Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - NORTHRIM BANCORP INC | d771182dex992.htm |

| 8-K - FORM 8-K - NORTHRIM BANCORP INC | d771182d8k.htm |

Exhibit 99.1

|

|

Exhibit 99.1

Northrim BanCorp,Inc.

ACQUISITION OF RESIDENTIAL MORTGAGE HOLDING COMPANY, LLC.

Investor Presentation—August 6, 2014

|

|

FORWARD LOOKING STATEMENTS

This presentation contains “forward-looking statements” that are subject to risks and uncertainties. These statements include, but are not limited to, descriptions of Northrim’s and RML’s financial condition, mortgage origination volume, results of operations, asset and credit quality trends and profitability and statements about the expected timing, completion, financial benefits and other effects of the proposed acquisition of Residential Mortgage Holding Company, LLC. (“RML” ) by Northrim Bank. All statements, other than statements of historical fact, regarding the financial position, business strategy and respective management’s plans and objectives for future operations of each of Northrim and RML are forward-looking statements. Readers should not place undue reliance on forward-looking statements, which reflect management’s views only as of the date hereof. When used in this presentation, the words “anticipate,” “believe,” “estimate,” “expect,” and “intend” and words or phrases of similar meaning, as they relate to Northrim, Northrim management, RML, or RML management are intended to help identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Although we believe that management’s respective expectations as reflected in forward-looking statements are reasonable, we cannot assure readers that those expectations will prove to be correct. Forward-looking statements are subject to various risks and uncertainties that may cause actual results to differ materially and adversely from expectations as indicated in the forward-looking statements. These risks and uncertainties include: expected cost savings, synergies and other financial benefits from the proposed transaction might not be realized within the expected time frames and costs or difficulties relating to integration matters might be greater than expected; the requisite regulatory approvals for the proposed transaction might not be obtained; and the ability of Northrim and RML to execute their respective business plans (including the acquisition of RML by Northrim Bank). Further, actual results may be affected by the ability to compete on price and other factors with other financial institutions; customer acceptance of new products and services; the regulatory environment in which we operate; and general trends in the local, regional and national banking industry and economy as those factors relate to the cost of funds and return on assets. In addition, there are risks inherent in the banking industry relating to collectability of loans and changes in interest rates. Many of these risks, as well as other risks that may have a material adverse impact on our operations and business, are identified in other filings of Northrim made with the Securities and Exchange Commission. However, you should be aware that these factors are not an exhaustive list, and you should not assume these are the only factors that may cause our actual results to differ from our expectations. These forward-looking statements are made only as of the date of this presentation, and neither Northrim nor RML undertakes an obligation to release revisions to these forward-looking statements to reflect events or conditions after the date of this presentation.

2

|

|

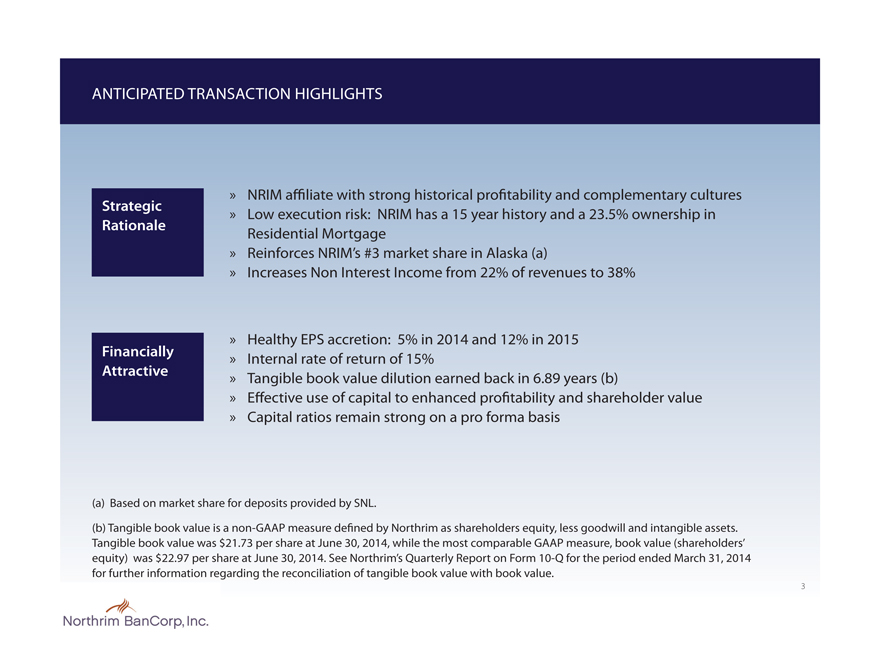

ANTICIPATED TRANSACTION HIGHLIGHTS

Strategic Rationale

NRIM affiliate with strong historical profitability and complementary cultures

Low execution risk: NRIM has a 15 year history and a 23.5% ownership in Residential Mortgage

