Attached files

| file | filename |

|---|---|

| EX-99.2 - PRESS RELEASE - BOB EVANS FARMS INC | d771855dex992.htm |

| 8-K - CURRENT REPORT - BOB EVANS FARMS INC | d771855d8k.htm |

Setting

the Record Straight

August 2014

Exhibit 99.1 |

Important Additional Information

2

Bob Evans Farms Inc. (the “Company”), its directors and certain of its

executive officers are participants in the solicitation of proxies in

connection with the Company's 2014 Annual Meeting of Stockholders. The Company has filed a definitive proxy statement and

form of WHITE proxy card with the U.S. Securities and Exchange Commission (the

“SEC”) in connection with such solicitation of proxies from the

Company's stockholders. WE URGE INVESTORS TO READ THE DEFINITIVE PROXY STATEMENT

(INCLUDING ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACCOMPANYING WHITE PROXY

CARD CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY CONTAIN IMPORTANT

INFORMATION. Information regarding the names of the Company's directors and

executive officers and their respective interests in the Company by

security

holdings

or

otherwise,

is

set

forth

in

the

Company's

proxy

statement

for

its

2014

Annual

Meeting

of

Stockholders,

filed

with

the SEC on July 11, 2014. Stockholders will be able to obtain, free of charge,

copies of the definitive proxy statement (and amendments or supplements

thereto) and accompanying WHITE proxy card, and other documents filed with the SEC at the SEC's

website at www.sec.gov. In addition, copies will also be available at no charge at

the Investors section of the Company's website at

http://investors.bobevans.com/sec.cfm.

This document contains quotes and excerpts from certain previously published

material. Consent of the author and publication has not been sought or

obtained to use the material as proxy soliciting material. |

Executive Summary: Consider the Facts

3

The Bob Evans Board believes that:

o

We have transformed the business while returning over $800 million to shareholders

since FY07 (including over $250 million in FY14)

o

We have a clear plan for continued, sustainable value creation as we emerge from

this investment and transformation phase

o

Sandell’s

“plan”

of

financial

engineering

has

shifted

a

number

of

times

since

he

entered

the stock last year

o

Sandell’s agenda is not in the best interests of the Company or its

stockholders; it is a misleading attempt to generate short-sighted

profit with no guarantees o

Bob Evans’

current leadership is the right team to lead the Company and maximize

stockholder value

Vote

for

Bob

Evans’

Nominees

on

the

WHITE

Card

Our proposed Board structure would result in an open-minded Board with diverse, relevant

perspectives and a range of tenure and would include two Sandell nominees

|

Sandell Remains Focused on a Flawed Agenda

for Short-Sighted Financial Engineering

4

After pushing specific financial engineering for nearly a year, Sandell suddenly

seeks to distance himself from his own economic agenda by scrubbing from his

latest presentation any mention of the flawed plans he has aggressively

insisted the Company immediately implement Sandell now claims that the

upcoming Annual Meeting “is NOT about any specific transaction”.

Notwithstanding this recent claim, stockholders should consider that:

o

As

recently

as

June

2014,

in

response

to

Bob

Evans’

offers

to

settle

the

proxy

contest,

Sandell

showed

his

true

colors

by

demanding

that

the

Company

implement

1)

a

sale

or

spin-off

of

BEF

by

the

end

of

CY14,

2)

a

sale-leaseback

of

nearly

half

of

the

Company’s

real

estate

within

90

days

and

3)

a

$350

million

share

repurchase

within

90

days

o

In

an

interview

in

July

2014,

Sandell

asserted

that

his

nominees,

if

elected

“will

take

immediate

steps

to

implement

a

comprehensive

plan

that

contemplates

operational,

financial

and

strategic

changes”

¹

While the Bob Evans Board welcomes ideas from stockholders, customers and employees,

