Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - KINDRED HEALTHCARE, INC | d772078dex991.htm |

| EX-99.2 - EX-99.2 - KINDRED HEALTHCARE, INC | d772078dex992.htm |

| 8-K - 8-K - KINDRED HEALTHCARE, INC | d772078d8k.htm |

Kindred

Healthcare Second Quarter Investor Update

August 6, 2014

Exhibit 99.3 |

2

Forward-Looking Statements

This

presentation

includes

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended.

All

statements

regarding

the

potential

acquisition

of

Gentiva

Health

Services,

Inc.

(“Gentiva”)

(NASDAQ:GTIV)

(including

financing

of

the

proposed

transaction

and

the

benefits,

results,

effects

and

timing

of

such

transaction),

and

the

Company’s

expected

future

financial

position,

results

of

operations,

cash

flows,

financing

plans,

business

strategy,

budgets,

capital

expenditures,

competitive

positions,

growth

opportunities,

plans

and

objectives

of

management

and

statements

containing

the

words

such

as

“anticipate,”

“approximate,”

“believe,”

“plan,”

“estimate,”

“expect,”

“project,”

“could,”

“should,”

“will,”

“intend,”

“may,”

“potential”

and

other

similar

expressions,

are

forward-looking

statements.

Statements

in

this

presentation

concerning

the

Company’s

business

outlook

or

future

economic

performance,

anticipated

profitability,

revenues,

expenses

or

other

financial

items,

and

product

or

services

line

growth,

together

with

other

statements

that

are

not

historical

facts,

are

forward-looking

statements

that

are

estimates

reflecting

the

best

judgment

of

the

Company

based

upon

currently

available

information.

Such

forward-looking

statements

are

inherently

uncertain,

and

stockholders

and

other

potential

investors

must

recognize

that

actual

results

may

differ

materially

from

the

Company’s

expectations

as

a

result

of

a

variety

of

factors,

including,

without

limitation,

those

discussed

below.

Such

forward-looking

statements

are

based

upon

management’s

current

expectations

and

include

known

and

unknown

risks,

uncertainties

and

other

factors,

many

of

which

the

Company

is

unable

to

predict

or

control,

that

may

cause

the

Company’s

actual

results,

performance

or

plans

to

differ

materially

from

any

future

results,

performance

or

plans

expressed

or

implied

by

such

forward-looking

statements.

These

statements

involve

risks,

uncertainties

and

other

factors

discussed

below

and

detailed

from

time

to

time

in

Kindred’s

filings

with

the

Securities

and

Exchange

Commission.

In

addition

to

the

factors

set

forth

above,

other

factors

that

may

affect

the

Company’s

plans,

results

or

stock

price

include,

without

limitation,

(a)

the

impact

of

healthcare

reform,

which

will

initiate

significant

changes

to

the

United

States

healthcare

system,

including

potential

material

changes

to

the

delivery

of

healthcare

services

and

the

reimbursement

paid

for

such

services

by

the

government

or

other

third

party

payors,

including

reforms

resulting

from

the

Patient

Protection

and

Affordable

Care

Act

and

the

Healthcare

Education

and

Reconciliation

Act

(collectively,

the

“ACA”)

or

future

deficit

reduction

measures

adopted

at

the

federal

or

state

level.

Healthcare

reform

is

affecting

each

of

the

Company’s

businesses

in

some

manner.

Potential

future

efforts

in

the

U.S.

Congress

to

repeal,

amend,

modify

or

retract

funding

for

various

aspects

of

the

ACA

create

additional

uncertainty

about

the

ultimate

impact

of

the

ACA

on

the

Company

and

the

healthcare

industry.

Due

to

the

substantial

regulatory

changes

that

will

need

to

be

implemented

by

the

Centers

for

Medicare

and

Medicaid

Services

(“CMS”)

and

others,

and

the

numerous

processes

required

to

implement

these

reforms,

the

Company

cannot

predict

which

healthcare

initiatives

will

be

implemented

at

the

federal

or

state

level,

the

timing

of

any

such

reforms,

or

the

effect

such

reforms

or

any

other

future

legislation

or

regulation

will

have

on

the

Company’s

business,

financial

position,

results

of

operations

and

liquidity,

(b)

the

Company’s

ability

to

adjust

to

the

new

patient

criteria

for

long-term

acute

care

(“LTAC”)

hospitals

under

the

Pathway

for

SGR

Reform

Act

of

2013,

which

will

reduce

the

population

of

patients

eligible

for

the

Company’s

hospital

services

and

change

the

basis

upon

which

the

Company

is

paid,

(c)

the

impact

of

the

final

rules

issued

by

CMS

on

August

1,

2012

which,

among

other

things,

will

reduce

Medicare

reimbursement

to

the

Company’s

transitional

care

(“TC”)

hospitals

in

2013

and

beyond

by

imposing

a

budget

neutrality

adjustment

and

modifying

the

short-stay

outlier

rules,

(d)

the

impact

of

the

final

rules

issued

by

CMS

on

July

29,

2011

which

significantly

reduced

Medicare

reimbursement

to

the

Company’s

nursing

centers

and

changed

payments

for

the

provision

of

group

therapy

services

effective

October

1,

2011,

(e)

the

impact

of

the

Budget

Control

Act

of

2011

(as

amended

by

the

American

Taxpayer

Relief

Act

of

2012

(the

“Taxpayer

Relief

Act”))

which

instituted

an

automatic

2%

reduction

on

each

claim

submitted

to

Medicare

beginning

April

1,

2013,

(f)

the

costs

of

defending

and

insuring

against

alleged

professional

liability

and

other

claims

and

investigations

(including

those

related

to

pending

investigations

and

whistleblower

and

wage

and

hour

class

action

lawsuits

against

the

Company)

and

the

Company’s

ability

to

predict

the

estimated

costs

and

reserves

related

to

such

claims

and

investigations,

including

the

impact

of

differences

in

actuarial

assumptions

and

estimates

compared

to

eventual

outcomes,

(g)

the

impact

of

the

Taxpayer

Relief

Act

which,

among

other

things,

reduces

Medicare

payments

by

an

additional

25%

for

subsequent

procedures

when

multiple

therapy

services

are

provided

on

the

same

day.

