Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - ASENSUS SURGICAL, INC. | d729762dex322.htm |

| EX-31.1 - EX-31.1 - ASENSUS SURGICAL, INC. | d729762dex311.htm |

| EX-31.2 - EX-31.2 - ASENSUS SURGICAL, INC. | d729762dex312.htm |

| EX-32.1 - EX-32.1 - ASENSUS SURGICAL, INC. | d729762dex321.htm |

| EX-10.4 - EX-10.4 - ASENSUS SURGICAL, INC. | d729762dex104.htm |

| EXCEL - IDEA: XBRL DOCUMENT - ASENSUS SURGICAL, INC. | Financial_Report.xls |

| 10-Q - 10-Q - ASENSUS SURGICAL, INC. | d729762d10q.htm |

EXHIBIT 10.3

SECOND AMENDMENT TO LEASE AGREEMENT

THIS SECOND AMENDMENT TO LEASE AGREEMENT (this “Amendment”) is entered into between LCFRE DURHAM KEYSTONE TECHNOLOGY PARK, L.P., a Delaware limited partnership (“Landlord”), and TRANSENTERIX, INC., a Delaware corporation (“Tenant”), with reference to the following:

A. GRE Keystone Technology Park Three LLC (predecessor-in-interest to Landlord) and Tenant entered into that certain Lease Agreement dated December 11, 2009, and that certain Lease Modification Agreement No. 1 dated May 4, 2010 (as amended, the “Lease”), covering approximately 37,347 square feet known as Suite 300 on the 1st floor (the “Leased Premises”) of the building commonly known as Keystone Technology Park – Building X and located at 635 Davis Drive, Durham, North Carolina (the “Building”).

B. Landlord and Tenant now desire to further amend the Lease as set forth below. Unless otherwise expressly provided in this Amendment, capitalized terms used in this Amendment shall have the same meanings as in the Lease.

FOR GOOD AND VALUABLE CONSIDERATION, the receipt and sufficiency of which are acknowledged, the parties agree as follows:

1. First Extension Period. The term of the Lease is extended for a period of thirty-eight (38) months (the “First Extension Period”) commencing on May 1, 2015, and expiring on June 30, 2018. Tenant acknowledges that it has no further extension or renewal rights or options under the Lease, except as provided below.

2. Base Rent. Commencing on May 1, 2015, and continuing through the First Extension Period, Tenant shall, at the time and in the manner provided in the Lease, pay to Landlord as Base Rent for the various portions of the Leased Premises the amounts set forth in the following rent schedules, plus any applicable tax thereon:

| FROM | THROUGH | ANNUAL RENTAL RATE PER SQ. FT. |

ANNUAL BASE RENT |

MONTHLY BASE RENT | ||||

| May 1, 2015 | April 30, 2016 | $12.50 | $466,837.50 | $38,903.13* | ||||

| May 1, 2016 | April 30, 2017 | $12.84 | $479,535.48 | $39,961.29 | ||||

| May 1, 2017 | April 30, 2018 | $13.20 | $492,980.40 | $41,081.70 | ||||

| May 1, 2018 | June 30, 2018 | $13.56 | $506,425.32 | $42,202.11 |

| * | Subject to Section 4 below, monthly Base Rent shall abate during the period commencing on May 1, 2015, and expiring on June 30, 2015. |

3. TICAM Expenses. During the First Extension Period, Tenant shall continue to pay Tenant’s proportionate share of TICAM Expenses as more particularly described in Article 4 of the Lease; provided, however, subject to Section 4 below, Tenant’s proportionate share of TICAM Expenses shall abate during the period commencing on May 1, 2015, and expiring on

June 30, 2015. Notwithstanding anything in the Lease to the contrary, increases in Controllable TICAM Expenses (as hereinafter defined) shall not, in the aggregate, exceed five percent (5%) annually on a cumulative, compounded basis. The term “Controllable TICAM Expenses” means all TICAM Expenses excluding expenses relating to the cost of utilities, snow removal, insurance, and taxes and assessments.

