Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MEDICAL PROPERTIES TRUST INC | d771191d8k.htm |

| EX-99.1 - EX-99.1 - MEDICAL PROPERTIES TRUST INC | d771191dex991.htm |

Exhibit 99.2

|

Table of Contents |

|||||

|

Company Information |

1 | |||||

|

Reconciliation of Net Income to Funds from Operations |

2 | |||||

|

Investment and Revenue by Asset Type, Operator, Country and State |

3 | |||||

|

Lease Maturity Schedule |

4 | |||||

|

Debt Summary |

5 | |||||

|

Consolidated Statements of Income |

6 | |||||

|

Consolidated Balance Sheets |

7 | |||||

|

Acquisitions and Summary of Development Projects |

8 | |||||

|

Detail of Other Assets |

9 | |||||

|

The information in this supplemental information package should be read in conjunction with the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other information filed with the Securities and Exchange Commission. You can access these documents free of charge at www.sec.gov and from the Company’s website at www.medicalpropertiestrust.com. The information contained on the Company’s website is not incorporated by reference into, and should not be considered a part of, this supplemental package.

For more information, please contact: Charles Lambert, Managing Director - Capital Markets at (205) 397-8897 Tim Berryman, Director - Investor Relations at (205) 397-8589 |

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Reconciliation of Net Income to Funds From Operations

(Unaudited)

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||

| June 30, 2014 | June 30, 2013 | June 30, 2014 | June 30, 2013 | |||||||||||||

| (A) | (A) | |||||||||||||||

| FFO information: |

||||||||||||||||

| Net income (loss) attributable to MPT common stockholders |

$ | (203,018 | ) | $ | 27,347,826 | $ | 7,038,276 | $ | 53,504,318 | |||||||

| Participating securities’ share in earnings |

(195,124 | ) | (179,263 | ) | (404,494 | ) | (372,325 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss), less participating securities’ share in earnings |

$ | (398,142 | ) | $ | 27,168,563 | $ | 6,633,782 | $ | 53,131,993 | |||||||

| Depreciation and amortization: |

||||||||||||||||

| Continuing operations |

12,441,777 | 8,642,893 | 26,131,379 | 17,112,093 | ||||||||||||

| Discontinued operations |

— | 74,751 | — | 252,701 | ||||||||||||

| Real estate impairment charges |

5,974,400 | — | 5,974,400 | — | ||||||||||||

| Gain on sale of real estate |

— | (2,054,229 | ) | — | (2,054,229 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Funds from operations |

$ | 18,018,035 | $ | 33,831,978 | $ | 38,739,561 | $ | 68,442,558 | ||||||||

| Write-off straight line rent |

— | — | 950,338 | — | ||||||||||||

| Debt refinancing costs |

290,635 | — | 290,635 | — | ||||||||||||

| Loan and other impairment charges |

23,657,032 | — | 44,153,495 | — | ||||||||||||

| Acquisition costs |

2,534,784 | 2,087,903 | 3,046,803 | 2,278,452 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Normalized funds from operations |

$ | 44,500,486 | $ | 35,919,881 | $ | 87,180,832 | $ | 70,721,010 | ||||||||

| Share-based compensation |

2,075,576 | 2,285,050 | 4,118,986 | 4,203,905 | ||||||||||||

| Debt costs amortization |

1,144,560 | 855,417 | 2,193,282 | 1,752,149 | ||||||||||||

| Additional rent received in advance (B) |

(300,000 | ) | (300,000 | ) | (600,000 | ) | (600,000 | ) | ||||||||

| Straight-line rent revenue and other |

(4,830,525 | ) | (4,012,026 | ) | (9,533,392 | ) | (7,904,654 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted funds from operations |

$ | 42,590,097 | $ | 34,748,322 | $ | 83,359,708 | $ | 68,172,410 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Per diluted share data: |

||||||||||||||||

| Net income (loss), less participating securities’ share in earnings |

$ | — | $ | 0.18 | $ | 0.04 | $ | 0.36 | ||||||||

| Depreciation and amortization: |

||||||||||||||||

| Continuing operations |

0.07 | 0.06 | 0.16 | 0.12 | ||||||||||||

| Discontinued operations |

— | — | — | — | ||||||||||||

| Real estate impairment charges |

0.03 | — | 0.03 | — | ||||||||||||

| Gain on sale of real estate |

— | (0.02 | ) | — | (0.01 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Funds from operations |

