Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GREAT PLAINS ENERGY INC | a8-k2q2014earningsrelease8.htm |

Exhibit 99.1

GREAT PLAINS ENERGY REPORTS SECOND QUARTER 2014 RESULTS

Kansas City, Mo. (August 7, 2014) — Great Plains Energy (NYSE: GXP) today announced second quarter 2014 earnings of $51.7 million or $0.34 per share of average common stock outstanding, compared with second quarter 2013 earnings of $63.2 million or $0.41 per share. For the first six months of 2014, earnings were $75.1 million or $0.49 per share compared to $88.8 million or $0.58 per share in the first six months of 2013. The Company is also reaffirming its 2014 full year earnings guidance range of $1.60 to $1.75 per share.

“The economy in our service territory continues to improve and we remain committed to our balanced approach of managing the business for the long term by providing safe, reliable and low cost power for our customers and solid returns to our shareholders,” said Terry Bassham, chairman and chief executive officer of Great Plains Energy. “Our financial results for the first half of 2014 include higher operating and maintenance expense compared to the same period last year. However, consistent with our expectations, during the second half of the year these expenses will be lower and a driver of earnings growth.”

Great Plains Energy Second Quarter:

On a per-share basis, favorable drivers for the second quarter 2014 compared to the same period in 2013 included the following:

• | An approximate $0.01 favorable variance from weather with cooling degree days 15 percent above the second quarter 2013; and |

• | An estimated $0.01 impact from an increase in weather-normalized retail demand. |

The factors above were more than offset by the following:

• | Other operating and maintenance expense increases of $0.05, including increases in transmission and distribution expenses and higher generation expenses; |

• | A $0.02 increase in operating and maintenance expense at the Wolf Creek nuclear unit primarily from a planned mid-cycle outage that began in March 2014 and ended in May 2014; |

• | $0.01 due to an increase in general taxes resulting from higher property taxes; and |

• | About a $0.01 increase in other items. |

Great Plains Energy Year-to-Date:

On a per-share basis, favorable drivers for the first six months of 2014 versus 2013 were the following:

• | About $0.06 from favorable weather primarily driven by an increase in heating degree days from winter weather that was colder than normal; |

• | Approximately $0.04 from new retail rates in Missouri which became effective in late January 2013; and |

• | An estimated $0.03 impact from an increase in weather-normalized retail demand. |

The factors above were more than offset by the following:

2

• | Other operating and maintenance expense increases of $0.11, including higher generation expenses which are weighted towards the first half of the year, increases in transmission and distribution expenses and increased Missouri Energy Efficiency Investment Act (MEEIA) expenses which are included in retail rates; |

• | A $0.06 increase in operating and maintenance expense at Wolf Creek relating to the 2014 mid-cycle outage and amortization relating to prior year refueling outages. These outages are not expected to have an unfavorable impact during the second half of the year; |

• | $0.03 due to an increase in general taxes resulting from higher property taxes; and |

• | About a $0.02 increase in other items. |

Electric Utility Segment Second Quarter:

The Electric Utility segment, which includes Kansas City Power & Light Company (KCP&L) and the regulated utility operations of KCP&L Greater Missouri Operations Company (GMO), generated net income of $54.7 million or $0.36 per share for the second quarter 2014 compared to $65.5 million or $0.43 per share in 2013.

Key drivers influencing the segment results included the following:

• | A $3.9 million increase in pre-tax gross margin primarily due to: |

◦ | An estimated $3 million from weather due to an increase in cooling degree days in the second quarter 2014 compared to 2013; and |

◦ | Approximately $2 million from an increase in weather-normalized retail demand; |

• | A $19.9 million increase in other operating expenses primarily due to the following: |

◦ | A $5.5 million increase in transmission and distribution expense that included higher cost of service as well as increased vegetation management costs; |

◦ | A $4.3 million increase in Wolf Creek operating and maintenance expense primarily due to the planned mid-cycle maintenance outage in 2014; |

◦ | A $3.2 million increase in operating and maintenance costs at coal units primarily due to planned outages; |

◦ | A $2.5 million increase in general taxes resulting from higher property taxes; and |

◦ | A $1.2 million increase in MEEIA costs which are included in retail rates; |

• | A $3.0 million increase in depreciation and amortization expense driven by capital additions; and |

• | A $5.9 million decrease in income tax expense primarily due to lower pre-tax income. |

Overall retail MWh sales were up 1.2 percent in the quarter compared to the second quarter 2013 with the increase driven by weather and weather-normalized retail demand. On a weather-normalized basis, retail MWh sales increased an estimated 0.7 percent compared to the second quarter 2013. Compared to normal weather, the favorable impact in the second quarter 2014 was approximately $0.03 per share.