Sandell’s hastily prepared operational suggestions are of limited utility

since they either lack substance or already are being implemented by the

Company THOUGH SANDELL TRIES TO DOWNPLAY HIS SHORT-SIGHTED AGENDA OF

FINANCIAL ENGINEERING, THE BOARD URGES STOCKHOLDERS NOT TO BE MISLED

(1)

The Activist Report, July 2014. |

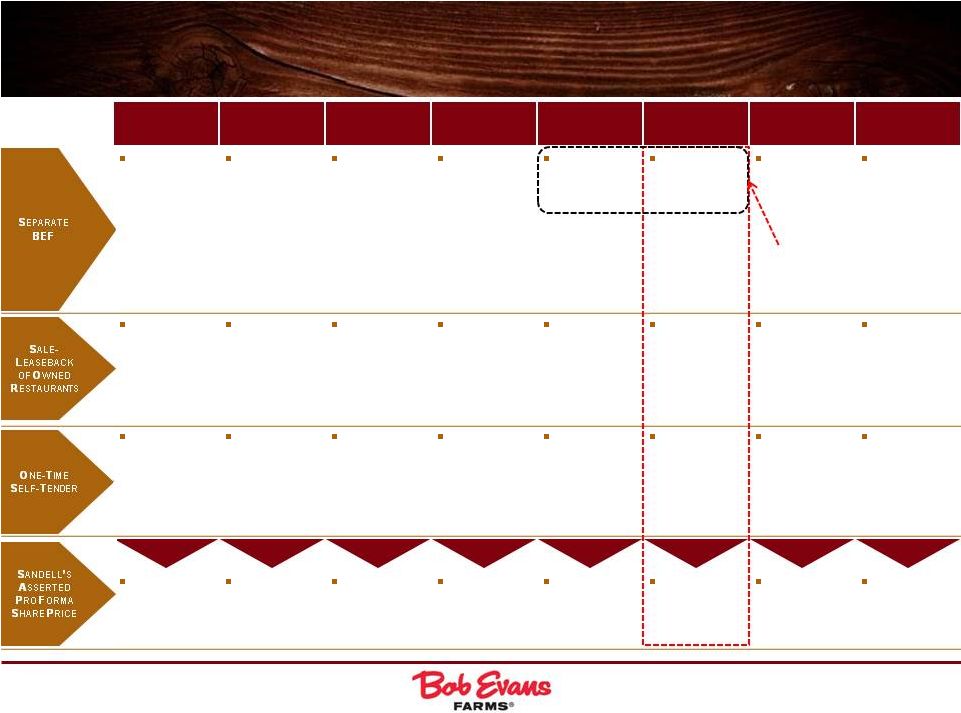

5

Sandell’s Shifting Demands for Financial

Engineering

AUGUST 5, 2013

SEPTEMBER 24, 2013

NOVEMBER 11, 2013

DECEMBER 9, 2013

APRIL 24, 2014

JUNE 10, 2014

JULY 2, 2014

JULY 28, 2014

Quickly reverted

back to financial

engineering;

subsequently

cloaked by more

vague generalities

Spin-off at 10x+

EBITDA or sell for

low-teens multiple

of EBITDA

Spin-off, or sell

for 11x FY14

EBITDA or

$558mm

Sell, or sell 19.9%

via IPO followed

by spin-off or

split-off, or split-

off at 11x FY15

EBITDA and

exchange for Bob

Evans shares at

$63/share

Sell 19.9% via

IPO followed by

spin-off or split-off

of remaining

80.1%, or split-off

at 10.5x FY15

EBITDA and

exchange for Bob

Evans shares at

$60/share and

retire 10mm

shares

Analyze /

implement

optimal structure

and evaluate

overtures

Sale or spin-off of

BEF by end of

CY14

Explore /

implement

Strategic review

100% for

~$720mm

100% for

~$720mm

~56% for

~$400mm

~56% for

~$400mm

50% for

~$450mm

43% for

undisclosed

amount within 90

days

Explore /

implement

“Top down”

