Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Thompson Creek Metals Co Inc. | a8k2q2014earnings.htm |

| EX-99.1 - EARNINGS RELEASE - Thompson Creek Metals Co Inc. | pressrelease2014q2.htm |

NYSE:TC TSX:TCM Second Quarter 2014 Financial Results Conference Call

2 Webcast Information Webcast: This Webcast can be accessed on the Thompson Creek Metals Company website under the Events Section: www.thompsoncreekmetals.com Q&A Instructions: If you would like to ask a question, please press star 1 on your telephone keypad. If you’re using a speakerphone, please make sure your mute function is turned off to allow your signal to reach the operator.

3 Cautionary Statement This document contains ‘‘forward-looking statements’’ within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Act of 1934, as amended and applicable Canadian securities legislation, which are intended to be covered by the safe harbor created by those sections and other applicable laws. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "intend," "future," "opportunity," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar expressions. Our forward-looking statements may include, without limitation, statements with respect to: future financial or operating performance of the Company or its subsidiaries and its projects; the availability of, and terms and costs related to, future borrowings, debt repayment, and refinancing; future inventory, production, sales, cash costs, capital expenditures and exploration expenditures; future earnings and operating results; expected concentrate and recovery grades; estimates of mineral reserves and resources, including estimated mine life and annual production; projected timing to ramp-up to design capacity at Mt. Milligan Mine; the potential development of our development properties and future exploration at our operations; future concentrate shipment dates and sizes; future operating plans and goals; and future molybdenum, copper and gold prices. Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from future results expressed, projected or implied by those forward-looking statements. Important factors that could cause actual results and events to differ from those described in such forward-looking statements can be found in the section entitled ‘‘Risk Factors’’ in Thompson Creek’s Annual Report on Form 10-K for the year ended December 31, 2013, Quarterly Reports on Form 10-Q and other documents filed on EDGAR at www.sec.gov and on SEDAR at www.sedar.com. Although we have attempted to identify those material factors that could cause actual results or events to differ from those described in such forward-looking statements, there may be other factors, currently unknown to us or deemed immaterial at the present time, that could cause results or events to differ from those anticipated, estimated or intended. Many of these factors are beyond our ability to control or predict. Given these uncertainties, the reader is cautioned not to place undue reliance on our forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise, and investors should not assume that any lack of update to a previously issued forward-looking statement constitutes a reaffirmation of that statement.

4 Management in Attendance Jacques Perron Chief Executive Officer and Director Pam Saxton Executive Vice President and Chief Financial Officer Scott Shellhaas President and Chief Operating Officer Mark Wilson Executive Vice President and Chief Commercial Officer

5 Jacques Perron Chief Executive Officer and Director Second Quarter 2014 Overview

6 Q214 Highlights Improved safety performance Cash flow from operations of $51 million, revenue of $248 million, operating income of $57 million, net income of $62 million and adjusted non-GAAP net income of $22 million Positive net cash flow Continued progress at Mt. Milligan Achieved average daily mill throughput of 48,065 tonnes in June, with daily record of 63,970 tonnes on June 16 Completed three shipments and recorded four sales (one sale from Q1 shipment) Copper and gold sales contributed $119 million to total revenue Molybdenum business significantly contributed to cash flow from operations S&P increased Company’s corporate credit rating to B- from CCC+ Completed exchange offer for 7,206,862 units, or 86.4% of the tMEDS Issued 42,129,829 shares of common stock, compared to 38,829,852 shares which would have been issued on mandatory conversion on May 15, 2014 Extinguished $10.4 million of future cash principal and interest payments

7 Pam Saxton Executive Vice President and Chief Financial Officer Financial Review

8 Financial Summary | Q214 vs Q213 248 118 57 17 91 32 62 (19) 22 14 51 45 [millions of US$] Revenue Operating Income Net Income (Loss) Adjusted Net Income Operating Cash Flow 1 Please refer to Appendix for non-GAAP reconciliation. Q214 Q213 1 Non-GAAP EBITDA 1

9 Financial Summary | First Half 2014 vs First Half 2013 409 227 70 34 130 63 23 (18) 26 32 67 61 [millions of US$] Revenue Operating Income Net Income (Loss) Adjusted Net Income Operating Cash Flow 1 Please refer to Appendix for non-GAAP reconciliation. H1 2014 H1 2013 1 Non-GAAP EBITDA 1

10 Financial Summary Non-GAAP EBITDA and Operating Cash Flow1 91 39 (4) 8 32 31 [millions of US$] 51 16 (35) 20 45 15 Q214 Q114 Q413 Q313 Q213 Q113 Non-GAAP EBITDA Operating Cash Flow 1 Please refer to Appendix for non-GAAP reconciliation.

