Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DARLING INGREDIENTS INC. | dar-2014812x8kinvestpres.htm |

Seeing the World Through Our Eyes August 2014 Creating sustainable food, feed and fuel ingredients for a growing population EXHIBIT 99.1

Creating sustainable food, feed and fuel ingredients for a growing population Safe Harbor Statement This media release contains “forward-looking” statements regarding the business operations and prospects of Darling Ingredients Inc. and industry factors affecting it. These statements are identified by words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “could,” “may,” “will,” “should,” “planned,” “potential,” “continue,” “momentum,” and other words referring to events that may occur in the future. These statements reflect Darling Ingredient’s current view of future events and are based on its assessment of, and are subject to, a variety of risks and uncertainties beyond its control, each of which could cause actual results to differ materially from those indicated in the forward-looking statements. These factors include, among others, existing and unknown future limitations on the ability of the Company's direct and indirect subsidiaries to upstream their profits to the Company for payments on the Company's indebtedness or other purposes; general performance of the U.S. and global economies; disturbances in world financial, credit, commodities and stock markets; any decline in consumer confidence and discretionary spending, including the inability of consumers and companies to obtain credit due to lack of liquidity in the financial markets; volatile prices for natural gas and diesel fuel; climate conditions; unanticipated costs or operating problems related to the acquisition and integration of Rothsay and Darling Ingredients International (including transactional costs and integration of the new enterprise resource planning (ERP) system); global demands for bio-fuels and grain and oilseed commodities, which have exhibited volatility, and can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering feedstock and selling prices for the Company’s products; reductions in raw material volumes available to the Company due to weak margins in the meat production industry as a result of higher feed costs, reduced consumer demand or other factors, reduced volume from food service establishments, reduced demand for animal feed, or otherwise; reduced finished product prices; changes to worldwide government policies relating to renewable fuels and greenhouse gas emissions that adversely affect programs like the National Renewable Fuel Standard Program (RFS2) and tax credits for biofuels both in the U.S. and abroad; possible product recall resulting from developments relating to the discovery of unauthorized adulterations to food or food additives; the occurrence of Bird Flu including, but not limited to H1N1 flu, bovine spongiform encephalopathy (or "BSE"), porcine epidemic diarrhea ("PED") or other diseases associated with animal origin in the U.S. or elsewhere; unanticipated costs and/or reductions in raw material volumes related to the Company’s compliance with the existing or unforeseen new U.S. or foreign regulations (including, without limitation, China) affecting the industries in which the Company operates or its value added products (including new or modified animal feed, Bird Flu, PED or BSE or similar or unanticipated regulations); risks associated with the renewable diesel plant in Norco, Louisiana owned and operated by a joint venture between Darling Ingredients and Valero Energy Corporation, including possible unanticipated operating disruptions; risks relating to possible third party claims of intellectual property infringement; increased contributions to the Company’s pension and benefit plans, including multiemployer and employer-sponsored defined benefit pension plans as required by legislation, regulation or other applicable U.S. or foreign law or resulting from a U.S. mass withdrawal event; bad debt write-offs; loss of or failure to obtain necessary permits and registrations; continued or escalated conflict in the Middle East, North Korea, Ukraine or elsewhere; and/or unfavorable export or import markets. Other risks and uncertainties regarding Darling Ingredients Inc., its business and the industries in which it operates are referenced from time to time in the Company’s filings with the Securities and Exchange Commission. Darling Ingredients Inc. is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise. 2

Creating sustainable food, feed and fuel ingredients for a growing population 3 Our History 3 By 2013, we were... The largest and most innovative recycling solutions company serving the nation’s food industry, with... • Over 120 locations across U.S. • Approx. 4,000 employees • $1.7+ billion in revenues

Creating sustainable food, feed and fuel ingredients for a growing population 4 And today... A global growth platform for the development and production of sustainable natural ingredients from edible and inedible bio-nutrients, creating a wide range of products and customized specialty solutions • Over 200 locations on 5 continents • Approx. 10,000 employees • $4.0+ billion in revenues

Creating sustainable food, feed and fuel ingredients for a growing population 5 2 0 1 3 • #1 position globally in value-added ingredients from the protein industry • Global platform focused on margins and emerging market potential • Strong cash generation model Our Strengths Today: RAW MATERIAL SOURCING EXPANSION- Wastewater value add; Access to DAF/SPN from food processing plants diversifies commodity exposure COMMODITY BUSINESS Renderer with established used cooking oil business (particularly east/west coasts) Pre 2004 VALUE ADD & REDUCTION OF COMMODITY EXPOSURE (countercyclical) Higher value use for fats produced by Darling, should be countercyclical to fat prices GEOGRAPHIC EXPANSION OF U.S. FOOTPRINT INTO CANADA Increase of both rendering and biodiesel GREW EXISTING BUSINESS ADDING PRODUCT DIVERSIFICATION; INITIAL MOVE TO VALUE ADD AND REDUCTION OF COMMODITY EXPOSURE Pet food ingredients; inclusion of poultry; incorporated value add concept for proteins; added significant bakery by-product business; developed Nutrient Recovery Technology GLOBAL PRESENCE/PRODUCT LINE EXPANSION INTO FOOD INGREDIENTS Provides access to raw material sourcing in Europe/Australia/Brazil/China (Brazil and China areas where animal slaughter will increase); Product segment diversification: Blood/Gelatin/Casings/Specialty Products; High added value proposition CORPORATE NAME CHANGE to DARLING INGREDIENTS INC. To reflect our global platform as a developer and producer of sustainable ingredients created from edible and inedible bio-nutrient streams 2 0 1 4 2 0 0 6 -1 0 The Evolution of Darling Ingredients Inc.

