Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Clifton Bancorp Inc. | d772349d8k.htm |

(Nasdaq:

CSBK) Annual Meeting Presentation

August 7, 2014

Exhibit 99.1 |

FORWARD-LOOKING STATEMENTS

2

Clifton Bancorp makes forward-looking statements in this presentation. These

forward-looking statements may include:

statements

of

goals,

intentions,

earnings

expectations,

and

other

expectations;

estimates

of

risks

and

of

future costs and benefits; assessments of probable loan and lease losses; assessments of

market risk; and statements of the ability to achieve financial and other goals.

Forward-looking statements are typically identified by words such as "believe,"

"expect," "anticipate," "intend," "outlook,"

"estimate," "forecast," "project" and other similar words and expressions. Forward-looking statements

are subject to numerous assumptions, risks and uncertainties, which change over time.

Forward-looking statements speak only as of the date they are made. Clifton Bancorp

does not assume any duty and does not undertake to update its forward-looking

statements. Because forward-looking statements are subject to assumptions and

uncertainties, actual results or future events could differ, possibly materially, from those that

Clifton Bancorp anticipated in its forward-looking statements and future results could

differ materially from historical performance.

Clifton Bancorp's forward-looking statements are subject to the following principal risks

and uncertainties: general economic conditions and trends, either nationally or

locally; conditions in the securities markets; changes in interest rates; changes in

deposit flows, and in the demand for deposit, loan, and investment products and other

financial services; changes in real estate values; changes in the quality or composition of

the Company's loan or investment portfolios; changes in competitive pressures among

financial institutions or from non-financial institutions; the Company's ability to

retain key members of management; changes in legislation, regulations, and

policies;

and

a

variety

of

other

matters

which,

by

their

nature,

are

subject

to

significant

uncertainties.

Clifton

Bancorp provides greater detail regarding some of these factors in its Annual Report on Form

10-K filed on June 6, 2014 in the Risk Factors section, and in its other SEC

reports. Clifton Bancorp's forward-looking statements may also be subject to other

risks and uncertainties, including those that it may discuss elsewhere in this news release

or in its filings with the SEC, accessible on the SEC's website at www.sec.gov.

|

CLIFTON BANCORP

INVESTMENT THESIS Strong Platform.

Soundly managed community financial

institution in desirable NJ/NY Metro market area.

Capital to Fuel Growth.

Second step offering provided solid

financial base to support strategic investments in growth.

Emerging Opportunities.

Committed to deploying capital by

prudently growing loans, core deposits and service offerings.

Shareholder-Focused Policies.

Track record of share

buybacks, attractive dividend.

Attractive Valuation.

Currently trades at a discount to

tangible book value.

3 |

STRONG

PLATFORM 4

Clifton Savings Bank chartered in

1928.

12 branches in Northern NJ plus

mortgage loan division office.

Historically a 1-4 family mortgage,

portfolio lender.

Disciplined credit and compliance

cultures.

Track record of cost efficiency.