11 Q2 2014 First Half 2014 Cash Flow from Operations 50.7 66.9 Cash (used) in Investing Activities (27.9) (65.4) Cash (used) in Financing Activities (10.6) (19.6) Effect of Exchange Rate Changes on Cash 1.2 0.3 Increase (Decrease) in Cash and Cash Equivalents 13.4 (17.8) Cash and Cash Equivalents, beginning of period 202.7 233.9 Cash and Cash Equivalents, end of period 216.1 216.1 Summary of Statement of Cash Flows [millions of US$]

12 Updated 2014 Production and Cash Cost Guidance Updated 2014 Estimate Previous 2014 Estimate Mt. Milligan Copper and Gold 1 Concentrate production (000’s wet tonnes) (000’s dry tonnes) 135 – 150 125 – 140 135 – 150 125 – 140 Copper payable production (000’s lb) 65,000 – 75,000 65,000 – 75,000 Gold payable production (000’s oz) 185 – 195 165 – 175 Unit cash cost – By-product ($/payable lb copper production) 2,3 1.00 – 1.50 1.55 – 1.70 Molybdenum (000’s lb): 4 TC Mine 15,000 – 17,000 14,000 – 16,000 Endako Mine (75%) 9,000 – 10,000 10,000 – 12,000 Total molybdenum production (000’s lb) 24,000 – 27,000 24,000 – 28,000 Cash Cost ($/lb produced): TC Mine 4.50 – 5.25 4.75 – 5.75 Endako Mine 3 10.50 – 12.00 9.00 – 10.50 Total molybdenum cash cost ($/lb produced) 6.75 – 7.75 6.50 – 7.75 1 For Mt. Milligan guidance assumes that 100% of design capacity mill throughput and designed copper and gold recoveries are not achieved until year-end 2015. 2 Copper by-product unit cash cost is calculated using payable production, with an assumed gold price for the gold by-product of approximately $1,290 per ounce, which is then adjusted to take into account the contractual price of $435 per ounce under the Gold Stream Arrangement. See “Non-GAAP Financial Measures” for the definition and reconciliation of these non-GAAP measures. 3 Estimates for cash costs assume a foreign exchange rate of US$1.00 = C$1.05. 4 Molybdenum production pounds represented are molybdenum oxide and high performance molybdenum disulfide (“HPM”) from our share of production from the mines but exclude molybdenum processed from purchased product.

13 Updated 2014 Cash Capital Expenditure Guidance Updated 2014 Estimate1,2 Previous 2014 Estimate1,2 Mt. Milligan Permanent Operations Residence (millions C$) 25 20 Mt. Milligan Operations (millions C$) 35 30 Operations (millions US$, excludes Mt. Milligan) 5 10 TOTAL3 65 60 1 Cash capital expenditures guidance numbers are as of August 5, 2014. Canadian to US foreign exchange rate for 2014 assumes C$1.00 = US$1.05. 2 Plus or minus 10%. 3 Excludes approximately $22 million of accruals related to the Mt. Milligan Mine as of December 31, 2013, which will be paid in 2014.

14 Mark Wilson Executive Vice President and Chief Commercial Officer Sales Summary

15 Copper (Cu) and Gold (Au) Sales 1 Please refer to Appendix for non-GAAP reconciliation. 21.9 10.8 32.7 Q214 Q114 H114 Cu Sales (millions lbs) Average Realized Price1 (US$/lb) Q214 Q114 H114 51,983 Au Sales (oz) Average Realized Price1 (US$/oz) $3.20 $3.01 $3.14 Q214 Q114 H114 23,874 75,857 Q214 Q114 H114 $1,047 $1,025 $1,040

16 Molybdenum Sales by Quarter Full Year 2013 – 2Q14 Sales [US$ in millions] Mo Sales Volumes [millions of pounds] $126.2 $102.9 $97.7 $85.7 9.7 9.8 9.7 8.3 9.7 8.8 Avg Realized Mo Price/Lb. $112.7 $104.7 $13.03 $10.45 $10.11 $10.30 $11.60 Q214 Q114 Q413 Q313 Q213 Q113 $11.87