Reinforces NRIM’s #3 market share in Alaska (a)

Increases Non Interest Income from 22% of revenues to 38%

Financially Attractive

Healthy EPS accretion: 5% in 2014 and 12% in 2015

Internal rate of return of 15%

Tangible book value dilution earned back in 6.89 years (b)

Effective use of capital to enhanced profitability and shareholder value

Capital ratios remain strong on a pro forma basis

(a) Based on market share for deposits provided by SNL.

(b) Tangible book value is a non-GAAP measure defined by Northrim as shareholders equity, less goodwill and intangible assets. Tangible book value was $21.73 per share at June 30, 2014, while the most comparable GAAP measure, book value (shareholders’ equity) was $22.97 per share at June 30, 2014. See Northrim’s Quarterly Report on Form 10-Q for the period ended March 31, 2014 for further information regarding the reconciliation of tangible book value with book value.

3

|

|

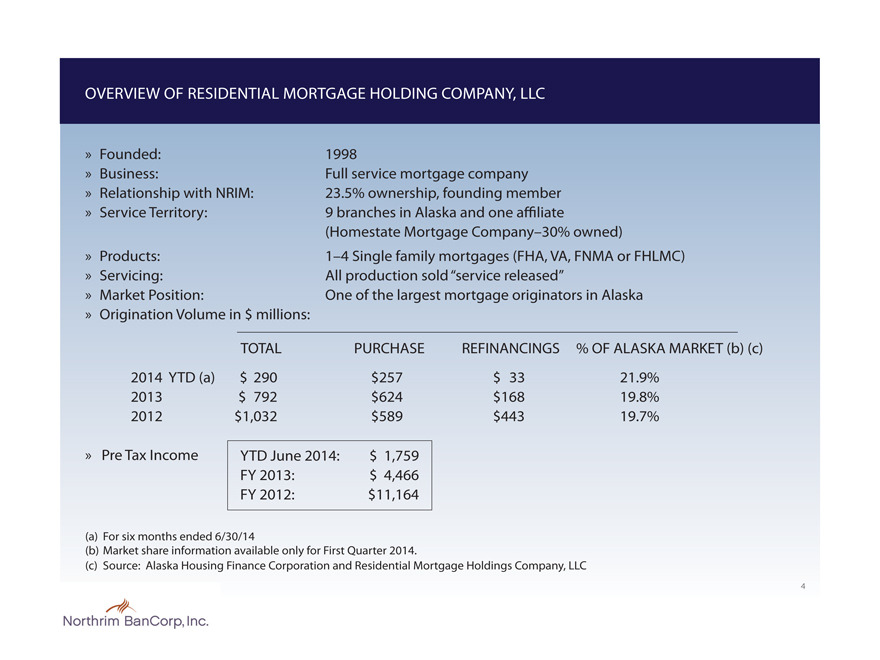

OVERVIEW OF RESIDENTIAL MORTGAGE HOLDING COMPANY, LLC

Founded:

Business:

Relationship with NRIM:

Service Territory:

1998

Full service mortgage company 23.5% ownership, founding member 9 branches in Alaska and one affiliate (Homestate Mortgage Company–30% owned)

Products:

Servicing:

Market Position:

Origination Volume in $ millions:

1–4 Single family mortgages (FHA, VA, FNMA or FHLMC) All production sold “service released” One of the largest mortgage originators in Alaska

TOTAL PURCHASE REFINANCINGS % OF ALASKA MARKET (b) (c) 2014 YTD (a) $ 290 $257 $ 33 21.9% 2013 $ 792 $624 $168 19.8% 2012 $1,032 $589 $443 19.7%

Pre Tax Income

YTD June 2014: $ 1,759 FY 2013: $ 4,466 FY 2012: $11,164

(a) For six months ended 6/30/14

(b) Market share information available only for First Quarter 2014.