4. Abated Rent. If this Amendment provides for a postponement of any Base Rent or payment of TICAM Expenses, a period of “free” rent, reduced rent, early occupancy, or other rent concession, such postponed rent, “free” rent, reduced rent or other rent concession shall be referred to herein as the “Abated Rent”. Tenant shall be credited with having paid all of the Abated Rent on the expiration of the First Extension Period only if Tenant has fully, faithfully, and punctually performed all of Tenant’s obligations hereunder, including the payment of all Base Rent and TICAM Expenses (other than the Abated Rent) and all other monetary obligations and the surrender of the Leased Premises in the physical condition required by the Lease. Tenant acknowledges that its right to receive credit for the Abated Rent is absolutely conditioned upon Tenant’s full, faithful and punctual performance of its obligations under the Lease. If a monetary event of default shall occur beyond applicable notice and cure periods, the Abated Rent shall immediately become due and payable in full and this Amendment shall be enforced as if there were no such rent abatement or other rent concession. In such case Abated Rent shall be calculated based on the full initial Base Rent payable under this Amendment.

5. Security Deposit. Notwithstanding anything to the contrary contained in the Lease, including anything contained in Section 4.07 of the Lease, as of May 1, 2015, the Letter of Credit amount set forth in Sections 2.01(i) and 4.07 of the Lease shall be reduced from $250,000.00 to $38,903.13.

6. Condition of the Leased Premises. Tenant accepts the Leased Premises in its “as-is” condition and configuration. However, any necessary construction of leasehold improvements shall be accomplished and the cost of such construction shall be paid in accordance with the “Work Letter” between Landlord and Tenant attached to this Amendment as Exhibit A. Tenant acknowledges that Landlord has not undertaken to perform any modification, alteration or improvement to the Leased Premises. TENANT WAIVES (I) ALL CLAIMS DUE TO DEFECTS IN THE LEASED PREMISES, THE BUILDING AND/OR THE PROJECT; AND (II) ALL WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING, WITHOUT LIMITATION, THOSE OF SUITABILITY, HABITABILITY AND FITNESS FOR ANY PARTICULAR PURPOSE. Tenant waives the right to terminate the Lease due to the condition of the Leased Premises.

7. Alterations; Restoration of the Leased Premises. Notwithstanding anything contained in the Lease to the contrary, including anything contained in Section 7.02(a), upon the expiration or earlier termination of the Lease, with respect to any Alterations installed prior to the Effective Date, except with respect to Tenant’s obligation to remove the clean rooms and equipment related thereto in accordance with Section 7.02(a) of the Lease and except to the extent required by this Section 7, Tenant shall not be required to remove any such Alterations or restore the Leased Premises to the condition existing prior to the installation of such Alteration. Tenant shall, however, be obligated to remove any epoxy flooring installed throughout the Leased Premises and agrees to restore the Leased Premises flooring to a clean concrete slab condition. With respect to any Alterations installed by Tenant after the Effective Date, at the time Tenant requests Landlord’s approval to such Alteration, Tenant shall request Landlord to determine

-2-

whether or not Landlord requires Tenant to remove such Alteration at the expiration or earlier termination of the Lease. Any Alteration that Landlord requires to be removed, shall be removed in accordance with Section 7.01 of the Lease. Prior to Tenant vacating the Leased Premises upon the expiration or earlier termination of the Lease, Tenant, at Tenant’s sole cost and expense, shall provide Landlord with a certification in a form acceptable to Landlord that the Leased Premises is free of all Hazardous or Toxic Materials (as defined in Section 6.03 of the Lease). Landlord shall have the right to require Tenant to restore its generator installed at the Project to a good and working condition prior to the expiration or earlier termination of the Lease. At Landlord’s determination, Tenant’s generator shall remain upon the Project and be surrendered with the Leased Premises and become the sole property of Landlord.