Electric Utility Segment Year-to-Date:

3

Year-to-date net income for the Electric Utility segment was $80.8 million or $0.52 per share compared to $93.1 million or $0.61 per share in 2013.

Key drivers influencing the segment results included the following:

• | A $31.0 million increase in pre-tax gross margin primarily due to: |

o | Approximately $16 million from favorable weather; |

o | An estimated $9 million from new retail rates in Missouri which became effective in late January 2013; and |

o | Approximately $7 million from an increase in weather-normalized retail demand; |

• | A $50.9 million increase in other operating expenses primarily due to the following: |

o | A $14.3 million increase in Wolf Creek operating and maintenance expense primarily due to the planned 2014 mid-cycle maintenance outage and increased amortization from the planned 2013 refueling outage, where costs are deferred and amortized; |

o | A $9.0 million increase in operating and maintenance costs at coal units primarily due to planned and unplanned outages; |

o | A $7.6 million increase in general taxes resulting from higher property taxes; |

o | A $7.3 million increase in transmission and distribution expense that included higher cost of service as well as increased vegetation management costs; and |

o | A $2.8 million increase in MEEIA costs which are included in retail rates; |

• | A $7.3 million increase in depreciation and amortization expense driven by capital additions; |

• | A $4.0 million increase in non-operating income and expense attributable to an increase in the equity component of Allowance for Funds Used During Construction (AFUDC); and |

• | An $8.7 million decrease in income tax expense primarily due to lower pre-tax income. |

Overall retail MWh sales were up 4 percent compared to the 2013 period with the increase driven by weather and weather-normalized retail demand. On a weather-normalized basis, year-to-date retail MWh sales increased an estimated 1.2 percent compared to the 2013 period. Compared to normal weather, the favorable effect in the first six months of 2013 was approximately $0.09 per share.

Other Category Second Quarter and Year-To-Date:

Results for the Other category primarily include unallocated corporate charges, GMO non-regulated operations and preferred dividends. For the second quarter 2014, the Other category recorded a loss of $3.0 million or $0.02 per share compared to a loss of $2.3 million or $0.02 per share for the same period in 2013.

For the first six months of 2014, the Other category reflected a loss of $5.7 million or $0.03 per share compared to a loss of $4.3 million or $0.03 per share in 2013.

4

Great Plains Energy will post its 2014 Second Quarter Form 10-Q, as well as supplemental financial information related to the second quarter on its website, www.greatplainsenergy.com.

Earnings Webcast Information:

An earnings conference call and webcast is scheduled for 9:00 a.m. EDT Friday, August 8, 2014, to review the Company’s 2014 second quarter earnings and operating results.

A live audio webcast of the conference call, presentation slides, supplemental financial information, and the earnings press release will be available on the investor relations page of Great Plains Energy’s website at www.greatplainsenergy.com. The webcast will be accessible only in a “listen-only” mode.

The conference call may be accessible by dialing (888) 353-7071 (U.S./Canada) or (724) 498-4416 (international) five to ten minutes prior to the scheduled start time. The pass code is 68328987.

A replay and transcript of the call will be available later in the day by accessing the investor relations section of the company’s website. A telephonic replay of the conference call will also be available through August 15, 2014, by dialing (855) 859-2056 (U.S./Canada) or (404) 537-3406 (international). The pass code is 68328987.

About Great Plains Energy:

Headquartered in Kansas City, Mo., Great Plains Energy Incorporated (NYSE: GXP) is the holding company of Kansas City Power & Light Company and KCP&L Greater Missouri Operations Company, two of the leading regulated providers of electricity in the Midwest. Kansas City Power & Light Company and KCP&L Greater Missouri Operations Company use KCP&L as a brand name. More information about the companies is available on the Internet at: www.greatplainsenergy.com or www.kcpl.com.