At

this

time,

the

Company

believes

that

the

rules

related

to

multiple

therapy

services

will

reduce

its

Medicare

revenues

by

$25

million

to

$30

million

on

an

annual

basis,

(h)

changes

in

the

reimbursement

rates

or

the

methods

or

timing

of

payment

from

third

party

payors,

including

commercial

payors

and

the

Medicare

and

Medicaid

programs,

changes

arising

from

and

related

to

the

Medicare

prospective

payment

system

for

LTAC

hospitals,

including

potential

changes

in

the

Medicare

payment

rules,

the

Medicare

Prescription

Drug,

Improvement,

and

Modernization

Act

of

2003,

and

changes

in

Medicare

and

Medicaid

reimbursement

for

the

Company’s

TC

hospitals,

nursing

centers,

inpatient

rehabilitation

hospitals

and

home

health

and

hospice

operations,

and

the

expiration

of

the

Medicare

Part

B

therapy

cap

exception

process,

(i)

the

effects

of

additional

legislative

changes

and

government

regulations,

interpretation

of

regulations

and

changes

in

the

nature

and

enforcement

of

regulations

governing

the

healthcare

industry,

(j)

the

ability

of

the

Company’s

hospitals

and

nursing

centers

to

adjust

to

medical

necessity

reviews,

(k)

the

impact

of

the

Company’s

significant

level

of

indebtedness

on

its

funding

costs,

operating

flexibility

and

ability

to

fund

ongoing

operations,

development

capital

expenditures

or

other

strategic

acquisitions

with

additional

borrowings,

(l)

the

Company’s

ability

to

successfully

redeploy

its

capital

and

proceeds

of

asset

sales

in

pursuit

of

its

business

strategy

and

pursue

its

development

activities,

including

through

acquisitions,

and

successfully

integrate

new

operations,

including

the

realization

of

anticipated

revenues,

economies

of

scale,

cost

savings

and

productivity

gains

associated

with

such

operations,

as

and

when

planned,

including

the

potential

impact

of

unanticipated

issues,

expenses

and

liabilities

associated

with

those

activities,

(m)

the

Company’s

ability

to

pay

a

dividend

as,

when

and

if

declared

by

the

Board

of

Directors,

in

compliance

with

applicable

laws

and

the

Company’s

debt

and

other

contractual

arrangements,

(n)

the

failure

of

the

Company’s

facilities

to

meet

applicable

licensure

and

certification

requirements,

(o)

the

further

consolidation

and

cost

containment

efforts

of

managed

care

organizations

and

other

third

party

payors,

(p)

the

Company’s

ability

to

meet

its

rental

and

debt

service

obligations,

(q)

the

Company’s

ability

to

operate

pursuant

to

the

terms

of

its

debt

obligations,

and

comply

with

its

covenants

thereunder,

and

the

Company’s

ability

to

operate

pursuant

to

its

master

lease

agreements

with

Ventas,

Inc.

(NYSE:VTR),

(r)

the

condition

of

the

financial

markets,

including

volatility

and

weakness

in

the

equity,

capital

and

credit

markets,

which

could

limit

the

availability

and

terms

of

debt

and

equity

financing

sources

to

fund

the

requirements

of

the

Company’s

businesses,

or

which

could

negatively

impact

the

Company’s

investment

portfolio,

(s)

the

Company’s

ability

to

control

costs,

particularly

labor

and

employee

benefit

costs,

(t)

the

Company’s

ability

to

successfully

reduce

(by

divestiture

of

operations

or

otherwise)

its

exposure

to

professional

liability

and

other

claims,

(u)

the

Company’s

obligations

under

various

laws

to

self-

report

suspected

violations

of

law

by

the

Company

to

various

government

agencies,

including

any

associated

obligation

to

refund

overpayments

to

government

payors,

fines

and

other

sanctions,

(v)

national,

regional

and

industry-

specific

economic,

financial,

business

and

political

conditions,

including

their

effect

on

the

availability

and

cost

of

labor,

credit,

materials

and

other

services,

(w)

increased

operating

costs

due

to

shortages

in

qualified

nurses,

therapists

and

other

healthcare

personnel,

(x)

the

Company’s

ability

to

attract

and

retain

key

executives

and

other

healthcare

personnel,

(y)

the

Company’s

ability

to

successfully

dispose

of

unprofitable

facilities,

(z)

events

or

circumstances

which

could

result

in

the

impairment

of

an

asset

or

other

charges,

such

as

the

impact

of

the

Medicare

reimbursement

regulations

that

resulted

in

the

Company

recording

significant

impairment

charges

in

the

last

three

fiscal

years,

(aa)

changes

in

generally

accepted

accounting

principles

or

practices

(“GAAP”),

and

changes

in

tax

accounting

or

tax

laws

(or

authoritative

interpretations

relating

to

any

of

these

matters),

(bb)

the

Company’s

ability

to

maintain

an

effective

system

of

internal

control

over

financial

reporting,

(cc)

the

Company’s

ability

to

realize

the

anticipated

operating

and

financial

synergies

from

the

potential

acquisition

of

Gentiva,

(dd)

the

uncertainties

as

to

whether

Gentiva

or

any

other

companies

that

the

Company

may

acquire

will

have

the

accretive

effect

on

the

Company’s

earnings

or

cash

flows

that

are

expected,

and

(ee)

the

outcome

of

the

potential

acquisition

of

Gentiva,

including

the

Company’s

ability

to

realize

the

strategic

rationale

behind

the

Gentiva

acquisition.

Many

of

these

factors

are

beyond

the

Company’s

control.

The

Company

cautions

investors

that

any

forward-looking

statements

made

by

the

Company

are

not

guarantees

of

future

performance.

