Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - LOJACK CORP | exhibit991earningsreleaseq.htm |

| 8-K - FORM 8-K - LOJACK CORP | a8-kq2earningsrelease.htm |

August 12, 2014

Forward-looking Statements Statements in this presentation that are not statements of historical fact are forward-looking statements. Such forward-looking statements, which include statements regarding the Company’s strategic plans and initiatives, markets and future financial performance, are based on a number of assumptions and involve a number of risks and uncertainties, and accordingly, actual results could differ materially. Factors that may cause such differences include, but are not limited to: (1) the continued and future acceptance of the Company’s products and services, including the Company’s pre-install program and fleet management and other telematics products; (2) the Company’s ability to obtain financing from lenders; (3) the outcome of ongoing litigation involving the Company; (4) the rate of growth in the industries of the Company’s customers; (5) the presence of competitors with greater technical, marketing, and financial resources; (6) the Company’s customers’ ability to access the credit markets, including changes in interest rates; (7) the Company’s ability to promptly and effectively respond to technological change to meet evolving customer needs; (8) the Company’s ability to successfully expand its operations, including through the introduction of new products and services; (9) changes in general economic or geopolitical conditions, including the European debt crisis; (10) conditions in the automotive retail market and the Company’s relationships with dealers, licensees, partners, agents and local law enforcement; (11) the expected timing of purchases by the Company’s customers; (12) the Company’s ability to achieve the expected benefits of its strategic alliance with TomTom; (13) the Company’s ability to maintain the strength of its brand; (14) financial and reputational risks related to product quality and liability issues; and (15) trade tensions and governmental regulations and restrictions in Argentina and the Company’s other international markets. For a further discussion of these and other significant factors to consider in connection with forward-looking statements concerning the Company, reference is made to the Company's Annual Report on Form 10-K for the year ended December 31, 2013 and the Company's other filings with the Securities and Exchange Commission. Such forward-looking statements speak only as of the date made. Except as required by law, the Company undertakes no obligation to update these forward-looking statements.

In addition to financial measures prepared in accordance with generally accepted accounting principles (GAAP), this presentation also contains the non-GAAP financial measure, adjusted EBITDA. The Company believes that the inclusion of this non-GAAP financial measure in this presentation helps investors to gain a meaningful understanding of changes in the Company's core operating results, and can also help investors who wish to make comparisons between LoJack and other companies on both a GAAP and a non-GAAP basis. LoJack management uses this non-GAAP measure, in addition to GAAP financial measures, as the basis for measuring our core operating performance and comparing such performance to that of prior periods and to the performance of our competitors. These measures are also used by management to assist with their financial and operating decision making. The non-GAAP financial measures included in this presentation are not meant to be considered superior to or a substitute for results of operations prepared in accordance with GAAP. In addition, the non-GAAP financial measures included in this presentation may be different from, and therefore may not be comparable to, similar measures used by other companies. Reconciliations of the non- GAAP financial measures used in this presentation to the most directly comparable GAAP financial measures are set forth in the accompanying appendix to this presentation. Use of Non-GAAP Financial Measures

