Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF CROWE MACKAY LLP - Corvus Gold Inc. | ex23_1.htm |

|

As filed with the Securities and Exchange Commission on August 7, 2014

333-197099

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

AMENDMENT NO. 2

AMENDMENT NO. 2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Corvus Gold Inc.

(Exact name of registrant as specified in its charter)

|

British Columbia

|

1040

|

98-0668473

|

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification No.)

|

Suite 2300, 1177 W. Hastings St.

Vancouver, British Columbia Canada

(604) 638-3246

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jeffrey Pontius

Chief Executive Officer

Suite 2300, 1177 W. Hastings St.

Vancouver, British Columbia Canada

(604) 638-3246

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Kenneth G. Sam

Jason K. Brenkert

Dorsey & Whitney LLP

1400 Wewatta Street, Suite 400

Denver, Colorado 80202

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (Check one):

|

Large Accelerated Filer o

|

Accelerated Filer o

|

Non-Accelerated Filer o |

Smaller Reporting Company x

|

|

(Do not check if a smaller

reporting company)

|

The Registrant previously paid a registration fee of $742.92 in connection with the filing of the initial registration statement on Form S-1 with the Commission on June 27, 2014.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended (the “Securities Act”), or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject To Completion, Dated August 7, 2014

PRELIMINARY PROSPECTUS

Corvus Gold Inc.

5,150,000 Common Shares

Corvus Gold Inc. (“Corvus”, “we”, “us” or “our”) are offering up to 5,150,000 Common Shares at a public offering price of $1.20 per Common Share (the “offering”). There will be no underwriter or broker/dealer involved in the transaction and there will be no commissions paid to any individuals from the proceeds of this sale. The offering price is payable in Canadian dollars only and all dollar amounts set forth in this prospectus are in Canadian dollars unless otherwise specified. See “Currency and Exchange Rates.”

The offering is being conducted on a best efforts self-underwritten basis and there is no minimum number of Common Shares required to be sold by us. All proceeds from the sale of these Common Shares will be delivered directly to us and will not be deposited in any escrow account. If the entire 5,150,000 Common Shares are sold, we will receive gross proceeds of $6,180,000 before expenses estimated to be approximately $200,000. We plan to complete or terminate this offering within 45 days of the date hereof. No assurance can be given to the number of Common Shares we will sell or even if we will be able to sell any Common Shares. There is no minimum offering amount.

The price at which the Common Shares are being sold was fixed by us pursuant to the rules of the TSX and is equal to the volume-weighted average price for the Common Shares on the TSX for the five-day period immediately preceding June 25, 2014, of $1.46 less a discount of approximately (17%) percent, as permitted by the TSX. The offering price will remain fixed for the duration of the offering.

Our Common Shares are currently quoted on the OTCQX, under the symbol “CORVF” and on the Toronto Stock Exchange under the symbol “KOR”. The last reported sale price of our Common Shares on the OTCQX on August 6, 2014 was US$1.17 per Common Share and on the Toronto Stock Exchange was $1.26 per Common Share.

We are an “emerging growth company” as defined under federal securities laws and, as such, may elect to comply with certain reduced public company requirements for future filings.

Investing in our securities involves a high degree of risk. You should read this entire prospectus carefully, including the section entitled “Risk Factors” beginning on page 3 of this prospectus.

Neither the Securities and Exchange Commission, or SEC, nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is [●], 2014

TABLE OF CONTENTS

| DEALER PROSPECTUS DELIVERY OBLIGATION | ii |

| GLOSSARY OF TERMS | iii |

| CAUTIONARY NOTE TO U.S. INVESTORS REGARDING MINERAL RESERVE AND RESOURCE ESTIMATES | viii |

| CURRENCY AND EXCHANGE RATES | viii |

| PROSPECTUS SUMMARY | 1 |

| RISK FACTORS | 3 |

| FORWARD-LOOKING STATEMENTS | 12 |

| USE OF PROCEEDS | 15 |

| MARKET FOR COMMON SHARES AND RELATED MATTERS | 16 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND OPERATING RESULTS | 19 |

| BUSINESS | 29 |

| PROPERTIES | 36 |

| LEGAL PROCEEDINGS | 71 |

| DIRECTORS AND EXECUTIVE OFFICERS | 71 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 76 |

| EXECUTIVE COMPENSATION | 77 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 86 |

| DESCRIPTION OF SECURITIES | 87 |

| DILUTION | 88 |

| PLAN OF DISTRIBUTION | 88 |

| CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS | 89 |

| CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS | 90 |

| CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 97 |

| LEGAL MATTERS | 97 |

| INTERESTS OF EXPERTS | 97 |

| WHERE YOU CAN FIND MORE INFORMATION | 98 |

| INDEX TO FINANCIAL STATEMENTS | F-1 |

You should rely only on the information contained in this prospectus that we have authorized for use in connection with this offering. Neither we nor the placement agent has authorized any other person to provide you with additional or different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

i

DEALER PROSPECTUS DELIVERY OBLIGATION

Until (90 days after the effective date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

ii

GLOSSARY OF TERMS

|

“Ag”

|

Silver

|

||

|

“alteration”

|

Changes in the chemical or mineralogical composition of a rock, generally produced by weathering or hydrothermal solutions

|

||

|

“Arrangement”

|

The corporate spin-out of Corvus from ITH by way of a plan of arrangement among ITH, the shareholders of ITH and Corvus under the BCBCA, effective August 26, 2010

|

||

|

“Au”

|

Gold

|

||

|

“Board”

|

The board of directors of Corvus

|

||

|

“BCBCA”

|

Business Corporations Act (British Columbia), Corvus’ governing statute

|

||

|

“Corvus Nevada”

|

Corvus Gold Nevada Inc., a wholly owned subsidiary of Corvus US subsisting under the laws of Nevada

|

||

|

“Corvus US”

|

Corvus Gold (USA) Inc., a wholly owned subsidiary of Corvus subsisting under the laws of Nevada

|

||

|

“Common Shares”

