic and diluted 196,045,136 194,185,622 189,782,209 107,828,254 44,165,573 Net income (loss) per common share: Basic and diluted 0.04$ 0.05$ (0.19)$ (0.08)$ (0.29)$

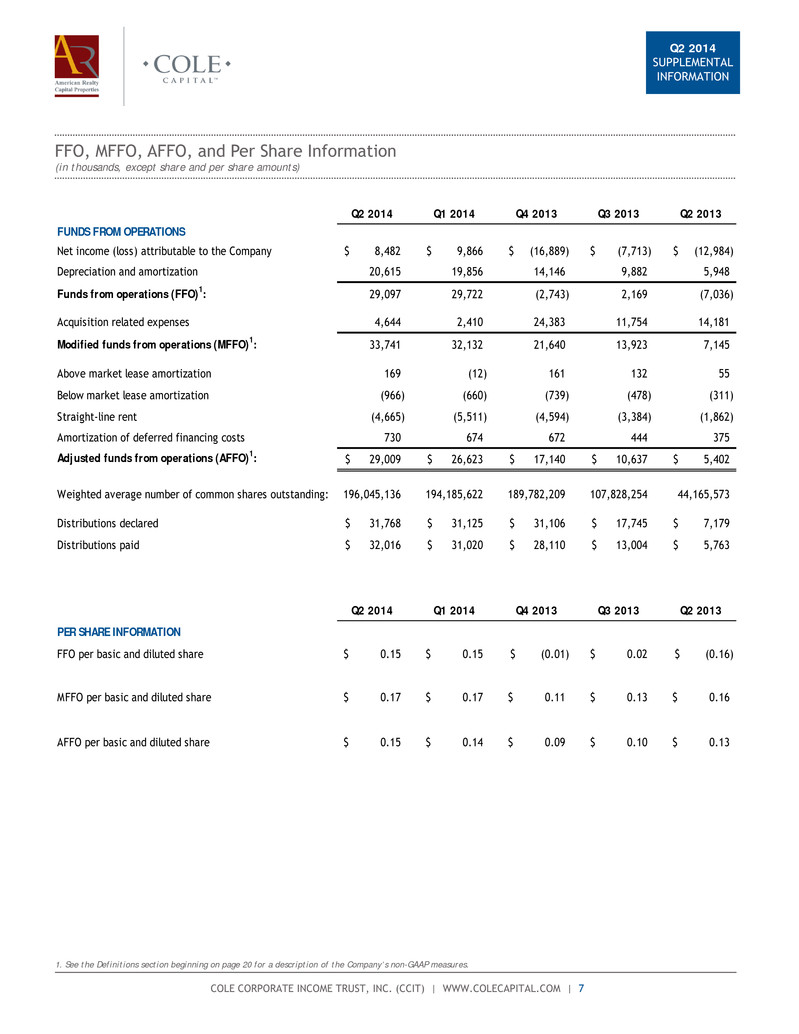

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 7 FFO, MFFO, AFFO, and Per Share Information (in thousands, except share and per share amounts) 1. See the Definitions section beginning on page 20 for a description of the Company’s non-GAAP measures. Q2 2014 Q1 2014 Q4 2013 Q3 2013 Q2 2013 FUNDS FROM OPERATIONS Net income (loss) attributable to the Company 8,482$ 9,866$ (16,889)$ (7,713)$ (12,984)$ Depreciation and amortization 20,615 19,856 14,146 9,882 5,948 Funds from operations (FFO)1: 29,097 29,722 (2,743) 2,169 (7,036) Acquisition related expenses 4,644 2,410 24,383 11,754 14,181 Modified funds from operations (MFFO)1: 33,741 32,132 21,640 13,923 7,145 Above market lease amortization 169 (12) 161 132 55 Below market lease amortization (966) (660) (739) (478) (311) Straight-line rent (4,665) (5,511) (4,594) (3,384) (1,862) Amortization of deferred financing costs 730 674 672 444 375 Adjusted funds from operations (AFFO)1: 29,009$ 26,623$ 17,140$ 10,637$ 5,402$ Weighted average number of common shares outstanding: 196,045,136 194,185,622 189,782,209 107,828,254 44,165,573 Distributions declared 31,768$ 31,125$ 31,106$ 17,745$ 7,179$ Distributions paid 32,016$ 31,020$ 28,110$ 13,004$ 5,763$ Q2 2014 Q1 2014 Q4 2013 Q3 2013 Q2 2013 PER SHARE INFORMATION FFO per basic and diluted share 0.15$ 0.15$ (0.01)$ 0.02$ (0.16)$ MFFO per basic and diluted share 0.17$ 0.17$ 0.11$ 0.13$ 0.16$ AFFO per basic and diluted share 0.15$ 0.14$ 0.09$ 0.10$ 0.13$

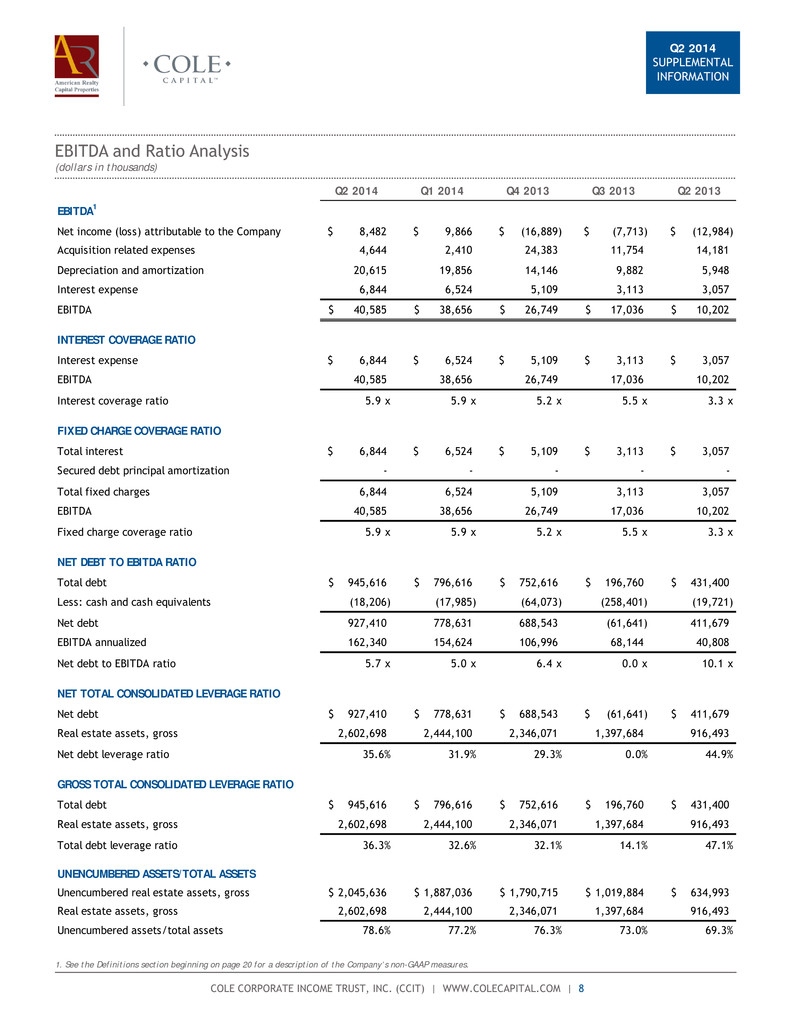

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 8 EBITDA and Ratio Analysis (dollars in thousands) 1. See the Definitions section beginning on page 20 for a description of the Company’s non-GAAP measures. Q2 2014 Q1 2014 Q4 2013 Q3 2013 Q2 2013 EBITDA1 Net income (loss) attributable to the Company 8,482$ 9,866$ (16,889)$ (7,713)$ (12,984)$ Acquisition related expenses 4,644 2,410 24,383 11,754 14,181 Depreciation and amortization 20,615 19,856 14,146 9,882 5,948 Interest expense 6,844 6,524 5,109 3,113 3,057 EBITDA 40,585$ 38,656$ 26,749$ 17,036$ 10,202$ INTEREST COVERAGE RATIO Interest expense 6,844$ 6,524$ 5,109$ 3,113$ 3,057$ EBITDA 40,585 38,656 26,749 17,036 10,202 Interest coverage ratio 5.9 x 5.9 x 5.2 x 5.5 x 3.3 x FIXED CHARGE COVERAGE RATIO Total interest 6,844$ 6,524$ 5,109$ 3,113$ 3,057$ Secured debt principal amortization - - - - - Total fixed charges 6,844 6,524 5,109 3,113 3,057 EBITDA 40,585 38,656 26,749 17,036 10,202 Fixed charge coverage ratio 5.9 x 5.9 x 5.2 x 5.5 x 3.3 x NET DEBT TO EBITDA RATIO Total debt 945,616$ 796,616$ 752,616$ 196,760$ 431,400$ Less: cash and cash equivalents (18,206) (17,985) (64,073) (258,401) (19,721) Net debt 927,410 778,631 688,543 (61,641) 411,679 EBITDA annualized 162,340 154,624 106,996 68,144 40,808 Net debt to EBITDA ratio 5.7 x 5.0 x 6.4 x 0.0 x 10.1 x NET TOTAL CONSOLIDATED LEVERAGE RATIO Net debt 927,410$ 778,631$ 688,543$ (61,641)$ 411,679$ Real estate assets, gross 2,602,698 2,444,100 2,346,071 1,397,684 916,493 Net debt leverage ratio 35.6% 31.9% 29.3% 0.0% 44.9% GROSS TOTAL CONSOLIDATED LEVERAGE RATIO Total debt 945,616$ 796,616$ 752,616$ 196,760$ 431,400$ Real estate assets, gross 2,602,698 2,444,100 2,346,071 1,397,684 916,493 Total debt leverage ratio 36.3% 32.6% 32.1% 14.1% 47.1% UNENCUMBERED ASSETS/TOTAL ASSETS Unencumbered real estate assets, gross 2,045,636$ 1,887,036$ 1,790,715$ 1,019,884$ 634,993$ Real estate assets, gross 2,602,698 2,444,100 2,346,071 1,397,684 916,493 Unencumbered assets/total assets 78.6% 77.2% 76.3% 73.0% 69.3%