17 Scott Shellhaas President and Chief Operating Officer Operations Review

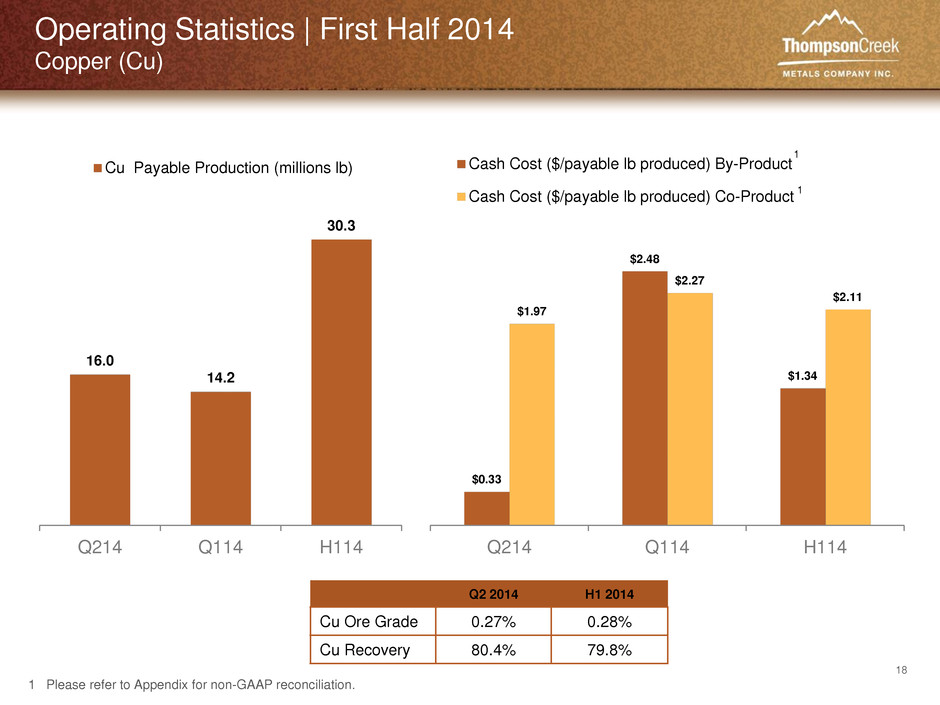

18 Operating Statistics | First Half 2014 Copper (Cu) 16.0 14.2 30.3 Q214 Q114 H114 Cu Payable Production (millions lb) $0.33 $2.48 $1.34 $1.97 $2.27 $2.11 Q214 Q114 H114 Cash Cost ($/payable lb produced) By-Product Cash Cost ($/payable lb produced) Co-Product 1 1 1 Please refer to Appendix for non-GAAP reconciliation. Q2 2014 H1 2014 Cu Ore Grade 0.27% 0.28% Cu Recovery 80.4% 79.8%

