Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Globalstar, Inc. | earningsrelease8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - Globalstar, Inc. | exhibit991.htm |

Earnings Call Presentation Q2 2014 August 11, 2014

Safe Harbor Language This press release contains certain statements that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward- looking statements. Forward-looking statements, such as the statements regarding our expectations with respect to actions by the FCC, future increases in our revenue and profitability and other statements contained in this release regarding matters that are not historical facts, involve predictions. Any forward-looking statements made in this press release are accurate as of the date made and are not guarantees of future performance. Actual results or developments may differ materially from the expectations expressed or implied in the forward-looking statements, and we undertake no obligation to update any such statements. Additional information on factors that could influence our financial results is included in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. 1

Financial Results Summary Revenue and Adjusted EBITDA for Q2 2014 were $24.0 million and $5.0 million – growth of 21% and 70%, respectively over the comparable prior year period Duplex service revenue was $6.9 million, representing growth of 29% over Q2 2013; Duplex ARPU (1) was $38.41, representing a 23% increase over the comparable prior year period SPOT and Simplex service revenue for Q2 2014 were $7.0 million and $2.2 million respectively (2) Adjusted to exclude non-cash compensation expense, reduction in the value of assets, foreign exchange (gains)/losses, R&D costs associated with the development of new products and certain other one-time charges. See reconciliation to GAAP Net Loss on Annex A. Major Highlights (1) Duplex ARPU for prior period adjusted for deactivation of approximately 26,000 suspended or non-paying subscribers in Q1 2014. ($ in millions except ARPU data) INCOME STATEMENT SUMMARY Q1 2012 Q2 2012 Q3 2012 Q4 2012 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 2013 Q1 2014 Q2 2014 Revenue: Service revenue Duplex $4.2 $4.5 $5.0 $4.8 $18.4 $4.8 $5.4 $6.2 $6.3 $22.8 $5.9 $6.9 SPOT 5.3 6.5 6.6 6.9 25.2 7.1 6.9 7.0 7.0 27.9 7.0 7.0 Simplex 1.3 1.4 1.7 1.8 6.1 1.8 1.6 2.1 2.0 7.6 1.9 2.2 IGO & Other 1.8 1.8 2.1 1.9 7.7 1.6 1.6 1.7 1.4 6.3 1.5 1.7 Total Service Revenue $12.6 $14.2 $15.4 $15.3 $57.5 $15.4 $15.4 $17.1 $16.8 $64.6 $16.2 $17.9 Equipment sales revenue $4.1 $5.8 $5.2 $3.7 $18.9 $3.9 $4.4 $5.5 $4.2 $18.1 $4.3 $6.1 Total revenue $16.7 $20.0 $20.5 $19.1 $76.3 $19.3 $19.8 $22.5 $21.0 $82.7 $20.5 $24.0 Cost of services $7.3 $7.5 $7.4 $7.9 $30.1 $7.5 $7.2 $8.2 $7.3 $30.2 $6.9 $7.1 Cost of subscriber equipment sales plus value reduction 3.0 3.8 4.7 3.3 14.7 2.9 3.6 4.1 8.7 19.4 3.1 11.6 Marketing, general, and administrative 6.6 7.0 7.4 6.4 27.5 6.9 6.6 9.1 7.3 29.9 7.8 8.2 Contract termination charge 0.0 22.0 0.0 0.0 22.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Depreciation, amortization, and accretion 14.7 15.9 18.7 20.5 69.8 20.3 22.1 23.7 24.5 90.6 23.3 22.0 Other operating expenses 0.1 7.1 0.0 0.0 7.2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Total operating expenses $31.7 $63.4 $38.2 $38.1 $171.3 $37.7 $39.4 $45.1 $47.8 $170.1 $41.1 $49.0 Loss from operations ($14.9) ($43.4) ($17.7) ($19.0) ($95.0) ($18.4) ($19.6) ($22.6) ($26.8) ($87.4) ($20.6) ($25.0) Gain (Loss) on extinguishment of debt 0.0 0.0 0.0 0.0 0.0 0.0 (47.2) (63.6) 1.7 (109.1) (10.2) (16.5) Other income (expense) (9.4) 16.0 (23.5) 0.1 (16.8) (6.6) (59.3) (118.7) (208.9) (393.5) (219.6) (391.2) Income tax expense (0.2) (0.1) (0.1) (0.1) (0.4) (0.1) (0.1) (0.1) (0.8) (1.1) (0.2) (1.0) Net loss ($24.5) ($27.5) ($41.2) ($19.0) ($112.2) ($25.1) ($126.3) ($205.0) ($234.8) ($591.1) ($250.5) ($433.7) Adjusted EBITDA (2) $1.4 $2.9 $3.1 $2.5 $9.8 $2.5 $2.9 $2.5 $3.9 $11.9 $3.8 $5.0 AR U Duplex $15.35 $16.74 $18.95 $18.49 $17.42 $19.24 $21.29 $24.50 $24.97 $22.54 $27.43 $38.41 Duplex Adjusted ARPU (1) 21.69 23.84 27.21 26.84 24.97 28.20 31.18 35.73 36.45 32.98 33.73 38.41 SPOT 8.57 9.91 9.44 9.60 9.47 10.45 10.69 10.64 10.54 10.04 10.52 10.34 Simplex 3.03 2.88 3.24 3.23 3.11 3.20 2.70 3.32 3.00 3.03 2.58 2.88 IGO / Wholesale 1.45 1.54 1.60 1.81 1.59 1.89 2.11 2.10 2.45 2.13 2.32 2.56 2