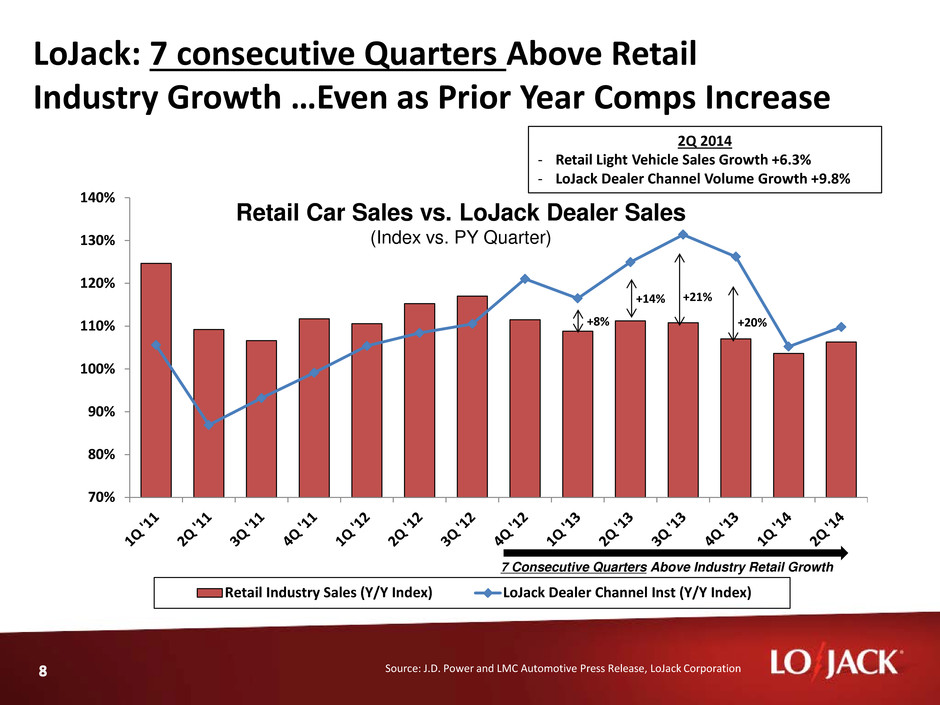

Q2 Overview • Q2 Revenues were $34.4 million, up 2% YoY • U.S. dealer product revenues up 3.7% on 10% increase in volume • Domestic SVR volume outpaces broader U.S. retail auto market for seventh consecutive quarter • Strong Preinstall volume continues to be a major factor in our market performance • Pace of LoJack dealer sales growth has picked up as weather improved and vehicle shipments arrived • Gross margin of 49.4% includes $1.7MM in reserves related to the battery evaluation • Reserves reduced gross margin by 490 basis points

Demand for Autos Continues in 2014 Source: J.D. Power and LMC Automotive Press Release, LoJack Corporation 12.8M 10.6M 8.6M 9.2M 10.3M 11.7M 12.8M 13.4M 6.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0 14.0 2007 2008 2009 2010 2011 2012 2013 2014 F'cst Li gh t Ve hi cl e Sa le s (M ill io ns ) Retail U.S. Light Vehicle Sales (2007 to 2014E) -2% -17% -19% +6% +12% +10% +4% -19% +6% +14% Forecast at January ’14 13.31 million Forecast at July’14 13.4 million The Wall Street Journal – July 1st, 2014 Low interest rates and a brighter economic outlook drove U.S. new-vehicle sales higher for most major auto makers in June, allaying worries of a market slowdown and setting the industry up for a strong second half.

Rail Backups Delayed Deliveries “New cars and trucks—including some of the season's hottest sellers—are stacked up outside U.S. factories as auto makers and railroads struggle to overcome delays brought on by winter weather and the rise of production outside the Midwest…” The logjams have left dealers short of some popular models, such as the Ford Explorer sport-utility vehicle and Toyota RAV4, ahead of the biggest months of the year for new-car sales…” Updated April 23, 2014 6:43 p.m. ET Source: The Wall Street Journal The Wall Street Journal – April 23rd, 2014

31% 32% 34% 43% 44% 45% 46% 51% 52% 55% 0% 10% 20% 30% 40% 50% 60% Advancing the Pre-Install Strategy Pre-Install Program Sales Mix % Share of Dealer Channel Volume LoJack continues to lay the foundation for stable recurring revenue

70% 80% 90% 100% 110% 120% 130% 140% Retail Industry Sales (Y/Y Index) LoJack Dealer Channel Inst (Y/Y Index) LoJack: 7 consecutive Quarters Above Retail Industry Growth …Even as Prior Year Comps Increase Source: J.D. Power and LMC Automotive Press Release, LoJack Corporation 7 Consecutive Quarters Above Industry Retail Growth Retail Car Sales vs. LoJack Dealer Sales (Index vs. PY Quarter) 2Q 2014 - Retail Light Vehicle Sales Growth +6.3% - LoJack Dealer Channel Volume Growth +9.8% +8% +14% +21% +20%

Commercial Segment • 25% unit decline in Q2 2014 vs. Q2 2013, due to timing and customer transitions to telematics solutions • Signals positive trend for Lojack’s telematics offering • Recorded 32% unit growth during past 12 months • Significant future opportunity • Total available market of 1.5M pieces of equipment* • Top customers have an estimated 500,000 pieces of equipment deployed • Continue to build strong relationships with largest construction equipment rental companies • * C.J Driscoll & Associates estimate