|

The Common Shares without par value in the capital stock of Corvus as the same are constituted on the date hereof

|

||

|

“Corvus”

|

Corvus Gold Inc., a company organized under the laws of British Columbia

|

||

|

“cut-off grade”

|

The lowest grade of mineralized material that qualifies as ore in a given deposit, that is, material of the lowest assay value that is included in a resource/reserve estimate

|

||

|

“deposit”

|

A mineralized body which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures. Such a deposit does not qualify as a commercially mineable ore body or as containing reserves or ore, unless final legal, technical and economic factors are resolved

|

||

|

“Director”

|

A member of the Board of Directors of Corvus

|

||

|

“disseminated”

|

Fine particles of mineral dispersed throughout the enclosing rock

|

||

|

“epigenetic”

|

Said of a mineral deposit of origin later than that of the enclosing rocks

|

||

|

“executive officer”

|

When used in relation to any issuer (including the Company) means an individual who is:

(a) a chair, vice chair or president;

(b) a vice-president in charge of a principal business unit, division or function,

including sales, finance or production; or

(c) performing a policy-making function in respect of the issuer

|

||

|

“g/t”

|

Grams per metric tonne

|

||

|

“grade”

|

To contain a particular quantity of ore or mineral, relative to other constituents, in a specified quantity of rock

|

||

iii

|

“heap leaching”

|

A method of recovering minerals from ore whereby crushed rock is stacked on a non-porous liner and an appropriate chemical solution is sprayed on the top of the pile (the “heap”) and allowed to percolate down through the crushed rock, dissolving the desired minerals(s) as it does so. The chemical solution is then collected from the base of the heap and is treated to remove the dissolved mineral(s)

|

||

|

“host”

|

A rock or mineral that is older than rocks or minerals introduced into it or formed within it

|

||

|

“host rock”

|

A body of rock serving as a host for other rocks or for mineral deposits, or any rock in which ore deposits occur

|

||

|

“hydrothermal”

|

A term pertaining to hot aqueous solutions of magmatic origin which may transport metals and minerals in solution

|

||

|

“ITH”

|

International Tower Hill Mines Ltd., a company subsisting under the laws of British Columbia

|

||

|

“massive”

|

Said of a mineral deposit, especially of sulphides, characterized by a great concentration of ore in one place, as opposed to a disseminated or veinlike deposit

|

||

|

“Moz”

|

Million ounces

|

||

|

“mineral reserve”

|

The economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined and processed

|

||

|

“mineral resource”

|

A concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. The term “mineral resource” covers mineralization and natural material of intrinsic economic interest which has been identified and estimated through exploration and sampling and within which mineral reserves may subsequently be defined by the consideration and application of technical, economic, legal, environmental, socio-economic and governmental factors. The phrase “reasonable prospects for economic extraction” implies a judgment by a qualified person (as that term is defined in NI 43-101) in respect of the technical and economic factors likely to influence the prospect of economic extraction. A mineral resource is an inventory of mineralization that, under realistically assumed and justifiable technical and economic conditions, might become economically extractable

|

||

|

“mineralization”

|

The concentration of metals and their chemical compounds within a body of rock

|

||

|

“National Instrument

43-101”/ “NI 43-101”

|

National Instrument 43-101 of the Canadian Securities Administrators entitled “Standards of Disclosure for Mineral Projects”

|

||

|

“NBP”

|

The North Bullfrog Project in Nevada held by Corvus Nevada, as more particularly described under “Properties”

|

||

|

“NSR”

|

Net smelter return

|

||

|

“Raven Gold”

|

Raven Gold Alaska Inc., a wholly owned subsidiary of Corvus US subsisting under the laws of Alaska

|

||

|

“SEC”

|

United States Securities and Exchange Commission

|

||

iv

|

“SoN”

|

SoN Land and Water, LLC, a limited liability company subsisting under the laws of Nevada, of which Corvus Nevada is the sole member

|

||

|

“tabular”

|

Said of a feature having two dimensions that are much larger or longer than the third, or of a geomorphic feature having a flat surface, such as a plateau

|

||

|

“TSX”

|

Toronto Stock Exchange

|

||

|

“vein”

|

An epigenetic mineral filling of a fault or other fracture, in tabular or sheetlike form, often with the associated replacement of the host rock; also, a mineral deposit of this form and origin

|

||

|

“Whittle® Software”

|

Computer software from Dassault Systemes Geovia used to create optimized open pit mine designs. The program implements the Lerchs-Grossman algorithim to identify the mineable portion of a resource model of tonnage and grade by considering parameters of price, mine operating cost, metallurgical recovery, resource grade and pit slope. It defines continuous volumes (pit shapes) of economically viable resource. “Whittle is a registered trademark.”

|

||

|

“Whittle® Analysis”

|

An analysis of a particular mining project carried out using the Whittle® Software system to define optimized mining volumes (pit shapes) based on a resource model that defines tonnage and resource grade, and using input parameters of price, operating cost, metallurgical recovery, and pit slope.

|

||

|

“$1,300 Whittle® Pit”

|

A mineable volume (pit shape) defined using the Whittle® Software with the gold price set equal to US $1,300 per ounce, and a resource model of tonnage and grade, with input parameters of mine operating cost, metallurgical recovery and pit slope.

|

||

|

SEC Industry Guide 7 Definitions:

|

|||

|

exploration stage

|

An “exploration stage” prospect is one which is not in either the development or production stage.

|

|

development stage

|

A “development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study.

|

|

mineralized material

|

The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction.

|

|

probable reserve

|

The term “probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

|

|

production stage

|

A “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product.

|

|

proven reserve

|

The term “proven reserve” refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

|

|

reserve

|

The term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. “Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing. A reserve includes adjustments to the in-situ tonnes and grade to include diluting

|

v

|

|

materials and allowances for losses that might occur when the material is mined.