The

Company

disclaims

any

obligation

to

update

any

such

factors

or

to

announce

publicly

the

results

of

any

revisions

to

any

of

the

forward-looking

statements

to

reflect

future

events

or

developments.

In

addition

to

the

results

provided

in

accordance

with

GAAP,

the

Company

has

provided

information

in

this

presentation

to

compute

certain

non-GAAP

measurements

for

specified

periods

before

certain

charges

or

on

a

core

basis.

A

reconciliation

of

the

non-GAAP

measurements

to

the

GAAP

measurements

is

included

in

this

presentation

and

on

our

website

at

www.kindredhealthcare.com

under

the

heading

“Investors.”

2 |

Kindred

Healthcare’s Second Quarter – Success and Opportunity

Continued Progress on Employee Engagement, Quality Assurance,

Clinical Outcomes and Patient Satisfaction Measures Across The Enterprise

Strong Second Quarter and First Half of the Year

Financial Results

Continued Progress Advancing Integrated Care Market Strategy and

Development of Care Management Capabilities

Completed Business Segment Repositioning, Refinancing and Successful

Equity Offering

Management Team, Balance Sheet and Industry Leading Infrastructure

Positioned for Growth!

Excited for the Opportunities in the Acquisition Pipeline

3 |

4

Strong Second Quarter –

Continuing Operations

(1)

($ in millions, except statistics)

Actual

Prior Year

% change

Revenues

$1,276

$1,191

+7%

Operating expenses

1,098

1,025

Operating income

178

166

+7

Margin

13.9%

14.0%

Net income

19

15

Diluted EPS

$0.34

$0.27

+26

Diluted EPS - Reported

($0.48)

$0.25

(1) Before certain disclosed items reconciled in the Appendix.

•

Key Q2 operating metrics:

Strong revenue and operating income growth, both up 7%

Improving hospital volumes, nursing center and Kindred at Home growth, lower interest costs

and solid cost controls across the organization drove year-over-year

results Results exclude debt refinancing, severance, reorganization and transaction

costs in both periods •

Recent common stock equity offering of 9.7 million shares generated $221 million in net proceeds

used to repay the Company’s revolving credit facility

•

Refinancing of the Company’s existing secured and unsecured debt on April 9 lowers

borrowing costs, extends debt maturities and reduces interest rate risk

|

5

Core Operating Margins

Annualized

impact

of

Medicare

cuts

($

in

millions):

--Sequestration

(effective

April

1,

2013)……………………………………………………………………………..

$45

--LTAC

Budget

Neutrality

(cumulative

impact

for

first

two

years

of

three-year

phase-in).……$35

--Rehab

Services

(effective

October

1,

2012

and

April

1,

2013)……………........................………$21 Total

$101

Margin Expansion Across Enterprise Reflects Full Recovery from Reimbursement Cuts

|

6

2014 Earnings Guidance

(1)

Adjusted to exclude new discontinued operations

($ millions, except statistics)

Low

High

Low

High

Revenue

$5,100

$5,100

$5,200

$5,200

EBITDAR

707

724

715

732

Rent

330

330

335

335

EBITDA

377

394

380

397

D&A

161

161

163

163

EBIT

216

233

217

234

Interest , net

98

98

98

98

Pretax

118

135

119

136

Taxes

45

52

46

53

Net income

73

83

73

83

Noncontrolling interest

(15)

(15)

(15)

(15)

Income to Kindred

$58

$68

$58

$68

Shares

58.3

58.3

53.2

53.2

Diluted EPS

$0.96

$1.14

$1.05

$1.25

As of August 6, 2014

As of June 16, 2014

(1)

2014

earnings

guidance

reaffirmed

with

dilution

impact

of

Q2

equity

offering.

The earnings guidance excludes the effect of reimbursement changes, debt refinancing costs,

severance, retirement, retention and restructuring costs, litigation costs,

transaction costs, any further acquisitions or divestitures, any impairment charges, and any repurchases of common stock. |

7

Post-Refinancing

Pre-Refinancing

Weighted Avg. Maturity: ~4.3 years

Upsized term loan to

$1 billion

Unstacked maturity

cliff in 2018

Reduced coupon on

ABL and Term Loan by

50bps and 25bps,

respectively

Reduced coupon on

unsecured notes by

1.875%

Increased duration of

notes by 3.0 years

Comments

$777.2

$750.0

$550.0

$1,527

$0

$500

$1,000

$1,500

$2,000

$2,500

2014

2015

2016

2017

2018

2019

2020

2021

2022

Term Loan

ABL

Unsecured

Weighted Avg. Maturity: ~7.3 years

$1,000.0

$750.0

$500.0

$0

$500

$1,000

$1,500

$2,000

$2,500

2014

2015

2016

2017

2018

2019

2020

2021

2022

Term Loan

ABL

Unsecured

Recapitalization Benefits

Funded Debt:

Equity Offering:

•

Completed an oversubscribed equity offering

•

$221M net proceeds

•

Increased shares outstanding from 54.8 million to 64.6 million

–

growth of 18%

($millions)

12/31/2013

Coupon

Maturity

ABL ($750mm)

$256.1

L+275 bps

Jun-18

Term Loan B

$777.2

L+275 bps

Jun-18

Unsecured

$550.0

8.25%

Jun-19

($millions)

6/30/2014

Coupon

Maturity

ABL ($750mm)

$43.6

L+225 bps

April-19

Term Loan B

$993.1

L+300 bps

April-21

Unsecured

$500.0

6.375%

April-22 |

Rehab / LTAC

/ Skilled Nursing 8

Kindred’s Current Capital Structure and Leverage Ratio Are

Positioned Strongly Against Peers and Set for Growth!