$5.4 $4.5 $5.4 $6.9 $3.5 $4.0 $4.5 $5.0 $5.5 $6.0 $6.5 $7.0 $7.5 Q2'11 Q2'12 Q2'13 Q2'14 $26.29 $23.84 $31.18 $38.41 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 Q2'11 Q2'12 Q2'13 Q2'14 (1,142) (1,866) 898 3,299 (3,000) (2,000) (1,000) 0 1,000 2,000 3,000 4,000 Q2'11 Q2'12 Q2'13 Q2'14 2,109 1,997 4,204 5,559 0 1,000 2,000 3,000 4,000 5,000 6,000 Q2'11 Q2'12 Q2'13 Q2'14 Q2 2014 Financial Performance ($ in millions) 22% Growth Duplex Performance Duplex Gross Adds Adjusted EBITDA (2) (2) Adjusted to exclude non-cash compensation expense, reduction in the value of assets, foreign exchange (gains)/losses, R&D costs associated with the development of new products and certain other one-time charges. See reconciliation to GAAP Net Loss on Annex A. Duplex Net Adds 267% Growth Duplex Service Revenue 29% Growth ($ in millions) Duplex Adjusted ARPU (1) 23% Growth 2011-2014 Q1 Comparison 2011-2014 Q2 Comparison 2011-2013 Q3 Comparison 2011-2013 Q4 Comparison ($2.5) $1.4 $2.5 $3.8 ($3.0) ($2.0) ($1.0) $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 Q1'11 Q1'12 Q1'13 Q1'14 ($2.0) $2.9 $2.9 $5.0 ($3.0) ($2.0) ($1.0) $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 Q2'11 Q2'12 Q2'13 Q2'14 ($3.5) $3.1 $2.5 ($4.0) ($3.0) ($2.0) ($1.0) $0.0 $1.0 $2.0 $3.0 $4.0 Q3' 1 Q3'12 Q3'13 $1.6 $2.5 $3.9 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 Q4'11 Q4'12 Q4'13 54% Growth ($ in millions) ($ in millions) ($ in millions) ($ in millions) ($ in millions) 70% Growth (1) Duplex ARPU for prior period adjusted for deactivation of approximately 26,000 suspended or non-paying subscribers in Q1 2014. 3

Liquidity Review and Balance Sheet Highlights $71.8 $71.8 $71.8 $47.0 $39.9 $29.8 $23.0 $42.5 $47.4 $53.5 $60.4 $62.2 $64.1 $64.1 $45.5 $47.5 $48.2 $51.7 $42.8 $38.9 $40.9 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 2010 2011 2012 2013 Q1 2014 Q2 2014 Q2 2014 2011 5% Notes 2009 8% Notes Subordinated Loan 2013 8% Notes Subordinated Debt Reductions Liquidity and Capital Sources Review ($ in millions) $159.8 $205.7 $214.5 $159.0 $145.0 $94.0 Cash & Cash Eq. Terrapin Equity Line Debt Service Reserve Account 12 month Run-rate OCF (adjusted) (1) Total Liquidity Unrestricted Liquidity $23.8 $24.0 $37.9 $22.1 $107.8 $69.9 ($ in millions) (1) Adjusted operating cash flow excludes the cash portion of the interest costs expensed during Q2 2014. See reconciliation to GAAP Net Loss on Annex B. $87.1 4 (2) (2) Pro forma debt balances after considering full amounts submitted by 2013 8% holders for conversion. (3) Numbers may not add to totals shown due to rounding