8. Maintenance and Repairs by Tenant. Subject to the provisions of this Section 8, Tenant is responsible for the repair and maintenance costs for the existing HVAC unit serving the Leased Premises. Prior to the replacement of the existing HVAC unit in the Leased Premises and so long as Tenant has performed the maintenance required for the HVAC unit, Landlord, at Landlord’s expense, shall be responsible for repairs or replacements to the existing HVAC unit in excess of $1,000.00 per year of the Term in the aggregate as identified either through service calls from Tenant or as otherwise identified in the course of the preventive maintenance and/or inspections (“Landlord’s HVAC Obligations”). In the event that it is determined by Landlord’s vendor (or by Tenant’s vendor and then confirmed by Landlord’s vendor) that the existing HVAC requires replacement during the term, Landlord shall contract with the vendor of Landlord’s choice for such replacement and schedule the installation thereof. The cost of such replacement shall be borne by Landlord but amortized over the First Extension Period as part of Base Rent at the rate of eight percent (8%) per annum. After a unit comprising the existing HVAC is replaced, Tenant shall, at Tenant’s expense, be responsible for all repairs and maintenance for such replacement or new HVAC unit for the remainder of the term as it may be extended.

9. Assignment and Sublease. Notwithstanding anything contained in the Lease to the contrary, including anything contained in Section 10.01(e) of the Lease, if Tenant desires to assign the Lease or sublease the Leased Premises, or any part thereof, Tenant shall give Landlord notice of the proposed assignment or sublease at least thirty (30) days’ in advance of the date on which Tenant desires to make such assignment or sublease.

10. Early Termination Option. Section 3.07 of the Lease (as modified by Section 2 of the First Amendment) is hereby deleted and of no further force or effect.

11. Renewal Option.

(a) Landlord and Tenant acknowledge that (a) this extension of the Lease Term for the First Extension Period set forth herein is in lieu of Tenant’s first (1st) Renewal Option provided in Exhibit G attached to the Lease, and (b) Tenant continues to have one (1) Renewal Option for three (3) years pursuant to such Exhibit G.

(b) Notwithstanding anything contained in the Lease to the contrary, Tenant’s notice of its election to exercise its Renewal Option must be given no earlier than eighteen (18) months nor later than twelve (12) months prior to the expiration of the First Extension Period. Further, the Base Rent during the Renewal Term shall be equal to the greater of: (i) the Market Base Rent Rate (as defined in Exhibit G to the Lease) or (ii) the Base Rent in effect during the last month of the First Extension Period escalated by two and three-quarters percent (2.75%).

-3-

(c) The first parenthetical contained in the second paragraph of Exhibit G to the Lease is deleted in its entirety and replaced with the following parenthetical:

“(taking into consideration, without limitation, whether the space is office space, lab space, or mixed office and lab space, use, location, and floor level within the applicable building, definition of rentable area, leasehold improvements provided, quality and location of the applicable building, rental concessions (e.g., abatements or Lease assumptions.))”

(d) The Renewal Option granted under Exhibit G is personal to TransEnterix, Inc. and shall not be assignable to any other person or entity. Except as modified herein, all terms of Exhibit G shall apply to Tenant’s exercise of its Renewal Option.

12. Right of First Offer. Tenant shall have a right of first offer pursuant to the attached Rider No. 1, which is incorporated into this Amendment for all purposes.

13. Confidentiality. The second (2nd) sentence of Section 11.04 of the Lease is deleted in its entirety and replaced with the following sentence:

“If Tenant is a publicly traded company and the Lease, any amendment to it or document related to the Lease is considered a material contract so must be filed with the Securities and Exchange Commission (“SEC”), Tenant may file the Lease, amendment or document only after: (i) it has notified Landlord of the fact that the Lease, amendment or document is material and its intent to file it with the SEC; and (ii) it makes a good faith effort to have the confidential portions of the Lease, amendment or document redacted, provides Landlord with notice of what confidential portions were in fact redacted, and if not redacted, proof of its good faith efforts.”

14. Consent. This Amendment is subject to, and conditioned upon, any required consent or approval being unconditionally granted by Landlord’s mortgagee(s). If any such consent shall be denied, or granted subject to an unacceptable condition, this Amendment shall be null and void and the Lease shall remain unchanged and in full force and effect.