$ | 0.10 | $ | 0.22 | $ | 0.23 | $ | 0.47 | ||||||||

| Write-off straight line rent |

— | — | 0.01 | — | ||||||||||||

| Debt refinancing costs |

— | — | — | — | ||||||||||||

| Loan and other impairment charges |

0.14 | — | 0.26 | — | ||||||||||||

| Acquisition costs |

0.02 | 0.02 | 0.02 | 0.01 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Normalized funds from operations |

$ | 0.26 | $ | 0.24 | $ | 0.52 | $ | 0.48 | ||||||||

| Share-based compensation |

0.01 | 0.02 | 0.02 | 0.03 | ||||||||||||

| Debt costs amortization |

0.01 | — | 0.01 | 0.01 | ||||||||||||

| Additional rent received in advance (B) |

— | — | — | — | ||||||||||||

| Straight-line rent revenue and other |

(0.03 | ) | (0.03 | ) | (0.06 | ) | (0.05 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted funds from operations |

$ | 0.25 | $ | 0.23 | $ | 0.49 | $ | 0.47 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (A) | Financials have been restated to reclass the operating results of certain properties sold after the 2013 second quarter to discontinued operations. |

| (B) | Represents additional rent from one tenant in advance of when we can recognize as revenue for accounting purposes. This additional rent is being recorded to revenue on a straight-line basis over the lease life. |

Investors and analysts following the real estate industry utilize funds from operations, or FFO, as a supplemental performance measure. FFO, reflecting the assumption that real estate asset values rise or fall with market conditions, principally adjusts for the effects of GAAP depreciation and amortization of real estate assets, which assumes that the value of real estate diminishes predictably over time. We compute FFO in accordance with the definition provided by the National Association of Real Estate Investment Trusts, or NAREIT, which represents net income (loss) (computed in accordance with GAAP), excluding gains (losses) on sales of real estate and impairment charges on real estate assets, plus real estate depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures.

In addition to presenting FFO in accordance with the NAREIT definition, we also disclose normalized FFO, which adjusts FFO for items that relate to unanticipated or non-core events or activities or accounting changes that, if not noted, would make comparison to prior period results and market expectations less meaningful to investors and analysts. We believe that the use of FFO, combined with the required GAAP presentations, improves the understanding of our operating results among investors and the use of normalized FFO makes comparisons of our operating results with prior periods and other companies more meaningful. While FFO and normalized FFO are relevant and widely used supplemental measures of operating and financial performance of REITs, they should not be viewed as a substitute measure of our operating performance since the measures do not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties, which can be significant economic costs that could materially impact our results of operations. FFO and normalized FFO should not be considered an alternative to net income (loss) (computed in accordance with GAAP) as indicators of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity.

We calculate adjusted funds from operations, or AFFO, by subtracting from or adding to normalized FFO (i) unbilled rent revenue, (ii) non-cash share-based compensation expense, and (iii) amortization of deferred financing costs. AFFO is an operating measurement that we use to analyze our results of operations based on the receipt, rather than the accrual, of our rental revenue and on certain other adjustments. We believe that this is an important measurement because our leases generally have significant contractual escalations of base rents and therefore result in recognition of rental income that is not collected until future periods, and costs that are deferred or are non-cash charges. Our calculation of AFFO may not be comparable to AFFO or similarly titled measures reported by other REITs. AFFO should not be considered as an alternative to net income (calculated pursuant to GAAP) as an indicator of our results of operations or to cash flow from operating activities (calculated pursuant to GAAP) as an indicator of our liquidity.