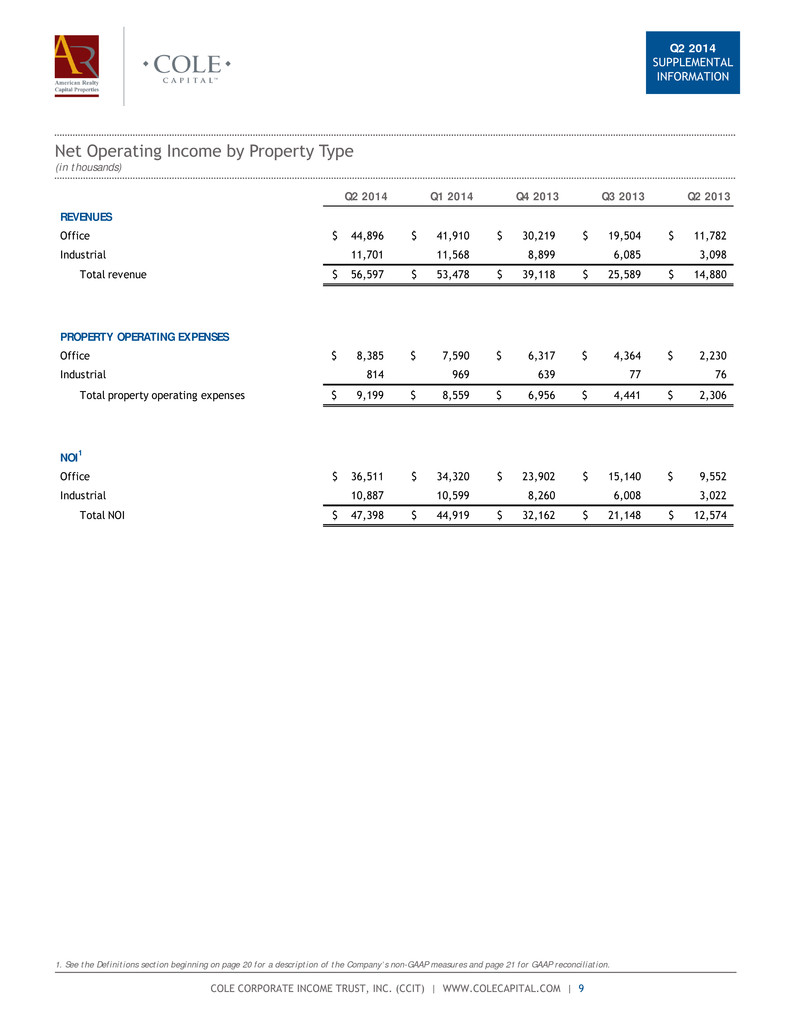

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 9 Net Operating Income by Property Type (in thousands) 1. See the Definitions section beginning on page 20 for a description of the Company’s non-GAAP measures and page 21 for GAAP reconciliation. Q2 2014 Q1 2014 Q4 2013 Q3 2013 Q2 2013 REVENUES Office 44,896$ 41,910$ 30,219$ 19,504$ 11,782$ Industrial 11,701 11,568 8,899 6,085 3,098 Total revenue 56,597$ 53,478$ 39,118$ 25,589$ 14,880$ PROPERTY OPERATING EXPENSES Office 8,385$ 7,590$ 6,317$ 4,364$ 2,230$ Industrial 814 969 639 77 76 Total property operating expenses 9,199$ 8,559$ 6,956$ 4,441$ 2,306$ NOI1 Office 36,511$ 34,320$ 23,902$ 15,140$ 9,552$ Industrial 10,887 10,599 8,260 6,008 3,022 Total NOI 47,398$ 44,919$ 32,162$ 21,148$ 12,574$

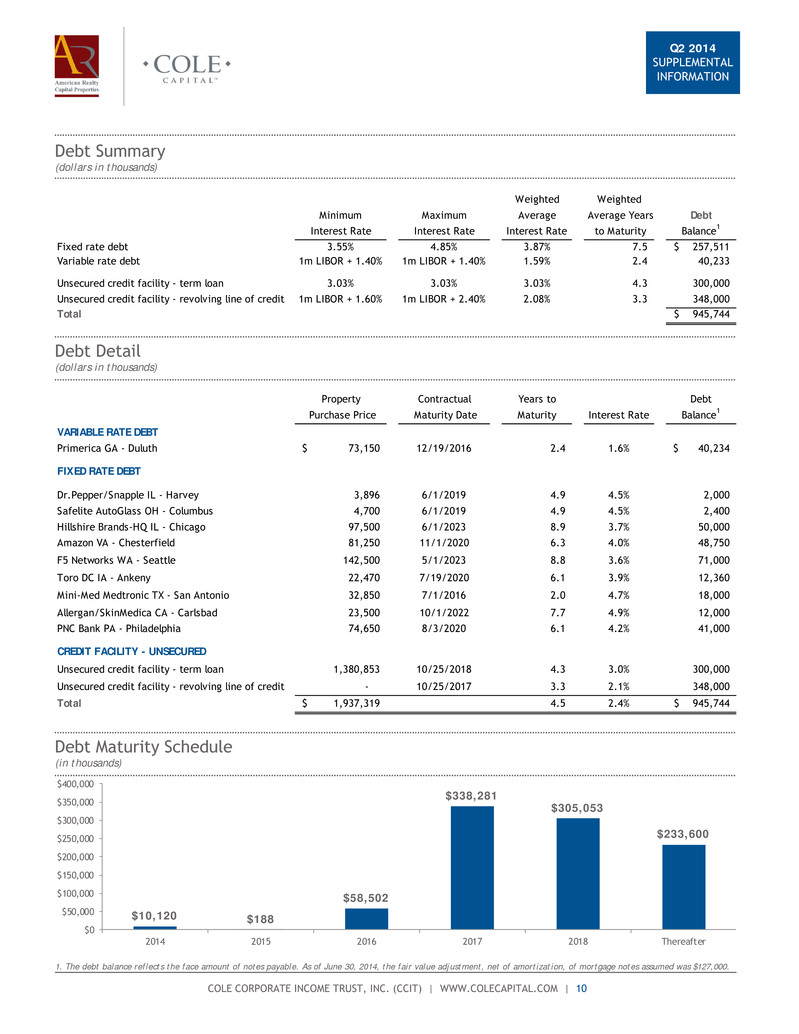

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 10 Debt Summary (dollars in thousands) 1. The debt balance reflects the face amount of notes payable. As of June 30, 2014, the fair value adjustment, net of amortization, of mortgage notes assumed was $127,000. Debt Detail (dollars in thousands) Debt Maturity Schedule (in thousands) $10,120 $188 $58,502 $338,281 $305,053 $233,600 $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 $400,000 2014 2015 2016 2017 2018 Thereafter Weighted Weighted Minimum Maximum Average Average Years Debt Interest Rate Interest Rate Interest Rate to Maturity Balance1 Fixed rate debt 3.55% 4.85% 3.87% 7.5 257,511$ Variable rate debt 1m LIBOR + 1.40% 1m LIBOR + 1.40% 1.59% 2.4 40,233 Unsecured credit facility - term loan 3.03% 3.03% 3.03% 4.3 300,000 Unsecured credit facility - revolving line of credit 1m LIBOR + 1.60% 1m LIBOR + 2.40% 2.08% 3.3 348,000 Total 945,744$ Property Contractual Years to Debt Purchase Price Maturity Date Maturity Interest Rate Balance1 VARIABLE RATE DEBT Primerica GA - Duluth 73,150$ 12/19/2016 2.4 1.6% 40,234$ FIXED RATE DEBT Dr.Pepper/Snapple IL - Harvey 3,896 6/1/2019 4.9 4.5% 2,000 Safelite AutoGlass OH - Columbus 4,700 6/1/2019 4.9 4.5% 2,400 Hillshire Brands-HQ IL - Chicago 97,500 6/1/2023 8.9 3.7% 50,000 Amazon VA - Chesterfield 81,250 11/1/2020 6.3 4.0% 48,750 F5 Networks WA - Seattle 142,500 5/1/2023 8.8 3.6% 71,000 Toro DC IA - Ankeny 22,470 7/19/2020 6.1 3.9% 12,360 Mini-Med Medtronic TX - San Antonio 32,850 7/1/2016 2.0 4.7% 18,000 Allergan/SkinMedica CA - Carlsbad 23,500 10/1/2022 7.7 4.9% 12,000 PNC Bank PA - Philadelphia 74,650 8/3/2020 6.1 4.2% 41,000 CREDIT FACILITY - UNSECURED Unsecured credit facility - term loan 1,380,853 10/25/2018 4.3 3.0% 300,000 Unsecured credit facility - revolving line of credit - 10/25/2017 3.3 2.1% 348,000 Total 1,937,319$ 4.5 2.4% 945,744$

