Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - BOB EVANS FARMS INC | d774351d8k.htm |

| EX-99.2 - PRESS RELEASE - BOB EVANS FARMS INC | d774351dex992.htm |

Transformed and

Ready to Grow

August 2014

Exhibit 99.1 |

Important Additional Information

2

Bob Evans Farms Inc. (the “Company”), its directors and certain of its

executive officers are participants in the solicitation of proxies in

connection with the Company's 2014 Annual Meeting of Stockholders. The Company has filed a definitive proxy statement and

form of WHITE proxy card with the U.S. Securities and Exchange Commission (the

“SEC”) in connection with such solicitation of proxies from the

Company's stockholders. WE URGE INVESTORS TO READ THE DEFINITIVE PROXY STATEMENT

(INCLUDING ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACCOMPANYING WHITE PROXY

CARD CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY CONTAIN IMPORTANT

INFORMATION. Information regarding the names of the Company's directors and

executive officers and their respective interests in the Company by

security

holdings

or

otherwise,

is

set

forth

in

the

Company's

proxy

statement

for

its

2014

Annual

Meeting

of

Stockholders,

filed

with

the SEC on July 11, 2014. Stockholders will be able to obtain, free of charge,

copies of the definitive proxy statement (and amendments or supplements

thereto) and accompanying WHITE proxy card, and other documents filed with the SEC at the SEC's

website at www.sec.gov. In addition, copies will also be available at no charge at

the Investors section of the Company's website at

http://investors.bobevans.com/sec.cfm.

This document contains quotes and excerpts from certain previously published

material. Consent of the author and publication has not been sought or

obtained to use the material as proxy soliciting material. |

Non-GAAP Financial Measures

The Company uses non-GAAP financial measures within this presentation. These

financial measures are used by management to monitor and

evaluate

the

ongoing

performance

of

the

Company.

The

Company

believes

that

the

additional

measures

are

useful

to

investors

for

financial analysis. However, non-GAAP measures are not in accordance with, nor

are they a substitute for, GAAP measures. Reconciliations of non-GAAP

financial measures to the most directly comparable GAAP financial measures are provided in the Appendix to this

presentation.

3 |

4

I.

Introduction

–

The Fundamental Choice

II.

The Transformation of Bob Evans

III.

Our

Value

Creation

and

Growth

Plan

–

Prudent, Responsible and Focused

IV.

Sandell’s Demands –

Short-Sighted, Unsustainable and Not in the Best

Interests of All Stockholders

V.

Our Leadership –

Independent, Highly Qualified and Open-Minded

VI.

Conclusion –

Bob Evans: The Clear Choice

Appendix |

I.

Introduction –

The Fundamental Choice |

Executive Summary: Consider the Facts

6

The Bob Evans Board believes that:

o

We have transformed the business while returning over $800 million to shareholders

since FY07 (including over $250 million in FY14)

o

We have a clear plan for continued, sustainable value creation as we emerge from

this investment and transformation phase

o

Sandell’s

“plan”

of

financial

engineering

has

shifted

a

number

of

times

since

he

entered

the stock last year

o

Sandell’s agenda is not in the best interests of the Company or its

stockholders; it is a misleading attempt to generate short-sighted

profit with no guarantees o

Bob Evans’

current leadership is the right team to lead the Company and maximize

stockholder value

Our proposed Board structure would result in an open-minded Board with diverse, relevant

perspectives and a range of tenure and would include two Sandell nominees

Vote

for

Bob

Evans’

Nominees

on

the

WHITE

Card |

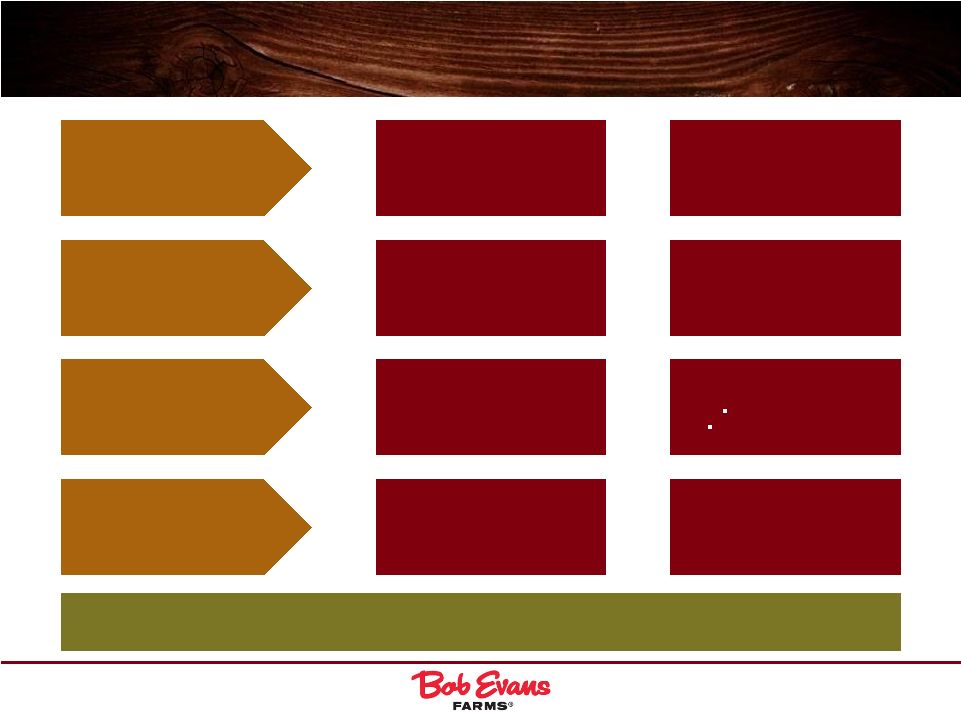

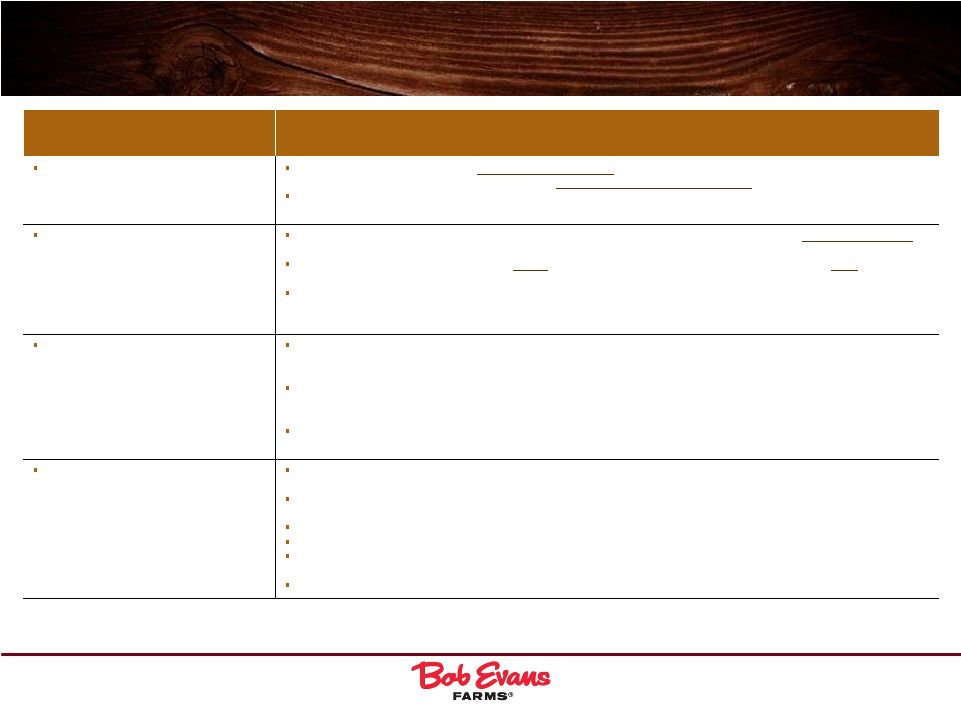

Proactive Evaluation of the Business

As part of its commitment to drive stockholder value, the Bob Evans Board employs a

rigorous and disciplined process to continually review its business and

either grow, fix or exit assets

7

Bob Evans Restaurants (e.g., Farm Fresh Refresh, carryout

growth, new units and Bob Evans Express)

Bob Evans Foods (e.g., increased retail accounts & SKUs,

acquisition of Kettle Creations)

GROW

Elimination of Bob Evans Foods co-packer model to vertical integration

Sausage optimization

Transportation consolidation

Plant closures/consolidations

FIX

Closed or disposed of over $125 million of assets since

FY06 (e.g., Mimi’s Café)

Selected restaurant closures

Elimination of Direct Store Delivery asset intensive model

EXIT |

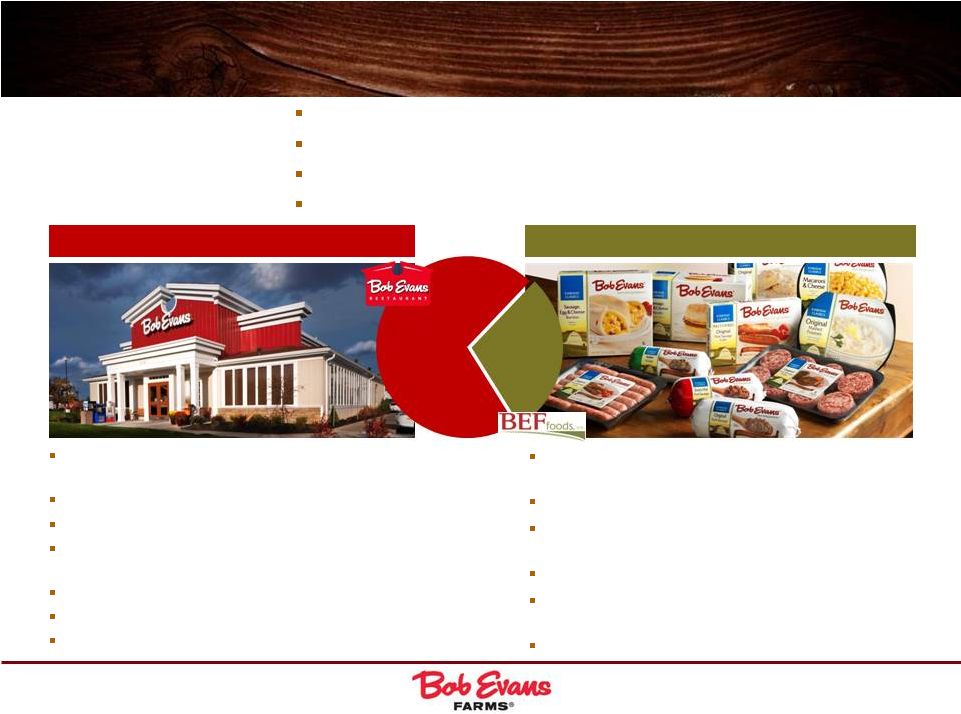

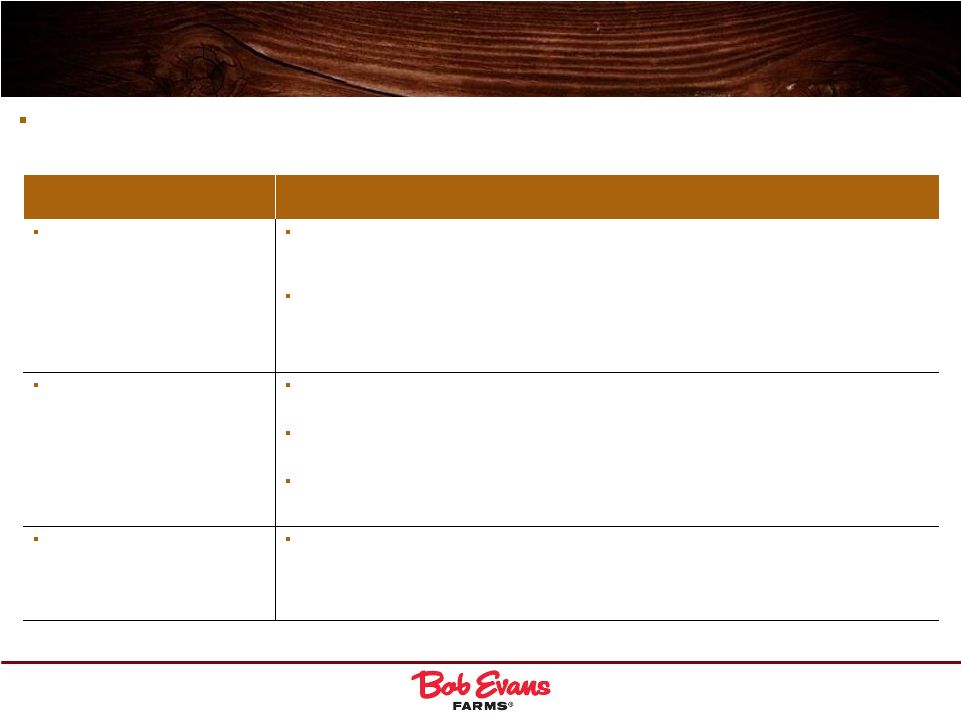

The

Fundamental Choice 8

Continue to drive profitable growth of existing

businesses

Continue to employ balanced approach to

investment and return of meaningful capital to

stockholders

Regularly and proactively review strategy;

continually engage with stockholders

Sustainable, Disciplined,

Responsible, Open-Minded

Divest Bob Evans Foods now, before reaping

benefits of our transformational investments

Sell real estate, losing strategic control of assets

while burdening Bob Evans with significant and

escalating annual rents and increased leverage

Rapidly effect large leveraged share repurchase

Unsustainable,

Not in the Best Interest of All

Stockholders

The Board structure proposed by Bob Evans would result in a fully independent Board,

except for the CEO; a majority of the independent directors would be new to

the Board since 2012; and 5 of 11 independent directors would be new to the

Board this year, including two Sandell nominees The 2014 annual meeting presents stockholders with

a fundamental choice between what we believe to be two very different approaches:

|

II.