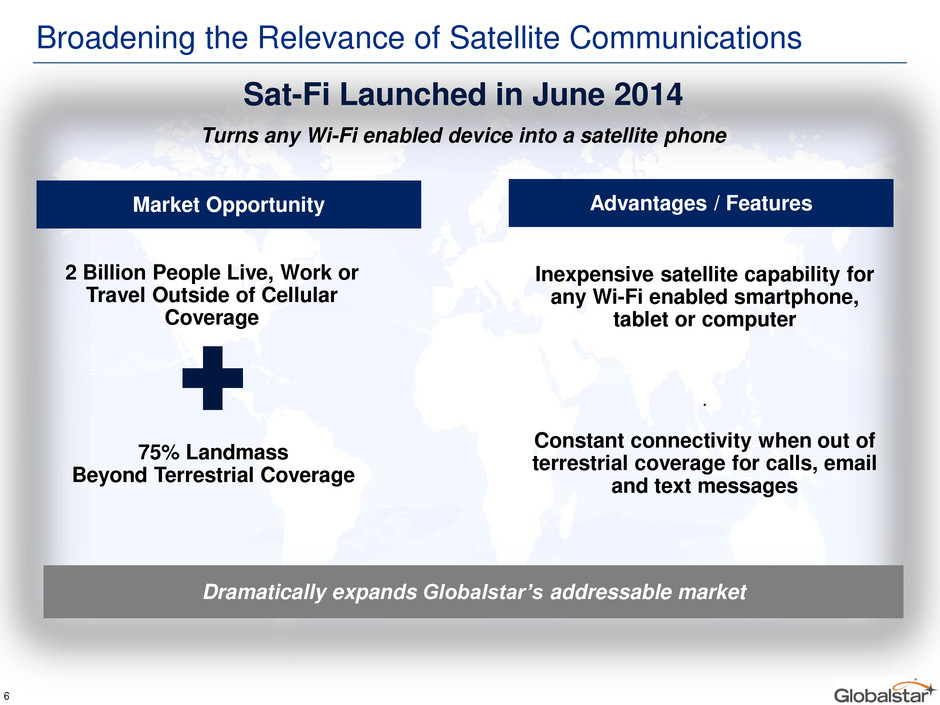

Second Quarter Highlights Built-out sales and marketing infrastructure in Brazil Initiated expansion efforts in Colombia and Latin America Initiated additional greenfield expansion opportunities Revenue and Adjusted EBITDA improvement year over year Globalstar’s shares listed on NYSE MKT on April 21, 2014 – improves visibility and trading liquidity Launched Sat-Fi in June 2014 – broadens Globalstar’s addressable market by extending wireless communications beyond the range of terrestrial networks Satellite augmented, scalable, reliable and secure air traffic management solution On November 1, 2013, the Federal Communications Commission voted to release Globalstar’s requested NPRM over 22 MHz of spectrum including licensed (2483.5-2495 MHz) and adjacent ISM spectrum (2473-2483.5 MHz) Initial comments received May 5, 2014 Comment cycle concluded June 4, 2014 Operational & Liquidity Geographical Expansion New Products and Future Opportunities Valuable Spectrum Assets 5

Broadening the Relevance of Satellite Communications Sat-Fi Launched in June 2014 Turns any Wi-Fi enabled device into a satellite phone Inexpensive satellite capability for any Wi-Fi enabled smartphone, tablet or computer . Constant connectivity when out of terrestrial coverage for calls, email and text messages 2 Billion People Live, Work or Travel Outside of Cellular Coverage 75% Landmass Beyond Terrestrial Coverage Market Opportunity Advantages / Features Dramatically expands Globalstar’s addressable market 6