Solid management team. |

STRONG

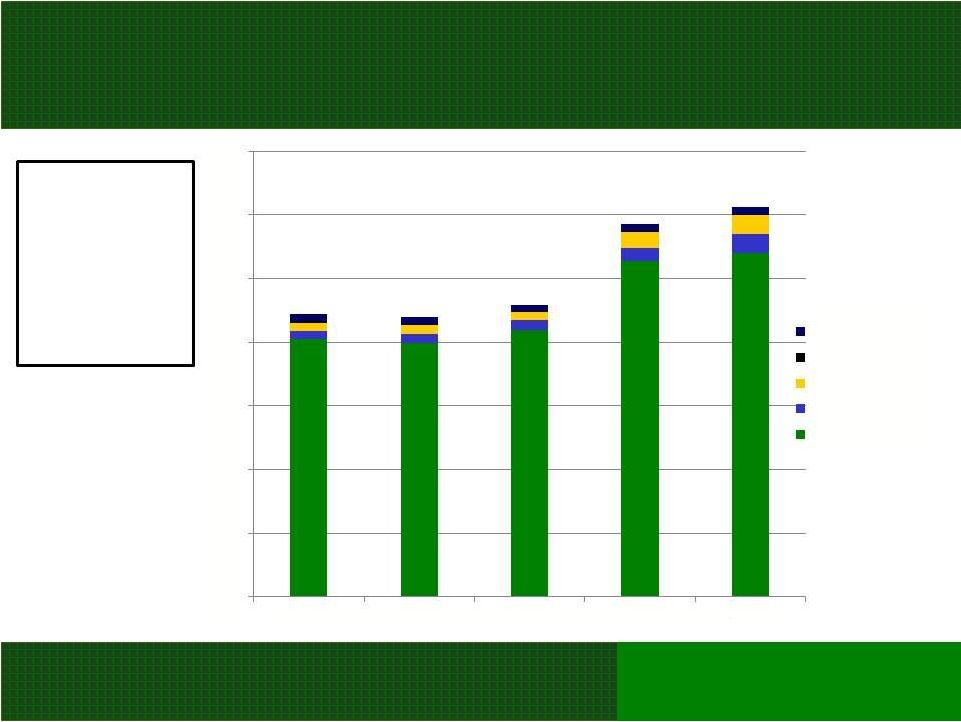

PLATFORM 5

10.08%

8.59%

9.47%

8.85%

Data in 000’s.

Fiscal Years ending 3/31.

Q1 2015 data as of 6/30/14.

Lending is

increasingly

diversified,

with non-1-4

family loans

growing as a

% of Total

Gross Loans.

0

100

200

300

400

500

600

700

FY 2011

FY 2012

FY 2013

FY 2014

Consum./Other

Construct.

Comm. RE

Multi-Fam.

1

-

4 Res.

11.68%

Q1’15 |

STRONG

PLATFORM 6

Disciplined Credit Culture

Allowance / total gross loans

NPAs / total assets

NPLs / total gross loans

Net charge-offs / avg. loans

Allowance / nonperforming loans

CSBK*

0.51%

0.45%

0.89%

0.01%

57.12%

* As of June 30, 2014. |

STRONG

PLATFORM 7

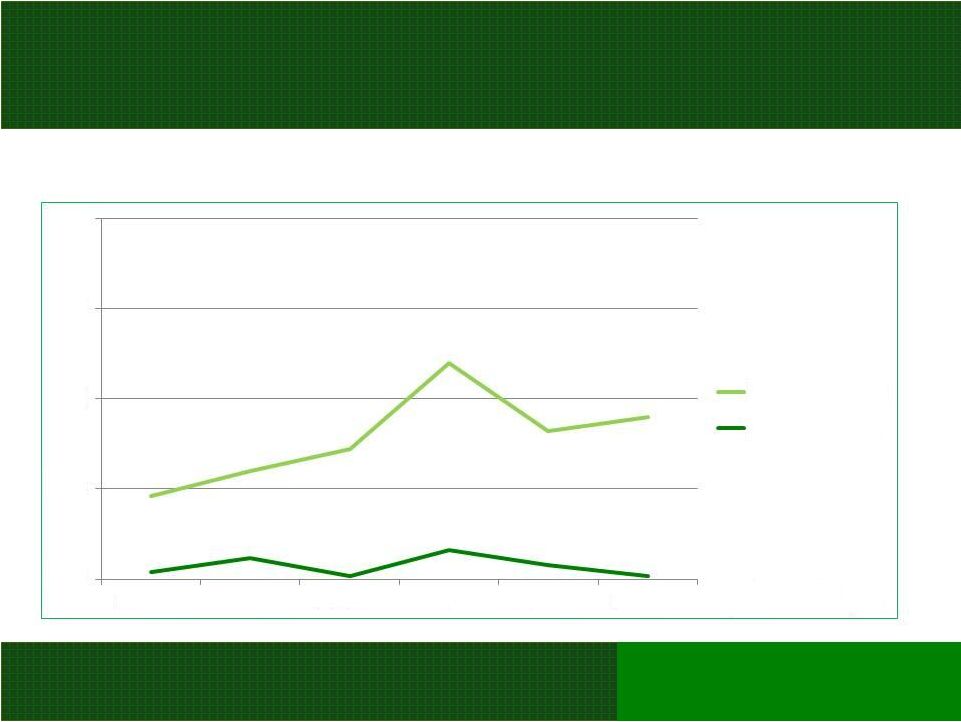

Credit Quality Track Record

Fiscal Years ending 3/31.

Q1 2015 data as of 6/30/14.