Total Adjusted Debt / 2014 EBITDAR

Senior Living

Home Health

Median: 5.5x

7.3x

6.8x

6.5x

6.2x

6.2x

5.5x

5.2x

3.3x

3.3x

3.0x

3.0x

PF BKD

GTIV

FVE

SKH

AMED

SEM

KND

HLS

AFAM

ENSG

LHCG

Current Kindred adjusted debt/ LTM EBITDAR 5.2x with goal of 4.5x and

operating range of 4.5x to 5.5x

Source: CitiBank |

Hospital

Division $2.5 billion Revenues

(1)

$518 million Operating Income

(2)

Transitional Care Hospitals (certified as LTAC hospitals)

•

97 Transitional Care Hospitals

(3)

•

7,145 licensed beds

(3)

Inpatient Rehabilitation Hospitals (IRFs)

•

5 IRFs

(3)

•

215 licensed beds

(3)

(1)

Revenues for the twelve months ended June 30, 2014 (divisional revenues before intercompany

eliminations). (2)

Operating income for the twelve months ended June 30, 2014.

(3)

As of June 30, 2014.

(4)

Before certain disclosed items reconciled in the Appendix.

•

Continued clinical success with low rates of

rehospitalizations and reduced employee

turnover with improved teammate engagement

•

Strong results with same-store admissions

increase of 3% and only 1% growth in core

operating costs per patient day; operating

income margin improvement to 21.7%

from 21.3%

(4)

9 |

•

2,237 sites of service served through

23,058 therapists

(3)

•

Including 104 hospital-based acute

rehabilitation units

(3)

•

Therapists continue to deliver outstanding

clinical results and patient functional

improvement across sites of service

•

Sequential core operating income and margin

improvements for second quarter in a row

•

Added 57 net new skilled nursing rehabilitation

sites during first half of 2014

•

In October 2013, acquired TherEX which provides

on-site, hospital-based rehabilitation services in

11 states

$1.3 billion Revenues

(1)

$121 million Operating Income

(2)

(1)

Revenues for the twelve months ended June 30, 2014 (divisional revenues before intercompany

eliminations). (2)

Operating income for the twelve months ended June 30, 2014.

(3)

As of June 30, 2014.

10

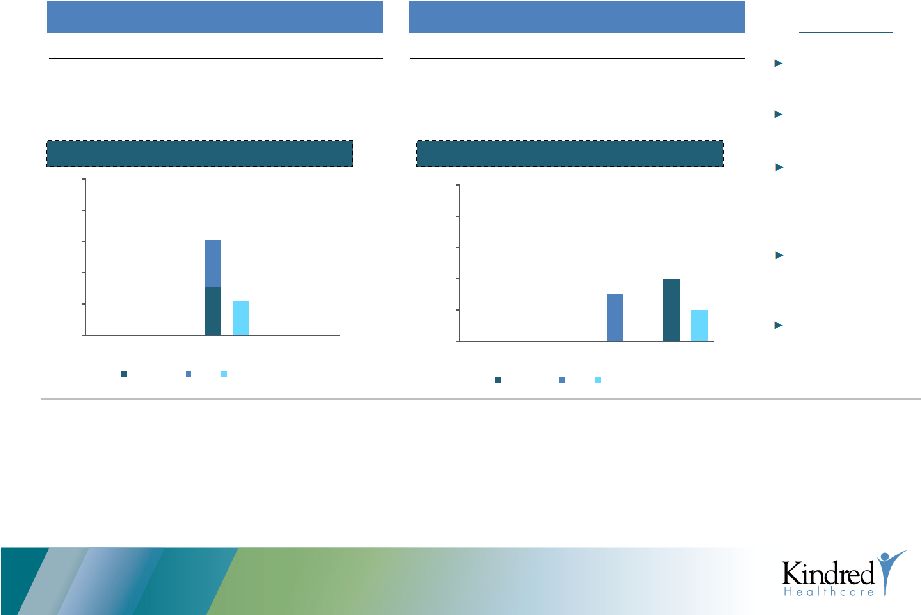

Total Sites of Service

Productivity |

Nursing Center

Division 47 Transitional Care Centers

(Sub-Acute facilities

licensed as SNFs)

(3)

13 Nursing and Rehabilitation Centers

(with Transitional Care Units)

(3)

12

Hospital-Based

Sub-Acute

Units

(3)

38

Skilled

Nursing

Centers

(Traditional

SNFs)

(3)

•

Reduced nurse turnover and

improved retention rates for all

teammates

•

Nursing center division core

operating income increased 11%

(4)

primarily due to growth in

revenues. Operating margins

significantly improved due to

improving reimbursement rates

and ongoing cost control initiatives

•

Admissions up 1% compared to

prior year

•

Declines in average length of stay

(ALOS) continue to weigh on

average daily census (ADC)

•

Divested of 55 of 59 nursing

centers leased from Ventas as of

August 1, 2014

$1.1 billion Revenues

(1)

$143 million Operating Income

(2)

(1)

Revenues for the twelve months ended June 30, 2014 (divisional revenues before intercompany

eliminations). (2)

Operating income for the twelve months ended June 30, 2014.

(3)

As of June 30, 2014.

(4)

Before certain disclosed items reconciled in the Appendix.

11

Nursing Center Operating Income Margin

(4) |

•

Patient satisfaction for Home Health and Hospice remain

high with Home Health outcome measures outperforming

national benchmarks

•

Care Management division delivered 66% revenue growth

and doubled core operating income compared to prior year

•

Operating 202 sites of service in 13 states

•

Focus on integration efforts has improved margin from 7.5%

in Q2 2013 to 9.0%

(2)