15. Broker. Tenant represents and warrants that it has not been represented by any broker or agent in connection with the execution of this Amendment except Thalhimer Raleigh, LLC as Tenant’s broker. Tenant shall indemnify, defend and hold harmless Landlord and its designated property management, construction and marketing firms, and their respective partners, members, affiliates and subsidiaries, and all of their respective officers, directors, shareholders, employees, servants, partners, members, representatives, insurers and agents from and against all claims (including costs of defense and investigation) of any broker or agent or similar party claiming by, through or under Tenant in connection with this Amendment. Landlord represents and warrants that it has not been represented by any broker or agent in connection with the execution of this Amendment, except Thalhimer Raleigh, LLC as Landlord’s broker. Landlord shall indemnify, defend and hold harmless Tenant and its partners, members, affiliates and subsidiaries, and all of

-4-

their respective officers, directors, shareholders, employees, servants, partners, members, representatives, insurers and agents from and against all claims (including costs of defense and investigation) of any other brokers or agent or similar party claiming by, through or under Landlord in connection with this Amendment.

16. OFAC List Representation. Tenant hereby represents and warrants to Landlord that neither Tenant nor any of its officers, directors, shareholders, partners, members or affiliates is or will be an entity or person: (a) that is listed in the annex to, or is otherwise subject to the provisions of, Executive Order 13224 issued on September 24, 2001 (“EO 13224”); (b) whose name appears on the United States Treasury Department’s Office of Foreign Assets Control (“OFAC”) most current list of “Specially Designated National and Blocked Persons” (which list may be published from time to time in various mediums including, but not limited to, the OFAC website, http:www.treas.gov/ofac/t11sdn.pdf); (c) who commits, threatens to commit or supports “terrorism,” as that term is defined in EO 13224; or (d) who is otherwise affiliated with any entity or person listed above.

17. Time of the Essence. Time is of the essence with respect to Tenant’s execution and delivery to Landlord of this Amendment. If Tenant fails to execute and deliver a signed copy of this Amendment to Landlord by 5:00 p.m. (in the city in which the Leased Premises is located) on June 30, 2014, this Amendment shall be deemed null and void and shall have no force or effect, unless otherwise agreed in writing by Landlord. Landlord’s acceptance, execution and return of this Amendment shall constitute Landlord’s agreement to waive Tenant’s failure to meet such deadline.

18. Miscellaneous. This Amendment shall become effective only upon full execution and delivery of this Amendment by Landlord and Tenant. This Amendment contains the parties’ entire agreement regarding the subject matter covered by this Amendment, and supersedes all prior correspondence, negotiations, and agreements, if any, whether oral or written, between the parties concerning such subject matter. There are no contemporaneous oral agreements, and there are no representations or warranties between the parties not contained in this Amendment on which the parties have relied. Except as modified by this Amendment, the terms and provisions of the Lease shall remain in full force and effect, and the Lease, as modified by this Amendment, shall be binding upon and shall inure to the benefit of the parties hereto, their successors and permitted assigns.

[Signatures to follow]

-5-

LANDLORD AND TENANT enter into this Amendment as of the Effective Date specified below Landlord’s signature.

| LANDLORD: | ||

| LCFRE DURHAM KEYSTONE TECHNOLOGY PARK, L.P., a Delaware limited partnership | ||

| By: LCFRE Durham Keystone Technology Park GP, LLC, a Delaware limited liability company, its general partner | ||

| By: | /s/ Thomas P. Patterson | |

| Name: | Thomas P. Patterson | |

| Title: | Senior Vice President | |

| Effective Date: June 12, 2014 | ||

| TENANT: | ||

| TRANSENTERIX, INC., a Delaware corporation | ||

| By: |

/s/ Todd M. Pope | |

| Name: | Todd M. Pope | |

| Title: | CEO | |

-6-

EXHIBIT A

WORK LETTER

This Work Letter is attached as an Exhibit to that certain Second Amendment to Lease Agreement (the “Amendment”) between LCFRE DURHAM KEYSTONE TECHNOLOGY PARK, L.P., as Landlord, and TRANSENTERIX, INC., as Tenant, that amends that certain Lease Agreement dated December 11, 2009 (as amended, the “Lease”) and relating to the lease by Landlord to Tenant of that certain Leased Premises. Unless otherwise specified, all capitalized terms used in this Work Letter shall have the same meanings as in the Lease as amended by the Amendment.