0.00

0.25

0.50

0.75

1.00

FY 2010

FY 2011

FY 2012

FY 2013

FY 2014

Q1 2015

NPA/Assets

NCO/Loans |

STRONG

PLATFORM 8

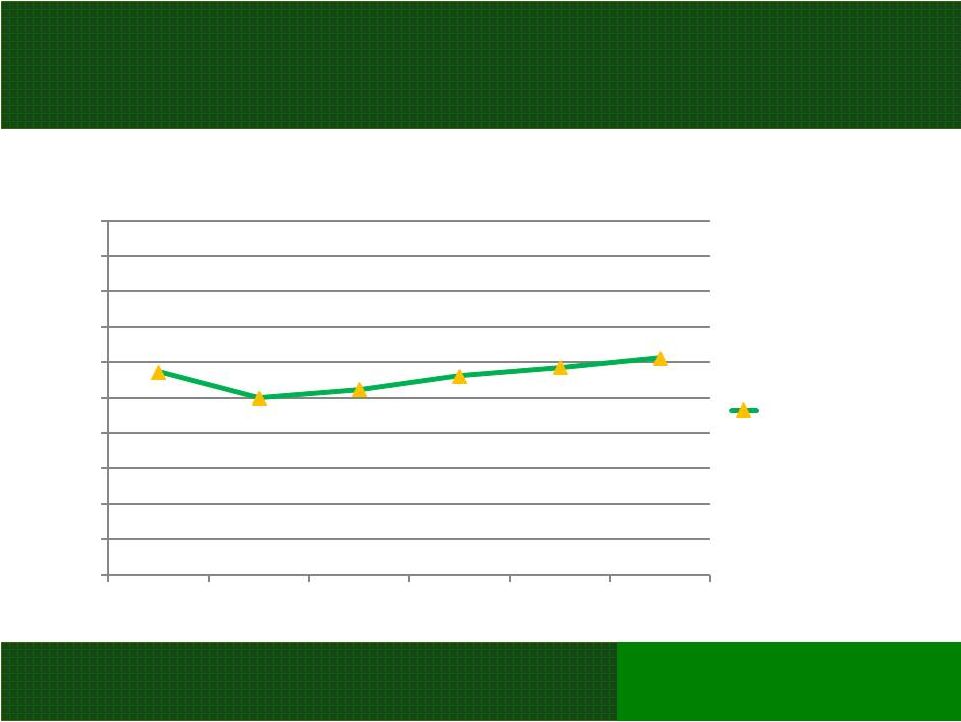

Sharp Cost Control Focus

Fiscal Years ending 3/31.

Q1 2015 data as of 6/30/14.

57.29

50.04

52.40

56.30

58.60

61.30

0

10

20

30

40

50

60

70

80

90

100

FY 2010

FY2011

FY 2012

FY 2013

FY 2014

Q1 '15

Effic. Ratio |

STRONG

PLATFORM Solid Director and Officer Team

Engaged Board of Directors: 6 of 7 members

independent, approximately 2% share ownership by

Board members.

Experienced senior management: average of 27 years in

the industry.*

Complementary balance of executive level tenure:

•

COO, CLO and CFO have 15-26 years with Clifton.

•

CEO, EVP-Chief Revenue Officer are recent additions, as well as

SVP-Commercial Real Estate lending.

9

* Includes all officers with SVP and EVP rank, plus CEO’s experience advising financial

institutions. |

CAPITAL TO

FUEL GROWTH 10

Total risk-based capital / risk-weighted assets

Tier 1 capital / risk-weighted assets

Tier 1 risk-based capital / adj. tangible assets

Clifton Savings*

48.44%

47.83%

20.88%

Required **

10.00%

6.00%

-----

* As of June 30, 2014 for Clifton Savings Bank and subsidiary only.

** For classification as Well-Capitalized. |

EMERGING

OPPORTUNITIES Deploy Capital with a Prudent, Disciplined Focus

Expand existing 1-4 family residential portfolio lending.

Selectively pursue multi-family and commercial RE lending.

Increase lower-cost core deposit accounts.

Build on tradition of personalized service and expand product

portfolio to become a true community financial institution.

Consider acquisitions that meet asset quality and accretion

parameters, while enhancing geographic reach, talent base

and/or product range.