in Q2 2014

•

Acquired

Silver

State

Accountable

Care

Organization

in

June

2014

•

Opportunities to expand Kindred Home Based Primary Care in

deal pipeline

12

•

202 sites of service in 13 states

•

69 in Kindred’s Integrated Care Markets

•

5,000

caregivers serving 16,100

patients on a daily basis

Care Management

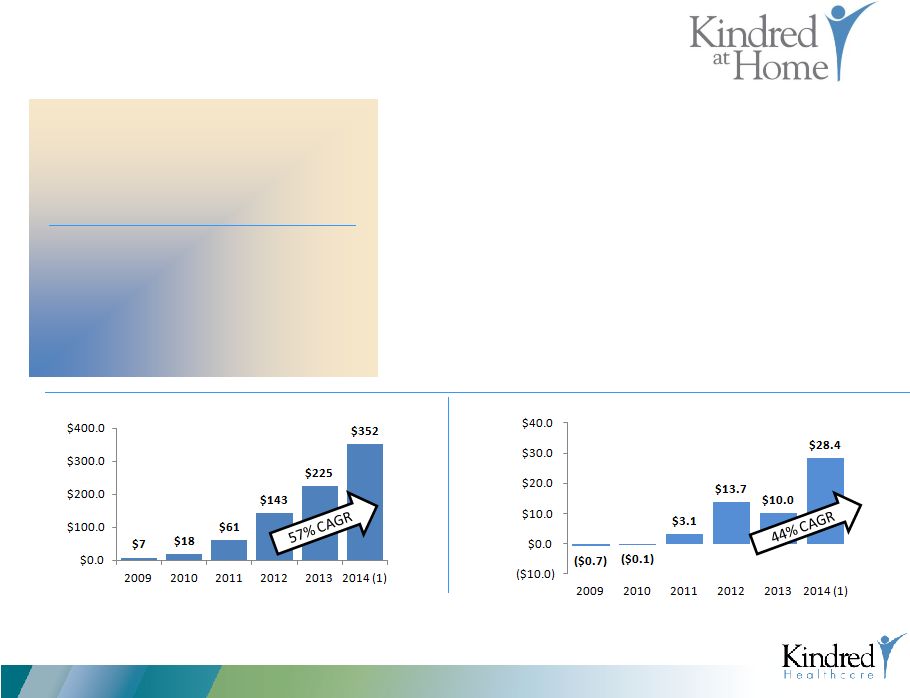

Division/Kindred At Home $352

million Pro Forma Annualized

Revenues

(1

)

Care Management Division and

(1)

Annualized based upon revenues and operating income for the three months ended June 30,

2014 (2)

Before certain disclosed items reconciled in the Appendix.

Revenue

Operating Income |

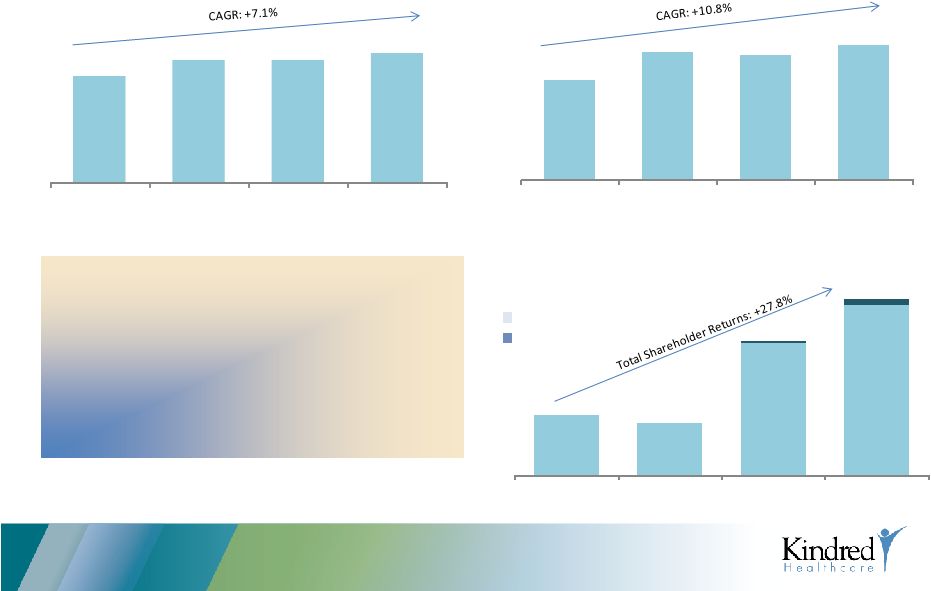

Delivered Attractive Financial Performances

13

(1)

Before certain disclosed items as reconciled in the Appendix

(2)

Reimbursement cuts totaled $70 million

(3)

Reflects midpoint of Company’s August 6, 2014 earnings guidance

Core Operating Margin

(1)

:

12.7%

13.9%

13.6%

14.0%

Share Price & Dividends

($ in millions)

Closing Share Price

Cumulative

Dividends

12/30/2011

12/31/2012

12/31/2013

8/5/2014

Despite sequential years of significant

reimbursement cuts and a whole-sale

restructuring of the Company’s business and

capital structure, the Company has delivered on

its promise to its patients, customers,

teammates and shareholders!

$4.2

$4.8

$4.8

$5.1

2011

2012

2013

2014

Revenue

($ in billions)

$529

$679

$658

$715

2011

2012

2013

2014

Core Operating Income

($ in millions)

(2)

