Attached files

| file | filename |

|---|---|

| EX-10 - FlikMedia, Inc. | ex10-3.htm |

| EX-99 - FlikMedia, Inc. | ex99-3.htm |

| EX-10 - FlikMedia, Inc. | ex10-2.htm |

| EX-99 - FlikMedia, Inc. | ex99-1.htm |

| EX-99 - FlikMedia, Inc. | ex99-2.htm |

| EX-10 - FlikMedia, Inc. | ex10-1.htm |

| EX-10 - FlikMedia, Inc. | ex10-4.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): July 25, 2014

FLIKMEDIA, INC.

(formerly, Crossbox, Inc.)

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

| Nevada | 000-53337 | 27-1139744 | ||

(STATE OR OTHER INCORPORATION OR |

(COMMISSION FILE NO.) | (IRS EMPLOYEE IDENTIFICATION NO.) |

5000 Birch Street, Suite 4800

Newport Beach, California

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(949) 373-7281

(ISSUER TELEPHONE NUMBER)

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

|

Copies to: Stephen A. Weiss, Esq. Hunter Taubman Weiss, LLP 575 Lexington Avenue, Floor 4 New York, New York 10022 (212) 600-2284 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

This Form 8-K/A amends and restates in its entirety the Form 8-K filed by to FlikMedia, Inc. (formerly, Crossbox, Inc.), a Nevada corporation and its wholly-owned subsidiary, Flikdate, Inc., a Delaware corporation on July 29, 2014. The purpose of this amendment is to include all of the Exhibits to the Form 8-K, including Exhibit 99.1 (the audited and unaudited financial statements of Flikdate, Inc. required to be filed pursuant to Items 9.01(a) of Form 8-K), which was inadvertently omitted from the original Form 8-K filed on July 29, 2014).

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this Form 8-K that are not historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These include statements about the Registrant’s expectations, beliefs, intentions or strategies for the future, which are indicated by words or phrases such as “anticipate,” “expect,” “intend,” “plan,” “will,” “we believe,” “management believes” and similar words or phrases. The forward-looking statements are based on management’s current expectations and are subject to certain risks, uncertainties and assumptions. Our actual results could differ materially from results anticipated in these forward-looking statements. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements.

As used in this Form 8-K, unless the context indicates otherwise, the terms “Company,” “we” and “us” refers collectively to FlikMedia, Inc. (formerly, Crossbox, Inc.), a Nevada corporation and its wholly-owned subsidiary, Flikdate, Inc., a Delaware corporation. All references to “Company Common Stock,” “Crossbox” or “FlikMedia” refers only to the Registrant, FlikMedia, Inc. (formerly, Crossbox, Inc.) and its Common Stock.

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

Historical Development

FlikMedia was incorporated in the State of Nevada on July 29, 2009, under the name Go Green Directories, Inc. and changed its name to Crossbox, Inc. on January 15, 2014. On July 7, 2014, in contemplation of its acquisition of Flikdate, Inc., Crossbox changed its name to FlikMedia, Inc. We are a development stage company and prior to our acquisition of Flikdate described below, did not have any material operations other than initial corporate formation and capitalization, the building of a website, and the development of a business plan related to the acquisition of the First Rate Boxing assets from Jeffrey Crawford.

Subsequent to the Company’s acquisition of the First Rate Boxing assets, management met with consultants and experts within the fitness industry to pursue our strategy of developing business focused around content for the fitness industry. While we received some cursory interest, it has become obvious that the best interests of the shareholders would be best served by actively seeking an alternative business strategy through acquisition or merger.

Agreement and Plan of Merger

On May 12, 2014, FD Acquisition Corp., a newly formed Delaware subsidiary of the Company (“MergerCo”) and the Company entered into an agreement and plan of merger with Flikdate, Inc., a Delaware corporation (“Flikdate”). Effective as of June 30, 2014, the Company, MergerCo and Flickdate amended and restated in its entirety the agreement and plan of merger (the “Merger Agreement”). On July 25, 2014, the transactions contemplated by the Merger Agreement were consummated and MergerCo was merged with and into Flikdate (the “Merger”), with Flikdate as the surviving corporation of the Merger..

| 2 |

Pursuant to the terms of the Merger Agreement, MergerCo has merged into Flikdate, with Flikdate as the surviving corporation of the Merger. As a result of the Merger, FlikMedia owns 100% of the capital stock of Flikdate. Under the terms of the Merger Agreement, the holders of 100% of the 14,880,674 outstanding shares of common stock of Flikdate, immediately prior to the Effective Date of the Merger (the “Flikdate Stockholders”) were to receive an aggregate of 32,291,287 shares of common stock, $0.001 par value per share, of FlikMedia (the “Company Common Stock”), or such other number of shares of Company Common Stock which shall represent approximately 71.5% of the fully-diluted Company Common Stock as at the closing date of the Merger.

Prior to the effective date of the Merger, as defined in the Merger Agreement (the “Effective Date”), FlikMedia had an authorized capital stock of 75,000,000 shares, divided into 70,000,000 shares of Company Common Stock, par value $0.001 per share, and 5,000,000 shares of preferred stock (“Company Preferred Stock”). Prior to the Merger, an aggregate of 12,860,000 shares of Company Common Stock and no shares of Company Preferred Stock was outstanding. Prior to the closing of the Merger all holdings of Flikdate convertible notes converted such notes into shares of Flikdate common stock. On the closing date of the Merger, the Flikdate Stockholders received an aggregate of 32,291,287 shares of Company Common Stock, representing 71.5% of the fully-diluted shares of Company Common Stock. Accordingly, after the Merger, an aggregate of 45,151,287 shares of Company Common Stock are issued and outstanding on s fully-diluted basis.

Following the execution of the May 12, 2014 agreement and plan of merger, at the request of Flikdate, on May 23, 2014 FlikMedia made a $325,000 loan to an unrelated entity Social Technology Holdings, Inc., evidenced by a 45 day 6% note of the borrower secured by a lien on the assets of the borrower. A third party company agreed to purchase the note from the Company for the principal amount plus accrued interest, in the event that the borrower has not repaid the loan by the maturity date. As at June 30, 2014, the note has not been repaid.

In a related transaction, upon consummation of the Merger David Walters and Peter Wells, the senior executive officers of FlikMedia prior to the Merger, returned to the Company for cancellation, all of the shares of Company Common Stock then owned by them, except for 2,700,000 shares of Company Common Stock. As a result Mr. Walters now owns 1,350,000 shares of Company Common Stock and Mr. Wells now owns 1,350,000 shares of Company Common Stock.

From and after the closing date of the Merger, our sole operations consist of the business and operations of Flikdate, our wholly-owned subsidiary.