analysis

Use after-tax

proceeds of

~$1.0bn from sale

of BEF and sale-

leaseback to

repurchase

~19mm shares at

$55/share

Use ~$800mm of

after-tax proceeds

from sale of BEF

and sale-

leaseback to

repurchase

~14mm shares at

$58/share

Use proceeds of

$400mm from

sale-leaseback

and $175mm of

incremental debt

to implement

$575mm self-

tender at

$63/share

Use proceeds of

~$400mm from

sale-leaseback

and $175mm of

incremental debt

to repurchase

~9.6mm shares at

$60/share

Use proceeds of

~$450mm from

sale-leaseback to

repurchase

~9.1mm shares at

$50/share

Use proceeds

from sale-

leaseback to

repurchase

$350mm of stock

within 90 days

Explore /

implement

??

>$72

$73-$84

$80-$90,

depending on

assumptions

$81

~$76 -

~$91

NA

NA

NA |

Sandell’s Misleading Claims/

Overstated

Criticisms

¹

The Facts

Sandell claims that Bob Evans’

stockholders have “suffered

years of woeful under-

performance”

Sandell’s

own

analysis

illustrates

that

the

Company

outperformed

the

S&P

500

by

over

10%

over

the

last

10

years

and

performed

generally

in-line

with

his

“Family

and

Casual

Dining”

peers

(Bob

Evans meaningfully outperformed RRGB & CAKE, performed in-line with BJRI

& EAT and underperformed DRI & CBRL) over the same time period

In fact, Sandell’s own relative performance graphs for each of the 1-year,

3-year, 5-year and 10-year periods illustrate that Bob Evans

performed generally in-line with Sandell’s peer set until late 2013

Sandell claims that the Company

“cherry-picked”

dates to measure

shareholder return

Measuring

performance

since

Steve

Davis

began

as

CEO

in

May

2006

is

the

most

relevant

time

period to evaluate the Board and management

From

May

1,

2006

to

July

31,

2014,

the

Company

has

meaningfully

outperformed

Sandell’s

own

“Family

and

Casual

Dining”

peer

group

by

~25%

Sandell NOW claims that DIN,

DENN and RT are not comparable

to Bob Evans

As recently as December 9, 2013, Sandell expressly included DIN and DENN in

Sandell's "peer group"

Each of DIN, DENN and RT are widely considered to be notable family/casual

competitors to Bob Evans

If

DIN,

DENN

and

RT

were

justly

included

in

Sandell’s

“peer

group”,

Bob

Evans’

outperformance

from May 1, 2006 to July 31, 2014 would be even more pronounced (~40%)

6

(1)

Sandell presentation, filed with the SEC August 4, 2014.

Sandell Continues to Make Misleading

Statements and Overstated Claims

A few of his misleading statements and overstated claims are highlighted below

|

Sandell’s Misleading Claims/

Overstated Criticisms

The Facts

Sandell claims that Bob Evans’

“exposure to the weather was not

unique”

Bob

Evans

has

the

most

Midwest

exposure

of

any

sizable

family

or

casual

dining

chain

Analysts

appreciate

this

fact:

“CBRL

only

has

~21%

of

units

in

Midwest,

vs.

~61%

for

BOBE,

who

revealed

stores

outside

the

Midwest

had

positive

comps

(e.g.

Florida).”

