Attached files

| file | filename |

|---|---|

| 8-K - MAXIMUS, INC. 8-K - MAXIMUS, INC. | a50922715.htm |

| EX-99.1 - EXHIBIT 99.1 - MAXIMUS, INC. | a50922715ex99_1.htm |

Exhibit 99.2

Operator: Greetings, and welcome to the MAXIMUS Fiscal 2014 Third Quarter Conference Call.

At this time, all participants are in a listen only mode.

A brief question and answer session will follow the formal presentation.

If anyone should require operator assistance during the conference, please press star, zero on your telephone keypad.

As a reminder, this conference is being recorded.

I would now like to turn the conference over to your host, Lisa Miles, Senior Vice President of Investor Relations.

Thank you. You may begin.

Ms. Lisa Miles: Good morning, and thanks for joining us on today's call.

I'd like to remind everyone that we've posted a presentation on our website on the Investor Relations page to assist you in following along with the call.

With me today is Rich Montoni, Chief Executive Officer, Bruce Caswell, President, and Rick Nadeau, our new Chief Financial Officer.

Rick comes to MAXIMUS from SRA International. He brings more than ten years of public company experience. Previously, Rick spent more than 30 years in public accounting and was previously a partner with KPMG, where he was the lead engagement and audit partner for several large government and commercial firms.

Before we begin, I'd like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions and actual events and results may differ materially as a result of risks we face, including those disclosed in Exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC.

|

Fiscal Year 2014 Third Quarter Earnings Call |

08/07/14 - 9:00 a.m. ET - 1 |

The company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Today's presentation may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results and providing meaningful period to period comparisons.

For a reconciliation of non-GAAP measures presented in this document, please see the company's most recent quarterly earnings press release.

And with that, I'll turn the call over to Rick.

Mr. Rick Nadeau: Thanks, Lisa, and good morning, everyone.

It is a pleasure to join you for today's earnings call. MAXIMUS has a talented and dedicated team, and I am really happy to be a part of it. I look forward to getting to know our analysts and shareholders, which includes reconnecting with some familiar faces who I know from my previous companies.

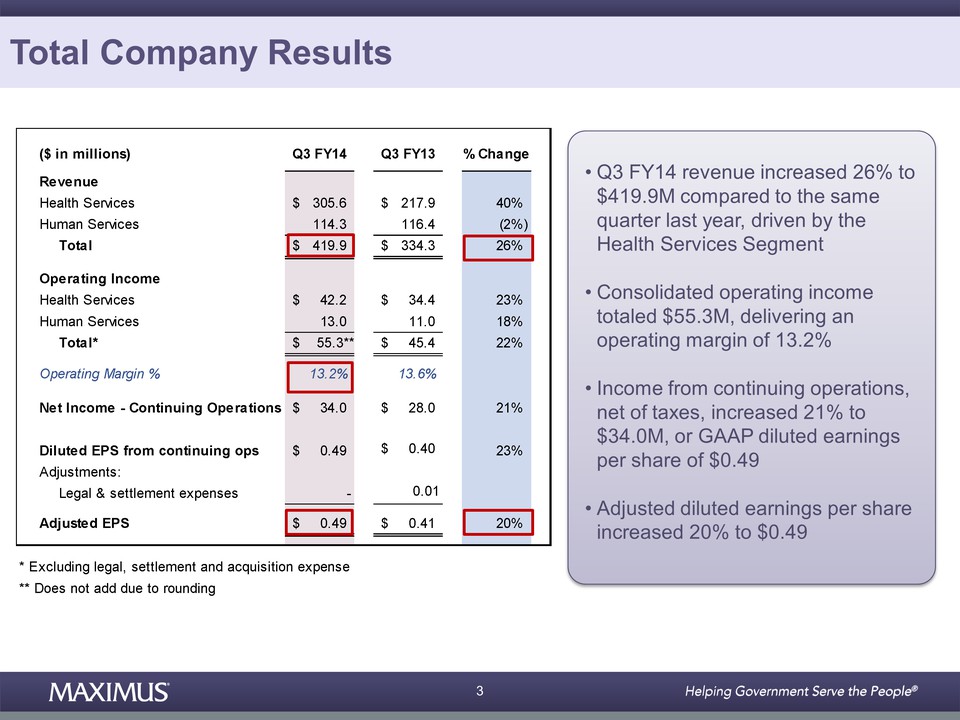

Let's dive into the results for the quarter. Compared to last year, third quarter revenue increased 26 percent to $419.9 million driven by the health services segment.

Consolidated operating income for the third quarter was strong and totaled $55.3 million. And the company delivered an operating margin of 13.2 percent, which was largely in line with our expectations.

For the third quarter, income from continuing operations net of taxes increased 21 percent to $34 million compared to $28 million reported last year. And adjusted diluted earnings per share for the third quarter also increased 20 percent to 49 cents compared to 41 cents reported in the prior year period.

|

Fiscal Year 2014 Third Quarter Earnings Call |

08/07/14 - 9:00 a.m. ET - 2 |

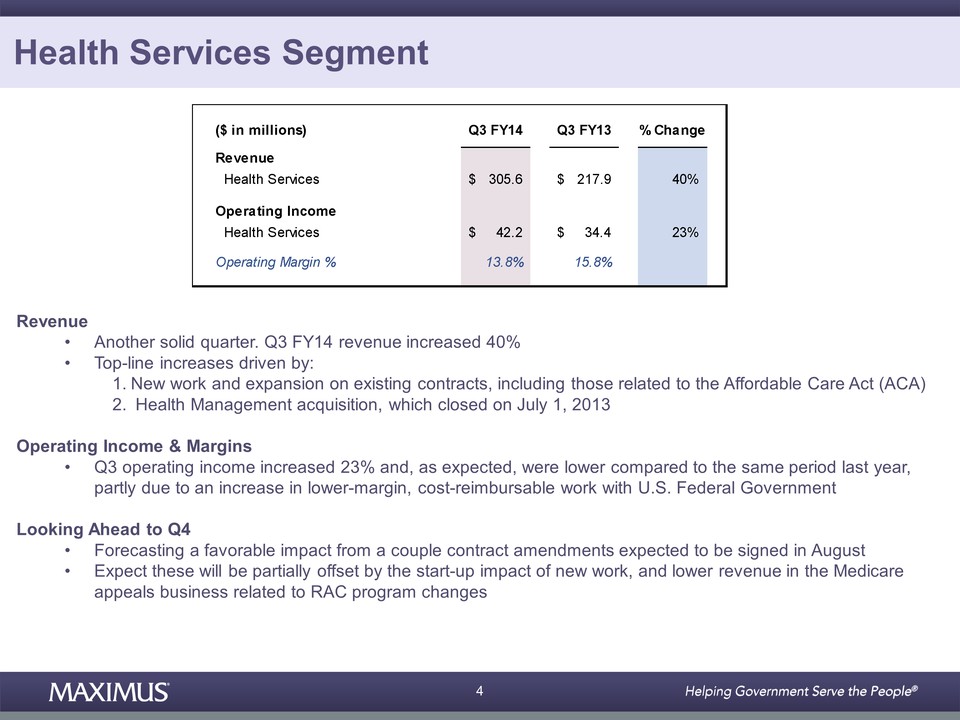

Let's jump into results by segment, starting with health services. As we expected, the health services segment delivered another solid quarter of financial results. Revenue for the third quarter increased 40 percent to $305.6 million compared to the same period last year.

Top line increases were driven by new work and expansion on existing contracts including those contracts related to the ongoing support of the Affordable Care Act and the Health Management Limited acquisition, which closed on July 1, 2013.

Segment operating income in the third quarter of fiscal 2014 increased 23 percent compared to the same period last year and totaled $42.4 million with an operating margin of 13.8 percent.

As expected, operating margins for the health services segment were lower compared to the same period last year due in part to an increase in lower margin cost reimbursable work with the US federal government.

Looking ahead to Q4, we are presenting forecasting a favorable impact from a couple of contract amendments that are expected to be signed in August. However, we expect that these will be partially offset by the startup impact of new work as well as ongoing softness in our Medicare appeals business related to the RAC program changes.