The Transformation of

Bob Evans |

Our

Vision 10

Make Our REGIONAL BRANDS

Powerful NATIONAL BRANDS

|

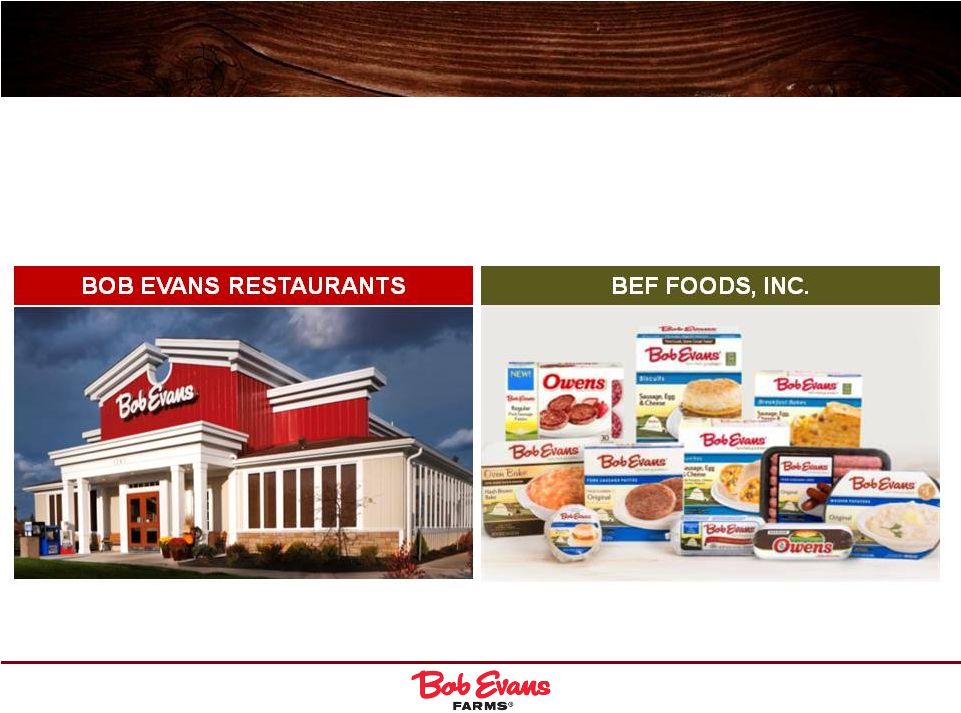

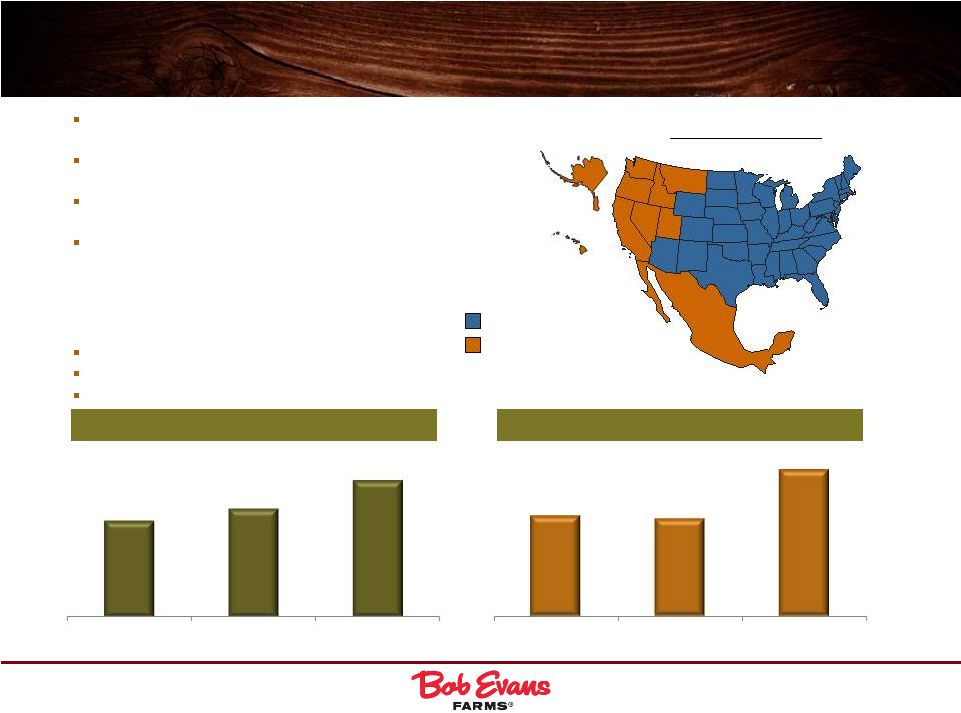

Overview: Regional Brands, National Potential

11

Leading full-service Midwest-based restaurant

chain

561 restaurants, 19 states

Quality, home-style food and friendly service

All three day parts served (32% Breakfast, 38%

Lunch, 30% Dinner)

13% of sales are off-premise

Adjusted EBITDA (FY14): $106mm

FY14 AUV of $1.71mm

Vertically integrated side dish and sausage

manufacturing

Refrigerated side dishes

Breakfast convenience items (refrigerated and

frozen)

Pork sausage

Distributed through retail, BER restaurants and

external food service

Adjusted EBITDA (FY14): $28mm

Founded in 1948

Ticker: BOBE

Market capitalization: ~$1.1bn

Two synergistic business segments

Bob Evans Restaurants (“BER”)

Bob Evans Foods (“BEF”)

Rev:

$957mm

(72%)

Rev:

$372mm

(28%) |

Our

Guiding Principles 12 |

13

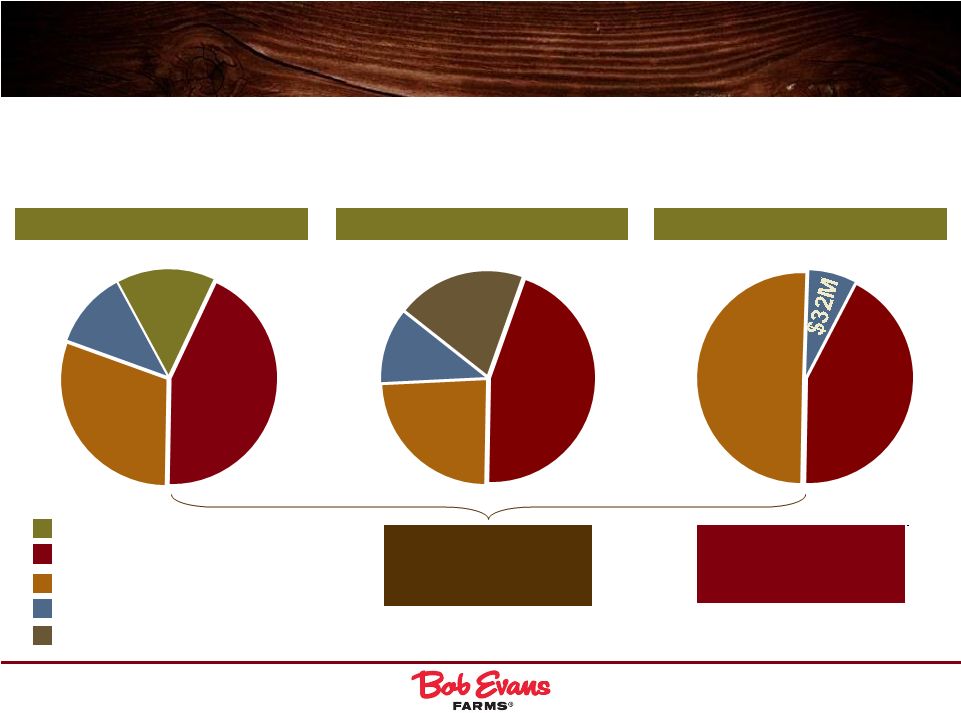

A Track Record of Balanced Capital Allocation

Fiscal 2013

Fiscal 2014

Fiscal 2007-2012

FY15 Capex expected to

be $85 to $90 million, in-

line with historical average

Bob Evans has returned meaningful capital to stockholders in a prudent, consistent

fashion Debt Repayment

Capex

Share Repurchases

Dividends

Acquisition

Over $800 million returned

to stockholders through

share repurchases and

dividends since FY07

$52M

$30M

$118M

$63M

$191M

$225M

$339M

$485M

$167M

$

$130M |

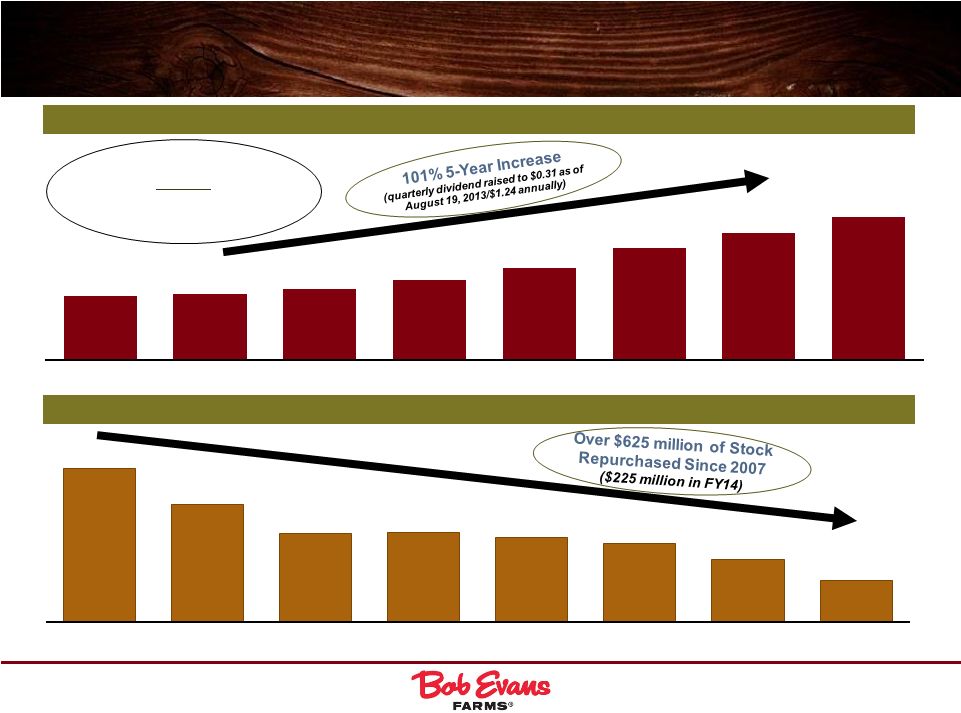

14

Track Record of Meaningful Dividends and

Share Repurchase

Trailing 12-month yield

(8/8/14):

BOBE: 2.6%

S&P 500: 1.9%

36,484

33,315

30,744

30,890

30,422

29,925

28,488

26,704

FY 2007

FY 2008

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

FY 2014

$0.54

$0.56

$0.60

$0.68

$0.78

$0.95

$1.075

$1.205

FY 2007

FY 2008

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

FY 2014

Annual Dividend Per Share has Doubled Since FY08

Weighted Average Diluted Shares Decreased by 27% since FY07 (000’s)

|

BER:

Remodeled and Ready to Grow 15

Recently completed Farm Fresh Refresh

o

First comprehensive remodeling program in brand

history

o

76% maintenance capex and 24% growth capex

o

Refreshed restaurants have consistently

outperformed non-refreshed restaurants

We are confident BER has exciting growth potential:

o

New sales layer growth (e.g., carryout, Broasted

platform and five-dollar soups to go)

o

Leveraging our regional strength to catalyze new

unit growth

o

Developing the compelling new Bob Evans Express

("BEX") license/franchise format

Farm Fresh Refresh Transformation

Exciting New Restaurant Design

Compelling New BEX Growth Format

Restaurant

Locations

as

of

4/25/14 |

16

The Company recently completed a multi-year renovation program of all its

units Farm

Fresh

Stores

–

Incremental

SSS

(Year-One Stores vs. Non-Refreshed Stores)

Farm Fresh Refresh Driving Sales

Dining Room &

Lobby

Restrooms

Bakery,

Catering &

Carryout

Exterior,

Signage,

& Landscaping

CapEx Summary

(76% maintenance capital, 24% growth capital)

Average Capital Investment per

Remodeled Restaurant: ~$225K

(1) Nation’s Restaurant News, Consumer Picks, March 24, 2014.