1. Construction. Tenant agrees to construct leasehold improvements (the “Tenant Work”) in a good and workmanlike manner in and upon the Leased Premises, at Tenant’s sole cost and expense, in accordance with the following provisions. Tenant shall submit to Landlord for Landlord’s approval complete plans and specifications for the construction of the Tenant Work (“Tenant’s Plans”). Within ten (10) business days after receipt of Tenant’s Plans, Landlord shall review and either approve or disapprove Tenant’s Plans. If Landlord disapproves Tenant’s Plans, or any portion thereof, Landlord shall notify Tenant thereof and of the revisions Landlord requires before Landlord will approve Tenant’s Plans. Within ten (10) business days after Landlord’s notice, Tenant shall submit to Landlord, for Landlord’s review and approval, plans and specifications incorporating the required revisions. The final plans and specifications approved by Landlord are hereinafter referred to as the “Approved Construction Documents”. Tenant will engage experienced, licensed contractors, architects, engineers and other consultants, approved by Landlord in its reasonable discretion, to construct the Tenant Work and will require in the applicable contracts that such parties (a) carry insurance in such amounts and types of coverages as are reasonably required by Landlord, and (b) design and construct the Tenant Work in a good and workmanlike manner and in compliance with all laws. Unless otherwise agreed to in writing by Landlord and Tenant, all work involved in the construction and installation of the Tenant Work shall be carried out by Tenant’s contractor under the sole direction of Tenant, in compliance with all Building rules and regulations and in such a manner so as not to unreasonably interfere with or disturb the operations, business, use and enjoyment of the Project by other tenants in the Building or the structural calculations for imposed loads. Tenant shall obtain from its contractors and provide to Landlord a list of all subcontractors providing labor or materials in connection with any portion of the Tenant Work prior to commencement of the Tenant Work. Tenant warrants that the design, construction and installation of the Tenant Work shall conform to the requirements of all applicable laws, including building, plumbing and electrical codes and parameters, and the requirements of any authority having jurisdiction over, or with respect to, such Tenant Work.

2. Costs. Subject to the terms and conditions of this Section 2, Landlord will provide Tenant with an allowance (the “Reimbursement Allowance”) to be applied towards the cost of constructing the Tenant Work.

Exhibit A - i

(A) Landlord’s obligation to reimburse Tenant for Tenant’s construction of the Tenant Work shall be: (i) limited to actual costs incurred by Tenant in its construction of the Tenant Work; (ii) limited to an amount up to, but not exceeding, $5.50 multiplied by the square footage of the Leased Premises; and (iii) conditioned upon Landlord’s receipt of written notice (which notice shall be accompanied by invoices and documentation set forth below) from Tenant that the Tenant Work covered by such submitted invoices has been completed and accepted by Tenant. The cost of all (a) space planning, design, consulting or review services, including the cost of engineering and architectural services, and construction drawings, (b) materials and labor, and (c) other reasonable costs of construction shall all be included in the cost of the Tenant Work and may be paid out of the Reimbursement Allowance, to the extent sufficient funds are available for such purpose. Up to thirty percent (30%) of the Reimbursement Allowance may be used towards Tenant’s soft costs for the Tenant Work including furniture, fixtures and equipment or moving expenses. Any reimbursement obligation of Landlord under this Work Letter shall be applied solely to the purposes specified above, as allocated, no later than December 31, 2015, or be forfeited with no further obligation on the part of Landlord. Notwithstanding the preceding sentence, Tennant shall submit its request for reimbursement of any Tenant Work that is performed from the Effective Date through December 31, 2014 no later than January 31, 2015, or with respect to such Tenant Work for calendar year 2014, be forfeited with no further obligation on the part of Landlord.

(B) Landlord shall pay installments of the Reimbursement Allowance to Tenant within forty-five (45) days following Landlord’s receipt of (i) third-party invoices for costs incurred by Tenant in constructing the Tenant Work; (ii) evidence that Tenant has paid the invoices for such costs; and (iii) interim or final lien waivers, as applicable, from any contractor or supplier who has constructed or supplied materials for the Tenant Work. If the costs incurred by Tenant in constructing the Tenant Work exceed the Reimbursement Allowance, then Tenant shall pay all such excess costs and Tenant agrees to keep the Leased Premises and the Project free from any liens arising out of the non-payment of such costs.

