Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Marina District Finance Company, Inc. | Financial_Report.xls |

| EX-31.2 - SOX 302 CERTIFICATION - CFO - Marina District Finance Company, Inc. | mdfc10q63014ex312.htm |

| EX-32.2 - SOX 906 CERTIFICATION - CFO - Marina District Finance Company, Inc. | mdfc10q63014ex322.htm |

| EX-32.1 - SOX 906 CERTIFICATION - CEO - Marina District Finance Company, Inc. | mdfc10q63014ex321.htm |

| 10-Q - 10-Q - Marina District Finance Company, Inc. | mdfcborgata6301410q.htm |

| EX-31.1 - SOX 302 CERTIFICATION - CEO - Marina District Finance Company, Inc. | mdfc10q63014ex311.htm |

AMENDED AND RESTATED SETTLEMENT AGREEMENT

THIS AMENDED AND RESTATED SETTLEMENT AGREEMENT (“Agreement”) is entered into as of the 30th day of June, 2014, effective as of June 5, 2014, by and between MARINA DISTRICT DEVELOPMENT CO., LLC, a New Jersey Limited Liability Company with offices located at 1 Borgata Way, Atlantic City, New Jersey (hereinafter “Borgata”) and the CITY OF ATLANTIC CITY (hereinafter “City”), a municipal corporation of the State of New Jersey in the County of Atlantic, with offices located at 1301 Bacharach Boulevard, Atlantic City, New Jersey (individually, a “Party” and collectively with Borgata, the “Parties”).

WHEREAS, Borgata is the taxpayer for the properties listed on Exhibit “A”, which is attached to this Agreement and specifically incorporated herein by reference (hereinafter the “Properties”);

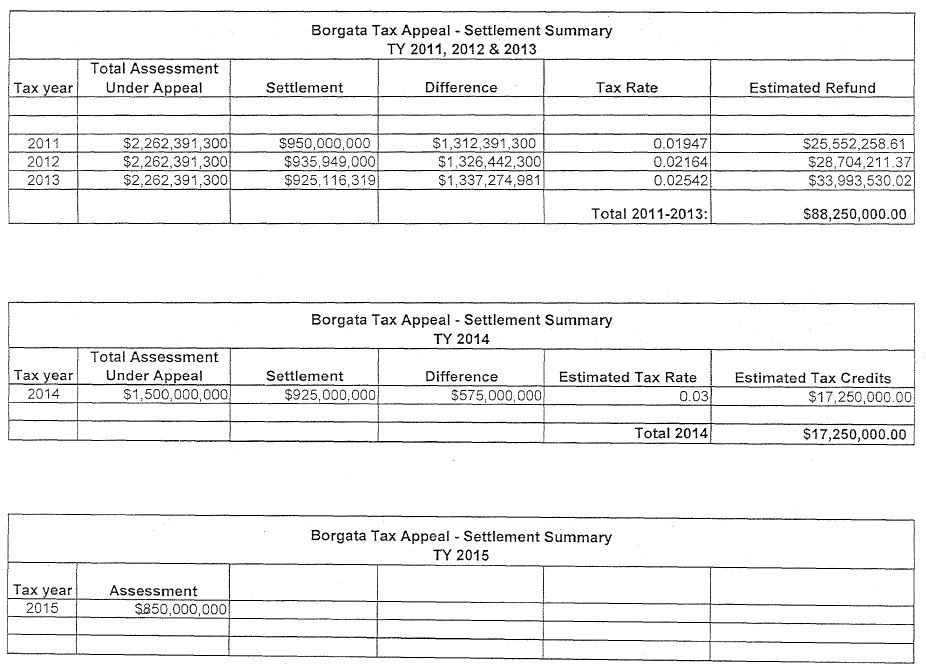

WHEREAS, the Parties desire to reach a settlement concerning the assessments of the Properties for the 2011, 2012, 2013, 2014 and 2015 tax years;

WHEREAS, the Parties have agreed to amicably resolve the assessment of the Properties for tax years 2011, 2012, 2013, 2014 and 2015 on the terms and conditions set forth herein;

WHEREAS, the Parties did enter into a certain settlement agreement on the 5th day of June, 2014 (the “Settlement Agreement”); and

WHEREAS, the Parties hereto have agreed to amend and restate the Settlement Agreement in its entirety, as hereinafter set forth.

NOW, THEREFORE, in consideration of the recitals herein, the sum of One Dollar ($1.00) each to the other in hand paid, and the mutual covenants, conditions, stipulations and agreements herein contained, the Parties intending to be legally bound hereby agree as follows:

1.The Parties agree that the fair assessable value of each of the Properties as of October 1, 2010, October 1, 2011 and October 1, 2012, is as reflected in Exhibit “A” hereof. The Parties agree they have made such an examination of the value and proper tax assessment of each of the Properties and have obtained such appraisals, analysis and information with respect to the valuation and assessment of the Properties as

they deem necessary and appropriate for the purpose of enabling them to enter into this Agreement. The City Tax Assessor (the “Assessor”) has consulted with the attorney for the City with respect to this Agreement and has concurred with the values set forth on Exhibit “A”.