44%

10%

22%

4.3%

4.8%

2.6%

3.6%

4.5%

4.0%

2.2%

2.8%

2.7%

3.4%

3.6%

FY12

Q1

FY12

Q2

FY12

Q3

FY12

Q4

FY13

Q1

FY13

Q2

FY13

Q3

FY13

Q4

FY14

Q1

FY14

Q2

FY14

Q3

24%

Refreshed stores consistently outperformed the non-refreshed stores over the

last three years According to WD Partners and Nation’s Restaurant News,

Bob Evans has made significant progress in areas of food quality, value,

service, menu variety and atmosphere, and took top position

in

the

“cleanliness”

category

1 |

17

Industry Traffic has Been Soft Across Dayparts

and Segments, Particularly in Midscale

Source: CREST®

AMJ ’14, The NPD Group, Inc..

Distribution

of

Traffic

and

Trend

by

Segment

and

Daypart

–

Qtr.

Ending

June

‘14

-4%

Morning Meal

YoY

-4%

-5%

-1%

-4%

-1%

-1%

+3%

Lunch

Supper

Late Night

YoY

YoY

NA

NA

NA

NA

23%

25%

4%

33%

35%

33%

26%

38%

59%

18%

2%

4%

QSR

Midscale

Casual Dining

BER is considered Midscale

according to the NPD Group |

Leveraging a Remodeled Base: Product and Operational Innovation to

Drive Positive Same-Store Sales in FY'15 and Beyond

18

Menu Innovation

New Sales Layers

Carryout

Catering

Operational Innovation

Labor Management

Carryout Service

Enhancements

New Kitchen

Technology &

Equipment

Objectives:

Bakery

All Initiatives

Rigorously Tested

KDS (kitchen

displays)

Clamshell grill

Broaster

Batch holding

Drive traffic

Increase avg. check

Leverage off-premise

Enhance margins |

19

Farm Fresh Refresh Will Catalyze Further Growth

in Carryout Sales

Off-Premise Sales Mix and Growth % by Year

Family Meals to Go

Bakery

Catering/Carryout

Carryout sales have demonstrated consistent growth trajectory since 2006

+8.6%

+5.3%

+8.5%

+3.9%

+0.6%

+15.4%

+12.9%

+7.9%

+2.4%

6.5%

7.0%

7.5%

8.0%

8.5%

9.0%

9.5%

10.0%

10.5%

11.0%

11.5%

12.0%

12.5%

2006

2007

2008

2009

2010

2011

2012

2013

2014

Off-Premise Sales Mix

Growth % by Year

As a result of FFR, 100%

of BER units now have

carryout capabilities |

20

Broasted Chicken has Reversed Dinner and Lunch

Sales and Traffic Declines in its Test Markets

Change in Same-Store Sales Since Mid-March Launch of Broasted in

Cincinnati Total sales improvement

vs. the balance is +2.65%

Broasted chicken is now the number one top seller in its test markets and already

accounts for 12% of sales mix (as compared to the previous top seller

Rise-and-Shine which accounts for 7% of sales) 1.20%

2.58%

5.72%

3.29%

2.52%

0.55%

-0.92%

0.64%

-2.00%

-1.00%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

Breakfast

Lunch

Dinner

Total

Cincinnati Test Restaurants (32)

BER Stores Excl. Cincinnati Test Restaurants (529)

Bob Evans menu is subject to continuous consumer testing, review and revision with

particular focus on increasing differentiation across users and platforms

|

21

Broasted Chicken is Fueling Incremental

Carryout Sales in its Test Markets

Broasted meals accounted for 56% of carryout sales increase

Cincinnati

D.M.A.

(April

17

th

–

July

27

th

)

1

Broasted accounts for

~$227K or 56% of total

increase in carryout sales

(1)

Media

launch

began

in

April

17

th

,

2014

Dine-In Sales

$122,526

Carryout Sales

407,710

Total

$530,236

Sales

Variance ($)

% of

Total

23%

77% |

BEF:

Restructured and Ready to Grow 22

Restructured to streamline and focus on more

profitable businesses

100% vertically integrated cost structure with

Kettle Creations acquisition

Mitigated over $66mm in sow cost inflation

since 2009

Four key lines of business

o

Refrigerated Sides (41% of sales)

o

Food Service (26%)

o

Sausage (24%)

o

Frozen/Other (9%)

Broad customer base

Sold at 30,000+ retail locations

Distributed in 50 states and Mexico

Number of Retail Stores

Average SKUs Per Store

Distribution

Presence

* Subsequently reduced SKU count & improved overall profitability

Bob Evans Growth Opportunity Markets

Bob Evans Core Markets

11.6

11.3

17.0

2010*

2014

2018 (Goal)

28,407

31,687

40,000

2010

2014

2018 (Goal) |

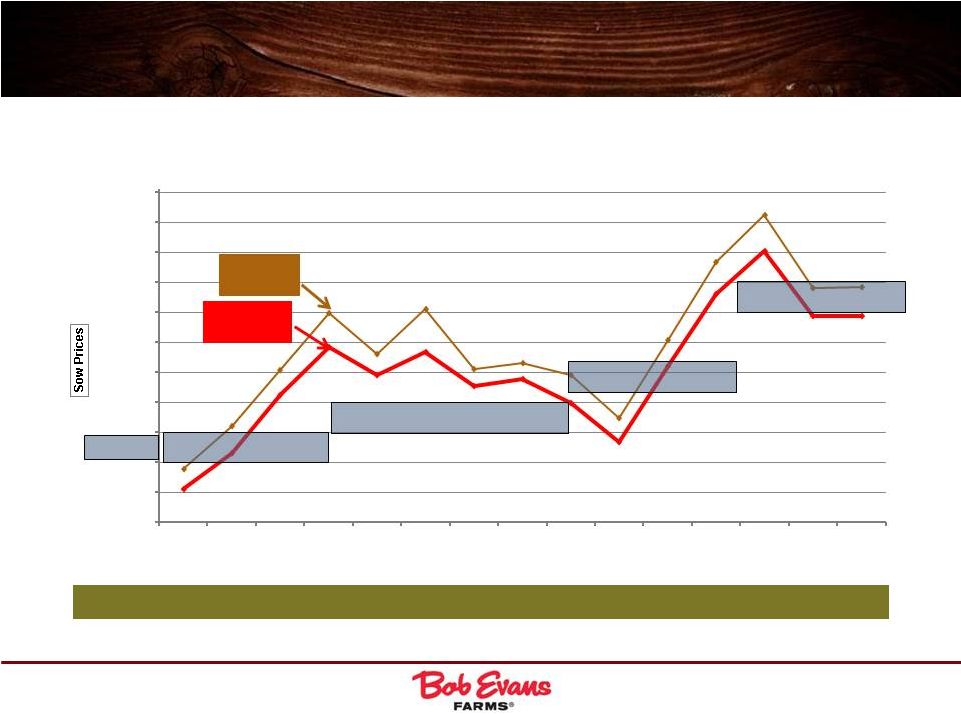

The

Run-Up in FY14 Sow Costs Made it Difficult to Guide Our Profit

Forecasts 23

The increase of sow costs, largely driven by unforeseen PED virus outbreaks, has been

the main reason we have reduced our guidance

Note: USDA data reflects top of trading range

$65-$70/cwt

(issued 8/19/13)

$60-$65/cwt

(issued 6/4/13)

$72-$77/cwt

(issued 1/21/14)

BOBE

Guidance

USDA

Cost

Bob Evans

Cost

There is no effective sow cost hedging mechanism in the U.S.

$88-$90/cwt

(issued 7/8/14)

$55.50

$61.57

$71.27

$79.14

$74.49

$78.42

$72.68

$73.93

$69.90

$63.46

$76.10

$88.02

$95.17

$84.39

$84.44

$58.94

$66.13

$75.35

$84.93

$77.96

$85.59

$75.62

$76.58

$74.50

$67.32

$80.44

$93.39

$101.16

$89.02

$89.18

$50.00

$55.00

$60.00

$65.00

$75.00

$80.00

$85.00

$90.00

$95.00

$100.00

$105.00

May

FY' 14

Jun

FY' 14

Jul

FY' 14

Aug

FY' 14

Sep

FY' 14

Oct

FY' 14

Nov

FY' 14

Dec

FY' 14

Jan

FY' 14

Feb

FY' 14

Mar

FY' 14

Apr

FY' 14

May

FY' 15

Jun

FY' 15

Jul

FY' 15

$70.00 |

24

Significant Intersegment Synergies

Brand and Advertising Synergies (e.g., TV, Print and In-Store)

Product Innovation Between BEF and BER (e.g., Mashed Potatoes)

Supply Chain Savings by Joint Procurement (e.g., Poultry)

Brand Credibility Leads to External Food Service Expansion

Margin Enhancement at BER and BEF as a Result of G&A Leverage

Restaurant Operational Efficiencies via In-Sourcing Strategy

We believe that the combination of BER and BEF offers

significant intersegment synergies, including: |

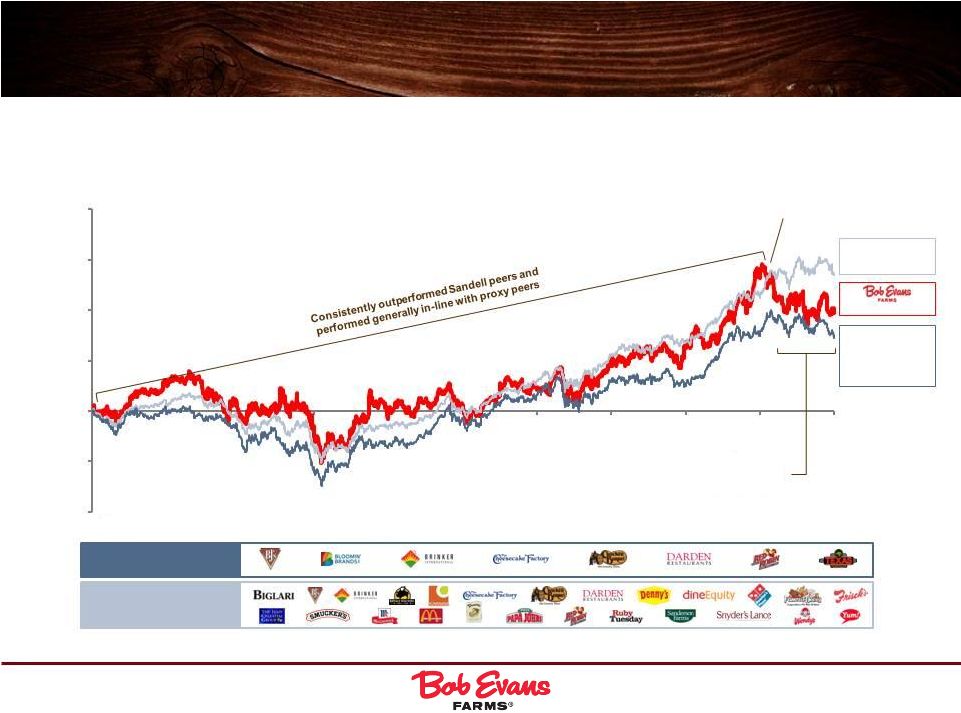

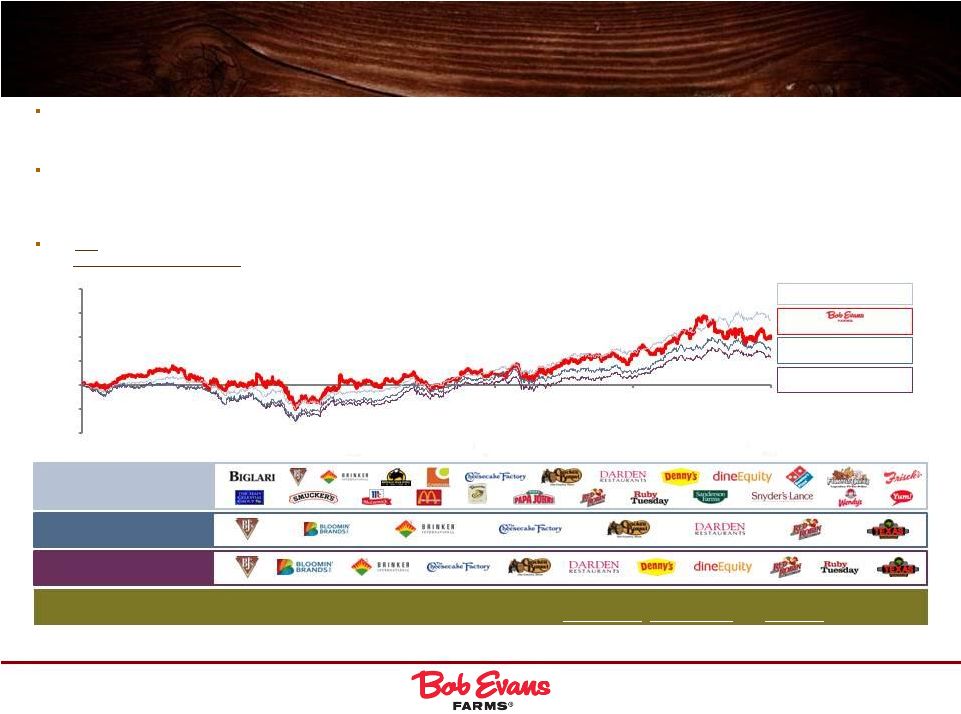

Consistent Value Creation

25

Source: FactSet as of 8/8/14.