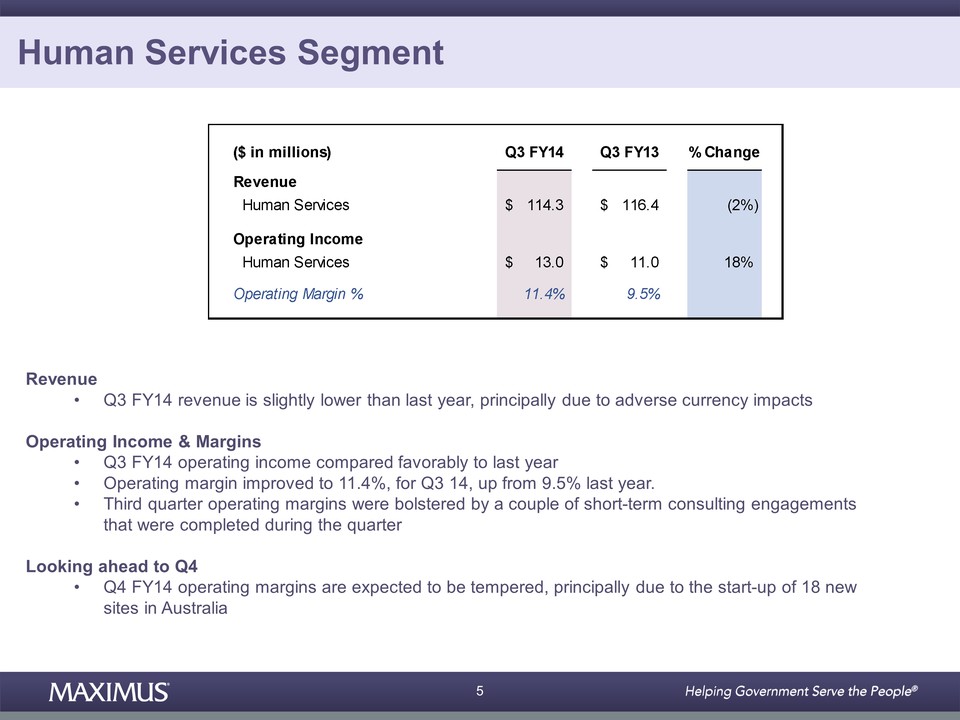

Let's now turn our attention to financial results for human services. For the third fiscal quarter, revenue for the human services segment totaled $114.3 million, which was slightly lower compared to the prior year, principally due to adverse currency impacts.

Third quarter operating income for the human services segment totaled $13 million, which compares favorably to $11 million reported last year. The human services segment operating margin improved to 11.4 percent for the third quarter, up from 9.5 percent a year ago.

|

Fiscal Year 2014 Third Quarter Earnings Call |

08/07/14 - 9:00 a.m. ET - 3 |

In the third quarter of fiscal 2014, the segment's margin was bolstered by a couple of short term consulting engagements that were completed during the quarter.

In addition to this uplift not recurring in the fourth quarter, Q4 margins are also expected to be tempered, principally due to the startup of 18 new sites in Australia. As a reminder, are very pleased to have recently won a sizeable reallocation of work in Australia as a result of our continued solid performance.

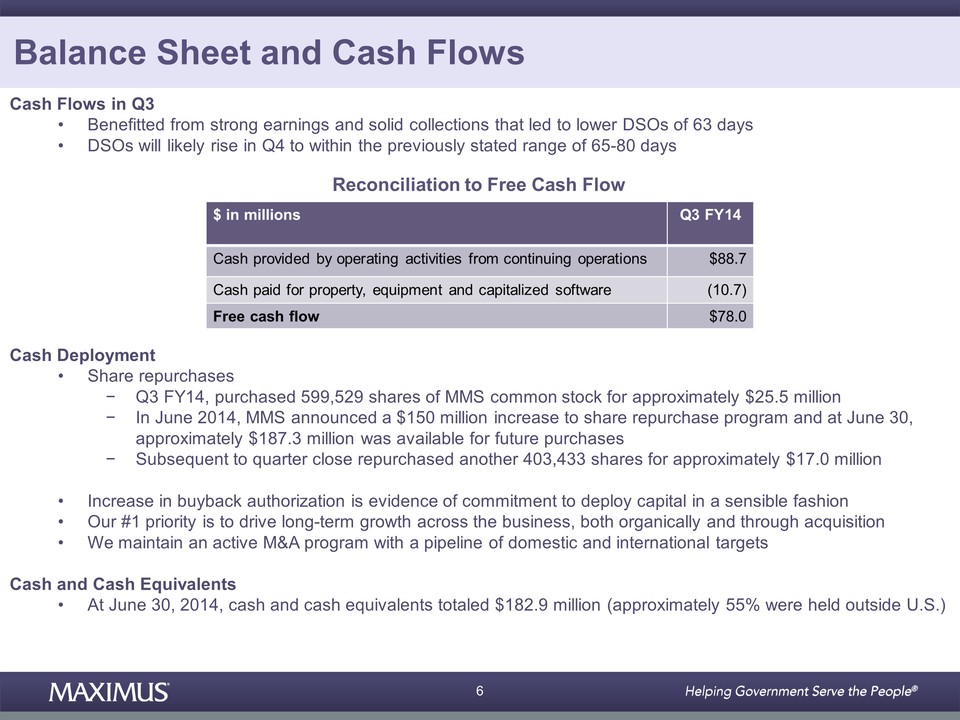

Let's move on to cash flow and balance sheet items. Cash flow in the quarter benefited from strong earnings delivery as well as solid collections that led to lower DSOs of 63 days.

While we are pleased with this very solid delivery, we presently anticipate that DSOs will likely rise in the fourth quarter to within the company's previously stated range of 65 to 80 days due to normal working capital fluctuations.

For the third quarter of fiscal 2014, cash provided by operating activities from continuing operations totaled $88.7 million, and free cash flow was $78.0 million. As a reminder, free cash flow is defined as cash provided by operating activities from continuing operations less property and equipment purchases and expenditures for capitalized software.

During the third quarter, we purchased 599,529 shares of MAXIMUS common stock for approximately $25.5 million under our board authorized program. In June, MAXIMUS announced a $150 million increase to our share repurchase program. As a result, we had approximately $187.3 million available for future repurchases at June 30th.

|

Fiscal Year 2014 Third Quarter Earnings Call |

08/07/14 - 9:00 a.m. ET - 4 |

Subsequent to quarter close and through July 31st, we continued the execution of our opportunistic share buybacks, repurchasing another 403,433 shares for a total of approximately $17.0 million.

The increase in the buyback authorization is evidence of our ongoing commitment to deploy capital in a sensible fashion.

We actively review and prioritize our capital needs on an ongoing basis. The bottom line is that our number one priority is to drive long term growth across the business, both organically and through acquisition.

As the company has discussed in prior quarters, we do maintain an active M&A program that has a pipeline of domestic and international targets.

At June 30th, we had $182.9 million in cash and cash equivalents of which approximately 55 percent were held outside the United States.

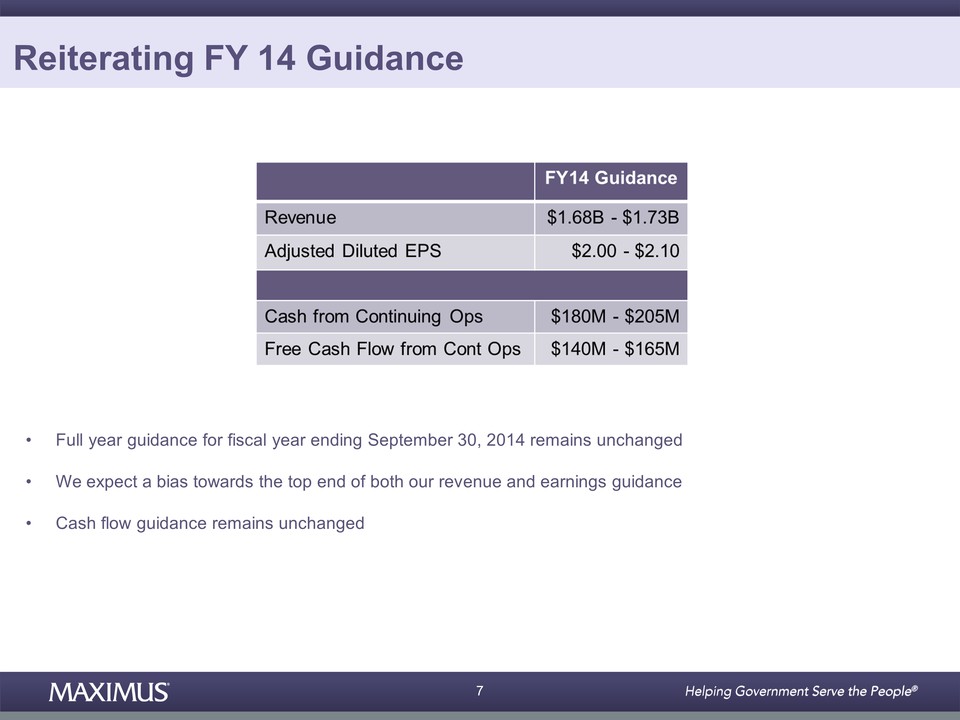

And lastly, our full year guidance for the fiscal year ending September 30th, 2014 remains unchanged. We continue to expect revenue in fiscal 2014 to range between $1.68 billion and $1.73 billion. And we expect earnings per diluted share from continuing operations to range between $2 and $2.10. We expect a bias toward the top end of both our revenue and earnings guidance.