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 11 Portfolio Composition by Tenant (dollars in thousands, sorted by rental revenue) 1. See the Definitions section beginning on page 20. % of Total Annualized % of Total % of Total Purchase Purchase Straight Line Rental Square # of Credit Tenant Price Price Rental Revenue1 Revenue Square Feet Feet Leases Rating1 Amazon 213,553$ 8.1% 14,272$ 7.4% 3,048,672 17% 3 S&P: AA- Tesoro 194,318 7.4% 13,717 7.1% 618,017 4% 1 S&P: BB+ F5 142,500 5.4% 9,814 5.1% 299,643 2% 2 Not Rated Noble Energy 114,750 4.4% 7,871 4.1% 497,477 3% 1 S&P: BBB FedEx 94,849 3.6% 6,872 3.5% 794,674 5% 14 S&P: BBB Hillshire Brands Company 97,500 3.7% 6,221 3.2% 233,869 1% 1 S&P: BBB Allstate Insurance 85,143 3.2% 5,949 3.1% 458,338 3% 1 S&P: A- Church & Dwight Co. 86,500 3.3% 5,752 3.0% 250,086 1% 1 S&P: BBB+ PNC Bank 74,650 2.8% 5,555 2.9% 441,000 3% 1 S&P: A Restoration Hardware 74,100 2.8% 5,285 2.7% 1,194,744 7% 1 Not Rated Top 10 Tenants Sub-Total 1,177,863$ 44.9% 81,308$ 41.9% 7,836,520 45% 26 Sanofi US 72,315$ 2.8% 5,119$ 2.6% 205,439 1% 1 S&P: AA Primerica 73,150 2.8% 5,035 2.6% 344,476 2% 1 S&P: A- ServiceNow 63,278 2.4% 4,626 2.4% 148,866 1% 2 Not Rated Compass Group USA 33,652 1.3% 4,131 2.1% 226,657 1% 2 Not Rated American Tire Distributors 46,574 1.8% 4,058 2.1% 693,880 4% 5 S&P: B BJ's Wholesale Club 48,673 1.9% 3,922 2.0% 633,836 4% 1 S&P: B- Evonik 32,352 1.2% 3,903 2.0% 150,500 1% 1 Not Rated CSG International 45,300 1.7% 3,900 2.0% 202,566 1% 1 S&P: BB Express Scripts 51,267 2.0% 3,896 2.0% 219,644 1% 1 S&P: BBB+ Arris Enterprises Inc. 46,587 1.8% 3,674 1.9% 131,680 1% 1 S&P: BB- Men's Wearhouse 51,250 2.0% 3,638 1.9% 206,362 1% 1 Not Rated Advance Bionics 44,000 1.7% 3,477 1.8% 146,385 1% 1 Not Rated Magellan Health 45,800 1.7% 3,454 1.8% 232,521 1% 1 S&P: BBB- DuPont Pioneer 44,685 1.7% 3,222 1.7% 198,554 1% 1 S&P: A Red Hat 44,700 1.7% 3,180 1.6% 175,000 1% 1 S&P: BBB Energizer Holdings/Exel 43,250 1.7% 3,025 1.6% 945,023 5% 1 S&P: BBB- AT&T 40,017 1.5% 2,875 1.5% 425,224 2% 2 S&P: A- MiniMed 32,850 1.3% 2,755 1.4% 145,025 1% 1 S&P: AA- United Launch Alliance 32,550 1.2% 2,486 1.3% 167,917 1% 1 Not Rated Acxiom Corporation 36,125 1.4% 2,464 1.3% 62,721 0% 1 S&P: BB Lattice Semiconductor 33,000 1.3% 2,446 1.3% 98,874 1% 1 Not Rated Duke Univeristy Health System 32,700 1.2% 2,418 1.2% 126,225 1% 1 S&P: AA Secret Service 29,700 1.1% 2,164 1.1% 78,634 0% 1 S&P: AA+ TGS-NOPEC 29,937 1.1% 2,148 1.1% 97,295 1% 1 Not Rated McKesson Corporation 27,700 1.1% 1,866 1.0% 450,163 3% 1 S&P: BBB+ Elizabeth Arden 23,500 0.9% 1,840 0.9% 399,182 2% 1 S&P: BB- SkinMedica 23,500 0.9% 1,767 0.9% 81,712 0% 1 S&P: A+ DeVry University 23,030 0.9% 1,719 0.9% 122,646 1% 1 Not Rated Harvard Vanguard 24,366 0.9% 1,710 0.9% 49,250 0% 1 Not Rated Toro 22,470 0.9% 1,593 0.8% 450,139 3% 1 S&P: BBB Orchard Supply 18,700 0.7% 1,590 0.8% 75,621 0% 1 Not Rated AON 22,572 0.9% 1,574 0.8% 222,717 1% 1 S&P: A- Caremark 18,880 0.7% 1,387 0.7% 99,734 1% 1 S&P: BBB+ HCA Patient Account Services 15,483 0.6% 1,371 0.7% 94,137 1% 1 S&P: B+

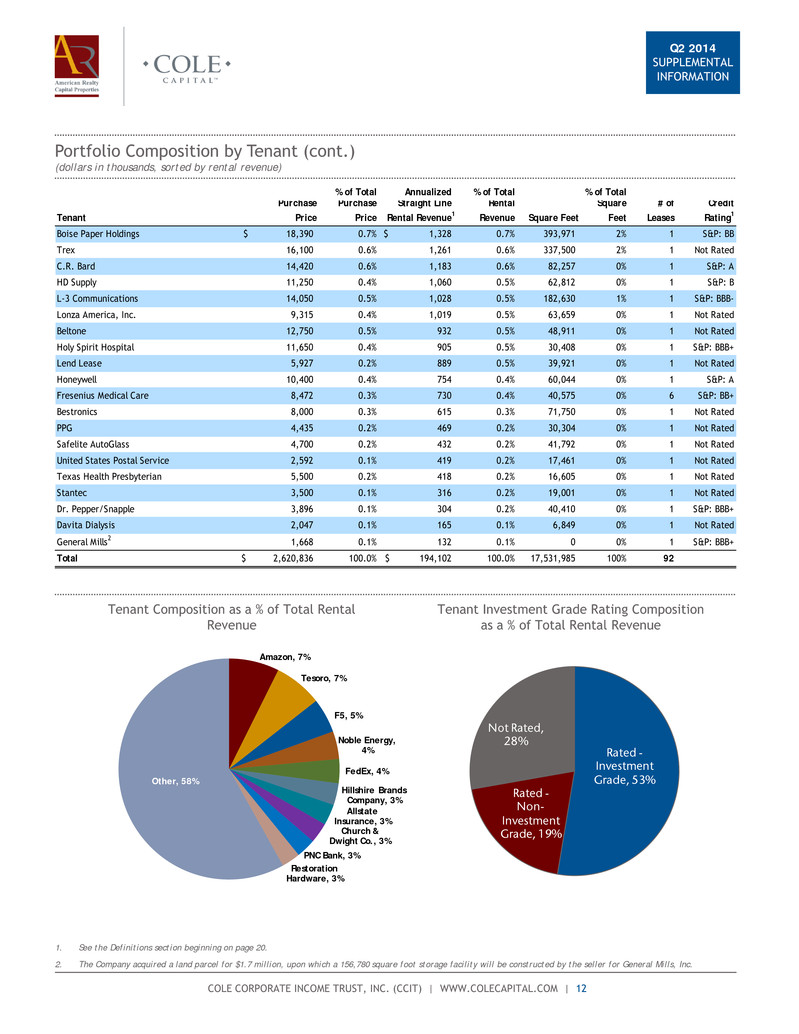

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 12 Portfolio Composition by Tenant (cont.) (dollars in thousands, sorted by rental revenue) 1. See the Definitions section beginning on page 20. 2. The Company acquired a land parcel for $1.7 million, upon which a 156,780 square foot storage facility will be constructed by the seller for General Mills, Inc. Rated - Investment Grade, 53% Rated - Non- Investment Grade, 19% Not Rated, 28% Amazon, 7% Tesoro, 7% F5, 5% Noble Energy, 4% FedEx, 4% Hillshire Brands Company, 3% Allstate Insurance, 3% Church & Dwight Co., 3% PNC Bank, 3% Restoration Hardware, 3% Other, 58% Tenant Composition as a % of Total Rental Revenue Tenant Investment Grade Rating Composition as a % of Total Rental Revenue % of Total Annualized % of Total % of Total Purchase Purchase Straight Line Rental Square # of Credit Tenant Price Price Rental Revenue1 Revenue Feet Leases Rating1 Boise Paper Holdings 18,390$ 0.7% 1,328$ 0.7% 393,971 2% 1 S&P: BB Trex 16,100 0.6% 1,261 0.6% 337,500 2% 1 Not Rated C.R. Bard 14,420 0.6% 1,183 0.6% 82,257 0% 1 S&P: A HD Supply 11,250 0.4% 1,060 0.5% 62,812 0% 1 S&P: B L-3 Communications 14,050 0.5% 1,028 0.5% 182,630 1% 1 S&P: BBB- Lonza America, Inc. 9,315 0.4% 1,019 0.5% 63,659 0% 1 Not Rated Beltone 12,750 0.5% 932 0.5% 48,911 0% 1 Not Rated Holy Spirit Hospital 11,650 0.4% 905 0.5% 30,408 0% 1 S&P: BBB+ Lend Lease 5,927 0.2% 889 0.5% 39,921 0% 1 Not Rated Honeywell 10,400 0.4% 754 0.4% 60,044 0% 1 S&P: A Fresenius Medical Care 8,472 0.3% 730 0.4% 40,575 0% 6 S&P: BB+ Bestronics 8,000 0.3% 615 0.3% 71,750 0% 1 Not Rated PPG 4,435 0.2% 469 0.2% 30,304 0% 1 Not Rated Safelite AutoGlass 4,700 0.2% 432 0.2% 41,792 0% 1 Not Rated United States Postal Service 2,592 0.1% 419 0.2% 17,461 0% 1 Not Rated Texas Health Presbyterian 5,500 0.2% 418 0.2% 16,605 0% 1 Not Rated Stantec 3,500 0.1% 316 0.2% 19,001 0% 1 Not Rated Dr. Pepper/Snapple 3,896 0.1% 304 0.2% 40,410 0% 1 S&P: BBB+ Davita Dialysis 2,047 0.1% 165 0.1% 6,849 0% 1 Not Rated General Mills2 1,668 0.1% 132 0.1% 0 0% 1 S&P: BBB+ Total 2,620,836$ 100.0% 194,102$ 100.0% 17,531,985 100% 92 Square Feet