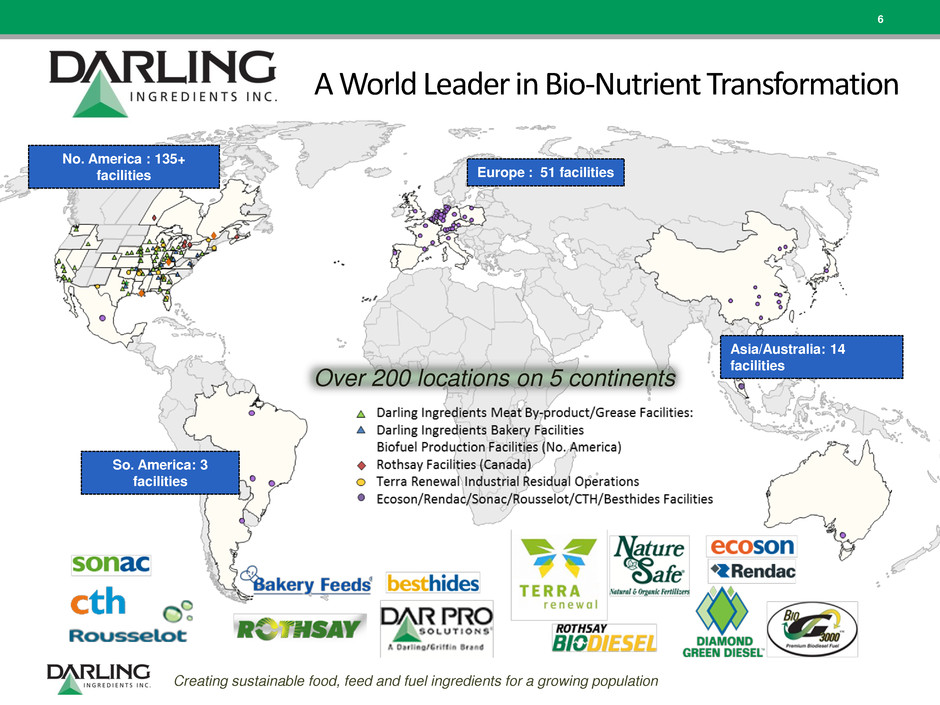

Creating sustainable food, feed and fuel ingredients for a growing population Over 200 locations on 5 continents A World Leader in Bio-Nutrient Transformation 6 Europe : 51 facilities Asia/Australia: 14 facilities No. America : 135+ facilities So. America: 3 facilities

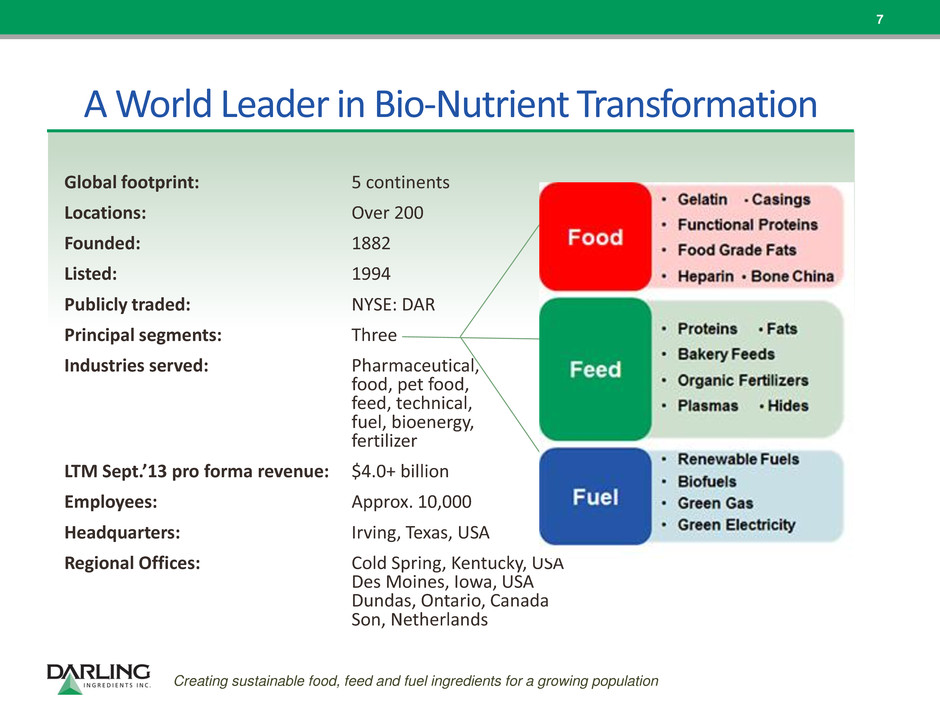

Creating sustainable food, feed and fuel ingredients for a growing population A World Leader in Bio-Nutrient Transformation Global footprint: 5 continents Locations: Over 200 Founded: 1882 Listed: 1994 Publicly traded: NYSE: DAR Principal segments: Three Industries served: Pharmaceutical, food, pet food, feed, technical, fuel, bioenergy, fertilizer LTM Sept.’13 pro forma revenue: $4.0+ billion Employees: Approx. 10,000 Headquarters: Irving, Texas, USA Regional Offices: Cold Spring, Kentucky, USA Des Moines, Iowa, USA Dundas, Ontario, Canada Son, Netherlands 7