ADS-B Link Augmentation System (“ALAS”) 7

● TLPS is a mobile broadband service provided over Globalstar’s 2.4 GHz spectrum – FCC released Notice of Proposed Rulemaking in November 2013 with authority expected by year-end 2014 ● Clear TLPS channel provides for improved range and effective capacity of averaging 5x and 4x, respectively, as compared to public Wi-Fi – performance differential is heightened in metropolitan areas ● All Wi-Fi-enabled devices, utilizing a worldwide standard, already have access to Channel 14 at the hardware level but are currently restricted due to regulatory constraints protecting Globalstar’s satellite service. Post-approval, devices can be upgraded via remote firmware updates to access Channel 14. ● TLPS can dramatically expand spectral capacity to relieve existing Wi-Fi congestion. Offers a superior and unmatched QoS for a device ecosystem. TLPS Helps Alleviate the Wi-Fi Traffic Jam The Problem: Wi-Fi Traffic Jam The Solution: Terrestrial Low Power Service (“TLPS”) “Wi-Fi has become a victim of its own popularity, and now faces congestion issues of its own. That’s why the Commission is hard at work providing spectrum for both licensed and unlicensed use. Both are critically important to our mobile ecosystem.” (Statement of Chairman Tom Wheeler) “The Nation’s demand for unlicensed services has increased so dramatically that we need more spectrum to support these services. The 2.4 GHz band, while critical to the success of Wi-Fi and other unlicensed technologies, is increasingly congested particularly in major cities. Densely populated centers are the most expensive geographic areas to deploy licensed networks.”(Statement of Commissioner Mignon Clyburn) Existing Wi-Fi channels 1, 6 and 11 are highly compromised by co-channel interference due to unlicensed Wi-Fi activity 8

FCC’s NPRM Regulatory Update Globalstar’s NPRM Process Overview November 13, 2012 Globalstar Files Petition for Rulemaking January 20, 2013 Initial & Reply Comments Filed September 5, 2013 FCC Circulates NPRM Internally November 1, 2013 FCC Unanimously Votes For and Releases NPRM February 19, 2014 NPRM Publication in Federal Register May 5, 2014 Comment Due Date June 4, 2014 Reply Comment Due Date 2H 2014 Process Completion Expected Com p le te d 9

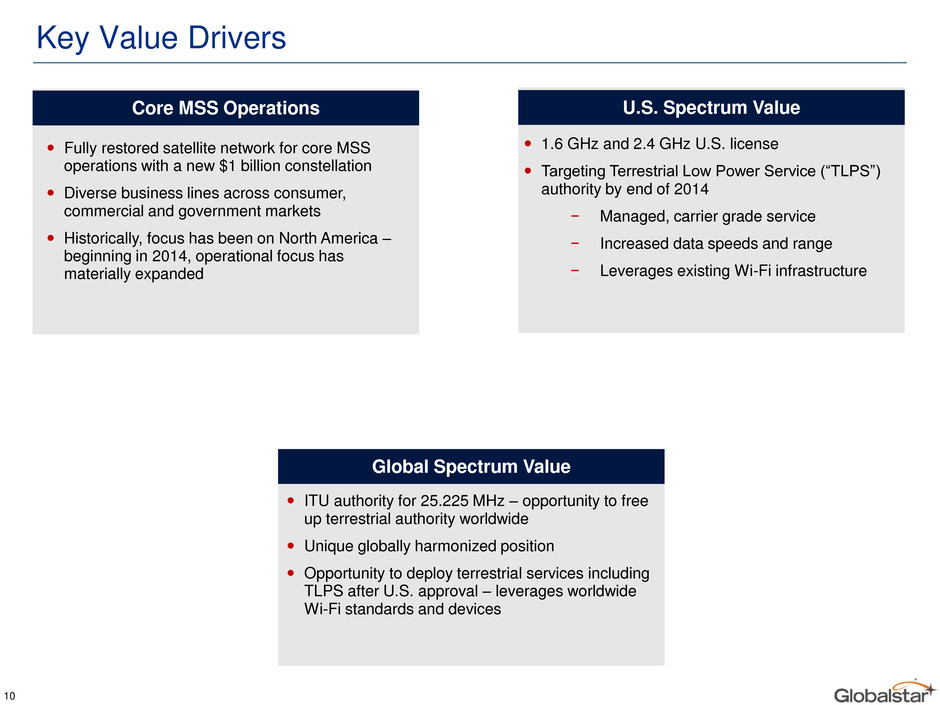

Key Value Drivers Fully restored satellite network for core MSS operations with a new $1 billion constellation Diverse business lines across consumer, commercial and government markets Historically, focus has been on North America – beginning in 2014, operational focus has materially expanded 1.6 GHz and 2.4 GHz U.S. license Targeting Terrestrial Low Power Service (“TLPS”) authority by end of 2014 − Managed, carrier grade service − Increased data speeds and range − Leverages existing Wi-Fi infrastructure ITU authority for 25.225 MHz – opportunity to free up terrestrial authority worldwide Unique globally harmonized position Opportunity to deploy terrestrial services including TLPS after U.S. approval – leverages worldwide Wi-Fi standards and devices Core MSS Operations U.S. Spectrum Value Global Spectrum Value 10