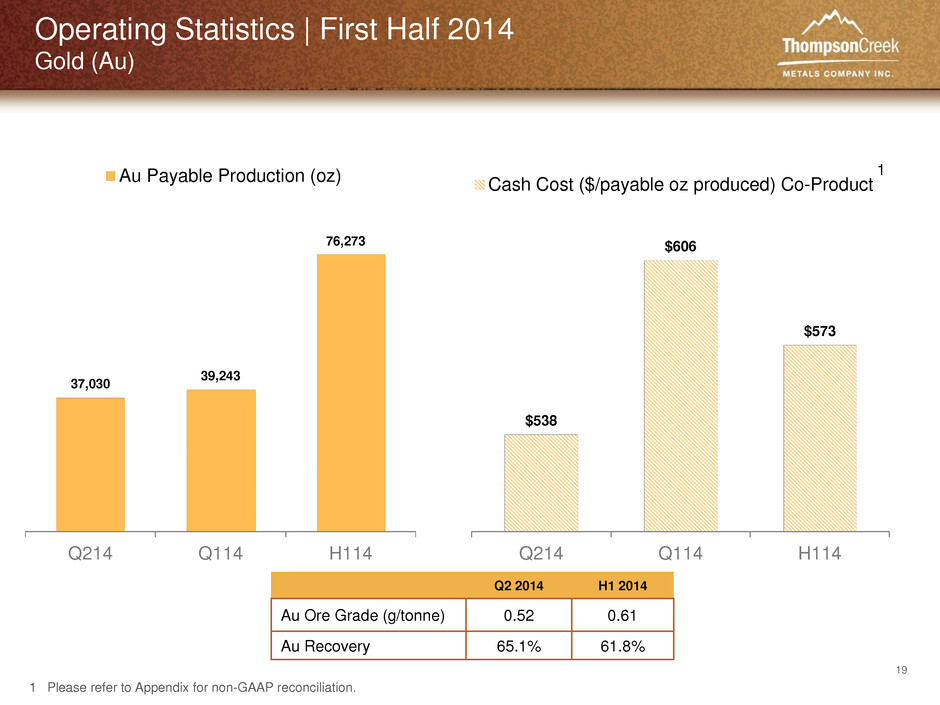

19 Operating Statistics | First Half 2014 Gold (Au) 37,030 39,243 76,273 Q214 Q114 H114 Au Payable Production (oz) $538 $606 $573 Q214 Q114 H114 Cash Cost ($/payable oz produced) Co-Product Q2 2014 H1 2014 Au Ore Grade (g/tonne) 0.52 0.61 Au Recovery 65.1% 61.8% 1 Please refer to Appendix for non-GAAP reconciliation. 1

20 Operating Statistics | Consolidated Molybdenum (Mo) Mines 7.5 15.4 6.5 14.2 $6.25 $5.99 $7.46 $6.62 1 Please refer to Appendix for non-GAAP reconciliation. Q214 Q213 H114 H113 Q214 Q213 H114 H113 Mo Production (millions lbs) Cash Costs1 (US$/lb)

21 Operating Statistics | Thompson Creek Mine Molybdenum (Mo) Mines 5.1 10.8 4.4 10.3 $3.97 $3.91 $5.33 $4.67 1 Please refer to Appendix for non-GAAP reconciliation. Q214 Q213 H114 H113 Q214 Q213 H114 H113 Mo Production (millions lbs) Cash Costs1 (US $/lb)

22 Operating Statistics | Endako Mine Molybdenum (Mo) Mines 2.4 4.6 2.1 3.9 $11.17 $10.87 $11.93 $11.85 1 Please refer to Appendix for non-GAAP reconciliation. Q214 Q213 H114 H113 Q214 Q213 H114 H113 Mo Production (75%) (millions lbs) Cash Costs1 (US $/lb)

23 Mt. Milligan Daily Mill Throughput 0 10,000 20,000 30,000 40,000 50,000 60,000 Start up Aug Month 1 Sep Month 2 Oct Month 3 Nov Month 4 Dec Month 5 Jan Month 6 Feb Month 7 Mar Month 8 Ap Month 9 May Month 10 Jun Da il y M il l T onne s P e r Da y Design tpd – 60,000 48,065

24 Mt. Milligan Hourly Mill Throughput 0 500 1,000 1,500 2,000 2,500 Start up Aug Month 1 Sep Month 2 Oct Month 3 Nov Month 4 Dec Month 5 Jan Month 6 Feb Month 7 Mar Month 8 Apr Month 9 May Month 10 Jun 2,193 Design tpoh – 2,715