Food, Feed & Fuel Our New Business Segments Creating sustainable food, feed and fuel ingredients for a growing population

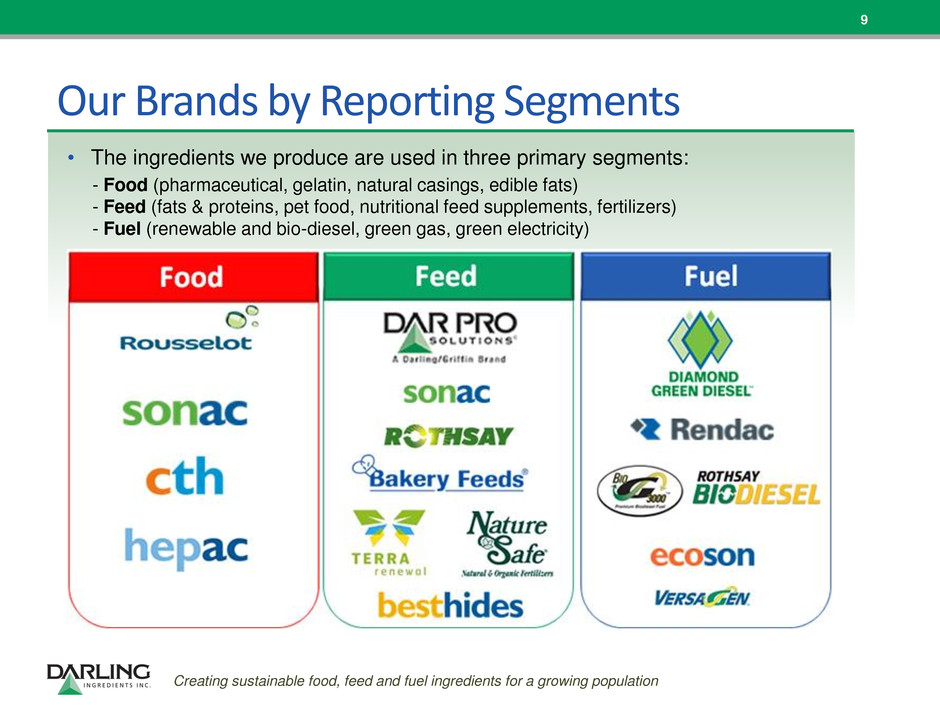

Creating sustainable food, feed and fuel ingredients for a growing population • The ingredients we produce are used in three primary segments: - Food (pharmaceutical, gelatin, natural casings, edible fats) - Feed (fats & proteins, pet food, nutritional feed supplements, fertilizers) - Fuel (renewable and bio-diesel, green gas, green electricity) 9 Our Brands by Reporting Segments

Creating sustainable food, feed and fuel ingredients for a growing population Unique Diversified Portfolio Provides broad stabilized market exposure worldwide 10

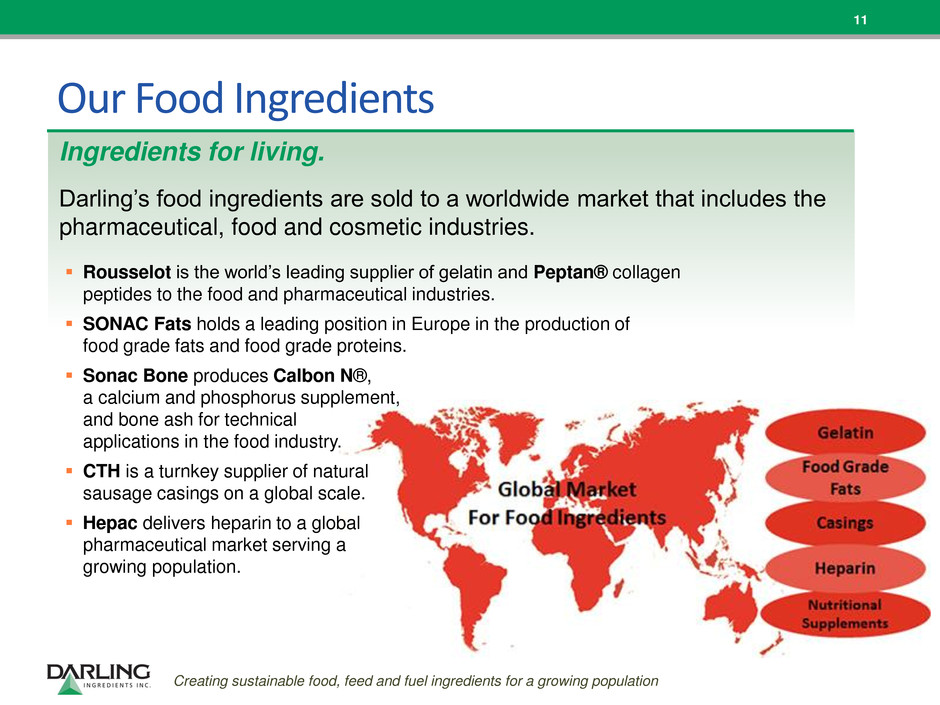

Creating sustainable food, feed and fuel ingredients for a growing population Ingredients for living. Darling’s food ingredients are sold to a worldwide market that includes the pharmaceutical, food and cosmetic industries. Rousselot is the world’s leading supplier of gelatin and Peptan® collagen peptides to the food and pharmaceutical industries. SONAC Fats holds a leading position in Europe in the production of food grade fats and food grade proteins. Sonac Bone produces Calbon N®, a calcium and phosphorus supplement, and bone ash for technical applications in the food industry. CTH is a turnkey supplier of natural sausage casings on a global scale. Hepac delivers heparin to a global pharmaceutical market serving a growing population. 11 Our Food Ingredients