11 |

EMERGING

OPPORTUNITIES 12

Strategic Initiatives

Develop a brand strategy to drive growth.

Market study identifying future growth opportunities.

Optimize existing branch network.

Align both physical and virtual channels.

Continue to grow existing client relationships. |

SHAREHOLDER-FOCUSED POLICIES

Track record of 10 share repurchases totaling $53.8

million from 2004-2012.

Next buyback window opens in April 2015.

Paid dividends for 42 consecutive quarters* since MHC

IPO in 2004.

13

*As of June 30, 2014; December 2013 and March 2014 dividends were combined.

|

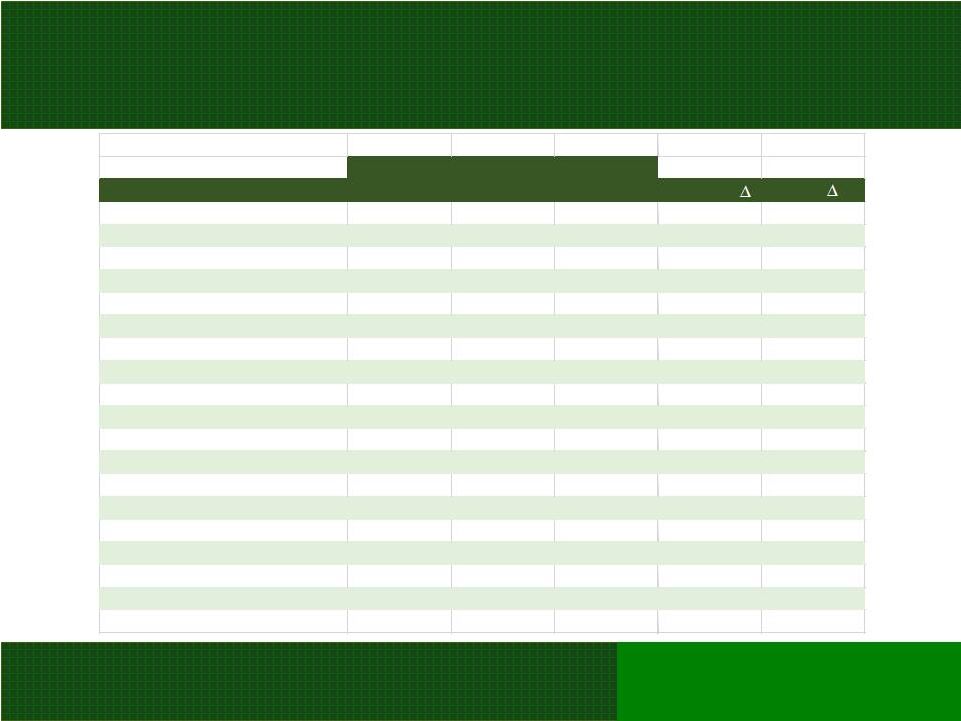

FINANCIAL

HIGHLIGHTS 14

($ In Millions Except Per Share Data)

6/30/2014

3/31/2014

6/30/2013

Linked Q

YOY

Total Assets

1,231.7

$

1,266.0

$

1,043.0

$

-2.71%

18.09%

Net Loans

611.0

$

584.5

$

492.2

$

4.53%

24.14%

Deposits

736.6

$

763.9

$

789.7

$

-3.57%

-6.72%

Total Stockholder's Equity

356.5

$

194.1

$

188.3

$

83.67%

89.33%

Net Income

1.62

$

1.56

$

1.75

$

4.17%

-7.21%

Basic & Diluted EPS

0.06

$

0.06

$

0.07

$

0.00%

-14.29%

Net Interest Income

6.40

$

6.31

$

5.67

$

1.36%

12.82%

Non-Interest Income

0.35

$

0.35

$

0.88

$

-1.14%

-60.59%

Non-Interest Expense

4.14

$

4.17

$

3.67

$

-0.82%

12.72%

Quarter Ended |

CLIF

TON

BANCORP

INVESTMENT

SUMMARY

Strong Platform.

Capital to Fuel Growth.

Emerging Opportunities.

Shareholder-Focused Policies.

Attractive Valuation.

15 |

CONTACT

INFORMATION Investor Relations Contact:

Bart D’Ambra

973-473-2200

Company website: CliftonSavings.com

16 |