|

|

1 For SEC Industry Guide 7 purposes this study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

2 SEC Industry Guide 7 does not require designation of a qualified person.

|

vi

Metric Equivalents

For ease of reference, the following factors for converting Imperial measurements into metric equivalents are provided:

|

To convert from Imperial

|

To metric

|

Multiply by

|

|

|

Acres

|

Hectares

|

0.404686

|

|

|

Feet

|

Metres

|

0.30480

|

|

|

Miles

|

Kilometres

|

1.609344

|

|

|

Tons

|

Tonnes

|

0.907185

|

|

|

Ounces (troy)/ton

|

Grams/Tonne

|

34.2857

|

|

|

1 mile = 1.609 kilometres

1 acre = 0.405 hectares

2,204.62 pounds = 1 metric ton = 1 tonne

|

2000 pounds (1 short ton) = 0.907 tonnes

1 ounce (troy) = 31.103 grams

1 ounce (troy)/ton = 34.2857 grams/tonne

|

||

vii

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING MINERAL RESERVE AND RESOURCE ESTIMATES

The mineral estimates in this prospectus have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7 under the United States Securities Act of 1933, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource” are defined in, and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part of a mineral deposit in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities laws and regulations, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this prospectus and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

CURRENCY AND EXCHANGE RATES

All dollar amounts in this prospectus are expressed in Canadian dollars unless otherwise indicated. The Company’s accounts are maintained in Canadian dollars and the Company’s financial statements are prepared in accordance with United States Generally Accepted Accounting Principles. All references to “U.S. dollars”, “USD” or to “US$” are to United States dollars.

The following table sets forth the rate of exchange for the Canadian dollar, expressed in United States dollars in effect at the end of the periods indicated, the average of exchange rates in effect during such periods, and the high and low exchange rates during such periods based on the noon rate of exchange as reported by the Bank of Canada for conversion of Canadian dollars into United States dollars.

|

Year Ended May 31

|

|||

|

Canadian Dollars to U.S. Dollars

|

2014 |

2013

|

2012

|

|

Rate at end of period

|

0.9202 |

0.9672

|

0.9663

|

|

Average rate for period

|

0.9379 |

0.9956

|

1.0007

|

|

High for period

|

0.9833 |

1.0299

|

1.0583

|

|

Low for period

|

0.8888 |

0.9599

|

0.9430

|

viii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before buying shares of our securities. You should read the entire prospectus carefully, especially the “Risk Factors” section and our financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our securities. Unless the context provides otherwise, all references to “Corvus,” “we,” “us,” “our,” or similar terms, refer to Corvus Gold Inc. In this prospectus, all references to “$” or “dollars” mean the Canadian dollar and, unless otherwise indicated, all currency amounts in this prospectus are stated in Canadian dollars.

About Our Company

We were incorporated under the BCBCA with the name “Corvus Gold Inc.” on April 13, 2010 as a wholly-owned subsidiary of International Tower Hill Mines Ltd., a company subsisting under the laws of British Columbia (“ITH”), with an authorized capital consisting of an unlimited number of Common Shares. Pursuant to the corporate spin-out of Corvus from ITH by way of a plan of arrangement among ITH, the shareholders of ITH and Corvus under the BCBCA, effective August 26, 2010, Corvus was spun out as a separate and independent public company, and each shareholder of ITH received one-half of a Common Share.

We are a reporting issuer in the Canadian Provinces of British Columbia, Alberta and Ontario and the Common Shares are listed for trading on the TSX under the trading symbol “KOR” and are quoted on the OTCQX under the symbol “CORVF”.

Our head office is located at Suite 2300 – 1177 West Hastings Street, Vancouver, British Columbia, Canada V6E 2K3, and our registered and records office is located at Suite 2300, Four Bentall Centre, 1055 Dunsmuir Street, P.O. Box 49122, Vancouver, British Columbia V7X 1J1.

We are a mineral exploration company engaged in the acquisition, exploration and development of mineral properties. We currently hold or have the right to acquire interests in a number of mineral properties in Alaska and Nevada, USA, including the NBP, which is our sole material mineral property. We are in the exploration stage as our properties have not yet reached commercial production and none of our properties is beyond the preliminary exploration stage. All work presently planned by us is directed at defining mineralization and increasing understanding of the characteristics of, and economics of, that mineralization.

Recent Developments

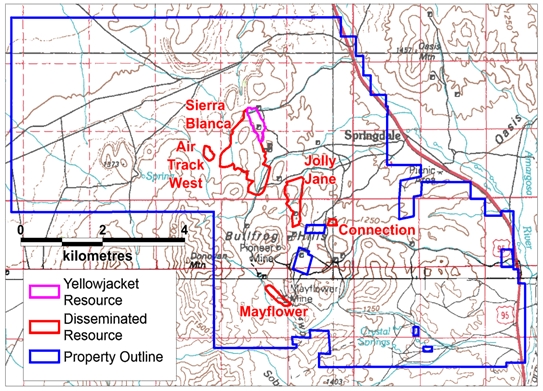

North Bullfrog Project Estimated Mineral Resource Update: The mineralization inventory at Sierra Blanca and Yellowjacket was recalculated, effective March 25, 2014, to incorporate all the new drilling done in 2012 and 2013. At the same time, the decision was made to change how the estimated mineral resources at the NBP were calculated. Instead of discussing the overall mineralization inventory as was done in the past, the estimated mineral resource is now limited to that part of the mineralization inventory that falls within a US $1300 Whittle® pit.