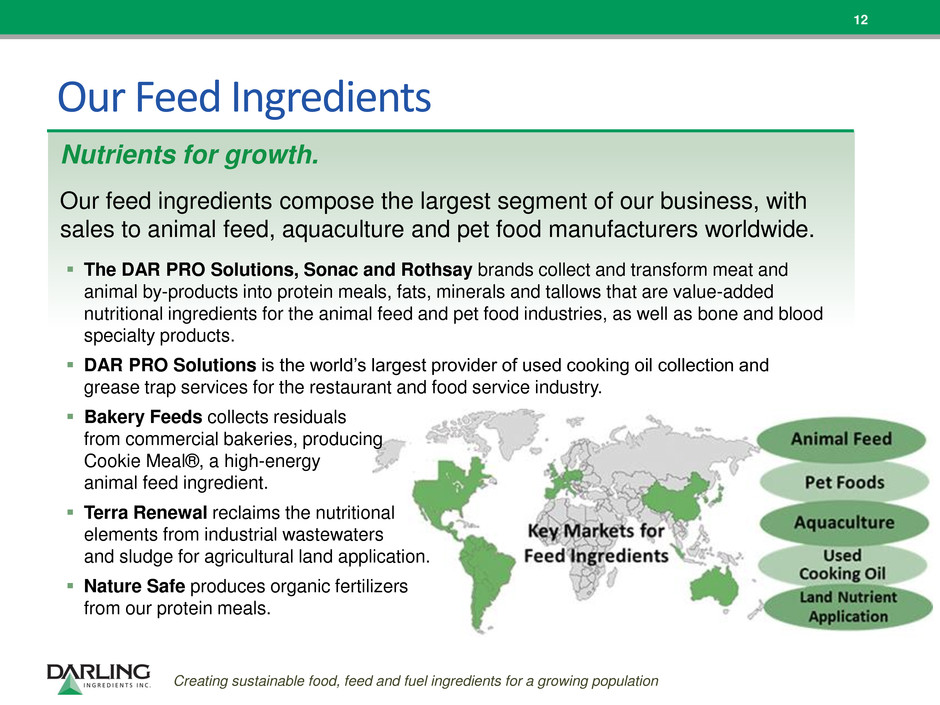

Creating sustainable food, feed and fuel ingredients for a growing population 12 Our Feed Ingredients Nutrients for growth. Our feed ingredients compose the largest segment of our business, with sales to animal feed, aquaculture and pet food manufacturers worldwide. The DAR PRO Solutions, Sonac and Rothsay brands collect and transform meat and animal by-products into protein meals, fats, minerals and tallows that are value-added nutritional ingredients for the animal feed and pet food industries, as well as bone and blood specialty products. DAR PRO Solutions is the world’s largest provider of used cooking oil collection and grease trap services for the restaurant and food service industry. Bakery Feeds collects residuals from commercial bakeries, producing Cookie Meal®, a high-energy animal feed ingredient. Terra Renewal reclaims the nutritional elements from industrial wastewaters and sludge for agricultural land application. Nature Safe produces organic fertilizers from our protein meals.

Creating sustainable food, feed and fuel ingredients for a growing population 13 Our Fuel Ingredients Energy for today’s world. For the past two decades, Darling has led the way in biofuel innovation and development. Rendac provides European-regulated animal by-products disposal, used for energy production. Diamond Green Diesel, a partnership with Valero Energy Corp., is the Company’s most innovative and largest-scale effort to meet the growing demand for renewable energy. Located in Norco, LA, the facility recycles animal fats and used cooking oils into 137 million gallons per year (or 9,300 barrels per day) of renewable diesel. Bio-G 3000, Rothsay Biodiesel and Ecoson brands also produce biofuels, green electricity and gas, biophosphate and other green energy from organic residuals, manure, animal by-products, fats and cooking oils.

Growth Strategy How we will grow and sustain our business Creating sustainable food, feed and fuel ingredients for a growing population