2.The Parties agree that the fair assessable value of the Properties in the aggregate is Nine Hundred Twenty-Five Million Dollars ($925,000,000.00) as of October 1, 2013, and Eight Hundred Fifty Million Dollars ($850,000,000.00) as of October 1, 2014. The Parties agree that the Assessor will file with the Atlantic County Board of Taxation (a) the 2015 certified tax list reflecting an aggregate assessment of the Properties in the amount of Eight Hundred Fifty Million Dollars ($850,000,000.00). The apportionment of the assessments of the Properties among the lots, the land and improvements will be reasonably determined by the Assessor.

3.As a result of the settlement and the reductions in the assessed value of the Properties for tax years 2011, 2012 and 2013, Borgata is entitled to a refund of taxes equal to Eighty-Eight Million Two Hundred Fifty Thousand Dollars ($88,250,000.00) (the “Refund Amount”). As a result of the reduction of the 2014 assessment from One Billion Five Hundred Million Dollars ($1,500,000,000.00) to Nine Hundred Twenty-Five Million Dollars ($925,000,000.00), Borgata is entitled to a credit against future real estate taxes in the approximate amount of Seventeen Million Eight Hundred Fifty Thousand Dollars ($17,850,000.00) (the “2014 Credit”). The Parties agree that the Seventeen Million Eight Hundred Fifty Thousand Dollars ($17,850,000.00) is an estimate and that the exact amount of the 2014 Credit cannot be determined until the City adopts the final 2014 tax rate. Accordingly the 2014 Credit will be adjusted to the appropriate amount based upon the 2014 final tax rate.

4.The 2014 Credit will be applied to the Borgata’s tax liability as set forth in this Section. The City will apply Five Million Dollar ($5,000,000.00) of the 2014 Credit, against the 2014 3rd quarter tax payment due on August 1, 2014, and apply an additional Five Million Dollar ($5,000,000.00) of the 2014 Credit against the 2014 4th quarter tax payment due on November 1, 2014 and a similar Five Million Dollar ($5,000,000.00) of the 2014 Credit to be applied to all subsequent quarterly payments thereafter until the

balance of the 2014 Credit is either utilized to reduce subsequent required quarterly tax payments or until the balance of the 2014 Credit together with the Refund Amount is paid to Borgata as hereinafter provided in Section 5. Moreover the City acknowledges that the Borgata will be entitled to a substantial reconciliation of the 3rd and 4th quarter taxes (the “Reconciliation Amount”) as a result of the City’s reduction in the Borgata’s 2014 tax assessment from Two Billion Two Hundred Sixty-Two Million Dollars ($2,262,000,000.00) to One Billion Five Hundred Million Dollars ($1,500,000,000.00). That Reconciliation Amount will be reflected in the final 2014 3rd and 4th quarter tax bill. If any portion of the Reconciliation Amount remains after the 2014 taxes are adjusted, the remaining portion of the Reconciliation Amount will be applied to Borgata’s 2015 taxes.

5.The City agrees that it will bond for the Refund Amount and the amount of the balance of the 2014 Credit as soon as practicable. The City represents that it has received the following approvals and will use its best efforts to adhere to the following schedule:

a. | The proposed settlement was brought before City Council. The City Council, in closed session, approved the proposed settlement on April 9, 2014. |

b. | A City Council bond ordinance (the “Bond Ordinance”) that authorizes the borrowing for the Refund Amount plus the balance of the 2014 Credit will be introduced for first reading on September 10, 2014. |

c. | The City will schedule Local Finance Board approval of the proposed settlement at the Local Finance Board’s September 17, 2014 meeting. |

d. | If the Local Finance Board approves the Bond Ordinance, then the Bond Ordinance would go back to City Council for a second reading and public hearing at its second September meeting on September 24, 2014. |

e. | Assuming the Bond Ordinance is adopted at the public hearing, it would become effective twenty (20) days after the date of the public hearing on October 14, 2014. |

f. | The City will go out to the public markets and issue the bond financing as soon as practicable and pay Borgata the Refund Amount and the balance of the 2014 Credit. |

6.In the event the Refund Amount and the balance of the 2014 Credit are not paid to Borgata on or before December 31, 2014, then after a thirty (30) day grace period the City shall pay a monthly payment of $150,000.00 per month to Borgata until the Refund Amount and the amount of the balance of the 2014 Credit are paid to Borgata or Borgata may pursue its remedies in Section 9. The City shall be entitled to a credit in the amount of the cumulative $150,000 monthly payments paid to Borgata to be offset against the amount of any refund or judgment due or owed to Borgata. The City’s obligation to pay the monthly payment of $150,000.00 shall cease upon Borgata’s written election to pursue the Filed Appeals or the City’s written notice of its inability to obtain bond financing for the Refund Amount.

7.The undersigned represent that this settlement will result in assessments at the fair assessable value of the Properties consistent with assessing practices generally applicable in the City as required by law.