–

Oppenheimer,

January

22, 2014

Sandell claims that “All eight of

Sandell’s nominees are

completely independent of

Sandell Asset Management”

Each

of

Sandell's

nominees

is

contractually

prohibited

from

publicly

expressing

any

opinion

on

Bob

Evans,

including

on

Sandell’s

economic

proposals,

without

Sandell's

prior

permission

None of Sandell’s nominees agreed to the Board’s good-faith effort to

meet to evaluate their candidacy in accordance with corporate governance best

practices Sandell mocks Bob Evans’

Broasted Chicken initiative, while

claiming that Sandell sees many

“low hanging fruit”

opportunities

Bob

Evans

is

committed

to

innovation

and

systematic

testing

and

evaluation

of

numerous

initiatives

to drive same-store sales

As

a

specific

example,

Broasted

Chicken

is

an

exclusive

(10

year

term),

trademarked

cooking

platform

that

will

meaningfully

differentiate

the

Company

from

its

family

dining

peers,

and

has

delivered significant sales increases in our test markets

Sandell

claims

that

Mimi’s

Café

is

an example of “failed Board

stewardship of the highest order”

Sandell

repeatedly

refers

to

Mimi’s

Cafe,

a

business

that

was

acquired

in

2004

and

was

sold

months

before

Sandell

began

to

buy

Bob

Evans’

stock

Steve

Davis

was

appointed

CEO

and

seven

of

the

Company’s

10

nominees

joined

the

Board

after

Mimi’s was acquired

Following the Board's decision to divest Mimi’s, the Company's stock gained

~20% in value between announcement to explore strategic alternatives for

Mimi’s (11/19/12) and the announcement of the sale agreement

(1/28/13) 7

(1)

Sandell presentation, filed with the SEC August 4, 2014.

Sandell Continues to Make Misleading

Statements and Overstated Claims (cont’d)

1 |

Sandell’s Misleading Claims/

Overstated Criticisms

The Facts

Sandell claims that average

director tenure is in excess of 14

years

Sandell presents old, stale and inaccurate portraits of your Board's composition; he

overstates current director tenure by a factor of ~80%, criticizes retired

directors and pretends the three newest independent directors do not

exist Sandell’s calculations of director tenure include Gordon Gee, who

has not been a director for months, and Larry Corbin and Robert Lucas, who

are not standing for reelection, but curiously ignores

Kathy

Lane,

Larry

McWilliams

and

Kevin

Sheehan,

who

each

joined

the

Board

in

April

2014

and are standing for reelection

Bob

Evans’

nominees

would

have

an

average

tenure

of

less

than

eight

years,

which

is

below

the

average tenure of 8.6 years for S&P boards

Sandell claims that Bob Evans’

Board is not committed to

“transparency and fresh,

independent thinking”

Bob Evans makes a practice of being available to investors, engaging in regular and

frequent communication and participating at most of the major consumer and

restaurant conferences As a result of our comprehensive investor outreach and

road shows, we have been able to increase research coverage from one to six

analysts over the past eight years The Board remains committed to maintaining

a dynamic, independent and highly qualified Board Bob Evans has attempted to

engage in constructive dialogue with Sandell on numerous occasions Bob Evans

is and has been willing to settle the proxy contest with the addition of an appropriate

number of open-minded, independent directors

Sandell

has

rebuffed

several

attempts

by

the

Board

to

settle

the

proxy

contest

8

(1)

Sandell presentation, filed with the SEC August 4, 2014.

Sandell Continues to Make Misleading

Statements and Overstated Claims (cont’d)

1 |

9

Sandell Manipulates the Data

to Try to Justify His Flawed Agenda

Sandell

has

repeatedly

shifted

his

“peer

group”

to

blatantly

exclude

underperforming

peers

o

Sandell’s

three

presentations

–

filed

with

the

SEC

on

September

24,

2013,

December

9,

2013

and

April

24,

2014

–

compare

Bob

Evans’

stock

performance

against

three

different,

cherry-picked

peer

groups

¹

In

Sandell’s

July

2014

presentation,

Sandell

omits

Denny’s,

DineEquity

and

Ruby

Tuesday’s

from

his

latest

set

of

Bob

Evans’

peers. A

reasonable list of family and casual dining peers would be expected to include each

of these three companies o

Indeed,

Sandell’s

December

2013

presentation

stated

that

Denny’s

and

DineEquity

are

two

of

Bob

Evans’