(c) Source: Alaska Housing Finance Corporation and Residential Mortgage Holdings Company, LLC

4

|

|

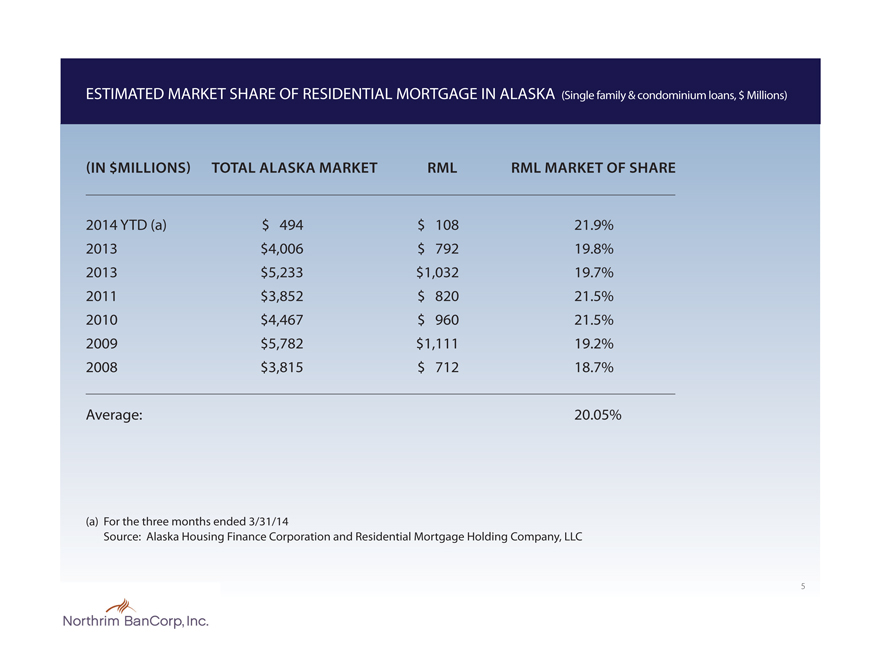

ESTIMATED MARKET SHARE OF RESIDENTIAL MORTGAGE IN ALASKA (Single family & condominium loans, $ Millions)

(IN $MILLIONS) TOTAL ALASKA MARKET RML RML MARKET OF SHARE

2014 YTD (a) $ 494 $ 108 21.9% 2013 $4,006 $ 792 19.8% 2013 $5,233 $1,032 19.7% 2011 $3,852 $ 820 21.5% 2010 $4,467 $ 960 21.5% 2009 $5,782 $1,111 19.2% 2008 $3,815 $ 712 18.7%

Average: 20.05%

(a) For the three months ended 3/31/14

Source: Alaska Housing Finance Corporation and Residential Mortgage Holding Company, LLC

5

|

|

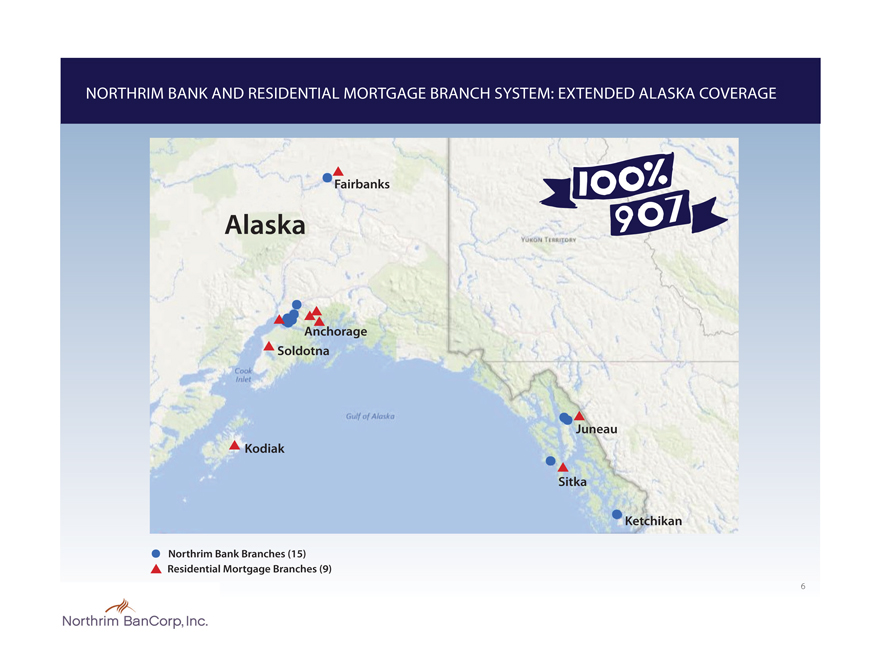

NORTHRIM BANK AND RESIDENTIAL MORTGAGE BRANCH SYSTEM: EXTENDED ALASKA COVERAGE

Fairbanks

Alaska

Anchorage Soldotna

Juneau Kodiak

Sitka

Ketchikan

Northrim Bank Branches (15) Residential Mortgage Branches (9)