In contemplation of the Merger, on July 7, 2014, and pursuant to Nevada Revised Statute 92A.180, we merged our newly formed Nevada corporate subsidiary, FlikMedia, Inc., with and into Crossbox, Inc. and changed the corporate name of our Company to FlikMedia, Inc.

The foregoing description of the terms and conditions of the Merger Agreement and the transactions contemplated thereunder that are material to the Company does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 2.01.

Cancellation of Shares Previously Issued

On January 14, 2014 pursuant to an Assignment and Assumption Agreement, Jeffrey Crawford and his affiliate First Rate Boxing assigned to the Company United States Patent No. 8,371,095 entitled “Speed Bag Apparatus” (the “Patent”), and in exchange therefore, we issued to Crawford 2,500,000 shares of Company Common Stock, paid $10,000 to a creditor and agreed to pay Crawford a minimum of $4,000 per month. In addition, in January 2014, the Company issued another 1,000,000 shares of Company Common Stock to Crawford for services to be rendered.

| 3 |

FlikMedia has submitted to Mr. Crawford a proposed settlement agreement, pursuant to which we proposed to return and assign to Crawford or his affiliate, all right, title and interest possessed by FlikMedia in and to: (a) the Patent, (b) all intellectual property associated with the Patent and the proprietary speed bag platform, (c) 20 speed bags already produced and paid for by the Company, (d) the sum of $2,500 and (e) 100,000 shares of Company Common stock, in exchange for Crawford’s agreement to waive all rights to, and return to FlikMedia for cancellation, all 2,400,000 remaining shares of Company Common Stock that we previously agreed to issue to Crawford of his affiliates. In view of the fact that no activities have occurred in connection with the patent or the other assets relating to First Rate Boxing, nor has Mr. Crawford provided any services to us, if the proposed settlement agreement is not executed by Mr. Crawford by August 15, 2014, we intend to rescind the January 2014 transactions in their entirety, return to Mr. Crawford all of the assets he and First Rate Boxing previously agreed to assign to us, and cancel all of the shares of Company Common Stock, less 100,000 Company shares, that we agreed to issue to Mr. Crawford. To date, none of the certificates evidencing such shares have been delivered to Mr. Crawford or First Rate Boxing.

In June 2014, FlikMedia returned for cancellation a total of 7,500,000 shares of Company Common Stock recorded as issued in January 2014 for services to be rendered by former and existing officers and consultants, including Joe Lopez, a former executive officer, and Messrs. Walters and Wells. These shares were never delivered by FlikMedia to the recipients as they were issued pending the execution of employment agreements and for the performance of services that were never provided. These cancelled shares included the 1,000,000 shares that FlikMedia previously agreed to issue to Mr. Crawford for services to be rendered, but which were never provided.

Prior to the Merger, we were a public reporting “shell company,” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended and the rules and regulations promulgated thereunder (“Exchange Act”). Accordingly, pursuant to the requirements of Item 2.01(f) of Form 8-K, set forth below is the information that would be required if we were filing a general form for registration of securities on Form 10 under the Exchange Act for Company Common Stock, which is the only class of our securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the Acquisition.

Appointment of Directors

Immediately after the effective time of the Merger, the current two directors on the Board of Directors of Crossbox, David Walters and Peter Wells tendered their resignations from the Board and Nikola Bicanic, Olivier Chaine and Arben Kryeziu were appointed to the Board. See Item 5. Executive Officers and Directors below in this Form 8-K.

Appointment of Executive Officers

Immediately after the effective time of the Merger, David Walters, our Interim CEO and Chief Financial Officer, and Peter Wells, our Secretary, tendered their resignations as executive officers of FlikMedia and Nikola Bicanic and Olivier Chaine became the executive officers of the Company. See Item 5. Executive Officers and Directors below in this Form 8-K.

Corporate Headquarters

Prior to the Flikdate Merger, our principal executive office was located at 5000 Birch Street, Suite 4800, Newport Beach, California 92660. As a result of the Flikdate Merger, our new principal executive offices will be located at 77 Hookele Street, Suite 201, Kahului, Hawaii 96732 and our main telephone number is 808.893.2400.

You are advised to read this Current Report on Form 8-K in conjunction with other reports and documents that we file from time to time with the Securities and Exchange Commission (“SEC”). In particular, please read our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and any Current Reports on Form 8-K that we may file from time to time. You may obtain copies of these reports from the SEC at the SEC’s Public Reference Room at 100 F Street, N.E. Washington, D.C. 20549. In addition, the SEC maintains information for electronic filers (including us) at its website at www.sec.gov. The public may obtain information regarding the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

| 4 |

| Item 1. | Business. |

As a result of the Flikdate Merger, we are now a digital media company focused on designing, developing and bringing to market video applications for use on mobile platforms.

Flikdate has developed a software application to enable men and women to engage in live video social “dating” interaction on their mobile phones. The technology permits users to go on a virtual date and quickly skip - or “flik” in the parliance of the application – between multiple users. The “Flikdate” concept is introduced in a speed dating format through the use of a users mobile phone in which users will have the ability to meet and talk to other users through Flikdate’s proprietary digital and mobile software. We believe that Flikdate is the world’s first video speed dating platform. We intend to generate revenue from a patented technology which bills users per duration of each video session:

Flikdate owns intellectual property that we rely on, including our proprietary software for video delivery and for mobile video monetization, as further described in our patent granted by the US Patent and Trademark Office in Feb 2014 under patent number US20140043426 A1

We believe the Flikdate technology has applications in various industries. We have elected to launch our first consumer mobile application in the online dating industry under the brand name Flikdate.

Flikdate was incorporated in the state of Delaware in 2012 and registered as a foreign corporation “doing business” in the state of Hawaii in 2014. Flikdate has developed a software application to enable men and women to engage in live video social “dating” interaction on their mobile phones. The technology permits users to go on a virtual date and quickly skip – or “flik” in the parlance of the application - between multiple users.

We are a development stage company with extremely limited revenues to date. Our business is subject to several significant risks, any of which could materially adversely affect our business, operating results, financial condition and the actual outcome of matters as to which we make forward-looking statements. Investors should carefully consider all of these risks before investing in our Company as you could lose all or part of your investment. (See Item 1A. “Risk Factors”).