Note: Appointment of Steve Davis as CEO announced on

5/2/06. Since Steve Davis was hired as CEO in May 2006, Bob Evans has

consistently outperformed Sandell’s designated Family and Casual Dining

Peers and performed generally in-line with Bob Evans’

proxy peers, until Fall of 2013

Sandell Family

& Casual

Dining Peers:

+76%

+102%

Proxy Peers:

+136%

Record sow costs and

unusually severe Midwest snow

storms impacted Q3 & Q4 EPS

October 2013

(100%)

(50%)

0%

50%

100%

150%

200%

Sandell Family & Casual

Dining Peers

Proxy Peers

May-06

Feb-07

Dec-07

Oct-08

Aug-09

Jun-10

Apr-11

Feb-12

Dec-12

Oct-13

Aug-14 |

Sandell Manipulates the Data to Try to Justify His

Flawed Agenda

26

Sandell

has

repeatedly

shifted

his

“peer

group”

to

blatantly exclude underperforming peers

o

Sandell’s

three

presentations

–

filed

with

the

SEC

on

September

24,

2013,

December

9,

2013

and

April

24,

2014

–

compare

Bob

Evans’

stock

performance

against

three

different,

cherry-picked

peer

groups

1

In

Sandell’s

July

2014

presentation,

Sandell

omits

Denny’s,

DineEquity

and

Ruby

Tuesday’s

from

his

latest

set

of

Bob

Evans’

peers. A

reasonable list of family and casual dining peers would be expected to include each

of these three companies o

Indeed,

Sandell’s

December

2013

presentation

stated

that

Denny’s

and

DineEquity

are

two

of

Bob

Evans’

“more

relevant

family

dining

peers”

The

fact

remains

that

–

whether

these

three

missing

peers

are

included

in

the

Sandell-constructed

peer

group

or

excluded

–

Bob

Evans

has

consistently

outperformed

Sandell’s

selected

peer

group

since

Steve

Davis

became

CEO

in

May

2006

through

August

8,

2014

Source: FactSet as of 8/8/14.

(1)

Sandell’s

presentations,

filed

on

Schedule

14A

with

the

SEC

on

September

24,

2013,

December

9,

2013

and

April

24,

2014,

compare

the

Company’s

stock

performance

against

as

few

as

three

and

as

many

as

eight

different

companies,

and

each

of

the

following

has

been

both

excluded

at

least

once

and

included

at

least

once:

BJRI,

BLMN,

CAKE,

DENN,

DIN,

DRI,

EAT,

RRGB,

TXRH.

Sandell Family & Casual

Dining Peers: +76%

Proxy Peers: +136%

Sandell Peer Group Plus

DENN, DIN and RT: +60%

Sandell’s

ever-shifting

economic

demands

and

curiously

“evolving”

peer

groups

aside,

Bob

Evans

is

focused

on

enhancing

performance

and

executing

on

our

value-creating

initiatives

under

the

leadership

of

an

independent,

open-minded

and

refreshed

Board

+102%

Proxy Peers

Sandell Family & Casual Dining

Peers

Sandell Peer Group Plus

DENN, DIN and RT

(100%)

(50%)

0%

50%

100%

150%

200%

May-06

Dec-07

Aug-09

Apr-11

Dec-12

Aug-14 |

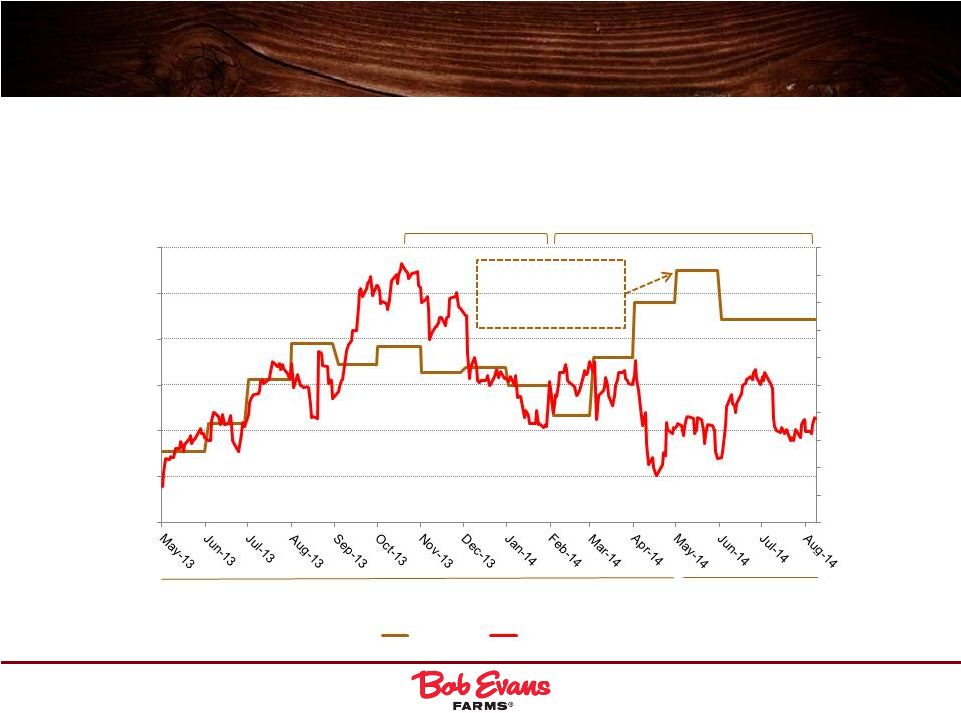

Record Sow Costs and Severe Weather Have Been the Primary

Factors Adversely Impacting Our Stock Price Since Last Fall

27

Since hitting nearly $60/share, the Company’s stock has been adversely impacted

by both severe weather and record sow costs

FY14

FY15

Source: FactSet, USDA data.

May-14: Sow costs hit

record highs;

increased by ~50%

since Feb-14

$40.00

$50.00

$60.00

$70.00

$80.00

$90.00

$100.00

$/CWT

Sow Costs

Stock Price

$42.00

$44.00

$46.00

$48.00

$50.00

$52.00

$54.00

$56.00

$58.00

$60.00

Stock Price

$40.00

Unusually severe winter

weather disproportionately

impacted BER

Dramatic rise in sow costs

to record levels |

Setting the Record Straight: Total Shareholder

Return

28

Sandell’s Misleading Claims/

Overstated Criticisms

1

The Facts

Sandell claims that Bob Evans’

stockholders have “suffered

years of woeful under-

performance”

Sandell’s

own

analysis

illustrates

that

the

Company

outperformed

the

S&P

500

by over 10% over

the

last

10

years

and

performed

generally

in-line

with

his

“Family

and

Casual

Dining”

peers (Bob

Evans meaningfully outperformed RRGB & CAKE, performed in-line with BJRI

& EAT and underperformed DRI & CBRL) over the same time period

In fact, Sandell’s own relative performance graphs for each of the 1-year,

3-year, 5-year and 10-year periods illustrate that Bob Evans

performed generally in-line with Sandell’s peer set until late 2013

Sandell claims that Bob Evans’

“exposure to the weather was not

unique”

Bob

Evans

has

the

most

Midwest

exposure

of

any

sizable

family

or

casual dining chain

Analysts

appreciate

this

fact:

“CBRL

only

has

~21%

of

units

in

Midwest,

vs.

~61%

for

BOBE,

who

revealed

stores

outside

the

Midwest

had

positive

comps

(e.g.

Florida).”

–

Oppenheimer,

January

22, 2014

Sandell claims that the Company

“cherry-picked”

dates to measure

shareholder return

Measuring

performance

since

Steve

Davis

began

as

CEO

in

May

2006

is

the most

relevant time

period to evaluate the Board and management

From

May

1,

2006

to

August

8,

2014,

the

Company

has

meaningfully

outperformed Sandell’s own

“Family

and

Casual

Dining”

peer group by ~26%

Sandell NOW claims that DIN,

DENN and RT are not comparable

to Bob Evans

As recently as December 9, 2013, Sandell expressly included DIN and DENN in

Sandell's "peer group"

Each of DIN, DENN and RT are widely considered to be notable family/casual

competitors to Bob Evans

If

DIN,

DENN

and

RT

were

justly

included

in

Sandell’s

“peer

group”,

Bob

Evans’

outperformance

from

May

1,

2006

to

August

8,

2014

would

be

even

more

pronounced

(~42%)

(1)

Sandell presentation, filed with the SEC August 4, 2014.

|

III.

Our Value Creation and Growth

Plan –

Prudent, Responsible

and Focused |

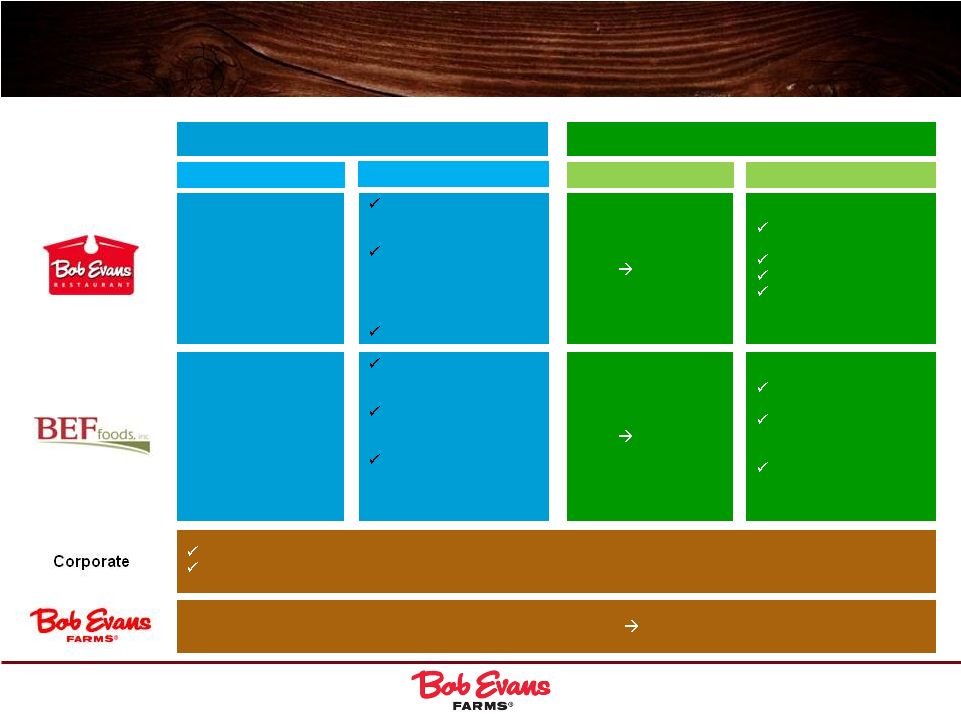

30

Our Plan: Transformed and Poised for Growth

Bob Evans Restaurants

Farm Fresh Refresh Completed

Up to 8 New Restaurants in FY15

10-12 Annually Thereafter

10-20 BEX to be

Licensed/Franchised Annually

Capital and Resource Allocation

Enterprise Resource Planning

Margin Innovation

Bob Evans Foods

Side Dish Vertical Integration

Sausage Network Optimization

Transportation Consolidation

Corporate |

31

Significant Asset Closures/Dispositions:

Over $125 Million of Asset Dispositions Since FY06

Asset

Consolidation

Sausage operations

(five facilities into two)

Ready-to-eat

operations

(four facilities into one)

Business

Closure

76 restaurants closed

Headquarters

closures

Owens HQ (Texas)

Mimi’s Café

(California)

Business

Reengineering

Direct-store-delivery to

warehouse conversion

Springfield, OH

transportation center

(four facilities into one)

Business

Sold/Divested

Mimi’s Cafe

Springfield, Ohio

distribution center

The Board does not hesitate to re-evaluate strategic decisions;

every business asset is subject to a review every quarter

|

ERP

Investment 32

SKU Level Cost and

Profit Insights

SKU Reduction and

Maximization

Segment Level Cost

Analysis

Trade Spending

Optimization and

Analytics

Platform for Growth

Speed to Market with

New Functionality

Compliance

Elimination of

Manual Processes

Integrated Systems

Complexity

Elimination

Plug-N-Play with

Future Integrations

(Complex

Transactions)

Cost Insights and

Analysis

Categorized

Spending

Online Auction

Integration

Contract

Administration,

Tracking and

Enforcement

Payroll Co-Sourcing

Employee and

Benefits Tracking

Employee

Optimization and

Productivity

Taxes and Fixed

Asset Accounting

Quarterly and Annual

Close Process

Electronic Audit

Evidence

Accounts Payable

and Receivable

Tracking

Integration with COS

and COL Systems

Spending and Cost

Analytics

Enterprise Resource Planning (ERP) Investment

Significantly Enhances Our Capabilities

“Mgmt.

maintained

its

outlook

for

300-350

bps

of

margin

expansion

in

the

coming

years,

which

we

expect

to

show

up

in

BEF

more

quickly,

due

to

the

aforementioned

plant

closures.