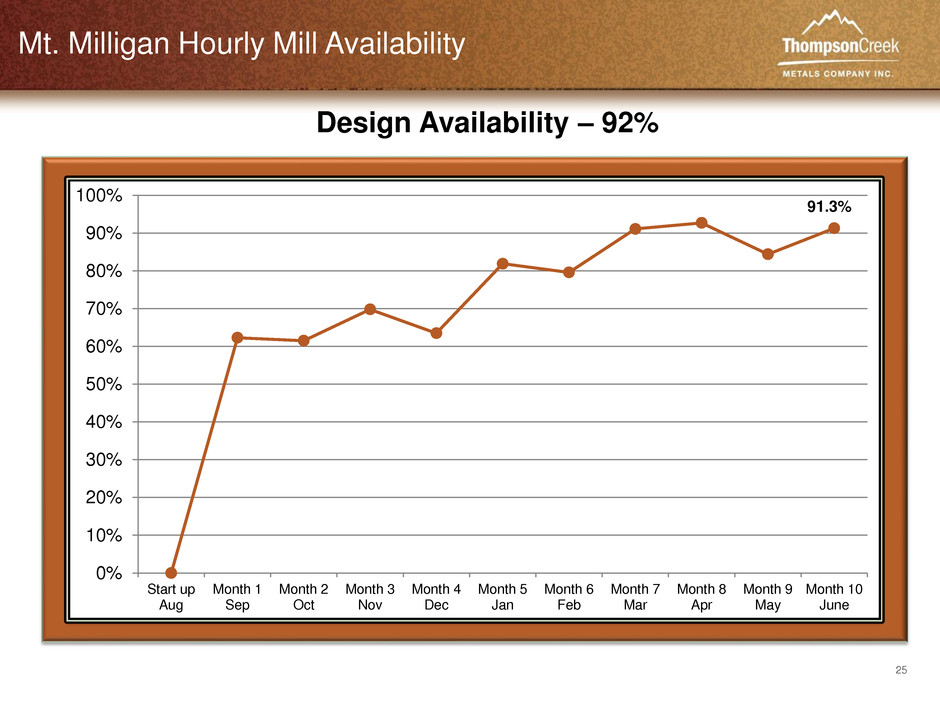

25 Mt. Milligan Hourly Mill Availability 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Start up Aug Month 1 Sep Month 2 Oct Month 3 Nov Month 4 Dec Month 5 Jan Month 6 Feb Month 7 Mar Month 8 Apr Month 9 May Month 10 June 91.3% Design Availability – 92%

26 Mt. Milligan Copper and Gold Recoveries 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Start up Aug Month 1 Sep Month 2 Oct Month 3 Nov Month 4 Dec Month 5 Jan Month 6 Feb Month 7 Mar Month 8 Apr Month 9 May Month 10 Jun Actual Gold Recovery Actual Copper Recovery Design Gold Recovery 71% Design Copper Recovery 84% 73.8% 59.4%

27 Jacques Perron Chief Executive Officer and Director Conclusion

28 Key Messages Primary focus through 2014 and 2015 is the Mt. Milligan ramp-up Expect to consistently achieve approximately 80% of mill throughput design capacity by year-end 2014 100% by year-end 2015 Expect Company to continue to be net cash flow positive in the second half of 2014 Continue to evaluate opportunities to strengthen the balance sheet Recent exchange offer of the tMEDS was just the first step towards reducing debt Repayment schedule for outstanding notes is December 2017, June 2018 and May 2019

29 NYSE:TC TSX:TCM Thompson Creek Metals Company www.thompsoncreekmetals.com Pamela Solly Director, Investor Relations and Corporate Responsibility Phone (303) 762-3526 Email psolly@tcrk.com

30 Appendix

31 Non-GAAP EDITDA Reconciliation Q214 Q114 Q413 Q313 Q213 Q113 Net income (loss) 61.6 (39.1) (210.5) 13.8 (19.2) 0.9 Interest Income/Expense 23.2 23.5 23.1 0.3 (0.2) (0.1) Taxes 14.5 (15.0) (66.4) 4.2 2.0 (3.2) DD&A 1 33.0 22.6 13.4 11.6 14.2 12.7 Accretion 0.9 0.9 0.4 0.6 0.6 0.8 Asset impairments - - 194.9 0.8 - - (Gain) loss on foreign exchange (41.9) 46.1 40.8 (23.8) 34.8 19.4 Non-GAAP EBITDA 91.3 39.0 (4.3) 7.5 32.2 30.5 1 Certain prior year reclassifications were made to DD&A to conform with current year presentation.

32 Non-GAAP Reconciliation Adjusted Net Income (Loss) Three Months Ended Six Months Ended June 30, 2014 June 30, 2013 June 30, 2014 June 30, 2013 Net income (loss) $ 61.6 $ (19.2 ) $ 22.5 $ (18.3) Add (Deduct): (Gain) loss on foreign exchange 1 (41.9 ) 34.8 4.2 54.2 Tax expense (benefit) on foreign exchange (gain) loss 2.3 (1.8 ) (0.4 ) (4.2) Non-GAAP adjusted net income (loss) $ 22.0 $ 13.8 $ 26.3 $ 31.7 Net income (loss) per share Basic $ 0.35 $ (0.11 ) $ 0.13 $ (0.11) Diluted $ 0.28 $ (0.11 ) $ 0.10 $ (0.11) Adjusted net income (loss) per share Basic $ 0.13 $ 0.08 $ 0.15 $ 0.19 Diluted $ 0.10 $ 0.06 $ 0.12 $ 0.15 Weighted-average shares Basic 174.5 171.1 173.1 170.4 Diluted 220.3 216.5 217.3 216.3 1 Included $0.4 million and nil of foreign exchange loss presented in income and mining tax expense (benefit) on the Condensed Consolidated Statements of Operations for the three and six months ended June 30, 2014, respectively. (US$ in millions, except pounds and per pound amounts)