Flikdate Products and Services

Flikdate is a mobile video dating service that has developed a proprietary software application to enable men and women to engage in live video social “dating” interaction from all over the world on their mobile phones. The technology is based on live video chat capabilities where you can see the person you are talking to in real-time video. The social mission of the Company is to assist users in building personal relationships among one another.

| 5 |

Our products and services include:

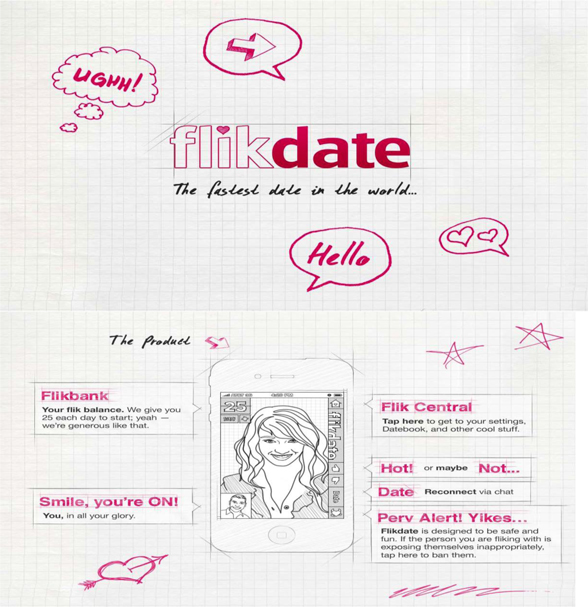

| o | Flikbank. Flikdate has an in-application currency called “fliks” and a new concept called “digital chivalry”: |

| o | “Fliks” |

| § | It costs one flik to see another person. |

| § | Two fliks to get another 90 seconds of chat time, and give fliks to add a person to your datebook. Flikdate has an in-application currency called “fliks” and a new concept called. |

| § | Under a concept called “Digital chivalry”, if a fellow extends an offer of a date to a girl- it costs two fliks- she pays nothing. If he adds a girl to his date list (and she agrees) its costs five fliks. |

| 6 |

| o | Business: The user can do everything in the application for free- but if they want to engage in a lot of use at the cost of fliks they will be required to buy “fliks.” A user’s flik balance is recharged to 25 fliks each day- for free. However, it costs $1.00 to purchase more than 25 fliks at any point in a day. The revenue model for the Company encompasses one of the following: |

| o | Premium Model- Using an upfront download fee for the “Fliks” purchased, this is the most straightforward and obvious way to monetize a mobile application. |

| o | Freemium Model- The application is a free download and contains content for purchase inside the application (aka in-app purchases) or an upgrade option to a premium version. |

| o | Ad Networks- The application and all its content can be completely free and still generate revenue through advertising. |

Marketing and Sales

We intend to focus our social marketing tactics to ensure that Flikdate is ranked high in the mobile dating application market so that it can be organically discovered; to fuel and optimize opportunities to generate users; and to effectively target and effectively speak to the broad demographic universe of users that we believe will greatly enjoy Flikdate. We intend to create a multi-channel online presence capable of optimizing the viral nature of social marketing to promote Flikdate and attract new users. Our marketing strategy includes:

| · | Targeting Twitter users; |

| · | Using social video outlets to showcase information animated video we have created to describe the Flikdate experience; |

| · | Createinga basic Tumblr or like blog; |

| · | Using Facebook through the creation of a Facebook page where we can actively engage our user and drive downloads of the Flikdate app;. |

| · | Creating engagement mechanisms for our Flikdate application to reconnect with consumers and remind them of Flikdate’s presence on their device; and |

| · | Staging events that ill generate human interest buzz for our product. |

We intend to lend ongoing online support to all of our marketing efforts through Google keyword search optimization and banner advertisement placement. And as social media continues to evolve, we intend to adopt emerging new social channels and technologies that demonstrate capabilities to further enhance and extend our efforts in the most cost efficient manner possible.

Our Opportunity

We believe the Flikdate addresses a number of limitations encountered by millions of consumers that subscribe to and use online dating services. We believe advances in mobile technology and mobile video, including our proprietary technology and business methods, may empower individuals to connect with one another in appealing new ways through our interface using their smartphone. Our conclusions are that online dating should be more casual, more convenient, less time consuming and more fun. We believe the success of other casual dating services like Tinder support our conclusions. According to published reports, as of March 2014, Tinder is processing an average of 750 million swipes and 10 million matches per day to the online dating industry.

We also believe that the technology behind Flikdate can be used to address a number of other vertical markets. We believe that dating is just the tip of the iceberg.

| 7 |

Our Solution

We believe our platform provides the following benefits to our members:

| · | Easy

to get started. In the language of mobile apps – users are usually forced into

a very lengthy onboarding process – which requires them to create an account, add

photos, add a credit card etc – a very cumbersome process that both scares and

confused potential users. We believe flikdate’s unique onboarding

process is the industry’s fastest by several orders of magnitude |

| · | Fast

to use. The whole idea with casual dating applications is to allow the user to dip

into and out of the experience as easily as possible. If they wish to flikdate

for only 5 minutes while waiting in line at a grocery store – that’s

fine. If they wish to stay on there for 3 hours – that’s fine also. The technology

is designed to function equally well for both types of users |

| · | Authenticity.

The most common complaint with traditional online dating is that people look nothing

like the pictures. The photos used in profile are often older, photo shopped or professionally-lit

– creating a chain of distrust and disappointment for many users. Real-time phone

or mobile tablet video is real and nearly impossible to fake. We believe only flikdate’s

technology capitalizes on this advantage |

| · | Step-by-step

interactions. Most dating sites and mobile apps rush directly from browsing and text

chatting to the first date or “real-world” meeting. This effectively creates

a “Blind Date” situation, which induces high-stress, and has a low probability

for success since there were only nominal notions of compatibility before meeting. Flikdate’s

technology allows for a smooth transition from image browsing, to text chatting,

to video voicemails to real-time video. We believe the Flikdate solution

can dramatically increase the interaction between people who are interested in each other,

and improve the odds for success. |

| · | Monetizing our business model. Many dating applications are free – which is not a very sustainable business model. We studied the dynamics of extremely successful online games such as Candy Crush Saga and Clash of Clans - and used their proven “gamification” models to improve our monetization, such as spending credits faster and reloading faster. We believe that this has led to a strong roadmap for the next releases of the flikDate application. |

Our Competitive Strengths. We believe that the Flikdate solution possesses certain advantage over the dating programs of our competitors. These include:

| · | Product

focus. Our team is focused on optimizing the user’s product experience. From

the very first launch of the application, to subsequent returns with and without prompting.