| 2 |

|

INVESTMENT AND REVENUE BY ASSET TYPE, OPERATOR, COUNTRY AND STATE

Investments and Revenue by Asset Type - As of June 30, 2014

| Total Assets |

Percentage of Gross Assets |

Total Revenue |

Percentage of Total Revenue |

|||||||||||||||||

| General Acute Care Hospitals |

A | $ | 1,850,017,764 | 54.9 | % | $ | 86,986,656 | 58.1 | % | |||||||||||

| Rehabilitation Hospitals |

663,696,680 | 19.7 | % | 34,735,809 | 23.2 | % | ||||||||||||||

| Long-Term Acute Care Hospitals |

456,800,666 | 13.6 | % | 27,095,981 | 18.1 | % | ||||||||||||||

| Wellness Centers |

15,624,817 | 0.5 | % | 830,676 | 0.6 | % | ||||||||||||||

| Other assets |

382,166,114 | 11.3 | % | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total gross assets |

3,368,306,041 | 100.0 | % | |||||||||||||||||

| Accumulated depreciation and amortization |

(178,261,853 | ) | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| Total |

$ | 3,190,044,188 | $ | 149,649,122 | 100.0 | % | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

Investments and Revenue by Operator - As of June 30, 2014

| Total Assets |

Percentage of Gross Assets |

Total Revenue |

Percentage of Total Revenue |

|||||||||||||

| Prime Healthcare |

$ | 711,782,124 | 21.1 | % | $ | 42,614,175 | 28.5 | % | ||||||||

| Ernest Health, Inc. |

481,600,641 | 14.3 | % | 28,226,237 | 18.9 | % | ||||||||||

| IASIS Healthcare |

347,611,962 | 10.3 | % | 13,675,524 | 9.1 | % | ||||||||||

| RHM |

239,610,001 | 7.1 | % | 10,947,969 | 7.3 | % | ||||||||||

| IJKG/HUMC |

124,645,948 | 3.7 | % | 7,968,918 | 5.3 | % | ||||||||||

| 22 other operators |

1,080,889,251 | 32.1 | % | 46,216,299 | 30.9 | % | ||||||||||

| Other assets |

382,166,114 | 11.4 | % | — | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total gross assets |

3,368,306,041 | 100.0 | % | |||||||||||||

| Accumulated depreciation and amortization |

(178,261,853 | ) | ||||||||||||||

|

|

|

|||||||||||||||

| Total |

$ | 3,190,044,188 | $ | 149,649,122 | 100.0 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||

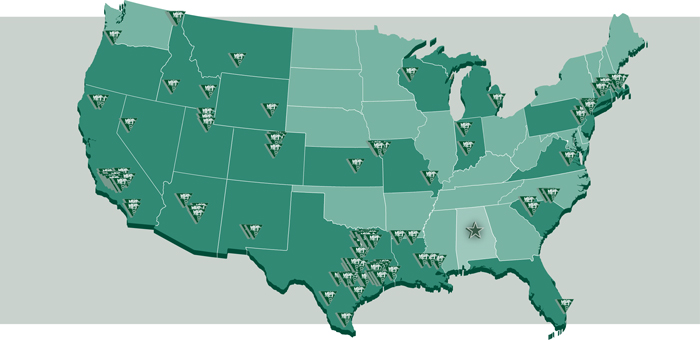

Investment and Revenue by Country and State - As of June 30, 2014

| Total Assets |

Percentage of Gross Assets |

Total Revenue |

Percentage of Total Revenue |

|||||||||||||

| United States |

||||||||||||||||

| Texas |

$ | 694,646,575 | 20.6 | % | $ | 35,017,299 | 23.4 | % | ||||||||

| California |

544,927,083 | 16.2 | % | 32,679,628 | 21.8 | % | ||||||||||

| New Jersey |

239,645,948 | 7.1 | % | 7,968,918 | 5.3 | % | ||||||||||

| Arizona |

200,844,185 | 6.0 | % | 4,187,780 | 2.8 | % | ||||||||||

| Louisiana |

133,934,517 | 4.0 | % | 10,840,023 | 7.3 | % | ||||||||||

| 20 other states |

932,531,618 | 27.7 | % | 48,007,505 | 32.1 | % | ||||||||||

| Other assets |

382,166,114 | 11.3 | % | — | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| United States Total |

3,128,696,040 | 92.9 | % | 138,701,153 | 92.7 | % | ||||||||||

| International |

||||||||||||||||

| Germany |

239,610,001 | 7.1 | % | 10,947,969 | 7.3 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| International Total |