“more

relevant

family

dining

peers”

The

fact

remains

that

–

whether

these

three

missing

peers

are

included

in

the

Sandell-constructed

peer

group

or

excluded

–

Bob

Evans

has

consistently

outperformed

Sandell’s

selected

peer

group

since

Steve

Davis

became

CEO

in

May

2006

through

July

31,

2014

Sandell Family & Casual

Dining Peers: +77%

Proxy Peers: +136%

Sandell Peer Group Plus

DENN, DIN and RT: +61%

Sandell’s

ever-shifting

economic

demands

and

curiously

“evolving”

peer

groups

aside,

Bob

Evans

is

focused

on

enhancing

performance

and

executing

on

our

value-creating

initiatives

under

the

leadership

of

an

independent,

open-minded

and

refreshed

Board

Sandell Peer Group Plus

DENN, DIN and RT

Proxy Peers

Sandell Family & Casual Dining

Peers

+102%

Source: FactSet as of 7/31/14. (1)

Sandell’s presentations, filed on Schedule 14A with the SEC on September 24, 2013, December 9, 2013 and April 24, 2014, compare the Company’s stock performance against as few as three and as many

as eight different companies, and each of the following has been both excluded at least once and

included at least once: BJRI, BLMN, CAKE, DENN, DIN, DRI, EAT, RRGB, TXRH. |

Sandell’s Misleading Claims/

Overstated Criticisms

The Facts

On May 30, 2014, Sandell claimed

that “at no point in our almost

year-long dialogue with the

Company has the Board shown

the slightest inclination toward

reaching an amicable resolution

with us”

In January 2013, the Board attempted to resolve the pending contest, and avoid the

significant time and expense of a proxy fight, by offering Sandell the

opportunity to consult with the Board in the identification and selection of

new independent candidates to be added to the Board prior to the Annual

Meeting. Sandell refused this offer Following Sandell’s nominations, the

Board publicly announced on April 28, 2014 that it would consider

the

candidates

in

connection

with

the

Board’s

nominations

for

election

–

when

Bob

Evans then sought to arrange meetings between Sandell’s nominees in a good

faith attempt to evaluate their candidacy, Sandell issued a press release

alleging that Bob Evans was attempting to “subvert”

the election process

On May 28, 2014, Sandell claimed

that the Board’s addition of three

new, highly-qualified and

independent directors to the

Board was a “knee-jerk

reactionary step”

in response to

Sandell’s nominations

In late 2012/early 2013, as part of our regular process, we reviewed and updated our

skills matrix with an independent search firm to identify board expertise

necessary to continue driving stockholder value

Subsequently, we instructed the independent search firm to seek director candidates

with specific skills and expertise identified as desirable as a result of the

skills matrix analysis, and commenced evaluating and interviewing candidates

As a result of this process, we added three highly qualified directors to the

Board with invaluable experience in hospitality and entertainment, packaged

foods and digital marketing/informational technology

On April 24, 2014, Sandell

claimed that the Board amended

the Company’s Bylaws to

enhance stockholder voice “only

after”

Sandell filed a lawsuit

The corporate governance changes announced by the Board in January to further

enfranchise stockholders went well beyond the changes sought by Sandell in

its lawsuit 10

Sandell has Misled Investors From the Beginning

Throughout his year-long campaign, Sandell has regularly distorted the truth,

overstated his claims and made unfounded allegations, a few of which are

highlighted below |

11

Bob Evans’

Proposal for a Fresh,

Independent Board

11

of

12

are

independent

(all

but

CEO),

at

least

six

are

current

or

former

CEOs

and

at

least

eight

have other public company board service

A majority of the independent directors would have been added within the last two

years Mary Kay Haben

Former President-North America of the Wm. Wrigley Jr. Company;

Former Group Vice President and Managing Director North America of

the Wm. Wrigley Jr. Company; Former Executive of Kraft Foods Inc.