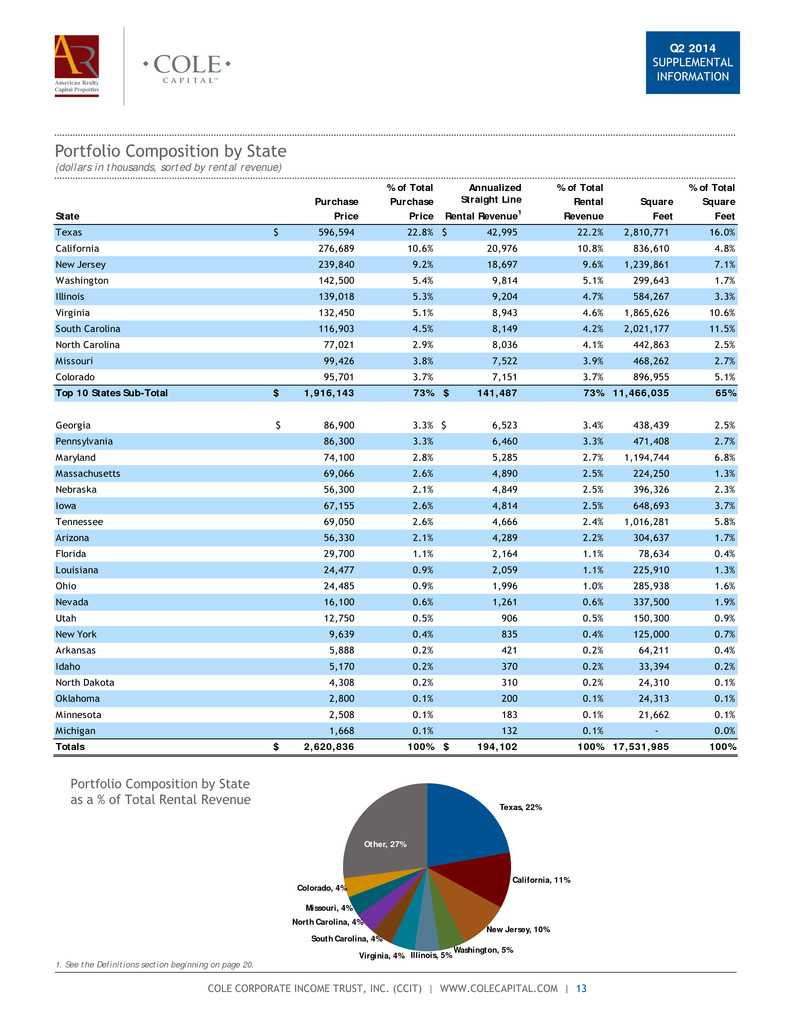

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 13 Portfolio Composition by State (dollars in thousands, sorted by rental revenue) 1. See the Definitions section beginning on page 20. Texas, 22% California, 11% New Jersey, 10% Washington, 5%Illinois, 5%Virginia, 4% South Carolina, 4% North Carolina, 4% Missouri, 4% Colorado, 4% Other, 27% Portfolio Composition by State as a % of Total Rental Revenue % of Total Annualized % of Total % of Total State Purchase Price Purchase Price Straight Line Rental Revenue1 Rental Revenue Square Feet Texas 596,594$ 22.8% 42,995$ 22.2% 2,810,771 16.0% California 276,689 10.6% 20,976 10.8% 836,610 4.8% New Jersey 239,840 9.2% 18,697 9.6% 1,239,861 7.1% Washington 142,500 5.4% 9,814 5.1% 299,643 1.7% Illinois 139,018 5.3% 9,204 4.7% 584,267 3.3% Virginia 132,450 5.1% 8,943 4.6% 1,865,626 10.6% South Carolina 116,903 4.5% 8,149 4.2% 2,021,177 11.5% North Carolina 77,021 2.9% 8,036 4.1% 442,863 2.5% Missouri 99,426 3.8% 7,522 3.9% 468,262 2.7% Colorado 95,701 3.7% 7,151 3.7% 896,955 5.1% Top 10 States Sub-Total 1,916,143$ 73% 141,487$ 73% 11,466,035 65% Georgia 86,900$ 3.3% 6,523$ 3.4% 438,439 2.5% Pennsylvania 86,300 3.3% 6,460 3.3% 471,408 2.7% Maryland 74,100 2.8% 5,285 2.7% 1,194,744 6.8% Massachusetts 69,066 2.6% 4,890 2.5% 224,250 1.3% Nebraska 56,300 2.1% 4,849 2.5% 396,326 2.3% Iowa 67,155 2.6% 4,814 2.5% 648,693 3.7% Tennessee 69,050 2.6% 4,666 2.4% 1,016,281 5.8% Arizona 56,330 2.1% 4,289 2.2% 304,637 1.7% Florida 29,700 1.1% 2,164 1.1% 78,634 0.4% Louisiana 24,477 0.9% 2,059 1.1% 225,910 1.3% Ohio 24,485 0.9% 1,996 1.0% 285,938 1.6% Nevada 16,100 0.6% 1,261 0.6% 337,500 1.9% Utah 12,750 0.5% 906 0.5% 150,300 0.9% New York 9,639 0.4% 835 0.4% 125,000 0.7% Arkansas 5,888 0.2% 421 0.2% 64,211 0.4% Idaho 5,170 0.2% 370 0.2% 33,394 0.2% North Dakota 4,308 0.2% 310 0.2% 24,310 0.1% Oklahoma 2,800 0.1% 200 0.1% 24,313 0.1% Minnesota 2,508 0.1% 183 0.1% 21,662 0.1% Michigan 1,668 0.1% 132 0.1% - 0.0% Totals 2,620,836$ 100% 194,102$ 100% 17,531,985 100% Square Feet

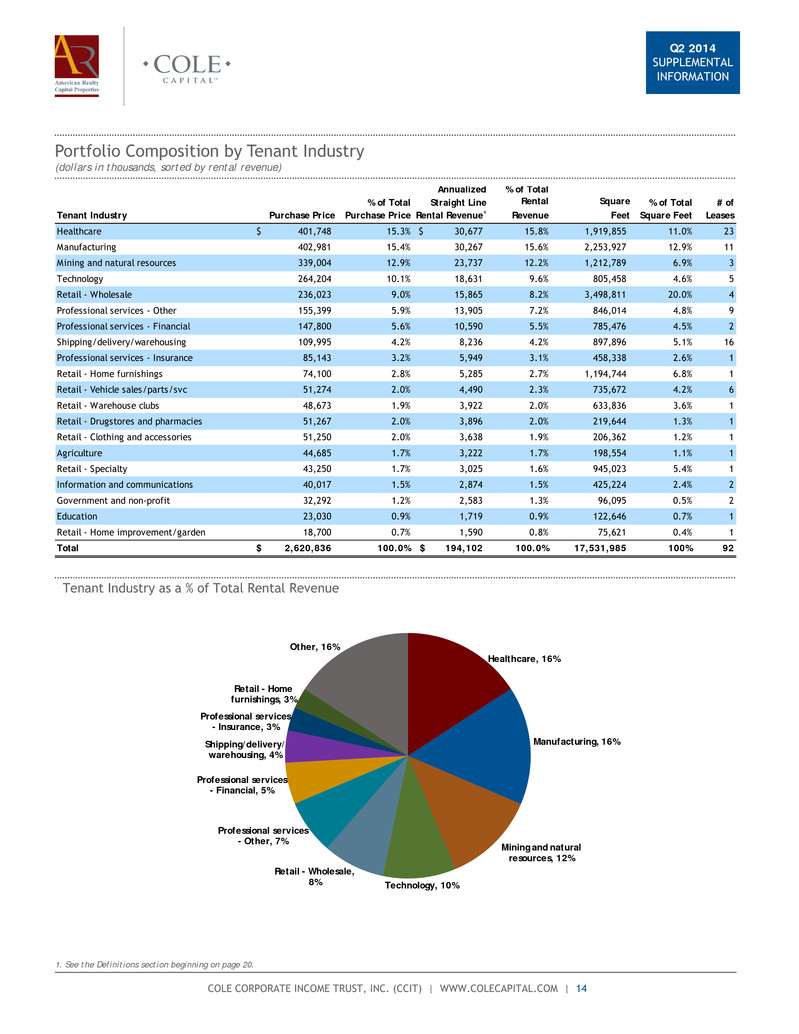

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 14 Portfolio Composition by Tenant Industry (dollars in thousands, sorted by rental revenue) 1. See the Definitions section beginning on page 20. Tenant Industry as a % of Total Rental Revenue Healthcare, 16% Manufacturing, 16% Mining and natural resources, 12% Technology, 10% Retail - Wholesale, 8% Professional services - Other, 7% Professional services - Financial, 5% Shipping/delivery/ warehousing, 4% Professional services - Insurance, 3% Retail - Home furnishings, 3% Other, 16% Annualized % of Total % of Total Straight Line % of Total # of Tenant Industry Purchase Price Purchase Price Rental Revenue1 Square Feet Leases Healthcare 401,748$ 15.3% 30,677$ 15.8% 1,919,855 11.0% 23 Manufacturing 402,981 15.4% 30,267 15.6% 2,253,927 12.9% 11 Mining and natural resources 339,004 12.9% 23,737 12.2% 1,212,789 6.9% 3 Technology 264,204 10.1% 18,631 9.6% 805,458 4.6% 5 Retail - Wholesale 236,023 9.0% 15,865 8.2% 3,498,811 20.0% 4 Professional services - Other 155,399 5.9% 13,905 7.2% 846,014 4.8% 9 Professional services - Financial 147,800 5.6% 10,590 5.5% 785,476 4.5% 2 Shipping/delivery/warehousing 109,995 4.2% 8,236 4.2% 897,896 5.1% 16 Professional services - Insurance 85,143 3.2% 5,949 3.1% 458,338 2.6% 1 Retail - Home furnishings 74,100 2.8% 5,285 2.7% 1,194,744 6.8% 1 Retail - Vehicle sales/parts/svc 51,274 2.0% 4,490 2.3% 735,672 4.2% 6 Retail - Warehouse clubs 48,673 1.9% 3,922 2.0% 633,836 3.6% 1 Retail - Drugstores and pharmacies 51,267 2.0% 3,896 2.0% 219,644 1.3% 1 Retail - Clothing and accessories 51,250 2.0% 3,638 1.9% 206,362 1.2% 1 Agriculture 44,685 1.7% 3,222 1.7% 198,554 1.1% 1 Retail - Specialty 43,250 1.7% 3,025 1.6% 945,023 5.4% 1 Information and communications 40,017 1.5% 2,874 1.5% 425,224 2.4% 2 Government and non-profit 32,292 1.2% 2,583 1.3% 96,095 0.5% 2 Education 23,030 0.9% 1,719 0.9% 122,646 0.7% 1 Retail - Home improvement/garden 18,700 0.7% 1,590 0.8% 75,621 0.4% 1 Total 2,620,836$ 100.0% 194,102$ 100.0% 17,531,985 100% 92 Rental Revenue Square Feet