239,610,001 | 7.1 | % | |||||||||||||

|

|

|

|

|

|||||||||||||

| Total gross assets |

3,368,306,041 | 100.0 | % | |||||||||||||

| Accumulated depreciation and amortization |

(178,261,853 | ) | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 3,190,044,188 | $ | 149,649,122 | 100.0 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| A | Includes two medical office buildings. |

| 3 |

|

LEASE MATURITY SCHEDULE - AS OF JUNE 30, 2014

| Total portfolio (1) |

Total leases | Base rent (2) | Percent of total base rent |

|||||||||

| 2014 |

1 | $ | 2,122,416 | 0.9 | % | |||||||

| 2015 |

2 | 4,155,412 | 1.8 | % | ||||||||

| 2016 |

1 | 2,250,000 | 1.0 | % | ||||||||

| 2017 |

— | — | 0.0 | % | ||||||||

| 2018 |

1 | 2,019,936 | 0.9 | % | ||||||||

| 2019 |

8 | 6,547,245 | 2.8 | % | ||||||||

| 2020 |

1 | 1,060,512 | 0.4 | % | ||||||||

| 2021 |

4 | 15,522,785 | 6.7 | % | ||||||||

| 2022 |

12 | 39,298,052 | 16.9 | % | ||||||||

| 2023 |

4 | 12,029,276 | 5.2 | % | ||||||||

| 2024 |

1 | 2,478,388 | 1.1 | % | ||||||||

| 2025 |

3 | 7,499,572 | 3.2 | % | ||||||||

| Thereafter |

62 | 137,448,171 | 59.1 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| 100 | $ | 232,431,764 | 100.0 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| (1) | Excludes 10 of our properties that are under development. |

Also, lease expiration is based on the fixed term of the lease and does not factor in potential renewal options provided for in our leases.

| (2) | Represents base rent on an annualized basis but does not include tenant recoveries, additional rents and other lease-related adjustments to revenue (i.e., straight-line rents and deferred revenues). |

Note: The tenant under the one lease that expires in 2014 exercised its purchase option and bought the property in the third quarter of 2014.

| 4 |

|

DEBT SUMMARY AS OF JUNE 30, 2014

| Instrument |

Rate Type | Rate | Balance | 2014 | 2015 | 2016 | 2017 | 2018 | Thereafter | |||||||||||||||||||||||||

| 2018 Credit Facility Revolver |

Variable | — | (1) | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||

| 2019 Term Loan |

Variable | 2.11 | % | 125,000,000 | — | — | — | — | — | 125,000,000 | ||||||||||||||||||||||||

| 2016 Unsecured Notes |

Fixed | 5.59 | %(2) | 125,000,000 | — | — | 125,000,000 | — | — | — | ||||||||||||||||||||||||

| 5.75% Notes Due 2020 (Euro) |

Fixed | 5.75 | %(3) | 273,840,000 | — | — | — | — | — | 273,840,000 | ||||||||||||||||||||||||

| 6.875% Notes Due 2021 |

Fixed | 6.88 | % | 450,000,000 | — | — | — | — | — | 450,000,000 | ||||||||||||||||||||||||

| 6.375% Notes Due 2022 |

Fixed | 6.38 | % | 350,000,000 | — | — | — | — | — | 350,000,000 | ||||||||||||||||||||||||

| 5.5% Notes Due 2024 |

Fixed | 5.50 | % | 300,000,000 | — | — | — | — | — | 300,000,000 | ||||||||||||||||||||||||

| Northland - Mortgage Capital Term Loan |

Fixed | 6.20 | % | 13,816,228 | 133,649 | 282,701 | 298,582 | 320,312 | 12,780,984 | — | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| $ | 1,637,656,228 | $ | 133,649 | $ | 282,701 | $ | 125,298,582 | $ | 320,312 | $ | 12,780,984 | $ | 1,498,840,000 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Debt Premium | $ | 2,697,390 | ||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||

| $ | 1,640,353,618 | |||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||

| (1) | Represents a $775 million unsecured revolving credit facility with spreads over LIBOR ranging from 1.70% to 2.25%. |

| (2) | Represents the weighted-average rate for four traunches of the Notes at June 30, 2014 factoring in interest rate swaps in effect at that time. The Company has entered into two swap agreements which began in July and October 2011. Effective July 31, 2011, the Company is paying 5.507% on $65 milllion of the Notes and effective October 31, 2011, the Company is paying 5.675% on $60 million of Notes. |

| (3) | Represents 200,000,000 of bonds issued in EUR and converted to USD at June 30, 2014. |

| 5 |

|

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Consolidated Statements of Income