Board Member of Equity Residential and The Hershey Company

Kathleen S. Lane

Former EVP and CIO of TJX Companies, Inc.; Former Group CIO at

National Grid Plc.; Former SVP and CIO of Gillette Company (Procter

& Gamble)

Board Member of Earthlink Holdings Corp.

Larry S. McWilliams

Co-CEO of Compass Marketing; Former CEO at Keystone Foods

LLC; Former SVP at Campbell Soup Company

Board Member of Armstrong World Industries

Kevin M. Sheehan

President and CEO of Norwegian Cruise Line; Former CFO of

Norwegian Cruise Line; Former CFO of Cendant Corporation

Board Member of Norwegian Cruise Line and New Media Investment

Group, Inc.

Sandell Nominee

Sandell Nominee

Steven A. Davis, Chairman and CEO

Former President, Long John Silver’s and A&W All-American Food

Restaurants (Yum! Brands); Former SVP, Concept Development,

Pizza Hut, Inc. (Yum! Brands)

Board Member of Walgreen Co. and Marathon Petroleum Corp.

Michael J. Gasser, Lead Independent Director

Executive Chairman of the Board of Greif Inc.; Former CEO and

Chairman of the Board of Greif, Inc.

Board Member of Greif, Inc.

E.W. (Bill) Ingram III

CEO of White Castle System, Inc.; Former President of

White Castle System, Inc.

Cheryl L. Krueger

CEO of Krueger + Co., LLC; Former President and CEO and

Founder of Cheryl & Co., Inc.

Paul S. Williams

Managing Director, Major, Lindsey and Africa; Former Chief Legal

Officer and Executive Vice President, Cardinal Health, Inc.

Board Member of State Auto Financial Corp. and Compass

Minerals International, Inc.

Eileen A. Mallesch

Former SVP and CFO at Nationwide Property & Casualty Insurance;

Former SVP and CFO at Genworth Life Insurance; Former VP and

CFO at General Electric Financial Employer Services Group

Board Member of State Auto Financial Corp.

–

Director since 1993

–

Director since 1997

–

Director since 1998

–

Director since 2006

–

Director since 2007

–

Director since 2008

–

Director since 2012

–

Director since 2014

–

Director since 2014

–

Director since 2014

Note:

Board composition following 2014 annual

meeting of stockholders assuming all ten Bob Evans nominees and two of Sandell’s nominees are elected. Since the Board has nominated a slate

of ten directors for the available twelve seats at the annual meeting, the Board expects that at least

two nominees who were not nominated by the Board will be elected at the annual meeting. Selected

experience noted; please refer to the Bob Evans' investor presentation, filed on Schedule 14A with the SEC on July 31, 2014 and Bob Evans’ proxy statement for its 2014 Annual Meeting

of Stockholders, filed with the SEC on July 11, 2014, for additional background.

|

The

Choice is Clear 12

Vote

for

Bob

Evans’

Nominees

on

the

WHITE

Card

Continue to drive profitable growth of existing

businesses

Continue to employ balanced approach to

investment and return of meaningful capital to

stockholders

Regularly and proactively review strategy;

continually engage with stockholders

Divest Bob Evans Foods now, before reaping

benefits of our transformational investments

Sell real estate, losing strategic control of assets

while burdening Bob Evans with significant and

escalating annual rents and increased leverage

Rapidly effect large leveraged share repurchase

Sustainable, Disciplined,

Responsible, Open-Minded

Unsustainable,

Not in the Best Interest of All

Stockholders

The Board structure proposed by Bob Evans would result in a fully independent Board,

except for the CEO; a majority of the independent directors would be new to

the Board since 2012; and 5 of 11 independent directors would be new to the

Board this year, including two Sandell nominees Stockholders have a clear choice between what we

believe are two very different approaches for Bob Evans’ future:

|