5

Forward-Looking Statements:

Statements made in this release that are not based on historical facts are forward-looking, may involve risks and uncertainties, and are intended to be as of the date when made. Forward-looking statements include, but are not limited to, the outcome of regulatory proceedings, cost estimates of capital projects and other matters affecting future operations. In connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Great Plains Energy and KCP&L are providing a number of important factors that could cause actual results to differ materially from the provided forward-looking information. These important factors include: future economic conditions in regional, national and international markets and their effects on sales, prices and costs; prices and availability of electricity in regional and national wholesale markets; market perception of the energy industry, Great Plains Energy and KCP&L; changes in business strategy, operations or development plans; the outcome of contract negotiations for goods and services; effects of current or proposed state and federal legislative and regulatory actions or developments, including, but not limited to, deregulation, re-regulation and restructuring of the electric utility industry; decisions of regulators regarding rates the Companies can charge for electricity; adverse changes in applicable laws, regulations, rules, principles or practices governing tax, accounting and environmental matters including, but not limited to, air and water quality; financial market conditions and performance including, but not limited to, changes in interest rates and credit spreads and in availability and cost of capital and the effects on nuclear decommissioning trust and pension plan assets and costs; impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management policies and procedures and the ability of counterparties to satisfy their contractual commitments; impact of terrorist acts, including but not limited to cyber terrorism; ability to carry out marketing and sales plans; weather conditions including, but not limited to, weather-related damage and their effects on sales, prices and costs; cost, availability, quality and deliverability of fuel; the inherent uncertainties in estimating the effects of weather, economic conditions and other factors on customer consumption and financial results; ability to achieve generation goals and the occurrence and duration of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of generation, transmission, distribution or other projects; Great Plains Energy’s ability to successfully manage transmission joint venture; the inherent risks associated with the ownership and operation of a nuclear facility including, but not limited to, environmental, health, safety, regulatory and financial risks; workforce risks, including, but not limited to, increased costs of retirement, health care and other benefits; and other risks and uncertainties.

This list of factors is not all-inclusive because it is not possible to predict all factors. Other risk factors are detailed from time to time in Great Plains Energy’s and KCP&L’s quarterly reports on Form 10-Q and annual report on Form 10-K filed with the Securities and Exchange Commission. Each forward-looking statement speaks only as of the date of the particular statement. Great Plains Energy and KCP&L undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Great Plains Energy Contacts:

Investors: Tony Carreño, Director, Investor Relations, 816-654-1763, anthony.carreno@kcpl.com

Media: Katie McDonald, Director, Corporate Communications, 816-556-2365,

katie.mcdonald@kcpl.com

6

Attachment A

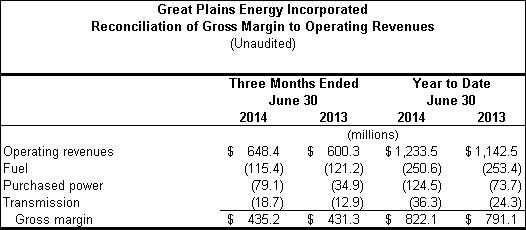

Gross margin is a financial measure that is not calculated in accordance with generally accepted accounting principles (GAAP). Gross margin, as used by Great Plains Energy, is defined as operating revenues less fuel, purchased power and transmission. The company’s expense for fuel, purchased power and transmission, offset by wholesale sales margin, is subject to recovery through cost adjustment mechanisms, except for KCP&L’s Missouri retail operations. As a result, operating revenues increase or decrease in relation to a significant portion of these expenses. Management believes that gross margin provides a more meaningful basis for evaluating the Electric Utility segment’s operations across periods than operating revenues because gross margin excludes the revenue effect of fluctuations in these expenses. Gross margin is used internally to measure performance against budget and in reports for management and the Board of Directors. The company’s definition of gross margin may differ from similar terms used by other companies. A reconciliation to GAAP operating revenues is provided in the table below.

7