Continued Progress on Telematics Initiatives • Expect 2014 to be a year of investment as we transition to enable new subscription-driven (SaaS) business models • Continue to ramp the Sales program with the addition of experienced sales management • Expanding pipeline of prospective customers for LoJack Fleet Management • Leveraging brand elasticity, dealer network, distribution capabilities and strong ties with law enforcement

0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 Te le m at ic s U ni ts In st al le d (0 00 s) LoJack Fleet Management Source: C.J Driscoll & Associates Local Fleets: Opportunity in an Underpenetrated Addressable Market Local Fleet Management Market – Telematics Units Installed Estimates • Addressable Market Estimated at 14 million • Approximately 3.5 million Units currently in service • As of the end of 2013, penetration of the local fleet market was estimated at 25%—leaving a large portion of the addressable market still untapped.

2014 Revised Guidance • Continued growth of base stolen vehicle recovery business in the U.S. • Expect full-year revenue growth in the range of 5-7% • International revenues could be uneven; ongoing trade restrictions in Argentina could hamper ability to meet full market demand • Continued investments to expand beyond stolen vehicle recovery to initiatives focused on telematics • Continued implementation of ERP system to support subscription- based business and broaden telematics offerings • Full-year adjusted EBITDA in the range of 5-6% of revenues

Q2 Revenues ($ in millions) Q2 2014 Q2 2013 % change Consolidated revenues $ 34.4 $ 33.7 2% U.S. revenues $ 22.9 $ 23.7 (3%) International licensees $ 7.3 $ 6.1 20% Canada $ 1.6 $ 2.0 (19%) Italy $ 1.5 $ 0.9 65% All other $ 1.1 $ 1.0 (10%) • U.S. dealer product revenues up 3.7% on 10% increase in unit volume • Pre-installs represented 55% of U.S. unit sales vs. 45% in Q2 2013 • Larger percentage of pre-installs enables fixed costs to be spread over increased unit volumes • Italy revenues up 65% over prior year, as subscriber base exceeded 40,000

Q2 Consolidated Results Highlights $ in millions, except per share data Q214 Q213 Revenue $ 34,411 $ 33,680 Y/Y change 2.2% Gross profit 16,992 18,364 Y/Y change (7.5%) Gross profit margin 49.4% 54.5% Operating expenses 19,866 18,149 Adjusted EBITDA* (1,474) 1,810 Y/Y change (181.0%) Operating loss (2,874) 0.2 Y/Y change (1441%) Net loss attributable to LoJack Corporation $ (3,388) $ 2,636 Net loss per diluted share $ (0.19) $ 0.15 *Please refer to Appendix for reconciliation of non-GAAP items

Balance Sheet Highlights ($ in millions) Jun. 30, 2014 Dec. 31, 2013 Cash and cash equivalents $ 21.7 $ 32.0 Accounts receivable, net $ 25.7 $ 26.5 Inventories $ 8.5 $ 7.2 Total assets $ 79.8 $ 86.8 Long-term debt $ 10.0 $ 6.0 Deferred revenue, current portion $ 9.5 $ 10.3 Deferred revenue, long term $ 10.1 $ 10.6 Total liabilities $ 51.5 $ 50.8 Total equity $ 28.3 $ 36.0

Summary • Pace of U.S. retail automotive growth has increased after a challenging Q1 • Domestic Stolen Vehicle Recovery business remains strong on the continued growth of our Pre-Install Program • Building systems infrastructure to support a subscription-based revenue model and to better support our core Stolen Vehicle Recovery business • Look for continued investment and growth in key telematics segments

August 12, 2014

Three Months Ended Three Months Ended June 30, 2014 June 30, 2013 $ $ Net (loss) income, as reported (3,435 ) 2,645 Adjusted for: Provision (benefit) for income taxes 141 (2,281 ) Other (expense) income (420 ) 150 Operating income (loss) (2,874 ) 214 Adjusted for: Depreciation and amortization 1,054 1,088 Stock compensation expense 359 521 Adjusted EBITDA (1,461 ) 1,823 Appendix: GAAP to Pro Forma Non-GAAP Reconciliation ($ in thousands) 19