(Unaudited)

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||

| June 30, 2014 | June 30, 2013 | June 30, 2014 | June 30, 2013 | |||||||||||||

| (A) | (A) | |||||||||||||||

| Revenues |

||||||||||||||||

| Rent billed |

$ | 45,927,570 | $ | 31,024,222 | $ | 88,889,236 | $ | 62,527,678 | ||||||||

| Straight-line rent |

3,178,229 | 2,776,592 | 5,366,552 | 5,468,147 | ||||||||||||

| Income from direct financing leases |

12,263,376 | 9,229,987 | 24,478,765 | 17,986,458 | ||||||||||||

| Interest and fee income |

15,191,292 | 14,093,034 | 30,914,569 | 28,755,304 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

76,560,467 | 57,123,835 | 149,649,122 | 114,737,587 | ||||||||||||

| Expenses |

||||||||||||||||

| Real estate depreciation and amortization |

12,441,777 | 8,642,893 | 26,131,379 | 17,112,093 | ||||||||||||

| Impairment charges |

29,631,432 | — | 50,127,895 | — | ||||||||||||

| Property-related |

(37,906 | ) | 649,281 | 700,397 | 1,062,003 | |||||||||||

| Acquisition expenses |

2,534,784 | 2,087,903 | 3,046,803 | 2,278,452 | ||||||||||||

| General and administrative |

8,205,885 | 7,110,537 | 17,164,674 | 14,876,486 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

52,775,972 | 18,490,614 | 97,171,148 | 35,329,034 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

23,784,495 | 38,633,221 | 52,477,974 | 79,408,553 | ||||||||||||

| Interest and other income (expense) |

(23,947,079 | ) | (13,488,033 | ) | (45,389,616 | ) | (28,645,399 | ) | ||||||||

| Income tax (expense) benefit |

(40,434 | ) | (114,833 | ) | 16,890 | (167,080 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from continuing operations |

(203,018 | ) | 25,030,355 | 7,105,248 | 50,596,074 | |||||||||||

| Income (loss) from discontinued operations |

— | 2,374,053 | (1,500 | ) | 3,018,459 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

(203,018 | ) | 27,404,408 | 7,103,748 | 53,614,533 | |||||||||||

| Net income (loss) attributable to non-controlling interests |

— | (56,582 | ) | (65,472 | ) | (110,215 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to MPT common stockholders |

$ | (203,018 | ) | $ | 27,347,826 | $ | 7,038,276 | $ | 53,504,318 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings per common share - basic: |

||||||||||||||||

| Income (loss) from continuing operations |

$ | — | $ | 0.16 | $ | 0.04 | $ | 0.35 | ||||||||

| Income (loss) from discontinued operations |

— | 0.02 | — | 0.02 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to MPT common stockholders |

$ | — | $ | 0.18 | $ | 0.04 | $ | 0.37 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings per common share - diluted: |

||||||||||||||||

| Income (loss) from continuing operations |

$ | — | $ | 0.16 | $ | 0.04 | $ | 0.34 | ||||||||

| Income (loss) from discontinued operations |

— | 0.02 | — | 0.02 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to MPT common stockholders |

$ | — | $ | 0.18 | $ | 0.04 | $ | 0.36 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Dividends declared per common share |