We are also reiterating our cash flow guidance for fiscal 2014.

Thanks for joining us this morning, and now I'll turn the call over to Rich.

Mr. Rich Montoni: Good morning, and thank you, Rick. Welcome to your first earnings call as Chief Financial Officer and Treasurer of MAXIMUS, Inc. It's great to have you on board.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 5 |

Just last week, we announced the appointment of Bruce Caswell as the Company's President effective at the start of the new fiscal year on October 1st.

In effect, we're splitting the role of CEO and President. In his new role, Bruce will be responsible for the operational execution and organic growth of the company across both segments. Bruce will also continue to lead our global health operations as the President of the Health Services Segment.

This well deserved appointment recognizes Bruce's accomplishments during his ten years with MAXIMUS. His stewardship of the health segment has been a key element to the overall strategy and extraordinary growth that we've experienced.

Going forward, I will continue in my role as CEO with a primary focus on the company's strategic vision in long term growth objectives. Much of my time will be spent directing our acquisition program and continuing to interface with shareholders.

It's been a pleasure teaming with Bruce, Rick and all the members of the management team, and I'm excited to work with them as we go forward.

With another solid quarter under our belt, I'd like to start out this morning with an update on our global operations where we have several new contracts in implementation mode.

Last Friday we successfully launched operations on schedule for our new debt management contract with the US Department of Education. MAXIMUS is helping administer a portfolio of approximately 5 million borrowers whose student loans are in default status.

Our operations include an in-bound customer contact center and correspondence unit, a financial transaction processing center and a mail fulfillment center. We executed a seamless transition and are now focused on providing high quality service to this new federal client.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 6 |

Also last week we began implementation on the new health and work service contract in the United Kingdom. To recap, the Department for Work and Pensions selected our Health Management subsidiary to operate the new Health and Work Service Program.

The 63 month contract is expected to have a total contract value of up to approximately $226 million. While we've anticipated an initial startup loss due to the nature of the contract, the overall program economics are favorable. Once ramped, the contract is in line with our targeted range of portfolio operating margin performance.

The goal of the Health and Work Service Program is to get employees of small and mid size businesses with extended absences due to illness on a path back to employment. Our team of clinicians will help employees manage their medical conditions more effectively.

They will do this by providing timely access to clinical service for non-emergency care, identifying the factors preventing the employee from returning to work, and then recommending a return to work plan.

This strategic win further validates the Health Management acquisition last year as we continue to grow in this important market. The strong brand and financial position of MAXIMUS coupled with the highly regarded clinical expertise of Health Management really helps solidify our position in this bid.

The activities are right in the sweet spot of Health Management's offerings and a tremendous opportunity to demonstrate our expertise in the occupational health market for a large government program. The team is hard at work on mobilization, and we are pleased to expand our relationship with DWP by providing services in this new area.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 7 |

And finally, as we mentioned last quarter, we are expanding our Australia operations with reallocated work under the Job Services Australia Program known as JSA. As a result of our strong performance under the Star Rating Program, we picked up 18 new sites. This increases our case load by approximately 15 percent to more than 100,000 job seekers and provides approximately $15 million in new annual revenue

This expanded scope of work is a reflection of our continued solid performance under the Government's Star Rating Program. This is important as we prepare for the upcoming rebid of the JSA contract. As I've discussed in the past, this client places a great reliance on performance.

The Australian model is very much a pay for performance program where the government pays for the outcomes that matter to them. In this case, it's helping people transition off benefits and into employment.

As a reminder, the rebid is not expected to be a “winner takes all” type of award. Based on past procurements, the awards are done on a location by location basis. We are tracking the rebid closely and it's expected to be released in the next few months.

Looking to the future, we have continued optimism for the remainder of fiscal 2014 and beyond. We see opportunities internationally as well as in the United States.

We anticipate that future international growth may come from new countries that are increasing their propensity to outsource as well as current geographies with expanded needs.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 8 |

For example, in Australia, we see substantive opportunities for growth, but the exact timing is not precisely known at this time. It's important to recognize that we remain a top performer in our performance based markets, which is a key differentiator as we see more privatization efforts underway into new and existing markets.

In the United States, we believe future opportunities will continue to come from supporting our clients with the ongoing implementation and stabilization of the Affordable Care Act. Our work covers our customer contact centers for the exchanges, our eligibility appeals operations for the federal marketplace in our support for our state Medicaid clients as they adapt their programs to meet the new requirements.

Starting with our state and federal customer contact centers, we are gearing up for the next open enrollment period, which is currently scheduled to run from November 15, 2014 to February 15, 2015. Our operations will adapt to a dynamic environment as states in the federal government supply the lessons learned from the first open enrollment.

You may recall that MAXIMUS benefited from additional ACA and Medicaid related work that helped bolster fiscal 2014. Based on our experience with operating other health programs, we believe that while some of this additional work will abate, most of it will continue into fiscal 2015 and beyond. In addition, we've identified and are pursuing new ACA related opportunities.

As a reminder, enrollment through the health insurance exchanges is not expected to reach a steady state until 2017 or even 2018. In the meantime, our flexible, scalable resourcing models allow us to meet the current demand for consumer assistance.

In addition, we also continue to manage the eligibility appeals process for the federal marketplace.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 9 |

And finally, I've also spoken previously about how we've benefited from new work as our state Medicaid clients adapt their program operations to meet the requirements of the Affordable Care Act. These include new rules for determining eligibility based on modified adjusted gross income--this is also known as MAGI--dealing with the “no wrong door” provisions of ACA that require states to seamlessly pass applications among multiple entities, addressing inconsistencies in backlogs and applications and implementing variations on Medicaid expansion based on waivers received.

Our work this summer has remained robust as we help our clients prepare for the next enrollment period, and in some cases, launch these new initiatives. We're actively engaged in new service opportunities and still developing others.

As the leading operator of contact centers for state based exchanges, we remain well positioned for when some states decide to transition from the federal marketplace and establish their own exchanges.