33 Non-GAAP Reconciliation Copper-Gold Operations Unit Cost Per Pound Produced Three Months Ended June 30, Six Months Ended June 30, 2014 2013 2014 2013 Direct mining costs 1 $ 39.8 $ — $ 89.4 $ — Truck and rail transportation and warehousing costs 4.6 — 6.2 — Costs reflected in inventory and operations costs $ 44.4 — $ 95.6 — Refining and treatment costs 5.7 — 8.5 — Ocean freight and insurance costs 1.5 — 3.5 — Direct costs reflected in revenue and selling and marketing costs $ 7.2 — $ 12.0 — Non-GAAP cash costs $ 51.6 $ — $ 107.6 $ — Reconciliation to amounts reported (US$ in millions) Direct costs $ (7.2 ) — $ (12.0 ) — Changes in inventory 25.0 — 16.2 — Non cash costs and other 0.3 — 0.7 — Copper-Gold segment US GAAP operating expenses $ 69.7 $ — $ 112.5 $ — 1 Mining, milling and on-site general and administration costs. Mining includes all stripping costs but excludes costs capitalized related to the construction of the tailings dam. Stripping costs that provide access to mineral reserves that will be produced in future periods are expensed as incurred under US GAAP. (US$ in millions, except pounds and per pound amounts) Non-GAAP Cash Cost

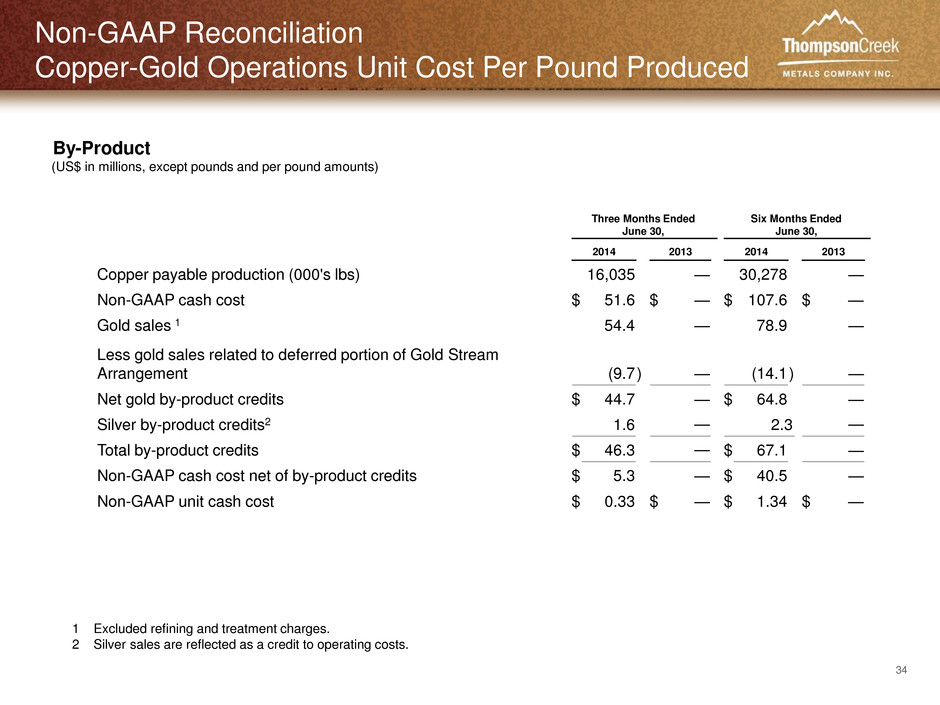

34 By-Product Three Months Ended June 30, Six Months Ended June 30, 2014 2013 2014 2013 Copper payable production (000's lbs) 16,035 — 30,278 — Non-GAAP cash cost $ 51.6 $ — $ 107.6 $ — Gold sales 1 54.4 — 78.9 — Less gold sales related to deferred portion of Gold Stream Arrangement (9.7 ) — (14.1 ) — Net gold by-product credits $ 44.7 — $ 64.8 — Silver by-product credits2 1.6 — 2.3 — Total by-product credits $ 46.3 — $ 67.1 — Non-GAAP cash cost net of by-product credits $ 5.3 — $ 40.5 — Non-GAAP unit cash cost $ 0.33 $ — $ 1.34 $ — (US$ in millions, except pounds and per pound amounts) Non-GAAP Reconciliation Copper-Gold Operations Unit Cost Per Pound Produced 1 Excluded refining and treatment charges. 2 Silver sales are reflected as a credit to operating costs.