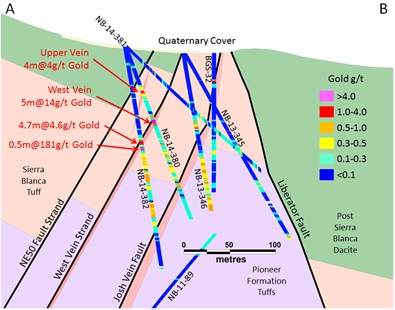

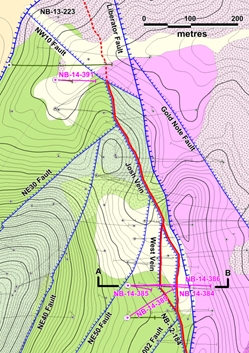

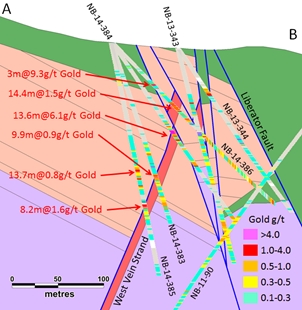

North Bullfrog Project Exploration: Assays from 2013 drilling continued to come in during December 2013 and January 2014 and additional channel sampling along road cuts was conducted in December 2013 and January 2014. The 2014 Phase I drilling campaign started in February 2014 with focus on the Yellowjacket vein system. Phase I is planned to consist of approximately 5000 metres of core drilling. The Company has received results from 9 drill holes in the Yellowjacket deposit. The results from these holes have defined a new parallel high-grade vein system immediately west of the Yellowjacket deposit and intersected high-grade mineralization along the northern extension of the deposit. The new drilling results continue to indicate that the Yellowjacket system is expanding.

North Bullfrog Project Infrastructure: In December 2013 the Company completed the purchase of a 430 acre fee simple parcel of land located about 30 kilometers north of the NBP area which carries with it 1,600 acre-feet of irrigation water rights within the Sarcobatus Flats water basin. Cost of the land and water was US$ 1,000,000. This water right is significant because it provides all water presently anticipated to be required under the current conceptual NBP mine plan.

North Bullfrog Project Metallurgy: The Company has completed a series of metallurgical test on the Yellowjacket deposit mineralization which have returned encouraging gold and silver recovery results. Initial grind size analysis test work indicated enhanced recoveries for gold and silver could be obtained from milling the rock to a relatively coarse particle size with follow-up gravity recovery followed by cyanide leaching of the tails. This initial test work has established the basis for future potential optimization metallurgical work focusing on a simple, low cost grinding circuit with gravity gold silver recovery followed by cyanide leaching of tails to obtain higher gold and silver recoveries from the higher grade Yellowjacket mineralization. See “Properties” below for further information.

1

The Offering

|

Common shares being Offered

|

Up to 5,150,000 Common Shares, at a per Common Share price of $1.20.

|

|

OTCQX and TSX Symbol

|

The Common Shares are listed on the OTCQX under the symbol “CORVF” and on the TSX under the symbol “KOR”.

|

|

Use of Proceeds:

|

We intend to use the net proceeds from this offering for additional work on the NBP and for general corporate purposes, including working capital.

|

|

Risk Factors:

|

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page 3 of this prospectus.

|

Summary Financial Information

The following tables summarize our financial data for the periods presented. The summary statements of operations and comprehensive loss for the years ended May 31, 2014 and 2013, and the statements of financial position as of May 31, 2014 and 2013, have been derived from our audited financial statements, which are included elsewhere in this prospectus. The historical results are not necessarily indicative of the results to be expected for any future periods. You should read this data together with our financial statements and the related notes included elsewhere in this prospectus, as well as “Management's Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 1 of this prospectus.

Statements of Operations and Comprehensive Loss

|

|

Years Ended May 31,

|

|||||||

|

2014

|

2013

|

|||||||

|

Total revenue

|

$

|

–

|

$

|

–

|

||||

|

Total operating expenses

|

(13,117,477

|

)

|

(12,505,999

|

)

|

||||

|

Net loss

|

(11,664,974

|

)

|

(12,462,880

|

)

|

||||

|

Basic and diluted loss per share

|

(0.17

|

)

|

(0.22

|

)

|

||||

Statements of Financial Position

|

Years Ended May 31,

|

||||||||

|

2014

|

2013

|

|||||||

|

Total assets

|

$

|

8,274,418

|

$

|

12,516,986

|

||||

|

Total liabilities

|

883,158

|

769,282

|

||||||

|

Total shareholders’ equity

|

7,391,260

|

11,747,704

|

||||||

2

Investing in the Common Shares involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information contained in this prospectus, before deciding to invest in the Common Shares. If any of the following risks materialize, our business, financial condition, results of operation and future prospects will likely be materially and adversely affected. In that event, the market price of the Common Shares could decline and you could lose all or part of your investment.

Risks Related To Our Company

We will require significant additional capital to fund our business plan.

We will be required to expend significant funds to determine if proven and probable mineral reserves exist at our properties, to continue exploration and if warranted, develop our existing properties and to identify and acquire additional properties to diversify our property portfolio. We have spent and will be required to continue to expend significant amounts of capital for drilling, geological and geochemical analysis, assaying and feasibility studies with regard to the results of our exploration. We may not benefit from some of these investments if we are unable to identify commercially exploitable mineralized material.

Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national and worldwide economy and the price of gold and silver. Capital markets worldwide have been adversely affected by substantial losses by financial institutions, caused by investments in asset-backed securities. We may not be successful in obtaining the required financing or, if we can obtain such financing, such financing may not be on terms that are favorable to us. Failure to obtain such additional financing could result in delay or indefinite postponement of further mining operations or exploration and development and the possible partial or total loss of our potential interest in our properties.

We have a limited operating history on which to base an evaluation of our business and prospects.