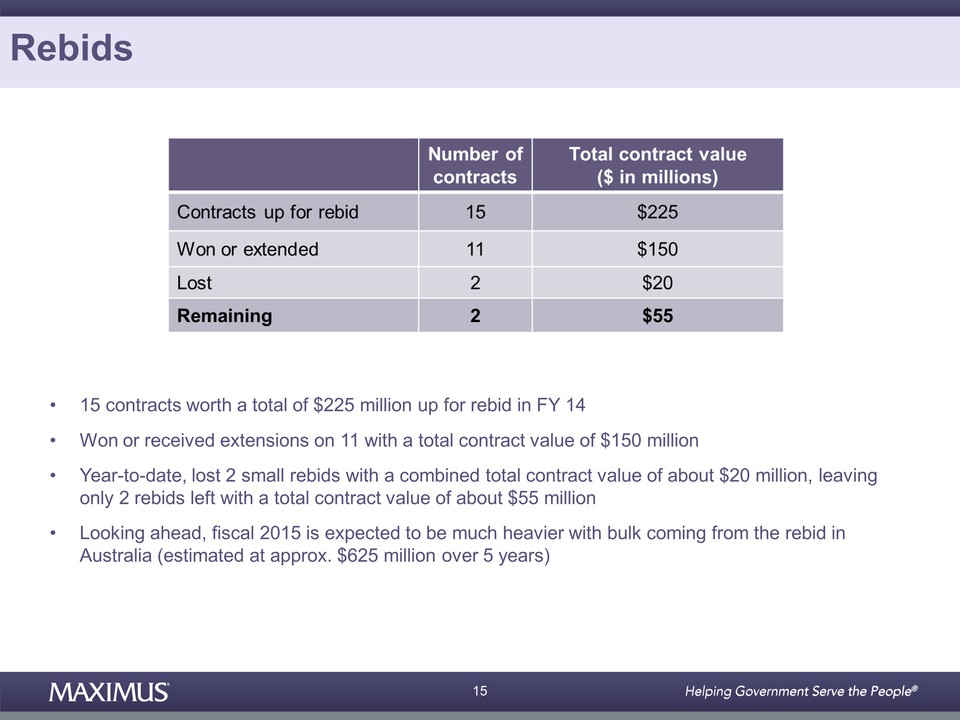

Moving now into rebids, of the 15 contracts with a total contract value $225 up for rebid in fiscal 2014, we've won or received extensions on 11 with a total contract value of $150 million. Year-to-date, we've lost two small rebids with a combined total contract value of about $20 million. That leaves only two rebids left with a total contract value of about $55 million.

As we've mentioned on previous calls, fiscal 2014 was a light year for rebids. Looking ahead, we expect fiscal 2015 to be much heavier with the bulk coming from the JSA rebid in Australia, which is presently estimated to be approximately $625 million over five years.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 10 |

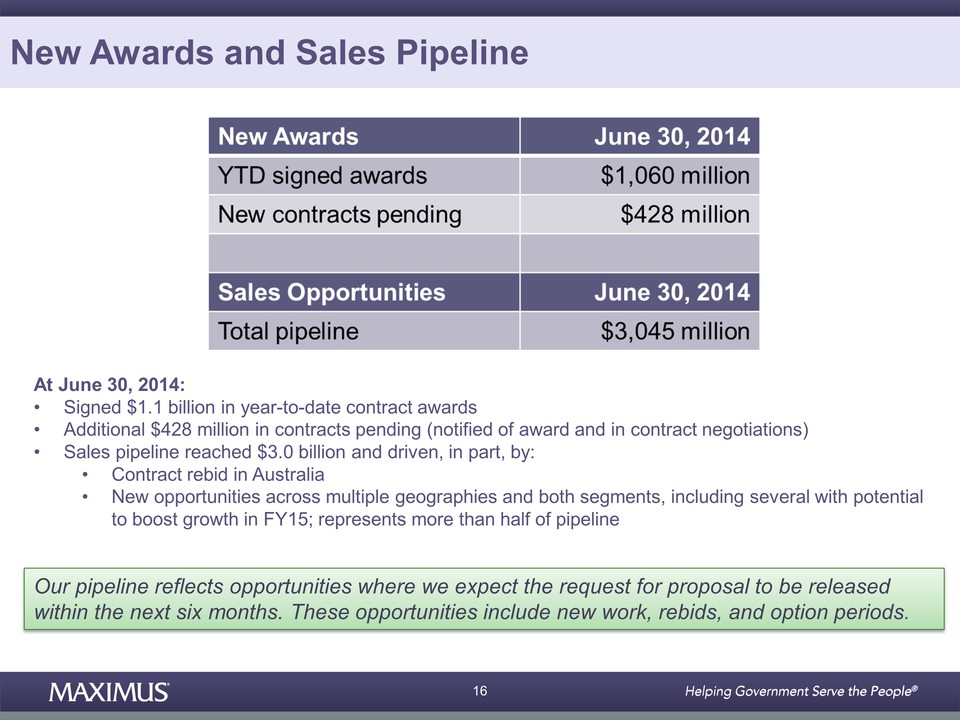

Wrapping up with our new sales awards in the pipeline, we are pleased with our year-to-date sales. For the third quarter of fiscal 2014, year-to-date signed awards were $1.1 billion. Ended June 30th, 2014, we had an additional $428 million in new contracts pending where we've been notified of award and are in contract negotiations. This compares to $1.3 billion in signed awards and $413 million in contracts pending at the same time last year.

We are also excited about our sales pipeline, which reached $3 billion at June 30th, 2014. The increase in the pipeline was driven in part by the contract rebid in Australia as well as new opportunities across multiple geographies in both segments including several key opportunities that have the potential to boost growth in fiscal 2015.

I'm very pleased with the composition of the pipeline, and in fact, more than half of the $3 billion is tied to new opportunities. We see this robust pipeline as confirmation of ongoing demand for business process outsourcing services for government programs.

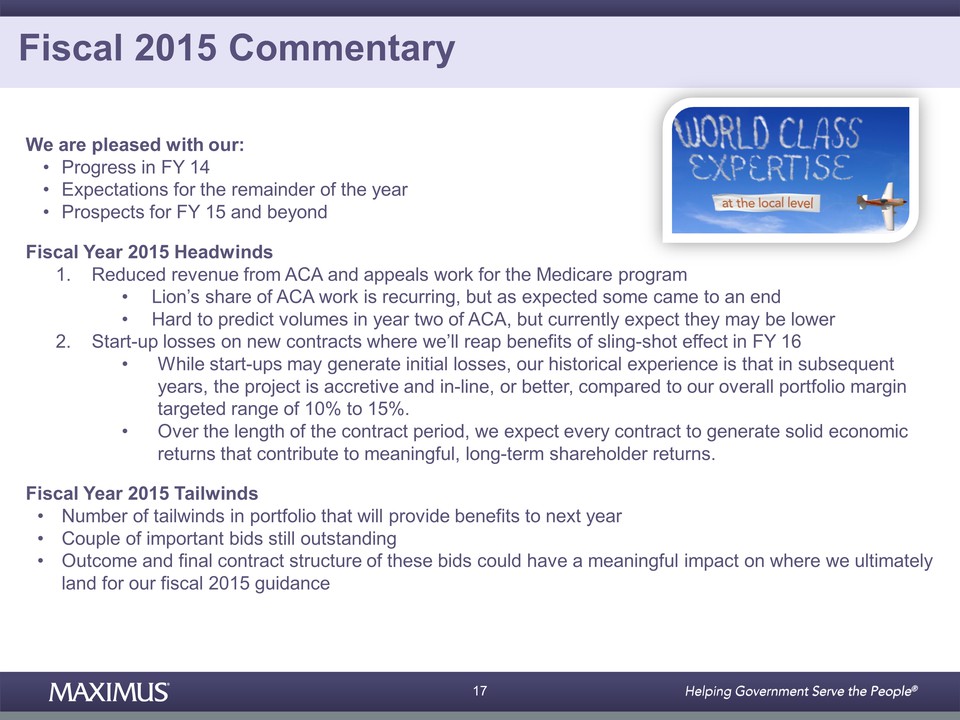

To conclude, we are pleased with our progress in fiscal '14, pleased with our expectations for the remainder of the year and pleased with our prospects for fiscal '15 and beyond.

While it's premature to provide a more detailed outlook into next year, let me provide some color on how fiscal '15 is shaping up. Coming into any fiscal year, we always have headwinds and tailwinds to consider. This is true today as we are in the process of planning fiscal '15. In fact, we have many dynamics and have communicated what we believe to be the major headwinds next year.

This includes reduced revenue from the Affordable Care Act in our appeals work for the Medicare program. While the lion's share of the ACA work is recurring, we do have some work that, as expected, came to an end. In addition, it's hard to predict how volumes will shape up in year two of ACA, but our current expectation is that volumes may be lower.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 11 |

Also, we have startup losses on several new contracts where we will reap the benefits of the slingshot effect in fiscal 2016.

And while startups may generate initial losses, our historical experience is that, in subsequent years, the project is accretive and in line or even better compared to our overall portfolio margin targeted range of 10 to 15 percent.

Over the length of the contract period, we expect every contract to generate solid economic returns that contribute to meaningful long term shareholder returns.

We also have a number of tailwinds in the portfolio that will provide benefits to next year, and we have a couple of important bids that are still outstanding. The outcome and final contract structure of these bids could have a meaningful impact on where we ultimately land for our fiscal 2015 guidance.