Our holistic approach to user experience design coupled with viewing performance marketing

as part of the product cycle – counts as one of our greatest strengths. |

| · | Patented

technology. We believe that flikdate has a broad technology patent

covering all aspects of timed video dating. |

| · | Mobile

first and mobile only. Most incumbent dating companies built their businesses (and

business models) before the smartphone revolution. However – we are now living

in a so-called post-PC world. As such – transitioning these pre-mobile business

models into mobile only is an extremely difficult task to pull off. However, with Flikdate,

both the user experience and the monetization model was designed from the ground

up to leverage touchscreen smartphones. |

| · | Broad platform. Both major smartphone platforms have dedicated application developer teams. We are in preliminary discussions to explore a partnership to bring Flikdate into the living room also (via Microsoft Xbox) – always focusing on maximing the amount of people who can use flikdate (but never forgetting to keep it very easy to use). |

| 8 |

Our Marketing Strategy

We believe that our next version of flikdate is primed for success. The most important thing for the next phase of growth is customer acquisition (supported by technological stability and continuous technical improvements.). Our strategy for growth includes various different user acquisition channels – all metrics-driven using well-proven direct response marketing techniques.

| · | App Store Optimization & Promotions |

| · | Public Relations & TV coverage. Initial tests show the rapid and sustainable impact of PR - Today show, Steve Harvey show + future outlets; |

| · | Paid search |

| · | Youtube / Videos. Creating grass-root style PR videos directly and indirectly through audience outreach drives download and engagement; |

| · | In-App Mobile Ad Networks, which currently provides lower performance due to small form factors, but rapidly gaining |

| · | Affiliate Networks. Includes dating networks to meetups to other sites with similar target audiences - provides a fixed customer acquisition cost at scale |

| · | Partnerships. After we have enhanced our user base over the next two to three years, we will seek to leverage selectively the existing incumbents in the online dating space for database customer acquisition and growth. This includes revenue share deals, affiliate traffic deals and possibly joint ventures (if correctly structured) |

Market Industry Data

We believe that data growth is currently being driven by the increased penetration of smart phones, in particular in emerging markets – and by increased data consumption per subscriber due to the faster download speeds and the uptake of data-hungry applications like video made possible by new technology, such as 4G. We also believe that advancement of network technologies, restructuring of revenue-sharing models, lowering of mobile data usage cost, growing adoption of smart phones and the increase in application usability will give rise to a global industry that it expects will continue to swell. In addition, management anticipates that in-app mobile ad-spend will continue to rise.

As more people meet online and through dating applications, they are also obliterating the stigma once associated with it. In a study conducted by the Pew Research Internet Project 1, researchers found that one in ten Americans have used an online dating site or mobile dating application themselves; and many people now know someone else who uses online dating or who has found a spouse or long-term partner via online dating. Moreover, 7% of smart phone applications users (representing 3% of all adults) say they currently have a dating application on their mobile phone. In fact, online daters now spend more time on dating applications than they do on the websites themselves. And, by 2018, it is estimated that more than 80% of the population will own a smart phone – up from 46% in 2012.

In 1970, just 28% of American adults were single; today the share is 47%, according to the Census Bureau, which supports an expanding target market for the online dating industry. Management believes that the trend for online dating migrating from desktop and laptop to mobile devices should continue.

Competition

The mobile application industry is characterized by rapidly evolving technology and intense competition. Other companies of various sizes engage in activities similar to ours. Many of our competitors have substantially greater financial and other resources available to them. Although we believe that there are approximately a total of 3,900+ online dating sites and mobile applications available to consumers to choose from, management believes the following represent the most serious competition to the Company’s product:

1 http://www.pewinternet.org/2013/10/21/online-dating-relationships/)

| 9 |

| o | Coffee Meets Bagel |

Similar to timed shopping sites, this free application sends one match to each user every day at noon. Users can see that person’s picture and profile and have only 24 hours to decide if they want to go on a date with them or not by clicking “yes” or “pass.”

| o | eHarmony Mobile |

One of the largest dating sites, eHarmony has provided services in this industry for more than 10 years. Upon downloading the free mobile app, members can complete a relationship questionnaire at no charge, receive a detailed personality profile for free, receive daily matches, send icebreakers, communicate with matches for free during free communication events, and when subscribed, freely communicate with matches. Unlike other dating applications, eHarmony takes into account things like common personality traits, interests, values and beliefs to make its matches.

| o | HowAboutWe |

With a similar interface to Twitter, How About We offers users the ability to post statuses such as, “How About We...hook up tonight!” Users can message other How About We users by upgrading to one of How About We’s messaging packages. By doing this, users are able to read messages from other users, ask users “out,” and respond when someone is intrigued. Although its subscription based, How About We lets users remain in charge by choosing the type of date they want to go on.

| o | Match.com Mobile |

Launched in April of 1995, Match.com is one of the largest online dating companies in the world. It is credited for pioneering the online dating industry and now serves 24 countries and territories and hosts Web sites in 15 different languages. Its mobile app, Match.com Mobile, was introduced in 2003 and offers users a profile that can be perused by other users through various search options. Eighty percent of its five million application users are under the age of 35. Searching other users’ profiles is free of charge, however only paying members may email or text each other.

| o | OKCupid- Blind Dating App |

Launched in 2004 and acquired by Match.com for $50 million in 2010, OKCupid’s free mobile application calculates match percentages using a patent pending algorithm that is based on how users respond to questions, such as “how messy are you?” and “have you ever cheated in a relationship?” The application requires that users reveal a few basic details, including first name, age, whether the user prefers men or women, and a profile picture, which the application will scramble. Next, the application prompts the user to create a date. Alternatively, the user can peruse other scrambled profile pictures and date offers from their matches.

| o | PlentyOfFish |

Founded in 2003 in Vancouver, PlentyOfFish has over 70 million registered users across the globe and 50,000 new members every day – 70% of its usage takes place solely via its mobile app. While it is free to use, the application offers premium services as part of their upgraded membership, such as seeing when a user profile was viewed, and allowing users to see whether a message has been read and/or deleted.

| 10 |

| o | Tinder |

Introduced in mid-2012, Tinder uses Facebook profiles to gather users’ basic information and analyzes users’ social graph to match potential candidates that are most likely to be compatible, based on geographical location, number of mutual friends and common interests. Only after two users “like” each other are they free to chat within the app. Users have control over who they want to connect with so that they are not bombarded with messages or approached by people they don’t want to match with. Tinder is anonymous in that it does not post users activity within the application on Facebook or reveal their matches and interactions.

| o | Skout |

Skout is one of the largest online dating platforms with over five million users using the free app. Skout’s “Meet Me” feature allows users to flip through and see who’s nearby and ready to hook up. Users can see who’s checked them out, send messages and send wink bombs.

Government Regulation

The Company will be subject to various federal, state and local laws that govern the conduct of its business, including state and local regulations. The Company does not anticipate at this time that the costs of complying with any such regulations will have a material effect on its business or financial condition.