Central

to

further

improvement

is

the

Company’s

current

ERP

implementation,

including

a

labor

management

tool

that

is

showing

a

60-70

bps

drop

in

labor

costs,

as

well

as

future

savings

around

insourcing,

supply

chain

and

food

waste.

”

-

Stephens, 1/22/2014

BEF Business

Insights

IT

Systems

Supply

Chain

Payroll

and HR

Financial

Controls |

Our

Long-Term Goal and Strategic Pillars 33

PROFITABLY

GROW &

CONTINUE

TO TRANSFORM

OUR CORE

BUSINESS

DRIVE

STOCKHOLDER

VALUE WITH

DISCIPLINED

CAPITAL

ALLOCATION

SELECTIVELY

INVEST IN

HIGH R.O.I.C.

GROWTH

OPPORTUNITIES

(Internal &

External)

10 –

12% Long-Term

EPS Growth Goal |

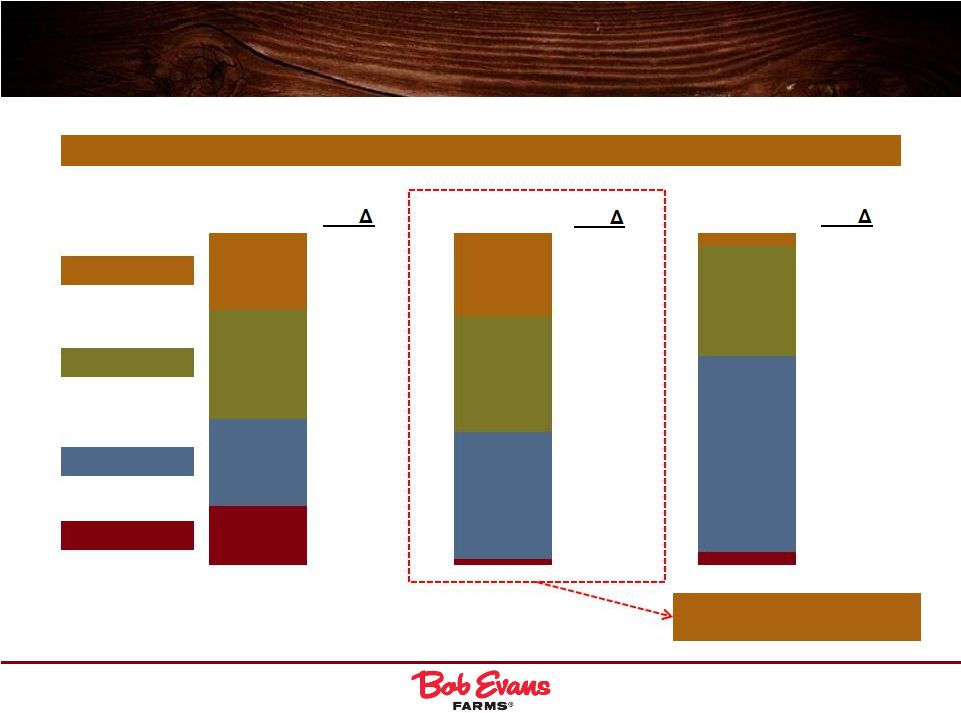

Our

Long-Term Goals 34

Operating Margin

Operating Margin

7.8%

11.2 -

11.7%

Net Sales

3.0% -

3.5%

Annual Growth

Initiatives

Up to 8 new restaurants in

FY15; 10-12 restaurants

thereafter

Same-store sales and new

restaurants expected to

contribute equally to net

sales growth (~1.50% to

1.75% each)

Rollout of BEX units

6.0% -

7.0%

Refrigerated side dish and

food service products to

drive growth

Expand points of

distribution (~32k in FY14

to ~40k by FY18)

Increase average SKU

count per point of

distribution (~11.3 in FY14

to ~17.0 FY18)

FY13-FY18 Improvement

Initiatives

Sales forecasting/labor

management

Food cost optimization

Menu management

Back-of-the-house

optimization

8.8%

11.8 -

12.3%

Side dish vertical

integration

Implement lean

manufacturing w/ side

dish production

Transformational

consolidation

8.4%

11.5 -

12.0%

Corporate

Refinancing/interest reduction

ERP implementation |

Analysts Appreciate the Company's Strategy

35

“In

our

opinion,

Bob

Evans

Farms

will

experience

impressive

margin

expansion

in

F2015

and

F2016.

Bob

Evans

remains

our

favorite

small-cap

pick

in

the

family

and

casual

dining

space,

owing

primarily

to

the

significant

margin

growth

we

foresee.

Management has outlined $34 million in estimated F2014 costs that are not expected

to impact F2015 results. These include more than $10 million in additional

costs due directly to this year’s harsh winter weather, $7 million in restaurant remodel costs, $6 million in Mimi’s

Café

carryover

costs

and

more

than

$4

million

due

to

a

supplier

dispute,

among

others.

We

forecast

190

basis

points

of

operating

margin

expansion

in

F2014-F2016

to

8.5%

on

increased

in-sourcing

of

food

products

at

the

restaurants,

continued

supply

chain

and

back-of-the-house

optimization,

implementation

of

new

labor

management

software,

personnel

reductions

and

food

plant

closures.

By

our

model,

the

margin

expansion

will

fuel

impressive

41%

EPS

growth

during

the

period.”

-

Sidoti & Co., 6/11/14

“BOBE provides a unique combination of restaurants (70% of profits) and a

faster growing grocery products business (30%). We believe both

segments

hold

catalysts

to

accelerate

sales,

elevate

margins

and

drive

better

than

expected

EPS

growth.

We

are

particularly

excited

for

next

fiscal

year

(F15)

as

the

model

butterflies

out

of

"transformative"

events

into

a

cleaner

platform

for

improving

earnings

power

and

lower

capital

expenditures.”

-

Oppenheimer, 7/9/14

“Mgmt.

is

estimating

that

sales

rebound

in

FY15,

to

a

growth

rate

of

~13%,

and that operating profit jumps to ~$37 mil. from $12.9 mil. in

FY14. The Company is looking for margin improvement primarily from improved plant

efficiencies, in addition to the realization of expected cost reductions

related to plant network closures. Additionally, mgmt. expects a newly implemented price increase on sausage

to

help

mitigate

higher

sow

costs

(guidance

incorporates

sows

of

$80-$90 per hundredweight). Despite some NT headwinds, we

continue

to

view

BEF

as

the

most

attractive

asset

within

BOBE

and

look

for

improvements

on

the

top

and

bottom

lines

in

FY15.

”

-

Stephens, 7/10/14

“The

company’s

most-recent

woes

are

linked

to

outside

pressures

such

as

high

pork

prices

and

poor

weather,

said

Keybanc

analyst

Christopher

O’Cull

and

Stephens

Inc.

analyst

Will

Slabaugh.

“It’s

tough

to

place

that

entirely

on

management’s

shoulders,”

Slabaugh

said,

“which

won’t

help

Sandell’s

argument.”

-

The Columbus Dispatch, 7/13/14 |

IV.

Sandell’s

Demands –

Short-Sighted,

Unsustainable

and

Not

in

the

Best

Interests

of

All

Stockholders |

Sandell Asset Management

37

Selected Background

Overview

Founded by Thomas Sandell in 1998

Thomas Sandell previously worked as co-head of Risk

Arbitrage at Bear Stearns and head of equity research

at Group Delphi

Sandell Asset Management reportedly managed

approximately $7.5 billion in assets at its peak; as of

2013, the fund managed approximately $1.0 billion

Sandell Asset Management paid more than $8 million

to settle a 2007 enforcement action in which the SEC

found that Sandell's asset management company

willfully violated anti-fraud provisions of the federal

securities laws and censured both the management

company and Sandell personally.

Source:

Sandell Asset Management Website.

Source:

Financial Times, 12/11/13; Sandell Asset Management Corp. Form ADV, filed with the

SEC for the year

ending

12/31/13;

In

re:

Sandell

Asset

Management.

SEC

Release

no.

33-8857

(October

10,

2007). |

38

Sandell’s Shifting Demands for Financial

Engineering

Spin-off at 10x+

EBITDA or sell for

low-teens multiple

of EBITDA

Spin-off, or sell

for 11x FY14

EBITDA or

$558mm

Sell, or sell 19.9%

via IPO followed

by spin-off or

split-off, or split-

off at 11x FY15

EBITDA and

exchange for Bob

Evans shares at

$63/share

Sell 19.9% via

IPO followed by

spin-off or split-off

of remaining

80.1%, or split-off

at 10.5x FY15

EBITDA and

exchange for Bob

Evans shares at

$60/share and

retire 10mm

shares

Analyze /

implement

optimal structure

and evaluate

overtures

Sale or spin-off of

BEF by end of

CY14

Explore /

implement

Strategic review

100% for

~$720mm

100% for

~$720mm

~56% for

~$400mm

~56% for

~$400mm

50% for

~$450mm

43% for

undisclosed

amount within 90

days

Explore /

implement

“Top down”

analysis

Use after-tax

proceeds of

~$1.0bn from sale

of BEF and sale-

leaseback to

repurchase

~19mm shares at

$55/share

Use ~$800mm of

after-tax proceeds

from sale of BEF

and sale-

leaseback to

repurchase

~14mm shares at

$58/share

Use proceeds of

$400mm from

sale-leaseback

and $175mm of

incremental debt

to implement

$575mm self-

tender at

$63/share

Use proceeds of

~$400mm from

sale-leaseback

and $175mm of

incremental debt

to repurchase

~9.6mm shares at

$60/share

Use proceeds of

~$450mm from

sale-leaseback to

repurchase

~9.1mm shares at

$50/share

Use proceeds

from sale-

leaseback to

repurchase

$350mm of stock

within 90 days

Explore /

implement

??

>$72

$73-$84

$80-$90,

depending on

assumptions

$81

~$76 -

~$91

NA

NA

NA

SANDELL’S

ASSERTED

PRO FORMA

SHARE PRICE

SEPARATE

BEF

SALE-

LEASEBACK

OF

OWNED

RESTAURANTS

ONE-TIME

SELF-TENDER AUGUST 5, 2013

SEPTEMBER 24, 2013

NOVEMBER 11, 2013

DECEMBER 9, 2013

APRIL 24, 2014

JUNE 10, 2014

JULY 2, 2014

JULY 28, 2014

Quickly reverted

back to financial

engineering;

subsequently

cloaked by more

vague generalities |

39

Sandell Remains Focused on a Flawed Agenda for

Short-Sighted Financial Engineering

After pushing specific financial engineering for nearly a year, Sandell suddenly

seeks to distance himself from his own economic agenda by scrubbing from his

latest presentation any mention of the flawed plans he has aggressively

insisted the Company immediately implement Sandell now claims that the

upcoming Annual Meeting “is NOT about any specific transaction”.