8.If the total assessed valuation on the tax list and duplicate for the tax year 2015 is other than as provided in this Agreement, then Borgata shall have the right to either file (i) a 2015 tax appeal and in such appeal Borgata shall have the unlimited right to contest the 2015 tax assessment but the City shall not be permitted to advocate for more than the agreed upon 2015 tax assessment of Eight Hundred Fifty Million Dollars ($850,000,000.00) or (ii) an action to specifically enforce its rights hereunder, and shall be entitled to collect reasonable attorney fees and costs associated with either action. In addition to the foregoing, the Parties shall have all rights and remedies available at law or in equity in enforcing the terms of this Agreement. If the 2015 assessment is set at Eight Hundred and Fifty Million ($850,000,000.00) Dollars and if Borgata or any purchaser, successor or assignee of Borgata files an appeal pursuant to N.J.S.A. 54:3.21 challenging the $850,000,000.00 assessment, Borgata agrees to defend, indemnify and hold harmless the City of Atlantic City for any costs the City incurs in defending such appeal.

9.Borgata has filed tax appeals with the New Jersey Tax Court (the “Filed Appeals”) contesting the 2011, 2012, 2013 and 2014 assessments of the Properties. The Parties agree to request that either (i) the Tax Court postpone the scheduled June 16, 2014 trial date of the Filed Appeals or (ii) the Tax Court place the Filed Appeals on the inactive list. If for any reason either: (i) the 2015 assessment is not set at the amount set forth in Section 2 of this Agreement or (ii) the Refund Amount and the balance of the 2014 Credit are not paid to Borgata on or before December 31, 2014, then after the thirty (30) day grace period referenced in Section 6, Borgata shall have the right to compel a trial of the Filed Appeals. Once the Refund Amount and the balance of the 2014 Credit are paid by the City to Borgata and the 2015 assessment is set at the amount specified in Section 2, Borgata will relinquish its right to contest the assessments and the Filed Appeals shall be dismissed with prejudice for the Properties for the 2011, 2012, 2013, 2014 and 2015 tax years.

10.This Agreement does not affect the pending appeals of the 2009 and 2010 Tax Court judgments that are currently on appeal before the Superior Court, Appellate Division.

11.Each of the Parties hereto represents and warrants that they have been duly authorized to enter into this Agreement and have the consent of their respective officers and directors to this Agreement.

12.The Parties acknowledge that they are executing this Agreement of their own volition and after consultation with their respective attorneys, with a full understanding of its terms.

13.Absent actual fraud, the Parties acknowledge that they may hereafter discover facts different from or in addition to those they now know or believe to be true with respect to the claims, causes of action, rights, obligations, costs, liabilities, damages, losses, and expenses herein resolved, and each Party agrees that, subject to the performance as agreed herein, this Agreement shall be and remain in effect in all respects as a complete release of any and all claims that either Party asserted or could have asserted in the appeals pending in the Tax Court listed in the recitals hereto.

14.This Agreement and the provisions contained herein shall not be construed or interpreted for or against either Party hereto because one of the Parties drafted or caused its legal representative to draft any of its provisions.

15.This Agreement, and the terms and conditions hereof, shall be binding upon and inure to the benefit of the Parties and their respective successors and assigns.

16.To the extent of a conflict between the provisions of the Settlement Agreement and this Agreement, the provisions of this Agreement shall be deemed to be controlling.

17.This Agreement may be amended only by a writing signed by the Party affected thereby and this Agreement shall be governed and construed in accordance with the laws of the State of New Jersey.

18.This Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original as against any Party whose signature appears thereon, and all of which shall together constitute one and the same instrument. This Agreement shall become binding when one or more counterparts hereof, individually or taken together, shall bear the signature of each Party.

19.The Parties agree that any disputes arising under this Agreement shall be resolved by litigation before Superior Court of New Jersey.

IN WITNESS WHEREOF, each of the Parties hereto, intending to be legally bound hereby, have caused their duly authorized representatives to execute this Agreement in counterparts as of the date set forth above.

SIGNATURES BEGIN ON FOLLOWING PAGE

ATTEST: | CITY OF ATLANTIC CITY | |

/s/ Rhonda Williams | /s/ Donald A. Guardian | |

Rhonda Williams, City Clerk | Donald A. Guardian, Mayor Date: 6/19/14 | |

ATLANTIC CITY TAX ASSESSOR | ||

/s/ Novelette Robinson | ||

Novelette Robinson, CTA Date: 6/23/14 | ||

MARINA DISTRICT DEVELOPMENT CO., LLC | DECOTIIS, FITZPATRICK & COLE, LLC | |

/s/ Keith E. Smith | /s/ Maurice L. Stone | |

By: An Authorized Representative Date: 6/30/14 | Maurice L. Stone, Esq. (AS TO FORM ONLY) Date: 6/23/14 | |

FOX ROTHSCHILD, LLP - ATTORNEYS FOR PLAINTIFF | ||

By: /s/ Jack Plackter | Date: 6/24/14 | |

Jack Plackter, Esq. (AS TO FORM ONLY) | ||

THE WITHIN AGREEMENT APPROVED AS TO FORM AND EXECUTION | ||

Date: 2/24/14 | By: /s/ Michael J. Perugini | |

Michael J. Perugini, Esq. Assistant City Solicitor | ||

EXHIBIT A