As part of our business, we will receive, transmit and store a large volume of personal information and other user data (including credit card data) in connection with the provision of online products and services, transactions with users and customers and advertising on our websites. The sharing, use, disclosure and protection of this information are determined by the respective privacy and data security policy of our business. These policies are, in turn, subject to federal, state and foreign laws and regulations, as well as evolving industry standards and practices, regarding privacy and the storing, sharing, use, disclosure and protection of personal information and user data (for example, various state regulations concerning minimum data security standards, industry self-regulating principles that become standard practice and more stringent contractual protections regarding privacy and data security (and related compliance obligations)).

In addition, if an online service provider fails to comply with its privacy policy, it could become subject to an investigation and proceeding for unfair or deceptive practices brought by the U.S. Federal Trade Commission under the Federal Trade Commission Act (and/or brought by a state attorney general pursuant to a similar state law), as well as a private lawsuit under various U.S. federal and state laws. In general, personal information is increasingly subject to legislation and regulation in numerous jurisdictions around the world, the intent of which is to protect the privacy of personal information that is collected, processed and transmitted in or from the governing jurisdiction.

U.S. legislators and regulators may enact new laws and regulations regarding privacy and data security. In February 2012, the White House released a proposed Consumer Privacy Bill of Rights, which is intended to serve as a framework for new privacy legislation. In March 2012, the U.S. Federal Trade Commission released a staff report making recommendations for businesses and policy makers in the area of consumer privacy. Similarly, new privacy laws and regulations at the state level, as well as new laws and directives abroad (particularly in Europe), are being proposed and implemented. For example, new legislation in the state of California that became effective on January 1, 2014 requires companies that collect personal information to disclose how they respond to web browser “Do Not Track” signals. In addition, existing privacy laws that were intended for brick-and-mortar businesses could be interpreted in a manner that would extend their reach to our business.

We are subject to the following regulations of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and applicable securities laws, rules and regulations promulgated under the Exchange Act by the SEC. Compliance with these requirements of the Exchange Act will also substantially increase our legal and accounting costs.

| 11 |

We are subject to the reporting requirements of Section 13 of the Exchange Act, and subject to the disclosure requirements of Regulation S-K of the SEC, as a “smaller reporting company.” That designation will relieve us of some of the informational requirements of Regulation S-K.

Section 14(a) of the Exchange Act requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act to comply with the rules and regulations of the SEC regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to stockholders at a special or annual meeting thereof or pursuant to a written consent will require us to provide our stockholders with the information outlined in Schedules 14A (where proxies are solicited) or 14C (where consents in writing to the action have already been received or anticipated to be received) of Regulation 14, as applicable; and preliminary copies of this information must be submitted to the SEC at least 10 days prior to the date that definitive copies of this information are forwarded to our stockholders.

We are also required to file annual reports on Form 10-K and quarterly reports on Form 10-Q with the Securities and Exchange Commission on a regular basis, and will be required to timely disclose certain material events (e.g., changes in corporate control; acquisitions or dispositions of a significant amount of assets other than in the ordinary course of business; and bankruptcy) in a Current Report on Form 8-K.

We are also subject to the Sarbanes-Oxley Act of 2002. The Sarbanes/Oxley Act created a strong and independent accounting oversight board to oversee the conduct of auditors of public companies and strengthens auditor independence. It also requires steps to enhance the direct responsibility of senior members of management for financial reporting and for the quality of financial disclosures made by public companies; establishes clear statutory rules to limit, and to expose to public view, possible conflicts of interest affecting securities analysts; creates guidelines for audit committee members’ appointment, compensation and oversight of the work of public companies’ auditors; management assessment of our internal controls; prohibits certain insider trading during pension fund blackout periods; requires companies and auditors to evaluate internal controls and procedures; and establishes a federal crime of securities fraud, among other provisions. Compliance with the requirements of the Sarbanes/Oxley Act will substantially increase our legal and accounting costs. The cost to develop, document and implement the internal control and disclosure procedures required under the Sarbanes/Oxley Act cost the Company approximately $3,000.

Employees

After giving effect to the Merger, the Company currently has 10 employees, of which three employees are executive officers, and the remaining employees are involved in technical support, sales and marketing and clerical and administrative duties. None of the Company employees are represented by a labor organization. We have entered into non-disclosure agreements with our key technicians and certain other employees. We consider our relationship with our employees to be good

Corporate Information

The principal executive office for the Company is located at 77 Hookele Street, Suite 201, Kahului, Hawaii 96732 and its main telephone number is 808-893-2400.

JOBS Act

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”). We will remain an emerging growth company until the earlier of the last day of the fiscal year following the fifth anniversary of the completion of this offering, the last day of the fiscal year in which we have total annual gross revenues of at least $1.0 billion, the date on which we are deemed to be a large accelerated filer (this means that we have been public for at least 12 months, have filed at least one annual report and the market value of Company Common Stock that is held by non-affiliates exceeds $700 million as of the end of the second quarter of that fiscal year), or the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

| 12 |

In addition, the JOBS Act provides that an emerging growth company can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

| Item IA. | Risk Factors. |

You should carefully consider the risks described below together with all of the other information included in this on Form 8-K before making an investment decision with regard to our securities. The statements contained in or incorporated into this Form 8-K that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of Company Common Stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business and Industry

We are a development stage company with a limited operating history that you can use to evaluate us, and the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a small developing company.

FlikMedia was incorporated in Nevada in July 2009 under the name Go Green Directories, Inc., changed its name to Crossbox, Inc. on January 15, 2014 and changed its name to FlikMedia, Inc. on July 7, 2014. Flikdate was incorporated in Delaware in 2012. Except for $1,000,000 received by in January 2014 from various investos and $350,000 in proceeds received from mBloom Fund I, L.P., a Hawaii State sponsored technology fund and other investors, in June 2014 and our U.S. patent, software and other intellectual property assets, neither FlikMedia nor its Flikdate subsidiary have any tangible significant assets or financial resources. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a small developing company starting a new business enterprise and the highly competitive environment in which we will operate. We cannot assure you that our business will be profitable or that we will ever generate sufficient revenues to meet our expenses and support our anticipated activities.

For the period since its inception (November 28, 2012) through June 30, 2014, Flikdate has only generated nominal revenues of less than $100.

We have incurred and expect to continue to incur additional losses.

FlikMedia incurred accumulated net losses of $193,065 from the date of inception (July 29, 2009) to February 29, 2014, and Flikdate incurred accumulated net losses of $3,073,019 from its date of inception (November 28, 2012) to June 30, 2014. We cannot assure you that we can achieve or sustain profitability on a quarterly or annual basis in the future. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. There can be no assurance that future operations will be profitable. Revenues and profits, if any, will depend upon various factors, including whether we will be able to continue expansion of our revenue. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

| 13 |

Our business prospects are difficult to predict because of our extremely limited operating history, early stage of development, unproven business strategy and unproven product. As a development stage company, we face numerous risks and uncertainties in the competitive markets. In particular, we have not proven that we can:

| · | develop our product and service offering in a manner that enables us to be profitable and meet our customers’ requirements; |

| · | raise sufficient capital in the public and/or private markets; or |

| · | respond effectively to competitive pressures. |

If we are unable to accomplish these goals, our business is unlikely to succeed and you should consider our prospects in light of these risks, challenges and uncertainties.