Gulf of Alaska

Yukon Territory

Cook Inlet

6

|

|

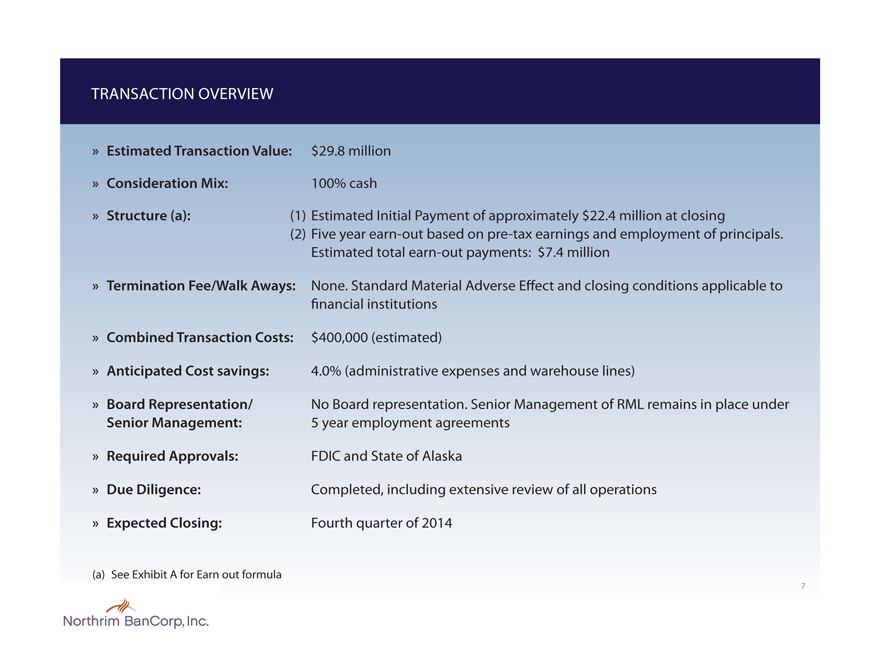

TRANSACTION OVERVIEW

Estimated Transaction Value: $29.8 million

Consideration Mix: 100% cash

Structure (a): (1) Estimated Initial Payment of approximately $22.4 million at closing

(2) Five year earn-out based on pre-tax earnings and employment of principals. Estimated total earn-out payments: $7.4 million

Termination Fee/Walk Aways: None. Standard Material Adverse Effect and closing conditions applicable to financial institutions

Combined Transaction Costs: $400,000 (estimated)

Anticipated Cost savings: 4.0% (administrative expenses and warehouse lines)

Board Representation/ No Board representation. Senior Management of RML remains in place under Senior Management: 5 year employment agreements