So, based on what we know today, we are confident that fiscal 2015 is shaping up to be a growth year both on the top and bottom lines.

We are currently conducting our annual planning process, and we will provide formal guidance in November. Be assured that, as we have accomplished in the past, the management team remains focused on the dynamics that best position MAXIMUS for future multi-year growth.

As I mentioned last quarter, we've consistently said that, over the long term, we believe we can grow revenue and earnings by 10 percent year in and year out. We recognize that there will be years of accelerated growth and years where overall growth may be tempered by timing of startups, rebids or government procurement cycles.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 12 |

Across our current geographies, we see more privatization efforts and expanded outsourcing markets. Global governments continue to advance reform efforts to manage complex social benefit programs.

We see common themes emerging that include a focus on eligibility validation and verification as well as a trend to help individuals move away from welfare dependency to get back to work and to contribute to their local economy.

As a trusted partner, MAXIMUS looks forward to continuing to provide clients with innovative, flexible and scalable ways to reform their social programs and achieve the outcomes that matter.

In summary, we still see confirming data points for increasing demand for our services over the long term. These demand trends tend to be decades long in nature and what we sell this year becomes the growth drivers for years to come.

Now, let's open it up for questions. Operator?

Operator: Thank you.

We will now be conducting a question and answer session.

If you would like to ask a question, please press star, one on your telephone keypad. A confirmation tone will indicate your line is in the question queue.

You may press star, two if you would like to remove your question from the queue.

For participants using speaker equipment, it may be necessary to pick up your handset before pressing the star keys.

One moment please while we poll for questions.

Our first question comes from Charlie Strauzer with CJS Securities. Please proceed.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 13 |

Mr. Charlie Strauzer: Hi, good morning.

Mr. Rich Montoni: Good morning, Charlie.

Mr. Charlie Strauzer: Rick, welcome aboard.

Mr. Rick Nadeau: Thank you. Pleased to be here--.

Mr. Charlie Strauzer: --And, two questions for you if I could - first is I know you kind of touched upon the non-reoccurring nature of some of the ACA work next year, and I was just wondering if you could maybe expand or maybe help quantify, you know, what you think the range might be in terms of the, the revenue impact from that.

And then, secondly, can you also give us a sense of, when you look at the pipeline and the startup expenses related to potentially winning some of these large new contracts, help us frame a little bit more about, the potential impact from those startup costs a little bit more there, too. Thanks.

Mr. Rich Montoni: Okay, Charlie. Let me give it a go.

As it relates to your first question regarding, the impact of the Affordable Care Act and the non-reoccurring aspects of it, you know, certainly, we're all focused on the Affordable Care Act, and certainly, that act can, has been and continues to be an excellent long term growth driver for MAXIMUS. And we're all anxious to talk specific as to the impact in fiscal '15.

However, just given where we are at this time, it's not appropriate for us to quantify the details. But, let me share some thoughts with you to frame it - first off, we do expect that most, underline most of the Affordable Care Act we've performed in year one, we expect most of it will recur.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 14 |

We expect a portion, a smaller portion will abate. How much abate really depends on several factors, as you know. It will depend upon the volumes, it'll depend upon technology readiness, on the state and federal health insurance exchanges, it will depend upon churn, it will depend upon, how life events, impact, the process and so on.

We're working with our clients to prepare and finalize individual service plans and, we will know much more in the coming months. But, at the same time, we're also pursuing new Affordable Care Act opportunities that might very meaningful--meaningfully offset the abatement.

So, we've considered, a factor, an ACA abatement factor, when we state that we think fiscal '15 will be a growth year, perhaps even a double digit growth year. And, we'll look forward to sharing our specific thoughts on this and the other drivers, for our fiscal '15 drivers, fiscal '15 guidance when we get together in November.

On the second point and the startups, in the pipeline, certainly, the startups will have an impact. And, I'd say this - I think it's best to first set aside the startups. And as I said in my remarks, the economics on the startups are much different. they're multi year in nature.

I think it's best to consider not only the loss year, the first year, of the startup but the subsequent years or what we refer to as the slingshot effect. And in all startups, we expect to have solid multi year economics.

So, it's a bit helpful to set those aside. It really is a different, dynamic and a very positive dynamic. I think net/net, startup losses are actually a very good thing because the long term economics are excellent for our shareholders.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 15 |

So we're not able to quantify the startups at this point because we do have a number still in motion. We're waiting to hear on some what I think are meaningful, proposals pending. And depending upon those results, the quantification of the startups in fiscal '15 will start to solidify.

But that being said, we do think that, depending upon those factors, and the startups are a big driver, we do think that we will still be, in a growth mode situation.

Mr. Charlie Strauzer: Great, thank you very much.

Ms. Lisa Miles: Stacy, next question please.

Operator: Dave Styblo with Jefferies, please proceed.

Mr. Dave Styblo: Sure, thanks for taking the questions and, congrats on--to the management team on all the moves, promotions and hires there.

Maybe starting out on that topic, Rich, now that, you're--you've moved to a more defined role, I suspect you might be able to look at some of the--some things that perhaps you didn't have quite as much time for. So, I'm wondering, with a little bit of the extra bandwidth now in your hands, what are some of the key priorities and things that you're looking at? Is it, a little bit more on the M&A side? And I know you had also mentioned strategic priorities. I was just hoping you could elaborate, on those items.

Mr. Rich Montoni: glad to do that. I will say that, I think the promotion's effective, October 1st, so that bandwidth will start in October.

But, the reality is, Bruce's promotion, I don't think it's a radical, redirection in terms of assignments. Bruce has been an important part of the management team along with, a number of other key contributors.

So, we very much operator in a team type fashion. So, I think what's going to happen here is we'll continue to team, and that will be our primary mantra in terms of how we go forward and how we operate.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 16 |

I don't think we're just--I don't think we're gonna create a big divide here and, we're gonna be exclusive in any particular swim lane.

That being said, we are focused on mergers and acquisition. We think there's opportunities out there.

We don't think we're compelled, given our growth opportunities, to rush out and do acquisitions to grow. But, we do think M&A is a very helpful way for us to, grow, enhance our capabilities where we see growth opportunities. And, so we have a very active program I think that will continue.

And, I think from a strategic perspective, I think in addition to M&A, we'll look at new markets and expanding those new markets as well as strategic partnerships.

Mr. Dave Styblo: Okay, that's helpful.

And just as a follow up to--to your comments about Charlie's question, you do see '15 as a growth year, perhaps double digit. I want to clarify if you were referring to EPS revenue on that front.

Mr. Rich Montoni: Yeah, I think I'm referring to both top line and bottom line.

Mr. Dave Styblo: Okay.

And so, is it--it sounds like the way to characterize, and not being too short termed about this, is that, you know, EPS could very well grow slower next year, than the top line, but then that would reverse and EPS accelerates, grows much faster than the top line as we move into '16. Is that kind of the way to think about it as we stand right now?

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 17 |

Mr. Rich Montoni: I think that's a great way to think about it. It's quite interesting because the more startups we have that have losses on the front end, in fiscal '15, what that will tend to do is to increase the rate of growth in revenue but decrease the rate of growth in earnings per share. But, all of that turns around, especially the earnings per share growth rate because we get what's referred to as a slingshot effect, much like we experienced with the work program in the United Kingdom, for those of you who recall that, a couple of years ago, and it was quite meaningful.

So, again, that's why I say you really need to take the startup losses and look at them differently because I think they are very much a precursor to substantial long term shareholder appreciation.

Mr. Dave Styblo: Super. Thanks for the color.

Mr. Rich Montoni: You bet.

Ms. Lisa Miles: Stacy, next question please.

Operator: Once again, if you would like to ask a question, please press star, one on your telephone keypad.

Our next question comes from Richard Close with Avondale Partners. Please proceed.

Mr. Richard Close: Yes, Richard Close from Avondale. Thanks for taking the questions. Congratulations, as well.

With respect to the 428 million pending, do you think that's likely to get done here near term and actually starting to contribute for fiscal '15?

Mr. Rich Montoni: Good morning, Richard.