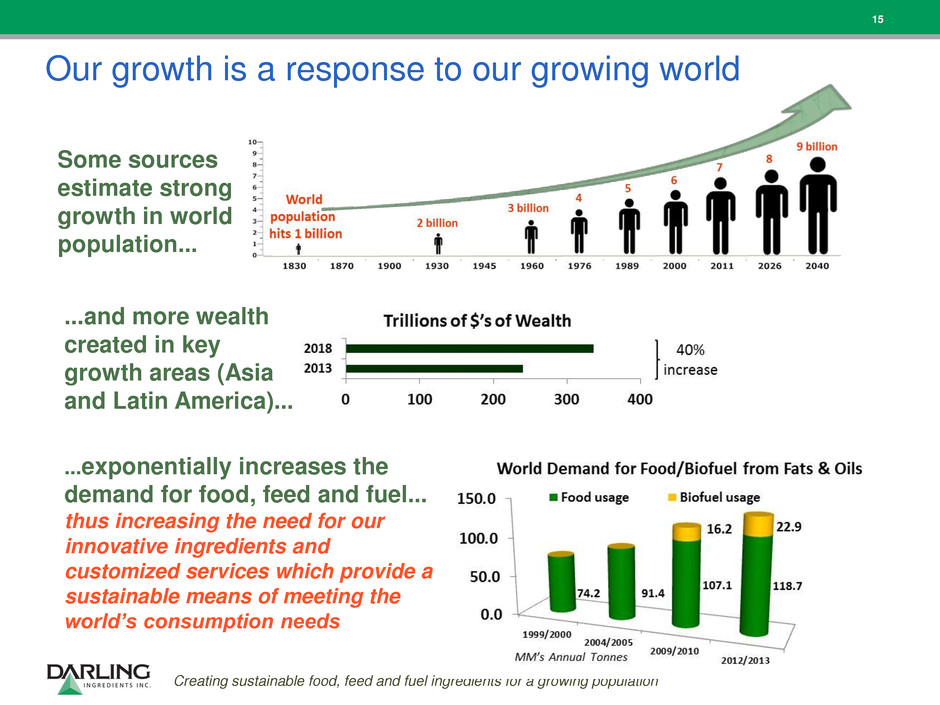

Creating sustainable food, feed and fuel ingredients for a growing population Our growth is a response to our growing world ...exponentially increases the demand for food, feed and fuel... thus increasing the need for our innovative ingredients and customized services which provide a sustainable means of meeting the world’s consumption needs Some sources estimate strong growth in world population... 15 ...and more wealth created in key growth areas (Asia and Latin America)...

Creating sustainable food, feed and fuel ingredients for a growing population Strengthen Current Position • Operational excellence: - Optimizing integration of global supply chains - Consolidation and realignment across brands of current raw materials, products and services - Use advanced and sustainable technology • Product innovation: Continue to research and evaluate new ideas and uses for our raw materials and develop new products & applications (R&D) • Customer intimacy: Build strong customer loyalty with increased products and services Darling’s growth strategy is centered on... Darling targets employing capital at a 15% or higher rate while maintaining a conservative balance sheet Capture Growth Opportunities • Expansions: Expansions of our existing operating facilities • Greenfield: Expand our operation facilities in new growing markets through our global platforms • Acquisitions: Strategically grow our business through acquisitions in growing and fragmented areas Creating sustainable food, feed and fuel ingredients for a growing population 16

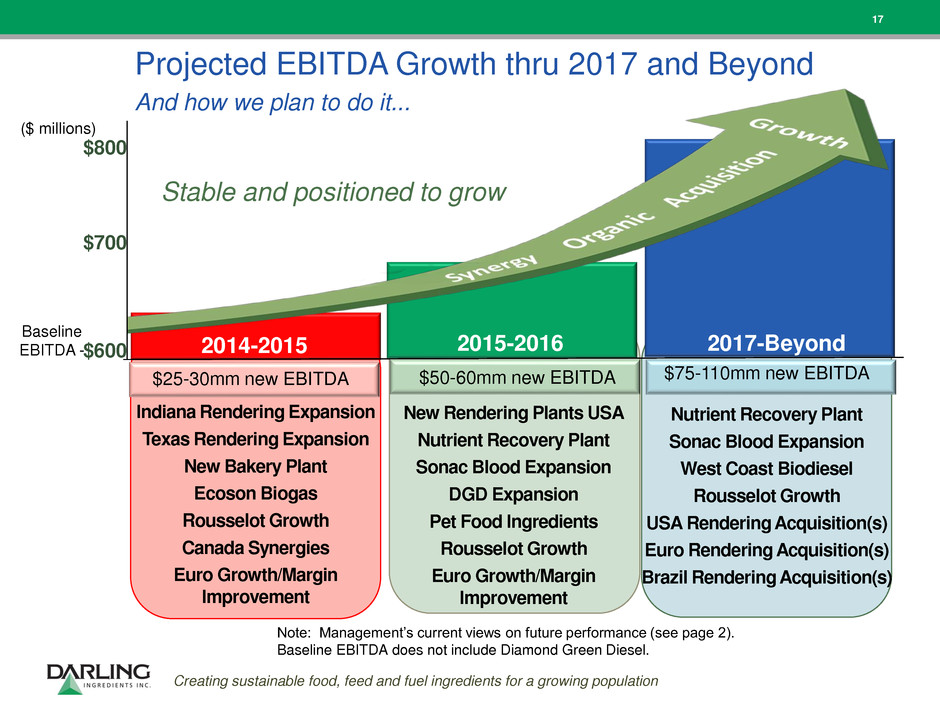

Creating sustainable food, feed and fuel ingredients for a growing population Nutrient Recovery Plant Sonac Blood Expansion West Coast Biodiesel Rousselot Growth USA Rendering Acquisition(s) Euro Rendering Acquisition(s) Brazil Rendering Acquisition(s) $75-110mm new EBITDA Note: Management’s current views on future performance (see page 2). Baseline EBITDA does not include Diamond Green Diesel. $50-60mm new EBITDA New Rendering Plants USA Nutrient Recovery Plant Sonac Blood Expansion DGD Expansion Pet Food Ingredients Rousselot Growth Euro Growth/Margin Improvement Indiana Rendering Expansion Texas Rendering Expansion New Bakery Plant Ecoson Biogas Rousselot Growth Canada Synergies Euro Growth/Margin Improvement $25-30mm new EBITDA 2014-2015 2017-Beyond 2015-2016 Baseline EBITDA - $600 $800 $700 Projected EBITDA Growth thru 2017 and Beyond And how we plan to do it... Stable and positioned to grow ($ millions) 17