We will require financing to achieve our current business strategy and our inability to obtain such financing could prohibit us from executing our business plan and cause us to slow down our expansion of operations.

We have received essentially no revenues from operations and have limited assets. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our company has a limited operating history and must be considered in the development stage. We may be unable to convince sufficient organizations to continue with us and as a result operate on a profitable basis. We are in the development stage and potential investors should be aware of the difficulties normally encountered by enterprises in the development stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

Due to the lack of positive earnings, we will need to raise additional funds through public or private debt or sale of equity to achieve our current business strategy. Such financing may not be available when needed. Even if such financing is available, it may be on terms that are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences, or other terms. Our capital requirements to implement our business strategy will be significant. We anticipate requiring additional funds in order to significantly expand our operations. No assurance can be given that such funds will be available or, if available, will be on commercially reasonable terms satisfactory to us. There can be no assurance that we will be able to obtain financing if and when it is needed on terms we deem acceptable.

If we are unable to obtain financing on reasonable terms, we could be forced to delay or scale back our plans for expansion. In addition, such inability to obtain financing on reasonable terms could have a material adverse effect on our business, operating results, or financial condition.

If we are unable to establish sales and marketing capabilities we may not be able to generate sales and product revenue.

In order to achieve our strategic goals and generate meaningful profits, we will need to expand our capabilities for the sales, marketing and distribution of our products and services. In addition to hiring additional sales and marketing personnel, we need to develop and maintain strategic relationships with third parties in order for them to market our products and services to schools and other their end users. We expect to face severe competition in this effort to establish strategic relationships from other companies vying for the same type of relationships. Some of these competitors may have a competitive advantage over us due to their size, reputation, relative financial stability or longer operating history. If we are unable to establish such relationships on terms that are favorable to us, or at all, we may not be able to penetrate the market on a scale required to become viable or profitable.

If we are unable to establish sufficient sales and marketing capabilities or enter into and maintain appropriate arrangements with third parties to sell, market and distribute our services, our business will be harmed.

We have limited experience as a company in the sale, marketing and distribution of our products and services. We depend almost entirely to demonstrate our ability to deliver value through customer trials and show enough internet hits on our listings websites resulting from links on our system. To achieve commercial success, we must develop sales and marketing capabilities and enter into and maintain successful arrangements with potential clients and prove our worth to them.

| 14 |

If we are unable to establish and maintain adequate sales, marketing and distribution capabilities, independently or with others, we may not be able to generate product revenue and may not become profitable. If our current or future customers do not receive adequate responses, our ability to achieve our expected revenue growth rate will be harmed.

Our future success is dependent, in part, on the performance and continued service of our officers and directors. Without the continuance of key employees of the Company, we may be forced to interrupt or eventually cease operations.

We are presently dependent to a great extent upon the experience, abilities and continued services of officers and directors of the Company, deemed Key Employees. The loss of their services could have a material adverse effect on our business, financial condition or results of operation.

Our success depends upon our ability to attract and hire key personnel. Our inability to hire qualified individuals will negatively affect our business, and we will not be able to implement or expand our business plan.

Our business is greatly dependent on our ability to attract key personnel. We will need to attract, develop, motivate and retain highly skilled technical employees. Competition for qualified personnel is intense and we may not be able to hire or retain qualified personnel. If we are unable to retain such employees, we will not be able to implement or expand our business plan.

As an internet dating company, we are in an intensely competitive industry and any failure to timely implement our business plan could diminish or suspend our development and possibly cease our operations.

The online dating industry is highly competitive, and has few barriers to entry. We can provide no assurance that additional competitors will not enter into the online dating industry. There are numerous other online dating companies that currently offer similar services, that have established user bases that are significantly larger than ours, and that have access to greater capital. If we are unable to efficiently and effectively institute our business plan as a result of intense competition or a saturated market, we may not be able to continue the development and enhancement of our web site and become profitable.

If we are unable to establish a large user base we may have difficulty attracting advertisers to our web site, which will hinder our ability to generate advertising revenues, which may affect our ability to expand our business operations and our user base.

An integral part of our business plan and marketing strategy requires us to establish a large user base. We will only be able to attract additional advertisers to our web site and possibly begin to generate significant advertising revenues if we can obtain a large enough user base. The number of users necessary to attract advertisers will be determined though discussions with the potential advertisers and their input as to whether we can obtain revenues from advertisements based upon the total members at that time. If for any reason our web site is ineffective at attracting consumers or if we are unable to continue to develop and update our web site to keep consumers satisfied with our service, our user base may decrease and our ability to generate advertising revenues may decline.

| 15 |

We may in the future be subject to intellectual property infringement claims, which are costly to defend, could result in significant damages awards, and could limit out ability to provides certain content or use certain technologies in the future.

Internet, technology, media companies and patent holding companies often possess a significant number of patents. In addition, effective copyright and trademark protection may be unenforceable or limited. Further, many of these companies and other parties are actively developing or purchasing search, indexing, electronic commerce and other Internet-related technologies, as well as a variety of online business models and methods. We believe that these parties will continue to take steps to protect these technologies, including, but not limited to, seeking patent protection. As a result, disputes regarding the ownership of technologies and rights associated with online business are likely to continue to arise in the future.

As we expand our business and develop new technologies, products and services, we may become increasingly subject to intellectual property infringement claims. In the event that there is a determination that we have infringed third-party proprietary rights such as patents, copyrights, trademark rights, trade secret rights or other third party rights such as publicity and privacy rights, we could incur substantial monetary liability, be required to enter into costly royalty or licensing agreements or be prevented from using the rights, which could require us to change our business practices in the future and limit our ability to compete effectively. We may also incur substantial expenses in defending against third-party infringement claims regardless of the merit of such claims. The occurrence of any of these results could harm our brand and negatively impact our operating results.

Failure to maintain or enhance our brand recognition in a cost-effective manner could harm our operating results.

To be successful, we must establish and strengthen the brand awareness of the Go Green brand. We believe that maintaining and enhancing our brand recognition is an important aspect of our efforts to attract and expand our user and advertiser base. We also believe that the importance of brand recognition will increase due to the relatively low barriers to entry in the Internet market. We may not be able to successfully maintain or enhance consumer awareness of our brands and, even if we are successful in our branding efforts, these efforts may not be cost-effective. If we are unable to maintain or enhance customer awareness of our brands in a cost-effective manner, our business, operating results and financial condition could be harmed.