I think it is very much short term, and I do think that it could be, a known and move out of that category to be a meaningful contributor in fiscal '15.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 18 |

Mr. Richard Close: And with respect to your bullet, on new opportunities across, multiple, geographies in both segments, wonder if you could go into a little bit more detail with respect to the several with the potential to boost the '15 growth. What exactly, you know, maybe is that, you know, and, possibly the timing?

Mr. Rich Montoni: Richard, I can't drill down too far for competitive reasons, as I'm sure you can appreciate. But, I think we've touched upon some of those markets that I think, are behind why we're excited.

It would include certainly Australia, dynamics in the United Kingdom, some additional work, that's different than year one work in the Affordable Care Act here in the States. Those would be the three that I would point to.

Mr. Richard Close: And then, the one half of the pipeline that's new opportunities, how does that compare to, you know, historical levels?

Mr. Rich Montoni: That's a great question. I think, in comparison to historical levels, I think it's, elevated. I think it's been in the 50 percent territory for the last few quarters running.

So, we're pleased as of late. And I think that's a quantification that just--it just reflects what's happening in the marketplace, that we're seeing some substantial new opportunities as these governments reengineer. And I do think there is an increasing propensity to outsource in many of these large central governments. So, I think that metric, correlates quite well with that dynamic.

Mr. Richard Close: Okay, thank you.

Mr. Rich Montoni: Sure. Thank you, Richard.

Ms. Lisa Miles: Next question please.

Operator: Thank you.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 19 |

Next question comes from Brian Gesuale with Raymond James.

Mr. Brian Gesuale: Yeah, good morning, guys.

Wanted to, drill into, margins and startup costs again. I believe the new UK contract, as well as the Department of Education contract are both gonna reside in the health segment. And I think you've talked generally about a 12 to 15 percent margin range. Do the startup costs potentially take you out of that range temporarily?

Mr. Rich Montoni: Good morning, Brian.

On that question, you're right - both the UK contract and the Department of Education contract, sit in the health segment. And we do expect that they each will generate startup losses in fiscal '15. And I think we're still in our health segment in the 10 to 15 percent range. I don't think those are, so monumental that they're gonna pull us out of that range.

Mr. Brian Gesuale: Great, that's very helpful.

And then, just a follow up on the appeals business - you guys have built up a really nice portfolio of appeals across several different programs. Can you maybe, size some of these ebbs and flows? It seems like some of those are growing, some of them are maybe contracting a little bit, and maybe just put more color around that.

Mr. Rich Montoni: Yeah, glad to give you some color on it. And I think you hit the nail on the head when you said a portfolio.

You know, our--one of our growth strategies, is premised upon the fact that, as governments are forced, because there are more folks applying for, these entitlement benefits and governments have tighter budgets that they are going to have to have, more stringent entitlement rules and regulations and processes. And that in turn, will require and will increase the number of appeals that happen.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 20 |

And, it's something that we see daily. You can look at The Wall Street Journal today, and you'll see something that touches upon it right on the front of The Journal.

So, it's not surprise to us that we've seen, additional significant opportunities grow. We've talked about the additional work we're doing for, the workers comp program in California. You know that we had a great year in fiscal '14, the appeals we do for Medicare.

We've said that we do think it's, starting to abate a bit because of the RAC dynamics. But, all said, we think what we do in the appeals space is, a great space to be in, and I expect that we're gonna see increasing demand, on a global basis for qualified independent, appeals and assessments.

Mr. Brian Gesuale: Great. Thanks for taking my questions.

Mr. Rich Montoni: Okay, Brian, thank you.

Ms. Lisa Miles: Next question please.

Operator: Carl McDonald with Citigroup, please proceed.

Mr. Carl McDonald: Great, thanks.

So, as we think--excuse we me--as we think about 2015, sounds like right now single digit growth, revenue in earnings, you know, but still some moving pieces. In terms of the, bids that are still outstanding, is it right to think about that if you were to win some of those bids, it potentially gets you to a 10 percent revenue--or 10 percent plus revenue growth next year, but potentially puts more pressure on margins because of the startup costs, or, would these bids that you're looking at not necessarily have a meaningful startup cost.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 21 |

Mr. Rich Montoni: You know, Carl, I think that's, I think that where we landed in 2015 guidance, while the startup, cost on existing work and more so on work to be determined, pending bids, is perhaps the biggest driver, there are other drivers that could, if, if it goes in our direction, could help us get it to, double digit growth. So, I don't think the startups are the only driver there, Carl.

And then, as it relates to the startups, we have some new work to be determined, some bids pending that will generate--we expect would generate startup losses. We also have some that would generate--not generate startup losses, and quite frankly, be profitable in year one. So, it's a little more complicated than all the startups generating losses. Does that help?

Mr. Carl McDonald: And then--yeah, that's helpful.

And then, the second question is just on the, the increase in the pipeline. As you said, you put the Australia contract in there. What's the value of the Australia contract that goes in? Do you put your 625 million in, or is it the total value of the entire Australia contract that goes in?

Mr. Rich Montoni: That's a great question. We put the total contract value in the pipeline. So, in this case, for Australia, it would be the I believe it's $625 million over five years.

Mr. Carl McDonald: Great. Okay, thank you.

Mr. Rich Montoni: Okay, Carl, thank you.

Operator: Once again, if you would like to ask a question, please press star, one on your telephone keypad.

Our next question comes from Frank Sparacino, First Analysis. Please proceed.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 22 |

Mr. Frank Sparacino: Hi, guys.

Rich, you talked earlier just about the transition from the federal to the state marketplaces, and I'm curious, you know, given all the, recent activities around the subsidies from a legal standpoint, if that in fact is, you know, driving a lot more state activity discussions on your part or just any thoughts around, you know, when does that transition start to happen?

Mr. Rich Montoni: Well, Frank, that's a great topic to talk about. And, you can rest assure there has been and continues to be a lot of discussion, with our state, clients.

But, I'm gonna ask Bruce Caswell to respond to that question. Bruce?

Mr. Bruce Caswell: Sure, happy to. Good morning, Frank, and a great question. You're right, it's caused a lot of states now to start thinking about what their plans might be for a few years out.

I think the first important note here is that nothing's gonna happen immediately as a result of these cases. It's not affecting individual subsidies this upcoming plan year. This still has to play out in the courts, and we really shouldn't speculate on any legal outcome.

You know, a number of court watchers would suggest it's headed to the Supreme Court. Others might suggest that a non-bank ruling at the district level in DC would align the rulings and keep it from going to the Supreme Court. So, we'll let that kind of play out as it will - no real immediate impact.

The, interesting thing on the horizon for states is both the outcome of this case, but also the fact that, by 2017, there's a provision in the act that allows states to exercise waiver authority and apply to CMS for broad waivers to implement state based exchanges.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 23 |

So, when you really look at the dynamics out there of technology issues firming up, states through this next plan year determining whether they can be comfortable with transfer systems such as the Connecticut system coming to Maryland, new systems coming online-- I understand--our view is that Idaho in this next plan year is actually the only state that's gonna make the transition from a federal marketplace to a state based exchange.

But then, you play it forward into 2016 and 2017 and those other factors we discussed in terms of the result of the subsidy ruling and also the waiver authority could create an environment where more states want to move, off of the federal marketplace.

And we've said for many, you know, quarters now that, our view, and I think it's substantiated, is that the federal government, never intended to be in the exchange business permanently. And, we believe it's likely there'll be incentives created in terms of technology transfer opportunities and so forth to help states facilitate that movement in the coming years. Does that help?

Mr. Frank Sparacino: Yes, it does. Thank you, guys.

Mr. Bruce Caswell: Great.

Mr. Rich Montoni: Thank you.

Ms. Lisa Miles: Next question please.

Operator: Brian Kinstlinger with Maxim Group. Please proceed.

Mr. Brian Kinstlinger: Hi, good morning. Rick, nice to work with you again.

Mr. Rick Nadeau: Yep, good to see you again.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 24 |

Mr. Brian Kinstlinger: The, back when you guys won the UK, Welfare to Work Program, you highlighted, some specifics on, the economics. I'm wondering if you combined the two largest contracts, the DOE debt, the new ones, and the UK health work, can you highlight what the fiscal '15 loss will look like just for those two because that's a known factor?

And then, maybe talk about, in '16, are they combined at mature profitability? Are they still at marginal profitability? that would be helpful. Thank you.