Since our inception we have had no revenue from operations. We have no history of producing metals from any of our properties. All of our properties are exploration stage properties in various stages of exploration. Advancing properties from exploration into the development stage requires significant capital and time, and successful commercial production from a property, if any, will be subject to completing feasibility studies, permitting and construction of the mine, processing plants, roads, and other related works and infrastructure. As a result, we are subject to all of the risks associated with developing and establishing new mining operations and business enterprises including:

|

·

|

completion of feasibility studies to verify reserves and commercial viability, including the ability to find sufficient gold/silver ore reserves to support a commercial mining operation;

|

|

·

|

the timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting and construction of infrastructure, mining and processing facilities;

|

|

·

|

the availability and costs of drill equipment, exploration personnel, skilled labor and mining and processing equipment, if required;

|

|

·

|

the availability and cost of appropriate smelting and/or refining arrangements, if required;

|

|

·

|

compliance with environmental and other governmental approval and permit requirements;

|

|

·

|

the availability of funds to finance exploration, development and construction activities, as warranted;

|

|

·

|

potential opposition from non-governmental organizations, environmental groups, local groups or local inhabitants which may delay or prevent development activities;

|

|

·

|

potential increases in exploration, construction and operating costs due to changes in the cost of fuel, power, materials and supplies; and

|

|

·

|

potential shortages of mineral processing, construction and other facilities related supplies.

|

The costs, timing and complexities of exploration, development and construction activities may be increased by the location of our properties and demand by other mineral exploration and mining companies. It is common in exploration programs to experience unexpected problems and delays during drill programs and, if commenced, development, construction and mine start-up. Accordingly, our activities may not result in profitable mining operations and we may not succeed in establishing mining operations or profitably producing metals at any of our properties.

3

We have a history of losses and expect to continue to incur losses in the future.

We have incurred losses since inception, have negative cash flow from operating activities and expect to continue to incur losses in the future. We incurred the following losses from operations before other income (expense) during each of the following periods:

|

·

|

Approximately $(13,117,477) for the year ended May 31, 2014; and

|

|

·

|

Approximately $(12,505,999) for the year ended May 31, 2013.

|

We expect to continue to incur losses unless and until such time as one of our properties enters into commercial production and generate sufficient revenues to fund continuing operations. We recognize that if we are unable to generate significant revenues from mining operations and dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition.

Increased costs could affect our financial condition.

We anticipate that costs at our projects that we may explore or develop, will frequently be subject to variation from one year to the next due to a number of factors, such as changing ore grade, metallurgy and revisions to mine plans, if any, in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities such as fuel, steel, rubber, and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production at certain operations less profitable. A material increase in costs at any significant location could have a significant effect on our profitability.

Risks Related to Mining and Exploration

All of our properties are in the exploration stage. Other than the NBP, which has estimated inferred and/or indicated resources identified, there are no known resources, and there are no known reserves, on any of our properties. There is no assurance that we can establish the existence of any mineral reserve on any of our properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from these properties and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral reserve in a commercially exploitable quantity, the exploration component of our business could fail.

We have not established that any of our mineral properties contain any mineral reserve according to recognized reserve guidelines, nor can there be any assurance that we will be able to do so. A mineral reserve is defined by the SEC in its Industry Guide 7 as that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a “reserve” that meets the requirements of the SEC’s Industry Guide 7 is extremely remote; in all probability our mineral properties do not contain any “reserves” and any funds that we spend on exploration could be lost. Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that they can be developed into producing mines and extract those minerals. Both mineral exploration and development involve a high degree of risk and few mineral properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the mineral deposit to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral deposit unprofitable.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses.

Exploration for and the production of minerals is highly speculative and involves much greater risk than many other businesses. Most exploration programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Our operations are, and any future development or mining operations we may conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and development of mineral properties, such as, but not limited to:

|

·

|

economically insufficient mineralized material;

|

|

·

|

fluctuation in production costs that make mining uneconomical;

|

|

·

|

labor disputes;

|

4

|

·

|

unanticipated variations in grade and other geologic problems;

|

|

·

|

environmental hazards;

|

|

·

|

water conditions;

|

|

·

|

difficult surface or underground conditions;

|

|

·

|

industrial accidents;

|

|

·

|

metallurgic and other processing problems;

|

|

·

|

mechanical and equipment performance problems;

|

|

·

|

failure of pit walls or dams;

|

|

·

|

unusual or unexpected rock formations;

|

|

·

|

personal injury, fire, flooding, cave-ins and landslides; and

|

|

·

|

decrease in the value of mineralized material due to lower gold and/or silver prices.

|

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures, potential revenues and production dates. We currently have very limited insurance to guard against some of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable, or result in additional expenses.

We have no history of producing metals from our current mineral properties and there can be no assurance that we will successfully establish mining operations or profitably produce precious metals.

We have no history of producing metals from our current mineral properties. We do not produce gold or silver and do not currently generate operating earnings. While we seek to move our projects into production, such efforts will be subject to all of the risks associated with establishing new mining operations and business enterprises, including:

|

·

|

the timing and cost, which are considerable, of the construction of mining and processing facilities;

|

|

·

|

the ability to find sufficient gold/silver reserves to support a profitable mining operation;

|

|

·

|

the availability and costs of skilled labor and mining equipment;

|

|

·

|

compliance with environmental and other governmental approval and permit requirements;

|

|

·

|

the availability of funds to finance construction and development activities;

|

|

·

|

potential opposition from non-governmental organizations, environmental groups, local groups or local inhabitants that may delay or prevent development activities; and

|

|

·

|

potential increases in construction and operating costs due to changes in the cost of labor, fuel, power, materials and supplies.

|

The costs, timing and complexities of mine construction and development may be increased by the remote location of some of our properties. It is common in new mining operations to experience unexpected problems and delays during construction, development and mine start-up. In addition, our management will need to be expanded. This could result in delays in the commencement of mineral production and increased costs of production. Accordingly, we cannot assure you that our activities will result in profitable mining operations or that we will successfully establish mining operations.

Estimates of mineralized material and resources are subject to evaluation uncertainties that could result in project failure.

Our exploration and future mining operations, if any, are and would be faced with risks associated with being able to accurately predict the quantity and quality of mineralized material and resources/reserves within the earth using statistical sampling techniques. Estimates of any mineralized material or resource/reserve on any of our properties would be made using samples obtained from appropriately placed trenches, test pits and underground workings and intelligently designed drilling. There is an inherent variability of assays between check and duplicate

5

samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. Additionally, there also may be unknown geologic details that have not been identified or correctly appreciated at the current level of accumulated knowledge about our properties. This could result in uncertainties that cannot be reasonably eliminated from the process of estimating mineralized material and resources/reserves. If these estimates were to prove to be unreliable, we could implement an exploitation plan that may not lead to commercially viable operations in the future.