Creating sustainable food, feed and fuel ingredients for a growing population Capture Growth Opportunities North America Sonac – Upper Midwest • Grow hemoglobin/plasma business 18 Rothsay - Canada • Grow the used cooking oil/ restaurant services • Introduce Terra Renewal Services to Canada • Potential investment in new bone facility Rousselot • Continued USA expansion of gelatin business Growth Opportunities: • Biodiesel expansion on west coast Diamond Green Diesel – Norco, LA • Renewable diesel expansion 18

Creating sustainable food, feed and fuel ingredients for a growing population Nutrient Recovery Technology Currently operating pilot plant in Hampton, FL What is it? • Protein and fat recovery process from industrial residuals • Discovering additional value and products • Restoring water stream to water treatment plants Growth Opportunities • New Nutrient Recovery locations in Canada and Arkansas Capture Growth Opportunities North America 19 Terra Renewal Permitted and active for land application in blue states What is it? • Repurposing nutrient-rich industrial residuals into eco-friendly fertilizer • Professional service and equipment • 250,000 acres permitted • Environmentally sound Growth Opportunities • Grow wastewater solids recovery • Expand across USA & Canada • Bundle services with key customers Current Terra Renewal operations Combine Synergies: • Solid and semi-solid residuals from Terra’s processing will be further refined through our Nutrient Recovery Technology 19

Creating sustainable food, feed and fuel ingredients for a growing population Capture Growth Opportunities South America Rousselot - Brazil • Continue to expand gelatin •Grow the Peptan® brand 20 Growth Opportunities • Enter rendering business • Enter blood processing business 20

Creating sustainable food, feed and fuel ingredients for a growing population Capture Growth Opportunities Europe Ecoson - Son, Netherlands • Expand biophosphate production 21 Growth Opportunities • Expand rendering business in Southern and Eastern Europe 21

Creating sustainable food, feed and fuel ingredients for a growing population Growth Opportunities China Growth Opportunities • Continued gelatin expansion •Growth of blood position • Enter core rendering business Rousselot - China •Gelatin expansion 22 22

Financials Creating sustainable food, feed and fuel ingredients for a growing population

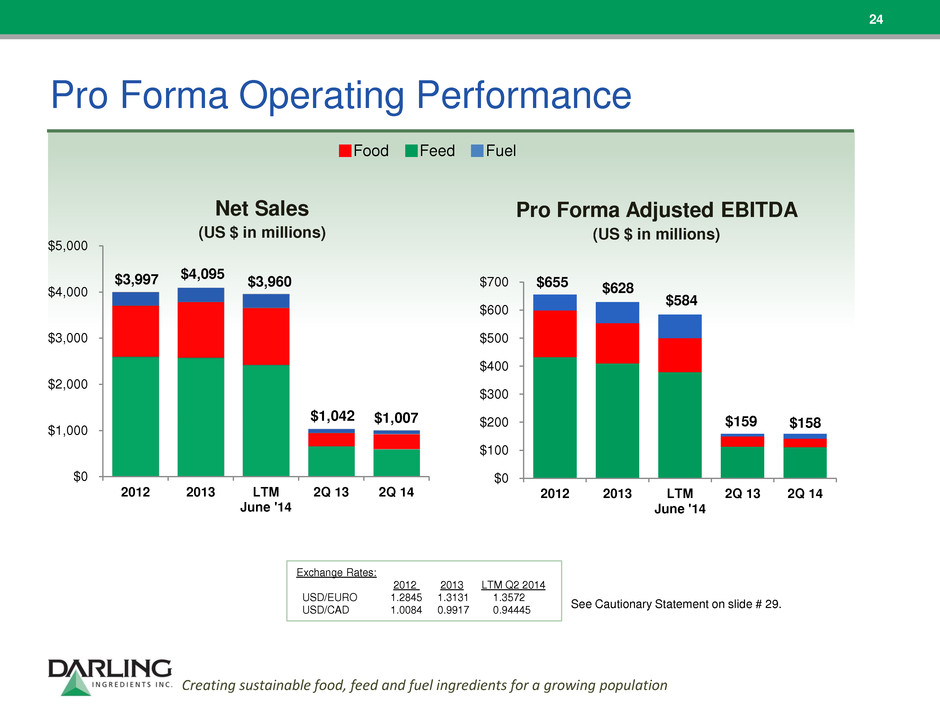

Creating sustainable food, feed and fuel ingredients for a growing population $0 $100 $200 $300 $400 $500 $600 $700 2012 2013 LTM June '14 2Q 13 2Q 14 $655 $0 $1,000 $2,000 $3,000 $4,000 $5,000 2012 2013 LTM June '14 2Q 13 2Q 14 24 Food Feed Fuel Pro Forma Operating Performance Net Sales (US $ in millions) Pro Forma Adjusted EBITDA (US $ in millions) $3,997 $584 $628 $3,960 $4,095 Exchange Rates: 2012 2013 LTM Q2 2014 USD/EURO 1.2845 1.3131 1.3572 USD/CAD 1.0084 0.9917 0.94445 $158 $159 $1,007 $1,042 See Cautionary Statement on slide # 29. 24