Required Approvals: FDIC and State of Alaska

Due Diligence: Completed, including extensive review of all operations

Expected Closing: Fourth quarter of 2014

(a) See Exhibit A for Earn out formula

7

|

|

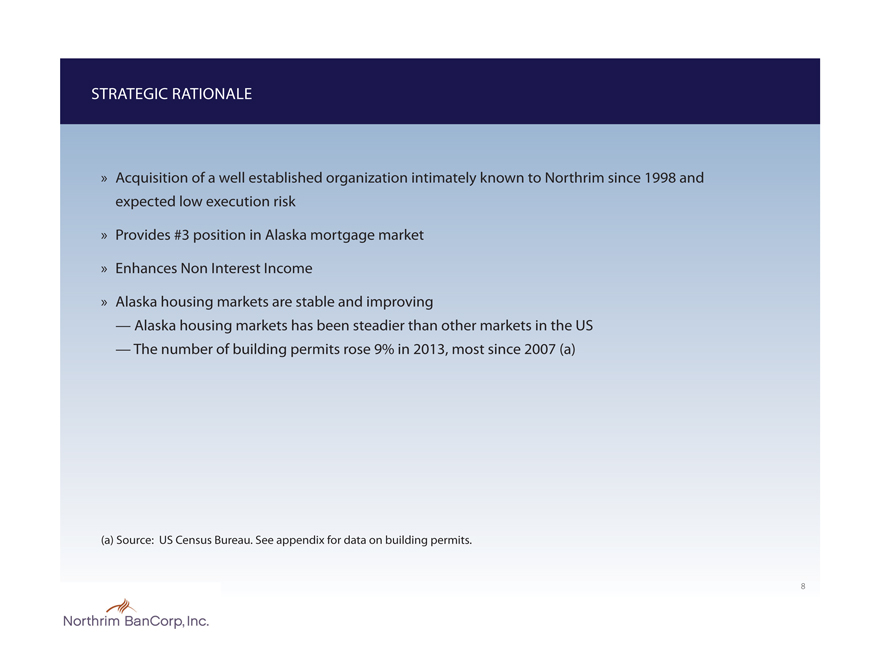

STRATEGIC RATIONALE

Acquisition of a well established organization intimately known to Northrim since 1998 and expected low execution risk

Provides #3 position in Alaska mortgage market

Enhances Non Interest Income

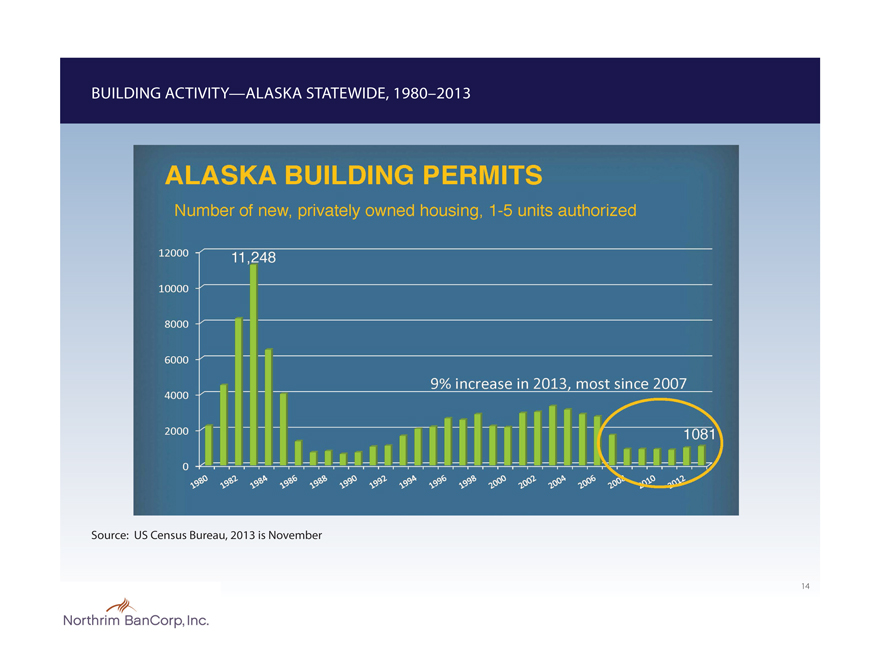

Alaska housing markets are stable and improving

— Alaska housing markets has been steadier than other markets in the US — The number of building permits rose 9% in 2013, most since 2007 (a)

(a) Source: US Census Bureau. See appendix for data on building permits.