Notwithstanding this recent claim, stockholders should consider that:

o

As

recently

as

June

2014,

in

response

to

Bob

Evans’

offers

to

settle

the

proxy

contest,

Sandell

showed

his

true

colors

by

demanding

that

the

Company

implement

1)

a

sale

or

spin-off

of

BEF

by

the

end

of

CY14,

2)

a

sale-leaseback

of

nearly

half

of

the

Company’s

real

estate

within

90

days

and

3)

a

$350

million

share

repurchase

within

90

days

o

In

an

interview

in

July

2014,

Sandell

asserted

that

his

nominees,

if

elected

“will

take

immediate

steps

to

implement

a

comprehensive

plan

that

contemplates

operational,

financial

and

strategic

changes”

1

While the Bob Evans Board welcomes ideas from stockholders, customers and employees,

Sandell’s hastily prepared operational suggestions are of limited utility

since they either lack substance or already are being implemented by the

Company THOUGH SANDELL TRIES TO DOWNPLAY HIS SHORT-SIGHTED AGENDA OF

FINANCIAL ENGINEERING, THE BOARD URGES STOCKHOLDERS NOT TO BE MISLED

(1)

The Activist Report, July 2014. |

Your

Board Believes Sandell’s Demands are Short- Sighted, Unsustainable and

NOT in Your Best Interests 40

Though Sandell’s specific proposals have continuously changed over the past

year, he has repeatedly demanded the following financial engineering

Divest BEF now, before reaping benefits of our transformational investments

Sell real estate, losing strategic control of assets while burdening Bob Evans

with significant and escalating annual rents and increased leverage

Rapidly effect large leveraged share repurchase

Leveraged Share

Repurchase

Sale-Leaseback

of Real Estate

Separate

BEF

1

2

3 |

BEF:

A Powerful Growth Engine 41

In

our

view,

Bob

Evans

is

uniquely

poised

to

reap

the

rewards

of

its

recently

completed,

multi-year investment in BEF, including:

o

Optimized network that creates significant runway for growth

o

Numerous synergies between the two segments

We have identified a variety of factors that would cause meaningful value erosion in

a separation:

o

Recurring dis-synergies

o

Ongoing incremental stand-alone costs

o

One-time separation costs

o

Significant tax expense in a conventional sale

BEF is an important component of the Company’s long-term growth plan and

your Board believes that an immediate disposition does not maximize

stockholder value 1

Your

Board

has

determined

that

separating

the

businesses

at

this

time

is

not

in

the

best

interest of stockholders. As part of its commitment to drive shareholder value, the

Bob Evans Board regularly evaluates the optimal strategy with respect to ALL

its assets |

42

Real Estate: A Strategic Asset

Increased rent expense

o

Reduced EBITDA and free cash flow

o

Treated as debt by rating agencies

o

Reduced incremental debt capacity

o

Future rent escalators

Higher cost relative to other forms of

available financing

Strategic and financial implications

o

Requires renegotiations of existing

debt/breakage costs

o

Significant tax expense

o

Loss of control

o

Reduced flexibility

o

Potential

impact

on

“OpCo”

multiple

Factors Overlooked by Sandell

2

Others are Also Skeptical of Sale-Leaseback

Based on our analysis, we believe that Sandell’s rationale for a

sale-leaseback of the Company’s real estate assets is flawed

“With regard to a potential sale leaseback, we agree with the

Company’s view that it would present one of (if not the most)

expensive forms of financing

in today’s low-rate environment.

Therefore, should mgmt. decide to place further leverage on the

Company, we would prefer it be bank debt with a rate in the historically

low range of roughly 2%.”

-

Stephens, 7/18/14

“It’s more expensive for us to monetize our real estate

than it would be

for us to look at the credit markets…[the value of real estate] is

significantly

higher

than

the

book

value

of

our

land…the

tax

hit

we

would

take in addition to the cap rate

that we would experience by doing that,

it just makes a whole lot more sense for us to go tap into 4% or

5%

money

than

it

would

to

spend

more

to

monetize

the

real

estate.”

-

Guy Constant, Brinker CFO, 1/22/2013

“We’ve examined various options to extract value from owned real

estate,

and

ultimately

concluded,

when

factoring

in

taxes

and

other

transaction

costs,

that

such

alternatives

produce

minimal

benefit

relative

to

current

bank

and

bond

financing

markets.”

-

Sandra Cochran, Cracker Barrel CEO, 11/21/2011 |

43

Leveraged Repurchase

3

In the summer of 2013, the Company announced it would increase its buyback program

by $150 million and announced a 3.0x target leverage level going forward;

ultimately, the Company repurchased a total of $225 million of stock in

FY14 37% of total share count repurchased

Stock repurchased at a 13% premium (based on

$50 repurchase price and $44.21 prevailing

market price)

Argues “intrinsic value”

of Bob Evans’

shares

is $76-$91

Examples of Sandell Assumptions

(1)

The Company’s Proven Track Record of

Balanced Capital Allocation

Over $625 million of stock repurchase since FY07

o

Share count reduced by 27%

Over $190 million of dividends since FY07

o

Annual dividend doubled over last five years to

$1.24/share

Total return of capital and leverage in-line with or

better than other casual dining operators

Going forward, objective is to maintain 3.0x

leverage and return excess cash to stockholders

Your Board does not expect stockholders would (or

should) sell shares into a repurchase program at

$50 if they are really “worth”

$76-$91

(1) Based on Sandell’s April 24, 2014 White Paper.

Sandell’s share repurchase demands are based on what we perceive to be unrealistic

assumptions; Bob Evans has consistently and responsibly returned over $800 million of

capital to its stockholders since FY07

|

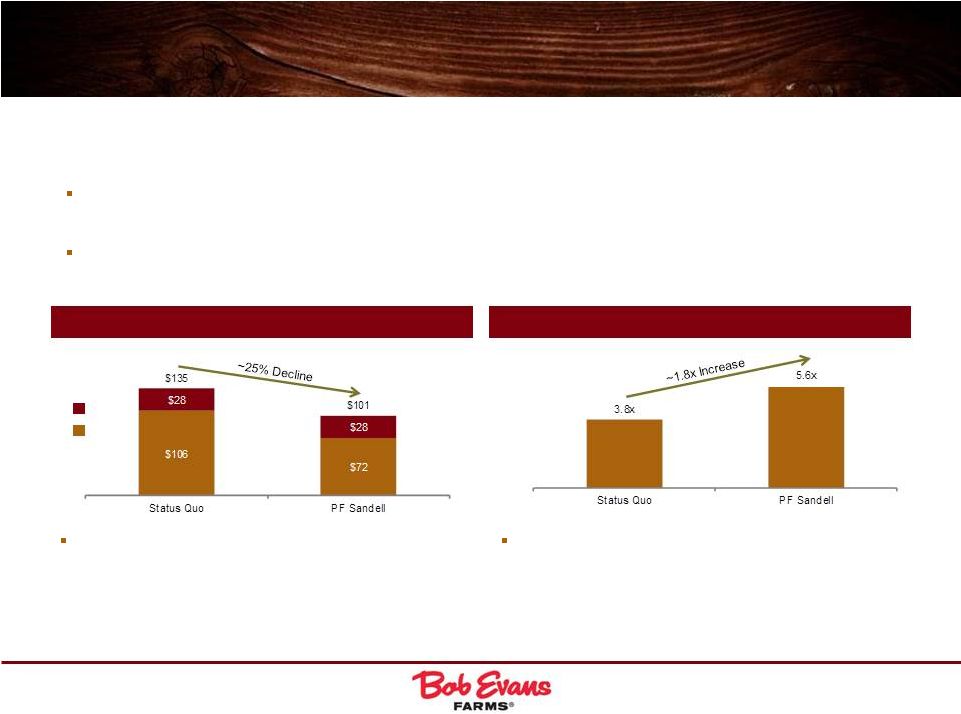

44

We Believe the Sandell Agenda Would Put the

Company at Undue Risk

For example, if the Company were to undertake a sale-leaseback and share

repurchase as proposed by Sandell, it would lead to an untenable amount of

leverage FY14 Adj. EBITDA

Incremental $34 million of rent expense

Adj. Net Leverage

(2)

~$425 million of status quo net debt at end of FY14

BEF

BER

Note:

Proposal based on Sandell’s White Paper on April 24, 2014.

(1) Proceeds net of estimated tax expense.

(2)

Enter into sale-leaseback for 50% of BER sites assuming highest proposed

valuation of real estate (~$380mm of net proceeds

(1)

)

Use all net proceeds from the sale-leaseback to repurchase shares

Per Moody’s, Adj. Net Leverage defined as (Net Debt plus annual rent expense

capitalized at 8.0x) / EBITDAR. |

45

While Sandell Makes Generic and Non-Substantive

Operational Suggestions, our Board Takes Action

In an attempt to argue its nominees have a plan for improving operating

performance, Sandell presents generic, “low hanging fruit”

platitudes which appear attractive on their face but lack

substance or are already being implemented. A few examples are below:

(1)

Sandell presentation, filed with the SEC July 28, 2014

Sandell “Suggestion”

1

Bob Evans Action

“Revise Brand Position and

Improve Customer

Experience”

”Simplify and Enhance

Menu”

“Optimize Marketing

Effectiveness”

“Improve Restaurant

Margins”

“Future Franchise

Opportunities”

The Board is taking steps to leverage the core aspects of the Bob Evans brand

while constantly reviewing optimal positioning. The Bob Evans menu is

subject to continuous consumer testing, review and revision with particular focus on increasing differentiation

across users and platforms and seeking opportunities to strengthen connections

with less frequent buyers, and also to permit innovation and “back of

house” efficiency.

The Company, in conjunction with our consultants, regularly reviews our marketing

programs to ensure that our message resonates

with

consumers.

We

employ

a

disciplined

and

creative

approach

across

all

mediums

–

social,

TV,

radio,

print

and local –

and continue to make progress on digital marketing initiatives.

The Board meets regularly with BER management to work towards improving

operational restaurant efficiency and deploy successfully tested

methods. The Board continuously analyzes ways to leverage the Bob Evans

brand into new growth markets on a capital efficient, high-ROI

basis.

For

example,

our

“Get

in

on

Something

Good”

campaign

is

designed

to

fully

leverage

natural

synergies

between

BEF

and BER and

is being rolled out nationally in packaging and marketing communications after

successful market testing. For

example,

BER

managers

have

been

tasked

with

maintaining

a

“balance

scorecard”

to

improve

food

expense

tracking and

accountability, and the Company recently rolled out sophisticated scheduling

software to ensure the appropriate balance of staffing and guest

satisfaction. For

example,

the

Bob

Evans

Express

franchising/licensing

model

is

being

tested

in

new

markets

and

we

expect

that,

if

results

are

successful

across

different

types

of

test

venues,

we

will

continue

the

rollout

schedule.

For

example,

the

recently

completed

Farm

Fresh

Refresh

–

the

first

comprehensive

remodeling

program

in

brand

history

–

modernized the customer experience while highlighting elements of the

Company’s farm heritage, utilizing consumer and consultant feedback

and survey data. Independent analysts have noted significant benefits in the areas of cleanliness, food

quality, value, service, menu variety and atmosphere.

For

example,

the

new

Broasted

platform

delivers

a

differentiated,

quality

product

versus

fried

chicken

and

has

delivered

significant sales turnaround in our test markets. Broasted Chicken is an exclusive

(10 year term), trademarked cooking platform

that

will

meaningfully

differentiate

the

Company

from

its

family

dining

peers. |

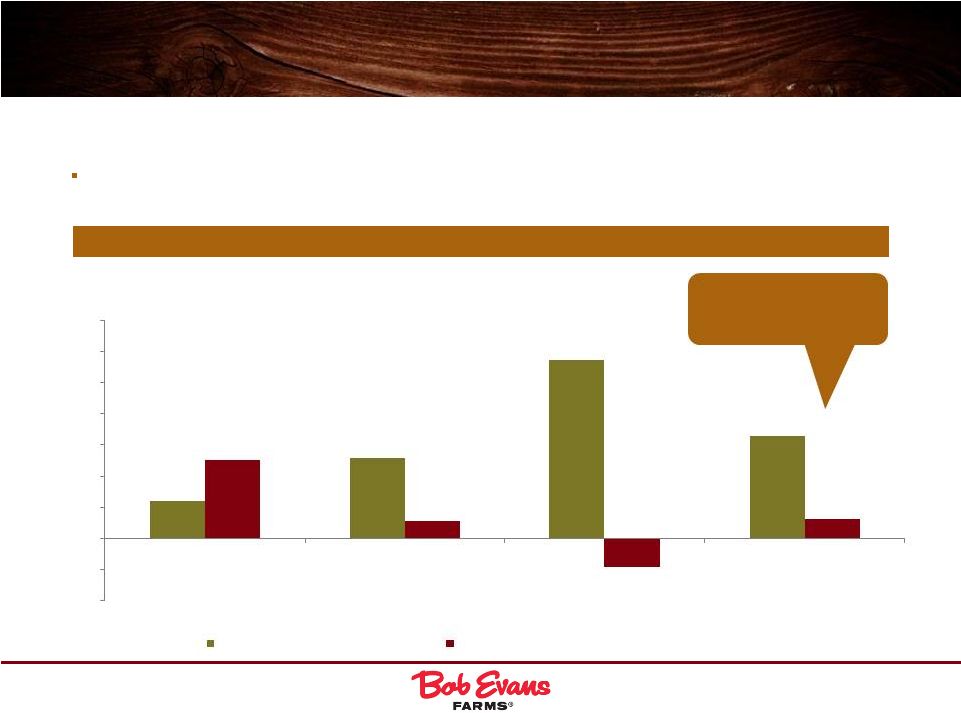

46

Setting the Record Straight: Margins

Sandell

makes

a

number

of

claims

about

Bob

Evans

that

we

believe

are

false

or

misleading.