Mr. Rich Montoni: Brian, this is Rich. And, great question.

What we're not gonna do is jump into a piecemeal, analysis of the many moving parts that we have at this time. I think you're right, and I think you're wise to recall the situation with the launch of the Welfare to Work Program where we had, I think, a meaningful loss in year one that was recovered and then, matched in year two.

I would expect that the dynamics of these two programs and startup losses, I kind of think that's the general template, for startup type losses. I'm not able to quantify the two that we have in hand at this particular point in time, but I do think the situation is analogous in terms of model and trend. I'll put it that way.

Mr. Brian Kinstlinger: So, without numbers, do they term profitable at the beginning of fiscal '16 jointly, in the middle of fiscal '16? I'm just curious when that slingshot effect maybe starts?

Mr. Rich Montoni: Yeah, I think, you know, we expect to achieve break even in, in 2016 or fiscal 2016. As to which quarter it--they'll break even in, we'll have to hold that discussion for a future point in time.

Mr. Brian Kinstlinger: Great.

One last question - on the new UK work, program you've got, work, program, the--is it structured similar to the older work program where you have a couple of regions and there's opportunity down the road to get more? Are there other contractors doing similar work?

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 25 |

Mr. Rich Montoni: This is on the work program that we have in the United Kingdom and--.

Mr. Brian Kinstlinger: --The new one you just won, yeah.

Mr. Rich Montoni: Yeah.

And there is one region that's up for reallocation. And the government in the United Kingdom said that they will reallocate work. It hasn't been a material driver. There is one potential to pick up some reallocated work, but I think it's-- the annual run rate on that is, well less than $10 million a year. So we'll see on that one.

But, I don't hold that out as a material new work growth driver, although we'd hope to pick up some additional work there.

Australia would be probably the better example of where we have and can pick-- can continue to pick up material amounts of new work.

Mr. Brian Kinstlinger: All right, thank you.

Mr. Rich Montoni: You bet, Brian. Thank you.

Ms. Lisa Miles: Next question please.

Operator: As a reminder, please press star, one on your telephone keypad if you would like to ask a question.

Next question comes from Dave Styblo with Jefferies. Please proceed.

Mr. Dave Styblo: Sure. Just had a follow up for you guys on the rebids that are up, the two rebids that are worth $55 million. Curious if you can provide any sort of color on your confidence in maintaining these or where you're at in the process with those two.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 26 |

Mr. Rich Montoni: Sure, glad to provide some color. I view them as normal course and I think, I think that one should never bee too confident that you're gonna win a rebid. But, the nature of the industry and our experience and even our year-to-date experience, Dave, is that we're tracking to what would round to a 90 percent win rate.

So, all things held equal, I kind of hold it out as a 90 percent probability that, we'll be successful in the rebid situation.

Mr. Dave Styblo: Okay.

And then, just touching base on the pipeline, seems like even excluding Australia, the core was up, you know, $250 million or so. That--you know, obviously, your pipeline only goes out six months, and I'm just trying to reconcile that with some of the comments that you made about international, and I suspect some of that might be even beyond six months.

Can you, talk a little bit more about--I just--I'm sensing that there might be something new emerging in Australia that is on your radar. Can you elaborate a little bit more on why it seems you're a little bit more excited about specifically that country? Is it kind of leveraging business in the sister segment or more on the, Welfare to Work side program?

Mr. Rich Montoni: Well, as you know, one of our strategies is to build our health business, in Australia and the United Kingdom. And we're very pleased to have our first data point with that Health and Work win.

And, we've been working very hard to identify and pursue, additional opportunities in that space. So, I think that's one of the drivers.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 27 |

Australia - I do have to point to Australia that Australia has been, kind of leader of the parade in terms of, achieving world class public private partnerships and continues to look at taking some work that heretofore has been done on a sovereign basis by government workers and entering into public private partnerships as is the UK.

So, I would--if I would pick out, you know, what's the biggest, the two biggest drivers in--behind your question and the dynamic you point to would be the UK health and human services, as well as, the Australian dynamic.

Mr. Dave Styblo: Great. Thanks.

Mr. Rich Montoni: You bet.

Ms. Lisa Miles: Next question please.

Operator: Richard Close with Avondale Partners, please proceed.

Mr. Richard Close: Thanks for taking the follow up.

Just wanted to, ask a little bit more about the Medicare appeals and the comments on the recovery audit contractors there. It was my understanding there was a pretty significant, backlog of claims, and I thought your comments were interesting.

So, if you can just give us an update there, it would be great, your thoughts on the RACK, appeals.

Mr. Rich Montoni: Richard, glad to do it.

Bruce Caswell, what do you think about that?

Mr. Bruce Caswell: Well, I think, Richard, you're right. I think what you're probably referring to is the moratorium on inpatient stay, auditing by the recovery audit contractors on inpatient stay claims. And that moratorium you may recall was extended by CMS to March of 2015. And, at the time, we, indicated that, you know, we'd continue to work through the backlog of claims related to that because the RACS really prohibited from introducing new claims I think from the period of October 1st, 2013 now through March of, 2015.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 28 |

So, as we worked through that backlog, we found that, we expected declines in those, Medicare appeals, to be occurring as we anticipated as we wind out this fiscal year. But, it's important to note that we continue to operate, as Rich has said previously, a portfolio of appeals and assessments contracts and some of that--those declines we've seen, obviously, offset by other programs in our portfolio.

So, I think, the latest news from the CMS on the fifth of August as it relates to the limited recovery audit contractors beginning to restart and look at claims, that's interesting. But, at the same time, as you’re well aware, that's pretty small volume. Those are, you know, reviews of things like spinal fusions and outpatient therapy services and DME prosthetics, orthotics, things like that.

So, the majority of the claims, though, and I think the volume--and quite frankly, the volume that's generated about $4 billion in recovery for the Medicare program has come from those in patient state claims.

So, be curious to see, right, how long that moratorium lasts, whether it goes anywhere beyond March of next year. I think the fiscal pressures obviously and the need for Medicare to, get back to collecting that $4 billion will, pressurize that environment a bit--.

Mr. Richard Close: --So, does the working off of the backlog, does that business go from like a $100 million, you know, annual revenue business down to 50 or just--what kind of headwind is that?

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 29 |

Mr. Rich Montoni: Richard, we don't get into, you know, project specific, P&Ls. But, I think this--I think of that business as a--the appeals business and, that is one project where we think, we have, headwind. On the other hand, we have an offsetting project that should neuter it.

So, I really look at that book of business as being pretty much steady-Eddie year-to-year.

Mr. Richard Close: Okay. Great. Thank you.

Mr. Rich Montoni: You bet, Richard. Thank you.

Operator: There are no further questions. This concludes today's teleconference. You may disconnect your lines at this time, and thank you for your participation.

| Fiscal Year 2014 Third Quarter Earnings Call | 08/07/14 - 9:00 a.m. ET - 30 |

1 Fiscal 2014 Third Quarter Earnings Richard J. Nadeau Chief Financial Officer and Treasurer August 7, 2014

2 Forward-looking Statements & Non-GAAP Information These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along with listening to or reading a transcript of the comments of Company management from the Company’s most recent quarterly earnings conference call. This document may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the Company’s most recent quarterly earnings press release. A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

3 Total Company Results Q3 FY14 revenue increased 26% to $419.9M compared to the same quarter last year, driven by the Health Services Segment Consolidated operating income totaled $55.3M, delivering an operating margin of 13.2% Income from continuing operations, net of taxes, increased 21% to $34.0M, or GAAP diluted earnings per share of $0.49 Adjusted diluted earnings per share increased 20% to $0.49

4 Health Services Segment Revenue Another solid quarter. Q3 FY14 revenue increased 40% Top-line increases driven by: 1. New work and expansion on existing contracts, including those related to the Affordable Care Act (ACA) 2. Health Management acquisition, which closed on July 1, 2013 Operating Income & Margins Q3 operating income increased 23% and, as expected, were lower compared to the same period last year, partly due to an increase in lower-margin, cost-reimbursable work with U.S. Federal Government Looking Ahead to Q4 Forecasting a favorable impact from a couple contract amendments expected to be signed in August Expect these will be partially offset by the start-up impact of new work, and lower revenue in the Medicare appeals business related to RAC program changes