In order to implement our business plan, we will need our users to pay fees for our services, although we currently allow our customers to utilize our services for free. If our users are not willing to pay for these services, we will be forced to suspend and eventually to cease our business activities.

We do not currently charge our members to utilize our services. However, there is an incentive for members to pay for greater continued access to the Flikdate application. Eventually, in order to implement our business plan, we will require our users to pay monthly fees for the use of our services. We cannot guarantee that either our current users or prospective users will be willing to pay for our services. If we are unable to generate sufficient revenues from our user fees, we will be forced to suspend and possible cease all operations.

Our market is characterized by rapid technological change, and if we fail to develop and market new technologies rapidly, we may not become profitable in the future.

The internet and the online commerce industry are characterized by rapid technological change that could render our existing web site obsolete. The development of our web site entails significant technical and business risks. We can give no assurance that we will successfully use new technologies effectively or adapt our web site to customer requirements or needs. If our management is unable, for technical, legal, financial, or other reasons, to adapt in a timely manner in response to changing market conditions or customer requirements, we may never become profitable which may result in the loss of all or part of your investment.

| 16 |

Adverse changes in general economic or political conditions in any of the countries in which we do business or intend to launch our products could adversely affect our operating results.

If we grow our business to customers located in the United States as well as customers located outside of the United States as we intend, we expect to become subject to the risks arising from adverse changes in domestic economic and political conditions. For example, the direction and relative strength of the United States economy remains uncertain and has and may in the future adversely affect the disposable income of households as it relates to the amount of money spent by each individual on entertainment, such as dating websites. In addition, difficulties in the financial services sector and credit markets and continuing geopolitical uncertainties may adversely affect our ability to access capital. This could result in a reduction in sales of our service or in a reduction in the growth of our product service revenues. Any of these events would likely harm investors view of our business, our results of operations and financial condition.

Litigation may adversely affect our business, financial condition and results of operations.

From time to time in the normal course of our business operations, we may become subject to litigation that may result in liability material to our financial statements as a whole or may negatively affect our operating results if changes to our business operation are required. The cost to defend such litigation may be significant and may require a diversion of our resources. There also may be adverse publicity associated with litigation that could negatively affect customer perception of our business, regardless of whether the allegations are valid or whether we are ultimately found liable. As a result, litigation may adversely affect our business, financial condition and results of operations.

We will incur significant increased costs as a public company and our management will be required to devote substantial time to new compliance initiatives.

As a public company, we will incur significant legal, accounting and other expenses that we would not incur if we were a private company. SEC rules and regulations impose heightened requirements on public companies, including requiring changes in corporate governance practices. Our management and other personnel will devote a substantial amount of time to these compliance initiatives. We may also need to hire additional finance and administrative personnel to support our compliance requirements. Moreover, these rules and regulations will increase our legal and financial costs and make some activities more time-consuming.

In addition, as described above, we will be required to maintain effective internal controls over financial reporting and disclosure controls and procedures pursuant to the Sarbanes-Oxley Act. Our testing, and the subsequent testing by our independent registered public accounting firm, may reveal deficiencies or material weaknesses in our internal controls over financial reporting. Our compliance with Section 404 of the Sarbanes-Oxley Act will require that we incur substantial accounting expense and expend significant management effort. We currently do not have an internal audit group and we may need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge. If we are not able to comply with the requirements of Section 404 in a timely manner, or if we or our independent registered public accounting firm identifies deficiencies or material weaknesses in our internal controls over financial reporting, the market price of our securities could decline and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

We are subject to SEC reporting requirements and we do not have significant SEC reporting experience.

We currently do not have a clear process, schedule, segregation of duties or review with respect to the SEC reporting process. In addition, we do not have significant experience with or knowledge about the Sarbanes-Oxley Act. The Company is committed to remedying this deficiency and weakness and plans to implement certain remedial measures, including hiring a comptroller or other finance personnel with SEC reporting experience, providing additional training to our accounting personnel on the requirements of SEC reporting requirements to increase their familiarity with those standards, and reassessing our existing finance and accounting policies and procedures.

| 17 |

Risk Relating to Our Common Stock.

There is presently no market for Company Common Stock. Any failure to develop or maintain a trading market could negatively affect the value of our shares and make it difficult or impossible for you to sell your shares.

Prior to this offering, there has been no public market for Company Common Stock and a public market for Company Common Stock may not develop upon completion of this offering. While we will attempt to have Company Common Stock quoted on the OTCBB we will have to seek market-makers to provide quotations for the common stock and it is possible that no market-maker will want to provide such quotations. Failure to develop or maintain an active trading market could negatively affect the value of our shares and make it difficult for you to sell your shares or recover any part of your investment in us. Even if a market for Company Common Stock does develop, the market price of Company Common Stock may be highly volatile. In addition to the uncertainties relating to our future operating performance and the profitability of our operations, factors such as variations in our interim financial results, or various, as yet unpredictable factors, many of which are beyond our control, may have a negative effect on the market price of Company Common Stock.

Even if Company Common Stock is quoted on the OTCBB under a symbol, that service provides a limited trading market. Accordingly, there can be no assurance as to the liquidity of any markets that may develop for Company Common Stock, the ability of holders of Company Common Stock to sell Company Common Stock, or the prices at which holders may be able to sell Company Common Stock.

Should our stock become listed on the OTCBB or if we fail to remain current on our reporting requirements, we could be removed from the OTCBB which would limited the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market.

Companies trading on the OTCBB, as we seek to become, must be reporting issuers under Section 12 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) and must be current in their reports under Section 13 in order to maintain price quotation privileges on the OTCBB service. If we fail to remain current on our reporting requirements, we could be removed from the listings and down-graded. As a result, the market liquidity for our securities could be severely adversely affected by limiting the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market. In addition, we may be unable to get re-listed on the OTCBB, which may have an adverse material effect on our Company.

Our stock is categorized as a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations which may limit a shareholder’s ability to buy and sell our stock.

Our stock is categorized as a “penny stock”. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of Company Common Stock.

| 18 |

FINRA sales practice requirements may also limit a shareholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy Company Common Stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

We expect to experience volatility in our stock price, which could negatively affect shareholders’ investments.

The market price for shares of Company Common Stock may be volatile and may fluctuate based upon a number of factors, including, without limitation, business performance, news announcements or changes in general market conditions.

To date, we have not paid any cash dividends and no cash dividends will be paid in the foreseeable future.