$ | 0.21 | $ | 0.20 | $ | 0.42 | $ | 0.40 | ||||||||

| Weighted average shares outstanding - basic |

171,718,449 | 149,508,958 | 167,845,813 | 144,927,768 | ||||||||||||

| Weighted average shares outstanding - diluted |

172,368,987 | 151,055,855 | 168,458,784 | 146,291,083 | ||||||||||||

| (A) | Financials have been restated to reclass the operating results of certain properties sold after the 2013 second quarter to discontinued operations. |

| 6 |

|

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

| June 30, 2014 | December 31, 2013 | |||||||

| (Unaudited) | (A) | |||||||

| Assets |

||||||||

| Real estate assets |

||||||||

| Land, buildings and improvements, and intangible lease assets |

$ | 1,973,883,213 | $ | 1,823,683,129 | ||||

| Construction in progress and other |

52,375,733 | 41,771,499 | ||||||

| Net investment in direct financing leases |

434,310,776 | 431,024,228 | ||||||

| Mortgage loans |

385,100,144 | 388,756,469 | ||||||

|

|

|

|

|

|||||

| Gross investment in real estate assets |

2,845,669,866 | 2,685,235,325 | ||||||

| Accumulated depreciation and amortization |

(178,261,853 | ) | (159,776,091 | ) | ||||

|

|

|

|

|

|||||

| Net investment in real estate assets |

2,667,408,013 | 2,525,459,234 | ||||||

| Cash and cash equivalents |

197,022,616 | 45,979,648 | ||||||

| Interest and rent receivable |

46,353,272 | 58,565,294 | ||||||

| Straight-line rent receivable |

51,192,748 | 45,828,685 | ||||||

| Other assets |

228,067,539 | 228,862,582 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 3,190,044,188 | $ | 2,904,695,443 | ||||

|

|

|

|

|

|||||

| Liabilities and Equity |

||||||||

| Liabilities |

||||||||

| Debt, net |

$ | 1,640,353,618 | $ | 1,421,680,749 | ||||

| Accounts payable and accrued expenses |

84,230,814 | 94,289,615 | ||||||

| Deferred revenue |

27,424,937 | 24,114,374 | ||||||

| Lease deposits and other obligations to tenants |

25,080,815 | 20,402,058 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

1,777,090,184 | 1,560,486,796 | ||||||

| Equity |

||||||||

| Preferred stock, $0.001 par value. Authorized 10,000,000 shares; no shares outstanding |

— | — | ||||||

| Common stock, $0.001 par value. Authorized 250,000,000 shares; issued and outstanding - 171,550,527 shares at June 30, 2014 and 161,309,725 shares at December 31, 2013 |

171,551 | 161,310 | ||||||

| Additional paid in capital |

1,750,808,870 | 1,618,054,133 | ||||||

| Distributions in excess of net income |

(330,074,847 | ) | (264,803,804 | ) | ||||

| Accumulated other comprehensive income (loss) |

(7,689,227 | ) | (8,940,649 | ) | ||||

| Treasury shares, at cost |

(262,343 | ) | (262,343 | ) | ||||

|

|

|

|

|

|||||

| Total Equity |

1,412,954,004 | 1,344,208,647 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Equity |

$ | 3,190,044,188 | $ | 2,904,695,443 | ||||

|

|

|

|

|

|||||

| (A) | Financials have been derived from the prior year audited financials and include certain minor reclasses to be consistent with the 2014 presentation. |

| 7 |

|

ACQUISITIONS FOR THE SIX MONTHS ENDED JUNE 30, 2014

| Name |

Location | Property Type | Acquisition / Development | Investment / Commitment |

||||||

| Legacy Health Partners |

Montclair, NJ | Acute Care Hospital | Acquisition | $ | 115,000,000 | |||||

|

|

|

|||||||||

| Total Investments / Commitments |

$ | 115,000,000 | ||||||||

|

|

|

|||||||||

SUMMARY OF DEVELOPMENT PROJECTS AS OF JUNE 30, 2014

| Property |

Location | Property Type | Operator | Commitment | Costs Incurred as of 6/30/14 |