5 Human Services Segment Revenue Q3 FY14 revenue is slightly lower than last year, principally due to adverse currency impacts Operating Income & Margins Q3 FY14 operating income compared favorably to last year Operating margin improved to 11.4%, for Q3 14, up from 9.5% last year. Third quarter operating margins were bolstered by a couple of short-term consulting engagements that were completed during the quarter Looking ahead to Q4 Q4 FY14 operating margins are expected to be tempered, principally due to the start-up of 18 new sites in Australia

6 Balance Sheet and Cash Flows Cash Flows in Q3 Benefitted from strong earnings and solid collections that led to lower DSOs of 63 days DSOs will likely rise in Q4 to within the previously stated range of 65-80 days Cash Deployment Share repurchases − Q3 FY14, purchased 599,529 shares of MMS common stock for approximately $25.5 million − In June 2014, MMS announced a $150 million increase to share repurchase program and at June 30, approximately $187.3 million was available for future purchases − Subsequent to quarter close repurchased another 403,433 shares for approximately $17.0 million Increase in buyback authorization is evidence of commitment to deploy capital in a sensible fashion Our #1 priority is to drive long-term growth across the business, both organically and through acquisition We maintain an active M&A program with a pipeline of domestic and international targets Cash and Cash Equivalents At June 30, 2014, cash and cash equivalents totaled $182.9 million (approximately 55% were held outside U.S.)

7 Reiterating FY 14 Guidance Full year guidance for fiscal year ending September 30, 2014 remains unchanged We expect a bias towards the top end of both our revenue and earnings guidance Cash flow guidance remains unchanged

8 Fiscal 2014 Third Quarter Earnings Richard A. Montoni President and Chief Executive Officer August 7, 2014

9 Changes to the Leadership for Future Growth New Chief Financial Officer, Rick Nadeau Comes to MAXIMUS from SRA International Brings more than 10 years of public company experience and more than 30 years experience in public accounting Bruce Caswell appointed to President Responsible for operational execution and organic growth of the Company, across both segments Continue to lead global health operations as President of the Health Services Segment Richard Montoni to continue as CEO Primary focus on the Company’s strategic vision and long-term growth objectives Directing acquisition program and continuing to interface with shareholders

10 New U.S. Contract – Debt Management Services Successfully launched operations – on schedule – for the new debt management contract with U.S. Department of Education Helping administer a portfolio of approximately five million borrowers whose student loans are in default status Operations include: − In-bound customer contact center and correspondence unit − Financial transaction processing center − Mail fulfillment center Executed seamless transition; focused on providing high-quality service for new client

11 New U.K. Contract – Health and Work Service Department for Work and Pensions selected Health Management for new program Terms 63-month contract with expected total contract value of up to approximately $226 million Anticipate initial start-up loss due to contract nature; overall program economics are favorable Once ramped, contract in-line with targeted range of portfolio operating margin performance Program Goals Goal is to get employees with extended absences on a path back to employment Our team of experienced clinicians will help employees manage medical conditions more effectively by: − Providing timely access to clinical services for non-emergency care − Identifying the factors preventing the employee from returning to work − Recommending a return-to-work plan Strategic win further validates our Health Management acquisition last year Strong brand and financial position of MAXIMUS, coupled with highly regarded clinical expertise of Health Management, helped solidify our position on this bid Program activities right in the sweet spot of core offerings and an opportunity to demonstrate our expertise in occupational health market for large government program Team is hard at work on mobilization Pleased to expand our relationship with DWP by providing services in a new area

12 Additional Work for Job Services Australia Reallocated work under Job Services Australia (JSA) program Strong performance under Star Rating program resulted in the award of 18 new sites Increases caseload by approximately 15% to more than 100,000 job seekers Provides approximately $15 million in new annual revenue Expanded scope of work is a reflection of continued solid performance under the government’s Star Rating program Important in preparation for upcoming rebid Client places a great reliance on performance Australian model is a pay-for-performance program where the government pays for outcomes that matter – helping people transition off benefits and into employment Reminder that rebid is not expected to be ‘winner-take-all’; awards are done on a location-by-location basis Rebid expected to be released in the next few months; we are tracking it closely

13 International Opportunities Future international growth may come from: New countries that are increasing their propensity to outsource Current geographies with expanded needs For example, in Australia: Substantive opportunities for growth Exact timing of opportunities is not precisely known We remain a top-performer in our performance-based markets – a key differentiator as we see more privatization efforts underway in new and existing markets.

14 US Operations and ACA Efforts See Future opportunities related to the support of the Affordable Care Act (ACA) Current status for customer contact centers for state and federal exchanges Gearing up for next open enrollment period and we will adapt to dynamic environment as governments apply “lessons learned” from the first open enrollment MAXIMUS benefitted from additional ACA- and Medicaid-related work that helped bolster FY 14; some will abate, but most will continue into FY 15 and beyond We have identified and are pursuing new ACA-related opportunities. Enrollment through exchanges is not expected to reach a steady state until 2017 or even 2018. In the meantime, our flexible, scalable resourcing models allow us to meet the current demand for consumer assistance. Continue to manage the eligibility appeals operations for the federal marketplace Support for our state Medicaid clients as they adapt their programs to meet new requirements of ACA: New rules for determining eligibility based on Modified Adjusted Gross Income (MAGI) Dealing with the “no wrong door” provisions of ACA that require states to seamlessly pass applications Addressing inconsistencies and backlogs in applications Implementing variations on Medicaid expansion based on waivers received As a leading operator of state-based exchange contact centers, we remain well-positioned if states transition from the federal marketplace and establish their own exchanges.

15 Rebids 15 contracts worth a total of $225 million up for rebid in FY 14 Won or received extensions on 11 with a total contract value of $150 million Year-to-date, lost 2 small rebids with a combined total contract value of about $20 million, leaving only 2 rebids left with a total contract value of about $55 million Looking ahead, fiscal 2015 is expected to be much heavier with bulk coming from the rebid in Australia (estimated at approx. $625 million over 5 years)

16 New Awards and Sales Pipeline At June 30, 2014: Signed $1.1 billion in year-to-date contract awards Additional $428 million in contracts pending (notified of award and in contract negotiations) Sales pipeline reached $3.0 billion and driven, in part, by: Contract rebid in Australia New opportunities across multiple geographies and both segments, including several with potential to boost growth in FY15; represents more than half of pipeline Our pipeline reflects opportunities where we expect the request for proposal to be released within the next six months. These opportunities include new work, rebids, and option periods.

17 Fiscal 2015 Commentary We are pleased with our: Progress in FY 14 Expectations for the remainder of the year Prospects for FY 15 and beyond Fiscal Year 2015 Headwinds 1. Reduced revenue from ACA and appeals work for the Medicare program Lion’s share of ACA work is recurring, but as expected some came to an end Hard to predict volumes in year two of ACA, but currently expect they may be lower 2. Start-up losses on new contracts where we’ll reap benefits of sling-shot effect in FY 16 While start-ups may generate initial losses, our historical experience is that in subsequent years, the project is accretive and in-line, or better, compared to our overall portfolio margin targeted range of 10% to 15%. Over the length of the contract period, we expect every contract to generate solid economic returns that contribute to meaningful, long-term shareholder returns. Fiscal Year 2015 Tailwinds Number of tailwinds in portfolio that will provide benefits to next year Couple of important bids still outstanding Outcome and final contract structure of these bids could have a meaningful impact on where we ultimately land for our fiscal 2015 guidance

18 Conclusion FY 15 shaping up to be a growth year, both top- and bottom-line Conducting annual planning process and will provide formal guidance in November Management team remains focused on dynamics that best position MAXIMUS for future, multi-year growth Over the long-term, believe revenue and earnings will grow by 10% year in and year out – with years of accelerated growth and years where overall growth may be tempered by timing of startups, rebids or government procurement cycles More privatization efforts and expanded outsourcing markets across our current geographies Global governments that advance reform efforts to manage complex social benefit programs Common themes include: eligibility validation and verification, and helping individuals move away from welfare dependency MAXIMUS looks forward to continuing to provide clients with innovative, flexible and scalable ways to reform social programs and achieve outcomes that matter Still see confirming data points for increasing demand for our services over the long term. These demand trends tend to be decades-long in nature and what we sell this year becomes the growth drivers for years to come.