For

example

–

a

non-exhaustive

list

of

Sandell’s

misleading

claims:

We urge investors to consider the facts and not be misled

Sandell’s Claim

1

The Facts

Considering The Facts

Sandell claims that our SG&A

expenses are very high relative

to his selected peers

Sandell does not adjust Bob Evans’

SG&A for BEF

transportation costs; our restaurant peers do not bear similar

expenses (see page 68 for further detail).

Using a normalized, apples-to-apples comparison, our SG&A

expenses as a percent of revenue are more in line with the peer

average

–

and

we

remain

focused

on

reducing

expenses

further.

Sandell claims that our

EBITDAR margins are very low

relative to his selected peers

Sandell only looks at FY14, a year in which our sales were

disproportionately impacted by severe weather, and our

margins were impacted by record sow costs and extraordinary

expenses.

Comparing our results and margins in years prior to FY14

demonstrates that we operate more closely in line with the peers

–

and initiatives are underway to further improve performance.

Sandell claims that our

“revenue-per-corporate

employee”

is very low relative

to his selected peers

Sandell uses outdated headcount figures for Bob Evans and at

least one peer, and includes non-corporate employees working

out of our headquarters. (We believe that “revenue-per-

corporate employee”

is a performance metric unique to

Sandell.)

Using correct figures (260 Bob Evans corporate and shared

services employees), our FY14 revenue-per-corporate employee

($5.1 million) is better than Sandell’s peer average.

Sandell claims that our

corporate headquarters are

wasteful

Sandell ignores the condition and constraints of the old

corporate headquarters, the significant municipal tax incentives

received in connection with the relocation and the savings from

consolidating three disparate headquarters from our legacy

businesses.

We had outgrown our old facilities and our analysis indicated that

the new space would be less expensive in the long run. Sandell

overstates the tax incentive amount we could have realized from

Columbus, and overstates the true, net cost of the corporate

headquarters by more than 50%.

(1)

Sandell presentation, filed with the SEC July 28, 2014

|

47

G&A Reconciliation

(1)

For additional information, see the Company’s 4Q Fiscal 2014 earnings release

dated July 8, 2014. (2)

Included in BER reported SG&A.

(3)

Included in BEF reported SG&A.

In order to properly analyze the Company's G&A expense, it is important to

consider the Company's relatively unique business model and significant

non-recurring charges We believe the items in BER and BEF adjustments

noted below are generally not included in SG&A

FY14 SG&A

$ in thousands

Non-GAAP SG&A

(1)

% of Sales

BER

$79,804

BEF

64,783

Total SG&A

$144,587

10.9%

BER

Adjustments

(2)

Manager in Training Wages

$5,052

BEF

Adjustments

(3)

BEF Transportation

17,109

Advertising & Marketing

6,372

Corporate

Adjustments

Activist Shareholder Response

2,884

Internal Processes & Controls

2,988

Total Adjustments

$34,405

Total Adjusted BOBE SG&A

$110,182

8.3% |

V.

Our

Leadership

–

Independent,

Highly Qualified and Open-Minded |

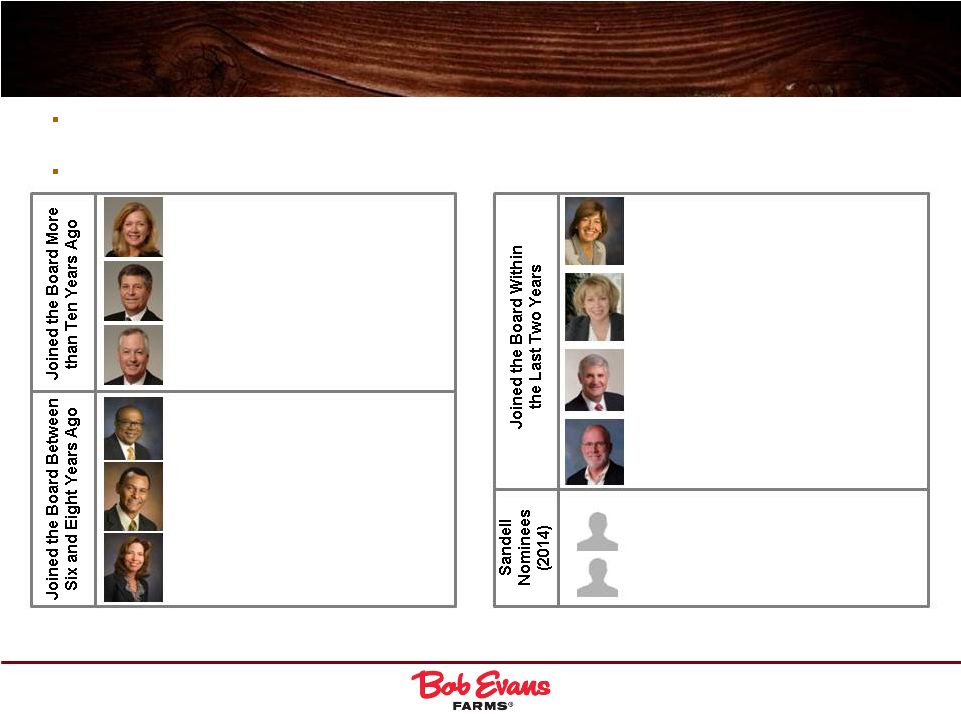

49

Bob Evans’

Proposal for a Fresh,

Independent Board

11 of

12

are

independent

(all

but

CEO),

at

least

six

are

current

or

former

CEOs

and

at

least

eight

have other public company board service

A majority of the independent directors would have been added within the last two

years Note:

Board

composition

following

2014

annual

meeting

of

stockholders

assuming

all

ten

Bob

Evans

nominees

and

two

of

Sandell’s

nominees

are

elected.

Since

the

Board

has

nominated

a slate of ten directors for the available twelve seats at the annual meeting, the

Board expects that at least two nominees who were not nominated by the Board will be elected at the

annual

meeting.

Selected

experience

noted;

please

refer

to

the

appendix

and

Bob

Evans’

proxy

statement

for

additional

background.

Mary Kay Haben

Former President-North America of the Wm. Wrigley Jr. Company;

Former Group Vice President and Managing Director North America of

the Wm. Wrigley Jr. Company; Former Executive of Kraft Foods Inc.

Board Member of Equity Residential and The Hershey Company

Kathleen S. Lane

Former EVP and CIO of TJX Companies, Inc.; Former Group CIO at

National Grid Plc.; Former SVP and CIO of Gillette Company (Procter

& Gamble)

Board Member of Earthlink Holdings Corp.

Larry S. McWilliams

Co-CEO of Compass Marketing; Former CEO at Keystone Foods

LLC; Former SVP at Campbell Soup Company

Board Member of Armstrong World Industries

Kevin M. Sheehan

President and CEO of Norwegian Cruise Line; Former CFO of

Norwegian Cruise Line; Former CFO of Cendant Corporation

Board Member of Norwegian Cruise Line and New Media Investment

Group, Inc.

Sandell Nominee

Sandell Nominee

Steven A. Davis, Chairman and CEO

Former President, Long John Silver’s and A&W All-American Food

Restaurants (Yum! Brands); Former SVP, Concept Development,

Pizza Hut, Inc. (Yum! Brands)

Board Member of Walgreen Co. and Marathon Petroleum Corp.

Michael J. Gasser, Lead Independent Director

Executive Chairman of the Board of Greif Inc.; Former CEO and

Chairman of the Board of Greif, Inc.

Board Member of Greif, Inc.

E.W. (Bill) Ingram III

CEO of White Castle System, Inc.; Former President of

White Castle System, Inc.

Cheryl L. Krueger

CEO of Krueger + Co., LLC; Former President and CEO and

Founder of Cheryl & Co., Inc.

Paul S. Williams

Managing Director, Major, Lindsey and Africa; Former Chief Legal

Officer and Executive Vice President, Cardinal Health, Inc.

Board Member of State Auto Financial Corp. and Compass

Minerals International, Inc.

Eileen A. Mallesch

Former SVP and CFO at Nationwide Property & Casualty Insurance;

Former SVP and CFO at Genworth Life Insurance; Former VP and

CFO at General Electric Financial Employer Services Group

Board Member of State Auto Financial Corp.

–

Director since 1993

–

Director since 1997

–

Director since 1998

–

Director since 2006

–

Director since 2007

–

Director since 2008

–

Director since 2012

–

Director since 2014

–

Director since 2014

–

Director since 2014 |

50

Committed to Transparency and Fresh Thinking

Investor

friendly

–

receptive

to

feedback;

regularly

meets

and

engages

with

stockholders

Added four new independent, highly qualified directors in the last two years

o

Followed a well-planned strategy of Board succession with the assistance of

independent experts and search firms, most recently:

In late 2012/early 2013, as part of our regular process, we reviewed and updated

our skills matrix with an

independent

search

firm

to

identify

board

expertise

necessary

to

continue

driving

stockholder

value

Subsequently, we instructed the independent search firm to seek director

candidates with specific skills and expertise identified as desirable as a

result of the skills matrix analysis, and commenced evaluating and

interviewing candidates In

Spring

2014,

we

added

three

highly

qualified

directors

to

the

Board

with

invaluable

experience in

hospitality and entertainment, packaged foods and digital marketing

Sandell’s

claim

that

the

addition

of

these

directors

was

a

“knee-jerk”

response

accomplished

in

24

hours

after he made his nominations is preposterous

Overseen the steps we believe are necessary to create sustainable stockholder value

(e.g., disposed of over $125 million of assets since FY06)

o

Business acquisitions (e.g., Kettle Creations) and dispositions (e.g., Mimi’s

Café) o

Restaurant closures

o

Plant closures/consolidations

o

Real estate sales and disposals

o

Business transformations

DSD to warehouse conversion

Distribution center sale

Bob Evans has consistently demonstrated its commitment to transparency and

fresh, independent thinking |

51

Bob Evans is Committed to Corporate

Governance Best Practices

All independent directors (except CEO)

Annual

director

elections

–

no

classified

board

Majority vote election standard with a director resignation policy

Entirely

independent

nominating,

audit,

finance

and

compensation

committees

A lead independent director empowered with robust responsibilities

Strong stock ownership guidelines for directors

Board and committee-level self-evaluations for board effectiveness

No authorization to issue blank check preferred stock without stockholder

approval |

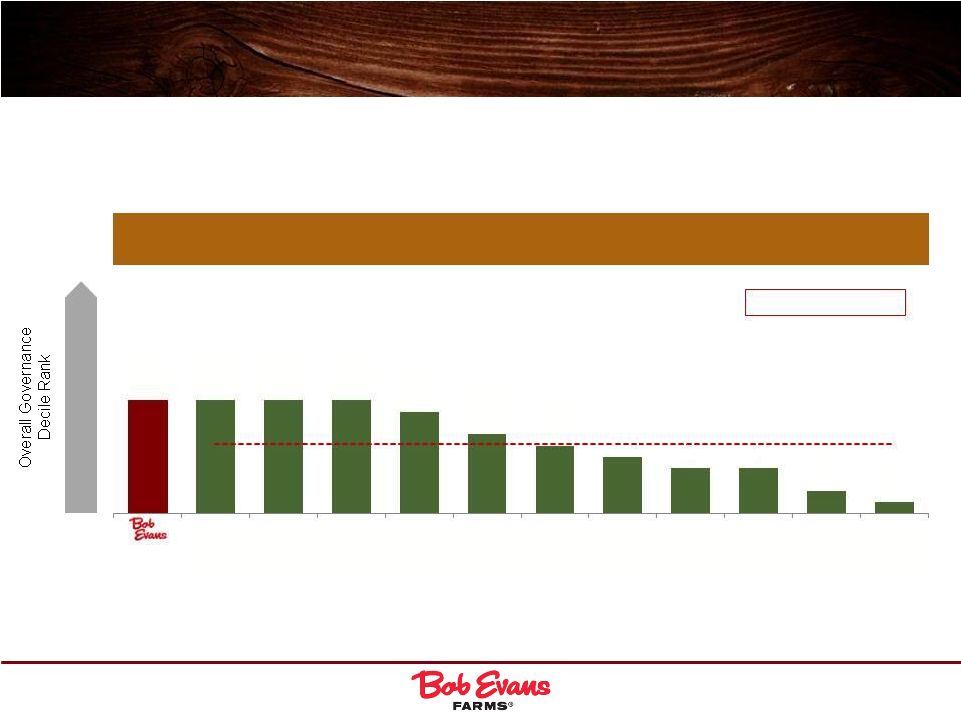

52

Bob Evans’