$11.77

$10.82

$19.74

$23.99

$0.24

$0.60

(3) |

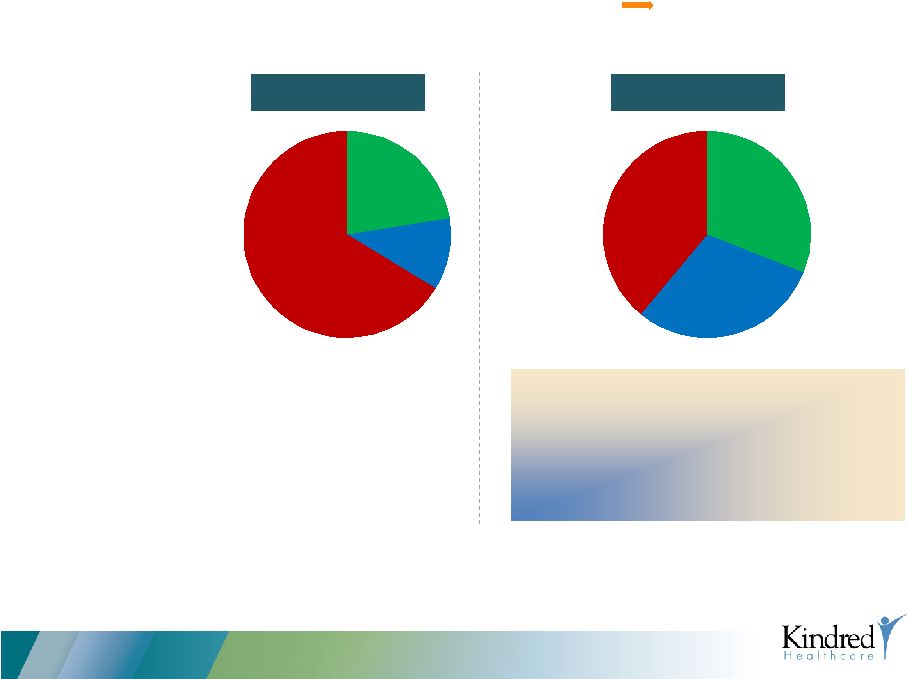

Revenue

Mix1

(1)

Revenue before intercompany eliminations for 12 months ended 2010 and in line with full year

guidance for 2014. (2)

Before certain disclosed items as reconciled in the Appendix.

Yesterday –

2010

14

Profitability

EBITDA Margin

(2)

Revenue

Repositioning and Recapitalization Complete Growth Phase Begins

Today –

2014

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

KND is successfully shifting its business to faster growing businesses, improving margins,

profitability and operating cash flows |

Equity

22.4%

Funded

Debt

11.3%

Capitalized

Leases

66.3%

Capital

Structure

(1)

15

Equity

31.0%

Funded

Debt

30.0%

Capitalized

Leases

39.0%

(1)

Leases capitalized using 6x rent; Equity represents market cap and Funded Debt

calculated as of 6/30/14 and 12/31/10 for 2010.

Repositioning and Recapitalization Complete Growth Phase Begins

Yesterday –

2010

Today –

2014

•

VTR Round I reduces capitalized lease exposure

by >$342M

•

VTR Round II reduces capitalized lease exposure

by >$360M

•

Add on equity offering completed in June 2014 |

16

Track Record of Accretive M&A Growth

2012

2013

2014

2011

Date: Dec 2013/

Feb. 2014

Paid: $83.0mm

Date: Dec. 2013

Paid: $95.0mm

Date: Dec. 2012

Paid: $2.0mm

Date: Aug. 2012

Paid: $71.0mm

Date: Sept. 2011

Paid: $51.0mm

Date: April 2011

Paid: Undisclosed

Date: Sept. 2013

Paid: $14.0mm

Date: June 2011

Paid: $1.3bn

Date: Oct. 2011

Paid: Undisclosed

Homecare

Advantage

Real Estate of 9 SNFs

(Previously Leased from HCP)

Synergy Home

Health Care, Inc.

Date: Oct. 2013

Paid: Undisclosed

All Heart Home Health

and Hospice &

Western Reserve

Date: Spring/Summer 2013

Paid: Undisclosed

Mercy Continuing Care Hospital &

Qstaff Home Health &

Caring Hearts Home Health

Date: Jun. 2013

Paid: Undisclosed

Arrowhead

Home Health

Date: Jul. 2012

Paid: Undisclosed

Illinois Family

Kindred has a history of thoughtful, disciplined growth, and successfully integrating

acquisitions and achieving synergies. Current acquisition opportunities build on this

track record of success. |

Demonstrated

Development Success by Line of Business 17

Footnotes:

-

Purchase multiple is calculated by investment amount (i.e. required cash at closing or capital

committed for de novo project) divided by trailing twelve month EBITDA as of 6/30/14.

-

KND Multiple derived using enterprise value and trailing twelve months EBITDA as of second

quarter 2014. -

Acquired revenue represents the trailing twelve month results ended 6/30/14.

$303

Home

Health &

Hospice

$250

LTAC

$13

Subacute

$56

IRF

Post RehabCare Acquisition, KND

has acquired $622 million in

revenues across our service lines

Acquisition Summary

($millions)

Advancing the Strategic Plan:

•

Successfully

divested

approx.

122

nursing

homes

and

15

hospitals

through

Ventas

non-renewals

and

other

transactions

while

deploying

approx.

$533M

of

capital

since

the

RehabCare

acquisition

to

grow

our

Integrated

Care

Markets

and

Care

Management

Division

Acquired Revenues

by Service Line:

Subacute

IRF

Home

Health

LTAC

Revenues

$13

$56

$303

$250

EBITDA Margin

15%

12%

11%

21%

Revenues

$622

EBITDA Margin

15%

Purchase Price

533

$

Post-Acquisition Purchase Multiple

5.6x

EPS / $10M

$0.010

Total Development |

18

Lower

Higher

What Are Our Development Priorities?

•

Home Health & Hospice

•

Rehab

•

Home Based Primary Care

•

ALF platform

Assets across all business lines that

in-fill our integrated care markets

and enable our “Continue-the-Care”

strategy.

Core assets at reasonable value that

enhance the execution of the

Integrated Care Market strategy

while driving earnings.

While prioritization of initiatives is important for focusing efforts, Kindred is

positioned to execute across the prioritization spectrum.

Preference

Higher

Lower

Key Considerations:

•

Does it advance our “Continue the Care”

strategy

•

Does it offer strong returns within the asset class

•

Does it build out our integrated care markets

•

Does it lead to population health and risk taking

•

Does it meet our financial criteria

Priorities: |

19

Hospitals (LTACs and

IRFs

Rehab Services

Transitional Care

Centers (Sub-Acute)

Home Care and Hospice

Assisted Living

Communities

Care Management

Services

Robust Pipeline of Growth Opportunities

•

Since 2011, Kindred has invested

in over $1.1 billion in acquisitions

that have created significant

value

•

Kindred continues to be the

buyer of choice for high quality

assets within the post-acute

sector

•

Kindred has a robust pipeline of

potential acquisition

opportunities and continues to

be poised for growth

Each Kindred business line has numerous opportunities for organic and

transactional growth. |

*

*

* |

Appendix

21

*

*

*

*

*

*

*

*

* |

Explanation of

Non-GAAP Measures The enclosed presentation includes financial measures referred to

as operating income, or earnings before interest, income taxes, depreciation,

amortization and rent. The Company’s management uses operating income as a meaningful

measure of operational performance in addition to other measures. The Company uses

operating income to assess the relative performance of its operating divisions as well as the employees that operate these

businesses. In addition, the Company believes this measurement is important because securities

analysts and investors use this measurement to compare the

Company’s

performance

to

other

companies

in

the

healthcare

industry.