Annex A – Reconciliation of Quarterly Adjusted EBITDA ($ in millions) Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Net loss ($6.5) ($14.1) ($0.7) ($33.7) ($24.5) ($27.5) ($41.2) ($19.0) ($25.1) ($126.3) ($205.0) ($234.8) ($250.5) ($433.7) Interest income and expense, net 1.2 1.2 1.2 1.2 3.1 3.8 6.6 8.1 7.8 15.2 16.9 28.0 10.9 13.9 Derivative (gain) loss (6.4) (3.9) (23.8) 10.3 6.5 (20.4) 16.5 (9.5) (0.5) 29.9 97.5 179.1 209.4 376.3 Income tax expense (benefit) 0.1 0.1 (0.0) (0.3) 0.2 0.1 0.1 0.1 0.1 0.1 0.1 0.8 0.2 1.0 Depreciation, amortization, and accretion 10.6 12.8 12.1 14.5 14.7 15.9 18.7 20.5 20.3 22.1 23.7 24.5 23.3 22.0 EBITDA ($1.0) ($3.9) ($11.2) ($8.0) ($0.1) ($28.1) $0.6 $0.2 $2.6 ($59.0) ($66.7) ($2.5) ($6.7) ($20.6) Reduction in the value of long-lived assets & inventory $0.4 $0.5 $4.0 $7.5 $0.3 $7.2 $0.7 $0.4 $0.0 $0.0 $0.0 $5.8 $0.0 $7.3 Non-cash compensation 0.7 0.8 0.5 0.2 0.3 0.3 0.3 0.3 0.4 0.3 1.2 0.4 0.8 0.6 Research and development 0.5 0.5 0.6 0.2 0.1 0.1 0.0 0.1 0.2 0.1 0.2 0.1 0.1 0.1 Severance 0.1 0.2 0.7 0.3 0.0 0.0 (0.0) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Foreign exchange and other (income) loss (1.2) (0.1) 1.9 0.3 (0.1) 0.6 0.4 1.3 (0.6) 0.2 1.5 1.8 (0.7) 1.1 (Gain) Loss on extinguishment of debt 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 47.2 63.6 (1.7) 10.2 16.5 Revenue recognized from Open Range lease term. (2.0) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Thales arbitration expenses 0.0 0.0 0.0 1.0 0.7 0.8 0.2 0.1 0.0 0.0 0.0 0.0 0.0 0.0 Contract termination charge 0.0 0.0 0.0 0.0 0.0 22.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Loss on future equity issuance 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 14.0 2.7 0.0 0.0 0.0 Write off of deferred financing costs 0.0 0.0 0.0 0.0 0.0 0.0 0.8 0.0 0.0 0.0 0.0 0.0 0.2 0.0 Adjusted EBITDA ($2.5) ($2.0) ($3.5) $1.6 $1.4 $2.9 $3.1 $2.5 $2.5 $2.9 $2.5 $3.9 $3.8 $5.0 11

Annex B – Reconciliation of Adjusted Operating Cash Flow ($ in millions) Q1 2014 Q2 2014 1H 2014 Net Loss ($250.5) ($433.7) ($684.3) Depreciation, amortization, and accretion 23.3 22.0 45.3 Change in fair value of derivative assets and liabilities 209.4 376.3 585.7 Stock-based compensation expense 0.6 0.5 1.1 Amortization of deferred financing costs 2.5 2.5 5.0 Provision for bad debts 0.6 0.5 1.1 Loss on extinguishment of debt 10.2 16.5 26.7 Loss on equity method investments - - - Noncash interest expense (includes accretion expense) 4.1 6.9 10.9 Noncash inventory impairment - 7.3 7.3 Foreign currency and other, net (0.2) 1.6 1.3 Changes in operating assets and liab ilities: Accounts receivable (0.9) (1.4) (2.3) Inventory 2.1 1.4 3.5 Prepaid expenses and other current assets (0.7) (0.0) (0.7) Other assets (0.6) (0.6) (1.2) Accounts payable and accrued expenses 2.9 (5.1) (2.2) Payables to affiliates 0.0 0.0 0.1 Other non-current liabilities (0.1) 0.8 0.7 Deferred revenue 1.1 3.1 4.2 Operating Cash Flow $3.8 ($1.4) $2.4 Cash interest costs expensed and not capitalized - 8.7 8.7 Adjusted Operating Cash Flow $3.8 $7.2 $11.0 12 Month Run-rate operating cash flow $22.1 12