35 Non-GAAP EDITDA Reconciliation Copper-Gold Operations Unit Cost Per Pound Produced Revision to By-Product Costs During the second quarter of 2014 the Company revised the calculation of its non-GAAP unit cash cost on a by- product basis for Mt. Milligan Mine. This revision in calculation had no effect on the Company’s Condensed Consolidated Balance Sheets, Condensed Statements of Operations, Condensed Statements of Cash Flow, or Condensed Statements of Shareholders’ Equity for the periods impacted. Following is a reconciliation of the Company’s previously reported and revised non-GAAP unit cash cost on a by- product basis for Mt. Milligan Mine for the first quarter of 2014. Three Months Ended March 31, 2014 As Previously Reported As Revised Copper payable production (000's lbs) 14,223 14,243 Non-GAAP cash cost $ 56.0 $ 56.0 Gold sales 1 24.5 24.5 Less gold sales related to deferred portion of Gold Stream Arrangement (1.7 ) (4.4 ) Net gold by-product credits $ 22.8 $ 20.1 Silver by-product credits 2 0.7 0.7 Total by-product credits $ 23.5 $ 20.8 Non-GAAP cash cost net of by-product credits 32.5 35.2 Non-GAAP unit cash cost $ 2.29 $ 2.48 (US$ in millions, except pounds and per pound amounts) 1 Excluded refining and treatment charges. 2 Silver sales are reflected as a credit to operating costs.

36 Co- Product (US$ in millions, except pounds and per pound amounts) Non-GAAP Reconciliation Copper-Gold Operations Unit Cost Per Pound Produced Three Months Ended June 30, Six Months Ended June 30, 2014 2013 2014 2013 Copper payable production (000’s lbs) 16,035 — 30,278 — Gold payable production in Cu eq. (000’s lbs) 1 10,125 — 20,565 — Payable production (000’s lbs) 26,160 — 50,843 — Non-GAAP cash cost allocated to Copper $ 31.6 $ — $ 64.1 $ — Non-GAAP unit cash cost $ 1.97 $ — $ 2.11 $ — Non-GAAP cash cost allocated to Gold $ 20.0 $ — $ 43.5 $ — Gold payable production (ounces) 37,030 — 76,273 — Non-GAAP unit cash cost $ 538 $ — $ 573 $ — 1 Gold has been converted from payable ounces to thousands of copper equivalent pounds by using the gold production for the periods presented, using a gold price of $842 and $844 per ounce for the three and six months ended June 30, 2014, respectively (adjusted for the Royal Gold price of $435 per ounce) and a copper price of $3.08 and $3.14 per pound for the three and six months ended June 30, 2014, respectively.

37 Average realized sales price The average realized sales price per payable pound or payable ounce sold is calculated by dividing copper or gold sales revenue, gross, by the pounds or ounces sold, respectively, as shown in the tables below. Non-GAAP Reconciliation Copper-Gold Operations Unit Cost Per Pound Produced Three Months Ended June 30, Six Months Ended June 30, 2014 2013 2014 2013 Average realized sales price for Copper Payable pounds of copper sold (000's lb) 21,939 — 32,732 — Copper sales, net $ 64.8 $ — $ 94.6 $ — Refining and treatment costs 5.4 — 8.1 — Copper sales, gross $ 70.2 $ — $ 102.7 $ — Average realized sales price per payable pound sold 1 $ 3.20 $ — $ 3.14 $ — Average realized sales price for Gold Payable ounces of gold sold under Gold Stream Arrangement 26,990 — 39,364 — TCM share of payable ounces of gold sold to MTM Customers 24,993 — 36,493 — Payable ounces of gold sold 51,983 — 75,857 — Gold sales related to cash portion of Gold Stream Arrangement $ 11.7 $ — $ 17.2 $ — Gold sales related to deferred portion of Gold Stream Arrangement 9.7 — 14.1 — Gold sales under Gold Stream Arrangement 21.4 — 31.3 — TCM share of gold sales to MTM Customers 32.7 — 47.2 — Gold sales, net 54.1 — 78.5 — Refining and treatment charges 0.3 — 0.4 — Gold sales, gross $ 54.4 $ — $ 78.9 $ — Average realized sales price related to cash portion of Gold Stream Arrangement $ 435 $ — $ 435 $ — Average realized sales price related to deferred portion of Gold Stream Arrangement $ 359 $ — $ 359 $ — Average realized sales price per payable ounce sold under Gold Stream Arrangement $ 794 $ — $ 794 $ — Average realized sales price per payable ounce sold for TCM share 1 $ 1,320 $ — $ 1,305 $ — Average realized sales price per payable ounce sold (1) $ 1,047 $ — $ 1,040 $ — 1 The average realized sales price per payable pound of copper sold and payable ounces of gold sold is impacted by any final volume and pricing adjustments and mark-to-market adjustments for shipments made in prior periods. (US$ in millions, except pounds and per pound amounts)