The

Company

believes

that

income

(loss)

from

continuing

operations

is

the

most comparable GAAP measure. Readers of the Company’s financial information should

consider income (loss) from continuing operations as an important measure of the

Company’s financial performance because it provides the most complete measure of its performance.

Operating income should be

considered in addition to, not as a substitute for, or superior to, financial measures based

upon GAAP as an indicator of operating performance. A reconciliation of operating

income to income (loss) from continuing operations is provided in the enclosed Appendix.

In addition to the results provided in accordance with GAAP, the

Company provides information in the enclosed presentation to compute certain non-GAAP

measurements

for

the

twelve

months

ended

June

30,

2014

and

three

months

ended

June

30,

2014

and

2013

before

certain

charges

or

on

a

core

basis.

The

charges that were excluded from core operating results are denoted in the tables in the

enclosed Appendix. The use of these non-GAAP measurements are not intended to

replace the presentation of the Company's financial results in accordance with GAAP. The

Company

believes

that

the

presentation

of

core

operating

results

provides

additional

information

to

investors

to

facilitate

the

comparison

between

periods

by excluding certain charges for the twelve months ended June 30, 2014 and three months ended

June 30, 2014 and 2013 that the Company believes are not representative of its ongoing

operations due to the materiality and nature of the charges. The Company's core operating results also represent a key

performance measure for the purpose of evaluating performance internally.

22 |

Reconciliation

of Non-GAAP Measures ($ in thousands)

23

Twelve

2013 Quarters

2014 Quarters

months ended

First

Second

Third

Fourth

First

Second

June 30, 2014

Revenues:

Hospital division

657,814

$

606,604

$

594,154

$

606,988

$

646,458

$

632,156

$

2,479,756

$

Nursing center division

270,205

264,847

265,696

270,080

277,902

280,255

1,093,933

Rehabilitation division:

Skilled nursing rehabilitation services

258,750

249,647

245,330

243,280

254,255

253,989

996,854

Hospital rehabilitation services

74,523

69,777

68,296

74,017

73,964

75,324

291,601

333,273

319,424

313,626

317,297

328,219

329,313

1,288,455

Care management division

51,621

53,039

53,801

66,466

87,704

87,986

295,957

1,312,913

1,243,914

1,227,277

1,260,831

1,340,283

1,329,710

5,158,101

Eliminations:

Skilled nursing rehabilitation services

(28,657)

(28,660)

(28,151)

(28,157)

(29,646)

(30,031)

(115,985)

Hospital rehabilitation services

(23,609)

(23,223)

(22,520)

(22,123)

(23,233)

(22,855)

(90,731)

Nursing centers

(1,213)

(1,001)

(1,161)

(875)

(662)

(860)

(3,558)

(53,479)

(52,884)

(51,832)

(51,155)

(53,541)

(53,746)

(210,274)

1,259,434

$

1,191,030

$

1,175,445

$

1,209,676

$

1,286,742

$

1,275,964

$

4,947,827

$

Income (loss) from continuing operations:

Operating income (loss):

Hospital division

147,493

$

129,366

$

112,483

$

126,788

$

145,395

$

132,878

$

517,544

$

Nursing center division

29,145

36,018

31,505

35,585

38,471

36,880

(b)

142,441

Rehabilitation division:

Skilled nursing rehabilitation services

13,239

21,623

(7,209)

14,260

18,328

19,982

(b)

45,361

Hospital rehabilitation services

18,132

19,573

18,215

18,005

19,820

20,084

(b)

76,124

31,371

41,196

11,006

32,265

38,148

40,066

121,485

Care management division

2,786

3,961

1,085

2,131

4,697

7,065

(b)

14,978

Corporate:

Overhead

(45,585)

(43,196)

(39,157)

(48,557)

(44,050)

(48,365)

(b)

(180,129)

Insurance subsidiary

(509)

(384)

(482)

(539)

(406)

(443)

(1,870)

(46,094)

(43,580)

(39,639)

(49,096)

(44,456)

(48,808)

(181,999)

Impairment charges

(187)

(438)

(441)

(76,127)

-

-

(76,568)

Transaction costs

(944)

(108)

(613)

(447)

(683)

(4,496)

(6,239)

Operating income

163,570

166,415

115,386

71,099

181,572

163,585

531,642

Rent

(76,519)

(77,324)

(76,762)

(80,921)

(81,048)

(80,209)

(c)

(318,940)

Depreciation and amortization

(41,598)

(38,554)

(36,507)

(37,547)

(39,337)

(39,442)

(152,833)

Interest, net

(28,074)

(27,600)

(24,389)

(23,900)

(25,616)

(78,081)

(d)

(151,986)

Income (loss) from continuing operations

before income taxes

17,379

22,937

(22,272)

(71,269)

35,571

(34,147)

(92,117)

Provision (benefit) for income taxes

6,505

9,208

(6,510)

(20,522)

13,585

(13,082)

(26,529)

10,874

$

13,729

$

(15,762)

$

(50,747)

$

21,986

$

(21,065)

$

(65,588)

$

|

Reconciliation

of Non-GAAP Measures (continued)

($ in thousands)

24

Three months ended

June 30,

2014

2013

Detail of charges:

Severance and other restructuring costs

($4,950)

$0

Litigation costs

(4,600)