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 15 Lease Expiration Schedule (dollars in thousands) Lease Expiration Schedule as a % of Total Rental Revenue Total 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Thereafter OFFICE Number of leases 59 1 1 1 1 1 2 1 - 11 6 34 Annualized rental income 147,898$ 16$ 469$ 419$ 889$ 1,387$ 1,798$ 2,755$ -$ 15,571$ 9,701$ 114,892$ INDUSTRIAL Number of leases 33 - - - - - 1 2 - 6 12 12 Annualized rental income 46,204$ -$ -$ -$ -$ -$ 180$ 1,839$ -$ 3,584$ 9,249$ 31,352$ TOTAL NUMBER OF LEASES 92 1 1 1 1 1 3 3 - 17 18 46 TOTAL RENTAL INCOME 194,102$ 16$ 469$ 419$ 889$ 1,387$ 1,978$ 4,595$ -$ 19,155$ 18,950$ 146,244$ % of Total 100.0% 0.0% 0.2% 0.2% 0.5% 0.7% 1.0% 2.4% 0.0% 9.9% 9.8% 75.3% Cumulative Total 0.0% 0.2% 0.4% 0.9% 1.6% 2.6% 5.0% 5.0% 14.9% 24.7% 100.0% Expiration Year 0.0% 0.2% 0.2% 0.5% 0.7% 1.0% 2.4% 0.0% 9.9% 9.8% 75.3% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 55% 60% 65% 70% 75% 80% 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Thereafter

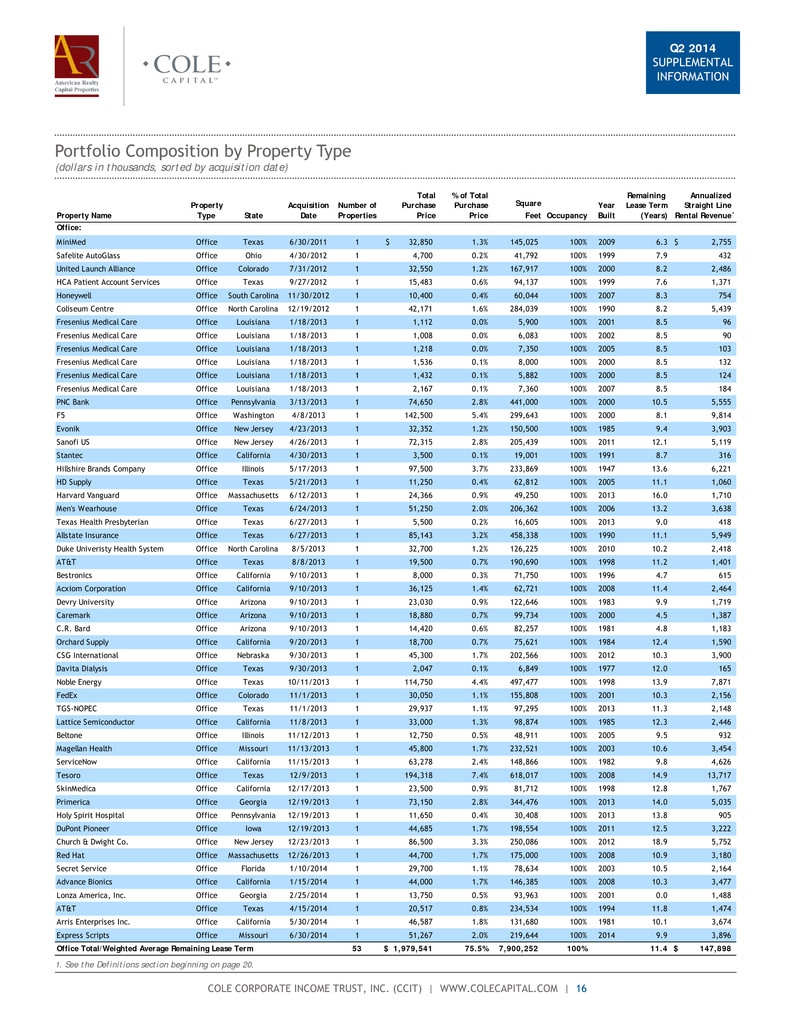

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 16 Portfolio Composition by Property Type (dollars in thousands, sorted by acquisition date) 1. See the Definitions section beginning on page 20. Total % of Total Remaining Annualized Property Acquisition Number of Purchase Purchase Year Lease Term Straight Line Property Name Type State Date Properties Price Price Occupancy Built (Years) Rental Revenue1 Office: MiniMed Office Texas 6/30/2011 1 32,850$ 1.3% 145,025 100% 2009 6.3 2,755$ Safelite AutoGlass Office Ohio 4/30/2012 1 4,700 0.2% 41,792 100% 1999 7.9 432 United Launch Alliance Office Colorado 7/31/2012 1 32,550 1.2% 167,917 100% 2000 8.2 2,486 HCA Patient Account Services Office Texas 9/27/2012 1 15,483 0.6% 94,137 100% 1999 7.6 1,371 Honeywell Office South Carolina 11/30/2012 1 10,400 0.4% 60,044 100% 2007 8.3 754 Coliseum Centre Office North Carolina 12/19/2012 1 42,171 1.6% 284,039 100% 1990 8.2 5,439 Fresenius Medical Care Office Louisiana 1/18/2013 1 1,112 0.0% 5,900 100% 2001 8.5 96 Fresenius Medical Care Office Louisiana 1/18/2013 1 1,008 0.0% 6,083 100% 2002 8.5 90 Fresenius Medical Care Office Louisiana 1/18/2013 1 1,218 0.0% 7,350 100% 2005 8.5 103 Fresenius Medical Care Office Louisiana 1/18/2013 1 1,536 0.1% 8,000 100% 2000 8.5 132 Fresenius Medical Care Office Louisiana 1/18/2013 1 1,432 0.1% 5,882 100% 2000 8.5 124 Fresenius Medical Care Office Louisiana 1/18/2013 1 2,167 0.1% 7,360 100% 2007 8.5 184 PNC Bank Office Pennsylvania 3/13/2013 1 74,650 2.8% 441,000 100% 2000 10.5 5,555 F5 Office Washington 4/8/2013 1 142,500 5.4% 299,643 100% 2000 8.1 9,814 Evonik Office New Jersey 4/23/2013 1 32,352 1.2% 150,500 100% 1985 9.4 3,903 Sanofi US Office New Jersey 4/26/2013 1 72,315 2.8% 205,439 100% 2011 12.1 5,119 Stantec Office California 4/30/2013 1 3,500 0.1% 19,001 100% 1991 8.7 316 Hillshire Brands Company Office Illinois 5/17/2013 1 97,500 3.7% 233,869 100% 1947 13.6 6,221 HD Supply Office Texas 5/21/2013 1 11,250 0.4% 62,812 100% 2005 11.1 1,060 Harvard Vanguard Office Massachusetts 6/12/2013 1 24,366 0.9% 49,250 100% 2013 16.0 1,710 Men's Wearhouse Office Texas 6/24/2013 1 51,250 2.0% 206,362 100% 2006 13.2 3,638 Texas Health Presbyterian Office Texas 6/27/2013 1 5,500 0.2% 16,605 100% 2013 9.0 418 Allstate Insurance Office Texas 6/27/2013 1 85,143 3.2% 458,338 100% 1990 11.1 5,949 Duke Univeristy Health System Office North Carolina 8/5/2013 1 32,700 1.2% 126,225 100% 2010 10.2 2,418 AT&T Office Texas 8/8/2013 1 19,500 0.7% 190,690 100% 1998 11.2 1,401 Bestronics Office California 9/10/2013 1 8,000 0.3% 71,750 100% 1996 4.7 615 Acxiom Corporation Office California 9/10/2013 1 36,125 1.4% 62,721 100% 2008 11.4 2,464 Devry University Office Arizona 9/10/2013 1 23,030 0.9% 122,646 100% 1983 9.9 1,719 Caremark Office Arizona 9/10/2013 1 18,880 0.7% 99,734 100% 2000 4.5 1,387 C.R. Bard Office Arizona 9/10/2013 1 14,420 0.6% 82,257 100% 1981 4.8 1,183 Orchard Supply Office California 9/20/2013 1 18,700 0.7% 75,621 100% 1984 12.4 1,590 CSG International Office Nebraska 9/30/2013 1 45,300 1.7% 202,566 100% 2012 10.3 3,900 Davita Dialysis Office Texas 9/30/2013 1 2,047 0.1% 6,849 100% 1977 12.0 165 Noble Energy Office Texas 10/11/2013 1 114,750 4.4% 497,477 100% 1998 13.9 7,871 FedEx Office Colorado 11/1/2013 1 30,050 1.1% 155,808 100% 2001 10.3 2,156 TGS-NOPEC Office Texas 11/1/2013 1 29,937 1.1% 97,295 100% 2013 11.3 2,148 Lattice Semiconductor Office California 11/8/2013 1 33,000 1.3% 98,874 100% 1985 12.3 2,446 Beltone Office Illinois 11/12/2013 1 12,750 0.5% 48,911 100% 2005 9.5 932 Magellan Health Office Missouri 11/13/2013 1 45,800 1.7% 232,521 100% 2003 10.6 3,454 ServiceNow Office California 11/15/2013 1 63,278 2.4% 148,866 100% 1982 9.8 4,626 Tesoro Office Texas 12/9/2013 1 194,318 7.4% 618,017 100% 2008 14.9 13,717 SkinMedica Office California 12/17/2013 1 23,500 0.9% 81,712 100% 1998 12.8 1,767 Primerica Office Georgia 12/19/2013 1 73,150 2.8% 344,476 100% 2013 14.0 5,035 Holy Spirit Hospital Office Pennsylvania 12/19/2013 1 11,650 0.4% 30,408 100% 2013 13.8 905 DuPont Pioneer Office Iowa 12/19/2013 1 44,685 1.7% 198,554 100% 2011 12.5 3,222 Church & Dwight Co. Office New Jersey 12/23/2013 1 86,500 3.3% 250,086 100% 2012 18.9 5,752 Red Hat Office Massachusetts 12/26/2013 1 44,700 1.7% 175,000 100% 2008 10.9 3,180 Secret Service Office Florida 1/10/2014 1 29,700 1.1% 78,634 100% 2003 10.5 2,164 Advance Bionics Office California 1/15/2014 1 44,000 1.7% 146,385 100% 2008 10.3 3,477 Lonza America, Inc. Office Georgia 2/25/2014 1 13,750 0.5% 93,963 100% 2001 0.0 1,488 AT&T Office Texas 4/15/2014 1 20,517 0.8% 234,534 100% 1994 11.8 1,474 Arris Enterprises Inc. Office California 5/30/2014 1 46,587 1.8% 131,680 100% 1981 10.1 3,674 Express Scripts Office Missouri 6/30/2014 1 51,267 2.0% 219,644 100% 2014 9.9 3,896 Office Total/Weighted Average Remaining Lease Term 53 1,979,541$ 75.5% 7,900,252 100% 11.4 147,898$ Square Feet