Any material changes in mineral resource/reserve estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital.

As we have not completed feasibility studies on any of our properties and have not commenced actual production, mineralization resource estimates may require adjustments or downward revisions. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by our feasibility studies and drill results. Minerals recovered in small scale tests may not be duplicated in large scale tests under on-site conditions or in production scale.

The resource estimates contained in this prospectus have been determined based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for gold or silver may render portions of our mineralization and resource estimates uneconomic and result in reduced reported mineralization or adversely affect any commercial viability determinations we may reach. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our share price and the value of our properties.

There are differences in U.S. and Canadian practices for reporting reserves and resources.

Our reserve and resource estimates are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements, as we generally report reserves and resources in accordance with Canadian requirements. These requirements are different from the practices used to report reserve and resource estimates in reports and other materials filed with the SEC. It is Canadian practice to report measured, indicated and inferred mineral resources, which are generally not permitted in disclosure filed with the SEC by United States issuers. In the United States, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into reserves.

Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations; however, the SEC only permits issuers to report “resources” as in place, tonnage and grade without reference to unit measures.

Accordingly, information concerning descriptions of mineralization, reserves and resources contained in this prospectus, or in the documents incorporated herein by reference, may not be comparable to information made public by other United States companies subject to the reporting and disclosure requirements of the SEC.

Our exploration activities on our properties may not be commercially successful, which could lead us to abandon our plans to develop our properties and our investments in exploration.

Our long-term success depends on our ability to identify mineral deposits on our existing properties and other properties we may acquire, if any, that we can then develop into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of gold, silver and other commodity exploration is determined in part by the following factors:

|

·

|

the identification of potential mineralization based on surficial analysis;

|

|

·

|

availability of government-granted exploration permits;

|

|

·

|

the quality of our management and our geological and technical expertise; and

|

|

·

|

the capital available for exploration and development work.

|

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if we are unable to identify commercially exploitable mineral reserves. The decision to abandon a project may have an adverse effect on the market value of our securities and the ability to raise future financing.

6

The volatility of the price of gold could adversely affect our future operations and, if warranted, our ability to develop our properties.

The potential for profitability of our operations, the value of our properties, the market price of the Common Shares and our ability to raise funding to conduct continued exploration and development, if warranted, are directly related to the market price of gold and silver. Our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before the first revenue from production would be received. A decrease in the price of gold and/or silver may prevent our property from being economically mined or result in the write-off of assets whose value is impaired as a result of lower gold and silver prices. The prices of gold and silver are affected by numerous factors beyond our control, including inflation, fluctuation of the U.S. dollar and foreign currencies, global and regional demand, the sale of gold by central banks, and the political and economic conditions of major gold and silver producing countries throughout the world.

The volatility in gold prices is illustrated in the table presented under the heading “Business – Business Operations – Gold Price History” below.

The volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can fully eliminate. In the event gold and/or silver prices decline or remain low for prolonged periods of time, we might be unable to develop our properties, which may adversely affect our results of operations, financial performance and cash flows.

We may not be able to obtain all required permits and licenses to place any of our properties into production.

Our current and future operations, including development activities and commencement of production, if warranted, require permits from governmental authorities and such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in mineral property exploration and the development or operation of mines and related facilities generally experience increased costs, and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. We cannot predict if all permits which we may require for continued exploration, development or construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms, if at all. Costs related to applying for and obtaining permits and licenses may be prohibitive and could delay our planned exploration and development activities. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions.

Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on our operations and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties.

We are subject to significant governmental regulations, which affect our operations and costs of conducting our business.

Our current and future operations are and will be governed by laws and regulations, including:

|

·

|

laws and regulations governing mineral concession acquisition, prospecting, development, mining and production;

|

|

·

|

laws and regulations related to exports, taxes and fees;

|

|

·

|

labor standards and regulations related to occupational health and mine safety; and

|

|

·

|

environmental standards and regulations related to waste disposal, toxic substances, land use and environmental protection.

|

Companies engaged in exploration activities often experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Failure to comply with applicable laws, regulations and permits may result in enforcement actions, including the forfeiture of mineral claims or other mineral tenures, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. We may be required to compensate those suffering loss or damage by reason of our mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits.

Existing and possible future laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation, could have a material adverse impact on our business and cause increases in capital expenditures or require abandonment or delays in exploration.

7

Our activities are subject to environmental laws and regulations that may increase our costs of doing business and restrict our operations.

All phases of our operations are subject to environmental regulation in the jurisdictions in which we operate. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. These laws address emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. Compliance with environmental laws and regulations and future changes in these laws and regulations may require significant capital outlays and may cause material changes or delays in our operations and future activities. It is possible that future changes in these laws or regulations could have a significant adverse impact on our properties or some portion of our business, causing us to re-evaluate those activities at that time.

Legislation has been proposed that would significantly affect the mining industry.

Members of the United States Congress have repeatedly introduced bills which would supplant or alter the provisions of the United States General Mining Law of 1872. If enacted, such legislation could change the cost of holding unpatented mining claims and could significantly impact our ability to develop mineralized material on unpatented mining claims. Such bills have proposed, among other things, to either eliminate or greatly limit the right to a mineral patent and to impose a federal royalty on production from unpatented mining claims. Although we cannot predict what legislated royalties might be, the enactment of these proposed bills could adversely affect the potential for development of unpatented mining claims and the economics of existing operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect our financial performance.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on our business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on us, our venture partners and our suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Given the emotion, political significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies in our industry could harm our reputation. The potential physical impacts of climate change on our operations are highly uncertain, and would be particular to the geographic circumstances in areas in which we operate. These may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels and changing temperatures. These impacts may adversely impact the cost, production and financial performance of our operations.

Land reclamation requirements for our properties may be burdensome and expensive.

Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance.