38 Molybdenum Operations - Cash Cost per Pound Produced, Weighted-Average Cash Cost per Pound Produced and Average Realized Sales Price per Pound Sold Three Months Ended June 30, 2014 June 30, 2013 Operating Expenses Pounds Produced 1 $/lb Operating Expenses Pounds Produced 1 $/lb TC Mine Cash cost - Non-GAAP $ 20.3 5,108 $ 3.97 $ 23.5 4,418 $ 5.33 Add/(Deduct): Stock-based compensation 0.2 0.3 Inventory and other adjustments 11.3 6.7 US GAAP operating expenses $ 31.8 $ 30.5 Endako Mine Cash cost - Non-GAAP $ 26.5 2,373 $ 11.17 $ 25.1 2,107 $ 11.93 Add/(Deduct): Stock-based compensation — 0.1 Inventory and other adjustments (6.6 ) (3.7 ) US GAAP operating expenses $ 19.9 $ 21.5 Other operations US GAAP operating expenses 2 $ 26.8 $ 25.1 Molybdenum segments US GAAP operating expenses $ 78.5 $ 77.1 Weighted-average cash cost—Non-GAAP $ 46.8 7,481 $ 6.25 $ 48.7 6,525 $ 7.46 (US$ in millions, except pounds and per pound amounts) Non-GAAP Reconciliation Cash Cost Per Pound Produced 1 Pounds produced are shown in molybdenum oxide and include an estimated loss from our share of the sulfide production from the mines to oxide. They exclude molybdenum processed from purchased product. 2 Other operations represent activities related to the roasting and processing of third-party concentrate and other metals at the Langeloth Facility and exclude product volumes and costs related to the roasting and processing of TC Mine and Endako Mine concentrate. The Langeloth Facility costs associated with roasting and processing of TC Mine and Endako Mine concentrate are included in their respective operating results above.

39 Six Months Ended June 30, 2014 June 30, 2013 Operating Expenses Pounds Produced 1 $/lb Operating Expenses Pounds Produced 1 $/lb TC Mine Cash cost - Non-GAAP $ 42.1 10,766 $ 3.91 $ 48.3 10,347 $ 4.67 Add/(Deduct): Stock-based compensation 0.4 0.5 Inventory and other adjustments 15.3 10.0 US GAAP operating expenses $ 57.8 $ 58.8 Endako Mine Cash cost - Non-GAAP $ 50.0 4,602 $ 10.87 $ 45.8 3,868 $ 11.85 Add/(Deduct): Stock-based compensation — 0.2 Inventory and other adjustments (0.4 ) (8.9 ) US GAAP operating expenses $ 49.6 $ 37.1 Other operations US GAAP operating expenses 2 $ 41.9 $ 49.9 Molybdenum segments US GAAP operating expenses $ 149.3 $ 145.8 Weighted-average cash cost—Non- GAAP $ 92.1 15,368 $ 5.99 $ 94.1 14,215 $ 6.62 Molybdenum Operations - Cash Cost per Pound Produced, Weighted-Average Cash Cost per Pound Produced and Average Realized Sales Price per Pound Sold (US$ in millions, except pounds and per pound amounts) 1 Pounds produced are shown in molybdenum oxide and include an estimated loss from our share of the sulfide production from the mines to oxide. They exclude molybdenum processed from purchased product. 2 Other operations represent activities related to the roasting and processing of third-party concentrate and other metals at the Langeloth Facility and exclude product volumes and costs related to the roasting and processing of TC Mine and Endako Mine concentrate. The Langeloth Facility costs associated with roasting and processing of TC Mine and Endako Mine concentrate are included in their respective operating results above. Non-GAAP Reconciliation Cash Cost Per Pound Produced