Governance Compares Favorably

with Sandell’s Peer Group

ISS Overall Governance QuickScore Versus

Sandell Family & Casual Dining Peers Plus DENN, DIN and RT¹

1

2

3

4

5

6

7

8

9

10

Mean ex. BOBE: 4.8

Institutional Shareholder Services (“ISS”) has awarded Bob Evans the

highest possible corporate governance score

1

1

1

1

2

4

5

6

7

7

9

10

EAT

DENN

RRGB

BJRI

CBRL

DIN

TXRH

CAKE

RT

BLMN

DRI

Note: QuickScore indicates decile rank relative to index or region. A decile score of 1 indicates

lower governance risk, while a 10 indicates higher governance risk. (1) Source: ISS

QuickScore 2.0 as of August 1, 2014 from Yahoo Finance. |

53

Sandell

has

rebuffed

several

attempts

by

the

Board

to

settle

the

proxy

contest

In January 2014, the Board attempted to settle the contest by offering Sandell the

opportunity to consult with the Board in the addition of new independent

directors Sandell refused, and in April 2014 the Board subsequently added

three new independent, highly qualified directors identified by an

independent search firm In June 2014, the Board attempted to settle the

contest by offering to add two of Sandell's nominees to the Board and the

Finance Committee, and have the Finance Committee review Sandell's economic

proposals Sandell replied at the time that he would only accept less than

"majority representation" on the Board if, among other things, the

Board committed to divest BEF by the end of 2014 and execute a

sale-leaseback of nearly half of BER’s real estate within 90 days, and use

the

proceeds

to

repurchase

$350

million

of

Bob

Evans’

stock

within

90

days.

Sandell

also

demanded up to $2 million in reimbursement of expenses

The Board expressly left the door open for productive conversations, but was not

prepared to adopt the full Sandell economic agenda as a condition of

settlement Open to Constructive Dialogue

Bob Evans has attempted to engage in constructive dialogue with Sandell on

numerous occasions |

54

Open to Constructive Dialogue (cont’d)

The Board remains committed to maintaining a dynamic,

independent and highly qualified Board

Bob Evans is and has been willing to settle the proxy contest with the addition

of an appropriate number of open-minded, independent directors

Following Bob Evans' disclosure of its repeated attempts to settle, Sandell contacted the

Board with an "exploding" offer that would have required the Board to add five of his

nominees, selected by Sandell in his sole discretion, to the Board Sandell demanded that two-thirds of

the Board, and all of the Finance Committee be composed of either new directors or directors

with only minimal experience - a turnover of two-thirds of the Board in the span of

less than three months The Board

then proposed a settlement that would have resulted in one-quarter of the Board and

one-third of the Finance Committee being composed of Sandell's nominees, and half of the

Board and half of the Finance Committee being composed of independent directors who joined the

Board in 2014 Sandell, rather than

engage in constructive dialogue, chose to issue an inflammatory press release in response to

our proposal |

55

Would Sandell’s Slate Make Their Own Independent

Decisions

in

the

Best

Interest

of

All

Stockholders?

None of Sandell’s nominees agreed to the Board’s good-faith effort to

meet to evaluate their candidacy in accordance with the Company’s best

practices o

Immediately after the period for stockholder nominations, the Board reached out to

Sandell’s nominees in a good- faith effort to arrange meetings

between the nominees and certain of the Board’s independent directors to evaluate

their candidacy and independence

o

Sandell issued a press release asserting that Bob Evans was attempting to

interfere with the election process o

In the wake of that press release, only one of Sandell’s nominees responded

to the Board’s invitation to meet (he declined)

Bob Evans is concerned that election of all, or even a large bloc, of the Sandell

nominees may result in advocacy for Sandell’s interests over the

interests of all stockholders

o

Sandell is willing to undergo a costly and disruptive proxy contest rather than

engaging constructively with Bob Evans, and these nominees appear to

support Sandell’s efforts in doing so Each of Sandell's nominees is

contractually prohibited from publicly expressing any opinion on Bob Evans,

including on Sandell’s economic proposals, without Sandell's prior

permission o

Several of Sandell’s nominees have met with analysts and investors to discuss

Sandell’s plan, notwithstanding their inability to speak freely about

the Company and their refusal to meet with the Board’s independent directors

o

While

certain

of

his

nominees

have

told

analysts

that

they

are

not

committed

to

any

strategy

(1)

,

Sandell

asserts

–

directly to the contrary –

that if elected, his nominees “will take immediate steps to implement a

comprehensive plan

that

contemplates

operational,

financial

and

strategic

changes”

(2)

Sandell is compensating the nominees for their participation on Sandell’s slate,

and has agreed to reimburse the nominees for legal liability and expenses

arising out of their participation in the solicitation (1)

Miller Tabak & Co., May 14, 2014.

(2)

The Activist Report, July 2014.

Bob

Evans

seeks

a

resolution

that

would

include

some

of

the

Sandell

nominees

along

with

Bob Evans’

slate of highly qualified, independent directors |

56

Sandell’s Misleading Claims/

Overstated Criticisms

¹

The Facts

Sandell claims that “All eight of

Sandell’s nominees are completely

independent of Sandell Asset

Management”

Each

of

Sandell's

nominees

is

contractually

prohibited

from

publicly

expressing

any

opinion

on

Bob

Evans,

including

on

Sandell’s

economic

proposals,

without

Sandell's

prior

permission

None of Sandell’s nominees agreed to the Board’s good-faith effort to

meet to evaluate their candidacy in accordance with corporate governance best

practices Sandell claims that Mimi’s Café

is an

example of “failed Board

stewardship of the highest order”

Sandell repeatedly refers to Mimi’s Cafe, a business that was acquired in 2004

and was sold months before Sandell

began

to

buy

Bob

Evans’

stock

Steve

Davis

was

appointed

CEO

and

seven

of

the

Company’s

10

nominees

joined

the

Board

after

Mimi’s

was

acquired

Following the Board's decision to divest Mimi’s, the Company's stock gained

~20% in value between announcement to explore strategic alternatives for

Mimi’s (11/19/12) and the announcement of the sale agreement

(1/28/13) Sandell claims that average director

tenure is in excess of 14 years

Sandell presents old, stale and inaccurate portraits of your Board's composition; he

overstates current director tenure by a factor of ~80%, criticizes retired

directors and pretends the three newest independent directors do not

exist Sandell’s calculations of director tenure include Gordon Gee, who

has not been a director for months, and Larry Corbin and Robert Lucas, who

are not standing for reelection, but curiously ignores Kathy Lane, Larry

McWilliams

and

Kevin

Sheehan,

who

each

joined

the

Board

in

April

2014

and

are

standing

for

reelection

Bob Evans’

nominees would have an average tenure of less than eight years,

which is below the average

tenure of 8.6 years for S&P boards

Sandell claims that Bob Evans’

Board is not committed to

“transparency and fresh,

independent thinking”

Bob Evans makes a practice of being available to investors, engaging in regular and

frequent communication and participating at most of the major consumer and

restaurant conferences As a result of our comprehensive investor outreach and

road shows, we have been able to increase research coverage from one to six

analysts over the past eight years The Board remains committed to maintaining

a dynamic, independent and highly qualified Board Bob Evans has attempted to

engage in constructive dialogue with Sandell on numerous occasions Bob Evans

is and has been willing to settle the proxy contest with the addition of an appropriate number of

open-minded, independent directors

Sandell has rebuffed several attempts by the Board to settle the

proxy contest

(1)

Sandell presentation, filed with the SEC August 4, 2014.

Setting the Record Straight: Governance |

57

Sandell has Misled Investors From the Beginning

Sandell’s Misleading Claims/

Overstated Criticisms

The Facts

On May 30, 2014, Sandell claimed

that “at no point in our almost

year-long dialogue with the

Company has the Board shown

the slightest inclination toward

reaching an amicable resolution

with us”

In January 2013, the Board attempted to resolve the pending contest, and avoid the

significant time and expense of a proxy fight, by offering Sandell the

opportunity to consult with the Board in the identification and selection of

new independent candidates to be added to the Board prior to the Annual

Meeting. Sandell refused this offer Following Sandell’s nominations, the

Board publicly announced on April 28, 2014 that it would consider

the

candidates

in

connection

with

the

Board’s

nominations

for

election

–

when

Bob

Evans then sought to arrange meetings between Sandell’s nominees in a good

faith attempt to evaluate their candidacy, Sandell issued a press release

alleging that Bob Evans was attempting to “subvert”

the election process

On May 28, 2014, Sandell claimed

that the Board’s addition of three

new, highly-qualified and

independent directors to the

Board was a “knee-jerk

reactionary step”

in response to

Sandell’s nominations

In late 2012/early 2013, as part of our regular process, we reviewed and updated our

skills matrix with an independent search firm to identify board expertise

necessary to continue driving stockholder value

Subsequently, we instructed the independent search firm to seek director candidates

with specific skills and expertise identified as desirable as a result of the

skills matrix analysis, and commenced evaluating and interviewing candidates

As a result of this process, we added three highly qualified directors to the

Board with invaluable experience in hospitality and entertainment, packaged

foods and digital marketing/informational technology

On April 24, 2014, Sandell

claimed that the Board amended

the Company’s Bylaws to

enhance stockholder voice “only

after”

Sandell filed a lawsuit

The corporate governance changes announced by the Board in January to further

enfranchise stockholders went well beyond the changes sought by Sandell in

its lawsuit Throughout his year-long campaign, Sandell has regularly

distorted the truth, overstated his claims and made unfounded allegations, a

few of which are highlighted below |

VI.

Conclusion –

Bob Evans: The Clear Choice |

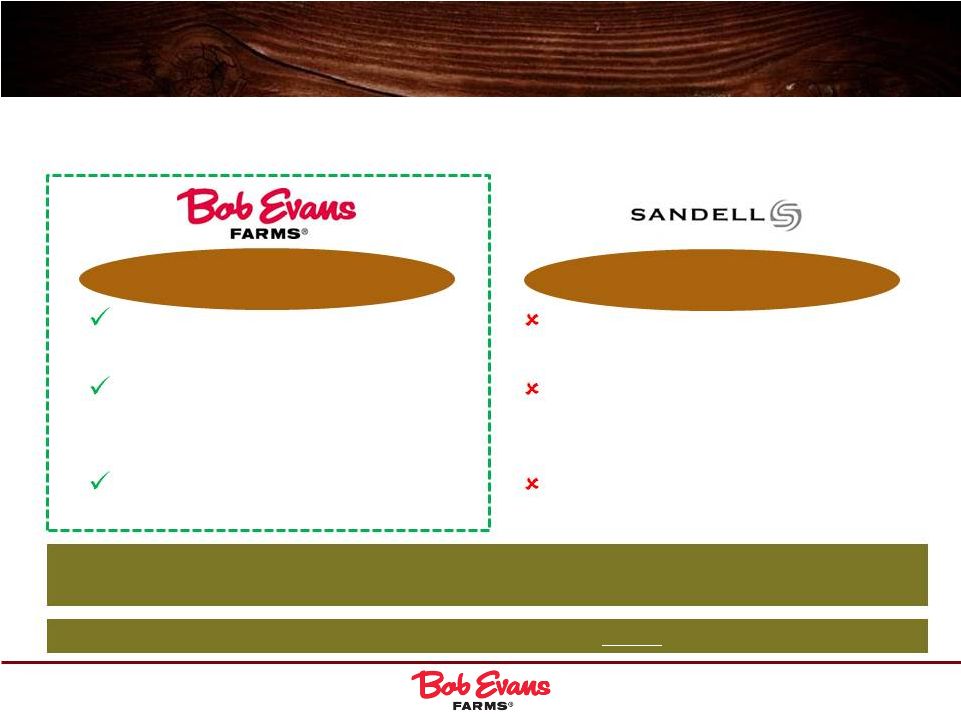

We

Believe We are the Right Team for Bob Evans and its Stockholders

59

We have transformed the business while returning over $800 million to shareholders

since FY07 (including over $250 million in FY14):

o

Divested Mimi's Café

o

Invested in BER restaurants (Farm Fresh Refresh program)

o

Consolidated and vertically integrated BEF operations

o

Investing in systems

We are confident that we have a clear plan for continued, sustainable value creation

as we emerge from this investment and transformation phase:

o

Profitably grow our core businesses

o

Selectively invest in high ROIC growth opportunities

o

Employ balanced approach to investment and return of meaningful capital to

stockholders Sandell’s

“plan”

of

financial

engineering

has

shifted

a

number

of

times