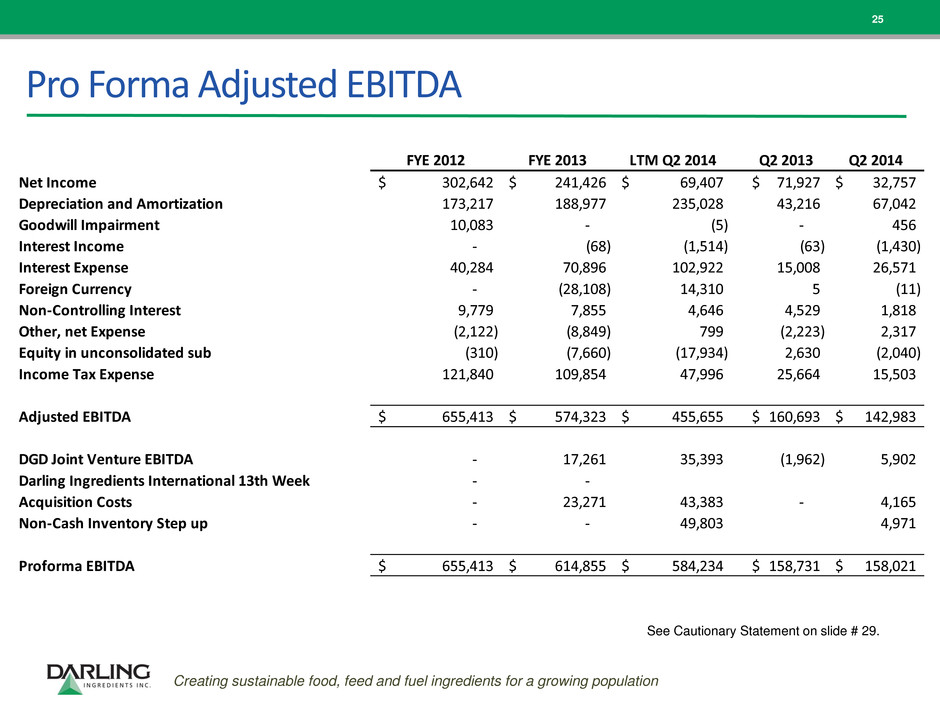

Creating sustainable food, feed and fuel ingredients for a growing population Pro Forma Adjusted EBITDA 25 See Cautionary Statement on slide # 29. FYE 2012 FYE 2013 LTM Q2 2014 Q2 2013 Q2 2014 Net Income 302,642$ 241,426$ 69,407$ 71,927$ 32,757$ Depreciation and Amortization 173,217 188,977 235,028 43,216 67,042 Goodwill Impairment 10,083 - (5) - 456 Interest Income - (68) (1,514) (63) (1,430) Interest Expense 40,284 70,896 102,922 15,008 26,571 Foreign Currency - (28,108) 14,310 5 (11) Non-Controlling Interest 9,779 7,855 4,646 4,529 1,818 Other, net Expense (2,122) (8,849) 799 (2,223) 2,317 Equity in unconsolidated sub (310) (7,660) (17,934) 2,630 (2,040) Income Tax Expense 121,840 109,854 47,996 25,664 15,503 Adjusted EBITDA 655,413$ 574,323$ 455,655$ 160,693$ 142,983$ DGD Joint Venture EBITDA - 17,261 35,393 (1,962) 5,902 Darling Ingredients International 13th Week - - Acquisition Costs - 23,271 43,383 - 4,165 Non-Cash Inventory Step up - - 49,803 4,971 Proforma EBITDA 655,413$ 614,855$ 584,234$ 158,731$ 158,021$

Creating sustainable food, feed and fuel ingredients for a growing population 0 100 200 300 400 500 600 700 Mar. 29, 2014 June 28, 2014 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 FYE 2012 FYE 2013 LTM Q2 2014 Note: Net working capital is defined as current assets less current liabilities. Operating Performance (US $ in millions) 26 Free Cash Net Working Capital June 28, 2014 Credit Agreement Revolving Credit Facility 200,018$ Term Loan A 336,421 Term Loan B 1,294,442 5.375% S nior Notes due 2022 500,000 Other Notes and Obligations 40,390 2,371,271 Less cash and cash equivalents 68,616 Net Debt: 2,302,655$ Debt Summary $430 $364 $412 $591 $569 Note: Free cash flow defined as Pro Forma Adjusted EBITDA less capital expenditures See Cautionary Statement on slide # 29.

Develop new products and applications and grow geographically to answer these needs Shareholder Value Value- Adding Success is consistently providing maximum value to the supply chain Our Recipe for Success... Creating sustainable food, feed and fuel ingredients for a growing population 27 Protein Production 27

Q&A 28 Creating sustainable food, feed and fuel ingredients for a growing population