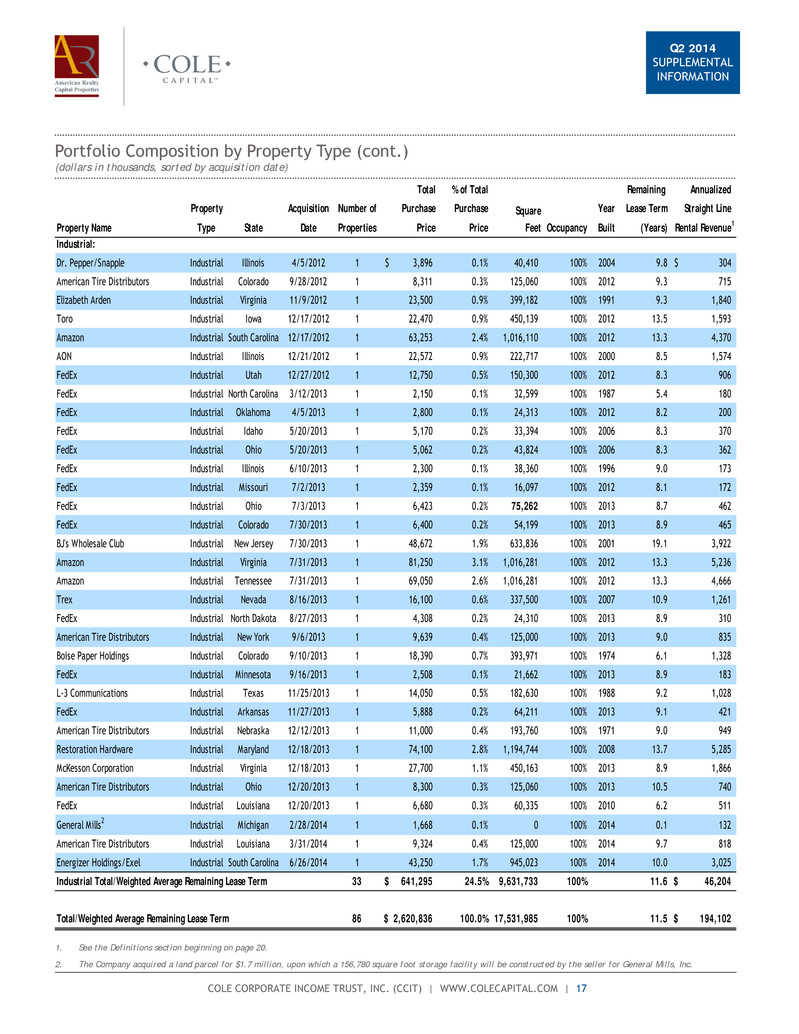

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 17 Portfolio Composition by Property Type (cont.) (dollars in thousands, sorted by acquisition date) 1. See the Definitions section beginning on page 20. 2. The Company acquired a land parcel for $1.7 million, upon which a 156,780 square foot storage facility will be constructed by the seller for General Mills, Inc. Total % of Total Remaining Annualized Property Acquisition Number of Purchase Purchase Year Lease Term Straight Line Property Name Type State Date Properties Price Price Occupancy Built (Years) Rental Revenue1 Industrial: Dr. Pepper/Snapple Industrial Illinois 4/5/2012 1 3,896$ 0.1% 40,410 100% 2004 9.8 304$ American Tire Distributors Industrial Colorado 9/28/2012 1 8,311 0.3% 125,060 100% 2012 9.3 715 Elizabeth Arden Industrial Virginia 11/9/2012 1 23,500 0.9% 399,182 100% 1991 9.3 1,840 Toro Industrial Iowa 12/17/2012 1 22,470 0.9% 450,139 100% 2012 13.5 1,593 Amazon Industrial South Carolina 12/17/2012 1 63,253 2.4% 1,016,110 100% 2012 13.3 4,370 AON Industrial Illinois 12/21/2012 1 22,572 0.9% 222,717 100% 2000 8.5 1,574 FedEx Industrial Utah 12/27/2012 1 12,750 0.5% 150,300 100% 2012 8.3 906 FedEx Industrial North Carolina 3/12/2013 1 2,150 0.1% 32,599 100% 1987 5.4 180 FedEx Industrial Oklahoma 4/5/2013 1 2,800 0.1% 24,313 100% 2012 8.2 200 FedEx Industrial Idaho 5/20/2013 1 5,170 0.2% 33,394 100% 2006 8.3 370 FedEx Industrial Ohio 5/20/2013 1 5,062 0.2% 43,824 100% 2006 8.3 362 FedEx Industrial Illinois 6/10/2013 1 2,300 0.1% 38,360 100% 1996 9.0 173 FedEx Industrial Missouri 7/2/2013 1 2,359 0.1% 16,097 100% 2012 8.1 172 FedEx Industrial Ohio 7/3/2013 1 6,423 0.2% 75,262 100% 2013 8.7 462 FedEx Industrial Colorado 7/30/2013 1 6,400 0.2% 54,199 100% 2013 8.9 465 BJ's Wholesale Club Industrial New Jersey 7/30/2013 1 48,672 1.9% 633,836 100% 2001 19.1 3,922 Amazon Industrial Virginia 7/31/2013 1 81,250 3.1% 1,016,281 100% 2012 13.3 5,236 Amazon Industrial Tennessee 7/31/2013 1 69,050 2.6% 1,016,281 100% 2012 13.3 4,666 Trex Industrial Nevada 8/16/2013 1 16,100 0.6% 337,500 100% 2007 10.9 1,261 FedEx Industrial North Dakota 8/27/2013 1 4,308 0.2% 24,310 100% 2013 8.9 310 American Tire Distributors Industrial New York 9/6/2013 1 9,639 0.4% 125,000 100% 2013 9.0 835 Boise Paper Holdings Industrial Colorado 9/10/2013 1 18,390 0.7% 393,971 100% 1974 6.1 1,328 FedEx Industrial Minnesota 9/16/2013 1 2,508 0.1% 21,662 100% 2013 8.9 183 L-3 Communications Industrial Texas 11/25/2013 1 14,050 0.5% 182,630 100% 1988 9.2 1,028 FedEx Industrial Arkansas 11/27/2013 1 5,888 0.2% 64,211 100% 2013 9.1 421 American Tire Distributors Industrial Nebraska 12/12/2013 1 11,000 0.4% 193,760 100% 1971 9.0 949 Restoration Hardware Industrial Maryland 12/18/2013 1 74,100 2.8% 1,194,744 100% 2008 13.7 5,285 McKesson Corporation Industrial Virginia 12/18/2013 1 27,700 1.1% 450,163 100% 2013 8.9 1,866 American Tire Distributors Industrial Ohio 12/20/2013 1 8,300 0.3% 125,060 100% 2013 10.5 740 FedEx Industrial Louisiana 12/20/2013 1 6,680 0.3% 60,335 100% 2010 6.2 511 General Mills2 Industrial Michigan 2/28/2014 1 1,668 0.1% 0 100% 2014 0.1 132 American Tire Distributors Industrial Louisiana 3/31/2014 1 9,324 0.4% 125,000 100% 2014 9.7 818 Energizer Holdings/Exel Industrial South Carolina 6/26/2014 1 43,250 1.7% 945,023 100% 2014 10.0 3,025 Industrial Total/Weighted Average Remaining Lease Term 33 641,295$ 24.5% 9,631,733 100% 11.6 46,204$ Total/Weighted Average Remaining Lease Term 86 2,620,836$ 100.0% 17,531,985 100% 11.5 194,102$ Square Feet