Reclamation may include requirements to:

|

·

|

control dispersion of potentially deleterious effluents;

|

|

·

|

treat ground and surface water to drinking water standards; and

|

|

·

|

reasonably re-establish pre-disturbance land forms and vegetation.

|

In order to carry out reclamation obligations imposed on us in connection with our potential development activities, we must allocate financial resources that might otherwise be spent on further exploration and development programs. We plan to set up a provision for our reclamation obligations on our properties, as appropriate, but this provision may not be adequate. If we are required to carry out unanticipated reclamation work, our financial position could be adversely affected.

8

We face intense competition in the mining industry.

The mining industry is intensely competitive in all of its phases. As a result of this competition, some of which is with large established mining companies with substantial capabilities and with greater financial and technical resources than ours, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for qualified employees, our exploration and development programs may be slowed down or suspended. We compete with other precious metal companies for capital. If we are unable to raise sufficient capital, our exploration and development programs may be jeopardized or we may not be able to acquire, develop or operate additional precious metal projects.

A shortage of equipment and supplies could adversely affect our ability to operate our business.

We are dependent on various supplies and equipment to carry out our mining exploration and, if warranted, development operations. The shortage of such supplies, equipment and parts could have a material adverse effect on our ability to carry out our operations and therefore limit, or increase the cost of, production.

Joint ventures and other partnerships may expose us to risks.

We may enter into joint ventures or partnership arrangements with other parties in relation to the exploration, development and production of certain of the properties in which we have an interest. Joint ventures can often require unanimous approval of the parties to the joint venture or their representatives for certain fundamental decisions such as an increase or reduction of registered capital, merger, division, dissolution, amendments of constating documents, and the pledge of joint venture assets, which means that each joint venture party may have a veto right with respect to such decisions which could lead to a deadlock in the operations of the joint venture. Further, we may be unable to exert control over strategic decisions made in respect of such properties. Any failure of such other companies to meet their obligations to us or to third parties, or any disputes with respect to the parties’ respective rights and obligations, could have a material adverse effect on the joint ventures or their properties and therefore could have a material adverse effect on our results of operations, financial performance, cash flows and the price of the Common Shares.

We may experience difficulty attracting and retaining qualified management to meet the needs of our anticipated growth, and the failure to manage our growth effectively could have a material adverse effect on our business and financial condition.

We are dependent on a relatively small number of key employees, including our President, our Chief Executive Officer and our Chief Operating Officer. The loss of any officer could have an adverse effect on us. We have no life insurance on any individual, and we may be unable to hire a suitable replacement for them on favorable terms, should that become necessary.

It may be difficult to enforce judgments or bring actions outside the United States against us and certain of our directors.

We are a Canadian corporation and certain of our Directors are neither citizens nor residents of the United States. A substantial part of the assets of several of these persons, are located outside the United States. As a result, it may be difficult or impossible for an investor:

|

·

|

to enforce in courts outside the United States judgments obtained in United States courts based upon the civil liability provisions of United States federal securities laws against these persons and the Company; or

|

|

·

|

to bring in courts outside the United States an original action to enforce liabilities based upon United States federal securities laws against these persons and the Company.

|

Our results of operations could be affected by currency fluctuations.

Our properties are all located in the United States and most costs associated with these properties are paid in U.S. dollars. There can be significant swings in the exchange rate between the U.S. and Canadian dollar. There are no plans at this time to hedge against any exchange rate fluctuations in currencies.

Title to our properties may be subject to other claims, which could affect our property rights and claims.

There are risks that title to our properties may be challenged or impugned. Our current properties are located in Nevada and Alaska and may be subject to prior unrecorded agreements or transfers or native land claims and title may be affected by undetected defects. There may be valid challenges to the title of our properties which, if successful, could impair development and/or operations. This is particularly the case in respect of those portions of the our properties in which we hold our interest solely through a lease with the claim holders, as such interest is substantially based on contract and has been subject to a number of assignments (as opposed to a direct interest in the property).

9

Several of the mineral rights to our properties consist of “unpatented” lode mining claims created and maintained in accordance with the United States General Mining Law of 1872. Unpatented mining claims are unique property interests, and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations under the United States General Mining Law of 1872. Also, unpatented mining claims are always subject to possible challenges by third parties or validity contests by the federal government. The validity of an unpatented lode mining or mill site claim, in terms of both its location and its maintenance, is dependent on strict compliance with a complex body of U.S. federal and state statutory and decisional law. In addition, there are few public records that definitively determine the issues of validity and ownership of unpatented mining claims. Should the federal government impose a royalty or additional tax burdens on the properties that lie within public lands, the resulting mining operations could be seriously impacted, depending upon the type and amount of the burden.

We may be unable to secure surface access or purchase required surface rights.

Although the Company acquires the rights to some or all of the minerals in the ground subject to the mineral tenures that it acquires, or has a right to acquire, in most cases it does not thereby acquire any rights to, or ownership of, the surface to the areas covered by such mineral tenures. In such cases, applicable mining laws usually provide for rights of access to the surface for the purpose of carrying on mining activities, however, the enforcement of such rights through the courts can be costly and time consuming. It is necessary to negotiate surface access or to purchase the surface rights if long-term access is required. There can be no guarantee that, despite having the right at law to access the surface and carry on mining activities, we will be able to negotiate satisfactory agreements with any such existing landowners/occupiers for such access or purchase of such surface rights, and therefore we may be unable to carry out planned mining activities. In addition, in circumstances where such access is denied, or no agreement can be reached, we may need to rely on the assistance of local officials or the courts in such jurisdiction the outcomes of which cannot be predicted with any certainty. Our inability to secure surface access or purchase required surface rights could materially and adversely affect our timing, cost or overall ability to develop any mineral deposits we may locate.

Our properties and operations may be subject to litigation or other claims.

From time to time our properties or operations may be subject to disputes which may result in litigation or other legal claims. We may be required to assert or defend against these claims which will divert resources and management time from operations. The costs of these claims or adverse filings may have a material effect on our business and results of operations.

We do not currently insure against all the risks and hazards of mineral exploration, development and mining operations.