-

Transaction costs

(4,496)

(108)

Lease cancellation charges (rent expense)

(247)

-

Debt refinancing charges (interest expense)

(56,643)

(1,365)

(70,936)

(1,473)

Income tax benefit

26,295

544

Charges net of income taxes

(44,641)

(929)

Allocation to participating unvested restricted stockholders

-

31

Available to common stockholders

($44,641)

($898)

Weighted average diluted shares outstanding

53,714

52,284

Diluted loss per common share related to charges

($0.83)

($0.02)

Reconciliation of operating income before charges:

Operating income before charges

$177,631

$166,523

Detail of charges excluded from core operating results:

Severance and other restructuring costs

(4,950)

-

Litigation costs

(4,600)

-

Transaction costs

(4,496)

(108)

(14,046)

(108)

Reported operating income

$163,585

$166,415

Reconciliation of income from continuing operations before charges:

Amounts attributable to Kindred stockholders:

Income from continuing operations before charges

$18,748

$14,542

Charges net of income taxes

(44,641)

(929)

Reported income (loss) from continuing operations

($25,893)

$13,613

Reconciliation of diluted income per common share from continuing operations

before charges:

Diluted income per common share before charges (a)

$0.34

$0.27

Charges net of income taxes

(0.83)

(0.02)

Other

0.01

-

Reported diluted income (loss) per common share from

continuing operations ($0.48)

$0.25

Weighted average diluted shares used to compute income per common share

from continuing operations before charges

53,792

52,284

Reconciliation of effective income tax rate before charges:

Effective income tax rate before charges

35.9%

40.0%

Impact of charges on effective income tax rate

2.4%

0.1%

Reported effective income tax rate

38.3%

40.1%

(a)

For purposes of computing diluted earnings per common share before charges, income from

continuing operations before charges was reduced by $0.6 million and $0.5 million for

the three months ended June 30, 2014 and 2013, respectively, for the allocation of

income to participating unvested restricted stockholders. |

Reconciliation

of Non-GAAP Measures (continued)

($ in thousands)

25

Three months ended June 30, 2014

Charges

Severance

Before

and other

Debt

Transaction

As

charges

restructuring

Litigation

refinancing

costs

Total

reported

Income (loss) from continuing operations:

Operating income (loss):

Hospital division

137,478

$

-

$

(4,600)

$

-

$

-

$

(4,600)

$

132,878

$

Nursing center division

40,085

(3,205)

-

-

-

(3,205)

36,880

Rehabilitation division:

Skilled nursing rehabilitation services

20,158

(176)

-

-

-

(176)

19,982

Hospital rehabilitation services

20,254

(170)

-

-

-

(170)

20,084

40,412

(346)

-

-

-

(346)

40,066

Care management division

7,908

(843)

-

-

-

(843)

7,065

Corporate:

Overhead

(47,809)

(556)

-

-

-

(556)

(48,365)

Insurance subsidiary

(443)

-

-

-

-

-

(443)

(48,252)

(556)

-

-

-

(556)

(48,808)

Transaction costs

-

-

-

-

(4,496)

(4,496)

(4,496)

Operating income

177,631

(4,950)

(4,600)

-

(4,496)

(14,046)

163,585

Rent

(79,962)

(247)

-

-

-

(247)

(80,209)

Depreciation and amortization

(39,442)

-

-

-

-

-

(39,442)

Interest, net

(21,438)

-

-

(56,643)

(56,643)

(78,081)

Income (loss) from continuing operations

before income taxes

36,789

(5,197)

(4,600)

(56,643)

(4,496)

(70,936)

(34,147)

Provision (benefit) for income taxes

13,213

(1,985)

(1,757)

(21,639)

(914)

(26,295)

(13,082)

23,576

$

(3,212)

$

(2,843)

$

(35,004)

$

(3,582)

$

(44,641)

$

(21,065)

$ |

Reconciliation

of Non-GAAP Measures (continued)

($ in thousands)

26

Three months ended June 30, 2013

Charges

Before

Debt

Transaction

As

charges

refinancing

costs

Total

reported

Income from continuing operations:

Operating income (loss):

Hospital division

129,366

$

-

$

-

$

-

$

129,366

$

Nursing center division

36,018

-

-

-

36,018

Rehabilitation division:

Skilled nursing rehabilitation services

21,623

-

-

-

21,623

Hospital rehabilitation services

19,573

-

-

-

19,573

41,196

-

-

-

41,196

Care management division

3,961

-

-

-

3,961

Corporate:

Overhead

(43,196)

-

-

-

(43,196)

Insurance subsidiary

(384)

-

-

-

(384)

(43,580)

-

-

-

(43,580)

Impairment charges

(438)

-

-

-

(438)

Transaction costs

-

-

(108)

(108)

(108)

Operating income

166,523

-

(108)

(108)

166,415

Rent

(77,324)

-

-

-

(77,324)

Depreciation and amortization

(38,554)

-

-

-

(38,554)

Interest, net

(26,235)

(1,365)

-

(1,365)

(27,600)

Income from continuing operations

before income taxes

24,410

(1,365)

(108)

(1,473)

22,937

Provision for income taxes

9,752

(504)

(40)

(544)

9,208

14,658

$

(861)

$

(68)

$

(929)

$

13,729

$ |

Reconciliation

of Non-GAAP Measures (continued)

($ in thousands)

27

2013

2012

2011

Reconciliation of operating income before charges:

Operating income before charges

$657,914

$679,471

$528,879

Detail of charges excluded from core operating results:

One-time bonus costs

(19,842)

-

-

Severance and other restructuring costs

(12,558)

(8,730)

(18,259)

Litigation costs

(30,850)

(5,000)

-

Impairment charges

(76,082)

(107,899)

(73,554)

Transaction costs

(2,112)

(2,231)

(33,937)

(141,444)

(123,860)

(125,750)

Reported operating income

$516,470

$555,611

$403,129 |

Second Quarter

Investor Update August 6, 2014 |