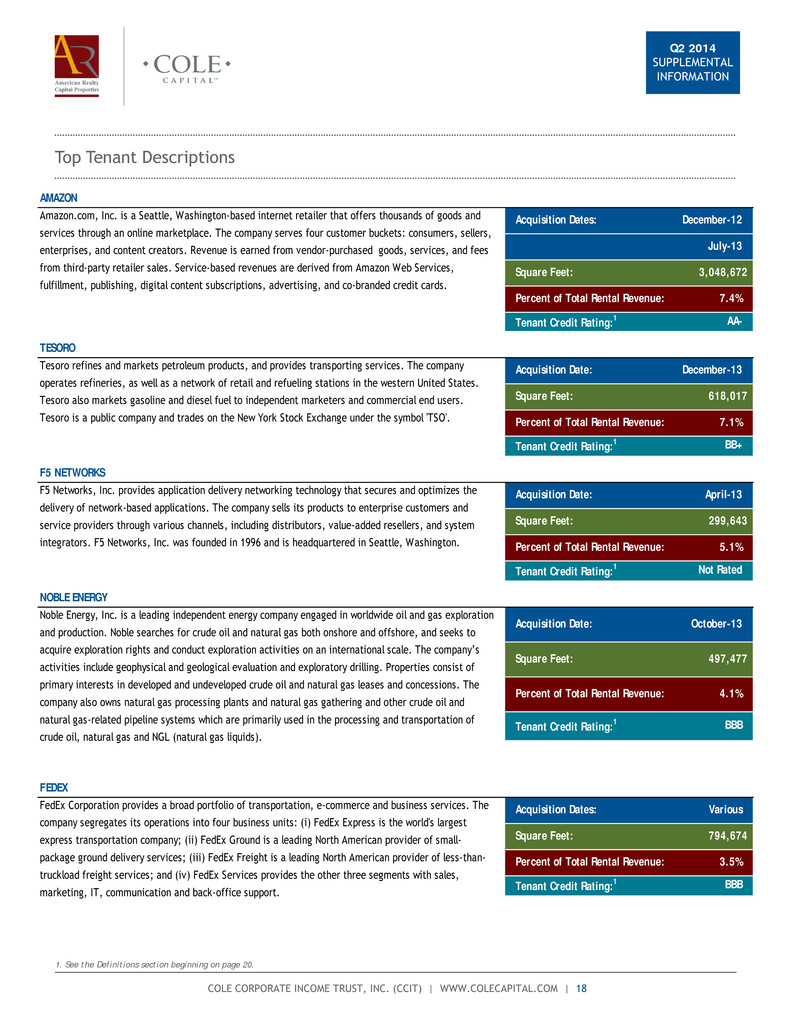

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 18 Top Tenant Descriptions 1. See the Definitions section beginning on page 20. AMAZON Acquisition Dates: December-12 July-13 Square Feet: 3,048,672 Percent of Total Rental Revenue: 7.4% Tenant Credit Rating:1 AA- TESORO Acquisition Date: December-13 Square Feet: 618,017 Percent of Total Rental Revenue: 7.1% Tenant Credit Rating:1 BB+ F5 NETWORKS Acquisition Date: April-13 Square Feet: 299,643 Percent of Total Rental Revenue: 5.1% Tenant Credit Rating:1 Not Rated NOBLE ENERGY Acquisition Date: October-13 Square Feet: 497,477 Percent of Total Rental Revenue: 4.1% Tenant Credit Rating:1 BBB FEDEX Acquisition Dates: Various Square Feet: 794,674 Percent of Total Rental Revenue: 3.5% Tenant Credit Rating:1 BBB Tesoro refines and markets petroleum products, and provides transporting services. The company operates refineries, as well as a network of retail and refueling stations in the western United States. Tesoro also markets gasoline and diesel fuel to independent marketers and commercial end users. Tesoro is a public company and trades on the New York Stock Exchange under the symbol 'TSO'. F5 Networks, Inc. provides application delivery networking technology that secures and optimizes the delivery of network-based applications. The company sells its products to enterprise customers and service providers through various channels, including distributors, value-added resellers, and system integrators. F5 Networks, Inc. was founded in 1996 and is headquartered in Seattle, Washington. FedEx Corporation provides a broad portfolio of transportation, e-commerce and business services. The company segregates its operations into four business units: (i) FedEx Express is the world's largest express transportation company; (ii) FedEx Ground is a leading North American provider of small- package ground delivery services; (iii) FedEx Freight is a leading North American provider of less-than- truckload freight services; and (iv) FedEx Services provides the other three segments with sales, marketing, IT, communication and back-office support. Amazon.com, Inc. is a Seattle, Washington-based internet retailer that offers thousands of goods and services through an online marketplace. The company serves four customer buckets: consumers, sellers, enterprises, and content creators. Revenue is earned from vendor-purchased goods, services, and fees from third-party retailer sales. Service-based revenues are derived from Amazon Web Services, fulfillment, publishing, digital content subscriptions, advertising, and co-branded credit cards. Noble Energy, Inc. is a leading independent energy company engaged in worldwide oil and gas exploration and production. Noble searches for crude oil and natural gas both onshore and offshore, and seeks to acquire exploration rights and conduct exploration activities on an international scale. The company’s activities include geophysical and geological evaluation and exploratory drilling. Properties consist of primary interests in developed and undeveloped crude oil and natural gas leases and concessions. The company also owns natural gas processing plants and natural gas gathering and other crude oil and natural gas-related pipeline systems which are primarily used in the processing and transportation of crude oil, natural gas and NGL (natural gas liquids).

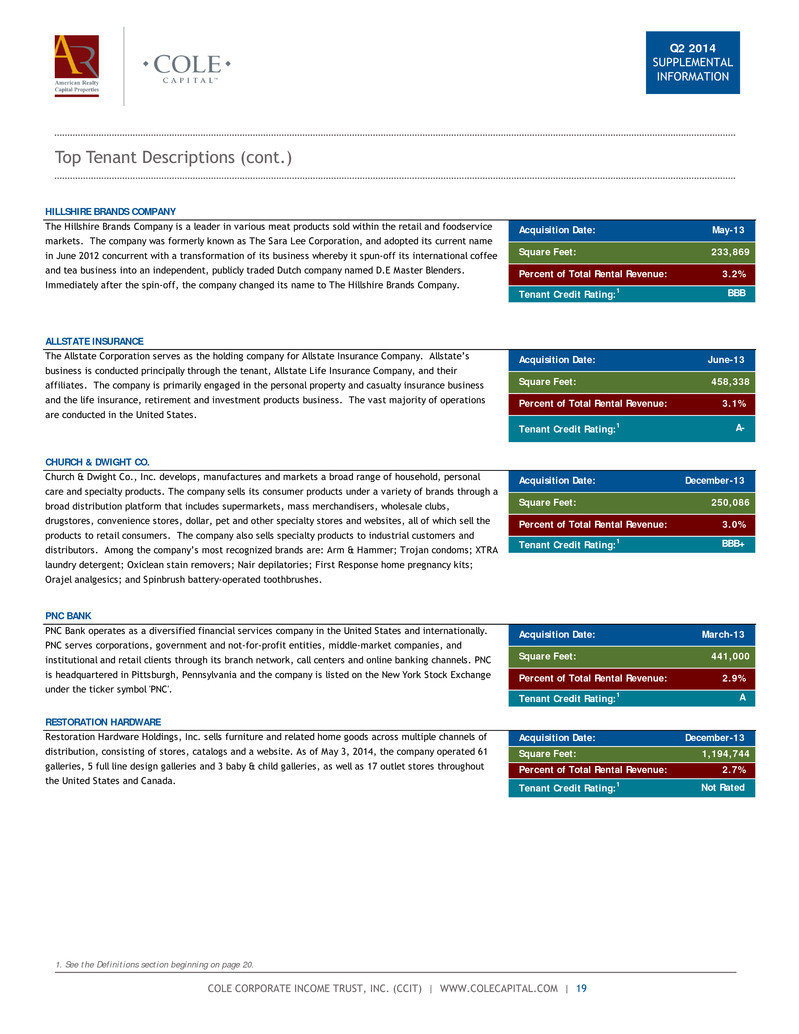

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 19 Top Tenant Descriptions (cont.) 1. See the Definitions section beginning on page 20. HILLSHIRE BRANDS COMPANY Acquisition Date: May-13 Square Feet: 233,869 Percent of Total Rental Revenue: 3.2% Tenant Credit Rating:1 BBB ALLSTATE INSURANCE Acquisition Date: June-13 Square Feet: 458,338 Percent of Total Rental Revenue: 3.1% Tenant Credit Rating:1 A- CHURCH & DWIGHT CO. Acquisition Date: December-13 Square Feet: 250,086 Percent of Total Rental Revenue: 3.0% Tenant Credit Rating:1 BBB+ PNC BANK Acquisition Date: March-13 Square Feet: 441,000 Percent of Total Rental Revenue: 2.9% Tenant Credit Rating:1 A RESTORATION HARDWARE Acquisition Date: December-13 Square Feet: 1,194,744 Percent of Total Rental Revenue: 2.7% Tenant Credit Rating:1 Not Rated PNC Bank operates as a diversified financial services company in the United States and internationally. PNC serves corporations, government and not-for-profit entities, middle-market companies, and institutional and retail clients through its branch network, call centers and online banking channels. PNC is headquartered in Pittsburgh, Pennsylvania and the company is listed on the New York Stock Exchange under the ticker symbol 'PNC'. The Hillshire Brands Company is a leader in various meat products sold within the retail and foodservice markets. The company was formerly known as The Sara Lee Corporation, and adopted its current name in June 2012 concurrent with a transformation of its business whereby it spun-off its international coffee and tea business into an independent, publicly traded Dutch company named D.E Master Blenders. Immediately after the spin-off, the company changed its name to The Hillshire Brands Company. The Allstate Corporation serves as the holding company for Allstate Insurance Company. Allstate’s business is conducted principally through the tenant, Allstate Life Insurance Company, and their affiliates. The company is primarily engaged in the personal property and casualty insurance business and the life insurance, retirement and investment products business. The vast majority of operations are conducted in the United States. Church & Dwight Co., Inc. develops, manufactures and markets a broad range of household, personal care and specialty products. The company sells its consumer products under a variety of brands through a broad distribution platform that includes supermarkets, mass merchandisers, wholesale clubs, drugstores, convenience stores, dollar, pet and other specialty stores and websites, all of which sell the products to retail consumers. The company also sells specialty products to industrial customers and distributors. Among the company’s most recognized brands are: Arm & Hammer; Trojan condoms; XTRA laundry detergent; Oxiclean stain removers; Nair depilatories; First Response home pregnancy kits; Orajel analgesics; and Spinbrush battery-operated toothbrushes. Restoration Hardware Holdings, Inc. sells furniture and related home goods across multiple channels of distribution, consisting of stores, catalogs and a website. As of May 3, 2014, the company operated 61 galleries, 5 full line design galleries and 3 baby & child galleries, as well as 17 outlet stores throughout the United States and Canada.