Exploration, development and mining operations involve various hazards, including environmental hazards, industrial accidents, metallurgical and other processing problems, unusual or unexpected rock formations, structural cave-ins or slides, flooding, fires, metal losses and periodic interruptions due to inclement or hazardous weather conditions. These risks could result in damage to or destruction of mineral properties, facilities or other property, personal injury, environmental damage, delays in operations, increased cost of operations, monetary losses and possible legal liability. We may not be able to obtain insurance to cover these risks at economically feasible premiums or at all. We may elect not to insure where premium costs are disproportionate to our perception of the relevant risks. The payment of such insurance premiums and of such liabilities would reduce the funds available for exploration and production activities.

Risks Related to the Common Shares

We believe that we may be a “passive foreign investment company” for the current taxable year which may result in materially adverse United States federal income tax consequences for United States investors.

We generally will be designated as a “passive foreign investment company” under the meaning of Section 1297 of the United States Internal Revenue Code of 1986, as amended (a “PFIC”) if, for a tax year, (a) 75% or more of our gross income for such year is “passive income” (generally, dividends, interest, rents, royalties, and gains from the disposition of assets producing passive income) or (b) if at least 50% or more of the value of our assets produce, or are held for the production of, passive income, based on the quarterly average of the fair market value of such assets. United States shareholders should be aware that we believe we were classified as a PFIC during our tax year ended May 31, 2014, and based on current business plans and financial expectations, believe that we may be a PFIC for the current and future taxable years. If we are a PFIC for any year during a U.S. shareholder’s holding period, then such U.S. shareholder generally will be required to treat any gain realized upon a disposition of Common Shares, or any “excess distribution” received on its Common Shares, as ordinary income, and to pay an interest charge on a portion of such gain or distribution, unless the shareholder makes a timely and effective "qualified electing fund" election (“QEF Election”) or a "mark-to-market" election with respect to the Common Shares. A U.S. shareholder who makes a QEF Election generally must report on a current basis its share of our net capital gain and ordinary earnings for any year in which we are a PFIC, whether or not we distribute any amount to our shareholders. A U.S. shareholder who makes a mark-to-market election generally must include as ordinary income

10

each year the excess of the fair market value of the Common Shares over the taxpayer’s basis therein. This paragraph is qualified in its entirety by the discussion below under the heading “Certain United States Federal Income Tax Considerations.” Each U.S. shareholder should consult its own tax advisors regarding the PFIC rules and the U.S. federal income tax consequences of the acquisition, ownership, and disposition of Common Shares.

Our share price may be volatile and as a result you could lose all or part of your investment.

In addition to volatility associated with equity securities in general, the value of your investment could decline due to the impact of any of the following factors upon the market price of the Common Shares:

|

·

|

Changes in the worldwide price for gold and/or silver;

|

|

·

|

Disappointing results from our exploration efforts;

|

|

·

|

Decline in demand for Common Shares;

|

|

·

|

Downward revisions in securities analysts’ estimates or changes in general market conditions;

|

|

·

|

Technological innovations by competitors or in competing technologies;

|

|

·

|

Investor perception of our industry or our prospects; and

|

|

·

|

General economic trends.

|

In the last 12 months, the closing price of our stock on the TSX has ranged from a low of $0.70 to a high of $2.12. In addition, stock markets in general have experienced extreme price and volume fluctuations and the market prices of securities have been highly volatile. These fluctuations are often unrelated to operating performance and may adversely affect the market price of the Common Shares. As a result, you may be unable to resell any Common Shares you acquire at a desired price.

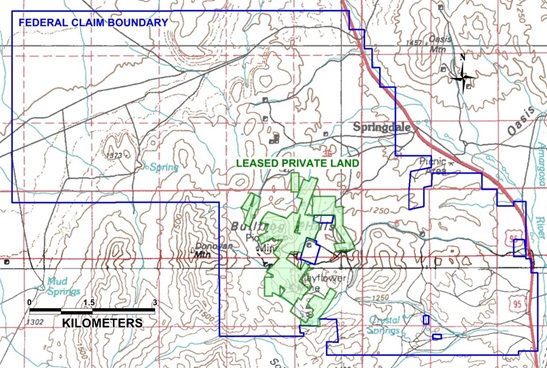

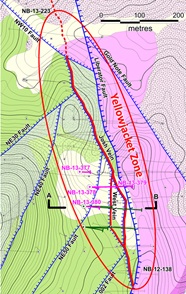

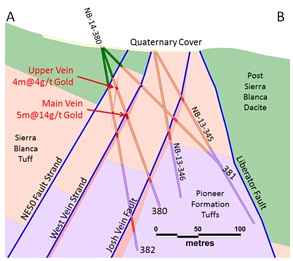

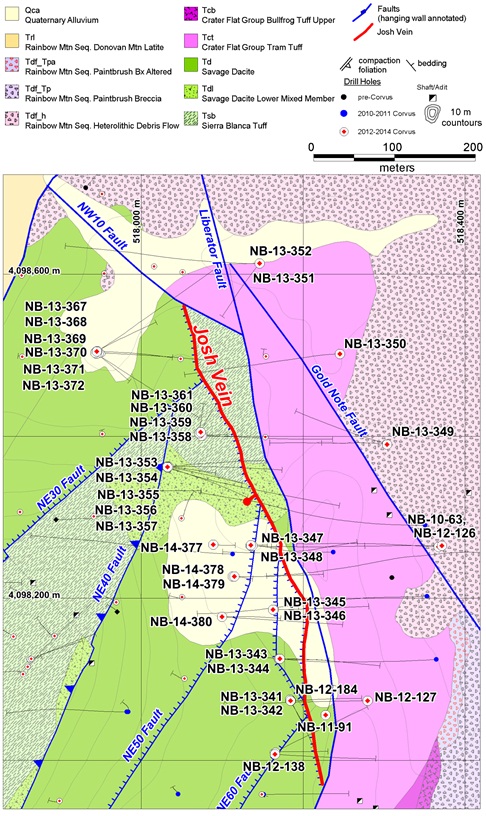

We have never paid dividends on the Common Shares.