We do not anticipate paying cash dividends on Company Common Stock in the foreseeable future and we may not have sufficient funds legally available to pay dividends. Even if the funds are legally available for distribution, we may nevertheless decide not to pay any dividends. We presently intend to retain all earnings for our operations.

| Item 2. | Financial Information. |

See Item 13 and Item 9.01 of this Form 8-K.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

Flikdate has developed a software application to enable men and women to engage in live video social “dating” interaction on their mobile phones. The technology permits users to go on a virtual date and quickly skip - or “flik” in the parliance of the application – between multiple users. . The “Flikdate” concept is introduced in a speed dating format through the use of a users mobile phone in which users will have the ability to meet and talk to other users through Flikdate’s proprietary digital and mobile software.

| 19 |

Plan of Operations

We intend to generate revenue from a patented technology which bills users per duration of each video session. We have no revenues to date and will require additional working capital to implement a marketing strategy for our Flikdate application, which will include application store promotions, YouTube and other video sites, strategic partnerships with other dating networks such as Match.com, and eHarmony to allow their subscribers to communicate by mobile phone

Basic Presentation

These financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States.

Note 2- Nature of Significant Accounting Policies

Critical Accounting Policies and Estimates

Our management’s discussion and analysis of our financial condition and results of operations are based on our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements as well as the reported net sales and expenses during the reporting periods. On an ongoing basis, we evaluate our estimates and assumptions. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

While our significant accounting policies are more fully described in Note 2 to our consolidated financial statements appearing at Exhibits 99.1 and 99.2, we believe that the following accounting policies are the most critical to aid you in fully understanding and evaluating this management discussion and analysis:

Cash and Cash Equivalents

The Company considers all highly liquid debt instruments purchased with maturity of three months or less to be cash equivalents.

Use of Estimates

The preparation of the Company’s financial statements requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from these estimates.

Fair Value of Financial Instruments

The Company’s short-term financial instruments consist of cash and cash equivalents and accounts payable. The carrying amounts of these financial instruments approximate fair value because of their short-term maturities. The Company does not hold or issue financial instruments for trading purposes nor does it hold or issue interest rate or leveraged derivative financial instruments.

Income Taxes

The Company uses the asset and liability method of accounting for income taxes. This method requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the carrying amounts and the tax basis of certain assets and liabilities. Deferred income tax assets and liabilities are computed annually for the difference between the financial statement and tax bases of assets and liabilities that will result in taxable or deductible amounts in the future, based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is the tax payable or refundable for the period, plus or minus the change during the period in deferred tax assets and liabilities.

| 20 |

Deferred income taxes may arise from temporary differences resulting from income and expense items reported for financial accounting and tax purposes in different periods. Deferred taxes are classified as current or non-current, depending on the classification of the assets and liabilities to which they relate. Deferred taxes arising from temporary differences that are not related to an asset or liability are classified as current or non-current depending on the periods in which the temporary differences are expected to reverse. As of February 28, 2014, the Company has recorded a valuation allowance to fully offset the deferred tax asset related to its cumulative net operating losses of $193,065.

Earnings (Loss) per Share

Basic Earnings per Share (“EPS”) is computed by dividing net income available to common stockholders by the weighted average number of common stock shares outstanding during the year. Diluted EPS is computed by dividing net income available to common stockholders by the weighted-average number of common stock shares outstanding during the year plus potential dilutive instruments such as stock options and warrants. Basic and diluted EPS are the same for the Company, as of February 28, 2014, as the Company does not have any common share equivalents outstanding.

Results of Operations

Six Months Ended June 30, 2014 Compared to Six Months Ended June 30, 2013

Revenues Revenues for the six month period ended June 30, 2014 were $67.00 and -0- for the six month period ended June 30, 2013.

Operating Expenses Operating expenses for the six months ended June 30, 2014 were $2,827,734, as compared to $40,247for the comparative six month period ended June 30, 2013. The increase was mainly due to an increase in research and development expenses ($135,556 vs. $21,900) and general and administrative expenses ($2,679,138 vs. $11,841) resulting from the hiring of additional technical and administrative personnel.

Net Loss For the six months ended June 30, 2013, Flikdate incurred a net loss of $2,828,888 as compared to a net loss of $41,594 for the comparable six month period ended June 30, 2014. The increase was primarily due to a substantial increase in operating expenses which was not offset by any increase in revenues.

Period of Inception (November 28, 2012) through Fiscal Year Ended December 31, 2013.

Revenues Revenues from inception to December 31, 2013 were $28.00.

Operating Expenses Operating expenses from inception to December 31, 2013 were $233,163, consisting primarily of research and development expenses ($144,005) and general and administrative expenses ($69,651).

Net Loss From inception to December 31, 2013, Flikdate incurred a net loss of $244,131.

Liquidity and Capital Resources

Flikdate has been financed primarily through approximately $3,500,000 of capital contributions provided by its former principal stockholders or their affiliates who are now principal stockholders of Crossbox. Of such amount, approximately, $350,000 was in the form of convertible notes sold by Flikdate to five accredited investors, including an affiliate of the Company’s principal stockholder. All of these notes were subsequently converted into shares of Flikdate common stock prior to consummation of the Merger.

| 21 |

On May 23, 2014, at the request of Flikdate, the Company made a $325,000 loan to Social Technology Holdings, Inc., evidenced by a 45 day 6% note of the borrower secured by a lien on the assets of the borrower. A third party company agreed to purchase the note from the Company for the principal amount plus accrued interest, in the event that the borrower has not repaid the loan by the maturity date.

In order to achieve its business goals and marketing strategy, the Company will be required to raise significant additional capital. There can be no assurance that the Company will be able to raise any additional capital, or otherwise raise capital on terms that are acceptable to the Company and beneficial to its stockholders

Contractual Obligations and Off-Balance Sheet Arrangements

Contractual Obligations The Company has no contractual obligations that are required to be disclosed on its balance sheet.

Off-Balance Sheet Arrangements

We have not entered into any other financial guarantees or other commitments to guarantee the payment obligations of any third parties. We have not entered into any derivative contracts that are indexed to our shares and classified as shareholder’s equity or that are not reflected in our consolidated financial statements. Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity. We do not have any variable interest in any unconsolidated entity that provides financing, liquidity, market risk or credit support to us or engages in leasing, hedging or research and development services with us.

Recent Accounting Pronouncements

In June 2013, the FASB issued FASB ASC 105, Generally Accepted Accounting Principles, which establishes the FASB Accounting Standards Codification as the sole source of authoritative generally accepted accounting principles. Pursuant to the provisions of FASB ASC 105, we have updated references to GAAP in our financial statements. The adoption of FASB ASC 105 did not impact the Company's financial position or results of operations.