Q2 2014 SUPPLEMENTAL INFORMATION COLE CORPORATE INCOME TRUST, INC. (CCIT) | WWW.COLECAPITAL.COM | 20 Definitions NON-GAAP FINANCIAL AND OTHER DISCLOSURES FFO, MFFO and AFFO Funds From Operations (“FFO”) is a non-GAAP financial performance measure defined by the National Association of Real Estate Investment Trusts (“NAREIT”) and widely recognized by investors as one measure of operating performance of a real estate company. The FFO calculation excludes items such as real estate depreciation and amortization. Depreciation and amortization as applied in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, it is management’s view, and the Company believes the view of many industry investors, that the presentation of operating results for real estate companies by using the historical cost accounting method alone is insufficient. The Company computes FFO in accordance with NAREIT’s definition. The Company uses Modified Funds from Operations (“MFFO”) as a non-GAAP supplemental financial performance measure to evaluate the operating performance of the Company. MFFO, as defined by the Company, excludes from FFO acquisition related costs that are required to be expensed in accordance with GAAP. The Company’s management believes that excluding these costs from FFO provides investors with supplemental performance information that is consistent with the performance models and analysis used by management, and provides investors a view of the performance of the Company’s portfolio over time. In addition to FFO and MFFO, the Company uses Adjusted Funds from Operations (“AFFO”) as a non-GAAP supplemental financial performance measure to evaluate the operating performance of the Company. AFFO, as defined by the Company, excludes from MFFO items such as straight-line rental revenue and certain charges such as amortization of intangibles. The Company’s management believes that excluding these costs from MFFO provides investors with supplemental performance information that is consistent with the performance models and analysis used by management, and provides investors a view of the performance of the Company’s portfolio over time, including after the Company ceases to acquire properties on a frequent and regular basis. AFFO also allows for a comparison of the performance of the Company’s operations with traded REITs that are not currently engaging in acquisitions and mergers, as well as a comparison of the Company’s performance with that of other non- traded REITs, as AFFO, or an equivalent measure, is routinely reported by traded and non-traded REITs, and the Company believes often used by investors for comparison purposes. For all of these reasons, the Company believes FFO, MFFO, and AFFO, in addition to net income and cash flows from operating activities, as defined by GAAP, are helpful supplemental performance measures and useful in understanding the various ways in which the Company’s management evaluates the performance of the Company over time. However, not all REITs calculate FFO, MFFO and AFFO the same way, so comparisons with other REITs may not be meaningful. FFO, MFFO and AFFO should not be considered as alternatives to net income or to cash flows from operating activities, and are not intended to be used as a liquidity measure indicative of cash flow available to fund the Company’s cash needs. MFFO and AFFO may provide investors with a view of the Company’s future performance and of the sustainability of the Company’s current distributions policy. However, because MFFO and AFFO excludes items that are an important component in an analysis of the historical performance of a property, MFFO and AFFO should not be construed as a historic performance measure. None of the Securities and Exchange Commission, NAREIT, or any other regulatory body has evaluated the acceptability of the exclusions contemplated to adjust FFO in order to calculate MFFO and AFFO and its use as a non-GAAP financial performance measure. EBITDA EBITDA as disclosed represents earnings before interest, taxes, depreciation and amortization, modified to include other adjustments to GAAP net income for acquisition related expenses which are considered non-recurring. The Company excludes these items from EBITDA as they are not the primary drivers in the Company’s decision making process. In addition, the Company’s assessment of the Company’s operations is focused on long-term sustainability and not on such non-cash items, which may cause short term fluctuations in net income but have no impact on cash flows. The Company believes that EBITDA is a useful supplemental measure to investors for assessing the performance of the Company’s business segments, although it does not represent net income that is computed in accordance with GAAP. Therefore, EBITDA should not be considered as an alternative to net income or as an indicator of the Company’s financial performance. The Company uses EBITDA as one measure of its operating performance when formulating corporate goals and evaluating the effectiveness of the Company’s strategies. EBITDA may not be comparable to similarly titled measures of other companies.

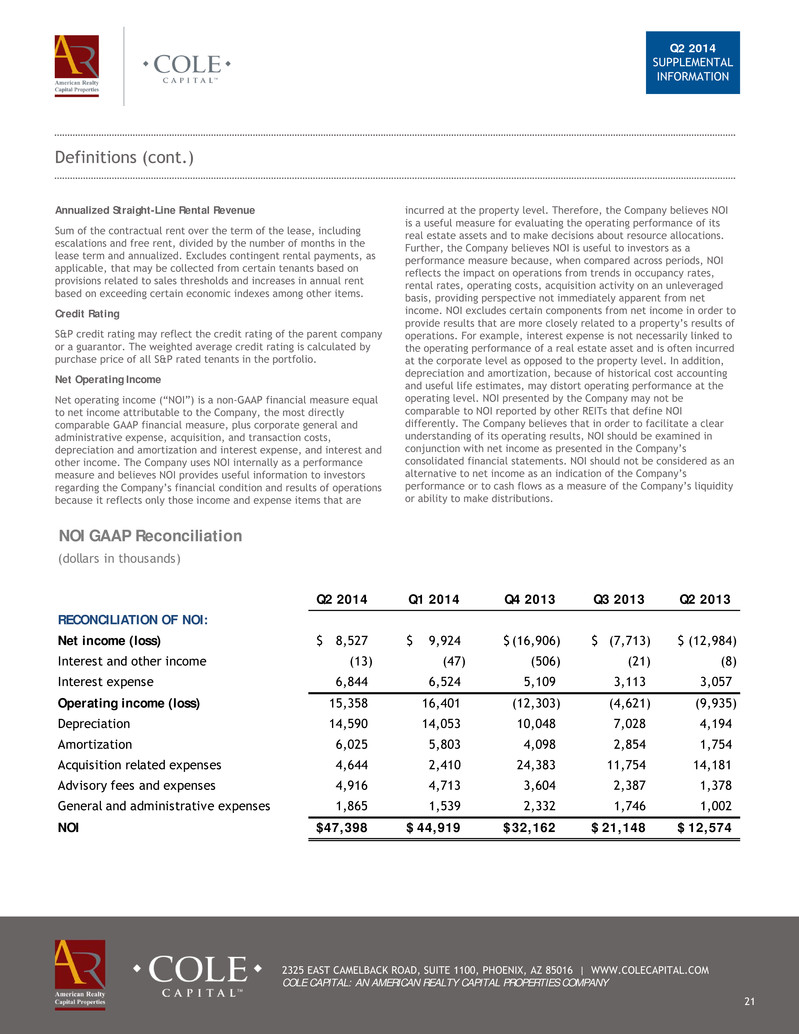

Q2 2014 SUPPLEMENTAL INFORMATION 2325 EAST CAMELBACK ROAD, SUITE 1100, PHOENIX, AZ 85016 | WWW.COLECAPITAL.COM COLE CAPITAL: AN AMERICAN REALTY CAPITAL PROPERTIES COMPANY 21 Definitions (cont.) Annualized Straight-Line Rental Revenue Sum of the contractual rent over the term of the lease, including escalations and free rent, divided by the number of months in the lease term and annualized. Excludes contingent rental payments, as applicable, that may be collected from certain tenants based on provisions related to sales thresholds and increases in annual rent based on exceeding certain economic indexes among other items. Credit Rating S&P credit rating may reflect the credit rating of the parent company or a guarantor. The weighted average credit rating is calculated by purchase price of all S&P rated tenants in the portfolio. Net Operating Income Net operating income (“NOI”) is a non-GAAP financial measure equal to net income attributable to the Company, the most directly comparable GAAP financial measure, plus corporate general and administrative expense, acquisition, and transaction costs, depreciation and amortization and interest expense, and interest and other income. The Company uses NOI internally as a performance measure and believes NOI provides useful information to investors regarding the Company’s financial condition and results of operations because it reflects only those income and expense items that are incurred at the property level. Therefore, the Company believes NOI is a useful measure for evaluating the operating performance of its real estate assets and to make decisions about resource allocations. Further, the Company believes NOI is useful to investors as a performance measure because, when compared across periods, NOI reflects the impact on operations from trends in occupancy rates, rental rates, operating costs, acquisition activity on an unleveraged basis, providing perspective not immediately apparent from net income. NOI excludes certain components from net income in order to provide results that are more closely related to a property’s results of operations. For example, interest expense is not necessarily linked to the operating performance of a real estate asset and is often incurred at the corporate level as opposed to the property level. In addition, depreciation and amortization, because of historical cost accounting and useful life estimates, may distort operating performance at the operating level. NOI presented by the Company may not be comparable to NOI reported by other REITs that define NOI differently. The Company believes that in order to facilitate a clear understanding of its operating results, NOI should be examined in conjunction with net income as presented in the Company’s consolidated financial statements. NOI should not be considered as an alternative to net income as an indication of the Company’s performance or to cash flows as a measure of the Company’s liquidity or ability to make distributions. NOI GAAP Reconciliation (dollars in thousands) Q2 2014 Q1 2014 Q4 2013 Q3 2013 Q2 2013 RECONCILIATION OF NOI: Net income (loss) 8,527$ 9,924$ (16,906)$ (7,713)$ (12,984)$ Interest and other income (13) (47) (506) (21) (8) Interest expense 6,844 6,524 5,109 3,113 3,057 Operating income (loss) 15,358 16,401 (12,303) (4,621) (9,935) Depreciation 14,590 14,053 10,048 7,028 4,194 Amortization 6,025 5,803 4,098 2,854 1,754 Acquisition related expenses 4,644 2,410 24,383 11,754 14,181 Advisory fees and expenses 4,916 4,713 3,604 2,387 1,378 General and administrative expenses 1,865 1,539 2,332 1,746 1,002 NOI 47,398$ 44,919$ 32,162$ 21,148$ 12,574$