Creating sustainable food, feed and fuel ingredients for a growing population 29 The unaudited pro forma financial information (“Unaudited Pro Forma Financial Information”) presented in the Financial Section pages of this presentation was prepared by Darling management and is based upon (i) Darling audited financial statements for the fiscal years ended December 29, 2012 and December 28, 2013, respectively, (ii) Darling unaudited financial statements for the six months ended June 29, 2013 and June 28, 2014, respectively, (iii) VION Ingredients audited financial statements for the year ended December 31, 2012 as prepared under Dutch GAAP, but including a US GAAP reconciliation footnote, (iv) VION Ingredients unaudited condensed consolidated and combined interim financial statements for the twelve months ended December 31, 2013 and six months ended June 29, 2013, respectively as prepared under Dutch GAAP, but including a US GAAP reconciliation footnote; (vi) the Rothsay audited statement of assets acquired and liabilities assumed and the related statement of net revenues and direct costs and operating expenses for the fiscal year ended December 29, 2012 and (vii) Rothsay unaudited statement of assets acquired and liabilities assumed and the related statement of net revenues and direct costs and operating expenses for the nine months ended September 28, 2013 and the six months ended June 29, 2013. Darling is presenting the Unaudited Pro Forma Financial Information for informational purposes only. Darling believes that the Unaudited Pro Forma Financial Information was prepared in good faith and on a reasonable basis based on the best information available at the time of its preparation. The Unaudited Pro Forma Financial Information, however, is not fact. The Unaudited Pro Forma Financial Information was not intended to be used as predictive of future performance. It was not prepared in compliance with the requirements of GAAP, the published guidelines of the SEC regarding pro forma information, or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of pro forma financial information. Darling’s independent public auditor has not audited or reviewed the Unaudited Pro Forma Financial Information. The inclusion of the Unaudited Pro Forma Financial Information in this presentation should not be regarded as a representation that Darling or any of its officers, affiliates, advisors, or representatives consider the Unaudited Pro Forma Financial Information to be a reliable prediction of future events or results, or a representation that actual results would have been comparable had the Transactions occurred on the dates indicated, and the information should not be relied upon as such. Darling acquired Rothsay on October 28, 2013 and VION Ingredients on January 7, 2014. Neither Rothsay nor VION Ingredients had been operated as a stand-alone business prior to the respective acquisitions, but rather as divisions of their respective parent entities. Management does not believe that the Unaudited Pro Forma Financial Information is necessarily indicative of future performance of Darling, and in fact, actual performance may differ significantly (either better or worse) from the performance indicated in the Unaudited Pro Forma Financial Information due to (i) the challenges inherent in integrating the businesses of Darling, Rothsay and VION Ingredients, (ii) changes to Darling’s operations and strategy that may have been implemented or may be implemented in the future as a result of the Transactions or otherwise, and (iii) numerous other potential risks and uncertainties, including, but not limited to, those set forth under “Risk Factors” in the Form 10-K of Darling International Inc. (predecessor by name change to Darling) for the year ended December 28, 2013, which was filed with the SEC on February 26, 2014. Investors are cautioned not to rely on the Unaudited Pro Forma Financial Information as a measure of future performance. There can be no assurance that the results indicated in Unaudited Pro Forma Financial Information would have been realized had the Transactions taken place on the dates assumed in the Unaudited Pro Forma Financial Information or that actual results for the combined entity will not be materially different. Pro forma information is inherently reliable and should not be used as the basis for an investment decision. Darling does not undertake to revise or update the Unaudited Pro Forma Financial Information, even if some or all of the assumptions utilized in preparing the information proves to be wrong. ASSUMPTIONS The key assumptions that were used to prepare the Unaudited Pro Forma Financial Information includes, but is not limited to the following: 1. The Unaudited Pro Forma Financial Information is not intended to and in fact does not comply with Regulation S-X Article 3; 2. The Unaudited Pro Forma Financial Information assumes that the acquisitions of Darling Ingredients International and Rothsay occurred on January 1, 2012, and have been presented herein on a combined basis. Thus, the presentation effectively combines the historic financial information (unless as otherwise noted below) of the respective businesses and does not eliminate any net sales and the profit related thereto for any transactions between Darling Ingredients Inc. and Darling Ingredients International (formerly known as VION Ingredients), or Darling Ingredients Inc. and Rothsay for periods prior to the respective acquisition dates; 3. For periods prior to January 7, 2014, the Unaudited Pro Forma Financial Information for Darling Ingredients International is based on the company’s underlying Dutch GAAP financial statements, which have been converted to US GAAP taking into account all known and material Dutch – US GAAP adjustments; 4. For periods prior to January 7, 2014, the Unaudited Pro Forma Financial Information for Darling Ingredients International does not reflect the application of purchase accounting in accordance with ASC 805 and hence, the recognition of Darling Ingredients International’s assets and liabilities assumed at their respective fair values. Thus, there is no non-cash inventory step-up adjustment for any financial period presented that excludes the six months ended June 28, 2014; 5. For periods prior to October 28, 2013, the Unaudited Pro Forma Financial Information for Rothsay is based on the Rothsay statement of assets acquired and liabilities assumed and the related statement of net revenues and direct costs and operating expenses, which were prepared under US GAAP; 6. For periods prior to October 28, 2013, the Unaudited Pro Forma Financial Information for Rothsay does not reflect the application of purchase accounting in accordance with ASC 805 and hence, the recognition of Rothsay’s assets and liabilities assumed at their respective fair values. Thus, there is no non-cash inventory step-up adjustment for any financial period presented that excludes the three months ended December 28, 2013; 7. No procedures were performed by management to ensure that the Unaudited Pro Forma Financial Information for Darling Ingredients International or Rothsay for the Second Quarter 2013 reflects an appropriate cut-off with respect to sales transactions, expense accruals, payroll, or other similar income statement items that could have an impact on the net sales and Pro Forma Adjusted EBITDA presented herein; 8. Prior to the acquisition by Darling Ingredients Inc. neither Darling Ingredients International Inc. nor Rothsay prepared segment financial information in accordance with segments reflected in the Unaudited Pro Forma Financial Information reflected herein; therefore, the allocation of SG&A costs to the respective segments for periods prior to the respective acquisition were based upon the allocation methodology utilized for Q2 2014; 9. The foreign currency translation rate for net sales and Pro Forma Adjusted EBITDA was based on the average rate for each of the respective periods presented. Cautionary Statement Regarding Unaudited Pro Forma Financial Information 29