8

|

|

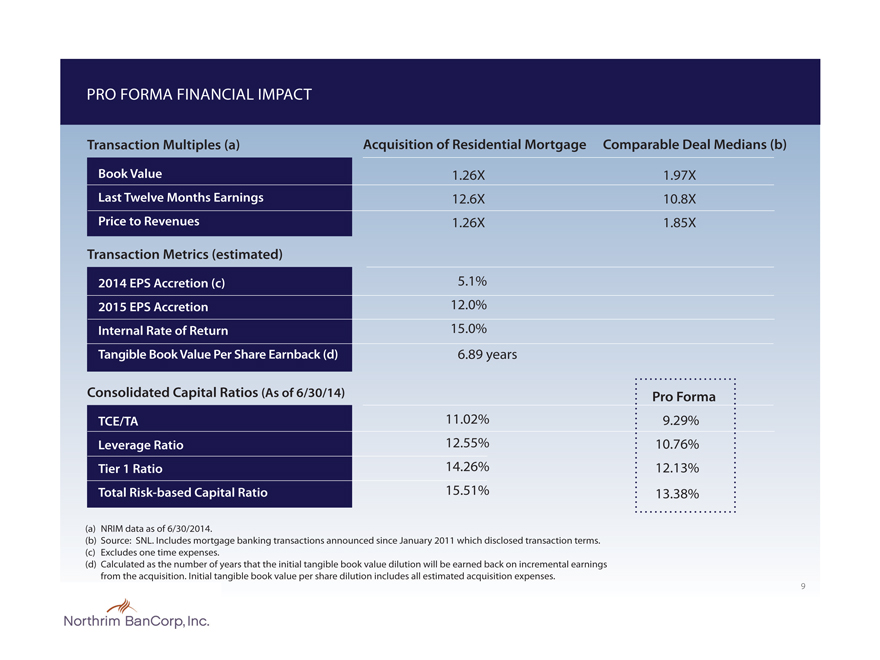

PRO FORMA FINANCIAL IMPACT

Transaction Multiples (a) Acquisition of Residential Mortgage Comparable Deal Medians (b)

Book Value 1.26X 1.97X Last Twelve Months Earnings 12.6X 10.8X Price to Revenues 1.26X 1.85X

Transaction Metrics (estimated)

2014 EPS Accretion (c) 5.1% 2015 EPS Accretion 12.0% Internal Rate of Return 15.0% Tangible Book Value Per Share Earnback (d) 6.89 years

Consolidated Capital Ratios

(As of 6/30/14) Pro Forma

TCE/TA 11.02% 9.29%

Leverage Ratio 12.55% 10.76% Tier 1 Ratio 14.26% 12.13% Total Risk-based Capital Ratio 15.51% 13.38%

(a) NRIM data as of 6/30/2014.

(b) Source: SNL. Includes mortgage banking transactions announced since January 2011 which disclosed transaction terms. (c) Excludes one time expenses.

(d) Calculated as the number of years that the initial tangible book value dilution will be earned back on incremental earnings from the acquisition. Initial tangible book value per share dilution includes all estimated acquisition expenses.

9

|

|

CONCLUSION

Northrim is buying 100% of an affiliate in expected low execution risk transaction

Acquisition is in line with Northrim strategic plan of strengthening its Alaska market share

Transaction expected to increase and diversify Northrim’s non interest income and position it for further growth of fee businesses

Financially attractive; expected 15% EPS accretion in 2015 and strong pro forma capital ratios

Complementary business models with strong franchises and consistent profitability

Increased size and scale favorably positions the company for further acquisitions and growth strategies

Transaction intended to enhance Northrim’s long-term shareholder value

10

|

|

APPENDIX

11

|

|

EARN-OUT PAYMENTS

EARN OUT PAYMENTS—The sellers will have the right to receive additional payments for the 60 months following closing based on the adjusted earnings of Residential Mortgage adjusted for certain benefits brought about by NRIM

These payments are contingent upon the continued employment of at least two of three sellers with RML for the duration of the earn-out

Payments for each 12 month period following closing will be calculated as follows: If Adjusted Earnings are: (a) less than $1 million: 0% (b) $1 to $2 million: 40% of earning over $1 million (c) $2 to $3 million: $400,000 plus 50% of earnings over $2 million (d) $3 to $4 million: $900,000 plus 70% of earnings over $3 million (e) $4 to $6 million: $1,600,000 plus 85% of earnings over $4 million

(f) Over $6 million: $3,300,000 plus 55% of earnings over $6 million

12

|

|

ALASKA PURCHASE MORTGAGE VOLUME HAS BEEN STEADIER THAN US AVERAGE

Single family and condominium new loan and refinancing activity in Alaska ($ Millions)

TOTAL NEW LOANS REFINANCING REFINANCING (AS A % OF TOTAL )

2013 $4,006 $2,424 $1,582 39.5% 2012 $5,233 $2,136 $3,097 59.2% 2011 $3,852 $1,795 $2,057 53.4% 2010 $4,467 $2,094 $2,373 53.1% 2009 $5,782 $2,085 $3,697 63.9% 2008 $3,815 $2,197 $1,618 42.4% 2007 NA $2,460 NA NA 2006 NA $2,560 NA NA 2005 NA $2,294 NA NA 2004 NA $2,095 NA NA 2003 NA $2,116 NA NA 2002 NA $1,954 NA NA 2001 NA $1,677 NA NA 2000 NA $1,111 NA NA

Source: Alaska Housing Finance Corporation

13

|

|

BUILDING ACTIVITY—ALASKA STATEWIDE, 1980–2013

ALASKA BUILDING PERMITS

Number of new, privately owned housing, 1-5 units authorized

12000

10000

8000

6000

4000

2000

0

1980

1982

1984

1986

1988

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

11,248

9% increase in 2013, most since 2007

1081

Source: US Census Bureau, 2013 is November

14