(C) All installations and improvements now or hereafter placed in the Leased Premises other than building standard improvements shall be for Tenant’s account and at Tenant’s cost. Tenant shall pay ad valorem taxes and increased insurance thereon or attributable thereto, which cost shall be payable by Tenant to Landlord as additional Rent within 30 days after receipt of an invoice therefor. Tenant’s failure to pay such cost shall constitute an event of default under the Lease.

3. ADA Compliance. Tenant shall, at its expense, be responsible for ADA compliance in the Leased Premises, including restrooms on any floor now or hereafter leased or occupied in its entirety by Tenant, its Affiliates or transferees. Landlord shall not be responsible for determining whether Tenant is a public accommodation under ADA or whether the Approved Construction Documents comply with ADA requirements. Such determinations, if desired by Tenant, shall be the sole responsibility of Tenant. Landlord’s approval of the Approved Construction Documents shall not be deemed a statement of compliance with applicable Laws, nor of the accuracy, adequacy, appropriateness, functionality or quality of the improvements to be made according to the Approved Construction Documents.

Exhibit A - ii

4. Landlord’s Oversight and Coordination. Construction of the Tenant Work shall be subject to oversight and coordination by Landlord, but such oversight and coordination shall not subject Landlord to any liability to Tenant, Tenant’s contractors or any other person. Landlord has the right to inspect construction of the Tenant Work from time to time upon reasonable notice. Within ten (10) days following the date of invoice, Tenant shall, for supervision and administration of the construction and installation of the Landlord Work, pay Landlord a construction management fee equal to five (5%) of the aggregate contract price for the Tenant Work, which may be paid from the unused portion of the Reimbursement Allowance (if any). Tenant’s failure to pay such construction management fee when due shall constitute an event of default under the Lease. Notwithstanding the foregoing, Landlord shall not charge a separate construction management fee if that Tenant hires a third party construction manager to manage Tenant’s construction of the Tenant Work.

5. Assumption of Risk and Waiver. Tenant hereby assumes any and all risks involved with respect to the Tenant Work and hereby releases and discharges all Landlord parties from any and all liability or loss, damage or injury suffered or incurred by Tenant or third parties in any way arising out of or in connection with the Tenant Work.