Percent Leased | Estimated Completion Date | |||||||||||||

| Oakleaf Surgical Hospital |

Altoona, WI | Acute Care Hospital |

National Surgical Hospitals |

$ | 33,500,000 | $ | 28,668,511 | 100 | % | 3Q 2014 | ||||||||||

| First Choice ER - Allen |

Allen, TX | Acute Care Hospital |

Adeptus Health | 6,186,769 | 3,365,443 | 100 | % | 3Q 2014 | ||||||||||||

| First Choice ER - Broomfield |

Broomfield, CO | Acute Care Hospital |

Adeptus Health | 5,238,100 | 2,514,945 | 100 | % | 3Q 2014 | ||||||||||||

| Frist Choice ER - Spring |

Spring, TX | Acute Care Hospital |

Adeptus Health | 5,803,500 | 2,676,288 | 100 | % | 3Q 2014 | ||||||||||||

| First Choice ER - Fountain |

Fountain, CO | Acute Care Hospital |

Adeptus Health | 6,194,181 | 3,380,295 | 100 | % | 3Q 2014 | ||||||||||||

| First Choice ER - Missouri City (Sienna) |

Houston, TX | Acute Care Hospital |

Adeptus Health | 5,393,656 | 3,564,734 | 100 | % | 3Q 2014 | ||||||||||||

| First Choice ER - Pearland |

Pearland, TX | Acute Care Hospital |

Adeptus Health | 5,691,295 | 2,331,274 | 100 | % | 4Q 2014 | ||||||||||||

| First Choice ER - Thornton |

Thornton, CO | Acute Care Hospital |

Adeptus Health | 6,029,465 | 2,651,724 | 100 | % | 4Q 2014 | ||||||||||||

| First Choice ER - Missouri City (Dulles) |

Houston, TX | Acute Care Hospital |

Adeptus Health | 5,692,875 | 2,515,636 | 100 | % | 4Q 2014 | ||||||||||||

| First Choice ER - Commerce City |

Denver, CO | Acute Care Hospital |

Adeptus Health | 5,371,550 | 706,883 | 100 | % | 4Q 2014 | ||||||||||||

|

|

|

|

|

|||||||||||||||||

| $ | 85,101,391 | $ | 52,375,733 | |||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| 8 |

|

DETAIL OF OTHER ASSETS AS OF JUNE 30, 2014

| Operator |

Investment | Annual Interest Rate |

YTD Ridea Income (3) |

Security / Credit Enhancements | ||||||||||

| Non-Operating Loans |

||||||||||||||

| Vibra Healthcare acquisition loan (1) |

$ | 10,975,310 | 10.25 | % | Secured and cross-defaulted with real estate, other agreements and guaranteed by Parent | |||||||||

| Vibra Healthcare working capital |

5,232,500 | 9.50 | % | Secured and cross-defaulted with real estate, other agreements and guaranteed by Parent | ||||||||||

| Post Acute Medical working capital |

7,892,327 | 11.10 | % | Secured and cross-defaulted with real estate; certain loans are cross-defaulted with other loans and real estate | ||||||||||

| IKJG/HUMC working capital |

13,294,117 | 10.40 | % | Secured and cross-defaulted with real estate and guaranteed by Parent | ||||||||||

| Ernest Health |

4,333,333 | 9.38 | % | Secured and cross-defaulted with real estate and guaranteed by Parent | ||||||||||

| Other |

2,190,643 | |||||||||||||

|

|

|

|||||||||||||

| 43,918,230 | ||||||||||||||

| Operating Loans |

||||||||||||||

| Ernest Health, Inc. (2) |

93,200,000 | 15.00 | % | 7,930,963 | Secured and cross-defaulted with real estate and guaranteed by Parent | |||||||||

| IKJG/HUMC convertible loan |

3,351,832 | 373,122 | Secured and cross-defaulted with real estate and guaranteed by Parent | |||||||||||

|

|

|

|

|

|||||||||||

| 96,551,832 | 8,304,085 | |||||||||||||

| Equity investments |

13,489,237 | 905,372 | ||||||||||||

| Deferred debt financing costs |

35,928,987 | Not applicable | ||||||||||||

| Lease and cash collateral |

4,543,801 | Not applicable | ||||||||||||

| Other assets (4) |

33,635,452 | Not applicable | ||||||||||||

|

|

|

|

|

|||||||||||

| Total |

$ | 228,067,539 | $ | 9,209,457 | ||||||||||

|

|

|

|

|

|||||||||||

| (1) | Original amortizing acquisition loan was $41 million; loan matures in 2019 |

| (2) | Cash rate is 10% effective March 1, 2014. |

| (3) | Income earned on operating loans is reflected in the interest income line of the income statement. |

| (4) | Includes prepaid expenses, office property and equipment and other. |

| 9 |

|