Exhibit A - iii

RIDER NO. 1

RIGHT OF FIRST OFFER

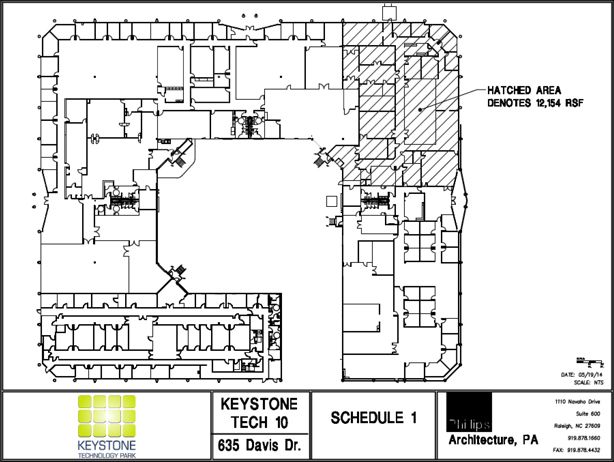

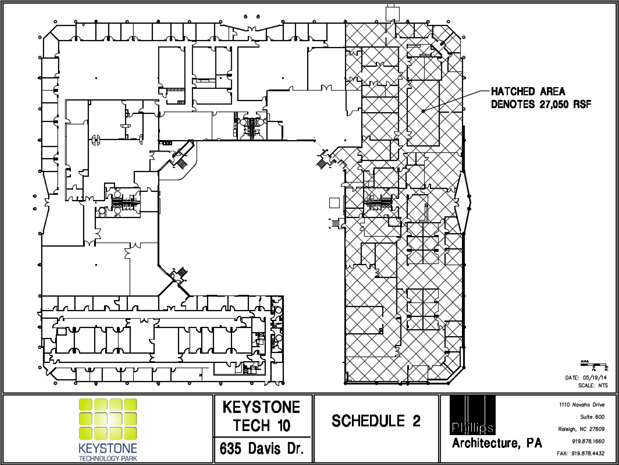

1. Right of First Offer. Subject to the terms and conditions of this Rider No. 1, so long as twenty-four months remain in the First Extension Period or in any exercised renewal term, Tenant shall have an one-time right of first offer (this “Right of First Offer”) to expand the Leased Premises to include, at Tenant’s election, either (i) approximately 12,154 square feet space located on the 1st floor of the Building as shown on the attached Schedule 1, or (ii) approximately 27,050 square feet space located on the 1st floor of the Building as shown on the attached Schedule 2 (the “ROFO Space”), at such time as such space becomes Available (as defined below) for direct lease to a new tenant (whether or not a bona fide offer has been made); provided no uncured default exists under the Lease (and no condition exists which, with the passage of time and/or giving of notice, would be a default under the Lease) and Tenant remains in occupancy of the entire Leased Premises. Notwithstanding the foregoing, if Landlord is involved in lease discussions with a third party tenant regarding the lease of greater than 12,154 square feet of space, then the term “ROFO Space” shall mean only that ROFO Space shown on Schedule 2. The ROFO Space shall be deemed “Available” at such time as Landlord decides to offer the ROFO Space for lease and such space is no longer any of the following: (i) leased or occupied; (ii) assigned or subleased by the then-current tenant of the space; (iii) re-leased by the then-current tenant of the space by renewal, extension or renegotiation (whether agreed to prior to or after the Effective Date); or (iv) subject to an expansion option, right of first refusal, preferential right or similar obligation existing under any other tenant leases for the Building as of the Effective Date.

2. Acceptance. Prior to leasing the ROFO Space to a new tenant, Landlord shall first offer such space in writing to Tenant specifying the amount and location of such space, the anticipated date of tender of possession, the rental rate, and other applicable terms (the “ROFO Notice”). Tenant shall have five (5) business days within which to accept or reject such offer. Landlord may consider, in Landlord’s sole and absolute discretion, any counter offer received from Tenant during such five (5) business day acceptance or rejection period. If Tenant accepts Landlord’s offer, Tenant shall, within fifteen (15) days after Landlord’s written request, execute and return a lease amendment adding the ROFO Space to the Leased Premises for all purposes under the Lease (including any extensions or renewals) and confirming the Base Rent and other applicable terms specified in the ROFO Notice. Such lease amendment may, if applicable, contain a construction agreement using Landlord’s then-current form setting forth the schedule and other terms and obligations of the parties regarding the construction of any leasehold improvements in the ROFO Space. If Tenant (a) rejects such offer or (b) fails timely to (i) accept such offer or (ii) execute and return the required lease amendment, then this Right of First Offer shall lapse and be of no further force and effect. In such event, Landlord shall be relieved of any future obligations hereunder and may thereafter lease all or part of the ROFO Space to any party without further notice or obligation to Tenant.

3. Tender of Possession. The ROFO Space shall be leased for the period commencing upon Landlord’s tender of possession of the ROFO Space in accordance with Landlord’s offer

Rider No. 1 - i

and this Rider (the “ROFO Space Commencement Date”) and continuing through the expiration or earlier termination of the Term of the Lease, as it may be extended or renewed. Landlord shall not be liable for any delay or failure to tender possession of the ROFO Space by the anticipated tender date for any reason, including by reason of any holdover tenant or occupant, nor shall such failure invalidate the Lease or extend the Term of the Lease.

4. Condition of Premises. The ROFO Space shall be tendered in an “as-is” condition. However, all leasehold improvements shall be constructed in the ROFO Space in accordance with the construction agreement (if any) attached to the applicable lease amendment. Any allowances shall be prorated for any delays in the ROFO Space Commencement Date, taking into account the economic assumptions underlying the terms in the ROFO Notice.

5. Personal. This Right of First Offer is personal to TransEnterix, Inc. and shall not be assignable to any other person or entity. Any assignment of the Lease or the subletting by Tenant of all or any portion of the Leased Premises shall terminate this Right of First Offer. Any assignment in violation of this paragraph is void and of no force or effect.

Rider No. 1 - ii

Schedule 1 to Rider No. 1

Schedule 1 to Rider No. 1 - i

Schedule 2 to Rider No. 2

Schedule 2 to Rider No. 1 - i